Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Evoqua Water Technologies Corp. | soxcertificationexhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - Evoqua Water Technologies Corp. | soxcertificationexhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Evoqua Water Technologies Corp. | cfocertificationexhibt312.htm |

| EX-31.1 - EXHIBIT 31.1 - Evoqua Water Technologies Corp. | ceocertificationexhibit311.htm |

| EX-10.1 - EXHIBIT 10.1 - Evoqua Water Technologies Corp. | exhibit101amendedandrestat.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

ý | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the quarterly period ended | ||

March 31, 2020 | ||

or | ||

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

Commission File Number: 001-38272

EVOQUA WATER TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 46-4132761 (I.R.S. Employer Identification No.) | |

210 Sixth Avenue Pittsburgh, Pennsylvania (Address of principal executive offices) | 15222 (Zip code) | |

(724) 772-0044

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | AQUA | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o Emerging growth company o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

There were 116,974,960 shares of the registrant’s common stock, par value $0.01 per share, outstanding as of April 30, 2020.

EVOQUA WATER TECHNOLOGIES CORP.

TABLE OF CONTENTS

Page | ||||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains forward‑looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You can generally identify forward‑looking statements by our use of forward‑looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “projection,” “seek,” “should,” “will” or “would” or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including growth of our various markets, our expectations, beliefs, plans, strategies, objectives, prospects, assumptions, or future events or performance, statements regarding our two-segment restructuring actions and expected restructuring charges and cost savings for fiscal 2020 and beyond, and statements related to the COVID-19 pandemic and its impact on our business contained in this Report are forward‑looking statements.

We have based these forward‑looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward‑looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended September 30, 2019, as filed with the Securities and Exchange Commission (“SEC”) on November 25, 2019, Part I, Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operation” of this Report and Part II, Item 1A. “Risk Factors” of this Report may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward‑looking statements, or could affect our share price. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward‑looking statements include:

• | general global economic and business conditions, including the impacts of the COVID-19 pandemic and recent disruptions in global oil markets; |

• | our ability to compete successfully in our markets; |

• | our ability to continue to develop or acquire new products, services and solutions and adapt our business to meet the demands of our customers, comply with changes to government regulations and achieve market acceptance with acceptable margins; |

• | our ability to implement our growth strategy, including acquisitions, and our ability to identify suitable acquisition targets; |

• | our ability to operate or integrate any acquired businesses, assets or product lines profitably or otherwise successfully implement our growth strategy; |

• | our ability to achieve the expected benefits of our restructuring actions and restructuring our business into two segments; |

• | material and other cost inflation and our ability to mitigate the impact of inflation by increasing selling prices and improving our productivity efficiencies; |

• | our ability to execute projects in a timely manner, consistent with our customers’ demands; |

• | our ability to accurately predict the timing of contract awards; |

• | delays in enactment or repeals of environmental laws and regulations; |

• | the potential for us to become subject to claims relating to handling, storage, release or disposal of hazardous materials; |

• | risks associated with product defects and unanticipated or improper use of our products; |

• | the potential for us to incur liabilities to customers as a result of warranty claims or failure to meet performance guarantees; |

1

• | our ability to meet our customers’ safety standards or the potential for adverse publicity affecting our reputation as a result of incidents such as workplace accidents, mechanical failures, spills, uncontrolled discharges, damage to customer or third‑party property or the transmission of contaminants or diseases; |

• | litigation, regulatory or enforcement actions and reputational risk as a result of the nature of our business or our participation in large‑scale projects; |

• | seasonality of sales and weather conditions; |

• | risks related to government customers, including potential challenges to our government contracts or our eligibility to serve government customers; |

• | the potential for our contracts with federal, state and local governments to be terminated or adversely modified prior to completion; |

• | risks related to foreign, federal, state and local environmental, health and safety laws and regulations and the costs associated therewith; |

• | risks associated with international sales and operations, including our operations in China; |

• | our ability to adequately protect our intellectual property from third‑party infringement; |

• | our increasing dependence on the continuous and reliable operation of our information technology systems; |

• | risks related to our substantial indebtedness; |

• | our need for a significant amount of cash, which depends on many factors beyond our control; |

• | risks related to AEA Investors LP’s (along with certain of its affiliates, collectively, “AEA”) ownership interest in us; and |

• | other risks and uncertainties, including those listed under Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2019, as filed with the SEC on November 25, 2019, Part II, Item 1A. “Risk Factors” of this Report, and in other filings we may make from time to time with the SEC. |

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward‑looking statements. The forward‑looking statements contained in this Report are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from the forward‑looking statements contained in this Report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward‑looking statements contained in this Report, they may not be predictive of results or developments in future periods.

Any forward‑looking statement that we make in this Report speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward‑looking statements, whether as a result of new information, future events or otherwise, after the date of this Report.

2

Part I - Financial Information

Item 1. Consolidated Financial Statements

INDEX TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Evoqua Water Technologies Corp. | |

Unaudited Consolidated Financial Statements | |

3

Evoqua Water Technologies Corp.

Consolidated Balance Sheets

(In thousands)

(Unaudited) | |||||||

March 31, 2020 | September 30, 2019 | ||||||

ASSETS | |||||||

Current assets | $ | 609,831 | $ | 637,293 | |||

Cash and cash equivalents | 108,495 | 109,881 | |||||

Receivables, net | 243,418 | 257,585 | |||||

Inventories, net | 151,427 | 137,164 | |||||

Contract assets | 81,249 | 73,467 | |||||

Prepaid and other current assets | 25,242 | 21,940 | |||||

Assets held for sale | — | 37,256 | |||||

Property, plant, and equipment, net | 344,918 | 333,584 | |||||

Goodwill | 388,881 | 392,890 | |||||

Intangible assets, net | 323,740 | 314,767 | |||||

Deferred income taxes, net of valuation allowance | 3,845 | 2,790 | |||||

Operating lease right-of-use assets, net | 42,885 | — | |||||

Other non‑current assets | 25,793 | 25,715 | |||||

Non-current assets held for sale | — | 30,809 | |||||

Total assets | $ | 1,739,893 | $ | 1,737,848 | |||

LIABILITIES AND EQUITY | |||||||

Current liabilities | $ | 322,490 | $ | 322,221 | |||

Accounts payable | 151,107 | 144,247 | |||||

Current portion of debt | 14,241 | 13,418 | |||||

Contract liabilities | 33,691 | 39,051 | |||||

Product warranties | 5,107 | 4,922 | |||||

Accrued expenses and other liabilities | 112,091 | 101,839 | |||||

Income tax payable | 6,253 | 4,536 | |||||

Liabilities held for sale | — | 14,208 | |||||

Non‑current liabilities | 994,900 | 1,049,805 | |||||

Long‑term debt, net of deferred financing fees | 854,981 | 951,599 | |||||

Product warranties | 1,161 | 2,332 | |||||

Obligation under operating leases | 34,033 | — | |||||

Other non‑current liabilities | 91,311 | 78,661 | |||||

Deferred income taxes | 13,414 | 13,548 | |||||

Non-current liabilities held for sale | — | 3,665 | |||||

Total liabilities | 1,317,390 | 1,372,026 | |||||

Commitments and Contingent Liabilities (Note 20) | |||||||

Shareholders’ equity | |||||||

Common stock, par value $0.01: authorized 1,000,000 shares; issued 119,070 shares, outstanding 116,876 at March 31, 2020; issued 116,008, outstanding 114,344 shares at September 30, 2019 | 1,185 | 1,154 | |||||

Treasury stock: 2,194 shares at March 31, 2020 and 1,664 shares at September 30, 2019 | (2,837 | ) | (2,837 | ) | |||

Additional paid‑in capital | 573,745 | 552,422 | |||||

Retained deficit | (115,356 | ) | (174,976 | ) | |||

Accumulated other comprehensive loss, net of tax | (36,306 | ) | (13,004 | ) | |||

Total Evoqua Water Technologies Corp. equity | 420,431 | 362,759 | |||||

Non‑controlling interest | 2,072 | 3,063 | |||||

Total shareholders’ equity | 422,503 | 365,822 | |||||

Total liabilities and shareholders’ equity | $ | 1,739,893 | $ | 1,737,848 | |||

See accompanying notes to these Unaudited Consolidated Financial Statements

4

Evoqua Water Technologies Corp.

Unaudited Consolidated Statements of Operations

(In thousands except per share data)

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2020 | 2019 | 2020 | 2019 | ||||||||||||

Revenue from product sales | $ | 205,969 | $ | 206,868 | $ | 402,529 | $ | 386,956 | |||||||

Revenue from services | 145,694 | 141,760 | 295,239 | 284,674 | |||||||||||

Revenue from product sales and services | 351,663 | 348,628 | 697,768 | 671,630 | |||||||||||

Cost of product sales | (144,156 | ) | (153,857 | ) | (284,612 | ) | (290,452 | ) | |||||||

Cost of services | (96,301 | ) | (99,160 | ) | (196,235 | ) | (196,837 | ) | |||||||

Cost of product sales and services | (240,457 | ) | (253,017 | ) | (480,847 | ) | (487,289 | ) | |||||||

Gross profit | 111,206 | 95,611 | 216,921 | 184,341 | |||||||||||

General and administrative expense | (62,130 | ) | (48,215 | ) | (107,900 | ) | (103,046 | ) | |||||||

Sales and marketing expense | (33,976 | ) | (35,435 | ) | (71,990 | ) | (71,587 | ) | |||||||

Research and development expense | (3,189 | ) | (3,957 | ) | (6,873 | ) | (8,103 | ) | |||||||

Total operating expenses | (99,295 | ) | (87,607 | ) | (186,763 | ) | (182,736 | ) | |||||||

Other operating income | 9,518 | 3,651 | 61,238 | 3,879 | |||||||||||

Other operating expense | (274 | ) | (187 | ) | (549 | ) | (375 | ) | |||||||

Income before interest expense and income taxes | 21,155 | 11,468 | 90,847 | 5,109 | |||||||||||

Interest expense | (13,252 | ) | (14,474 | ) | (26,835 | ) | (28,917 | ) | |||||||

Income (loss) before income taxes | 7,903 | (3,006 | ) | 64,012 | (23,808 | ) | |||||||||

Income tax benefit (expense) | 7 | 4,579 | (2,596 | ) | 9,093 | ||||||||||

Net income (loss) | 7,910 | 1,573 | 61,416 | (14,715 | ) | ||||||||||

Net income attributable to non‑controlling interest | 98 | 189 | 459 | 631 | |||||||||||

Net income (loss) attributable to Evoqua Water Technologies Corp. | $ | 7,812 | $ | 1,384 | $ | 60,957 | $ | (15,346 | ) | ||||||

Basic income (loss) per common share | $ | 0.07 | $ | 0.01 | $ | 0.52 | $ | (0.13 | ) | ||||||

Diluted income (loss) per common share | $ | 0.06 | $ | 0.01 | $ | 0.50 | $ | (0.13 | ) | ||||||

See accompanying notes to these Unaudited Consolidated Financial Statements

5

Evoqua Water Technologies Corp.

Unaudited Consolidated Statements of Comprehensive Income (Loss)

(In thousands)

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2020 | 2019 | 2020 | 2019 | ||||||||||||

Net income (loss) | $ | 7,910 | $ | 1,573 | $ | 61,416 | $ | (14,715 | ) | ||||||

Other comprehensive (loss) income | |||||||||||||||

Foreign currency translation adjustments | (14,724 | ) | 2,817 | (23,562 | ) | 1,263 | |||||||||

Unrealized derivative loss on cash flow hedges, net of tax | (162 | ) | (611 | ) | (211 | ) | (54 | ) | |||||||

Change in pension liability, net of tax | 235 | 97 | 471 | 193 | |||||||||||

Total other comprehensive (loss) income | (14,651 | ) | 2,303 | (23,302 | ) | 1,402 | |||||||||

Less: Comprehensive income attributable to non‑controlling interest | (98 | ) | (189 | ) | (459 | ) | (631 | ) | |||||||

Comprehensive (loss) income attributable to Evoqua Water Technologies Corp. | $ | (6,839 | ) | $ | 3,687 | $ | 37,655 | $ | (13,944 | ) | |||||

See accompanying notes to these Unaudited Consolidated Financial Statements

6

Evoqua Water Technologies Corp.

Unaudited Consolidated Statements of Changes in Equity

(In thousands)

Three Months Ended March 31, 2020 | |||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid‑in Capital | Retained Deficit | Accumulated Other Comprehensive Loss | Non‑controlling Interest | Total | |||||||||||||||||||||||||||

Shares | Cost | Shares | Cost | ||||||||||||||||||||||||||||||

Balance at December 31, 2019 | 117,653 | $ | 1,170 | 2,083 | $ | (2,837 | ) | $ | 560,132 | $ | (123,854 | ) | $ | (21,655 | ) | $ | 2,174 | $ | 415,130 | ||||||||||||||

Cumulative effect of adoption of new accounting standards | — | — | — | — | — | 686 | — | — | 686 | ||||||||||||||||||||||||

Equity based compensation expense | — | — | — | — | 2,304 | — | — | — | 2,304 | ||||||||||||||||||||||||

Issuance of common stock | 30 | 15 | — | — | 11,309 | — | — | — | 11,324 | ||||||||||||||||||||||||

Shares withheld related to net share settlement (including tax withholdings) | 1,387 | — | 111 | — | — | — | — | — | — | ||||||||||||||||||||||||

Dividends paid to non-controlling interest | — | — | — | — | — | — | — | (200 | ) | (200 | ) | ||||||||||||||||||||||

Net income | — | — | — | — | — | 7,812 | — | 98 | 7,910 | ||||||||||||||||||||||||

Other comprehensive loss | — | — | — | — | — | — | (14,651 | ) | — | (14,651 | ) | ||||||||||||||||||||||

Balance at March 31, 2020 | 119,070 | $ | 1,185 | 2,194 | $ | (2,837 | ) | $ | 573,745 | $ | (115,356 | ) | $ | (36,306 | ) | $ | 2,072 | $ | 422,503 | ||||||||||||||

Three Months Ended March 31, 2019 | |||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid‑in Capital | Retained Deficit | Accumulated Other Comprehensive Loss | Non‑controlling Interest | Total | |||||||||||||||||||||||||||

Shares | Cost | Shares | Cost | ||||||||||||||||||||||||||||||

Balance at December 31, 2018 | 115,048 | $ | 1,145 | 1,105 | $ | (2,837 | ) | $ | 538,013 | $ | (182,002 | ) | $ | (9,918 | ) | $ | 3,003 | $ | 347,404 | ||||||||||||||

Equity based compensation expense | — | — | — | — | 4,745 | — | — | — | 4,745 | ||||||||||||||||||||||||

Issuance of common stock | 51 | — | — | — | 273 | — | — | — | 273 | ||||||||||||||||||||||||

Shares withheld related to net share settlement (including tax withholdings) | 592 | 6 | 413 | — | (927 | ) | — | — | — | (921 | ) | ||||||||||||||||||||||

Net income | — | — | — | — | — | 1,384 | — | 189 | 1,573 | ||||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | 2,303 | — | 2,303 | ||||||||||||||||||||||||

Balance at March 31, 2019 | 115,691 | $ | 1,151 | 1,518 | $ | (2,837 | ) | $ | 542,104 | $ | (180,618 | ) | $ | (7,615 | ) | $ | 3,192 | $ | 355,377 | ||||||||||||||

7

Six Months Ended March 31, 2020 | |||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid‑in Capital | Retained Deficit | Accumulated Other Comprehensive Loss | Non‑controlling Interest | Total | |||||||||||||||||||||||||||

Shares | Cost | Shares | Cost | ||||||||||||||||||||||||||||||

Balance at September 30, 2019 | 116,008 | $ | 1,154 | 1,664 | $ | (2,837 | ) | $ | 552,422 | $ | (174,976 | ) | $ | (13,004 | ) | $ | 3,063 | $ | 365,822 | ||||||||||||||

Cumulative effect of adoption of new accounting standards | — | — | — | — | — | (1,337 | ) | — | — | (1,337 | ) | ||||||||||||||||||||||

Equity based compensation expense | — | — | — | — | 5,984 | — | — | — | 5,984 | ||||||||||||||||||||||||

Issuance of common stock | 150 | 31 | — | — | 15,339 | — | — | — | 15,370 | ||||||||||||||||||||||||

Shares withheld related to net share settlement (including tax withholdings) | 2,912 | — | 530 | — | — | — | — | — | — | ||||||||||||||||||||||||

Dividends paid to non-controlling interest | — | — | — | — | — | — | — | (1,450 | ) | (1,450 | ) | ||||||||||||||||||||||

Net income | — | — | — | — | — | 60,957 | — | 459 | 61,416 | ||||||||||||||||||||||||

Other comprehensive loss | — | — | — | — | — | — | (23,302 | ) | — | (23,302 | ) | ||||||||||||||||||||||

Balance at March 31, 2020 | 119,070 | $ | 1,185 | 2,194 | $ | (2,837 | ) | $ | 573,745 | $ | (115,356 | ) | $ | (36,306 | ) | $ | 2,072 | $ | 422,503 | ||||||||||||||

Six Months Ended March 31, 2019 | |||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid‑in Capital | Retained Deficit | Accumulated Other Comprehensive Loss | Non‑controlling Interest | Total | |||||||||||||||||||||||||||

Shares | Cost | Shares | Cost | ||||||||||||||||||||||||||||||

Balance at September 30, 2018 | 115,016 | $ | 1,145 | 1,087 | $ | (2,837 | ) | $ | 533,435 | $ | (163,871 | ) | $ | (9,017 | ) | $ | 3,161 | $ | 362,016 | ||||||||||||||

Cumulative effect of adoption of new accounting standards | — | — | — | — | — | (1,401 | ) | — | — | (1,401 | ) | ||||||||||||||||||||||

Equity based compensation expense | — | — | — | — | 9,270 | — | — | — | 9,270 | ||||||||||||||||||||||||

Issuance of common stock | 62 | — | — | — | 341 | — | — | — | 341 | ||||||||||||||||||||||||

Shares withheld related to net share settlement (including tax withholdings) | 613 | 6 | 431 | — | (942 | ) | — | — | — | (936 | ) | ||||||||||||||||||||||

Dividends paid to non-controlling interest | — | — | — | — | — | — | — | (600 | ) | (600 | ) | ||||||||||||||||||||||

Net (loss) income | — | — | — | — | — | (15,346 | ) | — | 631 | (14,715 | ) | ||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | 1,402 | — | 1,402 | ||||||||||||||||||||||||

Balance at March 31, 2019 | 115,691 | $ | 1,151 | 1,518 | $ | (2,837 | ) | $ | 542,104 | $ | (180,618 | ) | $ | (7,615 | ) | $ | 3,192 | $ | 355,377 | ||||||||||||||

See accompanying notes to these Unaudited Consolidated Financial Statements

8

Evoqua Water Technologies Corp.

Unaudited Consolidated Statements of Changes in Cash Flows

(In thousands)

Six Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Operating activities | |||||||

Net income (loss) | $ | 61,416 | $ | (14,715 | ) | ||

Reconciliation of net income (loss) to cash flows provided by operating activities: | |||||||

Depreciation and amortization | 52,514 | 47,252 | |||||

Amortization of debt related costs (includes $1,795 and $0 write off of deferred financing fees) | 3,103 | 1,231 | |||||

Deferred income taxes | (1,209 | ) | (11,411 | ) | |||

Share-based compensation | 5,984 | 9,270 | |||||

Loss (gain) on sale of property, plant and equipment | 170 | (122 | ) | ||||

Gain on sale of business | (68,051 | ) | — | ||||

Foreign currency exchange losses on intercompany loans and other non-cash items | 1,514 | 5,228 | |||||

Changes in assets and liabilities | |||||||

Accounts receivable | 7,256 | 20,600 | |||||

Inventories | (17,800 | ) | (14,175 | ) | |||

Contract assets | (5,377 | ) | (8,159 | ) | |||

Prepaids and other current assets | (3,715 | ) | 7,487 | ||||

Accounts payable | 6,004 | (8,875 | ) | ||||

Accrued expenses and other liabilities | (16,794 | ) | (11,178 | ) | |||

Contract liabilities | (4,920 | ) | 5,774 | ||||

Income taxes | 2,140 | (1,742 | ) | ||||

Other non‑current assets and liabilities | (252 | ) | 879 | ||||

Net cash provided by operating activities | 21,983 | 27,344 | |||||

Investing activities | |||||||

Purchase of property, plant and equipment | (38,759 | ) | (40,682 | ) | |||

Purchase of intangibles | (622 | ) | (2,898 | ) | |||

Proceeds from sale of property, plant and equipment | 271 | 2,875 | |||||

Proceeds from sale of business, net of cash of $12,117 | 118,894 | — | |||||

Acquisitions, net of $0 cash received | (11,164 | ) | 2,048 | ||||

Net cash provided by (used in) investing activities | 68,620 | (38,657 | ) | ||||

Financing activities | |||||||

Issuance of debt, net of deferred issuance costs | 8,212 | 10,663 | |||||

Borrowings under credit facility | 2,597 | 115,000 | |||||

Repayment of debt | (109,333 | ) | (120,856 | ) | |||

Repayment of capital lease obligation | (6,694 | ) | (4,925 | ) | |||

Payment of earn-out related to previous acquisitions | (175 | ) | (461 | ) | |||

Proceeds from issuance of common stock | 15,370 | 341 | |||||

Taxes paid related to net share settlements of share-based compensation awards | — | (936 | ) | ||||

Cash paid for interest rate cap | — | (2,235 | ) | ||||

Distribution to non‑controlling interest | (1,450 | ) | (600 | ) | |||

Net cash used in financing activities | (91,473 | ) | (4,009 | ) | |||

Effect of exchange rate changes on cash | (516 | ) | (293 | ) | |||

Change in cash and cash equivalents | (1,386 | ) | (15,615 | ) | |||

Cash and cash equivalents | |||||||

Beginning of period | 109,881 | 82,365 | |||||

End of period | $ | 108,495 | $ | 66,750 | |||

See accompanying notes to these Unaudited Consolidated Financial Statements

9

Evoqua Water Technologies Corp.

Unaudited Supplemental Disclosure of Cash Flow Information

(In thousands)

Six Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Supplemental disclosure of cash flow information | |||||||

Cash paid for taxes | $ | 2,133 | $ | 4,585 | |||

Cash paid for interest | $ | 22,953 | $ | 26,180 | |||

Non‑cash investing and financing activities | |||||||

Finance lease transactions | $ | 4,308 | $ | 8,296 | |||

Operating lease transactions | 10,076 | — | |||||

Option and Purchase Right | 7,167 | — | |||||

See accompanying notes to these Unaudited Consolidated Financial Statements

10

Evoqua Water Technologies Corp.

Notes to Unaudited Consolidated Financial Statements

(In thousands)

1. Description of the Company and Basis of Presentation

Background

Evoqua Water Technologies Corp. (referred to herein as the “Company” or “EWT”) was incorporated on October 7, 2013. On January 15, 2014, Evoqua Water Technologies Corp., acquired through its wholly owned entities, EWT Holdings II Corp. and EWT Holdings III Corp. (a/k/a Evoqua Water Technologies), all of the outstanding shares of Siemens Water Technologies, a group of legal entity businesses formerly owned by Siemens AG (“Siemens”). The stock purchase closed on January 15, 2014 and was effective January 16, 2014 (the “Acquisition”). The stock purchase price, net of cash received, was approximately $730,577. On November 6, 2017, the Company completed its initial public offering (“IPO”), pursuant to which an aggregate of 27,777 shares of common stock were sold, of which 8,333 were sold by the Company and 19,444 were sold by the selling shareholders, with a par value of $0.01 per share. After underwriting discounts and commissions and other expenses, the Company received net proceeds from the IPO of approximately $137,605. The Company used a portion of these proceeds to repay $104,936 of indebtedness (including accrued and unpaid interest) under EWT III’s senior secured first lien term loan facility and the remainder for general corporate purposes. The Company did not receive any proceeds from the sale of shares by the selling shareholders. On November 7, 2017, the selling shareholders sold an additional 4,167 shares of common stock as a result of the exercise in full by the underwriters of an option to purchase additional shares.

On March 19, 2018, the Company completed a secondary public offering, pursuant to which 17,500 shares of common stock were sold by certain selling shareholders. On March 21, 2018, the selling shareholders sold an additional 2,625 shares of common stock as a result of the exercise in full by the underwriters of an option to purchase additional shares. On March 10, 2020, the Company completed an additional secondary public offering, pursuant to which 13,000 shares of common stock were sold by certain selling shareholders. The Company did not receive any proceeds from the sale of shares by the selling shareholders in either of these secondary public offerings.

The Business

EWT provides a wide range of product brands and advanced water and wastewater treatment systems and technologies, as well as mobile and emergency water supply solutions and service contract options through its branch network. Headquartered in Pittsburgh, Pennsylvania, EWT is a multi‑national corporation with operations in the United States (“U.S.”), Canada, the United Kingdom (“UK”), the Netherlands, Germany, Australia, the People’s Republic of China, Singapore, the Republic of Korea and India.

The Company is organizationally structured into two reportable operating segments for the purpose of making operational decisions and assessing financial performance: (i) Integrated Solutions and Services and (ii) Applied Product Technologies.

Basis of Presentation

The accompanying Unaudited Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”). All intercompany transactions have been eliminated. Unless otherwise specified, all dollar amounts in these notes are referred to in thousands.

The interim Unaudited Consolidated Financial Statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and note disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such SEC rules. We believe that the disclosures made are adequate to make the information presented not misleading. We consistently applied the accounting policies described in our Annual Report on Form 10-K for the fiscal year ended September 30, 2019, as filed with the SEC on November 25, 2019 and as amended on December 4, 2019 (“2019 Annual Report”), in preparing these Unaudited Consolidated Financial Statements, with the exception of accounting standard updates described in Note 2, “Summary of Significant Accounting Policies.” These Unaudited Consolidated Financial Statements should be read in

11

conjunction with the audited financial statements and the notes included in our 2019 Annual Report. Certain prior period amounts have been reclassified to conform to the current period presentation.

2. Summary of Significant Accounting Policies

Fiscal Year

The Company’s fiscal year ends on September 30.

Use of Estimates

The Unaudited Consolidated Financial Statements have been prepared in conformity with GAAP and require management to make estimates and assumptions. These assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Unaudited Consolidated Financial Statements and the reported amounts of revenue and expenses during the reporting period. Estimates are revised as additional information becomes available. Actual results could differ from these estimates.

Cash and Cash Equivalents

Cash and cash equivalents are liquid investments with an original maturity of three or fewer months when purchased.

Accounts Receivable

Receivables are primarily comprised of uncollected amounts owed to us from transactions with customers and are presented net of allowances for doubtful accounts. Allowances are estimated based on historical write‑offs and the economic status of customers. The Company considers a receivable delinquent if it is unpaid after the term of the related invoice has expired. Write‑offs are recorded at the time all collection efforts have been exhausted.

Inventories

Inventories are stated at the lower of cost or market, where cost is generally determined on the basis of an average or first‑in, first‑out (“FIFO”) method. Production costs comprise direct material and labor and applicable manufacturing overheads, including depreciation charges. The Company regularly reviews inventory quantities on hand and writes off excess or obsolete inventory based on estimated forecasts of product demand and production requirements. Manufacturing operations recognize cost of product sales using standard costing rates with overhead absorption which generally approximates actual cost.

Property, Plant, and Equipment

Property, plant, and equipment is valued at cost less accumulated depreciation. Depreciation expense is recognized using the straight‑line method. Useful lives are reviewed annually and, if expectations differ from previous estimates, adjusted accordingly. Estimated useful lives for major classes of depreciable assets are as follows:

Asset Class | Estimated Useful Life |

Machinery and equipment | 3 to 20 years |

Buildings and improvements | 10 to 40 years |

Leasehold improvements are depreciated over the shorter of their estimated useful life or the term of the lease. Costs related to maintenance and repairs that do not extend the assets’ useful life are expensed as incurred.

12

Acquisitions

Acquisitions are recorded using the purchase method of accounting. The purchase price of acquisitions is allocated to the tangible and intangible assets acquired and liabilities assumed based on their estimated fair value at the acquisition date. The excess of the acquisition price over those estimated fair values is recorded as goodwill. Changes to the acquisition date preliminary fair values prior to the expiration of the measurement period, a period not to exceed 12 months from date of acquisition, are recorded as an adjustment to the associated goodwill. Contingent consideration resulting from acquisitions is recorded at its estimated fair value on the acquisition date. These obligations are revalued during each subsequent reporting period and changes in the fair value of the contingent consideration obligations can result from adjustments in the probability of achieving future development steps, sales targets and profitability and are recorded in General and administrative expenses in the Unaudited Consolidated Statements of Operations. Acquisition-related expenses and restructuring costs, if any, are recognized separately from the business combination and are expensed as incurred.

Goodwill and Other Intangible Assets

Goodwill represents purchase consideration paid in a business combination that exceeds the value assigned to the net assets of acquired businesses. Other intangible assets consist of customer‑related intangibles, proprietary technology, software, trademarks and other intangible assets. The Company amortizes intangible assets with definite useful lives on a straight‑line basis over their respective estimated economic lives which range from 1 to 26 years.

The Company reviews goodwill to determine potential impairment annually during the fourth quarter of the fiscal year, or more frequently if events and circumstances indicate that the asset might be impaired. Impairment testing for goodwill is performed at a reporting unit level. The quantitative impairment testing utilizes both a market (guideline public company) and income (discounted cash flows) method for determining fair value. In estimating the fair value of the reporting unit, the Company utilized a discounted cash flow (“DCF”) valuation technique, which incorporates judgments and estimates of future cash flows, future revenue and gross profit growth rates, terminal value amount, capital expenditures and applicable weighted‑average cost of capital used to discount these estimated cash flows. The estimates and projections used in the estimate of fair value are consistent with our current budget and long‑range plans, including anticipated change in market conditions, industry trend, growth rates and planned capital expenditures, among other considerations.

Impairment of Long‑Lived Assets

Long‑lived assets, such as property, plant, and equipment, and purchased intangibles subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be recoverable. Recoverability of the asset or asset group is measured by comparison of its carrying amount to undiscounted future net cash flows the asset or asset group is expected to generate. If the carrying amount of an asset or asset group is not recoverable, the Company recognizes an impairment loss based on the excess of the carrying amount of the asset or asset group over its respective fair value which is generally determined as the present value of estimated future cash flows or as the appraised value.

Assets Held for Sale

Assets and liabilities (the “disposal group”) are classified as held for sale when all of the following criteria are met: (i) the Company commits to a plan to sell the disposal group; (ii) it is unlikely the disposal plan will be significantly modified or discontinued; (iii) the disposal group is available for immediate sale in its present condition; (iv) actions required to complete the sale of the disposal group have been initiated; (v) the sale of the asset is probable and the completed sale is expected to occur within one year; and (vi) the disposal group is actively being marketed for sale at a price that is reasonable given its current market value. Upon classification as held for sale, such assets are no longer depreciated or depleted, and a measurement for impairment is performed to determine if there is any excess of carrying value over fair value less costs to sell. Subsequent changes to estimated fair value less the cost to sell will impact the measurement of assets held for sale if the fair value is determined to be less than the carrying value of the assets.

Debt Issuance Costs and Debt Discounts

Debt issuance costs are capitalized and amortized over the contractual term of the underlying debt using the straight line method which approximates the effective interest method. Debt discounts and lender arrangement fees deducted from the proceeds have been included as a component of the carrying value of debt and are being amortized to interest expense using the effective interest method.

13

Beginning in the first quarter of 2019, the Company entered into an interest rate cap to mitigate risks associated with the Company’s variable rate debt. See Note 11, “Derivative Financial Instruments” for further details. The Company paid $2,235 as a premium for the interest rate cap, which is being amortized to interest expense over its three-year term. The Company recorded $186 and $186 of premium amortization to interest expense during the three months ended March 31, 2020 and 2019, respectively and $372 and $248 during the six months ended March 31, 2020 and 2019, respectively.

In January 2020, the Company utilized $100,000 of the proceeds from the sale of the Memcor product line to repay a portion of the Company’s First Lien Term Loans. As a result of the prepayment, the Company wrote off $1,795 of deferred financing fees during the three months ended March 31, 2020.

In February 2020, the Company entered into Amendment No. 7 to the Credit Agreement, and as a result incurred $760 of fees which were recorded as deferred financing fees on the Consolidated Balance Sheets.

Amortization of debt issuance costs and discounts included in interest expense were $421 and $489 for the three months ended March 31, 2020 and 2019, respectively and $936 and $983 for the six months ended March 31, 2020 and 2019, respectively.

Revenue Recognition

The Company adopted Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606) on October 1, 2018, and recognizes sales of products and services based on the five-step analysis of transactions as provided in Topic 606 which requires an entity to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for such goods or services.

For sales of aftermarket parts or products with a low level of customization and engineering time, the Company recognizes revenues at the time risks and rewards of ownership pass, which is generally when products are shipped or delivered to the customer as the Company has no obligation for installation. Sales of short‑term service arrangements are recognized as the services are performed, and sales of long‑term service arrangements are typically recognized on a straight‑line basis over the life of the agreement.

For certain arrangements where there is significant customization to the product, the Company recognizes revenue either over time or at a point in time. These products include large capital water treatment projects, systems and solutions for municipal and industrial applications. The nature of the contracts is generally fixed price with milestone billings. The Company recognizes revenue over time if the product has no alternative use and the Company has an enforceable right to payment for the performance completed to date, including a normal profit margin, in the event of termination for convenience. If these two criteria are not met, revenues from these contracts will not be recognized until construction is complete. Contract revenues and cost estimates are reviewed and revised quarterly at a minimum and the cumulative effect of such adjustments are recognized in current operations. The amount of such adjustments have not been material. See Note 4, “Revenue” for further details.

Product Warranties

Accruals for estimated expenses related to warranties are made at the time products are sold and are recorded as a component of Cost of product sales in the Unaudited Consolidated Statements of Operations. The estimated warranty obligation is based on product warranty terms offered to customers, ongoing product failure rates, material usage and service delivery costs expected to be incurred in correcting a product failure, as well as specific obligations for known failures and other currently available evidence. The Company assesses the adequacy of the recorded warranty liabilities on a regular basis and adjusts amounts as necessary.

Leases

The Company accounts for leases in accordance with ASC Topic No. 842, Leases, adopted as of October 1, 2019 (Topic 842). Please see the “Accounting Pronouncements Recently Adopted” section below for information regarding this adoption. See Note 19, “Leases” for further details.

14

Lessee Accounting

The Company leases office space, buildings, vehicles, forklifts, computers, copiers and other assets under non-cancelable operating and finance leases. The Company determines whether an arrangement is or contains a lease at the inception of the arrangement based on the terms and conditions in the contract. A contract contains a lease if there is an identified asset and the Company has the right to control the asset. If the arrangement contains a lease, the Company recognizes a right-of-use (“ROU”) asset and an operating lease liability as of the lease commencement date. Operating lease assets and finance lease assets are included in Operating lease right-of-use assets, net and Property, plant, and equipment, net, respectively, on the Consolidated Balance Sheets. The corresponding operating lease liabilities are included in Accrued expenses and other liabilities and Obligation under operating leases on the Consolidated Balance Sheets. The corresponding finance lease liabilities are included in Accrued expenses and other liabilities and Other non‑current liabilities on the Consolidated Balance Sheets.

Lessor Accounting

The Company generates revenue through the lease of its water treatment equipment and systems to customers. In certain instances, the Company enters into a contract with a customer but must construct the underlying asset prior to its lease. At the time of contract inception, the Company determines if an arrangement is or contains a lease. These contracts generally contain both lease and non-lease components, including installation, maintenance and monitoring services of the Company owned equipment, in addition to sale of certain constructed assets. In situations where arrangements contain multiple elements, contract consideration is allocated based on relative standalone selling price. Lease components associated to underlying assets that have an alternative use are classified as operating leases with revenue recognized over time throughout the lease term, whereas lease components associated to underlying assets that have no alternative use are classified as sales-type leases, with point in time revenue recognition at the on-set of the lease. In order for a component to be separate, the Customer would be able to benefit from the right of use of the component separately or with other resources readily available to the Customer and the right of the use is not highly dependent or highly interrelated with the other rights to use the other underlying assets or components.

Shipping and Handling Cost

Shipping and handling costs are included as a component of Cost of product sales.

Derivative Financial Instruments

The Company’s risk-management strategy uses derivative financial instruments to manage interest rate risk and foreign currency exchange rate risk. The Company’s objective in using interest rate derivatives is to add stability to interest expense and manage its exposure to interest rate movements. To accomplish this objective, in November 2018, the Company entered into an interest rate cap which has been designated as a cash flow hedge. The Company uses foreign currency derivative contracts in order to manage the effect of exchange rate fluctuations on forecasted sales and purchases that are denominated in foreign currencies. To mitigate the impact of foreign exchange rate risk, the Company entered into a series of forward contracts designated as cash flow hedges. The Company does not enter into derivatives for trading or speculative purposes. The Company accounts for derivatives and hedging activities in accordance with ASC Topic No. 815, Derivatives and Hedging (ASC 815). The Company recognizes all derivatives on the balance sheet at fair value. Changes in the fair values of derivatives that are not designated as hedges are recognized in earnings. If the derivative is designated and qualifies as a hedge, depending on the nature of the hedge, changes in the fair value of the derivatives are either offset against the change in the hedged assets or liabilities through earnings or recognized in Accumulated other comprehensive income (loss), net of tax (“AOCI”) until the hedged item is recognized in earnings.

Income Taxes

The Company recognizes deferred tax assets and liabilities for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that included the enactment date. Valuation allowances are provided against deferred tax assets when it is deemed more likely than not that some portion or all of the deferred tax asset will not be realized within a reasonable time period. We assess tax positions using a two‑step process. A tax position is recognized

15

if it meets a more‑likely‑than‑not threshold, and is measured at the largest amount of benefit that is greater than 50% percent of being realized. Uncertain tax positions are reviewed each balance sheet date.

Foreign Currency Translation and Transactions

The functional currency for the international subsidiaries is the local currency. Assets and liabilities are translated into U.S. dollars using current rates of exchange, with the resulting translation adjustments recorded in AOCI within shareholders’ equity. Revenues and expenses are translated at the weighted‑average exchange rate for the period, with the resulting translation adjustments recorded in the Unaudited Consolidated Statements of Operations.

Foreign currency translation (gains) losses, mainly related to intercompany loans, which aggregated $7,614 and $593 for the three months ended March 31, 2020 and 2019, respectively and $1,171 and $5,408 for the six months ended March 31, 2020 and 2019, respectively, are primarily included in General and administrative expenses in the Unaudited Consolidated Statements of Operations.

Research and Development Costs

Research and development costs are expensed as incurred. The Company recorded $3,189 and $3,957 for the three months ended March 31, 2020 and 2019, respectively and $6,873 and $8,103 for the six months ended March 31, 2020 and 2019, respectively.

Equity‑based Compensation

The Company measures the cost of awards of equity instruments to employees based on the grant‑date fair value of the award. The grant‑date fair value of a non-qualified stock option is determined using the Black‑Scholes model. The fair value of restricted stock unit awards is determined using the closing price of the Company’s common stock on the date of grant. Compensation costs resulting from equity-based payment transactions are recognized primarily within General and administrative expenses, at fair value over the requisite vesting period on a straight-line basis.

Earnings (Loss) Per Share

Basic earnings (loss) per common share is computed based on the weighted average number of shares of common stock outstanding during the period. Diluted earnings per common share is computed based on the weighted average number of shares of common stock, plus the effect of diluted common shares outstanding during the period using the treasury stock method. Diluted potential common shares include outstanding stock options.

Retirement Benefits

The Company applies ASC Topic No. 715, Compensation—Retirement Benefits, which requires the recognition in pension obligations and AOCI of actuarial gains or losses, prior service costs or credits and transition assets or obligations that have previously been deferred. The determination of retirement benefit pension obligations and associated costs requires the use of actuarial computations to estimate participant plan benefits to which the employees will be entitled. The significant assumptions primarily relate to discount rates, expected long‑term rates of return on plan assets, rate of future compensation increases, mortality, years of service, and other factors. The Company develops each assumption using relevant experience in conjunction with market‑related data for each individual country in which such plans exist. All actuarial assumptions are reviewed annually with third‑party consultants and adjusted as necessary. For the recognition of net periodic postretirement cost, the calculation of the expected return on plan assets is generally derived by applying the expected long‑term rate of return on the market‑related value of plan assets. The fair value of plan assets is determined based on actual market prices or estimated fair value at the measurement date.

Variable Interest Entities

Treated Water Outsourcing (“TWO”) is a joint venture between the Company and Nalco Water, an Ecolab company, in which the Company holds a 50% partnership interest. The Company is obligated to absorb all risk of loss up to 100% of the joint venture partner’s equity. As such, the Company fully consolidates TWO as a variable interest entity (“VIE”) under ASC Topic No. 810, Consolidation. The Company has not provided additional financial support to this entity which it is not contractually required to provide, and the Company does not have the ability to use the assets of TWO to settle obligations of the Company’s other subsidiaries.

16

The following provides a summary of TWO’s balance sheet as of March 31, 2020 and September 30, 2019, and summarized financial information for the three and six months ended March 31, 2020 and 2019.

March 31, 2020 | September 30, 2019 | ||||||

Current assets (includes cash of $2,569 and $3,903) | $ | 4,567 | $ | 6,324 | |||

Property, plant and equipment | 1,212 | 2,186 | |||||

Goodwill | 2,206 | 2,206 | |||||

Other non-current assets | 3 | 3 | |||||

Total liabilities | (1,639 | ) | (2,388 | ) | |||

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2020 | 2019 | 2020 | 2019 | ||||||||||||

Total revenues | $ | 1,210 | $ | 3,222 | $ | 3,852 | $ | 6,378 | |||||||

Total operating expenses | (1,086 | ) | (2,806 | ) | (3,044 | ) | (5,036 | ) | |||||||

Income from operations | $ | 124 | $ | 416 | $ | 808 | $ | 1,342 | |||||||

On October 1, 2019, the Company acquired a 60% investment position in San Diego-based Frontier Water Systems, LLC (“Frontier”). The Frontier acquisition is a VIE because it has insufficient equity to finance its activities due to key assets being assigned to the Company upon acquisition. The Company, is the primary beneficiary of Frontier because the Company has the power to direct the activities that most significantly affect the Frontier’s economic performance. As the agreement to purchase the remaining interest was determined to be financing due to the mandatory Purchase Right, as per ASC Topic 480, Distinguishing Liabilities From Equity, the Company recognized a liability for the remaining 40% interest. Additionally, the Company fully consolidates Frontier as a VIE under ASC Topic No. 810, Consolidation. See Note 3, “Acquisitions and Divestitures” for further discussion of the Frontier acquisition.

The following provides a summary of Frontier’s balance sheet as of March 31, 2020, and summarized financial information for the three and six months ended March 31, 2020.

March 31, 2020 | |||

Current assets (includes cash of $3,721) | $ | 4,465 | |

Property, plant and equipment | 3,283 | ||

Goodwill | — | ||

Other non-current assets | — | ||

Total liabilities | (3,685 | ) | |

Three Months Ended March 31, | Six Months Ended March 31, | ||||||

2020 | 2020 | ||||||

Total revenues | $ | 1,078 | $ | 2,723 | |||

Total operating expenses | (1,612 | ) | (3,549 | ) | |||

Loss from operations | $ | (534 | ) | $ | (826 | ) | |

Recent Accounting Pronouncements

In March 2020, the Financial Accounting Standards Board (“FASB”) issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting which provides optional expedients and exceptions for contracts, hedging relationships and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform, if certain criteria are met. ASU 2020-04 is effective immediately

17

and expires on December 21, 2022. The ASU allows eligible contracts that are modified to be accounted for as a continuation of those contracts, permits companies to preserve their hedging accounting during the transition period and enables companies to make a one-time election to transfer or sell held-to-maturity debt securities that are affected by rate reform. The Company is currently assessing the impact of adoption on the Company’s Unaudited Consolidated Financial Statements and related disclosures.

In March 2020, the FASB issued ASU 2020-03, Codification Improvements to Financial Instruments, which includes several amendments to clarify, conform or improve the Codification and make it easier to apply by eliminating inconsistencies and providing clarifications. The ASU includes seven different issues that describe the areas of improvement and the related amendments, which have various effective dates. The Company is currently assessing the impact of adoption on the Company’s Unaudited Consolidated Financial Statements and related disclosures.

In November 2018, the FASB issued ASU 2018-19, Codification Improvements to Topic 326, Financial Instruments—Credit Losses which clarifies that receivables from operating leases are accounted for using the lease guidance and not as financial instruments. ASU 2018-19 will be effective for the Company for the quarter ending December 31, 2020, with early adoptions permitted. The Company is currently assessing the impact of adoption on the Company’s Unaudited Consolidated Financial Statements.

In November 2018, the FASB issued ASU 2018-18, Collaborative Arrangements (Topic 808) Clarifying the Interaction between Topic 808 and Topic 606, which clarifies that certain transactions between collaborative arrangement participants should be accounted for as revenue under Topic 606 when the collaborative arrangement participant is a customer in the context of a unit of account. In addition, unit-of-account guidance in Topic 808 was aligned with the guidance in Topic 606 (that is, a distinct good or service) when an entity is assessing whether the collaborative arrangement or a part of the arrangement is within the scope of Topic 606. ASU 2018-18 should be applied retrospectively to the date of initial adoption of Topic 606 and is effective for the Company for the quarter ending December 31, 2020, with early adoption permitted. The Company is currently assessing the impact of adoption on the Company’s Unaudited Consolidated Financial Statements.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Subtopic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement, which modifies the disclosure requirements on fair value measurements. The amendments on changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and the narrative description of measurement uncertainty should be applied prospectively for only the most recent interim or annual period presented in the initial year of adoption. All other amendments should be applied retrospectively to all periods presented upon their effective date. ASU 2018-14 will be effective for the Company for the quarter ending December 31, 2020, with early adoption permitted. The Company is currently assessing the impact of adoption on the Company’s disclosures.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, amended in November 2019 (ASU 2019-11 and 2019-10), which requires entities to use a new forward-looking “expected loss” model that reflects expected credit losses, including credit losses related to trade receivables, and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates which generally will result in the earlier recognition of allowances for losses. ASU 2016-13 will be effective for the Company for the quarter ending December 31, 2020, with early adoption permitted. The Company is currently assessing the impact of adoption on the Company’s Unaudited Consolidated Financial Statements.

Accounting Pronouncements Recently Adopted

The Company adopted ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, as of October 1, 2019, which simplifies the accounting for income taxes by removing certain exceptions and by clarifying and amending existing guidance in order to improve consistent application of and simplify GAAP for other areas of Topic 740. This adoption did not have an impact on the Company’s Unaudited Consolidated Financial Statements.

The Company adopted ASU 2018‑07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting, as of October 1, 2019. ASU 2018-07 expands the scope of Topic 718 to include share-based payment transactions for acquiring goods and services from nonemployees. This adoption did not have an impact on the Company’s Unaudited Consolidated Financial Statements.

18

The Company adopted ASU 2017‑12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, as of October 1, 2019. ASU 2017-12 expands and refines hedge accounting for both nonfinancial and financial risk components and aligns the recognition and presentation of the effects of the hedging instrument and the hedged item in the financial statements and also made certain targeted improvements to simplify the application of hedge accounting guidance and ease the administrative burden of hedge documentation requirements and assessing hedge effectiveness. This adoption did not have a material impact on the Company’s Unaudited Consolidated Financial Statements.

The Company adopted ASU 2016-02, Leases (Topic 842), including associated ASUs related to Topic 842, as of October 1, 2019. ASU No. 2016-02 requires recognition of operating leases as lease assets and liabilities on the balance sheet, and disclosure of key information about leasing arrangements. Amendments to the standard were issued by the FASB in January, July and December 2018, and March 2019 including certain practical expedients, an amendment that provides an additional and optional transition method to adopt the standard at the adoption date and recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption and certain narrow-scope improvements for lessors. The Company adopted this standard using a modified retrospective approach, applying the new standard to all leases existing at the date of initial adoption and the Company elected to apply the transition requirements at the October 1, 2019 effective date rather than the beginning of the earliest comparative period presented. As a result, the Company recorded a cumulative effect adjustment in the period of adoption, and prior periods were not restated and continue to be reported in accordance with historic accounting under ASC Topic No. 840. In addition, the Company has elected the package of practical expedients permitted under the transition guidance which does not require reassessment of prior conclusions related to contracts containing a lease, lease classification and initial direct lease costs. As an accounting policy election, the Company elected to exclude short-term leases (term of 12 months or less) from the balance sheet and accounts for non-lease and lease components separately for all asset classes. The following table summarizes the impact of adoption to the Consolidated Balance Sheet as of October 1, 2019:

As Reported September 30, 2019 | Impact of Adoption of ASU 2016-02 | Updated October 1, 2019 | |||||||||

Assets | |||||||||||

Prepaid and other current assets | $ | 21,940 | $ | (73 | ) | $ | 21,867 | ||||

Total current assets | 637,293 | (73 | ) | 637,220 | |||||||

Property, plant and equipment, net | 333,584 | 2,812 | 336,396 | ||||||||

Operating lease right-of-use assets, net | — | 42,073 | 42,073 | ||||||||

Total Assets | 1,737,848 | 44,812 | 1,782,660 | ||||||||

Liabilities | |||||||||||

Accrued expenses and other liabilities | 101,839 | 13,596 | 115,435 | ||||||||

Total current liabilities | 322,221 | 13,596 | 335,817 | ||||||||

Obligation under operating leases | — | 29,308 | 29,308 | ||||||||

Other non-current liabilities | 78,661 | 3,245 | 81,906 | ||||||||

Total non-current liabilities | 1,049,805 | 32,553 | 1,082,358 | ||||||||

Total liabilities | 1,372,026 | 46,149 | 1,418,175 | ||||||||

Shareholders' equity | |||||||||||

Retained deficit | (174,976 | ) | (1,337 | ) | (176,313 | ) | |||||

Total Evoqua Water Technologies Corp. equity | 362,759 | (1,337 | ) | 361,422 | |||||||

Total shareholder's equity | 365,822 | (1,337 | ) | 364,485 | |||||||

Total liabilities and shareholders' equity | $ | 1,737,848 | $ | 44,812 | $ | 1,782,660 | |||||

19

3. Acquisitions and Divestitures

Acquisitions

Acquisitions support the Company’s strategy of delivering a broad solutions portfolio with robust technology across multiple geographies and end markets. The Company continues to evaluate potential strategic acquisitions of businesses, assets and product lines and believes that capex-like, tuck-in acquisitions present a key opportunity within its overall growth strategy.

On October 1, 2019, the Company acquired a 60% investment position in San Diego-based Frontier Water Systems, LLC (“Frontier”) for $11,160 cash paid at closing. Frontier is a pioneer in the development of patented, engineered equipment packages for high-rate treatment and removal of selenium, nitrate and other metals from complex water systems. During the six months ended March 31, 2020, the Company incurred approximately $402 in acquisition costs, which are included in General and administrative expenses. Frontier is part of the Integrated Solutions and Services segment.

The Company has entered into an agreement to purchase the remaining 40% interest in Frontier on or prior to March 30, 2024. This agreement (a) gives holders of the remaining 40% interest in Frontier (the “Minority Owners”) the right to sell to Evoqua up to approximately 10% of the outstanding equity in Frontier at a predetermined price, which right may be exercised by the Minority Owners between January 1, 2021 and February 28, 2021 (the “Option”), and (b) obligates the Company to purchase and the Minority Owners to sell all of the Minority Owners’ remaining interest in Frontier at the fair market value at the time of sale on or prior to March 30, 2024 (the “Purchase Right”). The Purchase Right may be exercised early by the Minority Owners. The agreement to purchase the remaining interest was determined to be financing due to the mandatory Purchase Right, as per ASC Topic 480, Distinguishing Liabilities From Equity, and as such, the Company will recognize a liability for the remaining 40% interest.

The value of the Option was determined to be $506 using a Black Scholes model, and is included within Accrued expenses and other liabilities on the Consolidated Balance Sheets.

The value of the Purchase Right was determined to be $6,661, and is included within Other non‑current liabilities on the Consolidated Balance Sheets, based upon the enterprise value of Frontier upon the acquisition date as per ASC Topic 480, Distinguishing Liabilities From Equity. Pursuant to ASC Topic 480, the Company determined that this should be recorded as a liability and should be recognized at the fair value at the time of inception, adjusted for any consideration or unstated rights or privileges. The liability will be subsequently measured at an amount that would be paid on the reporting date with any change in value from the previous reporting date recognized as interest cost.

The accounting for the acquisition has not yet been completed because the Company has not finalized the valuations of the acquired assets, assumed liabilities and identifiable intangible assets, including goodwill. The preliminary opening balance sheet for Frontier is summarized as follows:

Current assets | $ | 3,186 | |

Property, plant and equipment | 3,570 | ||

Goodwill | 1,466 | ||

Intangible assets | 11,571 | ||

Total assets acquired | 19,793 | ||

Liabilities related to Option and Purchase Right | (7,167 | ) | |

Other liabilities assumed | (1,466 | ) | |

Net assets acquired | $ | 11,160 | |

Divestitures

On December 31, 2019, the Company completed the previously-announced sale of the Memcor product line to DuPont de Nemours, Inc. (“DuPont”). The aggregate purchase price paid by DuPont in the Transaction was $110,000 in cash, subject to certain adjustments. Following adjustments for cash and net working capital, gross proceeds paid by DuPont were $131,011. The Company recognized a $49,000 net pre-tax benefit on the sale of the Memcor product line, net of $8,300 of discretionary compensation payments to employees in connection with the transaction and $1,000 in transaction costs incurred in the three months ended December 31, 2019. As a result of net working capital adjustments, the Company

20

recognized an additional $9,000 net pre-tax benefit in the three months ended March 31, 2020. The Company utilized $100,000 of the proceeds from the transaction to repay a portion of the Company’s First Lien Term Loans in January 2020.

4. Revenue

Revenue Recognition

The Company recognizes sales of products and services based on the five-step analysis of transactions as provided in Topic 606. For all contracts with customers, the Company first identifies the contract which usually is established when the customer’s purchase order is accepted or acknowledged. Next the Company identifies the performance obligations in the contract. A performance obligation is a promise in a contract to transfer a distinct good or service to the customer. The Company then determines the transaction price in the arrangement and allocates the transaction price to each performance obligation identified in the contract. The Company’s allocation of the transaction price to the performance obligations are based on the relative standalone selling prices for the goods and services contained in a particular performance obligation. The transaction price is adjusted for the Company’s estimate of variable consideration which may include discounts if the Company would fail to meet certain performance requirements, volume discounts or early payment discounts. To estimate variable consideration, the Company utilizes historical experience and known terms. Variable consideration in contracts for the three and six months ended March 31, 2020 was insignificant.

For sales of aftermarket parts or products with a low level of customization and engineering time, the Company recognizes revenues at the time risks and rewards of ownership pass, which is generally when products are shipped or delivered to the customer as the Company has no obligation for installation. The Company considers shipping and handling services to be fulfillment activities and as such they do not represent separate performance obligations for revenue recognition. Sales of service arrangements are recognized as the services are performed.

For certain arrangements where there is significant customization to the product and for long-term construction-type sales contracts, revenue may be recognized over time. In these instances, revenue is recognized using a measure of progress that applies an input method based on costs incurred in relation to total estimated costs. These arrangements include large capital water treatment projects, systems and solutions for municipal and industrial applications. The nature of the contracts is generally fixed price with milestone billings. In order for revenue to be recognized over a period of time, the product must have no alternative use and the Company must have an enforceable right to payment for the performance completed to date, including a normal profit margin, in the event of termination for convenience. If these two criteria are not met, revenues from these contracts will not be recognized until construction is complete. Instead, revenues from these contracts will be recognized when construction is complete. Contract revenues and cost estimates are reviewed and revised quarterly at a minimum and the cumulative effect of such adjustments are recognized in current operations. The amount of such adjustments have not been material.

The Company has made accounting policy elections to exclude all taxes by governmental authorities from the measurement of the transaction price and that long-term construction-type sales contracts, or those contracts for products with significant customization that the total contract price is less than $100 will be recorded at the point in time when the construction is complete.

Performance Obligations

The Company elects to apply the practical expedient to exclude from this disclosure revenue related to performance obligations if the product has an alternative use and the Company does not have an enforceable right to payment for the performance completed to date, including a normal profit margin, in the event of termination for convenience. The Company maintains a backlog of confirmed orders of approximately $174,824 at March 31, 2020. This backlog represents the aggregate amount of the transaction price allocated to performance obligations that were unsatisfied or partially unsatisfied as of the end of the reporting period. The Company estimates that the majority of these performance obligations will be satisfied within the next twelve months.

The recording of assets recognized from the costs to obtain and fulfill customer contracts primarily relate to the deferral of sales commissions. The Company’s costs incurred to obtain or fulfill a contract with a customer are classified

21

as non-current assets and amortized to expense over the period of benefit of the related revenue. These costs are recorded within Cost of product sales and services. The amount of contract costs was insignificant at March 31, 2020.

The Company offers standard warranties that generally do not represent a separate performance obligation. In certain instances, a warranty is obtained separately from the original equipment sale or the warranty provides incremental services and as such is treated as a separate performance obligation.

Disaggregation of Revenue

In accordance with Topic 606, the Company disaggregates revenue from contracts with customers into source of revenue, reportable operating segment and geographical regions. The Company determined that disaggregating revenue into these categories meets the disclosure objective in Topic 606 which is to depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

Information regarding the source of revenues:

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2020 | 2019 | 2020 | 2019 | ||||||||||||

Revenue from contracts with customers recognized under Topic 606 | $ | 314,994 | $ | 316,098 | $ | 623,596 | $ | 609,102 | |||||||

Other (1) | 36,669 | 32,530 | 74,172 | 62,528 | |||||||||||

Total | $ | 351,663 | $ | 348,628 | $ | 697,768 | $ | 671,630 | |||||||

(1) | Other revenue relates to revenue recognized from Topic 842 (previously Topic 840), Leases, mainly attributable to long term rentals. |

Information regarding revenues disaggregated by source of revenue and segment is as follows:

Three Months Ended March 31, | |||||||||||||||||||||||

2020 | 2019 | ||||||||||||||||||||||

Integrated Solutions and Services | Applied Product Technologies | Total | Integrated Solutions and Services | Applied Product Technologies | Total | ||||||||||||||||||

Revenue from capital projects | $ | 66,092 | $ | 75,214 | $ | 141,306 | $ | 57,631 | $ | 76,271 | $ | 133,902 | |||||||||||

Revenue from aftermarket | 31,901 | 32,762 | 64,663 | 32,474 | 40,492 | 72,966 | |||||||||||||||||

Revenue from service | 139,892 | 5,802 | 145,694 | 136,759 | 5,001 | 141,760 | |||||||||||||||||

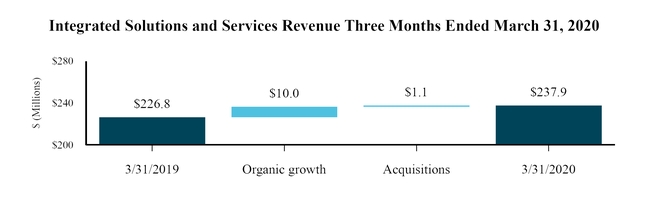

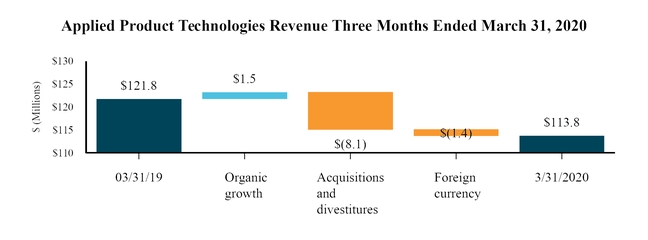

Total | $ | 237,885 | $ | 113,778 | $ | 351,663 | $ | 226,864 | $ | 121,764 | $ | 348,628 | |||||||||||

Six Months Ended March 31, | |||||||||||||||||||||||

2020 | 2019 | ||||||||||||||||||||||

Integrated Solutions and Services | Applied Product Technologies | Total | Integrated Solutions and Services | Applied Product Technologies | Total | ||||||||||||||||||

Revenue from capital projects | $ | 120,712 | $ | 150,140 | $ | 270,852 | $ | 100,640 | $ | 147,497 | $ | 248,137 | |||||||||||

Revenue from aftermarket | 61,574 | 70,103 | 131,677 | 63,270 | 75,549 | 138,819 | |||||||||||||||||

Revenue from service | 283,737 | 11,502 | 295,239 | 273,452 | 11,222 | 284,674 | |||||||||||||||||

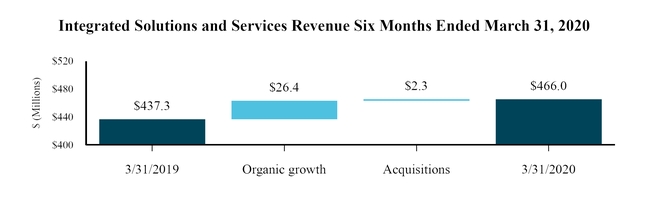

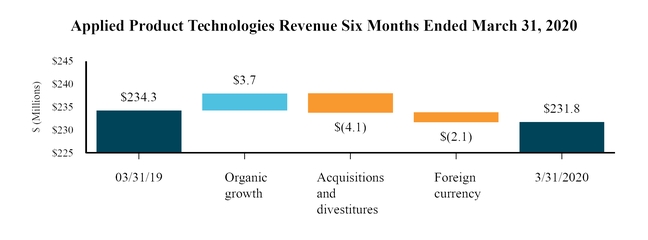

Total | $ | 466,023 | $ | 231,745 | $ | 697,768 | $ | 437,362 | $ | 234,268 | $ | 671,630 | |||||||||||

22

Information regarding revenues disaggregated by geographic area is as follows:

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2020 | 2019 | 2020 | 2019 | ||||||||||||

United States | $ | 290,273 | $ | 280,468 | $ | 567,990 | $ | 539,186 | |||||||

Europe | 30,381 | 23,141 | 56,493 | 44,558 | |||||||||||

Canada | 16,319 | 17,660 | 33,882 | 37,963 | |||||||||||

Asia | 12,720 | 20,496 | 31,462 | 39,404 | |||||||||||

Australia | 1,970 | 6,863 | 7,941 | 10,519 | |||||||||||

Total | $ | 351,663 | $ | 348,628 | $ | 697,768 | $ | 671,630 | |||||||

Contract Balances

The Company performs its obligations under a contract with a customer by transferring products and/or services in exchange for consideration from the customer. The Company receives payments from customers based on a billing schedule as established in its contracts.