Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ADESTO TECHNOLOGIES Corp | exh_991.htm |

| 8-K - FORM 8-K - ADESTO TECHNOLOGIES Corp | f8k_050918.htm |

EXHIBIT 99.2

1 May 9 th 2018 Adesto Technologies Acquisition of S3 Semiconductors

2 Safe Harbor Statement About Non - GAAP Financial Measures During this presentation, references to financial measures of Adesto Technologies Corporation will include references to non - GAAP financial measures. For an explanation to the most directly comparable GAAP financial measures, see the Appendix to these materials or the Company’s ear nin gs release, dated May 9, 2018. Forward - Looking Statements This presentation contains forward - looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements described as “Expected Financial Benefits,” on the slide entitled “Anticip ate d Benefits of the Transaction” and relating to expansion of the combined company’s addressable market, projections on the slide captioned “Financial Model” and sta tements regarding future events that involve risks and uncertainties. Actual results may differ materially from those contained in the forward - looking statemen ts contained in this presentation, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that cou ld cause actual results to differ from those projected include the risk that the businesses of the Company and S3 Semiconductors may not be combined successfully, o r s uch combination may take longer, be more difficult, time - consuming or costly to accomplish than expected; the risk that sales of S3 Semiconductors’ products will not be as high as anticipated; the expected growth opportunities, increases in average sales prices, revenues, gross margin and operating margin, sales channel imp rovements or cost savings from the acquisition may not be fully realized or may take longer to realize than expected; customer losses and business disruption fo llo wing the acquisition, including adverse effects on relationships with former employees of S3 Semiconductors, may be greater than expected; and the risk that the Comp any may incur unanticipated or unknown losses or liabilities in connection with the acquisition. Additional factors, that could cause actual results to diff er materially from those expressed in the forward - looking statements include our ability to predict the timing of design wins entering production and the potential future revenue associated with our design wins; market adoption of our CBRAM - based products; our limited operating history; our rate of growth; our ability to predict cus tomer demand for our existing and future products and to secure adequate manufacturing capacity; consumer demand conditions affecting our end markets; our abil ity to manage our growth; our ability to hire, retain and motivate employees; the effects of competition, including price competition; technological, regulatory an d l egal developments; and developments in the economy and financial markets.. These and other risks are discussed in greater detail in the Company's Securities and Exc han ge Commission filings, including its most recent annual report on Form 10 - K, which is available on the Company's investor relations website at ir.adestotech.com and on the SEC website at sec.gov. All information provided in this release and in the attachments is as of May 9, 2018, and the Company assumes no obligation to up dat e this information as a result of future events or developments.

3 Transaction Overview o Financed with a combination of existing cash and debt o $35 million senior secured loan Financing Structure o All cash transaction o $35M purchase price at the close o $15M earn out based on performance over 2 years Consideration o Acquisition of S3 Semiconductors o Dublin - based ASIC and IP solutions provider o Focused on industrial IoT and communications markets Transaction o Accelerates revenue growth o Immediately accretive to gross margin & EBITDA o Non - GAAP EPS accretive within 12 months Expected Financial Benefits

4 S3 Semiconductors Background Corporate Background Established : 1986, Headquartered in Dublin Offices : Ireland, Czech Republic, Portugal, US Competency : Mixed - Signal, Analog and Systems Engineering Solutions : Mixed - Signal, RF and Analog ASIC and IP Blocks Applications: Sensing, Controlling & Communication Nodes End Markets: Industrial IoT, Satellite Communication Markets and Applications Team : Over 70 Engineers Partners : Arm Global Design Partner Proven Track Record: Delivered Over 200 ASIC Designs Business Model Technical Excellence Revenue Sources: ASIC Supplier, ASIC Design, IP Licensing Gross Margin: Well Above Adesto’s Corp. Target Range Profile: Growing Revenue and Profitable

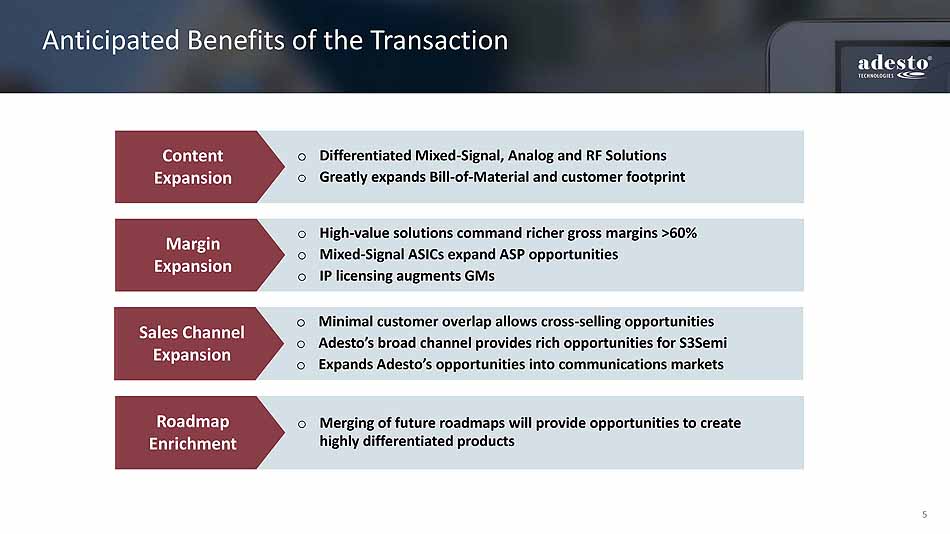

5 Anticipated Benefits of the Transaction o Merging of future roadmaps will provide opportunities to create highly differentiated products Roadmap Enrichment o High - value solutions command richer gross margins >60% o Mixed - Signal ASICs expand ASP opportunities o IP licensing augments GMs Margin Expansion o Differentiated Mixed - Signal, Analog and RF Solutions o Greatly expands Bill - of - Material and customer footprint Content Expansion o Minimal customer overlap allows cross - selling opportunities o Adesto’s broad channel provides rich opportunities for S3Semi o Expands Adesto’s opportunities into communications markets Sales Channel Expansion

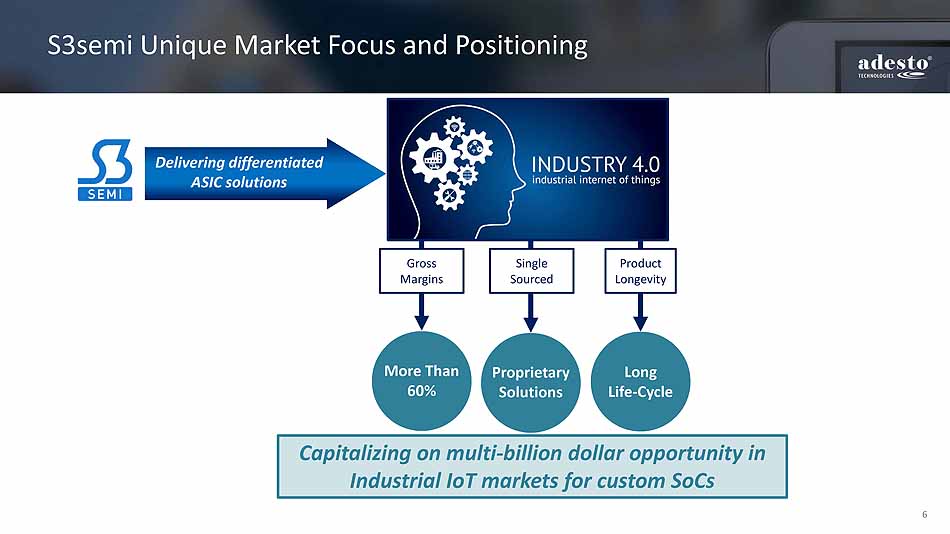

6 S3semi Unique Market Focus and Positioning Delivering differentiated ASIC solutions More Than 60% Long Life - Cycle Proprietary Solutions Single Sourced Product Longevity Gross Margins Capitalizing on multi - billion dollar opportunity in Industrial IoT markets for custom SoCs

7 SAM Expansion IoT Edge Node controller memory sensor analog communication memory Analog Communication Controller 20B Connected Nodes by 2020 Expanding BoM Opportunity by More Than 10x $1B+ $10B+

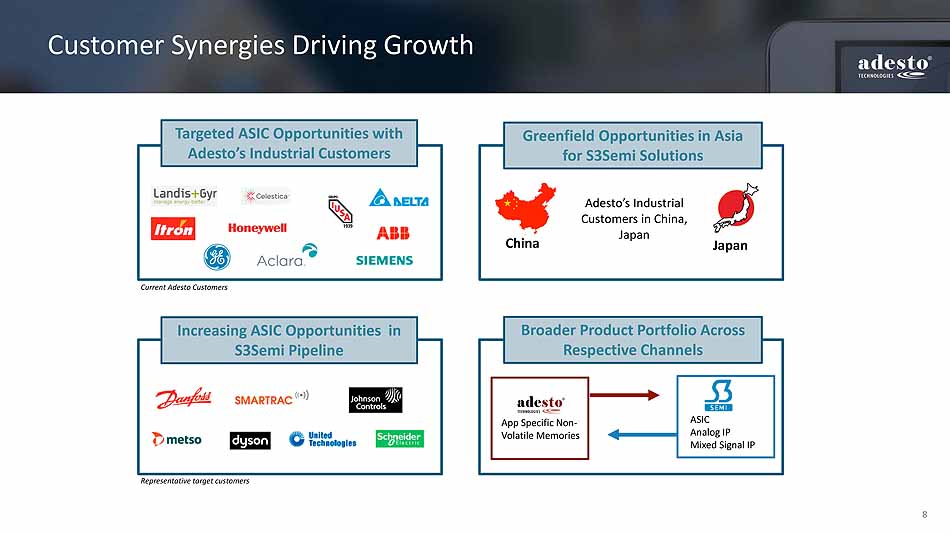

8 Customer Synergies Driving Growth Targeted ASIC Opportunities with Adesto’s Industrial Customers Increasing ASIC Opportunities in S3Semi Pipeline Greenfield Opportunities in Asia for S3Semi Solutions China Japan Adesto’s Industrial Customers in China, Japan Broader Product Portfolio Across Respective Channels ASIC Analog IP Mixed Signal IP App Specific Non - Volatile Memories Representative target customers Current Adesto Customers

9 A Powerful Combination of Two Companies Over 180 People Engineers Over 100 Global Presence US Europe Asia Application Specific Non - Volatile Memory Industrial Communication Medical Consumer Computing Mixed - Signal, Analog, RF ASIC and IP Industrial Communication Medical +

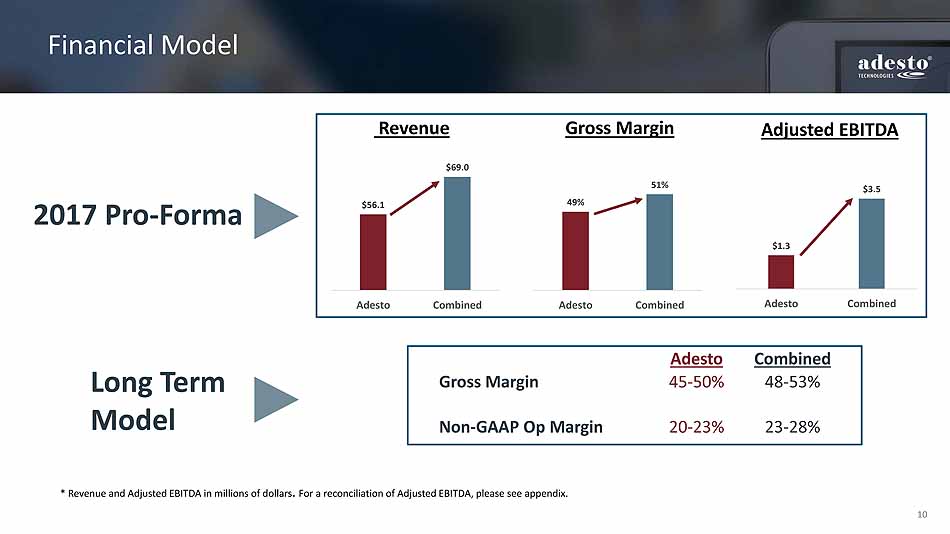

10 Financial Model Revenue Adjusted EBITDA Gross Margin $56.1 $69.0 Adesto Combined 49% 51% Adesto Combined Adesto Combined Gross Margin 45 - 50% 48 - 53% Non - GAAP Op Margin 20 - 23% 23 - 28% * Revenue and Adjusted EBITDA in millions of dollars . For a reconciliation of Adjusted EBITDA, please see appendix. 2017 Pro - Forma Long Term Model $1.3 $3.5 Adesto Combined

11 New Adesto Expansion of Revenue, SAM and Gross Margin Increase Silicon Content in IoT Edge Nodes Expand Industrial IoT Edge Leadership and Differentiation IoT Edge Node controller memory sensor analog communication A leading provider of Innovative Application - Specific Semiconductor Solutions for the IoT Era

12 Thank You!

13 Appendix: Reconciliation of Adjusted EBITDA Adesto (1) S3 (2) Total Reconciliation from net loss to adjusted EBITDA: Net income (loss): $ (5,688) $ 1,856 $ (3,832) Stock-based compensation expense 3,502 - 3,502 Amortization of acquisition-related intangible assets 1,222 - 1,222 Interest expense 781 - 781 Provision for income taxes 101 157 258 Depreciation and amortization 1,384 137 1,521 Adjusted EBITDA $ 1,302 $ 2,150 $ 3,452 (1) Derived from the consolidated audited financial statements for Adesto for the year ended December 31, 2017 (2) Derived from the unaudited, pro forma financial statements of S3 Semiconductors for the year ended December 31, 2017