Attached files

| file | filename |

|---|---|

| 8-K - Ault Global Holdings, Inc. | l4171818k.htm |

Exhibit 99.1

DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc. Our Keystone Holdings:

Disclaimers This presentation and other written or oral statements made from time to time by representatives of DPW Holdings, Inc. (sometimes referred to as “DPW”) contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements reflect the current view about future events. Statements that are not historical in nature, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward-looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward-looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward-looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 Annual Report”) and other information contained in subsequently filed current and periodic reports, each of which is available on our website and on the Securities and Exchange Commission’s website (www.sec.gov). Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the 2017 Annual Report. Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.Important factors that could cause actual results to differ materially from those in the forward looking statements include: a decline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; the ability to protect our intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other providers and products; risks in product development; inability to raise capital to fund continuing operations; changes in government regulation, the ability to complete customer transactions and capital raising transactions.Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.All forecasts are provided by management in this presentation and are based on information available to us at this time and management expects that internal projections and expectations may change over time. In addition, the forecasts are entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products. Safe Harbor DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

DPW Holdings, Inc. is a diversified holding company with operating segments in multiple strategic industries. The evolution of DPW Holdings has been congruent with the acceleration of our Company’s growth. Originally a leader and supplier of advanced power products and solutions, we have transformed into a diversified holding company. Through our subsidiaries we are engaged in commercial, defense/aerospace, industrial, telecom, medical, crypto-mining, hospitality, textile, and investment/corporate lending markets. Our developmental plan-in-action is to acquire undervalued assets and disruptive technologies with a global impact. DPW Holdings, Inc. DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

Summary Corporate Organizational Chart DPW HOLDINGS : DPW MTIX INTERNATIONALOTC: AVLP 100% *Percentage represents beneficial ownership DIGITAL POWER LENDING 74%* 100% COOLISYS TECHNOLOGIES SUPER CRYPTO Avalanche International Corp (OTC:AVLP) is doing business as MTIX International and is the parent company of MTIX Limited in Huddersfield, England. Crypto-Mining, Cloud Mining, Power Supply and Mining Machine Sales, Facility Management and Blockchain development projects. Digital Power Lending, LLC is a wholly-owned subsidiary of DPW Holdings, Inc. with a California finance lenders license. Coolisys is focused on manufacturing operations and includes companies: Digital Power Corporation (100%), Microphase (56.8%), Digital Power Ltd. dba Gresham Power (100%), and Power-Plus Technical Distributors (100%). DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc. WSI INDUSTRIESNASDAQ: WSCI 9% A leading contract manufacturer that specializes in the machining of complex, high-precision parts for a wide range of industries. SANDSTONE DIAGNOSTIC 4.5% Providing innovative, data-driven tools to help assess, manage and improve men’s health. 100%

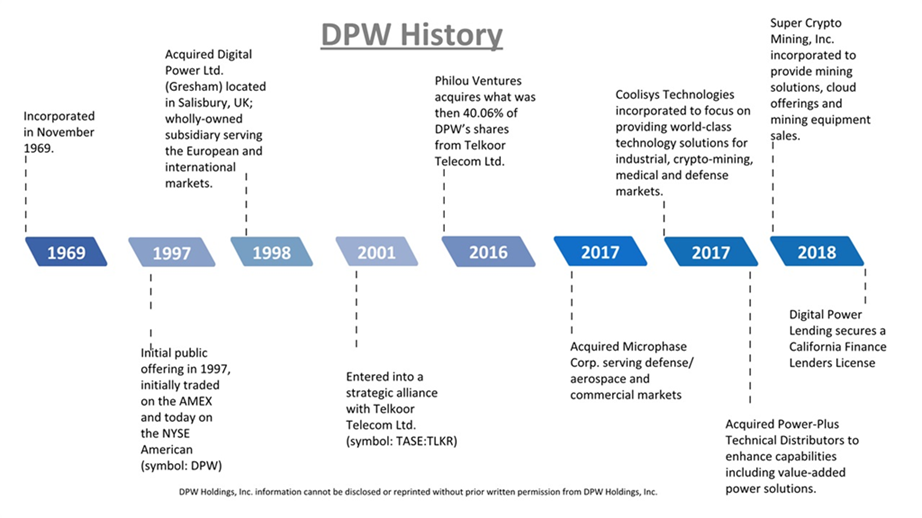

DPW History Incorporated in November 1969. Initial public offering in 1997, initially traded on the AMEX and today on the NYSE American (symbol: DPW) Acquired Digital Power Ltd. (Gresham) located in Salisbury, UK; wholly-owned subsidiary serving the European and international markets. Entered into a strategic alliance with Telkoor Telecom Ltd. (symbol: TASE:TLKR) Philou Ventures acquires what was then 40.06% of DPW’s shares from Telkoor Telecom Ltd. Acquired Microphase Corp. serving defense/ aerospace and commercial markets Coolisys Technologies incorporated to focus on providing world-class technology solutions for industrial, crypto-mining, medical and defense markets. Acquired Power-Plus Technical Distributors to enhance capabilities including value-added power solutions. Digital Power Lending secures a California Finance Lenders License Super Crypto Mining, Inc. incorporated to provide mining solutions, cloud offerings and mining equipment sales. IIIIII IIIII IIIII IIIIII IIIII IIIII IIIIIIIIII III IIIIIII III DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc. Sales increased 33.95% for 2017 over 2016 to $10,175,000 in 2017;Comprehensive income increased from a loss in 2016 of $362,000 to a gain of over $5,323,000 in 2017;Gross margins for 2017 improved to 37.8% from 35.6% in 2016;Total assets increased in 2017 to over $30,510,000 from total assets of $5,472,000 in 2016, an increase of 457% Book value increased over 34.13% for the first time in the last 6 years while increasing significantly for the first time in 10 years;DPW Holdings had a comprehensive loss of $5,931,000 for 2017 versus $1,484,000 for 2016;The Company had non-cash charges of $6,333,000 for 2017 versus $736,000 for 2016;The Company raised $13,391,000 for 2017 versus $1,279,000 for 2016;The Company used $8,674,000 for investments in 2017 versus $1,029,000 for 2016;DPW Holdings anticipates a reduction in its cost of capital for 2018 and beyond. As the asset base of the Company exceeds $30,510,000 as of December 31, 2018, the Company noted it has various methods in place to raise capital at lower rates and overall cost. Financial Highlights

RESULTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016The following table summarizes the results of our operations for the years ended December 31, 2017 and 2016 (in Millions). 2017 2016 Revenue $ 10,001 $ 7,596 Revenue, related party 174 — Cost of revenue 6,325 4,890 Gross profit 3,850 2,706 Total operating expenses 9,833 3,925 Loss from operations (5,983) (1,219) Interest (expense) income, net (4,990) 77 Loss before income taxes (10,973) (1,142) Income tax benefit 78 20 Net loss $ (10,895) $ (1,122) Less: Net loss attributable to non-controlling interest 279 — Net loss attributable to Digital Power Corp (10,616) (1,122) Preferred deemed dividends (584) — Preferred dividends (54) — Loss available to common shareholders $ (11,254) $ (1,122) Basic and diluted net loss per common share $ (0.88) $ (0.16) Basic and diluted weighted average common shares outstanding 12,789,130 6,916,568 Comprehensive Loss Loss available to common shareholders $ (11,254) $ (1,122) Other comprehensive income (loss) Change in net foreign currency translation adjustments 152 (362) Net unrealized loss on securities available-for-sale, net of income taxes 5,171 — Other comprehensive income (loss) 5,323 (362) Total Comprehensive loss $ (5,931) $ (1,484) DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

Coolisys Technologies, Inc (“Coolisys”) is primarily focused on world-class technology-based solutions where innovation is the main driver for mission-critical applications and lifesaving services. Coolisys will nurture its current and future subsidiaries including Digital Power Corporation, Digital Power Limited, Power-Plus, Microphase Corporation and other innovative technology driven organizations to “think out of the box” to achieve goals that previously seemed insurmountable. Coolisys Technology, Inc. was incorporated on April 25, 2017. Coolisys acquired Microphase Corp., a market leader of advanced radiofrequency (RF)/microwave and millimeter-wave products to defense and aerospace OEMs. With Coolisys’ broad spectrum of technology solutions, Coolisys acquired Power-Plus Technical Distributors, a company devoted to integrated and customized power solutions. Along with defense and aerospace, Coolisys primary market focus is on finding solutions for medical, industrial, telecom and cryptocurrency markets. Coolisys’ portfolio still includes Digital Power Corporation, which is a dedicated power solutions group. Its longstanding relationship with Gresham Power resides in our defense and aerospace group with a focus on the European market. Coolisys anticipates completing its newest acquisition, Enertec Systems. Enertec Systems is an Israeli-based developmental and manufacturing company for the defense and aerospace market. It also specializes in highly customized advanced products for the medical field. Other key initiatives include developing highly-efficient, reach-featured cryptocurrency power supplies along with developing the first Coolisys’ high-processes cryptocurrency miner. Coolisys also plans on increasing the US defense manufacturing capabilities for missiles defense systems and developing advanced DLVA/SLVDA and miniature filter product line to replace legacy product and enter to new markets including 5G. Coolisys Technologies, Inc. DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

Digital Power Lending (DPL) provides secured and unsecured debt financing for public and private companies. These loans will typically have 6-12 months maturity, and range from $250k to $5 million. We utilize our employees’ extensive track record of investment banking and network of family offices and hedge funds to share deal flow and cross pollinate investment opportunities within our network.DPL was organized in November of 2016 and secured a California Finance Lenders License #60DBO-77905 on February 23, 2018 to provide capital financing internally to subsidiaries and divisions of DPW as well as unaffiliated businesses that qualify pursuant to its investment criteria.DPL is a fintech company and will develop a network of cryptocurrency ATMS, first in California, and potentially elsewhere in the United States in the future. We plan on operating a financial platform and entering into curated blockchain lending. Digital Power Lending DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc. Super Crypto Mining – building mining farms with the goal of having 10,000 active mining machines by the end of 2018, subject to financing. Have purchased 2,500+ miners to date well on track to reach the goal. Active financing to ensure the ability to purchase more machines. Secured an agreement giving access to 25 megawatts of power which will power over 20,000 mining machines. Super Crypto Power – With the help of our sister company, Coolisys Technologies, Inc., are offering power supplies to support the crypto-mining industry. Also bringing an advanced power supply to market in the near future.Super Crypto Miner – In development of ASCI miner jointly with Coolisys Technologies.Super Crypto Cloud – Completed one round of Cloud mining services. Additional Cloud Offerings are planned for 2018.Super Crypto Blockchain – Taking short-term revenue and re-investing for the long term in mainstream Blockchain opportunities. Considering opportunities in Real-Estate and Finance. Super Crypto Mining

MTIX DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc. High voltage, high-frequency electrical discharge plasma and laser energy to enhance textiles. Atmospheric pressure, inserted gases with a combination of plasma and photonic energy to effect material synthesis. Key features:“Green technology” impact investment.Dry process.Significant reduction of environmental impact (energy, chemicals, water, greenhouse gas).Significant cost saving and performance improvements.In addition to providing a finishing platform free of toxic chemicals, independent studies have shown MLSE reduces water consumption by 75.5%, reduces greenhouse gas over baseline by 90.9% and reduces chemical use by 94.8%.As of April 16, 2018, we have machines that are in progress and that will provide substantial revenue to Coolisys in 2018. We believe the $50 million purchase order is now well under way.

As previously stated, we are committed to making strategic mergers and acquisitions that we believe will maximize shareholder value. We are in active negotiations with companies in commercial defense, hospitality and crypto-mining with acquisitions of Enertec and Flexisphere currently pending.We continue to seek opportunities that we see as undervalued assets and emerging technologies. We will continue to acquire companies that increase the performance and value of our existing business units, working smarter as we leverage efficiencies to drive performance. New Acquisitions DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

2018 Initiatives The Company Initiatives for 2018 include:The Coolisys team lead by CEO Amos Kohn anticipates closing the acquisition of Enertec Systems in the 2nd quarter of 2018. It will also continue to develop advanced power solutions for the crypto space, defense and aerospace, industrial endeavors and the medical field. The team is focused on leveraging efficiencies to maximize revenue between the family of companies. William “Bill” Corbett, CEO of Digital Power Lending’s is focused on an aggressive rollout of their online lending platform during the 2nd quarter of 2018 and anticipates the expansion of its service portfolio to include micro-loans to consumers as well as real estate mortgages. Digital Power Lending will continue to build out its commercial lending operations and expects the revenues from the lending business to become a larger contributor to DPW’s overall profitability for fiscal 2018.Super Crypto, lead by Darren Magot, CEO, is focused on the immediate goal of having 10,000 miners by the end of 2018. By the end of April, we will have 2,500+ miners well-on pace for the year. Additional Cloud Mining offerings and sales of power supplies will drive 2018 revenue numbers. Because of the strong interest in our test-the-waters Reg-A+ tier II, we believe we are on the right path to attaining our goals. DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

Summary DPW Holdings, Inc. is leveraging the success of 2017 as we continue with the momentum in 2018. With the primary focus on growing each subsidiary to add shareholder value. We are looking forward to the success of DP Lending’s microlending program, commercial loans to businesses, and real estate loans. Additionally, we believe in the inherent stored value in Bitcoin and are confident that Super Crypto’s focus on mining and holding Bitcoin over time is a winning strategy. We reaffirm that we maintain our objective to have 10,000 operating miners by the end of the year. Our subsidiary, Coolisys, also has a busy 2018 as they work on finalizing acquisitions, further integrating the companies, and increasing the US defense manufacturing capabilities for missiles defense systems, amongst others. We also have other projects developing that we will update investors on specific to hospitality and real-estate investments in 2018.Overall, DPW Holdings is evolving as planned with a combination of growth and carefully planned acquisitions. We believe we are on the right path to achieving our goals and maximizing shareholder value. DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc.

Thank You DPW Holdings, Inc. information cannot be disclosed or reprinted without prior written permission from DPW Holdings, Inc. Please go to www.DPWHoldings.com to review the letter from our Chairman. DPW HOLDINGS, INC.