Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Internap Corp | ex-992exhibit992inapv2.htm |

| EX-23.1 - EXHIBIT 23.1 - Internap Corp | exhibit231.htm |

| 8-K/A - 8-K/A - Internap Corp | form8kamendment.htm |

SingleHop, LLC Consolidated Financial Report December 31, 2017

SingleHop, LLC Contents Independent Auditor's Report 1 Consolidated Financial Statements Balance Sheet 2 Statement of Operations 3 Statement of Comprehensive Income 4 Statement of Members' Equity 5 Statement of Cash Flows 6 Notes to Consolidated Financial Statements 7-13

Independent Auditor's Report To the Board of Directors SingleHop, LLC We have audited the accompanying consolidated financial statements of SingleHop, LLC and its subsidiary (the "Company"), which comprise the consolidated balance sheet as of December 31, 2017 and the related consolidated statements of operations, comprehensive income, members' equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of SingleHop, LLC and its subsidiary as of December 31, 2017 and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. May 16, 2018 1

SingleHop, LLC Consolidated Balance Sheet December 31, 2017 Assets Current Assets Cash $ 3,715,365 Accounts receivable: Trade 881,835 Value-added tax 122,281 Due from member 299,125 Prepaid expenses and deposits 945,392 Total current assets 5,963,998 Property and Equipment - Net (Note 3) 16,708,253 Goodwill (Note 4) 5,917,739 Intangible Assets (Note 4) 7,558,329 Other Assets - Deposits 160,204 Total assets $ 36,308,523 Liabilities and Members' Equity Current Liabilities Trade accounts payable $ 1,442,461 Line of credit (Note 5) 5,785,699 Capital lease obligation (Note 6) 469,059 Deferred revenue 3,147,061 Accrued and other current liabilities: Accrued compensation 650,689 Accrued expenses - Cost of revenue 517,909 Other accrued liabilities 354,993 Total current liabilities 12,367,871 Customer Deposits and Advances 41,754 Capital Lease Obligation - Net of current portion (Note 6) 84,793 Other Long-term Liabilities - Deferred rent 2,891,538 Total liabilities 15,385,956 Members' Equity 20,922,567 Total liabilities and members' equity $ 36,308,523 See notes to consolidated financial statements. 2

SingleHop, LLC Consolidated Statement of Operations Year Ended December 31, 2017 Percent of Net Amount Revenue Net Revenue $ 47,936,147 100.0 Cost of Revenue 27,216,940 56.8 Gross Profit 20,719,207 43.2 Operating Expenses Selling 659,152 1.4 Administrative 13,667,220 28.5 Total operating expenses 14,326,372 29.9 Operating Income 6,392,835 13.3 Nonoperating Income (Expense) Other income 13,325 - Foreign exchange gain (loss) 489,833 1.0 Interest expense (409,870) (0.9) Transaction costs (91,332) (0.2) Total nonoperating income 1,956 (0.1) Net Income $ 6,394,791 13.2 See notes to consolidated financial statements. 3

SingleHop, LLC Consolidated Statement of Comprehensive Income Year Ended December 31, 2017 Percent of Net Amount Revenue Net Income $ 6,394,791 13.2 Other Comprehensive Loss - Foreign currency translation adjustment (155,588) (0.3) Comprehensive Income $ 6,239,203 12.9 See notes to consolidated financial statements. 4

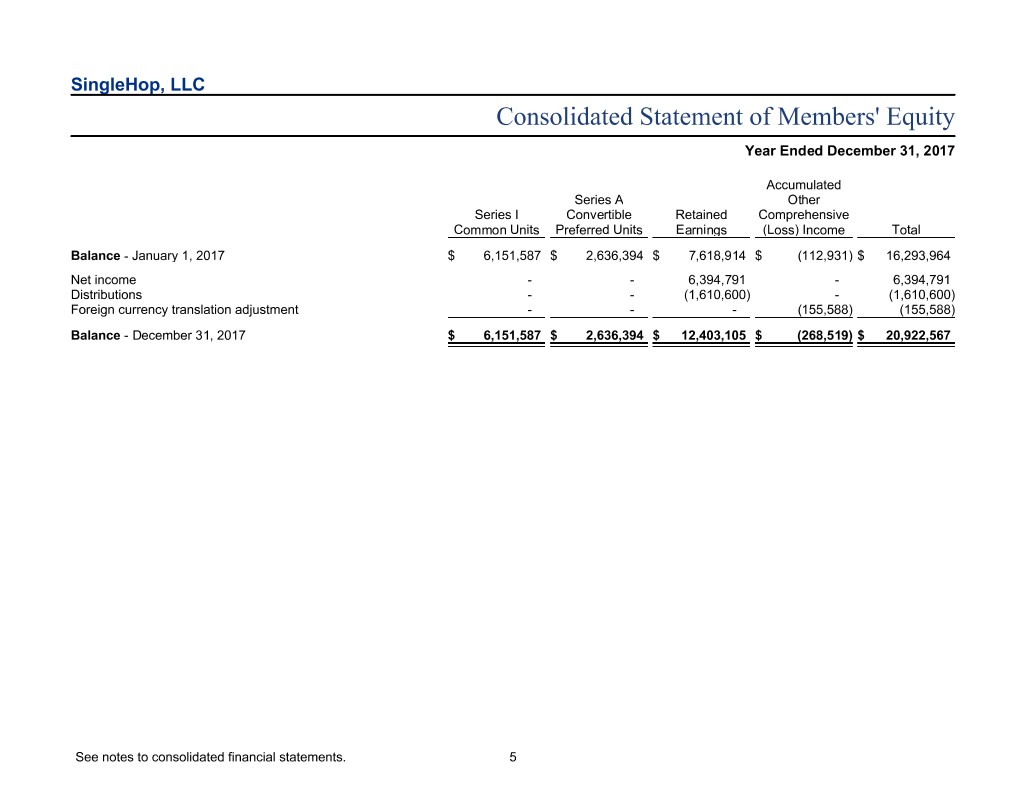

SingleHop, LLC Consolidated Statement of Members' Equity Year Ended December 31, 2017 Accumulated Series A Other Series I Convertible Retained Comprehensive Common Units Preferred Units Earnings (Loss) Income Total Balance - January 1, 2017 $ 6,151,587 $ 2,636,394 $ 7,618,914 $ (112,931) $ 16,293,964 Net income - - 6,394,791 - 6,394,791 Distributions - - (1,610,600) - (1,610,600) Foreign currency translation adjustment - - - (155,588) (155,588) Balance - December 31, 2017 $ 6,151,587 $ 2,636,394 $ 12,403,105 $ (268,519) $ 20,922,567 See notes to consolidated financial statements. 5

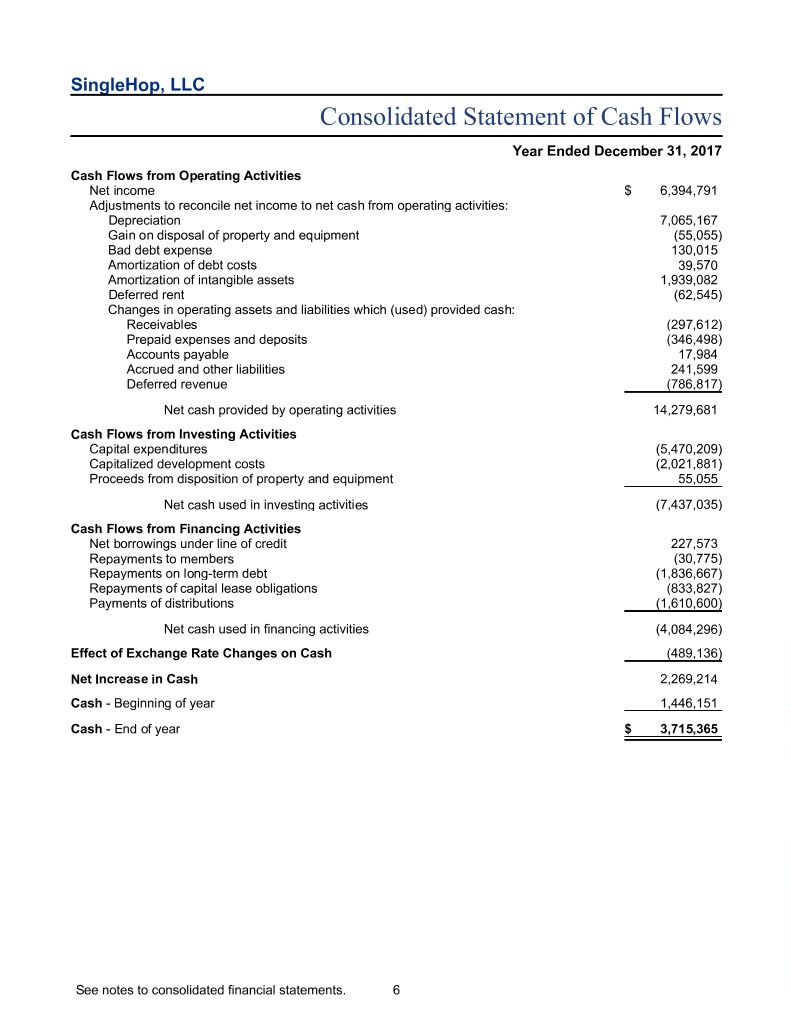

SingleHop, LLC Consolidated Statement of Cash Flows Year Ended December 31, 2017 Cash Flows from Operating Activities Net income $ 6,394,791 Adjustments to reconcile net income to net cash from operating activities: Depreciation 7,065,167 Gain on disposal of property and equipment (55,055) Bad debt expense 130,015 Amortization of debt costs 39,570 Amortization of intangible assets 1,939,082 Deferred rent (62,545) Changes in operating assets and liabilities which (used) provided cash: Receivables (297,612) Prepaid expenses and deposits (346,498) Accounts payable 17,984 Accrued and other liabilities 241,599 Deferred revenue (786,817) Net cash provided by operating activities 14,279,681 Cash Flows from Investing Activities Capital expenditures (5,470,209) Capitalized development costs (2,021,881) Proceeds from disposition of property and equipment 55,055 Net cash used in investing activities (7,437,035) Cash Flows from Financing Activities Net borrowings under line of credit 227,573 Repayments to members (30,775) Repayments on long-term debt (1,836,667) Repayments of capital lease obligations (833,827) Payments of distributions (1,610,600) Net cash used in financing activities (4,084,296) Effect of Exchange Rate Changes on Cash (489,136) Net Increase in Cash 2,269,214 Cash - Beginning of year 1,446,151 Cash - End of year $ 3,715,365 See notes to consolidated financial statements. 6

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 1 - Nature of Business SingleHop, LLC (the "Company") is a global provider of hosted IT infrastructure and cloud computing with data centers across the United States and Europe. In April 2013, the Company established SingleHop B.V., a wholly owned Netherlands company. SingleHop B.V. is a service organization that provides management of data center operations on behalf of SingleHop, LLC. The Company's customers are primarily located in the United States and Europe. The consolidated financial statements include the accounts of the Company and its wholly owned subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation. Note 2 - Significant Accounting Policies Aspects of a Limited Liability Company As a limited liability company, each member's liability is limited to the capital invested. Allocation of profits, losses, and distributions is in accordance with the terms as defined in the operating agreement. The Company has an unlimited life subject to consent to dissolve the Company by a majority of the Company's members. Certain members perform services for the Company and are paid for their services. Such payments are included in operating expenses rather than being reported as distributions. Basis of Accounting The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. Foreign Currency Exchange The expression of assets and liabilities in a foreign currency amount gives rise to exchange gains and losses when such obligations are paid in United States dollars. Foreign currency exchange rate adjustments (i.e., differences between amounts recorded and actual amounts owed or paid) are reported in the consolidated statement of operations as the foreign currency fluctuations occur. Foreign currency exchange rate adjustments are reported in the consolidated statement of cash flows using the exchange rates in effect at the time of the cash flows. Foreign Currency Translation Assets and liabilities of the Company’s foreign subsidiary are translated into U.S. dollars at the rate of exchange in effect at the close of the period. Income and expenses are translated at an average rate of exchange for the period. The aggregate effect of translating the consolidated financial statements is included in other comprehensive income. Trade Accounts Receivable Accounts receivable are stated at net invoice amounts. An allowance for doubtful accounts is established based on a specific assessment of all invoices that remain unpaid following normal customer payment periods. All amounts deemed to be uncollectible are charged against the allowance for doubtful accounts in the period that determination is made. The allowance for doubtful accounts on accounts receivable balances was $24,399 as of December 31, 2017. Property and Equipment Property and equipment are recorded at cost. Assets are depreciated over their estimated useful lives by use of the straight-line method. The cost of leasehold improvements is depreciated over the lesser of the length of the related leases or the estimated useful lives of the assets. Costs of maintenance and repairs are charged to expense when incurred. 7

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 2 - Significant Accounting Policies (Continued) Capitalized Software Costs The Company capitalizes significant costs incurred in the acquisition or development of software for internal use, including the costs of the software, materials, consultants, interest, payroll, and payroll- related costs for employees incurred in developing internal-use computer software once final selection of the software is made. Costs incurred prior to the final selection of software and costs not qualifying for capitalization are charged to expense. In addition, the Company capitalizes significant costs incurred in the development of its website, including the cost of acquiring or developing hardware and software to operate the website. Capitalized software and website development amortization expense was $1,582,171 in 2017. Intangible Assets Acquired intangible assets subject to amortization are stated at cost and are amortized using the straight- line method over the estimated useful lives of the assets. Intangible assets that are subject to amortization are reviewed for potential impairment whenever events or circumstances indicate that carrying amounts may not be recoverable. Assets not subject to amortization are tested for impairment at least annually. Goodwill The recorded amounts of goodwill from prior business combinations are based on management's best estimates of the fair values of assets acquired and liabilities assumed at the date of acquisition. Goodwill is not amortized, but rather is assessed at least on an annual basis for impairment. No impairment charge was recognized during the year ended December 31, 2017. It is reasonably possible that management's estimates of the carrying amount of goodwill will change in the near term. Revenue Recognition and Deferred Revenue The Company is a provider of hosting services. Customers occasionally pay a nonrefundable installation fee and a monthly recurring charge based upon the size and complexity of the IT systems deployed and the level of services purchased. Revenue is recognized when it is realized or realizable and earned. The Company considers revenue realized or realizable when it has persuasive evidence of an agreement, the product has been delivered, services have been provided to the customer, the sale price is fixed or determinable, and collectibility is reasonably assured. Monthly recurring charges are recognized on a daily basis, whether they are paid monthly, quarterly, semiannually, or annually, beginning on the date the customer commences use of the service. Nonrefundable installation fees are recognized on a monthly basis ratably over the term of the contract using the straight-line method beginning on the date the customer commences use of the service. Advertising Expenses Advertising expenses are charged to income during the year in which they are incurred. Advertising expense for 2017 was $657,652. Use of Estimates The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. 8

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 2 - Significant Accounting Policies (Continued) Income Taxes The Company is a limited liability company. The Company is treated as a partnership for federal income tax purposes. Consequently, federal income taxes are not payable or provided for by the Company. Members are taxed individually on their pro rata ownership share of the Company’s earnings. The Company’s net income or loss is allocated among the members in accordance with the Company’s operating agreement. Accordingly, the Company does not accrue income taxes. Other Comprehensive Income Accounting principles generally require that recognized revenue, expenses, gains, and losses be included in net income. Certain changes in assets and liabilities, however, such as unrealized gains and losses on foreign currency translation adjustments, are reported as a direct adjustment to the equity section of the consolidated balance sheet. Such items, along with net income, are considered components of comprehensive income. Credit Risk and Major Suppliers The Company maintains its cash in bank accounts, which at times may exceed federally insured limits. The Company has not experienced any losses in such accounts. The Company believes it is not exposed to any significant credit risk on cash. The Company procures almost all of the components necessary to build its servers from three suppliers. In addition, the Company utilizes three data centers to house the servers. If any of these suppliers had operational problems or ceased operations, the Company believes it would be able to readily identify additional suppliers with limited interruption. Upcoming Accounting Pronouncements In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606), which will supersede the current revenue recognition requirements in Topic 605, Revenue Recognition. The ASU is based on the principle that revenue is recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The ASU also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. The new guidance will be effective for the Company’s year ending December 31, 2019. The ASU permits application of the new revenue recognition guidance to be applied using one of two retrospective application methods. The Company's hosting service revenue is not expected to be significantly impacted by the standard. However, the Company is evaluating the effect of the standard on its other less significant revenue streams, which may be impacted. In February 2016, the FASB issued ASU No. 2016-02, Leases, which will supersede the current lease requirements in ASC 840. The ASU requires lessees to recognize a right-of-use asset and related lease liability for all leases, with a limited exception for short-term leases. Leases will be classified as either finance or operating, with the classification affecting the pattern of expense recognition in the statement of operations. Currently, leases are classified as either capital or operating, with only capital leases recognized on the balance sheet. The reporting of lease-related expenses in the statements of operations and cash flows will be generally consistent with the current guidance. The new lease guidance will be effective for the Company’s year ending December 31, 2020 and will be applied using a modified retrospective transition method to the beginning of the earliest period presented. The adoption of the new lease guidance is expected to significantly increase long-term assets and lease liabilities on the consolidated balance sheet. However, the Company does not expect a significant effect on its consolidated statement of operations. 9

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 2 - Significant Accounting Policies (Continued) Subsequent Events The consolidated financial statements and related disclosures include evaluation of events up through and including May 16, 2018, which is the date the consolidated financial statements were available to be issued. Note 3 - Property and Equipment Property and equipment are summarized as follows: Depreciable Amount Life - Years Servers and parts $ 37,124,321 5 IT infrastructure 10,697,170 5 Furniture and equipment 489,719 7 Software 333,341 3 Leasehold improvements 1,834,080 3-10 Total cost 50,478,631 Accumulated depreciation 33,770,378 Net property and equipment $ 16,708,253 Depreciation and amortization expense for 2017 was $7,065,167. At December 31, 2017, the Company had net property and equipment located in foreign jurisdictions of $2,450,680. Note 4 - Intangible Assets Intangible assets of the Company at December 31, 2017 are summarized as follows: Gross Carrying Accumulated Amount Amortization Amortized intangible assets: Customer contracts $ 5,137,000 $ 1,235,711 Noncompete 130,000 130,000 Webpage 875,876 776,012 Internally developed software 6,882,564 4,011,388 Total amortized intangible assets $ 13,025,440 $ 6,153,111 Unamortized intangible assets - Trademark $ 686,000 $ - Amortization expense for intangible assets totaled $1,939,082 for the year ended December 31, 2017. 10

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 4 - Intangible Assets (Continued) Estimated amortization expense for the year ended December 31 are as follows: Years Ending Amount 2018 $ 1,926,808 2019 1,384,693 2020 702,880 2021 342,467 2022 342,467 Thereafter 2,173,014 Total $ 6,872,329 Note 5 - Line of Credit Under a line of credit agreement with a bank, the Company is allowed borrowings of up to $12,000,000, subject to borrowing base limitations, as of December 31, 2017. Effective August 20, 2017, interest is payable monthly at a rate of 1.00 percent above the prime rate (an effective rate of 5.50 percent at December 31, 2017). For the period January 1, 2017 through August 20, 2017, interest was payable monthly at a rate of 1.25 percent above the prime rate. The line of credit is collateralized by all business assets. The agreement expires on August 3, 2019. The balance of the borrowings under the line of credit as of December 31, 2017 was $5,785,699. Total available borrowings under the line of credit were $6,186,625 as of December 31, 2017. Under the line of credit agreement with the bank, the Company is subject to various financial covenants, including maximum leverage ratio and minimum fixed-charge coverage ratio. Note 6 - Capital Leases The Company leases equipment under long-term lease arrangements that are classified as capital leases. For consolidated financial statement purposes, the present values of the net minimum lease payments have been capitalized and are being amortized over the useful lives of the assets. Under the terms of the lease agreements, payments ranging from $312 to $15,095 are due monthly through 2020. The leases have been imputed with interest at annual rates ranging from 2.31 percent to 7.01 percent. At December 31, 2017, property under capital leases consists of servers and infrastructure with a gross cost of $2,980,356. Accumulated depreciation on the property under capital leases was $1,787,001 at December 31, 2017. Depreciation expense on property under capital leases is included in the depreciation amount disclosed in Note 3. The future minimum lease payments under capital leases are as follows: Years Ending December 31 Amount 2018 $ 496,431 2019 75,620 2020 11,573 Total 583,624 Less amount representing interest 29,772 Present value of net minimum lease payments 553,852 Less current obligations 469,059 Long-term obligations under capital leases $ 84,793 11

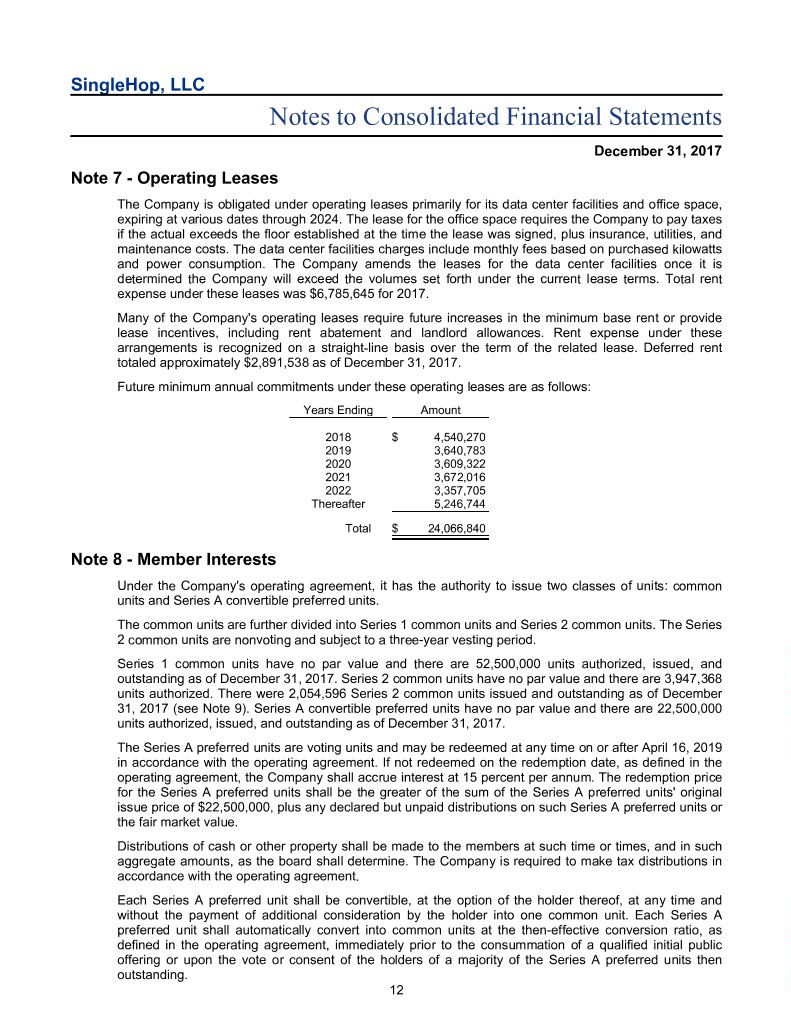

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 7 - Operating Leases The Company is obligated under operating leases primarily for its data center facilities and office space, expiring at various dates through 2024. The lease for the office space requires the Company to pay taxes if the actual exceeds the floor established at the time the lease was signed, plus insurance, utilities, and maintenance costs. The data center facilities charges include monthly fees based on purchased kilowatts and power consumption. The Company amends the leases for the data center facilities once it is determined the Company will exceed the volumes set forth under the current lease terms. Total rent expense under these leases was $6,785,645 for 2017. Many of the Company's operating leases require future increases in the minimum base rent or provide lease incentives, including rent abatement and landlord allowances. Rent expense under these arrangements is recognized on a straight-line basis over the term of the related lease. Deferred rent totaled approximately $2,891,538 as of December 31, 2017. Future minimum annual commitments under these operating leases are as follows: Years Ending Amount 2018 $ 4,540,270 2019 3,640,783 2020 3,609,322 2021 3,672,016 2022 3,357,705 Thereafter 5,246,744 Total $ 24,066,840 Note 8 - Member Interests Under the Company's operating agreement, it has the authority to issue two classes of units: common units and Series A convertible preferred units. The common units are further divided into Series 1 common units and Series 2 common units. The Series 2 common units are nonvoting and subject to a three-year vesting period. Series 1 common units have no par value and there are 52,500,000 units authorized, issued, and outstanding as of December 31, 2017. Series 2 common units have no par value and there are 3,947,368 units authorized. There were 2,054,596 Series 2 common units issued and outstanding as of December 31, 2017 (see Note 9). Series A convertible preferred units have no par value and there are 22,500,000 units authorized, issued, and outstanding as of December 31, 2017. The Series A preferred units are voting units and may be redeemed at any time on or after April 16, 2019 in accordance with the operating agreement. If not redeemed on the redemption date, as defined in the operating agreement, the Company shall accrue interest at 15 percent per annum. The redemption price for the Series A preferred units shall be the greater of the sum of the Series A preferred units' original issue price of $22,500,000, plus any declared but unpaid distributions on such Series A preferred units or the fair market value. Distributions of cash or other property shall be made to the members at such time or times, and in such aggregate amounts, as the board shall determine. The Company is required to make tax distributions in accordance with the operating agreement. Each Series A preferred unit shall be convertible, at the option of the holder thereof, at any time and without the payment of additional consideration by the holder into one common unit. Each Series A preferred unit shall automatically convert into common units at the then-effective conversion ratio, as defined in the operating agreement, immediately prior to the consummation of a qualified initial public offering or upon the vote or consent of the holders of a majority of the Series A preferred units then outstanding. 12

SingleHop, LLC Notes to Consolidated Financial Statements December 31, 2017 Note 9 - Incentive Units The Company's operating agreement allows the board of directors to issue up to 3,947,368 Series 2 common units as restricted incentive units. The purpose of the plan is to attract and retain key employees. The incentive units are to be granted and issued on a discretionary basis by the board of directors upon the consent of a majority of members. Each incentive unit provides the holder a participation in the profits and distributions of the Company, subject to the provisions of the Company's operating agreement. As of January 1, 2017, 769,112 incentive units remained outstanding to one individual, of which 640,926 units were vested. The remaining units vest evenly on a monthly basis through August 31, 2017. In May 2017, the individual terminated his employment, with 705,019 units being fully vested. In January 2017, 1,349,577 units were issued to two individuals, of which 461,909 units immediately vested. The remaining unvested units vest evenly on a monthly basis through September 30, 2019. As of December 31, 2017, 2,054,596 incentive units are outstanding, with 1,438,161 units vested. The Company did not record any compensation expense related to the issuance of the 2017 units as the amount was not deemed material for financial statement purposes. Note 10 - Cash Flows Cash paid for interest totaled $417,599 for 2017. There were no significant noncash investing and financing transactions during the year ended December 31, 2017. Note 11 - Subsequent Events On January 27, 2018, the Company and the members of the Company entered into a purchase and sale agreement for all of the membership interests of the Company. The aggregate cash amount to be paid for the membership interests is approximately $132,000,000. The transaction was finalized on February 28, 2018. In conjunction with the transaction, vested incentive units, as defined within the operating agreement (see Note 9), are to be paid out in the approximate amount of $621,000. 13