Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Inovalon Holdings, Inc. | ex-991x03312018.htm |

| 8-K - 8-K - Inovalon Holdings, Inc. | inovq12018-8xkcover033118.htm |

Q1 2018 Earnings Supplement May 8, 2018

Cautionary Note Regarding Forward-Looking Statement Certain statements contained in this presentation constitute forward-looking statements within the meaning of, and are intended to be covered by the safe harbor provisions of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this presentation other than statements of historical fact, including but not limited to statements regarding the roll-out of any product or capability, the timing, performance characteristics and utility of any such product or capability, and the impact of any such product or capability on the healthcare industry, future results of operations and financial position, business strategy and plans, market growth, and objectives for future operations, are forward- looking statements. The words “believe,” “may,” “see,” “will,” “estimate,” “continue,” “anticipate,” “assume,” “intend,” “expect,” “project,” “look forward,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this presentation include, but are not limited to, statements regarding the expected benefits and impact of the combination of Inovalon and ABILITY, including the expected accretive effect of the merger on Inovalon’s financial results, expectations about future business plans, prospective performance and opportunities, strategies and business plans, expectations regarding future results, expectations regarding the size of our datasets, and financial guidance for 2018. Inovalon has based these forward-looking statements largely on current expectations and projections about future events and trends that may affect financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs as of the date of this presentation. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, which could cause the future events and trends discussed in this presentation not to occur and could cause actual results to differ materially and adversely from those anticipated or implied in the forward-looking statements. These risks, uncertainties, and assumptions include, among others: the Company’s ability to continue and manage growth, including successfully integrating ABILITY; ability to grow the client base, retain and renew the existing client base and maintain or increase the fees and activity with existing clients; the effect of the concentration of revenue among top clients; the ability to innovate new services and adapt platforms and toolsets; the ability to successfully implement growth strategies, including the ability to expand into adjacent verticals, such as direct to consumer, growing channel partnerships, expanding internationally and successfully pursuing acquisitions; the ability to successfully integrate our acquisitions and the ability of the acquired business to perform as expected; the successful implementation and adoption of new platforms and solutions, including the Inovalon ONE™ Platform, ScriptMed™ Cloud, Clinical Data Extraction as a Service (CDEaaS), and Natural Language Processing as a Service (NLPaaS); the possibility of technical, logistical or planning issues in connection with the Company’s investment in and successful deployment of the Company’s products, services and technological advancements; the ability to enter into new agreements with existing or new platforms, products and solutions in the timeframes expected, or at all; the impact of pending M&A activity in the managed care industry, including potential positive or negative impact on existing contracts or the demand for new contracts; the effects of and costs associated with compliance with regulations applicable to the Company, including regulations relating to data protection and data privacy; the effects of changes in tax laws in the jurisdictions in which we operate, including the Tax Cuts and Jobs Act of 2017; the ability to protect the privacy of clients’ data and prevent security breaches; the effect of competition on the business; and the efficacy of the Company’s platforms and toolsets. Additional information is also set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, filed with the SEC on February 21, 2018, included under the heading Item 1A, “Risk Factors,” and in subsequent filings with the SEC. The Company is under no duty to, and disclaims any obligation to, update any of these forward- looking statements after the date of this presentation or conform these statements to actual results or revised expectations, except as required by law. Non-GAAP Financial Measures This presentation contains certain non-GAAP measures. These non-GAAP measures are in addition to, not a substitute for or necessarily superior to, measures of financial performance in accordance with U.S. GAAP. The GAAP measure most closely comparable to each non-GAAP measure used or discussed, and a reconciliation of the differences between each non-GAAP measure and the comparable GAAP measure, is available herein and within our public filings with the SEC. All data provided is as of March 31, 2018 unless stated otherwise. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 2

Contents 1.Acquisition of ABILITY Network This presentation serves as a 2.Inovalon ONE™ Platform Capability supplement to the Inovalon announcement on May 8, 2018 Expansion pertaining to first quarter (Q1) of 2018 results and guidance1. 3.Subscription Base Progression, G&A, and Capital Expenditure Insights 4.2018 Guidance (1) The Company‘s previously provided 2018 Guidance of March 7, 2018 remains unchanged, except for the impact of interest expense. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 3

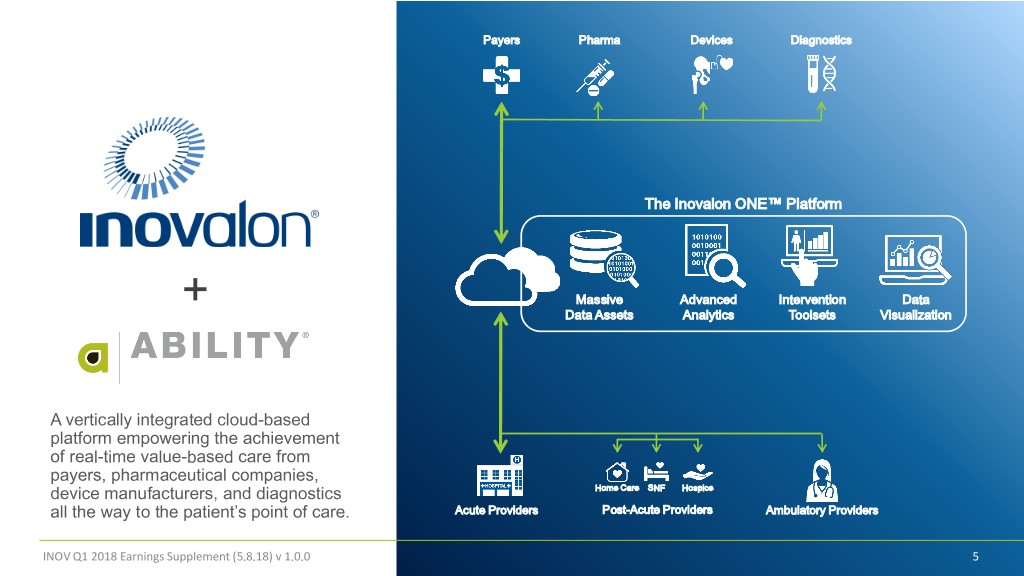

A Powerful Combination Through the Inovalon ONE™ Platform, Inovalon supports cloud-based, During Q1 of 2018, the Company real-time connectivity, analytics, interventions, and data visualization for announced a definitive agreement to hundreds of the nation’s leading health plans, pharmaceutical acquire ABILITY Network, Inc. companies, medical device manufacturers, and integrated provider (“ABILITY”). organizations informed by the data of more than 243 million patients and 38 billion medical events1. The acquisition closed on April 2, 2018. The combination of Inovalon and + ABILITY creates a vertically integrated leader in cloud-based enablement of data-driven, value-based care. Through the myABILITY® Platform, ABILITY supports cloud-based, real- time connectivity and analytics, helping providers and payers simplify the complexities of healthcare through innovative, integral and integrated applications at more than 44,000 acute, post-acute, and ambulatory provider sites. (1) Inovalon patient and medical event data counts are as of March 31, 2018. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 4

Payers Pharma Devices Diagnostics The Inovalon ONE™ Platform + Massive Advanced Intervention Data Data Assets Analytics Toolsets Visualization A vertically integrated cloud-based platform empowering the achievement of real-time value-based care from payers, pharmaceutical companies, device manufacturers, and diagnostics Home Care SNF Hospice all the way to the patient’s point of care. Acute Providers Post-Acute Providers Ambulatory Providers INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 5

• Achieves a vertically integrated cloud-based platform that empowers the achievement of real-time, value-based care from Meaningful payers, manufacturers, and diagnostics all the way to the Benefits to patient’s point of care • Expands on the data scale, connectivity, and impact reach of Healthcare data-driven healthcare for the entirety of the healthcare ecosystem Together, Inovalon and ABILITY will bring capabilities unparalleled in empowering a comprehensive vertical Leverages and Enhances Datasets integration of value-based healthcare. • • Expands Connectivity Efficiencies • Expands Patient-Level Impact Reach • Provides Distribution Channel for Applications Meaningful • Expands and Increases Addressability of TAM • Diversifies Customer Size Benefits to • Diversifies Customer Mix • Decreases Customer Concentration • Increases Competitive Differentiators Stockholders • Increases Sales Channel Together, Inovalon and ABILITY will • Increases Subscription-Based Revenue & Visibility achieve a multitude of very positive • Increases Margins business model and economic factors. • Highly Accretive INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 6

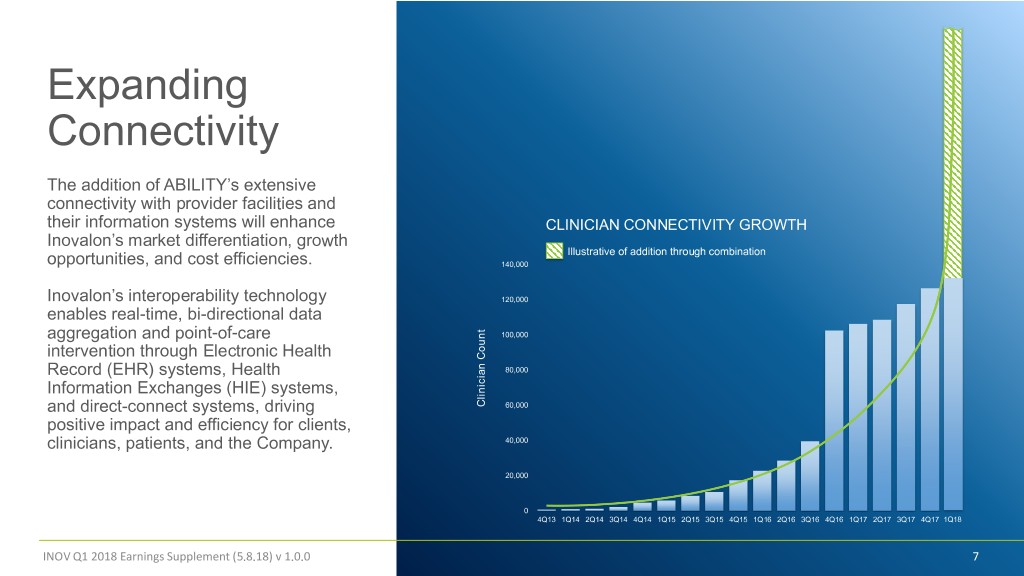

Expanding Connectivity The addition of ABILITY’s extensive connectivity with provider facilities and their information systems will enhance CLINICIAN CONNECTIVITY GROWTH Inovalon’s market differentiation, growth Illustrative of addition through combination opportunities, and cost efficiencies. 140,000 Inovalon’s interoperability technology 120,000 enables real-time, bi-directional data aggregation and point-of-care 100,000 intervention through Electronic Health Record (EHR) systems, Health 80,000 Information Exchanges (HIE) systems, and direct-connect systems, driving Clinician Count 60,000 positive impact and efficiency for clients, clinicians, patients, and the Company. 40,000 20,000 0 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 7

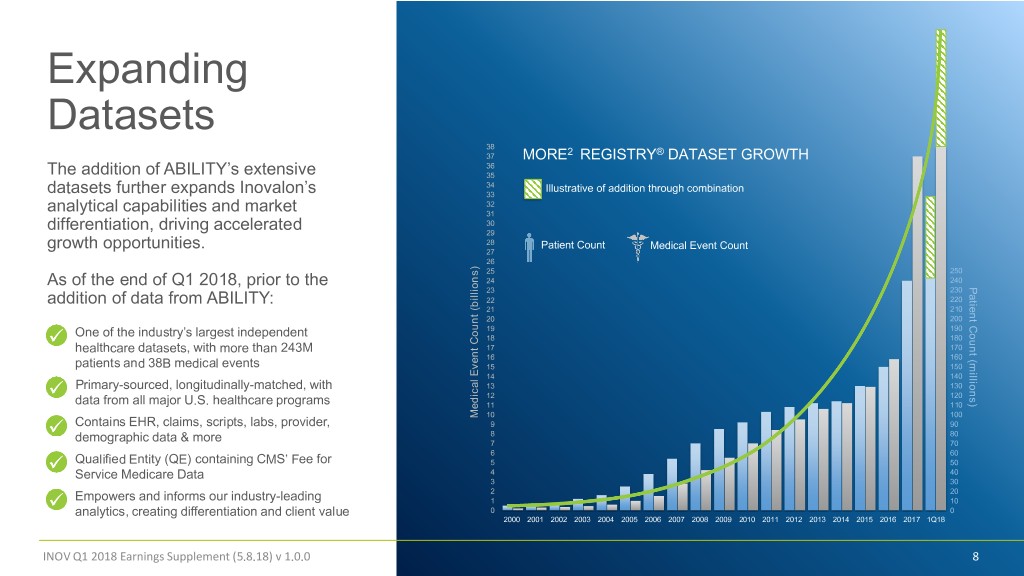

Expanding Datasets 38 2 ® 37 MORE REGISTRY DATASET GROWTH 36 The addition of ABILITY’s extensive 35 34 Illustrative of addition through combination datasets further expands Inovalon’s 33 32 analytical capabilities and market 31 30 differentiation, driving accelerated 29 28 Patient Count Medical Event Count growth opportunities. 27 26 25 250 24 240 As of the end of Q1 2018, prior to the (millions) Count Patient 23 230 addition of data from ABILITY: 22 220 21 210 20 200 19 190 One of the industry’s largest independent 18 180 healthcare datasets, with more than 243M 17 170 16 160 patients and 38B medical events 15 150 14 140 Primary-sourced, longitudinally-matched, with 13 130 12 120 data from all major U.S. healthcare programs 11 110 Medical Event CountEvent Medical (billions) 10 100 Contains EHR, claims, scripts, labs, provider, 9 90 8 80 demographic data & more 7 70 6 60 Qualified Entity (QE) containing CMS’ Fee for 5 50 Service Medicare Data 4 40 3 30 2 20 Empowers and informs our industry-leading 1 10 analytics, creating differentiation and client value 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1Q18 INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 8

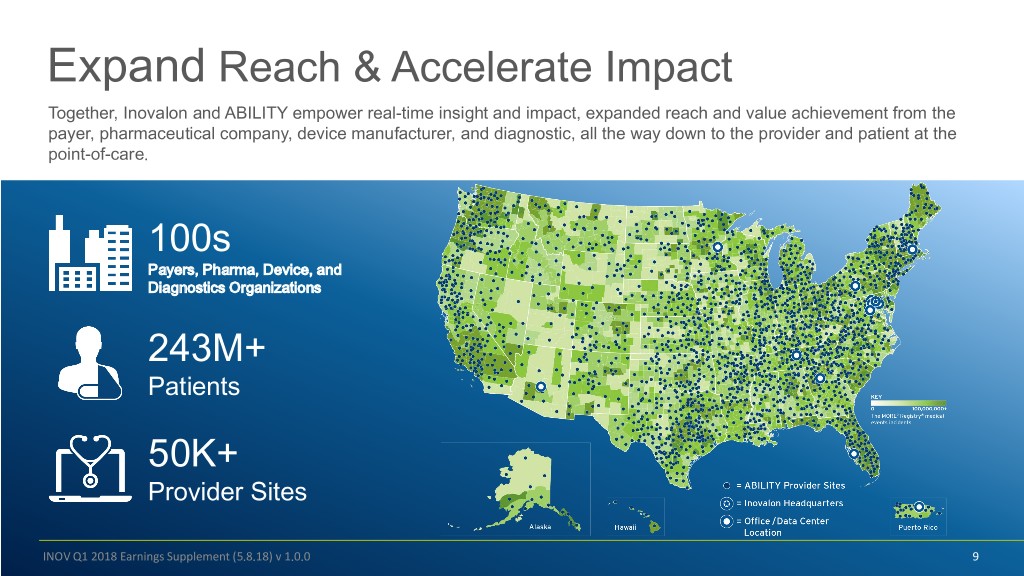

Expand Reach & Accelerate Impact Together, Inovalon and ABILITY empower real-time insight and impact, expanded reach and value achievement from the payer, pharmaceutical company, device manufacturer, and diagnostic, all the way down to the provider and patient at the point-of-care. 100s Payers, Pharma, Device, and Diagnostics Organizations 243M+ Patients 50K+ Provider Sites INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 9

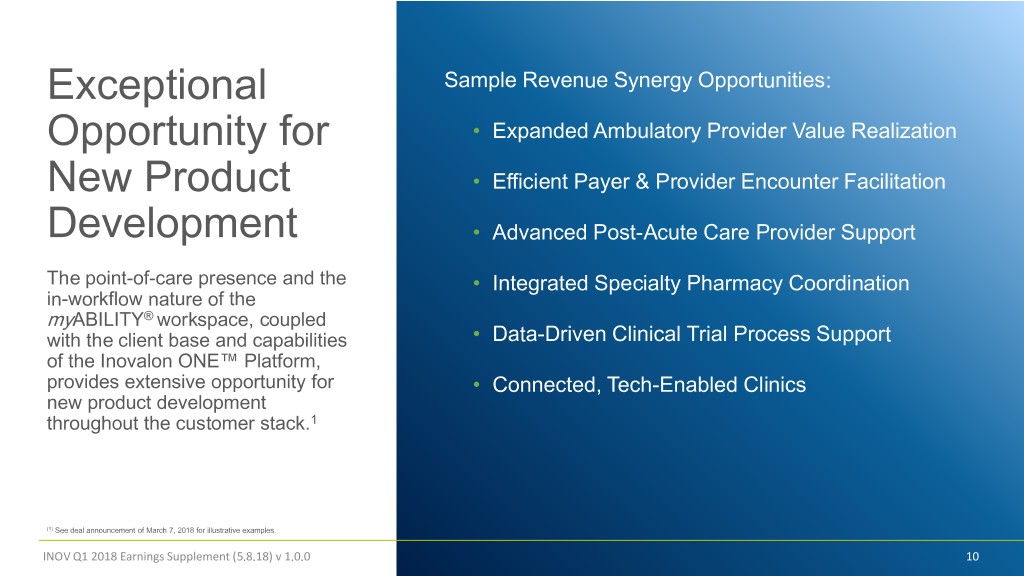

Exceptional Sample Revenue Synergy Opportunities: Opportunity for • Expanded Ambulatory Provider Value Realization New Product • Efficient Payer & Provider Encounter Facilitation Development • Advanced Post-Acute Care Provider Support The point-of-care presence and the • Integrated Specialty Pharmacy Coordination in-workflow nature of the myABILITY® workspace, coupled with the client base and capabilities • Data-Driven Clinical Trial Process Support of the Inovalon ONE™ Platform, provides extensive opportunity for • Connected, Tech-Enabled Clinics new product development throughout the customer stack.1 (1) See deal announcement of March 7, 2018 for illustrative examples. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 10

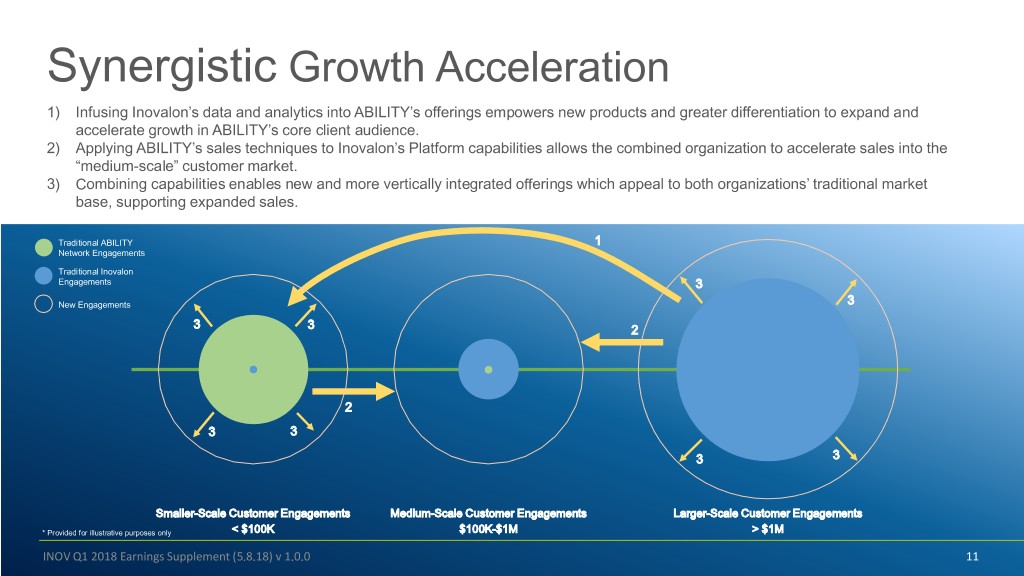

Synergistic Growth Acceleration 1) Infusing Inovalon’s data and analytics into ABILITY’s offerings empowers new products and greater differentiation to expand and accelerate growth in ABILITY’s core client audience. 2) Applying ABILITY’s sales techniques to Inovalon’s Platform capabilities allows the combined organization to accelerate sales into the “medium-scale” customer market. 3) Combining capabilities enables new and more vertically integrated offerings which appeal to both organizations’ traditional market base, supporting expanded sales. Traditional ABILITY 1 Network Engagements Traditional Inovalon Engagements 3 New Engagements 3 3 3 2 2 3 3 3 3 Smaller-Scale Customer Engagements Medium-Scale Customer Engagements Larger-Scale Customer Engagements * Provided for illustrative purposes only < $100K $100K-$1M > $1M INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 11

Contents 1.Acquisition of ABILITY Network This presentation serves as a 2.Inovalon ONE™ Platform Capability supplement to the Inovalon announcement on May 8, 2018 Expansion pertaining to first quarter (Q1) of 2018 results and guidance1. 3.Subscription Base Progression, G&A and Capital Expenditure Insights 4.2018 Guidance (1) The Company‘s previously provided 2018 Guidance of March 7, 2018 remains unchanged, except for the impact of interest expense. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 12

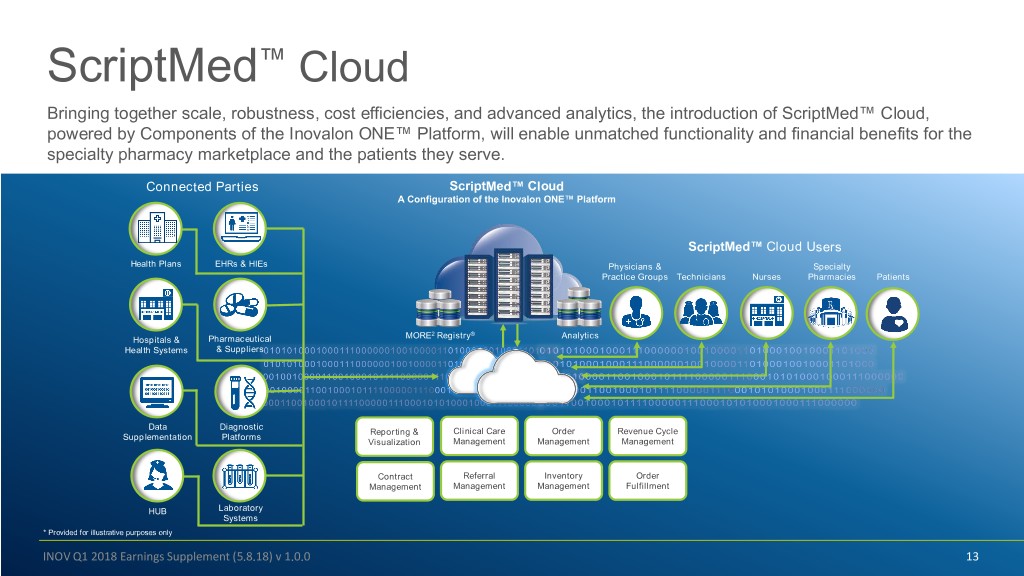

ScriptMed™ Cloud Bringing together scale, robustness, cost efficiencies, and advanced analytics, the introduction of ScriptMed™ Cloud, powered by Components of the Inovalon ONE™ Platform, will enable unmatched functionality and financial benefits for the specialty pharmacy marketplace and the patients they serve. Connected Parties ScriptMed™ Cloud A Configuration of the Inovalon ONE™ Platform ScriptMed™ Cloud Users Health Plans EHRs & HIEs Physicians & Specialty Practice Groups Technicians Nurses Pharmacies Patients MORE2 Registry® Analytics Hospitals & Pharmaceutical Health Systems & Suppliers Data Diagnostic Reporting & Clinical Care Order Revenue Cycle Supplementation Platforms Visualization Management Management Management Contract Referral Inventory Order Management Management Management Fulfillment HUB Laboratory Systems * Provided for illustrative purposes only INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 13

• Sophisticated clinical protocols powered by patient-specific data and ScriptMed™ advanced analytics • Extensive connectivity with EHRs, HIEs, payer systems, and provider- Cloud sites to speed necessary data capture and authorization processes • Modular design allowing health plans and provider systems to integrate more easily with in-house capabilities and other third-party Advanced Capabilities pharmacy solutions The ScriptMed™ Cloud configuration of the • Real-time analytics and data accessibility to timely inform clinical Inovalon ONE™ Platform brings together large-scale data assets, connectivity, interactions and improve patient experience analytics, and cloud-based speed to the high- complexity and high-cost arena of specialty • Simultaneous multi-stakeholder coordination enabling parallel pharmacy. processes related to each unique patient’s needs, materially accelerating time-to-fill improvements Meaningful Differentiation • Real-time process coordination of patient-level and provider-level data with all elements of care management, referral management, order The Platform’s capabilities meaningfully fulfillment, order management, inventory management, revenue cycle reduce time-to-fill, costs, and error management, and relevant contract management supporting payer rates, while empowering advanced and pharmaceutical manufacturer requirements functionality, greater flexibility, operational efficiency, and a focus on • Highly granular business intelligence tracking and reporting to deliver clinical and quality outcomes. insights on system, financial, clinical, and operational status and performance in real-time INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 14

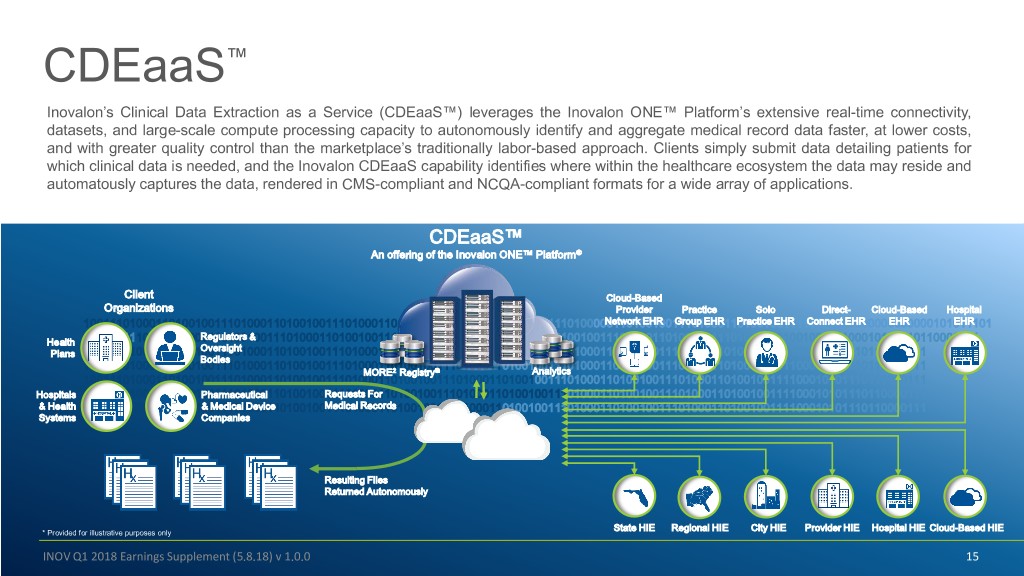

CDEaaS™ Inovalon’s Clinical Data Extraction as a Service (CDEaaS™) leverages the Inovalon ONE™ Platform’s extensive real-time connectivity, datasets, and large-scale compute processing capacity to autonomously identify and aggregate medical record data faster, at lower costs, and with greater quality control than the marketplace’s traditionally labor-based approach. Clients simply submit data detailing patients for which clinical data is needed, and the Inovalon CDEaaS capability identifies where within the healthcare ecosystem the data may reside and automatously captures the data, rendered in CMS-compliant and NCQA-compliant formats for a wide array of applications. CDEaaS™ An offering of the Inovalon ONE™ Platform® Client Cloud-Based Organizations Provider Practice Solo Direct- Cloud-Based Hospital 1001110100011010010011101000110100100111010001101001001110100011010010011101000001101001001110100011010010011110000000000000000000101011101Network EHR Group EHR Practice EHR Connect EHR EHR EHR Regulators & Health 10000111100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 Oversight Plans 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 Bodies 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 MORE2 Registry® Analytics 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 Hospitals 10011101000110100100111010001101001001110100011010010011101000110Pharmaceutical Requests For 1001001110100011010010011101000110100100111100010101110110000111 & Health 1001110100011010010011101000110100100111010001101001001110100011& Medical Device Medical Records 01001001110100011010010011101000110100100111100010101110110000111 Systems Companies Resulting Files Returned Autonomously State HIE Regional HIE City HIE Provider HIE Hospital HIE Cloud-Based HIE * Provided for illustrative purposes only INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 15

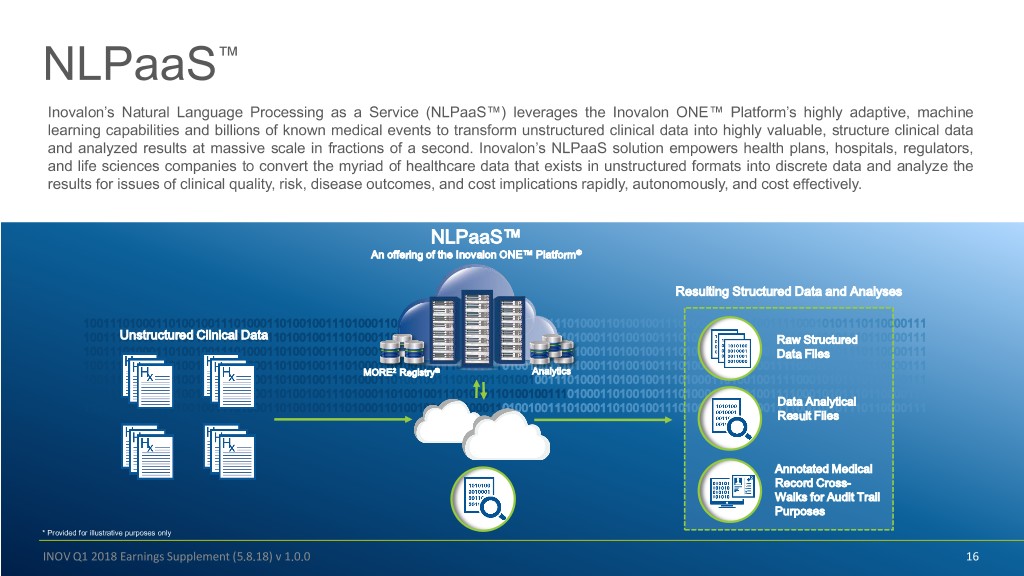

NLPaaS™ Inovalon’s Natural Language Processing as a Service (NLPaaS™) leverages the Inovalon ONE™ Platform’s highly adaptive, machine learning capabilities and billions of known medical events to transform unstructured clinical data into highly valuable, structure clinical data and analyzed results at massive scale in fractions of a second. Inovalon’s NLPaaS solution empowers health plans, hospitals, regulators, and life sciences companies to convert the myriad of healthcare data that exists in unstructured formats into discrete data and analyze the results for issues of clinical quality, risk, disease outcomes, and cost implications rapidly, autonomously, and cost effectively. NLPaaS™ An offering of the Inovalon ONE™ Platform® Resulting Structured Data and Analyses 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 10011101000110100100111010001101001001110100011010010011101000110100100Unstructured Clinical Data 1110100011010010011101000110100100111100010101110110000111Raw Structured 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111Data Files 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 MORE2 Registry® Analytics 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 Data Analytical 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 Result Files Annotated Medical Record Cross- Walks for Audit Trail Purposes * Provided for illustrative purposes only INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 16

™ • Faster: Results come back in minutes to hours, not weeks to CDEaaS months typically required by alternative, labor-based medical & record collection approaches ™ NLPaaS • More Comprehensive Results: Clients often are unaware of where patients’ clinical data actually resides - a problem solved by Broad Need Inovalon’s datasets of billions of medical events More than a 100 million medical records are • Highly-configurable: accepts various document types at massive sought for review and analysis every year scale, leveraging ML capabilities for document prioritization and within the United States. The need to access condition detection this deep clinical data is growing at tremendous rates as the market increasingly focuses on outcomes, compliance, and • Higher Quality: Platform-based data aggregation and machine financial performance. Easier access, faster learning on millions of medical record review training cycles speeds, and lower costs are seen to even avoids human error and allows for analytical process controls further drive demand. resulting in a vastly superior overall data quality Highly Scalable • Greater Operational Flexibility: No need to plan for staffing, training, and project coordination. The Inovalon Platform is always The Inovalon CDEaaS™ and NLPaaS™ ready for requests offerings are able to access and analyze massive amounts of clinical data at • Lower Costs: Much less expensive than the costs of alternative, ultra-high speeds in massive scale. labor-based medical record collection and analysis approaches INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 17

Contents 1.Acquisition of ABILITY Network This presentation serves as a 2.Inovalon ONE™ Platform Capability supplement to the Inovalon announcement on May 8, 2018 Expansion pertaining to first quarter (Q1) of 2018 results and guidance1. 3.Subscription Base Progression, G&A and Capital Expenditure Insights 4.2018 Guidance (1) The Company‘s previously provided 2018 Guidance of March 7, 2018 remains unchanged, except for the impact of interest expense. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 18

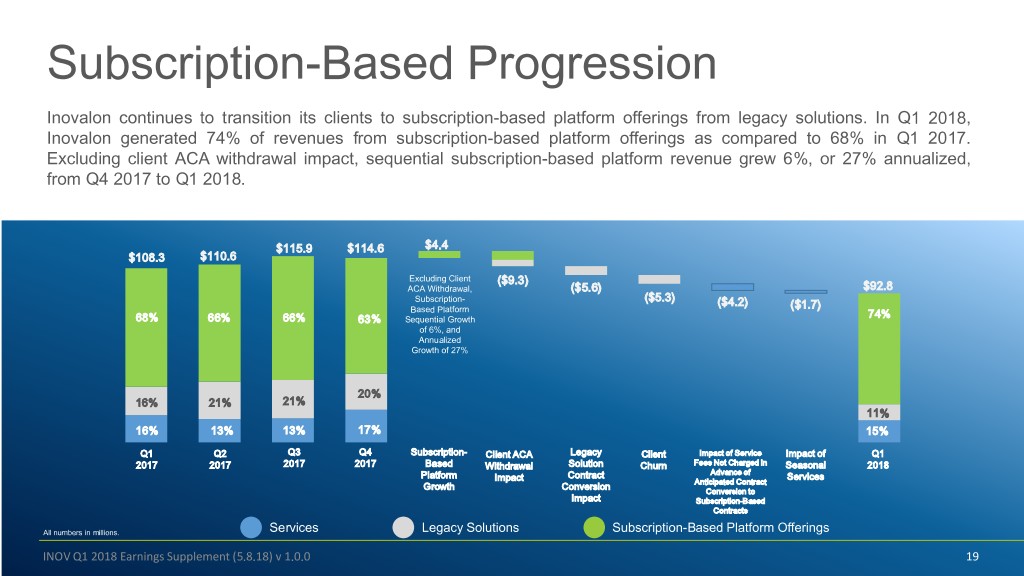

Subscription-Based Progression Inovalon continues to transition its clients to subscription-based platform offerings from legacy solutions. In Q1 2018, Inovalon generated 74% of revenues from subscription-based platform offerings as compared to 68% in Q1 2017. Excluding client ACA withdrawal impact, sequential subscription-based platform revenue grew 6%, or 27% annualized, from Q4 2017 to Q1 2018. $115.9 $114.6 $4.4 $108.3 $110.6 Excluding Client ($9.3) ACA Withdrawal, ($5.6) $92.8 Subscription- ($5.3) ($4.2) ($1.7) Based Platform 74% 68% 66% 66% 63% Sequential Growth of 6%, and Annualized Growth of 27% 20% 16% 21% 21% 11% 16% 13% 13% 17% 15% Q1 Q2 Q3 Q4 Subscription- Client ACA Legacy Client Impact of Service Impact of Q1 2017 2017 2017 2017 Based Withdrawal Solution Churn Fees Not Charged in Seasonal 2018 Platform Contract Advance of Services Impact Anticipated Contract Growth Conversion Conversion to Impact Subscription-Based Contracts All numbers in millions. Services Legacy Solutions Subscription-Based Platform Offerings INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 19

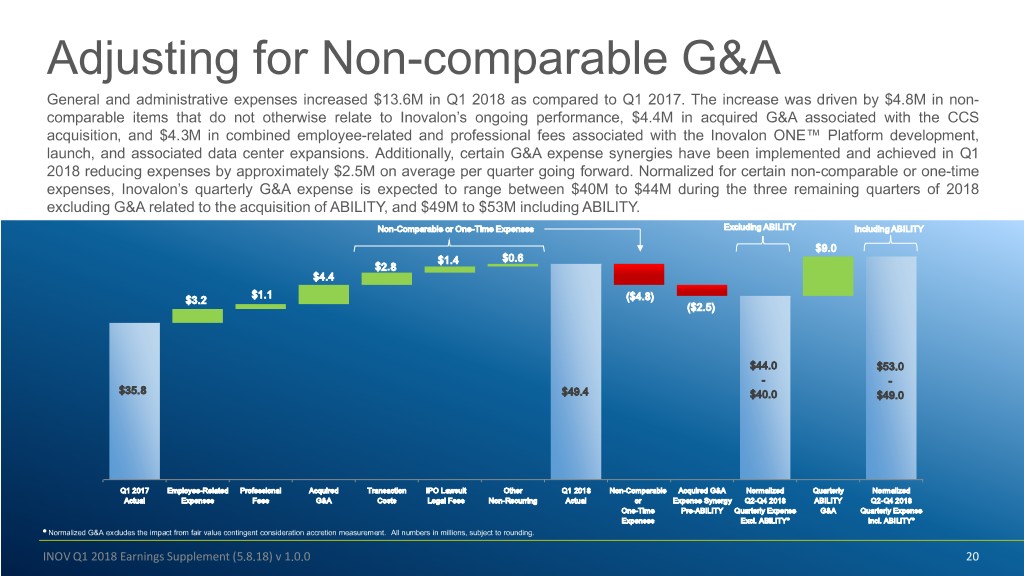

Adjusting for Non-comparable G&A General and administrative expenses increased $13.6M in Q1 2018 as compared to Q1 2017. The increase was driven by $4.8M in non- comparable items that do not otherwise relate to Inovalon’s ongoing performance, $4.4M in acquired G&A associated with the CCS acquisition, and $4.3M in combined employee-related and professional fees associated with the Inovalon ONE™ Platform development, launch, and associated data center expansions. Additionally, certain G&A expense synergies have been implemented and achieved in Q1 2018 reducing expenses by approximately $2.5M on average per quarter going forward. Normalized for certain non-comparable or one-time expenses, Inovalon’s quarterly G&A expense is expected to range between $40M to $44M during the three remaining quarters of 2018 excluding G&A related to the acquisition of ABILITY, and $49M to $53M including ABILITY. Inclusive of ABILITY Non-Comparable or One-Time Expenses Excluding ABILITY Including ABILITY $9.0 $1.4 $0.6 $2.8 $4.4 $1.1 $3.2 ($4.8) ($2.5) $44.0 $53.0 - - $35.8 $49.4 $40.0 $49.0 Q1 2017 Employee-Related Professional Acquired Transaction IPO Lawsuit Other Q1 2018 Non-Comparable Acquired G&A Normalized Quarterly Normalized Actual Expenses Fees G&A Costs Legal Fees Non-Recurring Actual or Expense Synergy Q2-Q4 2018 ABILITY Q2-Q4 2018 One-Time Pre-ABILITY Quarterly Expense G&A Quarterly Expense Expenses Excl. ABILITY* Incl. ABILITY* * Normalized G&A excludes the impact from fair value contingent consideration accretion measurement. All numbers in millions, subject to rounding. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 20

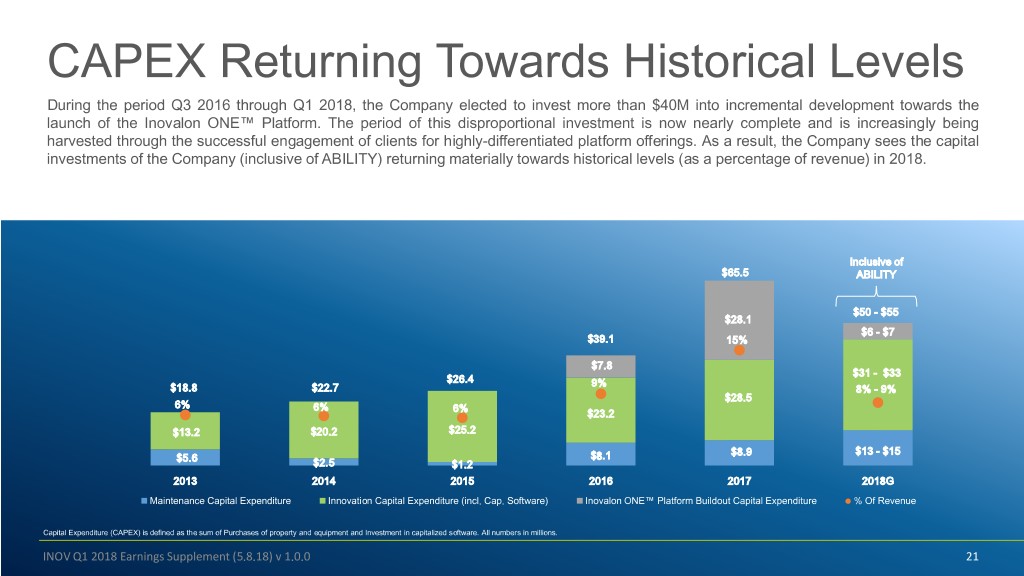

CAPEX Returning Towards Historical Levels During the period Q3 2016 through Q1 2018, the Company elected to invest more than $40M into incremental development towards the launch of the Inovalon ONE™ Platform. The period of this disproportional investment is now nearly complete and is increasingly being harvested through the successful engagement of clients for highly-differentiated platform offerings. As a result, the Company sees the capital investments of the Company (inclusive of ABILITY) returning materially towards historical levels (as a percentage of revenue) in 2018. Inclusive of $65.5 ABILITY $50 - $55 $28.1 $6 - $7 $39.1 15% $7.8 $31 - $33 $26.4 9% $18.8 $22.7 8% - 9% $28.5 6% 6% 6% $23.2 $13.2 $20.2 $25.2 $8.9 $13 - $15 $5.6 $8.1 $2.5 $1.2 2013 2014 2015 2016 2017 2018G Maintenance Capital Expenditure Innovation Capital Expenditure (incl. Cap. Software) Inovalon ONE™ Platform Buildout Capital Expenditure % Of Revenue Capital Expenditure (CAPEX) is defined as the sum of Purchases of property and equipment and Investment in capitalized software. All numbers in millions. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 21

Contents 1.Acquisition of ABILITY Network This presentation serves as a 2.Inovalon ONE™ Platform Capability supplement to the Inovalon announcement on May 8, 2018 Expansion pertaining to first quarter (Q1) of 2018 results and guidance1. 3.Subscription Base Progression, G&A and Capital Expenditure Insights 4.2018 Guidance (1) The Company‘s previously provided 2018 Guidance of March 7, 2018 remains unchanged, except for the impact of interest expense. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 22

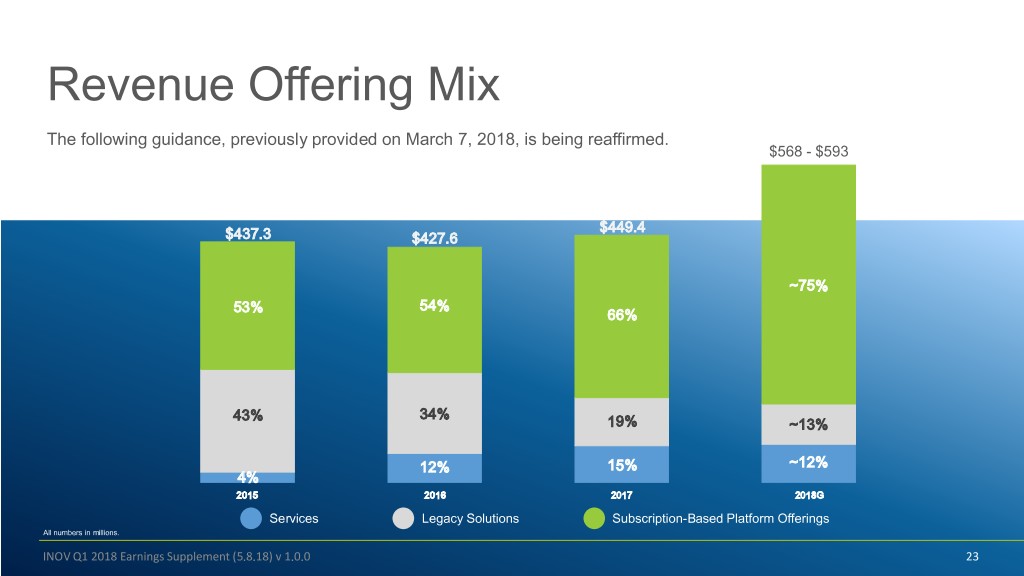

Revenue Offering Mix The following guidance, previously provided on March 7, 2018, is being reaffirmed. $568 - $593 $449.4 $437.3 $427.6 ~75% 53% 54% 66% 43% 34% 19% ~13% 12% 15% ~12% 4% 2015 2016 2017 2018G Services Legacy Solutions Subscription-Based Platform Offerings All numbers in millions. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 23

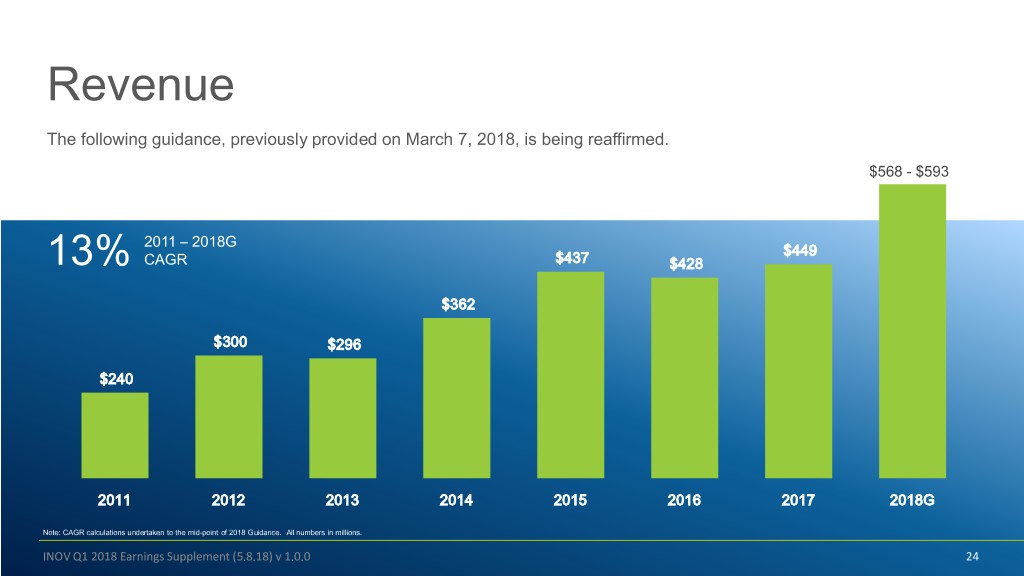

Revenue The following guidance, previously provided on March 7, 2018, is being reaffirmed. $568 - $593 2011 – 2018G $449 13% CAGR $437 $428 $362 $300 $296 $240 2011 2012 2013 2014 2015 2016 2017 2018G Note: CAGR calculations undertaken to the mid-point of 2018 Guidance. All numbers in millions. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 24

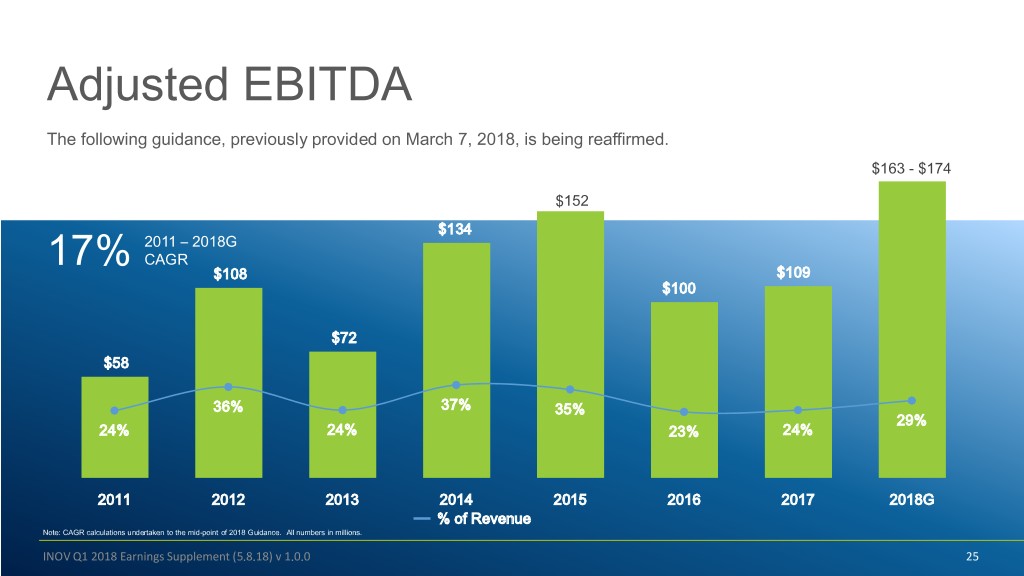

Adjusted EBITDA The following guidance, previously provided on March 7, 2018, is being reaffirmed. $163 - $174 $152 $134 2011 – 2018G CAGR 17% $108 $109 $100 $72 $58 36% 37% 35% 29% 24% 24% 23% 24% 2011 2012 2013 2014 2015 2016 2017 2018G % of Revenue Note: CAGR calculations undertaken to the mid-point of 2018 Guidance. All numbers in millions. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 25

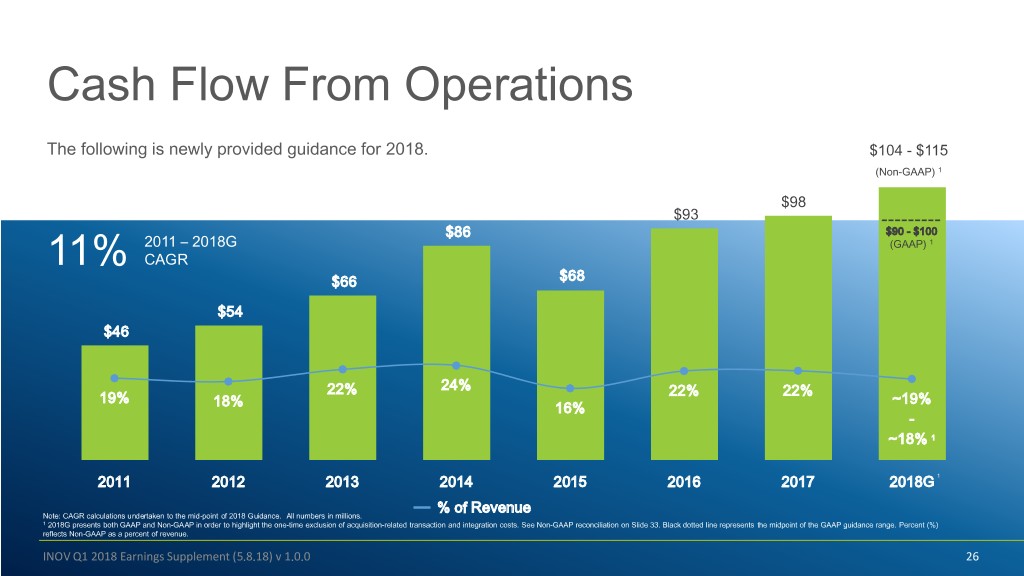

Cash Flow From Operations The following is newly provided guidance for 2018. $104 - $115 (Non-GAAP) 1 $98 $93 $86 $90 - $100 2011 – 2018G (GAAP) 1 11% CAGR $66 $68 $54 $46 22% 24% 22% 22% 19% ~19% 18% 16% - ~18% 1 2011 2012 2013 2014 2015 2016 2017 2018G 1 % of Revenue Note: CAGR calculations undertaken to the mid-point of 2018 Guidance. All numbers in millions. 1 2018G presents both GAAP and Non-GAAP in order to highlight the one-time exclusion of acquisition-related transaction and integration costs. See Non-GAAP reconciliation on Slide 33. Black dotted line represents the midpoint of the GAAP guidance range. Percent (%) reflects Non-GAAP as a percent of revenue. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 26

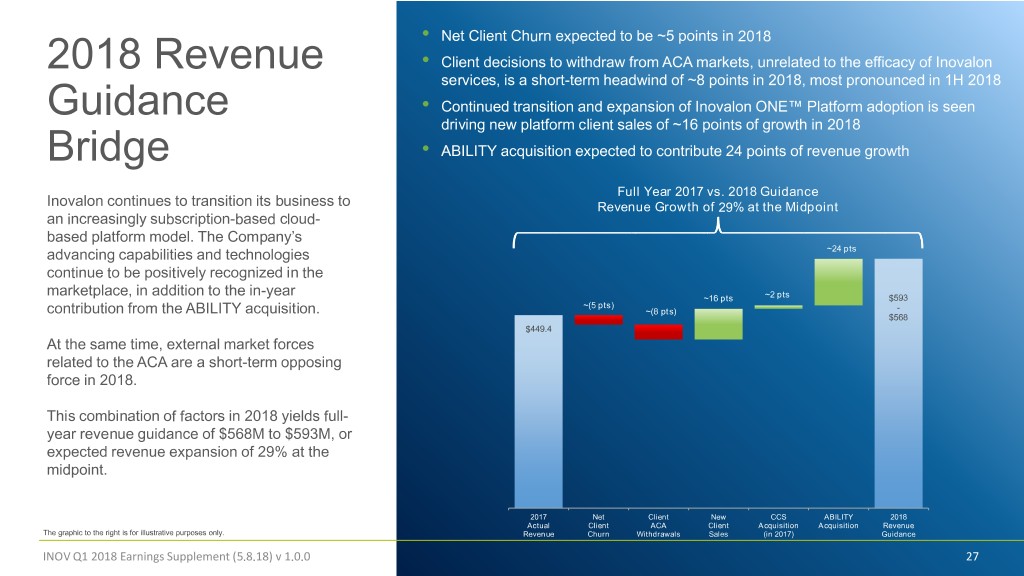

• Net Client Churn expected to be ~5 points in 2018 2018 Revenue • Client decisions to withdraw from ACA markets, unrelated to the efficacy of Inovalon services, is a short-term headwind of ~8 points in 2018, most pronounced in 1H 2018 • Continued transition and expansion of Inovalon ONE™ Platform adoption is seen Guidance driving new platform client sales of ~16 points of growth in 2018 Bridge • ABILITY acquisition expected to contribute 24 points of revenue growth Full Year 2017 vs. 2018 Guidance Inovalon continues to transition its business to Revenue Growth of 29% at the Midpoint an increasingly subscription-based cloud- based platform model. The Company’s advancing capabilities and technologies ~24 pts continue to be positively recognized in the marketplace, in addition to the in-year ~16 pts ~2 pts $593 ~(5 pts) contribution from the ABILITY acquisition. ~(8 pts) - $568 $449.4 At the same time, external market forces related to the ACA are a short-term opposing force in 2018. This combination of factors in 2018 yields full- year revenue guidance of $568M to $593M, or expected revenue expansion of 29% at the midpoint. 2017 Net Client New CCS ABILITY 2018 Actual Client ACA Client Acquisition Acquisition Revenue The graphic to the right is for illustrative purposes only. Revenue Churn Withdrawals Sales (in 2017) Guidance INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 27

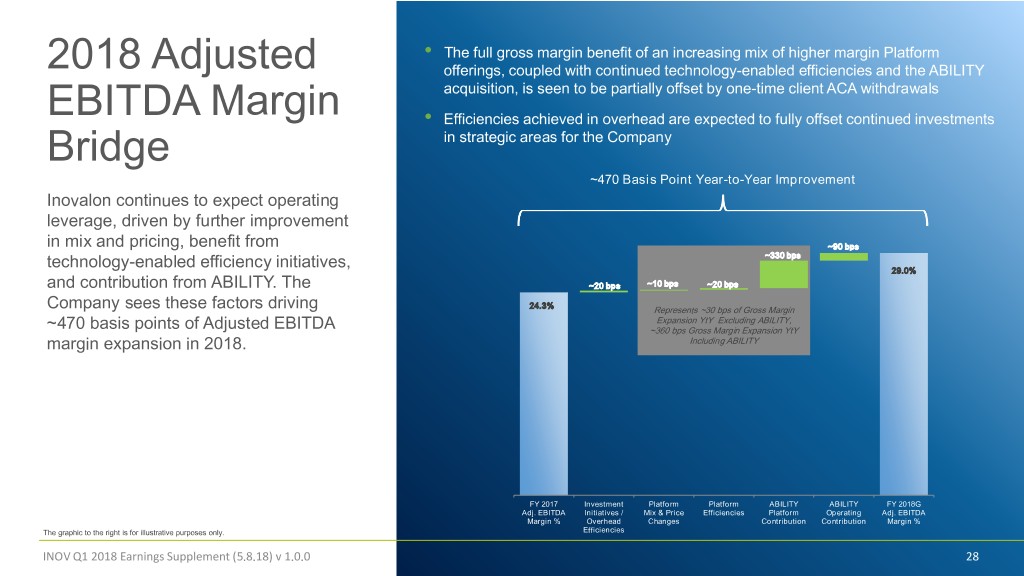

• The full gross margin benefit of an increasing mix of higher margin Platform 2018 Adjusted offerings, coupled with continued technology-enabled efficiencies and the ABILITY acquisition, is seen to be partially offset by one-time client ACA withdrawals EBITDA Margin • Efficiencies achieved in overhead are expected to fully offset continued investments Bridge in strategic areas for the Company ~470 Basis Point Year-to-Year Improvement Inovalon continues to expect operating leverage, driven by further improvement in mix and pricing, benefit from ~90 bps ~330 bps technology-enabled efficiency initiatives, 29.0% and contribution from ABILITY. The ~20 bps ~10 bps ~20 bps 24.3% Company sees these factors driving Represents ~30 bps of Gross Margin Expansion YtY Excluding ABILITY, ~470 basis points of Adjusted EBITDA ~360 bps Gross Margin Expansion YtY margin expansion in 2018. Including ABILITY FY 2017 Investment Platform Platform ABILITY ABILITY FY 2018G Adj. EBITDA Initiatives / Mix & Price Efficiencies Platform Operating Adj. EBITDA Margin % Overhead Changes Contribution Contribution Margin % The graphic to the right is for illustrative purposes only. Efficiencies INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 28

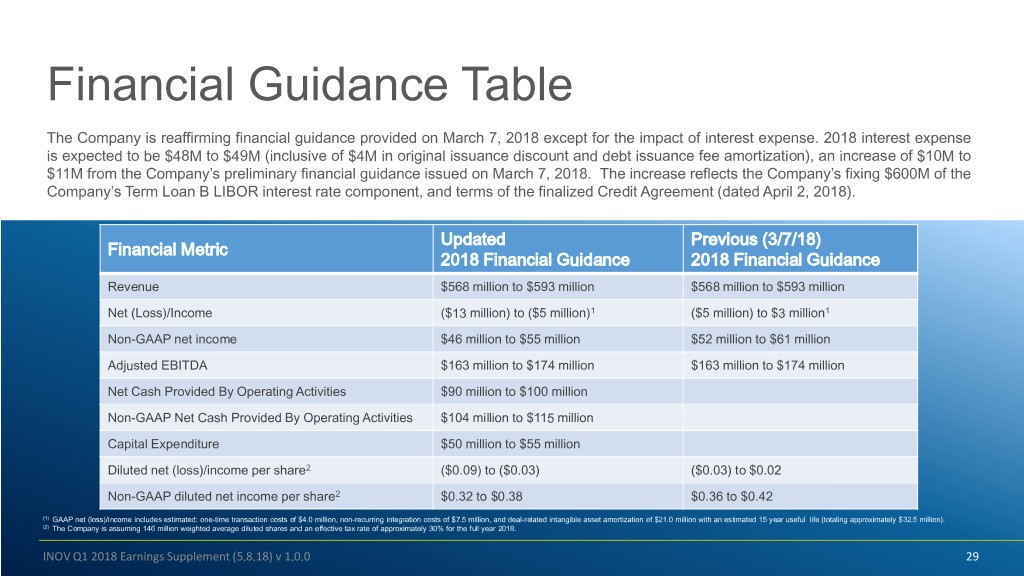

Financial Guidance Table The Company is reaffirming financial guidance provided on March 7, 2018 except for the impact of interest expense. 2018 interest expense is expected to be $48M to $49M (inclusive of $4M in original issuance discount and debt issuance fee amortization), an increase of $10M to $11M from the Company’s preliminary financial guidance issued on March 7, 2018. The increase reflects the Company’s fixing $600M of the Company’s Term Loan B LIBOR interest rate component, and terms of the finalized Credit Agreement (dated April 2, 2018). Updated Previous (3/7/18) Financial Metric 2018 Financial Guidance 2018 Financial Guidance Revenue $568 million to $593 million $568 million to $593 million Net (Loss)/Income ($13 million) to ($5 million)1 ($5 million) to $3 million1 Non-GAAP net income $46 million to $55 million $52 million to $61 million Adjusted EBITDA $163 million to $174 million $163 million to $174 million Net Cash Provided By Operating Activities $90 million to $100 million Non-GAAP Net Cash Provided By Operating Activities $104 million to $115 million Capital Expenditure $50 million to $55 million Diluted net (loss)/income per share2 ($0.09) to ($0.03) ($0.03) to $0.02 Non-GAAP diluted net income per share2 $0.32 to $0.38 $0.36 to $0.42 (1) GAAP net (loss)/income includes estimated: one-time transaction costs of $4.0 million, non-recurring integration costs of $7.5 million, and deal-related intangible asset amortization of $21.0 million with an estimated 15 year useful life (totaling approximately $32.5 million). (2) The Company is assuming 146 million weighted average diluted shares and an effective tax rate of approximately 30% for the full year 2018. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 29

Appendix INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 30

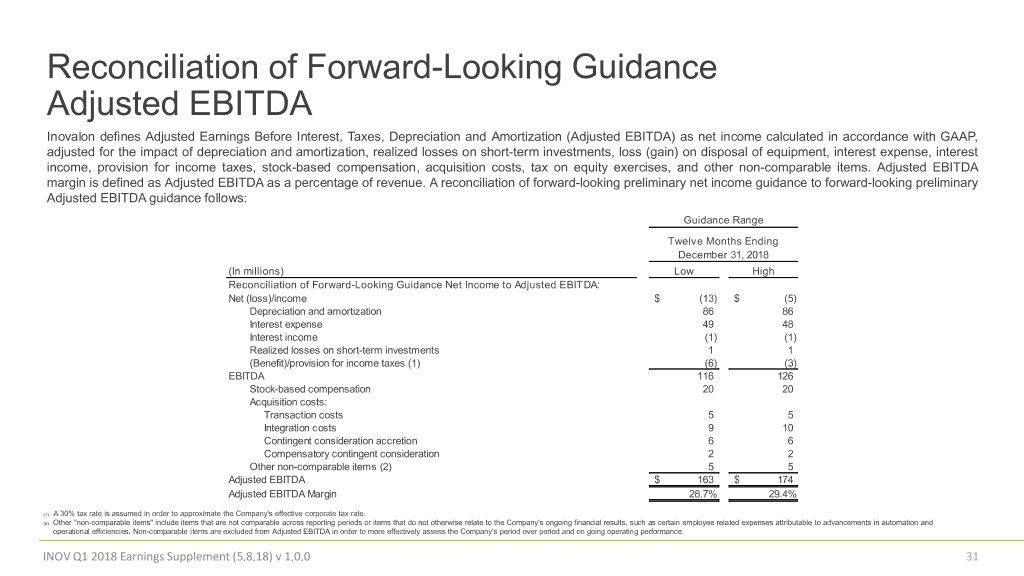

Reconciliation of Forward-Looking Guidance Adjusted EBITDA Inovalon defines Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) as net income calculated in accordance with GAAP, adjusted for the impact of depreciation and amortization, realized losses on short-term investments, loss (gain) on disposal of equipment, interest expense, interest income, provision for income taxes, stock-based compensation, acquisition costs, tax on equity exercises, and other non-comparable items. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of revenue. A reconciliation of forward-looking preliminary net income guidance to forward-looking preliminary Adjusted EBITDA guidance follows: Guidance Range Twelve Months Ending December 31, 2018 (In millions) Low High Reconciliation of Forward-Looking Guidance Net Income to Adjusted EBITDA: Net (loss)/income $ (13) $ (5) Depreciation and amortization 86 86 Interest expense 49 48 Interest income (1) (1) Realized losses on short-term investments 1 1 (Benefit)/provision for income taxes (1) (6) (3) EBITDA 116 126 Stock-based compensation 20 20 Acquisition costs: Transaction costs 5 5 Integration costs 9 10 Contingent consideration accretion 6 6 Compensatory contingent consideration 2 2 Other non-comparable items (2) 5 5 Adjusted EBITDA $ 163 $ 174 Adjusted EBITDA Margin 28.7% 29.4% (1) A 30% tax rate is assumed in order to approximate the Company's effective corporate tax rate. (2) Other "non-comparable items" include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and Theoperational Company isefficiencies. assuming NonXXXX-comparable million shares items for are the excluded full year from2018, Adjusted up from EBITDA 140 million in order shares to moreassumed effectively in guidance assess previous the Companyly. Additionally,'s period theover Company’s period and guidance on going assumesoperating anperformance. effective tax rate of approximately 30% for the full year 2018. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 31

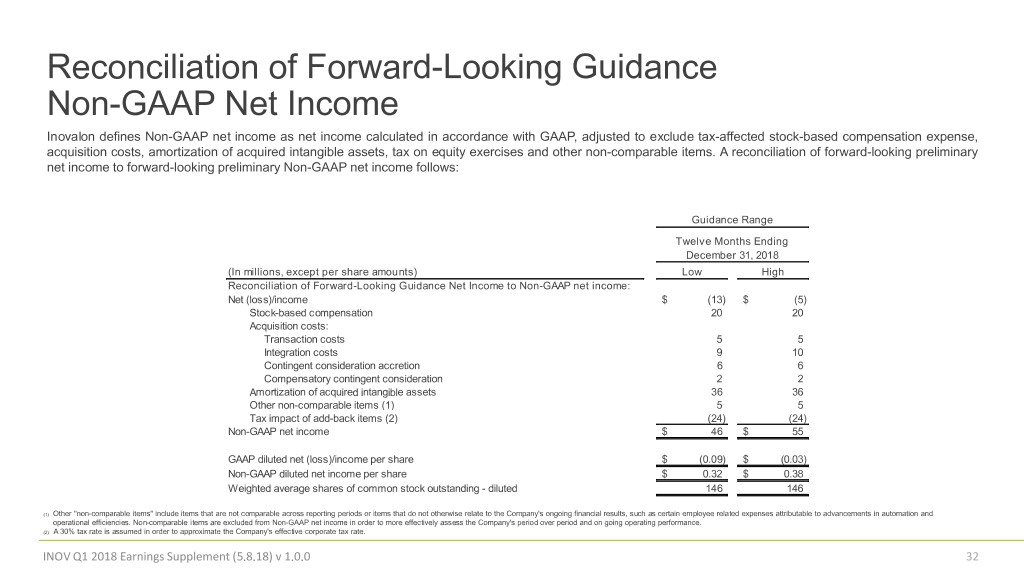

Reconciliation of Forward-Looking Guidance Non-GAAP Net Income Inovalon defines Non-GAAP net income as net income calculated in accordance with GAAP, adjusted to exclude tax-affected stock-based compensation expense, acquisition costs, amortization of acquired intangible assets, tax on equity exercises and other non-comparable items. A reconciliation of forward-looking preliminary net income to forward-looking preliminary Non-GAAP net income follows: Guidance Range Twelve Months Ending December 31, 2018 (In millions, except per share amounts) Low High Reconciliation of Forward-Looking Guidance Net Income to Non-GAAP net income: Net (loss)/income $ (13) $ (5) Stock-based compensation 20 20 Acquisition costs: Transaction costs 5 5 Integration costs 9 10 Contingent consideration accretion 6 6 Compensatory contingent consideration 2 2 Amortization of acquired intangible assets 36 36 Other non-comparable items (1) 5 5 Tax impact of add-back items (2) (24) (24) Non-GAAP net income $ 46 $ 55 GAAP diluted net (loss)/income per share $ (0.09) $ (0.03) Non-GAAP diluted net income per share $ 0.32 $ 0.38 Weighted average shares of common stock outstanding - diluted 146 146 (1) Other "non-comparable items" include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational efficiencies. Non-comparable items are excluded from Non-GAAP net income in order to more effectively assess the Company's period over period and on going operating performance. The(2) A Company 30% tax rate is assuming is assumed XXXX in order million to approximateshares for the the full Company's year 2018, effective up from corporate140 million tax shares rate. assumed in guidance previously. Additionally, the Company’s guidance assumes an effective tax rate of approximately 30% for the full year 2018. INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 32

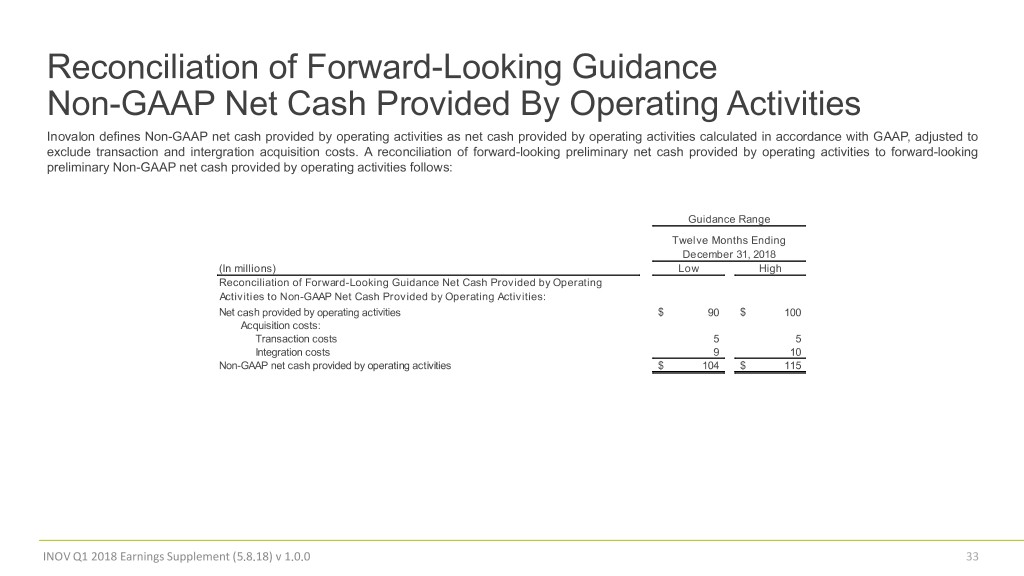

Reconciliation of Forward-Looking Guidance Non-GAAP Net Cash Provided By Operating Activities Inovalon defines Non-GAAP net cash provided by operating activities as net cash provided by operating activities calculated in accordance with GAAP, adjusted to exclude transaction and intergration acquisition costs. A reconciliation of forward-looking preliminary net cash provided by operating activities to forward-looking preliminary Non-GAAP net cash provided by operating activities follows: Guidance Range Twelve Months Ending December 31, 2018 (In millions) Low High Reconciliation of Forward-Looking Guidance Net Cash Provided by Operating Activities to Non-GAAP Net Cash Provided by Operating Activities: Net cash provided by operating activities $ 90 $ 100 Acquisition costs: Transaction costs 5 5 Integration costs 9 10 Non-GAAP net cash provided by operating activities $ 104 $ 115 INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0 33

Healthcare Empowered®