Attached files

| file | filename |

|---|---|

| EX-32.02 - EXHIBIT 32.02 - NuStar Energy L.P. | ns2q1810-qex3202.htm |

| EX-32.01 - EXHIBIT 32.01 - NuStar Energy L.P. | ns2q1810-qex3201.htm |

| EX-31.02 - EXHIBIT 31.02 - NuStar Energy L.P. | ns2q1810-qex3102.htm |

| EX-31.01 - EXHIBIT 31.01 - NuStar Energy L.P. | ns2q1810-qex3101.htm |

| EX-12.01 - EXHIBIT 12.01 - NuStar Energy L.P. | ns2q1810-qex1201.htm |

| EX-10.05 - EXHIBIT 10.05 - NuStar Energy L.P. | ns2q1810-qex1005.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 10-Q

_________________________________________

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018 | |

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______ | |

Commission File Number 1-16417

_________________________________________

NUSTAR ENERGY L.P.

(Exact name of registrant as specified in its charter)

_________________________________________

Delaware | 74-2956831 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

19003 IH-10 West San Antonio, Texas | 78257 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (210) 918-2000

_________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | x | Accelerated filer | o | ||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | ||

Emerging growth company | o | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of common units outstanding as of July 31, 2018 was 107,042,618.

NUSTAR ENERGY L.P.

FORM 10-Q

TABLE OF CONTENTS

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 6. | ||

2

PART I – FINANCIAL INFORMATION

Item 1. | Financial Statements |

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Thousands of Dollars, Except Unit Data)

June 30, 2018 | December 31, 2017 | ||||||

(Unaudited) | |||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 20,344 | $ | 24,292 | |||

Accounts receivable, net of allowance for doubtful accounts of $10,419 and $9,948 as of June 30, 2018 and December 31, 2017, respectively | 141,872 | 176,570 | |||||

Receivable from related party | 279 | 205 | |||||

Inventories | 28,071 | 26,857 | |||||

Other current assets | 26,526 | 22,508 | |||||

Total current assets | 217,092 | 250,432 | |||||

Property, plant and equipment, at cost | 6,514,589 | 6,243,481 | |||||

Accumulated depreciation and amortization | (2,054,908 | ) | (1,942,548 | ) | |||

Property, plant and equipment, net | 4,459,681 | 4,300,933 | |||||

Intangible assets, net | 758,767 | 784,479 | |||||

Goodwill | 1,094,661 | 1,097,475 | |||||

Deferred income tax asset | — | 233 | |||||

Other long-term assets, net | 116,768 | 101,681 | |||||

Total assets | $ | 6,646,969 | $ | 6,535,233 | |||

Liabilities, Mezzanine Equity and Partners’ Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 127,801 | $ | 145,932 | |||

Short-term debt | 63,000 | 35,000 | |||||

Current portion of long-term debt | — | 349,990 | |||||

Accrued interest payable | 36,192 | 40,449 | |||||

Accrued liabilities | 64,719 | 61,578 | |||||

Taxes other than income tax | 16,220 | 14,385 | |||||

Income tax payable | 3,357 | 4,172 | |||||

Total current liabilities | 311,289 | 651,506 | |||||

Long-term debt, less current portion | 3,380,366 | 3,263,069 | |||||

Deferred income tax liability | 23,113 | 22,272 | |||||

Other long-term liabilities | 105,013 | 118,297 | |||||

Total liabilities | 3,819,781 | 4,055,144 | |||||

Commitments and contingencies (Note 6) | |||||||

Series D preferred limited partners (15,760,441 preferred units outstanding as of June 30, 2018) (Note 11) | 370,711 | — | |||||

Partners’ equity (Note 12): | |||||||

Preferred limited partners (9,060,000 Series A preferred units, 15,400,000 Series B preferred units and 6,900,000 Series C preferred units outstanding as of June 30, 2018 and December 31, 2017) | 756,334 | 756,603 | |||||

Common limited partners (93,597,181 and 93,176,683 common units outstanding as of June 30, 2018 and December 31, 2017, respectively) | 1,740,768 | 1,770,587 | |||||

General partner | 25,999 | 37,826 | |||||

Accumulated other comprehensive loss | (66,624 | ) | (84,927 | ) | |||

Total partners’ equity | 2,456,477 | 2,480,089 | |||||

Total liabilities, mezzanine equity and partners’ equity | $ | 6,646,969 | $ | 6,535,233 | |||

See Condensed Notes to Consolidated Financial Statements.

3

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited, Thousands of Dollars, Except Unit and Per Unit Data)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenues: | |||||||||||||||

Service revenues | $ | 302,131 | $ | 283,700 | $ | 593,544 | $ | 550,162 | |||||||

Product sales | 184,073 | 151,788 | 368,541 | 372,756 | |||||||||||

Total revenues | 486,204 | 435,488 | 962,085 | 922,918 | |||||||||||

Costs and expenses: | |||||||||||||||

Costs associated with service revenues: | |||||||||||||||

Operating expenses (excluding depreciation and amortization expense) | 131,672 | 116,400 | 240,556 | 217,426 | |||||||||||

Depreciation and amortization expense | 73,613 | 65,402 | 143,510 | 120,073 | |||||||||||

Total costs associated with service revenues | 205,285 | 181,802 | 384,066 | 337,499 | |||||||||||

Cost of product sales | 170,849 | 144,479 | 347,577 | 352,285 | |||||||||||

General and administrative expenses (excluding depreciation and amortization expense) | 27,981 | 33,604 | 47,755 | 58,199 | |||||||||||

Other depreciation and amortization expense | 2,251 | 2,199 | 4,369 | 4,392 | |||||||||||

Total costs and expenses | 406,366 | 362,084 | 783,767 | 752,375 | |||||||||||

Operating income | 79,838 | 73,404 | 178,318 | 170,543 | |||||||||||

Interest expense, net | (48,936 | ) | (45,612 | ) | (96,708 | ) | (82,026 | ) | |||||||

Other income, net | 1,412 | 88 | 81,164 | 228 | |||||||||||

Income before income tax expense | 32,314 | 27,880 | 162,774 | 88,745 | |||||||||||

Income tax expense | 2,915 | 1,630 | 7,242 | 4,555 | |||||||||||

Net income | $ | 29,399 | $ | 26,250 | $ | 155,532 | $ | 84,190 | |||||||

Basic net income per common unit (Note 14) | $ | 0.15 | $ | 0.05 | $ | 1.30 | $ | 0.51 | |||||||

Basic weighted-average common units outstanding | 93,192,238 | 90,345,469 | 93,187,038 | 84,526,506 | |||||||||||

Comprehensive income | $ | 26,778 | $ | 27,381 | $ | 173,835 | $ | 89,084 | |||||||

See Condensed Notes to Consolidated Financial Statements.

4

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, Thousands of Dollars)

Six Months Ended June 30, | |||||||

2018 | 2017 | ||||||

Cash Flows from Operating Activities: | |||||||

Net income | $ | 155,532 | $ | 84,190 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization expense | 147,879 | 124,465 | |||||

Unit-based compensation expense | 4,277 | 5,117 | |||||

Amortization of debt related items | 3,965 | 3,146 | |||||

Gain from sale or disposition of assets | (1,218 | ) | (36 | ) | |||

Gain from insurance recoveries | (78,756 | ) | — | ||||

Deferred income tax expense | 1,142 | 23 | |||||

Changes in current assets and current liabilities (Note 15) | 42,733 | (15,344 | ) | ||||

(Increase) decrease in other long-term assets | (11,224 | ) | 2,698 | ||||

(Decrease) increase in other long-term liabilities | (20,073 | ) | 5,494 | ||||

Other, net | (407 | ) | (765 | ) | |||

Net cash provided by operating activities | 243,850 | 208,988 | |||||

Cash Flows from Investing Activities: | |||||||

Capital expenditures | (248,521 | ) | (108,849 | ) | |||

Change in accounts payable related to capital expenditures | (19,320 | ) | 6,851 | ||||

Proceeds from sale or disposition of assets | 2,097 | 1,966 | |||||

Proceeds from Axeon term loan | — | 110,000 | |||||

Proceeds from insurance recoveries | 78,419 | — | |||||

Acquisitions | (37,502 | ) | (1,476,719 | ) | |||

Net cash used in investing activities | (224,827 | ) | (1,466,751 | ) | |||

Cash Flows from Financing Activities: | |||||||

Proceeds from long-term debt borrowings | 677,272 | 1,037,161 | |||||

Proceeds from short-term debt borrowings | 456,000 | 565,000 | |||||

Proceeds from note offering, net of issuance costs | — | 543,313 | |||||

Long-term debt repayments | (905,521 | ) | (1,122,239 | ) | |||

Short-term debt repayments | (428,000 | ) | (574,000 | ) | |||

Proceeds from issuance of Series D preferred units | 400,000 | — | |||||

Payment of issuance costs for Series D preferred units | (29,289 | ) | — | ||||

Proceeds from issuance of other preferred units, net of issuance costs | — | 371,802 | |||||

Proceeds from issuance of common units, net of issuance costs | 10,000 | 643,858 | |||||

Contributions from general partner | — | 13,597 | |||||

Distributions to preferred unitholders | (32,713 | ) | (10,696 | ) | |||

Distributions to common unitholders and general partner | (172,324 | ) | (216,139 | ) | |||

Proceeds from termination of interest rate swaps | 8,048 | — | |||||

(Decrease) increase in cash book overdrafts | (436 | ) | 1,321 | ||||

Other, net | (5,587 | ) | (2,615 | ) | |||

Net cash (used in) provided by financing activities | (22,550 | ) | 1,250,363 | ||||

Effect of foreign exchange rate changes on cash | (421 | ) | 649 | ||||

Net decrease in cash and cash equivalents | (3,948 | ) | (6,751 | ) | |||

Cash and cash equivalents as of the beginning of the period | 24,292 | 35,942 | |||||

Cash and cash equivalents as of the end of the period | $ | 20,344 | $ | 29,191 | |||

See Condensed Notes to Consolidated Financial Statements.

5

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND BASIS OF PRESENTATION

Organization and Operations

NuStar Energy L.P. (NYSE: NS) is a publicly held Delaware limited partnership engaged in the transportation of petroleum products and anhydrous ammonia, and the terminalling, storage and marketing of petroleum products. Unless otherwise indicated, the terms “NuStar Energy,” “NS,” “the Partnership,” “we,” “our” and “us” are used in this report to refer to NuStar Energy L.P., to one or more of our consolidated subsidiaries or to all of them taken as a whole. As of June 30, 2018, NuStar GP Holdings, LLC (NuStar GP Holdings or NSH) owned our general partner, Riverwalk Logistics, L.P., and an approximate 11% common limited partner interest in us. As a result of the merger described below, NSH became a wholly owned subsidiary of ours on July 20, 2018.

We conduct our operations through our subsidiaries, primarily NuStar Logistics, L.P. (NuStar Logistics) and NuStar Pipeline Operating Partnership L.P. (NuPOP). We have three business segments: pipeline, storage and fuels marketing.

Recent Developments

Merger. On July 20, 2018, we completed the merger of NSH with a subsidiary of NS. Under the terms of the merger agreement, NSH unitholders are entitled to receive 0.55 of a common unit representing a limited partner interest in NS in exchange for each NSH unit owned at the effective time of the merger. See Note 2 for further discussion of the merger.

Issuance of units. On June 29, 2018, we issued 15,760,441 Series D Cumulative Convertible Preferred Units (Series D Preferred Units) at a price of $25.38 per unit in a private placement for net proceeds of $370.7 million. On July 13, 2018, we issued an additional 7,486,209 Series D Preferred Units at a price of $25.38 per unit in a private placement for net proceeds of $185.2 million. See Note 11 for further discussion. On June 29, 2018, we issued 413,736 common units at a price of $24.17 per unit to William E. Greehey, Chairman of the Board of Directors of NuStar GP, LLC.

Hurricane Activity. In the third quarter of 2017, several of our facilities were affected by the hurricanes in the Caribbean and Gulf of Mexico, including our St. Eustatius terminal, which experienced the most damage and was temporarily shut down. The damage caused by the Caribbean hurricane resulted in lower revenues for our bunker fuel operations in our fuels marketing segment and lower throughput and associated handling fees in our storage segment in 2017 and in the first quarter of 2018. In January 2018, we received $87.5 million of insurance proceeds in settlement of our property damage claim for our St. Eustatius terminal, of which $9.1 million related to business interruption. Proceeds from business interruption insurance are included in “Operating expenses” in the consolidated statements of income and in “Cash flows from operating activities” in the consolidated statements of cash flows. We recorded a $78.8 million gain in “Other income, net” in the consolidated statements of income in the first quarter of 2018 for the amount by which the insurance proceeds exceeded our expenses incurred during the period. We expect that the costs to repair the property damage at the terminal will not exceed the amount of insurance proceeds received.

Basis of Presentation

These unaudited condensed consolidated financial statements include the accounts of the Partnership and subsidiaries in which the Partnership has a controlling interest. Inter-partnership balances and transactions have been eliminated in consolidation.

These unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) for interim financial information and with the instructions to the Quarterly Report on Form 10-Q and Article 10 of Regulation S-X of the Securities Exchange Act of 1934. Accordingly, they do not include all of the information and notes required by GAAP for complete consolidated financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included, and all disclosures are adequate. All such adjustments are of a normal recurring nature unless disclosed otherwise. Financial information for the three and six months ended June 30, 2018 and 2017 included in these Condensed Notes to Consolidated Financial Statements is derived from our unaudited condensed consolidated financial statements. Operating results for the three and six months ended June 30, 2018 are not necessarily indicative of the results that may be expected for the year ending December 31, 2018. The consolidated balance sheet as of December 31, 2017 has been derived from the audited consolidated financial statements as of that date. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2017.

Certain previously reported amounts in the 2017 consolidated financial statements have been reclassified to conform to the 2018 presentation.

6

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

2. MERGER

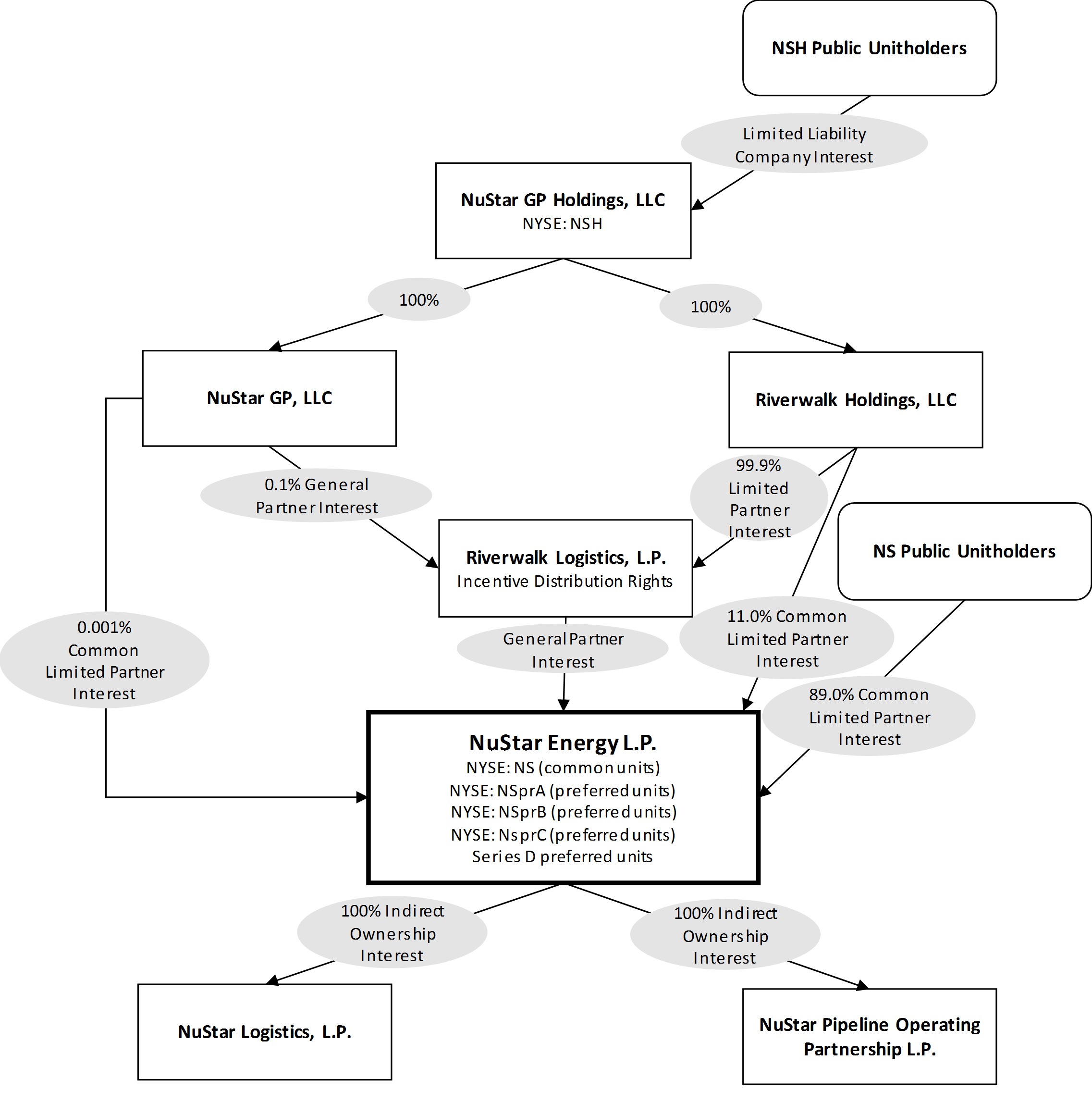

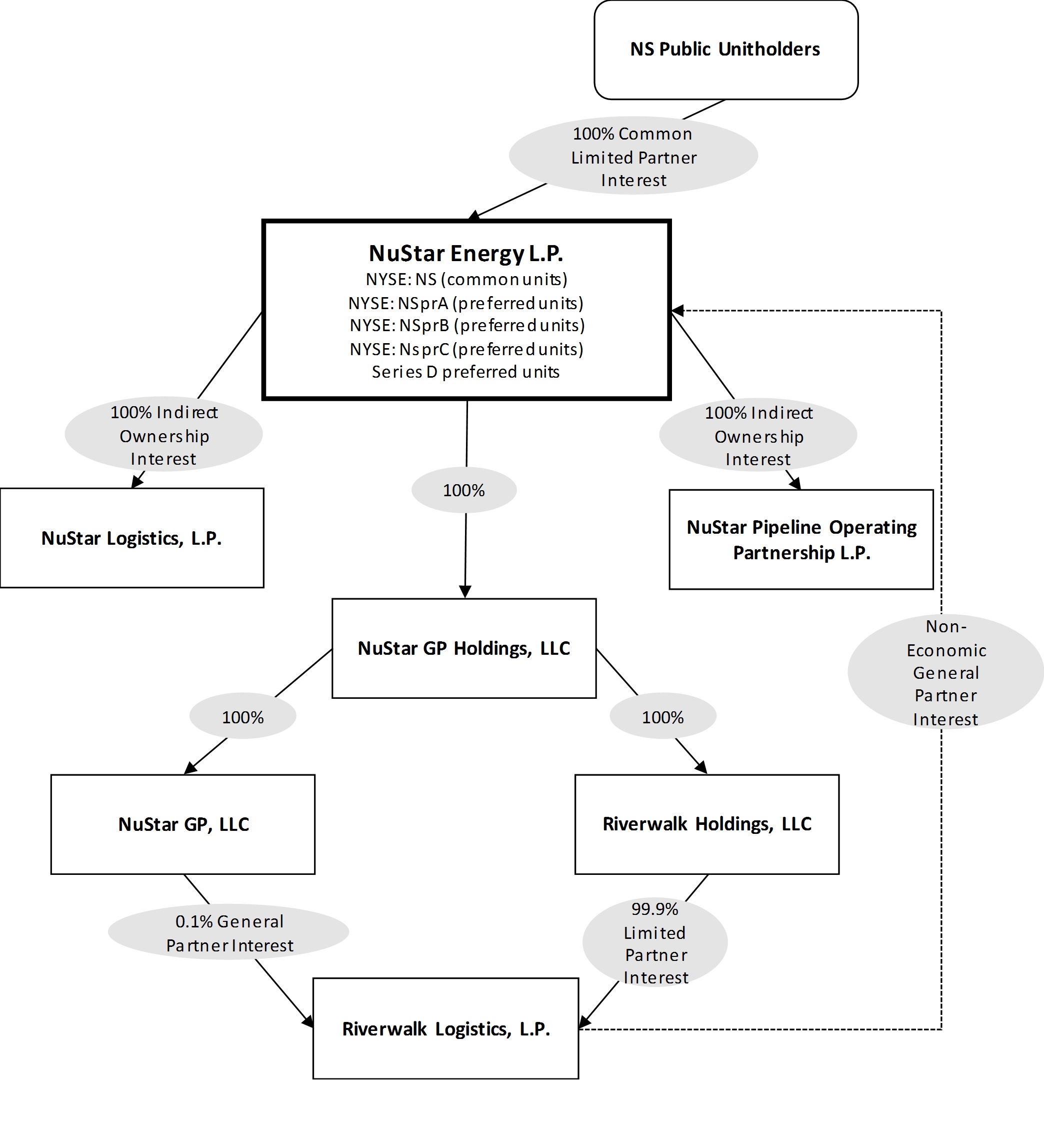

On February 7, 2018, NuStar Energy, Riverwalk Logistics, L.P., NuStar GP, LLC, Marshall Merger Sub LLC, a wholly owned subsidiary of NuStar Energy (Merger Sub), Riverwalk Holdings, LLC and NuStar GP Holdings entered into an Agreement and Plan of Merger (the Merger Agreement). Pursuant to the Merger Agreement, Merger Sub merged with and into NuStar GP Holdings with NuStar GP Holdings being the surviving entity (the Merger), such that NuStar Energy is the sole member of NuStar GP Holdings following the Merger (refer to the next two pages for charts depicting our organizational structure before and after the Merger). The Merger closed on July 20, 2018. Pursuant to the Merger Agreement and at the effective time of the Merger, NuStar Energy’s partnership agreement was amended and restated to, among other things, (i) cancel the incentive distribution rights held by our general partner, (ii) convert the 2% general partner interest in NuStar Energy held by our general partner into a non-economic management interest and (iii) provide the holders of our common units with voting rights in the election of the members of the board of directors of NuStar GP, LLC at an annual meeting, beginning in 2019.

At the effective time of the Merger, each outstanding NuStar GP Holdings common unit was converted into the right to receive 0.55 of a NuStar Energy common unit and all NuStar GP Holdings common units ceased to be outstanding. No fractional NuStar Energy common units were issued in the Merger; instead, each holder of NuStar GP Holdings’ common units otherwise entitled to receive a fractional NuStar Energy common unit is receiving cash in lieu thereof. As a result of the Merger, we issued approximately 23.6 million NuStar Energy common units and cancelled the 10.2 million NuStar Energy common units owned by subsidiaries of NuStar GP Holdings, resulting in approximately 13.4 million incremental NuStar Energy common units outstanding after the Merger.

Also at the effective time of the Merger, each outstanding award of NuStar GP Holdings restricted units was converted, on the same terms and conditions as were applicable to the awards immediately prior to the Merger, into an award of NuStar Energy restricted units. The number of NuStar Energy restricted units subject to the converted awards was determined pursuant to the 0.55 exchange ratio provided in the Merger Agreement.

Following the completion of the Merger, the NuStar GP, LLC board of directors consists of nine members, currently composed of the six members of the NuStar GP, LLC board of directors prior to the Merger and the three independent directors who served prior to the Merger on NuStar GP Holdings’ board of directors.

We plan to account for the Merger as an equity transaction similar to a redemption or induced conversion of preferred stock. The excess of (1) the fair value of the consideration transferred in exchange for the outstanding NSH units over (2) the carrying value of the general partner interest in the Partnership will be subtracted from net income available to common unitholders in the calculation of net income per unit. The consideration transferred includes the fair value of the incremental NS units issued, assumed NSH debt of $51.5 million and estimated transaction costs of approximately $10.0 million, resulting in an estimated reduction of $3.55 per common unit in the third quarter of 2018.

7

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The following chart depicts a summary of our organizational structure at June 30, 2018, before the Merger:

8

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The following chart depicts a summary of our organizational structure after the Merger:

3. NEW ACCOUNTING PRONOUNCEMENTS

Unit-Based Payments to Nonemployees

In June 2018, the Financial Accounting Standards Board (FASB) issued amended guidance which aligns the measurement and classification guidance for unit-based payments to nonemployees with the guidance for unit-based payments to employees, with certain exceptions. Under the amended guidance, unit-based payment awards to nonemployees will be measured at their grant date fair value. The guidance is effective for annual and interim periods beginning after December 15, 2018, with early adoption permitted. The amended guidance should be applied by means of a cumulative-effect adjustment to the balance sheet as of the beginning of the fiscal year of adoption. We are currently evaluating whether we will adopt these provisions early, but we do not expect the guidance to have a material impact on our financial position, results of operations or disclosures.

9

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Comprehensive Income

In February 2018, the FASB issued amended guidance which provides an entity the option to reclassify stranded tax effects caused by the Tax Cuts and Jobs Act of 2017 from accumulated other comprehensive income to retained earnings, and also requires certain additional disclosures about those stranded tax effects. The guidance is effective for annual and interim periods beginning after December 15, 2018, with early adoption permitted. The new requirements should be applied using one of two retrospective transition methods. We are currently evaluating whether we will adopt these provisions early, but we do not expect the guidance to have a material impact on our financial position, results of operations or disclosures.

Derivatives and Hedging

In August 2017, the FASB issued amended guidance intended to improve the financial reporting of hedging relationships to better portray the economic results of an entity’s risk management activities in its financial statements. The amended guidance also makes certain targeted improvements to simplify the application of current hedge accounting guidance. The guidance is effective for annual and interim periods beginning after December 15, 2018, with early adoption permitted. Certain of the new requirements should be applied prospectively while others should be applied using a modified retrospective transition method. We currently expect to adopt the amended guidance on January 1, 2019. We do not expect the guidance to have a material impact on our financial position or results of operations, and we are assessing the impact on our disclosures.

Defined Benefit Plans

In March 2017, the FASB issued amended guidance that changes the presentation of net periodic pension cost related to defined benefit plans. Under the amended guidance, the service cost component of net periodic benefit cost will be presented in the same income statement line items as other current employee compensation costs, but the remaining components of net periodic benefit cost will be presented outside of operating income. The changes are effective for annual and interim periods beginning after December 15, 2017, and amendments should be applied retrospectively. We began reporting the remaining components of net periodic benefit cost in “Other income, net” in the consolidated statements of comprehensive income upon adoption of the amended guidance on January 1, 2018. We applied the amended guidance prospectively as it did not have a material impact on previous periods.

Goodwill

In January 2017, the FASB issued amended guidance that simplifies the accounting for goodwill impairment by eliminating step 2 of the goodwill impairment test. Under the amended guidance, goodwill impairment will be measured as the excess of the reporting unit’s carrying value over its fair value, not to exceed the carrying amount of goodwill for that reporting unit. The changes are effective for annual and interim periods beginning after December 15, 2019, and amendments should be applied prospectively. Early adoption is permitted for any impairment tests performed after January 1, 2017, and we are currently evaluating whether we will adopt these provisions early. Regardless of our decision, we do not expect the guidance to have a material impact on our financial position, results of operations or disclosures.

Credit Losses

In June 2016, the FASB issued amended guidance that requires the use of a “current expected loss” model for financial assets measured at amortized cost and certain off-balance sheet credit exposures. Under this model, entities will be required to estimate the lifetime expected credit losses on such instruments based on historical experience, current conditions, and reasonable and supportable forecasts. This amended guidance also expands the disclosure requirements to enable users of financial statements to understand an entity’s assumptions, models and methods for estimating expected credit losses. The changes are effective for annual and interim periods beginning after December 15, 2019, and amendments should be applied using a modified retrospective approach. We currently expect to adopt the amended guidance on January 1, 2020, and we are assessing the impact of this amended guidance on our financial position, results of operations and disclosures. We plan to provide additional information about the expected financial impact at a future date.

Leases

In February 2016, the FASB issued amended guidance that requires lessees to recognize the assets and liabilities that arise from most leases on the balance sheet. For lessors, this amended guidance modifies the classification criteria and the accounting for sales-type and direct financing leases. The changes are effective for annual and interim periods beginning after December 15, 2018, and amendments should be applied using a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements, with the option to use certain practical expedients including those for land easements. In July 2018, the FASB issued amended guidance that, among other things, provides another transition method option which allows entities to initially apply the new lease guidance at the adoption date through a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. We currently expect to adopt these provisions on January 1, 2019 using this optional transition method.

10

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

We have identified our lease arrangements, continue the process of system implementation, and have begun to evaluate internal processes and controls. We are evaluating the impact of the amended guidance on our balance sheet, results of operations, disclosures and internal controls and plan to provide additional information about the expected impact once known.

Revenue Recognition

In May 2014, the FASB and the International Accounting Standards Board jointly issued a comprehensive new revenue recognition standard that requires an entity to recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration the entity expects to be entitled to in exchange for those goods or services. The standard is effective for public entities for annual and interim periods beginning after December 15, 2017, using one of two retrospective transition methods. We adopted these provisions January 1, 2018 using the modified retrospective approach. The transition adjustment related to the adoption was immaterial, and we do not expect the adoption of this standard to materially impact the amount or timing of our revenue going forward. Please refer to Note 13 for further discussion.

4. ACQUISITIONS

Council Bluffs Acquisition

On April 16, 2018, we acquired CHS Inc.’s Council Bluffs pipeline system, comprised of a 227-mile pipeline and 18 storage tanks, for approximately $37.5 million (the Council Bluffs Acquisition). The assets acquired and the results of operations are included in our pipeline segment from the date of acquisition. We accounted for this acquisition as an asset purchase.

Navigator Acquisition

On April 11, 2017, we entered into a Membership Interest Purchase and Sale Agreement (the Acquisition Agreement) with FR Navigator Holdings LLC to acquire (the Navigator Acquisition) all of the issued and outstanding limited liability company interests in Navigator Energy Services, LLC (Navigator) for approximately $1.5 billion. We closed the Navigator Acquisition on May 4, 2017. We acquired crude oil transportation, pipeline gathering and storage assets located in the Midland Basin in West Texas that we collectively refer to as our Permian Crude System. The assets acquired are included in our pipeline segment. The condensed consolidated statements of comprehensive income include the results of operations for Navigator commencing on May 4, 2017.

We accounted for the Navigator Acquisition using the acquisition method. The following table reflects the final purchase price allocation:

Purchase Price Allocation | |||

(Thousands of Dollars) | |||

Accounts receivable | $ | 4,747 | |

Other current assets | 2,359 | ||

Property, plant and equipment, net | 376,690 | ||

Intangible assets (a) | 700,000 | ||

Goodwill (b) | 398,024 | ||

Other long-term assets, net | 2,199 | ||

Current liabilities | (22,300 | ) | |

Purchase price allocation, net of cash acquired | $ | 1,461,719 | |

(a) | Intangible assets, which consist of customer contracts and relationships, are amortized on a straight-line basis over a period of 20 years. |

(b) | The goodwill acquired represents the expected benefit from entering new geographic areas and the anticipated opportunities to generate future cash flows from the assets acquired and potential future projects. |

11

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The unaudited pro forma information for the three and six months ended June 30, 2017 below presents the combined historical financial information for Navigator and the Partnership for those periods. This information assumes:

• | we completed the Navigator Acquisition on January 1, 2017; |

• | we issued approximately 14.4 million common units; |

• | we received a contribution from our general partner of $13.6 million to maintain its 2% interest; |

• | we issued 15.4 million Series B Preferred Units; |

• | we issued $550.0 million of 5.625% senior notes; |

• | additional depreciation and amortization that would have been incurred assuming the fair value adjustments to property, plant and equipment and intangible assets reflected in the purchase price allocation above; and |

• | we satisfied Navigator’s outstanding obligations under its revolving credit agreement. |

Three Months Ended June 30, 2017 | Six Months Ended June 30, 2017 | ||||||

(Thousands of Dollars, Except Per Unit Data) | |||||||

Revenues | $ | 439,933 | $ | 937,317 | |||

Net income | $ | 21,211 | $ | 63,659 | |||

Basic net (loss) income per common unit | $ | (0.03 | ) | $ | 0.16 | ||

The pro forma information for the three and six months ended June 30, 2017 includes transaction costs of approximately $14.0 million, which were directly attributable to the Navigator Acquisition and paid in the second quarter of 2017. The pro forma information is unaudited and is not necessarily indicative of the results of operations that would have resulted had the Navigator Acquisition occurred on January 1, 2017 or that may result in the future.

5. DEBT

Revolving Credit Agreement

On June 29, 2018, NuStar Logistics amended its revolving credit agreement (the Revolving Credit Agreement) to exclude the Series D Preferred Units from the definition of “Indebtedness.” Additionally, the amendment reduced the total amount available for borrowing from $1.75 billion to $1.575 billion, effective June 29, 2018, with a further reduction to $1.4 billion, effective December 28, 2018. The Revolving Credit Agreement was also amended to, among other things, add a consolidated interest coverage ratio (as defined in the Revolving Credit Agreement), which must not be less than 1.75-to-1.00 for each rolling period of four quarters, beginning with the rolling period ending June 30, 2018.

On March 28, 2018, NuStar Logistics amended the Revolving Credit Agreement to increase the maximum allowed consolidated debt coverage ratio (as defined in the Revolving Credit Agreement) to 5.25-to-1.00 for the rolling periods ending June 30, 2018 through December 31, 2018. For any rolling periods ending on or after March 31, 2019, the maximum allowed consolidated debt coverage ratio may not exceed 5.00-to-1.00. The Revolving Credit Agreement was also amended to, among other things, provide that the definition of “Change in Control” in the Revolving Credit Agreement excludes the Merger discussed in Note 2.

The maximum consolidated debt coverage ratio and minimum consolidated interest coverage ratio requirements may limit the amount we can borrow under the Revolving Credit Agreement to an amount less than the total amount available for borrowing. As of June 30, 2018, we had $553.7 million available for borrowing, and we believe that we are in compliance with the covenants in the Revolving Credit Agreement.

The Revolving Credit Agreement bears interest, at our option, based on an alternative base rate, a LIBOR-based rate or a EURIBOR-based rate. The interest rate on the Revolving Credit Agreement is subject to adjustment if our debt rating is downgraded (or upgraded) by certain credit rating agencies. In February 2018, Moody’s Investor Service Inc. (Moody’s) lowered our credit rating from Ba1 to Ba2. This rating downgrade caused the interest rate on our Revolving Credit Agreement to increase by 0.25% effective February 2018. As of June 30, 2018, our weighted-average interest rate related to borrowings under the Revolving Credit Agreement was 3.9%, and we had $1.0 billion outstanding.

NuStar Logistics Senior Notes

The credit rating downgrade by Moody’s in February 2018 increased the interest rate on our $350.0 million of 7.65% senior notes by 0.25%, resulting in an interest rate of 8.65% applicable to the interest payment due April 15, 2018. We repaid these notes on April 15, 2018 with borrowings under our Revolving Credit Agreement.

12

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

NuStar Logistics Subordinated Notes

Effective January 15, 2018, the interest rate on NuStar Logistics’ $402.5 million of fixed-to-floating rate subordinated notes due January 15, 2043 switched from a fixed annual rate of 7.625%, payable quarterly in arrears, to an annual rate equal to the sum of the three-month LIBOR for the related quarterly interest period, plus 6.734% payable quarterly, commencing with the interest payment due April 15, 2018. As of June 30, 2018, the interest rate was 9.1%.

Receivables Financing Agreement

NuStar Energy and NuStar Finance LLC (NuStar Finance), a special purpose entity and wholly owned subsidiary of NuStar Energy, are parties to a $125.0 million receivables financing agreement with third-party lenders (the Receivables Financing Agreement) and agreements with certain of NuStar Energy’s wholly owned subsidiaries (collectively with the Receivables Financing Agreement, the Securitization Program). NuStar Finance’s sole activity consists of purchasing receivables from NuStar Energy’s wholly owned subsidiaries that participate in the Securitization Program and providing these receivables as collateral for NuStar Finance’s revolving borrowings under the Securitization Program. NuStar Finance is a separate legal entity and the assets of NuStar Finance, including these accounts receivable, are not available to satisfy the claims of creditors of NuStar Energy, its subsidiaries selling receivables under the Securitization Program or their affiliates. The amount available for borrowing is based on the availability of eligible receivables and other customary factors and conditions. The March 28, 2018 amendment to the Revolving Credit Agreement also limits the amount of borrowings under the Receivables Financing Agreement to $125.0 million.

Borrowings by NuStar Finance under the Receivables Financing Agreement bear interest at the applicable bank rate, as defined under the Receivables Financing Agreement. The weighted average interest rate related to outstanding borrowings under the Securitization Program as of June 30, 2018 was 3.0%. As of June 30, 2018, $103.2 million of our accounts receivable, net of allowance for doubtful accounts, are included in the Securitization Program. The amount of borrowings outstanding under the Receivables Financing Agreement totaled $56.4 million as of June 30, 2018, which is included in “Long-term debt” on the consolidated balance sheet. On March 28, 2018, the Receivables Financing Agreement was amended to change the definition of Change in Control in the Receivables Financing Agreement such that the Merger discussed in Note 2 would not be a Change in Control for purposes of the Receivables Financing Agreement.

6. COMMITMENTS AND CONTINGENCIES

We have contingent liabilities resulting from various litigation, claims and commitments. We record accruals for loss contingencies when losses are considered probable and can be reasonably estimated. Legal fees associated with defending the Partnership in legal matters are expensed as incurred. We accrued $2.7 million for contingent losses as of June 30, 2018 and $7.3 million as of December 31, 2017. The amount that will ultimately be paid related to such matters may differ from the recorded accruals, and the timing of such payments is uncertain. We evaluate each contingent loss at least quarterly, and more frequently as each matter progresses and develops over time, and we do not believe that the resolution of any particular claim or proceeding, or all matters in the aggregate, would have a material adverse effect on our results of operations, financial position or liquidity.

7. FAIR VALUE MEASUREMENTS

We segregate the inputs used in measuring fair value into three levels: Level 1, defined as observable inputs, such as quoted prices for identical assets or liabilities in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable, such as quoted prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in markets that are not active; and Level 3, defined as unobservable inputs for which little or no market data exists. We consider counterparty credit risk and our own credit risk in the determination of all estimated fair values.

13

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Recurring Fair Value Measurements

The following assets and liabilities are measured at fair value on a recurring basis:

June 30, 2018 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(Thousands of Dollars) | |||||||||||||||

Assets: | |||||||||||||||

Other long-term assets, net: | |||||||||||||||

Interest rate swaps | $ | — | $ | 4,491 | $ | — | $ | 4,491 | |||||||

Liabilities: | |||||||||||||||

Accrued liabilities: | |||||||||||||||

Commodity derivatives | $ | (247 | ) | $ | — | $ | — | $ | (247 | ) | |||||

December 31, 2017 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(Thousands of Dollars) | |||||||||||||||

Assets: | |||||||||||||||

Other current assets: | |||||||||||||||

Product imbalances | $ | 3,890 | $ | — | $ | — | $ | 3,890 | |||||||

Liabilities: | |||||||||||||||

Accrued liabilities: | |||||||||||||||

Product imbalances | $ | (1,534 | ) | $ | — | $ | — | $ | (1,534 | ) | |||||

Commodity derivatives | (878 | ) | — | — | (878 | ) | |||||||||

Interest rate swaps | — | (5,394 | ) | — | (5,394 | ) | |||||||||

Other long-term liabilities: | |||||||||||||||

Interest rate swaps | — | (4,594 | ) | — | (4,594 | ) | |||||||||

Total liabilities | $ | (2,412 | ) | $ | (9,988 | ) | $ | — | $ | (12,400 | ) | ||||

Product Imbalances. Pursuant to the new revenue recognition standard we adopted January 1, 2018, we no longer recognize the fair value of product imbalances on our consolidated balance sheets. Prior to adoption, we valued our assets and liabilities related to product imbalances using quoted market prices in active markets as of the reporting date; accordingly, we included these product imbalances in Level 1 of the fair value hierarchy.

Commodity Derivatives. We base the fair value of certain of our commodity derivative instruments on quoted prices on an exchange; accordingly, we include these items in Level 1 of the fair value hierarchy. See Note 8 for a discussion of our derivative instruments.

Interest Rate Swaps. Because we estimate the fair value of our forward-starting interest rate swaps using discounted cash flows, which use observable inputs such as time to maturity and market interest rates, we include these interest rate swaps in Level 2 of the fair value hierarchy.

Fair Value of Financial Instruments

We recognize cash equivalents, receivables, payables and debt in our consolidated balance sheets at their carrying amounts. The fair values of these financial instruments, except for long-term debt, approximate their carrying amounts.

The estimated fair values and carrying amounts of long-term debt, including the current portion, were as follows:

June 30, 2018 | December 31, 2017 | ||||||

(Thousands of Dollars) | |||||||

Fair value | $ | 3,394,956 | $ | 3,677,622 | |||

Carrying amount | $ | 3,380,366 | $ | 3,613,059 | |||

14

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

We have estimated the fair value of our publicly traded notes based upon quoted prices in active markets; therefore, we determined that the fair value of our publicly traded notes falls in Level 1 of the fair value hierarchy. With regard to our other debt, for which a quoted market price is not available, we have estimated the fair value using a discounted cash flow analysis using current incremental borrowing rates for similar types of borrowing arrangements and determined that the fair value falls in Level 2 of the fair value hierarchy.

8. DERIVATIVES AND RISK MANAGEMENT ACTIVITIES

We utilize various derivative instruments to manage our exposure to interest rate risk and commodity price risk. Our risk management policies and procedures are designed to monitor interest rates, futures and swap positions and over-the-counter positions, as well as physical commodity volumes, grades, locations and delivery schedules, to help ensure that our hedging activities address our market risks.

Interest Rate Risk

We are a party to certain interest rate swap agreements to manage our exposure to changes in interest rates, which include forward-starting interest rate swap agreements related to forecasted debt issuances in 2020. We entered into these swaps in order to hedge the risk of fluctuations in the required interest payments attributable to changes in the benchmark interest rate during the period from the effective date of the swap to the issuance of the forecasted debt. Under the terms of the swaps, we pay a fixed rate and receive a rate based on the three-month USD LIBOR. These swaps qualify as cash flow hedges, and we designate them as such. We record the effective portion of mark-to-market adjustments as a component of “Accumulated other comprehensive income (loss)” (AOCI), and the amount in AOCI will be recognized in “Interest expense, net” as the forecasted interest payments occur or if the interest payments are probable not to occur. As of June 30, 2018 and December 31, 2017, the aggregate notional amount of forward-starting interest rate swaps totaled $250.0 million and $600.0 million, respectively. In April 2018, in connection with the maturity of the 7.65% senior notes due April 15, 2018, we terminated forward-starting interest rate swaps with an aggregate notional amount of $350.0 million and received $8.0 million.

Commodity Price Risk

We are exposed to market risks related to the volatility of petroleum product prices. In order to reduce the risk of commodity price fluctuations with respect to our petroleum product inventories and related firm commitments to purchase and/or sell such inventories, we utilize commodity futures and swap contracts, which qualify, and we designate, as fair value hedges. Derivatives that are intended to hedge our commodity price risk but fail to qualify as fair value or cash flow hedges are considered economic hedges, and we record associated gains and losses in net income. Our risk management committee oversees our trading controls and procedures and certain aspects of commodity and trading risk management. Our risk management committee also reviews all new commodity and trading risk management strategies in accordance with our risk management policy, as approved by our board of directors. We ceased marketing crude oil in the second quarter of 2017 and exited our heavy fuels trading operations in the third quarter of 2017, thereby reducing our overall hedging activity.

The volume of commodity contracts is based on open derivative positions and represents the combined volume of our long and short open positions on an absolute basis, which totaled 1.2 million barrels as of June 30, 2018 and December 31, 2017. We had $0.2 million and $0.3 million of margin deposits as of June 30, 2018 and December 31, 2017, respectively.

15

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The fair values of our derivative instruments included in our consolidated balance sheets were as follows:

Asset Derivatives | Liability Derivatives | ||||||||||||||||

Balance Sheet Location | June 30, 2018 | December 31, 2017 | June 30, 2018 | December 31, 2017 | |||||||||||||

(Thousands of Dollars) | |||||||||||||||||

Derivatives Designated as Hedging Instruments: | |||||||||||||||||

Interest rate swaps | Other long-term assets, net | $ | 4,491 | $ | — | $ | — | $ | — | ||||||||

Commodity contracts | Accrued liabilities | — | — | (70 | ) | (112 | ) | ||||||||||

Interest rate swaps | Accrued liabilities | — | — | — | (5,394 | ) | |||||||||||

Interest rate swaps | Other long-term liabilities | — | — | — | (4,594 | ) | |||||||||||

Total | 4,491 | — | (70 | ) | (10,100 | ) | |||||||||||

Derivatives Not Designated as Hedging Instruments: | |||||||||||||||||

Commodity contracts | Accrued liabilities | 1,278 | 742 | (1,455 | ) | (1,508 | ) | ||||||||||

Total Derivatives | $ | 5,769 | $ | 742 | $ | (1,525 | ) | $ | (11,608 | ) | |||||||

Certain of our derivative instruments are eligible for offset in the consolidated balance sheets and subject to master netting arrangements. Under our master netting arrangements, there is a legally enforceable right to offset amounts, and we intend to settle such amounts on a net basis. The following are the net amounts presented on the consolidated balance sheets:

Commodity Contracts | June 30, 2018 | December 31, 2017 | ||||||

(Thousands of Dollars) | ||||||||

Net amounts of assets presented in the consolidated balance sheets | $ | — | $ | — | ||||

Net amounts of liabilities presented in the consolidated balance sheets | $ | (247 | ) | $ | (878 | ) | ||

We recognize the impact of our commodity contracts on earnings in “Cost of product sales” on the condensed consolidated statements of comprehensive income, as follows:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(Thousands of Dollars) | |||||||||||||||

Derivatives Designated as Fair Value Hedging Instruments: | |||||||||||||||

(Loss) gain recognized in income on derivative | $ | (1,007 | ) | $ | 364 | $ | (1,303 | ) | $ | 2,461 | |||||

Gain (loss) recognized in income on hedged item | 981 | (313 | ) | 1,218 | (2,147 | ) | |||||||||

(Loss) gain recognized in income for ineffective portion | $ | (26 | ) | $ | 51 | $ | (85 | ) | $ | 314 | |||||

Derivatives Not Designated as Hedging Instruments: | |||||||||||||||

(Loss) gain recognized in income on derivative | $ | (90 | ) | $ | 52 | $ | (231 | ) | $ | (86 | ) | ||||

16

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Our interest rate swaps had the following impact on earnings:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(Thousands of Dollars) | |||||||||||||||

Derivatives Designated as Cash Flow Hedging Instruments: | |||||||||||||||

Gain (loss) recognized in other comprehensive income on derivative (effective portion) | $ | 5,106 | $ | (7,980 | ) | $ | 22,527 | $ | (7,941 | ) | |||||

Loss reclassified from AOCI into interest expense, net (effective portion) | $ | (1,162 | ) | $ | (1,729 | ) | $ | (2,552 | ) | $ | (3,528 | ) | |||

As of June 30, 2018, we expect to reclassify a loss of $3.7 million to “Interest expense, net” within the next twelve months associated with unwound forward-starting interest rate swaps.

9. RELATED PARTY TRANSACTIONS

Please refer to Note 2 for a discussion of the Merger.

Prior to the Merger, we were a party to the Amended and Restated Services Agreement with NuStar GP, LLC, effective March 1, 2016 (the Amended GP Services Agreement), which provided that we furnish administrative services necessary to conduct the business of NuStar GP Holdings, and NuStar GP Holdings compensated us for these services for an annual fee of $1.0 million, subject to adjustment. We terminated the Amended GP Services Agreement in conjunction with the Merger.

10. EMPLOYEE BENEFIT PLANS

NuStar’s Pension Plan is a qualified non-contributory defined benefit pension plan that provides eligible U.S. employees with retirement income as calculated under a cash balance formula. NuStar’s Excess Pension Plan is a nonqualified deferred compensation plan that provides benefits to a select group of management or other highly compensated employees. The Pension Plan and Excess Pension Plan are collectively referred to as the Pension Plans.

We also sponsor a contributory medical benefits plan for U.S. employees who retired prior to April 1, 2014. For employees who retire on or after April 1, 2014, we provide partial reimbursement for eligible third-party health care premiums.

17

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The components of net periodic benefit cost (income) related to our Pension Plans and other postretirement benefit plans were as follows:

Pension Plans | Other Postretirement Benefit Plans | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(Thousands of Dollars) | |||||||||||||||

For the three months ended June 30: | |||||||||||||||

Service cost | $ | 2,405 | $ | 2,239 | $ | 126 | $ | 113 | |||||||

Interest cost | 1,206 | 1,127 | 107 | 108 | |||||||||||

Expected return on assets | (1,854 | ) | (1,602 | ) | — | — | |||||||||

Amortization of prior service credit | (514 | ) | (516 | ) | (286 | ) | (286 | ) | |||||||

Amortization of net loss | 543 | 371 | 53 | 48 | |||||||||||

Net periodic benefit cost (income) | $ | 1,786 | $ | 1,619 | $ | — | $ | (17 | ) | ||||||

For the six months ended June 30: | |||||||||||||||

Service cost | $ | 4,811 | $ | 4,478 | $ | 252 | $ | 226 | |||||||

Interest cost | 2,412 | 2,254 | 215 | 216 | |||||||||||

Expected return on assets | (3,709 | ) | (3,205 | ) | — | — | |||||||||

Amortization of prior service credit | (1,028 | ) | (1,031 | ) | (573 | ) | (572 | ) | |||||||

Amortization of net loss | 1,087 | 742 | 107 | 96 | |||||||||||

Net periodic benefit cost (income) | $ | 3,573 | $ | 3,238 | $ | 1 | $ | (34 | ) | ||||||

11. SERIES D CUMULATIVE CONVERTIBLE PREFERRED UNITS

Purchase Agreement and Issuance of Series D Preferred Units

On June 26, 2018, the Partnership entered into a purchase agreement (the Series D Preferred Unit Purchase Agreement) with investment funds, accounts and entities (collectively, the Purchasers) managed by EIG Management Company, LLC and FS/EIG Advisors, LLC to issue and sell $590.0 million of Series D Preferred Units in a private placement. The Partnership issued a total of 23,246,650 Series D Preferred Units to the Purchasers at a price of $25.38 per Series D Preferred Unit (the Series D Preferred Unit Purchase Price). At the initial closing on June 29, 2018 (the Initial Closing), the Purchasers purchased 15,760,441 Series D Preferred Units for $400.0 million. We used net proceeds of $370.7 million received at the Initial Closing for general partnership purposes, including repayment of outstanding borrowings under our Revolving Credit Agreement. The Purchasers purchased the remaining 7,486,209 Series D Preferred Units for $190.0 million at a second closing on July 13, 2018. The aggregate net proceeds to the Partnership from the sale of the Series D Preferred Units, after deduction of a 3.5% transaction fee of $20.7 million paid to the Purchasers and other issuance costs of $13.4 million, were approximately $555.9 million.

Series D Preferred Units Rights

At the Initial Closing and pursuant to the Series D Preferred Unit Purchase Agreement, the Partnership amended and restated its partnership agreement to authorize and establish the rights, preferences and privileges of the Series D Preferred Units. The Series D Preferred Units rank equal to other classes of preferred units and senior to common units in the Partnership with respect to distribution rights and rights upon liquidation. The Series D Preferred Units generally will vote on an as-converted basis with the common units and will have certain class voting rights with respect to a limited number of matters as set forth in the partnership agreement.

Series D Preferred Units Distributions

Distributions on the Series D Preferred Units accrue and are cumulative from the issuance dates and are payable on the 15th day (or next business day) of each of March, June, September and December, beginning September 17, 2018 to holders of record on the first business day of each payment month. The distribution rate on the Series D Preferred Units is: (i) 9.75% per annum for the first two years; (ii) 10.75% per annum for years three through five; and (iii) the greater of 13.75% per annum or the common unit distribution rate thereafter. While the Series D Preferred Units are outstanding, the Partnership will be prohibited from paying distributions on any junior securities, including the common units, unless full cumulative distributions on the Series D Preferred Units (and any parity securities) have been, or contemporaneously are being, paid or set aside for payment

18

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

through the most recent Series D Preferred Unit distribution payment date. For the four distribution periods beginning with the initial Series D Preferred Unit distribution, the Series D Preferred Unit distributions may be paid, in the Partnership’s sole discretion, in (i) cash or (ii) a combination of additional Series D Preferred Units and cash, provided that up to 50% of the distribution amount may be paid in additional Series D Preferred Units. Thereafter, any Series D Preferred Unit distributions in excess of $0.635 may be paid, in the Partnership’s sole discretion, in additional Series D Preferred Units, with the remainder paid in cash.

If we fail to pay in full any Series D Preferred Unit distribution amount, then, until we pay such distributions in full, the applicable distribution rate for each of those distribution periods shall be increased by $0.048 per Series D Preferred Unit. In addition, if we fail to pay in full any Series D Preferred Unit distribution amount for three consecutive distribution periods, then until we pay such distributions in full: (i) each holder of the Series D Preferred Units may elect to convert its Series D Preferred Units into common units on a one-for-one basis, plus any unpaid Series D distributions, (ii) one person selected by the holders holding a majority of the outstanding Series D Preferred Units shall become an additional member of our board of directors and (iii) we will not be permitted to incur any indebtedness (as defined in the Revolving Credit Agreement) or engage in any acquisitions or asset sales in excess of $50.0 million without the consent of the holders holding a majority of the outstanding Series D Preferred Units. In addition, we will permanently lose the ability to pay any part of the distributions on the Series D Preferred Units in the form of additional Series D Preferred Units.

In July 2018, our board of directors declared an initial distribution of $0.525 per Series D Preferred Unit issued on June 29, 2018 and an initial distribution of $0.431 per Series D Preferred Unit issued on July 13, 2018, which will both be paid on September 17, 2018 to holders of record as of September 4, 2018.

Series D Preferred Units Conversion and Redemption Features

At any time on or after June 29, 2020, each holder of Series D Preferred Units may convert all or any portion of its Series D Preferred Units into common units on a one-for-one basis (plus any unpaid Series D distributions), subject to anti-dilution adjustments, at any time, but not more than once per quarter, so long as any conversion is for at least $50.0 million based on the Series D Preferred Unit Purchase Price (or such lesser amount representing all of a holder’s Series D Preferred Units).

The Partnership may redeem all or any portion of the Series D Preferred Units, in an amount not less than $50.0 million for cash at a redemption price equal to, as applicable: (i) $31.73 per Series D Preferred Unit at any time on or after June 29, 2023 but prior to June 29, 2024; (ii) $30.46 per Series D Preferred Unit at any time on or after June 29, 2024 but prior to June 29, 2025; (iii) $29.19 per Series D Preferred Unit at any time on or after June 29, 2025; plus, in each case, the sum of any unpaid distributions on the applicable Series D Preferred Unit plus the distributions prorated for the number of days elapsed (not to exceed 90) in the period of redemption (Series D Partial Period Distributions). The holders have the option to convert the units prior to such redemption as discussed above.

Additionally, at any time on or after June 29, 2028, each holder of Series D Preferred Units will have the right to require the Partnership to redeem all of the Series D Preferred Units held by such holder at a redemption price equal to $29.19 per Series D Preferred Unit plus any unpaid Series D distributions plus the Series D Partial Period Distributions. If a holder of Series D Preferred Units exercises its redemption right, the Partnership may elect to pay up to 50% of such amount in common units (which shall be valued at 93% of a volume-weighted average trading price of the common units); provided, that the common units to be issued do not, in the aggregate, exceed 15% of NuStar Energy’s common equity market capitalization at the time.

Series D Preferred Units Change of Control

Upon certain events involving a change of control, each holder of the Series D Preferred Units may elect to: (i) convert its Series D Preferred Units into common units on a one-for-one basis, plus any unpaid Series D distributions; (ii) require the Partnership to redeem its Series D Preferred Units for an amount equal to the sum of (a) $29.82 per Series D Preferred Unit plus (b) any unpaid Series D distributions plus (c) the applicable distribution amount for the distribution periods ending after the change of control event and prior to (but including) the fourth anniversary of the Initial Closing; (iii) if the Partnership is the surviving entity and its common units continue to be listed, continue to hold its Series D Preferred Units; or (iv) if the Partnership will not be the surviving entity, or it will be the surviving entity but its common units will cease to be listed, require the Partnership to use its commercially reasonable efforts to deliver a security in the surviving entity that has substantially similar terms as the Series D Preferred Units; however, if the Partnership is unable to deliver a mirror security, each holder is still entitled to option (i) or (ii) above.

19

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Registration Rights Agreement

On June 29, 2018, in connection with the Initial Closing and pursuant to the Series D Preferred Unit Purchase Agreement, the Partnership entered into a Registration Rights Agreement (the Registration Rights Agreement) with the Purchasers relating to the registration of the Series D Preferred Units and common units issuable upon conversion of the Series D Preferred Units (the Common Unit Registrable Securities, and, collectively with the Series D Preferred Units, the Registrable Securities). Pursuant to the Registration Rights Agreement, the Partnership is required to use its commercially reasonable efforts to file a registration statement and to cause such registration statement to become effective: (i) with respect to the Common Unit Registrable Securities, no later than one year after the Initial Closing; and (ii) with respect to the Series D Preferred Units, no later than one year after receipt by the Partnership after the second anniversary of the Initial Closing of a written request from holders holding a majority of the Series D Preferred Units to register the Series D Preferred Units. If the Partnership fails to cause such registration statements to become effective by such dates, the Partnership will be required to pay certain amounts to the holders of the Registrable Securities as liquidated damages.

Series D Preferred Units Accounting Treatment

The Series D Preferred Units include redemption provisions at the option of the holders of the Series D Preferred Units and upon a Series D Change of Control (as defined in the partnership agreement), which are outside the Partnership’s control. Therefore, they are presented in the mezzanine section of the consolidated balance sheets. The Series D Preferred Units have been recorded at their issuance date fair value, net of issuance costs. We reassess the presentation of the Series D Preferred Units in our consolidated balance sheets on a quarterly basis.

The Series D Preferred Units are subject to accretion from their carrying value at the issuance date to the redemption value, which is based on the redemption right of the Series D Preferred Unit holders that may be exercised at any time on or after June 29, 2028, using the effective interest method over a period of ten years. The accretion will be treated in the same manner as a distribution and deducted from net income to arrive at net income attributable to common units.

12. PARTNERS' EQUITY

Please refer to Note 2 for a discussion of the Merger.

Issuance of Common Units

On June 29, 2018, we issued 413,736 common units at a price of $24.17 per unit to William E. Greehey, Chairman of the Board of Directors of NuStar GP, LLC. We used the proceeds of approximately $10.0 million from the sale of these units for general partnership purposes.

Partners’ Equity Activity

The following table summarizes changes to our partners’ equity, which excludes the Series D Preferred Units, (in thousands of dollars):

Balance as of January 1, 2018 | $ | 2,480,089 | |

Net income | 155,320 | ||

Unit-based compensation | 3,051 | ||

Other comprehensive income | 18,303 | ||

Distributions to partners | (204,347 | ) | |

Issuance of common units, including contribution from general partner | 10,204 | ||

Other | (6,143 | ) | |

Balance as of June 30, 2018 | $ | 2,456,477 | |

20

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Cash Distributions

General Partner and Common Limited Partners. We make quarterly distributions to common unitholders, and, prior to the Merger, the general partner of 100% of our available cash, generally defined as cash receipts less cash disbursements, including distributions to our preferred units, and cash reserves established by the general partner, in its sole discretion. These quarterly distributions are declared and paid within 45 days subsequent to each quarter-end. The common unitholders receive a distribution each quarter as determined by the board of directors, subject to limitation by the distributions in arrears, if any, on our preferred units. Prior to the Merger, our available cash was distributed based on the percentages shown below:

Percentage of Distribution | ||||

Quarterly Distribution Amount per Common Unit | Common Unitholders | General Partner Including Incentive Distributions | ||

Up to $0.60 | 98% | 2% | ||

Above $0.60 up to $0.66 | 90% | 10% | ||

Above $0.66 | 75% | 25% | ||

The general partner was not allocated distributions for the second quarter of 2018 as a result of the Merger, which was effective prior to the record date for the second quarter distribution. The common limited partners’ distribution for the second quarter of 2018 includes the additional common units issued in exchange for previously outstanding NSH units pursuant to the terms of the Merger Agreement because the Merger closed prior to the common unit distribution record date. The general partner did not receive incentive distributions for the first quarter of 2018 because the distribution declared for the first quarter was $0.60 per common unit. The following table reflects the allocation of total cash distributions to the general partner and common limited partners applicable to the period in which the distributions were earned:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(Thousands of Dollars, Except Per Unit Data) | |||||||||||||||

General partner interest | $ | — | $ | 2,302 | $ | 1,141 | $ | 4,645 | |||||||

General partner incentive distribution | — | 10,912 | — | 23,824 | |||||||||||

Total general partner distribution | — | 13,214 | 1,141 | 28,469 | |||||||||||

Common limited partners’ distribution | 64,205 | 101,869 | 120,121 | 203,782 | |||||||||||

Total cash distributions | $ | 64,205 | $ | 115,083 | $ | 121,262 | $ | 232,251 | |||||||

Cash distributions per unit applicable to common limited partners | $ | 0.60 | $ | 1.095 | $ | 1.200 | $ | 2.190 | |||||||

The following table summarizes information about our quarterly cash distributions to our general partner and common limited partners:

Quarter Ended | Cash Distributions Per Unit | Total Cash Distributions | Record Date | Payment Date | ||||||||

(Thousands of Dollars) | ||||||||||||

June 30, 2018 | $ | 0.600 | $ | 64,205 | August 7, 2018 | August 13, 2018 | ||||||

March 31, 2018 | $ | 0.600 | $ | 57,057 | May 8, 2018 | May 14, 2018 | ||||||

December 31, 2017 | $ | 1.095 | $ | 115,267 | February 8, 2018 | February 13, 2018 | ||||||

21

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Preferred Units. The following table summarizes information about our cash distributions on our 8.50% Series A, 7.625% Series B and 9.00% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units:

Period | Cash Distributions Per Unit | Total Cash Distributions | Record Date | Payment Date | ||||||||

(Thousands of Dollars) | ||||||||||||

Series A Preferred Units: | ||||||||||||

June 15, 2018 - September 14, 2018 | $ | 0.53125 | $ | 4,813 | September 4, 2018 | September 17, 2018 | ||||||

March 15, 2018 - June 14, 2018 | $ | 0.53125 | $ | 4,813 | June 1, 2018 | June 15, 2018 | ||||||

December 15, 2017 - March 14, 2018 | $ | 0.53125 | $ | 4,813 | March 1, 2018 | March 15, 2018 | ||||||

Series B Preferred Units: | ||||||||||||

June 15, 2018 to September 14, 2018 | $ | 0.47657 | $ | 7,339 | September 4, 2018 | September 17, 2018 | ||||||

March 15, 2018 to June 14, 2018 | $ | 0.47657 | $ | 7,339 | June 1, 2018 | June 15, 2018 | ||||||

December 15, 2017 to March 14, 2018 | $ | 0.47657 | $ | 7,339 | March 1, 2018 | March 15, 2018 | ||||||

Series C Preferred Units: | ||||||||||||

June 15, 2018 to September 14, 2018 | $ | 0.56250 | $ | 3,881 | September 4, 2018 | September 17, 2018 | ||||||

March 15, 2018 to June 14, 2018 | $ | 0.56250 | $ | 3,881 | June 1, 2018 | June 15, 2018 | ||||||

November 30, 2017 - March 14, 2018 | $ | 0.65625 | $ | 4,528 | March 1, 2018 | March 15, 2018 | ||||||

Allocations of Net Income

Our partnership agreement sets forth the calculation to be used to determine the amount and priority of cash distributions that the unitholders will receive and, prior to the Merger, the general partner received. The partnership agreement also contains provisions for the allocation of net income to the unitholders and, prior to the Merger, to the general partner. Our net income for each quarterly reporting period is first allocated to the preferred limited partner unitholders in an amount equal to the earned distributions for the respective reporting period and, prior to the Merger, then to the general partner in an amount equal to the general partner’s incentive distribution calculated based upon the declared distribution for the respective reporting period. Prior to the Merger, we allocated the remaining net income or loss among the common unitholders (98%) and general partner (2%), as set forth in our partnership agreement.

The following table details the calculation of net income applicable to the general partner:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(Thousands of Dollars, Except Percentage Data) | |||||||||||||||

Net income | $ | 29,399 | $ | 26,250 | $ | 155,532 | $ | 84,190 | |||||||

Less preferred limited partner interest | 16,245 | 9,950 | 32,235 | 14,763 | |||||||||||

Less general partner incentive distribution | — | 10,912 | — | 23,824 | |||||||||||

Net income after preferred limited partner interest and general partner incentive distribution | 13,154 | 5,388 | 123,297 | 45,603 | |||||||||||

General partner interest allocation | 2 | % | 2 | % | 2 | % | 2 | % | |||||||

General partner interest allocation of net income | 263 | 108 | 2,466 | 912 | |||||||||||

General partner incentive distribution | — | 10,912 | — | 23,824 | |||||||||||

Net income applicable to general partner | $ | 263 | $ | 11,020 | $ | 2,466 | $ | 24,736 | |||||||

22

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Accumulated Other Comprehensive Income (Loss)

The balance of and changes in the components included in AOCI were as follows:

Foreign Currency Translation | Cash Flow Hedges | Pension and Other Postretirement Benefits | Total | ||||||||||||

(Thousands of Dollars) | |||||||||||||||

Balance as of January 1, 2018 | $ | (51,603 | ) | $ | (24,304 | ) | $ | (9,020 | ) | $ | (84,927 | ) | |||

Other comprehensive (loss) income: | |||||||||||||||

Other comprehensive (loss) income before reclassification adjustments | (6,379 | ) | 22,527 | — | 16,148 | ||||||||||

Net gain on pension costs reclassified into other income, net | — | — | (407 | ) | (407 | ) | |||||||||

Net loss on cash flow hedges reclassified into interest expense, net | — | 2,552 | — | 2,552 | |||||||||||

Other | 60 | — | (50 | ) | 10 | ||||||||||

Other comprehensive (loss) income | (6,319 | ) | 25,079 | (457 | ) | 18,303 | |||||||||

Balance as of June 30, 2018 | $ | (57,922 | ) | $ | 775 | $ | (9,477 | ) | $ | (66,624 | ) | ||||

13. REVENUE FROM CONTRACTS WITH CUSTOMERS

Transition

On January 1, 2018, we adopted Accounting Standards Codification Topic 606, “Revenue from Contracts with Customers”

(ASC Topic 606) using the modified retrospective method and applying ASC Topic 606 to all revenue contracts with customers. Results for reporting periods beginning after January 1, 2018 are presented under ASC Topic 606. In accordance with the modified retrospective approach, prior period amounts were not adjusted and are reported under ASC Topic 605, “Revenue Recognition.” The adoption of ASC Topic 606 affected our consolidated statements of comprehensive income as follows:

As Reported | Without Adoption of ASC Topic 606 | Effect of Change Higher/(Lower) | |||||||||

(Thousands of Dollars, Except Per Unit Data) | |||||||||||

For the three months ended June 30, 2018: | |||||||||||

Revenues | $ | 486,204 | $ | 484,646 | $ | 1,558 | |||||

Operating income | $ | 79,838 | $ | 78,280 | $ | 1,558 | |||||

Net income | $ | 29,399 | $ | 27,841 | $ | 1,558 | |||||

Basic net income per common unit | $ | 0.15 | $ | 0.13 | $ | 0.02 | |||||

For the six months ended June 30, 2018: | |||||||||||

Revenues | $ | 962,085 | $ | 966,432 | $ | (4,347 | ) | ||||

Operating income | $ | 178,318 | $ | 182,665 | $ | (4,347 | ) | ||||

Net income | $ | 155,532 | $ | 159,879 | $ | (4,347 | ) | ||||

Basic net income per common unit | $ | 1.30 | $ | 1.34 | $ | (0.04 | ) | ||||

Revenue-Generating Activities

Revenues for the pipeline segment are derived from interstate and intrastate pipeline transportation of refined products, crude oil and anhydrous ammonia and the applicable pipeline tariff.

Revenues for the storage segment include fees for tank storage agreements, whereby a customer agrees to pay for a certain amount of storage in a tank over a period of time (storage terminal revenues), and throughput agreements, whereby a customer pays a fee per barrel for volumes moving through our terminals (throughput terminal revenues). Our terminals also provide blending, additive injections, handling and filtering services for which we charge additional fees, and certain of our facilities charge fees to provide marine services such as pilotage, tug assistance, line handling, launch service, emergency response services and other ship services (all of which are considered optional services).

23

NUSTAR ENERGY L.P. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Revenues for the fuels marketing segment are derived from the sale of petroleum products.

Within our pipeline and storage segments, we provide services on an uninterruptible and interruptible basis. Uninterruptible services within our pipeline segment typically result from contracts that contain take-or-pay minimum volume commitments (MVCs) from the customer. Contracts with MVCs obligate the customer to pay for that minimum amount. If a customer fails to meet its MVC for the applicable service period, the customer is obligated to pay a deficiency fee based upon the shortfall between the actual volumes transported or stored and the MVC for that service period (deficiency payments). In exchange, those contracts with MVCs obligate us to stand ready to transport volumes up to the customer’s MVC.

Within our storage segment, uninterruptible services arise from contracts containing a fixed monthly fee for the portion of storage capacity reserved by the customer. These contracts require that the customer pay the fixed monthly fee, regardless of whether or not it uses our storage facility (i.e., take-or-pay obligation), and that we stand ready to store that volume.

Interruptible services within our pipeline and storage segments are generally provided when and to the extent we determine the requested capacity is available. The customer typically pays a per-unit rate for the actual quantities of services it receives.

Revenue Recognition