Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Emerald Holding, Inc. | eex-ex991_7.htm |

| 8-K - 8-K - Emerald Holding, Inc. | eex-8k_20180503.htm |

Emerald Expositions Q1 2018 Earnings Call Supplemental Materials May 3, 2018 Exhibit 99.2

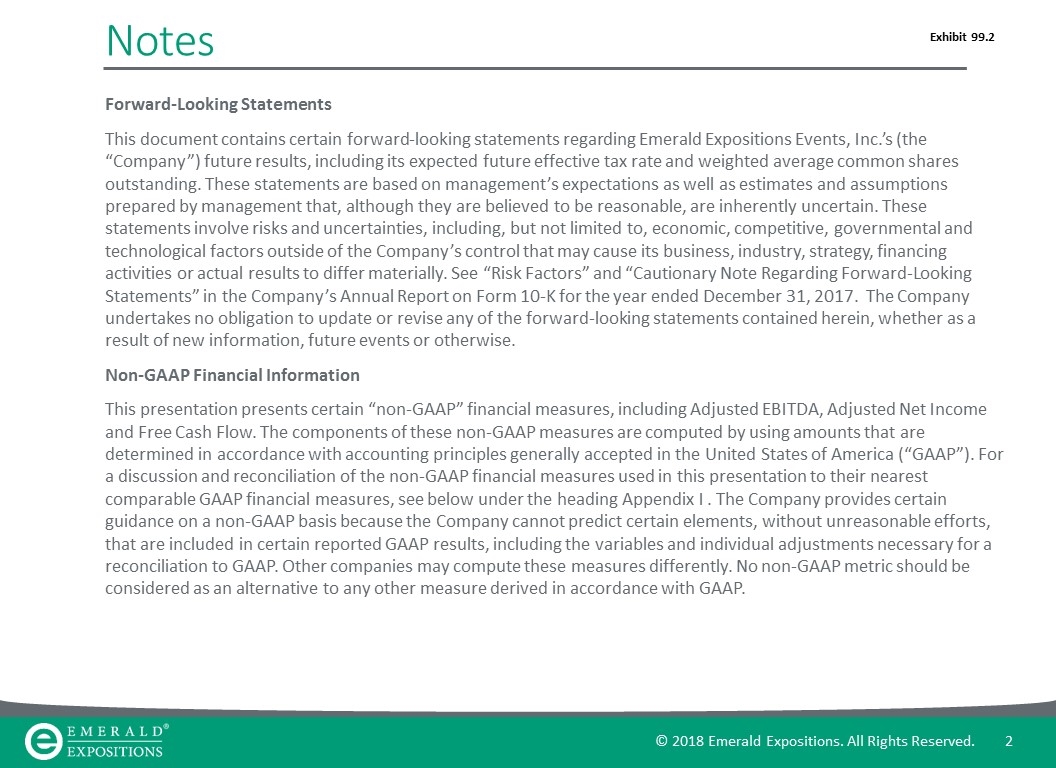

Notes Forward-Looking Statements This document contains certain forward-looking statements regarding Emerald Expositions Events, Inc.’s (the “Company”) future results, including its expected future effective tax rate and weighted average common shares outstanding. These statements are based on management’s expectations as well as estimates and assumptions prepared by management that, although they are believed to be reasonable, are inherently uncertain. These statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of the Company’s control that may cause its business, industry, strategy, financing activities or actual results to differ materially. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017. The Company undertakes no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise. Non-GAAP Financial Information This presentation presents certain “non-GAAP” financial measures, including Adjusted EBITDA, Adjusted Net Income and Free Cash Flow. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). For a discussion and reconciliation of the non-GAAP financial measures used in this presentation to their nearest comparable GAAP financial measures, see below under the heading Appendix I . The Company provides certain guidance on a non-GAAP basis because the Company cannot predict certain elements, without unreasonable efforts, that are included in certain reported GAAP results, including the variables and individual adjustments necessary for a reconciliation to GAAP. Other companies may compute these measures differently. No non-GAAP metric should be considered as an alternative to any other measure derived in accordance with GAAP. Exhibit 99.2

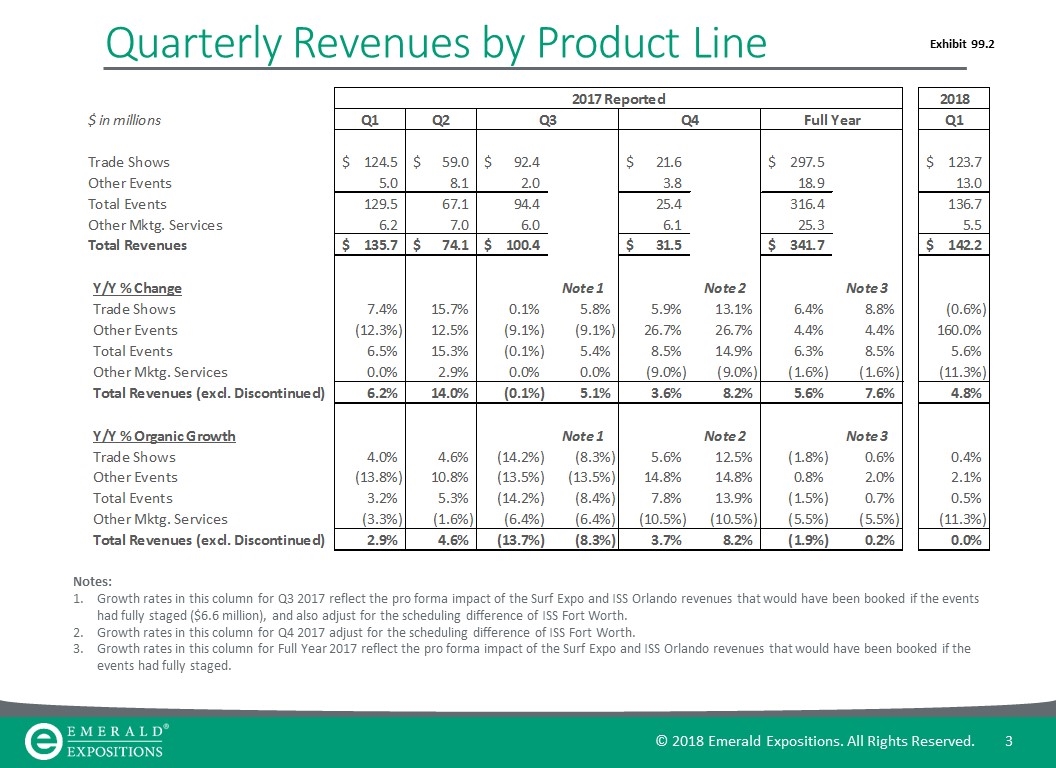

Quarterly Revenues by Product Line Notes: Growth rates in this column for Q3 2017 reflect the pro forma impact of the Surf Expo and ISS Orlando revenues that would have been booked if the events had fully staged ($6.6 million), and also adjust for the scheduling difference of ISS Fort Worth. Growth rates in this column for Q4 2017 adjust for the scheduling difference of ISS Fort Worth. Growth rates in this column for Full Year 2017 reflect the pro forma impact of the Surf Expo and ISS Orlando revenues that would have been booked if the events had fully staged. Exhibit 99.2

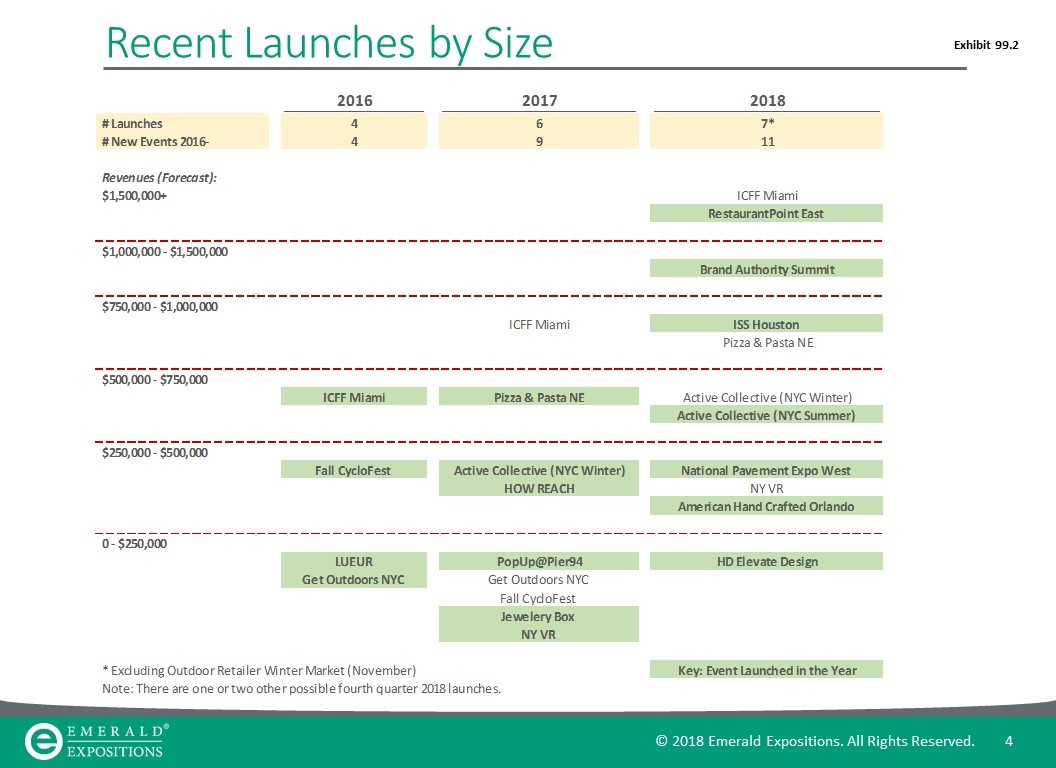

Recent Launches by Size Exhibit 99.2

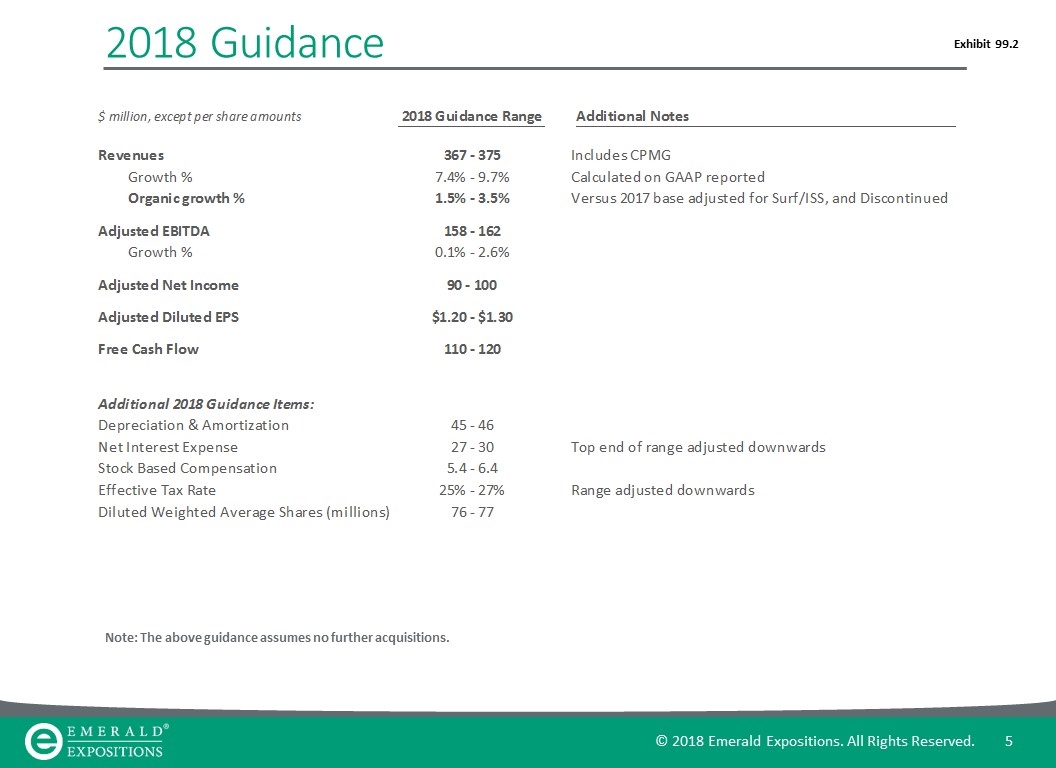

2018 Guidance Note: The above guidance assumes no further acquisitions. Exhibit 99.2

Appendix I The Company provides certain guidance solely on a non-GAAP basis because the Company cannot predict certain elements that would be required in certain reported GAAP results. The Company has not presented a quantitative reconciliation of the forward-looking non-GAAP measures, Adjusted EBITDA and Adjusted Net Income, to net income, and Free Cash Flow, to net cash provided by operating activities, their most comparable GAAP financial measures, because it is impractical to forecast certain items without unreasonable efforts due to the uncertainty and inherent difficulty of predicting the occurrence and financial impact of and the periods in which such items may be recognized. For Adjusted EBITDA and Adjusted Net Income, these items are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA and Adjusted Net Income in prior periods and include, but are not limited to, acquisition-related expenses, stock-based compensation, income tax expense, the effects of scheduling adjustments (in the case of Adjusted EBITDA only) and other assumptions about capital requirements for future periods. For Free Cash Flow, this includes assumptions about capital requirements for future periods. The variability of these items may have a significant impact on our future GAAP financial results. We use Adjusted EBITDA because we believe it assists investors and analysts in comparing Emerald’s operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management and Emerald’s board of directors use Adjusted EBITDA to assess our financial performance and believe it is helpful in highlighting trends because it excludes the results of decisions that are outside the control of management, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate, and capital investments. Adjusted EBITDA should not be considered as an alternative to net income as a measure of financial performance or to cash flows from operations as a liquidity measure. We define Adjusted EBITDA as net income before (i) interest expense, (ii) loss on extinguishment of debt, (iii) income tax expense, (iv) depreciation and amortization, (v) stock-based compensation, (vi) deferred revenue adjustment, (vii) intangible asset impairment charge, (viii) unrealized loss on interest rate swap and floor, net, (ix) the Onex management fee (which ended prior to the Company’s initial public offering), (x) material show scheduling adjustments, and (xi) other items that management believes are not part of our core operations. In addition to net income presented in accordance with GAAP, we present Adjusted Net Income because we believe it assists investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Our presentation of Adjusted Net Income adjusts net income for (i) loss on extinguishment of debt, (ii) stock-based compensation, (iii) deferred revenue adjustment, (iv) intangible asset impairment charge, (v) the Onex management fee (which ended prior to the Company’s initial public offering), (vi) other items that management believes are not part of our core operations, (vii) amortization of deferred financing fees and discount, (viii) amortization of (acquired) intangible assets and (ix) tax adjustments related to non-GAAP adjustments. We use Adjusted Net Income as a supplemental metric to evaluate our business’s performance in a way that also considers our ability to generate profit without the impact of certain items. For example, it is useful to exclude stock-based compensation expenses because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business, and these expenses can vary significantly across periods due to timing of new stock-based awards. We also exclude professional fees associated with debt refinancing, the amortization of intangible assets and certain discrete costs, including deferred revenue adjustments, impairment charges and transaction costs (including professional fees and other expenses associated with acquisition activity) in order to facilitate a period-over-period comparison of our financial performance. This measure also reflects an adjustment for the difference between cash amounts paid in respect of taxes and the amount of tax recorded in accordance with GAAP. Each of the normal recurring adjustments and other adjustments described in this paragraph help to provide management with a measure of our operating performance over time by removing items that are not related to day-to-day operations or are noncash expenses. Adjusted Net Income is a supplemental non-GAAP financial measure of operating performance and is not based on any standardized methodology prescribed by GAAP. Adjusted Net Income should not be considered in isolation or as an alternative to net income, cash flows from operating activities or other measures determined in accordance with GAAP. Also, Adjusted Net Income is not necessarily comparable to similarly titled measures presented by other companies. Adjusted Diluted EPS is defined as Adjusted Net Income divided by diluted weighted average common shares outstanding. We present Free Cash Flow because we believe it is a useful indicator of liquidity that provides information to management and investors about the amount of cash generated from our core operations that, after capital expenditures, can be used to maintain and grow our business, for the repayment of indebtedness, payment of dividends and to fund strategic opportunities. Free Cash Flow is a supplemental non-GAAP measure of liquidity and is not based on any standardized methodology prescribed by GAAP. Free Cash Flow should not be considered in isolation or as an alternative to cash flows from operating activities or other measures determined in accordance with GAAP. Exhibit 99.2