Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Evoqua Water Technologies Corp. | exhibit993proactproformas.htm |

| EX-99.1 - EXHIBIT 99.1 - Evoqua Water Technologies Corp. | exhibit991proact2017.htm |

| 8-K - 8-K/A - PROACT - Evoqua Water Technologies Corp. | a8-kproact.htm |

PROACT SERVICES CORPORATION AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS’ REVIEW REPORT June 30, 2018 and 2017

PROACT SERVICES CORPORATION AND SUBSIDIARIES CONTENTS Page Independent Auditors’ Review Report 1-2 Consolidated Balance Sheets 3 Consolidated Statements of Operations 4 Consolidated Statement of Stockholders’ Equity 5 Consolidated Statements of Cash Flows 6 Notes to Consolidated Financial Statements 7-14

Independent Auditors' Review Report Board of Directors and Stockholders ProAct Services Corporation We have reviewed the condensed interim consolidated financial statements of ProAct Services Corporation and Subsidiaries, which comprise the balance sheet as of June 30, 2018, and the related consolidated statements of operations and cash flows for the six-month periods ended June 30, 2018 and 2017, the related consolidated statement of stockholders’ equity for the six-month period ended June 30, 2018, and the related notes to the consolidated financial statements. Management’s Responsibility for the Consolidated Financial Information Management is responsible for the preparation and fair presentation of this condensed interim consolidated financial information in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control sufficient to provide a reasonable basis for the preparation and fair presentation of interim consolidated financial information in accordance with accounting principles generally accepted in the United States of America. Auditors’ Responsibility Our responsibility is to conduct our reviews in accordance with auditing standards generally accepted in the United States of America applicable to reviews of interim consolidated financial information. A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with auditing standards generally accepted in the United States of America, the objective of which is the expression of an opinion regarding the consolidatd financial information as a whole. Accordingly, we do not express such an opinion. Conclusion Based on our reviews, we are not aware of any material modifications that should be made to the condensed interim consolidated financial information referred to above in order for it to be in accordance with accounting principles generally accepted in the United States of America. 1

Change in Accounting Principle As described in Note 1, the Company changed its method of accounting for the treatment of mobilization costs and revenues for long-term construction remediation contracts. Our conclusion is not modified with respect to this matter. Report on the Consolidated Balance Sheet on December 31, 2017 We have previously audited, in accordance with auditing standards generally accepted in the United States of America, the consolidated balance sheet of ProAct Services Corporation and Subsidiaries as of December 31, 2017, and the related consolidated statements of income, changes in stockholders’ equity, and cash flows for the year then ended (not presented herein); and we expressed an unmodified audit opinion on those audited consolidated financial statements in our report dated February 19, 2018. As disclosed in Note 1, the Company retrospectively adjusted the 2017 consolidated financial statements for a change in accounting principle related to the treatment of mobilization costs and revenues for long-term construction remediation contracts. In our opinion, the accompanying consolidated balance sheet of ProAct Services Corporation and Subsidiaries as of December 31, 2017 is consistent, in all material respects, with the audited consolidated financial statements from which it has been derived as adjusted. Indianapolis, Indiana October 9, 2018 2

PROACT SERVICES CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS June 30, 2018 and December 31, 2017 ASSETS UNAUDITED ADJUSTED 2018 2017 CURRENT ASSETS Cash $ 13,574 $ 343,373 Accounts receivable, net of allowance for doubtful accounts ($272,167 for 2018 and $280,422 for 2017) 12,548,500 16,058,249 Inventories 2,089,682 2,125,940 Prepaids and other current assets 714,933 962,505 Total Current Assets 15,366,689 19,490,067 OTHER ASSETS Property and equipment, net 22,781,643 21,099,463 Goodwill 14,246,553 14,246,553 Amortizable intangible assets, net 2,559,549 2,756,072 Indefinite lived intangible asset 829,000 829,000 Total Other Assets 40,416,745 38,931,088 TOTAL ASSETS $ 55,783,434 $ 58,421,155 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $ 3,552,520 $ 4,253,009 Accrued payroll and related taxes 921,289 2,132,368 Accrued liabilities and other 1,866,512 2,631,924 Current portion of notes and capital lease obligations payable, net 1,952,368 1,896,380 Total Current Liabilities 8,292,689 10,913,681 LONG-TERM LIABILITIES Line of credit borrowings 13,388,714 11,711,008 Subordinated related party debt 1,750,000 1,750,000 Contingent note payable to seller 1,953,761 1,953,761 Notes and capital lease obligations payable, less current portion 7,863,877 8,513,730 Deferred tax liability 2,396,831 2,590,939 Total Long-term Liabilities 27,353,183 26,519,438 Total Liabilities 35,645,872 37,433,119 STOCKHOLDERS' EQUITY Common stock; no par value, 30,000,000 shares authorized and 18,452,789 (18,552,789 for 2017) shares issued and outstanding 18,452,789 18,552,789 Retained earnings 1,684,773 2,435,247 Total Stockholders' Equity 20,137,562 20,988,036 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 55,783,434 $ 58,421,155 See accompanying notes. 3

PROACT SERVICES CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Six-Month Periods Ended June 30, 2018 and 2017 UNAUDITED UNAUDITED 2018 2017 NET REVENUES $ 26,062,338 $ 17,665,454 COST OF REVENUES 14,052,400 8,962,454 Gross Profit 12,009,938 8,703,000 GENERAL AND ADMINISTRATIVE EXPENSES 11,444,134 7,584,419 Net Operating Income 565,804 1,118,581 OTHER INCOME (EXPENSE) Interest expense (831,184) (585,417) Amortization expense (197,238) (195,481) Management and board fees (209,660) (205,749) Gain on sales of property and equipment 5,456 Total Other Income (Expense) (1,232,626) (986,647) Net Income (Loss) before Income Taxes (666,822) 131,934 INCOME TAX BENEFIT 103,348 250,131 NET INCOME (LOSS) $ (563,474) $ 382,065 See accompanying notes. 4

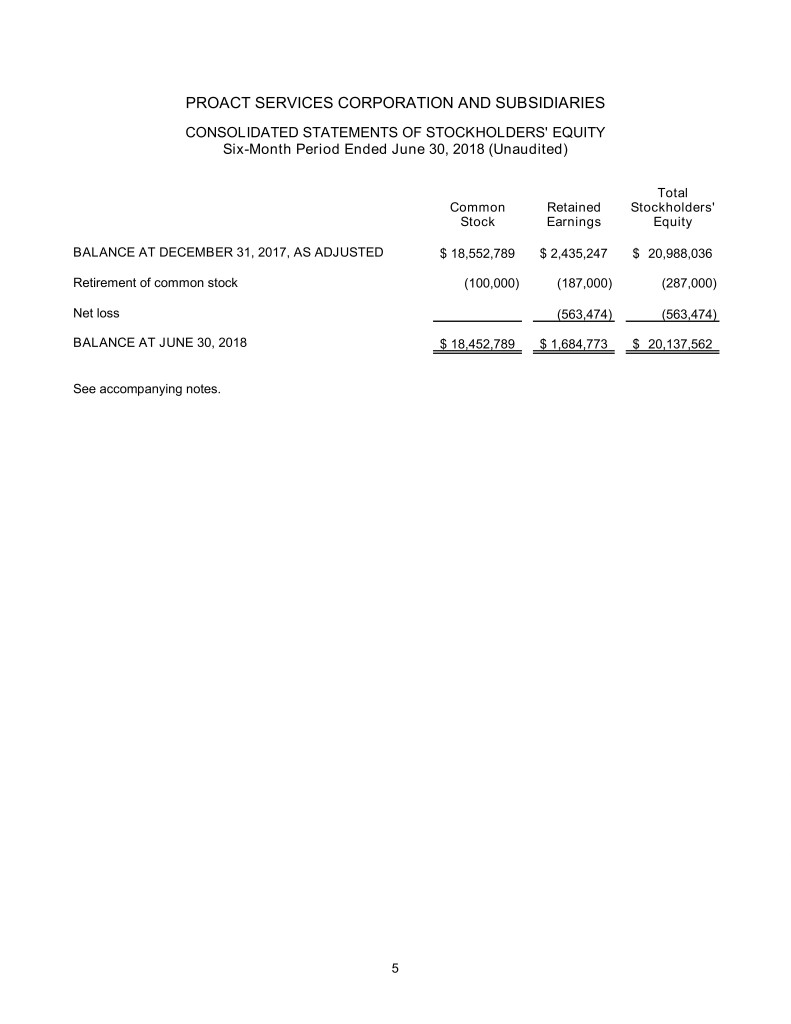

PROACT SERVICES CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Six-Month Period Ended June 30, 2018 (Unaudited) Total Common Retained Stockholders' Stock Earnings Equity BALANCE AT DECEMBER 31, 2017, AS ADJUSTED $ 18,552,789 $ 2,435,247 $ 20,988,036 Retirement of common stock (100,000) (187,000) (287,000) Net loss (563,474) (563,474) BALANCE AT JUNE 30, 2018 $ 18,452,789 $ 1,684,773 $ 20,137,562 See accompanying notes. 5

PROACT SERVICES CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS Six-Month Periods Ended June 30, 2018 and 2017 UNAUDITED UNAUDITED 2018 2017 OPERATING ACTIVITIES Net income (loss) $ (563,474) $ 382,065 Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: Depreciation of property and equipment 2,739,099 1,860,627 (Gain) on sales of property and equipment (5,456) Deferred taxes (194,367) (367,506) Amortization of customer lists 176,525 175,483 Amortization of right of first refusal 19,998 19,998 Debt issuance costs recognized as interest expense 26,167 80,978 (Increase) decrease in certain current assets: Accounts receivable 3,509,749 (3,016,179) Inventories 36,258 (526,753) Prepaids and other current assets 247,572 335,510 Increase (decrease) in certain current liabilities: Accounts payable (700,489) 748,895 Accrued payroll and related taxes (1,211,079) (552,337) Accrued liabilities and other (765,412) (497,643) Net Cash Provided (Used) by Operating Activities 3,315,091 (1,356,862) INVESTING ACTIVITIES Business acquisitions (1,075,000) Proceeds from sales of property and equipment 32,106 Purchases of property and equipment (4,447,670) (1,807,112) Net Cash Used by Investing Activities (4,415,564) (2,882,112) FINANCING ACTIVITIES Debt issuance costs (40,243) (98,848) Increase in deposits 22,666 Retirement of common stock (287,000) Proceeds from bank line of credit borrowings 17,541,194 11,735,035 Payments on bank line of credit (15,863,488) (14,330,657) Borrowings on long-term debt 422,623 6,901,779 Principal payments on long-term debt (1,002,412) (666,421) Net Cash Provided by Financing Activities 770,674 3,563,554 NET DECREASE IN CASH (329,799) (675,420) CASH Beginning of Period 343,373 682,930 End of Period $ 13,574 $ 7,510 SUPPLEMENTAL DISCLOSURES Cash paid for income taxes $ 117,797 $ 103,100 Cash paid for interest 831,184 644,440 Noncash investing and financing activities: Property and equipment acquired through long-term debt 370,598 Noncash consideration received for sale of capital leases 32,106 See accompanying notes. 6

PROACT SERVICES CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Six-Month Periods Ended June 30, 2018 and 2017 NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Consolidated Financial Statements: The accompanying consolidated financial statements include the balances and transactions of ProAct Services Corporation (ProAct) and its wholly-owned subsidiaries, Carbonair Environmental Systems, Inc. (CarbonAir) and FSI Field Specialties, Inc. (FSI) (collectively, the Company). CarbonAir was acquired by ProAct on December 22, 2015 and FSI was formed in 2016. All material intra-entity balances and transactions have been eliminated from the consolidated financial statements. On July 26, 2018, EWT Holdings III Corp. acquired 100% of the issued and outstanding shares of the Company’s common stock for $132 million. Organization: ProAct is headquartered in Ludington, Michigan with additional locations in Houston, Texas, Edgewater, Florida, and Bordentown, New Jersey. ProAct provides environmental air and water treatment services, customized to meet specific environmental needs. ProAct also leases, manufactures, installs and services environmental treatment equipment. CarbonAir is headquartered in Roseville, Minnesota with additional locations in Jacksonville, Florida, and Salem, Virginia. CarbonAir constructs, rents, and provides services for equipment and granular activated carbon and other filter media for water and air treatment. FSI is headquartered in Carson, California. FSI provides pipeline and storage tank degassing services for customers operating in the oil and gas industry. Estimates: The Company’s management uses estimates and assumptions in preparing the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses. Actual results could vary from those estimates. Change in Accounting Principle: Upon acquisition by EWT Holdings III Corp. on July 26, 2018, the Company retrospectively changed its method of accounting for the treatment of mobilization costs and revenues for its long- term construction remediation contracts. Previously, the Company recorded mobile revenues and costs when incurred. The Company subsequently changed its method of accounting to be consistent with its parent company, and defers all revenues and costs over the lesser of the life of the project or useful life of the built out system. As a result of this change in accounting principle, property and equipment increased by approximately $1,117,000, inventory increased by approximately $319,000, other current assets increased by approximately $158,000, accrued expenses increased by approximately $1,173,000, retained earnings increased by approximately $73,000, and accounts receivable decreased by approximately $349,000 as of December 31, 2017, from amounts previously reported. Revenue Recognition: ProAct recognizes revenues from services when the services are rendered and collectability is reasonably assured. Rates for services are typically per day, per man-hour, or a similar basis. ProAct, CarbonAir, and FSI recognize revenue for equipment sales at the time of the sale or shipment to the customer. 7

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) CarbonAir leases equipment to customers on operating leases. These leases are generally for one week to six month periods, with the average of approximately 30 days. Revenues from these leases are recognized ratably over the term of the lease. Direct costs related to this income include the cost of mobilization, maintenance, depreciation and other costs and supplies. Cash: The Company maintains its cash in bank deposit accounts which, at times, may exceed federally insured limits. The Company has not experienced any losses in such accounts. Receivables and Credit Policies: Accounts receivable represent uncollateralized customer obligations due under normal trade terms requiring payment within 30 to 120 days from the invoice date. No interest is applied to past due accounts. Accounts receivable are stated at the amount billed to the customer. Unbilled accounts receivable are stated at the amount equal to the revenue earned prior to the generation of an invoice and are included on the balance sheet as accounts receivable. Management individually reviews all accounts receivable balances that exceed 60 days from the due date and, based on an assessment of the current creditworthiness, estimates the portion, if any, of the balances that will not be collected. Surety Bonds: The Company, as a condition for entering into certain contracts, had outstanding surety bonds of approximately $2,621,000 at June 30, 2018 and $8,738,000 at December 31, 2017 Inventories are stated at the lower of cost, using the first-in, first-out (FIFO) method, or net realizable value. Property and Equipment are recorded at cost and are depreciated using the straight-line method over the following estimated useful lives: Treatment and rental equipment 3-10 years Shop equipment 10 years Leasehold improvements 20-40 years Vehicles 5-6 years Office furniture and equipment 5-15 years Amortization of assets held under capital lease obligations is included in depreciation expense. Amortizable Intangible Assets consist of acquired customer lists and right of first refusal. Customer lists are being amortized using the straight-line method over a 10 year period, and the right of first refusal is being amortized using the straight-line method over a 5 year period. Long-lived Assets, including the Company’s property and equipment and amortizable intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability is measured by comparison of the carrying amount of an asset to the future net undiscounted cash flows expected to be generated by the related asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount exceeds its fair market value. To date, no adjustments to the carrying value of the Company's long-lived assets have been required. Debt Issuance Costs of $640,905 at June 30, 2018 and $600,905 at December 31, 2017, are being amortized on the effective interest rate method over the term of the related debt and are presented as a reduction of the carrying amount of the related debt. Amortization of the debt issuance costs is reported as interest expense in the consolidated statements of operations. Accumulated amortization totaled $508,505 at June 30, 2018 and $482,338 at December 31, 2017. Related interest expense was $26,167 and $80,978 for the six-month periods ended June 30, 2018 and 2017, respectively. 8

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Goodwill represents the excess of the acquisition cost over the fair value of the net assets acquired in the business combinations. The Company assesses qualitative factors to determine if it is more likely than not that the fair value of the reporting unit related to the goodwill is less than the carrying amount. Since the Company’s assessment determined that it was not more likely than not that the fair value was less than the carrying amount at June 30, 2018, a two-step goodwill impairment test was not required to be performed. See Note 5. Indefinite Lived Intangible Asset represents a brand name that has been determined to have an indefinite life. The Company evaluates a number of factors to determine whether an indefinite life is appropriate, including the competitive environment, market share, brand history, product life cycles, operating plans and the macroeconomic environment in which brands are sold. The Company assesses qualitative factors to determine if it is more likely than not that the fair value of the brand name is less than its carrying amount. Since the Company’s assessment determined it was not more likely than not that the fair value was less than the carrying amount at June 30, 2018, a quantitative impairment test was not required to be performed. Contingent Note Payable to Sellers represents the estimated value of the federal income tax deductions related to the Transaction Bonuses paid by the previous owners (sellers) of ProAct. In accordance with the Transaction, any tax savings the Company realizes as a result of the Transaction Bonuses will be remitted to the sellers. Advertising Costs are expensed as incurred and were insignificant for the periods ended June 30, 2018 and 2017. Sales Tax collected from customers and remitted to government agencies are not included in revenues or costs and expenses. Income Taxes include federal and state income taxes currently payable and deferred income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period of enactment. Deferred income tax expense or benefit represents the change during the period in the deferred tax assets and liabilities. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax asset will not be realized. The Company files a U.S. federal income tax return and various state tax returns. The Company is no longer subject to U.S. federal and state income tax examinations by tax authorities for years before 2014. Subsequent Events: The Company has evaluated the consolidated financial statements for subsequent events occurring through October 9, 2018, the date the consolidated financial statements were available to be issued. See above. NOTE 2 - INVENTORIES Inventories consisted of the following: June 30, December 31, 2018 2017 Raw materials $1,661,301 $1,536,765 Work in progress 428,381 589,175 Total Inventories $2,089,682 $2,125,940 9

NOTE 3 - PROPERTY AND EQUIPMENT Property and equipment consisted of the following: June 30, December 31, 2018 2017 Land $ 100,735 $ 100,735 Machinery and equipment 26,501,362 24,879,987 Leasehold improvements 1,059,275 1,048,571 Vehicles 3,193,921 2,845,923 Office furniture and equipment 898,239 787,393 31,753,532 29,662,609 Less: Accumulated depreciation 12,600,333 9,994,996 19,153,199 19,667,613 Construction in progress 3,628,444 1,431,850 Total Property and Equipment, Net $22,781,643 $21,099,463 NOTE 4 - AMORTIZABLE INTANGIBLE ASSETS Amortizable intangible assets consisted of the following: June 30, 2018 December 31, 2017 Gross Accumulated Gross Accumulated Amount Amortization Amount Amortization Customer lists $3,530,509 $1,082,635 $3,530,509 $906,110 Right of first refusal 200,000 88,325 200,000 68,327 Total $3,730,509 $1,170,960 $3,730,509 $974,437 Estimated amortization expense for each of the next five periods is as follows: $393,051 in 2019 and 2020, $364,718 in 2021, $353,051 in 2022 and 2023. NOTE 5 - GOODWILL The following is a summary of the changes in goodwill during the six-month period ended June 30, 2018 and the year ended December 31, 2017. 2018 2017 Balance at beginning of year or period $14,246,553 $13,409,303 Acquisition of GES 731,000 Acquisition of ThermTech 106,250 Goodwill $14,246,553 $14,246,553 10

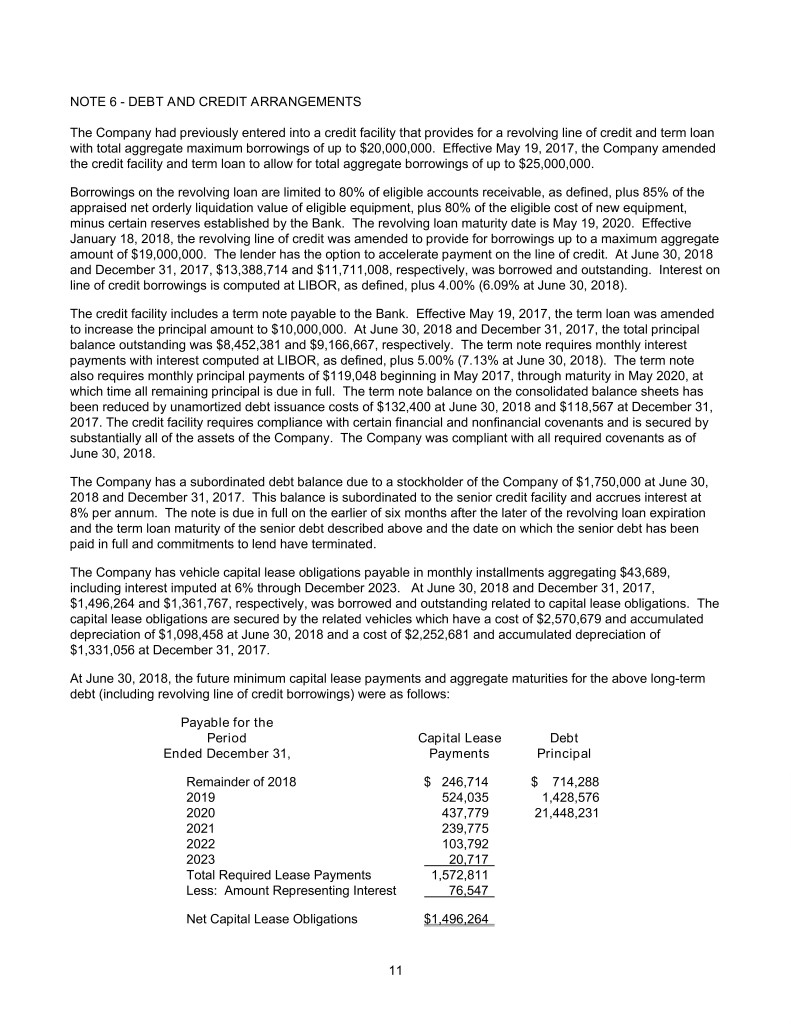

NOTE 6 - DEBT AND CREDIT ARRANGEMENTS The Company had previously entered into a credit facility that provides for a revolving line of credit and term loan with total aggregate maximum borrowings of up to $20,000,000. Effective May 19, 2017, the Company amended the credit facility and term loan to allow for total aggregate borrowings of up to $25,000,000. Borrowings on the revolving loan are limited to 80% of eligible accounts receivable, as defined, plus 85% of the appraised net orderly liquidation value of eligible equipment, plus 80% of the eligible cost of new equipment, minus certain reserves established by the Bank. The revolving loan maturity date is May 19, 2020. Effective January 18, 2018, the revolving line of credit was amended to provide for borrowings up to a maximum aggregate amount of $19,000,000. The lender has the option to accelerate payment on the line of credit. At June 30, 2018 and December 31, 2017, $13,388,714 and $11,711,008, respectively, was borrowed and outstanding. Interest on line of credit borrowings is computed at LIBOR, as defined, plus 4.00% (6.09% at June 30, 2018). The credit facility includes a term note payable to the Bank. Effective May 19, 2017, the term loan was amended to increase the principal amount to $10,000,000. At June 30, 2018 and December 31, 2017, the total principal balance outstanding was $8,452,381 and $9,166,667, respectively. The term note requires monthly interest payments with interest computed at LIBOR, as defined, plus 5.00% (7.13% at June 30, 2018). The term note also requires monthly principal payments of $119,048 beginning in May 2017, through maturity in May 2020, at which time all remaining principal is due in full. The term note balance on the consolidated balance sheets has been reduced by unamortized debt issuance costs of $132,400 at June 30, 2018 and $118,567 at December 31, 2017. The credit facility requires compliance with certain financial and nonfinancial covenants and is secured by substantially all of the assets of the Company. The Company was compliant with all required covenants as of June 30, 2018. The Company has a subordinated debt balance due to a stockholder of the Company of $1,750,000 at June 30, 2018 and December 31, 2017. This balance is subordinated to the senior credit facility and accrues interest at 8% per annum. The note is due in full on the earlier of six months after the later of the revolving loan expiration and the term loan maturity of the senior debt described above and the date on which the senior debt has been paid in full and commitments to lend have terminated. The Company has vehicle capital lease obligations payable in monthly installments aggregating $43,689, including interest imputed at 6% through December 2023. At June 30, 2018 and December 31, 2017, $1,496,264 and $1,361,767, respectively, was borrowed and outstanding related to capital lease obligations. The capital lease obligations are secured by the related vehicles which have a cost of $2,570,679 and accumulated depreciation of $1,098,458 at June 30, 2018 and a cost of $2,252,681 and accumulated depreciation of $1,331,056 at December 31, 2017. At June 30, 2018, the future minimum capital lease payments and aggregate maturities for the above long-term debt (including revolving line of credit borrowings) were as follows: Payable for the Period Capital Lease Debt Ended December 31, Payments Principal Remainder of 2018 $ 246,714 $ 714,288 2019 524,035 1,428,576 2020 437,779 21,448,231 2021 239,775 2022 103,792 2023 20,717 Total Required Lease Payments 1,572,811 Less: Amount Representing Interest 76,547 Net Capital Lease Obligations $1,496,264 11

NOTE 7 - INCOME TAXES Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The primary temporary differences that give rise to the deferred tax assets and liabilities are as follows: depreciation, amortizable intangible assets and net operating loss carryforwards. On December 22, 2017, the 2017 Tax Cuts and Jobs Act was enacted. With the signed tax reform impacting primarily 2018 and future periods, the Federal C corporation tax rate was set at a flat 21% as compared to a tiered system with a top rate of 35% in 2017 and prior periods. As a result of the change in enacted rates, deferred tax liability as of December 31, 2017, was decreased by $639,000. The components of the net deferred tax liability consisted of the following: June 30, December 31, 2018 2017 Net Deferred Tax Asset (Liability): Amortizable intangible assets $ (951,032) $ (978,029) Net operating loss carryforwards 2,625,327 2,405,959 Depreciation (4,267,794) (4,173,578) Other 196,668 154,709 Net Deferred Tax Liability $(2,396,831) $(2,590,939) The components of income tax (benefit) consisted of the following for the six-month periods ended June 30, 2018 and June 30, 2017: 2018 2017 Current: State $ 91,019 $ 117,375 Total Current 91,019 117,375 Deferred: Federal (136,057) (110,252) State (58,310) (257,254) Total Deferred (194,367) (367,506) Income Tax (Benefit) $(103,348) $(250,131) The Company’s effective income tax rate is lower than what would be expected if the federal statutory rate (21%) were applied to net income before income taxes primarily due to certain permanent differences and the change in the federal statutory rate. At June 30, 2018, the Company had available net operating loss carryforwards of approximately $8.6 million, which may be applied against future taxable income and which start to expire in 2034. Management believes that the Company’s income tax filing positions will be sustained on audit and does not anticipate any adjustments that will result in a material change. Therefore, no reserve for uncertain income tax positions has been recorded. The Company’s policy for recording interest and penalties, if any, associated with income tax examinations is to record such items as a component of income taxes. 12

NOTE 8 - RELATED PARTY TRANSACTIONS The Company pays management fees and board of directors’ fees to Hammond, Kennedy, Whitney & Company, Inc. (“HKW”). HKW is affiliated with the majority stockholder of the Company. Management, board fees, and reimbursable expenses totaled $209,660 and $205,749 for the six-month periods ended June 30, 2018 and 2017, respectively. The Company paid professional fees to HKW and entities associated with HKW as part of the acquisitions (see Note 12). As of June 30, 2018 and December 31, 2017, there are no amounts payable to HKW or affiliated entities. The Company leases office space from related parties. See Note 9. NOTE 9 - COMMITMENTS AND CONTINGENCIES Commitments: The Company rents office space and vehicles and equipment under long-term noncancellable operating leases, which include various renewal options and escalation clauses. The leases require monthly payments ranging from $410 to $18,500 at June 30, 2018, and have expiration dates ranging from July 2020 through February 2025. Rent expense paid pursuant to all operating leases was $424,521 and $381,268 for the six-month periods ended June 30, 2018 and 2017, respectively, which includes rent expense paid to related parties of $171,210 and $169,512, respectively. At June 30, 2018, the future minimum rental payments required by all long-term noncancellable operating leases are as follows: Payable for the Period Related Ended December 31, Parties Other Total Remainder of 2018 $171,210 $ 253,311 $ 424,521 2019 288,210 471,105 759,315 2020 420,700 420,700 2021 368,562 368,562 2022 313,258 313,258 2023 222,000 222,000 Thereafter 240,500 240,500 Total $459,420 $2,289,436 $2,748,856 Contingencies: In the course of normal operations, the Company is subject to various claims and assessments and is involved in various litigation that management intends to vigorously defend. The range of loss, if any, from these potential claims cannot be reasonably estimated. However, management believes the ultimate resolution of these matters will not have a material adverse impact on the Company’s business or financial position. NOTE 10 - EMPLOYEE BENEFIT PLANS The Company sponsors a 401(k) defined contribution retirement plan for the benefit of all of its eligible employees. The Company matches 100% of employee contributions up to 4%. Employer contributions related to this Plan were $204,316 and $168,741 for the six-month periods ended June 30, 2018 and 2017, respectively. The Company has a partially self-funded group health program. The Plan includes $40,000 of special stop-loss insurance per individual with an aggregate limit of $1,380,651 at June 30, 2018, and $842,222 at December 31, 2017. 13

NOTE 10 - EMPLOYEE BENEFIT PLANS (CONTINUED) The Company establishes reserves for health claims by estimating unpaid losses and loss expenses with respect to claims occurring on or before the consolidated balance sheet date. Such estimates include provisions for reported and incurred-but-not-reported claims. The estimates of unpaid losses are established and continually reviewed by the Company using a variety of statistical and analytical techniques. Reserve estimates reflect past claims experience, currently known factors and trends and estimates of future claims trends. Included in accrued expenses is the Company’s estimate of approximately $243,000 and $171,000 incurred-but-not-reported claims at June 30, 2018 and December 31, 2017, respectively. NOTE 11 - CONCENTRATIONS Two customers accounted for approximately 30% of the Company’s total revenue for the six-month period ended June 30, 2018. Two customers accounted for approximately 28% of the Company’s total revenue for the six- month period ended June 30, 2017. One customer accounted for approximately 26% of the Company’s total accounts receivable at June 30, 2018. Two customers accounted for approximately 52% of the Company’s total accounts receivable at December 31, 2017. NOTE 12 - BUSINESS ACQUISITIONS In accordance with the asset purchase agreement, dated January 30, 2017, FSI acquired 100% of the assets of Groundwater and Environment Services, Inc., a Pennsylvania corporation, for $1,075,000. FSI financed the transaction with borrowings on the Company’s revolving line of credit. The acquisition was recorded as a business combination in accordance with FASB ASC 805, Business Combinations, with identifiable assets acquired and liabilities assumed recorded at their estimated fair values on the acquisition date. The following table summarizes the fair values assigned to the assets acquired and liabilities assumed as of the acquisition date, as determined by management: Property and equipment $ 219,000 Goodwill 731,000 Customer lists 125,000 Net Assets Acquired $1,075,000 In accordance with the asset purchase agreement, dated August 25, 2017, ProAct acquired 100% of the assets of ThermTech, Inc., a Texas corporation, for $198,981. ProAct financed the transaction with borrowings on the Company’s line of credit. The purchase price includes $64,242 payment of accounts payable outstanding as the Company was previously a customer of the acquired entity at the time of the acquisition between ProAct and ThermTech. The acquisition was recorded as a business combination in accordance with FASB ASC 805, Business Combinations, with identifiable assets acquired and liabilities assumed recorded at their estimated fair values on the acquisition date. The following table summarizes the fair values assigned to the assets acquired and liabilities assumed as of the acquisition date, as determined by management: Goodwill $106,250 Accounts receivable 28,489 Paydown of accounts payable 64,242 Net Assets Acquired $198,981 14