Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - LSI INDUSTRIES INC | ex_123573.htm |

| EX-32.2 - EXHIBIT 32.2 - LSI INDUSTRIES INC | ex_123575.htm |

| EX-32.1 - EXHIBIT 32.1 - LSI INDUSTRIES INC | ex_123574.htm |

| EX-31.1 - EXHIBIT 31.1 - LSI INDUSTRIES INC | ex_123572.htm |

| EX-23.1 - EXHIBIT 23.1 - LSI INDUSTRIES INC | ex_123571.htm |

| EX-21 - EXHIBIT 21 - LSI INDUSTRIES INC | ex_123570.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

|

|

|

☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED JUNE 30, 2018.

OR

|

|

|

|

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO .

Commission File No. 0-13375

LSI INDUSTRIES INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Ohio |

10000 Alliance Road |

|

(513) 793-3200

(Telephone number of principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

|

|

|

|

|

Common shares, no par value |

|

The NASDAQ Stock Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer ☐ |

|

Accelerated filer ☑ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

Emerging growth company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As of December 31, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $136,501,096 based upon a closing sale price of $6.88 per share as reported on The NASDAQ Global Select Market.

At August 31, 2018 there were 25,641,913 no par value Common Shares issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement filed with the Commission for its 2018 Annual Meeting of Shareholders are incorporated by reference in Part III, as specified.

LSI INDUSTRIES INC.

2018 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

|

Begins on |

|

|

|

Page |

|

| PART I | ||

|

|

|

|

|

ITEM 1. BUSINESS |

|

1 |

|

|

|

|

|

ITEM 1A. RISK FACTORS |

|

5 |

|

|

|

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS |

|

9 |

|

|

|

|

|

ITEM 2. PROPERTIES |

|

10 |

|

|

|

|

|

ITEM 3. LEGAL PROCEEDINGS |

|

10 |

|

|

|

|

|

ITEM 4. MINE SAFETY DISCLOSURES |

|

11 |

|

|

|

|

|

PART II |

||

|

|

|

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

11 |

|

|

|

|

|

ITEM 6. SELECTED FINANCIAL DATA |

|

12 |

|

|

|

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

12 |

|

|

|

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

13 |

|

|

|

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

|

14 |

|

|

|

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

14 |

|

|

|

|

|

ITEM 9A. CONTROLS AND PROCEDURES |

|

14 |

|

|

|

|

|

ITEM 9B. OTHER INFORMATION |

|

15 |

|

PART III |

||

|

|

|

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

|

15 |

|

|

|

|

|

ITEM 11. EXECUTIVE COMPENSATION |

|

15 |

|

|

|

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

15 |

|

|

|

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

15 |

|

|

|

|

|

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES |

|

15 |

|

|

|

|

|

PART IV |

||

|

|

|

|

|

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

|

16 |

|

|

|

|

| ITEM 16. FORM 10-K SUMMARY | 17 | |

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

This document contains certain forward-looking statements that are subject to numerous assumptions, risks or uncertainties. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements may be identified by words such as “estimates,” “anticipates,” “projects,” “plans,” “expects,” “can,” “intends,” “believes,” “seeks,” “may,” “will,” “should” or the negative versions of those words and similar expressions, and by the context in which they are used. Such statements, whether expressed or implied, are based upon current expectations of the Company and speak only as of the date made. Reliance should not be placed on forward-looking statements because they involve known and unknown risks, and other factors which may cause actual results performance or achievements to differ materially from those contained in or implied and could materially impart financial condition. Statements concerning expected financial performance, ongoing business strategies, and, possible future actions which the Company intends to pursue in order to achieve strategic objectives constitute forward-thinking information. Implementation of these strategies and the achievement of such financial performance is each subject to numerous conditions, uncertainties and risk factors These risks and uncertainties include, but are not limited to, the impact of competitive products and services, product demand and market acceptance risks, potential costs associated with litigation and regulatory compliance, reliance on key customers, financial difficulties experienced by customers, the cyclical and seasonal nature of our business, the adequacy of reserves and allowances for doubtful accounts, fluctuations in operating results or costs whether as a result of uncertainties inherent in tax and accounting matters or otherwise, tax law changes, failure of an acquisition or acquired company to achieve its plans or objectives generally, unexpected difficulties in integrating acquired businesses, the ability to retain key employees, unfavorable economic and market conditions, the impact of tariffs and trade wars, the results of asset impairment assessments, the ability to maintain an effective system of internal control over financial reporting, the ability to remediate any material weaknesses in internal control over financial reporting and any other risk factors that are identified herein. In addition to the factors described in this paragraph, the risk factors identified in our Form 10-K and other filings the Company may make with the SEC constitute risks and uncertainties that may affect the financial performance of the Company and are incorporated herein by reference. The Company does not undertake and hereby disclaims any duty to update any forward-looking statements to reflect subsequent events or circumstances.

PART I

|

ITEM 1. |

BUSINESS |

Our Company

We are a customer-centric company that positions itself as a value-added, trusted partner in developing superior image solutions through our lighting, graphics, and technology capabilities. Our products and services include digital signage, printed and structural graphics, and electrical signage capabilities, a wide variety of high quality indoor and outdoor lighting products, lighting control systems, and related professional services including engineering, installation, and project management. We also provide graphics and lighting products on a stand-alone basis. Our company is the leading provider of corporate visual image solutions to the petroleum / convenience store industry. We use this leadership position to penetrate national retailers and multi-site retailers, including quick service and casual restaurants, retail chain stores and automobile dealerships, located primarily in the United States. We seek to expand our market share in the traditional commercial / industrial lighting market by combining our LED product innovation and lighting control solutions utilizing the latest technology along with a strong emphasis on high service levels and market focused solutions. Our solutions are targeted at both renovation and new construction markets. We have comprehensive design and product development capabilities for targeted markets. We also provide a variety of lighting control solutions which allow our customers to reduce energy and maintenance costs. In addition to designing and producing traditional signage, we design and integrate digital signage technology where customers are provided a turnkey solution that includes design, software, hardware content development, implementation, service and support.

We believe that national retailers and other companies in the markets we serve are increasingly seeking single-source suppliers with the project management skills and service expertise necessary to execute a comprehensive visual image program. The integration of our graphics, lighting, and technology coupled with our professional services capabilities allows our customers to outsource to us the development of an entire visual image program from the planning and design stage through installation. Our approach is to combine our lighting products and custom graphics applications utilizing the latest technology along with our professional service capabilities to create complete customer-focused visual image solutions. We also offer our lighting products and graphics elements on a stand-alone basis to service our existing image solutions customers, to establish a presence in a new market or to create a relationship with a new customer. We believe that our ability to combine lighting, graphics, and technology coupled with professional services into a comprehensive visual image solution differentiates us from our competitors who offer only stand-alone products for lighting or graphics and who lack professional services offerings. During the past several years, we have continued to enhance our ability to provide comprehensive corporate visual image solutions by adding additional graphics capabilities such as digital signage and media content management, wireless lighting control systems, new and innovative LED lighting products and professional services through acquisitions and internal development.

Our focus on product development and innovation creates products that are essential components of our customers’ corporate visual image strategy. Our spending on research and development was $6.0 million in fiscal 2018, $5.7 million in fiscal 2017, and $5.5 million in fiscal 2016. We develop and manufacture lighting including solid-state LED lighting, lighting control systems, and graphics and distribute them through an extensive multi-channel distribution network that allows us to effectively service our target markets. Customers include dealers, franchisee and national corporate accounts represented by the following companies: BP, Chevron Texaco, ExxonMobil, Shell, Phillips 66, Burger King, Dairy Queen, Taco Bell, Wendy’s, Wal-Mart Stores, Chrysler, Ford, General Motors, Nissan, Toyota, Sports Clips, AAA, Panda Express, and SunTrust Bank.

We also focus on the elimination of non-value added activities throughout our organization through the LSI Business System, a Lean Management System utilizing kaizen events and lean tools to drive continuous improvement in our processes. The LSI Business System improves shareholder value by increasing customer satisfaction and eliminating waste, both of which will improve the bottom line. We are committed to this company-wide initiative through employee education and training with the ultimate goal to make it part of the corporate culture and way of thinking of all employees.

Our business is organized as follows: the Lighting Segment, which represented 76% of our fiscal 2018 net sales and the Graphics Segment, which represented 24% of our fiscal 2018 net sales. See Note 2 of Notes to Consolidated Financial Statements beginning on page 45 of this Form 10-K for additional information on business segments. Net sales by segment are as follows (in thousands):

|

2018 |

2017 |

2016 |

||||||||||

|

Lighting Segment |

$ | 260,613 | $ | 258,997 | $ | 244,228 | ||||||

|

Graphics Segment |

81,410 | 72,395 | 77,968 | |||||||||

|

Total Net Sales |

$ | 342,023 | $ | 331,392 | $ | 322,196 | ||||||

Lighting Segment

Our Lighting Segment manufactures and markets outdoor and indoor lighting and lighting controls for the commercial, industrial and multi-site retail markets including the petroleum / convenience store, quick-service, and automotive markets. Our products are designed and manufactured to provide maximum value and meet the high-quality, competitively-priced product requirements of the markets we serve. We generally avoid specialty or custom-designed, low-volume products for single order opportunities. Our concentration is on our high-volume, standard product lines that meet our customers’ needs. By focusing our product offerings, we achieve significant manufacturing and cost efficiencies.

Our lighting fixtures, poles and brackets are produced in a variety of designs, styles and finishes. Important functional variations include types of mounting, such as pole, bracket and surface, and the nature of the light requirement, such as interior and exterior down-lighting, wall-wash lighting, canopy lighting, flood-lighting, area lighting and security lighting. Our engineering staff performs photometric analyses and wind load safety studies for all light fixtures and also designs our fixtures and lighting systems. Our lighting products utilize a variety of different light sources, with the primary light source being solid-state LED. The major products and services offered within our lighting segment include: exterior area lighting, interior lighting, canopy lighting, landscape lighting, lighting controls, light poles, lighting system design, and photometric layouts. All of our products are designed for performance, reliability, ease of installation and service, as well as attractive appearance. The Company also has a focus on designing lighting system solutions and implementing strategies related to energy savings in substantially all markets served.

We offer our customers expertise in developing and utilizing high-performance solid-state LED solutions, which when combined with the Company’s lighting fixture expertise and technology, has the potential to result in a broad spectrum of white light LED fixtures that offer equivalent or improved lighting performance with significant energy and maintenance savings as compared to the present metal halide and fluorescent lighting fixtures.

Graphics Segment

Our Graphics Segment manufactures and sells exterior and interior visual image elements related to signage and graphics, including integrated digital signage solutions and menu boards. The major products and services offered within our Graphics Segment include the following: signage and canopy graphics, pump dispenser graphics, building fascia graphics, electrical signage, decals, interior signage and marketing graphics, aisle markers, wall mural graphics, fleet graphics, video boards, menu boards and digital signage and media content management. Our Company also manages and executes the implementation of large rollout programs. These products are used in graphics displays and visual image programs in several markets, including the petroleum / convenience store market, quick-service restaurant, grocery, and multi-site retail operations. Our extensive lighting and graphics expertise, product offering, visual image solution implementation capabilities and other professional services represent significant competitive advantages. We work with corporations and design firms to establish and implement cost effective corporate visual image programs to advance our customer’s brand. Increasingly, we have become the primary supplier of exterior and interior graphics for our customers. We also offer installation management services for those customers who require the installation of interior or exterior products (utilizing pre-qualified independent subcontractors throughout the United States).

Our business can be significantly impacted by participation in a customer’s “image conversion program,” especially if it were to involve a “roll out” of that new image to a significant number of that customer’s and its franchisees’ retail sites. The impact to our business can be very positive with growth in net sales and profitability when we are engaged in an image conversion program. This can be followed in subsequent periods by lesser amounts of business or negative comparisons following completion of an image conversion program, unless we are successful in replacing that completed business with participation in new image conversion programs of similar size with one or more customers. An image conversion program can potentially involve any or all of the following improvements, changes or refurbishments at a customer’s retail site: interior or exterior lighting (see discussion above about our lighting segment), interior or exterior store signage and graphics, and installation of these products in both the prototype and roll out phases of their program.

Our Competitive Strengths

Single Source Comprehensive Visual Image Solution Provider. We believe that we are the only company serving our target markets that combines digital signage and graphics capabilities, lighting products and installation implementation capabilities to create comprehensive image solutions. We believe that our position as a single-source provider creates a competitive advantage over competitors who can only address either the lighting or the graphics component of a customer’s corporate visual image program. Using our broad visual image solutions capabilities, our customers can maintain complete control over the creation of their visual image programs while avoiding the added complexity of coordinating separate lighting and graphics suppliers and service providers. We can use high technology software to produce computer-generated virtual prototypes of a customer’s new or improved retail site image. We believe that these capabilities are unique to our target markets and they allow our customers to make educated, cost-effective decisions quickly.

Proven Ability to Penetrate Target Markets. We have grown our business by establishing a leadership position in many of the markets we serve, including petroleum / convenience stores, automobile dealerships and specialty retailers. Although our relationship with our customers may begin with the need for a single product or service, we leverage our broad product and service offering to identify additional products and solutions. We promote the combination of graphics, lighting, and technology, along with image element offerings, and services to create comprehensive solutions for our customers.

Focus on Product Innovation. We believe that our ability to successfully identify, develop and patent new products has allowed us to expand our market opportunity and enhance our market position. Our product innovation initiatives are designed to increase the value of our product offering by addressing the needs of our customers and target markets through retrofit enhancements to existing products or the development of new products. New product development includes developing an expanding portfolio of technology patents. We believe our product innovation process creates value for our customers by producing products that offer energy efficiency, low maintenance requirements and long-term operating performance at competitive prices based upon the latest technologies available.

Strong Relationships with our Customers. We have used our innovative products and high-quality services to develop close, long-standing relationships with a large number of our customers. Many of our customers are recognized among the leaders in their respective markets, including customers such as BP, Chevron Texaco, ExxonMobil, Shell, Phillips 66, Burger King, Dairy Queen, Taco Bell, Wendy’s, Wal-Mart Stores, Chrysler, Ford, General Motors, Nissan, Toyota, Sports Clips, AAA, Panda Express, and SunTrust Bank. Their use of our products and services raises the visibility of our capabilities and facilitates the acceptance of our products and services in their markets. Within each of these markets, our ability to be a single source provider of image solutions often creates repeat business opportunities through corporate reimaging programs. We have served some of our customers since our inception in 1976.

An Appropriately Capitalized Balance Sheet. As part of our long-term operating strategy, we believe the Company maintains a conservative capital structure. With a solid equity base, we are able to preserve operating flexibility in times of industry expansion and contraction. In the current business environment, a strong balance sheet demonstrates financial viability to our existing and targeted customers. In addition, a strong balance sheet enables us to invest in the company through research and development and allows the Company to invest in capital projects that support the Company’s growth.

Aggressive Use of Visual Marketing Centers. The capabilities of our Image Center and I-Zone Marketing Centers provide us with a distinct competitive advantage to demonstrate the effectiveness of integrating graphics, lighting, and technology into a complete corporate visual image program. These centers, which demonstrate the depth and breadth of our product and service offerings, have become an effective component of our sales process.

Maintain our Vertically Integrated Business Model. Our Company balances its strength as a vertically integrated manufacturer with its sourcing of purchased finished goods through the global supply chain. We focus on developing lighting and graphics products coupled with technology, and outsource certain non-core processes and product components as necessary.

Commitment to Continuous Improvement. We are committed to a philosophy of continuous improvement through the LSI Business System, which is a Lean Management System utilizing Kaizen events and lean tools to identify and eliminate waste and increase customer satisfaction with the ultimate goal to improve shareholder value.

Sales, Marketing and Customers

Sales: Our lighting products including lighting controls, are sold primarily throughout the United States, but also in Canada, Australia, and Latin America (less than 5% of consolidated net sales are outside the United States) using a combination of regional sales managers and independent sales representatives serving primarily the commercial / industrial market along with several of the other markets we serve. LSI has traditionally been a project based business, quoting and receiving orders as a preferred vendor for product sales to multiple end-users, including customer-owned as well as franchised and licensed dealer operations. With the acquisition of Atlas, we now market and sell standard product to stocking distributors, who subsequently provide product to electrical contractors and end users for a variety of lighting applications. Our graphics products, which in many instances are program-driven, are sold primarily through our own sales force. Our marketing approach and means of distribution vary by product line and by type of market.

Sales are developed through a wide variety of contacts such as, but not limited to, national retail marketers, branded product companies, franchise and dealer operations. In addition, sales are also achieved through recommendations from local architects, engineers, petroleum and electrical distributors and contractors. The Company utilizes the latest technology to track sales leads and customer quotes with the ultimate goal to turn them into orders from our customers. Our sales are partially seasonal as installation of outdoor lighting and graphic systems in the northern states decreases during the winter months.

Marketing: The capabilities of our Image Center and I-Zone Marketing Centers are important parts of our sales process. These centers, unique within the lighting and graphics industry, are facilities that can produce a computer-generated virtual prototype of a customer’s facility on a large screen through the combination of high technology software and audio/visual presentation. The I-Zone marketing center is a digitally controlled facility containing a large solid-state LED video screen and several displays that showcase our LED technology and LED products. With these capabilities, our customers can instantly explore a wide variety of lighting and graphics alternatives to develop consistent day and nighttime images. These centers give our customers more options, greater control, and more effective time utilization in the development of lighting, graphics and visual image solutions, all with much less expense than traditional prototyping. In addition to being cost and time effective for our customers, we believe that the capabilities of these marketing centers contribute to the development of the best solution for our customers’ needs.

The Image and I-Zone marketing centers also contain comprehensive indoor and outdoor product display areas that allow our customers to see many of our products and services in one setting. This aids our customers in making quick and effective lighting and graphic design decisions through hands-on product demonstrations and side-by-side comparisons. More importantly, these capabilities allow us to expand our customer’s interest from just a single product into other products and solutions. We believe that the capabilities of these centers have further enhanced our position as a highly qualified outsourcing partner capable of guiding a customer through image alternatives utilizing our lighting and graphics products and services. We believe this capability distinguishes us from our competitors and will become increasingly beneficial in attracting additional customers.

In addition to the capabilities of our Image and I-Zone Marketing Centers, the Company markets its products and service capabilities to end users in multiple channels through a broad spectrum of marketing and promotional methods, including direct customer contact, trade shows, on-site training, print advertising in industry publications, product brochures and other literature, as well as the internet and social media.

Manufacturing and Operations

We design, engineer and manufacture most of our lighting and graphics products through utilizing lean manufacturing principals. We periodically invest in new machinery and equipment utilizing the latest technology in order to leverage the manufacturing efficiencies gained from our high-volume production. When appropriate, we utilize alliances with domestic and international vendors to outsource certain products and components. The majority of products and related software are engineered, designed and final-assembled by the Company, while a portion of the manufacturing has been performed by select qualified vendors. We are not dependent on any one supplier for critical component parts.

The principal raw materials and purchased components used in the manufacturing of our products are steel, aluminum, aluminum castings, fabrications, LEDs, power supplies, powder paint, steel tubing, wire harnesses, acrylic, silicon and glass lenses, inks, various graphics substrates such as foam board and vinyls, and digital screens. We source these materials and components from a variety of suppliers. Although an interruption of these supplies and components could disrupt our operations, we believe generally that alternative sources of supply exist and could be readily arranged. We strive to reduce price volatility in our purchases of raw materials and components through annual contracts with strategic suppliers. The Company continued to experience some of the inflationary pressures in certain commodities experienced in fiscal 2017. Our Lighting operations generally carry a certain level of sub-assemblies and finished goods inventory to meet quick delivery requirements. Most lighting products are made to order and shipped shortly after they are manufactured. Our Graphics operations manufacture custom graphics products for customers who require us to stock certain amounts of finished goods in exchange for their commitment to that inventory. Our digital signage business requires an investment in digital screens in order to meet the demands of a large roll-out program. In some Graphics programs, customers also give us a cash advance for the inventory that we stock for them. The Company’s operations dealing with LED products generally carry LED and LED component inventory due to longer lead times.

We currently operate out of eleven manufacturing, office and warehouse facilities in six U.S. states.

Most of our operations received ISO 9001:2015 Certification thru ANAB (Cert# 5369-Eagle Registrations Inc) with plans to certify the Company’s other facilities. Our manufacturing operations are subject to various federal, state and local regulatory requirements relating to environmental protection and occupational health and safety. We do not expect to incur material capital expenditures with regard to these matters and believe our facilities are in compliance with such regulations.

Goodwill and Intangible Asset Impairment

There was no impairment of the Company’s goodwill or indefinite-lived intangible assets in fiscal year 2016. The Company recorded a $479,000 impairment of a finite-lived intangible asset in the Graphics Segment in fiscal year 2017 and recorded a $28,000,000 impairment of goodwill in the Lighting Segment in fiscal year 2018.

Competition

We experience strong competition in all segments of our business, and in all markets served by our product lines. Although we have many competitors, some of which have greater financial and other resources, we do not compete with the same companies across our entire product and service offerings. We believe product quality and performance, price, customer service, prompt delivery, and reputation to be important competitive factors. We also have several product and process patents which have been obtained in the normal course of business which provide a competitive advantage in the marketplace.

Recent Developments

In August 2018, the Company announced that Wilfred (Bill) T. O’Gara has been appointed Chairman of the Board by the Board of Directors, succeeding Gary P. Kreider, who has served as Chairman of the Board since November, 2014. Mr. Kreider will remain a board member until a successor director is appointed, at which time Mr. Kreider intends to retire from the board. The Company also announced that Ronald D. Brown, current CEO, has been nominated by the Board to stand for election as a Director at the November 6th, 2018 annual shareholders’ meeting.

Also in August 2018, the Company announced organization and leadership changes. LSI’s structure is being aligned around its key markets and customers. This will enable the Company to better package its technology, products and services in a unique way to continue to provide its customers with innovative solutions. This organization change will allow the Company to grow the business by improving and expanding its capabilities to better serve its customers in targeted markets and in addition to developing and acquiring technologies, products and services to improve the experience for its customers’ customers.

In conjunction with this new organization structure, the Company is eliminating the positions of President of LSI Lighting, President of Atlas Lighting and President of LSI Graphics, as well as the separate organizations aligned around the products each business produced and sold. The Company is now organizing as one LSI organization, focused on serving key customer markets with its full package of capabilities. The Company also made several structural leadership changes in order to align the entire organization and better leverage LSI’s full scope of capabilities (lighting, graphics, digital signage, control and IoT technologies).

Additional Information

Our sales are partially seasonal as installation of outdoor lighting and graphic systems in the northern states lessens during the harshest winter months. We had a backlog of orders, which we believe to be firm, of $28.8 million and $30.2 million at June 30, 2018 and 2017, respectively. All orders are expected to be shippable or installed within twelve months.

We have 1,223 full-time employees and 123 agency employees as of June 30, 2018. We offer a comprehensive compensation and benefits program to our employees, including competitive wages, medical and dental insurance, an incentive plan that is based upon the achievement of the Company’s business plan goals, and a 401(k) retirement savings plan and, for certain employees, a nonqualified deferred compensation plan and an equity based incentive plan.

We file reports with the Securities and Exchange Commission (“SEC”) on Forms 10-K, 10-Q and 8-K. You may read and copy any materials filed with the SEC at its public reference room at 100 F. Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain that information by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet website that contains reports, proxy and information statements and other information regarding us. The address of that site is http://www.sec.gov. Our internet address is http://www.lsi-industries.com. We make available free of charge through our internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practical after we electronically file them with the SEC. LSI is not including the other information contained on its website as part of or incorporating it by reference into this Annual Report on Form 10-K.

LSI Industries Inc. is an Ohio corporation, incorporated in 1976.

|

ITEM 1A. |

RISK FACTORS |

In addition to the other information set forth in this report, you should carefully consider the following factors which could materially affect our business, financial condition, cash flows or future results. Any one of these factors could cause the Company’s actual results to vary materially from recent results or from anticipated future results. The risks described below are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results.

Lower levels of economic activity in our end markets could adversely affect our operating results.

Our businesses operate in several market segments including, but not limited to, commercial, industrial, retail, petroleum / convenience store and automotive. Operating results can be negatively impacted by volatility in these markets. Future downturns in any of the markets we serve could adversely affect our overall sales and profitability.

The markets in which we operate are subject to competitive pressures that could affect selling prices, and therefore could adversely affect our operating results.

Our businesses operate in markets that are highly competitive, and we compete on the basis of price, quality, service and/or brand name across the industries and markets served. Some of our competitors for certain products, primarily in the Lighting Segment, have greater sales, assets and financial resources. Some of our competitors are based in foreign countries and have cost structures and prices in foreign currencies. Accordingly, currency fluctuations could cause our U.S. dollar-priced products to be less competitive than our competitors’ products which are priced in other currencies. Competitive pressures could affect prices we charge our customers or demand for our products, which could adversely affect our operating results. Additionally, customers for our products may attempt to reduce the number of vendors from which they purchase in order to reduce the size and diversity of their inventories and their transaction costs. To remain competitive, we will need to invest continuously in research and development, manufacturing, marketing, customer service and support, and our distribution networks. We may not have sufficient resources to continue to make such investments and we may be unable to maintain our competitive position.

Our operating results may be adversely affected by unfavorable economic, political and market conditions.

Economic and political conditions worldwide have from time to time contributed to slowdowns in our industry at large, as well as to the specific segments and markets in which we operate. When combined with ongoing customer consolidation activity and periodic manufacturing and inventory initiatives, an uncertain macro-economic and political climate, including but not limited to the effects of possible weakness in domestic and foreign financial and credit markets, could lead to reduced demand from our customers and increased price competition for our products, increased risk of excess and obsolete inventories and uncollectible receivables, and higher overhead costs as a percentage of revenue. If the markets in which we participate experience further economic downturns, as well as a slow recovery period, this could negatively impact our sales and revenue generation, margins and operating expenses, and consequently have a material adverse effect on our business, financial condition and results of operations.

Price increases or significant shortages of raw materials and components could adversely affect our operating margin.

The Company purchases large quantities of raw materials and components such as steel, aluminum, LEDs, electronic components, plastic lenses, glass lenses, vinyls, inks, and corrugated cartons. Materials comprise the largest component of costs, representing approximately 61% and 60% of the cost of sales in 2018 and 2017, respectively. While we have multiple sources of supply for most of our material requirements, significant shortages could disrupt the supply of raw materials. Further significant tariffs or increases in the price of these raw materials and components could further increase the Company’s operating costs and materially adversely affect margins. Although the Company attempts to pass along increased costs in the form of price increases to customers, the Company may be unsuccessful in doing so for competitive reasons. Even when price increases are successful, the timing of such price increases may lag significantly behind the incurrence of higher costs. On occasion, there are selected electronic component parts and certain other parts shortages in the market place, some of which have affected the Company’s manufacturing operations and shipment schedules even though multiple suppliers may be available. The lead times of these suppliers can increase and the prices of some of these parts have increased during periods of shortages.

We have a concentration of net sales to the petroleum / convenience store market, and any substantial change in this market could have an adverse effect on our business.

Approximately 30% of our net sales in fiscal year 2018 are concentrated in the petroleum / convenience store market. Sales to this market segment are dependent upon the general conditions prevailing in and the profitability of the petroleum and convenience store industries and general market conditions. Our petroleum market business can be subject to reactions by the petroleum industry to world political events, particularly those in the Middle East, and to the price and supply of oil. Major disruptions in the petroleum industry generally result in a curtailment of retail marketing efforts, including expansion and refurbishing of retail outlets, by the petroleum industry and adversely affect our business. Any substantial change in purchasing decisions by one or more of our larger customers whether due to actions by our competitors, customer financial constraints, industry factors or otherwise, could have an adverse effect on our business.

The Company may pursue future growth through strategic acquisitions, alliances, or investments, which may not yield anticipated benefits.

The Company has strengthened its business through strategic acquisitions, alliances, and investments and may continue to do so as opportunities arise in the future. Such investments have been and may be start-up or development stage entities. The Company will benefit from such activity only to the extent that it can effectively leverage and integrate the assets or capabilities of the acquired businesses and alliances including, but not limited to, personnel, technology, and operating processes. Moreover, unanticipated events, negative revisions to valuation assumptions and estimates, diversions of resources and management’s attention from other business concerns, and difficulties in attaining synergies, among other factors, could adversely affect the Company’s ability to recover initial and subsequent investments, particularly those related to acquired goodwill and intangible assets or non-controlling interests. In addition, such investment transactions may limit the Company’s ability to invest in other activities, which could be more profitable or advantageous.

If we do not develop the appropriate new products or if customers do not accept new products, we could experience a loss of competitive position which could adversely affect future revenues.

The Company is committed to product innovation on a timely basis to meet customer demands. Development of new products for targeted markets requires the Company to develop or otherwise leverage leading technologies in a cost-effective and timely manner. Failure to meet these changing demands could result in a loss of competitive position and seriously impact future revenues. Products or technologies developed by others may render the Company’s products or technologies obsolete or noncompetitive. A fundamental shift in technologies in key product markets could have a material adverse effect on the Company’s operating results and competitive position within the industry. More specifically, the development of new or enhanced products is a complex and uncertain process requiring the anticipation of technological and market trends. Rapidly changing product technologies could adversely impact operating results due to potential technological obsolescence of certain inventories or increased warranty expense related to newly developed LED lighting products. We may experience design, manufacturing, marketing or other difficulties, such as an inability to attract a sufficient number of experienced engineers that could delay or prevent our development, introduction or marketing of new products or enhancements and result in unexpected expenses. Such difficulties could cause us to lose business from our customers and could adversely affect our competitive position. In addition, added expenses could decrease the profitability associated with those products that do not gain market acceptance.

Our business is cyclical and seasonal, and in downward economic cycles our operating profits and cash flows could be adversely affected.

Historically, sales of our products have been subject to cyclical variations caused by changes in general economic conditions. Our revenues in our third quarter ending March 31 are also affected by the impact of weather on construction and installation programs and the annual budget cycles of major customers. The demand for our products reflects the capital investment decisions of our customers, which depend upon the general economic conditions of the markets that our customers serve, including, particularly, the petroleum and convenience store industries. During periods of expansion in construction and industrial activity, we generally have benefited from increased demand for our products. Conversely, downward economic cycles in these industries result in reductions in sales and pricing of our products, which may reduce our profits and cash flow. During economic downturns, customers also tend to delay purchases of new products. The cyclical and seasonal nature of our business could at times adversely affect our liquidity and financial results.

A loss of key personnel or inability to attract qualified personnel could have an adverse effect on our operating results.

The Company’s future success depends on the ability to attract and retain highly skilled technical, managerial, marketing and finance personnel, and, to a significant extent, upon the efforts and abilities of senior management. The Company’s management philosophy of cost-control results in a lean workforce. Future success of the Company will depend on, among other factors, the ability to attract and retain other qualified personnel, particularly management, research and development engineers and technical sales professionals. The loss of the services of any key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on the Company’s results of operations.

The costs of litigation and compliance with environmental regulations, if significantly increased, could have an adverse effect on our operating profits.

We are, and may in the future be, a party to any number of legal proceedings and claims, including those involving patent litigation, product liability, employment matters, and environmental matters, which could be significant. Given the inherent uncertainty of litigation, we can offer no assurance that existing litigation or a future adverse development will not have a material adverse impact. We are also subject to various laws and regulations relating to environmental protection and the discharge of materials into the environment, and it could potentially be possible we could incur substantial costs as a result of the noncompliance with or liability for clean up or other costs or damages under environmental laws.

The turnover of independent commissioned sales representatives could cause a significant disruption in sales volume.

Commissioned sales representatives are critical to generating business in the Lighting Segment. From time to time, commissioned sales representatives representing a particular region resign or are terminated and replaced with new commissioned sales representatives. During this period of transition from the previous agency to the new one, sales in the particular region will likely fall as business is disrupted. It may take several months for the new sales representative to generate sales that will equal or exceed the previous sales representative. There is also the risk that the new sales agency will not attain the sales volume of the previous agency. These sales representative changes may occur individually as one agency is replaced due to lack of performance. On the other hand, these sales representative changes can be widespread as a result of the competitive nature of the lighting industry as LSI and its competition vie for the strongest sales agency in a particular region.

The Company may be unable to sustain significant customer and/or channel partner relationships.

Relationships with customers are directly impacted by the Company’s ability to deliver quality products and services. Although no individual customer exceeded 10% of sales during the current fiscal year, the loss of or a substantial decrease in the volume of purchases by certain large customers could harm the Company in a meaningful manner. The Company has relationships with channel partners such as electrical distributors, home improvement retailers, independent sales agencies, system integrators, and value-added resellers. While the Company maintains positive, and in many cases long-term relationships with these channel partners, the loss of a number of channel partners or substantial decrease in the volume of purchases from a major channel partner or group of channel partners could adversely affect the Company.

Changes in a customer’s demands and commitment to proprietary inventory could result in significant inventory write-offs.

Upgrading or replacing a customer’s current image requires the manufacture of inventory that is specific to the particular customer. This is particularly true in the Graphics Segment. In as many instances as possible, we require a commitment from the customer before the inventory is produced. Our request for a commitment can range from a single site or store to a large roll-out program involving many sites or stores. The risk does exist that a customer cannot or will not honor its commitment to us. The reasons a customer cannot or will not honor its commitment can range from the bankruptcy of the customer, to the change in the image during the roll-out program, to canceling the program before its completion and before the inventory is sold to the customer. In each of these instances, we could be left with significant amounts of inventory required to support the customer’s re-imaging. While all efforts are made to hold the customer accountable for its commitment, there is the risk that a significant amount of inventory could be deemed obsolete or no longer usable which could result in significant inventory write-offs.

If we are unable to adequately protect our intellectual property, we may lose some of our competitive advantage.

Our success is determined in part by our ability to obtain United States and foreign patent protection for our technology and to preserve our trade secrets. Our ability to compete and the ability of our business to grow could suffer if our intellectual property rights are not adequately protected. There can be no assurance that our patent applications will result in patents being issued or that current or additional patents will afford protection against competitors. We rely on a combination of patents, copyrights, trademarks and trade secret protection and contractual rights to establish and protect our intellectual property. Failure of our patents, copyrights, trademarks and trade secret protection, non-disclosure agreements and other measures to provide protection of our technology and our intellectual property rights could enable our competitors to more effectively compete with us and have an adverse effect on our business, financial condition and results of operations. In addition, our trade secrets and proprietary know-how may otherwise become known or be independently discovered by others. No guarantee can be given that others will not independently develop substantially equivalent proprietary information or techniques, or otherwise gain access to our proprietary technology.

Sudden or unexpected changes in a customer’s creditworthiness could result in significant accounts receivable write-offs.

The Company takes a conservative approach when extending credit to its customers. Customers are granted an appropriate credit limit based upon the due diligence performed on the customer which includes, among other things, the review of the company’s financial statements and banking information, various credit checks, and payment history the customer has with the Company. At any given time, the Company can have a significant amount of credit exposure with its larger customers. While the Company is frequently monitoring its outstanding receivables with its customers, the likelihood does exist that a customer with large credit exposure is unable to make payment on its outstanding receivables which could result in a significant write-off of accounts receivable.

Failure of the Company’s operating or information system or a compromise of security with respect to its operating system or portable electronic devices could adversely affect the Company’s results of operations and financial condition or the effectiveness of internal controls over operations and financial reporting.

Information technology system failures, network disruptions and breaches of data security caused by such factors, including, but not limited to, earthquakes, fire, theft, fraud, malicious attack or other causes could disrupt the Company’s operations by causing delays or cancellation of customer orders, negatively affecting the Company’s online offerings and services, impeding the manufacture or shipment of products, processing transactions and reporting financial results, resulting in the unintentional disclosure of customer or Company information, or damage to the Company’s reputation. While management has taken steps to address these concerns by implementing network security and internal control measures, there can be no assurance that a system failure or loss or data security breach will not materially adversely affect the Company’s financial condition and operating results.

If the Company’s products are improperly designed, manufactured, packaged, or labeled, the Company may need to recall those items, may have increased warranty costs, and could be the target of product liability claims.

The Company may need to recall products if they are improperly designed, manufactured, packaged, or labeled, and the Company does not maintain insurance for such recall events. Many of the Company's products and solutions have become more complex in recent years and include more sophisticated and sensitive electronic components. The Company has increasingly manufactured certain of those components and products in its own facilities. The Company has previously initiated product recalls as a result of potentially faulty components, assembly, installation, and packaging of its products. Widespread product recalls could result in significant losses due to the costs of a recall, the destruction of product inventory, penalties, and lost sales due to the unavailability of a product for a period of time. In addition, products developed by the Company that incorporate new technologies, such as LED technology, generally provide for more extensive warranty protection which may result in higher costs if warranty claims on these products are higher than historical amounts. The Company may also be liable if the use of any of its products causes harm, and could suffer losses from a significant product liability judgment against the Company in excess of its insurance limits. The Company may not be able to obtain indemnity or reimbursement from its suppliers or other third parties for the warranty costs or liabilities associated with its products. A significant product recall, warranty claim, or product liability case could also result in adverse publicity, damage to the Company’s reputation, and a loss of consumer confidence in its products.

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

None.

|

ITEM 2. |

PROPERTIES |

|

|

|

|

|

|

|

|

|

|

|||

|

Description |

|

Size |

|

Location |

|

Status |

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

1) |

|

LSI Industries Corporate Headquarters and lighting fixture manufacturing |

|

243,000 sq. ft. (includes 66,000 sq. ft. of office space) |

|

Cincinnati, OH |

|

Owned |

|||

|

|

|

|

|

|

|

|

|

|

|||

|

2) |

|

LSI Lighting pole manufacturing and dry powder-coat painting |

|

122,000 sq. ft. |

|

Cincinnati, OH |

|

Owned |

|||

|

|

|

|

|

|

|

|

|

|

|||

|

3) |

LSI Industries technology center |

9,000 sq. ft. |

Cincinnati, OH |

Leased |

|||||||

|

4) |

LSI Lighting assembly |

12,000 sq. ft. |

Hawthorne, CA |

Leased (b) |

|||||||

|

5) |

LSI Lighting inventory storage facility |

25,000 sq. ft. |

Burlington, NC |

Leased (b) |

|||||||

|

6) |

|

LSI Lighting Fabrication manufacturing and dry powder-coat painting |

|

96,000 sq. ft. (includes 5,000 sq. ft. of office space) |

|

Independence, KY |

|

Owned |

|||

|

7) |

LSI Graphics office; screen printing manufacturing; and architectural graphics manufacturing |

141,000 sq. ft. (includes 34,000 sq. ft. of office space) |

Houston, TX |

Leased |

|||||||

|

8) |

LSI Graphics office and manufacturing |

212,000 sq. ft. (includes 22,000 sq. ft. of office space) |

North Canton, OH |

Owned |

|||||||

|

9) |

LSI Lighting office and manufacturing |

170,000 sq. ft. (includes 10,000 sq. ft. of office space) |

New Windsor, NY |

Owned and Leased (a) |

|||||||

|

10) |

LSI Lighting office and manufacturing |

57,000 sq. ft. (includes 5,000 sq. ft. of office space) |

Columbus, OH |

Owned |

|||||||

|

11) |

LSI Lighting office and manufacturing |

336,000 sq. ft. (included 60,000 sq. ft. of office space) |

Burlington, NC |

Leased |

|||||||

| (a) | The land at this facility is leased and the building is owned. | |

| (b) | The leased facilities were vacated subsequent to June 30, 2018 |

The Company considers these eleven operating facilities (total of approximately 1,400,000 square feet) adequate for its current level of operations.

|

ITEM 3. |

LEGAL PROCEEDINGS |

See Note 13 of Notes to the Consolidated Financial Statements beginning on page 58 of this Form 10-K

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

None.

PART II

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

(a) |

Common share information appears in Note 17 — SUMMARY OF QUARTERLY RESULTS (UNAUDITED) under “Range of share prices” beginning on page 62 of this Form 10-K. Information related to “Earnings (loss) per share” and “Cash dividends paid per share” appears in SELECTED FINANCIAL DATA on page 66 of this Form 10-K. LSI’s shares of common stock are traded on the NASDAQ Global Select Market under the symbol “LYTS.” |

The Company’s Board of Directors has adopted a dividend policy which indicates that dividends will be determined by the Board of Directors in its discretion based upon its evaluation of earnings, cash flow requirements, financial condition, debt levels, stock repurchases, future business developments and opportunities, and other factors deemed relevant by the Board of Directors. The Company has paid annual cash dividends beginning in fiscal 1987 through fiscal 1994, and quarterly cash dividends since fiscal 1995. The Company’s indicated annual rate for payment of a cash dividend at the end of fiscal 2018 was $0.20 per share.

At August 30, 2018, there were approximately 654 shareholders of record. The Company believes this represents approximately 3,000 beneficial shareholders.

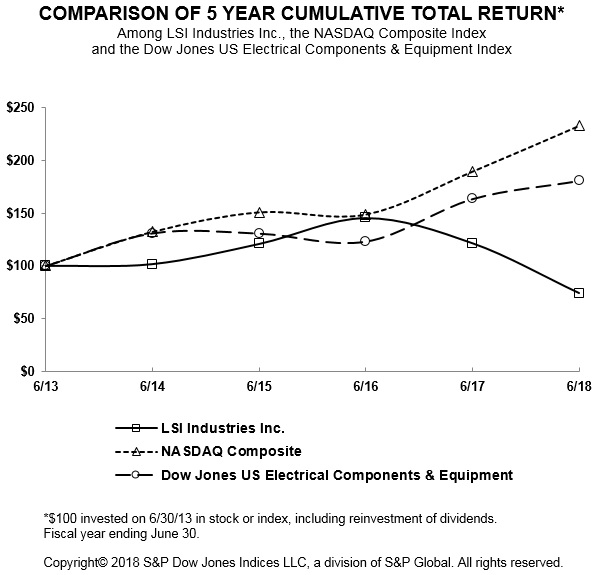

The following graph compares the cumulative total shareholder return on the Company’s common shares during the five fiscal years ended June 30, 2018 with a cumulative total return on the NASDAQ Stock Market Index (U.S. companies) and the Dow Jones Electrical Equipment Index. The comparison assumes $100 was invested June 30, 2013 in the Company’s Common Shares and in each of the indexes presented; it also assumes reinvestment of dividends.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

|

ITEM 6. |

SELECTED FINANCIAL DATA |

“Selected Financial Data” begins on page 66 of this Form 10-K.

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” appears on pages 19 through 33 of this Form 10-K.

|

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

The Company is exposed to market risk from changes in variable interest rates, changes in prices of raw materials and component parts, and changes in foreign currency translation rates. Each of these risks is discussed below.

Interest Rate Risk

The Company earns interest income on its cash, cash equivalents, and short-term investments (if any) and pays interest expense on its debt (if any). Because of variable interest rates, the Company is exposed to the risk of interest rate fluctuations, which impact interest income, interest expense, and cash flows.

The Company’s $100,000,000 line of credit is subject to interest rate fluctuations, should the Company borrow certain amounts on this line of credit. Additionally, the Company expects to generate cash from its operations that will subsequently be used to pay down as much of the debt (if any is outstanding) as possible or invest cash in short-term investments (if no debt is outstanding), while still funding the growth of the Company.

Raw Material Price Risk

The Company purchases large quantities of raw materials and components, mainly steel, aluminum, castings, fabrications, LEDs, electronic components, power supplies, powder paint, plastic, silicon and glass lenses, vinyls, inks, and corrugated cartons. The Company’s operating results could be affected by the availability and price fluctuations of these materials. The Company’s strategic sourcing plans include mitigating risk by utilizing multiple suppliers for a commodity to avoid significant dependence on any single supplier. While the possibility does exist of industry-wide supply shortages at any time in the future, the Company has not experienced any significant supply problems in recent years. Price risk for these materials is related to price increases in commodity items that affect all users of the materials, including the Company’s competitors. For the fiscal year ended June 30, 2018, the raw material component of cost of goods sold subject to price risk was approximately $155 million. The Company does not actively hedge or use derivative instruments to manage its risk in this area. The Company does, however, seek and qualify new suppliers, negotiate with existing suppliers, and arranges stocking agreements to mitigate risk of supply and price increases. On occasion, the Company’s Lighting Segment has announced price increases with customers in order to offset raw material price increases and to mitigate the impact of trade tariffs. In fiscal 2018, the Company announced price increases for all lighting and pole products in order to attempt to offset material price inflation in certain commodities. The price increases with customers did not fully offset the commodity price increases. The Company’s Graphics Segment generally establishes new sales prices, reflective of the then current raw material prices, for each custom graphics program as it begins.

Foreign Currency Translation Risk

The Company has essentially no foreign currency risk as all operations are conducted in U.S. dollars.

|

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Index to Financial Statements

|

|

|

Begins |

|

|

|

on Page |

||

|

Financial Statements: |

|

|

|

|

|

|

|

|

|

Management’s Report On Internal Control Over Financial Reporting |

|

|

34 |

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm |

|

|

35 |

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm |

|

|

36 |

|

|

|

|

|

|

Consolidated Statements of Operations for the years ended June 30, 2018, 2017, and 2016 |

|

|

37 |

|

|

|

|

|

|

Consolidated Balance Sheets at June 30, 2018 and 2017 |

|

|

38 |

|

|

|

|

|

|

Consolidated Statements of Shareholders’ Equity for the years ended June 30, 2018, 2017, and 2016 |

|

|

40 |

|

|

|

|

|

|

Consolidated Statements of Cash Flows for the years ended June 30, 2018, 2017, and 2016 |

|

|

41 |

|

|

|

|

|

|

Notes to Consolidated Financial Statements |

|

|

42 |

|

|

|

|

|

|

Financial Statement Schedules: |

|

|

|

|

|

|

|

|

|

Schedule II – Valuation and Qualifying Accounts for the years ended June 30, 2018, 2017, and 2016 |

|

|

66 |

Schedules other than those listed above are omitted for the reason(s) that they are either not applicable or not required or because the information required is contained in the financial statements or notes thereto. Selected quarterly financial data is found in Note 19 of the accompanying consolidated financial statements.

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

None.

|

ITEM 9A. |

CONTROLS AND PROCEDURES |

Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures (as such term is defined Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are designed to ensure that information required to be disclosed by the Company in the reports that it files under the Exchange Act is recorded, processed, summarized and reported within required time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed is accumulated and communicated to management, including the Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

We conducted, under the supervision of our management, including the Chief Executive Officer and Chief Financial Officer, an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act. Based upon our evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of June 30, 2018, our disclosure controls and procedures were effective. Management believes that the consolidated financial statements included in this Annual Report on Form 10-K are fairly presented in all material respects in accordance with U.S GAAP, and the Company’s Chief Executive Officer and Chief Financial Officer have certified that, based on their knowledge, the consolidated financial statements included in this report fairly present in all material respects the Company’s financial condition, results of operations, statement of shareholders’ equity, and cash flows for each of the periods presented in this report.

Management's Report on Internal Control over Financial Reporting appearing on page 33 of this report is incorporated by reference in this Item 9A.

Changes in Internal Control

There have been no changes in the Company’s internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the fiscal quarter ended June 30, 2018, that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting. See Management’s Report On Internal Control Over Financial Reporting on page 34. In January 2018, the Company hired PricewaterhouseCoopers to serve as its internal auditors.

|

ITEM 9B. |

OTHER INFORMATION |

None.

PART III

ITEMS 10, 11, 12, 13 and 14 of Part III are incorporated by reference to the LSI Industries Inc. Proxy Statement for its Annual Meeting of Shareholders to be held November 6, 2018, as filed with the Commission pursuant to Regulation 14A.

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

The description of equity compensation plans required by Regulation S-K, Item 201(d) is incorporated by reference to the LSI Industries Inc. Proxy Statement for its Annual Meeting of Shareholders to be held November 6, 2018, as filed with the Commission pursuant to Regulation 14A.

The following table presents information about the Company’s equity compensation plans (LSI Industries Inc. 2003 Equity Compensation Plan and the 2012 Stock Incentive Plan) as of June 30, 2018.

|

|

|

|

(c) |

|

|

|

|

|

Number of securities |

|

|

|

(a) |

|

remaining available |

|

|

|

Number of securities to |

(b) |

for future issuance |

|

|

|

be issued upon |

Weighted average |

under equity |

|

|

|

exercise of outstanding |

exercise price of |

compensation plans |

|

|

|

options, warrants and |

outstanding options, |

(excluding securities |

|

|

Plan category |

rights |

warrants and rights |

reflected in column (a)) |

|

|

Equity compensation plans approved by security holders |

3,668,074 |

$8.17 |

1,436,303 |

|

|

Equity compensation plans not approved by security holders |

— |

— |

— |

|

|

Total |

3,668,074 |

$8.17 |

1,436,303 |

|

PART IV

|

ITEM 15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

|

(a) |

The following documents are filed as part of this report: |

|

(1) |

Consolidated Financial Statements Appear as part of Item 8 of this Form 10-K. |

|

(2) |

Exhibits — Exhibits set forth below are either on file with the Securities and Exchange Commission and are incorporated by reference as exhibits hereto, or are filed with this Form 10-K. |

|

Exhibit No. |

Exhibit Description | ||

|

|

|

||

|

3.1 |

|||

|

|

|

||

|

3.2 |

|||

|

|

|

||

|

3.3 |

|||

|

|

|

||

|

10.1 |

|||

|

10.2 |

* |

||

|

|

|

|

|

|

10.3 |

* |

||

|

10.4 |

* |

||

|

|

|

|

|

|

10.5 |

* |

||

|

|

|

|

|

|

10.6 |

* |

||

|

10.7 |

* |

||

|

10.8 |

* |

||

|

10.9 |

* |

||

|

10.10 |

* |

||

|

10.11 |

* |

||

|

10.12 |

|

|

10.13 |

* |

||

|

10.14 |

* |

||

|

10.15 |

* |

||

|

10.16 |

* |

||

|

101.INS |

XBRL Instance Document |

|

|

101.SCH |

XBRL Taxonomy Extension Schema |

|

|

101.CAL |

XBRL Taxonomy Extension Calculation Linkbase |

|

|

101.LAB |

XBRL Taxonomy Extension Label Linkbase |

|

|

101.PRE |

XBRL Taxonomy Extension Presentation Linkbase |

|

|

101.DEF |

XBRL Taxonomy Extension Definition Document |

|

|

* |

Management Compensatory Agreements |

LSI will provide shareholders with any exhibit upon the payment of a specified reasonable fee, which fee shall be limited to LSI’s reasonable expenses in furnishing such exhibit. The exhibits identified herein as being filed with the SEC have been so filed with the SEC but may not be included in this version of the Annual Report to Shareholders.

ITEM 16. FORM 10-K SUMMARY

Not included.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

LSI INDUSTRIES INC. |

||

|

|

|

|

|

|

September 11, 2018

|

BY: |

/s/ Ronald D. Brown |

|

|

Date |

|

Ronald D. Brown Interim Chief Executive Officer |

|

We, the undersigned directors and officers of LSI Industries Inc. hereby severally constitute Ronald D. Brown and James E. Galeese, and each of them singly, our true and lawful attorneys with full power to them and each of them to sign for us, in our names in the capacities indicated below, any and all amendments to this Annual Report on Form 10-K filed with the Securities and Exchange Commission.

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Signature |

|

Title |

|

|

|

|

||

|

/s/ Ronald D. Brown |

Interim Chief Executive Officer |

||

|

Ronald D. Brown |

(Principal Executive Officer) |

||

| Date: September 11, 2018 | |||

|

/s/ James E. Galeese |

Executive Vice President, and Chief Financial Officer |

||

|

James E. Galeese |

(Principal Financial Officer) |

||

|

Date: September 11, 2018 |

|||

|

/s/ Jeffery S. Bastian |

Vice President and Chief Accounting Officer |

||

|

Jeffery S. Bastian |

(Principal Accounting Officer) |

||

| Date: September 11, 2018 | |||

|

/s/ Robert P. Beech |

Director |

||

|

Robert P. Beech |

|||

| Date: September 11, 2018 | |||

|

/s/ Gary P. Kreider |

Director |

||

|

Gary P. Kreider |

|||

| Date: September 11, 2018 | |||

|

/s/ Wilfred T. O’Gara |

Chairman of the Board of Directors |

|||

|

Wilfred T. O’Gara |

|

|

||

| Date: September 11, 2018 |

|

|

||

|

/s/ James P. Sferra

|

|

Director |

||

|

James P. Sferra Date: September 11, 2018 |

|

|

||

|

/s/ John K. Morgan |

Director |

|||

|

John K. Morgan |

||||

| Date: September 11, 2018 |

|

|||

|

/s/ Robert A. Steele

|

Director |

|||

|

Robert A. Steele Date: September 11, 2018 |

|

|||