Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - GI DYNAMICS, INC. | d613352d8ka.htm |

Q3 2018 GI Dynamics, Inc. Investor Presentation Exhibit 99.1

Q3 2018 Important Notice This presentation has not been approved by an authorised person in accordance with Section 21 of the UK Financial Services and Markets Act 2000, as amended (“FSMA”). This presentation does not constitute, and GI Dynamics, Inc. is not making, an offer of transferable securities to the public within the meaning of sections 85B and 102B of FSMA and it is being delivered for information purposes only to a very limited number of persons and companies who are ‘qualified investors’ within the meaning of section 86(7) of FSMA purchasing as principal or in circumstances under section 86(2) of FSMA, as well as persons who have professional experience in matters relating to investments and who fall within the category of persons set out in Article 19 of the UK Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or are high net worth companies within the meaning set out in Article 49 of the Order or are certified sophisticated investors within the meaning set out in Article 50 of the Order or are otherwise permitted to receive it (together, the "Relevant Persons"). This presentation is directed only at Relevant Persons and must not be acted on or relied upon by persons who are not Relevant Persons. Any other person who receives this presentation should not rely or act upon it. By accepting this presentation and not immediately returning it, the recipient is deemed to represent and warrant that: (i) they are a person who falls within the above description of persons entitled to receive the presentation; (ii) they have read, agree and will comply with the contents of this notice; and (iii) they will use the information in this document solely for evaluating your possible interest in acquiring securities of GI Dynamics, Inc. Currency References Financial amounts in this presentation are expressed in US Dollars, except where specifically noted. Forward-Looking Statements The announcement may contain forward-looking statements. These statements are based on GI Dynamics management’s current estimates and expectations of future events as of the date of this announcement. Furthermore, the estimates are subject to several risks and uncertainties that could cause actual results to differ materially and adversely from those indicated in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, risks associated with our ability to continue to operate as a going concern; our ability to raise sufficient additional funds to continue operations and to conduct the planned clinical trial of EndoBarrier in the United States (GID 18-1 Trial); our ability to execute the GID 18-1 Trial under FDA IDE; our ability to enlist clinical trial sites and enroll patients in accordance with the GID 18-1 Trial; the risk that the FDA stops the GID 18-1 Trial early as a result of the occurrence of certain safety events; our ability to maintain compliance with our obligations under our existing convertible note and warrant agreements executed with Crystal Amber Fund Limited, including our obligations to make payment on the notes when due in December 2018; obtaining and maintaining regulatory approvals required to market and sell our products; the possibility that future clinical trials will not be successful or confirm earlier results; the timing and costs of clinical trials; the timing of regulatory submissions; the timing, receipt and maintenance of regulatory approvals; the timing and amount of other expenses; the timing and extent of third-party reimbursement; intellectual-property risk; risks related to excess inventory; risks related to assumptions regarding the size of the available market; the benefits of our products; product pricing; timing of product launches; future financial results; and other factors, including those described in our filings with the U.S. Securities and Exchange Commission. Given these uncertainties, one should not place undue reliance on these forward-looking statements. We do not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or otherwise, unless we are required to do so by law. Disclaimer This presentation and any supplemental materials have been prepared by GI Dynamics, Inc. based on available information. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of such information and opinions and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of GI Dynamics, Inc., or any of its members, directors, officers, employees, or agents or advisors, nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of GI Dynamics, Inc. or any of its directors, officers, employees or agents. EndoBarrier® is not approved for sale in the European Union or in the United States and is limited by Federal (US) Law to investigational use only. (OUS patients in data disclosed). Property of GI Dynamics, Inc

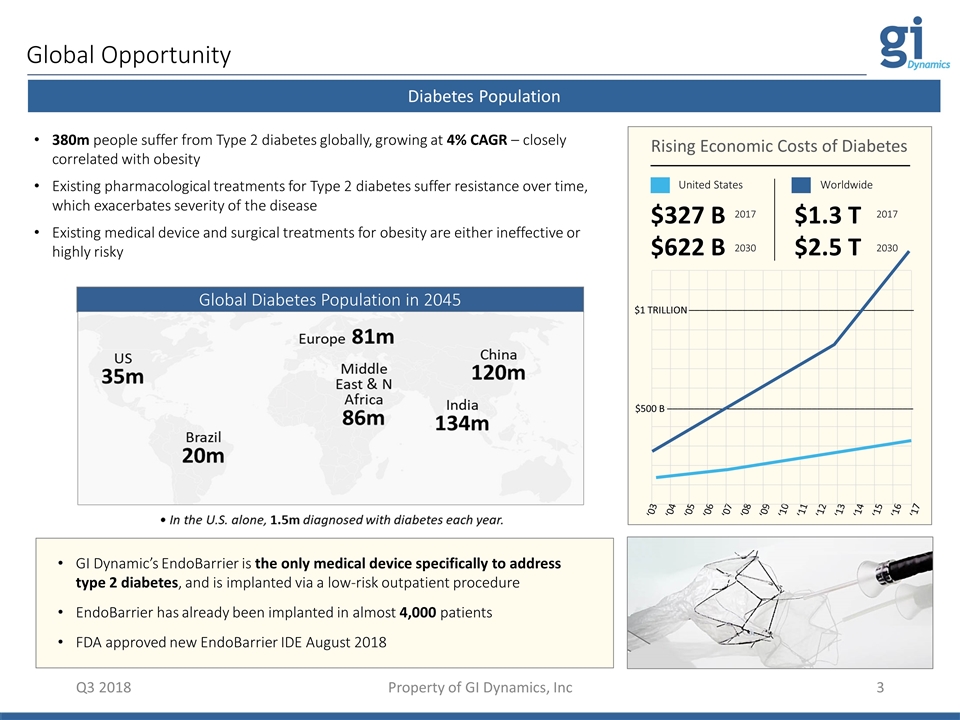

Global Opportunity Q3 2018 Property of GI Dynamics, Inc Diabetes Population 380m people suffer from Type 2 diabetes globally, growing at 4% CAGR – closely correlated with obesity Existing pharmacological treatments for Type 2 diabetes suffer resistance over time, which exacerbates severity of the disease Existing medical device and surgical treatments for obesity are either ineffective or highly risky GI Dynamic’s EndoBarrier is the only medical device specifically to address type 2 diabetes, and is implanted via a low-risk outpatient procedure EndoBarrier has already been implanted in almost 4,000 patients FDA approved new EndoBarrier IDE August 2018 Global Diabetes Population in 2045 ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 $500 B –––––––––––––––––––––––––––––––––––––––––––––– $1 TRILLION –––––––––––––––––––––––––––––––––––––––––– Rising Economic Costs of Diabetes United States Worldwide $327 B $622 B $1.3 T $2.5 T 2017 2030 2017 2030

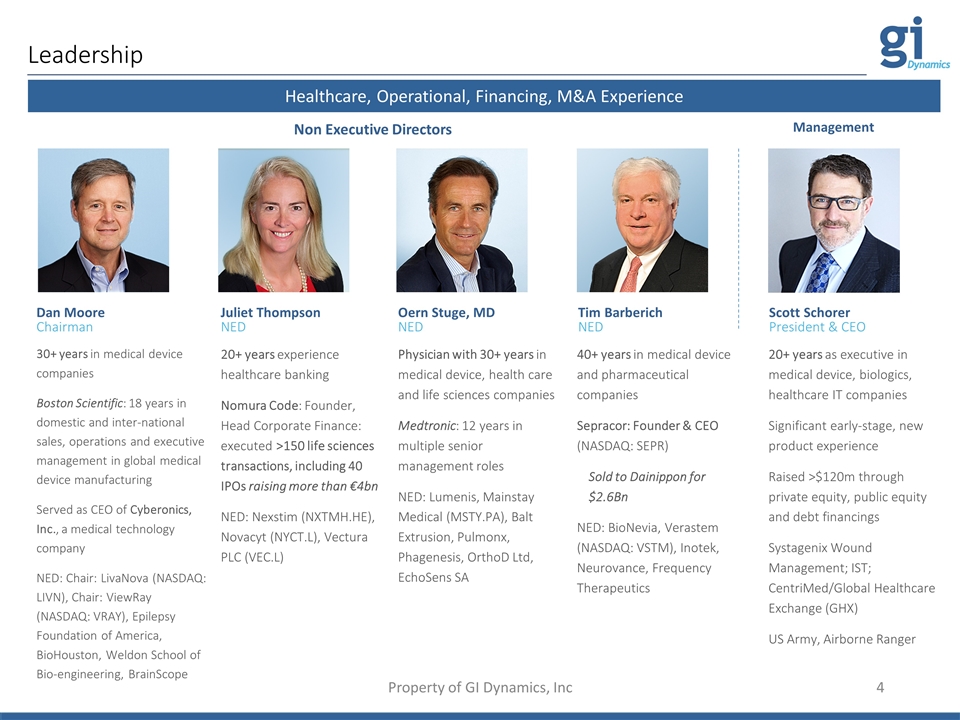

Leadership Property of GI Dynamics, Inc Dan Moore Chairman Juliet Thompson NED Oern Stuge, MD NED Tim Barberich NED Scott Schorer President & CEO 20+ years as executive in medical device, biologics, healthcare IT companies Significant early-stage, new product experience Raised >$120m through private equity, public equity and debt financings Systagenix Wound Management; IST; CentriMed/Global Healthcare Exchange (GHX) US Army, Airborne Ranger 20+ years experience healthcare banking Nomura Code: Founder, Head Corporate Finance: executed >150 life sciences transactions, including 40 IPOs raising more than €4bn NED: Nexstim (NXTMH.HE), Novacyt (NYCT.L), Vectura PLC (VEC.L) 40+ years in medical device and pharmaceutical companies Sepracor: Founder & CEO (NASDAQ: SEPR) Sold to Dainippon for $2.6Bn NED: BioNevia, Verastem (NASDAQ: VSTM), Inotek, Neurovance, Frequency Therapeutics Healthcare, Operational, Financing, M&A Experience 30+ years in medical device companies Boston Scientific: 18 years in domestic and inter-national sales, operations and executive management in global medical device manufacturing Served as CEO of Cyberonics, Inc., a medical technology company NED: Chair: LivaNova (NASDAQ: LIVN), Chair: ViewRay (NASDAQ: VRAY), Epilepsy Foundation of America, BioHouston, Weldon School of Bio-engineering, BrainScope Non Executive Directors Management Physician with 30+ years in medical device, health care and life sciences companies Medtronic: 12 years in multiple senior management roles NED: Lumenis, Mainstay Medical (MSTY.PA), Balt Extrusion, Pulmonx, Phagenesis, OrthoD Ltd, EchoSens SA

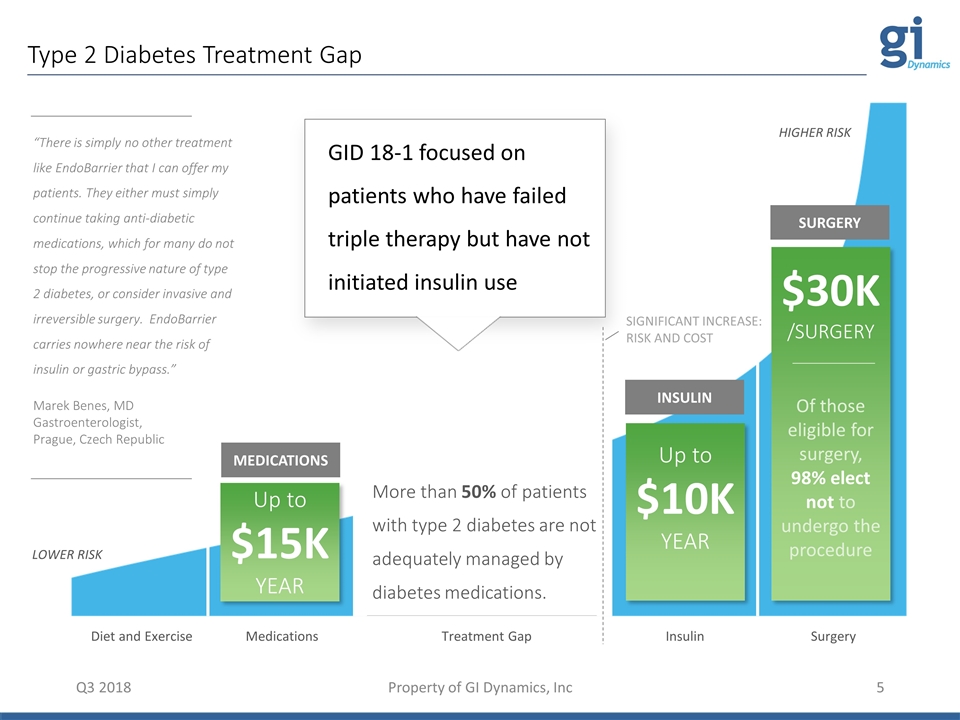

Type 2 Diabetes Treatment Gap Q3 2018 Property of GI Dynamics, Inc Diet and Exercise Medications Insulin Surgery Treatment Gap LOWER RISK HIGHER RISK Up to $15K YEAR MEDICATIONS INSULIN SURGERY Up to $10K YEAR $30K /SURGERY Of those eligible for surgery, 98% elect not to undergo the procedure More than 50% of patients with type 2 diabetes are not adequately managed by diabetes medications. “There is simply no other treatment like EndoBarrier that I can offer my patients. They either must simply continue taking anti-diabetic medications, which for many do not stop the progressive nature of type 2 diabetes, or consider invasive and irreversible surgery. EndoBarrier carries nowhere near the risk of insulin or gastric bypass.” Marek Benes, MD Gastroenterologist, Prague, Czech Republic SIGNIFICANT INCREASE: RISK AND COST GID 18-1 focused on patients who have failed triple therapy but have not initiated insulin use

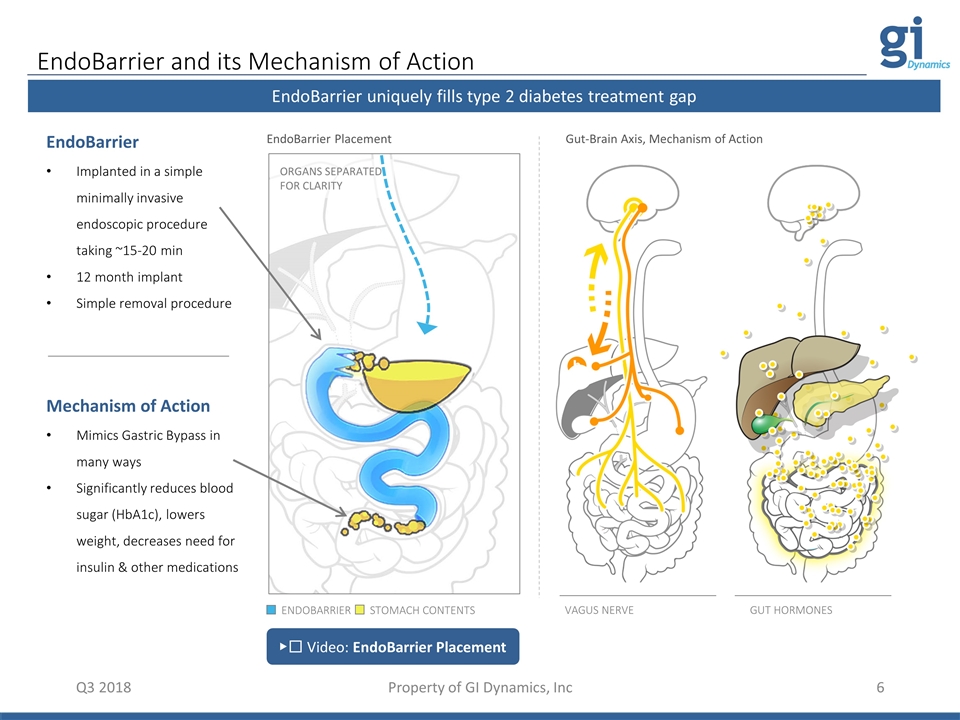

EndoBarrier and its Mechanism of Action Q3 2018 Property of GI Dynamics, Inc EndoBarrier uniquely fills type 2 diabetes treatment gap VAGUS NERVE ORGANS SEPARATED FOR CLARITY EndoBarrier Implanted in a simple minimally invasive endoscopic procedure taking ~15-20 min 12 month implant Simple removal procedure Mechanism of Action Mimics Gastric Bypass in many ways Significantly reduces blood sugar (HbA1c), lowers weight, decreases need for insulin & other medications ENDOBARRIER STOMACH CONTENTS ▶︎ Video: EndoBarrier Placement GUT HORMONES EndoBarrier Placement Gut-Brain Axis, Mechanism of Action

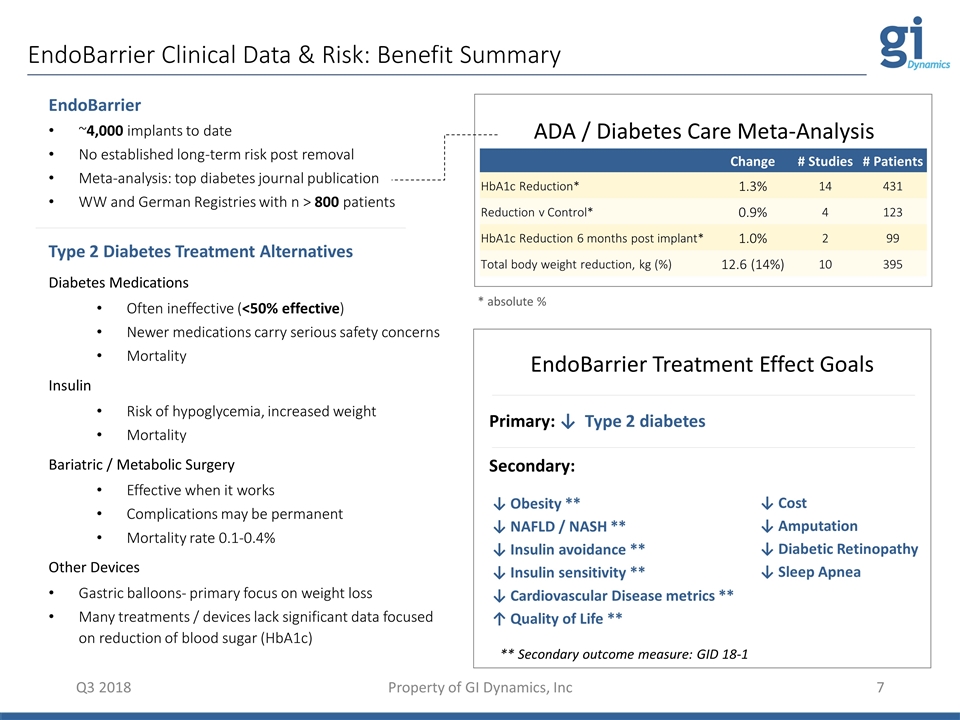

EndoBarrier Clinical Data & Risk: Benefit Summary Q3 2018 Property of GI Dynamics, Inc Change # Studies # Patients HbA1c Reduction* 1.3% 14 431 Reduction v Control* 0.9% 4 123 HbA1c Reduction 6 months post implant* 1.0% 2 99 Total body weight reduction, kg (%) 12.6 (14%) 10 395 EndoBarrier ~4,000 implants to date No established long-term risk post removal Meta-analysis: top diabetes journal publication WW and German Registries with n > 800 patients Type 2 Diabetes Treatment Alternatives Diabetes Medications Often ineffective (<50% effective) Newer medications carry serious safety concerns Mortality Insulin Risk of hypoglycemia, increased weight Mortality Bariatric / Metabolic Surgery Effective when it works Complications may be permanent Mortality rate 0.1-0.4% Other Devices Gastric balloons- primary focus on weight loss Many treatments / devices lack significant data focused on reduction of blood sugar (HbA1c) ADA / Diabetes Care Meta-Analysis * absolute % Primary: ↓ Type 2 diabetes Secondary: ↓ Cost ↓ Amputation ↓ Diabetic Retinopathy ↓ Sleep Apnea ↓ Obesity ** ↓ NAFLD / NASH ** ↓ Insulin avoidance ** ↓ Insulin sensitivity ** ↓ Cardiovascular Disease metrics ** ↑ Quality of Life ** EndoBarrier Treatment Effect Goals ** Secondary outcome measure: GID 18-1

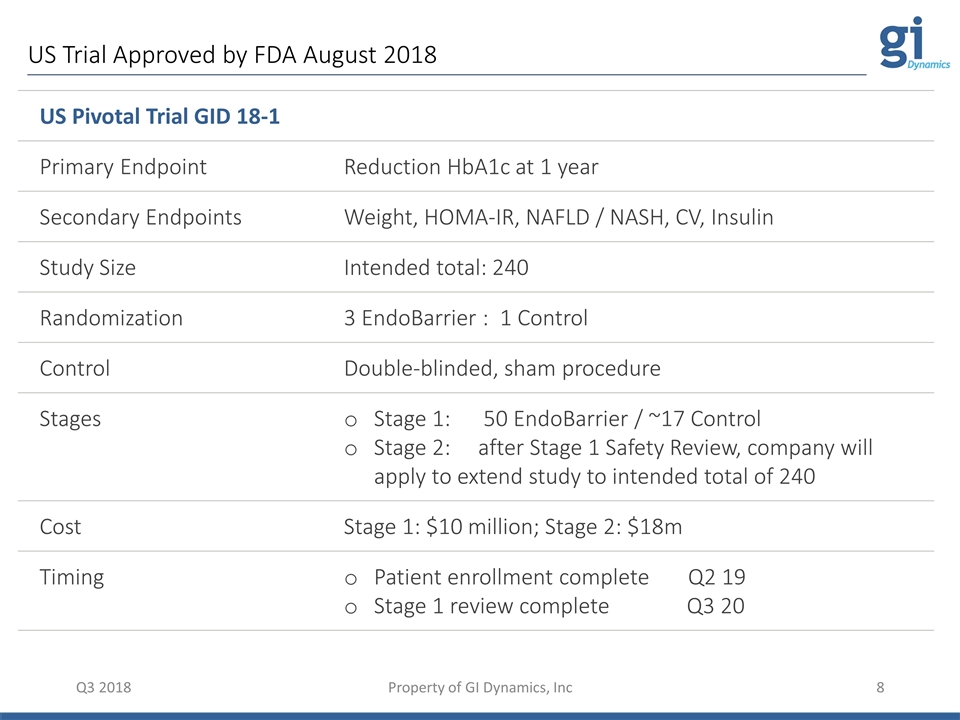

Q3 2018 Property of GI Dynamics, Inc US Pivotal Trial GID 18-1 Primary Endpoint Reduction HbA1c at 1 year Secondary Endpoints Weight, HOMA-IR, NAFLD / NASH, CV, Insulin Study Size Intended total: 240 Randomization 3 EndoBarrier : 1 Control Control Double-blinded, sham procedure Stages Stage 1: 50 EndoBarrier / ~17 Control Stage 2: after Stage 1 Safety Review, company will apply to extend study to intended total of 240 Cost Stage 1: $10 million; Stage 2: $18m Timing Patient enrollment complete Q2 19 Stage 1 review complete Q3 20 US Trial Approved by FDA August 2018

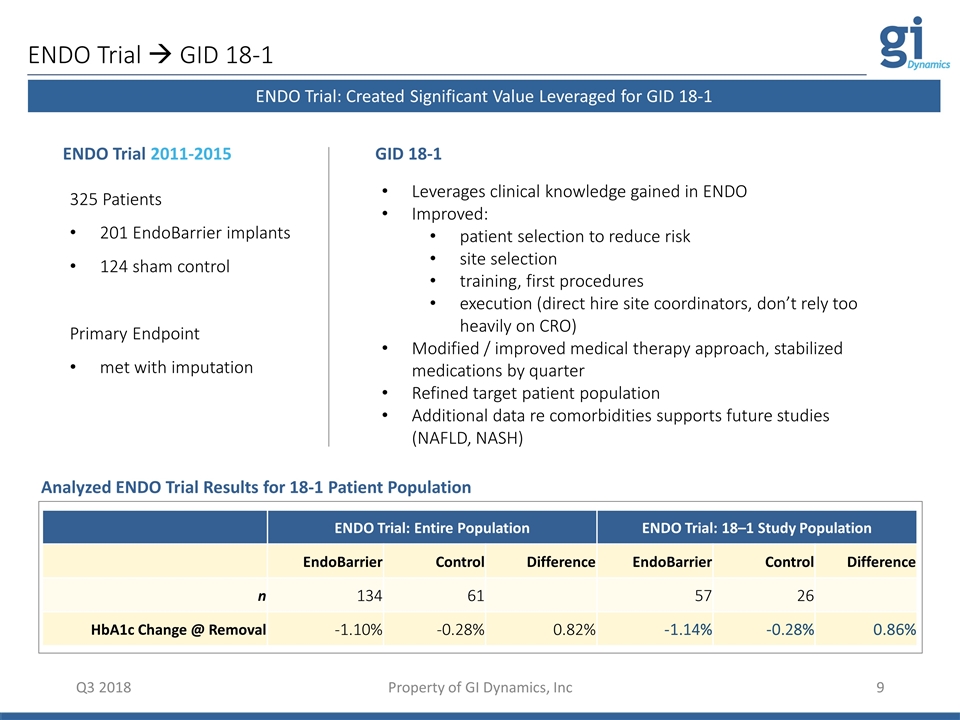

Q3 2018 Property of GI Dynamics, Inc ENDO Trial à GID 18-1 325 Patients 201 EndoBarrier implants 124 sham control Primary Endpoint met with imputation ENDO Trial 2011-2015 Leverages clinical knowledge gained in ENDO Improved: patient selection to reduce risk site selection training, first procedures execution (direct hire site coordinators, don’t rely too heavily on CRO) Modified / improved medical therapy approach, stabilized medications by quarter Refined target patient population Additional data re comorbidities supports future studies (NAFLD, NASH) GID 18-1 Analyzed ENDO Trial Results for 18-1 Patient Population ENDO Trial: Created Significant Value Leveraged for GID 18-1 ENDO Trial: Entire Population ENDO Trial: 18–1 Study Population EndoBarrier Control Difference EndoBarrier Control Difference n 134 61 57 26 HbA1c Change @ Removal -1.10% -0.28% 0.82% -1.14% -0.28% 0.86%

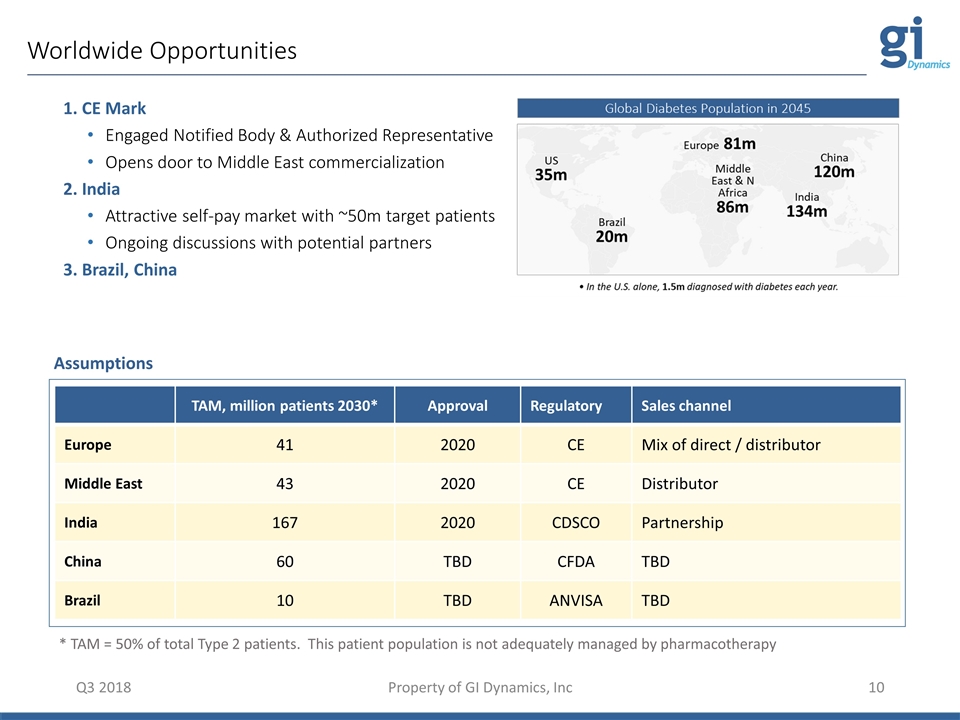

Worldwide Opportunities Q3 2018 Property of GI Dynamics, Inc TAM, million patients 2030* Approval Regulatory Sales channel Europe 41 2020 CE Mix of direct / distributor Middle East 43 2020 CE Distributor India 167 2020 CDSCO Partnership China 60 TBD CFDA TBD Brazil 10 TBD ANVISA TBD * TAM = 50% of total Type 2 patients. This patient population is not adequately managed by pharmacotherapy 1. CE Mark Engaged Notified Body & Authorized Representative Opens door to Middle East commercialization 2. India Attractive self-pay market with ~50m target patients Ongoing discussions with potential partners 3. Brazil, China Assumptions

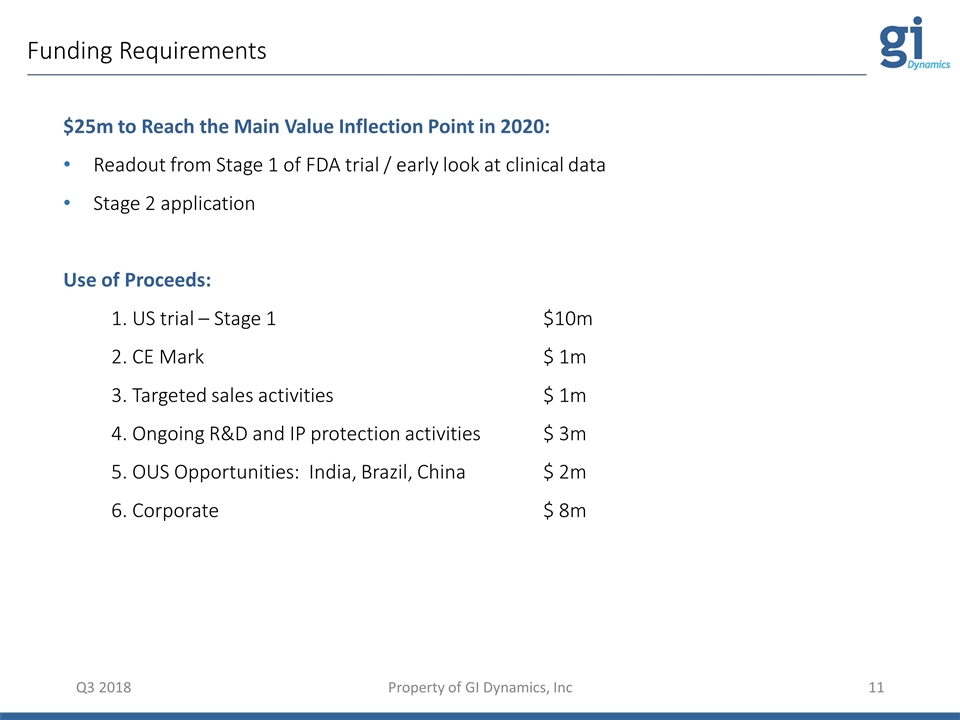

Funding Requirements Q3 2018 Property of GI Dynamics, Inc $25m to Reach the Main Value Inflection Point in 2020: Readout from Stage 1 of FDA trial / early look at clinical data Stage 2 application Use of Proceeds: 1. US trial – Stage 1 $10m 2. CE Mark $ 1m 3. Targeted sales activities $ 1m 4. Ongoing R&D and IP protection activities $ 3m 5. OUS Opportunities: India, Brazil, China$ 2m 6. Corporate $ 8m

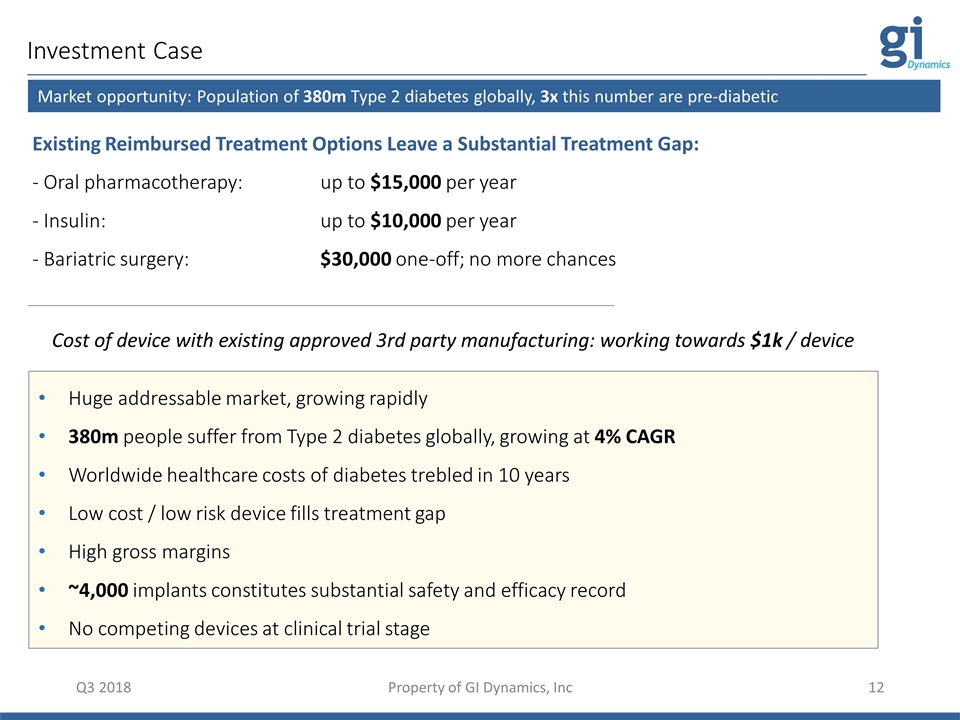

Investment Case Q3 2018 Property of GI Dynamics, Inc Existing Reimbursed Treatment Options Leave a Substantial Treatment Gap: - Oral pharmacotherapy: up to $15,000 per year - Insulin: up to $10,000 per year - Bariatric surgery: $30,000 one-off; no more chances Huge addressable market, growing rapidly 380m people suffer from Type 2 diabetes globally, growing at 4% CAGR Worldwide healthcare costs of diabetes trebled in 10 years Low cost / low risk device fills treatment gap High gross margins ~4,000 implants constitutes substantial safety and efficacy record No competing devices at clinical trial stage Market opportunity: Population of 380m Type 2 diabetes globally, 3x this number are pre-diabetic Cost of device with existing approved 3rd party manufacturing: working towards $1k / device

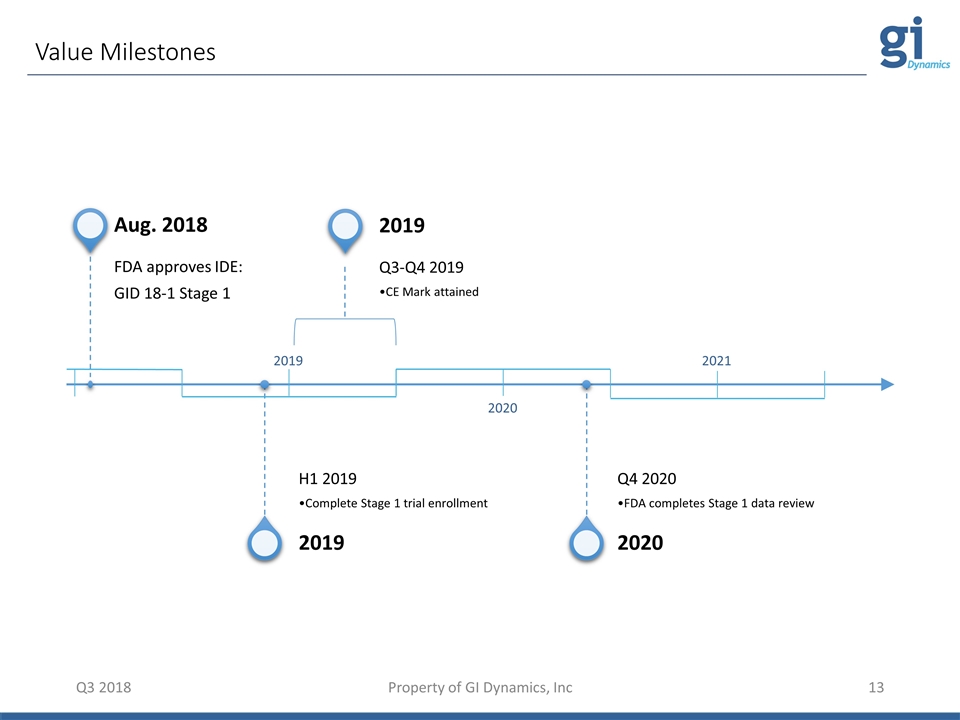

Value Milestones Q3 2018 Property of GI Dynamics, Inc 2019 2020 2021 Aug. 2018 FDA approves IDE: GID 18-1 Stage 1 2019 H1 2019 Complete Stage 1 trial enrollment 2019 Q3-Q4 2019 CE Mark attained 2020 Q4 2020 FDA completes Stage 1 data review

Appendices Q3 2018 Global Diabetes 2017 to 2045 Economic Impact of Diabetes EndoBarrier Registries Summary Benefit Risk Comparison to Adjacent Therapies GID 18-1 Stage I Safety Review GID 18-1 Clinical Risk Reduction Summary of EndoBarrier Adverse Event Data Limits of Diet, Exercise: Cortical Function Gut-Brain Axis: Neural and Hormonal Signals… Scientific Advisory Board (SAB) EndoBarrier & Treatment Perspectives Property of GI Dynamics, Inc

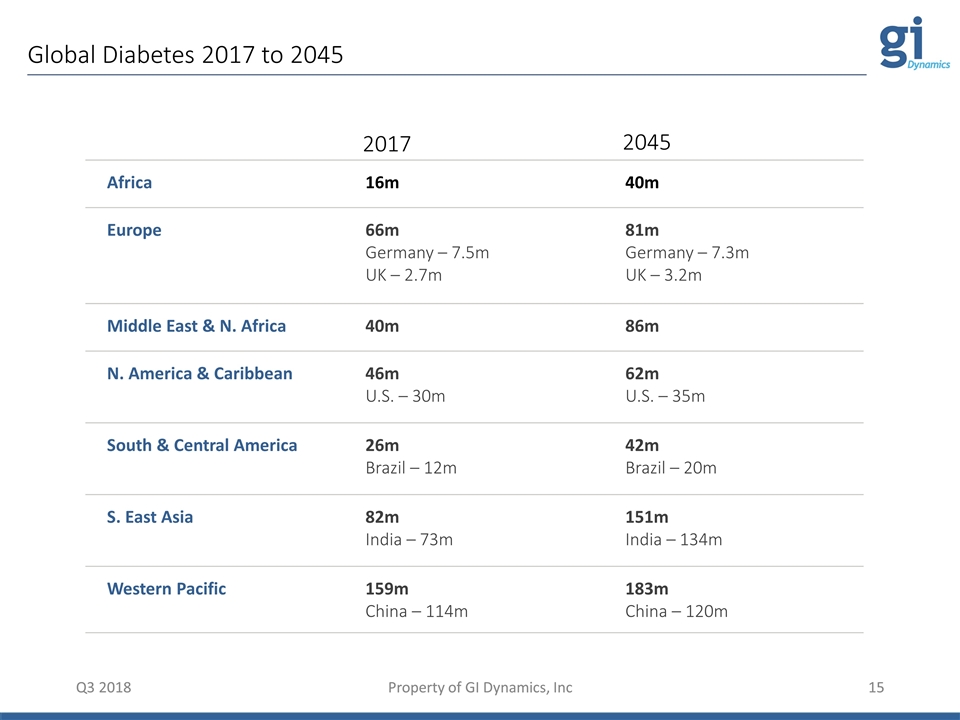

Global Diabetes 2017 to 2045 Q3 2018 Property of GI Dynamics, Inc Q3 2018 Property of GI Dynamics, Inc Africa 16m 40m Europe 66m Germany – 7.5m UK – 2.7m 81m Germany – 7.3m UK – 3.2m Middle East & N. Africa 40m 86m N. America & Caribbean 46m U.S. – 30m 62m U.S. – 35m South & Central America 26m Brazil – 12m 42m Brazil – 20m S. East Asia 82m India – 73m 151m India – 134m Western Pacific 159m China – 114m 183m China – 120m 2017 2045

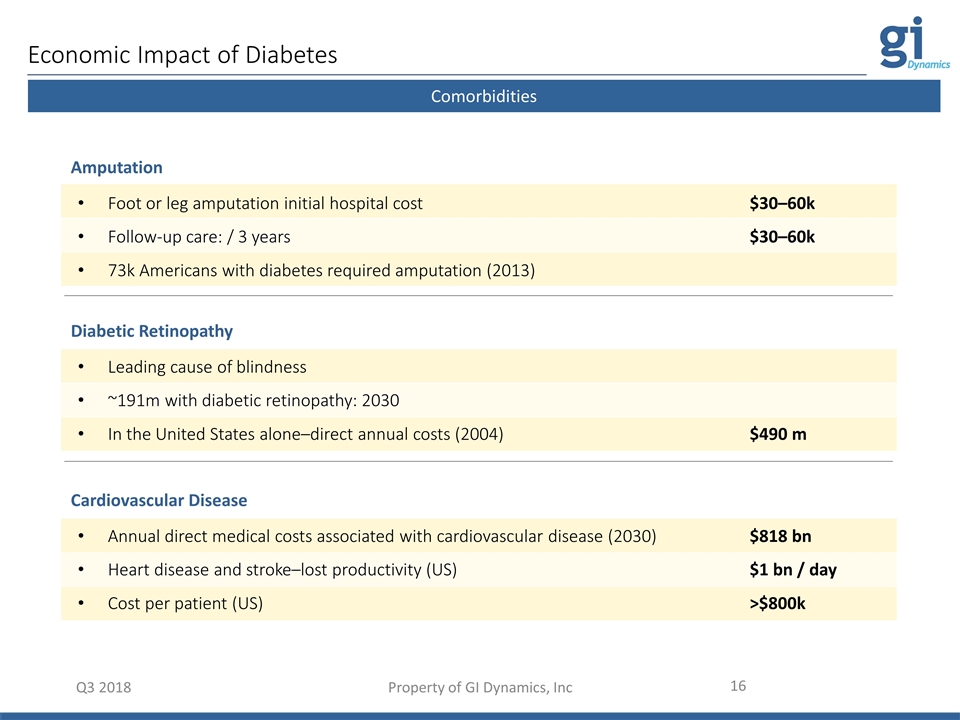

Q3 2018 Property of GI Dynamics, Inc EndoBarrier Procedure Foot or leg amputation initial hospital cost$30–60k Follow-up care: / 3 years $30–60k 73k Americans with diabetes required amputation (2013) Amputation Comorbidities Leading cause of blindness ~191m with diabetic retinopathy: 2030 In the United States alone–direct annual costs (2004)$490 m Diabetic Retinopathy Annual direct medical costs associated with cardiovascular disease (2030)$818 bn Heart disease and stroke–lost productivity (US)$1 bn / day Cost per patient (US)>$800k Cardiovascular Disease Economic Impact of Diabetes

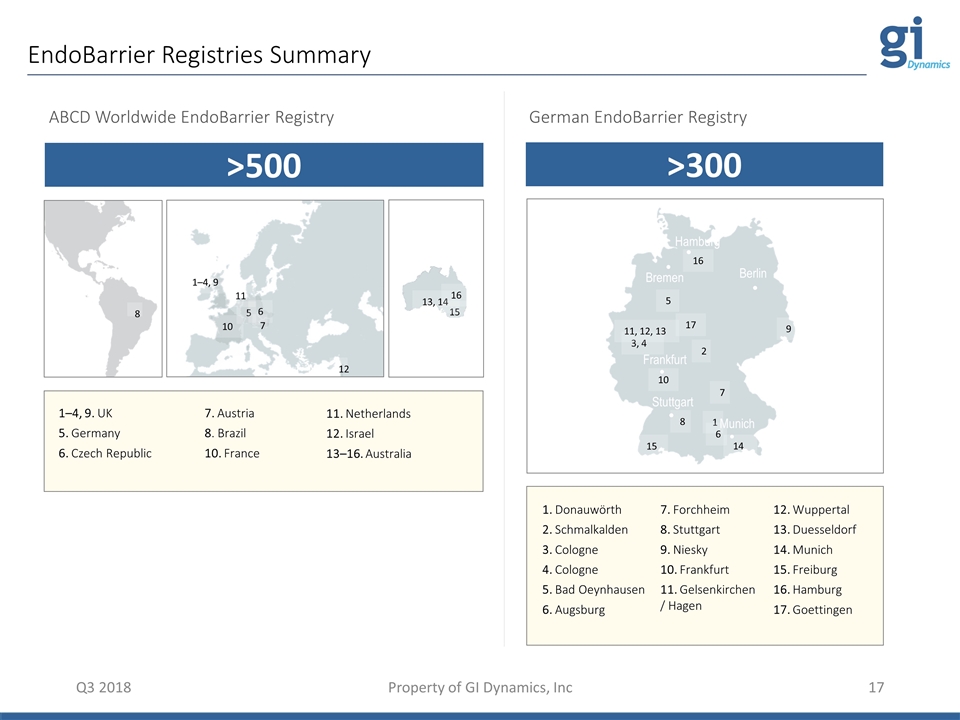

1 2 3, 4 5 6 7 8 9 10 11, 12, 13 14 15 16 17 Munich Stuttgart Berlin Frankfurt Hamburg Bremen EndoBarrier Registries Summary Q3 2018 Property of GI Dynamics, Inc German EndoBarrier Registry Hamburg 5 ABCD Worldwide EndoBarrier Registry 16 1–4, 9 5 6 7 8 10 11 12 15 13, 14 16 1. Donauwörth 2. Schmalkalden 3. Cologne 4. Cologne 5. Bad Oeynhausen 6. Augsburg 7. Forchheim 8. Stuttgart 9. Niesky 10. Frankfurt 11. Gelsenkirchen / Hagen 12. Wuppertal 13. Duesseldorf 14. Munich 15. Freiburg 16. Hamburg 17. Goettingen >500 >300 1–4, 9. UK 5. Germany 6. Czech Republic 7. Austria 8. Brazil 10. France 11. Netherlands 12. Israel 13–16. Australia

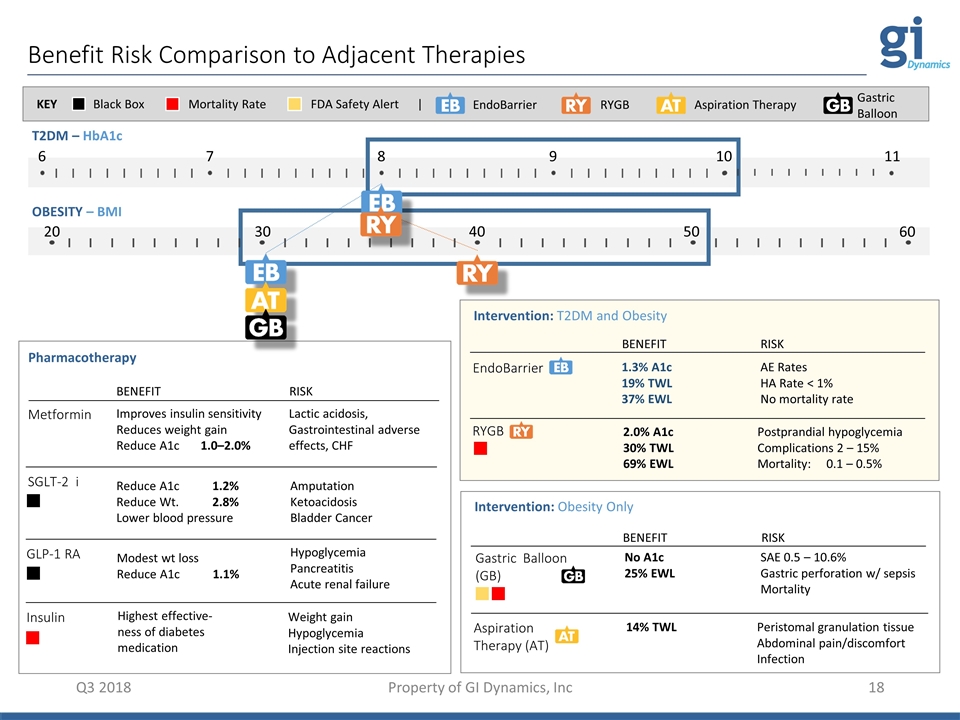

Benefit Risk Comparison to Adjacent Therapies Pharmacotherapy Metformin SGLT-2 i Insulin GLP-1 RA BENEFIT Improves insulin sensitivity Reduces weight gain Reduce A1c 1.0–2.0% Reduce A1c 1.2% Reduce Wt. 2.8% Lower blood pressure Highest effective-ness of diabetes medication Modest wt loss Reduce A1c 1.1% RISK Lactic acidosis, Gastrointestinal adverse effects, CHF Amputation Ketoacidosis Bladder Cancer Weight gain Hypoglycemia Injection site reactions Hypoglycemia Pancreatitis Acute renal failure T2DM – HbA1c OBESITY – BMI Intervention: T2DM and Obesity EndoBarrier RYGB BENEFIT 1.3% A1c 19% TWL 37% EWL 2.0% A1c 30% TWL 69% EWL RISK AE Rates HA Rate < 1% No mortality rate Postprandial hypoglycemia Complications 2 – 15% Mortality: 0.1 – 0.5% Black Box Mortality Rate KEY FDA Safety Alert | 6 7 8 9 10 11 20 40 50 30 60 Aspiration Therapy (AT) 14% TWL Peristomal granulation tissue Abdominal pain/discomfort Infection Gastric Balloon (GB) No A1c 25% EWL SAE 0.5 – 10.6% Gastric perforation w/ sepsis Mortality Intervention: Obesity Only BENEFIT RISK EndoBarrier RYGB Aspiration Therapy Gastric Balloon Q3 2018 Property of GI Dynamics, Inc

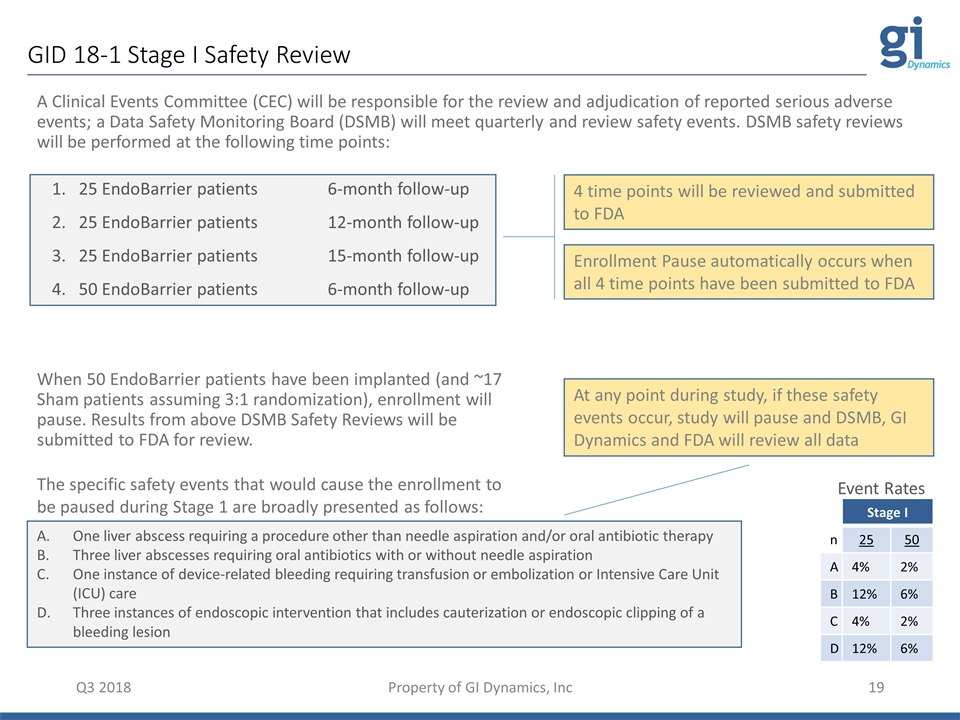

GID 18-1 Stage I Safety Review Q3 2018 Property of GI Dynamics, Inc A Clinical Events Committee (CEC) will be responsible for the review and adjudication of reported serious adverse events; a Data Safety Monitoring Board (DSMB) will meet quarterly and review safety events. DSMB safety reviews will be performed at the following time points: 1. 25 EndoBarrier patients 6-month follow-up 2. 25 EndoBarrier patients 12-month follow-up 3. 25 EndoBarrier patients 15-month follow-up 4. 50 EndoBarrier patients 6-month follow-up When 50 EndoBarrier patients have been implanted (and ~17 Sham patients assuming 3:1 randomization), enrollment will pause. Results from above DSMB Safety Reviews will be submitted to FDA for review. The specific safety events that would cause the enrollment to be paused during Stage 1 are broadly presented as follows: One liver abscess requiring a procedure other than needle aspiration and/or oral antibiotic therapy Three liver abscesses requiring oral antibiotics with or without needle aspiration One instance of device-related bleeding requiring transfusion or embolization or Intensive Care Unit (ICU) care Three instances of endoscopic intervention that includes cauterization or endoscopic clipping of a bleeding lesion 4 time points will be reviewed and submitted to FDA Enrollment Pause automatically occurs when all 4 time points have been submitted to FDA At any point during study, if these safety events occur, study will pause and DSMB, GI Dynamics and FDA will review all data Stage I n 25 50 A 4% 2% B 12% 6% C 4% 2% D 12% 6% Event Rates

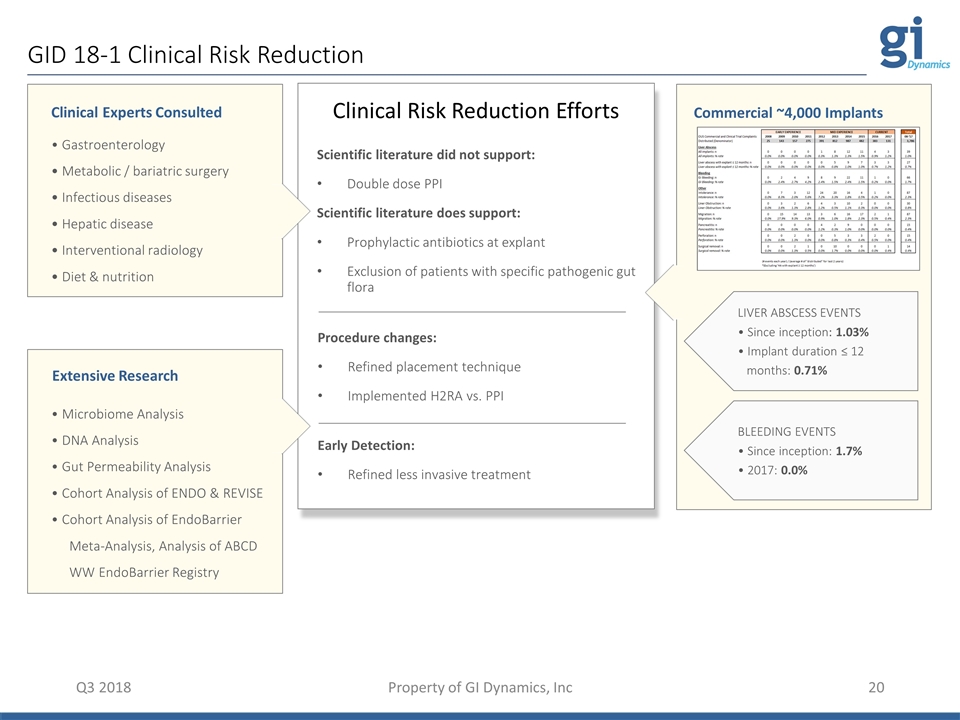

GID 18-1 Clinical Risk Reduction Q3 2018 Property of GI Dynamics, Inc • Gastroenterology • Metabolic / bariatric surgery • Infectious diseases • Hepatic disease • Interventional radiology • Diet & nutrition Clinical Experts Consulted Extensive Research • Microbiome Analysis • DNA Analysis • Gut Permeability Analysis • Cohort Analysis of ENDO & REVISE • Cohort Analysis of EndoBarrier Meta-Analysis, Analysis of ABCD WW EndoBarrier Registry Scientific literature did not support: Double dose PPI Scientific literature does support: Prophylactic antibiotics at explant Exclusion of patients with specific pathogenic gut flora Procedure changes: Refined placement technique Implemented H2RA vs. PPI Early Detection: Refined less invasive treatment Clinical Risk Reduction Efforts Commercial ~4,000 Implants LIVER ABSCESS EVENTS • Since inception: 1.03% • Implant duration ≤ 12 months: 0.71% BLEEDING EVENTS • Since inception: 1.7% • 2017: 0.0%

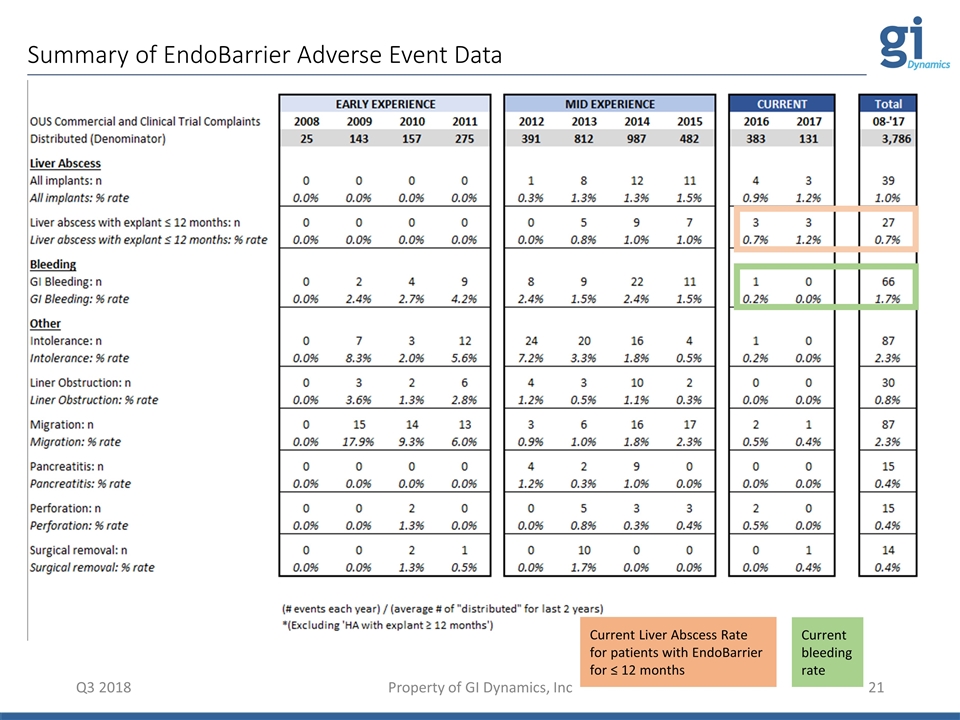

Summary of EndoBarrier Adverse Event Data Property of GI Dynamics, Inc Q3 2018 Current Liver Abscess Rate for patients with EndoBarrier for ≤ 12 months Current bleeding rate

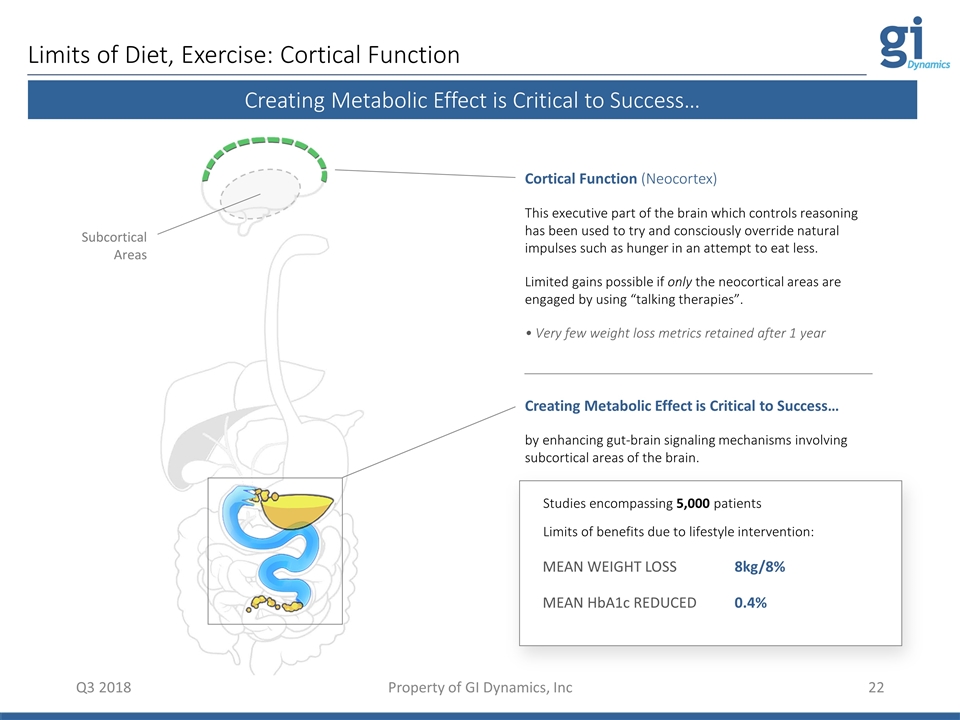

Limits of Diet, Exercise: Cortical Function Q3 2018 Property of GI Dynamics, Inc Cortical Function (Neocortex) This executive part of the brain which controls reasoning has been used to try and consciously override natural impulses such as hunger in an attempt to eat less. Limited gains possible if only the neocortical areas are engaged by using “talking therapies”. • Very few weight loss metrics retained after 1 year Creating Metabolic Effect is Critical to Success… by enhancing gut-brain signaling mechanisms involving subcortical areas of the brain. MEAN WEIGHT LOSS 8kg/8% MEAN HbA1c REDUCED 0.4% Studies encompassing 5,000 patients Limits of benefits due to lifestyle intervention: Creating Metabolic Effect is Critical to Success… Subcortical Areas

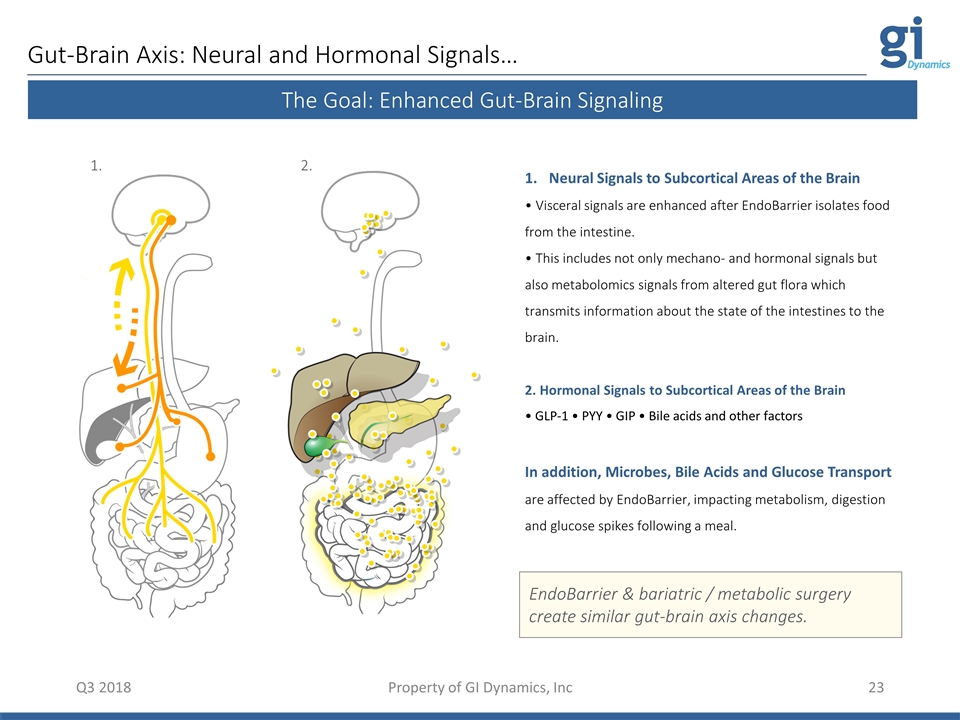

Gut-Brain Axis: Neural and Hormonal Signals… Q3 2018 Neural Signals to Subcortical Areas of the Brain • Visceral signals are enhanced after EndoBarrier isolates food from the intestine. • This includes not only mechano- and hormonal signals but also metabolomics signals from altered gut flora which transmits information about the state of the intestines to the brain. 2. Hormonal Signals to Subcortical Areas of the Brain • GLP-1 • PYY • GIP • Bile acids and other factors In addition, Microbes, Bile Acids and Glucose Transport are affected by EndoBarrier, impacting metabolism, digestion and glucose spikes following a meal. Property of GI Dynamics, Inc The Goal: Enhanced Gut-Brain Signaling EndoBarrier & bariatric / metabolic surgery create similar gut-brain axis changes. 1. 2.

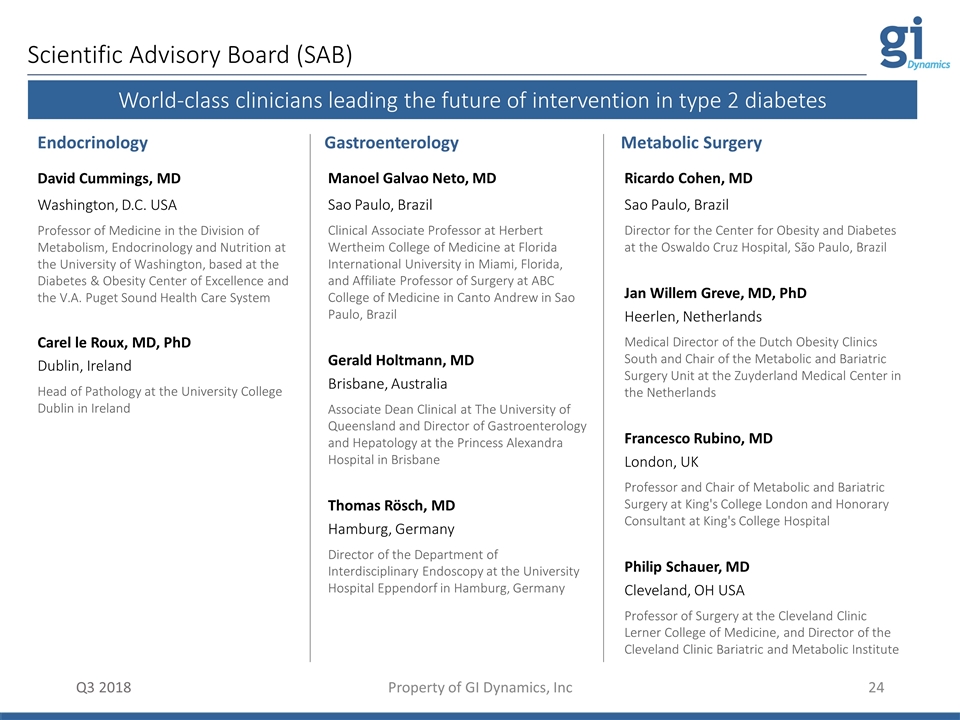

Scientific Advisory Board (SAB) Q3 2018 Property of GI Dynamics, Inc World-class clinicians leading the future of intervention in type 2 diabetes Manoel Galvao Neto, MD Sao Paulo, Brazil Clinical Associate Professor at Herbert Wertheim College of Medicine at Florida International University in Miami, Florida, and Affiliate Professor of Surgery at ABC College of Medicine in Canto Andrew in Sao Paulo, Brazil Gerald Holtmann, MD Brisbane, Australia Associate Dean Clinical at The University of Queensland and Director of Gastroenterology and Hepatology at the Princess Alexandra Hospital in Brisbane Thomas Rösch, MD Hamburg, Germany Director of the Department of Interdisciplinary Endoscopy at the University Hospital Eppendorf in Hamburg, Germany David Cummings, MD Washington, D.C. USA Professor of Medicine in the Division of Metabolism, Endocrinology and Nutrition at the University of Washington, based at the Diabetes & Obesity Center of Excellence and the V.A. Puget Sound Health Care System Carel le Roux, MD, PhD Dublin, Ireland Head of Pathology at the University College Dublin in Ireland Ricardo Cohen, MD Sao Paulo, Brazil Director for the Center for Obesity and Diabetes at the Oswaldo Cruz Hospital, São Paulo, Brazil Jan Willem Greve, MD, PhD Heerlen, Netherlands Medical Director of the Dutch Obesity Clinics South and Chair of the Metabolic and Bariatric Surgery Unit at the Zuyderland Medical Center in the Netherlands Francesco Rubino, MD London, UK Professor and Chair of Metabolic and Bariatric Surgery at King's College London and Honorary Consultant at King's College Hospital Philip Schauer, MD Cleveland, OH USA Professor of Surgery at the Cleveland Clinic Lerner College of Medicine, and Director of the Cleveland Clinic Bariatric and Metabolic Institute Metabolic Surgery Gastroenterology Endocrinology

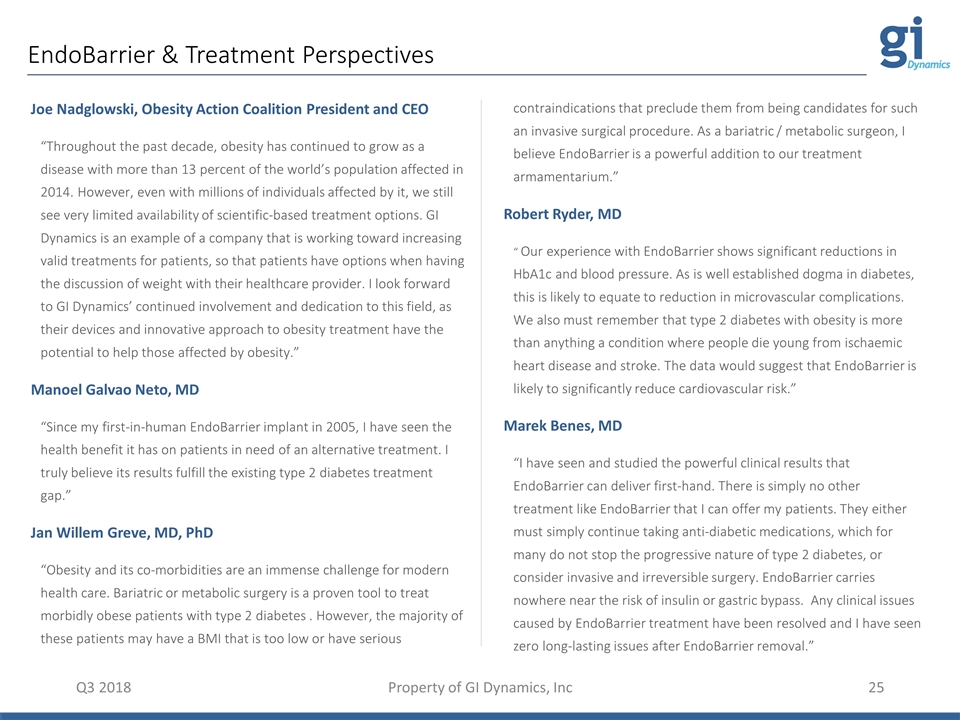

EndoBarrier & Treatment Perspectives Joe Nadglowski, Obesity Action Coalition President and CEO “Throughout the past decade, obesity has continued to grow as a disease with more than 13 percent of the world’s population affected in 2014. However, even with millions of individuals affected by it, we still see very limited availability of scientific-based treatment options. GI Dynamics is an example of a company that is working toward increasing valid treatments for patients, so that patients have options when having the discussion of weight with their healthcare provider. I look forward to GI Dynamics’ continued involvement and dedication to this field, as their devices and innovative approach to obesity treatment have the potential to help those affected by obesity.” Manoel Galvao Neto, MD “Since my first-in-human EndoBarrier implant in 2005, I have seen the health benefit it has on patients in need of an alternative treatment. I truly believe its results fulfill the existing type 2 diabetes treatment gap.” Jan Willem Greve, MD, PhD “Obesity and its co-morbidities are an immense challenge for modern health care. Bariatric or metabolic surgery is a proven tool to treat morbidly obese patients with type 2 diabetes . However, the majority of these patients may have a BMI that is too low or have serious Q3 2018 Property of GI Dynamics, Inc contraindications that preclude them from being candidates for such an invasive surgical procedure. As a bariatric / metabolic surgeon, I believe EndoBarrier is a powerful addition to our treatment armamentarium.” Robert Ryder, MD “ Our experience with EndoBarrier shows significant reductions in HbA1c and blood pressure. As is well established dogma in diabetes, this is likely to equate to reduction in microvascular complications. We also must remember that type 2 diabetes with obesity is more than anything a condition where people die young from ischaemic heart disease and stroke. The data would suggest that EndoBarrier is likely to significantly reduce cardiovascular risk.” Marek Benes, MD “I have seen and studied the powerful clinical results that EndoBarrier can deliver first-hand. There is simply no other treatment like EndoBarrier that I can offer my patients. They either must simply continue taking anti-diabetic medications, which for many do not stop the progressive nature of type 2 diabetes, or consider invasive and irreversible surgery. EndoBarrier carries nowhere near the risk of insulin or gastric bypass. Any clinical issues caused by EndoBarrier treatment have been resolved and I have seen zero long-lasting issues after EndoBarrier removal.”