Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Evoqua Water Technologies Corp. | a2233959zex-32_2.htm |

| EX-32.1 - EX-32.1 - Evoqua Water Technologies Corp. | a2233959zex-32_1.htm |

| EX-31.2 - EX-31.2 - Evoqua Water Technologies Corp. | a2233959zex-31_2.htm |

| EX-31.1 - EX-31.1 - Evoqua Water Technologies Corp. | a2233959zex-31_1.htm |

Use these links to rapidly review the document

FORM 10-K TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the Fiscal Year Ended September 30, 2017 |

||

or |

||

o |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

Commission File Number: 001-38272

EVOQUA WATER TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

46-4132761 (I.R.S. Employer Identification No.) |

|

210 Sixth Avenue Pittsburgh, Pennsylvania (Address of principal executive offices) |

15222 (Zip code) |

(724) 772-0044

(Registrant's telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of each class: | Name of each exchange on which registered: | |

|---|---|---|

| Common Stock, par value $0.01 per share | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the common stock of the Registrant held by non-affiliates of the Registrant on November 2, 2017, based upon the closing price of $20.88 of the Registrant's common stock as reported on the New York Stock Exchange, was $1,388,450,010. The Registrant has elected to use November 2, 2017 as the calculation date, which was the initial trading date of the Registrant's common stock on the New York Stock Exchange, because on March 31, 2017 (the last business day of the Registrant's most recently completed second fiscal quarter), the Registrant was a privately held company.

There were 113,264,709 shares of the registrant's common stock, par value $0.01 per share, outstanding as of November 30, 2017.

1

On January 15, 2014, Evoqua Water Technologies Corp. (formerly EWT Holdings I Corp.), or the "Successor," acquired, through its wholly-owned entities, EWT Holdings II Corp. and EWT Holdings III Corp., all of the outstanding shares of Siemens Water Technologies (the "Predecessor"), a group of legal entity businesses formerly owned by Siemens Aktiengesellschaft ("Siemens"). This acquisition, which we refer to as the "Acquisition," closed on January 15, 2014 and was effective January 16, 2014. The stock purchase price, net of cash received, was approximately $730.6 million.

Unless otherwise indicated or the context otherwise requires, all references to "the Company," "Evoqua," "Evoqua Water Technologies Corp.," "EWT Holdings I Corp.," "we," "us," "our" and similar terms mean (1) the Predecessor for periods ending on or prior to January 15, 2014 and (2) the Successor for periods beginning on or after January 16, 2014, in each case together with its consolidated subsidiaries.

Our fiscal year ends on September 30 of each year. References in this Annual Report on Form 10-K to a fiscal year mean the year in which that fiscal year ends. References in this Annual Report on Form 10-K to: "fiscal 2013" or "FY 2013" relate to the fiscal year ended September 30, 2013, "fiscal 2014" or "FY 2014" relate to the fiscal year ended September 30, 2014, "fiscal 2015" or "FY 2015" relate to the fiscal year ended September 30, 2015, "fiscal 2016" or "FY 2016" relate to the fiscal year ended September 30, 2016 and "fiscal 2017" or "FY 2017" relate to the fiscal year ended September 30, 2017.

Numerical figures included in this Annual Report on Form 10-K have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. In addition, we round certain percentages presented in this Annual Report on Form 10-K to the nearest whole number. As a result, figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). You can generally identify forward-looking statements by our use of forward-looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "projection," "seek," "should," "will" or "would" or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including growth of our various markets, and our expectations, beliefs, plans, strategies, objectives, prospects, assumptions, or future events or performance contained in this Annual Report on Form 10-K in Item 1A, "Risk Factors," Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Item 1, "Business" are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this Annual Report on Form 10-K in Item 1, "Business," Item 1A, "Risk Factors" and Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements, or could affect our share price. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

- •

- general global economic and business conditions;

- •

- our ability to compete successfully in our markets;

- •

- our ability to continue to develop or acquire new products, services and solutions and adapt our business to meet the demands of our customers,

comply with changes to government regulations and achieve market acceptance with acceptable margins;

- •

- our ability to implement our growth strategy, including acquisitions and our ability to identify suitable acquisition targets;

- •

- our ability to operate or integrate any acquired businesses, assets or product lines profitably or otherwise successfully implement our growth

strategy;

- •

- delays in enactment or repeals of environmental laws and regulations;

- •

- the potential for us to become subject to claims relating to handling, storage, release or disposal of hazardous materials;

- •

- risks associated with product defects and unanticipated or improper use of our products;

- •

- the potential for us to incur liabilities to customers as a result of warranty claims of failure to meet performance guarantees;

- •

- our ability to meet our customers' safety standards or the potential for adverse publicity affecting our reputation as a result of incidents

such as workplace accidents, mechanical failures, spills, uncontrolled discharges, damage to customer or third-party property or the transmission of contaminants or diseases;

- •

- litigation, regulatory or enforcement actions and reputational risk as a result of the nature of our business or our participation in large-scale projects;

3

- •

- seasonality of sales and weather conditions;

- •

- risks related to government customers, including potential challenges to our government contracts or our eligibility to serve government

customers;

- •

- the potential for our contracts with federal, state and local governments to be terminated or adversely modified prior to completion;

- •

- risks related to foreign, federal, state and local environmental, health and safety laws and regulations and the costs associated therewith;

- •

- risks associated with international sales and operations, including our operations in China;

- •

- our ability to adequately protect our intellectual property from third-party infringement;

- •

- our increasing dependence on the continuous and reliable operation of our information technology systems;

- •

- risks related to our substantial indebtedness;

- •

- our need for a significant amount of cash, which depends on many factors beyond our control;

- •

- risks related to AEA Investors LP's (along with certain of its affiliates, collectively, "AEA") ownership interest in us; and

- •

- other risks and uncertainties, including those listed under Item 1A, "Risk Factors."

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements contained in this Annual Report on Form 10-K, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Annual Report on Form 10-K speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report on Form 10-K.

4

History and Company Overview

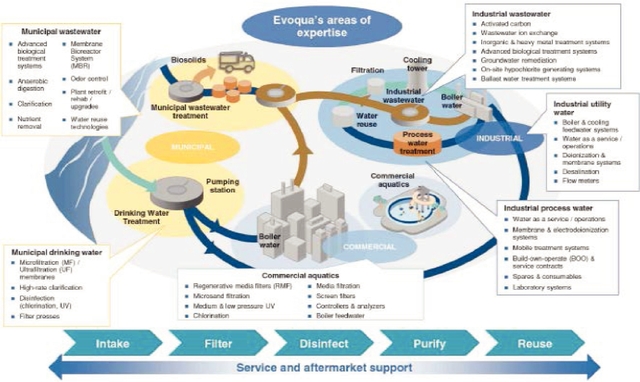

Evoqua Water Technologies is a leading provider of mission critical water treatment solutions, offering services, systems and technologies to support our customers' full water lifecycle needs. With over 200,000 installations worldwide, we hold leading positions in the industrial, commercial and municipal water treatment markets in North America. We offer a comprehensive portfolio of differentiated, proprietary technology solutions sold under a number of market leading and well established brands. We deliver and maintain these mission critical solutions through the largest service network in North America, assuring our customers continuous uptime with 87 branches which are located no further than a two hour drive from more than 90% of our customers' sites.

Our solutions are designed to provide "worry free water" by ensuring that our customers have access to an uninterrupted quantity and level of quality of water that meets their unique product, process and recycle or reuse specifications. We enable our customers to achieve lower costs through greater uptime, throughput and efficiency in their operations and support their regulatory compliance and environmental sustainability. We have worked to protect water, the environment and our employees for over 100 years. As a result, we have earned a reputation for quality, safety and reliability and are sought out by our customers to solve the full range of their water treatment needs, and maintaining our reputation is critical to the success of our business.

We provide solutions across the entire water cycle. The water cycle begins with "influent" water, which is sourced from oceans, rivers, lakes, as well as other sources. We treat the influent water so that it can be used for a wide variety of industrial, commercial and municipal applications. In industrial applications, influent water, after it is treated, is used as process water for applications, such as microelectronic production, as an ingredient in the production of food and beverage and other goods and in utility applications including boiler feed water, cooling water and steam condensate. Commercial applications for influent water include laboratory testing and aquatic activities, while municipal applications for influent water include treatment to produce safe drinking water and wastewater that is compliant with applicable regulations. After the water is used it is considered "effluent water," and we

5

enable its treatment through the removal of impurities so that it can be discharged safely back into the environment or reused for industrial, commercial or municipal applications.

We have developed a broad set of well established, unique relationships across a highly diverse customer base. In the industrial market we serve over 25,000 customers, including a substantial majority of the industrial companies within the Fortune 500. We partner with our industrial customers through our direct sales and service team, which is organized geographically and by specific end market. In the municipal market we serve over 7,800 U.S. wastewater sites and over 1,800 global drinking water treatment sites, providing solutions that help treat over 40% of the U.S. municipal wastewater sites as of September 30, 2017. Our deep institutional relationships with independent sales representatives across North America, who serve as the primary channel for new municipal water treatment projects, and upon whom we depend to successfully market and sell our products, services and solutions provide us significant access to new projects up for bid and for servicing our installed base.

For the fiscal year ended September 30, 2017, we generated 86% of our revenues in North America with a strong and growing international presence and we currently employ approximately 4,000 individuals across eight countries. For the fiscal year ended September 30, 2017, we generated revenue, net income and Adjusted EBITDA of $1.2 billion, $6.4 million and $207.7 million, respectively. For the fiscal year ended September 30, 2016, we generated revenue, net income and Adjusted EBITDA of $1.1 billion, $13.0 million and $160.1 million, respectively. For more information on Adjusted EBITDA, including a reconciliation to the most directly comparable GAAP financial measure, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—How We Assess the Performance of Our Business—Adjusted EBITDA."

We serve our customers through three segments: Industrial, Municipal and Products. These segments all draw from the same reservoir of leading technologies, shared manufacturing infrastructure, common business processes and corporate philosophies. Our Industrial Segment provides fully-integrated systems and service solutions that selectively utilize our comprehensive portfolio of water treatment technologies to satisfy our customers' unique water needs. Our Municipal Segment provides engineered water treatment equipment and solutions based on our proprietary technology and odor and

6

corrosion control services. Our Products Segment sells equipment, based on our broad technology portfolio, which is used as components in integrated solutions specified by water treatment designers and offered by original equipment manufacturers ("OEMs"), engineering firms, integrators and our own Industrial and Municipal Segments. For financial information regarding our reportable segments, see Note 21, "Business Segments," of Part II, Item 8 of this Annual Report on Form 10-K.

| |

Industrial | Municipal | Products | |||

|---|---|---|---|---|---|---|

Overview |

• Tailored solutions in collaboration with our customers backed by life-cycle services including on-demand water, build-own-operate ("BOO"), recycle / reuse and emergency response service alternatives to improve operational reliability, performance and environmental compliance |

• Delivers solutions, equipment and services to engineering firms, OEMs and municipalities to treat wastewater and purify drinking water |

• Highly differentiated and scalable range of products and technologies specified by global water treatment designers, OEMs, engineering firms and integrators |

|||

|

||||||

Channel |

• Direct sales with market vertical focus |

• Independent representative network supported by technical sales team

• Direct sales and aftermarket channels |

• Direct and indirect sales and aftermarket channels |

|||

|

||||||

Key offerings |

• Full lifecycle service and solutions for influent, effluent and process water, including on-demand water, BOO, recycle / reuse and emergency response services

• Equipment systems for industrial needs: influent water, boiler feed water, ultrahigh purity, process water, wastewater treatment and recycle / reuse

• Full-scale outsourcing of operations and maintenance |

• Wide range of wastewater solutions:

• Ultrafiltration membrane bioreactors

• Advanced biological treatment

• Clarifiers, aerators, screens and dewatering

• Ballasted clarification

• Odor and corrosion control equipment and services

• Ultrafiltration for drinking water

• Retrofit, rehabilitation and aftermarket |

• Filtration

• Regenerative media and microsand

• Self-cleaning filters and intake screens

• Disinfection

• Low and medium pressure ultraviolet ("UV")

• Electrochlorination and gas chlorination

• Anode technology

• Electrodeionization

• Analyzers and controllers |

|||

|

||||||

Percentage of FY 2017 revenue |

52% | 22% | 26% |

7

As depicted in the table below, we target attractive global end-markets that utilize water as a critical part of their operations or production processes including pharmaceuticals and health sciences, microelectronics, food and beverage, hydrocarbon and chemical processing, power, general manufacturing, municipal drinking water and wastewater, marine and aquatics end markets. While a decline in general global and economic conditions could adversely affect us, our business is highly diversified across our key attractive and growing end markets presented below, and we believe that no single end market drives the overall results of our business.

Industrial. Our Industrial Segment provides application-specific solutions and full lifecycle services for critical water applications. We focus on treating industrial process water, utility water and wastewater. Industrial process water requires specific purity standards, which are used in making goods in industries such as microelectronics, pharmaceuticals and health sciences and food and beverage, including ingredient water. Industrial utility water is used for critical industrial applications including boiler feed and cooling water. Industrial wastewater is effluent water discharged from plants or facilities which is treated before it is returned to the environment or recycled or reused within the water cycle. Our operations across the water cycle are complex and, if conducted improperly, may result in potential costs and liabilities, including as a result of environmental damage. Our comprehensive solutions are comprised of capital systems and related recurring aftermarket services, parts and consumables, along with long-term and short-term service contracts and emergency services. Our comprehensive capabilities range from discrete offerings to the provision of highly complex, fully integrated solutions. We are able to leverage our broad range of products and technologies to deliver a tailored solution that best

8

addresses a specific customer's needs, including a growing portfolio of smart water technologies encompassed in our Water One platform. Key capital and related aftermarket service and product offerings include filtration, reverse osmosis, ion exchange and continuous deionization. As a result of our speed, capabilities and experience, we are a trusted partner to 25,000 industrial customers, including a substantial majority of Fortune 500 industrial companies. As water is a critical component in many industrial production processes, unavailability of proper water purity, specification or quality can lead to significant constraints, downtime and increased operating costs.

The cost of an installation can range from a few thousand dollars to a few million dollars and often presents an ongoing service and aftermarket revenue opportunity that can reach or exceed the original project cost. The service and aftermarket sales component is supported by our broad application and process expertise and the largest integrated industrial service network in North America, based on management's estimate. Our network is comprised of certified technicians and the largest fleet of mobile reverse osmosis and deionization water treatment systems in North America based on management's estimate, and enables us to provide a complete range of services spanning from regular maintenance and emergency support to our unique Water One platform. Water One provides remote monitoring capabilities which enable us to optimize our routine service calls through predictive analytics and provide customers a more predictable, cost efficient water solution. We offer services which include water on demand, mobile solutions and smart water systems that leverage our extensive branch network, technical personnel and technology portfolio.

We market our Industrial offerings through our direct sales force, which is organized by market vertical and is complemented by an inside sales force, field sales engineers and a growing e commerce platform.

Municipal. Our Municipal Segment leverages its proven application expertise to provide engineered solutions and equipment for the treatment of wastewater, purification of drinking water and odor and corrosion control for municipalities. Our portfolio of solutions includes ultrafiltration systems, advanced biological treatment, clarifiers, aerators, odor and corrosion control services, equipment for new municipal plant builds and retrofit, rehabilitation and aftermarket parts and services for our extensive installed base. We have provided solutions across a large municipal installed base with capacities ranging from 25,000 gallons per day to over 100 million gallons per day. Our operations are focused within the U.S. market, with a presence in the United Kingdom, Australia, Canada and Singapore.

We maintain a comprehensive municipal representative network that broadly covers the United States, providing us with a differentiated ability to influence specifications and the basis of design for new treatment facilities. We also maintain relationships with engineering firms, operators and other key influencers through our direct technical sales force to drive adoption of our offerings.

Products. Our Products Segment sells differentiated technologies to a diverse set of water treatment system specifiers, integrators and end users globally. Our offerings are highlighted by our filtration and disinfection, electrodeionization and electrochlorination technologies, separation technologies and anodes offerings. Our filtration and disinfection offerings include our Defender line of products, which is a regenerative media filtration leader in the commercial aquatics market. Our IONPURE electrodeionization solutions allow customers to achieve ultrahigh purity water without the use of chemicals in the treatment process. Our electrochlorination products provide extensive water treatment solutions for the maritime, oil and gas and power markets. We also have extensive capabilities in anode technologies, cathodic protection, solid and liquid separation technologies and various aftermarket parts, consumables and accessories. All of our offerings are highly scalable and designed to meet current and future water treatment needs, with a focus on generating repeat business from our customers. We generally service the equipment we provide our customers: however, their

9

failure to properly use, safeguard or maintain their equipment of product defects or unanticipated use of our products could result in liability to us.

Our portfolio of technologies and products are sold either as discrete offerings or as components of broader Evoqua solutions through our Industrial and Municipal Segments. Our Products Segment also sells externally to a customer base comprised of globally located OEMs, integrators, regional distributors, customers, regional engineering firms and various other end users that we reach through multiple established sales and aftermarket channels.

Our Industry

We estimate the global water and wastewater market to represent more than $600 billion in total revenue and include both capital and operating expenditures for the treatment and transportation of water by industrial, municipal, commercial and residential end users. Within the global water and wastewater market, we estimate our addressable market, comprised of equipment, consumables, aftermarket parts and operations-related and maintenance-related services for the treatment of water for industrial, commercial and municipal end users, to represent over $85 billion in total revenue.

Our addressable market is further refined to include our served market, which is currently focused on the North American region, and totals approximately $10 billion in total revenue according to Amane Advisors. As compared to our larger addressable market, our served market excludes sectors that would require meaningful growth investment on our part to capture new customers or market opportunities.

While a decline in general global economic and business conditions may adversely affect demand for our products, services and solutions, we believe the global water market will continue to experience growth, supported by a variety of anticipated secular trends that will drive the demand for water across a multitude of industrial, commercial and municipal applications. These secular trends include global population growth, urbanization, industrialization and overall economic growth. In addition, the supply of clean water could be adversely impacted by factors including an aging water infrastructure within North America and increased levels of water stress from seasonal rainfall, inadequate water storage options or treatment technologies. More specific to our business, water is a critical component and byproduct of many processes, including in manufacturing and product development. As such, as global consumption patterns evolve and water shortages persist, demand for equipment and services will continue to increase. We estimate the global water market is expected to grow in total revenue by approximately 3% annually from 2017 to 2020, although such growth may not be concentrated in the markets that we serve or may be otherwise affected by global or regional economic conditions.

We hold leading positions in our market verticals that have been cultivated by our suite of differentiated solutions and our comprehensive service network, which had over four times as many locations as our closest competitor at September 30, 2017. Despite our leading positions in the individual market verticals where we participate, our market share did not exceed 25% in any single market vertical in which we participated during fiscal 2017.

We serve three primary market verticals: (i) industrial, (ii) commercial and (iii) municipal. Industrial and commercial customers vary in size, scope and the complexity of their water treatment needs and include small manufacturing clients with a single facility, large commercial waterparks and multinational corporations with a significant global footprint. The municipal market consists of potable water and wastewater treatment solutions that are sold to municipalities and private companies operating under a concession agreement to own and operate treatment facilities on behalf of municipalities. We serve each market with a full range of solutions, services, technologies and aftermarket offerings.

10

Initial Public Offering

On November 6, 2017, we completed our initial public offering of 27,777,777 shares of common stock at a price of $18.00 per share, of which 8,333,333 shares were sold by us and 19,444,444 shares were sold by the selling stockholders, and on November 7, 2017, the selling stockholders sold an additional 4,166,666 shares of common stock as a result of the exercise in full by the underwriters of an option to purchase additional shares. Our common stock began trading on the New York Stock Exchange (the "NYSE") on November 2, 2017 under the ticker symbol "AQUA." After underwriting discounts and commissions but before expenses, we received net proceeds from our initial public offering of approximately $141.0 million. We used a portion of these proceeds to repay $104.9 million of indebtedness (including accrued and unpaid interest) under our senior secured first lien term loan facility and the remainder for general corporate purposes. We did not receive any proceeds from the sale of shares by the selling stockholders.

Our Growth Strategy

The key elements of our strategy include:

Grow and further penetrate our existing customer base. We believe our strong brands, leading position in highly fragmented markets, scalable and global offerings, leading installed base and unique ability to provide complete treatment solutions will enable us to capture a larger share of our existing customers' water treatment spend while expanding with existing and new customers into adjacent end-markets and underpenetrated regions, including by investing in our sales force and cross-selling to existing customers. Our growth initiatives include both expanding our presence in our core North American market as well as replicating our leading position and strategies into underpenetrated global regions. For example, through innovative technologies such as IONPURE continuous electrodeionization and Defender aquatic regenerative media filtration systems, we have expanded our positions in markets such as Asia and the Middle East.

Through direct sales efforts, outreach and education, we plan to continue to enhance our relationships and enable further adoption of our products, technologies and solutions by end customers and key influencers, including municipal representatives, engineering firms, designers and other system specifiers. Our performance depends, in part, on our ability to attract, incentivize and retain third party sales representatives that will be able to market and support our products effectively, and competing for sales personnel with established customer relationships intense.

Continued transition of our customers to a higher value-add service-based business model. Our goal is to provide "worry-free water" by combining our products and technologies with extensive service and distribution capabilities. We selectively target high value projects with opportunities for recurring business through service, parts and other aftermarket opportunities over the lifecycle of the process or capital equipment. In particular, we have developed a pipeline of smart, internet-connected monitoring technologies through the deployment of our Water One smart water platform that provides us with an increasing ability to handle our customers' complete water needs through on-demand water management, predictive maintenance and service response planning. Water One also enables us to transition our customers to more accurate pricing models based on usage, which otherwise would not have been possible without technological advancement. Our future growth depends, in part, on our ability to develop or acquire new products, services and solutions, identify emerging technological trends in our target end markets and maintain the integrity of our information technology systems.

Drive margin expansion and cash flow improvements through continued focus on operational excellence and execution. Since fiscal 2014, we have realigned our organizational structure, achieved significant cost savings through operational efficiencies and revitalized our culture, which has energized our workforce and reduced employee turnover. This organizational realignment transformed our business

11

into a streamlined organization focused on improved accountability, responsiveness and resulted in an overall lower cost structure. We have identified and are pursuing a number of discrete initiatives which, if successful, we expect could result in additional cost savings over the next three years. These initiatives include our ePro and supply chain improvement program to consolidate and manage global spending, our improved logistics and transportation management program, further optimizing our engineering cost structure, capturing benefits of our Water One remote system monitoring and data analytics offerings. Furthermore, as a result of significant investments we have made in our footprint and facilities, we believe have capacity to support our planned growth without commensurate increases in fixed costs.

Commercialize and drive adoption of nascent and newly acquired technologies by leveraging our sales channels and application expertise. We offer a full range of services, systems and technologies that we continually develop to meet our customers' evolving water lifecycle needs. We develop our technologies through in-house research, development and engineering and targeted tuck-in, technology-enhancing and geography-expanding acquisitions and have a reservoir of recently launched technologies and a pipeline of new offerings designed to provide customers with innovative, value-enhancing solutions. Furthermore, we have successfully completed eight technology-enhancing and geography-expanding acquisitions since April 2016 to add new capabilities and cross-selling opportunities in areas such as electrochemical and electrochlorination cells, regenerative media filtration, anodes, UV disinfection and aerobic and anaerobic biological treatment technologies. We must continue to develop and acquire new products, services and solutions to successfully compete in our markets.

We believe a key differentiator for our technology development program is our strong record of incorporating new technologies into the comprehensive solutions we provide to our customers across our platform. We are able to rapidly scale new technologies using our leading direct and third-party sales channels and our relationships with key influencers, including municipal representatives, engineering firms, designers and other system specifiers. Through our service network, we have a direct view of our customers' water needs which allows us to focus on developing and acquiring the most relevant and sought-after solutions.

We believe our continued investment in driving penetration of our recently launched technologies, robust pipeline of new capabilities and best-in-class channels to market will allow us to continue to address our customer needs across the water lifecycle.

Continue to evaluate and pursue accretive tuck-in acquisitions to add new technologies, attractive geographic regions and end-markets. As a complement to our organic growth initiatives, we view tuck-in acquisitions as a key element of our overall growth strategy which will enable us to accelerate our growth in our current addressable market, new geographies and new end market verticals. Our existing customer relationships, channels to market and ability to rapidly commercialize technologies provide a strong platform to drive growth in the businesses we acquire. To capitalize on these opportunities we have built an experienced team dedicated to mergers and acquisitions that has successfully completed eight technology-enhancing and geography-expanding acquisitions since April 2016, including the addition of capabilities in the attractive aquatics market, which we have typically financed through borrowings under our revolving credit facility and cash on hand. Although we may not continue to identify suitable acquisition targets and implement our growth strategy, we currently have a pipeline which includes more than 60 potential targets, which has been developed proactively by our team as well as informed by our customer base.

12

Our Industrial Segment

Our Industrial Segment provides application-specific solutions and full lifecycle services for critical water applications. We focus on treating industrial process water, utility water and wastewater. Industrial process water requires specific purity standards, which are used in making goods in industries such as microelectronics, pharmaceuticals and health sciences and food and beverage, including ingredient water. Industrial utility water is used for critical industrial applications, including as boiler feed and cooling water. Industrial wastewater is effluent water discharged from plants or facilities which is treated before it is returned to the environment or recycled or reused within the water cycle. Our operations across the water cycle are complex and, if conducted improperly, may result in potential costs and liabilities, including as a result of environmental damage. Our comprehensive solutions are comprised of capital systems and related recurring aftermarket services, parts and consumables, along with long-term and short-term service contracts and emergency services. Our comprehensive capabilities range from discrete offerings to the provision of highly complex, fully integrated solutions. We are able to leverage our broad range of products and technologies to deliver a tailored solution that best addresses a specific customer's needs, including a growing portfolio of smart water technologies encompassed in our Water One platform. Key capital and related aftermarket service and product offerings include filtration, reverse osmosis, ion exchange and continuous deionization. As a result of our speed, capabilities and experience, we are a trusted partner to 25,000 industrial customers, including a substantial majority of Fortune 500 industrial companies. As water is a critical component in many industrial production processes, unavailability of proper water purity, specification or quality can lead to significant constraints, downtime and increased operating costs.

The cost of an installation can range from a few thousand dollars to a few million dollars and typically provides an ongoing service and aftermarket revenue opportunity that itself reaches or exceeds the original project cost. The service and aftermarket sales component is supported by our broad application and process expertise and what we believe to be the largest integrated industrial service network in North America. Our network is comprised of certified technicians and the largest fleet of mobile reverse osmosis and deionization water treatment systems in North America, based on management's estimate, and enables us to provide a complete range of services spanning from regular maintenance and emergency support to our unique Water One platform. Water One provides remote monitoring capabilities which enable us to optimize our routine service calls through predictive analytics and provide customers a more predictable, cost-efficient water solution. We offer services which include water on-demand, mobile solutions and smart water systems that leverage our extensive branch network, technical personnel and technology portfolio.

We partner with our industrial customers through our direct sales and service team, which is organized geographically and by market vertical and is complemented by an inside sales force, field sales engineers and a growing e-commerce platform. We primarily target three broad categories of customers in our Industrial Segment, principally based on their end markets and primary applications: Light Industries, Heavy Industries and Environmental Solutions.

Light Industries

Our light industries offerings include our usage-based, Water One deionized water service, preventative maintenance service contracts, integrated process and wastewater systems and aftermarket consumables and spare parts. We generally provide light industries services to general manufacturing, light industrial, pharmaceutical, food and beverage, microelectronics and health sciences customers.

Heavy Industries

Our heavy industries offerings include mobile, rapidly deployable services based on short-term operating contracts, "build-own-operate" outsourcing services and accompanying technological support,

13

integrated process and wastewater systems and aftermarket consumables and spare parts. We generally provide heavy industries services to power generation, chemical processing, hydrocarbon processing and mining and pulp and paper customers.

Environmental Solutions

Our environmental solutions offerings include activated carbon, wastewater ion exchange and groundwater remediation solutions. We generally provide environmental solutions to hydrocarbon processing, chemical processing, food and beverage and municipal water customers.

Our Municipal Segment

Our Municipal Segment leverages its proven application expertise to provide engineered solutions and equipment for the treatment of wastewater, purification of drinking water and odor and corrosion control for municipalities. Our portfolio of solutions includes ultrafiltration systems, advanced biological treatment, clarifiers, aerators, odor and corrosion control services, equipment for new municipal plant builds and retrofit, rehabilitation and aftermarket parts and services for our extensive installed base. We have provided solutions across a large municipal installed base with capacities ranging from 25,000 gallons per day to over 100 million gallons per day. Our operations are focused within the U.S. market, with a presence in the United Kingdom, Australia, Canada and Singapore.

We maintain a comprehensive municipal representative network that broadly covers the U.S., providing us with a differentiated ability to influence specifications and the basis of design for new treatment facilities. We also maintain relationships with engineering firms, operators and other key influencers through our direct technical sales force to drive adoption of our offerings. We primarily target three broad categories of customers in our Municipal Segment, principally based on their end markets and primary application: Wastewater Treatment, Municipal Services and MEMCOR.

Wastewater Treatment

Our wastewater treatment offerings include advanced biological treatment, clarification, filtration, nutrient removal, odor and corrosion control, biosolid and field-erected biological wastewater treatment plant solutions. We generally provide wastewater treatment solutions to both municipal and industrial wastewater treatment facilities. We provide aftermarket and retrofit solutions to our extensive installed base.

Municipal Services

Our municipal service offerings include odor and corrosion control and disinfection capabilities, including advanced remote-monitoring and automated control solutions and multi-product liquid and vapor phase product combinations for wastewater collection. We also provide municipal service solutions for drinking water treatment and distribution.

MEMCOR

Our MEMCOR membrane technology offerings include CPII membrane systems, membrane bioreactor systems and XP and XP-E technologies. These include custom solutions built from standard components, modular designs for flexibility and fast installation and membrane modules for aftermarket replacement. We generally provide MEMCOR solutions to municipal drinking water treatment facilities, municipal and industrial wastewater treatment facilities and industrial utility and process water facilities.

14

Our Products Segment

Our Products Segment sells differentiated technologies to a diverse set of water treatment system specifiers, integrators and end users globally. Our offerings are highlighted by our filtration and disinfection, electrodeionization and electrochlorination technologies, separation technologies and anodes offerings. Our filtration and disinfection offerings include our Defender line of products, which is a regenerative media filtration leader in the commercial aquatics market. Our IONPURE electrodeionization solutions allow customers to achieve ultrahigh purity water without the use of chemicals in the treatment process. Our electrochlorination products provide extensive water treatment solutions for the maritime, oil and gas and power markets. We also have extensive capabilities in anode technologies, cathodic protection, solid and liquid separation technologies and various aftermarket parts, consumables and accessories. All of our offerings are highly scalable and designed to meet current and future water treatment needs, with a focus on generating repeat business from our customers. We generally service the equipment we provide our customers; however, their failure to properly use, safeguard or maintain their equipment or product defects or unanticipated use of our products could result in liability to us.

Our portfolio of technologies and products are sold either as discrete offerings or as components of broader solutions through our Industrial and Municipal Segments. Our Products Segment also sells externally to a customer base comprised of globally located OEMs, integrators, regional distributors, customers, regional engineering firms and various other end users that we reach through multiple established sales and aftermarket channels. We target customers in our Products Segment principally based on their end markets and primary application: Aquatics and Disinfection, Process and Drinking Water, Electrochlorination, Separation Technology and Anodes.

Aquatics and Disinfection

Our aquatics and disinfection products include a wide range of filtration (regenerative media filters, high rate sand filters, microsand filters and screen filters), chlorination and UV disinfection systems, analyzers, controllers and related accessories. We sell to commercial aquatics, municipal drinking water, industrial and light manufacturing and commercial customers worldwide. Primary applications include filtration and disinfection of municipal and recreational pools and leisure facilities, fountains and water features and recreational water and waterparks, gas chlorination, UV and on-site chlorination and disinfection and water chemistry measurement and control for municipal drinking water, as well as pre-treatment and purification systems where ultrapure water polishing is required.

Process and Drinking Water

Our process and drinking water products include chemical-free ultrafiltration, microelectronic processing technologies and desalination solutions. We generally provide these products to municipal, power, microelectronic processing, solar, hydrocarbon and chemical processing and pharmaceutical customers. Primary applications include high purity process water for use in pharmaceutical, laboratory and microelectronic processing plants and the removal of dissolved salts from seawater, brackish water and municipal wastewater.

Electrochlorination

Our electrochlorination products are used with seawater for on-site sodium hypochlorite generating systems for maritime, oil and gas, power, military and ballast water customers. Our maritime growth prevention systems are used on military and commercial ships and in offshore oil and gas applications, and our ballast water management systems enable ships' owners and operators in all global waters to safely comply with stringent U.S. Coast Guard and future International Maritime Organization regulations.

15

Separation Technology

Our products separate solids from liquids in a variety of slurries, for either disposal or reuse. We generally provide separation technology products and solutions to power, mining, microelectronics, solar, heavy and light industrial and municipal customers, for applications including the separation of solids from liquids in mining companies' tailings ponds and the separation and recovery of minerals from slurry for further processing within mineral companies' manufacturing processes.

Anodes

We produce custom-designed, state-of-the-art mixed-metal oxide anodes, provide recoating and repair services to our external customers and supply the anodes used across our own internal processing capabilities. We provide anode products and solutions to mining, chemical processing, light industrial and microelectronics customers for primary applications including biotechnology, water treatment, cathodic protection, seawater electrolysis, metal finishing and electroplating and swimming pool chlorination.

Customers

We serve three primary market verticals: (i) industrial, (ii) commercial and (iii) municipal. Industrial and commercial customers vary in size, scope and the complexity of their water treatment needs and include small manufacturing clients with a single facility, large commercial waterparks and multinational corporations with a significant global footprint. The municipal market consists of potable water and wastewater treatment solutions that are sold to municipalities and private companies operating under a concession agreement to own and operate a treatment facility on behalf of a municipality. We serve each market with a full range of solutions, services, technologies and aftermarket offerings.

The industrial market is comprised of direct end market distribution channels. The commercial market includes a variety of routes to market including direct and third party channel relationships. The municipal market is comprised of a wide range of drinking and wastewater treatment facilities.

As of September 30, 2017, we had over 38,000 customers spanning a diverse range of industries and include the twenty largest U.S. companies in each of the pharmaceutical, hydrocarbon processing, power, chemical and food and beverage industries as well as U.S. wastewater sites and global drinking water treatment sites. We also have customers in the health science, microelectronics, drinking water, wastewater, general manufacturing, commercial aquatics, maritime and other industries. We provide products, services and solutions to federal, state and local government customers both directly and indirectly as a supplier to general contractors. During fiscal 2017, no single customer accounted for more than 1% of our revenues, and our top ten customers accounted for approximately 7% of our revenues.

We provide products, services and solutions to federal, state and local government customers both directly and indirectly as a supplier to general contractors. Many of our government contracts contain a termination for convenience clause, regardless of whether we are the prime contractor or a subcontractor. Upon a termination for convenience, we are generally able to recover the purchase price for delivered items and reimbursement of allowable work in process costs. See Item 1A, "Risk Factors." In the industrial market we served over 25,000 customers as of September 30, 2017, including a substantial majority of the industrial companies within the Fortune 500. In the municipal market, we had equipment installed in over 40% of the U.S. municipal wastewater sites as of September 30, 2017.

16

Suppliers

We maintain a cost-effective, diversified procurement program through strong relationships with strategic suppliers across key inputs. We have implemented ePro, our supply chain excellence initiative that centralizes and standardizes purchasing across the organization. The top materials in our supply chain include metal, calcium nitrate, membranes and ion exchange resin. Further, we seek to insource certain products that align with our existing core competencies, including our manufacturing capabilities, and further enable us to provide our customers with a complete lifecycle solution. We seek sources of supply from multiple suppliers and often from multiple geographies, and we believe that our supply chain is well positioned to remain stable and cost-effective.

Seasonality

While we do not believe it to be significant, our business does exhibit seasonality resulting from our customers' increasing demand for our products and services during the spring and summer months as compared to the fall and winter months. For example, our Municipal Segment experiences increased demand for our odor control product lines and services in the warmer months which, together with other factors, typically results in improved performance in the second half of our fiscal year. Inclement weather, such as hurricanes, droughts and floods, can also drive increased demand for our products and services. As a result, our results from operations may vary from period to period.

Sales and Marketing

Our sales organization is positioned across our segments to drive top-line growth and increase market share for our Company. Our network includes third-party representatives, internal general managers, sales directors, sales engineers, third-party distributors and other personnel who support our day-to-day sales and marketing operations.

Industrial Segment

We market our offerings through our direct sales and service team, which is organized geographically and by end market and is complemented by an inside sales force, field sales engineers and a growing e-commerce platform. Our Industrial Segment sales organization focuses on direct sales with a market-vertical focus across geographic, strategic and e-commerce channels to market. As of September 30, 2017, our Industrial Segment services network consisted of 80 industrial service branches across North America, with 624 field service and 149 engineering employees, and over 90% of our customers are within two hours' travel of one of our branches.

Municipal Segment

We maintain a comprehensive municipal representative network in the United States, providing us with a unique ability to influence specifications and the basis of design for new treatment facilities. We also maintain relationships with engineering firms, operators and other key influencers through our direct technical sales force to drive adoption of our offerings. As of September 30, 2017, our Municipal Segment sales organization consisted of a network of 56 independent manufacturing representative companies, supported by our approximately 119 field service technicians and approximately 137 sales personnel, organized across wastewater treatment, municipal services and MEMCOR structures.

Products Segment

Our Products Segment customer base includes water treatment designers, OEMs, engineering firms, integrators and our own Industrial and Municipal Segments. Our Products Segment sales organization consists of five direct and indirect sales and aftermarket channels: (i) our direct and third-party aquatics and disinfection sales representatives target commercial aquatics, municipal and

17

industrial water treatment in Americas, Europe, Middle East and Africa and Asia Pacific geographies, (ii) our process and drinking water sales channels work with non-exclusive OEMs and with our Industrial Segment to build small, "skidded" solutions for global industrial customers, to get our modular solutions specified into larger units and projects, (iii) our electrochlorination sales managers typically work with representatives of ship builders, shipyards, ship owners, service providers and manufacturers to have our products, services and solutions specified into commercial and military ships and offshore oil and gas rigs, (iv) our separation technology channel managers and sales representatives work with a large network of third-party manufacturers' representatives that are exclusive to specific territories or industries and leverage direct sales in industries not covered by third-party representatives and (v) our direct sales force sell our anodes into Americas, Europe and China geographies, and opportunistically cross-sell electrocatalytic products to our anode customers. As of September 30, 2017, we had active relationships with more than 200 OEM partnerships and managed over 300 channel partners.

Research, Development and Engineering

We utilize a disciplined, stage-gate process—consisting of development, field test, commercialization, supply chain and sourcing decisions—to identify and develop new technologies to commercialize, focus our efforts on and engage early with supply-chain management to promote profitability. We focus on tuck-in acquisitions as additional resources for new product innovation and development.

Our global research, development and engineering footprint includes six facilities located in the United States, the Netherlands, Germany, Singapore and Australia, staffed with managers, scientists, researchers, engineers and technicians, along with partnerships spanning leading universities research centers and other outside agencies. We spent approximately $20.0 million in fiscal 2017 on research, development and engineering, primarily related to employee costs.

Information Technology

Our information technology systems consist of enterprise management, e-commerce, customer relationship and field service management, customer quoting and billing, environmental compliance, business and operational support, procurement and sales force management systems. We utilize an e-commerce platform that makes our products available to customers at all times, and we provide our e-commerce customers with both general and customer-specific portals, which provide customized pricing for strategic customer accounts. Further, in connection with our ePro initiative, we have adopted SAP Ariba to assist in automating and centralizing our procurement process. We update and build our information technology infrastructure through further investments focused on cost efficiencies, reliability, functionality and scalability.

Intellectual Property

Our intellectual property and proprietary rights are important to our business. We currently have over 1,250 granted or pending patents. We undertake to strategically and proactively develop our intellectual property portfolio by pursuing patent protection, obtaining copyrights and registering our trademarks in the United States and in foreign countries. We currently rely primarily on patent, trademark, copyright and trade secret laws, and control access to our intellectual property through license agreements, confidentiality procedures, non-disclosure agreements with third parties, employment agreements and other contractual rights, to protect our intellectual property rights.

18

Competition

Our industry is highly fragmented, and includes a number of regional and niche-offering focused competitors. Competition is largely based on product performance, reliability and innovativeness of products, services and solutions, application expertise and process knowledge, brand reputation, energy and water efficiency, product compliance with regulatory and environmental requirements, product lifecycle cost, scalability, timeliness of delivery, proximity of service centers to our customers, effectiveness of our distribution channels and price. Within each of our segments and the various businesses that comprise them, we compete with a fragmented range of companies, but do not have any individually key competitors.

Backlog

Backlog represents the total amount of revenue we expect to receive as a result of contracts and orders awarded to us. However, because many of our contracts and orders are subject to reduction, cancellation or termination at the option of our customer, backlog is not an indication of our future performance. In 2017 we implemented a new methodology to record service orders to improve visibility of backlog and revenues associated with service contracts. Under this new methodology a service contract is recorded as an order when both parties have agreed to the terms and conditions, including contract value and length. The value assigned to the order is based on the fixed portion of the contract for the entire contract term. Utilizing our new methodology, as of September 30, 2017, our backlog was approximately $636.3 million.

Employees

As of September 30, 2017, we had 3,958 employees. Of these employees 59% were full-time salaried level staff and the remaining employees consisted of a mix of full-time and part-time hourly workers. Approximately 74% of our employees work in our U.S. operations and approximately 26% work in foreign operations. None of our facilities in the United States or Canada are covered by collective bargaining agreements. As is common in Germany and the Netherlands, our employee populations there are represented by works councils. We are not involved in any material disputes with our employees and believe that relations with our employees and, to the extent applicable, with our organized labor unions, are good.

Insurance

We maintain insurance policies to cover directors' and officers' liability, fiduciary, crime, special accident, property, business interruption, cargo, workers' compensation, automobile, general liability, environmental, umbrella and excess liability insurance.

All of our insurance policies are with third-party carriers and syndicates with financial ratings of an A or better. We and our global insurance broker regularly review our insurance policies and believe the premiums, deductibles, coverage limits and scope of coverage under such policies are reasonable and appropriate for our business. The continued availability of appropriate insurance policies on commercially reasonable terms is important to our ability to operate our business and to maintain our reputation. See Item 1A, "Risk Factors."

Government Regulation

We are subject to extensive and varied laws and regulations in the jurisdictions in which we operate, including those relating to anti-corruption and trade, data security and privacy, employment, workplace safety, public health and safety, product safety, intellectual property, transportation, zoning and fire codes. We operate our business in accordance with standards and procedures designed to comply with applicable laws and regulations.

19

In particular, our international operations subject us to laws and regulations related to anti corruption and trade, including those related to export and import compliance, anti-trust and money laundering. Our policies mandate compliance with these laws and regulations, and we have established policies and procedures designed to assist us and our personnel in compliance with applicable United States and international laws and regulations. However, any violation of such laws, regulations or policies could result in substantial fines, sanctions, civil and/or criminal penalties, imprisonment, disgorgement of profits, debarment from government contracts and curtailment of operations in certain jurisdictions, and might materially adversely affect our business, financial condition, results of operations or prospects. See Item 1A, "Risk Factors—Failure to comply with applicable anti-corruption and trade laws, regulations and policies, including the U.S. Foreign Corrupt Practices Act, could result in fines and criminal penalties, causing a material adverse effect on our business, financial condition, results of operations or prospects."

In certain countries where we operate, our employees are represented by a works council, as required by local law. In such countries, we are required to consult and seek the consent or advice of these works councils in connection with certain corporate decisions, such as a major restructuring, a change of control or changes to local management. Certain other decisions that directly involve employment matters applicable either to all employees or certain groups of employees may also require works council approval. Further, certain of our international operations offer employees defined benefit plans in compliance with applicable local legal provisions requiring payments of, among other things, mandatory pension payments or allocations for severance pay. None of our U.S. employees are represented by unions or works councils, and our U.S. operations do not maintain defined-benefit plans.

In addition, there are numerous U.S. federal, state and local laws and regulations and foreign laws and regulations regarding data security, privacy and the collection, sharing, use, processing, disclosure and protection of personal information and other user data, the scope of which is changing, subject to differing interpretations, and may be inconsistent among different jurisdictions. If our efforts to protect the security of information about our customers, suppliers and employees are unsuccessful, a significant data security breach may result in costly government enforcement actions, private litigation and negative publicity resulting in reputation or brand damage with customers, and our business, financial condition, results of operations or prospects could suffer. See Item 1A, "Risk Factors—If we experience a significant data security breach or fail to detect and appropriately respond to a significant data security breach, our business and reputation could suffer." Further, governments are continuing to focus on privacy and data security and it is possible that new privacy or data security laws will be passed or existing laws will be amended in a way that is material to our business.

Environmental Matters

The geographic breadth of our facilities and the nature of our operations subject us to extensive environmental, health and safety laws and regulations in jurisdictions throughout the world. Such laws and regulations relate to, among other things, emissions to air, the treatment and discharge of drinking water and wastewater, the discharge of hazardous materials into the environment, the handling, storage, use, transport, treatment and disposal of hazardous materials and solid, hazardous and other wastes, product safety and workplace health and safety. These laws and regulations impose a variety of requirements and restrictions on our operations and the products we distribute. The failure by us to comply with these laws and regulations could result in fines, penalties, enforcement actions, third-party claims, damage to property or natural resources and personal injury claims, requirements to investigate or cleanup property or to pay for the costs of investigation or cleanup or regulatory or judicial orders requiring corrective measures, including the installation of pollution control equipment, remedial actions or the pulling of products from the market, and could negatively impact our reputation with customers. We are not aware of any pending environmental compliance or remediation matters that, in

20

the opinion of management, are reasonably likely to have a material effect on our business, financial condition, results of operations or prospects. However, environmental, health and safety laws and regulations applicable to our business, the products we distribute, the services we provide and the business of our customers, and the interpretation or enforcement of these laws and regulations, are constantly evolving and it is impossible to predict accurately the effect that changes in these laws and regulations, or their interpretation or enforcement, may have upon our business, financial condition, results of operations or prospects. Should environmental, health and safety laws and regulations, or their interpretation or enforcement, become more stringent, our costs could increase and significant capital expenditures or operational restrictions could be required, which may have an adverse effect on our business, financial condition, results of operations or prospects. However, such increased stringency could also increase demand for our products, services and solutions, which assist various industries and municipalities in meeting environmental and safety requirements for the treatment and discharge of drinking water and wastewater. In addition, increased public awareness of the presence and human health impacts of man-made chemicals and naturally occurring contaminants in drinking water may increase demand for our municipal service offerings. Correspondingly, if stringent laws or regulations are delayed or are not enacted, or repealed or amended to be less stringent, or enacted with prolonged phase-in periods, or not enforced, then demand for our products and services may also be reduced.

The nature of our operations, which involve the handling, storage, use, transport, treatment and disposal of hazardous materials and solid, hazardous and other wastes, exposes us to the risk of liability and claims associated with contamination at our current and former facilities or sites where we have disposed of or arranged for the disposal of waste, or with the impact of our products and services on human health and safety and the environment. Laws and regulations with respect to the investigation and remediation of contaminated sites can impose joint and several liability for releases or threatened releases of hazardous materials upon statutorily defined parties, including us, regardless of fault or the lawfulness of the original activity or disposal. We have been subject to claims and remediation obligations, including having been named as a potentially responsible party, in certain proceedings initiated pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, and similar state and foreign laws, regulations and statutes, and may be named a potentially responsible party in other similar proceedings in the future. Unforeseen expenditures or liabilities may arise in connection with such matters.

Available Information

We are subject to the informational requirements of the Exchange Act, and in accordance therewith, we file reports, proxy and information statements and other information with the SEC. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available through the "Investors" section of our website at www.evoqua.com. Reports are available free of charge as soon as reasonably practicable after we electronically file them with, or furnish them to, the U.S. Securities and Exchange Commission (the "SEC"). The information contained on our website is not incorporated by reference into this Annual Report on Form 10-K.

In addition to our website, you may read and copy public reports we file with or furnish to the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains our reports, proxy and information statements, and other information that we file electronically with the SEC at www.sec.gov.

21

The following risk factors may be important to understanding any statement in this Annual Report on Form 10-K or elsewhere. Our business, financial condition, results of operations or prospects could be materially and adversely affected by a number of factors, whether currently known or unknown, including but not limited to those described below. Any one or more of such factors could directly or indirectly cause our actual results of operations and financial condition to vary materially from past or anticipated future results of operations and financial condition. Any of these factors, in whole or in part, could materially and adversely affect our business, financial condition, results of operations or prospects.

Risks Relating to Our Business

General global economic and business conditions may materially adversely affect demand for our products, services and solutions.

We compete in various end markets and geographic regions around the world. Among these, the most significant are global industrial markets and municipal markets. In fiscal 2017, 86% and 14% of our revenue was from customers located in the United States and Canada and in other markets, respectively. We have experienced, and expect to continue to experience, fluctuations in revenues and operating results due to economic and business cycles. Important factors for our businesses and the businesses of our customers, both in the United States and abroad, include local and global macroeconomic conditions, the overall strength of and our customers' confidence in the economy, industrial and governmental capital spending, governmental fiscal and trading policies, global environmental and regulatory policies, the strength of the residential and commercial real estate markets, unemployment rates, consumer spending, availability of financing, interest rates, tax rates and changes in tax laws, political conditions and energy and commodity prices. The businesses of many of our industrial customers are, to varying degrees, cyclical, and have experienced periodic downturns. While we attempt to minimize our exposure to economic or market fluctuations by serving a balanced mix of end markets and geographic regions, any of the above factors, individually or in the aggregate, or a significant or sustained downturn in a specific end market or geographic region, could materially reduce demand for our products, services and solutions.

Levels of municipal spending may particularly impact our business, financial condition, results of operations or prospects. Reduced tax revenue in certain regions, or inability to access traditional sources of credit, may limit spending and new development by municipalities or local governmental agencies, which in turn may materially adversely affect the demand for our solutions and reduce our revenue.

Failure to compete successfully in our markets could materially adversely affect our business, financial condition, results of operations or prospects.

We offer our products, services and solutions in highly competitive markets. We believe the principal points of competition in our markets are product performance, reliability and innovation of our solutions, application expertise and process knowledge, brand reputation, energy and water efficiency, product compliance with environmental and regulatory requirements, product lifecycle cost, scalability, timeliness of delivery, proximity of service centers to our customers, effectiveness of our distribution channels and price. Maintaining and improving our competitive position will require successful management of these factors, including continued investment by us in research and development, engineering, marketing, customer service and support and our distribution networks. Our future growth rate depends upon our ability to compete successfully, which is impacted by a number of factors, including our ability to (i) identify emerging technological trends in our target end markets, (ii) develop and maintain a wide range of competitive and appropriately priced products, services and solutions and defend our market share against an ever-expanding number of competitors including

22