Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | a11-7x188xk.htm |

| EX-99.1 - EXHIBIT 99.1 - R1 RCM INC. | a991-q32018pressrelease.htm |

Exhibit 99.2 Third Quarter 2018 Results Conference Call November 7, 2018

Forward-Looking Statements and Non-GAAP Financial Measures This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements contain these identifying words. Such forward-looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors, including, including, but not limited to, our ability to integrate the Intermedix business as planned and to realize the expected benefits from the acquisition, our ability to successfully deliver on our commitments to Intermountain and Ascension, our ability to deploy new business as planned, our ability to successfully implement new technologies, fluctuations in our results of operations and cash flows, and the factors discussed under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2017 and any other periodic reports that the Company files with the Securities and Exchange Commission. This presentation includes the following non-GAAP financial measure: Adjusted EBITDA and net debt. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measure. 2

Q3 2018 Financial Highlights ▪ Revenue of $250.4 million, up $127.2 million year-over-year ▪ GAAP net loss of $13.4 million compared to net loss of $3.6 million in Q3’17 ▪ Adjusted EBITDA of $20.4 million, up $17.3 million year-over-year ▪ 2018 guidance unchanged: Revenue of $850-900 million, and adjusted EBITDA of $50-55 million; expect adjusted EBITDA at higher end of range provided 3

Digital Transformation Office (DTO) ▪ Highlights ▪ DTO goal is to systematically automate manual tasks across the revenue cycle ▪ Staffed with dedicated internal talent, augmented by best-in-class advisors ▪ Increases confidence in delivering on our financial targets ▪ Over the long term, we believe this investment coupled with our scaled infrastructure and delivery expertise creates a sustainable advantage versus competing offerings in the market ▪ Three levers with high applicability to our business: ▪ Patient/Physician Interface with the revenue cycle ▪ Launched Patient Experience Platform in March 2018, currently in early stages of scaling this capability across our customer base ▪ Robotic Process Automation (RPA) ▪ Selected Automation Anywhere as RPA technology platform ▪ Expected to automate several hundred transactional processes over the next five quarters ▪ Machine Learning and Predictive Modeling ▪ Improve complex revenue cycle processes such as denials 4

Commercial Activity Three Near-Term Focus Areas: ▪ Increased Sales & Marketing Efforts ▪ Translating to progression of pipeline across both end-to-end and modular discussions ▪ Increase in pro-active discussions as well as inbound RFPs ▪ Intermedix End-Markets ▪ Increased sales momentum across Intermedix end-markets ▪ Recently signed two large multi-specialty physician groups: CarePoint Health and Holston Medical Group ▪ Integrated Physician-Acute Offering ▪ Deploying integrated solution at Intermountain Healthcare and Ascension Medical Group; to be deployed at Presence/AMITA Health ▪ Preparing for broader-based market launch in early 2019 5

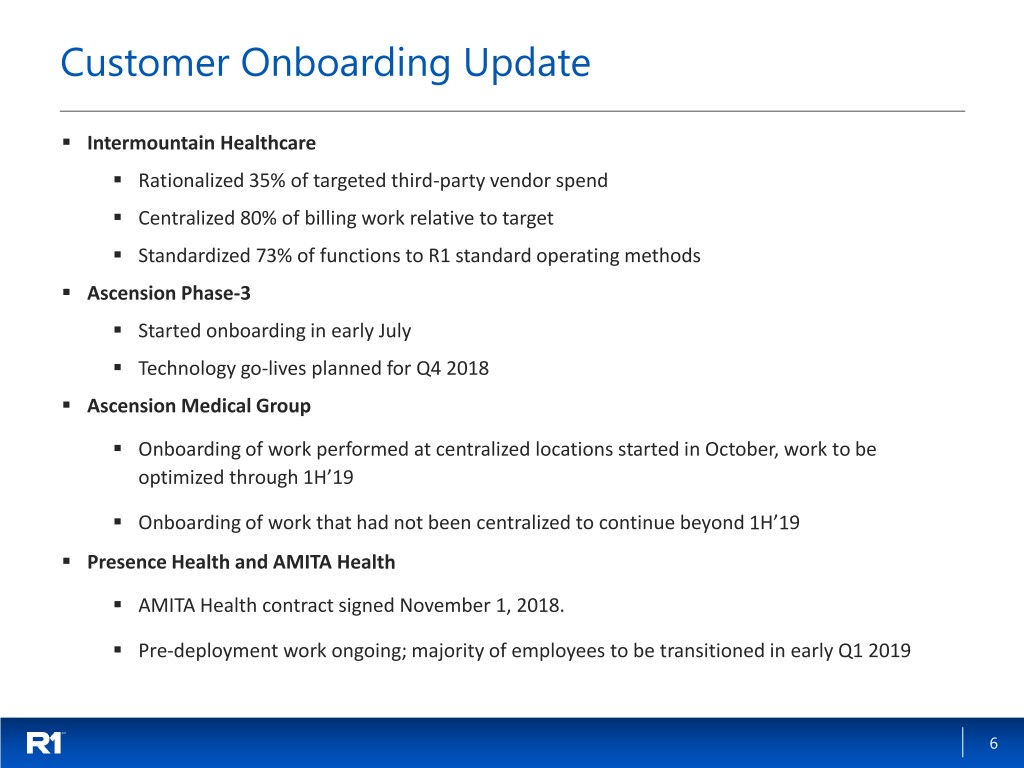

Customer Onboarding Update ▪ Intermountain Healthcare ▪ Rationalized 35% of targeted third-party vendor spend ▪ Centralized 80% of billing work relative to target ▪ Standardized 73% of functions to R1 standard operating methods ▪ Ascension Phase-3 ▪ Started onboarding in early July ▪ Technology go-lives planned for Q4 2018 ▪ Ascension Medical Group ▪ Onboarding of work performed at centralized locations started in October, work to be optimized through 1H’19 ▪ Onboarding of work that had not been centralized to continue beyond 1H’19 ▪ Presence Health and AMITA Health ▪ AMITA Health contract signed November 1, 2018. ▪ Pre-deployment work ongoing; majority of employees to be transitioned in early Q1 2019 6

3Q’18 non-GAAP Results – Q/Q and Y/Y Comparison ($ in millions) 3Q’18 2Q’18 3Q’17 Key change driver(s) • Q/Q: Full quarter of contribution from Intermedix and Intermountain Revenue $250.4 $207.9 $123.2 • Y/Y: New customers onboarded in last twelve months and Intermedix • Q/Q and Y/Y: Full quarter of costs associated with Intermedix and Cost of Services (non-GAAP) $206.5 $181.1 $106.6 Intermountain; Presence/AMITA and AMG upfront costs • Q/Q: Inclusion of Intermedix SG&A (non-GAAP) $23.4 $17.8 $13.4 • Y/Y: Expansion of commercial efforts and inclusion of Intermedix • Q/Q and Y/Y: Contribution from Adjusted EBITDA (non-GAAP) $20.4 $9.2 $3.1 customers onboarded in 2017 and contribution from Intermedix A reconciliation of non-GAAP to GAAP measures is provided in the Appendix to this presentation 7

Additional Commentary ▪ Net debt of $325.3 million as of 9/30/18, including restricted cash ▪ Expect to start paying down debt with cash from operations in mid-2019 ▪ Net interest expense of $10.0 million in Q3’18 ▪ Interest on subordinated debt paid in cash, did not exercise payment-in-kind option ▪ Capex of $4.8 million in Q3’18 ▪ Primarily related to purchases of software licenses and computer equipment, as well as capitalized software 8

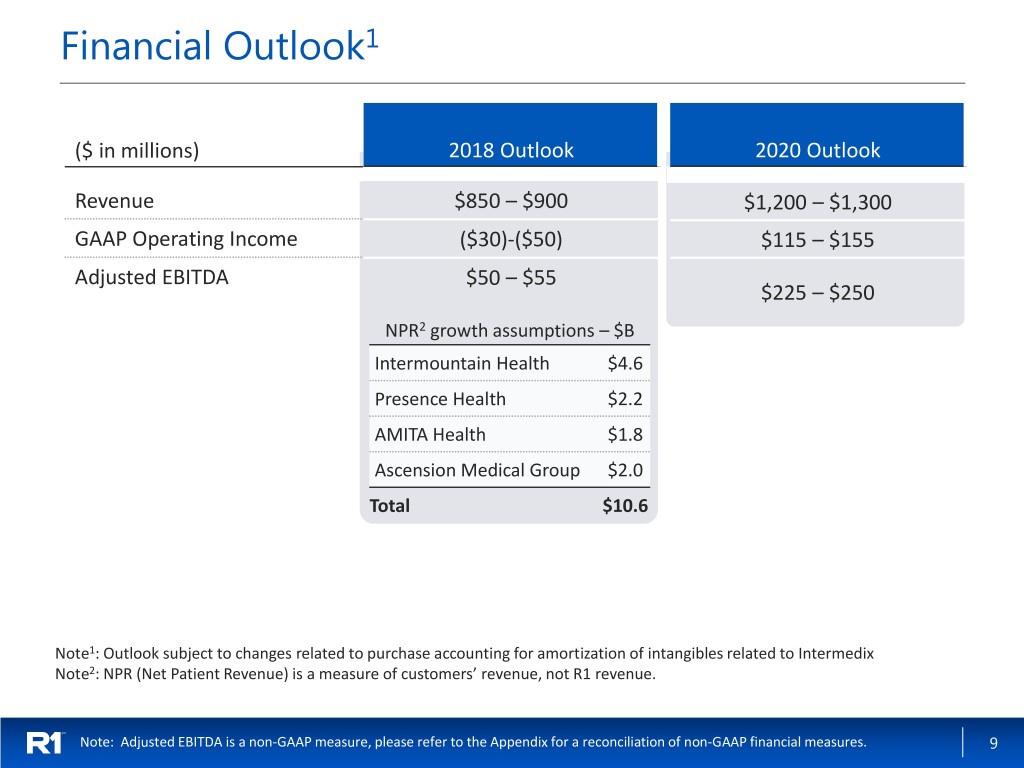

Financial Outlook1 ($ in millions) 2018 Outlook 2020 Outlook Revenue $850 – $900 $1,200 – $1,300 GAAP Operating Income ($30)-($50) $115 – $155 Adjusted EBITDA $50 – $55 $225 – $250 NPR2 growth assumptions – $B Intermountain Health $4.6 Presence Health $2.2 AMITA Health $1.8 Ascension Medical Group $2.0 Total $10.6 Note1: Outlook subject to changes related to purchase accounting for amortization of intangibles related to Intermedix Note2: NPR (Net Patient Revenue) is a measure of customers’ revenue, not R1 revenue. Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures. 9

Appendix

Use of Non-GAAP Financial Measures ▪ In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including adjusted EBITDA. Adjusted EBITDA is defined as GAAP net income before net interest expense, income tax provision, depreciation and amortization expense, share-based compensation expense, reorganization-related expenses, transaction-related expenses and certain other items. Net debt is defined as debt less cash and equivalents, inclusive of restricted cash. ▪ Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. ▪ A reconciliation of GAAP net income to adjusted non-GAAP EBITDA, GAAP operating income guidance to non-GAAP adjusted EBITDA guidance, and debt to net debt is provided in this appendix. ▪ Adjusted EBITDA and net debt should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP. 11

Reconciliation of GAAP Net Income (Loss) to non-GAAP Adjusted EBITDA n.m. – not meaningful Due to rounding, numbers presented in this table may not add up precisely to the totals provided. 12

Reconciliation of GAAP to non-GAAP Financials Reconciliation of GAAP Cost of Services to Non-GAAP Cost of Services $ in millions Three Months Ended Nine Months Ended September 30, September 30, 2018 2017 2018 2017 (Unaudited) (Unaudited) Cost of services $ 219.3 $ 111.8 $ 547.9 $ 289.1 Less: Share-based compensation expense 1.6 1.2 4.4 3.3 Depreciation and amortization expense $ 11.2 $ 4.0 23.1 10.4 Non-GAAP cost of services $ 206.5 $ 106.6 $ 520.4 $ 275.4 Reconciliation of GAAP Selling, General and Administrative to Non-GAAP Selling, General and Administrative $ in millions Three Months Ended Nine Months Ended September 30, September 30, 2018 2017 2018 2017 (Unaudited) (Unaudited) Selling, general and administrative $ 29.6 $ 15.1 $ 69.1 $ 41.6 Less: Share-based compensation expense 3.2 1.2 9.3 4.8 Depreciation and amortization expense 3.0 0.5 4.5 1.1 Non-GAAP selling, general and administrative $ 23.4 $ 13.4 $ 55.3 $ 35.7 13

Reconciliation GAAP Operating Income Guidance to non-GAAP Adjusted EBITDA Guidance 2018 and 2020 Outlook $ in millions 2018 2020 GAAP Operating Income Guidance ($30)-($50) $130-$170 Plus: Depreciation and amortization expense $25-$30 $35-$45 Share-based compensation expense $15-$20 $20-$25 Amortization of intangibles $10-$15 $15-$20 Transaction expenses, severance and other costs $25-$30 $5-$10 Adjusted EBITDA Guidance $50-$55 $225-$250 14

Net Debt as of 9/30/18 $ in millions June 30, September 30, 2018 2018 (Unaudited) (Unaudited) Long-term debt $ 270.0 $ 270.0 Subordinated notes 110.0 110.0 380.0 380.0 Less: Cash and cash equivalents 38.8 52.4 Current portion of restricted cash 2.0 1.8 Non-current portion of restricted cash equivalents 1.5 0.5 Net Debt $ 337.7 $ 325.3 15