Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 Q2 2018 CASH DIVIDEND - Blue Hills Bancorp, Inc. | dividendsq22018.htm |

| 8-K - 8-K 2018 ANNUAL MEETING - Blue Hills Bancorp, Inc. | annualmeeting2018.htm |

Annual Meeting May 16, 2018 Our Transformative Journey Continues 1 1. Footnote.

Forward-Looking Statements This presentation, as well as other written communications made from time to time by the Company and its subsidiaries and oral communications made from time to time by authorized officers of the Company, may contain statements relating to the future results of the Company (including certain projections and business trends) that are considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). Such forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “intend” and “potential.” For these statements, the Company claims the protection of the safe harbor for forward-looking statement contained in the PSLRA. The Company cautions you that a number of important factors could cause actual results to differ materially from those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: our ability to implement successfully our business strategy, which includes continued asset and liability growth; changes that could adversely affect the business in which the Company and the Bank are engaged; prevailing economic and geopolitical conditions; changes in interest rates, loan demand, real estate values and competition; changes in accounting principles, policies and guidelines; changes in any applicable law, rule, regulation or practice with respect to tax or legal issues; and other economic, competitive, governmental, regulatory and technological factors affecting the Company’s operations, pricing, products and services. For additional information on some of the risks and important factors that could affect the Company’s future results and financial condition, see “Risk Factors” in the Company’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission. The forward-looking statements are made as of the date of this presentation, and, except as may be required by applicable law or regulation, the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements. 2

3

Building Franchise Value Experienced leadership team Upgraded leverageable infrastructure Diversified business model Positive interest rate risk management Strong direct lending capabilities Strong asset quality Attractive deposit mix with ongoing growth Improving spread / fee revenue diversity 4

5

Loan Driven Growth Total assets ($ million) Net loans ($ million) 6

Well Diversified Portfolio Loan composition at 3/31/2018 Loan composition at 12/31/2011 Construction Consumer 3% 1% Other Loans 5% C&I 11% Residential 43% CRE 39% Home Equity Residential 3% 95% $2.2 billion $279 million 7

Valuable Origination Platform Residential mortgages Commercial & construction loans ($ million) ($ million) 13 6 100 489 85 132 36 509 110 66 121 319 224 281 193 291 89 104 171 56 88 194 $59 111 13 46 77 72 46 8

Improved Deposit Mix Deposits ($ million) Deposit composition NOW & Demand At 12/31/2011 11% Savings CDs 23% 51% Money market 15% NOW & Demand CDs 19% At 03/31/2018 36% Savings 10% Money market 35% 9

Net Interest Income Growth Net interest income ($ millions) and Net interest margin Q1 '18 Q1 '17 Net Interest Margin Reported Adjusted (1) Q1 '18 2.92% 2.89% 2017 2.77% 2.75% 2016 2.68% 2.66% 2015 2.83% 2.64% 2014 2.81% 2.57% (1) Adjusted net interest margin excludes the impact of volatile items: mutual fund dividends, purchase accounting accretion and accelerated bond amortization/accretion. 10

Improving Core Fee Income Core fee income ($ millions) Note: Core fee income includes deposit account fees, interchange & ATM fees, mortgage banking revenue, and loan level derivative income (CRE loan swaps) 11

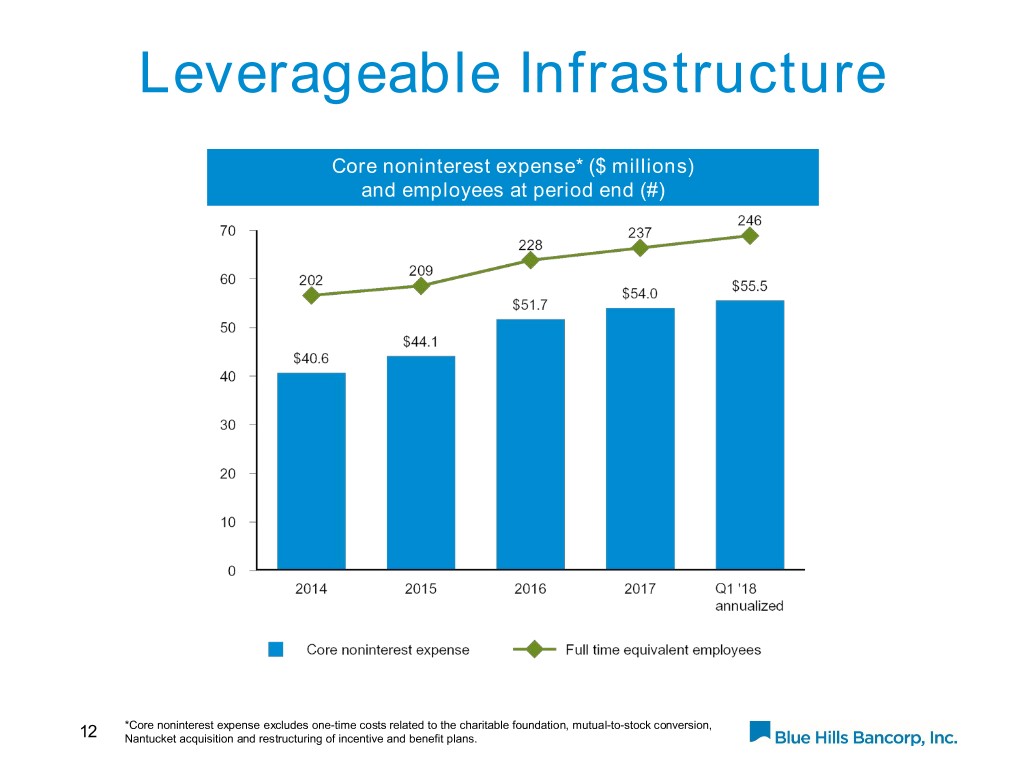

Leverageable Infrastructure Core noninterest expense* ($ millions) and employees at period end (#) *Core noninterest expense excludes one-time costs related to the charitable foundation, mutual-to-stock conversion, 12 Nantucket acquisition and restructuring of incentive and benefit plans.

Noninterest Expense Growth ($ thousands) Q1 '18 LTM 2017 2016 2015 Reported Noninterest Expense $ 54,777 $ 54,306 $ 51,746 $ 44,082 Less: Pension settlement charges (317) (317) — — Less: Equity Plans (1) (5,424) (5,483) (4,868) (1,124) Less: Denovo branches (2) (2,693) (2,589) (1,458) (501) Adjusted Noninterest Expense $ 46,343 $ 45,917 $ 45,420 $ 42,457 (1) Effective Q4 '15 (2) Effective Q4 '15 and Q4 '16 Note: Growth in adjusted noninterest expense since 2015 includes costs related to the expansion of the mortgage business, the onboarding of new asset-based lending and municipal banking businesses, and relocating to a new headquarters. 13

Improvement in Earnings ($ thousands) Q1 2018 2017 2016 2015 Pre-Tax Income $ 8,846 $ 27,715 $ 12,458 $ 10,064 Securities gains and losses (653) (5,821) (1,280) (1,968) Unrealized losses on equity securities 69 — — — Gain on sale of fixed assets (271) — — — Loss on Sale of Home Equity Portfolio — 118 — — Pension settlement charge — 317 — — BOLI Death Benefits — — (506) — Mutual Fund Dividends — — (961) (3,647) Adjusted Pre-tax income $ 7,991 $ 22,329 $ 9,711 $ 4,449 14

Positive Operating Leverage ($ thousands) Q1 '18 Q1 '17 % change Net Interest Income $ 18,359 $ 15,881 Noninterest Income 3,898 6,816 NRS gain (653) (5,947) Unrealized losses on equity securities 69 — Securities (Gains) / Losses — 1,022 Gain on sale of property plant and equipment (271) — Adjusted Revenue 21,402 17,772 20% Noninterest Expense 13,871 13,400 4% Adjusted pre-tax, pre-loan loss provision earnings $ 7,531 $ 4,372 72% Adjusted Efficiency Ratio 65% 75% 15

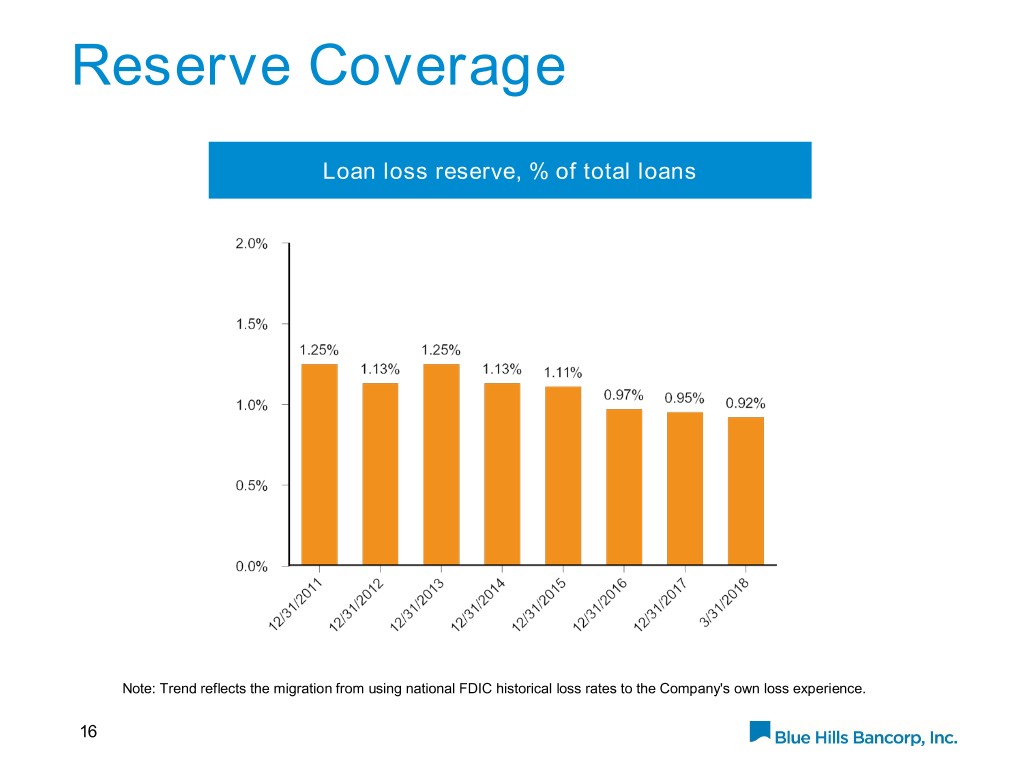

Reserve Coverage Loan loss reserve, % of total loans Note: Trend reflects the migration from using national FDIC historical loss rates to the Company's own loss experience. 16

Nonperforming Assets NPAs, % of assets 17

Stock Valuation Dividend Yield 0.0% 0.5% 0.6% 4.0% 4.4% P/TBV =Price/tangible book value P/ITBV=Price/invested tangible book value (8.0%) P/E=Price earnings Dividend yield calculation includes regular quarterly dividends and special dividends

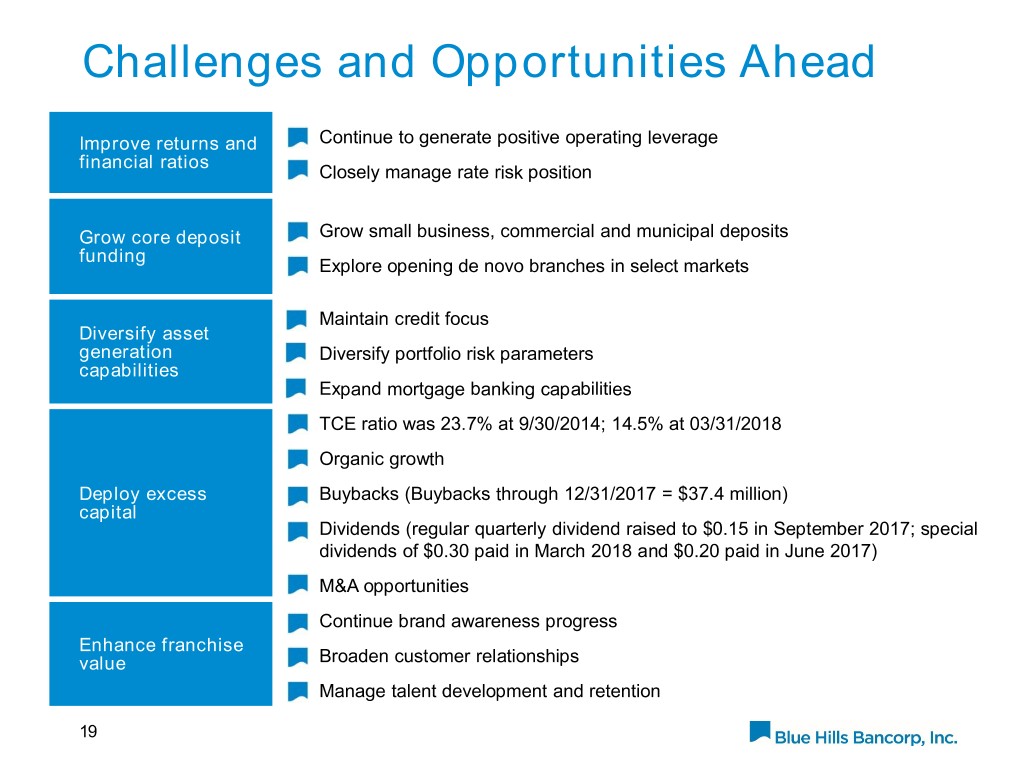

Challenges and Opportunities Ahead Improve returns and Continue to generate positive operating leverage financial ratios Closely manage rate risk position Grow core deposit Grow small business, commercial and municipal deposits funding Explore opening de novo branches in select markets Maintain credit focus Diversify asset generation Diversify portfolio risk parameters capabilities Expand mortgage banking capabilities TCE ratio was 23.7% at 9/30/2014; 14.5% at 03/31/2018 Organic growth Deploy excess Buybacks (Buybacks through 12/31/2017 = $37.4 million) capital Dividends (regular quarterly dividend raised to $0.15 in September 2017; special dividends of $0.30 paid in March 2018 and $0.20 paid in June 2017) M&A opportunities Continue brand awareness progress Enhance franchise value Broaden customer relationships Manage talent development and retention 19

Appendix 20

Balance Sheet $ thousands 03/31/2018 12/31/2017 12/31/2016 Cash and equivalents $45,072 $46,167 $30,496 Equity securities, at fair value 9,651 — — Securities available for sale, at fair value — 9,720 204,836 Securities held to maturity, at amortized cost 304,036 303,716 201,027 FHLB Stock, at cost 10,730 12,105 13,352 Loans held for sale 5,865 8,992 2,761 Total loans 2,204,475 2,207,024 1,931,621 Allowance for loan losses (20,185) (20,877) (18,750) Loans, net 2,184,290 2,186,147 1,912,871 Premises and equipment, net 20,685 21,573 22,034 Other real estate owned 3,649 — — Accrued interest receivable 6,120 6,438 6,057 Goodwill and core deposit intangible 9,566 9,717 10,560 Net deferred tax asset 5,197 6,000 10,146 Bank-owned life insurance 33,354 33,078 32,015 Other assets 30,936 24,867 23,537 Total assets $2,669,151 $2,668,520 $2,469,692 Deposits $2,077,838 $2,039,869 $1,808,687 Short-term borrowings 65,000 100,000 146,000 Long-term debt 105,000 105,000 105,000 Other liabilities 25,869 25,845 23,098 Stockholders' equity 395,444 397,806 386,907 Total liabilities and stockholders' equity $2,669,151 $2,668,520 $2,469,692 21

Income Statement Quarters ended $ thousands, except per share data 3/31/2018 12/31/2017 3/31/2017 Net interest and dividend income $18,359 $17,794 $15,881 Provision for loan losses (460) 681 57 Net interest and dividend income, after provision 18,819 17,113 15,824 Noninterest income 3,898 2,930 6,816 Noninterest expense 13,871 14,185 13,400 Income before income taxes 8,846 5,858 9,240 Provision for income taxes 2,263 4,565 1,753 Net income $6,583 $1,293 $7,487 Earnings per common share: Basic $0.27 $0.05 $0.31 Diluted $0.27 $0.05 $0.31 Note: Excluding unrealized loss on equity securities, a gain on exchange of investments and a gain on sale of property plant and equipment, Q1 '18 net income was $5,949 or $0.24 per diluted share. Excluding a charge related to the impact of tax reform on the valuation of deferred tax assets and a charge for pension settlements, Q4 '17 net income was $3,981 or $0.16 per diluted share. Excluding a gain on exchange of investments, a loss on sale of mutual funds,and the reversal of a state tax allowance, Q1 '17 net income was $2,652, or $0.11 per diluted share. 22

Loans and Deposits $ thousands 3/31/2018 12/31/2017 12/31/2016 Loans 1-4 family residential $938,030 $926,117 $854,478 Home equity 75,737 81,358 79,132 Commercial real estate 849,040 833,978 686,522 Construction 73,113 90,712 75,950 Total real estate loans 1,935,920 1,932,165 1,696,082 Commercial business 248,521 253,001 205,832 Consumer 20,034 21,858 29,707 Total loans $2,204,475 $2,207,024 $1,931,621 Deposits NOW and demand $382,406 $381,316 $331,508 Regular savings 216,894 221,004 262,984 Money market 643,336 646,603 573,204 Certificates of deposit 504,996 448,382 340,114 Brokered money market 90,369 92,798 53,357 Brokered certificates of deposit 239,837 249,766 247,520 Total deposits $2,077,838 $2,039,869 $1,808,687 Loans / total deposits 106% 108% 107% 23

Financial Highlights Quarters ended $ thousands, except per share data 3/31/2018 12/31/2017 3/31/2017 Performance ratios (1) ROA 0.91% 0.60% 0.43% ROE 6.04% 3.93% 2.74% Efficiency ratio 65% 67% 75% Asset Quality Nonperforming assets $13,319 $11,523 $13,109 Nonperforming assets / total assets 0.50% 0.43% 0.53% Allowance for loan losses / total loans 0.92% 0.95% 0.95% Allowance for loan losses / nonperforming loans 209% 181% 144% Net charge-offs (recoveries) / average loans, annualized 0.04% 0.01% (0.01)% Capital metrics Common shares outstanding 26,861,521 26,827,660 26,858,328 Book value per share $14.72 $14.83 $14.78 Tangible book value per share $14.37 $14.47 $14.40 Tangible common equity / tangible assets 14.51% 14.60% 15.55% (1) Q1 '18 excludes, where applicable the Tax Act, unrealized losses on equity securities, a gain from the exchange of an investment and a gain on sale of property, plant and equipment. Q4 '17 excludes pension settlement charges and Q1 '17 excludes a gain from the exchange of an investment, loss on sale of mutual funds and the reversal of a state tax valuation allowance. 24