Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20180731.htm |

2nd Quarter 2018 Investor Presentation Exhibit 99.1

Forward Looking Statements This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on CenterState’s capital ratios. Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customer, supplier, employee or other business partner relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of Charter’s businesses into CenterState, (5) the failure to obtain the necessary approvals by the stockholders of Charter, with respect to the Merger, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by CenterState to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing the Merger, (10) the risk that the integration of Charter’s operations into the operations of CenterState will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by CenterState’s issuance of additional shares of its common stock in the Merger, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in CenterState’s Annual Report on Form 10-K for the year ended December 31, 2017, Charter’s Annual Report on Form 10-K for the year ended September 30, 2017, and other documents subsequently filed by CenterState and Charter with the SEC. Consequently, no forward-looking statement can be guaranteed. CenterState and Charter do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For any forward-looking statements made in this presentation, the exhibits hereto or any related documents, CenterState and Charter claim protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

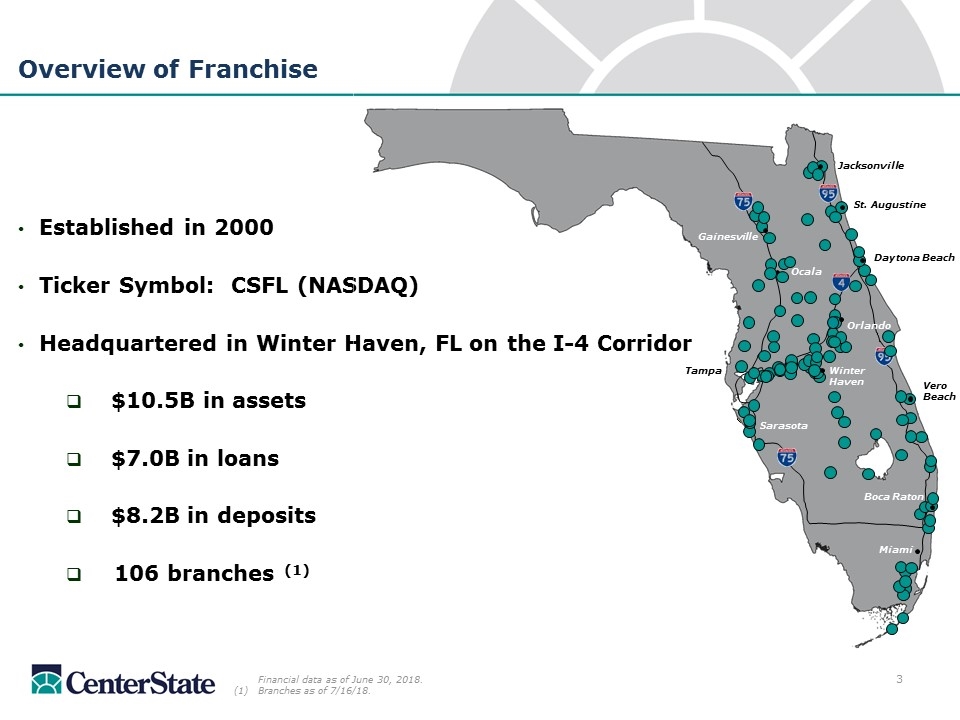

Established in 2000 Ticker Symbol: CSFL (NASDAQ) Headquartered in Winter Haven, FL on the I-4 Corridor $10.5B in assets $7.0B in loans $8.2B in deposits 106 branches (1) Tampa Jacksonville Winter Haven Miami Ocala Gainesville Sarasota Daytona Beach St. Augustine Vero Beach Boca Raton Orlando Overview of Franchise Financial data as of June 30, 2018. (1)Branches as of 7/16/18.

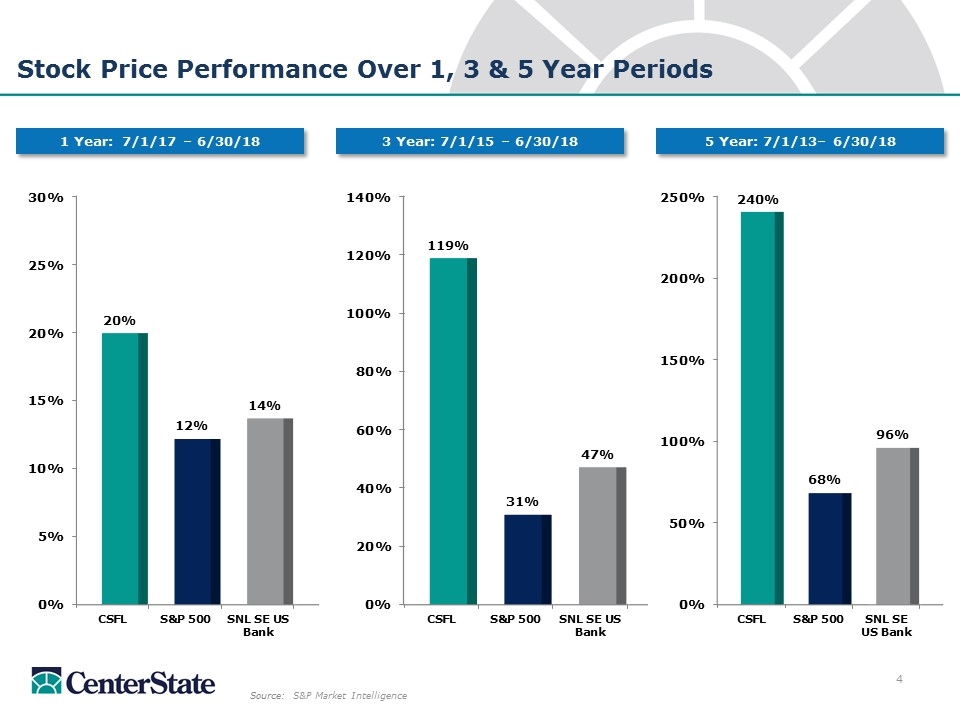

Stock Price Performance Over 1, 3 & 5 Year Periods Source: S&P Market Intelligence 1 Year: 7/1/17 – 6/30/18 3 Year: 7/1/15 – 6/30/18 5 Year: 7/1/13– 6/30/18

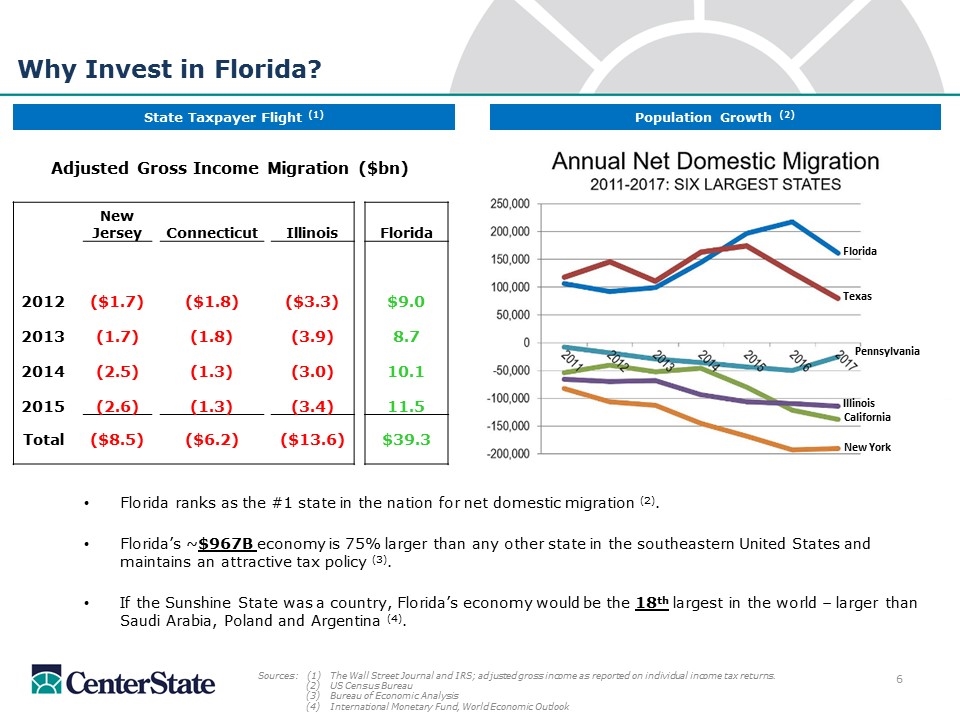

Banking the Sunshine State Image Credit: ESA/NASA

Florida ranks as the #1 state in the nation for net domestic migration (2). Florida’s ~$967B economy is 75% larger than any other state in the southeastern United States and maintains an attractive tax policy (3). If the Sunshine State was a country, Florida’s economy would be the 18th largest in the world – larger than Saudi Arabia, Poland and Argentina (4). Why Invest in Florida? Sources:(1) The Wall Street Journal and IRS; adjusted gross income as reported on individual income tax returns. (2)US Census Bureau (3)Bureau of Economic Analysis (4)International Monetary Fund, World Economic Outlook Population Growth (2) Adjusted Gross Income Migration ($bn) New Jersey Connecticut Illinois Florida 2012 ($1.7) ($1.8) ($3.3) $9.0 2013 (1.7) (1.8) (3.9) 8.7 2014 (2.5) (1.3) (3.0) 10.1 2015 (2.6) (1.3) (3.4) 11.5 Total ($8.5) ($6.2) ($13.6) $39.3 State Taxpayer Flight (1) Florida Texas Pennsylvania Illinois California New York

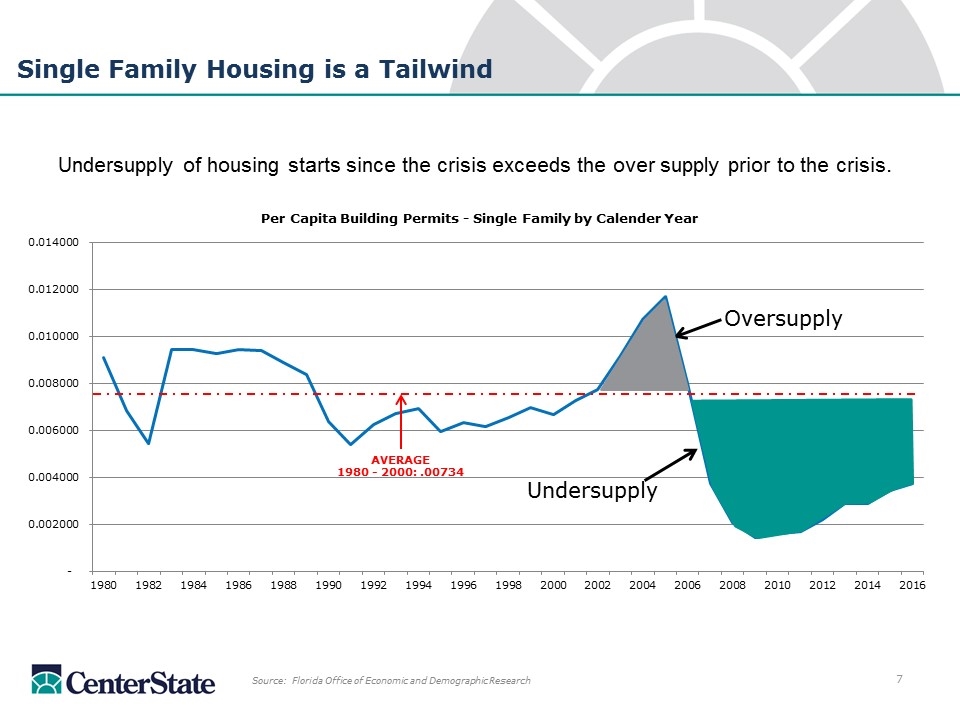

AVERAGE 1980 - 2000: .00734 Single Family Housing is a Tailwind Undersupply of housing starts since the crisis exceeds the over supply prior to the crisis. Source: Florida Office of Economic and Demographic Research Oversupply Undersupply

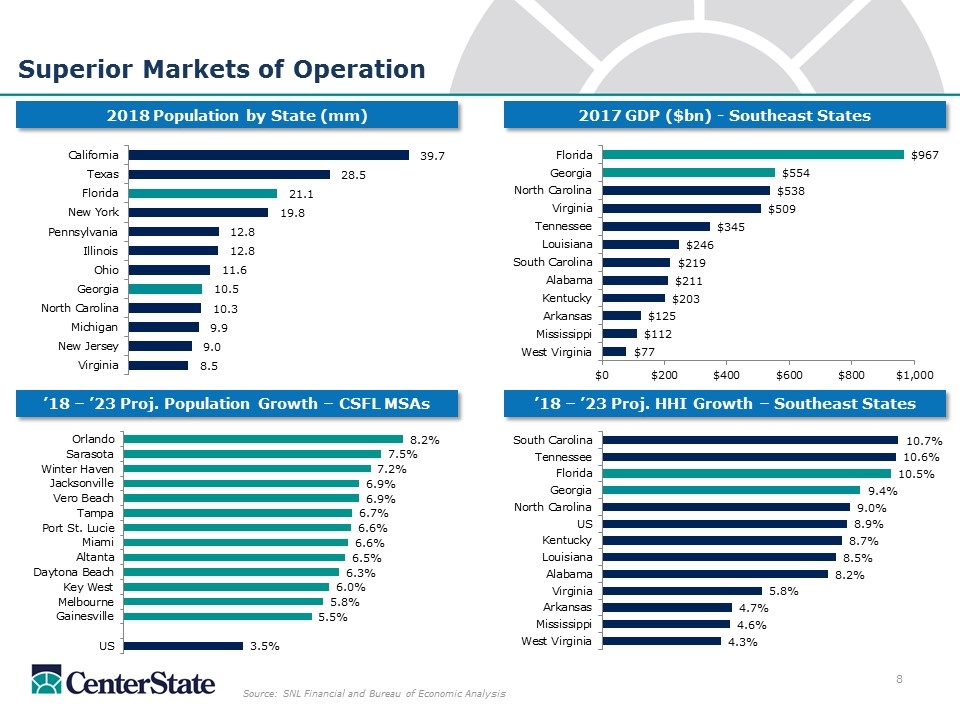

Source: SNL Financial and Bureau of Economic Analysis Superior Markets of Operation 2018 Population by State (mm) 2017 GDP ($bn) - Southeast States ’18 – ’23 Proj. HHI Growth – Southeast States ’18 – ’23 Proj. Population Growth – CSFL MSAs

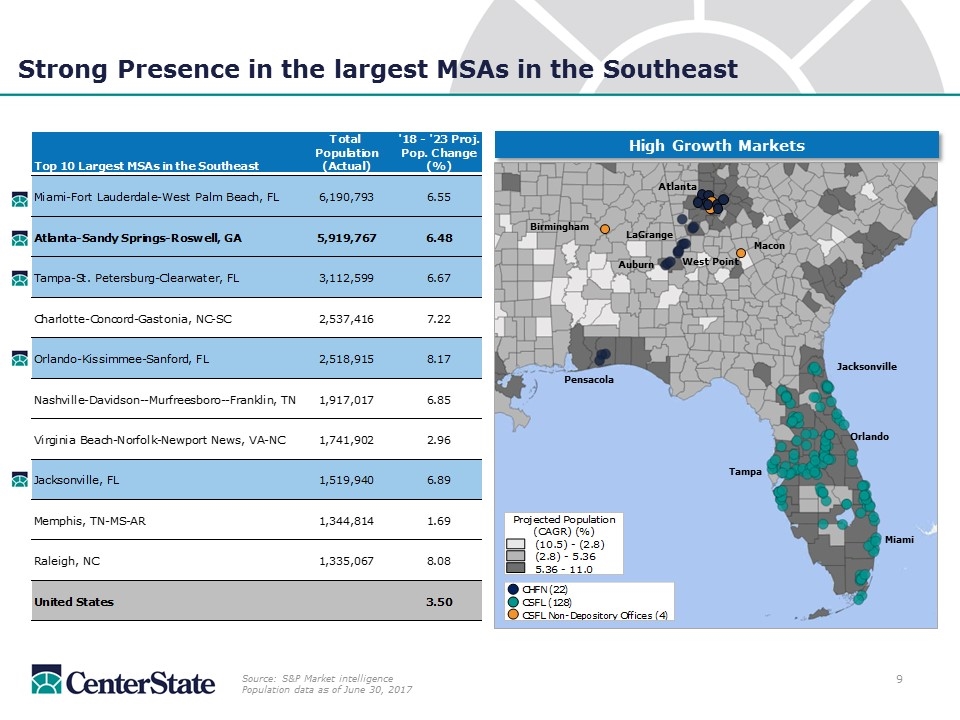

Strong Presence in the largest MSAs in the Southeast Source: S&P Market intelligence Population data as of June 30, 2017 Jacksonville Orlando Miami Pensacola Atlanta LaGrange Auburn Tampa High Growth Markets West Point Macon Birmingham

Capital Management

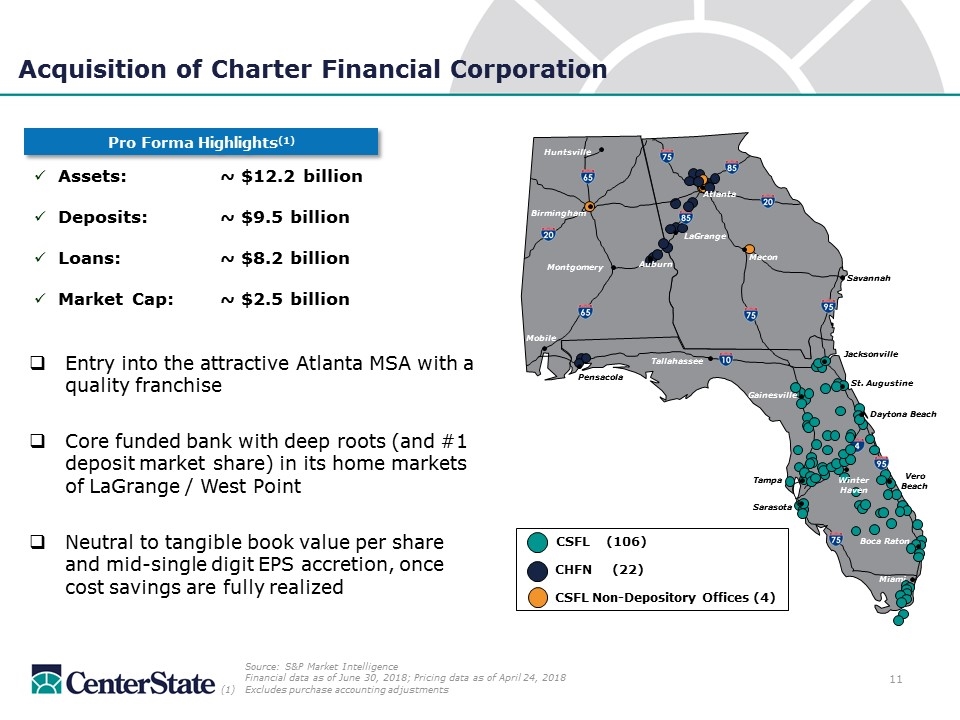

Assets: ~ $12.2 billion Deposits: ~ $9.5 billion Loans: ~ $8.2 billion Market Cap: ~ $2.5 billion Acquisition of Charter Financial Corporation Source: S&P Market Intelligence Financial data as of June 30, 2018; Pricing data as of April 24, 2018 Excludes purchase accounting adjustments Pro Forma Highlights(1) Entry into the attractive Atlanta MSA with a quality franchise Core funded bank with deep roots (and #1 deposit market share) in its home markets of LaGrange / West Point Neutral to tangible book value per share and mid-single digit EPS accretion, once cost savings are fully realized Gainesville Tallahassee Sarasota LaGrange Montgomery Mobile Jacksonville St. Augustine Daytona Beach Pensacola Tampa Miami Winter Haven Boca Raton Vero Beach Savannah Birmingham Huntsville Auburn Macon Atlanta CSFL (106) CHFN (22) CSFL Non-Depository Offices (4)

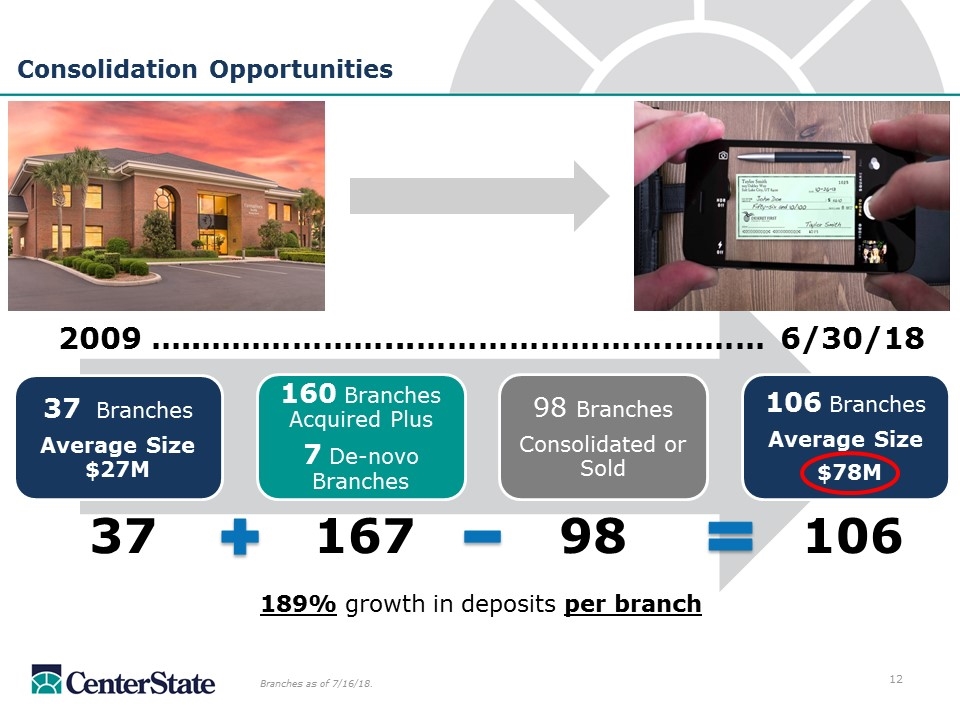

Consolidation Opportunities 189% growth in deposits per branch 37 167 98 106 2009 …..………………...…………………….……… 6/30/18 Branches as of 7/16/18. 37 Branches Average Size $27M 160 Branches Acquired Plus 7 De-novo Branches 98 Branches Consolidated or Sold 106 Branches Average Size $78M

Operating Performance

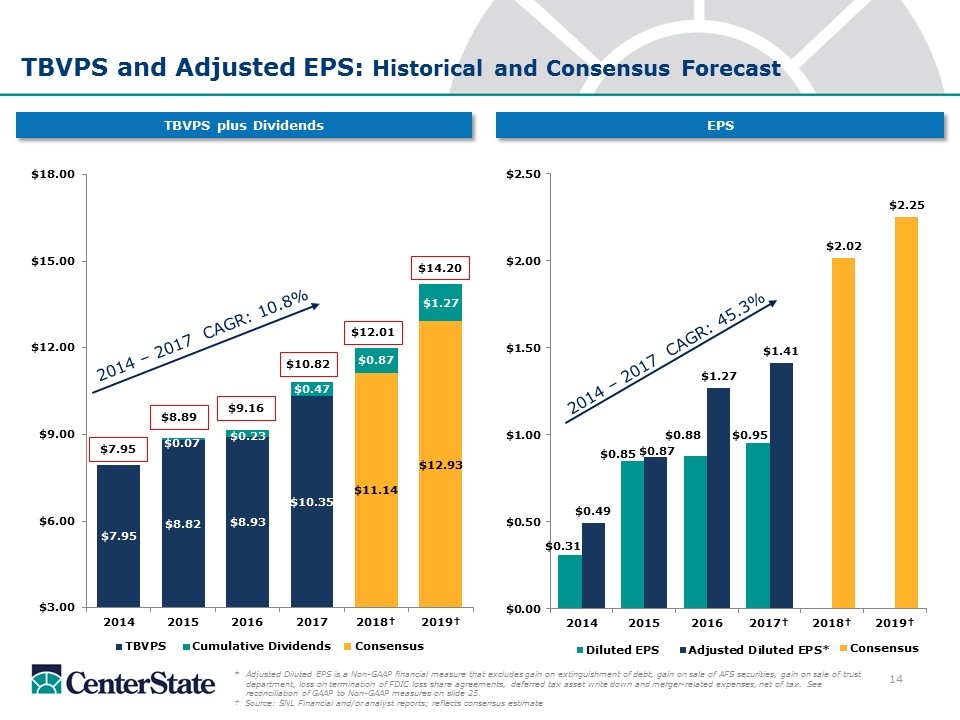

TBVPS and Adjusted EPS: Historical and Consensus Forecast *Adjusted Diluted EPS is a Non-GAAP financial measure that excludes gain on extinguishment of debt, gain on sale of AFS securities, gain on sale of trust department, loss on termination of FDIC loss share agreements, deferred tax asset write down and merger-related expenses, net of tax. See reconciliation of GAAP to Non-GAAP measures on slide 25. † Source: SNL Financial and/or analyst reports; reflects consensus estimate TBVPS plus Dividends EPS 2014 – 2017 CAGR: 10.8% $8.89 $9.16 $10.82 Consensus $12.01 $7.95 2014 – 2017 CAGR: 45.3% Consensus $14.20

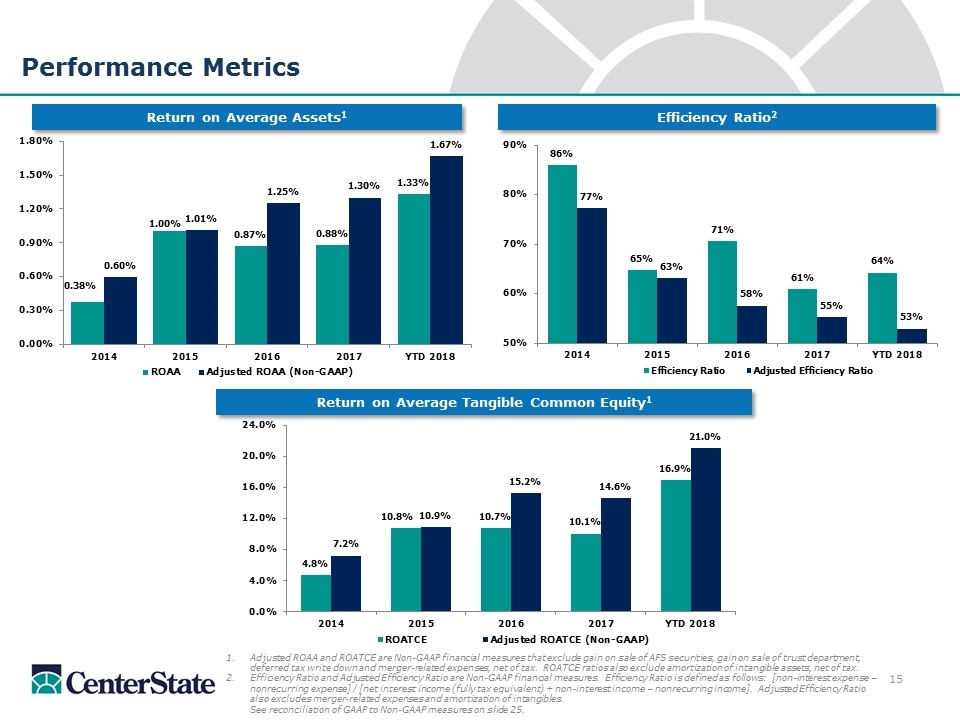

Efficiency Ratio2 Performance Metrics Adjusted ROAA and ROATCE are Non-GAAP financial measures that exclude gain on sale of AFS securities, gain on sale of trust department, deferred tax write down and merger-related expenses, net of tax. ROATCE ratios also exclude amortization of intangible assets, net of tax. Efficiency Ratio and Adjusted Efficiency Ratio are Non-GAAP financial measures. Efficiency Ratio is defined as follows: [non-interest expense – nonrecurring expense] / [net interest income (fully tax equivalent) + non-interest income – nonrecurring income]. Adjusted Efficiency Ratio also excludes merger-related expenses and amortization of intangibles. See reconciliation of GAAP to Non-GAAP measures on slide 25. Return on Average Tangible Common Equity1 Return on Average Assets1

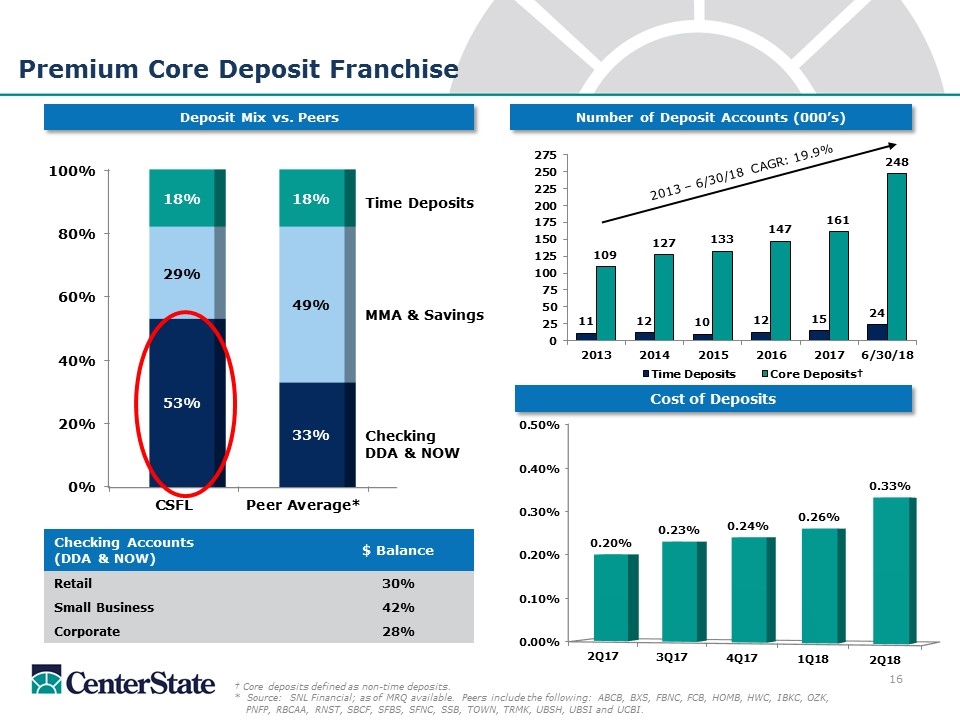

Number of Deposit Accounts (000’s) Premium Core Deposit Franchise Cost of Deposits 2013 – 6/30/18 CAGR: 19.9% Deposit Mix vs. Peers † Core deposits defined as non-time deposits. * Source: SNL Financial; as of MRQ available. Peers include the following: ABCB, BXS, FBNC, FCB, HOMB, HWC, IBKC, OZK, PNFP, RBCAA, RNST, SBCF, SFBS, SFNC, SSB, TOWN, TRMK, UBSH, UBSI and UCBI. MMA & Savings Time Deposits Checking Accounts (DDA & NOW) $ Balance Retail 30% Small Business 42% Corporate 28%

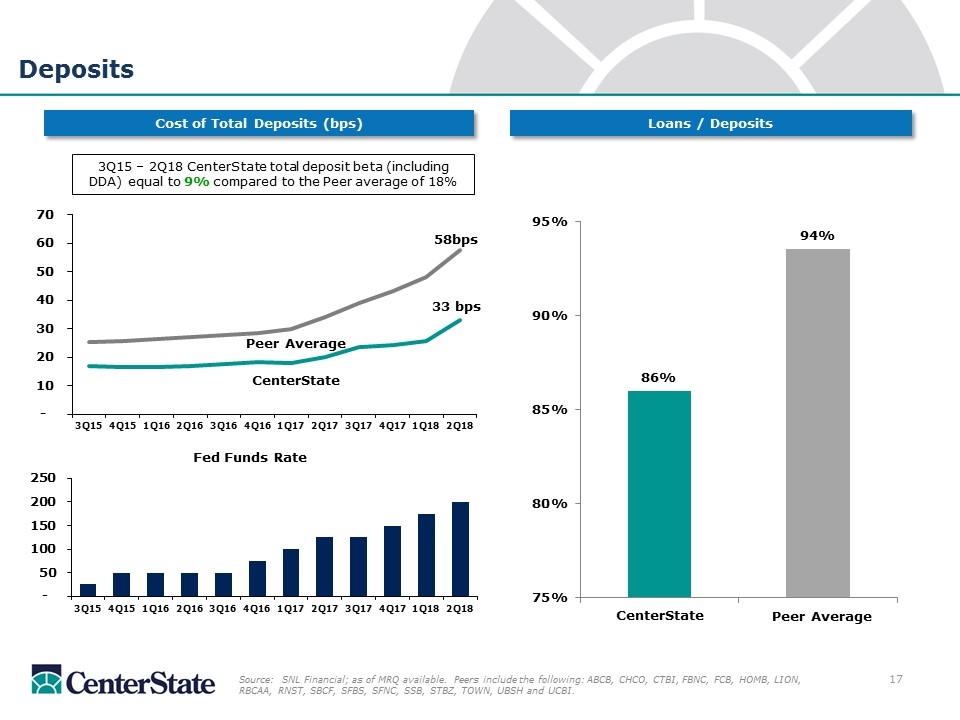

Deposits Loans / Deposits Cost of Total Deposits (bps) Peer Average CenterState 58bps 33 bps 3Q15 – 2Q18 CenterState total deposit beta (including DDA) equal to 9% compared to the Peer average of 18% CenterState Peer Average Source: SNL Financial; as of MRQ available. Peers include the following: ABCB, CHCO, CTBI, FBNC, FCB, HOMB, LION, RBCAA, RNST, SBCF, SFBS, SFNC, SSB, STBZ, TOWN, UBSH and UCBI.

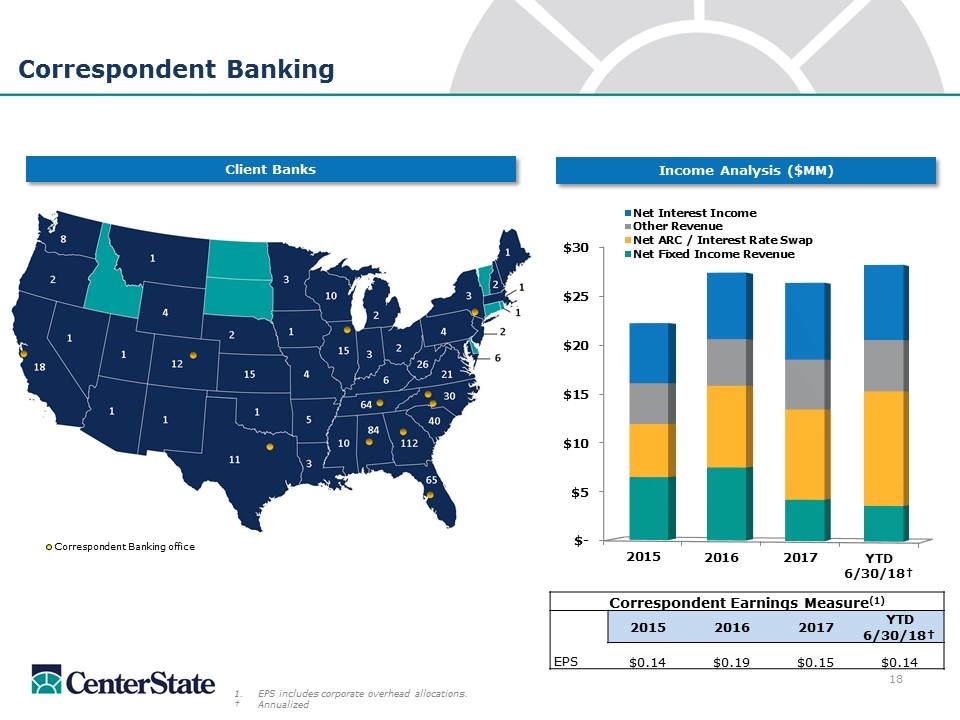

EPS includes corporate overhead allocations. †Annualized Correspondent Banking Income Analysis ($MM) Client Banks Correspondent Banking office Correspondent Earnings Measure(1) 2015 2016 2017 YTD 6/30/18† EPS $0.14 $0.19 $0.15 $0.14

Investment Thesis CenterState is among the largest banking companies headquartered in Florida by assets, market capitalization, deposit market share and branch footprint(1). CenterState’s markets are some of the strongest markets in the Southeastern U.S. with new entry into Atlanta, the largest GDP MSA in Southeastern U.S. Premium core deposit franchise with strong checking account base should outperform peers in a rising rate environment. Source: SNL Financial (1)Data as of MRQ; deposit market share data as of 6/30/17. Note: Community bank defined as institutions with total assets less than $20.0 billion

Supplemental

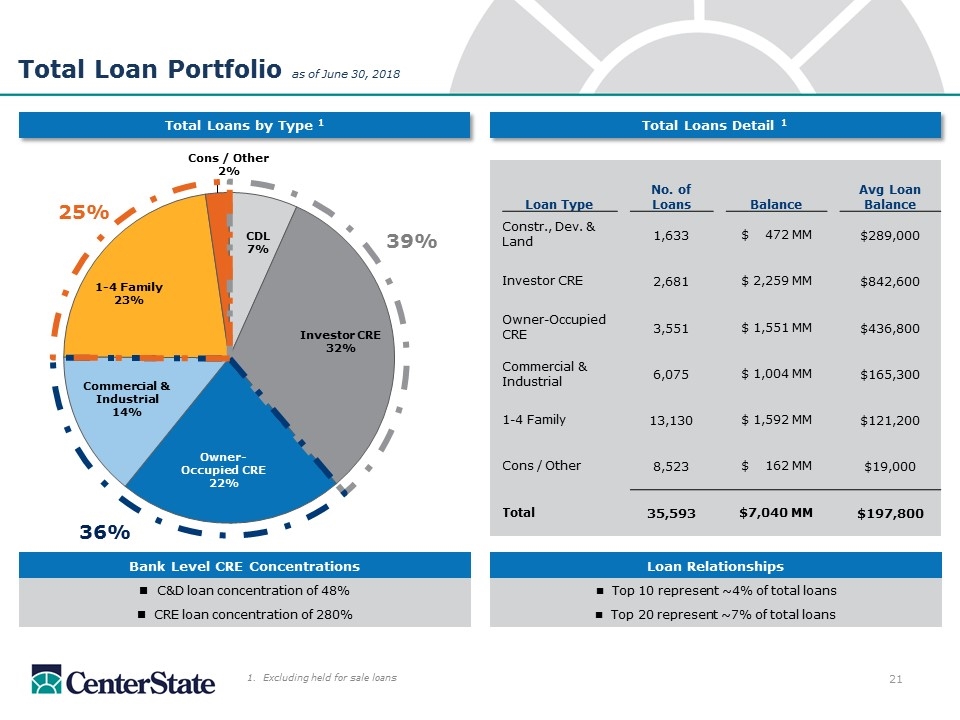

Total Loan Portfolio as of June 30, 2018 Total Loans by Type 1 Total Loans Detail 1 1. Excluding held for sale loans Loan Relationships n Top 10 represent ~4% of total loans n Top 20 represent ~7% of total loans Bank Level CRE Concentrations C&D loan concentration of 48% CRE loan concentration of 280% 39% 36% 25% Loan Type No. of Loans Balance Avg Loan Balance Constr., Dev. & Land 1,633 $ 472 MM $289,000 Investor CRE 2,681 $ 2,259 MM $842,600 Owner-Occupied CRE 3,551 $ 1,551 MM $436,800 Commercial & Industrial 6,075 $ 1,004 MM $165,300 1-4 Family 13,130 $ 1,592 MM $121,200 Cons / Other 8,523 $ 162 MM $19,000 Total 35,593 $7,040 MM $197,800

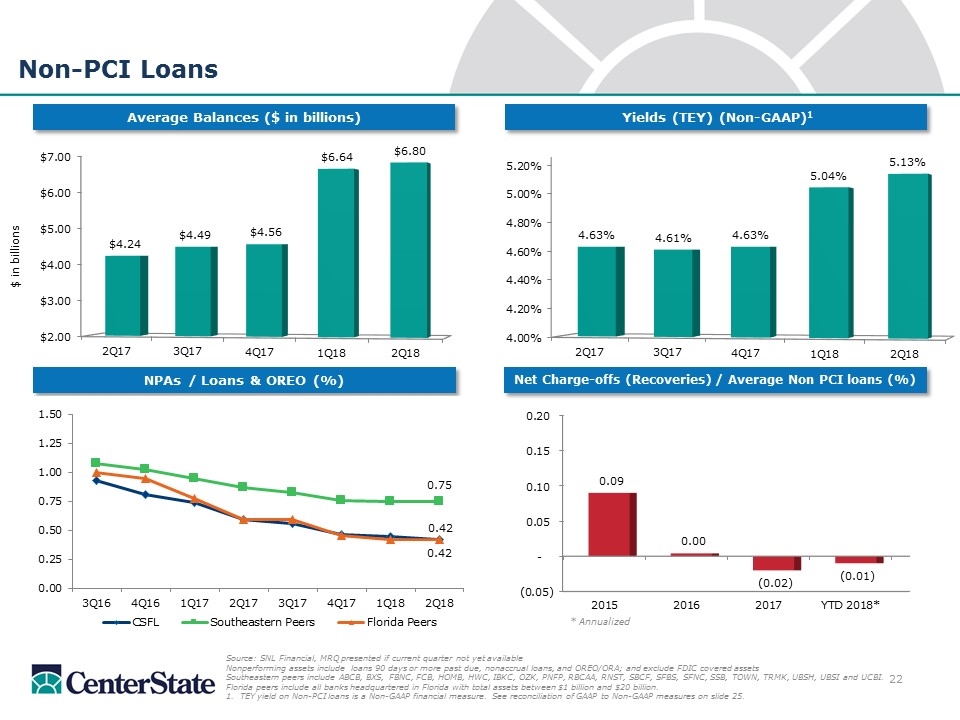

Non-PCI Loans Yields (TEY) (Non-GAAP)1 Average Balances ($ in billions) Source: SNL Financial, MRQ presented if current quarter not yet available Nonperforming assets include loans 90 days or more past due, nonaccrual loans, and OREO/ORA; and exclude FDIC covered assets Southeastern peers include ABCB, BXS, FBNC, FCB, HOMB, HWC, IBKC, OZK, PNFP, RBCAA, RNST, SBCF, SFBS, SFNC, SSB, TOWN, TRMK, UBSH, UBSI and UCBI. Florida peers include all banks headquartered in Florida with total assets between $1 billion and $20 billion. 1. TEY yield on Non-PCI loans is a Non-GAAP financial measure. See reconciliation of GAAP to Non-GAAP measures on slide 25. NPAs / Loans & OREO (%) Net Charge-offs (Recoveries) / Average Non PCI loans (%) * Annualized

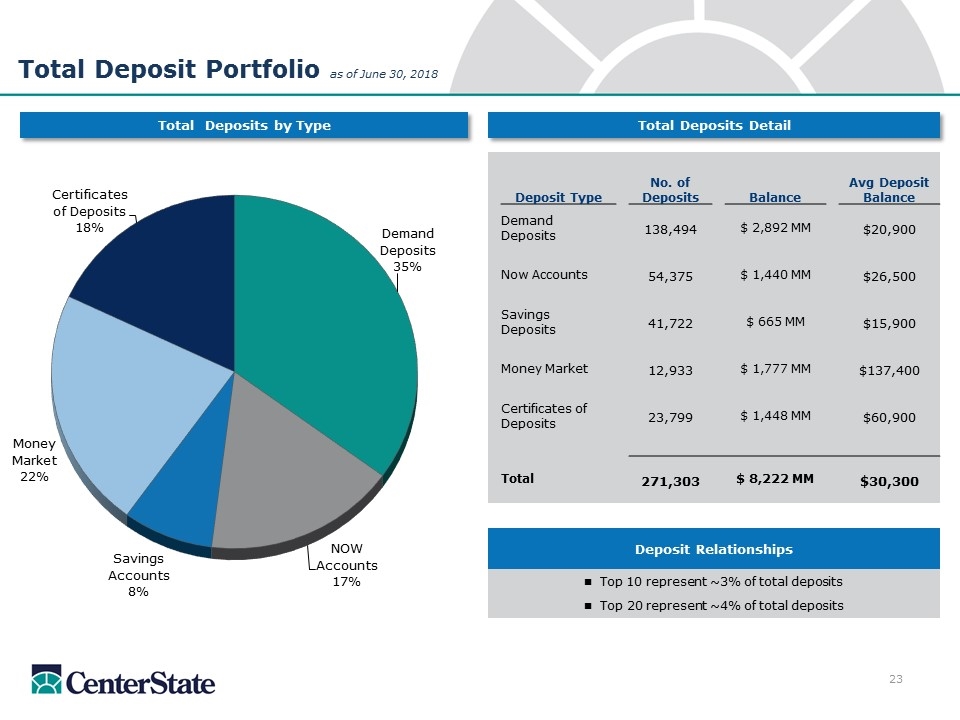

Deposit Relationships n Top 10 represent ~3% of total deposits n Top 20 represent ~4% of total deposits Total Deposits by Type Total Deposits Detail 23 Total Deposit Portfolio as of June 30, 2018 Deposit Type No. of Deposits Balance Avg Deposit Balance Demand Deposits 138,494 $ 2,892 MM $20,900 Now Accounts 54,375 $ 1,440 MM $26,500 Savings Deposits 41,722 $ 665 MM $15,900 Money Market 12,933 $ 1,777 MM $137,400 Certificates of Deposits 23,799 $ 1,448 MM $60,900 Total 271,303 $ 8,222 MM $30,300

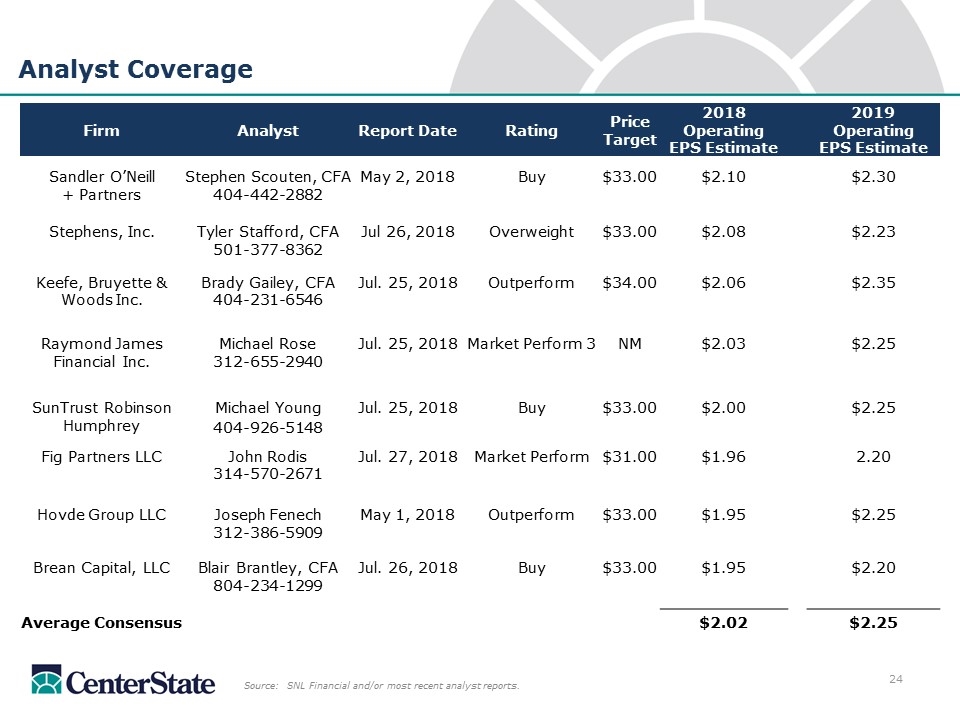

Analyst Coverage Source: SNL Financial and/or most recent analyst reports. Firm Analyst Report Date Rating Price Target 2018 Operating EPS Estimate 2019 Operating EPS Estimate Sandler O’Neill Stephen Scouten, CFA May 2, 2018 Buy $33.00 $2.10 $2.30 + Partners 404-442-2882 Stephens, Inc. Tyler Stafford, CFA Jul 26, 2018 Overweight $33.00 $2.08 $2.23 501-377-8362 Keefe, Bruyette & Brady Gailey, CFA Jul. 25, 2018 Outperform $34.00 $2.06 $2.35 Woods Inc. 404-231-6546 Raymond James Michael Rose Jul. 25, 2018 Market Perform 3 NM $2.03 $2.25 Financial Inc. 312-655-2940 SunTrust Robinson Michael Young Jul. 25, 2018 Buy $33.00 $2.00 $2.25 Humphrey 404-926-5148 Fig Partners LLC John Rodis Jul. 27, 2018 Market Perform $31.00 $1.96 2.20 314-570-2671 Hovde Group LLC Joseph Fenech May 1, 2018 Outperform $33.00 $1.95 $2.25 312-386-5909 Brean Capital, LLC Blair Brantley, CFA Jul. 26, 2018 Buy $33.00 $1.95 $2.20 804-234-1299 Average Consensus $2.02 $2.25

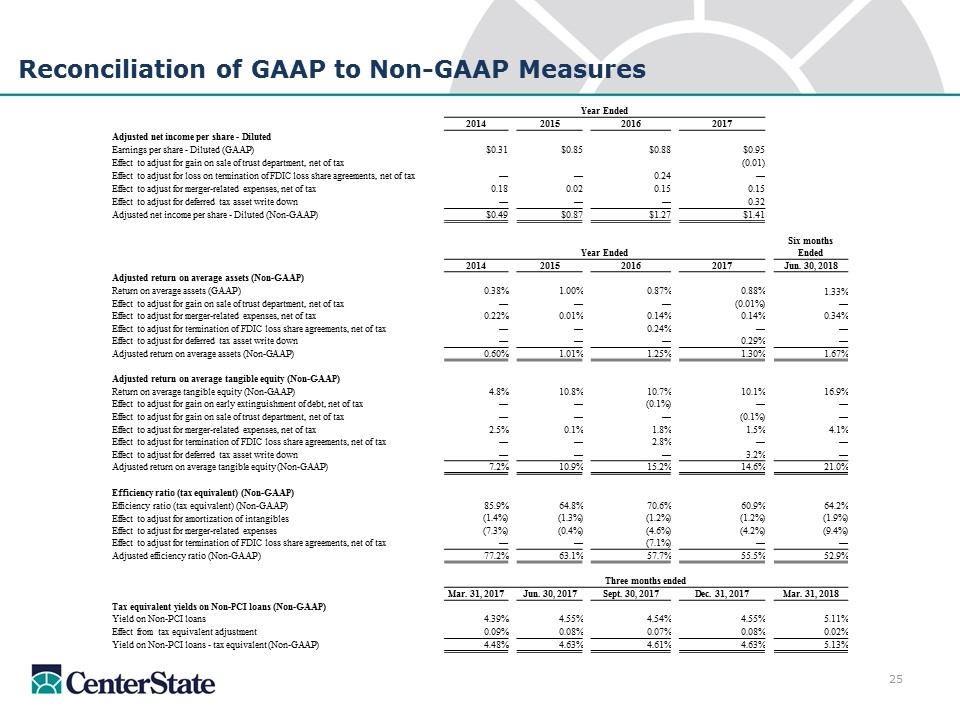

Reconciliation of GAAP to Non-GAAP Measures Year Ended 2014 2015 2016 2017 Adjusted net income per share - Diluted Earnings per share - Diluted (GAAP) $0.31 $0.85 $0.88 $0.95 Effect to adjust for gain on sale of trust department, net of tax (0.01) Effect to adjust for loss on termination of FDIC loss share agreements, net of tax — — 0.24 — Effect to adjust for merger-related expenses, net of tax 0.18 0.02 0.15 0.15 Effect to adjust for deferred tax asset write down — — — 0.32 Adjusted net income per share - Diluted (Non-GAAP) $0.49 $0.87 $1.27 $1.41 Six months Year Ended Ended 2014 2015 2016 2017 Jun. 30, 2018 Adjusted return on average assets (Non-GAAP) Return on average assets (GAAP) 0.38% 1.00% 0.87% 0.88% 1.33% Effect to adjust for gain on sale of trust department, net of tax — — — (0.01%) — Effect to adjust for merger-related expenses, net of tax 0.22% 0.01% 0.14% 0.14% 0.34% Effect to adjust for termination of FDIC loss share agreements, net of tax — — 0.24% — — Effect to adjust for deferred tax asset write down — — — 0.29% — Adjusted return on average assets (Non-GAAP) 0.60% 1.01% 1.25% 1.30% 1.67% Adjusted return on average tangible equity (Non-GAAP) Return on average tangible equity (Non-GAAP) 4.8% 10.8% 10.7% 10.1% 16.9% Effect to adjust for gain on early extinguishment of debt, net of tax — — (0.1%) — — Effect to adjust for gain on sale of trust department, net of tax — — — (0.1%) — Effect to adjust for merger-related expenses, net of tax 2.5% 0.1% 1.8% 1.5% 4.1% Effect to adjust for termination of FDIC loss share agreements, net of tax — — 2.8% — — Effect to adjust for deferred tax asset write down — — — 3.2% — Adjusted return on average tangible equity (Non-GAAP) 7.2% 10.9% 15.2% 14.6% 21.0% Efficiency ratio (tax equivalent) (Non-GAAP) Efficiency ratio (tax equivalent) (Non-GAAP) 85.9% 64.8% 70.6% 60.9% 64.2% Effect to adjust for amortization of intangibles (1.4%) (1.3%) (1.2%) (1.2%) (1.9%) Effect to adjust for merger-related expenses (7.3%) (0.4%) (4.6%) (4.2%) (9.4%) Effect to adjust for termination of FDIC loss share agreements, net of tax — — (7.1%) — — Adjusted efficiency ratio (Non-GAAP) 77.2% 63.1% 57.7% 55.5% 52.9% Three months ended Mar. 31, 2017 Jun. 30, 2017 Sept. 30, 2017 Dec. 31, 2017 Mar. 31, 2018 Tax equivalent yields on Non-PCI loans (Non-GAAP) Yield on Non-PCI loans 4.39% 4.55% 4.54% 4.55% 5.11% Effect from tax equivalent adjustment 0.09% 0.08% 0.07% 0.08% 0.02% Yield on Non-PCI loans - tax equivalent (Non-GAAP) 4.48% 4.63% 4.61% 4.63% 5.13%

Investor Contacts Ernie Pinner John Corbett Executive Chairman President & Chief Executive Officer epinner@centerstatebank.com jcorbett@centerstatebank.com Steve Young Jennifer Idell Chief Operating Officer Chief Financial Officer syoung@centerstatebank.com jidell@centerstatebank.com

Additional Information CenterState has filed with the Securities and Exchange Commission a Registration Statement on Form S-4 (No. 333-225541) and a Definitive Proxy Statement of Charter and a Prospectus of the Company, as well as other relevant materials in connection with the proposed merger transaction involving CenterState and Charter. The proposed transaction is being submitted to Charter’s stockholders for their consideration. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION (AND ANY OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the Securities and Exchange Commission on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the Securities and Exchange Commission by CenterState on its website at www.centerstatebanks.com and by Charter on its website at www.charterbk.com. CenterState, Charter and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from Charter stockholders in connection with the Merger. Information regarding the directors and executive officers of CenterState and Charter and other persons who may be deemed participants in the solicitation of the stockholders of Charter in connection with the Merger will be included in the proxy statement/prospectus for Charter’s special meeting of stockholders, which will be filed by CenterState with the SEC. Information about the directors and officers of CenterState and their ownership of CenterState common stock can also be found in CenterState’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on March 12, 2018, and other documents subsequently filed by CenterState with the SEC. Information about the directors and officers of Charter and their ownership of Charter common stock can also be found in Charter’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on January 5, 2018, and other documents subsequently filed by Charter with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the Merger filed with the SEC.