Attached files

| file | filename |

|---|---|

| 8-K - 8-K - W R GRACE & CO | a20188-kxgsmaterialsconfer.htm |

Investor Presentation May 15, 2018 Goldman Sachs Basic Materials Conference

SAFE HARBOR Statement Regarding Safe Harbor For Forward-Looking Statements This presentation contains forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues,” or similar expressions. Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities; benefits from new technology and cost reduction initiatives; and markets for securities. For these statements, Grace claims the protections of the safe harbor for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Like other businesses, Grace is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to differ materially from those contained in the forward-looking statements include, without limitation: risks related to foreign operations, especially in emerging regions; the effects of international trade disputes, tariffs and sanctions; the costs and availability of raw materials, energy and transportation; the effectiveness of its research and development and growth investments; acquisitions and divestitures of assets and businesses; developments affecting Grace’s outstanding indebtedness; developments affecting Grace's pension obligations; its legal and environmental proceedings; environmental compliance costs; the inability to establish or maintain certain business relationships; the inability to hire or retain key personnel; natural disasters such as storms and floods, and force majeure events; changes in tax laws and regulations; the potential effects of cyberattacks; and those additional factors set forth in Grace's most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov. Reported results should not be considered as indications of future performance. Readers are cautioned not to place undue reliance on Grace's projections and forward-looking statements, which speak only as of the dates those projections and statements are made. Grace undertakes no obligation to release publicly any revision to the projections and forward-looking statements contained in this presentation, or to update them to reflect events or circumstances occurring after the date of this presentation. Non-GAAP Financial Terms In this presentation, Grace presents financial information in accordance with U.S. generally accepted accounting principles (U.S. GAAP), as well as the non-GAAP financial information described in the Appendix. Grace believes that this non-GAAP financial information provides useful supplemental information about the performance of its businesses, improves period-to-period comparability and provides clarity on the information management uses to evaluate the performance of its businesses. In the Appendix, Grace has provided reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. These non-GAAP financial measures should not be considered as a substitute for financial measures calculated in accordance with U.S. GAAP, and the financial results calculated in accordance with U.S. GAAP and reconciliations from those results should be evaluated carefully. © 2018 W. R. Grace & Co. | 2

AGENDA Today’s Discussion . Executing Against Our Strategy . Investment Case . Financial Framework and Capital Allocation . Key Takeaways Hudson La Force President and Chief Operating Officer © 2018 W. R. Grace & Co. | 3

GRACE AT A GLANCE The leading global supplier of process catalysts and specialty silicas Materials 2017 Grace Catalysts Technologies Sales3 Distribution Technologies ~$5B ~$2B 31% Market Adj. EBITDA $0.4B $1.8B 2, 3 2 2,3 2017 Sales 2 20% Sales 80% Sales Cap1 Margin 7% 6% Coatings 27% Traditional 6% Fuels Consumer/ PetroChem 80% 75% 24% Pharma 22% 7% Feedstocks #1 or #2 Business Adj. EBIT Chemical Plastics Business Outside 24% ROIC2 Process Clean Fuels Positions the US Operating Refining Technologies | Specialty Catalysts | Materials Technologies Segments 1 As of 2/20/18 2 Based on FY2017 3 Catalysts Technologies includes unconsolidated ART joint venture; FCC = Fluid Catalytic Cracking, SC = Specialty Catalysts, ART = Advanced Refining Technologies; FCC and ART together constitute the Refining Technologies operating segment * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix © 2018 W. R. Grace & Co. | 4

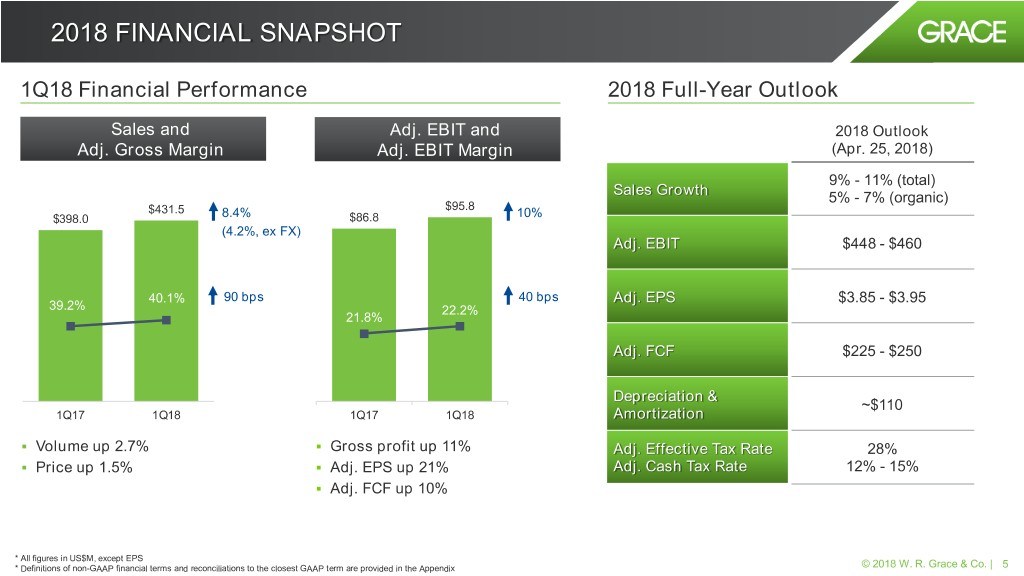

2018 FINANCIAL SNAPSHOT 1Q18 Financial Performance 2018 Full-Year Outlook Sales and Adj. EBIT and 2018 Outlook Adj. Gross Margin Adj. EBIT Margin (Apr. 25, 2018) 9% - 11% (total) Sales Growth 5% - 7% (organic) $431.5 $95.8 $398.0 8.4% $86.8 10% (4.2%, ex FX) Adj. EBIT $448 - $460 40.1% 90 bps 40 bps Adj. EPS $3.85 - $3.95 39.2% 22.2% 21.8% Adj. FCF $225 - $250 Depreciation & ~$110 1Q17 1Q18 1Q17 1Q18 Amortization . Volume up 2.7% . Gross profit up 11% Adj. Effective Tax Rate 28% . Price up 1.5% . Adj. EPS up 21% Adj. Cash Tax Rate 12% - 15% . Adj. FCF up 10% * All figures in US$M, except EPS * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix © 2018 W. R. Grace & Co. | 5

OUR STRATEGY FOR PROFITABLE GROWTH… EXECUTING ON STRATEGIC INITIATIVES 1 Invest to accelerate . Key growth and Operating Excellence investments on track growth and extend our . Value selling initiatives improving growth rates, pricing and margins competitive advantages 2 Invest in great people . Announced CEO succession to strengthen our . Recently hired VP, Integrated Supply Chain with responsibility for global manufacturing, high-performance culture procurement, order fulfillment, logistics, and supply chain planning activities 3 Formalize the . Operating Excellence improving manufacturing costs, throughput and availability Grace Value Model . Grace Manufacturing System (GMS) being implemented in 5 plants to drive operating excellence 4 Acquire to build our technology . Single-site, polyolefin catalysts acquisition closed on April 3 and manufacturing capabilities for . Integration and business performance are off to a strong start our customers . Customer and employee feedback very positive … INVESTING IN OUR BUSINESS © 2018 W. R. Grace & Co. | 6

COMPELLING INVESTMENT THESIS 1 2 3 4 Investing to Extend Clear Path to Deliver Sustainable, Delivering Value Our Competitive 2016-2021 Financial Profitable Growth Advantages Framework . Industry leader with . Grace Value Model . High-return investments . Disciplined capital unique and value-added provides comprehensive in growth capacity, allocation global platform framework for technology and operating . Long-term outlook . optimization; Significant excellence Leveraging a robust set of runway for value creation reinforces investment growth initiatives and . Balanced and disciplined thesis macro tailwinds capital allocation strategy . driving strong investment Clear path to revenue returns growth and margin expansion Strategy, operating discipline and team in place to create value © 2018 W. R. Grace & Co. | 7

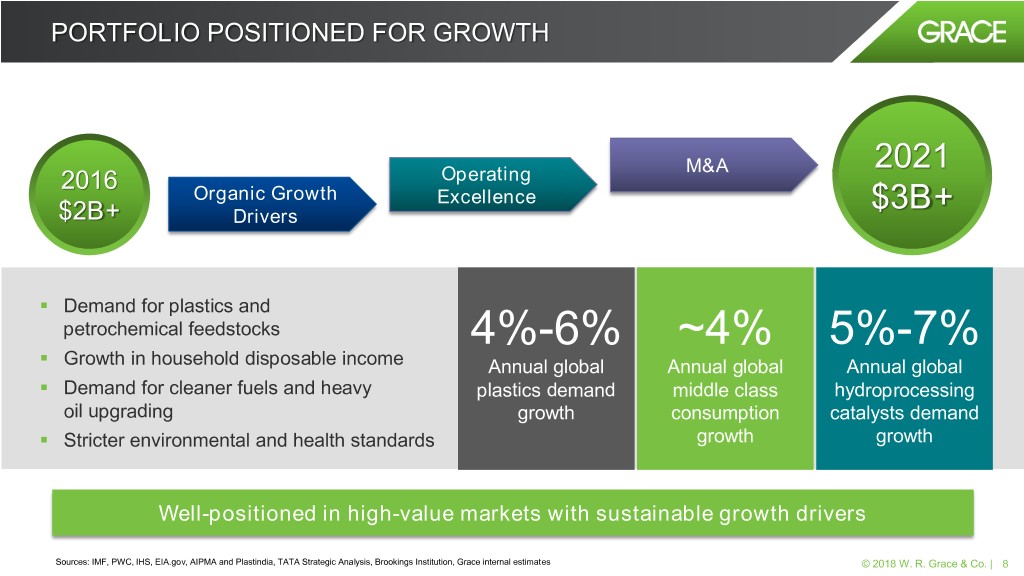

PORTFOLIO POSITIONED FOR GROWTH M&A 2021 2016 Operating Organic Growth Excellence $3B+ $2B+ Drivers . Demand for plastics and petrochemical feedstocks . 4%-6% ~4% 5%-7% Growth in household disposable income Annual global Annual global Annual global . Demand for cleaner fuels and heavy plastics demand middle class hydroprocessing oil upgrading growth consumption catalysts demand . Stricter environmental and health standards growth growth Well-positioned in high-value markets with sustainable growth drivers Sources: IMF, PWC, IHS, EIA.gov, AIPMA and Plastindia, TATA Strategic Analysis, Brookings Institution, Grace internal estimates © 2018 W. R. Grace & Co. | 8

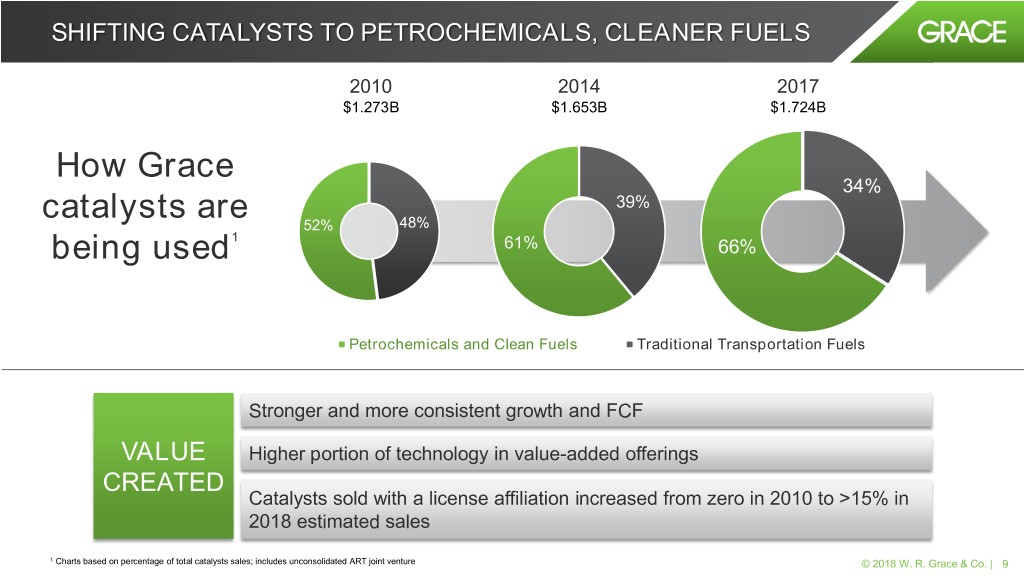

SHIFTING CATALYSTS TO PETROCHEMICALS, CLEANER FUELS 2010 2014 2017 $1.273B $1.653B $1.724B How Grace 34% catalysts are 39% 52% 48% 1 being used 61% 66% Petrochemicals and Clean Fuels Traditional Transportation Fuels Stronger and more consistent growth and FCF VALUE Higher portion of technology in value-added offerings CREATED Catalysts sold with a license affiliation increased from zero in 2010 to >15% in 2018 estimated sales 1 Charts based on percentage of total catalysts sales; includes unconsolidated ART joint venture © 2018 W. R. Grace & Co. | 9

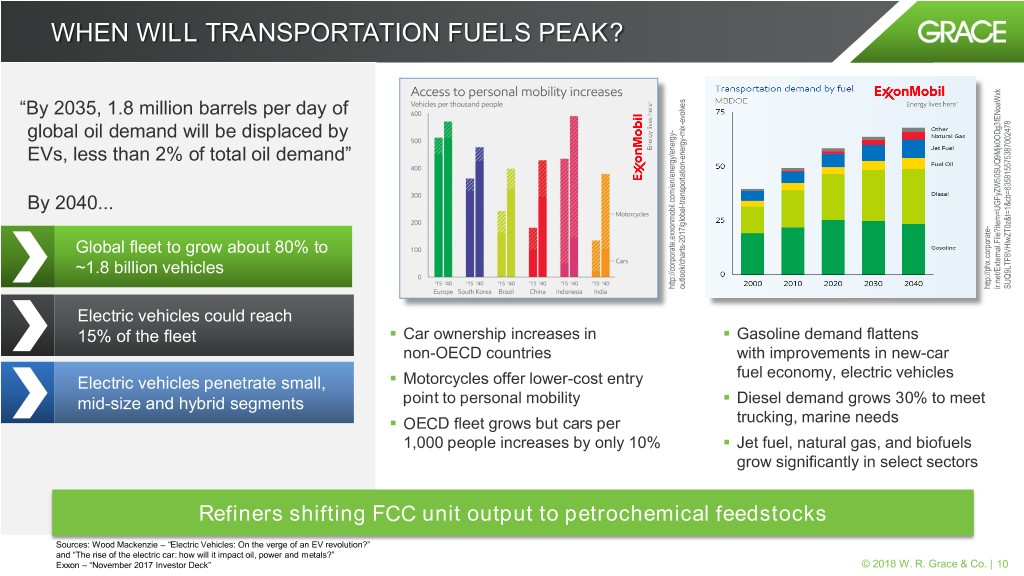

WHEN WILL TRANSPORTATION FUELS PEAK? “By 2035, 1.8 million barrels per day of evolves - - mix global oil demand will be displaced by - energy EVs, less than 2% of total oil demand” - transportation By 2040... - - 2017/global Global fleet to grow about 80% to - ~1.8 billion vehicles http://corporate.exxonmobil.com/en/energy/energy outlook/charts http://phx.corporate ir.net/External.File?item=UGFyZW50SUQ9Mjk0ODg3fENoaWxk SUQ9LTF8VHlwZT0z&t=1&cb=635815575387002478 Electric vehicles could reach . . 15% of the fleet Car ownership increases in Gasoline demand flattens non-OECD countries with improvements in new-car . Motorcycles offer lower-cost entry fuel economy, electric vehicles Electric vehicles penetrate small, . mid-size and hybrid segments point to personal mobility Diesel demand grows 30% to meet . OECD fleet grows but cars per trucking, marine needs 1,000 people increases by only 10% . Jet fuel, natural gas, and biofuels grow significantly in select sectors Refiners shifting FCC unit output to petrochemical feedstocks Sources: Wood Mackenzie – “Electric Vehicles: On the verge of an EV revolution?” and “The rise of the electric car: how will it impact oil, power and metals?” Exxon – “November 2017 Investor Deck” © 2018 W. R. Grace & Co. | 10

FCC UNITS REMAIN CORE TO REFINERIES . Gasoline Producing Unit FCC Reformer Alkylation Isomerization Hydrocracker Straight Run Shift from fuels to propylene (% of total pool) (40%) (25%) (10%) (5%) (10%) (10%) underway for many years – Requires higher-value FCC Highest value gasoline source (rank order, #1 best) 1 2 2 4 4 6 catalyst, especially when processing low quality crudes Margin uplift + + + + + + - . FCC units are generally the Flexibility to process low- most flexible and profitable units cost / difficult feedstocks + + - - - - - + - - in the refinery Octane value / Blending flexibility + + + + + + + - - - - . Refiners continue to invest in FCC units Olefins for petrochemical feedstocks + + - - - - - - - - - - – Significant growth in FCC capacity in last 5 years Upgrade residual and heavy products to + + - - - - - - + - - – Announced investments transportation fuels continue to add capacity Ability to switch between gasoline and diesel + + - - - - - - + - - +++ very advantaged ++ more advantaged + advantaged - less advantaged - - least advantaged FCC units will produce $ billions in value to and through the peak © 2018 W. R. Grace & Co. | 11

LEVERAGING THE GRACE VALUE MODEL (GVM) At the company level, we focus At the business level, we focus on portfolio, strategic position, on customers, innovation, and capital allocation growth, and profitability . We invest to grow our . Our customer-focused, businesses, improve our solutions-oriented approach to strategic position, and maintain innovation is a competitive our high ROIC advantage . Value selling is the core of our commercial approach . The Grace Manufacturing Great talent and our System is the foundation of our high-performance culture operating excellence strategy are competitive advantages . We invest in great people to . Integrated Business strengthen our high-performance Management aligns our core culture processes Our tightly aligned business model delivers value for customers, investors and employees © 2018 W. R. Grace & Co. | 12

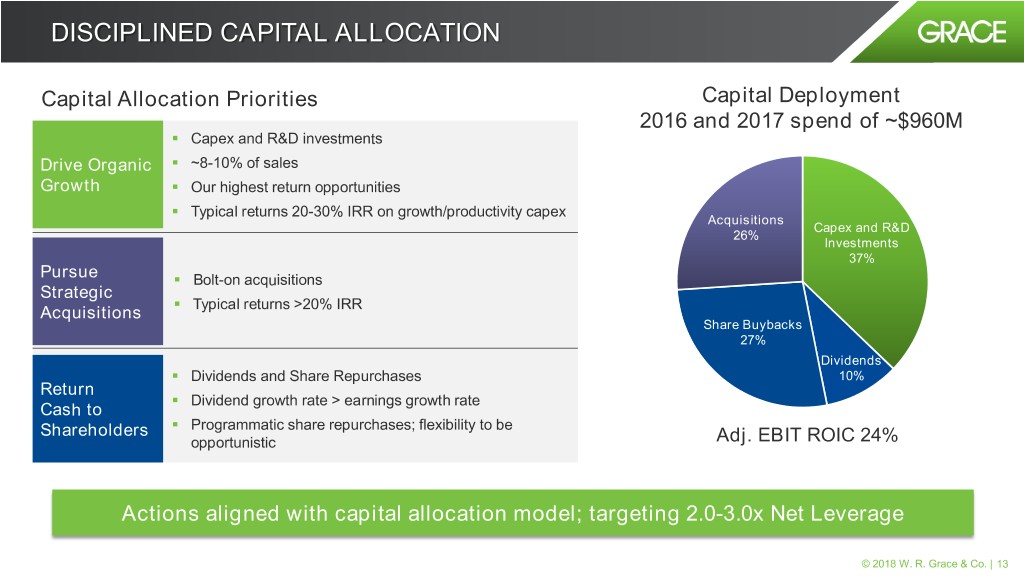

DISCIPLINED CAPITAL ALLOCATION Capital Allocation Priorities Capital Deployment 2016 and 2017 spend of ~$960M . Capex and R&D investments Drive Organic . ~8-10% of sales Growth . Our highest return opportunities . Typical returns 20-30% IRR on growth/productivity capex Acquisitions Capex and R&D 26% Investments 37% Pursue . Bolt-on acquisitions Strategic . Typical returns >20% IRR Acquisitions Share Buybacks 27% Dividends . Dividends and Share Repurchases 10% Return . Dividend growth rate > earnings growth rate Cash to . Shareholders Programmatic share repurchases; flexibility to be opportunistic Adj. EBIT ROIC 24% Actions aligned with capital allocation model; targeting 2.0-3.0x Net Leverage © 2018 W. R. Grace & Co. | 13

REAFFIRMING 2016-2021 FINANCIAL FRAMEWORK Sales Organic Growth CAGR with Sales Adj. EBITDA Adj. EPS Adj. Acquisitions CAGR CAGR CAGR FCF 6%-8% 4%-6% 6%-8% >10% >$1B Over 5 Years . Framework reflects targeted investments to accelerate growth across our portfolio . Double-digit average Adj. EPS growth . Grow dividends faster than Adj. EPS growth . Strong free cash flow available for acquisitions and return to shareholders Long-term outlook reinforces investment thesis © 2018 W. R. Grace & Co. | 14

KEY TAKEAWAYS Strong strategic position; well-positioned for growth Grace Value Model focused on creating value Investing in operating excellence; long runway of opportunity Attractive financial framework for growth, earnings and cash © 2018 W. R. Grace & Co. | 15

Business Unit Overviews

GRACE AT A GLANCE The leading global supplier of process catalysts and specialty silicas Materials 2017 Grace Catalysts Technologies Sales3 Distribution Technologies ~$5B ~$2B 31% Market Adj. EBITDA $0.4B $1.8B 2, 3 2 2,3 2017 Sales 2 20% Sales 80% Sales Cap1 Margin 7% 6% Coatings 27% Traditional 6% Fuels Consumer/ PetroChem 80% 75% 24% Pharma 22% 7% Feedstocks #1 or #2 Business Adj. EBIT Chemical Plastics Business Outside 24% ROIC2 Process Clean Fuels Positions the US Operating Refining Technologies | Specialty Catalysts | Materials Technologies Segments 1 As of 2/20/18 2 Based on FY2017 3 Catalysts Technologies includes unconsolidated ART joint venture; FCC = Fluid Catalytic Cracking, SC = Specialty Catalysts, ART = Advanced Refining Technologies; FCC and ART together constitute the Refining Technologies operating segment * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix © 2018 W. R. Grace & Co. | 17

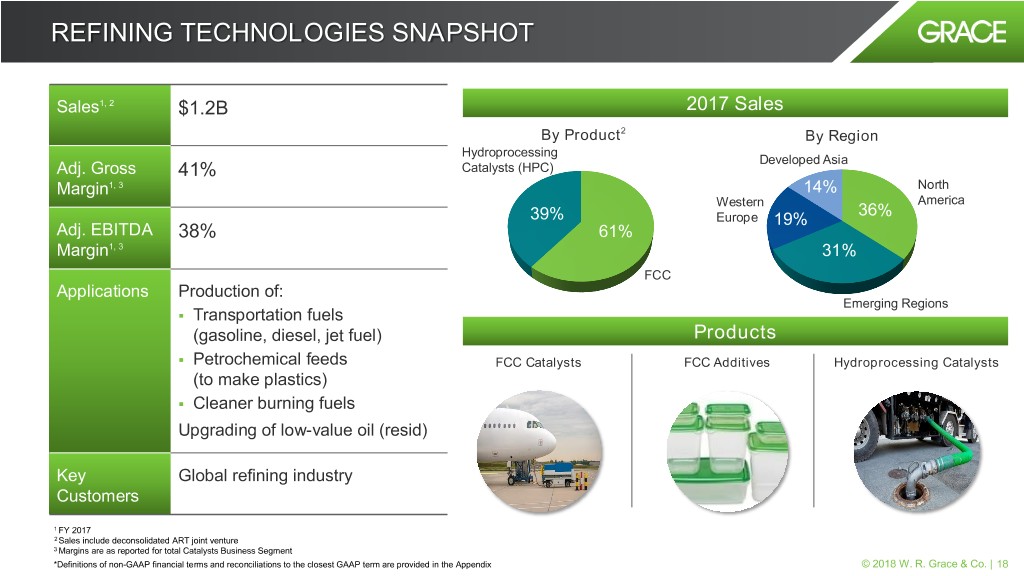

REFINING TECHNOLOGIES SNAPSHOT Sales1, 2 $1.2B 2017 Sales By Product2 By Region Hydroprocessing Developed Asia Adj. Gross 41% Catalysts (HPC) Margin1, 3 14% North America Western 36% 39% Europe 19% Adj. EBITDA 38% 61% Margin1, 3 31% FCC Applications Production of: Emerging Regions . Transportation fuels (gasoline, diesel, jet fuel) Products . Petrochemical feeds FCC Catalysts FCC Additives Hydroprocessing Catalysts (to make plastics) . Cleaner burning fuels Upgrading of low-value oil (resid) Key Global refining industry Customers 1 FY 2017 2 Sales include deconsolidated ART joint venture 3 Margins are as reported for total Catalysts Business Segment *Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix © 2018 W. R. Grace & Co. | 18

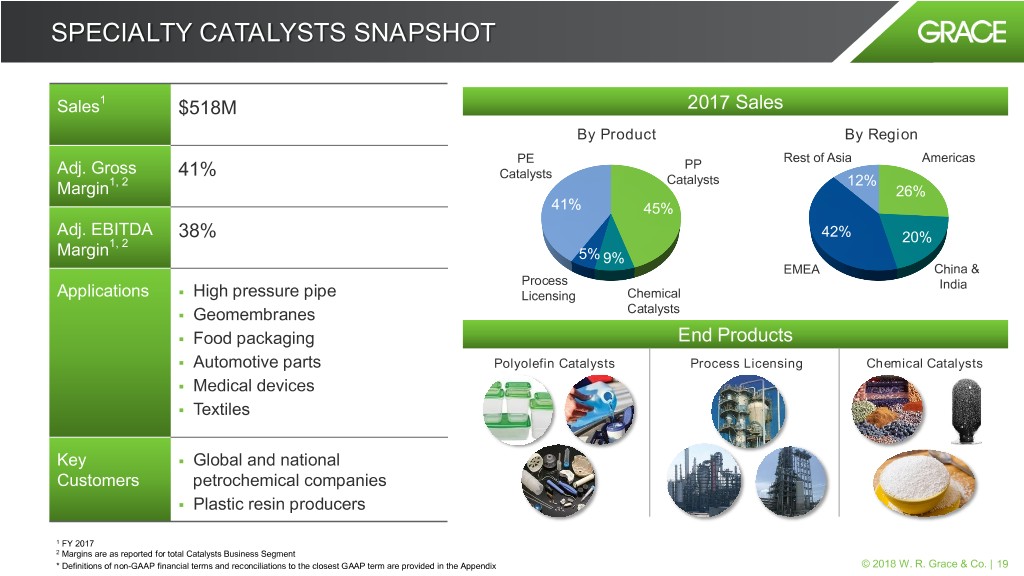

SPECIALTY CATALYSTS SNAPSHOT Sales1 $518M 2017 Sales By Product By Region Rest of Asia Americas PE PP Adj. Gross 41% Catalysts 1, 2 Catalysts 12% Margin 26% 41% 45% Adj. EBITDA 38% 42% 1, 2 20% Margin 5% 9% EMEA China & . Process India Applications High pressure pipe Licensing Chemical . Geomembranes Catalysts . Food packaging End Products . Automotive parts Polyolefin Catalysts Process Licensing Chemical Catalysts . Medical devices . Textiles Key . Global and national Customers petrochemical companies . Plastic resin producers 1 FY 2017 2 Margins are as reported for total Catalysts Business Segment * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix © 2018 W. R. Grace & Co. | 19

MATERIALS TECHNOLOGIES SNAPSHOT Sales1 $440M 2017 Sales By End Market By Region Developed Asia Adj. Gross Chemical 1 38% Consumer/ Process Margin Pharma 5% 29% W. Europe Adj. EBITDA 37% N. America 23% 38% 1 27% Margin . Pharmaceutical companies 34% . Consumer products manufacturers 34% . Industrial chemical manufacturers Coatings Key Customers . Petrochemical and natural gas producers Emerging Regions . Plastic resin and film manufacturers . Tire and rubber manufacturers Applications . Paint and coatings companies Consumer/Pharma Chemical Process Coatings . Pharmaceutical intermediates . Excipients and chromatography . Consumer products additives and processing aids Applications . Environmental catalysts . Gas and petrochemical processing . Plastics and rubber additives . Coatings additives . Paint additives . Digital media 1 FY 2017 Note: color coding within “key customers” and “applications” correlates to “By End Market” pie graph colors * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix © 2018 W. R. Grace & Co. | 20

Appendix

BIOGRAPHIES Hudson La Force PRESIDENT AND CHIEF OPERATING OFFICER As President Chief Operating Officer of W. R. Grace & Co., Hudson La Prior to joining Grace, Hudson served as Chief Operating Officer and Force is responsible for Grace's Catalysts Technologies and Materials Senior Counselor to the Secretary at the U.S. Department of Education Technologies business segments and Grace's global manufacturing where he led a transformation of the department's management and supply chain operations. As COO, Hudson is focused primarily on practices. He also served as a member of the President's Management safety, sales growth, manufacturing excellence and capital investment. Council. He was named to this role in February 2016, elected to the Grace Before entering public service in 2005, Hudson worked at Dell Inc., Board of Directors in November 2017 and in May 2018, the Grace where he held general management and financial leadership positions Board of Directors designated Hudson as successor to Fred Festa as at the company's headquarters in Austin, Texas and in China. From the company’s next CEO following Fred’s retirement in 4Q 2018. 2002 to 2005, Hudson served as a general manager for Dell in China, Hudson joined Grace as Senior Vice President and Chief Financial leading a $500 million business unit through a period of double-digit Officer in 2008. In that role, he focused on improving the company's sales growth, triple-digit earnings growth and significant operational profitability, cash flow, and return on invested capital. During his change. Before joining Dell in 1997, he worked at AlliedSignal, Inc. (now tenure as CFO, gross margins increased eight percentage points, Honeywell), Emerson Electric Co. and Arthur Andersen & Co. Adjusted EBITDA margins increased 11 percentage points, adjusted Hudson earned an MBA at the Kellogg School of Management at free cash flow increased nearly three times, and adjusted return on Northwestern University and a Bachelor's degree at Baylor University. invested capital increased 11 percentage points. Hudson was deeply He is a board member of Madison Industries, a Chicago-based industrial involved in Grace's internal transformation into a fully-integrated global holding company, and a former board member of KIPP DC, a public operating company and its external transformation into two industry- charter school operator in Washington, D.C. leading public companies in February 2016. © 2018 W. R. Grace & Co. | 22

DEFINITIONS AND RECONCILIATIONS OF NON-GAAP MEASURES Non-GAAP Financial Terms Adjusted EBIT means income from continuing operations attributable to W. R. Grace & Co. shareholders adjusted for interest income and expense; income taxes; costs related to legacy product, environmental and other claims; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; income and expense items related to divested businesses, product lines, and certain other investments; gains and losses on sales of businesses, product lines, and certain other investments; third-party acquisition- related costs and the amortization of acquired inventory fair value adjustment; and certain other items that are not representative of underlying trends. Adjusted EBITDA means Adjusted EBIT adjusted for depreciation and amortization. Adjusted EBIT Return On Invested Capital means Adjusted EBIT (on a trailing four quarters basis) divided by the sum of net working capital, properties and equipment and certain other assets and liabilities. Adjusted Gross Margin means gross margin adjusted for pension-related costs included in cost of goods sold and the amortization of acquired inventory fair value adjustment. Adjusted Earnings Per Share (Adjusted EPS) means diluted EPS from continuing operations adjusted for costs related to legacy product, environmental and other claims; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; income and expense items related to divested businesses, product lines, and certain other investments; gains and losses on sales of businesses, product lines, and certain other investments; third-party acquisition-related costs and the amortization of acquired inventory fair value adjustment; certain other items that are not representative of underlying trends; and certain discrete tax items. Adjusted ETR means the effective tax rate on Adjusted EBIT less net interest expense, plus or minus certain discrete items (such as changes in tax laws and APB 23 reserves) and the incremental temporary increase to anti- base erosion taxes that results from our U.S. net operating losses. Adjusted Free Cash Flow means net cash provided by or used for operating activities from continuing operations minus capital expenditures plus cash flows related to legacy product, environmental and other claims; cash paid for restructuring and repositioning; capital expenditures related to repositioning; cash paid for third-party acquisition-related costs; and accelerated payments under defined benefit pension arrangements. Net Sales, constant currency means the period-over-period change in net sales calculated using the foreign currency exchange rates that were in effect during the previous comparable period. Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, Adjusted EPS, Adjusted Free Cash Flow and Net Sales, constant currency do not purport to represent income or liquidity measures as defined under U.S. GAAP, and should not be considered as alternatives to such measures as an indicator of Grace's performance or liquidity. Grace uses Adjusted EBIT as a performance measure in significant business decisions and in determining certain incentive compensation. Grace uses Adjusted EBIT as a performance measure because it provides improved period-to-period comparability for decision making and compensation purposes, and because it better measures the ongoing earnings results of its strategic and operating decisions by excluding the earnings effects of the legacy product, environmental and other claims; restructuring and repositioning activities; divested businesses; the effects of acquisitions; and certain other items that are not representative of underlying trends. Grace uses Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, and Adjusted EPS as performance measures and may use these measures in determining certain incentive compensation. Grace uses Adjusted EBIT Return On Invested Capital in making operating and investment decisions and in balancing the growth and profitability of operations. Grace uses Adjusted Free Cash Flow as a liquidity measure to evaluate its ability to generate cash to support its ongoing business operations, to invest in its businesses, and to provide a return of capital to shareholders. Grace also uses Adjusted Free Cash Flow as a performance measure in determining certain incentive compensation. Grace uses Net Sales, constant currency as a performance measure to compare current period financial performance to historical financial performance by excluding the impact of foreign currency exchange rate fluctuations that are not representative of underlying business trends and are largely outside of its control. Grace is unable without unreasonable efforts to estimate the annual mark-to-market pension adjustment or 2017 net income, and without the availability of this significant information, Grace is unable to provide reconciliations for the forward- looking information set forth in the 2017 outlook, above. These measures are provided to investors and others to improve the period-to-period comparability and peer-to-peer comparability of Grace’s financial results, and to ensure that investors and others understand the information Grace uses to evaluate the performance of its businesses. They distinguish the operating results of Grace's current business base from the costs of Grace's legacy product, environmental and other claims; restructuring and repositioning activities; divested businesses; and other items discussed above. These measures may have material limitations due to the exclusion or inclusion of amounts that are included or excluded, respectively, in the most directly comparable measures calculated and presented in accordance with U.S. GAAP and thus investors and others should review carefully the financial results calculated in accordance with U.S. GAAP. © 2018 W. R. Grace & Co. | 23

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (CONTINUED) Adjusted EBIT by Operating Segment: 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Catalysts Technologies segment operating income $ 395.4 $ 81.2 $ 101.3 $ 103.6 $ 109.3 $ 92.1 Materials Technologies segment operating income 100.6 24.8 24.2 26.4 25.2 24.1 Corporate costs (69.0) (16.1) (18.3) (18.5) (16.1) (16.6) Gain on curtailment of postretirement plans related to current businesses — — — — — — Certain pension costs(B) (13.0) (3.1) (3.2) (3.4) (3.3) (3.8) Adjusted EBIT 414.0 86.8 104.0 108.1 115.1 95.8 (Costs) benefit related to legacy product, environmental and other claims (30.8) (2.1) (14.9) (8.5) (5.3) (1.5) Restructuring and repositioning expenses (26.7) (2.3) (5.4) (9.3) (9.7) (5.6) Accounts receivable reserve—Venezuela (10.0) — — (10.0) — — Third-party acquisition-related costs (2.9) — — (0.4) (2.5) (0.9) Amortization of acquired inventory fair value adjustment — — — — — — Pension MTM adjustment and other related costs, net (51.1) (1.9) — — (49.2) — Gain on sale of product line — — — (0.4) 0.4 — Income and expense items related to divested businesses (2.3) (0.3) (0.7) (0.3) (1.0) (0.5) Gain on curtailment of postretirement plans related to divested businesses — — — — — — Loss on early extinguishment of debt — — — — — — Interest expense, net (78.5) (19.3) (19.5) (20.2) (19.5) (18.9) (Provision for) benefit from income taxes (200.5) (18.0) (19.6) (11.6) (151.3) (24.8) Income (loss) from continuing operations attributable to W. R. Grace & Co. shareholders $ 11.2 $ 42.9 $ 43.9 $ 47.4 $ (123.0) $ 43.6 © 2018 W. R. Grace & Co. | 24

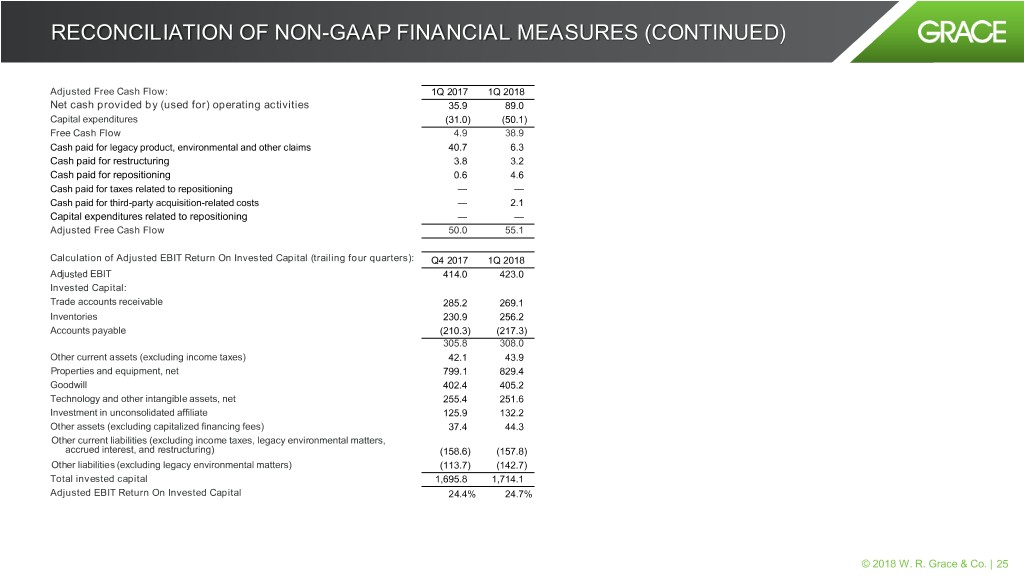

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (CONTINUED) Adjusted Free Cash Flow: 1Q 2017 1Q 2018 Net cash provided by (used for) operating activities 35.9 89.0 Capital expenditures (31.0) (50.1) Free Cash Flow 4.9 38.9 Cash paid for legacy product, environmental and other claims 40.7 6.3 Cash paid for restructuring 3.8 3.2 Cash paid for repositioning 0.6 4.6 Cash paid for taxes related to repositioning — — Cash paid for third-party acquisition-related costs — 2.1 Capital expenditures related to repositioning — — Adjusted Free Cash Flow 50.0 55.1 Calculation of Adjusted EBIT Return On Invested Capital (trailing four quarters): Q4 2017 1Q 2018 Adjusted EBIT 414.0 423.0 Invested Capital: Trade accounts receivable 285.2 269.1 Inventories 230.9 256.2 Accounts payable (210.3) (217.3) 305.8 308.0 Other current assets (excluding income taxes) 42.1 43.9 Properties and equipment, net 799.1 829.4 Goodwill 402.4 405.2 Technology and other intangible assets, net 255.4 251.6 Investment in unconsolidated affiliate 125.9 132.2 Other assets (excluding capitalized financing fees) 37.4 44.3 Other current liabilities (excluding income taxes, legacy environmental matters, accrued interest, and restructuring) (158.6) (157.8) Other liabilities (excluding legacy environmental matters) (113.7) (142.7) Total invested capital 1,695.8 1,714.1 Adjusted EBIT Return On Invested Capital 24.4% 24.7% © 2018 W. R. Grace & Co. | 25

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (CONTINUED) Three months ended March 31, 2018 2017 Tax at Tax at Pre- Actual After- Per Pre- Actual After- Per (In millions, except per share amounts) Tax Rate Tax Share Tax Rate Tax Share Diluted Earnings Per Share (GAAP) $ 0.64 $ 0.63 Costs (benefit) related to legacy product, environmental and other claims $ 1.5 $ 0.4 $ 1.1 0.02 $ 2.1 $ 0.8 $ 1.3 0.02 Restructuring and repositioning expenses 5.6 1.1 4.5 0.07 2.3 0.8 1.5 0.02 Income and expense related to divested businesses 0.5 0.1 0.4 0.01 0.3 0.1 0.2 — Third-party acquisition-related costs 0.9 0.3 0.6 0.01 — — — — Pension MTM adjustment and other related costs, net — — — — 1.9 0.7 1.2 0.02 Discrete tax items: Income tax expense related to historical tax attributes(1) (4.7) 4.7 0.07 — — — Discrete tax items — — — 0.5 (0.5) (0.01) Adjusted EPS (non-GAAP) $ 0.82 $ 0.68 (1) Our historical tax attribute carryforwards (net operating losses and tax credits) unfavorably affect our tax expense with respect to certain provisions of the Act. To normalize the effective tax rate, an adjustment is made to eliminate the tax expense impact associated with the historical tax attributes. © 2018 W. R. Grace & Co. | 26

Investor Presentation May 15, 2018 Goldman Sachs Basic Materials Conference