Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number 001-37680

ELEVATE CREDIT, INC.

(Exact name of registrant as specified in its charter)

Delaware | 46-4714474 | |||

State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | |||

4150 International Plaza, Suite 300 Fort Worth, Texas 76109 | 76109 | |||

Address of Principal Executive Offices | Zip Code | |||

(817) 928-1500 | ||||

Registrant’s Telephone Number, Including Area Code | ||||

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Shares, $0.0004 par value | ELVT | New York Stock Exchange | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes | x | No | o |

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes | x | No | o |

1

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Non-accelerated filer | o |

Accelerated filer | x | Smaller reporting company | x |

Emerging growth company | x | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the Registrant's common stock, par value $0.0004 per share, held by non-affiliates as of June 30, 2019 was approximately $137,459,610.

The number of shares outstanding of the Registrant's common stock, par value $0.0004 per share, as of February 12, 2020 was 43,020,373 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2020 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the Registrant’s fiscal year ended December 31, 2019.

2

TABLE OF CONTENTS

YEAR ENDED DECEMBER 31, 2019

INDEX TO FORM 10-K

Part I | |||

Item 1. | |||

Item 1A. | |||

Item 1B. | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Part II | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A. | |||

Item 8. | |||

Item 9. | |||

Item 9A. | |||

Item 9B. | |||

Part III | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

Part IV | |||

Item 15. | |||

Item 16. | |||

3

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") that are based on our management’s beliefs and assumptions and on information currently available to our management. The forward-looking statements are contained throughout this Annual Report on Form 10-K, including in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” Forward-looking statements include information concerning our strategy, future operations, future financial position, future revenues, projected expenses, margins, prospects and plans and objectives of management. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “seek,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

• | our future financial performance, including our expectations regarding our revenue, cost of revenue, growth rate of revenue, cost of borrowing, credit losses, marketing costs, net charge-offs, gross profit or gross margin, operating expenses, marketing costs, operating margins, loans outstanding, loan loss provision, credit quality, ability to generate cash flow and ability to achieve and maintain future profitability; |

• | the availability of debt financing, funding sources and disruptions in credit markets; |

• | our ability to meet anticipated cash operating expenses and capital expenditure requirements; |

• | anticipated trends, growth rates, seasonal fluctuations and challenges in our business and in the markets in which we operate; |

• | our ability to anticipate market needs and develop new and enhanced or differentiated products, services and mobile apps to meet those needs, and our ability to successfully monetize them; |

• | our expectations with respect to trends in our average portfolio effective annual percentage rate; |

• | our anticipated growth and growth strategies and our ability to effectively manage that growth; |

• | our anticipated expansion of relationships with strategic partners, including banks; |

• | customer demand for our product and our ability to rapidly grow our business in response to fluctuations in demand; |

• | our ability to attract potential customers and retain existing customers and our cost of customer acquisition; |

• | the ability of customers to repay loans; |

• | interest rates and origination fees on loans; |

• | the impact of competition in our industry and innovation by our competitors; |

• | our ability to attract and retain necessary qualified directors, officers and employees to expand our operations; |

• | our reliance on third-party service providers; |

• | our access to the automated clearing house system; |

• | the efficacy of our marketing efforts and relationships with marketing affiliates; |

• | our anticipated direct marketing costs and spending; |

• | the evolution of technology affecting our products, services and markets; |

• | continued innovation of our analytics platform, including releases of new credit models; |

• | our ability to prevent security breaches, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of the platform or adversely impact our ability to service loans; |

• | our ability to detect and filter fraudulent or incorrect information provided to us by our customers or by third parties; |

• | our ability to adequately protect our intellectual property; |

• | our compliance with applicable local, state, federal and foreign laws; |

4

• | our compliance with, and the effects on our business and results of operations from, current or future applicable regulatory developments and regulations, including developments or changes from the Consumer Financial Protection Bureau (the "CFPB") and developments or changes in state law; |

• | regulatory developments or scrutiny by agencies regulating our business or the businesses of our third-party partners; |

• | public perception of our business and industry; |

• | the anticipated effect on our business of litigation or regulatory proceedings to which we or our officers are a party; |

• | the anticipated effect on our business of natural or man-made catastrophes; |

• | the increased expenses and administrative workload associated with being a public company; |

• | failure to maintain an effective system of internal controls necessary to accurately report our financial results and prevent fraud; |

• | our liquidity and working capital requirements; |

• | the estimates and estimate methodologies used in preparing our consolidated financial statements; |

• | the utility of non-GAAP financial measures; |

• | the future trading prices of our common stock and the impact of securities analysts’ reports on these prices; |

• | our anticipated development and release of certain products and applications and changes to certain products; |

• | our anticipated investing activity; |

• | trends anticipated to continue as our portfolio of loans matures; and |

• | any future repurchases under our share repurchase program, including the timing and amount of repurchases thereunder. |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss these risks in greater detail in “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Annual Report on Form 10-K. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

5

PART I

Item 1. Business

Unless expressly indicated or the context requires otherwise, the terms “Elevate,” “company,” “we,” “us” and “our” used below refer to Elevate Credit, Inc. and, where appropriate, our wholly owned subsidiaries and consolidated variable interest entities, as well as the direct lending and branded product business of our predecessor, Think Finance, Inc. ("TFI"), for periods prior to our 2014 spin-off from TFI. We generally refer to loans, customers and other information and data associated with each of Rise, Elastic, Sunny and Today Card as Elevate’s loans, customers, information and data, irrespective of whether Elevate originates the credit to the customer or whether such credit is originated by a third party, or originated loans by FinWise Bank, Republic Bank and Capital Community Bank, where Elevate serves as a service provider.

OUR COMPANY

We provide online credit solutions to consumers and banks in the United States (the "US") and the United Kingdom (the "UK") who are not well-served by traditional bank products and who are looking for better options than payday loans, title loans, pawn and storefront installment loans. Non-prime consumers—approximately 170 million people in the US and UK, typically defined as those with credit scores of less than 700—now represent a larger market than prime consumers but are difficult to underwrite and serve with traditional approaches. We’re succeeding at it—and doing it responsibly—with best-in-class advanced technology and proprietary risk analytics honed by serving more than 2.4 million customers with $8.1 billion in credit. Our current online credit products, Rise, Elastic, Sunny and our recently test launched Today Card reflect our mission to provide customers with access to competitively priced credit and services while helping them build a brighter financial future with credit building and financial wellness features. We call this mission "Good Today, Better Tomorrow."

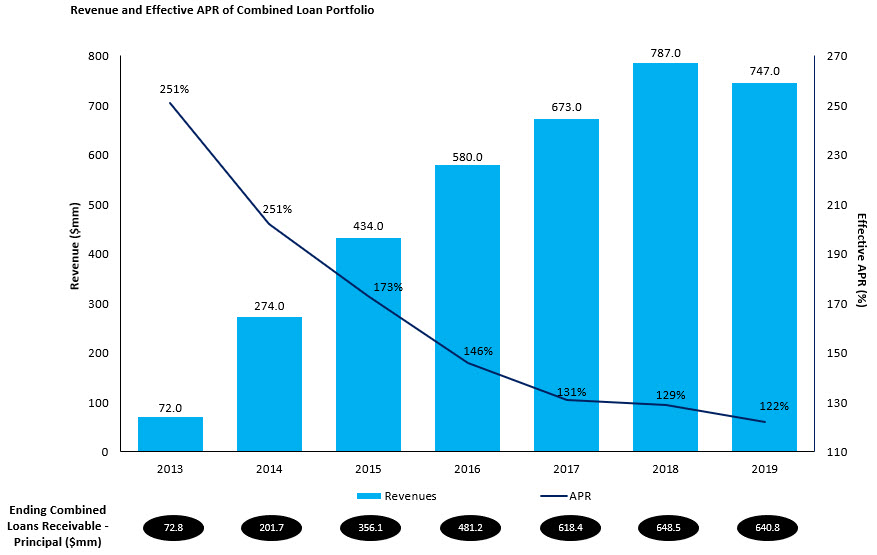

As of December 31, 2019, Rise, Elastic, Sunny and Today Card, together, have provided approximately $6.6 billion in credit to approximately 1.6 million customers. Our revenues for the year ended December 31, 2019 decreased 5% to $747.0 million from $786.7 million for the year ended December 31, 2018. Our operating income for the years ended December 31, 2019 and 2018 was $111.4 million and $94.9 million, respectively, and our total assets at December 31, 2019 and 2018 were $784 million and $753 million, respectively. We have committed funding sources to support our expected continued growth. See "Management’s discussion and analysis of financial condition and results of operations—Liquidity and Capital Resources."

Along with improving operating margins, we have also reduced the effective APR of our products for our customers. For the year ended December 31, 2019, our effective APR was 122%, a drop of approximately 51% compared to the year ended December 31, 2013 when the effective APR was 251%. We estimate that, since 2013, our products have saved our customers more than $6.5 billion over what they would have paid for payday loans, based on a comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau ("CFPB"). As of December 31, 2019, more than 39,000 Rise customers in good standing received at least a 50% reduction in their APR. Furthermore, with help from our reporting their successful payment history to a major credit bureau, more than 140,000 of our customers have seen their credit scores improve appreciably, according to data from that credit bureau. We believe that these rate reductions and other benefits help differentiate our products in the market and reflect improvements in our underwriting and the maturing of our loan portfolios. Moreover, we believe doing business this way is the right thing to do.

6

We believe our growth demonstrates our ability to rapidly scale our business by utilizing our advanced technology platform, proprietary risk analytics and sophisticated multi-channel marketing capabilities. The chart above details our annual total combined loans receivable, revenues and effective APR of the customer loan portfolio since 2013.

Our products in the US and the UK are:

Ø | Rise. A product available in 12 US states as a state-licensed installment loan product, in one state as a CSO-originated installment loan product, in two states as a line of credit product, and as an installment loan product in an additional 19 US states originated by a third-party bank; |

Ø | Elastic. A line of credit product originated by a third-party bank and offered in 40 states in the US; |

Ø | Sunny. An installment loan product available in the UK; and |

Ø | Today Card. A credit card product originated by a third-party bank and in test launch in the US. |

We differentiate ourselves in the following ways:

Ø | Online and mobile products that are “Good Today, Better Tomorrow.” Our products, and those originated by banks for which we serve as service providers, are “Good Today” because they help solve our customers’ immediate financial needs with competitively priced credit and a simple online application process that provides credit decisions in seconds and funds as soon as the next business day (in the US) or in minutes (in the UK). We are committed to transparent pricing with no prepayment penalties or punitive fees as well as amortizing loan balances and flexible repayment schedules that let customers design the loan repayment terms that they can afford. Our five-day risk-free guarantee provides confidence to customers that if they can find a better financial solution within that timespan, they simply repay the principal with no other fees. In addition, our products are “Better Tomorrow” because they reward successful payment history with rates on subsequent loans (installment loan products) that can decrease over time and can help customers improve their long-term financial well-being with features like credit bureau reporting, free credit monitoring (for US customers), and online financial literacy videos and tools. |

7

Ø | Industry-leading technology and proprietary risk analytics optimized for the non-prime credit market. We have made substantial investments in our proven technology and analytics platforms to support rapid scaling and innovation, robust regulatory compliance, and ongoing improvements in underwriting. Our proven technology platform provides for nimble testing and optimization of our user interface and underwriting strategies, highly automated loan originations, cost-effective servicing, and robust compliance oversight. Our proprietary risk analytics infrastructure utilizes a massive (approximately 80+ terabyte) Hadoop database composed of more than ten thousand potential data variables related to each of the 2.4 million customers we have served and about 8.6 million applications that we have processed. Our team of over 50 data scientists uses our proprietary technology to build and test scores and strategies across the entire underwriting process, including segmented credit scores, fraud scores, affordability scores and former customer scores. We use a variety of analytical techniques from traditional multivariate regression to machine learning and artificial intelligence to continue to enhance our underwriting accuracy while complying with applicable US and UK lending laws and regulations. As a result of our proprietary technology and risk analytics, approximately 94% of loan applications are automatically decisioned in seconds with no manual review required. |

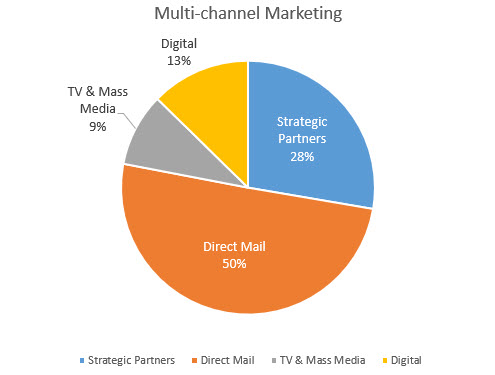

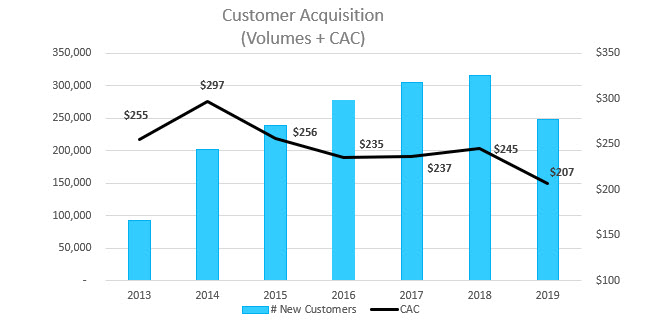

Ø | Integrated multi-channel marketing strategy. We use a multi-channel marketing strategy to directly reach potential customers through our paid, earned and owned channels. Our marketing strategy includes coordinated direct mail programs, strategic partnerships and digital marketing. Our direct-to-consumer approach allows us to focus on higher quality, lower cost customer acquisitions and to control overall marketing costs. Our customer acquisition costs (“CAC”) have remained within the range of $200 to $300 over the past five years. We continue to invest in new marketing capabilities that we believe will provide us with competitive advantages and support ongoing growth. We invest in improved customer targeting analytics and increasingly sophisticated response models to allow us to expand our marketing reach while maintaining target CAC. |

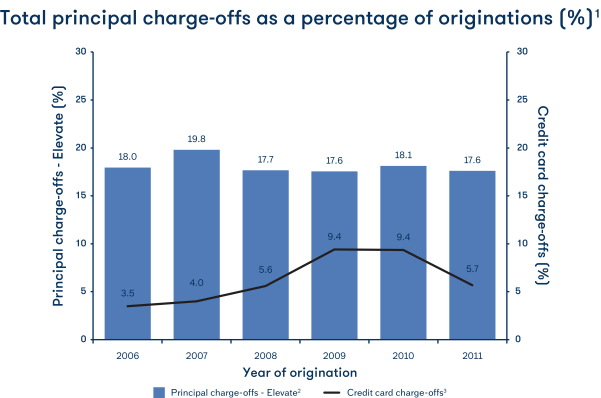

Our seasoned management team has, on average, more than 12 years of online technology and financial services experience and has worked together for an average of over ten years in the non-prime consumer credit industry. Our management team has overseen the origination of $8.1 billion in credit to 2.4 million customers for the combined current and predecessor direct lending and branded products business that was contributed to Elevate in our spin-off from TFI. In addition, our management team achieved stable credit performance for our predecessor products through the last decade's financial crisis, maintaining total principal losses as a percentage of loan originations of between 17% and 20% each year from 2006 through 2011. See “—Advanced Analytics and Risk Management—History of stable credit quality through the economic downturn.”

INDUSTRY OVERVIEW

Non-prime consumers represent the largest segment of the credit market

We provide credit to non-prime consumers, many of whom face reduced credit options and increased financial pressure due to macro-economic changes over the past few decades. We believe that this segment of the population represents a massive and underserved market of approximately 170 million consumers in the US and UK—a larger population than the market for prime credit and over half of the US adult population:

Ø | According to an analysis of FICO credit score data as of 2018, nearly 42% of the US population had non-prime credit score of less than 700, representing approximately 105 million Americans adults. |

Ø | Approximately 22% of Americans over the age of 18, or approximately 53 million Americans, do not have a credit score at all or had credit records that were treated as “unscorable” by traditional credit scoring models used by nationwide credit reporting agencies, according to a 2015 report by Fair Isaac Corporation. |

Ø | According to a PwC report from 2016, it is estimated that the UK near-prime credit market consisted of approximately 10 million people. |

8

Typical customers in both the US and UK are middle-income and have a mainstream demographic profile as illustrated below, according to a 2019 Elevate analysis of income and homeownership of customers, including self-reported customer information. This is in line with the average of the populations of the US and UK, respectively, in terms of income, educational background and rate of homeownership. We refer to them as the “New Middle Class.”

Rise and Elastic Customer Profile | Sunny Customer Profile | |||

Average income | $52,395 for Rise $41,837 for Elastic | £21,184 | ||

% Attended college | 82% | N/A | ||

% Own their homes | 17.4% | 9.3% | ||

Typical range of FICO score(1) | 511-623 | N/A | ||

(1) Range of middle quintile of Elevate US customers - 2019 Elevate data.

Customers have varying credit profiles and are more likely to be turned down for credit by many traditional bank lenders. They are risky and can be difficult to underwrite—often due to factors outside of their control. To provide insight into the different types of credit histories and financial needs facing our non-prime customers and the challenges of serving them, the following categories are illustrative:

Ø | “Prime-ish.” Consumers with significant credit history and access to traditional credit sources who are now looking for non-bank credit. They may be over-extended on their existing credit sources and their creditworthiness may be eroding. |

Ø | “Challenged.” Consumers who have had traditional credit in the past but experienced defaults or had a history of late payments and as a result may now use alternative non-prime products such as payday, pawn and title loans. |

Ø | “Invisibles.” Consumers with no credit history or such minimal credit experience that they cannot be sufficiently scored by traditional means and as a result are often kept outside the traditional credit markets. These consumers often have limited or no credit profile and may have a high chance of potential fraud. |

These categories do not correspond to specific credit score bands or precise scores or definitions for the customers included in such categories. We continue to identify additional customer categories and evolve our customer category definitions over time.

The New Middle Class has an unmet need for credit

Due to wage stagnation over the past several decades and the continued impact of the last decade's financial crisis, the New Middle Class is characterized by a lack of savings and significant income volatility. According to a Federal Reserve survey in 2017, 40% of American adults said they could not cover an emergency expense of $400 or would cover it by selling an asset or borrowing money. In the UK, according to a 2018 study published by Zurich UK 24% of adults have no savings at all and 34% feel they would be unable to recover from financial shock. Further, the JPMorgan Chase Institute reported in a 2015 study of 100,000 US customers that 41% saw their incomes vary by more than 30% from month-to-month and noted that the bottom 80% of households by income lacked sufficient savings to cover the volatility observed in income and spending. Compounding these financial realities is the fact that average household income has generally remained flat for over a decade. As a result, our customer base often must rely on credit to fund unexpected expenses, like car and home repairs or medical emergencies.

Non-prime credit can be less vulnerable to recessionary factors

Based on our own experiences during the last decade’s financial crisis, as well as research conducted by the credit bureau TransUnion, we believe that patterns of credit charge-offs for non-prime consumers can be acyclical or counter-cyclical when compared to prime consumers in credit downturns. In a recession, banks and traditional prime credit providers often experience increases in credit charge-off rates and tighten standards which reduces access to traditional credit and pushes certain consumers out of the market for bank credit. Conversely, with advanced underwriting, lenders serving non-prime consumers are able to maintain comparatively flat charge-off rates in part because of these new customers who are unable to avail themselves of the traditional credit market. See “—Advanced Analytics and Risk Management—History of stable credit quality through the economic downturn.”

9

Non-prime consumers have different needs for credit

Non-prime consumers generally have unique and immediate credit needs, which differ greatly from the typical prime consumer. Whereas prime consumers consider price most often in selecting their credit products, we believe that non-prime consumers will often consider a variety of features, including the simplicity of the application process, speed of decisioning and funding, how they will be treated if they cannot pay their loan back on time, and flexible repayment terms.

Banks do not adequately serve the New Middle Class

Following the last decade's financial crisis, most banks tightened their underwriting standards and increased their minimum FICO score requirements for borrowers, leaving non-prime borrowers with severely reduced access to traditional credit. Despite the improving economy, banks continue to underserve the New Middle Class. According to our analysis of master pool trust data of securitizations for the five major credit card issuers, we estimate that from 2008 to 2016 revolving credit available to US borrowers with a FICO score of less than a 660 was reduced by approximately $142 billion. This reduction has had a profound impact on non-prime consumers in the US and UK who typically have little to no savings. Often, the only credit-like product offered by banks that is available to non-prime borrowers is overdraft protection, which in essence provides credit at extremely high rates. According to a 2008 study by the FDIC, bank overdraft fees can have an effective APR of greater than 3,500%, depending upon the amount of the overdraft transaction and the length of time to bring the account positive.

Legacy non-prime lenders are not innovative

As a result of limited access to credit products offered by banks, the New Middle Class has historically had to rely on a variety of legacy non-prime lenders, such as storefront installment lenders, payday lenders, title lenders, pawn and rent-to-own providers that typically do not offer customers the convenience of online and mobile access. While legacy non-prime credit products may fulfill a borrower’s immediate funding needs, many of these products have significant drawbacks for consumers, including a potential cycle of debt, higher interest rates, punitive fees and aggressive collection tactics. Additionally, legacy non-prime lenders do not typically report to major credit bureaus, so non-prime consumers often remain in a cycle of non-prime and rarely improve their financial options.

Fintech startups have largely ignored the non-prime credit market

Despite the growing and unmet need for non-prime credit, few innovative solutions tailored for non-prime consumers have come to market and achieved any meaningful scale. Where new online marketplace lenders and small business lenders have emerged to serve prime consumers, we believe that non-prime consumers still have relatively few responsible online credit options. We believe this is because underwriting non-prime consumers presents significantly greater analytical challenges than underwriting prime consumers. Unlike prime consumers, the credit profiles of non-prime consumers vary greatly and may contain significant derogatory information, yet non-prime consumers often need instant decisions with a minimum of paperwork and inconvenience. While new data and techniques can assist in improving underwriting capabilities, we believe lenders still require deep insight and extensive experience to successfully serve non-prime consumers while maintaining target loss rates. Additionally, we believe the compliance and other systems necessary to serve non-prime consumers in a manner consistent with regulatory requirements can be a barrier to entry. Having originated $8.1 billion in credit to more than 2.4 million customers, we believe we have a significant lead over new entrants.

Consumers are embracing the internet for their personal finances

Consumers are increasingly turning to online and mobile solutions to fulfill their personal finance needs. A 2015 study published by the CFI Group found that 88% of bank customers surveyed in the US conduct about half to all their banking online. In the UK, the Office of National Statistics found in 2018 that seven out of ten adults now bank online, doubling the percentage from ten years before. We believe this growth is an indication of borrower preferences for online and mobile financial products that are more convenient and easier to access than products provided by legacy brick-and-mortar lenders.

OUR SOLUTIONS

Our innovative online credit solutions provide immediate relief to customers today and can help them build a brighter financial future. We call this mission “Good Today, Better Tomorrow” and it drives our product design. Elevate’s current generation of credit products includes Rise, Elastic, Sunny and Today Card. See “—Our Products.”

10

We provide more convenient, competitively priced financial solutions to our customers, who are not well-served by either banks or legacy non-prime lenders, by using our advanced technology platform and proprietary risk analytics. We also offer a number of financial wellness and consumer-friendly features such as rates that can go down over time, no punitive fees, a five-day risk-free guarantee, free online financial literacy videos and tools, credit bureau reporting and free credit monitoring (in the US) that we believe are unmatched in the non-prime lending market.

We have made substantial investments in our proven technology and analytics platforms to support rapid scaling and innovation, robust regulatory compliance, and ongoing improvements in underwriting. We have also established a research organization focused on non-prime consumers called the “Center for the New Middle Class” to raise the awareness of their unique needs. As a result, we believe we are leading a new breed of more responsible online credit providers for the New Middle Class.

Our products provide the following key benefits:

Ø | Competitive pricing with no hidden or punitive fees. Our US products offer rates that we believe are typically more than 50% lower than many generally available alternatives from legacy non-prime lenders, and since 2013 have saved our customers more than $5.2 billion over what they would have paid for payday loans. Our products offer rates on subsequent loans (installment loan products) that can decrease over time based on successful loan payment history. For instance, as of December 31, 2019, approximately half of Rise customers in good standing had received a rate reduction, typically after a refinance or on a subsequent loan. In addition, to help our customers facing financial hardships, we have eliminated punitive fees, including returned payment fees and late charges, among others on all products excluding our Today Card credit card, which does include some modest industry-standard fees. |

Ø | Access and convenience. We provide convenient, easy-to-use products via online and mobile platforms. Consumers are able to apply using a mobile-optimized online application, which takes only minutes to complete from a mobile or desktop device. Credit determinations are typically made in seconds and approximately 94% of loan application decisions are fully automated with no manual review required. Funds are typically available the next-day in the US and within minutes in the UK. Consumers can elect to make payments via preapproved automated clearinghouse (“ACH”) authorization or other methods such as check or debit card transfer. |

Ø | Flexible payment terms and responsible lending features. Our customers can select a payment schedule that fits their needs with no prepayment penalties. We do not offer any “single-payment” or “balloon-payment” credit products that can lead to a cycle of debt and have been criticized by many consumer groups as well as the CFPB. To ensure that consumers fully understand the product and their alternatives, we provide extensive “Know Before You Borrow” disclosures as well as an industry-leading five-day “Risk-Free Guarantee” during which customers can rescind their loan at no cost. Consistent with our goal of being sensitive to the unique needs of non-prime consumers, we also offer flexible solutions to help customers facing issues impacting their ability to make scheduled payments. Our solutions include notifications before payment processing, extended due dates, grace periods, payment plans and special payment programs. |

Ø | Financial wellness features. Our products include credit building and financial wellness programs, such as credit bureau reporting, free credit monitoring (in the US) and online financial literacy videos and tools. Our goal is to help our customers improve their financial options and behaviors at no additional charge. We are very proud of the fact that, with help from our reporting their successful payment history to a major credit bureau, more than 140,000 of our customers have seen an appreciable increase in their credit scores, according to data from that credit bureau. |

This combination of features has resulted in extremely high customer satisfaction for our products. Internal customer satisfaction ratings were generally over 92% for all of our products during 2019.

OUR COMPETITIVE ADVANTAGES

Using our proven technology platform and proprietary risk analytics infrastructure, we are able to offer our customers innovative credit solutions that place us as a leader among a new breed of more responsible, online non-prime lenders. We believe the following are our key competitive advantages:

Ø | Differentiated online and mobile products for non-prime consumers. Our product development is driven by a deep commitment to solving customers’ immediate financial need for credit and helping them improve their long-term financial future. We call this mission “Good Today, Better Tomorrow.” Our products are “good today” due to their convenience, cost, transparency and flexibility. Our average customer receives an interest rate that we believe is more than 50% less than that offered by many legacy non-prime lenders. In fact, since 2013 our customers have saved more than $6.5 billion over what they would have paid for payday loans based on a comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the CFPB. |

11

Furthermore, the convenience of online and mobile access and flexible repayment options distinguish our products from many legacy non-prime credit options. However, we go even further in creating credit products that can help enable customers to have a “better tomorrow.” Based on successful payment history, rates on subsequent loans (installment loan products) can decrease over time, and we provide a path to prime credit for struggling consumers by reporting to credit bureaus, providing free credit monitoring (for US products), and offering online financial literacy videos and tools to help build better financial management skills. With help from our reporting their successful payment history to a major credit bureau, more than 140,000 of our customers have seen their credit scores improve appreciably, according to data from that credit bureau.

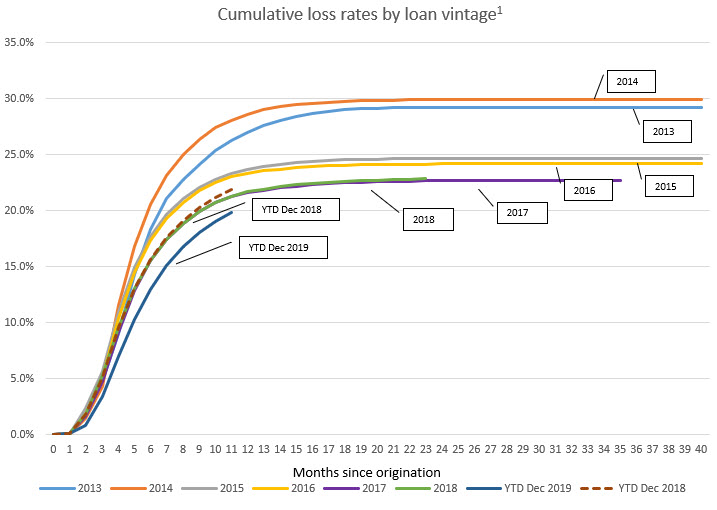

Ø | Industry-leading risk analytics infrastructure and underwriting scores. Traditional approaches for underwriting credit such as FICO scores are not adequate for non-prime consumers who may have significant derogatory credit history or no credit history at all. Because continued leadership in non-prime underwriting is essential to drive growth, support continued rate reductions to customers, and manage losses, we built our proprietary risk analytics infrastructure to support the development and enhancement of our underwriting scores and strategies. Our risk analytics infrastructure utilizes a massive (approximately 80+ terabyte) Hadoop database composed of more than ten thousand potential data variables related to each of the 2.4 million customers we have served and the about 8.6 million applications that we have processed. This data is composed of variables from consumer applications and website behavior, credit bureaus, bank account transaction data, numerous other alternative third-party data providers as well as performance history for funded customers. Our team of over 50 data scientists uses our risk analytics platform to build and test scores and strategies across the entire underwriting process including segmented credit scores, fraud scores, affordability scores and former customer scores. They use a variety of analytical techniques from traditional multivariate regression to machine learning to continue to enhance our underwriting accuracy while complying with applicable US and UK lending laws and regulations. See “—Advanced Analytics and Risk Management—Segmentation strategies across the entire underwriting process.” Across the portfolio of products we currently offer, we have maintained stable credit quality as evidenced by charge-off rates that are generally between 20% and 30% of the original principal loan balances. While we experience month-to-month variability in our loan losses for any variety of reasons, including due to seasonality, on an annual basis, our annual principal charge-off rates have remained consistent since the launch of our current generation of products in 2013. See “Management’s discussion and analysis of financial condition and results of operations—Key Financial and Operating Metrics—Credit quality.” Furthermore, our proprietary credit and fraud scoring models allow not only for the scoring of a broad range of non-prime consumers, but also across a variety of products, channels, geographies and regulatory requirements. |

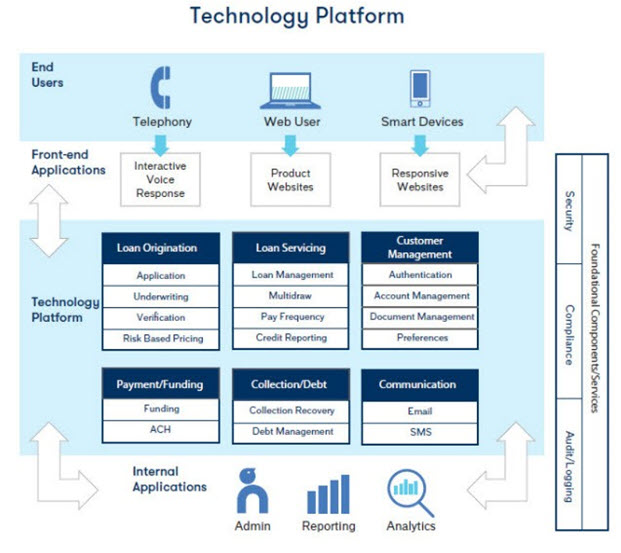

Ø | Innovative and flexible proven technology platform. Investment in our flexible and scalable technology platform has enabled us to rapidly grow and innovate new products - notably supporting the launch of our current generation of products in 2013. Our proven technology platform provides for nimble testing and optimization of our user interface and underwriting strategies, highly automated loan originations, cost-effective servicing, and robust compliance oversight. In addition, our platform is adaptable to allow us to enhance current products or launch future online products to meet evolving consumer preferences and respond to a dynamic regulatory environment. Further, our open architecture allows us to easily integrate with best-in-class third-party providers, including strategic partners, data sources and outsourced vendors. |

Ø | Seasoned management team with strong industry track record. We have a seasoned team of senior executives with an average of more than 12 years of experience in online technology and financial services at companies such as Bank of America, MasterCard, BlackRock and Silicon Valley Bank, led by Jason Harvison, a financial services industry veteran with more than 21 years of experience, who has launched more than ten financial products. The team has overseen the origination of $8.1 billion in credit to more than 2.4 million customers for the combined current and predecessor products that were contributed to Elevate in our spin-off from TFI. Additionally, the team has a proven track record of managing defaults through the last decade's financial crisis. From 2006 to 2011, the principal charge-offs of Elevate's legacy and predecessor credit products remained comparatively flat compared to credit card charge-off rates which nearly tripled during the same period. Elevate was certified as a “Great Place To Work” in 2019 for the fourth consecutive year. We believe this reflects our commitment to build a strong and lasting company and a customer-focused corporate culture. |

12

OUR STRATEGY

To achieve our goal of being the most trusted provider of financial services to the New Middle Class, we intend to execute the following strategies:

Ø | Continue to grow our brands. Rise, Elastic and Sunny were launched in 2013, and the Today Card was launched in 2018. Given strong consumer demand and organic growth potential, we believe that significant opportunities exist to expand these four brands within their current markets via existing marketing channels. In addition to our lending activities, we license our US brands and provide marketing and underwriting services to FDIC regulated banks. As non-prime consumers become increasingly familiar and comfortable with online and mobile financial services, we also plan to capture the new business generated as they migrate away from less convenient legacy brick-and-mortar lenders. We continue to see strong desire from banks to leverage our capabilities. In 2020, we look to continue to grow new marketing and partner channels for all brands. |

Ø | Widen the credit spectrum of borrowers served with new products. We continue to evaluate new product and market opportunities that fit into our overall strategic objective of delivering next-generation online and mobile credit products that span the non-prime credit spectrum. Our newest product, the Today Card offers much lower rates than our other products and has helped Elevate be able to offer products across the non-prime spectrum. In addition, we are continually focused on improving our analytics to effectively underwrite and serve consumers within those segments of the non-prime credit spectrum that we do not currently reach. |

Ø | Pursue additional strategic partnerships and digital marketing channels. Our progressive non-prime credit solutions have attracted top-tier affiliate partners including Credit Karma and Lending Tree as a way to serve customers they have acquired. We intend to continue growing our existing affiliate partnerships and will evaluate opportunities to enter into new partnerships with affiliates. We expect these partnerships to provide us with access to a broad range of potential new customers with low customer acquisition costs. In addition, we continue to expand our digital marketing efforts across our products. In 2020, we look to grow these channels at a more rapid rate. |

Ø | Expand our relationship with existing customers. Customer acquisition costs represent one of the most significant expenses for online lenders. We will seek to expand our strong relationships with existing customers by providing qualified customers with new loans on improved terms or offering other products and services. We believe we can better serve our customers with improved products and services while, at the same time, achieving better operating leverage. |

Ø | Enter new markets. We will explore pursuing strategic opportunities to expand into additional international and domestic markets. However, we plan to take a disciplined approach to international expansion, utilizing customized products and in-market expertise. As reflected in our approach to entering the UK market, we believe that local teams with products developed for each unique local market will ultimately be the most successful. We currently do not expect to undertake any international expansion in the near term. |

OUR PRODUCTS

Rise, Elastic and Sunny are exclusively available through online and mobile devices. The Today Card is a credit card product, but user interfaces all happen online or through mobile device application. These products reflect the deep experience of our management team in the online non-prime lending industry and utilize leading technology and proprietary risk analytics to effectively manage profitability and optimize the customer experience.

Each of these products reflects our “Good Today, Better Tomorrow” mission and offers competitive rates and responsible lending features along with credit building and financial wellness tools. Our products have rates on subsequent loans that can decrease over time (installment loan products), no punitive fees, a five day "Risk Free Guarantee," credit bureau reporting, free credit monitoring (in the US), and online financial literacy videos and tools. The five day "Risk Free Guarantee" allows the borrower five business days to change their mind about the loan and return the principal with no fees.

Rise, Elastic, Sunny, and Today Card each follow distinct regulatory models, providing diversification across different regulatory frameworks. Rise operates under licenses from each state it serves and is additionally regulated by the CFPB; it also operates as a bank-originated credit product in an additional 19 states and is regulated by the FDIC; Elastic is a bank-originated credit product that is offered in 40 states across the US and is regulated by the FDIC and other bank regulators; Sunny is a UK credit product regulated by the Financial Conduct Authority (the “FCA”); and Today Card is a bank-originated credit card product that is offered across the US and is regulated by the FDIC and other bank regulators.

13

Year launched | 2013 | 2013 | 2017 | 2018 | ||||

Product type | Rise - Installment | Rise - CSO | Rise - Line of credit | Rise - FinWise | ||||

Geographies served | 12 states | 1 state | 2 states | 19 states | ||||

Loan size | $300 to $5,000 | $300 to $5,000 | $500 to $5,000 | $500 to $5,000 | ||||

Loan term | 4-26 months | 4-19 months | N/A | 7-26 months | ||||

Repayment schedule | Bi-weekly, semi-monthly, or monthly | Bi-weekly, semi-monthly, or monthly | Bi-weekly, semi-monthly, or monthly | Bi-weekly, semi-monthly, or monthly | ||||

Prepayment penalties | None | None | None | None | ||||

Pricing(1) | 60% to 299% annualized.(2) | 60% to 299% annualized.(2)(3) | 60% to 299% annualized.(4) | 99% to 149% annualized. | ||||

Other fees | None | None | None | None | ||||

Combined loans receivable principal (All Rise products = $350.1 million) | $196.7 million | $20.6 million | $11.4 million | $121.4 million | ||||

% of Combined loans receivable principal | 30.7% | 3.2% | 1.8% | 18.9% | ||||

Top states as a percentage of combined loans receivable – principal | CA (9%), GA (6%) | TX (3%) | TN (1%), KS (1%) | FL (5%), OH (4%) | ||||

IL (4%) | MI (2%) | |||||||

Weighted-average effective APR | 117% | 158% | 187% | 129% | ||||

New / former customers | New - 52.8% / Former - 47.2% | New - 34.2% / Former - 65.8% | New - 98.2% / Former - 1.8% | New - 74.8% / Former - 25.2% | ||||

(1) | Rise interest rates may differ significantly by state. See “—Regulatory Environment—APR by geography” for a breakdown of the APR. The number shown is based on a calculation of an effective APR. |

(2) | As of December 31, 2019. Some legacy customers will have rates as low as 36%. |

(3) | In Texas, Rise charges a CSO fee instead of interest. See “Management’s discussion and analysis of financial condition and results of operations—Key Financial and Operating Metrics—Revenues-Revenues.” |

(4) | Rise line of credit includes interest in addition to fees. The number shown is based on a calculation of an effective APR. |

14

Year launched | 2013 | 2013 | 2018 | |||

Product type | Line of credit | Installment | Credit card | |||

Geographies served | 40 states | UK | US - nationwide | |||

Loan size | $500 to $4,500 | £100 to £5,000 | $1,000 to $3,500 | |||

Loan term | Up to 10 months per funding(1) | 6-14 months | N/A | |||

Repayment schedule | Bi-weekly, semi-monthly, or monthly | Weekly, bi-weekly, semi-monthly, or monthly | Monthly minimum payments | |||

Prepayment penalties | None | None | None | |||

Pricing | Initially $5/$10 per $100 borrowed plus an average of 5%/10% of outstanding principal per billing period(2) | 10.5% to 24% monthly | 29.99% to 34.99% variable | |||

Other fees | None | None | Late fees, returned payment fees, annual fee and other customary fees | |||

Combined loans receivable principal | $252.6 million | $33.6 million | Test launch | |||

% of Combined loans receivable principal | 39.4% | 5.2% | 0.7% | |||

Top states as a percentage of combined loans receivable – principal | FL (6%), TX (4%) | N/A | N/A | |||

CA (3%) | ||||||

Weighted-average effective APR | 98%(3) | 224% | N/A | |||

(1) | Elastic term is based on minimum principal payments of 10% of last draw amount per month. |

(2) | Elastic pricing differs based on billing frequency. |

(3) | Elastic is a fee-based product. The number shown is based on a calculation of an effective APR. |

Rise—US installment loans and lines of credit

The structure of the Rise brand varies as a result of differing state laws and federal law governing the portfolio: Rise is currently offered as an installment loan directly to consumers in 12 states ("Rise installment"), a line of credit loan product ("Rise line of credit") in two states (Kansas and Tennessee), Rise is available in Texas through a CSO program that provides consumers access to installment loans offered by a third-party lender ("Rise CSO"), and lastly as installment loans originated by FinWise Bank in 19 other states.

We utilize risk-based pricing across the portfolio to optimally serve a large percentage of non-prime customers with rates ranging from 60% to 299%. There are no origination fees, monthly fees, late fees, over-limit fees, or fees for returned payments on the product. Eligible customers may receive a rate reduction on their next loan if certain eligibility criteria are met. As of December 31, 2019, more than 50% of Rise installment customers in good standing had received a rate reduction mid-loan or after a refinance or on a subsequent loan. Approximately 55% of Rise installment customers in good standing had refinanced or taken out a subsequent loan as of December 31, 2019, with 40% of the outstanding Rise installment loan balances on that date consisting of new customer loans and 60% related to returning customer loans. The Rise installment effective APR was 117% for the year ended December 31, 2019, which we believe is more than two-thirds lower than the average effective rate of a typical payday loan, based on the CFPB’s findings that the average APR for a payday loan is approximately 400%.

15

FinWise Bank licensed the Rise brand in the second half of 2018 and began to originate installment loans in 19 additional states. Under the terms of our agreement with FinWise Bank, we provide FinWise Bank with marketing services related to the Rise brand and license to FinWise Bank our technology platform and proprietary credit and fraud scoring models in order to originate and service Rise customers in certain states not otherwise covered by the Elevate-originated Rise brand. As the originator of the Rise loans in those states, FinWise Bank reviews and approves all marketing materials and campaigns and determines the underwriting strategies and score cutoffs used in processing applications. In addition, FinWise Bank defines all program parameters and provides full compliance oversight over all aspects of the program. Our platform supports FinWise Bank’s operational and compliance activities related to the Rise program. The FinWise Bank Rise installment loan effective APR was 129% for the year ended December 31, 2019. See “Management’s discussion and analysis of financial condition and results of operations—Overview” regarding the structure of EF SPV, Ltd. and how we recognize revenue associated with Rise loans originated by FinWise Bank.

The Rise line of credit product, which was launched in 2017, is available in two states under current applicable state law. Rise line of credit offers a maximum credit limit of $5,000 and charges interest based on the APR of the loan and the average balance for the period. The Rise line of credit effective APR was 187% for the year ended December 31, 2019.

Elastic—US bank-originated lines of credit

Elastic, currently available in 40 US states, is an online line of credit designed to be a financial safety net for non-prime consumers. It is originated by a third-party lender, Republic Bank. Elastic offers a maximum credit limit of $4,500 and charges an initial advance fee of $5 for each $100 advanced against the credit line, as well as a fixed charge of approximately 5% of open balances each payment period. Elastic’s effective APR based on this was approximately 98% for the year ended December 31, 2019, more than 75% lower than the average effective rate of a typical payday loan, based on the above-mentioned findings by the CFPB. There are no origination fees, monthly fees, late fees, over-limit fees or fees for returned payments on the product. Additionally, consumers must make a 10% mandatory principal reduction each month designed to encourage the full repayment of the original loan amount in approximately 10 months or less.

Under the terms of our agreement with Republic Bank, we provide them with marketing services related to the Elastic program and license them our technology platform and proprietary credit and fraud scoring models to originate and service Elastic customers. However, as the originator of the Elastic lines of credit, Republic Bank reviews and approves all marketing materials and campaigns and determines the underwriting strategies and score cutoffs used in processing applications. In addition, Republic Bank defines all program parameters and provides full compliance oversight over all aspects of the program. Our platform supports Republic Bank’s operational and compliance activities related to the Elastic program. See “Management’s discussion and analysis of financial condition and results of operations—Overview” regarding the structure of Elastic and how we recognize revenue associated with Elastic loans.

Sunny—UK installment loans

Sunny is our online UK installment loan product, currently offering loans of up to £5,000. It has a differentiated offering based on a wider range of loan amounts, a no-fee guarantee, price promotions and more flexible repayment options than most other providers in the UK short-term lending market.

After seven years, we believe Sunny has become one of, if not the top online, high-cost short-term loan providers in the UK. In 2019, Sunny helped approximately 88,000 new customers gain access to credit, and generated revenue of $108 million.

From 2018 to 2019, we have demonstrated stability and strong performance of a Sunny branded installment product that allows customers to borrow from £2,000 to £5,000 with the maximum APR of less than 100% ("Sub 100"). We have also started to migrate a proportion of existing customers to our Sub 100 product, with early indicators showing a high level of uptake and performance.

In the fourth quarter of 2019, we introduced the first stage of our open banking platform, which allows banks to share transaction data and integrate third-party apps onto partner platforms in order to improve the way we give our customers access to credit.

16

Today Card—US credit card

Today Card, currently in test launch, is a credit card product designed to meet the spending needs of non-prime consumers by offering a prime customer experience. Today Card is originated by Capital Community Bank of Utah and is issued through Mastercard.

As our lowest APR product, Today Card allows us to serve a broader spectrum of non-prime Americans. As of December 31, 2019, we have cross-marketed Today Card to existing and former Rise customers, as well as through direct mail to new customers. It is our plan to continue to scale this product in 2020. Customer response to the Today Card continues to be strong, with extremely high response rates, customer engagement, and customer satisfaction scores.

ADVANCED ANALYTICS AND RISK MANAGEMENT

The non-prime lending challenge

Traditional underwriting requires manual review of physical documents and human credit decisions. This is inconvenient for customers and for lenders it is resource-intensive, time-consuming and can lead to inconsistent results. "Fintech" lenders have recently used Big Data techniques to revolutionize the offering of credit. Instant credit decisions and automated processes are increasingly the norm for innovative online lenders.

In non-prime consumer lending, however, the analytical challenges are significantly greater. Traditional credit scores like FICO are poorly correlated with risk for non-prime consumers. Whereas prime consumers have established positive credit histories with traditional credit products and very little derogatory information, non-prime consumers are more varied and difficult to underwrite since they may have significant derogatory credit history or no credit history at all. Because of the wider variety of credit backgrounds and higher credit risk, automated analytical techniques for underwriting non-prime consumers must be much more sophisticated.

We use our deep insights into non-prime consumers and extensive experience serving more than 2.4 million customers with $8.1 billion in credit to develop differentiated analytical techniques and scores to better underwrite and price credit for the New Middle Class. This approach provides for extremely high levels of automation in the underwriting process and has been proven to be effective, resulting in stable credit performance for our predecessor products through the last decade's financial crisis and continued improvements since launching the current generation of products. See “—History of stable credit quality through the economic downturn.” Furthermore, we invest significant resources into the research and development of new data sources and new analytical techniques to continue to improve our capabilities.

Proprietary risk analytics infrastructure

Unlike prime lenders who can use off-the-shelf credit scores such as FICO or build custom scores with limited data fields, we believe that successfully underwriting non-prime consumers in an online environment requires access to a much wider variety of data including not only traditional credit attributes and application information, but also website behavior, internal information, bank account information, social media information, email and phone number information, among others. Because continued leadership in non-prime underwriting is essential to drive growth, support further rate reductions to customers, and manage losses, we have made substantial investments in our risk analytics infrastructure and in the development of the latest generation of our underwriting scores and strategies. The risk analytics infrastructure utilizes a massive (approximately 80+ terabyte) Hadoop database composed of more than 10,000 potential data variables related to each of the more than 2.4 million customers we have served and the about 8.6 million applications that we have processed including performance data from our funded customers. Our team of more than 50 data scientists uses our proprietary risk analytics infrastructure to build and test scores and strategies across the entire underwriting process described below (see “—Segmentation strategies across the entire underwriting process”). Our rusk analytics infrastructure supports a variety of analytical techniques and model outputs from traditional multivariate regression to machine learning and artificial intelligence. We believe this Big Data approach and investment is foundational to our ongoing initiatives to improve underwriting and lower rates to our customers.

17

Segmentation strategies across the entire underwriting process

Based on our extensive experience and track record in the industry, we have found that FICO and other monolithic credit scores are inadequate for the non-prime market. Instead, we have used our proprietary risk analytics infrastructure to develop an array of proprietary scores and strategies using highly predictive data sources and advanced analytical techniques targeting unique customer segments and marketing channels as well as different fraud types. This analytical approach, while more complex than most prime underwriting approaches, allows us to serve an expanding set of non-prime consumer segments and marketing channels while maintaining stable credit quality and acceptable customer acquisition costs. We use this approach across the entire underwriting process for both new and former customers, as described in the following chart:

18

Segment specific credit scores

We use our proprietary risk analytics infrastructure to build targeted credit scores for key customer segments and channels. Based on our segmentation model, we utilize highly predictive data (including nationwide credit reporting agencies (“NCRA”), non-prime bureau data, and wide-ranging alternative data sources, as well as internally collected proprietary customer credit performance history) and analytical techniques (including multivariate regression, machine learning and artificial intelligence techniques) to achieve a high level of accuracy for our scores. For instance, for “prime-ish” consumers who have access to traditional credit sources but supplement them with non-prime credit, we use NCRA data extensively in our proprietary credit and fraud scoring models. For “challenged” consumers who have derogatory NCRA credit information and, as a result, non-prime credit data is more relevant, our proprietary credit and fraud scoring models leverage data provided by non-prime credit bureau sources like Clarity and Teletrack. For “credit invisibles” with limited or no credit history, we may utilize a host of alternative data sources, such as detailed bank account data as well as the duration for which an applicant has used the same mobile phone number or used an email address. Our definitions of our customer segments and the ways they affect our credit scoring models evolve over time. We assess more than 10,000 data inputs while developing our segmented credit models.

Targeted fraud scores

In addition to our segment-specific credit scores, we have developed targeted fraud scores for different types of fraud. For instance, we have found that first-party fraud (when the loan applicant provides correct identity information but has no intent of repaying the loan), third-party fraud (when the applicant has stolen someone else’s identity information) and bank account fraud (when the borrower intends to shut down his or her account shortly after receiving the proceeds from the loan) are fundamentally different and require unique analysis and risk management tools.

Our proprietary fraud scores are built from over 10,000 available data inputs from our risk analytics infrastructure and make extensive use of non-linear (e.g., machine learning) analytical tools and techniques. Examples of data sources that we have found to be predictive in our fraud scores include IP address information, how applicants use our website (including pages viewed), and email and bank account information as well as identity information provided by third parties.

Affordability analysis and line offers

Although not currently required by US federal law, we proactively assess the affordability of our products for our customers. We use multiple approaches including debt to income, payment to income and full budgeting (required by UK regulations), based on third-party and self-reported information, and continue to evaluate the effectiveness of each approach. Where applicable, we integrate real-time bank account information into our affordability scores. Our affordability assessment impacts both the decision of whether to provide the loan, as well as the maximum amount to offer. We use an enhanced affordability analysis that integrates previous payment history to underwrite current customers seeking to refinance their loan and for former customers requesting additional credit.

Customer management

In addition to underwriting new customers, we have built scores and strategies for underwriting customers who have paid off their initial loan and are looking for a new loan, or for customers who may want to refinance their current loan, typically for a larger amount and a lower rate. These scores and strategies reassess the customer’s creditworthiness integrating their payment history on previous loans. Based on this information and revised affordability analysis, the customer is either offered a new maximum loan amount and APR or declined for additional credit.

Fully automated, near-instant credit decisions

Credit and fraud determinations are made in seconds and approximately 94% of loan applications for all products are fully automated with no manual review required, based on our proprietary credit and fraud scoring models and affordability assessments. Once approved, the customer is provided the loan amount and relevant terms of the credit being offered. Of the approximately 6% of loan applications requiring manual review, in the US, the majority require further documentation, which can be provided via scanning, fax, email or mail. Others may have failed a fraud rule in the applicable underwriting methodology and are managed based on the rule failed, and others are reviewed to address “know your customer” and/or OFAC requirements. In the UK, of the loan applications requiring manual review, the vast majority require further verifications or other forms of identification, while the remaining portion requires further review based on fraud alerts by an industry database of fraudulent consumer activity, known as CIFAS. We provide declined customers with the reasons for the decision as per regulatory requirements.

19

Elevate fraud detection agents manually review a limited number of applicants based on the results of the fraud scores and any discrepancies in the application data they provide (such as identity information prior to the funding of the loan). Fraud detection specialists generate and review intraday reports to identify cross-application fraud risk and use such reports to flag additional loan applications requiring review. Elevate fraud detection agents use sophisticated link analysis of application information to identify potentially fraudulent activity and pursue additional investigation if they suspect fraud.

History of stable credit quality through the economic downturn

We bring extensive experience in managing defaults through the most recent financial crisis. Including products that preceded our current generation of credit products, we have provided $8.1 billion in credit to 2.4 million non-prime consumers since 2002. As the following chart indicates, our management team delivered stable credit quality for our predecessor products through the last decade's financial crisis. The chart below also presents the levels of volatility experienced by the US credit card industry over the same period.

(1) | Elevate legacy predecessor credit product from 2006-2011. Includes losses related to credit and fraud. |

(2) | Years presented pre-date the spin-off. For recent cumulative loss rates by vintage, see “Management’s discussion and analysis of financial condition and results of operations—Key Financial and Operating Metrics—Credit quality.” |

(3) | Credit card information based on Federal Reserve data. |

20

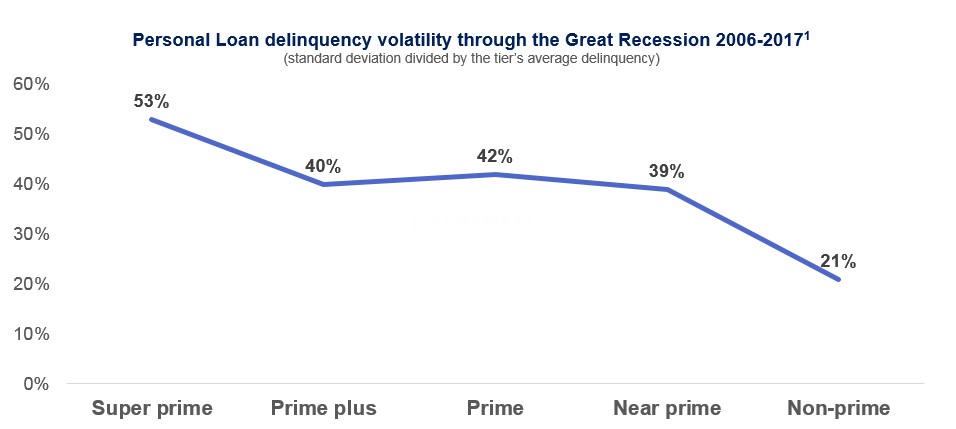

Additionally, research conducted by the credit bureau TransUnion indicates that non-prime personal loan portfolios show significantly less volatility due to recessionary factors than portfolios with higher credit quality customers. As shown in the following chart, according to TransUnion data, non-prime portfolios demonstrated approximately half of the charge-off rate volatility of Prime, Prime-Plus and Super Prime portfolios during the Great Recession between 2006 and 2011. We believe this indicates that patterns of credit charge-offs for non-prime consumers can be acyclical or counter-cyclical when compared to prime consumers in credit downturns. In a recession, banks and traditional prime credit providers often experience increases in credit charge-off rates and tighten standards, which reduces access to traditional credit and pushes certain consumers out of the market for bank credit. Conversely, with advanced underwriting, lenders serving non-prime consumers are able to maintain comparatively flat charge-off rates, in part, because of these new customers who are unable to avail themselves of the traditional credit market.

(1) | TransUnion data on 90-day delinquency rates of balances for different Vantage Score bands from the first quarter of 2005 through the first quarter of 2017. Volatility is calculated by dividing the standard deviation of Vantage Score bands from the first quarter of 2006 to the first quarter of 2017 by the average during the same period per TransUnion. Super prime includes those with credit scores ranging from 781 to 850, Prime plus from 721 to 780, Prime from 661 to 720, Near prime from 601 to 660 and Non-prime from 300 to 600. |

Commitment to research and development

We have built a team of over 300 employees in our Risk Management and Technology department, over 50 of which work specifically in risk analytics and work with data on a daily basis. Our Advanced Analytics team is primarily focused on analysis of new (typically non-traditional) data sources and analytical techniques. We believe our commitment to research and development in risk analytics results in consistently improving capabilities, which give us an on-going competitive advantage in the market by allowing us to scale our business while providing savings back to our customers in the form of lower rates.

21

OUR SALES AND MARKETING CAPABILITIES

Multi-channel approach to customer acquisition

Online providers of non-prime credit often rely on third-party lead generators for customer acquisition, which we believe limits growth and provides challenges to achieving cost and quality targets. In contrast, we rely on a multi-channel marketing mix, which supports improved CAC, faster growth and heightened brand awareness. This approach allows us to gradually expand investments to grow prospects, while thoughtfully balancing the investment split within channels. We monitor each channel, and how each contributes to a user's path to conversion. The following chart shows the percentage of total customers attributable to each marketing channel for the year ended December 31, 2019.

Our multi-channel approach is demonstrated by the following:

Ø | Direct mail: More than 62 million pre-selected credit offers mailed during the year ended December 31, 2019; |

Ø | TV and mass media: Both brand and direct response-oriented campaigns launched for Sunny; |

Ø | Strategic partnerships: Multiple partnerships with large customer aggregators to drive traffic; and |

Ø | Digital marketing campaigns: Search engine optimization, content marketing, social media, paid search, digital advertising and email marketing. |

Analytically-driven channel optimization

Each new marketing channel we introduce requires extensive testing and optimization before it can be scaled cost-effectively and requires significant on-going analytical support. For instance, we spent several years developing, testing, and optimizing our response and credit models for preapproved direct mail campaigns to achieve an acceptable CAC for this channel. As a result, direct mail is now our largest and most profitable marketing capability, and we continue to identify new analytical approaches that help expand the addressable market through the direct mail channel.

22

Over the last few years, we've built a successful digital acquisition strategy and found the right baseline tactics to drive strong conversions. We continuously test within our digital channels and have a pipeline of new testing opportunities to help identify strong performers. In order to scale up support, we are focusing on testing tactics which help drive consumer awareness and engagement through search, digital advertising and social media. We anticipate expanding growth in all of our digital marketing channels based on improved customer targeting analytics and increasingly sophisticated response models that allow us to enhance our marketing reach while maintaining our target CAC. Our dedicated channel management teams continually monitor and manage campaign effectiveness. We believe our investment in developing multiple customer acquisition channels provides a significant competitive advantage over other online non-prime lenders who rely primarily on lead generators.

Multi-channel management

In addition to optimizing the performance of each channel, we are increasingly optimizing our marketing mix to improve marketing impact and enhance brand-building. We have found that coordinating the timing of individual channel campaigns and leveraging creative across channels can accelerate growth at lower costs.

Through a multi-channel marketing approach, Sunny remains one of the most well-known brands in the sector. Sunny is now number one in active short-term loan brand awareness and we have benefited commercially from several competitors exiting the market. In addition, investment in digital marketing channels has continued to deliver dividends in both brand visibility and commercial efficiency. In the last year, Sunny drove marketing efficiency with a record-low CAC (33% decrease year-over-year).

Strategic partner development

Rather than utilizing lead generators who are often accused of deceptive practices, we have focused on developing relationships through large strategic partnerships with trusted brands. Our strategic partners refer prospects from their site to our product website. Because the customer completes the loan application on our website, rather than on a lead generator’s site, we control the messaging received by the customer about our products. This method allows us to better control application quality, customer experience and CAC. Aligning with strategic partners that share our values and commitment to the customer helps us fulfill our mission of providing better products to the New Middle Class.

We expect our relationships with strategic partners to continue to expand over time, and we will evaluate opportunities to enter into new partnerships. We also have the ability to make targeted offers with discounted rates to strategic partners who have been shown to deliver higher quality applicants.

Customer relationship optimization

Our sales and marketing efforts are not only focused on acquiring new customers. We focus on strong customer engagement, providing added value and developing a mutually beneficial relationship with current and former customers. If customers or former customers need additional liquidity, we strive to be the top of their consideration set.

Based on rigorous creditworthiness and affordability analysis, we typically offer increased credit lines to former customers—often at lower rates. Also, subject to our usage caps, we may offer current customers the ability to refinance loans to receive additional funds (in the US). We use both email and text messaging campaigns to reach customers with additional credit offers. Because there is no additional CAC for originating those additional loans, these transactions are highly profitable and can support offering a lower APR for consumers.

23

History of strong growth in new customer acquisition volumes at or below target CAC

As a result of our unique marketing capabilities discussed above, we have shown significant growth in annual new customer acquisition volumes while managing our customer acquisition costs within or below our target level of $250 to $300.

OUR TECHNOLOGY PLATFORM AND INFORMATION SECURITY

Underlying our innovative customer centric product offerings, loan processing and multitude of servicing features is our flexible proven technology platform. Loan originations, advanced proprietary underwriting and decisioning, loan management and loan servicing are all supported by our scalable and flexible technology platform built with modern cloud-based architecture principles. Our continuous technological innovations to our platform position us to respond quickly to new market opportunities, customer feedback, market trends and regulatory changes. Inherent to our technology platform is support and monitoring for compliant applications, loan processing and business controls. In addition, because we collect and store extensive amounts of consumer information, we have invested in and are committed to best practice levels of information security.

Flexible and scalable proven technology platform