Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF MARCUM LLP - PALTALK, INC. | f10k2015ex23i_snap.htm |

| EX-3.3 - CERTIFICATE OF AMENDMENT TO CERTIFICATE OF INCORPORATION, DATED MARCH 8, 2016 - PALTALK, INC. | f10k2015ex3iii_snap.htm |

| EX-32.1 - CERTIFICATION - PALTALK, INC. | f10k2015ex32i_snapinter.htm |

| EX-31.1 - CERTIFICATION - PALTALK, INC. | f10k2015ex31i_snapinter.htm |

| EX-21.1 - SUBSIDIARIES OF THE COMPANY - PALTALK, INC. | f10k2015ex21i_snapinter.htm |

| EX-10.13 - RESTRICTED STOCK AWARD AGREEMENT, DATED AS OF MARCH 3, 2016, BY AND BETWEEN CLIFFORD LERNER AND SNAP INTERACTIVE, INC - PALTALK, INC. | f10k2015ex10xiii_snapinter.htm |

| EX-23.2 - CONSENT OF ERNST & YOUNG LLP - PALTALK, INC. | f10k2015ex23ii_snap.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| þ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2015

| ☐ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-52176

| SNAP INTERACTIVE, INC. | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 20-3191847 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

320 W 37th Street, 13th Floor New York, NY |

10018 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (212) 594-5050

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

|

Non-accelerated filer (Do not check if a smaller reporting company) |

☐ | Smaller reporting company | þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the registrant’s common stock, par value $0.001 per share, held by non-affiliates of the registrant, based on the closing price of the common stock as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $3,358,830.

As of March 7, 2016, the registrant had 39,692,826 shares of common stock outstanding, excluding 10,325,000 unvested shares of restricted stock.

DOCUMENTS INCORPORATED BY REFERENCE:

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated by reference to the registrant’s Definitive Proxy Statement on Schedule 14A relating to the 2016 Annual Meeting of Stockholders which will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates.

SNAP INTERACTIVE, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| ITEM 1. | Business | 1 |

| ITEM 1A. | Risk Factors | 7 |

| ITEM 1B. | Unresolved Staff Comments | 17 |

| ITEM 2. | Properties | 17 |

| ITEM 3. | Legal Proceedings | 17 |

| ITEM 4. | Mine Safety Disclosures | 17 |

| PART II | ||

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

| ITEM 6. | Selected Financial Data | 18 |

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 28 |

| ITEM 8. | Financial Statements and Supplementary Data | 29 |

| ITEM 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 30 |

| ITEM 9A. | Controls and Procedures | 30 |

| ITEM 9B. | Other Information | 30 |

| Part III | ||

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 31 |

| ITEM 11. | Executive Compensation | 31 |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 31 |

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 31 |

| ITEM 14. | Principal Accountant Fees and Services | 31 |

| PART IV | ||

| ITEM 15. | Exhibits and Financial Statement Schedules | 32 |

Our Corporate Information

Snap Interactive, Inc. was incorporated under the laws of the State of Delaware on July 19, 2005. Our principal executive office is located at 320 W 37th Street, 13th Floor, New York, New York 10018.

Unless the context otherwise indicates, all references in this Annual Report on Form 10-K to “Snap,” “we,” “our,” “us,” and the “Company” refer to Snap Interactive, Inc. and its subsidiary on a consolidated basis.

FirstMet, AYI, the AYI logo, Snap, the Snap logo and other trademarks or service marks appearing in this report are the property of Snap Interactive, Inc. Trade names, trademarks and service marks of other companies appearing in this report are the property of their respective owners.

In March 2016, we completed a rebranding of our dating application “Are You Interested?” (“AYI”) under the name FirstMet. Unless the context indicates otherwise, references in this report to FirstMet are to the application after the rebranding and references to AYI are to the application prior to the rebranding.

A reference to a swipe is a gesture that a user of The Grade makes when browsing a profile, swiping to the right to signify interest, or to the left to proceed to the next profile. Unless otherwise indicated, metrics for users are based on information that is reported by Facebook and internally-derived metrics for users across all platforms through which our application is accessed. References in this report to users mean those persons who have created a user name and password, and active subscribers means users that have prepaid a subscription fee for current unrestricted communication on the FirstMet application and whose subscription period has not yet expired. The metrics for active subscribers are based on internally-derived metrics across all platforms through which our application is accessed.

i

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K constitute “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on current expectations, estimates, forecasts and assumptions and are subject to risks and uncertainties. Words such as “anticipate,” “assume,” “began,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “would” and variations of such words and similar expressions are intended to identify such forward-looking statements. All forward-looking statements speak only as of the date on which they are made. Such forward-looking statements are subject to certain risks, uncertainties and assumptions relating to factors that could cause actual results to differ materially from those anticipated in such statements, including, without limitation, the following:

| ● | our ability to generate and sustain increased revenue levels and achieve profitability in the future; | |

| ● | our ability to meet our current and future debt service obligations; | |

| ● | our ability to maintain good relationships with Apple Inc., Facebook, Inc. and Google Inc., our heavy reliance on their platforms and their ability to discontinue, limit or restrict access to their platforms by us or our applications, change their terms and conditions or other policies or features (including restricting methods of collecting payments, sending notifications or placing advertisements), establish more favorable relationships with one or more of our competitors or develop applications or features that compete with our applications; | |

| ● | our ability to obtain additional capital or financing to execute our business plan and limitations in the agreements governing our indebtedness related to the incurrence of additional indebtedness; | |

| ● | our ability to maintain compliance with the covenants in the agreements governing our indebtedness, including maintaining minimum cash balances; | |

| ● | our reliance on our executive officers; | |

| ● | the intense competition in the online dating industry; | |

| ● | our ability to release new applications or improve upon existing applications and derive revenue therefrom; | |

| ● | our ability to offset fees associated with the distribution platforms that host our applications; | |

| ● | our reliance on a small percentage of our total users for substantially all of our revenue; | |

| ● | our ability to develop, establish and maintain strong brands; | |

| ● | our ability to update our applications to respond to the trends and preferences of online dating consumers; | |

| ● | our ability to adapt or modify our applications for the international market and derive revenue therefrom; | |

| ● | our ability to develop and market new technologies to respond to rapid technological changes; | |

| ● | our ability to effectively manage our headcount, including attracting and retaining qualified employees; | |

| ● | our ability to generate subscribers through advertising and marketing agreements with third party advertising and marketing providers; | |

| ● | our reliance on third party email service providers for delivery of email campaigns to convert users to subscribers and to retain subscribers; | |

| ● | our ability to manage our affiliate marketers’ compliance with internal brand standards or state and federal marketing laws and regulations; | |

| ● | our reliance in internal systems to maintain and control marketing expenditures and corresponding return on investments; | |

| ● | the effects of interruptions, maintenance or failures of our data center, programming code, servers or technological infrastructure; | |

| ● | the effect of security breaches, computer viruses and computer hacking attacks; | |

| ● | our ability to comply with laws and regulations regarding privacy and protection of user data; | |

| ● | our reliance upon credit card processors and related merchant account approvals; | |

| ● | governmental regulation or taxation of the online dating or the Internet industries; | |

| ● | the impact of any claim that we have infringed on intellectual property rights of others; | |

| ● | our ability to protect our intellectual property rights; | |

| ● | the risk that we might be deemed a “dating service” or an “Internet dating service” under various state regulations; | |

| ● | the possibility that our users or third parties may be physically or emotionally harmed following interaction with other users; and | |

| ● | our ability to manage or mitigate adverse changes in foreign currency exchange rates relating to international bookings. |

For a more detailed discussion of these and other factors that may affect our business, see the discussion in “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. We caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business. We do not undertake any obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this report, except to the extent required by applicable securities laws.

ii

| ITEM 1. | BUSINESS |

Overview

The Company operates a portfolio of two dating applications, FirstMet, available through desktop and mobile platforms, and The Grade, which is available through iOS and AndroidTM platforms. We also intend to expand our portfolio through the development of new applications, including a new application based on our existing product platform that we expect will launch in the third quarter of 2016. In March 2016, we completed a rebranding of our dating application “Are You Interested?” (“AYI”) under the name FirstMet. FirstMet offers distinctive features and superior user experience of AYI under a refreshed brand identity.

Our dating applications and the revenues generated therefrom are supported by a large user database of approximately 30 million users. Our management believes that the scale of our user database presents a competitive advantage in the dating industry and can present growth opportunities to build future dating application brands or to commercialize by presenting third party advertising.

FirstMet

We provide a leading online dating application under the FirstMet brand that is native on Facebook, iOS and Android platforms and is also accessible on mobile devices and desktops at FirstMet.com. Our FirstMet application is available to users and active subscribers. FirstMet is extremely scalable and requires limited incremental operational cost to add users, active subscribers or new features catering to additional discrete audiences. FirstMet was the #16 grossing application in the U.S. Lifestyle Category on Apple® App StoreSM in the United States as of March 7, 2016.

In March 2016, we completed a rebranding of AYI under the name FirstMet. As a result of devoting our efforts to the rebranding, we decreased our marketing investment in AYI throughout the latter half of 2015 to reserve cash for the planned rebranding to FirstMet, as well as for other growth initiatives.

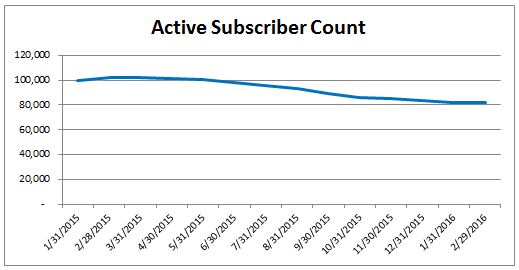

We believe that the number of active subscribers is directly correlated to our spending on sales and marketing. For the year ended December 31, 2015, our spending on sales and marketing was 5.7% lower than the year ended December 31, 2014, which we believe resulted in a decrease in the number of active subscribers during 2015, as seen in the chart below:

As of March 7, 2016, FirstMet had approximately 82,600 active subscribers, which constituted a 18.0% decrease in active subscribers since December 31, 2014. New subscription transactions for FirstMet for the year ended December 31, 2015 decreased 20% as compared to the same period in 2014. Although the number of active subscribers and new subscription transactions decreased in 2015 compared to 2014, in December 2015, as part of a plan to support the rebranding of AYI to FirstMet, we diverted a portion of our sales and marketing budget from The Grade to FirstMet. As a result, we achieved a 6.3% increase in bookings in December 2015 compared to the prior month and a 3.4% increase in bookings in January 2016 compared to the prior month. We expect that, for the foreseeable future, we will continue to allocate the significant majority of our resources and spending to FirstMet in an effort to increase our operating cash flow by focusing on our revenue-generating application.

The Grade

We also provide an online dating application under The Grade brand that is native on iOS and AndroidTM. The Grade is a mobile application that we launched in November 2014 to pursue our strategy of providing a portfolio of dating and social applications. The Grade is a mobile dating application that holds users accountable to a high standard of behavior by using a proprietary algorithm that assigns letter grades to users ranging from “A+” to “F” based on profile quality, messaging quality and reviews from other users of the application. Users with a grade of “D” receive a warning and instructions on how to improve their grade, while users who fail to improve an “F” grade are at risk of expulsion. By providing user grades and expelling low-quality users who receive an “F” grade, The Grade aims to create a community of high-quality users who are desirable, articulate and responsive.

| 1 |

The Grade is presently building an audience focusing on the New York metropolitan area as its core market for user adoption. During this introductory growth phase, the application is offered free to users and, apart from testing monetization approaches, there are no immediate plans to monetize The Grade. Our growth strategy for The Grade has been to rely principally on word-of-mouth advertising and public relations campaigns, which has resulted in The Grade appearing in a number of print, television and online media sources during 2015, including a mention on the front page of the Wall Street Journal in October 2015. In addition, as part of our marketing initiatives for The Grade, we appointed Lauren Urasek, author of the book “Popular: The Ups and Downs of Online Dating from the Most Popular Girl in New York City,” as a brand ambassador to The Grade in October 2015, which we believe has helped raise The Grade’s profile and drive user growth. Since its launch through December 31, 2015, The Grade has achieved cumulative user activity of more than 43.3 million swipes.

In December 2015, we began realigning our focus from The Grade to FirstMet. We expect that, for the foreseeable future, we will continue to allocate the significant majority of our resources and spending to FirstMet in an effort to increase our operating cash flow by focusing on our revenue-generating application. As we sustain this lower level of spending on sales and marketing for The Grade, we expect that we may experience a decrease in the number of The Grade’s users and the growth in the cumulative number of swipes may slow over time.

Sources of Competitive Strength

We believe the success of our online dating applications is the direct result of the superior user experience the applications provide. While many online dating applications and websites provide similar functionality, most competitive services require meaningful effort and initiative on the part of the user to make contact with other users. Our applications are designed to eliminate effort and friction in user-to-user interaction by automating certain aspects of the introductory dialog between users. As a consequence, we believe our users find our experience more social and enjoyable than many competitive interactive dating services.

Our data-driven business practices also differentiate us from our competitors and provide us with a competitive advantage. The user engagement of our applications and the propensity of users to subscribe is continually enhanced through constant experimentation. Our sophisticated A/B testing framework, a framework for comparing two versions of the same application, can support millions of different versions of our applications in parallel in order to test new features and functionality, design changes and changes to our algorithms. We have also developed business processes and human resources dedicated to business intelligence to analyze and interpret A/B test data, with the result that every change we make to our applications produces verifiable benefits, and the user experience and economics of our applications continually improve.

Financial Overview

We generate revenues from subscriptions as well as advertising agreements with third parties. For the years ended December 31, 2015 and 2014, our revenues were $12.0 million and $13.6 million, respectively. We had net losses of $1.3 million and $1.7 million for the years ended December 31, 2015 and 2014, respectively. As of March 7, 2016, we had 24 employees, all of whom were located in our New York City headquarters.

Our Applications

FirstMet

FirstMet attracts a demographically and geographically diverse user base, with users in over 180 different countries. FirstMet is intuitive, and allows users and subscribers to easily find, connect and communicate with each other. Key features and tools of our FirstMet application include:

Profile Creation

Users can join FirstMet by creating a personal profile that is connected to their email address or by using “Facebook Connect” to create a profile. A FirstMet user with a Facebook profile can easily import information from his or her profile, including photos and interest data. FirstMet profiles are also updated in real time as users add interests on Facebook. Once a profile has been created, FirstMet users are able to browse for potential matches, including other singles with similar interests. Using this information, FirstMet has designed features around similar interests that improve the online dating experience and, compared to traditional online dating websites, more closely mirrors the way singles traditionally meet offline. We continually update FirstMet’s feature set with new features to increase user engagement, make users more social and to increase the number of users that are converted to active subscribers.

Browse Function

FirstMet’s game-like “browse” function presents profiles of other users that match user criteria and prompts them to indicate if they are “interested” by either clicking on a “yes” or “skip” button above the profile picture or by sending a message when viewing that user’s profile. Users are notified when another user has clicked “yes” on their profile or if they have received a message from another user. In instances where users select "yes" on another user’s profile, the application automatically introduces the two users, who are likely to have similar interests.

Subscription Benefits

FirstMet operates on a “freemium” model, whereby certain application features are free to all users and other features are only available to paid subscribers. All users are allowed to create a profile, browse, search and view other user’s profiles, send instant messages and send an initial message to any user. Unlimited messaging and other premium features require a paid subscription.

| 2 |

Accessibility

Our easy-to-use mobile interface allows our users to engage with our online dating application from virtually anywhere at any time. The availability of our online dating application across mobile devices, tablets and personal computers enables our users to move seamlessly between devices, increasing the opportunities for user engagement and real-time interactions.

The Grade

We designed The Grade as a free mobile application that caters to individuals who are dissatisfied with the quality of user interactions on mobile online dating applications. By providing user grades and expelling users who receive a failing “F” grade, the application holds users accountable for their behavior and aims to create a community of desirable, responsive and articulate users. As of March 7, 2016, we had more than 52.9 million swipes by users of The Grade. Some of the key features and tools of The Grade include:

Profile Creation

Users can join The Grade by using “Facebook Connect” to easily create a profile. With the user’s permission, The Grade will obtain certain information from a user’s Facebook profile, including photos and location data. The Grade then displays other users as potential matches based on location, gender and age preferences.

Browse Function

Once a user creates a profile, The Grade automatically presents the user with potential matches by displaying a profile picture of the potential match along with the user's overall grade. The browse function allows users to indicate whether they “like” a profile by selecting a checkmark or selecting an “X” if they are not interested in the potential match. By scrolling up or down on the profile picture, users can view additional pictures as well as other profile information, including similar interests, common friends, education, religion, ethnicity, “about me” and grades in the three categories - profile quality, messaging and peer reviews. Users are automatically notified when a “match” exists, meaning both users “like” one another’s profile. Once users have been matched, they are allowed to send messages to each other.

Grading System

A user’s overall grade is based on an algorithm that incorporates the grades based on profile quality, messaging and peer-reviews generated from the opinions received from other users. The profile quality grade is based on several factors, including the quantity and quality of a user’s photos, how many optional profile fields are filled out, how often a user’s profile gets “liked” and the length and quality of a user’s “about me” section. The messaging grade uses an algorithm to analyze how often a user responds to messages and how often the user obtains a response back, as well as analyzes messages for grammatical mistakes, spelling errors, use of slang and length, and whether a user’s messages contain inappropriate content. These three categories are combined to create a user’s overall grade, which is visible to other users of the application.

Application Development

Our application development processes are designed to enable us to rapidly and cost effectively develop our online dating applications to meet the expectations and preferences of users and the requirements of the third party platforms through which we offer our applications. These processes include a sophisticated A/B testing framework that allows us to run a significant number of statistically relevant tests on our applications at any given time. We can test new features, new functionality, design changes and changes to our proprietary algorithms and compare the results to control groups to see if they would be likely to improve the conversion of users into subscribers. We have also integrated Splunk Enterprise technology, a data analysis and management tool, into our data analytics and application development processes to provide a real-time granular analysis of user behavior and the ability to “lock-in” features that outperform their relevant control groups.

A significant amount of our logins occur through third party platforms. We believe we provide value to these third party platforms by: (i) creating and maintaining user engagement on, and integrating with, the platforms; (ii) driving traffic to the platforms to generate advertising revenue for such platforms, including through the placement of advertisements on our online dating applications, and (iii) directly purchasing advertising from these platforms.

In March 2016, we completed a rebranding of AYI under the name FirstMet. We are coupling an aggressive win-back strategy with the launch of FirstMet in order to reactivate dormant AYI users. In addition, we are currently developing a new application based on FirstMet’s platform that is expected to launch in the third quarter of 2016. The new application is planned to have similar functionality to FirstMet but will address a different target audience and will be based on a new brand identity. We expect that we will operate the new application in parallel with FirstMet in order to leverage FirstMet’s user base and cross-sell our users with multiple brands. We believe that FirstMet’s highly scalable infrastructure provides us with a significant competitive advantage, and in the future we expect that we may continue to develop new applications based on FirstMet’s platform that address new audiences. FirstMet is available on mobile and desktop platforms and our new application is planned to be available on mobile and desktop platforms at launch.

| 3 |

A significant portion of our users continue to access our applications through mobile applications and our application development and support is substantially focused on mobile platforms. We plan to continue development on iPhone, Android and other mobile devices, and on January 13, 2016, we launched The Grade on Apple Watch through iOS.

With our vast amount of data that we have accumulated over several years across multiple platforms, we believe that leveraging this user base and the data therefrom allows us to create an exceptional experience for users looking to meet people with mutual friends or similar interests.

Our Strengths

Since our inception, we have developed and are leveraging the following key strengths of our business model:

| ● | “Freemium” Online Dating Model. We operate FirstMet on a “freemium” model in which certain application features are free to all users and other features are only available to subscribers. We believe this “freemium” model, when combined with our development of FirstMet as an online dating application, differentiates us from other applications in the online dating industry. | |

| ● | Engaging Functionality on a Highly Scalable Platform. We have designed our applications with game-like “browse” functions and other features that prompt interactions between users, which make our applications highly engaging and easy to use. While many online dating applications and websites provide similar functionality, most competitive services require meaningful effort and initiative on the part of the user to make contact with other users. Our applications are designed to eliminate effort and friction in user-to-user interaction by automating certain aspects of the introductory dialogue between users. We have developed many different and popular online dating features for our applications, including the ability to search for potential matches with similar interests on FirstMet and the ability to view a user’s grade on The Grade. Our applications are also extremely scalable and require limited incremental cost to add additional users, create new features catering to additional discrete audiences or to build new applications based on developed feature-sets with new brand identities. | |

| ● | Marketing Effectiveness and Data Analytics. We believe that our data analytics and application development processes provide us with a competitive advantage over other online dating websites and applications. Our data analytics provides us with critical visibility into the effectiveness of our sales and marketing expense and allow us to quickly modify such expenditures to create more effective user acquisition campaigns. Our application development processes also include a sophisticated A/B testing framework that allows us to test new features, new functionality, design changes, changes to our proprietary algorithms and compare our results to control groups. These processes provide a real-time granular analysis of user behavior and allow us to modify our applications to increase user engagement and the number of users that convert into paying subscribers. | |

| ● | Increased Mobile Penetration. Our easy-to-use mobile dating applications have been designed to acquire users on every platform and allow users to interact with other users from virtually anywhere and at any time. Our applications have been designed to work on small screens and other mobile devices, and allow users to create a profile, interact with other users and pay for subscriptions using their mobile devices. The Grade is only available as a mobile application and our mobile FirstMet application is increasingly being adopted by our users over the desktop application. For example, in December 2015, approximately 55.1% of logins to FirstMet were made through a mobile device as compared to 43.9% of logins to FirstMet in December 2014. |

Our Strategy

Our strategy includes the following key components:

| ● | Increase Our Subscriber Base Through Cost-Effective Advertising. Although we continue to invest in user acquisition campaigns to promote FirstMet and The Grade and increase the number of users and paid subscribers, we decreased our sales and marketing expense in AYI throughout the latter half of 2015 to reserve cash for the rebranding to FirstMet and other growth initiatives. We frequently analyze our sales and marketing expense in an effort to ensure that we optimize our return on investments in these areas. | |

| ● | Increase Our Mobile Presence. We plan to increase the presence of the FirstMet and The Grade applications in the mobile market through improving the mobile user experience, increasing our prominence on the Apple iTunes store and Google Play store and transitioning desktop users to become mobile users. Consistent with this objective, we recently relaunched FirstMet on iOS and Android. In addition, we have created a seamless cross-platform experience that allows new and existing FirstMet users to login to any platform to access their messages, communicate cross-platform with other users and subscribe to access the entire feature set. In January 2016, we launched our application The Grade for Apple Watch. We are also continuing to prioritize initiatives that will improve the rate at which we convert our mobile users into paid subscribers. |

| 4 |

| ● | Introduce New Applications. We plan to develop a portfolio of applications around the core FirstMet application by investing substantial resources to develop and launch new mobile and desktop applications or by developing separate versions of our existing product platform for specific target demographics or geographies. We began to implement this portfolio approach through the launch of The Grade in November 2014, and, as described above, we plan to launch a new application in the third quarter of 2016. | |

| ● | Increase Our International Presence. We have begun to prioritize efforts to increase the international presence of the FirstMet application, including by developing localized and translated versions of the FirstMet application for certain international countries. We expect that by localizing and translating the FirstMet application to various international countries, we will increase the number of our users and paid subscribers and will realize higher user conversion and retention rates. |

Marketing Strategy

Our current marketing activities aim to raise awareness of the FirstMet and The Grade brands and attract users by promoting the unique content and quality of our applications. We primarily advertise through Internet and mobile advertising and run hundreds of user acquisition campaigns at any given time, targeting various classifications of users.

We acquire a significant number of our users through paid marketing channels. We plan our sales and marketing activities based on our expected return on investment (which we measure based on the profit margin of proceeds from sales and marketing expenditures, divided by sales and marketing expense) and believe that we lead or equal our public company competitors based on our overall revenue yield from sales and marketing expense. Our sales and marketing efficiency continues to be enhanced by constant experimentation and optimizations to increase user engagement and the number of users that are converted to paid subscribers.

Throughout the latter half of 2015, we decreased our marketing investment in AYI to reserve cash for the rebranding to FirstMet in the first quarter of 2016, as well as for other growth initiatives.

As part of the marketing initiatives for The Grade, we appointed Lauren Urasek, author of the book “Popular: The Ups and Downs of Online Dating from the Most Popular Girl in New York City,” as a brand ambassador to The Grade in October 2015, which we believe has helped raise The Grade’s profile and drive user growth. We also market The Grade by, among other things, providing online dating information to the media. During 2015, The Grade was referenced in The Wall Street Journal, Good Morning America, New York Post, USA Today, Fortune, BuzzFeed, ABC News, TIME and People.

In December 2015, as part of a plan to realign our focus from The Grade to FirstMet, we diverted a portion of our sales and marketing budget from The Grade to FirstMet. As a result, we achieved a 6.3% increase in bookings in December 2015 compared to the prior month and a 3.4% increase in bookings in January 2016 compared to the prior month. As we sustain this lower level of sales and marketing for The Grade, we expect that we may experience a decrease in the number of The Grade’s users and the growth in the cumulative number of swipes may slow over time.

Payment Options

Our users have a variety of methods by which to purchase subscriptions to FirstMet. Users can pay by credit card, electronic check, PayPal, Fortumo or as an in-App purchase through Apple Inc.’s App Store. Pursuant to Apple Inc.’s terms of service, Apple Inc. retains 30% of the revenue that is generated from sales on our iPhone application through in-App purchases. Regardless of which payment method is utilized, users may access FirstMet through any of the gateways we offer.

Competition

We face substantial competition from online dating websites such as Christianmingle.com, Cupid.com, eHarmony.com, POF.com, Match.com, LLC (“Match.com”) or other IAC/InterActiveCorp. (“IAC”) properties, as well as online dating applications provided by Badoo Trading Limited, IAC, MeetMe, Inc. and Zoosk, Inc. (“Zoosk”). We also face substantial competition from mobile-based applications including Tinder, Happn, Hinge and Bumble. We believe that users often utilize multiple dating websites or applications, and the use of one dating website or application is not necessarily to the exclusion of others. In addition, there are relatively few significant barriers to entry in our industry and, as a result, any organization that has adequate financial resources and technical expertise may become a competitor.

Achieving a critical mass of users is crucial for online dating websites and applications. As a result of our user base, we believe we are well-positioned to continue as a leader in online dating. We believe that our user base also allows us to compete favorably in the marketplace with our current and future applications. Additionally, we seek to offer applications and services that are differentiated in the industry, superior in quality, and more appealing than those of our competitors. Additionally, we believe that we have the tools and expertise to attract new users through Facebook and other sources at a lower cost per subscriber than certain of our traditional online dating competitors. We also believe that the industry offers substantial room for growth as social networking application platforms and mobile platforms continue to expand as the Internet becomes more of a mainstream method for finding a relationship.

| 5 |

Patent and Trademarks

To establish and protect our proprietary rights, we rely on a combination of trademarks, copyrights, trade secrets, license agreements, patent applications, confidentiality agreements and other contractual rights. We are also pursuing patents related to certain feature sets on the FirstMet application currently under development. We have two registered trademarks in the United States for “Snap Interactive”; three registered trademarks for “Are You Interested?” and variations thereof in the United States, including several pending applications and registrations in other countries; a registered trademark for a question-mark-heart logo in the United States and pending applications for “ayi” and “FirstMet” in the United States.

Governmental Regulations

We are subject to a number of U.S. federal and state laws and regulations that affect companies conducting business on the Internet, many of which are still evolving and being litigated in the courts and could be interpreted in ways that could harm our business. These laws and regulations may involve user privacy, data protection, content, intellectual property, distribution, electronic contracts and other communications, competition, protection of minors, consumer protection, taxation and online payment services. In particular, we are subject to federal and state laws regarding privacy and protection of user data, which are constantly evolving and can be subject to significant change. We are also subject to diverse and evolving laws and regulations in other countries in which we operate. The application and interpretation of these laws and regulations are often uncertain, particularly in the new and rapidly-evolving industry in which we operate. Because our online dating applications are accessible worldwide and used by residents of some foreign countries, foreign jurisdictions may claim that we must comply with foreign laws, even in jurisdictions in which we have no local business entity, employees or infrastructure.

We are also subject to federal laws and regulations regarding content, privacy and the protection of user data, including The Communications Decency Act of 1996, as amended (“The Communications Decency Act”), The Children’s Online Privacy Protection Act of 1998, as amended, The Digital Millennium Copyright Act, The Electronic Communications Privacy Act of 1986, as amended, the USA PATRIOT Act of 2001, and the Controlling the Assault of Non-Solicited Pornography And Marketing (“CAN-SPAM”) Act of 2003, among others. The Digital Millennium Copyright Act limits our liability as an online service provider for linking to or hosting third-party content that infringes copyrights. The Communications Decency Act provides statutory protections to online service providers like us who distribute third-party content. The Children’s Online Privacy Protection Act restricts the ability of online service providers to collect personal information from children under 13. Congress, the Federal Trade Commission (“FTC”) and many states have promulgated laws and regulations regarding email advertising, including the CAN-SPAM Act. Any changes in these laws or judicial interpretations narrowing the protections of these laws may subject us to increased risk, increased costs of compliance, and limits on the operation of certain parts of our business.

Growing public concern about privacy and the use of personal information may subject us to increased regulatory scrutiny. The FTC has, over the last few years, begun investigating companies that have used personally identifiable information in a deceptive or unfair manner or in violation of a posted privacy policy. If we are accused of violating the terms of our privacy policy or implementing unfair privacy practices, we may be forced to expend significant financial and managerial resources to defend against an FTC enforcement action. Our user database holds the personal information of our users and subscribers residing in the United States and other countries, and we could be sued by those users if any of the information is misappropriated. Any failure by us to adequately protect our users’ privacy and data could also result in loss of user confidence in our online dating applications and services and ultimately in a loss of active subscribers, which could adversely affect our business.

In addition, virtually every U.S. state has passed laws requiring notification to users when there is a security breach for personal data resulting in unauthorized disclosure, many of which are modeled on California’s Information Practices Act. There are a number of legislative proposals pending before the U.S. Congress and various state legislative bodies concerning data protection that could, if adopted, have an adverse effect on our business. We are unable to determine if and when such legislation may be adopted. Many jurisdictions, including the European Union, have adopted breach notification and other data protection notification laws designed to prevent unauthorized disclosure of personally identifiable information. The introduction of new privacy and data breach laws and the interpretation of existing privacy and data breach laws in the United States, Europe and other foreign jurisdictions is constantly evolving. There is a risk that new laws may be introduced or existing laws may be applied in a way that would conflict our current data protection practices or prevent the transfer of data between countries in which we operate.

While online personal services are not currently required to verify the age or identity of subscribers, or to run criminal background checks, legislation in this area has been proposed over the last few years in Ohio, Texas, California, Michigan, New Jersey, Florida and Virginia. Companies that provide personals services are not currently subject to the same type of regulation as companies deemed “dating service” providers. However, if a court holds that we are legally providing “dating services” as defined in the relevant regulations, we may be required to comply with additional state regulations. Further, Connecticut, New York, Florida, Texas and New Jersey each have enacted laws that require us to display safety warnings and disclosures to users that we do not conduct background checks.

In addition, rising concern about the use of social networking technologies for illegal conduct may in the future produce legislation or other governmental action that could require changes to our online dating applications or restrict or impose additional costs upon the conduct of our business. These regulatory and legislative developments, including excessive taxation, may prevent or significantly limit our ability to expand our business.

Employees

As of March 7, 2016, we had 24 employees, all of whom are employed on a full-time basis. We believe that our future success depends in part on our continued ability to hire, assimilate and retain qualified personnel.

| 6 |

| ITEM 1A. | Risk Factors |

The risks below are those that we believe are the material risks that we currently face, but are not the only risks facing us and our business. If any of these risks actually occur, our business, financial condition and results of operations could be materially adversely affected.

Risks Relating to Our Business

Our independent registered public accounting firm’s report, contained herein, includes an explanatory paragraph that expresses substantial doubt about our ability to continue as a going concern, indicating the possibility that we may not be able to operate in the future.

Our financial statements have been prepared on the basis that we will continue as a going concern. For the year ended December 31, 2015, we incurred a net loss of $1.3 million. As of December 31, 2015, our accumulated deficit was $14.7 million. We expect to continue incurring losses for the foreseeable future and must raise additional capital in order to repay our 12% Senior Secured Convertible Note (the “Note”), which is due on February 13, 2017, and sustain our operations while continuing the longer term efforts contemplated under our business plan. Our ability to raise capital on reasonable terms or at all may be adversely impacted by doubts about our ability to continue as a going concern.

If we are unable to secure additional capital, we may be required to curtail our research and development initiatives and take additional measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations. If we become insolvent, investors in our stock may lose the entire value of their investment in our business. The accompanying consolidated financial statements do not include any adjustments that may be necessary should we be unable to continue as a going concern. It is not possible for us to predict at this time the potential success of our business.

Our ability to repay our indebtedness is dependent on our ability to generate cash flow from operations, which depends on many factors beyond our control. Any failure to meet our debt obligations could harm our business, financial condition and results of operations.

On February 13, 2015, we issued the Note to Sigma Opportunity Fund II, LLC (“Sigma II”) in the aggregate principal amount of $3,000,000. The Note matures on the earlier of February 13, 2017 or a change of control. Our ability to make payments on and to repay our indebtedness, including the Note, will depend on our ability to generate cash flow from operating activities and other resources in the future. This ability, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We may be required to dedicate a substantial portion of our cash flow from operating activities to payments on our indebtedness, including the Note, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes. Although we currently believe that we have sufficient resources to make our required payments on the Note throughout 2016, we believe that our cash flow and capital resources will be insufficient to pay the outstanding balance of the Note when it becomes due in February 2017. In order to repay the Note upon its maturity, we expect that we will need to issue additional equity or debt securities, sell assets or refinance or restructure the Note before it becomes due. These remedies may not be available on commercially reasonable terms, or at all. In addition, any failure to make scheduled payments of interest and principal on our outstanding indebtedness, including the Note, would likely harm our ability to incur additional indebtedness on acceptable terms, if at all. In the future, our cash flow and capital resources may be insufficient for payment of interest on and principal of our indebtedness, including the Note, which could cause us to default on our obligations and could impair our liquidity.

If we cannot make scheduled payments on the Note or repay the Note when it becomes due, we will be in default and Sigma II could declare all outstanding principal and interest on the Note to be immediately due and payable and could foreclose against the assets securing the Note, which could force us into bankruptcy or liquidation. Our inability to generate sufficient cash flows to satisfy our indebtedness, or to refinance our indebtedness on commercially reasonable terms or at all, would materially and adversely affect our financial position and results of operations.

The Note contains operating and financial covenants that may prevent us from engaging in transactions that might benefit us, including responding to changing business and economic conditions or securing additional financing, if needed.

The terms of the Note contain customary events of default and covenants that prohibit us and our subsidiary from taking actions without satisfying certain conditions or obtaining the consent of Sigma II. These restrictions, among other things, limit our ability to:

| ● | incur additional indebtedness; | |

| ● | create liens against our assets; | |

| ● | amend our Certificate of Incorporation and Amended and Restated By-Laws; | |

| ● | make certain repurchases and repayments of our equity and debt securities; | |

| ● | make certain payments and distributions; | |

| ● | pay dividends; | |

| ● | engage in certain issuances of our common stock; and | |

| ● | engage in certain transactions with affiliates. |

| 7 |

As a result of these covenants and restrictions, we are limited in how we conduct our business and we may be unable to raise additional debt financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. We may not be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from Sigma II and/or amend these covenants. A breach of these covenants could result in an event of default under the Note, which could result in the acceleration of our obligations. If that should occur, we may be unable to repay all of our obligations, which could force us into bankruptcy or liquidation.

We may be unable to repay our current or future indebtedness or make future investments necessary to implement our business strategy.

We cannot provide any assurance that we will be able to raise the necessary capital to repay our current or future indebtedness or make future investments necessary to implement our business strategy, and the failure to do so could have a material adverse effect on our business, financial condition, results of operations and liquidity, on our ability to service our indebtedness and other obligations. In recent years, it has been difficult for certain companies to access capital or other sources of funds. We cannot provide any assurance that conditions will not deteriorate further or that our access to capital and other sources of funding will not become further constrained, which could adversely affect our business, results of operation or financial condition.

To address constraints on our access to capital, we could, among other things, (i) obtain commitments from banks or other lenders to either refinance indebtedness or increase amounts of indebtedness under existing promissory notes, (ii) access the capital markets, or (iii) dispose of assets. As with other public companies, our access to debt and equity capital depends, in part, on the trading prices of our common stock, which, in turn, depend upon market conditions that change from time to time, such as the market’s perception of our financial condition, our growth potential and our current and future earnings. No assurance can be provided that we will be successful in our efforts to gain access to capital. Our failure to meet the market’s expectation with regard to future earnings could impact our ability to access capital or increase our borrowing costs. If we cannot access capital at an acceptable cost or at all, we may be required to sell assets.

We derive a portion of our revenue from the Apple and Google platforms, and if we are unable to maintain a good relationship with Apple Inc. or Google Inc., our business could suffer.

A portion of our revenue, primarily our revenue from mobile platforms, is derived from Apple Inc.’s iOS and Google Inc.’s Android platforms and we believe that we have a good relationship with Apple Inc. and Google Inc. Any deterioration in our relationship with either Apple Inc. or Google Inc. could materially harm our business, results of operations or financial condition.

We are subject to each of Apple Inc.’s and Google Inc.’s standard terms and conditions for application developers, which govern the promotion, distribution and operation of our applications on their respective storefronts. Each of Apple Inc. and Google Inc. has broad discretion to change its standard terms and conditions. In addition, these standard terms and conditions can be vague and subject to changing interpretations by Apple Inc. or Google Inc. In addition, each of Apple Inc. and Google Inc. has the right to prohibit a developer from distributing applications on the storefront if the developer violates the standard terms and conditions. In the event that either Apple Inc. or Google Inc. ever determines that we are in violation of its standard terms and conditions and prohibits us from distributing our applications on its storefront, it could materially harm our business, results of operations or financial condition.

We also rely on the continued function of the Apple App Store and the Google PlayTM Store, as a portion of our revenue is derived from these two digital storefronts. There have been occasions in the past when these digital storefronts were unavailable for short periods of time or where there have been issues with the in-App purchasing functionality from the storefront. In the event that either the Apple App Store or the Google Play Store is unavailable or if in-App purchasing functionality from the storefront is non-operational for a prolonged period of time, it could have a material adverse effect on our business, results of operations or financial condition.

Our future success is dependent, in part, on the performance and continued service of our executive officers. Without their continued service, we may be forced to interrupt or eventually cease our operations.

We are dependent to a great extent upon the experience, abilities and continued service of Alexander Harrington, our Chief Executive Officer and Chief Financial Officer, and Clifford Lerner, our President of The Grade and Chairman of the Board of Directors. The loss of the services of either of Messrs. Harrington or Lerner would substantially affect our business or operations and could have a material adverse effect on our business, results of operations or financial condition.

| 8 |

As an online dating company, we are in the intensely competitive online dating industry and any failure to attract new users and subscribers could diminish or suspend our development and possibly cease our operations.

The online dating industry is highly competitive and has few barriers to entry. If we are unable to efficiently and effectively attract new users and subscribers as a result of intense competition or a saturated market, we may not be able to continue the development and enhancement of our applications or become profitable on a consistent basis in the future.

Important factors affecting our ability to successfully compete include:

| ● | our ability to hire and retain talented employees, including technical employees, executives, and marketing experts; | |

| ● | competition for acquiring users that could result in increased user acquisition costs; | |

| ● | reliance upon the platforms through which our applications are accessed and the platforms’ ability to control our activities on such platforms; | |

| ● | our ability to innovate in our ever-changing industry; and | |

| ● | our good standing with billing providers and email service providers. |

We face substantial competition from online dating websites such as Christianmingle.com, Cupid.com, eHarmony.com, POF.com, Match.com or other IAC properties, as well as online dating applications provided by Badoo Trading Limited, IAC, MeetMe, Inc. and Zoosk. We also face substantial competition from mobile-based applications including Tinder, Happn, Hinge and Bumble.

Many of our current and potential competitors offer similar services, have longer operating histories, significantly greater capital, financial, technical, marketing and other resources and larger user or subscriber bases than we do. These factors may allow our competitors to more quickly respond to new or emerging technologies and changes in user preferences. These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive subscription prices that may allow them to build larger user and paying subscriber bases. Our competitors may develop applications or services that are equal or superior to our applications or that achieve greater market acceptance than our applications. It is possible that a new product developed by one of our competitors could gain rapid scale at the expense of existing brands through harnessing a new technology or distribution channel, creating a new approach to connecting people or some other means. In addition, new and different types of social networking may also increase in popularity at the expense of online dating. Moreover, costs for consumers to switch between products in the dating industry are generally low, and consumers have a propensity to try new products to connect with new people. As a result, new entrants and business models are likely to continue to emerge in our industry. These activities could attract users and subscribers away from our application, reduce our market share and have a material adverse effect on our business, results of operations and financial condition.

We rely on a small portion of our total users for nearly all of our revenue.

Compared to the total number of users in any given period, only a small portion of our users are paying subscribers. We primarily generate revenue through subscription sales to this small portion of users and secondarily generate revenue through paid advertisements. Users discontinue the use of our applications in the ordinary course of business and to sustain our revenue levels, we must attract, retain and increase the number of users or more effectively monetize our existing users. To retain existing users, and particularly those users who are paying subscribers, we must devote significant resources so that our applications retain their interest. If we fail to grow or sustain the number of our users, or if the rates at which we attract and retain existing users declines or the rate at which users become paying subscribers declines, it could have a material adverse effect on our business, results of operations or financial condition.

As the distribution of FirstMet through application stores increases, we may incur additional fees from the developers of application stores.

As our user base continues to shift to mobile solutions, we increasingly rely on the Apple Inc.’s iOS and Google Inc.’s Android platforms to distribute FirstMet. While FirstMet is free to download from these stores, we offer our users the opportunity to purchase paid memberships and certain premium features through FirstMet. We determine the prices at which these memberships and features are sold and, in exchange for facilitating the purchase of these memberships and features through FirstMet to users who download FirstMet from these stores, we pay Apple Inc. a share (currently 30%) of the revenue we receive from these transactions. In the future, other distribution platforms that we utilize may charge us fees for the distribution of our applications. As the distribution of FirstMet through application stores increases, the amount of fees that we must pay to the developers of these application stores will also increase. Unless we find a way to offset these fees, our business, financial condition and results of operations could be adversely affected.

Because we recognize revenue from subscriptions over the subscription term, downturns or upturns in subscription sales may not be immediately reflected in our results of operations or financial condition.

We recognize subscription revenue from customers monthly over the subscription term, and subscriptions are offered in durations of one-, three-, six- and twelve-month terms. As a result, much of the subscription revenue we report in each period is deferred revenue from subscription agreements entered into during previous periods. Consequently, a decline in new or renewed subscriptions in any one quarter will not necessarily be reflected in the revenue for that quarter and will negatively affect our revenue in future quarters. In addition, we might not be able to immediately adjust our costs and expenses to reflect these reduced revenues. Accordingly, the effect of significant downturns in user acceptance of our applications may not be fully reflected in our results of operations until future periods. Our subscription model also makes it difficult for us to quickly increase our revenue through additional sales in any period, as revenue from new subscribers must be recognized over the subscription term.

| 9 |

Our business depends on developing, establishing and maintaining strong brands. If we are unable to maintain and enhance our brands, we may be unable to expand or retain our user and paying subscriber bases.

We believe that developing, establishing and maintaining awareness of our application brands is critical to our efforts to achieve widespread acceptance of our applications and is an important element to expanding our user and subscriber bases. Successful promotion of our application brands will depend largely on the effectiveness of our advertising and marketing efforts and on our ability to provide reliable and useful applications at competitive prices. If paying subscribers do not perceive our applications to be of high quality, or if our applications are not favorably received by users and subscribers, the value of our brands could diminish, thereby decreasing the attractiveness of our applications to users and subscribers. In addition, advertising and marketing activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we incurred in building our brands. If we fail to successfully promote and maintain our application brands, or incur substantial expenses in unsuccessfully attempting to promote and maintain our brands, we may fail to attract enough new subscribers or retain our existing subscribers to the extent necessary to realize a sufficient return on our advertising and marketing activities, and it could have a material adverse effect on our business, results of operations or financial condition.

The online dating industry is characterized by rapid technological change and the development enhancements and new applications, and if we fail to keep pace with technological developments or launch new applications, our business may be adversely affected.

The online dating industry is characterized by rapid change and our future success is dependent upon our ability to adopt and innovate. To attract new users and increase revenues from existing users, we need to enhance, add new features to and improve our existing applications and introduce new applications in the future. The success of any enhancements or new features and applications depends on several factors, including timely completion, introduction and market acceptance. For example, we recently launched The Grade, a new online dating application, the commercial success of which has not yet been determined. In addition, we recently completed the rebranding of AYI to FirstMet and we are developing a new application that is expected to be completed in the third quarter of 2016. Building a new brand or product is generally an iterative process that occurs over a meaningful period of time and involves considerable resources and expenditures, and we may expend significant time and resources developing and launching an application that may not result in revenues in the anticipated timeframe or at all, or may not result in revenue growth that is sufficient to offset increased expenses. If we are unable to successfully develop enhancements, new features or new applications to meet user trends and preferences, our business and operating results could be adversely affected.

In addition, our applications are designed to operate on a variety of network, hardware and software platforms using Internet tools and protocols and we need to continuously modify and enhance our applications to keep pace with technological changes. If we are unable to respond in a timely and cost-effective manner, our current and future applications may become less marketable and less competitive or even obsolete.

If we fail to effectively manage our growth or attract and have qualified employees, our business, results of operations or financial condition could be harmed.

As of March 7, 2016, approximately 29% of our employees have been with us for less than one year and approximately 58% of our employees have been with us for less than two years. As we continue to grow, we must expend significant resources to identify, hire, integrate, develop, motivate and retain a number of qualified employees, including certain highly skilled technical employees. If we fail to effectively manage our employment needs and successfully integrate our new hires, our ability to launch new applications and enhance or support our existing applications could suffer and it could have a material adverse effect on our business, results of operations or financial condition.

Our business depends in large part upon the availability of cost-effective advertising space through a variety of media and keeping pace with trends in consumer behavior.

We depend upon the availability of advertising space through a variety of media, including third party applications on platforms such as Facebook, to recruit new users and subscribers, generate activity from existing users and subscribers and direct traffic to our application. Historically, we have had to increase our marketing expenditures in order to attract and retain users and sustain our growth. The availability of advertising space varies, and a shortage of advertising space in any particular media or on any particular platform, or the elimination of a particular medium on which we advertise, could limit our ability to generate new subscribers, generate activity from existing subscribers or direct traffic to our applications, any of which could have a material adverse effect on our business, results of operations and financial condition. In addition, evolving consumer behavior can affect the availability of profitable marketing opportunities. For example, as consumers communicate less via email and more via text messaging and other virtual means, the reach of email campaigns designed to attract new and repeat users (and retain current users) for our applications is adversely impacted. To continue to reach potential users and grow our business, we must devote more of our overall marketing expenditures to newer advertising channels, which may be unproven and undeveloped, and we may not be able to continue to manage and fine-tune our marketing efforts in response to these trends.

Our heavy reliance on Facebook may negatively affect our business.

Facebook is the primary third-party platform on which our applications operate. During 2015 and 2014, the majority of our subscription revenue was generated from subscribers to FirstMet that were acquired through the Facebook platform and we expect this trend to continue in the foreseeable future.

| 10 |

We are subject to Facebook, Inc.'s standard terms and conditions for application developers, which govern the development, promotion, distribution, operation and use of our applications on the Facebook platform. Accordingly, we are subject to numerous risks and uncertainties and our business would be harmed if:

| ● | Facebook, Inc. discontinues, limits or restricts access to its platform by us or our applications; | |

| ● | Facebook, Inc. changes its terms and conditions or other policies and features, including restricting the method of collecting payments through the Facebook platform; | |

| ● | Facebook, Inc. establishes more favorable relationships with one or more of our competitors or develops applications or features that compete with our application; or | |

| ● | Facebook, Inc. discontinues, limits or restricts our ability to send notifications through the Facebook platform. |

If any of these actions occur, they could have a material adverse effect on our business, results of operations or financial condition.

Our applications rely heavily on email campaigns. We face a risk that any disruptions in or restrictions on the sending or receipt of emails, or any increase in the associated costs could adversely affect our business, results of operations or financial condition.

Our emails are an important driver of our users’ and subscribers’ activities. We send a large volume of emails to our subscribers notifying them of a variety of activities on our applications, such as new matches. We face a risk that service providers or email applications may block bulk email transmissions or otherwise experience technical difficulties that result in our inability to successfully deliver emails to our users and subscribers. Third parties may also block our emails as spam, impose restrictions on, or start to charge for, the delivery of emails through their email systems. Without the ability to email these users and subscribers, we may have limited means of promoting new subscriptions and inducing subscribers to return to and use our applications.

In addition, we face the risk that, as consumer habits evolve, usage of email will decline as users focus on communicating through text messages and social networking applications. While we continually work to find new means of communicating and connecting with our members, these new means may not be as effective as email has historically been for us. Due to the importance of email to our business, any disruptions or restrictions on the distribution or receipt of emails or increase in the associated costs or erosion in our ability to communicate with our users via email could have a material adverse effect on our business, results of operations and financial condition.

Any interruption or failure of our data center could impair our ability to effectively provide our application, which could have a material adverse effect on our business, results of operations or financial condition.

Our corporate headquarters and our primary data center are located in New York, New York. While we lease the equipment at our data center, we rent space and bandwidth from a co-located facility. Our applications depend on the continuing operation of our data center and any damage to or failure of our data center could result in interruptions in our services. Our data center is vulnerable to damage or interruption from break-ins, sabotage, acts of vandalism, terrorist attacks, floods, fires, power loss, telecommunications failures, computer viruses or cyber-attacks and other unforeseeable events. Any interruption in our service could damage our reputation, cause our users and subscribers to terminate their use of our applications and prevent us from gaining additional business from current or future users and subscribers, which could have a material adverse effect on our business, results of operations or financial condition.

Interruption, maintenance or failure of our programming code, servers or technological infrastructure could hurt our ability to effectively provide our applications, which could damage our reputation and harm our results of operations.

The availability of our applications depend on the continued operation of our programming code, databases, servers and technological infrastructure. Any damage to, or failure of, our systems could result in interruptions in service for our applications, which could damage our brands and have a material adverse effect on our business, results of operations or financial condition. Our systems are vulnerable to damage or interruption from terrorist attacks, floods, fires, power loss, telecommunications failures, computer viruses, computer denial of service attacks or other attempts to harm our systems. Some of our systems are not fully redundant, and our disaster recovery planning cannot account for all eventualities.

In addition, from time to time we experience limited periods of server downtime due to maintenance or enhancements. If our applications are unavailable during these periods of downtime or if our users are unable to access our applications within a reasonable amount of time, our business would be adversely affected and the reputation of our brands could be harmed.

Security breaches, computer viruses and computer hacking attacks could harm our business, results of operations or financial condition.

Security breaches, computer malware and computer hacking attacks have become more prevalent in our industry. Any security breach caused by hacking, including efforts to gain unauthorized access to our applications, servers or websites, or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment, and the inadvertent transmission of computer viruses could harm our business, financial condition and results of operations. Though it is difficult to determine what harm may directly result from any specific interruption or breach, any failure to maintain performance, reliability, security and availability of our applications, servers or website may result in significant expenses, loss of revenue and have a material adverse effect on our business, results of operations or financial condition.

| 11 |

If there are changes in laws or regulations regarding privacy and the protection of user data, or if we fail to comply with such laws or regulations, we may face claims brought against us by regulators or users that could adversely affect our business, results of operations or financial condition.