Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Emerald Holding, Inc. | eex-ex321_7.htm |

| EX-31.2 - EX-31.2 - Emerald Holding, Inc. | eex-ex312_6.htm |

| EX-31.1 - EX-31.1 - Emerald Holding, Inc. | eex-ex311_9.htm |

| EX-23.1 - EX-23.1 - Emerald Holding, Inc. | eex-ex231_534.htm |

| EX-21.1 - EX-21.1 - Emerald Holding, Inc. | eex-ex211_353.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-38076

Emerald Expositions Events, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

42-1775077 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

31910 Del Obispo Street, Suite 200 San Juan Capistrano, CA |

92675 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (949) 226-5700

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Common Stock, Par Value $0.01 Per Share |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

☒ |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting stock held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The New York Stock Exchange on June 30, 2017, the last business day of the Registrant’s most recently completed second quarter, was $392,872,312.50.

Shares of the registrant's voting stock held by each executive officer and director and by each entity or person that, to the registrant's knowledge, owned 10% or more of the registrant's outstanding common stock as of June 30, 2017 have been excluded from this number in that these persons may be deemed affiliates of the registrant. This determination of possible affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of Registrant’s Common Stock outstanding as of February 19, 2018 was 72,779,195.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to the 2018 Annual Meeting of Shareholders, are incorporated by reference into Part III of this Report. The Registrant’s Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2017.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

2 |

|

|

Item 1A. |

16 |

|

|

Item 1B. |

32 |

|

|

Item 2. |

32 |

|

|

Item 3. |

32 |

|

|

Item 4. |

32 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

33 |

|

|

Item 6. |

34 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 |

|

Item 7A. |

66 |

|

|

Item 8. |

67 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

106 |

|

Item 9A. |

106 |

|

|

Item 9B. |

106 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

107 |

|

|

Item 11. |

107 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

107 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

107 |

|

Item 14. |

107 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

107 |

|

|

Item 16. |

107 |

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by our use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect” “intend,” “may,” “might,” “plan,” “potential” “predict,” “seek” or “should,” or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including growth of our various markets, and our expectations, beliefs, plans, strategies, objectives, prospects, assumptions or future events or performance contained in this report are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this report under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements, or could affect the trading price of our common stock on the New York Stock Exchange. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to, those discussed in Part I, Item 1A of this Form 10-K under the heading “Risk Factors,” which are incorporated herein by reference.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this report are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from the forward-looking statements contained in this report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements contained in this report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Annual Report on Form 10-K speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this report.

Except where the context requires otherwise, references in this Annual Report on Form 10-K to “Emerald Expositions”, “Emerald”, “the Company”, “we”, “us”, and “our” refer to Emerald Expositions Events, Inc., formerly known as Expo Event Holdco, Inc., together with its consolidated subsidiaries. In this Annual Report on Form 10-K, when we refer to our fiscal years, we refer to the year number, as in “2017,” which refers to our fiscal year ended December 31, 2017.

1

BUSINESS

Our Company

We are a leading operator of business-to-business trade shows in the United States. We currently operate more than 55 trade shows, as well as numerous other face-to-face events. In 2017, Emerald’s events connected over 500,000 global attendees and exhibitors and occupied more than 6.9 million net square feet (“NSF”) of exhibition space. We have been recognized with many awards and accolades that reflect our industry leadership as well as the importance of our shows to the exhibitors and attendees we serve.

All of our trade show franchises typically hold market-leading positions within their respective industry verticals, with significant brand value established over a long period of time. Each of our trade shows is held at least annually, with certain franchises offering multiple trade shows per year. As our shows are frequently the largest and most well attended in their respective industry verticals, we are able to attract high-quality attendees, including those who have the authority to make purchasing decisions on the spot or subsequent to the show. The participation of these attendees makes our trade shows “must-attend” events for our exhibitors, further reinforcing the leading positions of our trade shows within their respective industry verticals. Our attendees use our shows to fulfill procurement needs, source new suppliers, reconnect with existing suppliers, identify trends, learn about new products and network with industry peers, which we believe are factors that make our shows difficult to replace with non-face-to-face events. Our portfolio of trade shows is well-balanced and diversified across both industry sectors and customers. The scale and “must-attend” nature of our trade shows translates into an exceptional value proposition for participants, resulting in a self-reinforcing “network effect” whereby the participation of high-value attendees and exhibitors drives high participant loyalty and predictable, recurring revenue streams.

We generated 93% of our revenue for the year ended December 31, 2017 through the live events that we operate. The remaining 7% of our revenue for the year ended December 31, 2017 was generated from other marketing services, including digital media and print publications that complement our event properties in the industry sectors we serve. Each of our other marketing services products allows us to remain in close contact with, and market to, our existing event audiences throughout the year.

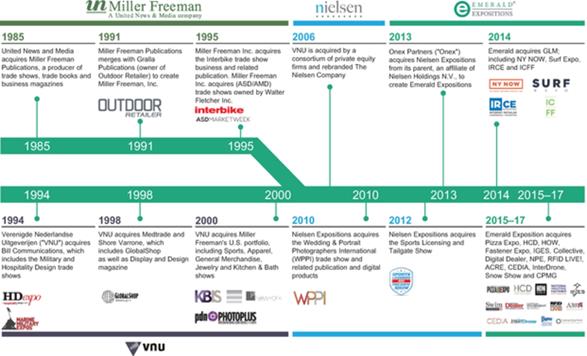

Our History

Our current portfolio of trade shows has come together as a result of many acquisitions completed over the last few decades. In 1994, one of our predecessor companies, Verenigde Nederlandse Uitgeverijen (“VNU”), acquired Bill Communications, adding the Military and Hospitality Design trade shows to its pre-existing portfolio of events. This was followed by the acquisitions of Medtrade and GlobalShop in 1998. In 2000, VNU acquired Miller Freeman’s U.S. events portfolio, which significantly expanded our business into the Sports, Apparel, General Merchandise, Jewelry and Kitchen and Bath categories.

In 2006, VNU was purchased by a consortium of private equity firms and rebranded The Nielsen Company (“Nielsen”). The trade show operations, which became known as Nielsen Expositions, operated autonomously from the rest of Nielsen, except with respect to corporate shared services. Under Nielsen’s ownership, capital allocated to the exhibitions division for acquisition was limited and we therefore expanded our portfolio only modestly by acquiring the Wedding & Portrait Photographers International trade show in 2010 and the Sports Licensing & Tailgate Show in 2012.

In June 2013, Nielsen Expositions was acquired by Onex (the “Onex Acquisition”). Rebranded Emerald Expositions, we have since focused on expanding our portfolio of leading events organically, complemented by an increased focus on acquisitions. Since the Onex Acquisition, we have acquired 15 industry-leading, high-quality events of various sizes for aggregate consideration of approximately $590 million.

2

In January 2014, we acquired George Little Management (“GLM”) for $335 million. At the time, GLM operated more than 20 trade shows, including four of the largest 100 trade shows in the United States. GLM significantly expanded our presence within a number of industry sectors, including Gift, Home & General Merchandise and Sports, and added new sectors such as Technology.

In 2015, we completed four acquisitions. In February, we acquired the Healthcare Media division of Vendome Group, which included leading events such as the Healthcare Design Conference and Expo, Healthcare Design Magazine, Environments for Aging and Construction SuperConference (collectively, “HCD Group”). In March, we acquired the International Pizza Expo (“Pizza Expo” and together with the trade magazine Pizza Today, “Pizza Group”), the largest trade show for independent pizzerias in the world. In October, we acquired HOW Design Live and the HOW Interactive Design Conference Sense (“HOW”), the largest graphic design conference and expo in the nation. In November, we acquired the National Industrial Fastener and Mill Supply Expo (“Fastener Expo,” together with HCD Group, Pizza Group and HOW, the “2015 Acquisitions”), the world’s largest industrial fastener trade show.

In 2016, we completed six acquisitions. In August, we acquired International Gift Exposition in the Smokies and The Super Souvenir Show (“IGES”), the largest dedicated gathering of wholesale souvenir, resort, and gift buyers in the United States. Also in August, we acquired the Swim Collective and Active Collective trade shows (“Collective”), which include the first trade show focused entirely on activewear and the leading swimwear trade show on the West Coast. In October, we acquired the Digital Dealer Conference and Expo (“Digital Dealer”), the leading trade show series focused on the retail automotive industry’s digital strategy and operations. Also in October, we acquired the National Pavement Expo (“Pavement”), adding to our portfolio the largest U.S. trade show focused on paving and pavement maintenance. In November, we acquired RFID Journal LIVE! (“RFID LIVE!”), the largest trade show focused on radio frequency identification technologies used to identify, track, and manage corporate assets and inventory across a wide range of industries. In December, we acquired American Craft Retailers Expo (“ACRE,” together with IGES, Collective, Digital Dealer, Pavement and RFID LIVE!, the “2016 Acquisitions”), a wholesale craft exposition consisting of two shows.

In 2017, we completed four acquisitions. In January, we acquired CEDIA Expo (“CEDIA”), the largest trade show in the home technology market. In March, we acquired the International Drone Conference & Exposition (“InterDrone”), the leading trade show in the U.S. commercial drone market. In May, we acquired the SnowSports Industries America Snow Show (“Snow Show”), which at the time of its acquisition was the largest snow sports industry event in North America. In November, we acquired Connected Point Marketing Group (“CPMG,” together with CEDIA, InterDrone and Snow Show, the “2017 Acquisitions”), a producer of best in class hosted-buyer model trade events focused on innovation for the hospitality, restaurant, healthcare, grocery and retail industries.

3

On May 3, 2017, we completed our IPO of 17,825,000 shares of our common stock at a price of $17.00 per share. We sold 10,333,333 shares, resulting in net proceeds to us after underwriting discounts and expenses of $159.1 million, and funds managed by Onex sold 7,491,667 shares from which we did not receive any proceeds. We used all of the net proceeds from the offering plus cash on hand, to prepay $159.2 million of borrowings outstanding under our Term Loan Facility (as defined herein).

Products and Services

We operate leading trade shows in multiple attractive, fragmented industry sectors that represent significant portions of the U.S. economy and serve a large and diverse set of global exhibitors and attendees. This fragmentation of exhibitors and attendees is an especially important characteristic of the trade show industry. In markets characterized by diffuse buyers and sellers, trade shows offer a great opportunity for interaction between large numbers of participants on both sides of a potential transaction (a “many-to-many” environment) within a short period of time, thus enhancing the value delivered to all trade show participants. Further, the highly fragmented nature of our markets enhances the stability of our entire platform as the loss of any single exhibitor or attendee is unlikely to cause other exhibitors or attendees to derive less value from and cease participating in a show.

We generated 93% of our revenue for the year ended December 31, 2017 through the live events that we operate. The remaining 7% of our revenue for the year ended December 31, 2017 was generated from other marketing services, including digital media and print publications that complement our event properties in the industry sectors we serve. Each of our other marketing services products allows us to remain in close contact with, and market to, our existing event audiences throughout the year.

4

The following is a summary of our trade shows by sector and a discussion of our complementary products.

Gift, Home & General Merchandise

We currently operate 13 trade shows in the Gift, Home & General Merchandise sector focused on a broad range of consumer goods used in and around the home. Our events are primarily order-writing shows where exhibitors, whose product assortment is always evolving, generate sales during the shows themselves. The base of exhibitors and attendees across these trade shows is highly fragmented, which mitigates the importance of any single exhibitor.

|

• |

ASD Market Week — Founded over 55 years ago and held in Las Vegas twice a year in March and August, ASD Market Week is the largest and most comprehensive value-oriented general merchandise trade show in the industry. Each ASD Market Week trade show features nine shows in a single location and covers the following categories: gift and home accents; jewelry; general store products; fashion and accessories; beauty and fragrance products; toys and novelty products; convenience store products; cultural products; and direct sourcing (which allows buyers to purchase certain products directly from the factory as opposed to from distributors), largely offered at a value-oriented price point. The population of exhibitors tend to be highly fragmented and include small importers, manufacturers, and distributors of low- to mid-priced goods. Attendees include domestic and international chains, mass merchants, kiosks, dollar stores, specialty retail stores, close-out and liquidation retailers, resorts, convenience stores, gift stores, amusement and theme park operators, and online retailers from over 110 countries. Given the size and breadth of the trade show, ASD Market Week enables attendees to source a wide variety of products for their stores in a single location in a short period of time. These are order-writing shows that exhibitors rely on to generate a material portion of their annual revenue. We estimate that 98% of attendees at ASD Market Week are primary decision-makers responsible for purchasing, and that the average attendee spends over $80,000 on products as a result of the show. ASD Market Week’s two annual events are designed to address different buying cycles for attendees. |

5

|

distributors of products from close to 70 countries across the categories listed above. Attendees include international chains and department stores, specialty retail stores, gift stores, online retailers, museums, designers, distributors, importers, and wholesalers from over 90 countries. Given the size and breadth of the show, NY NOW enables attendees to source a wide variety of products for their stores in a single location in a short period of time. We believe that approximately 50% of attendees at NY NOW do not shop at any other trade show, and that more than 85% of attendees consider NY NOW to be a “must-attend” event. As with ASD Market Week, NY NOW is primarily an order-writing show with sales executed on the show floor. Given its size and prominence, NY NOW receives significant media coverage from over 400 domestic and international media outlets. |

|

• |

Kitchen & Bath Industry Show (“KBIS”) — Founded over 35 years ago and held annually in January typically either in Orlando or Las Vegas, KBIS is the world’s largest kitchen and bath design trade show specifically serving residential kitchen and bath dealers, designers, architects, remodelers, wholesalers and custom builders who consider KBIS to be a “must-attend” event. Emerald Expositions has been operating the show on behalf of the National Kitchen and Bath Association since 1987 and has a contract to continue doing so through 2028. Exhibitors include manufacturers, distributors, and importers of residential kitchen and bath products, and attendees include architects, remodelers, designers, hardware professionals, and dealers from over 55 countries. The show has been co-located with the International Builders’ Show (owned by the National Association of Home Builders) since 2014, a partnership that has been beneficial to both shows given their exhibitor and attendee overlap. |

|

• |

International Contemporary Furniture Fair (“ICFF”) — Founded over 25 years ago and held in New York City each May and in South Florida each December, ICFF is North America’s leading trade show for high-end contemporary furniture and interior design. Exhibitors include manufacturers and sellers of contemporary furniture, seating, carpet and flooring, lighting, outdoor furniture, materials, wall coverings, accessories, textiles, and kitchen and bath products for residential and commercial interiors, while attendees include interior designers, architects, retailers, distributors, facility managers, developers, store designers, and visual merchandisers who attend from around 80 countries. |

|

• |

National Stationery Show (“NSS”) — Founded over 70 years ago and held in New York City each year in May, NSS is the only North American trade show for global buyers and sellers of stationery and specialty paper products. Exhibitors include manufacturers and designers of stationery and paper products while attendees include stationery, card and gift shops; bookstores; bridal shops; party stores; department, chain and specialty stores; large chains and “big box” mass retailers; and online retailers and mail order catalog distributors; as well as special event planners, corporate buyers, importers, and distributors. |

|

• |

International Gift Exposition in the Smokies and The Super Souvenir Show (“IGES”) — Founded over 15 years ago and held in eastern Tennessee each year in November, IGES is the largest dedicated gathering of wholesale souvenir, resort and gift buyers in the United States. Exhibitors include manufacturers and distributors of apparel, gifts, souvenirs, games, toys, personal care products, licensed items, novelties, kiosk items, promotional goods, jewelry, Made-in-America products, handicrafts, and more. Attendees include wholesale resort, souvenir and gift merchandisers, and retailers. |

|

• |

American Craft Retailers Expo (“ACRE”) — ACRE, founded in 2006, is the premier wholesale craft exposition in North America, taking place annually in Philadelphia, Pennsylvania. ACRE connects wholesale American and Canadian makers of handmade products with national and international buyers from art & fine craft galleries, modern gift & home stores, independent retailers, guilds & arts institutions, e-retailers, national retail chains, museums and other key influencers in the home, gift and lifestyle marketplace. |

6

We currently operate 19 trade shows within the Sports industry sector focused on sporting goods and related apparel and accessories for various active outdoor pursuits ranging from camping, hiking, climbing, skiing, bicycling and paddle sports. We believe that several of our trade shows in this sector have iconic status in the markets they serve, and offer a many-to-many environment where, for example, thousands of specialty sports retailers from across the country interact with hundreds of specialty equipment and apparel manufacturers. The Sports sector is highly fragmented where the sports enthusiast clientele is well-served by independent specialized retailers.

|

• |

Outdoor Retailer (“OR”) — Founded over 35 years ago, OR is the largest outdoor sports and lifestyle trade show brand in the United States. In recent years, OR held a winter and a summer show in Salt Lake City. In May 2017, Emerald acquired Snow Show from Snow Sports Industries America. At the time of its acquisition, Snow Show was the largest snow sports industry event in North America. In January 2018, Snow Show staged with OR for the first time as a combined show, referred to as Outdoor Retailer + Snow Show, endorsed and sponsored by SnowSports Industries America and OIA. In addition to this January show, OR will produce a summer event in June/July and an early winter season show in November, all three of which will be staged in Denver, Colorado. Partnering with OIA since 1992, OR has earned loyalty from high-end specialty brands and has solidified itself as a destination event for specialty retailers selling to outdoor enthusiasts. OR is organized across categories such as accessories, footwear, hard goods, apparel, and gear serving lifestyle sports such as camping, climbing, hiking, paddle sports, back-country and cross-country skiing, snowboarding and snow shoeing. Exhibitors include manufacturers, suppliers, importers, and licensees and distributors of sports gear from 30 countries. Attendees include independent, chain, and online retailers of active lifestyle sporting goods and media and licensing agents from 55 countries; however, the focus is on independent, high-end, specialty outdoor retailers, whose enthusiast clientele is not served by the mass-market products sold through major retail channels. The products at this trade show are technical and performance-oriented, so buyers want to touch and test the products in person in order to make good purchasing decisions which they can then communicate to their end-customer. For this reason, this is an important trade show for exhibitors and attendees who attend loyally each year. There is no major general outdoor sporting goods show that competes directly with OR. The events receive considerable media attention with coverage from approximately 275 media outlets. |

7

|

for action water and board sports as well as resort-oriented merchandise that one would typically find at a beach or resort store. Surf Expo is also unique in that it is the only show focused exclusively on the water sports and resort sectors covering both hard goods and soft goods. Held in partnership with the Association of Wind and Water Sports Industries, the Board Retailers Association, the Water Sports Industry Association, and the Stand Up Paddle Industry Association, exhibitors include manufacturers serving the surf, skate, stand-up paddling, wakeboarding, windsurfing, kayaking, swim, resort, and coastal giftware markets from close to 30 countries, while attendees include retail buyers from specialty stores, big box stores, cruise lines, hotels, and theme parks from over 70 countries. Trade shows are well-suited for the surf and water sports industry, in particular in the hard-goods side of the market where products are performance-oriented and there is a desire by buyers to touch and test products in person in order to make good purchasing decisions. For example, Surf Expo has a “board demo day” at the Orlando Watersports Complex that gives buyers a chance to try the products out before the core trade show begins. |

|

• |

Interbike — Founded over 35 years ago, Interbike is the largest bicycle trade event in North America, offered in partnership with the National Bicycle Dealers Association, People for Bikes, and the Bicycle Products Suppliers Association. Through 2017, Interbike included a two-day biking event on dirt trails and roads, followed by a three-day trade show in Las Vegas, Nevada. In 2018, Interbike Marketweek will take place in the Reno/Tahoe region, beginning with a new consumer demo and festival, followed by two days of outdoor events and demonstrations for retailers, and closing with a three-day Interbike Expo in Reno, Nevada. Exhibitors include manufacturers of bikes for road, mountain, triathlon, and electric use, and manufacturers of accessories and related products including apparel, safety, power, nutrition, and more from 35 countries, while attendees include specialty bicycle retailers, importers, and distributors from over 60 countries. Much like OR and Surf Expo, Interbike trade shows are well suited for the biking industry as the products are highly performance-oriented and there is a desire from buyers to touch and test products in person and experience new product innovation in order to make good purchasing decisions. In October 2016, we launched Fall CycloFest, a hybrid B2B/B2C event under the Interbike brand. |

|

• |

Imprinted Sportswear Shows (“ISS”) — Founded over 35 years ago and held five times a year in different markets in the United States (most recently in Long Beach, Atlantic City, Fort Worth, Nashville, and Orlando), the ISS shows are the leaders of the decorated apparel industry and allow industry professionals to see the latest sportswear imprinting equipment, supplies, industry trends, and techniques. Exhibitors include providers of blank apparel, ink, design technology, screen printing, and embroidery equipment, while attendees include independent and chain retailers serving school teams, recreational leagues, and community groups from close to 15 countries. The industry is particularly well-suited for trade shows as, short of having a national salesforce, trade shows are the only way for these exhibitors to access customers (including many small buyers) in all corners of the country. |

|

• |

Sports Licensing & Tailgate Show — Founded over ten years ago and held in Las Vegas each January, the Sports Licensing & Tailgate Show attracts, as exhibitors, manufacturers that hold licenses for any professional or collegiate sports teams with respect to products, including accessories, apparel, collectibles, footwear, gifts and novelty items, headwear, home furnishings, imprinted items, picnic or tailgating products, sports equipment, stationery and school supplies, or toys and games. Attendees include retailers from independent and chain sporting stores, suppliers, mass market retailers, general merchandise and specialty stores, and fan shops. This is primarily an order-writing show with sales generated directly on the show floor. |

|

• |

Swim Collective and Active Collective Shows — Founded in 2010, the Swim Collective and Active Collective shows present swimwear, resort, and active wear collections to an audience of swimwear specialty retailers, active athleisure sport specialty retailers, swim and surf specialty retailers, gift and department stores, as well as luxury resorts, boutiques and cruise retailers. Swim Collective is the leading swimwear trade show on the West Coast, while Active Collective is a more recently-launched, fast-growing show focused on activewear. In January 2017, we launched an Active Collective event in New York. |

Design & Construction

We currently operate 5 trade shows in the Design & Construction industry sector catering to the construction, hospitality, and interior design sectors serving the hotel, resort, retail, healthcare facilities, restaurant, bar, spa, and in-store marketing categories. Targeted attendees include interior designers, architects, owners and operators,

8

developers, and specifiers and purchasers working within these industries. This sector is well-suited for trade shows because design and construction are highly visual and tactile processes, requiring the in-person experience and interaction provided by trade shows. These trade shows enable designers and contractors to stay current with trends in product styles and techniques, which tend to change from year-to-year. Upcoming renovation and new-build construction projects are often discussed at these shows, making it important for both exhibitors and attendees to attend in order to stay close to the pipeline of future business. By aggregating a wide range of products under one roof, these trade shows save time and expense for designers and other attendees who would otherwise have to independently visit hundreds of showrooms that may be located in different cities. These shows are mostly lead-generating, enabling designers to see the latest trends and product offerings, and develop design ideas.

|

• |

Hospitality Design Expo (“HD Expo”) — Founded over 20 years ago and held in Las Vegas each May, HD Expo is the largest trade show for the hospitality design industry serving the hotel, resort, restaurant, bar and cruise categories. Run in partnership with the American Society of Interior Designers, the Boutique & Lifestyle Lodging Association, the International Interior Design Association, the International Society of Hospitality Purchasers, and the Hospitality Industry Network, HD Expo includes a hospitality conference with accredited conference sessions where continuing educational credentials and learning unit credentials can be earned. Exhibitors include manufacturers and marketers of flooring, seating, fabric, case goods and lighting from over 20 countries, while attendees include interior designers, architects, planners and builders from over 55 countries. |

|

• |

GlobalShop — Founded over 20 years ago and held in Chicago beginning in March 2018, GlobalShop is the largest trade show and conference dedicated to store design, visual merchandising, and shopper marketing. GlobalShop is organized into five categories: the Store Fixturing Show, Visual Merchandising Show, Store Design & Operations, Digital Store and At-Retail Marketplace. Exhibitors include manufacturers and marketers of fixtures, lighting, flooring, and retail displays as well as contractors, while attendees include retailers, brands, procurement agencies, contract architects and designers from over 50 countries. |

|

• |

Healthcare Design Expo & Conference — Founded over 15 years ago and held annually in November in rotating cities (Phoenix in 2018), the Healthcare Design Expo & Conference is the industry’s best attended trade show and conference primarily focused on evidence-based design for healthcare facilities. Exhibitors include manufacturers of healthcare facility related products, including fixtures, materials, furniture, and equipment. Attendees include architects, interior designers, healthcare facility administrators, contractors, engineers, educators, nurses, project managers and purchasing executives involved in the design of healthcare facilities. |

|

• |

National Pavement Expo (“Pavement”) — Founded approximately 30 years ago, Pavement is the largest U.S. trade show specifically designed for paving and pavement maintenance professionals, bringing vendors and suppliers together with contractors who make their living from asphalt and concrete paving, infrared pavement repair, sealcoating, striping, sweeping, crack repair, pavement repair and snow removal. The trade show also includes a conference and seminar component serving as a source of education to the industry. |

9

Technology

We currently operate 6 trade shows in the technology industry sector, a sector we entered in 2014 through the GLM acquisition.

|

• |

Internet Retailer Conference & Exhibition (“IRCE”) — Founded over ten years ago and held in Chicago each June, IRCE is the largest conference and exhibition for the eCommerce industry, primarily targeting senior executives and owners of eCommerce businesses looking for ways to optimize and improve their offerings. Exhibitors include solution and service providers for analytics, eCommerce consulting, content management, customer satisfaction measurement, data services, delivery services, digital marketing, eCommerce platforms, and e-mail marketing from over 25 countries, while attendees include branded consumer product manufacturers, catalogers, consumer service providers, financial service providers, store retailers and shopping portals from over 40 countries. This trade show and conference serves an industry that is constantly evolving and, as such, the knowledge-sharing enabled by this annual event is highly valued by exhibitors and attendees. The significant paid conference component features high-profile guest speakers and workshops. |

|

• |

CEDIA Expo (“CEDIA”) — Founded over 25 years ago, CEDIA is the largest trade show in the home technology market, serving industry professionals that manufacture, design and integrate goods and services for the connected home. The trade show features five days of networking, brand exposure and product launches, and is the annual connecting point for manufacturers, home technology professionals, media and industry partners within the “smart home” industry. CEDIA features industry leading educational content including training sessions, industry talks and panel sessions. The Custom Electronic Design & Installation Association officially endorses CEDIA and retains control and ownership of all educational programming, while we own and operate the trade show. |

|

• |

Digital Dealer Conference and Expo (“Digital Dealer”) — Founded approximately 20 years ago and held twice annually in the spring and fall in Tampa/Orlando and Las Vegas, respectively, Digital Dealer is the leading exhibition and conference series focused on digital marketing for franchised automotive dealerships. Attendees include automotive dealership executives and employees, while exhibitors and presenters include providers of eCommerce solutions for the industry, including auction tools, data and analytics, email marketing, inventory management, lead generation and tracking, mobile marketing and applications, sales training and tools providers. |

10

|

• |

The International Drone Conference & Exposition (“InterDrone”) — Founded in 2015 and held annually in September, InterDrone is the leading commercial drone-focused show in the United States. The event attracts exhibitors and attendees from a wide variety of commercial applications, including aerial photography, surveying & terrain mapping, construction & building inspection, agriculture, real estate, cinematography and more. |

Jewelry

We currently operate 5 trade shows in the Jewelry industry sector targeting high-end and mid-range segments of the jewelry market.

|

• |

COUTURE — Founded over 20 years ago and held in Las Vegas each June, COUTURE is the number one trade show in the high-end luxury jewelry and timepiece market. Known as the definitive annual event for upscale retailers, exhibitors include designers and manufacturers of fine jewelry and timepieces from top international brands as well as the industry’s rising stars from close to 25 countries. Attendees include top-tier buyers representing highly distinguished independent, boutique and chain retailers from close to 70 countries. |

|

• |

JA New York — Founded over 110 years ago and held three times a year in New York City (JA New York Spring in March, JA New York Summer in July, and JA Special Delivery in November), the JA New York franchise is the leading trade show on the East Coast for the mid-tier jewelry market. Held in partnership with Jewelers of America since 1992, these trade shows are geared towards order writing and their timing allows retailers to restock during the winter, summer, and pre-holiday buying seasons with approximately 80% of attendees placing orders at the show. With a large number of jewelry wholesalers and jewelry retailers based in the Northeast, New York City is a well-suited location for this show. Exhibitors include manufacturers, distributors, designers, dealers, and importers of jewelry and loose stones, while attendees are independent, boutique, chain and online jewelry and antique retailers from close to 80 countries. |

|

• |

The Las Vegas Antique Jewelry & Watch Show — Founded over 20 years ago, the annual Las Vegas Antique Jewelry & Watch Show is the largest trade event serving the antique and estate jewelry and watch category. The show brings nearly 300 exhibitors to Las Vegas each summer to meet with independent, boutique, chain, and online jewelry and antique retailers. The show is primarily an order-writing show. |

11

Our Other Trade Shows include 10 trade shows across the Photography, Food, Healthcare, Industrials, and Military sectors.

|

• |

Wedding & Portrait Photographers International (“WPPI”) — Founded over 35 years ago and held in Las Vegas each February, WPPI is the largest trade show and conference for wedding and portrait photographers and filmmakers. Exhibitors include manufacturers and distributors of cameras, printers, and other photography tools, while attendees include commercial, professional and “prosumer” (i.e., professional consumer) photographers from close to 60 countries. |

|

• |

International Pizza Expo (“Pizza Expo”) — Founded over 30 years ago and held in Las Vegas each March, Pizza Expo is the world’s largest trade show for pizzeria owners and operators. Featuring educational workshops from the School of Pizzeria Management, exhibitors include manufacturers and exhibitors of ingredients, equipment, and ancillary products to the pizza industry, while attendees include independent and chain pizzeria owners and operators. Pizza Expo’s unique positioning as the only global trade show focused on the pizza industry makes it a must-attend event for accessing high quality buyers, generating leads, and maintaining brand presence. In October 2017, we successfully launched the related Pizza & Pasta Northeast trade show, which delivered a one-stop shop exhibit hall for Italian and pizza-concept restaurant owners to meet face-to-face with leading national and regional industry suppliers. |

|

• |

PhotoPlus Expo — Founded over 30 years ago and held in New York City each October, the PhotoPlus Expo is the largest photography and imaging show in North America. Featuring educational seminars such as Photo Walks and Master Classes, which are of high interest to attendees, the show’s exhibitors include manufacturers and distributors of cameras, printers, and other photography tools and accessories, while attendees include professional photographers, photography enthusiasts, videographers, students and educators from 65 countries. |

|

• |

Medtrade — Founded over 35 years ago and held twice each year (March in Las Vegas and November in Atlanta), Medtrade is the largest U.S. home medical equipment trade show. Exhibitors include manufacturers and distributors of respiratory systems, rehabilitation home aid products, oxygen systems, wheelchairs, scooters, braces, canes, and home diabetic supplies, while attendees include home medical equipment providers, pharmacy and drug store owners, rehab therapists, respiratory therapists, home health agencies, home health nurses, hospitals, occupational therapists and physical therapists. |

12

|

interface with procurement experts in the U.S. Marine Corps in addition to meeting soldiers back from tour. Exhibitors include providers of combat equipment and technology, and they display soft goods such as bulletproof vests as well as larger mission-critical items, including infantry combat equipment, combat vehicles, and aviation equipment. Attendees include Department of Defense-related personnel, uniformed Marines and civilians from the U.S. Marine Corps command and procurement officers. |

|

• |

National Industrial Fastener & Mill Supply Expo (“Fastener Expo”) — Founded over 35 years ago and held annually in October at Las Vegas, Fastener Expo is the world’s largest exposition for fasteners and brings the manufacturers and master distributors of industrial fasteners, precision formed parts, fastener machinery and tooling and other related products and services together with distributors and sales agents in the distribution chain. |

Other Events

We currently operate more than 70 additional events across a wide variety of forums including B2B conferences, hosted buyer events, B2C events, summits, awards and luxury private sales. We hold luxury private sale events through our Soiffer Haskin brand and hosted buyer events under our CPMG brand. Through our HD Expo, ICFF, HCD and GlobalShop brands, we host close to 20 annual networking sessions called CityScenes. These networking events bring together both up-and-coming and seasoned industry professionals and are very well received within their respective industries.

|

• |

HOW Design Live (“HOW”) — Founded over 25 years ago and held annually in May in rotating cities (Boston in 2018), HOW is the largest graphic design trade show and conference in the United States. HOW represents a marquee event for the industry it serves, where creative professionals in all disciplines and all levels of experience come to learn from peers in the creative industry and designers discover new ideas, sources of inspiration and skills, and to develop new connections with other creative professionals. Exhibitors include paper suppliers, printer services and companies that provide design and workflow software. Attendees include graphic designers from in-house creative services departments, designers who work for or own small design firms and other marketing professionals. |

|

• |

CPMG— Founded almost 15 years ago, CPMG organizes and hosts nine senior executive level business-intensive trade events focused on innovation for the hospitality, restaurant, healthcare, grocery and retail industries. These four-day events are highly-curated, invitation-only forums that bring together leaders in each vertical market. |

|

• |

Soiffer Haskin — Founded almost 35 years ago, Soiffer Haskin conducts approximately 40 exclusive and discreet B2C sale events in its New York City showroom for luxury apparel, personal accessory and jewelry brands seeking to sell surplus inventory at discounted prices. |

13

|

• |

New York Antique Jewelry & Watch Show (“NY AJWS”) — Founded ten years ago, NY AJWS has established itself as a must-attend antique and estate jewelry event that provides access to historical and premium merchandise directly to customers. Categories of jewelry featured include cameos, tennis bracelets, rings, decorative necklaces, brooches, gemstones and pendants. |

Other Marketing Services

Other Marketing Services consist of print publications and digital media products that complement our trade show properties, and generated 7% of our revenues for the year ended December 31, 2017. These print and digital media products are closely aligned with several of our events, and allow us to remain in close contact with, and market to, our existing event audiences throughout the year.

Competition

The trade show industry is highly fragmented, with approximately 9,400 B2B trade shows held per year in the United States according to the Center for Exhibition Industry Research, of which a majority are owned by industry associations, according to Advanced Market Research. Individual trade shows typically compete for attendees and exhibitors only against the other trade shows that are relevant to their industry vertical. The level of competition each of our trade shows faces therefore varies by industry vertical.

Other well-established for-profit companies competing in the U.S. trade show industry include Reed Exhibitions, UBM and Informa Exhibitions.

Seasonality

As is typical for the trade show industry, our business is seasonal, with revenue recognized from trade shows typically reaching its highest levels during the first and third quarters of each calendar year, and its trough during the fourth quarter, largely due to the timing of our trade shows. In 2017, 41%, 21%, 31% and 7% of our trade show revenue was generated from trade shows during the first, second, third and fourth quarters, respectively.

Intellectual Property

Our intellectual property and proprietary rights are important to our business. We undertake to strategically and proactively develop our intellectual property portfolio by registering our trademarks. We currently rely

14

primarily on trademark laws to protect our intellectual property rights. We do not own, but have a license to use, certain trademarks belonging to an industry association in connection with our Kitchen & Bath Industry Show and CEDIA Expo. The KBIS license runs through 2028 and the CEDIA Expo license continues in perpetuity.

Employees

As of December 31, 2017, we had approximately 427 employees. We are not involved in any disputes with our employees and believe that relations with our employees are good. None of our employees are subject to collective bargaining agreements with unions. However, some facilities where we hold our trade shows require our decorators to use unionized labor.

Insurance

We maintain insurance policies to cover the principal risks associated with our business, including event cancellation, business interruption, workers’ compensation, directors’ and officers’ liability, product liability, auto, property, and umbrella and excess liability insurance. All of our insurance policies are with third-party carriers and syndicates with financial ratings of A or better. We believe the premiums, deductibles, coverage limits and scope of coverage under such policies are reasonable and appropriate for our business. Event cancellation insurance provides coverage that allows us to refund a proportionate share, relative to the compromised enforced attendance reduction or show closure, of the deposits and booth and sponsorship fees paid to us by exhibitors in the event that we are forced to cancel a trade show or other event for reasons covered by the policies, such as natural disasters, communicable disease, terrorism, or venue closures. Business interruption insurance provides further coverage for our office property leases in cases where we are not able to conduct ongoing business, including sales and event planning. The continued availability of appropriate insurance policies on commercially reasonable terms is important to our ability to operate our business and to maintain our reputation.

Our event cancellation insurance, currently bound through the end of 2019, provides 100% indemnity for all of our events’ and conferences’ gross revenues individually and 50% in the aggregate. The coverage has no deductible and covers cancellation, curtailment, postponement, removal to alternative premises, or abandonment, of the event as well as enforced reduced attendance. In addition, coverage extends to include additional promotional and marketing expenses necessarily incurred by us should a covered loss occur. This insurance also extends to cover losses resulting from an outbreak of communicable disease as well as a terrorism endorsement covering an act of terrorism and/or threat of terrorism directed at the insured event or within the United States or its territories.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act, are filed with the SEC. We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements and other information with the SEC. Such reports and other information filed by us with the SEC are available free of charge on our website at investor.emeraldexpositions.com when such reports are made available on the SEC’s website. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

15

Investing in our common stock involves a high degree of risk. You should carefully consider the following factors, as well as other information contained in this Annual Report on Form 10-K, in evaluating our Company and business. If any of the following risks occur, our business, results of operations, and financial condition may be materially adversely affected.

Risks Relating to Our Business and Industry

At any given point in time, general economic conditions may have an adverse impact on the industry sectors in which our trade shows and conferences operate, and therefore may negatively affect demand for exhibition space and attendance at our trade shows and conferences.

Our results are influenced by domestic as well as global general economic conditions because we draw exhibitors and attendees from around the world. However, we are affected to a larger degree by conditions within the individual industry sectors in which our trade shows operate. For example, the downturn in the domestic housing market that began in 2007 had a negative impact on the performance of KBIS during the period from 2008 to 2013. The longer a recession or economic downturn continues, the more likely it becomes that our customers may reduce their marketing and advertising or procurement budgets. Any material decrease in marketing or procurement budgets could reduce the demand for exhibition space or reduce attendance at our trade shows, which could have a material adverse effect on our business, financial condition, cash flows and results of operations.

The success of each of our trade shows depends on the reputation of that show’s brand.

Our exhibitors and attendees primarily know us by the names of our trade shows that operate in their specific industry sector rather than by our corporate brand name, Emerald Expositions. In addition, a single brand name is sometimes used for shows that occur more than once a year; for example, the brand name “ASD Market Week” is used at our ASD Market Week March and ASD Market Week August shows, and the brand name Outdoor Retailer is used for both the OR Summer Market and OR Winter Market versions of the show. If the image or reputation of one or more of these shows is tarnished, it could impact the number of exhibitors and attendees attending that show or shows. A decline in one of our larger shows could have a material adverse effect on our business, financial condition, cash flows and results of operations.

The dates and location of a trade show can impact its profitability and prospects.

The demand for desirable dates and locations is high. Consistent with industry practice, we typically maintain multi-year non-binding reservations for dates at our trade show venues. Aside from a nominal deposit in some cases, we do not pay for these reservations, and, while they almost always entitle us to a last look before the venue is rented to someone else during the reservation period, these reservations are not binding on the facility owners until we execute a definitive contract with the owner. We typically sign contracts that guarantee the right to specific dates at venues only one or two years in advance. Therefore, our multi-year reservations may not lead to binding contracts with facility owners. Consistency in location and all other aspects of our trade shows is important to maintaining a high retention rate from year to year, and we rely on our highly loyal customer base for the success of our shows. Moving major shows to new cities, such as the planned move of Interbike from Las Vegas, Nevada to Reno, Nevada in September 2018 and the move of OR from Salt Lake City, Utah to Denver, Colorado in January 2018, can adversely affect customer behavior. Similarly, significant timing changes, such as the acceleration of OR Winter Market from January 2019 to November 2018, can also result in unanticipated customer reactions. External factors such as legislation and government policies at the local or state level, including policy related to social issues, may depress the desire of exhibitors and attendees to attend our trade shows held in certain locations. For example, our organic revenue growth in 2017 was modestly adversely impacted by certain political issues in Utah that affected exhibitor participation at our 2017 OR Summer Market show. Our inability to secure or retain desirable dates and locations for our trade shows could have a material effect on our business, financial condition, cash flows and results of operations.

16

Attendance at our shows could decline as a result of disruptions in global or local travel conditions, such as congestion at airports, the risk of or an actual terrorist action, adverse weather or fear of communicable diseases.

The number of attendees and exhibitors at our trade shows may be affected by a variety of factors that are outside our control. Because many attendees and exhibitors travel to our trade shows via airplane, factors that depress the ability or desire of attendees and exhibitors to travel to our trade shows, including, but not limited to, an increased frequency of flight delays or accidents, outbreaks of contagious disease or the potential for infection, increased costs associated with air travel, actual or threatened terrorist attacks, the imposition of heightened security standards or bans on visitors from particular countries outside the United States, or acts of nature, such as earthquakes, storms and other natural disasters, could have a material adverse effect on our business, financial condition, cash flows and results of operations. For example, during the third quarter of 2017, we experienced disruptions to ISS Orlando, Surf Expo and ICFF South Florida as a result of the impact of Hurricane Irma, and we may be forced to cancel or re-locate future trade shows in the event of natural or man-made disasters. While we are generally insured against direct losses, one or more of the factors described above could cause a long-term reduction in the willingness of exhibitors and attendees to travel to attend our trade shows, which could have a material adverse effect on our business, financial condition, cash flows and results of operations.

We may fail to accurately monitor or respond to changing market trends and adapt our trade show portfolio accordingly.

Our success depends in part upon our ability to monitor changing market trends and to adapt our trade shows, acquire existing trade shows or launch new trade shows to meet the evolving needs of existing and emerging target audiences. The process of researching, developing, launching and establishing profitability for a new trade show may lead to initial operating losses. In 2017, we launched six new events. Our efforts to adapt our trade shows, or to introduce new trade shows into our portfolio, in response to our perception of changing market trends, may not succeed, which could have a material adverse effect on our business, financial condition, cash flows and results of operations.

If we fail to attract leading brands as exhibitors in, or high-quality attendees to, our trade shows, we may lose the benefit of the self-reinforcing “network effect” we enjoy today.

The leading brands represented by our exhibitors attract attendees who, in many cases, have authority to make purchasing decisions, or who offer other benefits (such as publicity or press coverage) by virtue of their attendance. The presence of these exhibitors and attendees creates the self-reinforcing “network effect” that benefits our business; however, if representatives of leading brands decide for any reason not to participate in our trade shows, the number and quality of attendees could decline, which could lead to a rapid decline in the results of one or more trade shows and have an adverse effect on our business, financial condition, cash flows and results of operations.

We may face increased competition from existing trade show operators or new competitors.

Although the trade show market is highly fragmented, we currently face competition in certain of our industry sectors. Further, our high profit margins and low start-up costs could encourage new operators to enter the trade show business. Both existing and new competitors present an alternative to our product offerings, and if competition increases or others are successful in attracting away our exhibitors and attendees, it could have a material adverse effect on our business, financial condition, cash flows and results of operations.

A significant portion of our revenue is generated by our top five trade shows.

We depend on our top five trade shows to generate a significant portion of our revenues. For the year ended December 31, 2017, our top five shows were ASD Market Week March, ASD Market Week August, NY NOW Summer, NY NOW Winter and KBIS. For the year ended December 31, 2017, these shows represented 33% of our total revenues. Notwithstanding the fact that ASD Market Week and NY NOW represent multiple product categories and that all of our shows are highly diversified by customer, a significant decline in the performance or prospects of any one of these significant trade shows could have a material adverse effect on our business, financial condition, results of operations and cash flows.

17

We intend to continue to be highly acquisitive, and our acquisition growth strategy entails risk.

Our acquisition growth strategy entails various risks, including, among others:

|

• |

the risks inherent in identifying desirable acquisition candidates, including management time spent away from running our core business and external costs associated with identifying such acquisition candidates; |

|

• |

the risk that we turn out to be wrong with respect to selecting and consummating what we had believed to be accretive acquisitions; |

|

• |

the risk of overpaying for a particular acquisition; |

|

• |

the risks of successfully integrating an acquisition and retaining the key employees and/or customers of acquired businesses; |

|

• |

the risks relating to potential unknown liabilities of acquired businesses; |

|

• |

the cultural, execution, currency, tax and other risks associated with any future international expansion; and |

|

• |

the risks associated with financing an acquisition, which may involve diluting our existing stockholders, reducing our liquidity or incurring additional debt, which in turn could result in increased debt service costs and/or a requirement to comply with certain financial or other covenants. |

In furtherance of our strategy of growth through acquisitions, we routinely review and conduct investigations of potential acquisitions, some of which may be material. When we believe a favorable opportunity exists, we seek to enter into discussions with target shows or sellers regarding the possibility of such acquisitions. At any given time, we may be in discussions with one or more counterparties. There can be no assurances that any such negotiations will lead to definitive agreements, or if such agreements are reached, that any transactions would be consummated.

Our exhibitors may choose to use an increasing portion of their marketing and advertising budgets to fund online initiatives or otherwise reduce the amount of money they have available to spend in connection with our trade shows.

Our trade shows have high NSF renewal rates, and we expect to continue to derive the substantial majority of our revenues from selling booth space to exhibitors. Although we have not observed a decline in demand for our trade shows as a result of the increasing use of the internet and social media for advertising and marketing, the increasing influence of online marketing and any resulting reductions of the budgets our participants allocate to our trade shows could have a material adverse effect on our business, financial condition, cash flows and results of operations.

We may lose the services of members of our senior management team or of certain of our key full time employees and we may not be able to replace them adequately.

We benefit substantially from the leadership and experience of members of our senior management team and we depend on their continued services to successfully implement our business strategy. The loss of any member of our senior management team or other key employee could materially and adversely affect our financial condition and results of operations. We currently maintain key man insurance only for our CEO. We cannot be certain that we will continue to retain our executives’ services, or the services of other key personnel, many of whom have significant industry experience and/or institutional knowledge. Moreover, we may not be able to attract and retain other qualified personnel. The loss of the services of senior management or other key full-time employees, or our inability to attract and retain other qualified personnel, could have a material adverse effect on our business, financial condition, cash flows and results of operations.

We use third-party agents whom we do not control to sell space at our trade shows, particularly to international exhibitors.

We supplement our sales employees with third-party agents, who often have deeper connections in international markets than we could have on our own. We do not have full control over these agents, and they have the potential to expose us to reputational and legal risks either through representing our company poorly, selling exhibition space at our trade shows to low quality or otherwise inappropriate exhibitors or violating certain laws or

18

regulations including the U.S. Foreign Corrupt Practices Act and other applicable anti-bribery laws in contravention of our policies and procedures. Our relationships with these agents are not always exclusive, and any of a number of factors could lead to a reduction or cessation of their efforts to sell exhibit space at our trade shows, potentially reducing participation at our trade shows and having a material adverse effect on our business, financial condition, cash flows and results of operations.

Changes in legislation, regulation and government policy, including as a result of U.S. presidential and congressional elections, may have a material adverse effect on our business in the future.

The presidential and congressional elections in the United States could result in significant changes in, and uncertainty with respect to, legislation, regulation and government policy. While it is not possible to predict whether and when any such changes will occur, changes at the local, state or federal level could significantly impact our business. Specific legislative and regulatory proposals discussed during and after the election that could have a material impact on us include, but are not limited to, infrastructure renewal programs; changes to immigration policy; modifications to international trade policy, including withdrawing from trade agreements; and changes to financial legislation and public company reporting requirements. In particular, changes to immigration policy could make it more difficult for some exhibitors and attendees to attend our events.

We are currently unable to predict whether policy change discussions will meaningfully change existing legislative and regulatory environments relevant for our business. To the extent that such changes have a negative impact on us, including as a result of related uncertainty, these changes may materially and adversely impact our business, financial condition, cash flows and results of operations.

Recently enacted changes to the U.S. tax laws may have a material impact on us.

On December 20, 2017, the U.S. House of Representatives and the U.S. Senate each voted to approve H.R. 1 (commonly referred to as the “Tax Cuts and Jobs Act”) and, on December 22, 2017, the President signed the Tax Cuts and Jobs Act into law. The Tax Cuts and Jobs Act makes extensive changes to the U.S. tax laws and includes provisions that, among other things, reduce the U.S. corporate income tax rate, introduce a capital investment deduction, limit the interest deduction, limit the use of net operating losses to offset future taxable income, and make extensive changes to the U.S. international tax system, including the taxation of foreign earnings of U.S. multinational corporations. In addition, the Tax Cuts and Jobs Act modifies the deductibility of certain executive officer compensation, which may limit our ability to deduct performance-based compensation, including compensation related to the exercise of options by certain executive officers. The Tax Cuts and Jobs Act is complex and far-reaching and we cannot predict with certainty the resulting impact its enactment will have on us.

A loss or disruption of the services from one or more of the limited number of outside contractors who specialize in decoration, facility set-up and other services in connection with our trade shows could harm our business.

We, and to a greater extent, our exhibitors, use a limited number of outside contractors for decoration, facility set-up and other services in connection with our trade shows, and we and our exhibitors rely on the availability, capability and willingness of these contractors to provide services on a timely basis and on favorable economic and other terms. Notwithstanding our long-term contracts with these contractors, many factors outside our control could harm these relationships and the availability, capability or willingness of these contractors to provide these services on acceptable terms. The partial or complete loss of these contractors, or a significant adverse change in our or our exhibitors’ relationships with any of these contractors, could result in service delays, reputational damage and/or added costs that could harm our business and customer relationships to the extent we or our exhibitors are unable to replace them in a timely or cost-effective fashion, which could have a material adverse effect on our business, financial condition, cash flows and results of operations.

Some facilities where we hold our trade shows require decorators, facility set-up and other service providers to use unionized labor. Any union strikes or work stoppages could result in delays in launching or running our trade shows, reputational damage and/or added costs, which could have a material adverse effect on our business, financial condition, cash flows and results of operations.

19

The industry associations that sponsor and market our trade shows could cease to do so effectively, or could be replaced or supplemented by new industry associations who do not sponsor or market our trade shows.

We often enter into long-term sponsorship agreements with industry associations whereby the industry association endorses and markets our trade show to its members, typically in exchange for a percentage of the trade show’s revenue. Our success depends, in part, on our continued relationships with these industry associations and our ability to enter into similar relationships with other industry associations. Although we frequently enter into long-term agreements with these counterparties, these relationships remain subject to various risks, including, among others:

|

• |

failure of an industry trade association to renew a sponsorship agreement upon its expiration; |

|

• |

termination of a sponsorship agreement by an industry trade association in specified circumstances; |

|

• |

the willingness, ability and effectiveness of an industry trade association to market our trade shows to its members; |

|

• |

dissolution of an industry trade association and/or the failure of a new industry trade association to support us; and |

|

• |

the ability on the part of an industry trade association to organize a trade show itself. |

Any disruptions or impediments in these existing relationships, or the inability to establish a new relationship, could have a material adverse effect on our business, financial condition, cash flows and results of operations.

Our launch of new trade shows or new initiatives with respect to current trade shows may be unsuccessful and consume significant management and financial resources.

From time to time, we launch new trade shows or new initiatives with respect to current trade shows. In 2017, we launched six new events. We may expend significant management time and start-up expenses during the development and launch of new trade shows or initiatives, and if such trade shows or initiatives are not successful or fall short of expectations, we may be adversely affected. Because we have limited resources, we must effectively manage and properly allocate and prioritize our efforts. There can be no assurance that we will be successful or, even if successful, that any resulting new trade shows or new initiatives with respect to current trade shows will achieve customer acceptance.

We do not own certain of the trade shows that we operate or certain trademarks associated with some of our shows.

Risks associated with our relationships with industry trade associations or other third-party sponsors of our events are particularly applicable in the cases of KBIS and CEDIA, which are trade shows owned by industry associations, and in the case of the JA New York trade shows and our Military trade shows, which are the trade shows in our portfolio where the show trademarks are owned by an industry association or other third party and not by us. Any material disruption to our relationship with these third parties could have a material adverse impact on the revenue stream from these trade shows.

The infringement or invalidation of proprietary rights could have an adverse effect on our business.

We rely on trademark, trade secret and copyright laws in the United States and on company policies and confidentiality agreements with our employees, consultants, advisors and collaborators to protect our proprietary rights, including with respect to the names of our trade shows, our exhibitor and attendee contact databases and other intellectual property rights. Our confidentiality agreements may not provide adequate protection of our proprietary rights in the event of unauthorized use or disclosure of our proprietary information or if our proprietary information otherwise becomes known, or is independently developed, by competitors. Failure to obtain or maintain adequate protection of our intellectual property rights for any reason could have a material adverse effect on our business. We rely on our trademarks, trade names and brand names to distinguish our trade shows from those of our competitors, and have registered and applied to register many of these trademarks. We cannot assure you that our trademark applications will be approved or that our federal registrations will be upheld if challenged. Third parties may oppose our applications or otherwise challenge our use of our trademarks through administrative processes or litigation. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products

20