Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99 - FORD MOTOR CREDIT CO LLC | april2018salesfinalfilingver.pdf |

| 8-K - 8-K - FORD MOTOR CREDIT CO LLC | sales8-kdated05x01x2018.htm |

? Ford Motor Company U.S. sales for April totaled

204,651 vehicles – a 4.7 percent decline

? Fleet performance is down 8.6 percent due to order

timing, with sales of 67,602 vehicles

? Ford’s overall transaction prices are almost $4,000

higher than the industry average, at $36,300 per

vehicle, while retail sales declined 2.6 percent

? Ford F-Series now marks 12 straight months of

year-over-year gains, posting its best April

performance since 2000 on total sales of 73,104

trucks

? Retail sales of the all-new Ford Expedition jumped

25.8 percent last month, as dealer inventories

continue to expand. Expedition is spending just 17

days on dealer lots on average

? All-new Ford EcoSport sales had it’s best monthly

sales to date; sales totaled 5,277 SUVs for April.

Some of our strongest sales regions for EcoSport last

month were New York, Boston, and Philadelphia

? Retail sales of Lincoln Navigator soared in April,

with the all-new SUV up 135.0 percent; customer

orders continue to exceed supply, with overall

average transaction prices up $26,300 over year-ago

levels

# # #

About Ford Motor Company

Ford Motor Company is a global company based in Dearborn, Michigan. The

company designs, manufactures, markets and services a full line of Ford

cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides

financial services through Ford Motor Credit Company and is pursuing

leadership positions in electrification, autonomous vehicles and mobility

solutions. Ford employs approximately 202,000 people worldwide. For more

information regarding Ford, its products and Ford Motor Credit Company,

please visit www.corporate.ford.com.

*U.S. sales volume reflects transactions with (i) retail and fleet customers

(as reported by dealers), (ii) government and (iii) Ford management. Average

transaction pricing based on J.D. Power and Associates PIN data.

A P R I L 2 0 1 8 S A L E S

“The industry continues to operate at

historically strong levels. We are seeing

this with our F-Series trucks, which

have now posted 12 consecutive

months of year-over-year gains. The

market continues to strongly favor well-

equipped SUVs and trucks and our

F-Series and new Expedition and

Lincoln Navigator are capitalizing on

this generational shift.”

– Mark LaNeve, Ford vice president,

U.S. Marketing, Sales and Service

F-Series Posts Best April Results in 18 Years While New

Expedition Climbs 26 Percent At Retail; New Navigator Retail

Sales Jump 135 Percent

Total Vehicle Retail Fleet Truck SUV Car

U.S. Sales 204,651 137,049 67,602 92,338 69,940 42,373

Versus

April 2017 -4.7% -2.6% -8.6% 0.9% -4.6% -15.0%

H I G H L I G H T S

K E Y V E H I C L E S

F-Series is now reporting 12

consecutive months of year-over-

year increases, with top trim level

Lariat, King Ranch, Platinum and

Limited Super Duty pickups

representing 49 percent of sales.

Overall F-Series average transaction

pricing gained $900 last month.

2018 Ford Super Duty

2018 Ford Expedition

2018 Lincoln Navigator

EcoSport volumes continue to grow,

with April marking the highest

volumes yet – 5,277 SUVs sold. We

continue to see a strong mix of

1.0-liter EcoBoost®-powered

vehicles, at more than 40 percent.

Navigator sales are up 135 percent

at retail and 122 percent overall.

Average time on dealer lots remains

a quick 13 days overall, just 10

days for Black Label. We’re seeing

triple-digit increases in every region,

with the West producing the most

sizable gains - 188 percent.

Average transaction pricing is up

$26,300, at $81,200.

www.twitter.com/Ford

Expedition is spending an average of

just 17 days on dealer lots, as retail

sales show a gain of 25.8 percent

last month. Our West region is

reporting the highest growth, with

retail sales up 59 percent. Average

transaction prices are up $12,100

over year-ago levels.

2018 Ford EcoSport

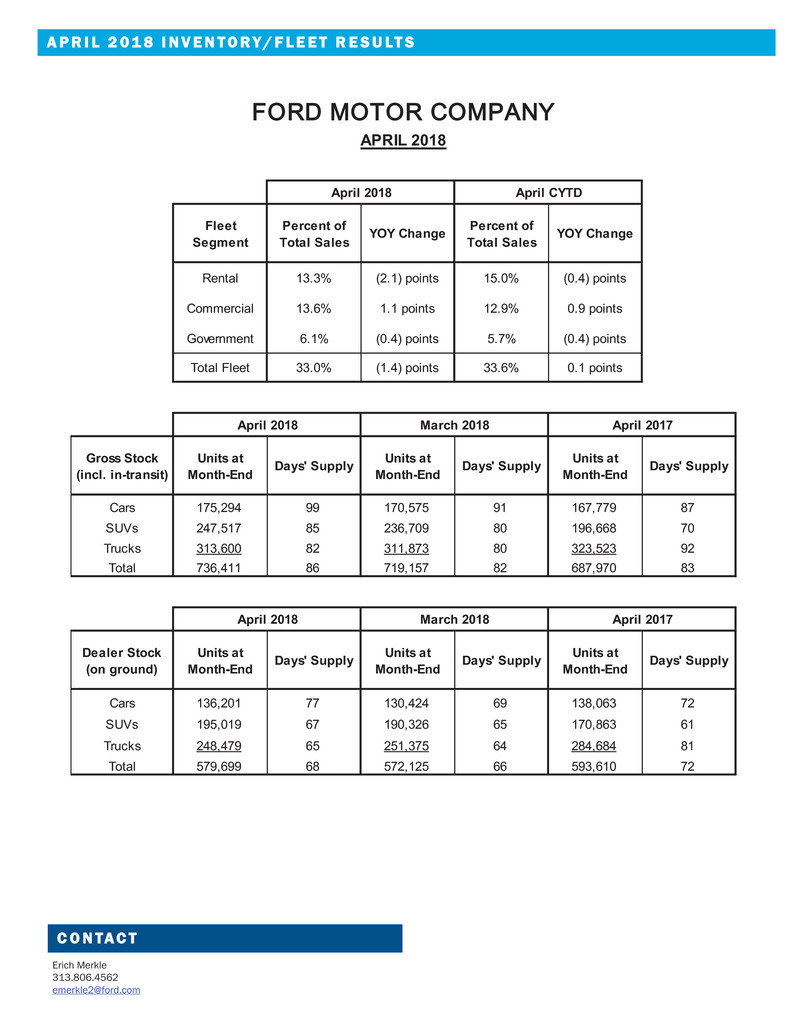

A P R I L 2 0 1 8 I N V E N T O R Y / F L E E T R E S U LT S

C O N TA C T

Erich Merkle

313.806.4562

emerkle2@ford.com

Fleet

Segment

Percent of

Total Sales YOY Change

Percent of

Total Sales YOY Change

Rental 13.3% (2.1) points 15.0% (0.4) points

Commercial 13.6% 1.1 points 12.9% 0.9 points

Government 6.1% (0.4) points 5.7% (0.4) points

Total Fleet 33.0% (1.4) points 33.6% 0.1 points

Gross Stock

(incl. in-transit)

Units at

Month-End Days' Supply

Units at

Month-End Days' Supply

Units at

Month-End Days' Supply

Cars 175,294 99 170,575 91 167,779 87

SUVs 247,517 85 236,709 80 196,668 70

Trucks 313,600 82 311,873 80 323,523 92

Total 736,411 86 719,157 82 687,970 83

Dealer Stock

(on ground)

Units at

Month-End Days' Supply

Units at

Month-End Days' Supply

Units at

Month-End Days' Supply

Cars 136,201 77 130,424 69 138,063 72

SUVs 195,019 67 190,326 65 170,863 61

Trucks 248,479 65 251,375 64 284,684 81

Total 579,699 68 572,125 66 593,610 72

April 2018 March 2018 April 2017

??????????????????

APRIL 2018

April 2018 April CYTD

April 2018 March 2018 April 2017