Attached files

| file | filename |

|---|---|

| EX-10.2 - ASSIGNMENT OF TENANTS INTEREST AND ASSUMPTION OF LEASE - SharpSpring, Inc. | shsp_ex102.htm |

| 8-K - CURRENT REPORT - SharpSpring, Inc. | shsp_8k.htm |

Exhibit 10.1

OFFICE LEASE AGREEMENT

BETWEEN

CELEBRATION POINTE OFFICE PARTNERS

II, LLC,

a

Florida limited liability company, Landlord

AND

SHARPSPRING TECHNOLOGIES, INC.

a Delaware corporation,

Tenant

FOR

CELEBRATION POINTE

Gainesville, Florida

Dated:

April 18, 2018

TABLE

OF CONTENTS

|

ARTICLE I

|

3

|

|

INTRODUCTORY

PROVISIONS

|

3

|

|

Section

1.1. References and Conflicts

|

3

|

|

Section

1.2. Exhibits

|

3

|

|

Section

1.3. General Definitions

|

3

|

|

ARTICLE II

|

5

|

|

GRANT

AND TERM

|

5

|

|

Section

2.1. Premises

|

5

|

|

Section

2.2. Term

|

6

|

|

ARTICLE III

|

6

|

|

RENT

|

6

|

|

Section

3.1 Minimum Rent

|

6

|

|

Section

3.2 Insurance

|

6

|

|

Section

3.3 Taxes

|

6

|

|

Section

3.4 Installments of Insurance and Taxes

|

7

|

|

Section

3.5 True-Up of Insurance and Taxes

|

7

|

|

Section

3.6 Treatment of Taxes and Insurance for Partial Years

|

7

|

|

Section

3.7 Payment of Rent

|

7

|

|

Section

3.8 Late Charge

|

7

|

|

Section

3.9 Sales and Use Tax

|

7

|

|

ARTICLE IV

|

7

|

|

PREPARATION

OF PREMISES

|

7

|

|

Section

4.1 Landlord’s Work

|

7

|

|

Section

4.2 Delivery of Possession

|

8

|

|

Section

4.3 Warranty

|

8

|

|

Section

4.4 Alterations by Tenant

|

8

|

|

Section

4.5 Removal by Tenant

|

9

|

|

Section

4.6 Construction Insurance

|

9

|

|

ARTICLE V

|

9

|

|

CONDUCT

OF BUSINESS

|

9

|

|

Section

5.1 Use

|

9

|

|

Section

5.2 Signs.

|

9

|

|

Section

5.3 Tenant’s Covenants

|

10

|

|

Section

5.4 Notice by Tenant

|

10

|

|

Section

5.5 Hazardous Materials

|

10

|

|

ARTICLE VI

|

11

|

|

LANDLORD’S

SERVICES

|

11

|

|

Section

6.1 Maintenance

|

11

|

|

Section

6.2 Landlord’s Services

|

11

|

|

Section

6.3 Utilities; Excess Usage

|

12

|

|

Section

6.4 Parking (Vehicles and Bicycles)

|

12

|

|

ARTICLE VII

|

13

|

|

REPAIRS

AND MAINTENANCE BY TENANT

|

13

|

|

Section

7.1 Repairs and Maintenance by Tenant

|

13

|

|

ARTICLE VIII

|

14

|

|

RESERVED

|

14

|

|

ARTICLE IX

|

14

|

|

INSURANCE,

INDEMNITY AND LIABILITY

|

14

|

|

Section

9.1 Landlord’s Insurance Obligations

|

14

|

|

Section

9.2 Tenant’s Insurance Obligations

|

14

|

|

Section

9.3 Waiver of Subrogation

|

15

|

|

Section

9.4 Covenant to Hold Harmless

|

15

|

|

Section

9.5 Consequential Damages

|

16

|

|

ARTICLE X

|

16

|

|

DESTRUCTION

OF PREMISES

|

16

|

|

Section

10.1 Casualty

|

16

|

|

ARTICLE XI

|

17

|

|

CONDEMNATION

|

17

|

|

Section

11.1 Eminent Domain

|

17

|

|

Section

11.2 Rent Apportionment

|

17

|

|

ARTICLE XII

|

17

|

|

ASSIGNMENT,

SUBLETTING AND ENCUMBERING LEASE

|

17

|

|

Section

12.1 No Assignment, Subletting or Encumbering of Lease

|

17

|

|

Section

12.2 Assignment or Sublet

|

18

|

|

Section

12.3 Transfer of Landlord’s Interest

|

18

|

|

Section

12.4 Recapture of Premises

|

18

|

|

Section

12.5 Continuing Liability

|

18

|

|

ARTICLE XIII

|

19

|

|

SUBORDINATION,

ATTORNMENT, FINANCING AND ESTOPPEL CERTIFICATE

|

19

|

|

Section

13.1 Subordination

|

19

|

|

Section

13.2 Attornment

|

19

|

|

Section

13.3 Estoppel Certificate

|

19

|

|

ARTICLE XIV

|

20

|

|

RESERVED

|

20

|

|

ARTICLE XV

|

20

|

|

DEFAULT

AND REMEDIES

|

20

|

|

Section

15.1 Elements of Default

|

20

|

|

Section

15.2 Landlord’s Remedies

|

20

|

|

Section

15.3 Bankruptcy

|

22

|

|

Section

15.4 Additional Remedies and Waivers

|

22

|

|

Section

15.5 Landlord’s Cure of Default

|

22

|

|

Section

15.6 Landlord's Default and Tenant's Remedies

|

22

|

|

ARTICLE XVI

|

23

|

|

RIGHT

OF ACCESS

|

23

|

|

ARTICLE XVII

|

23

|

|

DELAYS

|

23

|

|

ARTICLE XVIII

|

23

|

|

END

OF TERM

|

23

|

|

Section

18.1 Return of Premises

|

23

|

|

Section

18.2 Holding Over

|

24

|

|

ARTICLE XIX

|

24

|

|

COVENANT

OF QUIET ENJOYMENT

|

24

|

|

ARTICLE XX

|

24

|

|

RESERVED

|

24

|

|

ARTICLE XXI

|

24

|

|

MISCELLANEOUS

|

24

|

|

Section

21.1 Entire Agreement

|

24

|

|

Section

21.2 Notices

|

24

|

|

Section

21.3. Governing Law

|

25

|

|

Section

21.4. Successors

|

25

|

|

Section

21.5 Brokers

|

25

|

|

Section

21.6 Transfer by Landlord

|

25

|

|

Section

21.7 No Partnership

|

25

|

|

Section

21.8 Waiver of Counterclaims

|

25

|

|

Section

21.9 Waiver of Jury Trial

|

25

|

|

Section

21.10 Severability

|

25

|

|

Section

21.11. No Waiver

|

25

|

|

Section

21.12 Interest

|

26

|

|

Section

21.13 Rules and Regulations

|

26

|

|

Section

21.14 Financial Statements

|

26

|

|

Section

21.15 General Rules of Construction

|

26

|

|

Section

21.16 Recording

|

26

|

|

Section

21.17 Effective Date

|

26

|

|

Section

21.18 Headings

|

26

|

|

Section

21.19 Tenant Liability

|

26

|

|

Section

21.20 Other Tenants

|

27

|

|

Section

21.21 Due Authorization

|

27

|

|

Section

21.22 Confidentiality

|

27

|

|

Section

21.23 Attorney’s Fees

|

27

|

|

Section

21.24 Waiver of Redemption by Tenant

|

27

|

|

Section

21.25 Non-Discrimination

|

27

|

|

Section

21.26 [Intentionally deleted]

|

27

|

|

Section

21.27 Telecommunications Equipment/Early Access

|

27

|

|

Section

21.28 Landlord’s Right to Interrupt Utilities

|

28

|

|

Section

21.29 Liability of Landlord

|

28

|

|

Section

21.30 Radon Gas

|

28

|

|

Section

21.31 Non-Responsibility for Certain Liens

|

28

|

|

Section

21.32 Landlord Representations

|

28

|

|

Section

21.33 Expansion Right

|

28

|

EXHIBITS

|

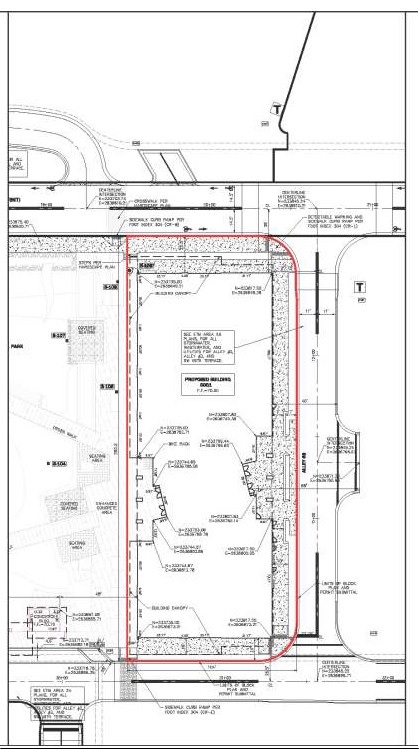

Exhibit

A -

|

Site Plans (A-1 =

Project; A-2 = Building)

|

|

Exhibit B

-

|

Rules and

Regulations

|

|

Exhibit

C -

|

Form of

Commencement and Expiration Date Declaration Exhibit

D-Intentionally Deleted

|

|

Exhibit

E -

|

Description of

Landlord’s Work – “Turnkey

Condition”

|

|

Exhibit

F -

|

Form of

Subordination, Non-Disturbance and Attornment

Agreement

|

OFFICE LEASE AGREEMENT

This OFFICE LEASE AGREEMENT (the

“Lease”) is made

and entered into as of this day of April, 2018

(being the “Effective

Date” as defined in Section 21.17 below), by and

between CELEBRATION POINTE OFFICE

PARTNERS II, LLC, a Florida limited liability company

(“Landlord”),

and SHARPSPRING TECHNOLOGIES,

INC., a Delaware corporation (“Tenant”).

SUMMARY OF CERTAIN PROVISIONS

The

following references furnish data to be incorporated in the

specified Sections of this Lease and shall be construed to

incorporate all of the terms of the entire applicable Section as

fully set forth in this Lease:

1.

Building

Address: 5001 Celebration Pointe Avenue, Gainesville,

Florida.

2.

Premises:

Approximately 25,000 rentable square feet of Class A office space

located on the third (3rd) and fourth

(4th)

floors of Office Building 5001 that will be more particularly

depicted on a space plan that will be prepared pursuant to Section

4.4(b). The Premises do not include the area above dropped ceilings

(if applicable), below the upper surface of floor slabs or the

areas outside of the inner surface of walls and plate

glass.

Usable Area of the Premises:

■

3rd Floor = 7,820

square feet; and

■

4th Floor = 16,468

square feet.

Rentable Area of the Premises including load factor:

■

3rd Floor with

12% load factor = 8,758

square feet; and

■

4th Floor with

9% load factor = 17,950

square feet.

Rentable Area of

Building 5001: 85,357

square feet.

3.

Delivery Date/Rent

Commencement: The Premises are available immediately for

Tenant build out. Tenant’s Minimum Rent shall commence the

date upon which Tenant takes possession of and occupies all or any

part of the Premises for normal business activities.

4.

Initial Lease

Term: A ten (10) year initial term.

5.

Renewal Option

Term: After the Initial Lease Term, Tenant shall have the

option to renew the lease for five (5) years in incremental

one-year periods, in each case by providing written notice at least

one-hundred and eighty (180) days in advance of the end of the then

current lease term. Such renewals shall include an increase of

Minimum Rent of 2.5% per year on as-is basis.

6.

Expiration

Date: The last day of the calendar month that is ten (10)

years following the Commencement Date unless extended pursuant to

Section 2.2(b).

7.

[Intentionally

deleted.]

-1-

8.

Minimum

Rent: [Section 3.1] Minimum Rent, as further described in

Section 3.1, is comprised of a “Rental Element” and a

“CAM Element,” as further set forth in the following

table:

|

Lease

Year

|

Rental Element

(PSF per year)

|

CAM Element

(PSF per year)

|

Minimum

Rent

(PSF per

year)

|

Estimated

Rentable Area of Premises

|

Annual Minimum

Rent

|

Monthly

Minimum Rent

|

|

1

|

$17.00

|

$6.16

|

$23.16

|

26,708

|

$618,557.28

|

$51,546.44

|

|

2

|

$17.00

|

$6.16

|

$23.16

|

26,708

|

$618,557.28

|

$51,546.44

|

|

3

|

$18.00

|

$6.16

|

$24.16

|

26,708

|

$645,265.28

|

$53,772.11

|

|

4

|

$18.00

|

$6.16

|

$24.16

|

26,708

|

$645,265.28

|

$53,772.11

|

|

5

|

$19.00

|

$6.16

|

$25.16

|

26,708

|

$671,973.28

|

$55,997.77

|

|

6

|

$19.00

|

$6.16

|

$25.16

|

26,708

|

$671,973.28

|

$55,997.77

|

|

7

|

$20.00

|

$6.16

|

$26.16

|

26,708

|

$698,681.28

|

$58,223.44

|

|

8

|

$20.00

|

$6.16

|

$26.16

|

26,708

|

$698,681.28

|

$58,223.44

|

|

9

|

$21.00

|

$6.16

|

$27.16

|

26,708

|

$725,389.28

|

$60,449.11

|

|

10

|

$21.00

|

$6.16

|

$27.16

|

26,708

|

$725,389.28

|

$60,449.11

|

Minimum

Rent does not include Taxes or Insurance Costs. As further provided

in Article III of this Lease, Tenant shall be responsible for

paying Tenant’s Share of Taxes and Insurance

Costs.

9.

Rent Payment

Address: [Section 3.7]

Celebration Pointe

Office Partners II, LLC

2579 SW

87th Drive

Gainesville, FL

32608

Attention: Svein H.

Dyrkolbotn

Landlord’s

FEIN: 47-3795681

10.

Permitted

Use: For office use and related ancillary uses to support

Tenant’s daily operations; provided that all such uses shall

comply with applicable laws, codes, regulations and matters of

record. [Section 5.1]

11.

Broker(s):

Front Street Commercial Real Estate Group, representing Landlord

and Tenant [Section 21.5]

12.

Minimum Rent

includes Common Area maintenance costs (represented by the

“CAM Element” set forth in Paragraph 8 above) but does

not include Taxes or Insurance Costs. As further provided herein,

Tenant shall be responsible for paying Tenant’s Share of

Taxes and Insurance Costs.

(i)

Tenant shall be

responsible for electrical and janitorial services inside the

Premises. Landlord shall be responsible for electrical and

janitorial services throughout the Common Areas.

(ii)

As further provided

in Section 3.9, Tenant shall be responsible for the payment of

sales and use tax.

(iii)

Tenant shall be

responsible for supplying its own furniture, fixtures and

furnishings; telephone and internet services.

- 2 -

ARTICLE I

INTRODUCTORY PROVISIONS

Section

1.1. References and

Conflicts. References

to Sections appearing in the Summary of Certain Provisions are to

designate some of the other locations in this Lease where

additional provisions applicable to the particular items within the

Summary of Certain Provisions appear. Each reference in this Lease

to any item within the Summary of Certain Provisions shall be

construed to incorporate all of the terms provided for under such

provision and shall be read in conjunction with all other

provisions of this Lease applicable thereto. If there is any

conflict between the terms contained in the Summary of Certain

Provisions and any other provisions of this Lease, the latter shall

control. The Summary of Certain Provisions is incorporated by this

reference into this Lease.

Section

1.2. Exhibits.

The following drawings and special provisions are attached to this

Lease as exhibits and are hereby made a part of this

Lease:

|

Exhibit

A -

|

Site Plans (A-1 =

Project; A-2 = Building)

|

|

Exhibit B

-

|

Rules and

Regulations

|

|

Exhibit

C -

|

Commencement and

Expiration Date Declaration Exhibit D-Intentionally

Deleted

|

|

Exhibit

E -

|

Description of

Landlord’s Work

|

|

Exhibit

F -

|

Subordination

Non-Disturbance and Attornment Agreement

|

Section

1.3. General

Definitions. In

addition to the terms defined in the Summary of Certain Provisions,

the following terms, whenever used in this Lease with the first

letter of each word capitalized, shall have only the meanings set

forth in this Section 1.3, unless such meanings are expressly

modified, limited or expanded elsewhere in this Lease:

(a) “Additional

Rent” means all amounts other than Minimum Rent due

and owing to Landlord under this Lease including, without

limitation, Tenant’s Share of Taxes and

Insurance.

(b) “Common

Areas” mean all areas, facilities and improvements (as

the same may be enlarged, reduced, replaced, removed or otherwise

altered by Landlord) from time to time made available in the

Project by Landlord under Section 2.1 of this Lease for the

non-exclusive common use of occupants of the Project, including

Tenant, its agents, employees and invitees. The Common Areas shall

include, without limitation, lobbies (at ground level or

otherwise), mail rooms, parking areas, decks and facilities,

sidewalks, stairways, escalators, conduits, elevators, service

corridors, fire corridors, seating areas, truck ways, ramps,

loading docks, delivery areas, landscaped areas, park areas,

hardscape elements (including fountains), retention/detention

areas, park areas, package pickup stations, public restrooms and

comfort stations, access and interior roads, retaining walls,

drainage systems, bus stops and lighting facilities.

Notwithstanding anything in the foregoing to the contrary, the

Common Areas shall not include any stairways, ramps, loading docks

or delivery areas included in the Premises, if any, or in the

premises of any occupant of the Project and intended for such

occupant’s exclusive use.

Subject

to Landlord’s right to change or alter any of the Common

Areas, Tenant shall have, as appurtenant to the Premises, the

non-exclusive right to use the Common Areas in common with others,

subject to reasonable rules of general applicability to tenants and

other occupants and users of the Project from time to time made by

Landlord of which Tenant is given notice.

- 3 -

(c) “Force

Majeure” means a material delay beyond the reasonable

control of the delayed party caused by labor strikes, lock outs,

industry wide inability to procure materials, extraordinary

restrictive governmental laws or

regulations (such as gas rationing), mass riots, war, military

power, sabotage, material fire or other material casualty, Severe

Weather, or an extraordinary and material act of God (such as a

tornado or earthquake), but excludes inadequacy of insurance

proceeds, litigation or other disputes, financial inability, lack

of suitable financing, delays of the delayed party’s

contractor and failure to obtain approvals or permits unless

otherwise caused by an event of Force Majeure.

“Severe

Weather” means weather

that a reasonable person would find unusual and unanticipated at

the time of the scheduling of the activity based on recent weather

patterns for the period in question that actually results in delay,

provided that the delayed party delivers to the other party, upon

request, reasonable documentation from an unbiased weather

authority substantiating such claim. If either party hereto is

delayed or hindered in or prevented from the performance of any

obligation required hereunder by Force Majeure, the time for

performance of such obligation shall be extended for the period of

the delay, provided that Force Majeure shall not excuse prompt and

timely payments when due under this Lease or other delays that are

explicitly excluded from Force Majeure

hereunder.

(d) “Lease

Year” means the twelve (12) month period beginning on

the first day of the month immediately following the Commencement

Date and terminating on the last day of the same month of the

succeeding year, and each successive twelve (12) month period

thereafter during the Term. The period of time, if any, between the

Commencement Date and the first day of the month immediately

following the Commencement Date shall be considered to be a part of

the first Lease Year.

(e)

“Tenant

Delay(s)” shall have the meaning attributed thereto in

Exhibit

E.

(f) “Tenant’s

Share” means a fraction, the numerator of which is the

Rentable Area of the Premises and the denominator of which is the

Rentable Area of the Building.

(g) “Insurance”

shall mean all insurance carried and maintained by Landlord with

respect to the Building including, without limitation, those

coverages described in Section 9.1 hereof.

(h) “Insurance

Costs” shall mean all premiums and other amounts paid

or incurred by Landlord for Insurance.

(i) “Interest”

means the Prime Rate reported in the Money Rates section of

The Wall Street Journal on

the twenty-fifth (25th) day of the month preceding the date upon

which the applicable obligation is incurred plus three percent

(3%).

(j) “Office

Building” or “Building” means the office

building known as Building 5001 as identified on the site plan that

is attached as Exhibit A-2

to this Lease.

(k) “Project”

means the mixed-use center located in Gainesville, Alachua County,

Florida, and known as “Celebration

Pointe” or such other name as Landlord may designate

from time to time. The Project is further shown and delineated on

the site plan attached hereto as Exhibit

A-1.

(l)

“Rent” means

Minimum Rent and Additional Rent.

(m) “Rentable

Area” means rentable square footage, whether or not

actually leased or occupied, measured per the 1996 BOMA standards

with a load factor of 12% on the third (3rd) floor and 9% on

the fourth (4th

floor).

- 4 -

The

amount of Minimum Rent set forth in Paragraph 8 of the Summary of

Certain Provisions is based upon the Rentable Area of the Premises.

Upon substantial completion of construction of Tenant’s Work

(as defined in Section 4.1 below), the Rentable Area of the

Premises shall be determined by Landlord’s architect. If the

measured Rentable Area of the Premises is more than one percent

(1%) different than the Rentable Area of the Premises set forth in

Paragraph 2 of the Summary of Certain Provisions, then prior to the

Commencement Date the Rentable Area of the Premises shall be

adjusted accordingly and Minimum Rent shall be calculated using the

Rentable Area of the Premises as adjusted; provided, however, that

in no event shall the Rentable Area of the Premises be 3% more than

the Rentable Area of the Premises set forth in Paragraph 2 of the

Summary of Certain Provisions for purposes of calculating Minimum

Rent. Promptly after the Commencement Date, Landlord and Tenant

shall execute and deliver a written declaration in the form

attached hereto as Exhibit C.

Landlord shall have the right to adjust the Rentable Area of the

Office Building once completed; provided, however, that

Tenant’s Share shall not increase due to any such

adjustments.

(n)

“Rentable Area of the

Premises” means the amount of space upon which Rent is

payable under this Lease as set forth in Paragraph 2 of the Summary

of Certain Provisions.

(o)

“Retail Area” means the

retail portion of the Project.

(p)

“State” means

the State of Florida.

(q) “Taxes”

shall mean and include all federal, state, county, or local

governmental or municipal taxes, fees, charges or other impositions

of every kind and nature, whether general, special, ordinary or

extraordinary (including, without limitation, real estate taxes,

general and special assessments and interest thereon whenever the

same may be payable in installments), transit taxes, leasehold

taxes or taxes based upon the receipt of rent, including sales

taxes applicable to the receipt of rent, unless required to be paid

by Tenant, which may be levied or assessed by, or are payable to,

any lawful authority during or with respect to any calendar or

fiscal year falling in whole or in part during the Term because of

or in connection with the ownership, leasing and operation of the

Building. Taxes shall also include, without limitation, any

assessment, tax, fee, levy or charge in addition to, or in

substitution, partially or totally, for or as a supplement to any

assessment, tax, fee, levy or charge previously included within the

definition of Taxes. All such new and increased assessments, taxes,

fees, levies and charges and all similar assessments, taxes, fees,

levies and charges and service payments in lieu of Taxes shall be

included within definition of Taxes. Tax refunds shall be deducted

from Taxes in the year they are received by Landlord, but if such

refund shall relate to Taxes paid in a prior year of the Term, and

the Lease shall have expired, Landlord shall mail Tenant’s

Share of such net refund (after deducting expenses and

attorneys’ fees), up to the amount Tenant paid towards Taxes

during such year, to Tenant’s last known address. Taxes shall

not include: (a) any net income, excise, profits (other than a tax

on gross profits), estate, gift, franchise, or capital stock tax or

assessment upon Landlord; and (b) any fine, penalty, cost or

interest for any tax or assessment, or part thereof, which Landlord

failed to timely pay (except if same are imposed by reason of

Tenant’s default hereunder). For purposes of reimbursements

by Tenant to Landlord according to Section 3.3, “Taxes”

shall be based on ad valorem real estate taxes that include the

maximum early payment discount.

(r) “Underlying

Documents”. The terms, conditions and provisions of

this Lease and the rights of the parties hereto are subject to all

matters of public record, public or private restrictions affecting

Landlord or the Building, and all applicable governmental rules and

regulations, and are subject to and subordinate to that certain

Master Declaration of Easements, Covenants and Restrictions for

Celebration Pointe executed by Celebration Pointe Holdings, LLC,

recorded in the Public Records of Alachua County, Florida, as

amended from time to time (the “Declaration”). Tenant agrees to

comply with the provisions of the Declaration and any other

recorded or unrecorded documents affecting the Building

(collectively, the “Underlying Documents”). Landlord

represents and warrants that the Permitted Use does not violate any

restrictions, terms or conditions of the Declaration. Landlord

warrants and represents that, as of the Effective Date, Landlord

has provided Tenant with true, correct and complete copies of the

Underlying Documents. Landlord covenants that it will provide

Tenant with true, correct and complete copies of any amendments of

the Underlying Documents during the Term.

- 5 -

ARTICLE II

GRANT AND TERM

Section

2.1. Premises.

Landlord, in consideration of the Rent to be paid and the covenants

to be performed by Tenant, does hereby lease and demise to Tenant,

and Tenant hereby rents and hires from Landlord, for the Term, the

Premises. Landlord shall have and hereby reserves the right at its

reasonable discretion, at any time and from time to time during the

Term, to (i) redesignate, modify, alter, expand, reduce and change

the Common Areas including, without limitation, the area, level,

location and arrangement of all parking areas, decks, roadways and

driveways; and (ii) make alterations or additions to, and build

additional stories on, the buildings in the Retail Area and to

construct other buildings and improvements of any type in the

Project for lease to tenants or for such other uses as Landlord

desires, including the right to locate and/or erect thereon

permanent or temporary kiosks and structures; and (iii) exclude

from the Common Areas such building areas and related areas as

Landlord shall designate. If Landlord elects to enlarge the

Project, any additional area may be included by Landlord in the

definition of the Project. Landlord shall also have the general

right from time to time to include within and/or to exclude from

the defined Project any existing or future areas, subject to the

foregoing limitations. In exercising its rights in this subsection,

Landlord shall (i) conform to the requirements of the Underlying

Documents, (ii) not change the Common Areas or any other components

of the Project in a manner that limits or reduces Tenant’s

right to use them or reduces their quality, (iii) not change the

parking provided pursuant to Section 6.4, (iv) not adversely affect

the views from the Premises, (v) not materially and adversely limit

or reduce access to and from public roads adjoining the Project,

and (vi) not increase Minimum Rent or Tenant’s Share. This

Lease is subject to all applicable building restrictions, planning

and zoning ordinances, governmental rules and regulations, existing

underlying leases, and all other encumbrances, covenants,

restrictions and easements affecting the Project.

Section

2.2.

Term.

(a) Term.

The initial term of this Lease (the “Initial Term”) shall commence on

the Commencement Date and, unless sooner terminated as hereinafter

provided, shall end on the Expiration Date, as such dates are

respectively specified in the Summary of Certain Provisions. The

Initial Term and any Option Periods are collectively referred to as

the “Term” in

this Lease. Landlord shall deliver the Premises to Tenant in

accordance with Section 4.2 herein.

(b) Option

Periods. Provided that Tenant is not then in default hereof

beyond any applicable notice and cure periods, Tenant shall have

the option (each an “Option”) to extend the Term for

the Option Periods identified in the Summary of Certain Provisions.

Each Option shall be exercised, if at all, by written notice to

Landlord at least one hundred eight (180) days prior to the

expiration of the Initial Term or the then- current Option Period,

as applicable. All terms and conditions contained herein shall

apply during the Option Periods except that Minimum Rent shall

change as set forth below. If Tenant does not exercise the

foregoing Options to renew this Lease within the required time

periods, then such Options shall become null and void and be of no

further force or effect. Beginning on the first day of each Option

Period, if exercised, Minimum Rent shall be payable in the amount

of Minimum Rent as of the last day of the prior period plus an

increase of 2.5%.

ARTICLE III

RENT

Section

3.1 Minimum

Rent. During the

Initial Term, Tenant shall pay annual minimum rental

(“Minimum

Rent”) for the

Premises in the amount set forth in the Summary of Certain

Provisions, which sum shall be payable by Tenant in equal

consecutive monthly installments in the amount set forth in the

Summary of Certain Provisions, without demand. The first

installment of Minimum Rent shall be paid in advance on the

Commencement Date. If the Commencement Date occurs on a day other

than the first day of a month, the first installment of Minimum

Rent shall be prorated at a daily rate based on the number of days

in such month.

Section

3.2 Insurance.

In addition to any Minimum Rent payable under Section 3.1 above,

Tenant shall pay as Additional Rent in accordance with Section 3.4,

at the same time as payments of Minimum Rent are due,

Tenant’s Share of Insurance Costs incurred by

Landlord.

Section

3.3 Taxes. In

addition to any Minimum Rent payable under Section 3.1 above,

Tenant shall pay as Additional Rent in accordance with Section 3.4,

at the same time as payments of Minimum Rent are due,

Tenant’s Share of Taxes incurred by Landlord for the

Building. The expiration or termination of this Lease shall not

affect the obligations of Tenant and rights of Landlord pursuant to

Section 3.2 or 3.3 which remain to be performed after such

expiration or termination, Landlord and Tenant agreeing that said

obligations and rights shall survive such expiration or

termination.

- 6 -

Section

3.4 Installments of

Insurance and Taxes. With each payment of Minimum Rent,

Landlord may require Tenant to pay one-twelfth (1/12th) of the

estimated amount of Insurance Costs and Taxes for the applicable

calendar year. Landlord will provide Tenant with a good faith

estimate of Tenant’s Share of Insurance Costs and Taxes at

least forty-five (45) days in advance of the end of each calendar

year. If Landlord has not furnished Tenant an estimate for any

given calendar year, Tenant shall continue to pay on the basis of

the prior calendar year’s estimate until the month after such

estimate is given. Landlord’s estimate of Insurance Costs and

Taxes for the initial calendar year of the Term is $2.84 per square

foot per year (comprised of an estimated $0.34 per square foot per

year for Insurance Costs and an estimated $2.50 per square foot per

year for Taxes).

Section

3.5 True-Up of

Insurance and Taxes. Landlord shall, within no more than

ninety (90) days after each calendar year during the Term, provide

Tenant a statement of such year’s actual Insurance cost and

Taxes, including a copy of the invoices for Insurance and the tax

bill. If actual Insurance Costs and/or Taxes are greater than the

estimated amounts theretofore paid by Tenant, Tenant shall pay

Landlord within thirty (30) days after receipt of such statement

Tenant’s Share of the difference thereof. If actual Insurance

Costs and/or Taxes are less than the estimated amounts theretofore

paid by Tenant, Landlord shall, at Landlord’s option, either

refund the excess to Tenant within thirty (30) days after the

delivery of such statement or provide Tenant a credit against Rent

in an amount equal to such excess.

Section

3.6 Treatment of Taxes

and Insurance for Partial Years. For partial calendar years during

the term of this Lease, the amount of Insurance and Taxes payable

that is applicable to that partial calendar year shall be prorated

based on the ratio of the number of days of such partial calendar

year falling during the term of this Lease to 365.

Section

3.7 Payment of

Rent. Minimum Rent and Additional Rent shall be paid to

Landlord, in advance, on or before the first day of the Term hereof

and on or before the first day of each and every successive

calendar month thereafter during the Term of this Lease, at the

Rent Payment Address set forth in the Summary of Certain Provisions

(or at such other address of which Landlord shall have given Tenant

notice in accordance with this Lease). All other Rent shall be paid

as provided elsewhere in this Lease. In the event the term of this

Lease commences on a day other than the first day of a calendar

month or ends on a day other than the last day of a calendar month,

then the monthly rental for the first and last fractional months of

the term hereof shall be appropriately prorated.

Section

3.8 Late

Charge. If any Rent

or other sums are not received within ten (10) days of when due,

Tenant shall pay upon demand by Landlord, as Additional Rent, (i) a

service charge equal to one and one half percent (1.5%) of the

amount of such overdue payment for the purpose of defraying

Landlord’s administrative expenses relative to handling such

overdue payment plus (ii) Interest, which Interest shall accrue

beginning on the date the payment was originally due and

payable.

Section

3.9 Sales and Use

Tax. Tenant shall pay all Florida sales and use tax due on

Minimum Rent, Additional Rent and all other amounts payable by

Tenant to Landlord under this Lease upon which Florida sales and

use tax may be imposed from time to time pursuant to Section

212.031, Florida Statutes, or any similar or successor

law.

ARTICLE IV

PREPARATION OF PREMISES

Section

4.1 Landlord’s

Work. Landlord

anticipates developing the Project to a sustainable standard

according to USGC LEED Certification. Landlord, at Landlord’s

sole expense, shall construct the shell of the Office Building

wherein the Premises is to be located and otherwise perform the

work described in Exhibit E

attached hereto (“Landlord’s Work”), at

Landlord’s expense. Landlord shall obtain all certificates

and approvals necessary with respect to Landlord’s Work, and

shall construct the Office Building to be LEED Certified.

Acceptance of possession of the Premises by Tenant shall be

conclusive evidence that Landlord’s Work has been fully

performed in the manner required, subject to punch list items. Any

items of Landlord’s Work that are not completed as of

delivery of the Premises shall be identified by Tenant on a punch

list submitted to Landlord within fifteen (15) business days after

such delivery, or as soon as possible thereafter and Landlord shall

thereafter complete the same within thirty (30) days. Any items of

Landlord’s Work that are not timely identified on such a

punch list shall be deemed completed to the extent that they are

capable of detection as of delivery of the Premises. All work other

than Landlord’s Work to be carried out and completed in the

Premises is the responsibility of Tenant (collectively,

“Tenant’s

Work”).

- 7 -

Section

4.2 Delivery of

Possession. Landlord

shall use best efforts to deliver possession of the Premises to

Tenant with Landlord’s Work complete and in turnkey condition

such that Tenant is able to obtain permits for Tenant’s Work

without further action by Landlord (“Turnkey Condition” as described in

Exhibit E”). If despite using reasonable efforts,

Landlord is unable to deliver possession of the Premises to Tenant

in the Turnkey Condition on or before the Estimated Delivery Date,

Landlord may extend the Estimated Delivery Date by up to ninety

(90) days upon written notice to Tenant provided such notice is

given at least sixty (60) days prior to the Estimated Delivery

Date. If possession of the Premises has not been delivered to

Tenant in the Turnkey Condition by the Estimated Delivery Date plus

any applicable extensions for any reason whatsoever other than a

Tenant Delay, then (a) Landlord shall, promptly after demand

therefor, reimburse Tenant for its Holdover Costs, and (b) Tenant

shall receive one (1) day of free Rent for each day after the

Estimated Delivery Date plus any applicable extensions that

Landlord has not delivered possession in the Turnkey Condition.

Anything in this Lease to the contrary notwithstanding, if Landlord

has not delivered possession of the Premises to Tenant in the

Turnkey Condition on or before September 1, 2018, then Tenant may

terminate this Lease by written notice to Landlord and this Lease

shall terminate as of the date of such notice. As used herein,

“Holdover Costs”

shall mean those amounts charged to Tenant by its prior landlord

for holding over in their then existing leased premises (the

“Prior Lease”)

in excess of the rent and other charges payable by Tenant under the

Prior Lease for the period immediately prior to the Holdover Date,

as established by documentation reasonably acceptable to

Landlord.

Section

4.3 Warranty.

Landlord warrants to Tenant, for a period of twelve (12) months

after delivery of the Premises in the Turnkey Condition, that

Landlord’s Work shall be free from faulty materials and

defective work, in accordance with all applicable legal

requirements, and sound engineering standards. Such warranty

includes, without limitation, the repair or replacement (including

labor), at Landlord’s sole cost, of all materials, fixtures

and equipment (including appliances) which are defective, or which

are defectively installed by Landlord in connection with

Landlord’s Work. Landlord shall, at Tenant’s option,

assign to Tenant, or enforce for the benefit of Tenant, all

warranties from subcontractors and material suppliers for such

materials, workmanship, fixtures and equipment in effect after the

expiration of such twelve (12) month warranty period. The

provisions of this subparagraph shall survive the termination or

expiration of this Lease. If Landlord fails to satisfy its

obligations hereunder within a reasonable amount of time after

notice from Tenant of any such faulty materials or defective work,

Tenant may cause such work to be repaired and may deduct the same

from the next payment(s) of Rent due hereunder up to fifty percent

(50%) of each installment of such Rent until fully recouped, or if

the Term has expired, Landlord shall reimburse Tenant for same upon

demand.

Section

4.4 Alterations by

Tenant.

(a) Tenant

Improvement Construction. Landlord agrees to deliver the

space turnkey per Tenant’s construction guidelines and

specifications up to a $60/square foot budget. Tenant will work

with Landlord to develop plans, specifications, and pricing based

on similar finishes to tenant’s existing office space,

including the number of square footage of offices and kitchens and

the overall quality and style of finishes, as compared to

Tenant’s existing space. If the build out cost less than

$60/square foot, any savings will go to Landlord. Tenant agrees to

achieve a LEED Certification for interiors for their space within

the Premises as a minimum commitment to occupancy to support the

Project goal for a sustainable development neighborhood program.

Tenant shall have access to the Premises before the Commencement

Date to perform certain of Tenant’s Work as set forth in

Section 21.27.

(b) Landlord

shall, as part of Landlord’s Work, prepare a space plan for

the 3rd

and 4th

floors of the Premises. The space plan shall identify areas that

are under the exclusive control of Tenant. Landlord and Tenant

shall work with one another in good faith to finalize the space

plan on or before the thirtieth (30th) day after

Landlord’s delivery of the Premises in the Turnkey Condition.

Within sixty (60) days after approval of the final space plan, or

as soon as possible thereafter, Tenant shall deliver to Landlord

plans and specifications in such detail as Landlord may reasonably

request covering Tenant's Work. Tenant shall not commence any work

in the Premises until Landlord has approved the plans and

specifications therefore in writing, which approval shall not be

unreasonably withheld, conditioned or delayed; provided, however,

if Tenant has not received Landlord’s written approval within

fifteen (15) days of Tenant’s delivery of the plans and

specifications to Landlord, the plans and specifications shall be

deemed approved by Landlord and Tenant may proceed with

Tenant’s Work. Once the plans and specifications are approved

or are deemed approved, they shall constitute the

“Approved Plans”

under this Lease.

- 8 -

(c) Except

as specifically set forth immediately above, Tenant shall not make

any alterations, repairs, additions or improvements to the Premises

without the prior written consent of Landlord, such consent not to

be unreasonably withheld, conditioned or delayed. All alterations,

additions or improvements shall be performed in good and

workmanlike manner and in accordance with all applicable legal and

insurance requirements and all drawings and specifications approved

by Landlord, and in accordance with the provisions of this Lease.

If consent is required, Tenant shall not commence any alterations

or improvements to the Premises unless and until Landlord approves

the plans and specifications for such work, which approval shall

not be unreasonably withheld, conditioned or delayed.

(d) Prior

to the commencement of any work by Tenant, Tenant shall obtain the

insurance required in Section 4.6 below and all plans and

specifications shall be approved by Landlord. Landlord shall have

the right, at no expense to Landlord, to require Tenant to furnish

Landlord with payment and performance bonds guaranteeing the

completion of any such repairs, alterations, additions or

improvements. No liens arising out of any work performed, materials

furnished, or obligations incurred by or for the benefit of Tenant

shall exist against the Premises or the Office Building. The

interest of Landlord in the Premises, the Office Building and the

Project shall not be subject to liens for improvements made by or

on behalf of Tenant. If any mechanics’, materialmen’s

or other lien (each, a “lien”) is filed against the

Premises or the Office Building(s) as a result of Tenant’s

actions or inactions, Tenant, at its expense, shall cause the lien

to be discharged of record or fully bonded to the satisfaction of

Landlord within fifteen (15) days after notice of the filing

thereof, or as soon as possible thereafter. If Tenant fails to

discharge or bond against said lien within thirty (30) day period,

Landlord may, in addition to any other rights or remedies Landlord

may have, but without obligation to do so, bond against or pay the

lien without inquiring into the validity or merits of such lien,

and all sums so advanced, including reasonable attorneys’

fees, shall be paid by Tenant on demand as Additional

Rent.

Section

4.5 Removal by

Tenant. All present

and future permanent repairs, alterations, additions and

improvements made to the Premises by either party shall become the

property of Landlord upon attachment. Upon the expiration or sooner

termination of this Lease, Tenant shall not remove any of

Tenant’s alterations, additions and improvements, without

Landlord’s written approval, except that Tenant shall remove

any alterations, additions or improvements that Landlord designates

by written notice to Tenant at the time of Tenant’s request

to make such changes, and Tenant shall remove its trade fixtures if

Tenant is not in default hereunder. Nothing herein shall obligate

Tenant to remove any work done in accordance with the Approved

Plans, including, without limitation, cabling and wiring. Tenant

shall promptly repair any damage to the Premises caused by such

removal. Tenant will not have any restoration obligations related

to Landlord’s Work.

Section

4.6 Construction

Insurance. Prior to

the commencement of any Tenant alterations, repairs, additions or

improvements to the Premises, Tenant shall carry, or cause its

contractor to carry, “Builder’s All Risk”

insurance in an amount reasonably approved by Landlord covering the

performance of the same, workers’ compensation coverage as

required by law and shall provide evidence of such coverage to

Landlord, if requested. Landlord and any mortgagee of the Building

shall be named as additional insureds or loss payees, as applicable

on such policies.

ARTICLE V

CONDUCT OF BUSINESS

Section

5.1 Use. Tenant

shall continuously use and occupy the Premises during the Term

solely for the purpose of conducting the business specifically set

forth in the Summary of Certain Provisions, and for no other

purpose. Landlord represents that the Permitted Use is permitted as

of the Effective Date. Tenant shall procure all license(s) and/or

permit(s) required for the lawful conduct of Tenant’s

business and submit the same for inspection by Landlord upon

demand. Tenant, at Tenant’s expense, shall at all times

comply with the requirements of such license(s) or permit(s).

Tenant shall have access to the Building and the Premises 24 hours

a day, seven days a week, and the Building entrances shall be

accessible through a keyless card system installed by

Landlord.

Section

5.2 Signs.

Landlord, at Landlord’s sole expense, shall provide Tenant

signage on the ground floor elevator lobby directory of the Office

Building including Tenant’s name and location, and Landlord

reserves the right to exclude any other names therefrom. Landlord

shall also provide Tenant, at Landlord’s expense, (i) signage

on Tenant’s suite entry to the Premises, (ii) signage on the

3rd and

4th floors

of the Building providing direction to the Premises if such floor

is shared by one or more tenants. Any additional name, the size,

design, and location of each of the foregoing must first be

approved by Landlord, which approval shall not be unreasonably

withheld, conditioned or delayed, and further subject to Tenant

obtaining, at Tenant’s sole cost and expense, all approvals

required for such signage under any applicable zoning ordinances,

building codes, other governmental requirements and documents of

record. Tenant shall also be permitted to construct, install,

illuminate (if applicable) and maintain, all at Tenant’s sole

cost and expense, signage (x) in a prominent location at or near

the top of the northeast corner of the north side of the Building,

and (y) in a prominent location at or near the top of the southwest

corner of the south side of the Building (collectively,

“Tenant’s Building Signs”). Landlord may permit

the installation of one other sign on the same side of the Building

(including, without limitation, at the top of such side) but shall

establish reasonable separation between Tenant’s Building

Signs and such other sign. The design, locations and installation

of Tenant’s Building Signs shall be subject to Landlord's

prior written approval, which approval shall not be unreasonably

withheld, conditioned or delayed. Tenant shall be solely

responsible for obtaining, at Tenant’s sole cost and expense,

all approvals required for Tenant’s Building Signs under any

applicable zoning ordinances, building codes, other governmental

requirements and documents of record, and Landlord’s approval

of Tenant’s Building Signs, if granted, shall be subject to

Tenant obtaining all such approvals.

- 9 -

Section

5.3 Tenant’s

Covenants. Tenant

covenants and agrees that, in the operation of its business within

the Premises, Tenant shall: (a) pay before delinquency any and all

taxes, assessments and public charges levied, assessed or imposed

upon Tenant’s business, or upon Tenant’s fixtures,

furnishings or equipment in the Premises; provided, however, that

Tenant shall have the right to contest such taxes; (b) not use any

space outside the Premises for sale, storage, display, hand

billing, advertising, solicitation or any other similar

undertaking; (c) not use the plumbing facilities in the Premises

for any purpose other than that for which they were constructed;

(d) not use any advertising medium or sound devices inside or

adjacent to the Premises which produce or transmit sounds which are

audible beyond the interior of the Premises, except as otherwise

approved by Landlord in writing; (e) not permit any odor to emanate

from the Premises which is reasonably objected to by Landlord or by

any tenant or occupant of the Office Building (and, upon written

notice from Landlord, Tenant shall immediately cease and desist

from causing such odor, failing which Landlord may deem the same a

material breach of this Lease); (f) not use the Premises in a

manner that would constitute a nuisance; (g) keep the Premises in a

neat, clean, safe and sanitary condition; (h) be authorized to do

business in the State; (i) not store, display, sell or distribute

for any alcoholic beverages or any dangerous materials other than

serving alcoholic beverages for employee social events and events

for clients; (j) not operate or permit to be operated on the

Premises any coin or token operated vending machine or similar

device other than vending machines for the exclusive use of

Tenant’s employees; (k) not permit any improper, immoral and

“adult” entertainment or nudity in the Premises, and

not distribute or display any paraphernalia commonly used in the

use or ingestion of illicit drugs, or any x-rated, pornographic or

so-called “adult” newspaper, book, magazine, film,

picture, video tape, video disk or other similar representation or

merchandise of any kind; (l) use good faith efforts to avoid any

action which would cause any work stoppage, picketing, labor

disruption or dispute, or any interference with the business or

rights and privileges of Landlord or any other tenant, occupant or

other person lawfully in the Project; (m) not interfere with the

transmission or reception of microwave, television, or radio

communications signals by antennae located on the roof of any

building in the Office Building or elsewhere in the Project; (n)

not move any heavy machinery, heavy equipment or fixtures into or

out of the Premises without Landlord’s prior written consent,

or place a load on any floor exceeding the floor load per square

foot that such floor was designed to carry, or install, operate or

maintain in the Premises any heavy equipment except in such manner

as to achieve a proper distribution of weight; and (o) promptly

comply with all present and future laws, ordinances, orders, rules,

regulations and requirements of all governmental authorities having

jurisdiction over the Premises, or the generation, use and/or

disposal of any Hazardous Materials (as defined in Section 5.5

below) brought to the Premises by Tenant, its employees, agents or

contractors, or the cleanliness, safety, occupancy and use of the

same, whether or not any such law, ordinance, order, rule,

regulation, covenant, restriction or other requirement is

substantial, or foreseen or unforeseen, or ordinary or

extraordinary, or shall necessitate structural changes or

improvements, shall interfere with the use or enjoyment of the

Premises, and Tenant shall hold Landlord harmless from any and all

cost or expense on account thereof (so long as such compliance with

all Laws is required as a direct result of Tenant’s specific

use of the Premises and not office use in general) but only to the

extent that any of the foregoing are directly applicable to

Tenant’s Use of the Premises for the Permitted Use

(collectively, “Laws”); provided, however, that

Landlord shall be responsible at Landlord’s costs and expense

for ensuring that the Premises are at all times compliant with the

Americans with Disabilities Act of 1990, as amended (the

“ADA”) (as used

in this Lease, the term “legal requirements” shall include

the requirements set forth in this subparagraph

5.3(o)).

Section

5.4 Notice by

Tenant. Tenant shall give prompt notice to Landlord in case

of fire or accidents that cause material damage to the Premises,

or, the extent that Tenant has actual knowledge thereof, in the

Office Building.

Section

5.5 Hazardous

Materials.

(a) Tenant

shall not cause or permit the presence, use, generation, release,

discharge, storage, disposal or transportation of any Hazardous

Materials on, under, in, about, to or from the Premises and/or the

Project, other than typical office supplies. As used herein, the

term “Hazardous

Materials” shall mean any hazardous or toxic

substances, materials or waste, pollutants or contaminants, as

defined, listed or regulated by any federal, state, county or local

law, regulation or order or by common law decision including,

without limitation: (i) trichloroethylene, tetrachloroethylene,

perchloroethylene and other chlorinated solvents;

(ii)

petroleum products or by-products; (iii) asbestos; and (iv)

polychlorinated biphenyls.

(b) Should

a release of any Hazardous Materials occur at the Premises or the

Project as the direct result of the acts or omissions of Tenant,

Tenant shall immediately (i) notify Landlord and any mortgagee of

the Project for whom Tenant has been provided contact information,

and (ii) contain, remove and dispose of, off the Premises or the

Project, such Hazardous Materials and any material that was

contaminated by the release, and remedy and mitigate all threats to

human health or the environment relating to such release. When

conducting any such measures Tenant shall comply with all

environmental laws.

(c) Tenant

shall exonerate, indemnify, pay and protect, defend (with counsel

reasonably approved by Landlord) and hold harmless Landlord, and

its directors, trustees, beneficiaries, officers, shareholders,

partners, employees, agents, and invitees, any mortgagee of the

Office Building and those of the other tenants of the Office

Building (collectively, the “Related Parties”) from and against

any claims (including, without limitation, third party claims for

personal injury or real or personal property damage), actions,

administrative proceedings (including informal proceedings),

judgments, damages, punitive damages, penalties, fines, costs,

taxes, assessments, liabilities (including sums paid in settlements

of claims), interest or losses, including reasonable

attorneys’ fees and expenses (including any such fees and

expenses incurred in enforcing this Lease or collecting any sums

due hereunder), consultant fees, and expert fees, together with all

other reasonable costs and expenses of any kind or nature actually

incurred (collectively, the “Costs”) that arise directly or

indirectly in connection with the presence, suspected presence,

release or suspected release of any Hazardous Materials in or into

the air, soil, ground water, surface water or improvements at, on,

about, under or within the Premises or the Project, or any portion

thereof, or elsewhere in connection with the transportation of

Hazardous Materials to or from the Premises or the Project, in any

such case by or on behalf of Tenant. This indemnification shall

survive the termination of this Lease and shall be binding upon

Tenant and its successors in interest whenever such threat, claim

or cause of action may arise. To the maximum extent permitted by

applicable law, Tenant expressly waives any defense concerning

laches or the statute of limitations, constructive eviction or rent

abatement with respect to such claims. Tenant's obligations under

this Section 5.5 shall survive the termination of this Lease for

any reason whatsoever.

- 10 -

(d) Landlord

shall exonerate, indemnify, pay and protect, defend (with counsel

reasonably approved by Tenant) and hold harmless Tenant, and its

directors, trustees, beneficiaries, officers, shareholders,

partners, employees, agents, and invitees, any mortgagee of the

Office Building and those of the other tenants of the Office

Building (collectively, the “Related Parties”) from and against

any claims (including, without limitation, third party claims for

personal injury or real or personal property damage), actions,

administrative proceedings (including informal proceedings),

judgments, damages, punitive damages, penalties, fines, costs,

taxes, assessments, liabilities (including sums paid in settlements

of claims), interest or losses, including reasonable

attorneys’ fees and expenses (including any such fees and

expenses incurred in enforcing this Lease or collecting any sums

due hereunder), consultant fees, and expert fees, together with all

other reasonable costs and expenses of any kind or nature actually

incurred (collectively, the “Costs”) that arise directly or

indirectly in connection with the presence, suspected presence,

release or suspected release of any Hazardous Materials in or into

the air, soil, ground water, surface water or improvements at, on,

about, under or within the Premises or the Project, or any portion

thereof, or elsewhere in connection with the transportation of

Hazardous Materials to or from the Premises or the Project, in any

such case by or on behalf of Landlord. This indemnification shall

survive the termination of this Lease and shall be binding upon

Landlord and its successors in interest whenever such threat, claim

or cause of action may arise. Landlord's obligations under this

Section 5.5 shall survive the termination of this Lease for any

reason whatsoever.

ARTICLE VI

LANDLORD’S SERVICES

Section

6.1 Maintenance.

Landlord shall maintain, at Landlord’s sole cost and expense,

in condition and repair equal to or better than other similar Class

A office buildings in the Gainesville, Florida area, subject to

normal wear and tear, casualty and condemnation, every element of

the Office Building (excluding the Premises and other portions of

the Office Building leased to other tenants), including, without

limitation, the Common Areas, public areas, any and all parking

levels and landscaped areas, elevators, stairs, common corridors,

common restrooms, the mechanical, plumbing and electrical systems

(including HVAC and life safety systems), exterior windows, parking

areas, driveways (including, without limitation, driveways

providing ingress from and egress to public roads), and the

foundations and footers of the Building and its structural walls

and roof. Landlord shall keep the sidewalks, driveways, parking

areas, and all other means of ingress and egress for the Premises

and all public portions of the Building in condition equal to or

better than other similar Class A office buildings in the

Gainesville, Florida area and in a clean and safe condition and

shall provide adequate lighting. Notwithstanding the foregoing

obligation, the cost of any repairs or maintenance to the foregoing

that are directly necessitated by the intentional acts or

omissions, or gross negligence of Tenant, or its agents, employees,

contractors, invitees, licensees, or assignees, shall be deemed

Additional Rent hereunder and shall be reimbursed by Tenant to

Landlord upon demand.

Section

6.2 Landlord’s

Services.

(a) Landlord

agrees to furnish the following services at Landlord’s sole

costs and expense:

(i) heat

and air conditioning for the Building (including, without

limitation, the Premises and the interior Common Areas) at

reasonably comfortable temperatures and standard for buildings of

similar class, size, age and location, or as required by

governmental authority; such services to be provided from 8:00 a.m.

to 6:00 p.m. on weekdays and from 8:00 a.m. to 1:00 p.m. on

Saturdays (except on New Year's Day, Memorial Day, Independence

Day, Labor Day, Thanksgiving and Christmas and such other public

holidays hereafter created by governmental authority and designated

by Landlord), or such shorter period as may be prescribed by any

applicable policies or regulations adopted by any utility or

governmental agency;

(ii) elevator

service, lighting replacement for the entire Building (including,

without limitation, the Premises and the Common Areas, as

applicable), and regular janitorial and restroom supplies for the

Common Areas;

- 11 -

(iii)

maintenance and repair in accordance with Section 6.1;

(iv)

subject to Section 6.3, all utilities other than electricity

(including, without limitation, water and sewer) to the Building

(including, without limitation, the Common Areas, as applicable) 24

hours per day, seven days per week; provided, however, that Tenant

(A) shall be responsible for procuring all telephone, internet,

electricity, and janitorial services used in the Premises and (B)

shall pay all charges incurred for such services directly to the

applicable service provider; and

(v) Landlord

shall, upon Tenant’s request, provide after-hours heating and

air conditioning for times beyond the hours of operation set forth

in Section 6.2(a)(i) at the rate of $35.00 per hour.

(b) Landlord

shall not be in default hereunder or be liable for any damages

directly or indirectly resulting from, nor shall Rent be abated by

reason of, (i) the installation, use or interruption of use of any

equipment in connection with the furnishing of any of the foregoing

services, (ii) failure to furnish or delay in furnishing any such

services when such failure or delay is caused by accident or any

condition beyond the reasonable control of Landlord or by the

making of necessary repairs or improvements to the Premises or to

the Office Building, or (iii) the limitation, curtailment,

rationing or restrictions on use of water, electricity, gas or any

other form of energy serving the Premises or the Office Building

not caused by Landlord. Landlord shall use best efforts to promptly

remedy any interruption in the furnishing of such

services.

Section

6.3 Utilities; Excess

Usage. Whenever heat

generating equipment, other than standard office equipment

(i.e., computers,

telephones, etc.) or lighting other than building standard lights

or those included in the Approved Plans are used in the Premises by

Tenant which materially and adversely affect the temperature

otherwise maintained by the air conditioning system, Landlord shall

have the right, after notice to Tenant and Tenant’s

opportunity to cure, to install supplementary air conditioning

facilities in the Premises or otherwise modify the ventilating and

air conditioning system serving the Premises, and the cost of

installation, construction, maintenance and repair of such

facilities and modifications shall be borne by Tenant.

Section

6.4 Parking (Vehicles

and Bicycles). (a) Parking shall be provided by Landlord to

Tenant in the following consecutive stages (each a

“Stage” and

collectively, the “Stages”) and in the following

locations:

(i) Stage

1 – on the existing surface parking lot that is located

within the area identified as P-1 in Exhibit “A” (the

“Surface

Lot”)

(ii)

Stage 2 – within the existing structured parking facility

that is located within the area identified as P-2 in Exhibit

“A” (the “P-2

Facility”)

(iii)

Stage 3 – within a structured parking facility that will

constructed by Landlord and located within the area identified as

P-1 in Exhibit “A” (the “P-1 Facility,” and together with

the Surface Lot and the P-2 Facility, the “Parking Areas”)

During

each Stage, Tenant shall have the exclusive right to use 1 reserved

parking space per 1,000 square feet of Rentable Area within the

Premises at no additional charge (the “Exclusive Spaces”). During each

Stage, the Exclusive Spaces shall be as close and as convenient as

possible to the Building. During Stage 2 and Stage 3, the Exclusive

Spaces shall be located on the ground floor of the P-2 Facility and

the P-1 Facility, respectively, or, if the ground floor of the P-2

Facility and/or the P-1 Facility is used for retail purposes and

not parking then on the second floor. During each Stage, Tenant

shall also have the exclusive right, subject to the conditions of

the Section, to use additional parking spaces (the “

Semi-Exclusive

Spaces”) at the cost of Zero Dollars ($0.00) during

Stage 1 and Stage 2 and Thirty-five and No/100 Dollars ($35.00) per

space per month, with two percent (2%) annual increases, during

Stage 3. The Semi-Exclusive Spaces shall be available for use by

Landlord and its agents, invitees and employees after 6:00 p.m. and

before 8:00 a.m. Monday through Friday, on weekends, and on

Federally observed holidays. Parking will be non-exclusive and

non-reserved, except that Landlord will identify five (5) reserved

parking spaces for Tenant’s exclusive use. Landlord shall

have the right to control access to the Parking Areas, remove

improperly parked automobiles and require that the designated

automobile display decals or other evidence of its right to use the

Parking Areas. Landlord acknowledges that parking in the P-2

Facility is a material inconvenience for Tenant. Landlord shall

exercise best efforts to complete the P-1 Facility as quickly as

possible.

- 12 -

(b) Subject

to the Declaration, Landlord shall have the right, but not the

obligation, to assign parking spaces to tenants of the Office

Building and other buildings in the Project, provided that it does

not interfere with Tenant’s rights set forth in Section

6.4(a). From time to time during the Term, Tenant shall provide the

license plate numbers and vehicle descriptions for all of its

employees working in the Premises within ten (10) days following

receipt of Landlord’s written request.

(c) Landlord

shall make bicycle racks available at the Building, at

Landlord’s sole cost, to the extent any of Tenant’s

employees commute to the Premises by bicycle.

(d)

Notwithstanding the foregoing provisions of Section 6.4(a), if the

Rentable Area of the Premises is determined to be, or if it changes

in the future to be, less or more than 26,708 square feet

aggregately, then the number of Exclusive Spaces provided pursuant

to Section 6.4(a) above may be reduced or increased

proportionately, in accordance with the amount by which the actual

Rentable Area of the Premises is less than or greater than

26,708.

ARTICLE VII

REPAIRS AND MAINTENANCE BY TENANT

Section

7.1 Repairs and

Maintenance by Tenant.

(a) Except

to the extent of the work to be performed pursuant to Sections 4.1

and 4.3 above, by occupancy of the Premises, Tenant accepts the

Premises as being in the condition in which Landlord is obligated

to deliver the Premises. Subject to Landlord’s obligations

pursuant to Article VI, Tenant shall, at Tenant's sole cost and

expense, at all times during the Term keep, and at the end of the

Term surrender to Landlord, the Premises and every part thereof and

all alterations, additions and improvements thereto (subject to

Section 4.5) in good condition and repair, except for normal wear

and tear and damage (which damage shall not have been caused by the

negligence or intentional act of Tenant or its agents, employees,

contractors, invitees, licensees, tenants or assigns) thereto by

fire, earthquake, act of God or the elements. Landlord has no

obligation and has made no promise to alter, remodel, improve,

repair, decorate or paint the Premises or any part thereof, except

as specifically and expressly herein set forth. No representations

respecting the condition of the Premises or the Office Building

have been made by Landlord to Tenant, except as specifically and

expressly herein set forth.

(b) Tenant

agrees that Tenant’s use of electrical current will at no

time exceed the capacity of the electric distribution system and

that Tenant will not make any alteration or addition to

Tenant’s electrical system without Landlord’s prior

written consent, not to be unreasonably withheld, conditioned or

delayed.

(c) If

Tenant fails, refuses or neglects to properly maintain the

Premises, or to commence or to complete repairs for which it is

expressly responsible under this Lease promptly and adequately, or

if Landlord finds it necessary to make any repairs or replacements

otherwise required to be made by Tenant, then Landlord may, after

reasonable advance notice to Tenant, in addition to all other

remedies, but without obligation to do so, enter the Premises and

proceed to have such maintenance, repairs or replacements made, and

Tenant shall pay to Landlord, on demand, the cost and expenses

therefor plus a charge of three percent (3%) of such costs and

expenses to compensate Landlord for its administrative and overhead

costs.

- 13 -

ARTICLE VIII

RESERVED

ARTICLE IX

INSURANCE, INDEMNITY AND LIABILITY

Section

9.1

Landlord’s

Insurance Obligations. Landlord agrees to obtain and