Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 EARNINGS RELEASE Q2-18 - CrossAmerica Partners LP | capl-ex991_6.htm |

| 8-K - 8-K EARNINGS RELEASE Q2-18 - CrossAmerica Partners LP | capl-8k_20180806.htm |

August 2018 Second Quarter 2018 Earnings Call Exhibit 99.2

Safe Harbor Statement Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s Forms 10-Q or Form 10-K filed with the Securities and Exchange Commission and available on CrossAmerica’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise.

CrossAmerica Business Overview Gerardo Valencia, CEO & President

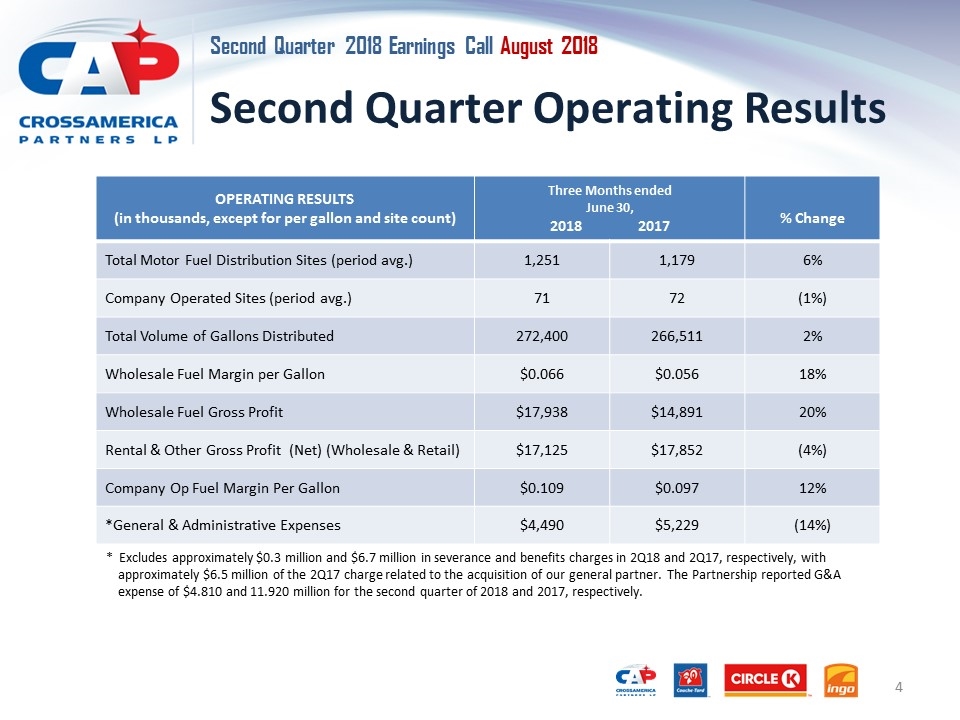

Second Quarter Operating Results OPERATING RESULTS (in thousands, except for per gallon and site count) Three Months ended June 30, 2018 2017 % Change Total Motor Fuel Distribution Sites (period avg.) 1,251 1,179 6% Company Operated Sites (period avg.) 71 72 (1%) Total Volume of Gallons Distributed 272,400 266,511 2% Wholesale Fuel Margin per Gallon $0.066 $0.056 18% Wholesale Fuel Gross Profit $17,938 $14,891 20% Rental & Other Gross Profit (Net) (Wholesale & Retail) $17,125 $17,852 (4%) Company Op Fuel Margin Per Gallon $0.109 $0.097 12% *General & Administrative Expenses $4,490 $5,229 (14%) * Excludes approximately $0.3 million and $6.7 million in severance and benefits charges in 2Q18 and 2Q17, respectively, with approximately $6.5 million of the 2Q17 charge related to the acquisition of our general partner. The Partnership reported G&A expense of $4.810 and 11.920 million for the second quarter of 2018 and 2017, respectively.

Second Quarter Highlights Strong base business Strong Base Business – Growth of Gross Profit by 6% Wholesale Segment - Overall Gross Profit Increased 6%; Operating Expenses Declined 9% Retail Segment - Overall Gross Profit Increased 5%, Motor Fuel Gross Profit Increased 22% Disciplined Cost Control and Synergies Excluding severance and benefit charges, G&A expenses declined 14% from Second Quarter 2017 to Second Quarter 2018 Fuel Distribution Synergies approaching $1m 2018 YTD Performance of Jet-Pep Assets Integration has continued and improvement to supply chain and fuel programs is occurring Pricing and Operational Capabilities Future Brand will provide further improvements

Second Quarter Highlights Strengthening for growth Applegreen in Florida - 43 locations Investment to bring a world class convenience retail operator and developer Applegreen will operate over 60 CrossAmerica locations by end of 2018 Adjusted EBITDA growth despite of omnibus cash payment Increased Adjusted EBITDA 2% from Second Quarter 2017 to Second Quarter 2018 despite change in omnibus agreement payment in cash Strategic Progress Continuing to progress portfolio alignment and evaluating transaction with our General Partner Actively progressing fuel synergies through strategic supplier collaborations. Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

CrossAmerica Financial Overview Evan Smith, Chief Financial Officer

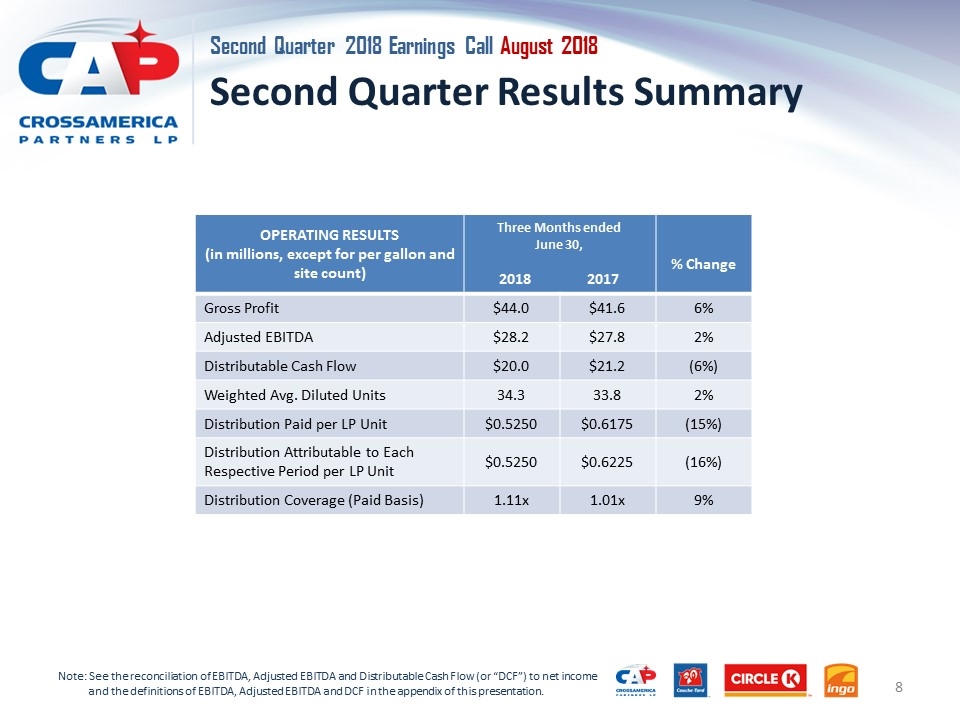

Second Quarter Results Summary OPERATING RESULTS (in millions, except for per gallon and site count) Three Months ended June 30, 2018 2017 % Change Gross Profit $44.0 $41.6 6% Adjusted EBITDA $28.2 $27.8 2% Distributable Cash Flow $20.0 $21.2 (6%) Weighted Avg. Diluted Units 34.3 33.8 2% Distribution Paid per LP Unit $0.5250 $0.6175 (15%) Distribution Attributable to Each Respective Period per LP Unit $0.5250 $0.6225 (16%) Distribution Coverage (Paid Basis) 1.11x 1.01x 9% Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Capital Strength and Quarterly Transactions Leverage, as defined under our credit facility, was 4.38X as of June 30, 2018 Maintain Distribution Rate Distribution rate of $0.5250 per unit ($2.10 per unit annualized) attributable to the second quarter of 2018 Improved coverage ratio to 1.11 times in 2Q18 from 1.01 times in 2Q17 Agreement with Applegreen We will transition 43 sites in Florida from DMS in the third and fourth quarters Agreements have an initial 10-year term with four 5-year renewal options In 2Q18, we accrued a $3.8 million contract termination payment expected to be paid in 3Q18 and a $2.2 million non-cash charge to write off deferred rent income Payment was approved by the independent conflicts committee of our Board Further develops a strategic relationship with a world class convenience retail operator and developer that is looking to grow its footprint in the U.S. and that delivers an exceptional customer experience Circle K’s Acquisition of Holiday Required to divest nine sites in connection with Circle K’s acquisition Circle K to compensate us for the forced divestiture We anticipate Circle K’s payment will be made once the FTC has approved the third party buyers

Appendix Second Quarter 2018 Earnings Call

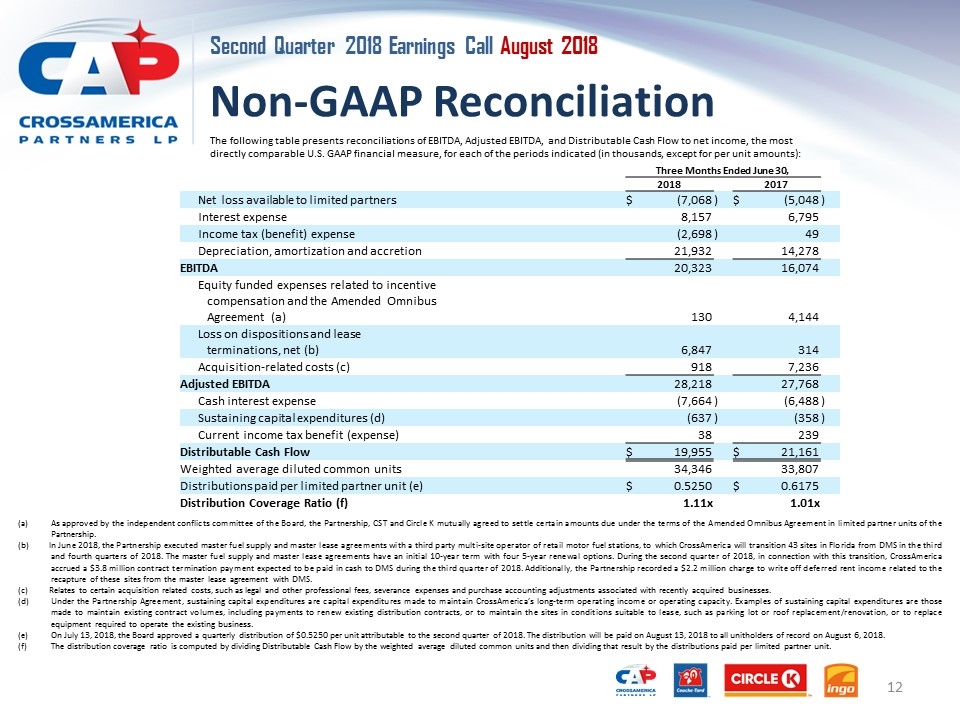

Non-GAAP Financial Measures Non-GAAP Financial Measures We use non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income available to us before deducting interest expense, income taxes and depreciation, amortization and accretion. Adjusted EBITDA represents EBITDA as further adjusted to exclude equity funded expenses related to incentive compensation and the Amended Omnibus Agreement, gains or losses on dispositions and lease terminations, certain acquisition related costs, such as legal and other professional fees and severance expenses associated with recently acquired companies, and certain other non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax expense. Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by the weighted average diluted common units and then dividing that result by the distributions paid per limited partner unit. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess our financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess the operating performance of our business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of our retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess the ability to generate cash sufficient to make distributions to our unit-holders. We believe the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing the financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in our industry, our definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Non-GAAP Reconciliation The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts): Three Months Ended June 30, 2018 2017 Net loss available to limited partners $ (7,068 ) $ (5,048 ) Interest expense 8,157 6,795 Income tax (benefit) expense (2,698 ) 49 Depreciation, amortization and accretion 21,932 14,278 EBITDA 20,323 16,074 Equity funded expenses related to incentive compensation and the Amended Omnibus Agreement (a) 130 4,144 Loss on dispositions and lease terminations, net (b) 6,847 314 Acquisition-related costs (c) 918 7,236 Adjusted EBITDA 28,218 27,768 Cash interest expense (7,664 ) (6,488 ) Sustaining capital expenditures (d) (637 ) (358 ) Current income tax benefit (expense) 38 239 Distributable Cash Flow $ 19,955 $ 21,161 Weighted average diluted common units 34,346 33,807 Distributions paid per limited partner unit (e) $ 0.5250 $ 0.6175 Distribution Coverage Ratio (f) 1.11x 1.01x (a)As approved by the independent conflicts committee of the Board, the Partnership, CST and Circle K mutually agreed to settle certain amounts due under the terms of the Amended Omnibus Agreement in limited partner units of the Partnership. (b) In June 2018, the Partnership executed master fuel supply and master lease agreements with a third party multi-site operator of retail motor fuel stations, to which CrossAmerica will transition 43 sites in Florida from DMS in the third and fourth quarters of 2018. The master fuel supply and master lease agreements have an initial 10-year term with four 5-year renewal options. During the second quarter of 2018, in connection with this transition, CrossAmerica accrued a $3.8 million contract termination payment expected to be paid in cash to DMS during the third quarter of 2018. Additionally, the Partnership recorded a $2.2 million charge to write off deferred rent income related to the recapture of these sites from the master lease agreement with DMS. (c) Relates to certain acquisition related costs, such as legal and other professional fees, severance expenses and purchase accounting adjustments associated with recently acquired businesses. (d)Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain CrossAmerica’s long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes, including payments to renew existing distribution contracts, or to maintain the sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business. (e)On July 13, 2018, the Board approved a quarterly distribution of $0.5250 per unit attributable to the second quarter of 2018. The distribution will be paid on August 13, 2018 to all unitholders of record on August 6, 2018. (f)The distribution coverage ratio is computed by dividing Distributable Cash Flow by the weighted average diluted common units and then dividing that result by the distributions paid per limited partner unit.