Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LILIS ENERGY, INC. | form8kearningspresentation.htm |

Second Quarter 2018 Earnings Presentation August 10, 2018 NYSE American | LLEX

Disclaimer This presentation contains forward-looking statements. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward-looking statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward-looking information. The identification in this presentation of factors that may affect Lilis’ future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. These forward-looking statements are given only as of the date of this presentation. Except as required by law, we do not intend, and undertake no obligations to update any forward -looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. These forward-looking statements include, among other things, statements about Lilis’ expectations, beliefs, intentions or business strategies for the future, statements concerning Lilis’ outlook with regard to the timing and amount of future production of oil, natural gas liquids and natural gas, price realizations, the nature and timing of capital expenditures for exploration and development, plans for funding operations and drilling program capital expenditures, the timing and success of specific projects, operating costs and other expenses, proved oil and natural gas reserves, liquidity and capital resources, outcomes and effects of litigation, claims and disputes and derivative activities. Factors that could cause Lilis’ actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: the success of Lilis’ exploration and development efforts; the price of oil, gas and other produced gases and liquids; the worldwide economic situation; changes in interest rates or inflation; the ability of Lilis to transport gas, oil and other products; the ability of Lilis to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; Lilis’ capital costs, which may be affected by delays or cost overruns; cost of production; environmental and other regulations, as the same presently exist or may later be amended; Lilis’ ability to identify, finance and integrate any future acquisitions; and the volatility of Lilis’ stock price. See the risks discussed in Lilis’ Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. RECONCILIATION OF NET INCOME TO EBITDAX (UNAUDITED) EBITDAX (as defined below) is presented herein and reconciled from the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator. The Company defines EBITDAX as net income, plus (1) exploration and abandonments expense, (2) depreciation, depletion and amortization expense, (3) accretion of discount on asset retirement obligations expense, (4) non-cash stock-based compensation expense, (5) (gain) loss on derivatives, (6) net cash receipts from (payments on) derivatives, (7) gain on disposition of assets, net, (8) interest expense, (9) loss on extinguishment of debt, (10) gain on equity method investment distribution and (11) federal and state income tax expense. EBITDAX is not a measure of net income or cash flows as determined by GAAP. The Company’s EBITDAX measure provides additional information which may be used to better understand the Company’s operations. EBITDAX is one of several metrics that the Company uses as a supplemental financial measurement in the evaluation of its business and should not be considered as an alternative to, or more meaningful than, net income as an indicator of operating performance. Certain items excluded from EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic cost of depreciable and depletable assets. EBITDAX, as used by the Company, may not be comparable to similarly titled measures reported by other companies. The Company believes that EBITDAX is a widely followed measure of operating performance and is one of many metrics used by the Company’s management team and by other users of the Company’s consolidated financial statements. For example, EBITDAX can be used to assess the Company’s operating performance and return on capital in comparison to other independent exploration and production companies without regard to financial or capital structure, and to assess the financial performance of the Company’s assets and the Company without regard to capital structure or historical cost basis. Strictly Private and Confidential

Lilis Energy Financial & Operational Highlights ▪ Current production exceeds 7,300 Boe/d ▪ Year-end target exit rate of 8,000 Boe/d ▪ Second quarter production of 5,297 Boe/d(1) and pro forma production of 6,369(2) ▪ Production increased by 210% year-over-year ▪ Proved Reserves increased by 228% since December 31, 2017 ▪ Strong well results from the Company’s Wolfcamp A, B and XY and 3rd Bone Spring ▪ Liquidity increased by $55 million (without dilution) through executing crude gathering and water gathering and disposal contracts, including $20 million to be received in the third quarter ▪ Infrastructure for crude oil, gas, and water fully in place: – June 1 – February 28, 2019 – 100% of oil production at lease via truck – March 1 – June 30, 2019 – 5,000 Bbl/d firm takeaway – July 1, 2019 at Gulf Coast pricing for 6,000 Bbl/d in year 1 and 5,000 Bbl/d for next 4 years – Firm transportation for natural gas in place ▪ Executed acreage swaps increasing the Company’s working interest and net revenue Lilis Acreage interest to approximately 100%, as well as PDP and PUD reserves ▪ Owned and committed acreage exceeds 22,000 acres Centennial / GMT Exploration* ▪ Capex in second half of 2018 is focused exclusively on 1.5 mile laterals with higher IRRs Concho Resources / RSP Permian* Concho Resources / Endurance* (1) Production is reported as 4,805 Boe/d in the 10Q due to a transitory working interest adjustment Oasis Petroleum / Forge Energy* (2) Pro forma production for 2’Q18 is 5,297 Boe/d plus adjustments of (i) 590 Boe/d of curtailment due to upgrades and maintenance shut-ins and (ii) 482 Boe/d from recently executed acreage swaps, results in production of 6,369 Boe/d * Select recent Delaware Basin acquisitions 3

Infrastructure - Crude and Natural Gas Takeaway in Place Flow assurance and firm takeaway Lilis Acreage ▪ Secured cost-effective movement of Lilis’ oil production in Texas and New Mexico, to Wink, Texas for transport via long- Lea haul pipeline(s) to the Gulf Coast New Mexico ▪ Executed five and a half-year agreement, commencing Texas second-half 2019, securing firm takeaway and Gulf Coast pricing Loving Winkler – Average Differential: Magellan East Houston (MEH) less approximately $5.50 over life of agreement – Firm, long-haul, transportation of 5,000-6,000 Bbl/d – Flexibility to expand capacity during the term of ✓ agreement Mar. 2018 LLEX announces third- party midstream ✓ Aug. 2018 – 100% CAPEX borne by Gatherer solution to meet LLEX announces firm ▪ current and future gas takeaway to Gulf Firm transportation for natural gas and NGLs transportation needs Coast (MEH) with Salt Creek Midstream for – Gatherer has secured sufficient firm takeaway to handle ✓ Jul. 2018 crude starting July 2019 100% of Lilis’ gas and NGL production LLEX announces Water Gathering and Disposal agreement – Natural gas pricing at Waha with SCM Water – NGL pricing at Mont Belvieu 4

Infrastructure – Crude Gathering & Water Disposal Enhancing Shareholder Value Securing crude oil gathering / transportation and water gathering / disposal agreements will significant savings over the life of the agreements. Pro-forma Savings: Existing Cost Basis Negotiated Cost Basis Crude Gathering $5.15 / Bbl trucking $0.75 / Bbl Gathering Fee on crude gathering system Water Gathering and ~$2.00-$4.00 / Bbl trucking; or, $0.485 / Bbl on Gathering and Disposal Fee on water Disposal $1.08 / Bbl via pipeline gathering and disposal system Crude Firm Transport 100% produced crude under sales Firm takeaway (6k Bbl/d from Jul/19 – Jun/20; 5k Bbl/d and Pricing agreement through Feb/19 applying from Jul/20 – Dec/24) applying Magellan East Houston Mid-Cush differential to NYMEX WTI differential to NYMEX WTI and fixed transportation deduct ($5.85 / Bbl from Jul/19 – Jun/20; $5.54 / Bbl from Jul/20 – Dec/24) Cost Savings per Year1 $12.00 Savings of Savings of $10.00 $8.2 million $8.5 million per year $8.00 per year $6.00 $4.00 $2.00 $- Crude Gathering Water Existing Future Solution 1) Assumes oil of 5,000 Bbl / day and water of 15,000 Bbl/d; using exit rate of 8,000 Boe / d, 63% oil, and 3:1 water to oil ratio 5

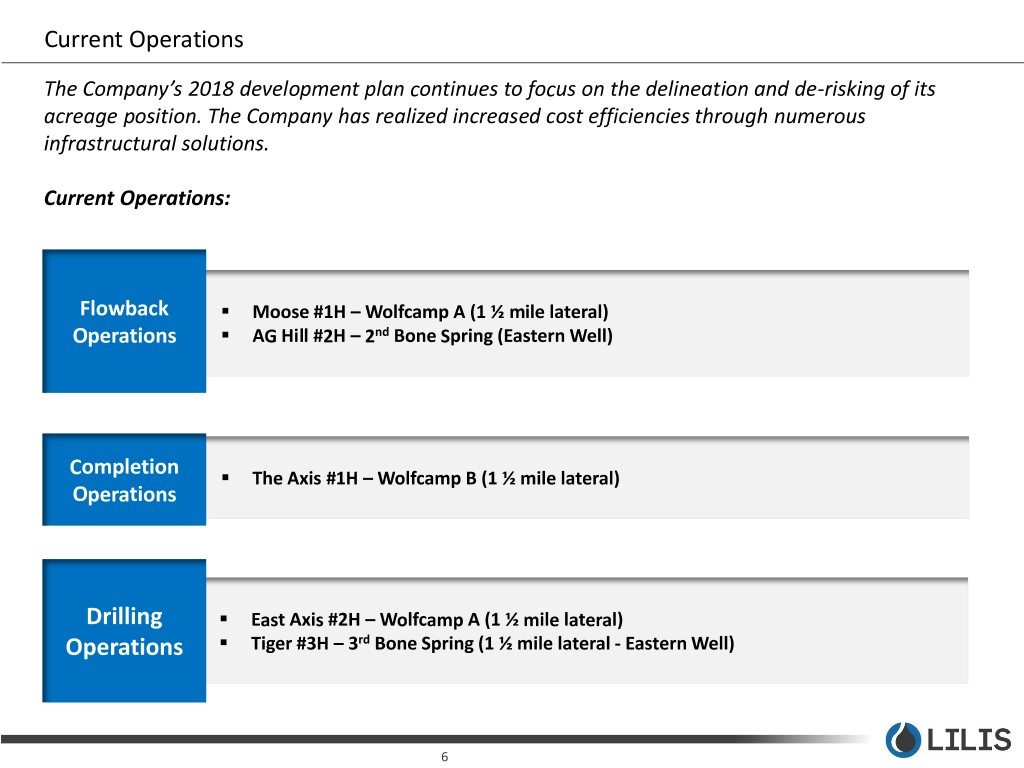

Current Operations The Company’s 2018 development plan continues to focus on the delineation and de-risking of its acreage position. The Company has realized increased cost efficiencies through numerous infrastructural solutions. Current Operations: Flowback ▪ Moose #1H – Wolfcamp A (1 ½ mile lateral) Operations ▪ AG Hill #2H – 2nd Bone Spring (Eastern Well) Completion ▪ The Axis #1H – Wolfcamp B (1 ½ mile lateral) Operations Drilling ▪ East Axis #2H – Wolfcamp A (1 ½ mile lateral) ▪ Operations Tiger #3H – 3rd Bone Spring (1 ½ mile lateral - Eastern Well) 6

Recent Well Results Overview and Statistics Location Map ➢ The first well drilled by Lilis in the Wolfcamp XY, in New Mexico further validating the Wolfcamp XY in Lilis’ eastern Wildhog #2H - WCXY: New Mexico acreage ➢ Lilis’ highest recorded Wolfcamp B (2,149 IP per 1,000 ft.) well drilled to date, and also the highest recorded Hippo #2H – WCB: Wolfcamp B (IP per 1,000 ft) well among the Company’s offset producers in the Delaware Basin ➢ The first Wolfcamp XY well drilled by Lilis and one of the top two performing wells in the Wolfcamp XY in the Meerkat #1H – WCXY: surrounding area ➢ The furthest eastern well drilled on the Company’s acreage provides additional validation of the prolific nature of the AG Hill #1H – WCB: Company’s eastern acreage ➢ The first Wolfcamp A well drilled by Lilis in New Mexico, registering the highest IP 24 rate (1,825 IP per 1,000 ft.) the Prizehog #2H – WCA: Company has completed in New Mexico to date ➢ The furthest eastern well drilled by the Company in the Wolfcamp XY, validating additional bench in the Company’s Howell #1H – WCXY: eastern acreage ➢ The first Bone Spring well drilled by Lilis in Texas, completed in the 3rd Bone Spring, confirming an additional viable Antelope #1H – 3RD BS: bench 7

Condensed Consolidated Statement of Operations - Unaudited For Three Months Ended For Six Months Ended June 30, June 30, 2018 2017 2018 2017 ($ in thousands except per share data) Oil and gas revenue $ 17,483 $ 5,305 $ 31,878 $ 8,387 Operating expenses Production costs 2,670 1,097 5,760 1,927 Gathering, processing and transportation 872 338 1,334 437 Production taxes 1,135 278 2,158 420 General and administrative 7,380 16,169 17,844 25,329 Depreciation, depletion, amortization and accretion 5,759 1,358 10,400 2,504 Total operating expenses 17,816 19,240 37,496 30,617 Operating income (loss) (333) (13,935) (5,618) (22,230) Other income (expense) Other income (expense) — (141) 1 (133) Loss from commodity derivative (2,802) — (4,572) ) — Fair value change in derivative instruments (19,501) (2,418) 8,887 (2,114) Interest expense (8,572) (6,654) (17,660) (7,427) Total other income (expense) (30,875) (9,213) (13,344) (9,674) Net income (loss) before income tax (31,208) (23,148) (18,962) (31,904) Dividends on redeemable 6% preferred stock — (92) (4,117) — Dividends and deemed dividends on Series B convertible preferred stock — (4,422) — (122) Dividends on Series C convertible preferred stock (2,465) — — (4,635) Net income (loss) $ (33,673 ) $ (27,662 ) $ (23,079) $ (36,661 ) Basic and diluted income (loss) per share $ (0.53 ) $ (0.62 ) $ (0.40) $ (1.70 ) Weighted average common shares outstanding 64,098,309 44,332,270 57,801,098 34,282,784 8

Capitalization & Liquidity - Unaudited Pro forma liquidity at 6/30/18 was $47.4 million • Liquidity will be bolstered by the following in the third quarter: – $20 million cash payment from the recently announced water gathering and disposal agreement – Expected closing of a reserve based revolving credit facility in the third quarter further increases liquidity – Liquidity sufficient to meet D&C Capex program in 2018 – Cash flow neutrality expected in early 2019 ($ in thousands) 6/30/2018 Cash $ 27,398 1 First Lien Term Loan 50,000 Second Lien Term Loan 162,189 Total Debt $ 212,189 Series C Convertible Preferred Stock 97,506 Other Equity (22,911) Total Shareholders Equity $ 74,595 Total Capitalization $ 286,784 1) Excludes $20 million of additional cash to be received from the water disposal agreement in the third quarter 9

Adjusted EBTIDAX and Adjusted Earnings Per Share - Unaudited The following table provides a reconciliation of the GAAP measure of net income to EBITDAX (non-GAAP) for the periods indicated, please see first page Disclaimer: Three Months Ended Six Months Ended June 30, June 30, EBITDAX Reconciliation: 2018 2017 2018 2017 ($ in thousands except per share data) Net loss $ (31,208) $ (23,148) $ (18,962) $ (31,903) Equity instruments issued as compensation (non-cash) 2,524 6,607 5,554 9,386 Interest expense 8,572 6,653 17,660 7,427 Depreciation, depletion, accretion and amortization 5,759 1,358 10,400 2,504 Loss from fair value changes of conditionally redeemable 6% preferred stock - 41 - 41 Gain from fair value changes of debt conversion and warrant derivatives 19,501 2,418 (8,887) 2,072 Loss from commodity derivatives, net 2,803 - 4,572 - Net cash settlement paid for commodity derivative contracts (1,195) - (1,710) - Other income (0) 142 (1) 134 Non-recurring cash G&A expenses 1,497 2,119 4,104 8,785 Adjusted EBITDAX $ 8,252 $ (3,810) $ 12,730 $ (1,555) Curtailment and other adjustments 2,997 - 2,997 - Acreage swap pro forma adjustment 1,449 - 1,449 - Pro Forma EBITDAX $ 12,698 $ (3,810) $ 17,176 $ (1,555) Earnings per Share Reconciliation: Net loss (31,208) (23,148) (18,962) (31,903) Preferred stock dividends (2,465) (4,464) (4,117) (4,464) Net loss attributable to common stockholders $ (33,673) $ (27,612) $ (23,079) $ (36,661) Loss from fair value changes of conditionally redeemable 6% preferred stock - 41 - 41 Gain from fair value changes of debt conversion and warrant derivatives 19,501 2,418 (8,887) 2,072 Loss from commodity derivatives, net 2,803 - 4,572 - Net cash settlement paid for commodity derivative contracts (1,195) - (1,710) - Other income * (0) 142 (1) 134 Non-recurring cash G&A expenses 1,497 2,119 4,104 8,785 Adjusted Net Income (Loss) $ (11,067) $ (22,892) $ (25,001) $ (25,629) Weighted Average Common Shares 64,098,309 44,332,270 57,801,098 34,282,784 Adjusted Earnings per Common Share $ (0.17) $ (0.52) $ (0.43) $ (0.75) *Earnings per Common Share is adjusted for non-cash, changes of debt conversion and warrant derivatives 10

Wobbe Ploegsma VP of Finance & Capital Markets ir@lilisenergy.com 210.999.5400 NYSE American | LLEX