Attached files

| file | filename |

|---|---|

| 8-K - TRINITY CAPITAL CORP | form8k_20180530.htm |

1

2 Forward-Looking Statements This presentation contains forward-looking statements of Trinity Capital Corporation (“Trinity” or “the Company”) within the meaning of the Private Securities Litigation Reform Act of 1995, with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Actual results could differ materially from the results indicated in this presentation because of risks and uncertainties, known or unknown (many of which are beyond the Company’s control), including those described in Item 1A “Risk Factors” in the Company’s Annual Report on Form10-K for the year ended December 31, 2017. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. All subsequent written and oral forward-looking statements made during this presentation attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. You should not place undue reliance on any such forward looking statements. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update or revise any statement in light of new information or future events, except as required by law.

3 Jim Goodwin

4 Bob Worcester

5 Gregg Antonsen

6 Jim Deutsch

7 John S. Gulas

8 Jeffrey Howell

9 Tom Hubbard

10 Leslie Nathanson Juris

11 Art Montoya

12 Tony Scavuzzo

13 Charlie Slocomb

14 Experienced Management Team Name Title Years of Experience Year started with LANB John S. Gulas President & Chief Executive Officer 35 2014 Tom Dolan EVP, Chief Financial Officer 36 2017 Eddie Ho EVP, Chief Information Officer, Chief Operating Officer 40 2014 Joe Martony EVP, Chief Risk Officer 31 2016 Stan Sluder EVP, Chief Lending Officer & Director of Sales 29 2015 Tom Lilly EVP, Chief Credit Officer 26 2013 Liddie Martinez SVP, Market President, Los Alamos 28 2016 Dion Silva SVP, Market President, Santa Fe 17 2001

15 2017 - Continuing Our Recovery & Executing Our Business Plan Building Stakeholder Value

16 2017 Achievements Enhance the Control Environment Released from OCC Consent Order in November 2017Released from Federal Reserve Written Agreement in February 2018Timely filed all SEC reportsRemediated all material weaknesses in financial reporting

17 2017 Achievements Continue Credit Improvement Non-performing loans reduced from $21.5 million at 12/31/16 to $12.6 million at 03/31/18Allowance coverage ratio* of 1.59% at 03/31/18 * Allowance coverage ratio = total allowance for loan losses / total gross loans

18 2017 Achievements Improve Efficiency Non-interest expense was reduced from $13.9 million for the three months ended 3/31/17 to $9.8 million for the three months ended 03/31/18

19 2017 Achievements Execute Business Development Strategies Trinity’s common stock was listed on OTCQX under the symbol “TRIN”Relocated Albuquerque office to a prominent location with a new branch designHired experienced, quality commercial lendersBeginning to see strong loan growth in all markets in Q1 2018Completed successful $10 million Rights Offering in NovemberPaid off a $10.3 million portion of high cost trust preferred securities in March 2018

20 2017 Achievements Superior Service Culture Added new control structure to improve service deliveryNamed Eddie Ho head of operations and retail deliveryImplemented Key Performance Indicators and Service Level Agreements

21 Trinity Capital Corporation & SubsidiariesConsolidated Results(Dollars in thousands)

22 Trinity Capital Corporation & SubsidiariesConsolidated Balance Sheet(Dollars in thousands)

23 Trinity Capital Corporation & SubsidiariesConsolidated Income Statement(Dollars in thousands)

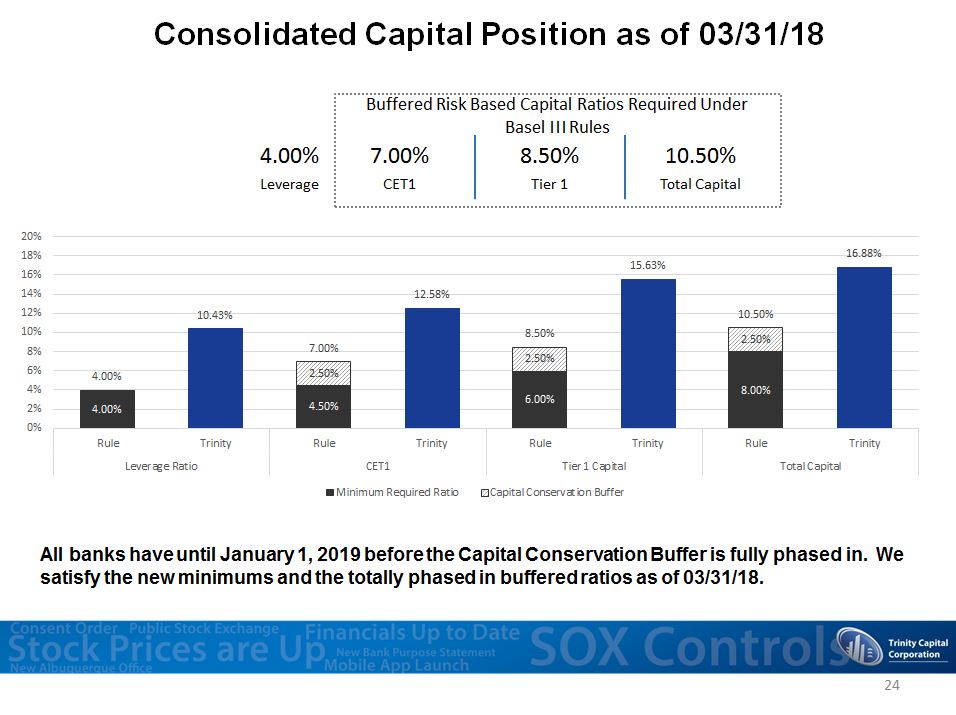

24 7.00% 4.00% 8.50% 10.50% CET1 Leverage Tier 1 Total Capital Buffered Risk Based Capital Ratios Required Under Basel III Rules All banks have until January 1, 2019 before the Capital Conservation Buffer is fully phased in. We satisfy the new minimums and the totally phased in buffered ratios as of 03/31/18. Consolidated Capital Position as of 03/31/18

25 TRIN Market Performance

26 Building Stakeholder Value Executing 2018 Business Plan