Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - WEST PHARMACEUTICAL SERVICES INC | exh991q32018earningsrelease.htm |

| 8-K - 8-K - WEST PHARMACEUTICAL SERVICES INC | wst-q32018form8k.htm |

West Pharmaceutical Services, Inc. Third-Quarter 2018 Analyst Conference Call 9 a.m. Eastern Time, October 25, 2018 ▪ A webcast of today’s call can be accessed in the “Investors” section of the Company’s website: www.westpharma.com Speakers: ▪ To participate on the call, please dial: Eric M. Green − 877-930-8295 (U.S.) President and Chief Executive Officer − 253-336-8738 (International) − The conference ID is 8341499 Bernard J. Birkett Senior Vice President and Chief Financial Officer ▪ An online archive of the broadcast will be available at the site three hours after the live call and will be available through Thursday, November 1, 2018, by dialing: − 855-859-2056 (U.S.) − 404-537-3406 (International) − The conference ID is 8341499 These presentation materials are intended to accompany today’s press release announcing the Company’s results for the third-quarter 2018 and management’s discussion of those results during today’s conference call. 1

Safe Harbor Statement Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development and operational performance. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. Non-U.S. GAAP Financial Measures Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non-GAAP financial measures. Non-GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with GAAP. Please refer to “Reconciliation of Non-GAAP Measures” at the end of these materials for more information. Trademarks Registered trademarks used in this report are the property of West Pharmaceutical Services, Inc. or its subsidiaries, in the United States and other jurisdictions, unless noted otherwise. 2

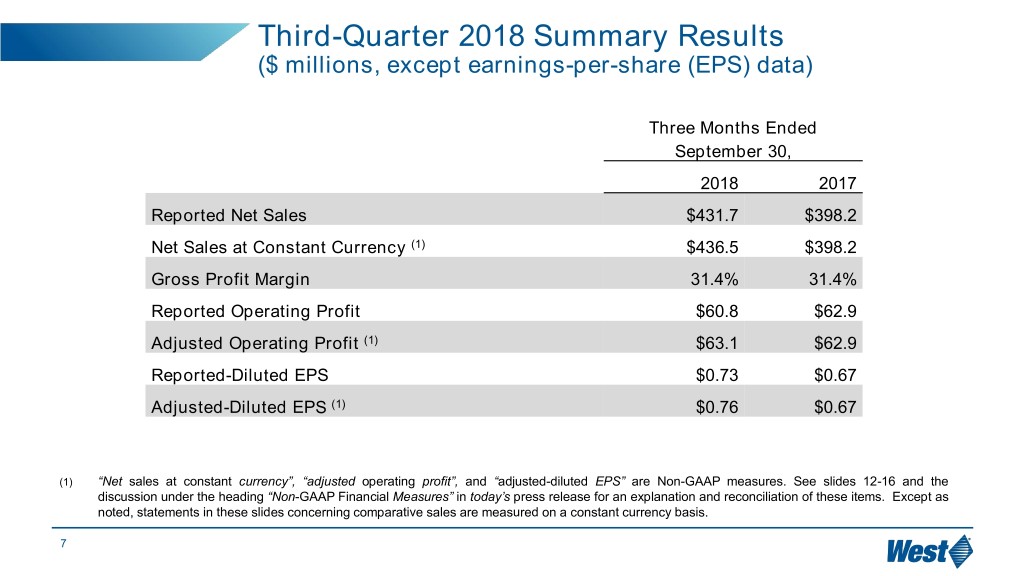

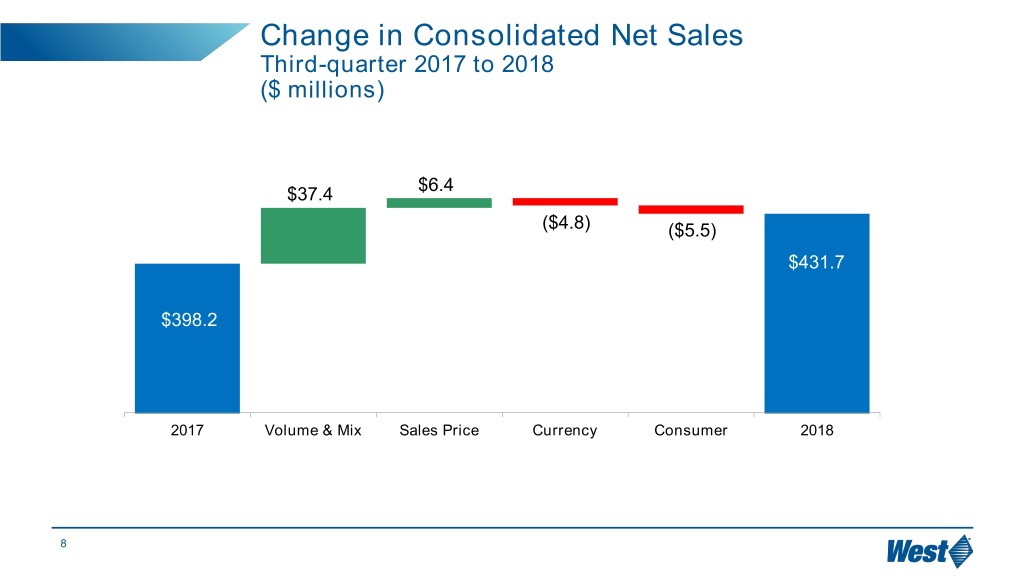

2018 Third-Quarter Results & Full-Year Outlook ▪ Q3 2018 reported net sales of $431.7 million, representing 9.6% organic sales growth ▪ Q3 2018 reported-diluted EPS was $0.73, compared to $0.67 for the same period last year ▪ Excluding restructuring-related and other charges, Q3 2018 adjusted- diluted EPS(1) was $0.76. ▪ Reaffirming 2018 financial guidance: ‒ Full-year 2018 net sales guidance range of $1.720 billion to $1.730 billion ‒ Full-year 2018 adjusted-diluted EPS range of $2.80 to $2.90 (1) Please refer to “Notes to Non-GAAP Financial Measures” on slides 12-16, and “Non-GAAP Financial Measures” in today’s press release, for additional information regarding adjusted-diluted EPS. 3

Abbreviations: LSD – low-single digit; MSD – mid-single digit; Organic Sales Growth HSD – high-single digit; DD – double digit Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Overall Organic 3.7% 4.5% 0.2% 9.0% 9.6% Sales Growth Biologics MSD DD (LSD) LSD (MSD) Generics LSD HSD HSD DD MSD Pharma (MSD) (MSD) (HSD) HSD DD Contract DD DD HSD DD DD Manufacturing 4

Self Injection Update ▪ SmartDose® Drug Delivery Platform ‒ FDA-approved with two full years of commercial experience ‒ Active clinical development programs ‒ Solid pipeline of customer interest ▪ SelfDose® Patient Controlled Injector ‒ Commercial launch in 2018 ‒ Award-winning technology ‒ Rising customer demand ‒ Additional pipeline opportunities identified 5

Integrated Solutions Program Launched Simplify the Journey™ PHARMA ▪ West’s Integrated Solutions Program BIOLOGICS offers suites of products, combined with GENERICS expert testing and support services for ▪ Reduce Development the unique needs of the drug product and Supply Risk and its delivery system ▪ Accelerate Path to Market ▪ Minimize Total Cost of Ownership ▪ Improve the Patient Experience ▪ New option to make the move to market fast, while reducing risk and mitigating regulatory complexity for customers PACKAGING, DEVICE AND COMBINATION PRODUCT SOLUTIONS 6

Third-Quarter 2018 Summary Results ($ millions, except earnings-per-share (EPS) data) Three Months Ended September 30, 2018 2017 Reported Net Sales $431.7 $398.2 Net Sales at Constant Currency (1) $436.5 $398.2 Gross Profit Margin 31.4% 31.4% Reported Operating Profit $60.8 $62.9 Adjusted Operating Profit (1) $63.1 $62.9 Reported-Diluted EPS $0.73 $0.67 Adjusted-Diluted EPS (1) $0.76 $0.67 (1) “Net sales at constant currency”, “adjusted operating profit”, and “adjusted-diluted EPS” are Non-GAAP measures. See slides 12-16 and the discussion under the heading “Non-GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. Except as noted, statements in these slides concerning comparative sales are measured on a constant currency basis. 7

Change in Consolidated Net Sales Third-quarter 2017 to 2018 ($ millions) $6.4 $37.4 ($4.8) ($5.5) $431.7 $398.2 2017 Volume & Mix Sales Price Currency Consumer 2018 8

Gross Profit Update ($ millions) Three Months Ended September 30, 2018 2017 Proprietary Products: Gross Profit $120.4 $110.6 Gross Profit Margin 37.0% 35.8% Contract-Manufactured Products: Gross Profit $15.2 $14.5 Gross Profit Margin 14.3% 16.3% Consolidated Gross Profit $135.6 $125.1 Consolidated Gross Profit Margin 31.4% 31.4% 9

Cash Flow and Balance Sheet Metrics ($ millions) CASH FLOW ITEMS (UNAUDITED) (in millions) Nine Months Ended September 30, 2018 2017 Depreciation and amortization $78.1 $71.8 Operating cash flow $215.4 $181.8 Capital expenditures $74.7 $101.3 FINANCIAL CONDITION (UNAUDITED) (in millions) As of As of September 30, 2018 December 31, 2017 Cash and cash equivalents $297.3 $235.9 Debt $196.2 $197.0 Equity $1,351.8 $1,279.9 Working capital $561.3 $464.0 10

Full-Year 2018 Guidance ▪ Reaffirming full-year 2018 reported net sales guidance range of $1.720 billion to $1.730 billion* ▪ Reaffirming full-year 2018 adjusted-diluted EPS range of between $2.80 to $2.90(1,2) ▪ Capital spending is expected to be in a range of between $110 million to $120 million, compared to a prior range of between $120 million and $130 million * Using an exchange rate of $1.15 per Euro for the remainder of the year. (1) Please refer to “Notes to Non-GAAP Financial Measures” on slides 12-16, and “Non-GAAP Financial Measures” in today’s press release, for additional information regarding adjusted diluted EPS. (2) Guidance excludes possible cost and benefits from the announced Global Operations restructuring plan, the impact of tax law changes and the Argentina currency devaluation. 11

Notes to Non-GAAP Financial Measures For additional details, please see today’s press release & Safe Harbor Statement Today’s press release, these presentation materials and associated presentation use the following financial measures that have not been calculated in accordance with generally accepted accounting principles (GAAP) accepted in the U.S., and therefore are referred to as non-GAAP financial measures: • Net sales at constant currency (organic sales) • Adjusted operating profit • Adjusted operating profit margin • Adjusted net income • Adjusted income tax expense • Adjusted-diluted EPS West believes that these non-GAAP measures of financial results provide useful information to management and investors regarding business trends, results of operations, and the Company’s overall performance and financial position. Our executive management team uses these financial measures to evaluate the performance of the Company in terms of profitability and efficiency, to compare operating results to prior periods, to evaluate changes in the operating results of each segment, and to measure and allocate financial resources to our segments. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing its financial measures with other companies. Our executive management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in accordance with GAAP. The principal limitation of these financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded. In order to compensate for these limitations, non-GAAP financial measures are presented in connection with GAAP results. We urge investors and potential investors to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate the Company’s business. Net sales at constant currency translates the current-period reported sales of subsidiaries whose functional currency is other than the U.S. dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. In calculating adjusted operating profit, adjusted income tax expense, adjusted net income and adjusted-diluted EPS, we exclude the impact of items that are not considered representative of ongoing operations. Such items generally include restructuring and related costs, certain asset impairments, other specifically identified gains or losses, and discrete income tax items. Please see “Financial Guidance” and “Non-GAAP Financial Measures” in today’s press release for further information concerning reconciling items. 12

Notes to Non-GAAP Financial Measures RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) See “Notes to Non-GAAP Financial Measures” (Slides 12-16), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ million, except EPS data) Operating Income tax Net Diluted Three months ended September 30, 2018 profit expense income EPS Reported (GAAP) $60.8 $8.0 $55.2 $0.73 Restructuring and related charges 1.2 0.3 0.9 0.01 Argentina devaluation 1.1 - 1.1 0.02 Tax law changes - (0.4) 0.4 - Adjusted (Non-GAAP) $63.1 $7.9 $57.6 $0.76 Operating Income tax Net Diluted Nine months ended September 30, 2018 profit expense income EPS Reported (GAAP) $174.5 $26.5 $154.9 $2.05 Restructuring and related charges 6.7 1.5 5.2 0.07 Argentina devaluation 1.1 - 1.1 0.02 Tax law changes - 4.1 (4.1) (0.06) Adjusted (Non-GAAP) $182.3 $32.1 $157.1 $2.08 13

Notes to Non-GAAP Financial Measures RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) See “Notes to Non-GAAP Financial Measures” (Slides 12-16), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ million, except EPS data) Income tax Net Nine months ended September 30, 2017 Operating profit expense income Diluted EPS Reported (GAAP) $165.5 $19.1 $150.7 $1.99 Venezuela deconsolidation 11.1 - 11.1 0.15 Adjusted (Non-GAAP) $176.6 $19.1 $161.8 $2.14 14

Notes to Non-GAAP Financial Measures RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) See “Notes to Non-GAAP Financial Measures” (Slides 12-16), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Net Sales to Net Sales at Constant Currency (1) ($ million, except EPS data) Three months ended September 30, 2018 Proprietary CM Eliminations Total Reported net sales (GAAP) $325.2 $106.7 $(0.2) $431.7 Effect of changes in currency translation rates 4.3 0.5 - 4.8 Net sales at constant currency (Non-GAAP) (1) $329.5 $107.2 $(0.2) $436.5 Nine months ended September 30, 2018 Proprietary CM Eliminations Total Reported net sales (GAAP) $997.4 $297.7 $(0.2) $1,294.9 Effect of changes in currency translation rates (30.5) (6.0) - (36.5) Net sales at constant currency (Non-GAAP) (1) $966.9 $291.7 $(0.2) $1,258.4 (1) Net sales at constant currency translates the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. 15

Notes to Non-GAAP Financial Measures RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) See “Notes to Non-GAAP Financial Measures” (Slides 12-16), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported-Diluted EPS Guidance to Adjusted-Diluted EPS guidance Full Year 2018 Guidance(1) (2) Reported-diluted EPS guidance $2.71 to $2.86 Restructuring and related charges 0.08 to 0.13 Argentina devaluation 0.02 Tax law changes (0.06) Adjusted-diluted EPS guidance $2.80 to $2.90 (1) Please refer to “Notes to Non-GAAP Financial Measures” on slides 12 and 13, and “Non-GAAP Financial Measures” in today’s press release, for additional information regarding adjusted diluted EPS. (2) Guidance includes various currency exchange rate assumptions, most significantly the euro at $1.15 for the remainder of 2018. Actual results will vary as a result of exchange rate variability. 16