Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PALTALK, INC. | f8k100918_peerstreaminc.htm |

Exhibit 99.1

Ticker: PEER INVESTOR PRESENTATION PeerStream , Inc. | OTCQB: PEER October 2018

Ticker: PEER This presentation is for discussion purposes only. Certain material is based upon third party information that we consider r eli able, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Certain statements in this presentation constitute “forward - looking statements” relating to PeerStream , Inc. (“PEER,” “ PeerStream ” or the “Company”) made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that are based on current expectations, estimates, forecasts and assumpt ion s and are subject to risks and uncertainties. Words such as “anticipate,” “assume,” “began,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend, ” “ may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “would” and variations of such words and similar expressions are intended to identify such forward - looking statements. All forward - looking statements speak only as of the date on which they are made. Such forward - looking statements are subject to certain risks, uncertainties and assumptions relating to fac tors that could cause actual results to differ materially from those anticipated in such statements, including, without limitation, the following: • our increasing focus on the use of new and novel technologies, such as blockchain, to enhance our applications, and our abili ty to timely complete development of applications using new technologies; • our ability to effectively market and generate revenue from our new business solutions unit; • our ability to generate and maintain active subscribers and to maintain engagement with our user base; • development and acceptance of blockchain technologies and the continuing growth of the blockchain industry; • the intense competition in the industries in which our business operates and our ability to effectively compete with existing com pet itors and new market entrants; • legal and regulatory requirements related to us investing in cryptocurrencies and accepting cryptocurrencies as a method of payment fo r our services; • risks related to our holdings of XPX tokens, including risks related to the volatility of the trading price of the XPX tokens and o ur ability to convert XPX tokens into fiat currency; • our ability to develop functional new blockchain - based technologies that will be accepted by the marketplace, including PSP; • our ability to obtain additional capital or financing to execute our business plan, including through offerings of debt or equity; • our ability to develop, establish and maintain strong brands; • the effects of current and future government regulation, including laws and regulations regarding the use of the internet, privac y a nd protection of user data and blockchain and cryptocurrency technologies; • our ability to manage our partnerships and strategic alliances, including the resolution of any material disagreements and the ab ili ty of our partners to satisfy their obligations under these arrangements; • our reliance on our executive officers; and • our ability to release new applications on schedule or at all, as well as our ability or improve upon existing applications. For a more detailed discussion of these and other factors that may affect our business, see our filings with the Securities a nd Exchange Commission, including the discussion under “Risk Factors” set forth in our latest Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q. We caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business. We do not undertake any obligation to update any forward - lookin g statement, whether written or oral, relating to the matters discussed in this report, except to the extent required by applicable securities laws. Safe Harbor 2

Ticker: PEER Closing Price 1 $ 5 . 99 Shares Outstandin g 1 6. 9MM Market Cap 1 $ 41.3MM Enterprise Value 2 $ 33.6MM FY 2017 Rev enues $ 24.8MM Total Cash 3 $ 7 . 7MM 1 As of 9/25/18. 2 Market Cap plus cash at 6/30/18 3 Cash and cash equivalents as of 6/30/18, includes approximately $5.0 million of consideration we received under our agreement with ProximaX in May 2018. 3 OTCQB:PEER A global internet solutions provider pioneering real - world adoption of emerging blockchain technologies by developing software, services and applications for corporate clients and consumers

Ticker: PEER Investment Highlights 4 Unique small cap investment opportunity in blockchain software solutions innovation Experienced management team combines entrepreneurial drive with enterprise leadership Blockchain is one of today’s most transformative technologies and provides a high growth market opportunity to build infrastructure and drive adoption Strong balance sheet to support organic growth and potential acquisitions Seizing the opportunity: our commercial blockchain software and services should enable us to build a pipeline of new projects

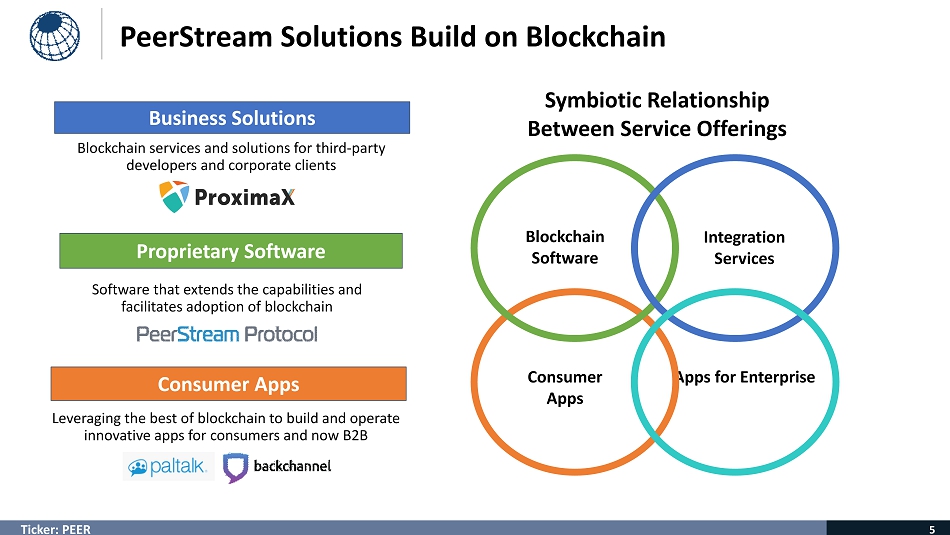

Ticker: PEER PeerStream Solutions Build on Blockchain 5 Leveraging the best of blockchain to build and operate innovative apps for consumers and now B2B Blockchain services and solutions for third - party developers and corporate clients Software that extends the capabilities and facilitates adoption of blockchain Symbiotic Relationship Between Service Offerings Consumer Apps Proprietary Software Business Solutions Blockchain Software Apps for Enterprise Consumer Apps Integration Services 5

Ticker: PEER 6 Opportunity for blockchain technology to impact virtually every key sector Cost Efficient Enhanced Privacy Highly - Scalable More Secure Blockchain is Disrupting the Way Business is Done BLOCKCHAIN

Ticker: PEER x Enterprise and government sectors are embracing the value of blockchain tech x Nearly 6 in 10 large corporations considering blockchain deployment 1 x The market for blockchain services was approximately $695MM in 2017 and expected to grow to more than $79 billion by 2025 2 x IBM recently announced a 5 - year deal with the Australian government valued at $740MM x Estimated operating and capital cost savings in financial services from blockchain - $ 35 billion 2 x PeerStream’s current and future capabilities position us to capture market share x Media streaming blockchain services anticipated to be a $4.4 billion market by 2025 3 x R&D for new capabilities is expected to expand our addressable market opportunity 7 1 Juniper Research July 31, 2017 2 Bain and Company 2017 3 (2018) Global Market Estimates Research & Consultants Blockchain High Growth Market Opportunity

Ticker: PEER Business Overview 8 8 Consumer Apps Proprietary Software Business Solutions

Ticker: PEER Business Solutions: Enterprise Blockchain Integration Enterprise interest in blockchain and a global tech talent shortage create our market opportunity 9 9 PEERSTREAM BUSINESS SOLUTIONS B2B revenue streams are expected to include blockchain strategy consulting, implementation and support Provides technology services and support for blockchain implementations aiming to serve enterprise and governments Dedicated to providing a bridge between emerging blockchain technologies and commercial implementations • Strength in blockchain software development is a competitive advantage • Preferred integrator partnership with ProximaX expected to generate leads • Ramping up sales and business development capabilities and marketing efforts • Building capabilities across several key tech disciplines and industry verticals

Ticker: PEER 10 The Project The Engagement • PeerStream to supply multimedia streaming and communication solution • Licensing and integration of Peerstream Protocol (PSP) into the ProximaX platform • Service fees payable in cash or highly liquid cryptocurrencies and ProximaX tokens* • First client for Business Solutions services • High - profile PSP adopter validates technology • PEER appointed preferred ProximaX integrator in North America The Benefits: * First milestone payment of $5MM and 216MM XPX tokens has been paid; remaining fees and tokens to be paid upon subsequent milestones as set forth in our technology services agreement with ProximaX . 10 Business Solutions Launch Client: • Next generation blockchain protocol enhanced with storage and media streaming/messaging layers • Led by blockchain foundation pioneer Lon Wong, former President of the NEM.io foundation • ProximaX Completed successful ICO in Q2 2018

Ticker: PEER Business Overview 11 Consumer Apps Business Solutions 11 Proprietary Software

Ticker: PEER 12 Proprietary Software Powerful, but still emerging, blockchain protocols present rich opportunity for enhancement OPPORTUNITY APPROACH MONETIZATION Developing blockchain - based software that can support decentralized applications in many industry verticals Focusing development on middleware for leading and emerging blockchain protocols • Enhance and extend capabilities • Facilitate blockchain implementations We expect Business Solutions engagements to identify future opportunities for proprietary software Expected revenue streams include: • Software licenses • Bundled software licenses and implementation services • Support for licensed software Proprietary Software: Unleashing the Power of Protocols

Ticker: PEER Consumer Apps social networks live video streaming video chat distance learning Proprietary Software: 13 PSP is designed to be a multimedia communication protocol featuring privacy and security 13 B2B Apps video conferencing workforce collaboration sales demos telehealt h Slated for Q4 2018, PSP is expected to offer scalability and cost efficiency to applications that require real - time data and video communications, such as: PSP will route live rich media streams over blockchain enabled P2P networks

Ticker: PEER Business Overview 14 Proprietary Software Business Solutions 14 Consumer Apps

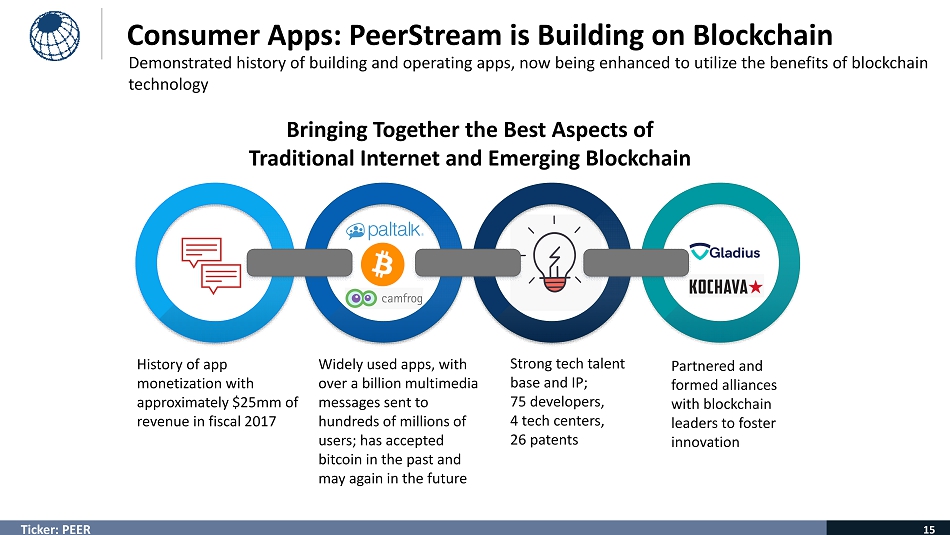

Ticker: PEER 15 Consumer Apps: PeerStream is Building on Blockchain Demonstrated history of building and operating apps, now being enhanced to utilize the benefits of blockchain technology History of app monetization with approximately $25mm of revenue in fiscal 2017 Bringing Together the Best Aspects of Traditional Internet and Emerging Blockchain Widely used apps, with over a billion multimedia messages sent to hundreds of millions of users; has accepted bitcoin in the past and may again in the future Strong tech talent base and IP; 75 developers, 4 tech centers, 26 patents Partnered and formed alliances with blockchain leaders to foster innovation

Ticker: PEER D ecentralized media delivery No p ersonally i dentifiable information F reemium app with token payments 16 16 Consumer Apps: Backchannel Backchannel will be a secure, private video messaging app powered by blockchain using PSP Bought by Facebook in 2014 for $19B; Had 1.5B MAUs in 2017 1 Secure Messaging is a Large and Fast Growing Market Other secure messaging apps growing rapidly: Expected launch* in Q4 2018 Backchannel will be decentralized and use the identity features of blockchain to offer greater privacy to end users Raised $ 1.7B 2 in ICO 1 https://www.forbes.com/sites/parmyolson/2014/10/06/facebook - closes - 19 - billion - whatsapp - deal/amp/ 2 https:// www.bloomberg.com/news/articles/2018 - 03 - 30/telegram - raises - 1 - 7 - billion - in - coin - offering - may - seek - more * The proof - of - concept release is expected to by a hybrid version that is partially decentralized, with the fully decentralized version expected to launch in 2019.

Ticker: PEER Jason Katz Chairman, President + COO Judy Krandel Alex Harrington CEO CFO • Joined PeerStream in 2014 and has also served as interim CFO • CEO of MeetMoi, a mobile dating pioneer (sold to Match.com) • SVP of Strategy & Operations for Zagat (acquired by Google) • MBA from Wharton and a B.A. from Williams College • 25 - year veteran as a small - cap portfolio manager and equity analyst • MBA from the University of Chicago, and a B.S.E. from Wharton • Member of the Board of Directors of Cynergistek (CTEK) • Founder of A.V.M. Software • Authority on instant messaging as well as web - based voice and video • Co - founder of MJ Capital, a money management firm • J.D. from NYU Law and a B.A. from the University of Pennsylvania 17 17 Seasoned Leadership with Diverse and Complementary Expertise

Ticker: PEER • Active angel investor with more than $2.5B in exits • CEO of Science, Inc. • Recent exits include: Dollar Shave Club, Famebit, DogVacay and HelloSociety • Previous CEO of MySpace, Userplane and Tsavo • Recently launched his newest incubator, Science Blockchain, which recently completed an ICO Lon Wong Lou Kerner Blockchain Advisory Board 18 Advisors with impressive credentials broaden our network of opportunities M ike Jones • Former equity analyst from Goldman Sachs, Merrill Lynch • Ranked among the 5 most influential crypto bloggers on Medium • Formerly a Managing Partner of The Social InternetFund (SIF) • Angel investor, best known for investing in Facebook • Globally recognized blockchain pioneer, former President of NEM Foundation, Founder of ProximaX • Serial tech entrepreneur, 30+ years of technical and industry expertise building startups • Founder and CEO of Dragonfly Fintech Pte.Ltd. Sheri Kaiserman • Founder and principal advisor of Maco.la , a dynamic blockchain VC, advisory and talent resource firm • Previously Head of the Equities at Wedbush Securities; 25+ years equity sales leadership experience • Received numerous achievement awards in industry leadership and innovation • Past media appearances include CNBC Squawk on the Street 18

Ticker: PEER Next Steps to Fuel Strategic Growth 19 Branding/ marketing/ build market awareness and presence Assessing future proprietary software development to expand capabilities Evaluating tuck - in acquisitions Exploring partnerships and joint ventures Referrals from ProximaX integration partner and inbound inquiries Building business d evelopment and sales efforts

Ticker: PEER Impact of ProximaX Deal on Q2 2018 and Beyond 20 • The deal is valued in total at $13.4MM • The upfront payment of $5MM and $3.4MM in tokens will be recognized ratably over the contract term, beginning with Q2 2018 • Upfront net cash received of $4.9MM posted to balance sheet on 5/7/18 2 • Upfront 216MM XPX tokens valued at $ 3.4MM posted to assets on 6/2/18 3 . For accounting purposes, t he tokens are treated as an intangible asset and could be subject to periodic impairment charges • Two additional payments of $2.5MM each to be recognized at fulfillment of contract terms • An additional 2% of ProximaX’s outstanding XPX tokens are reserved for issuance upon the completion of future services • PeerStream has an NOL worth approximately $19MM, with $6MM of the NOL available for use in 2018 Under our agreement with ProximaX we provide PSP licensing and integration, with contract services expected to be completed in Q2 2019 1 1 Based on our anticipated schedule for completing PSP, which may be subject to unanticipated delays and could change. 2 Net of trading commissions and conversion costs 3 Token value based on the initial market price on a public exchange

Ticker: PEER Income Statement Highlights ($000s) 21 • Most recent financial results includes revenue of $2.1 million from the ProximaX technology services agreement signed in March 2018. 1 Adjusted EBITDA is a non - GAAP measure. See Appendix for a reconciliation of Adjusted EBITDA to net loss, the most directly comp arable financial measure calculated in accordance with GAAP. Revenue $13,139 $12,959 $24,841 Net Loss $(2,674) $(2,523) $(5,894) Adjusted EBITDA 1 $1,223 $(729) $(1,931) Six Months Ended June 30, 2018 Six Months Ended June 30, 2017 Year Ended December 31, 2017

Ticker: PEER Balance Sheet Highlights ($ 000s) 22 June 30, 2018 Cash and Cash Equivalents $7,739 Digital Tokens $1,409 Total Assets $26,770 Deferred Revenue $8,666 Total Liabilities $11,220 Shareholder’s Equity $15,550 Total Liabilities and Shareholders Equity $26,770

Ticker: PEER Investment Highlights 23 Unique small cap investment opportunity in blockchain software solutions innovation Experienced management team combines entrepreneurial drive with enterprise leadership Blockchain is one of today’s most transformative technologies and provides a high growth market opportunity to build infrastructure and drive adoption Strong balance sheet to support organic growth and potential acquisitions Seizing the opportunity: our commercial blockchain software and services should enable us to build a pipeline of new projects

Ticker: PEER ir@peerstream.com 24 THANK YOU PeerStream , Inc. | Ticker: PEER

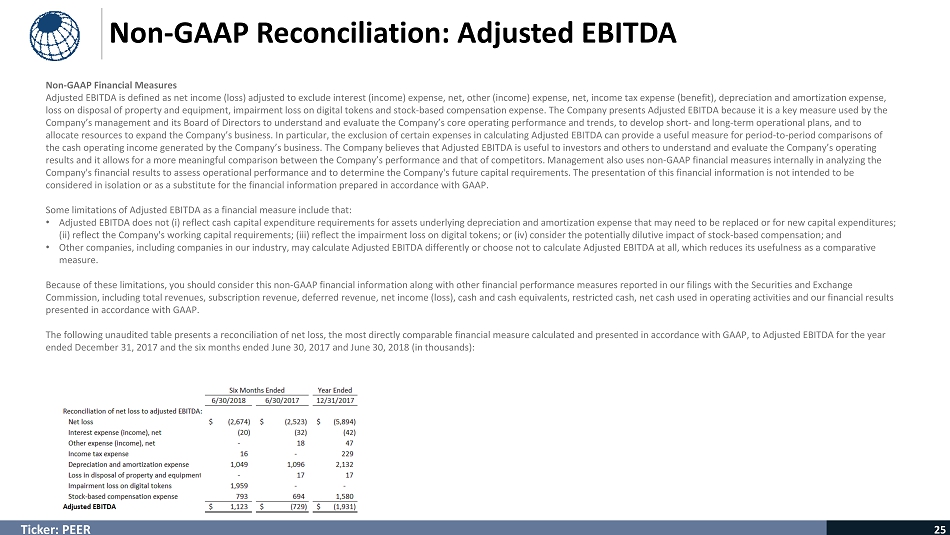

Ticker: PEER Non - GAAP Financial Measures Adjusted EBITDA is defined as net income (loss) adjusted to exclude interest (income) expense , net, other (income) expense, net, income tax expense (benefit), depreciation and amortization expense, loss on disposal of property and equipment, impairment loss on digital tokens and stock - based compensation expense. The Company presents Adjusted EBITDA because it is a key measure used by the Company’s management and its Board of Directors to understand and evaluate the Company’s core operating performance and trend s, to develop short - and long - term operational plans, and to allocate resources to expand the Company’s business. In particular, the exclusion of certain expenses in calculating Adjusted EB ITDA can provide a useful measure for period - to - period comparisons of the cash operating income generated by the Company’s business. The Company believes that Adjusted EBITDA is useful to investo rs and others to understand and evaluate the Company’s operating results and it allows for a more meaningful comparison between the Company’s performance and that of competitors. Management also uses non - GAAP financial measures internally in analyzing the Company's financial results to assess operational performance and to determine the Company's future capital requirements. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared in accordance with GAAP. Some limitations of Adjusted EBITDA as a financial measure include that: • Adjusted EBITDA does not ( i ) reflect cash capital expenditure requirements for assets underlying depreciation and amortization expense that may need to be replaced or for new capital expenditures; (ii) reflect the Company's working capital requirements; ( iii ) reflect the impairment loss on digital tokens; or (iv) consider the potentially dilutive impact of stock - based compensation; and • Other companies, including companies in our industry, may calculate Adjusted EBITDA differently or choose not to calculate Ad jus ted EBITDA at all, which reduces its usefulness as a comparative measure. Because of these limitations, you should consider this non - GAAP financial information along with other financial performance mea sures reported in our filings with the Securities and Exchange Commission, including total revenues, subscription revenue, deferred revenue, net income (loss), cash and cash equivalents, r est ricted cash, net cash used in operating activities and our financial results presented in accordance with GAAP. The following unaudited table presents a reconciliation of net loss, the most directly comparable financial measure calculate d a nd presented in accordance with GAAP, to Adjusted EBITDA for the year ended December 31, 2017 and the six months ended June 30, 2017 and June 30, 2018 ( in thousands): Non - GAAP Reconciliation: Adjusted EBITDA 25