Attached files

| file | filename |

|---|---|

| 8-K - 8-K - General Motors Financial Company, Inc. | q320188-kinvestorpresentat.htm |

Exhibit 99.1 Strategic and Operational Overview October 31, 2018 1

Safe Harbor Statement This presentation contains several “forward-looking statements.” Forward-looking statements are those that use words such as “believe,” “expect,” “intend,” “plan,” “may,” “likely,” “should,” “estimate,” “continue,” “future” or “anticipate” and other comparable expressions. These words indicate future events and trends. Forward-looking statements are our current views with respect to future events and financial performance. These forward-looking statements are subject to many assumptions, risks and uncertainties that could cause actual results to differ significantly from historical results or from those anticipated by us. The most significant risks are detailed from time to time in our filings and reports with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2017. Such risks include - but are not limited to - GM’s ability to sell new vehicles that we finance in the markets we serve; the viability of GM-franchised dealers that are commercial loan customers; changes in the automotive industry that result in a change in demand for vehicles and related vehicle financing; the sufficiency, availability and cost of sources of financing, including credit facilities, securitization programs and secured and unsecured debt issuances; our joint ventures in China, which we cannot operate solely for our benefit and over which we have limited control; the adequacy of our underwriting criteria for loans and leases and the level of net charge-offs, delinquencies and prepayments on the loans and leases we purchase or originate; the adequacy of our allowance for loan losses on our finance receivables; the effect, interpretation or application of new or existing laws, regulations, court decisions and accounting pronouncements; the prices at which used vehicles are sold in the wholesale auction markets; vehicle return rates, our ability to estimate residual value at the inception of a lease and the residual value performance on vehicles we lease; interest rate fluctuations and certain related derivatives exposure; foreign currency exchange rate fluctuations and other risks applicable to our operations outside of the U.S.; our ability to effectively manage capital or liquidity consistent with evolving business or operational needs, risk management standards, and regulatory or supervisory requirements; changes in local, regional, national or international economic, social or political conditions; our ability to maintain and expand our market share due to competition in the automotive finance industry from a large number of banks, credit unions, independent finance companies and other captive automotive finance subsidiaries; our ability to secure private customer data or our proprietary information and manage risks related to security breaches and other disruptions to our networks and systems; and changes in business strategy, including expansion of product lines and credit risk appetite, acquisitions and divestitures. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected. It is advisable not to place undue reliance on any forward-looking statements. We undertake no obligation to, and do not, publicly update or revise any forward-looking statements, except as required by federal securities laws, whether as a result of new information, future events or otherwise. Unless otherwise noted, prior period information excludes Discontinued Operations and reflects results for North America and our continuing International Operations. 2

GM Financial Company Overview • GM Financial is General Motors’ global captive finance company • Earning assets of $93.1B • Global operations covering ~90% of GM’s worldwide sales - Offering auto finance products to 14,000 dealers worldwide - Over 6 million retail contracts outstanding • GM Financial is a strategic business for GM and well- positioned for profitable growth and contribution to overall enterprise value GM Financial’s overall objective is to support GM vehicle sales while achieving appropriate risk-adjusted returns 3

GM Financial Evolution Leveraging the Platform Captive (2018 and Beyond) Expansion Acquisition of (2014-2017) International Operations (2013-2015) Acquisition of GM Financial (2010-2013) Launched prime loan KEY AREAS product in the U.S. OF FOCUS Became exclusive Global expansion to subvented loan & lease align with GM sales provider in the U.S. Drive captive value Launched lease and footprint, covering proposition floorplan enabling about 90% of GM’s Increased percentage “captive light” worldwide sales of GM retail business in support in North America North America 4

GM Financial Captive Value Proposition • Drive vehicle sales • Support GM customers and dealers - Offer competitive, comprehensive suite across economic cycles of finance products and services - Leverage strong financial and liquidity - Support GM’s go-to-market strategies position - Provide programs to support dealer • Contribute to enterprise profitability sales - Target annual earnings before taxes in • Enhance customer experience and the $2.0B range when full captive loyalty penetration levels are achieved on a consistent basis - Integrated GM/GM Financial CRM activities - Customer-centric servicing approach GM Financial ranks highest when it comes to manufacturer loyalty1 1. Based on CY 2017 IHS Markit Lease and Retail Return to Market Manufacturer Loyalty. Data based on disposal methodology and GM custom segmentation in the U.S. Manufacturer Loyalty rate equals households who return to market from a captive OEM leased or purchased vehicle and remain loyal to the same manufacturer. 5

Strong Operating Results Earnings Before Taxes ($M) Net Charge-offs on Loans1 $1,477 2.4% 2.0% $1,196 1.9% 1.8% $895 $762 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 North America International Origination Volume ($B) Operating Expense Ratio2 2.1% $45.3 $39.7 1.8% 1.8% 1.7% $35.1 $35.1 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 International Retail Lease International Retail Loan North America Retail Lease North America Retail Loan 1. As an annualized percentage of average retail finance receivables 2. As an annualized percentage of average earning assets 6

Solid Balance Sheet Ending Earning Assets ($B) Available Liquidity ($B) $93.1 $25.3 $86.0 $68.6 $17.9 $12.2 Dec 31, 2016 Dec 31, 2017 Sep 30, 2018 Dec 31, 2016 Dec 31, 2017 Sep 30, 2018 Retail Loan Retail Lease Commercial Loan Borrowing capacity Cash Tangible Net Worth ($B)1 Leverage Ratio2,3 $10.7 10.41x $9.1 9.49x $7.5 8.56x Dec 31, 2016 Dec 31, 2017 Sep 30, 2018 Dec 31, 2016 Dec 31, 2017 Sep 30, 2018 1. Total shareholders’ equity less goodwill 2. Calculated consistent with GM/GM Financial Support Agreement, filed with the Securities and Exchange Commission as an exhibit to our Current Report on Form 8-K dated April 18, 2018 3. December 31, 2016 ratio as originally reported 7

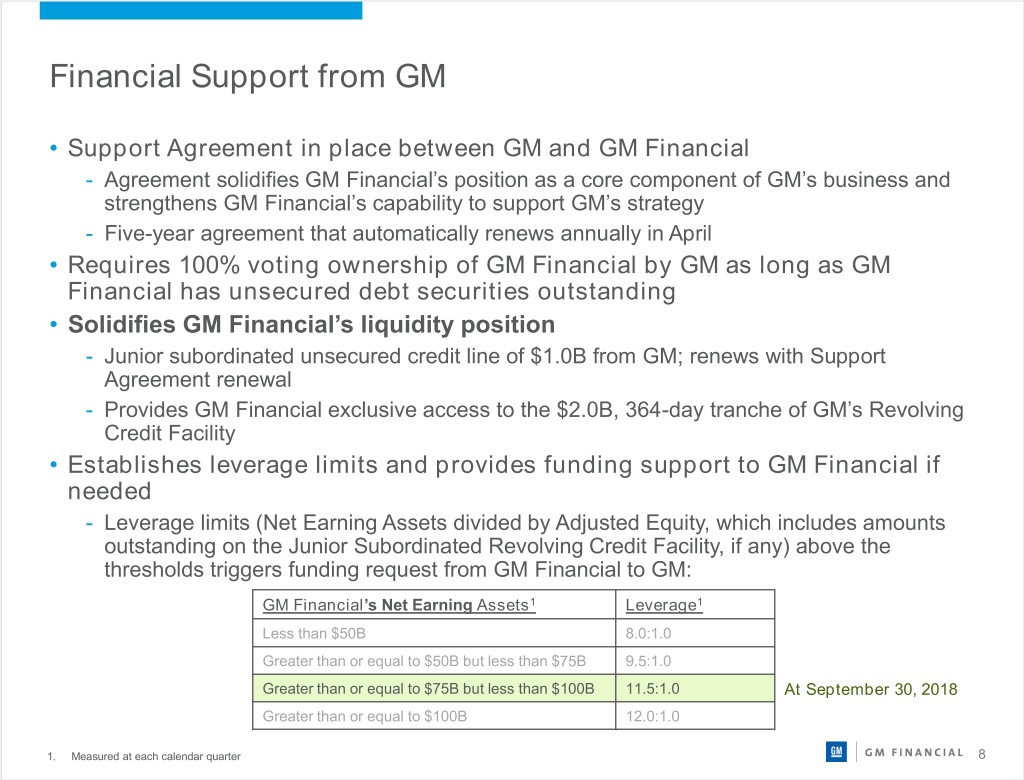

Financial Support from GM • Support Agreement in place between GM and GM Financial - Agreement solidifies GM Financial’s position as a core component of GM’s business and strengthens GM Financial’s capability to support GM’s strategy - Five-year agreement that automatically renews annually in April • Requires 100% voting ownership of GM Financial by GM as long as GM Financial has unsecured debt securities outstanding • Solidifies GM Financial’s liquidity position - Junior subordinated unsecured credit line of $1.0B from GM; renews with Support Agreement renewal - Provides GM Financial exclusive access to the $2.0B, 364-day tranche of GM’s Revolving Credit Facility • Establishes leverage limits and provides funding support to GM Financial if needed - Leverage limits (Net Earning Assets divided by Adjusted Equity, which includes amounts outstanding on the Junior Subordinated Revolving Credit Facility, if any) above the thresholds triggers funding request from GM Financial to GM: GM Financial’s Net Earning Assets1 Leverage1 Less than $50B 8.0:1.0 Greater than or equal to $50B but less than $75B 9.5:1.0 Greater than or equal to $75B but less than $100B 11.5:1.0 At September 30, 2018 Greater than or equal to $100B 12.0:1.0 1. Measured at each calendar quarter 8

Committed to Investment Grade • GM targeting performance consistent with “A” ratings criteria • Investment grade status achieved with all agencies and aligned with GM’s ratings • Investment grade rating critical for captive strategy execution GM GM Financial Company Bond Company Bond Outlook ST Rating Outlook Current Ratings Rating Rating Rating Rating DBRS BBB N/A Positive BBB BBB R-2 Positive Fitch BBB BBB Stable BBB BBB F-2 Stable Moody’s I.G. Baa3 Stable Baa3 Baa3 P-3 Stable Standard and Poor’s BBB BBB Stable BBB BBB A-2 Stable 9

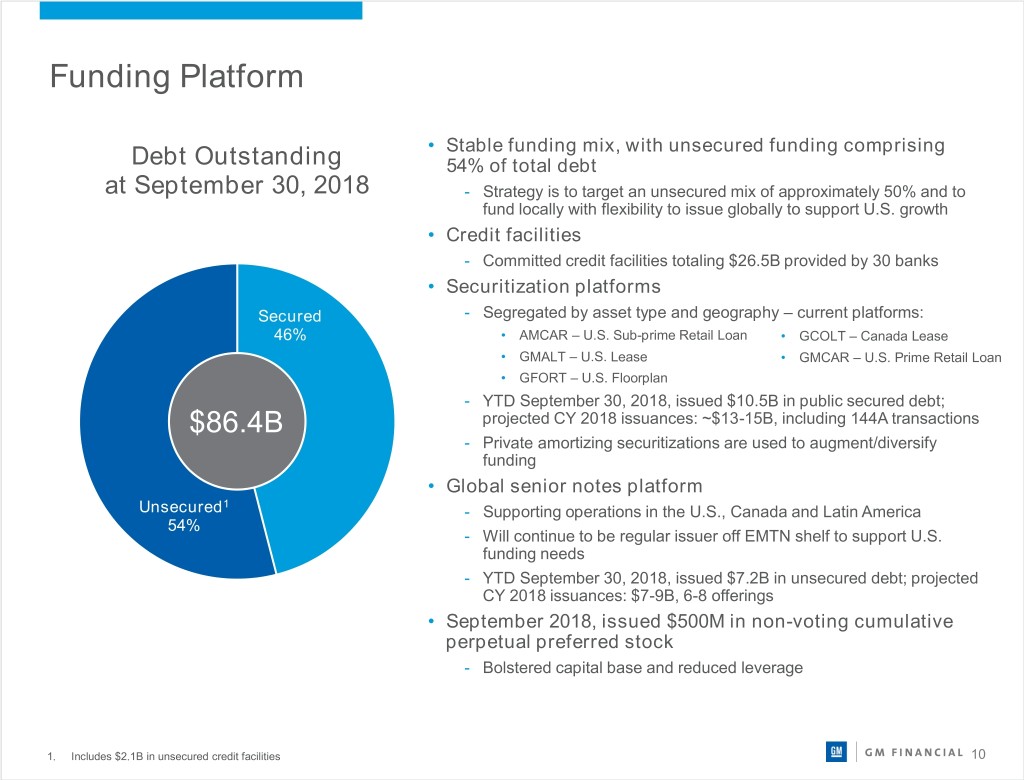

Funding Platform • Stable funding mix, with unsecured funding comprising Debt Outstanding 54% of total debt at September 30, 2018 - Strategy is to target an unsecured mix of approximately 50% and to fund locally with flexibility to issue globally to support U.S. growth • Credit facilities - Committed credit facilities totaling $26.5B provided by 30 banks • Securitization platforms Secured - Segregated by asset type and geography – current platforms: 46% • AMCAR – U.S. Sub-prime Retail Loan • GCOLT – Canada Lease • GMALT – U.S. Lease • GMCAR – U.S. Prime Retail Loan • GFORT – U.S. Floorplan - YTD September 30, 2018, issued $10.5B in public secured debt; $86.4B projected CY 2018 issuances: ~$13-15B, including 144A transactions - Private amortizing securitizations are used to augment/diversify funding • Global senior notes platform 1 Unsecured - Supporting operations in the U.S., Canada and Latin America 54% - Will continue to be regular issuer off EMTN shelf to support U.S. funding needs - YTD September 30, 2018, issued $7.2B in unsecured debt; projected CY 2018 issuances: $7-9B, 6-8 offerings • September 2018, issued $500M in non-voting cumulative perpetual preferred stock - Bolstered capital base and reduced leverage 1. Includes $2.1B in unsecured credit facilities 10

Operating Metrics 11

GM and GM Financial Penetration Statistics Q3 2018 Q2 2018 Q3 2017 GMF as a % of GM Retail Sales U.S. 50.0% 45.4% 35.6% Latin America 54.7% 53.2% 57.4% GMF Wholesale Dealer Penetration U.S. 23.6% 22.9% 19.4% Latin America 96.9% 96.4% 96.0% • U.S. retail penetration increased year-over-year primarily due to further alignment with GM and greater dealer engagement • Latin America penetration of GM retail sales remains strong due to joint campaign activity with GM 12

Retail Loan Originations & Portfolio Balance ($B) $37.9 North America GM New1 $35.7 $34.3 $32.3 $32.8 $32.6 North America GM Used2 $30.6 $28.8 $27.0 $27.6 $6.7 North America NonNon-GM-GM3 $6.0 $5.1 International $4.7 $4.4 North America Retail Finance $4.7 $4.1 Receivables, at quarter-end $2.6 $3.1 Total Retail Finance Receivables, $2.4 at quarter-end $0.6 $0.5 $0.6 $0.6 $0.7 $0.5 $0.5 $0.5 $0.5 $0.5 $1.0 $1.0 $0.9 $0.8 $0.8 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 U.S. Metrics: GM Financial as % of 18% 14% 29% 34% 43% GM New ≥620 GM Financial as % of 40% 34% 36% 38% 42% GM New <620 Weighted Average 696 702 716 728 736 FICO Score 1. Loans originated on new vehicles by GM dealers 2. Loans originated on used vehicles by GM dealers 3. Loans originated on vehicles by non-GM dealers 13

Retail Loan Credit Performance 5.0% 4.0% Net charge-offscharge-offs1 3.0% 2.2% 2.1% 31-60 day delinquency 1.9% 2.0% 1.7% 1.7% 61+ day delinquency 1.0% 0.0% Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 North America 52% 50% 51%3 52% 54% Recovery Rate2 • Q3 2018 net charge-offs percentage is down year-over-year due to continued positive impact of credit mix shift to prime in the U.S. and increased recovery rates on repossessed vehicles - Finance receivables with a FICO score <620 comprise 30% of the North America retail loan portfolio at September 30, 2018, compared to 39% at September 30, 2017 - North America recovery rate expected to trend down on a year-over-year basis through 2019 1. As an annualized percentage of average retail finance receivables 2. As a percentage of gross repossession charge-offs 3. Recovery rate for the three months ended March 31, 2018 was revised due to the reclassification of $4.0M in non-repossession recoveries 14

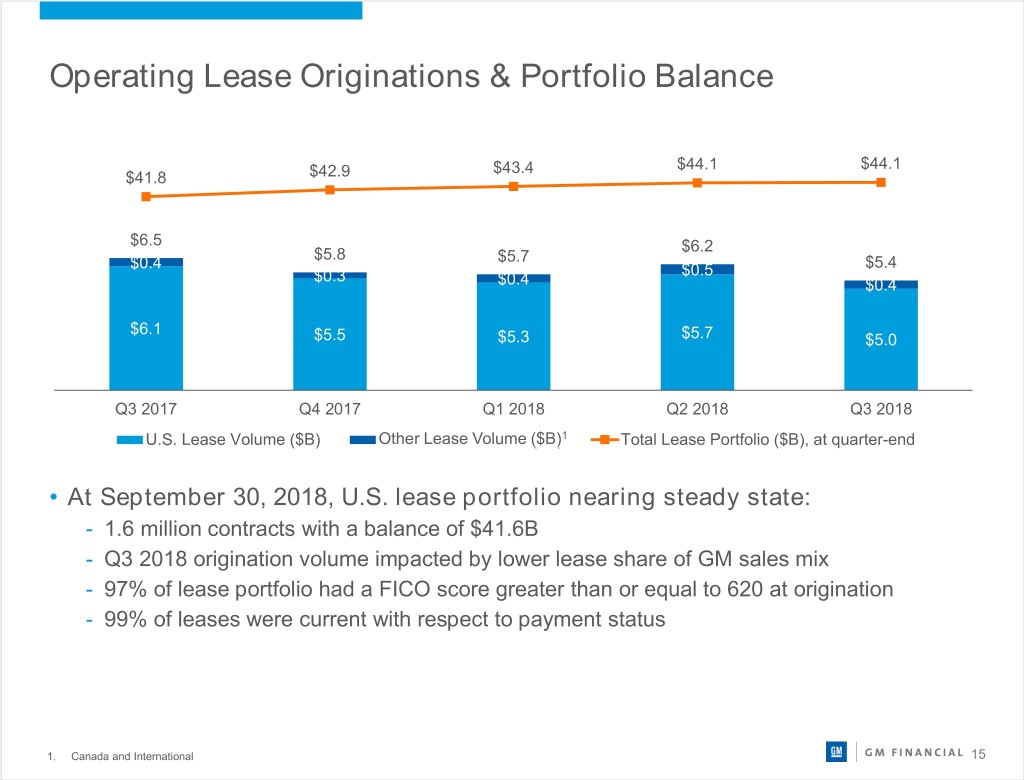

Operating Lease Originations & Portfolio Balance $43.4 $44.1 $44.1 $41.8 $42.9 $6.5 $5.8 $6.2 $0.4 $5.7 $5.4 $0.3 $0.5 $0.4 $0.4 $6.1 $5.5 $5.3 $5.7 $5.0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 U.S. Lease Volume ($B) Other Lease Volume ($B)1 Total Lease Portfolio ($B), at quarter-end • At September 30, 2018, U.S. lease portfolio nearing steady state: - 1.6 million contracts with a balance of $41.6B - Q3 2018 origination volume impacted by lower lease share of GM sales mix - 97% of lease portfolio had a FICO score greater than or equal to 620 at origination - 99% of leases were current with respect to payment status 1. Canada and International 15

U.S. Residual Value GM and GM Financial jointly support residual values U.S. GM Financial Gross Proceeds vs. ALG Residuals at Origination1 Q3 2017 – Q3 2018 Sales Car Sales 2 CUV/SUV/Truck Sales (Avg % Per Unit ) – 120% Car Avg G(L) 70,000 CUV/SUV/Truck Avg G(L) 115% Total Avg G(L) 60,000 110% 50,000 40,000 105% 30,000 Volume Gain/(Loss) 100% 20,000 Residual Realization Realization Residual 95% 10,000 90% 0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 • Residual performance on returned vehicles - U.S. disposition proceeds on leased vehicles returned in the quarter were favorable compared to estimates at origination due to stable used vehicle pricing environment - Despite stronger results year-to-date, used vehicle prices expected to be weaker in Q4 consistent with normal seasonal trends • Expect used vehicle price decline of 4-5% in 2019 over 2018 due to peak off-lease supply 1. Base ALG residual with mileage modifications 2. Reflects average per unit gain/(loss) on vehicles returned to GM Financial and sold in the period 16

Commercial Lending 1,682 1,592 1,643 1,502 1,538 $11.1 $10.3 $10.4 $10.7 $9.5 $1.5 $1.6 $1.5 $1.3 $1.4 $9.4 $9.6 $8.1 $8.7 $8.9 Sep 30, 2017 Dec 31, 2017 Mar 31, 2018 Jun 30, 2018 Sep 30, 2018 North America Commercial Finance Receivables ($B) International Commercial Finance Receivables ($B) Number of Dealers • Steady growth in number of U.S. dealers and receivables outstanding - U.S. dealers totaled 1,045 at September 30, 2018, a 20% increase from September 30, 2017 • Floorplan financing represents more than 90% of commercial portfolio 17

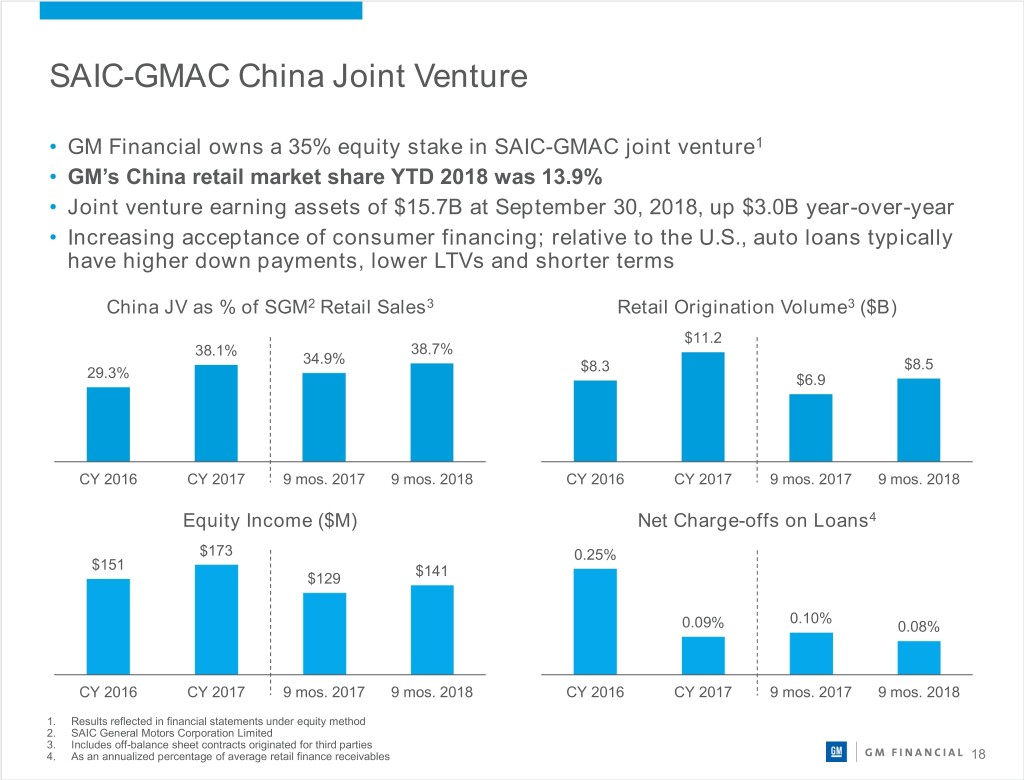

SAIC-GMAC China Joint Venture • GM Financial owns a 35% equity stake in SAIC-GMAC joint venture1 • GM’s China retail market share YTD 2018 was 13.9% • Joint venture earning assets of $15.7B at September 30, 2018, up $3.0B year-over-year • Increasing acceptance of consumer financing; relative to the U.S., auto loans typically have higher down payments, lower LTVs and shorter terms China JV as % of SGM2 Retail Sales3 Retail Origination Volume3 ($B) $11.2 38.1% 38.7% 34.9% $8.3 $8.5 29.3% $6.9 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 Equity Income ($M) Net Charge-offs on Loans4 $173 0.25% $151 $141 $129 0.10% 0.09% 0.08% CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 CY 2016 CY 2017 9 mos. 2017 9 mos. 2018 1. Results reflected in financial statements under equity method 2. SAIC General Motors Corporation Limited 3. Includes off-balance sheet contracts originated for third parties 4. As an annualized percentage of average retail finance receivables 18

GM Financial Key Strengths STRATEGIC • GM priority to grow GM Financial INTERDEPENDENCE - Expansion of captive presence in the U.S. WITH GM - Maintain captive penetration levels outside of the U.S. • Operations covering ~90% of GM’s worldwide sales FULL SUITE OF AUTO - Incremental growth opportunities through product offerings FINANCE SOLUTIONS and enhancements and geographic expansion - Growing finance penetration in China provides opportunity for increased profitability SOLID GLOBAL FUNDING PLATFORM • Investment grade rating; committed bank lines, well-established ABS and unsecured debt issuance programs STRONG FINANCIAL - Along with GM, committed to running the business PERFORMANCE consistent with “A” ratings criteria • Earned $1.2B in earnings before taxes (EBT) for EXPERIENCED AND calendar year 2017; target annual EBT in the $2.0B SEASONED range when full captive penetration levels are MANAGEMENT TEAM achieved on a consistent basis 19

GM FINANCIAL CONFIDENTIAL - RESTRICTED TO INTERNAL COMMUNICATION 20