Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra1025188-kxearningsprese.htm |

Kraton Corporation Third Quarter 2018 Earnings Presentation October 25, 2018

Disclaimers Forward Looking Statements Some of the statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation includes forward-looking statements that reflect our plans, beliefs, expectations, and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often identified by words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans”, “on track” “on trend”, or “anticipates,” or by discussions of strategy, plans or intentions, including our expectations regarding our Panama City, Florida and Wesseling, Germany sites, logistics costs and global tariffs, as well as all matters described on the slide titled “2018 Modeling Assumptions” and our expectations for targeted debt reduction and 2018 Adjusted EBITDA.. All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and unknown risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed in forward-looking statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: Kraton's ability to repay its indebtedness; Kraton's reliance on third parties for the provision of significant operating and other services; conditions in the global economy and capital markets; fluctuations in raw material costs; limitations in the availability of raw materials; competition in Kraton's end-use markets; natural disasters and weather conditions and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on our forward- looking statements. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update such information in light of new information or future events. Kraton Third Quarter 2018 Earnings Call 2

Disclaimers GAAP Disclaimer This presentation includes the use of non-GAAP financial measures, as defined below. Tables included in this presentation reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see our Annual Report on Form 10-K for the fiscal year ended December 31, 2017. We consider these non-GAAP financial measures to be important supplemental measures in the evaluation of our absolute and relative performance. However, we caution that these non-GAAP financial measures have limitations as analytical tools and may vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States. EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes, depreciation and amortization. For each reporting segment, EBITDA represents operating income before depreciation and amortization, disposition and exit of business activities and earnings of unconsolidated joint ventures. Among other limitations, EBITDA does not: reflect the significant interest expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements since it calculation differs in such agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated bases, as applicable). Adjusted Gross Profit and Adjusted Gross Profit Per Ton: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume (for each reporting segment or on a consolidated basis, as applicable). We define Adjusted Gross Profit as gross profit excluding certain charges and expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Certain amounts reported in the prior periods have been reclassified to conform to the current reporting presentation. Adjusted Diluted Earnings Per Share: Adjusted Diluted Earnings Per Share is Diluted Earnings (Loss) Per Share excluding the impact of a number of non- recurring items we do not consider indicative of our on-going performance. Net Debt and Consolidated Net Debt: Net debt for Kraton is total debt (excluding debt of KFPC due to its own capital structure) less cash and cash equivalents. Consolidated net debt is Kraton net debt plus debt of Kraton Formosa Polymers (KFPC) joint venture less KFPC’s cash and cash equivalents. Management believes that net debt is useful to investors in determining our leverage since we could choose to use cash and cash equivalents to satisfy our debt obligations. Consolidated Net Debt Leverage Ratio: The consolidated net debt leverage ratio is defined as consolidated net debt as of the balance sheet date dividedby Adjusted EBITDA for the twelve months then ended. Our use of this term may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Kraton Third Quarter 2018 Earnings Call 3

Third Quarter 2018 Summary . The decline in Q3’18 Adjusted EBITDA(1) from $121.7 million in Q3’17 to $98.7 million reflects: . Lower sales in non-core paving markets and to a lesser extent, Polymer segment adhesive markets . Impact of unplanned outages in Belpre and Berre . Higher operating costs, including transportation and logistics costs . Margin preservation through “Price Right” . Chemical unit margins improved vs. Q3’17 . Performance Product margins in line with Q3’17 . Maintained target margins in Specialty Polymers, albeit down vs. strong Q3’17 which benefitted from falling raw material prices . Full year 2018 Adjusted EBITDA(1)(2) expected to be approximately $380 million . Reflects Q3’18 results . Near-term global demand uncertainty . Estimated delay in startup at Wesseling (raw material availability) . Excludes Panama City impact (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) We have not reconciled Adjusted EBITDA guidance to net income (loss) because we do not provide guidance for net income (loss) or for items that we do not consider indicative of our on-going performance, including, but not limited to, transaction costs and production downtime, as certain of these items are out of our control and/or cannot be reasonably predicted. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding U.S. GAAP measures is not available without unreasonable effort. Kraton Third Quarter 2018 Earnings Call 4

Polymer Segment - Third Quarter 2018 Results ($ In millions, except volume) . Volume decline in Q3’18 predominately confined to paving and roofing outside of North America and Europe . YTD volume up in Specialty Polymers, Cariflex, and in North Q3’ 17 Q3’ 18 YTD’17 YTD’18 America and Europe paving and roofing markets Volume (kT) 91.9 84.2 258.1 249.5 . Q3’17 Adjusted EBITDA(1) benefitted from a significant decline in butadiene costs Revenue $314.2 $321.0 $920.2 $948.2 . Impact, therefore, is a decline in Specialty Polymer margins . Overall unit margins, however, remain in line with Operating income $18.7 $44.9 $98.3 $137.9 expectations . Higher Q3’18 and operating costs included unplanned outages (Ohio and France), logistics, and transportation Adjusted EBITDA(1) and . YTD’18 Adjusted EBITDA(1) reflects solid unit margins, which Adjusted EBITDA Margin(2) mitigated higher costs including unplanned outages, logistics, and transportation costs $250.0 . YTD Adjusted Gross Profit(1) per ton of $1,019 ($980 in Q3 2018) $200.0 vs. $987 in YTD‘17 ($1,154 in Q3'17) $150.0 Global Butadiene Price(3) and Kraton HSBC Margin $100.0 $172.2 $170.5 $50.0 $77.4 $57.0 $‐ Q3'17 Q3'18 YTD'17 YTD'18 Adj. EBITDA (2) Margin 24.6% 17.8% 18.7% 18.0% Kraton SEBS margin/mT Global BD - USD/mT Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. (3) Source: IHS Markit and Kraton Corporation Kraton Third Quarter 2018 Earnings Call 5

Chemical Segment - Third Quarter 2018 Results ($ In millions, except volume) Q3’ 17 Q3’ 18 YTD’17 YTD’18 . Sales volume in line with Q3’17 with YTD growth driven by 4.1% growth in Performance Chemicals Volume (kT) 107.8 105.9 327.5 332.7 partially offset by 3.3% decline in Adhesives sales Revenue $196.8 $202.1 $574.2 $615.7 volume Operating income $23.6 $27.5 $66.6 $79.4 . Unit margins improved in Q3’18 vs Q3’17 . Higher average pricing for TOFA, TOFA derivatives and other high value products . Tire business performing well Adjusted EBITDA(1) and . Adhesives margins in-line sequentially Adjusted EBITDA Margin(2) . Q3’18 Adjusted EBITDA(1) reflects the increase in core unit margins offset by higher operating costs, including $140.0 planned maintenance, logistics and transportation $120.0 $100.0 . YTD’18 Adjusted EBITDA(1) up $5.9 million or 5.1% on $80.0 improved margins, partially offset by higher costs, $60.0 $116.5 $122.4 including costs for planned maintenance, and $40.0 transportation and logistics costs $20.0 $44.3 $41.6 . Maintaining 20% Adjusted EBITDA(1) margins $‐ Q3'17 Q3'18 YTD'17 YTD'18 Adj. EBITDA Margin(2) 22.5% 20.6% 20.3% 19.9% (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. Kraton Third Quarter 2018 Earnings Call 6

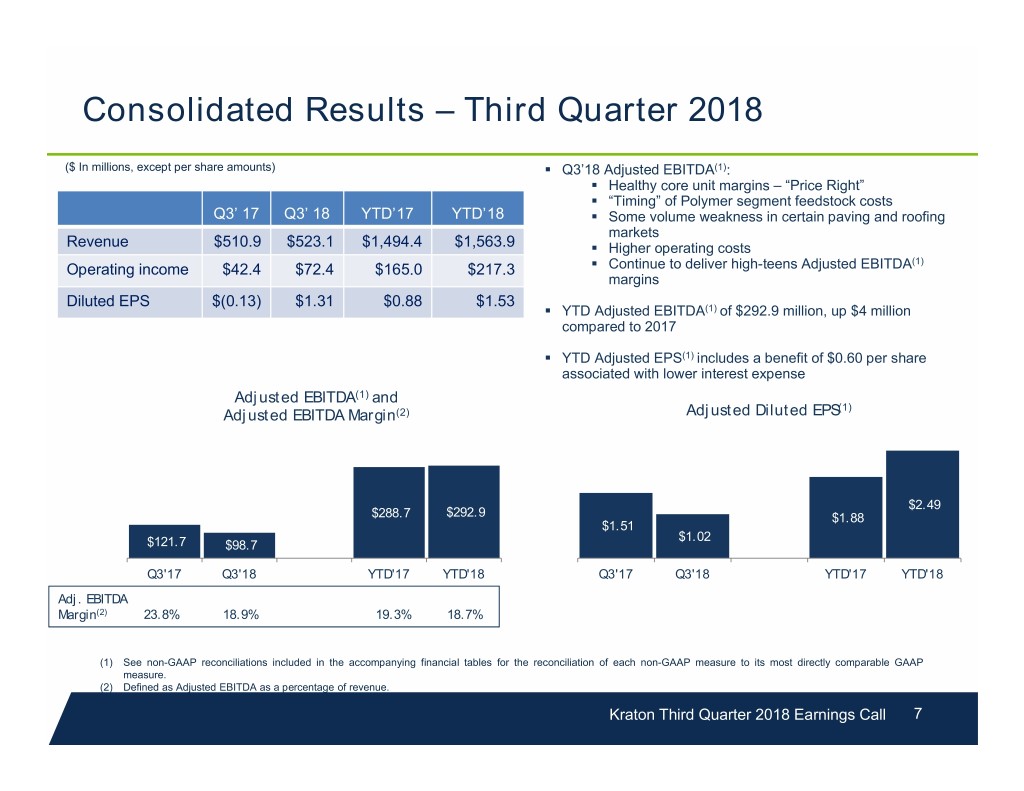

Consolidated Results – Third Quarter 2018 ($ In millions, except per share amounts) . Q3’18 Adjusted EBITDA(1): . Healthy core unit margins – “Price Right” . “Timing” of Polymer segment feedstock costs Q3’ 17 Q3’ 18 YTD’17 YTD’18 . Some volume weakness in certain paving and roofing markets Revenue $510.9 $523.1 $1,494.4 $1,563.9 . Higher operating costs (1) Operating income $42.4 $72.4 $165.0 $217.3 . Continue to deliver high-teens Adjusted EBITDA margins Diluted EPS $(0.13) $1.31 $0.88 $1.53 . YTD Adjusted EBITDA(1) of $292.9 million, up $4 million compared to 2017 . YTD Adjusted EPS(1) includes a benefit of $0.60 per share associated with lower interest expense Adjusted EBITDA(1) and (1) Adjusted EBITDA Margin(2) Adjusted Diluted EPS $3.00 $375.0 $2.50 $325.0 $275.0 $2.00 $225.0 $1.50 $175.0 $2.49 $288.7 $292.9 $1.00 $1.88 $125.0 $1.51 $0.50 $75.0 $1.02 $121.7 $98.7 $25.0 $‐ Q3'17 Q3'18 YTD'17 YTD'18 Q3'17 Q3'18 YTD'17 YTD'18 Adj. EBITDA Margin(2) 23.8% 18.9% 19.3% 18.7% (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. Kraton Third Quarter 2018 Earnings Call 7

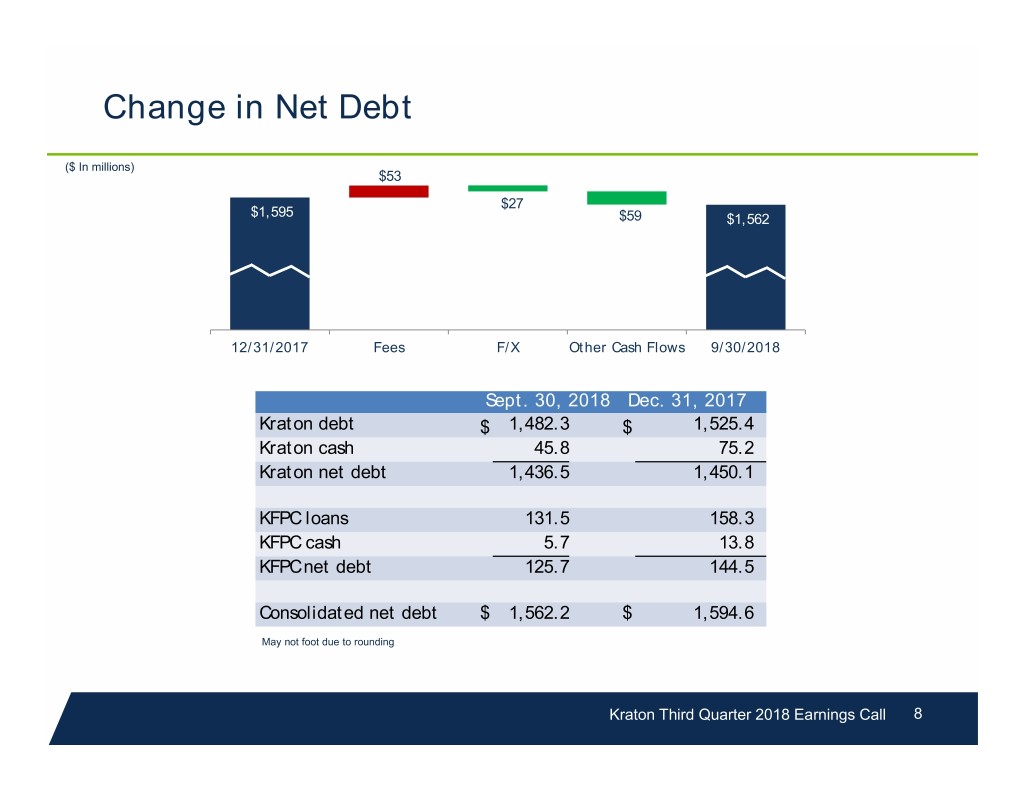

Change in Net Debt ($ In millions) $53 $27 $1,595 $1,563$59 $1,562 12/31/2017 Fees F/X Other Cash Flows 9/30/2018 Sept. 30, 2018 Dec. 31, 2017 Kraton debt $ 1,482.3 $ 1,525.4 Kraton cash 45.8 75.2 Kraton net debt 1,436.5 1,450.1 KFPC loans 131.5 158.3 KFPC cash 5.7 13.8 KFPC net debt 125.7 144.5 Consolidated net debt $ 1,562.2 $ 1,594.6 May not foot due to rounding Kraton Third Quarter 2018 Earnings Call 8

Appendix

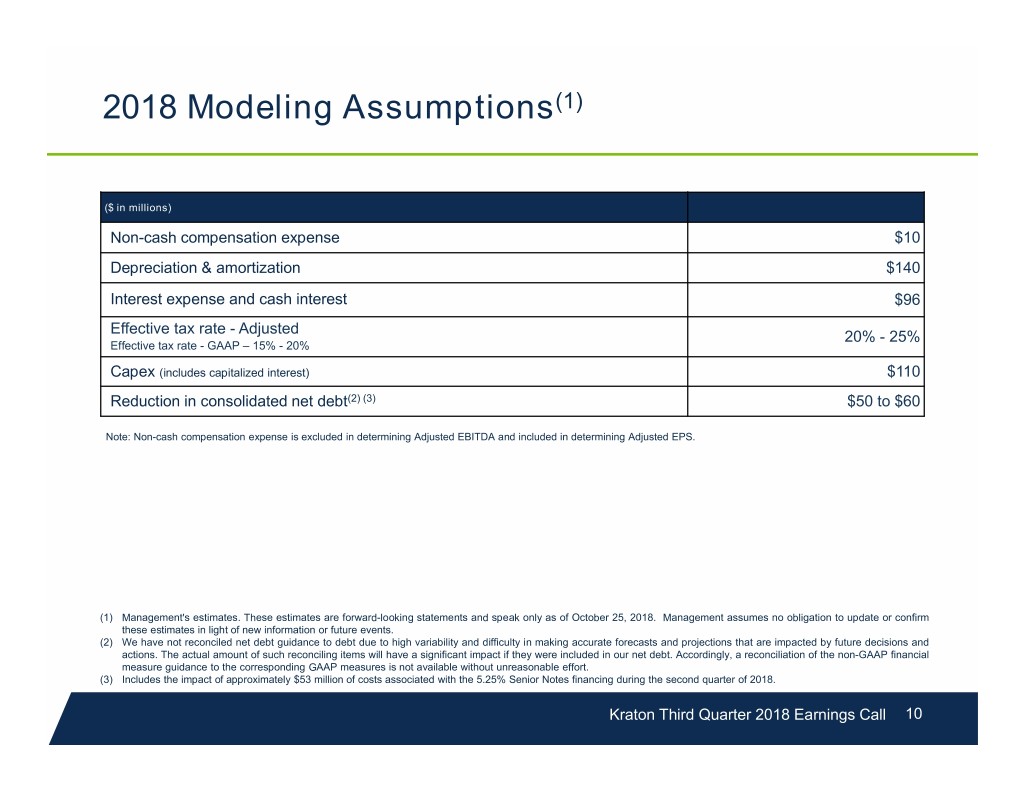

2018 Modeling Assumptions(1) ($ in millions) Non-cash compensation expense $10 Depreciation & amortization $140 Interest expense and cash interest $96 Effective tax rate - Adjusted 20% - 25% Effective tax rate - GAAP – 15% - 20% Capex (includes capitalized interest) $110 Reduction in consolidated net debt(2) (3) $50 to $60 Note: Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS. (1) Management's estimates. These estimates are forward-looking statements and speak only as of October 25, 2018. Management assumes no obligation to update or confirm these estimates in light of new information or future events. (2) We have not reconciled net debt guidance to debt due to high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. The actual amount of such reconciling items will have a significant impact if they were included in our net debt. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP measures is not available without unreasonable effort. (3) Includes the impact of approximately $53 million of costs associated with the 5.25% Senior Notes financing during the second quarter of 2018. Kraton Third Quarter 2018 Earnings Call 10

Polymer Segment - Revenue by Geography and End Use (TTM September 30, 2018) Segment Revenue by Geography Segment Revenue by End Use Other Medical 18% 16% Asia Pacific Industrial 28% 6% Americas 40% Adhesives & Coatings Paving 6% 21% Personal Care Consumer 10% 2% EMEA 32% Roofing 9% Lubricant Additives Polymod 8% 4% Kraton Third Quarter 2018 Earnings Call 11

Polymer Segment – Product Group Revenue by Geography and End Use (TTM September 30, 2018) CARIFLEX SPECIALTY POLYMERS PERFORMANCE PRODUCTS Revenue by Geography Revenue by Revenue by End Revenue by Use Kraton Third Quarter 2018 Earnings Call 12

Chemical Segment - Revenue by Geography and Product Group (TTM September 30, 2018) ADHESIVES PERFORMANCE CHEMICALS TIRES 36% of TTM Revenue 58% of TTM Revenue 6% of TTM Revenue Asia Pacific 11% Asia Pacific Americas Americas 17% 42% 21% Asia Pacific 31% EMEA Americas 34% 55% EMEA 41% EMEA 48% Chemical Segment TTM Revenue Asia Pacific 16% Americas 45% EMEA 39% Kraton Third Quarter 2018 Earnings Call 13

Polymer Reconciliation of Gross Profit to Adjusted Gross Profit Three Months Three Months Nine Months Nine Months Ended September Ended September Ended September Ended September 30, 2018 30, 2017 30, 2018 30, 2017 (In thousands) Gross profit $ 90,202 $ 67,308 $ 281,407 $ 242,807 Add (deduct): Restructuring and other charges (a) —1,028—6,528 Weather related costs (b) — 760 — 760 KFPC startup costs (c) —2,341—7,662 Non-cash compensation expense 149 133 457 442 Spread between FIFO and ECRC (7,771) 34,451 (27,711) (3,431) Adjusted gross profit (non-GAAP) $ 82,580 $ 106,021 $ 254,153 $ 254,768 Sales volume (kilotons) 84.2 91.9 249.5 258.1 Adjusted gross profit per ton $ 980 $ 1,154 $ 1,019 $ 987 a) Severance expenses and other restructuring related charges. b) Costs related to Hurricane Harvey and Hurricane Irma. c) Startup costs related to the joint venture company, KFPC. Kraton Third Quarter 2018 Earnings Call 14

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Three Months Ended September 30, 2018 Three Months Ended September 30, 2017 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income (loss) attributable to Kraton $ 42,349 $(4,033) ) Net income (loss) attributable to noncontrolling interest 928 (818) Consolidated net income (loss) 43,277 (4,851) Add (deduct): Income tax expense (benefit) 8,334 (2,165) Interest expense, net 20,143 33,017 Earnings of unconsolidated joint venture (100) (125) Loss on extinguishment of debt — 15,632 Other expense 740 846 Operating income $ 44,899 $ 27,495 72,394 $ 18,731 $ 23,623 42,354 Add (deduct): Depreciation and amortization 17,554 17,563 35,117 17,342 16,965 34,307 Other income (expense) (958) 218 (740) (929) 83 (846) Loss on extinguishment of debt — — — (15,632) — (15,632) Earnings of unconsolidated joint venture 100 — 100 125 — 125 EBITDA 61,595 45,276 106,871 19,637 40,671 60,308 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (a) 689 (177) 512 2,240 61 2,301 Loss on extinguishment of debt — — — 15,632 — 15,632 Weather related costs (b) — — — 760 1,320 2,080 KFPC startup costs (c) — — — 2,424 — 2,424 Non-cash compensation expense 2,495 — 2,495 2,219 — 2,219 Spread between FIFO and ECRC (7,771) (3,456) (11,227) 34,451 2,272 36,723 Adjusted EBITDA $ 57,008 $ 41,643 $ 98,651 $ 77,363 $ 44,324 $ 121,687 a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. b) Costs related to Hurricane Harvey and Hurricane Irma c) Startup costs related to the joint venture company, KFPC Kraton Third Quarter 2018 Earnings Call 15

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Nine Months Ended September 30, 2018 Nine Months Ended September 30, 2017 Polymer Chemical Total Polymer Chemical(f) Total (In thousands) Net income attributable to Kraton $ 49,491 $ 27,941 Net income (loss) attributable to noncontrolling interest 1,743 (5,178) Consolidated net income 51,234 22,763 Add (deduct): Income tax expense 8,743 2,907 Interest expense, net 74,835 101,766 Earnings of unconsolidated joint venture (357) (370) Loss on extinguishment of debt 79,921 35,370 Other expense 2,960 2,517 Operating income $ 137,930 $ 79,406 217,336 $ 98,339 $ 66,614 164,953 Add (deduct): Depreciation and amortization 52,914 52,719 105,633 50,439 51,601 102,040 Other income (expense) (3,600) 640 (2,960) (2,767) 250 (2,517) Loss on extinguishment of debt (79,921) — (79,921) (35,370) — (35,370) Earnings of unconsolidated joint venture 357 — 357 370 — 370 EBITDA 107,680 132,765 240,445 111,011 118,465 229,476 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (a) 2,062 (963) 1,099 11,493 (509) 10,984 Loss on extinguishment of debt 79,921 — 79,921 35,370 — 35,370 Weather related costs (b) — — — 760 1,320 2,080 KFPC startup costs (c) 897 — 897 9,664 — 9,664 Non-cash compensation expense 7,620 — 7,620 7,366 — 7,366 Spread between FIFO and ECRC (27,711) (9,371) (37,082) (3,431) (2,771) (6,202) Adjusted EBITDA $ 170,469 $ 122,431 $ 292,900 $ 172,233 $ 116,505 $ 288,738 a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. b) Costs related to Hurricane Harvey and Hurricane Irma c) Startup costs related to the joint venture company, KFPC Kraton Third Quarter 2018 Earnings Call 16

Reconciliation of Diluted EPS to Adjusted Diluted EPS Three Months Ended Nine Months Ended September 30, September 30, 2018 2017 2018 2017 Unaudited Diluted Earnings (Loss) Per Share $ 1.31 $ (0.13 ) $ 1.53 $ 0.88 Transaction, acquisition related costs, restructuring, and other costs (a) 0.02 0.05 0.03 0.25 Loss on extinguishment of debt - 0.32 1.89 0.72 Weather-related costs (b) - 0.04 - 0.04 KFPC startup costs (c) - 0.04 0.01 0.16 Spread between FIFO and ECRC (0.31 ) 1.19 (0.97 ) (0.17 ) Adjusted Diluted Earnings Per Share (non-GAAP) $ 1.02 $ 1.51 $ 2.49 $ 1.88 a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. b) Costs related to Hurricane Harvey and Hurricane Irma. c) Startup costs related to the joint venture company, KFPC. Kraton Third Quarter 2018 Earnings Call 17