Attached files

| file | filename |

|---|---|

| 8-K - 2018 ANNUAL MEETING RESULTS - CITIZENS FINANCIAL SERVICES INC | 2018annualmeetingresults.htm |

| EX-99.2 - 2018 ANNUAL MEETING PRESS RELEASE - CITIZENS FINANCIAL SERVICES INC | annualmeetingpressrelease.htm |

Exhibit 99.1

Citizens Financial Services, Inc. Annual Meeting2018

Why Increase Shares Benefits to increasing authorized shares:

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award shares

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award sharesFlexibility to raise capital

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award sharesFlexibility to raise capitalFlexibility for cash and stock dividends

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award sharesFlexibility to raise capitalFlexibility for cash and stock dividendsPossible acquisition opportunities

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award sharesFlexibility to raise capitalFlexibility for cash and stock dividendsPossible acquisition opportunitiesDiscourage persons seeking to take control

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award sharesFlexibility to raise capitalFlexibility for cash and stock dividendsPossible acquisition opportunitiesDiscourage persons seeking to take controlWill not change number of shares outstanding

Why Increase Shares Benefits to increasing authorized shares:Flexibility to award sharesFlexibility to raise capitalFlexibility for cash and stock dividendsPossible acquisition opportunitiesDiscourage persons seeking to take controlWill not change number of shares outstandingNo specific plans for the increase

2017 Initiatives Opened our 2nd Lancaster County facility Narvon facility

2017 Initiatives Opened our 2nd Lancaster County facilityPurchased and integrated a branch in Centre County Dave Richards

2017 Initiatives Opened our 2nd Lancaster County facilityPurchased and integrated a branch in Centre CountyEstablished a cash management division

2017 Initiatives Opened our 2nd Lancaster County facilityPurchased and integrated a branch in Centre CountyEstablished a cash management divisionImplications of the new Tax Cuts and Jobs Act

2017 Tactical Projects TEAM Ag12/31/2017 ag portfolio of $286 millionRanked as one of the top 100 farm lenders by dollar volume in the nationBecame a business partner with the Pennsylvania Farm BureauLaunched our Ag Banking website

2017 Tactical Projects TEAM AgCredit card portfolio conversion

2017 Tactical Projects TEAM AgCredit card portfolio conversionEstablished a Next Generation Development TEAM

2017 Tactical Projects TEAM AgCredit card portfolio conversionEstablished a Next Generation Development TEAMRecruited additional TEAM members Jami John Doug

2017 Tactical Projects TEAM AgCredit card portfolio conversionEstablished a Next Generation Development TEAMRecruited additional TEAM membersAcquired a branch in State College

Management Team Terry Osborne – EVP, Chief Credit OfficerMick Jones – EVP, Chief Financial Officer/ Chief Operating OfficerDave Richards – EVPJeff Carr – SVP, Chief Retail Banking OfficerBob Mosso – SVP, Wealth Management Division Manager

Management Team Kathleen Campbell – SVP, Marketing ManagerChris Landis – SVP, Senior Lending OfficerGreg Anna – SVP, Information Systems ManagerDoug Byers – SVP, Southcentral Regional ExecutiveDwight Rohrer – SVP, Senior LenderSean McKinney – VP, Ag Lender and TEAM Leader

Management Team Blaine Fessler – VP, Ag Lender and TEAM LeaderJim Rovito – VP, CRA/Fair Lending OfficerJason Landis – VP, Ag LenderGina Boor – Executive/Shareholder ServicesJeff Wilson – EVP, Chief Lending OfficerCindy Pazzaglia – SVP, Human Resources Manager

Retirements 2018 Employee RetirementsCindy Estep – 35 yearsRobin Grabb – 38 yearsDebbie Johnson – 21 yearsDebi Castle – 18 yearsKathy Telep – 2 yearsDora Walter – 2 yearsCindy Pazzaglia – 35 yearsAllan Reed – 37 yearsMarsha Wills – 18 years

TEAM Member Jamie FreesHired April 24, 2017 as a Vice President, Business Development Officer6/28/1971 – 2/1/2018

Unity Back in Community

Unity Back in Community

2017 Financial Performance

Efficiency Ratio History-FCCB Finished in the 79th percentile for 2017 compared to the UBPR peer groupFinished in the 100th percentile compared to the CZFS peer group

Return on Equity History Finished in the 75th percentile for 2017 compared to the UBPR peer groupFinished in the 100th percentile compared to the CZFS peer group

Return on Assets History Finished in the 69th percentile for 2017 compared to the UBPR peer groupFinished in the 93rd percentile compared to the CZFS peer group

Cash Dividends Paid History 1% stock dividend paid in 2014 & 2016, and a 5% stock dividend paid in 2013 & 2017

Industry Recognition For the 10th consecutive year, CZFS has been named as one of the top 200 community banks.

Industry Recognition For the 10th consecutive year, CZFS has been named as one of the top 200 community banks.First Citizens named on the top 100 Ag Lenders list.

Industry Recognition For the 10th consecutive year, CZFS has been named as one of the top 200 community banks.First Citizens named on the top 100 Ag Lenders list.For the 6th consecutive year, FCCB has earned a 5-star rating.

Industry Recognition For the 10th consecutive year, CZFS has been named as one of the top 200 community banks.First Citizens named on the top 100 Ag Lenders list.For the 6th consecutive year, FCCB has earned a 5-star rating.Ranked #1 in small business & ag lending.

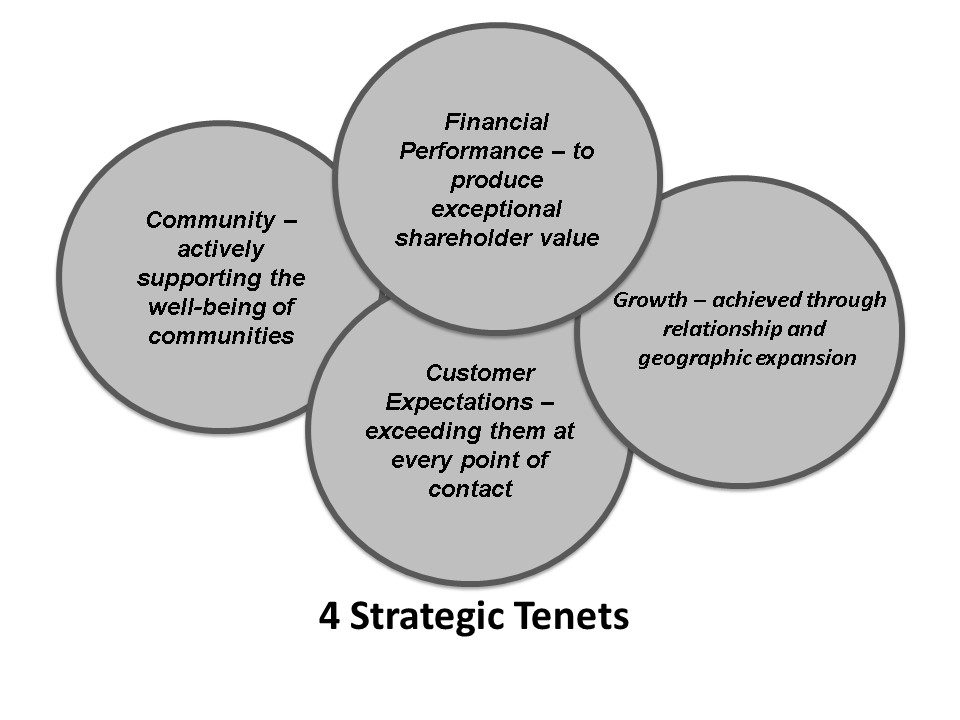

35 4 Strategic Tenets Community – actively supporting the well-being of communities Customer Expectations – exceeding them at every point of contact Financial Performance – to produce exceptional shareholder value Growth – achieved throughrelationship and geographic expansion

Thank you