Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AVADEL PHARMACEUTICALS PLC | q22018earningsrelease.htm |

| 8-K - 8-K - AVADEL PHARMACEUTICALS PLC | avadel_8kx20180807.htm |

Second Quarter 2018 Earnings Conference Call August 7, 2018

Safe Harbor This presentation may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “will,” “may,” “believe,” “expect,” “anticipate,” “estimate,” “project” and similar expressions, and the negatives thereof, identify forward-looking statements, each of which speaks only as of the date the statement is made. Although we believe that our forward-looking statements are based on reasonable assumptions within the bounds of our knowledge of our business and operations, our business is subject to significant risks and as a result there can be no assurance that actual results of our research, development and commercialization activities and our results of operations will not differ materially from the results contemplated in such forward-looking statements. These risks include: (i) risks relating to our exchangeable senior notes including use of the net proceeds from the offering of the notes and other future events related to the notes; (ii) risks relating to the divestiture of our former pediatric business including whether such divestiture will be accretive to our operating income and cash flow; (iii) risks relating to our license agreement with Serenity Pharmaceuticals, LLC including that our internal analyses may overstate the market opportunity in the United States for the drug desmopressin acetate (the “Drug”) or we may not effectively exploit such market opportunity, that significant safety or drug interaction problems could arise with respect to the Drug, that we may not successfully increase awareness of nocturia and the potential benefits of the Drug, and that the need for management to focus attention on the development and commercialization of the Drug could cause our ongoing business operations to suffer; and (iv) the other risks, uncertainties and contingencies described in the Company's filings with the U.S. Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2017, in particular disclosures that may be set forth in particular under the captions “Forward-Looking Statements” and “Risk Factors,” including without limitation: our dependence on a small number of products and customers for the majority of our revenues; the possibility that our Bloxiverz®,Vazculep® and Akovaz® products, which are not patent protected, could face substantial competition resulting in a loss of market share or forcing us to reduce the prices we charge for those products; the possibility that we could fail to successfully complete the research and development for pipeline products we are evaluating for potential application to the FDA pursuant to our "unapproved-to-approved" strategy, or that competitors could complete the development of such products and apply for FDA approval of such products before us; the possibility that our products may not reach the commercial market or gain market acceptance; our need to invest substantial sums in research and development in order to remain competitive; our dependence on certain single providers for development of several of our drug delivery platforms and products; our dependence on a limited number of suppliers to manufacture our products and to deliver certain raw materials used in our products; the possibility that our competitors may develop and market technologies or products that are more effective or safer than ours, or obtain regulatory approval and market such technologies or products before we do; the challenges in protecting the intellectual property underlying our drug delivery platforms and other products; and our dependence on key personnel to execute our business plan. 2

2Q 2018 Call Outline I. Opening remarks II. REST-ON Phase III trial I. Enrollment II. Protocol amendment III. Initiatives & new sites III. NOCTIVA™ launch update I. Demand, prescribers, and awareness II. Coverage progress III. Life cycle management IV. Financial Results 3

2Q 2018 Overview Akovaz® • Hospital products have Total provided cash to transition Hospital Products company from drug delivery to Bloxiverz® Revenue specialty pharma $29M • Major long-term value opportunities with NOCTIVA Urology Vazculep® and FT 218 (investigational) • 4th hospital product (AV 001) will add to top line in 2020 NOCTIVA™ 4

REST-ON Phase III Trial 5

REST-ON Status Update Enrollment Progress Total Needed Enrolled • Majority of patients from US and Canada • Only fully operation in US since 2Q 2017 due to site initiation delays in part from: • DEA licensing procedural change 264 • Delayed IRB approval • Additional sites & enrollment initiatives is expected to improve second half of enrollment 6

Protocol Change • Prior to June 2018, patients had to be naïve to sodium oxybate • New protocol admits patients with limited past use of sodium oxybate who meet the following criteria: Dose of sodium Duration on drug At least one year Initial review, via online oxybate never for no more than 2 since past exposure screening tool, provided exceeded 4.5 g weeks to sodium oxybate +100 patients to contact to gather past use of sodium oxybate 7

REST-ON Status Update Majority of patients enrolled to date from US and Canada Only fully operation in US since 2Q 2017 7 new US sites in US & 3 Australian sites to be initiated over next few months 16 total sites to open by Q1 2019 Specific site closures pending 8

REST-ON Status Update High awareness for FT 218 & REST-ON: over 2,000 online screening questionnaires completed Almost 50% of patients discontinue sodium oxybate within 12 months - recent data suggests ~27% patients non-compliant with 2nd dose1 Qualitative market research shows physician preference for 1x-nightly sodium oxybate over 2x-low sodium and generics is, on average, greater than 50%2 Continue to raise awareness for REST-ON trial and 1x – nightly sodium oxybate 1. Data on file 2. Data on file 9

NOCTIVA™ Launch Update 10

NOCTIVA™: 2018 Revenue Guidance Updated full year 2018 revenue guidance: $5 - $10 million Net revenue realized a function of: • Mix of Medicare Part D to commercial insurance plans – no preferred brand Part D coverage to date • Commercial copay assistance for non-preferred brand status plans Over 2,600 prescriptions from more than 1,000 unique prescribers > 50% patients Medicare Part D 70% success rate of getting Part D patients on treatment via specialty pharmacy partner “cash pay” program 11

NOCTIVA™: Increasing Awareness 1st >10 % To market in Have nocturia and Less than 10% are Over 60% unaided indication never wake 2 or more diagnosed and brand awareness, before approved times per night to being treated2-8 up from 15%, in 2 urinate1 months promotion 1. Bosch JLH, Weiss JP. The prevalence and causes of nocturia. J Urol. 2010;184(2):440-446. 2. QuintilesIMS Secondary Research. 3. Lee LK, Goren A, Zou KH, et al. Potential benefits of diagnosis and treatment on health outcomes among elderly people with symptoms of overactive bladder. Int J Clin Pract. 2016;70(1):66-81. 4. Decision Resources, Treatment Algorithm in OAB. 5. Vuichoud C, Loughlin KR. Benign prostatic hyperplasia: epidemiology, economics and evaluation. J Urol. 2015;22(51):1-6. 6. Helfand BT, Evans RM, McVary KT. A comparison of the frequencies of medical therapies for overactive bladder in men and women: analysis of more than 7.2 million aging patients. Eur Urol. 2010;57(4):586-591. 7. Goldman HB, Anger JT, Esinduy CB, et al. Real-world patterns of care for the overactive bladder syndrome in the United States. Urology. 2016;87:64-69. 12 8. Data on file.

NOCTIVA™: Keys to Success ➢ Increase relevance of nocturia and condition to be treated independently • Up to 9 new publications over coming months to highlight innovation of Noctiva and importance of treating nocturia ➢ Increase trial and experience for physicians and patients • Over 7,000 full-size samples in market – potential catalyst for future script growth ➢ Improve preferred brand status, especially in Medicare Part D, to increase revenue generating prescriptions 13

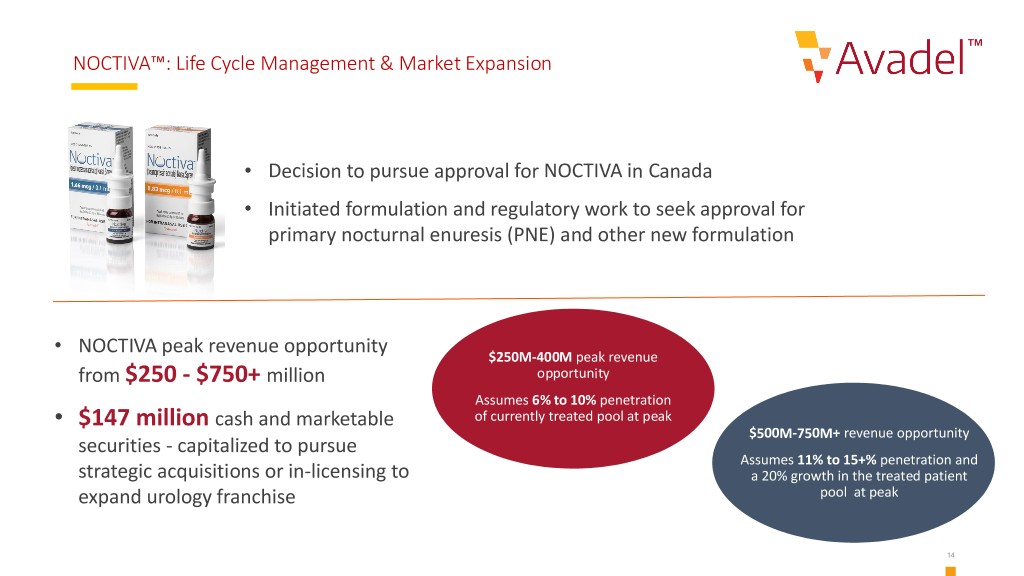

NOCTIVA™: Life Cycle Management & Market Expansion • Decision to pursue approval for NOCTIVA in Canada • Initiated formulation and regulatory work to seek approval for primary nocturnal enuresis (PNE) and other new formulation • NOCTIVA peak revenue opportunity $250M-400M peak revenue from $250 - $750+ million opportunity Assumes 6% to 10% penetration • $147 million cash and marketable of currently treated pool at peak $500M-750M+ revenue opportunity securities - capitalized to pursue Assumes 11% to 15+% penetration and strategic acquisitions or in-licensing to a 20% growth in the treated patient expand urology franchise pool at peak 14

Second Quarter 2018 Financial Results 15

Non-GAAP Financial Results Three Months Ended (in $000s, except for per share amounts 06/30/18 03/31/18 06/30/17 Total revenues $ 29,230 $ 33,293 $ 47,411 Cost of products 3,512 6,592 4,561 Research and development expenses 11,890 9,951 6,792 Selling, general and admin expenses 27,843 24,487 12,429 Operating expenses 43,245 41,030 23,782 Contingent consideration payments and accruals 5,060 5,790 8,516 Operating income (loss) (19,075) (13,527) 15,113 Investment income and other income (expense), net 478 185 527 Interest expense, net (1,617) (941) (263) Other expense - contingent consideration payments and accruals (751) (797) (1,166) Income (loss) before income taxes (20,965) (15,080) 14,211 Income tax (benefit) provision (704) (2,082) 6,046 Net income (loss) $ (20,261) $ (12,998) $ 8,165 Diluted earnings (loss) per share $ (0.55) $ (0.34) $ 0.19 Weighted average number of shares outstanding - diluted 36,772 38,559 42,487 *Reconciliations from GAAP to Non-GAAP can be found in the appendix 16

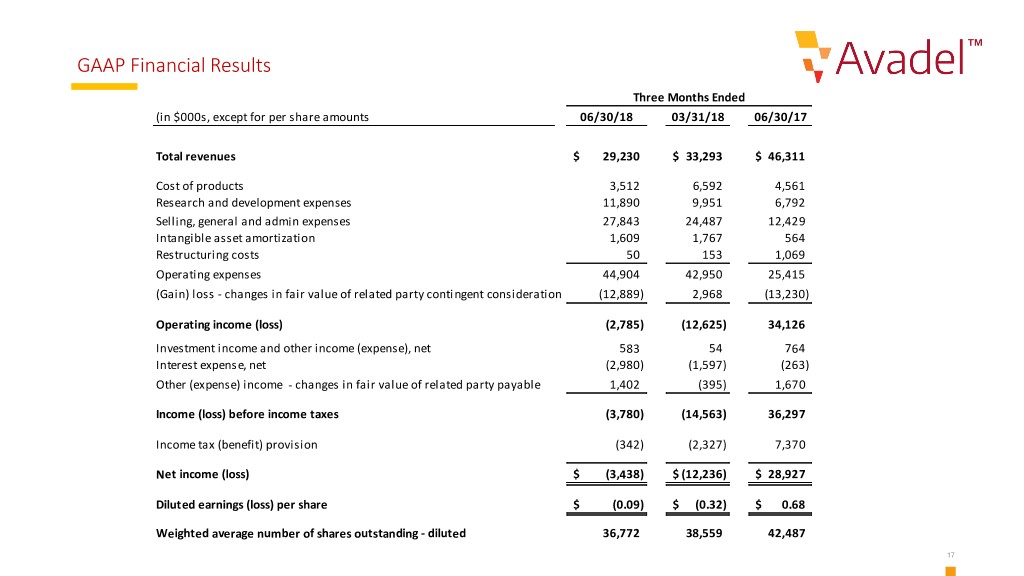

GAAP Financial Results Three Months Ended (in $000s, except for per share amounts 06/30/18 03/31/18 06/30/17 Total revenues $ 29,230 $ 33,293 $ 46,311 Cost of products 3,512 6,592 4,561 Research and development expenses 11,890 9,951 6,792 Selling, general and admin expenses 27,843 24,487 12,429 Intangible asset amortization 1,609 1,767 564 Restructuring costs 50 153 1,069 Operating expenses 44,904 42,950 25,415 (Gain) loss - changes in fair value of related party contingent consideration (12,889) 2,968 (13,230) Operating income (loss) (2,785) (12,625) 34,126 Investment income and other income (expense), net 583 54 764 Interest expense, net (2,980) (1,597) (263) Other (expense) income - changes in fair value of related party payable 1,402 (395) 1,670 Income (loss) before income taxes (3,780) (14,563) 36,297 Income tax (benefit) provision (342) (2,327) 7,370 Net income (loss) $ (3,438) $ (12,236) $ 28,927 Diluted earnings (loss) per share $ (0.09) $ (0.32) $ 0.68 Weighted average number of shares outstanding - diluted 36,772 38,559 42,487 17

Cash Flow Summary in $000's Six Months ended June 30, 2018 2017 TOTAL Cash and Marketable Securities Beginning Balance $ 94,075 $ 154,195 Operating cash flows (excl earnouts and tax payments) (24,802) 62,608 Earnout payments (12,731) (19,467) Tax Payments (409) (9,605) Total Operating Cash Flows (37,942) 33,536 Issuance of exchangeable notes, net of issuance costs 137,990 - Share repurchases (27,637) (13,081) Purchases of intangible assets (20,000) - Warrant and stock option exercises 3,446 376 Royalty payments (645) (665) Other (2,180) (564) Total Investing and Financing Cash Flows 90,974 (13,934) Total Change in Cash and Marketable Securities 53,032 19,602 Ending Balance $ 147,107 $ 173,797 18

Guidance Updated Guidance 2018 Guidance Revenue - Total $90M - $105M Revenue - Noctiva $5M - $10M R&D Expense $40M - $50M SG&A Expense $80M - $90M Cash Interest Expense $6M Income Tax Benefit – Non-GAAP 0% - 10% 19

Question & Answer 20

Appendix 21

GAAP to NON-GAAP Reconciliations (in $000s, except for per share amounts) GAAP to Non-GAAP adjustments for the three months ended June 30, 2018 Exclude Include Contingent Equity securities Amortization of related party Contingent Foreign unrealized debt discount payable related party Intangible asset exchange Restructuring (gain)/loss and debt fair value payable Total GAAP amortization (gain)/loss impacts impact issuance costs remeasurements paid/accrued Adjustments Adjusted GAAP Product sales $ 29,116 $ - $ - $ - $ - $ - $ - $ - $ - $ 29,116 License revenue 114 - - - - - - - - 114 Total revenue 29,230 - - - - - - - - 29,230 Cost of products 3,512 - - - - - - - - 3,512 Research and development expenses 11,890 - - - - - - - - 11,890 Selling, general and administrative expenses 27,843 - - - - - - - - 27,843 Intangible asset amortization 1,609 (1,609) - - - - - - (1,609) - Changes in fair value of related party contingent consideration (12,889) - - - - - 12,889 5,060 17,949 5,060 Restructuring costs 50 - - (50) - - - - (50) - Total operating expenses 32,015 (1,609) - (50) - - 12,889 5,060 16,290 48,305 Operating income (loss) (2,785) 1,609 - 50 - - (12,889) (5,060) (16,290) (19,075) Investment and other income (expense), net 583 - 7 - (112) - - - (105) 478 Interest Expense (2,980) - - - - 1,363 - - 1,363 (1,617) Other Expense - changes in fair value of related party payable 1,402 - - - - - (1,402) - (751) - (2,153) (751) Income (loss) before income taxes (3,780) 1,609 7 50 (112) 1,363 (14,291) (5,811) (17,185) (20,965) Income tax provision (benefit) (342) 338 - - (2) - (471) (227) (362) (704) Net income (loss) $ (3,438) $ 1,271 $ 7 $ 50 $ (110) $ 1,363 $ (13,820) $ (5,584) $ (16,823) $ (20,261) Net income (loss) per share - diluted $ (0.09) $ 0.03 $ - $ - $ - $ 0.04 $ (0.38) $ (0.15) $ (0.46) $ (0.55) Weighted average number of shares outstanding - Diluted 36,772 36,772 36,772 36,772 36,772 36,772 36,772 36,772 36,772 36,772 22

GAAP to NON-GAAP Reconciliations (in $000s, except for per share amounts) GAAP to Non-GAAP adjustments for the three months ended March 31, 2018 Exclude Include Contingent Amortization of related party Contingent Foreign Equity Securities debt discount payable related party Intangible asset exchange (loss) Restructuring unrealized and debt fair value payable GAAP amortization gain impacts gain/loss issuance costs remeasurements paid/accrued Total Adjustments Adjusted GAAP Product sales $ 33,161 $ - $ - $ - $ - $ - $ - $ - $ - $ 33,161 License revenue 132 - - - - - - - - 132 Total revenue 33,293 - - - - - - - - 33,293 - - - - - - - Cost of products 6,592 - - - - - - - - 6,592 Research and development expenses 9,951 - - - - - - - - 9,951 Selling, general and administrative expenses 24,487 - - - - - - - - 24,487 Intangible asset amortization 1,767 (1,767) - - - - - - (1,767) - Changes in fair value of related party contingent consideration 2,968 - - - - - (2,968) 5,790 2,822 5,790 Restructuring costs 153 - - (153) - - - - (153) - Total operating expenses 45,918 (1,767) - (153) - - (2,968) 5,790 902 46,820 Operating income (loss) (12,625) 1,767 - 153 - - 2,968 (5,790) (902) (13,527) - - - - - - Investment and other income (expense), net 54 - (167) - 298 - - - 131 185 Interest Expense (1,597) - - - - 656 - - 656 (941) Other Expense - changes in fair value of related party payable (395) - - - - - 395- (797) - (402) (797) Income (loss) before income taxes (14,563) 1,767 (167) 153 298 656 3,363 (6,587) (517) (15,080) Income tax provision (benefit) (2,327) 371 - - (3) - 123 (246) 245 (2,082) Net (loss) income $ (12,236) $ 1,396 $ (167) $ 153 $ 301 $ 656 $ 3,240 $ (6,341) $ (762) $ (12,998) Net (loss) income per share - diluted $ (0.32) $ 0.04 $ - $ - $ 0.01 $ 0.02 $ 0.08 $ (0.15) $ (0.02) $ (0.34) Weighted average number of shares outstanding - Diluted 38,559 38,559 38,559 38,559 38,559 38,559 38,559 38,559 38,559 38,559 23

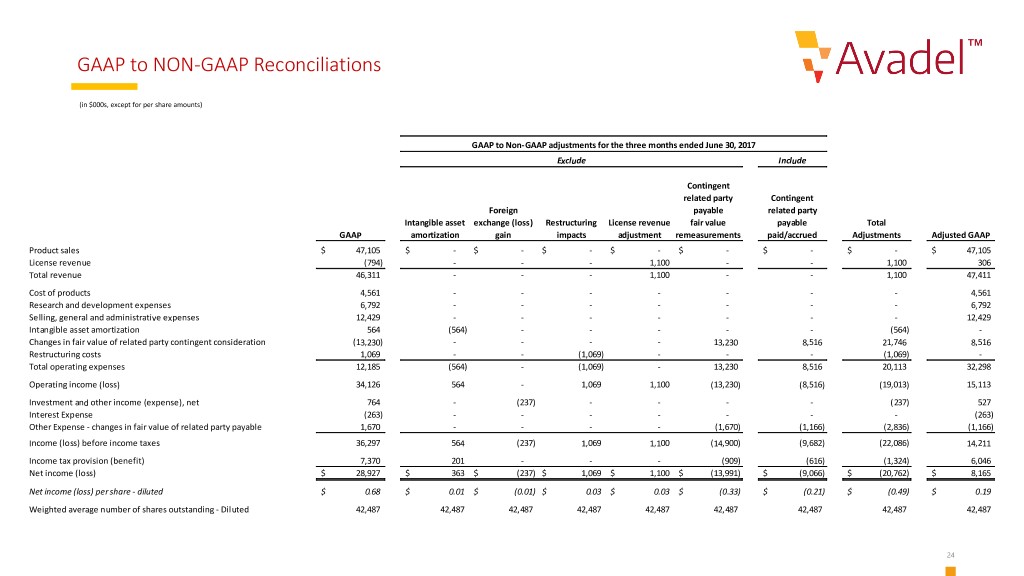

GAAP to NON-GAAP Reconciliations (in $000s, except for per share amounts) GAAP to Non-GAAP adjustments for the three months ended June 30, 2017 Exclude Include Contingent related party Contingent Foreign payable related party Intangible asset exchange (loss) Restructuring License revenue fair value payable Total GAAP amortization gain impacts adjustment remeasurements paid/accrued Adjustments Adjusted GAAP Product sales $ 47,105 $ - $ - $ - $ - $ - $ - $ - $ 47,105 License revenue (794) - - - 1,100 - - 1,100 306 Total revenue 46,311 - - - 1,100 - - 1,100 47,411 Cost of products 4,561 - - - - - - - 4,561 Research and development expenses 6,792 - - - - - - - 6,792 Selling, general and administrative expenses 12,429 - - - - - - - 12,429 Intangible asset amortization 564 (564) - - - - - (564) - Changes in fair value of related party contingent consideration (13,230) - - - - 13,230 8,516 21,746 8,516 Restructuring costs 1,069 - - (1,069) - - - (1,069) - Total operating expenses 12,185 (564) - (1,069) - 13,230 8,516 20,113 32,298 Operating income (loss) 34,126 564 - 1,069 1,100 (13,230) (8,516) (19,013) 15,113 Investment and other income (expense), net 764 - (237) - - - - (237) 527 Interest Expense (263) - - - - - - - (263) Other Expense - changes in fair value of related party payable 1,670 - - - - (1,670) (1,166) (2,836) (1,166) Income (loss) before income taxes 36,297 564 (237) 1,069 1,100 (14,900) (9,682) (22,086) 14,211 Income tax provision (benefit) 7,370 201 - - - (909) (616) (1,324) 6,046 Net income (loss) $ 28,927 $ 363 $ (237) $ 1,069 $ 1,100 $ (13,991) $ (9,066) $ (20,762) $ 8,165 Net income (loss) per share - diluted $ 0.68 $ 0.01 $ (0.01) $ 0.03 $ 0.03 $ (0.33) $ (0.21) $ (0.49) $ 0.19 Weighted average number of shares outstanding - Diluted 42,487 42,487 42,487 42,487 42,487 42,487 42,487 42,487 42,487 24