Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NuStar Energy L.P. | a20180815nsform8-kciticonf.htm |

Exhibit 99.1 2018 CITI One- on- O n e M L P / M i d s t r e a m I n f r a s t r u c t u r e C o n f e r e n c e AUGUST 15 – 16, 2018

Forward-Looking Statements Statements contained in this presentation other than statements of historical fact are forward-looking statements. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance presented or suggested in this presentation. These forward-looking statements can generally be identified by the words "anticipates," "believes," "expects," "plans," "intends," "estimates," "forecasts," "budgets," "projects," "could," "should," "may" and similar expressions. These statements reflect our current views with regard to future events and are subject to various risks, uncertainties and assumptions. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in the company’s expectations. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see NuStar Energy L.P.’s annual report on Form 10-K and quarterly reports on Form 10-Q, filed with the SEC and available on NuStar’s website at www.nustarenergy.com. We use financial measures in this presentation that are not calculated in accordance with generally accepted accounting principles (“non-GAAP”) and our reconciliations of non- GAAP financial measures to GAAP financial measures are located in the appendix to this presentation. These non-GAAP financial measures should not be considered an alternative to GAAP financial measures. 2

Overview

With Our Simplification Complete, We Have Achieved the Five Characteristics Critical to MLP Success as Markets Recover Minimal Capital Needs Simplified Structure/ Lower Leverage Transparent Governance Strong, Strong Coverage Stable No IDR Burden Growth 4

Our Newly Simplified Structure: One Public Company, No IDRs NYSE: NS IPO Date: 4/16/2001 Common Unit Price (8/10/18): $28.64 Annualized Distribution/Common Unit: $2.40 Yield (8/10/18): 8.4% Market Capitalization: $3.1 billion Enterprise Value: $7.8 billion Credit Ratings Moody's: Ba2/Negative S&P: BB/Negative Fitch: BB/Negative 5

NuStar Has a Broad, Diverse Portfolio of Assets Current Profile Volumes Handled(1): ➢ >1.4MM BPD pipeline volumes ➢ >330M BPD storage throughput terminal volumes Total Pipeline Miles: ~9,700 Total Storage Capacity:~97MM bbls Total Enterprise Value: ~$8B Total Assets: ~$7B Key Takeaways: Highly integrated U.S. crude oil pipeline & terminal system Minimal direct exposure to commodity prices Significant crude oil midstream footprint in the Midland Basin of the Permian (1) Average daily Pipeline segment and Storage segment volumes for the quarter ending 6/30/18. 6

NuStar’s Assets are Well-Balanced and Have Performed Consistently, Through Market Challenges 2017 EBITDA1, By Segment Historical Pipeline and Storage Segment EBITDA1 $719 $707 ($ in millions) $690 $671 $610 $554 Oil Price Crash Great Recession 50% 49% $498 $477 $360 $455 $355 $338 $432 $394 $323 $277 $211 $198 $199 $190 $186 Shale Boom Backwardated Market Structure $335 $333 $347 $279 $287 $277 $287 Crude $242 $256 Refined Crude - Refined 33% $208 Products 53% Products 47% 67% 2008 2009 2010 2011 2012 2013* 2014 2015 2016 2017 2018 Est. Storage Segment Pipeline Segment Both Segments Combined Pipeline Throughput Volumes, Storage Revenues, * Adjusted for Goodwill Impairment Loss by Product by Product 1 - Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 7

We Are Well-Positioned to Build on Our Foundational Strengths … Expected 2018 Debt/EBITDA1 of about 4.7x Simplified Structure & No IDRs Lower Leverage & Strong Coverage Expected 2018 distribution + coverage1 in the range of 1.20x to 1.30x Disciplined Project Management Diverse, Balanced and Well-Maintained Asset Base Safe, Efficient Operations 1 - Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 8

Permian Crude System Growth Platform

The Permian Phenomenon A massive oil basin of epic proportions… A pool of more recoverable oil than any field in the world except for Saudi Arabia’s Ghawar 250 miles wide, 300 miles long (75,000 square miles) The Wolfcamp Formation, all by itself, is estimated to hold 20 billion barrels of oil The world’s hottest oil basin Many major U.S. E&P firms have shifted resources away from other plays to focus on the Permian ➢ Permian investments reaped double-digit returns in 2017, even with oil barely 60% of what it was in 2014 Currently accounts for 55% of nation’s active oil rigs If it were a standalone country, the Permian Basin would already rank #7 among the world’s top liquids producers The Basin’s growth projections are unprecedented Expected to rise to a record 3.5 million barrels of oil per day by year end, over 25% of nation’s output Could reach 5.0 million barrels a day by the end of 2020, more than either Iran or Iraq Expected to surge to 8.0-10.0 million barrels per day over next decade, potentially surpassing all OPEC members 10

Advances in Drilling Activity and Technology Are Driving the Basin’s Unparalleled Growth • Midland Basin Production Permian Basin rig count, now 485, 3.31 has grown from 342 or 42%, since (MMBOE/D) we acquired our system last May1 2.47 2.57 • The basin’s record-level DUCs will 2.25 2.05 baseload 2018 completion activity, 1.98 1.88 1.70 and experts predict >600mb/d 1.52 growth in 2018 1.28 1.36 Y Q1 Q2 Q3 Q4 Q1 Q2 Q3 (e) Q4 (e) Y (e) Y (e) 2016 2017 2018 2019 2020 As techniques and technology have evolved, producers have improved well performance, reflected in higher initial production rates (IP) and estimated ultimate recovery (EUR) 1. As of July 20, 2018 Source: Baker Hughes, Rystad Energy 11 1. As of August 10, 2018

Producers Remain Bullish on Permian Growth, Strength & Resiliency August 2, 2018 Second Quarter 2018 Conference Call August 9, 2018 Second Quarter 2018 Conference Call “With nearly half the drilling rigs and completion crews in the country “The second quarter was another strong quarter for Diamondback as running in the Permian Basin, the region is as busy as we've ever seen. we continued our operational excellence by growing production We estimate that more than $50 billion in capital will 10% quarter-over-quarter…” be invested to drill and complete wells in the Permian “But in general on the Midland Basin side, we complete or we drill in 2018.” roughly 22 wells per rig per year, and we drill longer and longer laterals on average each year…” August 8, 2018 Second Quarter 2018 Conference Call August 8, 2018 Second Quarter 2018 Conference Call ““On the well front, we just wanted to point out as an example that “We surged past 100,000 Boe per day during the second quarter, we continue to show impressive performance. The extending a remarkable run of production growth that is example in particular here is the Wolfcamp D…” “And numbers are unmatched in the industry.” sort of staggering. About a 75% improvement over the early life of these wells compared to the earlier style “With our rigs and crews well-seasoned and running smoothly, completions that were done say 3 and 4 years ago in the exact we're confident that we can sustain our drilling and same area.” completion performance while spreading facility cost over more wells and taking steps towards an optimized full-scale development approach.” Source: Earnings Call Transcripts 12

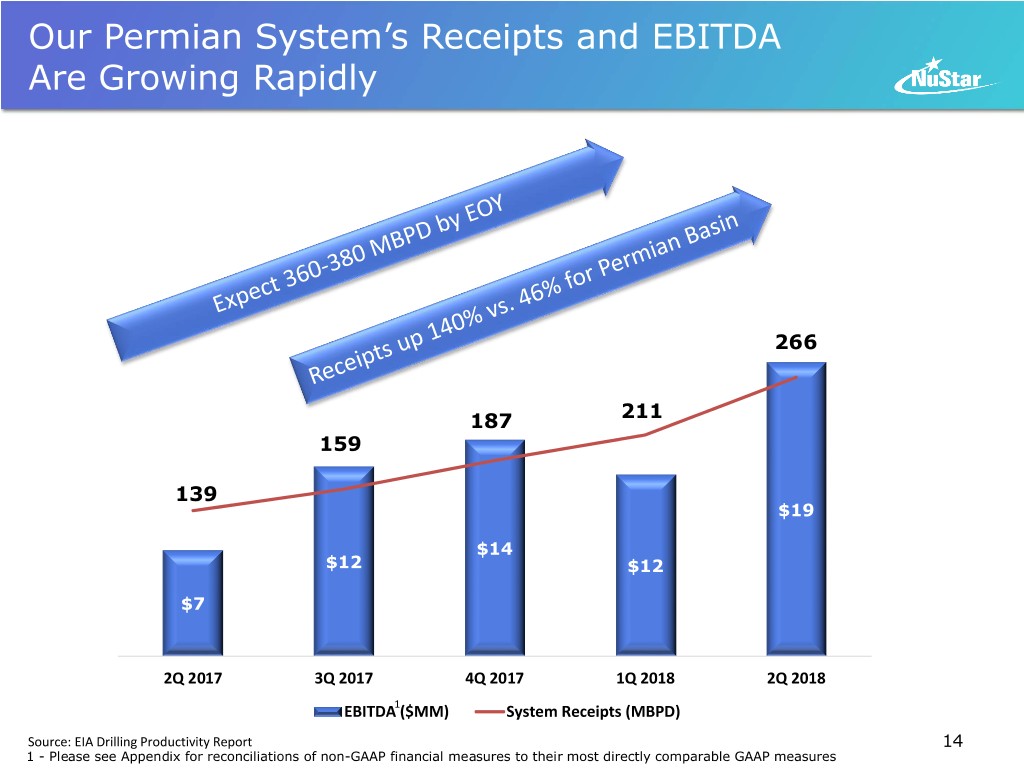

Our Permian Crude System Continues to Prove Itself – “Core of the Core” Our system throughput is now 300,000 BPD, up 140% since the System is located in 5 of the 6 most active counties in the acquisition prolific Midland Basin Permian overall up 46% in same period ~700 miles of pipeline with 460,000 BPD of capacity, 1MM barrels of storage capacity, over 500,000 dedicated acres, as well Based on our producer projections, we expect our 2018 exit rate as 5MM acres of Areas of Mutual Interest, or AMI to be 360,000-380,000 BPD Since last May, we have: Constructed ~200 miles of pipe Added 20,000 dedicated acres ➢ We expect 82 new wells on this additional acreage, through 2019 Increased the number of well connection sites on our system from 102 to 173 ➢ Recently approved projects to connect to another 40 sites We project the System’s expected EBITDA to more than double from 2018 to 2020 We are constructing a 10-bay truck rack with capability to load 30,000 BPD Evaluating whether to construct a second truck rack with up to 10,000 BPD of loading capacity We are evaluating additional connections, including connecting Wichita Falls Crude Pipeline to Sunrise Expansion (Colorado City to Wichita Falls) The system provides customers with excellent access to multiple downstream end markets Delivery points and flow assurance into Big Spring, Midland and Colorado City Source: EIA Drilling Productivity Report 13

Our Permian System’s Receipts and EBITDA Are Growing Rapidly $20 266 300 $18 250 $16 187 211 $14 159 200 $12 $10 139 150 $19 $8 $14 100 $6 $12 $12 $4 $7 50 $2 $0 0 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 EBITDA1 ($MM) System Receipts (MBPD) Source: EIA Drilling Productivity Report 14 1 - Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

We are Focused on Three Key Objectives to Continue to Realize Our System’s Growth Potential Providing • Working to match producers with downstream markets with “firm” space • Identifying new shippers and marketers with downstream pipeline capacity Flow • Completing truck loading projects to add new takeaway capacity Assurance • Working to connect to multiple new takeaway pipelines Developing •Anticipate building another ~60 new well connections next year •Completing connections to Enterprise’s Midland Terminal and Plains’ SunRise Our Existing Pipeline System •Developing expansion projects to increase our system’s capacity and efficiency Expanding •Continuing to bring new volumes from existing producers through interconnects and dedicated acreage On Our •Leveraging our Permian Crude System to benefit other NuStar assets, including our Reach South Texas System, Corpus Christi North Beach Terminal and Wichita Falls pipelines 15

Growth Projects Outside the Permian

Outside the Permian, We Have Developed Projects to Utilize Our Existing Assets to Enhance Unitholder Value Northern Mexico St. James Terminal Refined Product Unit Train Assets Supply West Coast South Texas Crude System & Terminals North Beach Dock Bio-Fuels Strategy Connections 17

We Have Executed Contracts to Support Northern Mexico Supply Projects Nuevo Laredo Project - Valero Energy has recently announced their plans related to our projects to supply refined products to Nuevo Laredo via our Odem and Laredo pipeline systems Howard Energy Corpus Christi Connection – Howard Energy has announced an open season for capacity on a pipeline to supply their Corpus Christi rail terminal via a connection to our Corpus Christi pipeline infrastructure Valley Pipeline Project – We have secured a commitment from a large customer for the majority of the capacity of an expansion of our Valley Pipeline system. The customer will supply refined products to Mexico via a third party’s Brownsville terminal We will conduct an open-season to solicit commitments for additional capacity during in 3rd quarter 18

We Have Executed Contracts to Support Northern Mexico Supply Projects (continued) These long-term throughput & deficiency contracts will support a series of healthy-return capital projects to: Connect to pipelines and third-party rail facilities in Corpus Christi Supply refined products to Nuevo Laredo via our Odem and Laredo pipeline systems Upgrade our Nuevo Laredo Terminal Expand our Valley Pipeline System to supply refined products to South Texas and Mexico via NuStar’s and third party terminals in Edinburg, Harlingen and Brownsville 19

The Council Bluffs System That We Acquired in April is Performing Well as We Complete Our Integration In April, we closed on an immediately accretive $38 million acquisition of CHS’ Council Bluffs system, consisting of a 227-mile pipeline and 18 storage tanks Since April, we have worked to integrate the pipeline and terminal into our Central East system We plan to complete our integration in early October, when we are scheduled to reactivate two intermediate pump stations at Abilene, Kansas and Tecumseh, Nebraska Even during our integration, we have achieved our expectations for volumes at the terminal rack and exceeded expectations for line throughput We expect to see increased volumes when the rack is opened to third-party customers Third-party throughput will continue to increase as intermediate pump stations are reactivated 20

We have Recently Renewed T&D Commitments in South Texas Beginning next month, we will have T&D contracts for ~116,000 BPD Renewed commitments totaling ~50,000 BPD with existing customers Maintaining throughput by offering industry-leading service options and flexibility to attract/retain committed/walkup customers We are developing connections with several Permian long-haul pipelines to access storage/dock capacity at our Corpus Christi North Beach Terminal and potentially utilizing portions of our available pipeline capacity Providing our shippers with optionality to Corpus Christi and beyond, utilizing available underutilized assets 21

Other Opportunities Across our Footprint St. James Terminal • Executed new contract for unit train off-loading due to widening differentials out of the Permian (expect 3-10 trains per month) • Likely to be among the first of our facilities to benefit from a return to contango West Coast • Several low-cost, high-return capital projects totaling ~$60 million are executed and construction is nearing completion (as well as some that are still in development), related to opportunities for renewable diesel, bio diesel and ethanol 22

Finance Update

We Project 2018 Strategic Capital Spending Needs In the Range of $360 to $390 Million $2,000 $1,789 $1,500 Majority of 2018 spending relates to: Permian Crude Permian Crude System (~$190) $1,000 System $1,462 Northern Mexico (~$50) $690 Council Bluffs Acquisition $38M $316 $500 $431 $143 $262 $360 $96 $374 $328 $327 to $302 $288 $390 $166 $0 2012 2013 2014 2015 2016 2017 2018 Forecast Internal Growth Acquisitions 24

Debt Maturity Schedule (as of June 30, 2018) We have no significant maturities until 2020 $1,750 Receivables Financing $1,524 Sub Notes $1,500 $56 GO Zone Financing $1,250 $450 Senior Unsecured Notes Revolver $1,000 $750 $500 $1,018 $250 $550 $365 $403 $300 $250 $0 2018 2019 2020 2021 2022 2027 2038-2041 2043 We repaid our $350 million 7.65% senior unsecured notes that matured in April with our revolver, but we plan to issue up to $500 million new senior unsecured notes by EOY 25

Capital Structure as of June 30, 2018 ($ in Millions) $1.75 billion Credit Facility $1,018 NuStar Logistics Notes (4.75%) 250 Series D Preferred Units – Mezzanine2 $371 NuStar Logistics Notes (4.80%) 450 NuStar Logistics Notes (5.625%) 550 Partner’s Equity NuStar Logistics Notes (6.75%) 300 Series A, B and C Preferred Units $756 NuStar Logistics Sub Notes 403 Common Equity, General Partner and AOCI 1,701 GO Zone Bonds 365 Total Partners’ Equity 2,457 Receivables Financing 56 Total Capitalization $6,271 Short-term Debt & Other 51 Total Debt $3,443 As of June 30, 2018: Credit Facility availability ~$554 million Debt to EBITDA ratio1 4.7x 1 - Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 2 – On July 13, 2018, we closed on the issuance of an additional $190 million of Series D preferred units 26

Appendix

Reconciliation of Non-GAAP Financial Information NuStar Energy L.P. utilizes financial measures, such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow (DCF) and distribution coverage ratio, which are not defined in U.S. generally accepted accounting principles (GAAP). Management believes these financial measures provide useful information to investors and other external users of our financial information because (i) they provide additional information about the operating performance of the partnership’s assets and the cash the business is generating, (ii) investors and other external users of our financial statements benefit from having access to the same financial measures being utilized by management and our board of directors when making financial, operational, compensation and planning decisions and (iii) they highlight the impact of significant transactions. Our board of directors and management use EBITDA and/or DCF when assessing the following: (i) the performance of our assets, (ii) the viability of potential projects, (iii) our ability to fund distributions, (iv) our ability to fund capital expenditures and (v) our ability to service debt. In addition, our board of directors uses a distribution coverage ratio, which is calculated based on DCF, as one of the factors in its compensation determinations. DCF is a widely accepted financial indicator used by the master limited partnership (MLP) investment community to compare partnership performance. DCF is used by the MLP investment community, in part, because the value of a partnership unit is partially based on its yield, and its yield is based on the cash distributions a partnership can pay its unitholders. None of these financial measures are presented as an alternative to net income, or for any period presented reflecting discontinued operations, income from continuing operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For purposes of segment reporting, we do not allocate general and administrative expenses to our reported operating segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in the segment reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP measure. 28

Reconciliation of Non-GAAP Financial Information (continued) 29

Reconciliation of Non-GAAP Financial Information (continued) Projected for the Year Ended December 31, 2018 30

Reconciliation of Non-GAAP Financial Information (continued) 31

Reconciliation of Non-GAAP Financial Information (continued) 32