Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Oaktree Strategic Income Corp | d585266dex993.htm |

| EX-99.1 - EX-99.1 - Oaktree Strategic Income Corp | d585266dex991.htm |

| 8-K - 8-K - Oaktree Strategic Income Corp | d585266d8k.htm |

Second Quarter Fiscal Year 2018 Earnings Presentation May 8, 2018 Nasdaq: OCSI Exhibit 99.2

Forward Looking Statements Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of our Investment Adviser to find lower-risk investments to reposition our portfolio and to implement our Investment Adviser’s future plans with respect to our business; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; and the cost or potential outcome of any litigation to which we may be a party. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K and our quarterly report on Form 10-Q for the quarter ended March 31, 2018. Other factors that could cause actual results to differ materially include: changes in the economy, financial markets and political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; and other considerations that may be disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Unless otherwise indicated, data provided herein are dated as of March 31, 2018.

Forward Looking Statements (continued) Participants in the Solicitation Oaktree Strategic Income Corporation, its directors and certain of its executive officers, the directors and executive officers and employees of Oaktree Capital Management, L.P. and its affiliates that provide services to the Company and its subsidiaries pursuant to the Investment Advisory Agreement, dated October 17, 2017, between the Company and Oaktree Capital Management, L.P. and the Administration Agreement, dated October 17, 2017, between the Company and Oaktree Fund Administration, LLC may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Company’s Special Meeting of Stockholders (the “Special Meeting”). Additional Information and Where to Find It The Company has filed a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the Special Meeting. Additional information regarding the identity of these potential participants, none of whom owns in excess of 1% of the shares of Company common stock (other than Oaktree Capital Management, L.P., which, together with its affiliates, has shared voting and dispositive power over an aggregate of approximately 27.1% of the Company’s common stock based on 29,466,768 shares of common stock outstanding as of May 7, 2018, as reported in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018), and their direct or indirect interests, by security holdings or otherwise, is set forth in the preliminary proxy statement and other materials to be filed with the SEC in connection with the Special Meeting. This information can also be found in (i) the Company’s definitive proxy statement for its 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting Proxy Statement”), filed with the SEC on January 29, 2018 and (ii) the Company’s Annual Report on Form 10-K for the year ended September 30, 2017, filed with the SEC on December 11, 2017 (the “Form 10-K”). To the extent holdings by the directors and executive officers of the Company of the shares of Company common stock have changed since the amounts printed in the 2018 Annual Meeting Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT FOR THE SPECIAL MEETING (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE 2018 ANNUAL MEETING PROXY STATEMENT, THE FORM 10-K AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain, free of charge, copies of the definitive proxy statement for the special meeting (when available), the 2018 Annual Meeting Proxy Statement, the Form 10-K and any other documents (including a proxy card) filed or to be filed by the Company with the SEC in connection with the Special Meeting at the SEC’s website, www.sec.gov, or at the Company’s website www.oaktreestrategicincome.com or by writing to the Company’s Secretary at 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071. In addition, copies of the proxy materials, when available, may be requested by contacting the Company’s proxy solicitor, Broadridge Investor Communication Solutions, Inc., by calling toll-free at (855) 486-7909 or by mail at 51 Mercedes Way, Edgewood, NY 11717.

Q2 2018 Accomplishments and Highlights Net asset value per share of $9.99 as of March 31, 2018 vs. $9.84 as of December 31, 2017 NAV per share increased $0.15 from December 31, 2017 Monetized approximately $40 million of non-core investments during the quarter ended March 31, 2018 $39 million of non-core performing and $1 million of non-core, non-accrual investments Non-core investments represented only 22% of the portfolio at fair value as of March 31, 2018 Monetized approximately $188 million of non-core investments since September 30, 2017 Entered into $94 million of new investment commitments Primary focus on credit selection in a low yield environment First lien originations represented 88% of new investment commitments 8.4% weighted average yield of new investments Net investment income per share of $0.16 for the quarter ended March 31, 2018 vs. $0.15 for the quarter ended December 31, 2017 Our Board of Directors declared a dividend of $0.145 per share (an increase of $0.005 per share); payable on June 29, 2018 to stockholders of record as of June 15, 2018

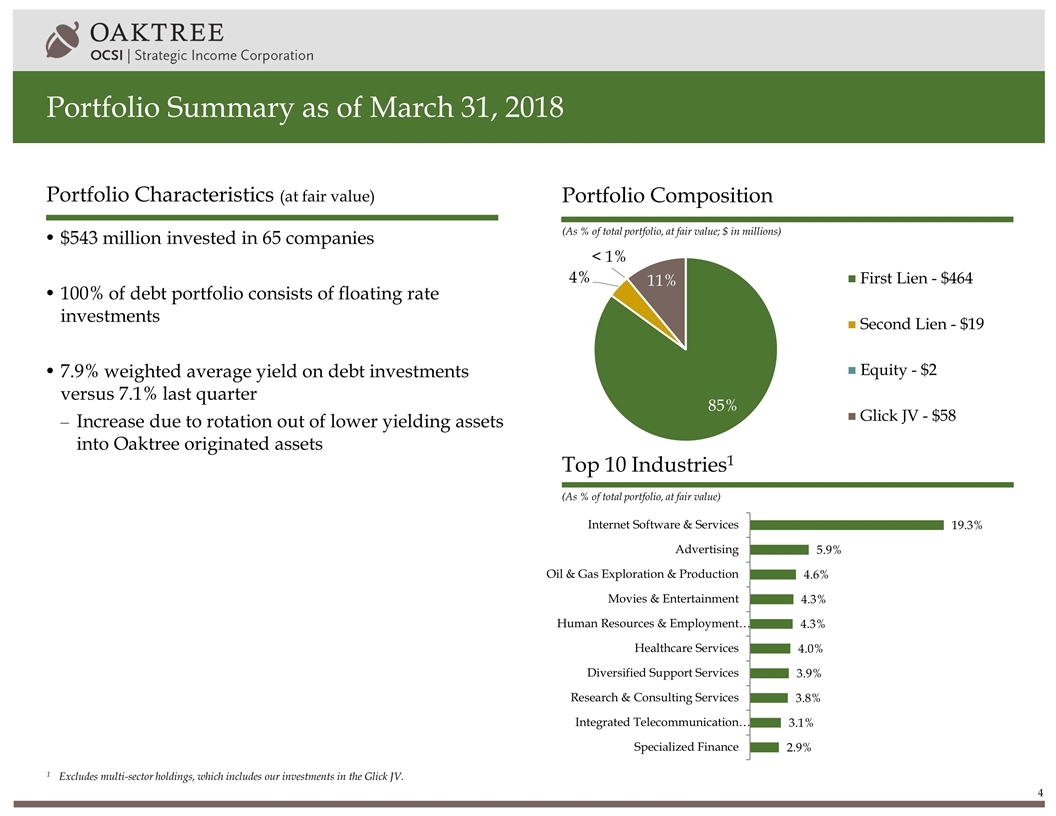

Portfolio Summary as of March 31, 2018 (As % of total portfolio, at fair value; $ in millions) (As % of total portfolio, at fair value) Portfolio Composition Top 10 Industries1 Portfolio Characteristics (at fair value) $543 million invested in 65 companies 100% of debt portfolio consists of floating rate investments 7.9% weighted average yield on debt investments versus 7.1% last quarter Increase due to rotation out of lower yielding assets into Oaktree originated assets 1 Excludes multi-sector holdings, which includes our investments in the Glick JV. < 1%

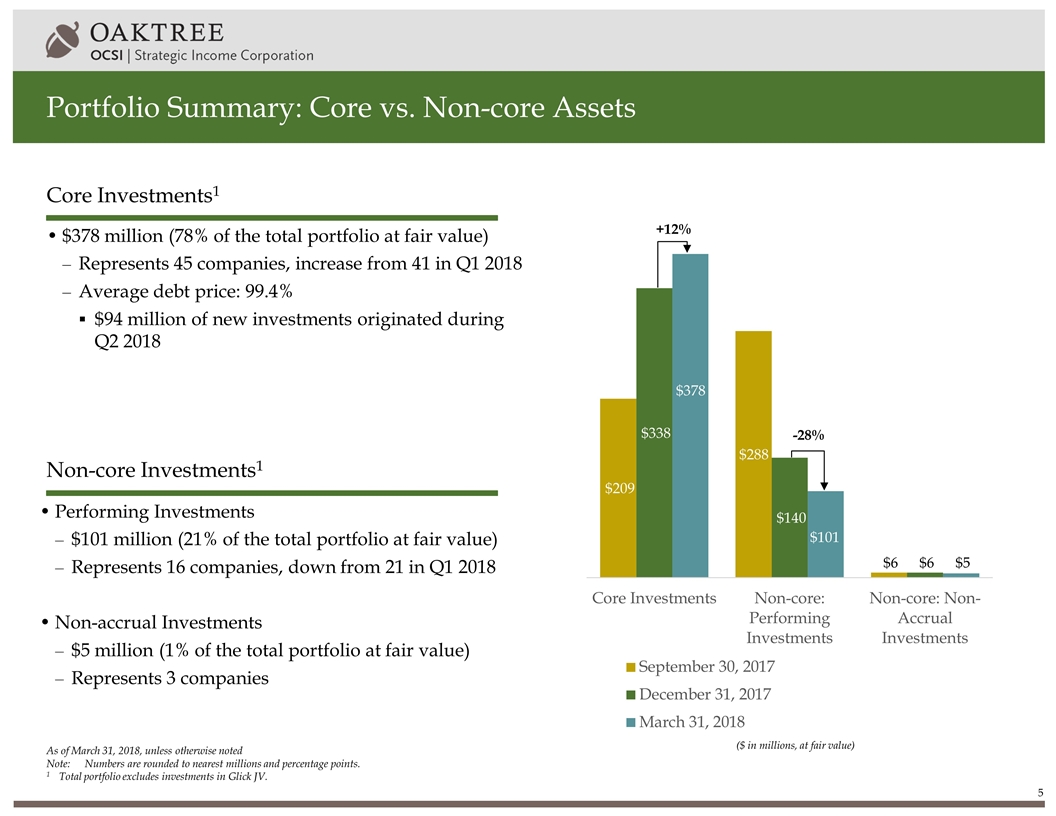

Portfolio Summary: Core vs. Non-core Assets ($ in millions, at fair value) $378 million (78% of the total portfolio at fair value) Represents 45 companies, increase from 41 in Q1 2018 Average debt price: 99.4% $94 million of new investments originated during Q2 2018 Core Investments1 Non-core Investments1 Performing Investments $101 million (21% of the total portfolio at fair value) Represents 16 companies, down from 21 in Q1 2018 Non-accrual Investments $5 million (1% of the total portfolio at fair value) Represents 3 companies As of March 31, 2018, unless otherwise noted Note:Numbers are rounded to nearest millions and percentage points. 1Total portfolio excludes investments in Glick JV. -28% +12%

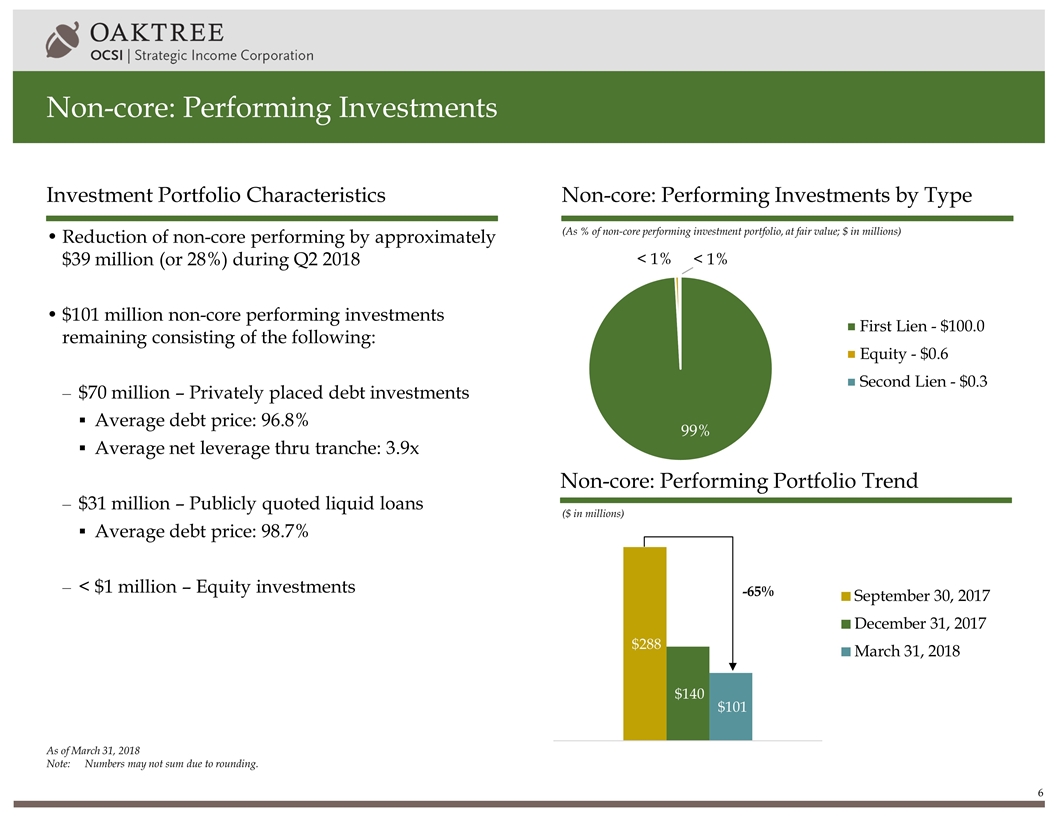

Investment Portfolio Characteristics Reduction of non-core performing by approximately $39 million (or 28%) during Q2 2018 $101 million non-core performing investments remaining consisting of the following: $70 million – Privately placed debt investments Average debt price: 96.8% Average net leverage thru tranche: 3.9x $31 million – Publicly quoted liquid loans Average debt price: 98.7% < $1 million – Equity investments (As % of non-core performing investment portfolio, at fair value; $ in millions) Non-core: Performing Investments by Type Non-core: Performing Investments As of March 31, 2018 Note:Numbers may not sum due to rounding. < 1% -65% ($ in millions) Non-core: Performing Portfolio Trend

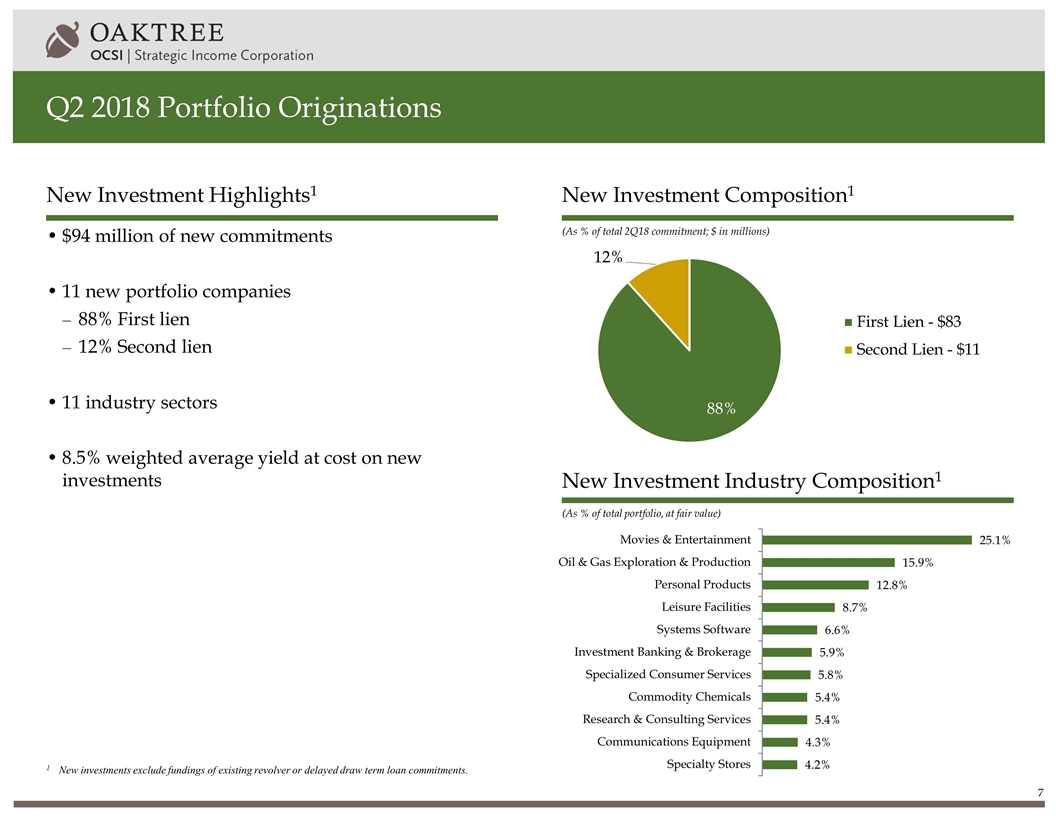

Q2 2018 Portfolio Originations $94 million of new commitments 11 new portfolio companies 88% First lien 12% Second lien 11 industry sectors 8.5% weighted average yield at cost on new investments New Investment Highlights1 (As % of total portfolio, at fair value) New Investment Industry Composition1 (As % of total 2Q18 commitment; $ in millions) New Investment Composition1 1New investments exclude fundings of existing revolver or delayed draw term loan commitments.

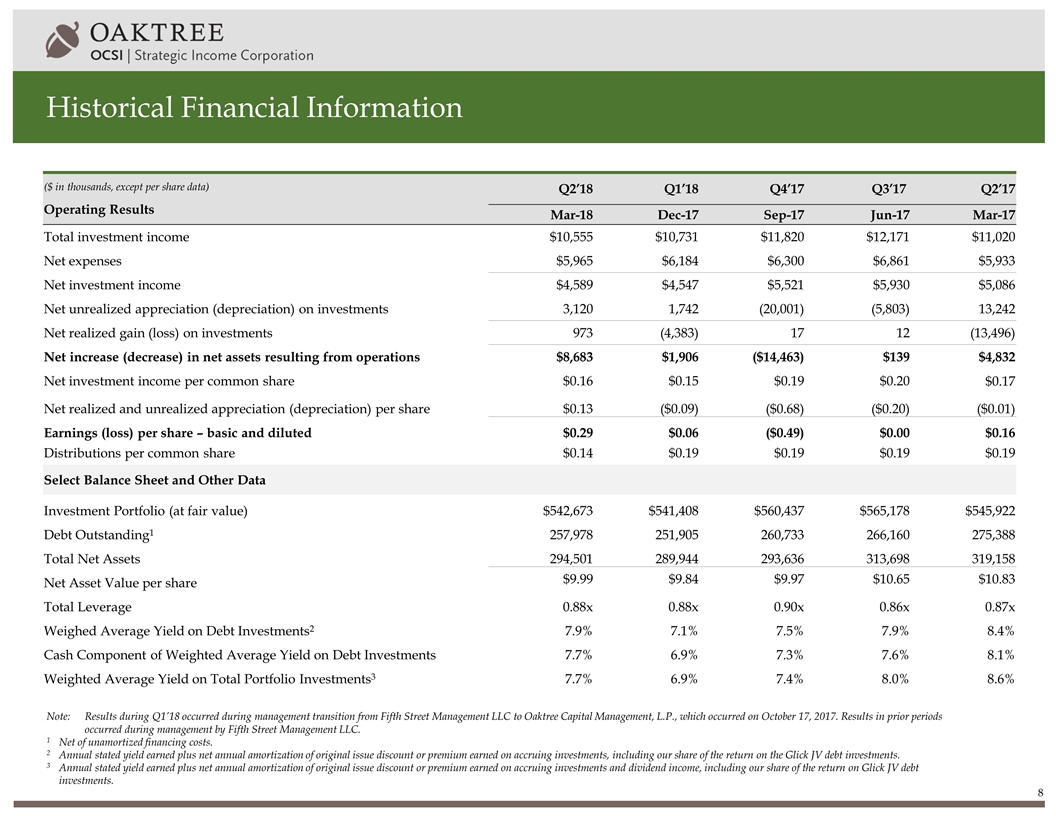

Historical Financial Information ($ in thousands, except per share data) Operating Results Q2’18 Q1’18 Q4’17 Q3’17 Q2’17 Mar-18 Dec-17 Sep-17 Jun-17 Mar-17 Total investment income $10,555 $10,731 $11,820 $12,171 $11,020 Net expenses $5,965 $6,184 $6,300 $6,861 $5,933 Net investment income $4,589 $4,547 $5,521 $5,930 $5,086 Net unrealized appreciation (depreciation) on investments 3,120 1,742 (20,001) (5,803) 13,242 Net realized gain (loss) on investments 973 (4,383) 17 12 (13,496) Net increase (decrease) in net assets resulting from operations $8,683 $1,906 ($14,463) $139 $4,832 Net investment income per common share $0.16 $0.15 $0.19 $0.20 $0.17 Net realized and unrealized appreciation (depreciation) per share $0.13 ($0.09) ($0.68) ($0.20) ($0.01) Earnings (loss) per share – basic and diluted $0.29 $0.06 ($0.49) $0.00 $0.16 Distributions per common share $0.14 $0.19 $0.19 $0.19 $0.19 Select Balance Sheet and Other Data Investment Portfolio (at fair value) $542,673 $541,408 $560,437 $565,178 $545,922 Debt Outstanding1 257,978 251,905 260,733 266,160 275,388 Total Net Assets 294,501 289,944 293,636 313,698 319,158 Net Asset Value per share $9.99 $9.84 $9.97 $10.65 $10.83 Total Leverage 0.88x 0.88x 0.90x 0.86x 0.87x Weighed Average Yield on Debt Investments2 7.9% 7.1% 7.5% 7.9% 8.4% Cash Component of Weighted Average Yield on Debt Investments 7.7% 6.9% 7.3% 7.6% 8.1% Weighted Average Yield on Total Portfolio Investments3 7.7% 6.9% 7.4% 8.0% 8.6% Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree Capital Management, L.P., which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. 1Net of unamortized financing costs. 2Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments, including our share of the return on the Glick JV debt investments. 3Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments and dividend income, including our share of the return on Glick JV debt investments.

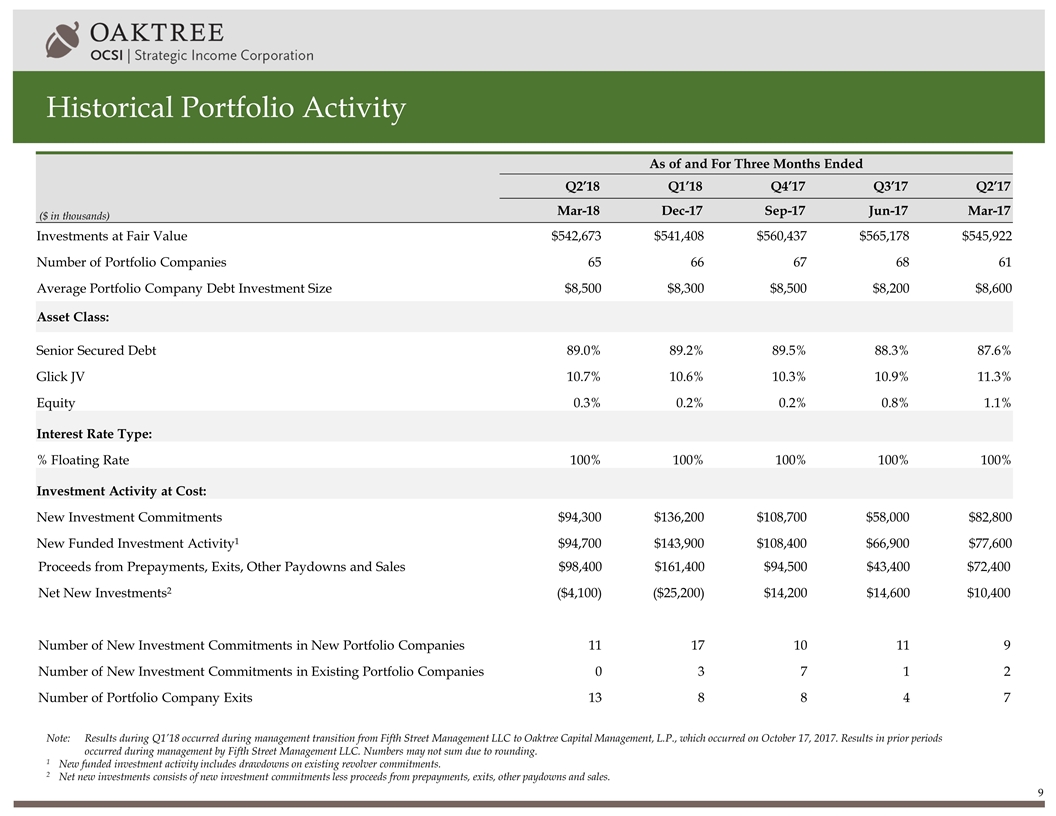

Historical Portfolio Activity ($ in thousands) As of and For Three Months Ended Q2’18 Q1’18 Q4’17 Q3’17 Q2’17 Mar-18 Dec-17 Sep-17 Jun-17 Mar-17 Investments at Fair Value $542,673 $541,408 $560,437 $565,178 $545,922 Number of Portfolio Companies 65 66 67 68 61 Average Portfolio Company Debt Investment Size $8,500 $8,300 $8,500 $8,200 $8,600 Asset Class: Senior Secured Debt 89.0% 89.2% 89.5% 88.3% 87.6% Glick JV 10.7% 10.6% 10.3% 10.9% 11.3% Equity 0.3% 0.2% 0.2% 0.8% 1.1% Interest Rate Type: % Floating Rate 100% 100% 100% 100% 100% Investment Activity at Cost: New Investment Commitments $94,300 $136,200 $108,700 $58,000 $82,800 New Funded Investment Activity1 $94,700 $143,900 $108,400 $66,900 $77,600 Proceeds from Prepayments, Exits, Other Paydowns and Sales $98,400 $161,400 $94,500 $43,400 $72,400 Net New Investments2 ($4,100) ($25,200) $14,200 $14,600 $10,400 Number of New Investment Commitments in New Portfolio Companies 11 17 10 11 9 Number of New Investment Commitments in Existing Portfolio Companies 0 3 7 1 2 Number of Portfolio Company Exits 13 8 8 4 7 Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree Capital Management, L.P., which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. Numbers may not sum due to rounding. 1New funded investment activity includes drawdowns on existing revolver commitments. 2Net new investments consists of new investment commitments less proceeds from prepayments, exits, other paydowns and sales.

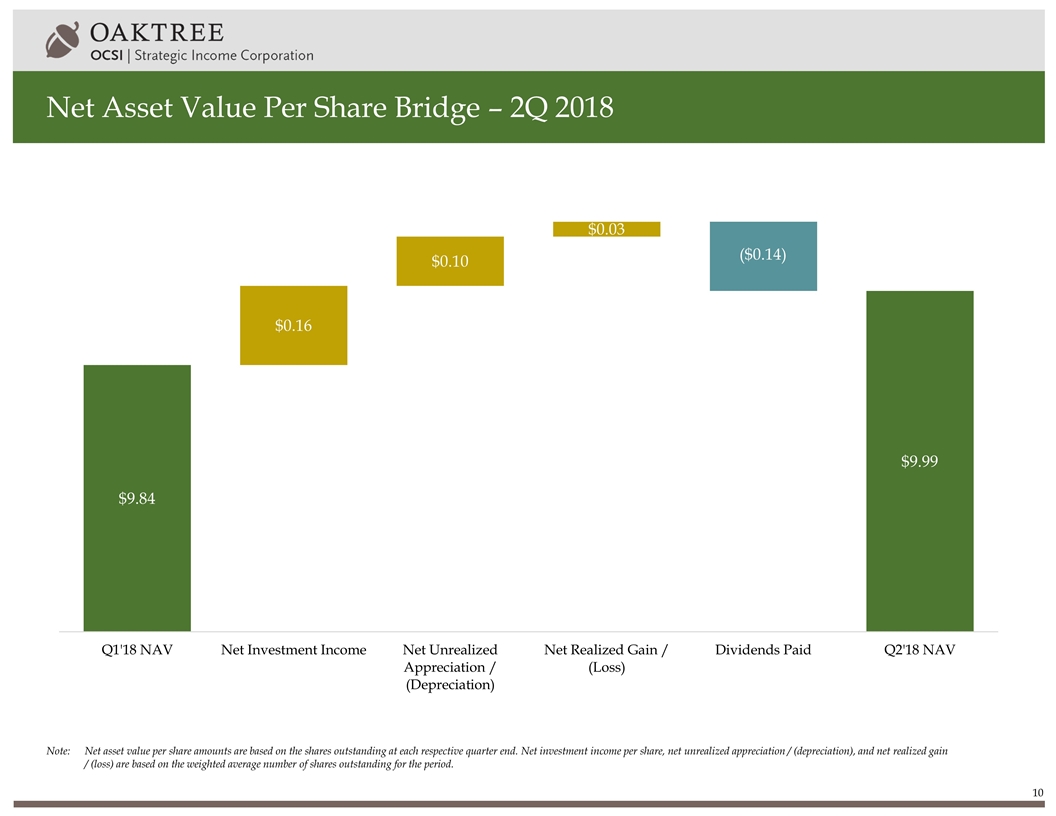

Net Asset Value Per Share Bridge – 2Q 2018 ($0.14) Note:Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period.

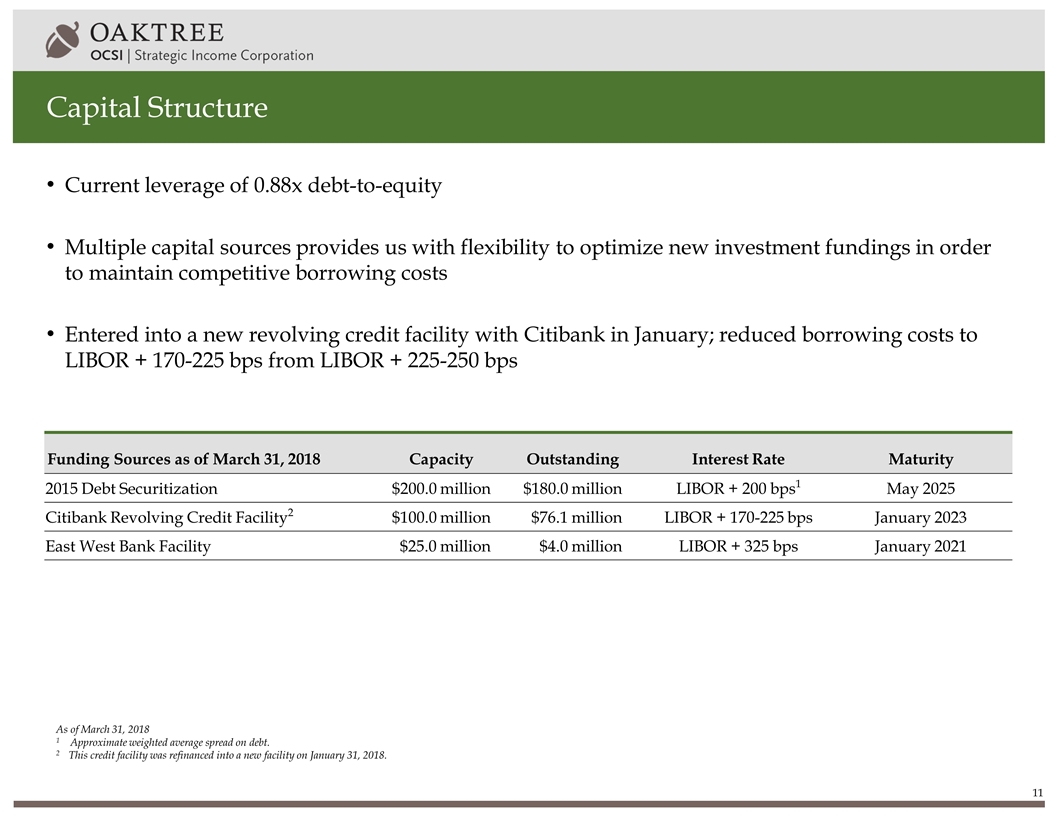

Capital Structure As of March 31, 2018 1 Approximate weighted average spread on debt. 2This credit facility was refinanced into a new facility on January 31, 2018. Current leverage of 0.88x debt-to-equity Multiple capital sources provides us with flexibility to optimize new investment fundings in order to maintain competitive borrowing costs Entered into a new revolving credit facility with Citibank in January; reduced borrowing costs to LIBOR + 170-225 bps from LIBOR + 225-250 bps Funding Sources as of March 31, 2018 Capacity Outstanding Interest Rate Maturity 2015 Debt Securitization $200.0 million $180.0 million LIBOR + 200 bps1 May 2025 Citibank Revolving Credit Facility2 $100.0 million $76.1 million LIBOR + 170-225 bps January 2023 East West Bank Facility $25.0 million $4.0 million LIBOR + 325 bps January 2021

Reduced Asset Coverage On May 3, 2018, our Board of Directors unanimously approved the application of the reduced asset coverage requirements As a result, the required minimum asset coverage ratio will be reduced from 200% to 150%, effective May 3, 2019 In addition, we are seeking stockholder approval of the application of the reduced asset coverage requirements to the Company If the stockholder proposal is passed at the upcoming special meeting, we would be subject to the modified asset coverage requirement the day after the special meeting We believe the modified asset coverage requirement is appropriate primarily for the following reasons: Our investment strategy and focus on first lien senior secured loans is well-positioned to incur additional leverage 96% of the portfolio is comprised of first lien investments1 Ability to scale our investment portfolio, which will allow us to make larger loans to portfolio companies while maintaining the diversification of the current portfolio Flexibility to manage our capital to take advantage of attractive investment opportunities The potential to increase return on equity to stockholders Target leverage ratio will be 1.2x to 1.6x debt-to-equity, depending on market conditions Expected special meeting date: July 2018 As of March 31, 2018 1 Excludes investments in the Glick JV. The Board of Directors has approved and unanimously recommends a vote “FOR” the approval of the application of the reduced asset coverage requirement

Opportunities to Increase Return on Equity Rotation out of broadly syndicated loans priced below LIBOR + 400 Monetized approximately $43 million of broadly syndicated loans priced below LIBOR + 400 during Q2 2018; $15 million of these loans remain as of March 31, 2018 Redeploy non-income generating investments comprised of equity and loans on non-accrual Received approximately $1 million of proceeds as a result of the monetization of certain assets of Ameritox Ltd. and affiliated entities Modest increase in second lien investments Increased to 4% of the portfolio at fair value as of March 31, 2018; 12% of new originations during the quarter were 2nd lien Realization of lower borrowing costs generated from refinancing Citibank facility Weighted average borrowing costs are approximately 40 basis points lower Benefit from rising interest rates as 100% of investment portfolio is comprised of floating rate securities During the quarter, 3-month USD LIBOR increased 0.62% to 2.31% Operating cost savings from leveraging Oaktree’s platform Professional fees, administrator and other G&A costs declined by over $400,000 as compared with Q1 2018 Reducing the required minimum asset coverage ratio from 200% to 150% Seeking stockholder approval of the application of the reduced asset coverage requirements to the Company, which will allow us to increase leverage to up to 2x debt-to-equity effective the day after a successful vote

Contact: Michael Mosticchio, Investor Relations ocsi-ir@oaktreecapital.com