Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - MARRIOTT VACATIONS WORLDWIDE Corp | d593986dex993.htm |

| EX-99.2 - EX-99.2 - MARRIOTT VACATIONS WORLDWIDE Corp | d593986dex992.htm |

| 8-K - 8-K - MARRIOTT VACATIONS WORLDWIDE Corp | d593986d8k.htm |

Exhibit 99.1

Supplemental Information Regarding MVW and ILG

August 6, 2018

Except where the context otherwise suggests, as used herein, (i) “MVW” refers to Marriott Vacations Worldwide Corporation, a Delaware corporation and the parent company of the Marriott Ownership Resorts, Inc. (the “Issuer”), and its subsidiaries, (ii) “ILG” refers to ILG, Inc., a Delaware corporation and the parent company of Interval Acquisition Corp. (“IAC”), and its subsidiaries; (iii) “Combined Company” refers to MVW and its subsidiaries, following completion of the Combination Transactions (as defined below); (iv) “we,” “our” and “us” refer to MVW, ILG or the Combined Company, as the context requires.

On April 30, 2018, Marriott Vacations Worldwide Corporation entered into that certain Agreement and Plan of Merger, dated as of April 30, 2018, by and among Marriott Vacations Worldwide Corporation, ILG, Inc., Ignite Holdco, Inc., Ignite Holdco Subsidiary, Inc., Volt Merger Sub, Inc. and Volt Merger Sub, LLC, as it may be amended, restated or otherwise modified (the “Merger Agreement”), pursuant to which MVW agreed to acquire ILG through a series of business combinations (the “Combination Transactions”).

The below supplemental information reflects certain information included in the Offering Memorandum dated August 6, 2018.

1

For the twelve months ended June 30, 2018, after giving effect to the Transactions, the Combined Company would have generated total pro forma revenue of $4,049 million and would have generated as adjusted combined total revenue excluding cost reimbursements of $2,976 million and Adjusted EBITDA of $737 million, inclusive of an estimated $75 million of annual cost synergies, which are expected to be fully realized within two years of the completion of the Combination Transactions, but exclusive of $34 million of estimated lost Adjusted EBITDA from disruption of sales operations and rental and ancillary operations at certain MVW and ILG locations due to one or both of Hurricane Irma and Hurricane Maria in the second half of 2017 (the “2017 Hurricanes”). For information regarding MVW’s Adjusted EBITDA and a reconciliation of MVW’s Adjusted EBITDA to net income, the most directly comparable GAAP measure, on a pro forma basis for the Combination Transactions, see “—Summary Unaudited Pro Forma Combined Financial Data.”

* * *

2

As of June 30, 2018, ILG had a total of 43 managed resorts within its Vistana and HVO businesses and managed more than 200 resorts and/or HOAs through its VRI, VRI Europe, TPI and Aqua-Aston businesses. Through the Interval Network, ILG served 1.8 million members, while providing access to nearly 3,200 resorts located in over 80 countries.

* * *

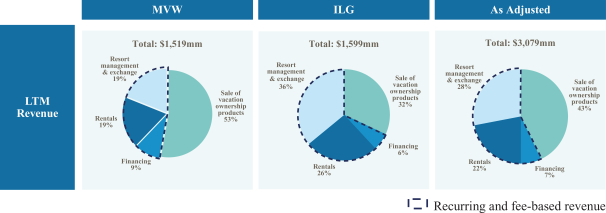

As Adjusted Net Revenue for the Twelve-Month Period Ended June 30, 2018

Note: As adjusted revenues shown in the charts above exclude cost reimbursements and include an estimated adjustment of $45 million, $58 million and $103 million for MVW, ILG and as adjusted, respectively, for the impact of the 2017 Hurricanes on revenues during the period.

* * *

In addition, as of June 30, 2018, MVW and ILG had finished vacation ownership inventory balances of $325 million and $483 million, respectively. MVW’s disciplined inventory approach and use of capital efficient deal structures, including working with third parties that develop new inventory or convert previously built units that are sold to us close to when such inventory is needed to support sales, is expected to support strong free cash flow generation.

We expect to have an attractive leverage profile after giving pro forma effect to the Transactions. As of June 30, 2018, on an as adjusted basis after giving effect to the Transactions, we would have had corporate net debt of approximately $2,129 million, and for the twelve months ended June 30, 2018, on an as adjusted basis after giving effect to the Transactions, our Adjusted EBITDA would have been $737 million (including an estimated $75 million of annual cost synergies, but excluding of $34 million of estimated lost Adjusted EBITDA from disruption of sales operations and rental and ancillary operations at certain MVW and ILG locations due to one or both of the 2017 Hurricanes), resulting in a ratio of as adjusted corporate net debt to Adjusted EBITDA of approximately 2.89x for the twelve-month period ended June 30, 2018. See “Presentation of Financial and Other Information” for an explanation of how we calculate corporate net debt and “—Summary Unaudited Pro Forma Combined Financial Data” for a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure on a pro forma basis.

We intend to meet our ongoing liquidity needs through cash on hand, operating cash flow, a $600 million five-year Revolving Credit Facility that we expect to enter into in connection with the Transactions, our existing $250 million Warehouse Credit Facility (the “MVW Warehouse Credit Facility”) and continued access to the asset-backed securities (“ABS”) term financing market. We believe that this will enable the Combined Company to maintain a level of liquidity that ensures financial flexibility, which will allow us to optimize our cost of capital, de-lever, help us withstand potential future economic downturns and continue to pursue compelling new business opportunities.

* * *

For the twelve months ended June 30, 2018, on a combined basis after giving effect to the Transactions, our non-guarantor subsidiaries represented 19% of our revenue, 41% of our income before income taxes and 29% of our Adjusted EBITDA. As of June 30, 2018, on a combined basis after giving effect to the Transactions, our non-guarantor subsidiaries represented 40% of our total assets and had $1,971 million of total liabilities, including debt and trade payables but excluding intercompany liabilities.

* * *

The aggregate amount of New Credit Facilities outstanding at the closing of the Transactions is expected to be $951 million, including $51 million under the Revolving Credit Facility (excluding $5 million of expected outstanding letters of credit).

3

SUMMARY UNAUDITED PRO FORMA COMBINED

FINANCIAL DATA

The following table shows summary unaudited pro forma combined financial data for the financial condition and results of operations of MVW after giving effect to the Combination Transactions and related transactions as further described in the section entitled “Unaudited Pro Forma Combined Financial Statements.” This information has been prepared using the acquisition method of accounting under GAAP, under which the assets and liabilities of ILG will be recorded by MVW at their respective fair values as of the date the Combination Transactions are completed. The summary unaudited pro forma combined balance sheet data as of June 30, 2018 and 2017 is presented as if the Combination Transactions had occurred on June 30, 2018 and 2017, respectively. The unaudited pro forma combined statement of income data for the six months ended June 30, 2018 and 2017, the fiscal year ended December 31, 2017 and the twelve months ended June 30, 2018 are presented as if the Combination Transactions occurred on December 31, 2016.

This summary unaudited pro forma combined financial data does not reflect the realization of any cost savings from operating efficiencies, synergies or other restructuring, or associated costs to achieve such savings, that may result from the Combination Transactions (other than as set forth below). Further, this data does not reflect the effect of any regulatory actions that may impact MVW when the Combination Transactions are completed. This data has been derived from and should be read in conjunction with the section entitled “Unaudited Pro Forma Combined Financial Statements” appearing elsewhere in this offering memorandum and the accompanying notes thereto. In addition, the summary unaudited pro forma combined financial statements were based on and should be read in conjunction with the historical consolidated financial statements and related notes of both MVW and ILG for the applicable periods, which have been incorporated in this offering memorandum by reference. The unaudited pro forma combined financial data for the twelve months ended June 30, 2018 is derived by taking the December 31, 2017 pro forma information, subtracting the June 30, 2017 pro forma information and then adding the June 30, 2018 pro forma information.

This summary unaudited pro forma combined financial data has been presented for informational purposes only and is not necessarily indicative of what MVW’s financial position or results of operations actually would have been had the Combination Transactions been completed as of the dates indicated. In addition, this summary unaudited pro forma combined financial data does not purport to project the future financial position or operating results of MVW. The unaudited summary pro forma combined financial data is based upon currently available information and estimates and assumptions that MVW’s management believes are reasonable as of the date hereof. Any of the factors underlying these estimates and assumptions may change or prove to be materially different, and the estimates and assumptions may not be representative of facts existing at the closing date of the Combination Transactions.

4

This summary unaudited pro forma combined financial data should be read in conjunction with MVW’s and ILG’s Current Reports on Form 8-K, each filed with the SEC on June 5, 2018, the sections entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in MVW’s and ILG’s Current Reports on Form 8-K, each filed with the SEC on July 19, 2018 and MVW’s and ILG’s Quarterly Reports on Form 10-Q for the quarterly period ended June 30, 2018, and the sections entitled “The Transactions,” “Capitalization” and “Unaudited Pro Forma Combined Financial Statements,” appearing elsewhere in this offering memorandum.

| Six Months Ended June 30, |

Year Ended December 31, |

Twelve Months Ended June 30, |

||||||||||||||

| ($ in millions) | 2018 | 2017 | 2017 | 2018 | ||||||||||||

| Consolidated Statement of Income Data: |

||||||||||||||||

| Revenues |

||||||||||||||||

| Sale of vacation ownership products |

$ | 624 | $ | 589 | $ | 1,221 | $ | 1,256 | ||||||||

| Resort management and other services |

433 | 372 | 757 | 818 | ||||||||||||

| Financing |

110 | 104 | 214 | 220 | ||||||||||||

| Rental |

373 | 344 | 653 | 682 | ||||||||||||

| Cost reimbursements |

549 | 552 | 1,076 | 1,073 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Revenues |

2,089 | 1,961 | 3,921 | 4,049 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses |

||||||||||||||||

| Cost of vacation ownership products |

170 | 155 | 298 | 313 | ||||||||||||

| Marketing and sales |

371 | 334 | 675 | 712 | ||||||||||||

| Resort management and other services |

204 | 140 | 310 | 374 | ||||||||||||

| Financing |

16 | 16 | 35 | 35 | ||||||||||||

| Rental |

261 | 267 | 518 | 512 | ||||||||||||

| General and administrative |

191 | 198 | 394 | 387 | ||||||||||||

| Litigation settlement |

16 | — | 4 | 20 | ||||||||||||

| Consumer financing interest |

20 | 17 | 37 | 40 | ||||||||||||

| Royalty fee |

53 | 53 | 106 | 106 | ||||||||||||

| Amortization expense of intangibles |

22 | 22 | 45 | 45 | ||||||||||||

| Cost reimbursements |

549 | 552 | 1,076 | 1,073 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Expenses |

1,873 | 1,754 | 3,498 | 3,617 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Losses) gains and other (expense) income, net |

(6 | ) | — | 6 | — | |||||||||||

| Interest expense |

(67 | ) | (59 | ) | (122 | ) | (130 | ) | ||||||||

| Other |

(21 | ) | 12 | 2 | (31 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income Before Income Taxes and Non-Controlling Interests |

122 | 160 | 309 | 271 | ||||||||||||

| (Benefit) provision for income taxes |

(40 | ) | (53 | ) | 20 | 33 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income |

82 | 107 | 329 | 304 | ||||||||||||

| Net Income attributable to non-controlling interests |

(2 | ) | (1 | ) | (3 | ) | (4 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income attributable to common stockholders |

$ | 80 | $ | 106 | $ | 326 | $ | 300 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Selected Balance Sheet Data: |

||||||||||||||||

| Cash and cash equivalents |

$ | 190 | ||||||||||||||

| Total assets |

$ | 8,887 | ||||||||||||||

| Total debt, gross |

$ | 3,896 | ||||||||||||||

| Total equity |

$ | 3,493 | ||||||||||||||

| Credit Statistics: |

||||||||||||||||

| Adjusted EBITDA(1) |

$ | 737 | ||||||||||||||

| Secured corporate net debt(2) |

745 | |||||||||||||||

| Ratio of secured corporate net debt to Adjusted EBITDA |

1.01 | x | ||||||||||||||

| Total corporate net debt(3) |

$ | 2,109 | ||||||||||||||

| Ratio of total corporate net debt to Adjusted EBITDA |

2.86 | x | ||||||||||||||

| (1) | MVW defines EBITDA, a financial measure that is not prescribed by GAAP, as earnings, or net income, before interest expense (excluding consumer financing interest expense), income taxes, depreciation and amortization. MVW defines Adjusted EBITDA, a financial measure that is not prescribed by GAAP, as EBITDA adjusted for certain other items and excludes non-cash share-based compensation expense and the impact of the application of purchase accounting. For purposes of MVW’s EBITDA and Adjusted EBITDA calculations, MVW does not adjust for consumer financing interest expense as MVW considers it to be an operating expense of its business. EBITDA and Adjusted EBITDA have limitations and should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. See “Presentation of Financial and Other Information—Non-GAAP Financial Measures of MVW and ILG.” |

5

The following table presents a reconciliation of MVW’s pro forma net income, the most directly comparable GAAP measure, to pro forma EBITDA and pro forma Adjusted EBITDA for the six months ended June 30, 2018 and 2017, the year ended December 31, 2017 and the twelve months ended June 30, 2018.

| Six Months Ended June 30, |

Year Ended December 31, |

Twelve Months Ended June 30, |

||||||||||||||

| ($ in millions) | 2018 | 2017 | 2017 | 2018 | ||||||||||||

| Net income attributable to common stockholders |

$ | 80 | $ | 106 | $ | 326 | $ | 300 | ||||||||

| Interest expense |

67 | 59 | 122 | 130 | ||||||||||||

| Tax provision |

40 | 53 | (20 | ) | (33 | ) | ||||||||||

| Amortization expense of intangibles |

22 | 22 | 45 | 45 | ||||||||||||

| Depreciation |

42 | 40 | 81 | 83 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA |

$ | 251 | $ | 280 | $ | 554 | $ | 525 | ||||||||

| Non-cash share-based compensation |

21 | 20 | 38 | 39 | ||||||||||||

| Certain items(a) |

39 | 4 | 34 | 69 | ||||||||||||

| Impact of purchase accounting(b) |

14 | 5 | 20 | 29 | ||||||||||||

| Cost synergies(c) |

75 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA(d) |

$ | 325 | $ | 309 | $ | 646 | $ | 737 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | “Certain items” includes various adjustments made by MVW and ILG in calculating each respective company’s historical Adjusted EBITDA. Included from the MVW historical Adjusted EBITDA table are the amounts reflected under the line item titled “Certain items,” and included from the ILG historical Adjusted EBITDA table are the amounts included in the line items titled “Other special items,” “Asset impairments,” “Acquisition-related and restructuring costs,” and “Less: Other non-operating (income) expense, net.” For further details regarding these historical adjustments to Adjusted EBITDA for MVW and ILG, respectively, see Note (2) under “Summary Historical Financial Data of MVW” and Note (3) under “Summary Historical Financial Data of ILG.” An incremental adjustment has been made to the historical Adjusted EBITDA adjustments related to acquisition costs to avoid double counting since they are eliminated as part of the pro forma adjustments and added back as part of the historical Adjusted EBITDA adjustments. |

6

| (b) | Reflects the remeasurement of assets and liabilities acquired in a business combination from book value to their respective fair values as a result of the application of purchase accounting. This adjustment includes the historical adjustments made to ILG’s Adjusted EBITDA in connection with its previous acquisitions as well as the impact of the applicable pro forma adjustments related to purchase accounting associated with the Combination Transactions. |

| (c) | Reflects cost savings and other synergies from the Combination Transactions as a result of restructuring activities and other cost savings initiatives that MVW expects to realize within two years following the consummation of the Combination Transactions. MVW currently anticipates that there will be one-time costs of $85 million in order to achieve these cost savings and other synergies, which costs are expected to be incurred within two years following the consummation of the Combination Transactions. However, (i) there can be no assurance that such cost savings and other synergies will be achieved, (ii) it may take longer than anticipated to achieve such cost savings and other synergies and (iii) it may require additional costs to achieve these cost savings and other synergies. See “Risk factors—Risks Relating to the Combined Company Upon Completion of the Combination Transactions.” |

| (d) | Calculated excluding $34 million of estimated lost Adjusted EBITDA from disruption of sales operations and rental and ancillary operations at certain MVW and ILG locations due to one or both of the 2017 Hurricanes, for which the Company expects to receive business interruption proceeds upon settlement of outstanding insurance claims. |

| (2) | Represents secured debt and includes indebtedness incurred under the New Credit Facilities of $928 million and capital leases of $7 million. See Note (l) to the unaudited pro forma combined financial statements presented under “Unaudited Pro Forma Combined Financial Statements.” Excludes non-recourse, securitized debt, including any borrowings under the MVW Warehouse Credit Facility; net of cash and cash equivalents of $190 million. |

| (3) | Includes indebtedness incurred under the New Credit Facilities of $928 million, $750 million of Notes offered hereby, $353 million of Exchange Notes, $230 million of Convertible Notes, $7 million of capital leases and $31 million of other debt. Excludes non-recourse securitized debt, including any borrowings under the MVW Warehouse Credit Facility; net of cash and cash equivalents of $190 million. |

7

Non-GAAP Financial Information

Certain financial measures presented above are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), including EBITDA, Adjusted EBITDA, adjusted free cash flow, pro forma EBITDA and pro forma Adjusted EBITDA.

MVW defines EBITDA as earnings, or net income, before interest expense (excluding consumer financing interest expense), income taxes, depreciation and amortization. MVW’s Adjusted EBITDA reflects EBITDA as adjusted for certain other items described under “Summary Historical Financial Data of MVW,” and excludes non-cash share-based compensation expense to address considerable variability among companies in recording compensation expense because companies use share-based payment awards differently, both in the type and quantity of awards granted, and the impact of the application of purchase accounting. For purposes of MVW’s EBITDA and Adjusted EBITDA calculations, MVW does not adjust for consumer financing interest expense because MVW considers it to be an operating expense of its business. MVW considers EBITDA and Adjusted EBITDA to be indicators of operating performance, which it uses to measure its ability to service debt, fund capital expenditures and expand its business. MVW uses EBITDA and Adjusted EBITDA, as do analysts, lenders, investors and others, because these measures exclude certain items that can vary widely across different industries or among companies within the same industry. For example, interest expense can be dependent on a company’s capital structure, debt levels and credit ratings. Accordingly, the impact of interest expense on earnings can vary significantly among companies. The tax positions of companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provision for income taxes can vary considerably among companies. EBITDA and Adjusted EBITDA also exclude depreciation and amortization because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets. These differences can result in considerable variability in the relative costs of productive assets and the depreciation and amortization expense among companies. Together, EBITDA and Adjusted EBITDA facilitate MVW’s comparison of results from its ongoing core operations before the impact of these items with results from other vacation ownership companies.

MVW defines adjusted free cash flow as net cash, cash equivalents and restricted cash provided by operating activities less capital expenditures for property and equipment (excluding inventory), changes in restricted cash, and the borrowing and repayment activity related to MVW’s securitizations and certain other adjustments described in the section entitled “Summary Historical Financial Data of MVW.” MVW evaluates adjusted free cash flow as a liquidity measure that provides useful information to MVW management and investors about the amount of cash provided by operating activities after capital expenditures for property and equipment, changes in restricted cash, and the borrowing and repayment activity related to MVW’s securitizations, which cash can be used for strategic opportunities, including acquisitions and strengthening the balance sheet. Adjusted free cash flow allows for period-over-period comparisons of the cash generated by MVW’s business before the impact of these items. Analysis of adjusted free cash flow also facilitates MVW’s management’s comparison of its results with its competitors’ results.

MVW defines corporate debt as total gross debt outstanding less gross securitization debt.

ILG

ILG defines EBITDA as net income attributable to common stockholders excluding, if applicable: (1) non-operating interest income and interest expense, (2) income taxes, (3) depreciation expense and (4) amortization expense of intangibles. ILG defines Adjusted EBITDA as EBITDA excluding, if applicable: (1) non-cash compensation expense, (2) goodwill and asset impairments, (3) acquisition-related and restructuring costs, (4) other non-operating income and expense, (5) the impact of the application of purchase accounting, and (6) other special items. ILG’s presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly-titled measures used by other companies. ILG believes the performance measures such as EBITDA and Adjusted EBITDA are useful to investors because they represent the consolidated operating results from its segments, excluding the effects of any non-core expenses or gains. ILG also believes these measures improve the transparency of its disclosures, provide a meaningful presentation of its results from its business operations, excluding the impact of certain items not related to its core business operations and improve the period-to-period comparability of results from business operations. These non-GAAP performance measures have certain limitations in that they do not take into account the impact of certain expenses to ILG’s statement of operations, such as non-cash compensation and acquisition-related and restructuring costs as it relates to Adjusted EBITDA.

ILG defines free cash flow as cash and restricted cash provided by operating activities less capital expenditures, plus net changes in financing-related restricted cash and net borrowing and repayment activity pertaining to securitizations, and excluding changes in operating-related restricted cash and certain payments unrelated to ILG’s ongoing core business, such as acquisition-related and restructuring costs.

8

Pro forma

Pro forma EBITDA and pro forma Adjusted EBITDA present EBITDA and Adjusted EBITDA on a pro forma basis for the Combination Transactions. To the extent that MVW’s and ILG’s definitions of EBITDA and Adjusted EBITDA differ, pro forma EBITDA and pro forma Adjusted EBITDA are calculated using MVW’s definitions of EBITDA and Adjusted EBITDA.

EBITDA, Adjusted EBITDA, adjusted free cash flow, pro forma EBITDA and pro forma Adjusted EBITDA have limitations and should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. In addition, other companies in MVW’s and ILG’s industry may calculate EBITDA, Adjusted EBITDA, adjusted free cash flow, pro forma EBITDA and pro forma Adjusted EBITDA differently than MVW and ILG do or may not calculate them at all, limiting their usefulness as comparative measures.

Pro Forma Information

Certain pro forma information is included herein. The pro forma information is presented for illustrative purposes only and is not necessarily indicative of the results that would have occurred if the Combination Transactions had been previously consummated, nor is it indicative of future results.

Disclaimer

The information contained herein (unless otherwise indicated) has been provided by MVW solely for informational purposes. This information does not constitute a recommendation regarding the securities of MVW. This information does not constitute, or form part of, any offer, invitation to sell or issue, or any solicitation of any offer to subscribe for, purchase or otherwise acquire any securities of MVW, nor shall it, or the fact of its communication, form the basis of, or be relied upon in connection with, or act as any inducement to enter into any contract or commitment whatsoever with respect to such securities. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require registration of licensing within such jurisdiction. The information contained herein is provided as of the date set forth above and is subject to change without notice. The information contained herein may be updated, completed, revised and amended and such information may change materially in the future. MVW is under no obligation to update or keep current the information contained herein.

9