Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Elevate Credit, Inc. | exhibit991pressreleaseq220.htm |

| 8-K - 8-K - Elevate Credit, Inc. | a07-18pressrelease.htm |

Q2 2018 Earnings Call July 2018

Forward-Looking Statements This presentation and responses to various questions contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements present our current expectations and projections relating to our business, financial condition and results of operations, and do not refer to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning. The forward-looking statements include statements regarding: our future financial performance including our outlook for full fiscal year 2018 and the third quarter 2018; our perspectives on 2018, including our expectations regarding revenue, growth rate of revenue, net charge-offs, gross margin, operating expenses, operating margins, Adjusted EBITDA, net income, loan loss provision, direct marketing and other cost of sales and Adjusted EBITDA margin; our expectations regarding regulatory trends; our expectations regarding the cumulative loss rate as a percentage of originations for the 2017 and 2018 vintage; our growth strategies and our ability to effectively manage that growth; anticipated key marketing and underwriting initiatives; new and expanded products like a US credit card and lower-priced installment product in the UK; our expectations regarding the future expansion of the states in which our products are offered; the cost of customer acquisition, new customer originations, the efficacy and cost of our marketing efforts, including in the third quarter of 2018; the cost of capital remaining high until 2019; expanded marketing channels and new and growing marketing partnerships; continued growth and investment in data science and analytics; and additional bank partnerships. Forward‐looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. These risks and uncertainties include, but are not limited to: the Company’s limited operating history in an evolving industry; new laws and regulations in the consumer lending industry in many jurisdictions that could restrict the consumer lending products and services the Company offers, impose additional compliance costs on the Company, render the Company’s current operations unprofitable or even prohibit the Company’s current operations; scrutiny by regulators and payment processors of certain online lenders’ access to the Automated Clearing House system to disburse and collect loan proceeds and repayments; a lack of sufficient debt financing at acceptable prices or disruptions in the credit markets; the impact of competition in our industry and innovation by our competitors; our ability to prevent security breaches, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service loans; and other risks related to litigation, compliance and regulation. Additional factors that could cause actual results to differ are discussed under the heading "Risk Factors" and in other sections of the most recent Annual Report on Form 10-K and in the Company's other current and periodic reports filed from time to time with the SEC. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements regarding risks and uncertainties that are included in our public communications. You should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties. Neither we nor any of our respective agents, employees or advisors intend or have any duty or obligation to supplement, amend, update or revise any of the forward-looking statements contained in this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. The information and opinions contained in this presentation are provided as of the date of this presentation and are subject to change without notice. This presentation has not been approved by any regulatory or supervisory agency. See Appendix for additional information and definitions. 2

Elevate is reinventing non-prime credit with online products that provide financial relief today, and help people build a brighter financial future. So far, we’ve originated $5.9 billion to two million customers1 and saved them more than $4 billion over payday loans2 33

Elevate key performance highlights Q2 2018 Performance Elevate Goals Highlights 1 23% revenue growth YOY 23% combined loans receivable – 2 Strong Growth principal growth YOY 3 45% growth in Adjusted EBITDA YOY 16% Adjusted EBITDA margin3 Expanding Margins 240 basis point expansion YOY Stable Credit Quality Continued performance in target range $260 Q2, $276 YTD Managed CAC 30% more customers acquired over 1H17 Outsized Continued secular shift to responsible online products Customer Impact Average APR down almost 50% since 2013 Adjusted EBITDA, Adjusted EBITDA margin and combined loans receivable – principal are non-GAAP financial measures. See Appendix for a reconciliation to GAAP measures. 4

Recent Business Highlights Celebrated Elevate’s 2 Millionth Non-Prime Customer -Innovative credit solutions offer responsible alternatives to payday, title and storefront installment loans Named a 2018 Financial Health Leader by the CFSI Financial Health Network -Leading consumer financial health network highlights Elevate’s commitment to customer financial wellness Customers have saved more then $4 Billion over Payday Loans1 -More than $2 Billion saved in the last 18 months alone2 Launched Today Card Mastercard: Prime Credit Card for Non-Prime Consumers -New first-of-its-kind credit card product offered through Capital Community Bank of Utah 5

Today Card • Non-prime credit card with a prime experience • Larger lines than competing cards due to underwriting prowess • Broadens product portfolio • Continues commitment to customer financial health with “prime” rates • Expands bank partnership model 6

Growth in key financial measures ($mm) Ending combined loans receivable – principal, Adjusted EBITDA and Adjusted Net Income (Loss) are non-GAAP financial measures. See appendix for a reconciliation to a GAAP measure. 7

Consistent and improving credit quality The 2017 and 2018 vintages are not yet fully mature from a loss perspective – expected to be slightly better than 2016. 8

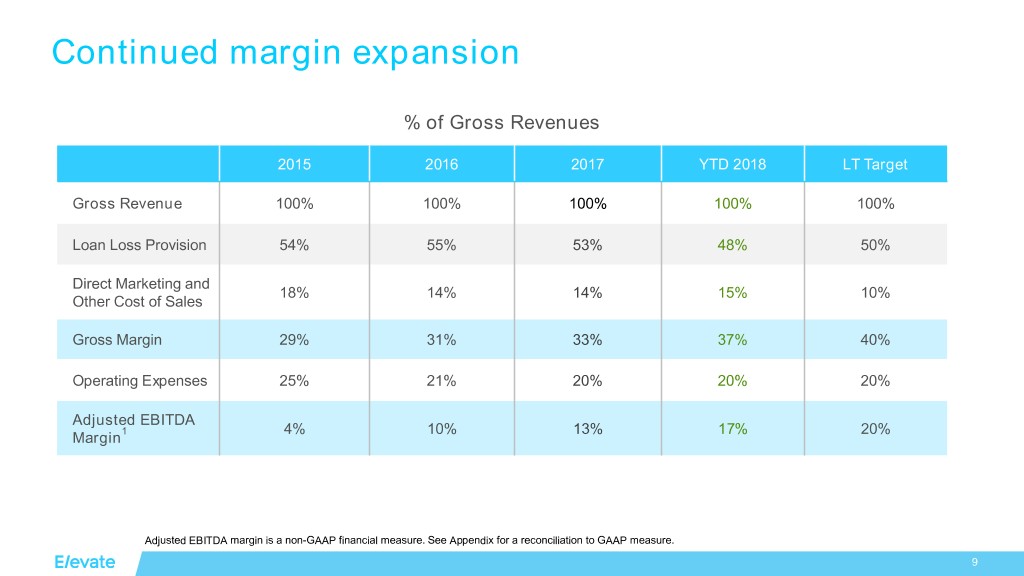

Continued margin expansion % of Gross Revenues 2015 2016 2017 YTD 2018 LT Target Gross Revenue 100% 100% 100% 100% 100% Loan Loss Provision 54% 55% 53% 48% 50% Direct Marketing and 18% 14% 14% 15% 10% Other Cost of Sales Gross Margin 29% 31% 33% 37% 40% Operating Expenses 25% 21% 20% 20% 20% Adjusted EBITDA 1 4% 10% 13% 17% 20% Margin Adjusted EBITDA margin is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure. 9

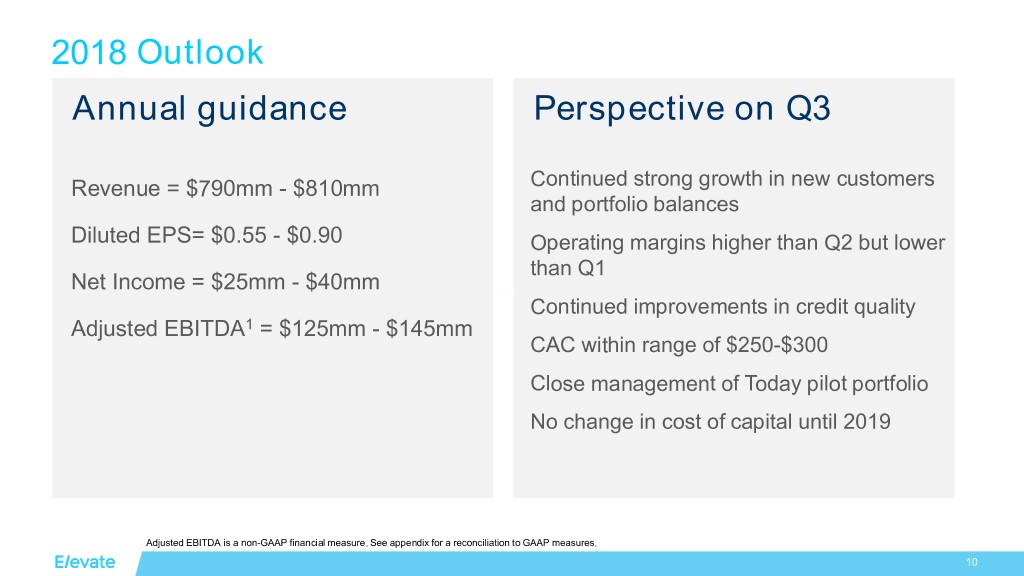

2018 Outlook Annual guidance Perspective on Q3 Revenue = $790mm - $810mm Continued strong growth in new customers and portfolio balances Diluted EPS= $0.55 - $0.90 Operating margins higher than Q2 but lower than Q1 Net Income = $25mm - $40mm Continued improvements in credit quality Adjusted EBITDA1 = $125mm - $145mm CAC within range of $250-$300 Close management of Today pilot portfolio No change in cost of capital until 2019 Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation to GAAP measures. 10

We believe everyone deserves a lift. 1111

Appendix 12

Footnotes Page 3: 1 Originations and customers from 2002-June 2018, attributable to the combined current and predecessor direct and branded products. 2 For the period from 2013 to June 30, 2018. Based on the average effective APR of 129% for the six months ended June 30, 2018. This estimate, which has not been independently confirmed, is based on our internal comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau, or the "CFPB." Page 4: 1 Second quarter 2018 revenue of $184 million and second quarter 2017 revenue of $150 million. 2 Combined loans receivable – principal at June 30, 2018 of $589 million and at June 30, 2017 of $481 million. Combined loans receivable - principal is not a financial measure prepared in accordance with GAAP. Combined loans receivable – principal represents loans owned by the company plus loans originated and owned by third-party lenders pursuant to our CSO programs. 3 Second quarter 2018 Adjusted EBITDA of $29 million and second quarter 2017 Adjusted EBITDA of $20 million. Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; non-operating income; share-based compensation expense and income tax expense. See the Appendix for a reconciliation to GAAP net income. Adjusted EBITDA margin is Adjusted EBITDA divided by revenue. Page 5: 1 For the period from 2013 to June 30, 2018. Based on the average effective APR of 129% for the six months ended June 30, 2018. This estimate, which has not been independently confirmed, is based on our internal comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau, or the "CFPB.“ 2 For the period from January 2017 to June 30, 2018. Based on the average effective APR of 129% for the six months ended June 30, 2018. This estimate, which has not been independently confirmed, is based on our internal comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau, or the "CFPB." Page 7: 1 Ending combined loans receivable - principal is a non-GAAP financial measure. See appendix for a reconciliation to a GAAP measure. 2 19% is based on 2018 estimate midpoint. 3 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; non-operating income; stock-based compensation expense and income tax expense. See the Appendix for a reconciliation to GAAP net income. 4 55% is based on 2018 estimate midpoint. 5 2017 adjusted net income of $5.5 million is not a financial measure prepared in accordance with GAAP. Adjusted net income for 2017 represents our $6.9 million net loss for the year ended December 31, 2017, adjusted to exclude the impact of $12.5 million in tax expense incurred during the fourth quarter of 2017 due to the enactment of the Tax Cuts and Jobs Act. 13

Footnotes (continued) Page 9 1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; loss on discontinued operations; non-operating income; stock-based compensation expense and income tax expense. See the Appendix for a reconciliation to GAAP income. Adjusted EBITDA margin is Adjusted EBITDA divided by revenue. Page 10 1 Adjusted EBITDA margin is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. Adjusted EBITDA represents our net income (loss), adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; loss on discontinued operations; non-operating income; share-based compensation expense and income tax benefit. See the Appendix for a reconciliation to GAAP income. 14

Non-GAAP financials reconciliation Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure. The Company’s Adjusted EBITDA guidance does not include certain charges and costs. The adjustments in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior periods, such as the impact of income tax benefit or expense, non-operating income, foreign currency transaction gain or loss associated with our UK operations, net interest expense, stock-based compensation expense and depreciation and amortization expense, among others. The Company is not able to provide a reconciliation of the Company’s non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs. 15

Combined loans reconciliation 16

Combined loans reconciliation (continued) 1 Represents loans originated by third-party lenders through the CSO programs, which are not included in our financial statements. 2 Represents finance charges earned by third-party lenders through CSO programs, which are not included in our financial statements. 3 Non-GAAP measure. . 17

© 2017 Elevate. All Rights Reserved.