Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - UQM TECHNOLOGIES INC | c449-20171231ex32184f24e.htm |

| EX-31.2 - EX-31.2 - UQM TECHNOLOGIES INC | c449-20171231ex312934cff.htm |

| EX-31.1 - EX-31.1 - UQM TECHNOLOGIES INC | c449-20171231ex311cd0bb7.htm |

| EX-23.2 - EX-23.2 - UQM TECHNOLOGIES INC | c449-20171231ex232ef2db0.htm |

| EX-23.1 - EX-23.1 - UQM TECHNOLOGIES INC | c449-20171231ex231e25089.htm |

| EX-21.1 - EX-21.1 - UQM TECHNOLOGIES INC | c449-20171231ex21128878a.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended December 31, 2017 |

OR

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from |

Commission file number 1-10869

UQM TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Colorado |

|

84-0579156 |

|

(State or other jurisdiction |

|

(I.R.S. Employer |

|

of incorporation or organization) |

|

Identification No.) |

|

4120 Specialty Place, Longmont, Colorado |

|

80504 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (303) 682-4900

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

|

|

Name of each exchange on which registered |

|

Title of each class |

|

NYSE American |

|

Common Stock |

|

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer [ ] |

Accelerated filer [ ] |

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company) |

Smaller reporting company [X] |

|

|

Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the registrant’s common stock (“Common Stock”) held by non-affiliates as of June 30, 2017, based on the closing price of the Common Stock as reported by the NYSE American on such date was approximately $41,294,661. As of March 18, 2018, there were 54,126,647 shares of the registrant’s Common Stock outstanding.

|

DOCUMENTS INCORPORATED BY REFERENCE |

|

|

Document |

Parts Into Which Incorporated |

|

Portions of the Proxy Statement for the 2018 Annual |

Part III |

|

Meeting of Shareholders. |

|

i

This Report contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. These could be statements regarding our plans, beliefs or current expectations; including those plans, beliefs and expectations of our officers and directors with respect to, among other things, the sufficiency of our cash and other resources to support our continued operations and liquidity needs over the coming twelve months, new product developments, future orders to be received from our customers, sales of products from inventory, future financial results, liquidity and the continued growth of the electric-powered vehicle industry. Important Risk Factors that could cause actual results to differ from those contained in the forward-looking statements are listed below in Part I, Item 1A. Risk Factors.

ITEM 1.

UQM Technologies, Inc., (“UQM”, “Company”, “we”, “our”, or “us”) develops, manufactures and sells power dense, high efficiency electric motors, generators, power electronic controllers and fuel cell compressors for the commercial truck, bus, automotive, marine, and industrial markets. Our primary focus is incorporating our advanced technology as propulsion systems for electric, hybrid electric, plug-in hybrid electric and fuel cell electric vehicles, delivering the heart of the electric vehicle.

We believe our proprietary permanent magnet propulsion motor and motor control technology delivers exceptional performance at a competitive cost. Our principal products include propulsion motors and generators with power ratings from 50 kilowatts to 250 kilowatts, auxiliary motors and electronic controls and DC-to-DC converters. The principal attributes that we believe differentiate our proprietary products are compact size, high torque delivery, high power density (the ratio of power output to weight), design and manufacture of integrated motor/controller systems, and superior energy efficiency with full system ratings as high as 95%.

Our management team has significant experience in the automotive and electric propulsion industry with critical experience in state-of-the-art design and high quality production. We are ISO/TS 16949 certified, the highest level of quality certification in the automotive supplier industry, and ISO 14001 certified, the highest environmental standards. We have an approximately 130,000 square foot combined headquarters and manufacturing facility located in Longmont, Colorado. We were incorporated in 1967 as a Colorado corporation.

In August 2017, we entered into a definitive stock purchase agreement (“Agreement”) with China National Heavy Duty Truck Group Co., Ltd. through its wholly owned subsidiary, Sinotruk (BVI) Limited (collectively, “CNHTC”), the parent company of Sinotruk (Hong Kong) Limited (“Sinotruk”), a leading Chinese commercial vehicle manufacturer, and also announced that UQM and CNHTC plan to create a joint venture (“JV”) to manufacture and sell electric propulsion systems for commercial vehicles and other vehicles in China. CNHTC has headquarters in Jinan, China. CNHTC’s investment is expected to occur in two stages. First, CNHTC will acquire newly issued common shares of UQM, resulting in a 9.9% ownership interest of common shares issued and outstanding. This stage was completed on September 25, 2017, with net proceeds to UQM of $5.1 million. Second, CNHTC will acquire additional newly issued common shares resulting in CNHTC owning a total of 34% of UQM’s issued and outstanding common stock on a fully diluted basis. The purchase price is $0.95 per share for each stage, which represents a 15% premium over the 30-day closing price average for the period ending on the last trading date before the execution date of the Agreement. If completed, the total transaction will bring approximately $28.3 million in cash to UQM. The terms of the Agreement were unanimously approved by the boards of directors of both companies. UQM shareholders will continue to hold their shares in UQM, and UQM stock will continue to be traded on the NYSE American.

Closing of the second stage investment is subject to certain closing conditions, including the approval by the Committee on Foreign Investment in the United States (“CFIUS”) under Section 721 of the Defense Production Act of 1950, as amended, as it would result in a material investment by a foreign-controlled entity in UQM. On March 5, 2018, we announced that UQM, along with CNHTC, have decided to withdraw their joint application to CFIUS for the approval of the second stage investment provided. Based upon the request of CFIUS, the application has been withdrawn to allow

1

for more time to consider modifications to the business relationship of UQM and CNHTC that CFIUS would find acceptable. Upon completion of this re-evaluation, both parties intend to resubmit the application to CFIUS for approval.

The Market

The global electrified vehicle market is an emerging market with high growth potential being driven by several factors. In China, the market for electric vehicles is driven by strong government pressure to deal with the environmental concerns in its major cities. The government has a number of initiatives to encourage electric vehicle market growth including mandates for purchases of New Energy Vehicles by municipalities, incentives and other tools. We are seeing strong demand for electric buses across several cities and regions. We are also seeing demand for electric buses, delivery vans, trucks and taxi fleets across several cities and regions in China. As China is the world’s largest market for electric vehicles, we believe that our presence in China is critical to our long-term success. Therefore, we continue to devote significant time and resources to business development efforts in China, including the new relationship with CNHTC.

In other global markets, including the United States, the drivers for growth in the electric commercial truck and bus market include the demand for zero tailpipe emissions from full electric vehicles or during the electric only range for hybrids, improved operating costs due to a more efficient powertrain on a gas equivalent basis and reduced maintenance costs for the powertrain system and other systems, such as improved brake life. Moreover, there is community support for cleaner buses and trucks operating in congested areas, along with government incentives and requirements to purchase electric and hybrid vehicles. In the automotive market, these same growth drivers exist, as well as growing consumer acceptance of electric vehicles due to their excellent performance, quiet operation, zero or reduced tailpipe emissions and improved operating cost. In addition, significant Corporate Average Fuel Economy (“CAFE”) standards in the United States are expected to accelerate further electrification of vehicle fleets.

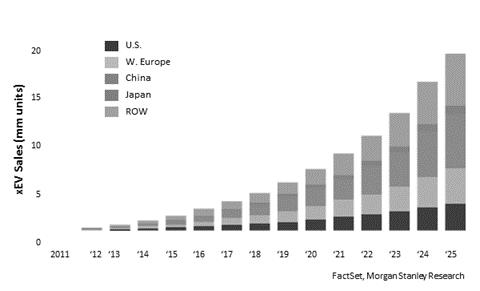

Many studies have been conducted indicating the potential growth for electric vehicles over the next several years. For example, Morgan Stanley Research has forecasted that almost 20 million electric vehicles will be sold by 2025, as shown in the chart below:

There are several economic drivers that support this anticipated growth of electric vehicles. First, and perhaps most important, battery costs, which comprise the single largest component cost in any electric vehicle, have declined dramatically. In 2010, the cost per kW- hour of a lithium-ion battery was about $1,000; in 2015, this cost had fallen to about $200, and is projected to continue to fall. This decline in battery costs has spurred higher demand. Second, published studies have shown that ownership costs of electric vehicles are significantly lower than diesel powered vehicles. A diesel bus, for example, has a range of four miles per gallon; an electric bus has the equivalent of twenty-one miles per gallon. Third, maintenance costs of electric vehicles are significantly lower than diesel powered vehicles.

2

The same studies showed that a diesel bus costs about one dollar per mile to maintain; the maintenance cost for an electric bus was about six cents per mile. All of these economic benefits are helping to drive the market for electric vehicles.

Governments around the world have implemented financial incentives to promote the sales of electric vehicles. For example, the U.S. federal government currently offers a $7,500 federal tax credit for the purchase of an electric passenger vehicle, and there are additional tax credits and other benefits such as HOV lane access in various states for purchasers of qualifying vehicles. In China, beginning on January 1, 2017, subsidies for electric buses varied depending on the efficiency performance of the vehicle, and could reach a maximum subsidy of $120,000 per bus. This bodes well for the use of our propulsion systems since they are highly efficient. In Europe, a majority of European Union member states provide tax incentives for electrically chargeable passenger vehicles, with Norway providing the most generous package of subsidies totaling almost EUR 17,000 (approximately $19,000). The government of India has announced its desire that plug-in vehicles would represent 30 percent of new sales by 2030.

We believe that the trend toward increasing electrification of vehicles coupled with the government subsidies offered world-wide and lower battery and vehicle operating costs provide a substantial opportunity for the broad commercial application of our products.

Business Strategy

We are focused primarily on the transportation markets, with a strong emphasis on the commercial truck and bus space, followed by automotive and then marine, and other applications. We have developed two basic frame size propulsion systems: the PowerPhase® Pro for passenger car, light commercial applications, light duty marine and other lighter duty applications and the PowerPhase® HD lineup of products for heavier commercial bus and truck applications and heavier duty marine and other applications. In 2016, we introduced the PowerPhase® DT, a full electric drivetrain including the motor, inverter, transmission and transmission control unit. We also utilize these products, customized versions of these products and all new custom solutions in these markets to meet various customer requirements. We provide motor and controller systems for full-electric, hybrid electric, plug-in hybrid and fuel cell applications. We also provide units for non-automotive markets including auxiliary systems and motor and controller systems for aircraft. Further, we manufacture fuel cell compressor systems for the fuel cell business.

Our products are used in the following applications:

|

· |

Passenger Buses – Electric and hybrid passenger buses can have large positive impacts on the environment and many municipalities around the world are demanding more of these vehicles on the road. We supply electric propulsion systems to Proterra, Inc., a developer and manufacturer of all-electric composite transit buses, under a multi-year supply agreement. We have also provided electric propulsion systems for customers in China, South America, Europe and Japan. |

|

· |

Commercial Trucks, Vans and Shuttles - We supply electric propulsion systems to Zenith Motors, LLC for their electric shuttle vans and have in the past supplied Electric Vehicles International (“EVI”) for their all-electric medium-duty delivery trucks. |

|

· |

Fuel Cell Compressors – We manufacture fuel cell compressors which are an integral component of hydrogen powered fuel cell vehicles designed for light duty automotive and commercial bus applications for 30kW to 150kW fuel cell stacks. |

|

· |

Aircraft HVAC – We provide small motors and controllers for aircraft HVAC usage to AirComm. |

|

· |

Mining vehicles – In January 2015, we announced a long-term supply agreement with the KESHI Group, a Chinese market leader that manufactures vehicles for the mining industry in China. KESHI will manufacture under license explosion proof electric mining vehicles using UQM’s designs and parts supplied by UQM to KESHI. This first phase is for the vehicles that move the coal from the mines. Future stages could also include vehicles that move people in and out of the mines and other potential applications. |

|

· |

Airplane tugs – In January 2016, we announced that Kalmar Motor AB in Sweden had successfully passed vehicle trials with major airlines and plans on beginning production orders by mid-2016 using our heavy-duty |

3

commercial traction electric motor/controller system, for their TBL50 airplane tugs. Ground handling tugs play a vital role at airports by enabling large aircraft to be moved from their hangars to the passenger gate, as well as for pushback and other taxiing functions on the runway. |

|

· |

Marine –We supply UQM motors and controllers used in a variety of marine applications and for a variety of customers. We believe the marine market could be a growing sector of electrified vehicles. |

|

· |

Automobiles – Government mandates for fuel economy and clean air emissions are accelerating the demand for electric passenger cars. In the United States, for example, CAFE standards will increase the average fuel economy of each manufacturer’s passenger car and light truck model offerings to 35.5 miles per gallon in 2017 and 54.5 miles per gallon by 2025. We have in the past provided electric propulsion systems to many original equipment manufacturers (“OEMs”) for testing and product development. |

Our business strategy is also comprised of the following:

|

· |

Highly qualified and experienced management – We have a management team with significant experience in the automotive industry and the requirements for high quality production programs and very deep technical knowledge of the electric motor and controller business. |

|

· |

State-of-the-art manufacturing facility – Our headquarters and manufacturing plant are located in an approximately 130,000 square foot facility. We have designed, installed and qualified volume production lines for our motors and their related electronic controllers. |

|

· |

Manufacturing capacity – We currently have the capacity to build motor/controller systems, in quantities sufficient to meet demands of our current and future customers for the foreseeable future. |

|

· |

Highest production quality standards – Our Company is certified under the ISO/TS 16949 standards, the highest level of automotive quality standards in the industry and ISO 14001, the highest environmental standards. |

|

· |

Leading edge technology – Our technology base includes a number of proprietary technologies and patents related to brushless permanent magnet motors, generators and power electronic controllers, together with software code to intelligently manage the operation of our systems. We continue to develop next generation products to achieve improved performance and efficiency, smaller package sizes and lower production costs. |

|

· |

Presence in China – The signing of the Agreement with CNHTC gives us the ability, through the joint venture, to locally manufacture our products in the largest market in the world for electric vehicles. We have hired a vice president of Asia operations and two technical support personnel in China so far and have created UQM Technologies Asia Limited as the legal entity for our Asia headquarters operations. |

Products

We offer a full range of motors and controllers for electric, hybrid electric, plug-in hybrid electric and fuel cell electric commercial trucks, vans, buses and automobiles. Our current core electric propulsion products are:

|

· |

PowerPhase HD® 220: Designed for medium and heavy duty trucks and buses. |

|

· |

PowerPhase HD® 220(+): A high continuous power version designed for heavy duty trucks and buses that requires additional power for higher GVW or more challenging hilly terrain, this product delivers 25% higher continuous performance compared to the PowerPhase HD® 220. |

|

· |

PowerPhase HD® 950T: A high torque version designed for commercial vehicle that requires additional torque where gear ratios are limited, this product delivers especially high torque performance compared to the PowerPhase HD® 220. |

|

· |

PowerPhase HD® 250: A high voltage version of the product that produces high torque and power, designed for buses as well as medium and heavy duty trucks. |

4

|

· |

PowerPhase DT®: A full electric drivetrain, this system includes our PowerPhase HD® 220/250 motor and inverter system, an Eaton 2-speed transmission, and a Pi Innova transmission control unit. |

|

· |

PowerPhase Pro® 100: Designed for passenger vehicles and light duty truck or van applications. |

|

· |

PowerPhase Pro® 135: The PP 135 offers higher performance for those applications that require it versus our PowerPhase Pro® 100. |

|

· |

Auxiliary Motor Systems: Multiple products are offered for compressor, pump and fan applications, including a family of motor/controller systems for fuel cell air compressors, an integrated motor/controller for aircraft air conditioning compressors, and an integrated motor/controller for aircraft air conditioning condenser fans. |

|

· |

Custom Solutions: We offer variations of the above motors in semi-custom configurations as well as fully customized solutions to meet individual customer specifications. |

|

· |

R340 and R410 Fuel Cell Compressor Systems: These fuel cell compressors are used in hydrogen powered fuel cell vehicles. |

Product Development Activities

We continue to develop new variations of our product lineup to meet expanding customer requirements and work on custom solutions for new prospective customers meeting their precise specifications. We are also developing the next generation of PowerPhase Pro® and PowerPhaseHD® products designed to be smaller, lighter weight, more energy efficient and producible at lower cost with equal or better performance than our current PowerPhase systems. The resulting products from this development effort are expected to launch in the next two years. Development targets include a substantial size and cost reduction of the motor controllers. Adopting new generation components and control strategies are also elements of this development. Target applications include automotive and light commercial truck, medium and heavy-duty truck, and bus, markets.

In September, 2016, we completed our work on an advanced motor design technology that eliminates the need for rare-earth elements in the magnets. The technology incorporates permanent magnets of an alternate chemistry, arranged in a unique way that maintains performance benefits. A patent has been awarded to protect this innovation. We had a $4.0 million program with the Department of Energy (“DOE”) to develop non-rare-earth magnet electric motors for use in electric and hybrid vehicles. The DOE provided $3.0 million of funding for this program and the Company provided $1.0 million of cost-share contribution. This award was announced in August 2011.

In January 2017, we announced a development agreement with Meritor, Inc. to jointly develop and supply full electric axle systems (E-axles) targeting the medium and heavy-duty commercial vehicle market. This next-generation technology could accelerate market demand over the next few years due to improved component packaging, lower costs from integration, and increased vehicle performance.

5

Excess Inventory

We re-evaluated the carrying value of the PowerPhase Pro® inventory during 2016 and as of December 31, 2016. A key factor in our analysis during the nine months ended December 31, 2016 was that in October of 2016, our customer ITL had informed us of their intention to purchase in cash a significant portion of the PowerPhase Pro® inventory, which did not happen. Because of the long delays in this customer’s product launch and the lack of a significant cash payment towards this inventory, we determined that, out of a total of $7.6 million, approximately $6.8 million of this inventory should be reserved as excess inventory and we took a charge for this amount against this inventory as of December 31, 2016. At that time, we had purchase orders from existing customers to acquire the remaining balance of the PowerPhase Pro® inventory. We also reserved approximately $350,000 for other obsolete inventory as of December 31, 2016. As of December 31, 2017, no additional reserve was required.

Competition

All of the markets in which we operate are highly competitive and are characterized by changes due to technological advances that could render existing technologies and products obsolete, although we are not currently aware of any such advances that could render our current product portfolio obsolete. We believe our competitors are large automotive OEMs, Tier 1 suppliers to OEMs, Chinese electric motor manufacturers offering lower cost options, and numerous other competitors in nearly every region of the world.

As a result, additional vehicle makers in both on-road and off-road markets are expected to develop and introduce a variety of hybrid electric and all-electric vehicles as market acceptance of these vehicles continues to grow. We cannot assure that we will be able to compete successfully in this market or any other market that now exists or may develop in the future. There are numerous companies developing products that do or soon will compete with our systems. Some of these companies possess significantly greater financial, personnel and other resources than we do, including established supply arrangements, volume manufacturing operations and access to governmental incentive programs.

Customers and Suppliers

We derive our revenue from the following sources: 1) the sale of products designed, engineered and manufactured by us primarily to OEMs, Tier 1 suppliers of OEMs, and vehicle integrators; 2) funded contract research and development services performed for strategic partners, customers, and in the past from the U.S. government, directed toward either the advancement of our proprietary technology portfolio or the application of our proprietary technology to customers’ products; and 3) after-market services and remanufacture.

Our business is subject to revenue fluctuation based on the buying cycles of our customers. Specific customers that reach 10% or more of revenues in any given fiscal quarter or year will also vary depending on these buying cycles. In the fiscal year ended December 31, 2017, two customers individually comprised 10% or more of our total revenues. Any loss of business with these customers could have a material adverse effect on our business, financial condition and results of operation.

Principal raw materials and components purchased by us include iron, steel, electronic components, rare-earth magnets and copper wire. Most of these items are available from several suppliers. In the fiscal year ended December 31, 2017, one supplier comprised 10% or more of our total purchases. Certain components used by us are custom designs and if our current supplier no longer made them available to us, we could experience production delays.

We can experience significant price fluctuation in the cost of magnets used in our motors, which contain the rare-earth elements neodymium and dysprosium and are primarily sourced from China. We have not experienced any disruption in supply of magnets, and magnet prices may continue to be volatile until mining operations outside of China increase or restart.

6

Financial Information about Geographic Areas

The following summarizes total revenue by geographic area:

|

|

|

Year ended December 31, |

|

Nine months ended December 31, |

||

|

|

|

2017 |

|

2016 |

||

|

United States |

|

$ |

4,009,941 |

|

$ |

3,101,153 |

|

Foreign Countries |

|

|

3,768,808 |

|

|

1,021,842 |

|

|

|

$ |

7,778,749 |

|

$ |

4,122,995 |

Classification of geographic area is determined based upon the country where the purchase transaction originated.

U.S. Government Contracts

We had a $4.0 million program with the DOE to develop non-rare-earth magnet electric motors for use in electric and hybrid vehicles. This grant ended in September 2016. The DOE provided $3.0 million of funding for this program and the Company provided $1.0 million of cost-share contribution. The objective of the program was to identify and evaluate magnet materials and technology that can deliver performance comparable to our rare-earth magnet motors, broaden our product portfolio, potentially lower magnet costs and limit our exposure to price and supply concerns associated with rare-earth magnets. We have been granted a U.S. patent for our electric and hybrid electric vehicle motor design using non-rare earth magnets.

Backlog

Our order backlog for products at January 31, 2018 was approximately $2.4 million versus $4.9 million at January 31, 2017. Certain orders are blanket purchase orders which are subject to the issuance of subsequent release orders directing the number and timing of actual deliveries. We had backlog of service contracts from customers, which will provide future revenue upon completion, totaling approximately $200,000 at January 31, 2018 versus $0 at January 31, 2017. Substantially all of the backlog amounts at January 31, 2018 and 2017 are subject to amendment, modification or cancellation. We expect to ship motor and controller backlog products over the next twelve months.

Intellectual Property

We have numerous patents in the United States and in other countries to protect our intellectual property.

We determine if our intellectual property should be treated as a trade secret or submitted to the patent application process by deciding whether a technology successfully passes through three evaluation gates. The first gate is an assessment of whether the expected breadth of the patent would offer a high level of protection or whether it will serve as an educational tool for competitors. Based upon a patent and literature search, if the expected coverage is broad, the evaluation moves to the second gate, which is an assessment of infringement detection. This is a review of whether or not it will be possible to detect patent infringement if a competitor were to adopt the technology. Difficulty in detection reduces the value of a patent and will lead us to handle the technology as a trade secret rather than a patent. The last gate is an assessment of whether the technology will have value for many years or whether the technology is a stepping stone to a different technology. The patent process is a multi-year endeavor from the initial disclosure to the granted patent, which leads to the importance of this gate. A technology that is expected to have value for five or more years will pass the final gate and the patent application process will then commence.

We also implement measures to protect our intellectual property, including the guarding and protection of source code, nondisclosure of control techniques, and protection of product design details, drawings and documentation.

Trademarks

We have registered the letters "UQM" in the U.S. Patent and Trademark Office. Counterpart applications have been filed in numerous countries throughout the world, most of which have granted registrations or indicated them to be allowable. We own three U.S. Trademark Registrations for "UQM" (International Class 7 for power transducers, Class 12 for utility land vehicles, and Class 16 for publications). The foreign trademark registrations and applications include major markets where we are doing business or establishing business contacts.

7

We have also registered the trademark "POWERPHASE" which we use in conjunction with certain of our propulsion systems. The trademark is registered in the European Community and several other foreign countries.

As of January 31, 2018, we had 51 employees, all of whom are full-time employees. We have entered into employment agreements with our executive officers. The employment agreements expire on December 31, 2019. We believe our relationship with employees has been generally satisfactory.

In addition to our full-time staff, we from time to time engage the services of outside consultants and contract employees to meet peak workload or specialized program requirements. We do not anticipate any difficulty in locating additional qualified engineers, technicians and production workers, if so required, to meet expanded research and development or manufacturing operations.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Anyone seeking information about our business can receive copies of our 2017 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports and other documents, filed with the SEC at the public reference section of the SEC at 100 F Street, NE, Room 1580, Washington, D.C. 20549. These documents also may be obtained, free of charge, by: contacting our Investor Relations office by e-mail at investor@uqm.com; by phone at (303) 682-4900; writing to UQM Technologies, Inc., Investor Relations, 4120 Specialty Place, Longmont, CO 80504-5400; or accessing our website at www.uqm.com. We make our Transition Report on Form 10-KT, Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, available on our website as soon as reasonably practicable after we file or furnish the materials electronically with the SEC. To obtain any of this information, go to www.uqm.com, select “Investor Relations” and select the form you would like to access. Our website also includes our Audit Committee Charter and Code of Business Conduct and Ethics as well as the procedures for reporting a violation of business ethics. Information on our website does not constitute part of this Annual Report.

We operate in a challenging and changing environment that involves numerous known and unknown risks and uncertainties that could materially affect our operations. The risks, uncertainties and other factors set forth below may cause our actual results, performances or achievements to be materially different from those expressed or implied by our forward-looking statements. If any of these risks or events occur, our business, financial condition or results of operations may be adversely affected.

We have incurred significant losses and may continue to do so.

We have incurred significant net losses as shown in the following tables:

|

|

|

Year ended December 31, |

|

Three months ended March 31, |

|

Nine months ended December 31, |

||||||

|

|

|

2017 |

|

2016 |

|

2016 |

|

2016 |

||||

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

Net loss |

|

$ |

4,778,316 |

|

$ |

13,948,426 |

|

$ |

930,918 |

|

$ |

13,017,508 |

We determined in 2016 that most of our PowerPhase Pro® inventory was impaired. As a result, the net loss for the year ended December 31, 2016 (unaudited) and nine months ended December 31, 2016 includes a reserve for excess inventory of $6,817,010 related to that inventory and a reserve of $349,906 for other obsolete inventory.

As of December 31, 2017, we had an accumulated deficit of $124,671,250.

8

In the future, we plan to make additional investments in product development, facilities and equipment and other costs related to the commercialization of our products. As a result, we expect to continue to incur net losses for the foreseeable future.

Our operating losses, anticipated capital expenditures and working capital requirements in the longer term may exceed our current cash balances.

Our net loss for the year ended December 31, 2017 was $4,778,316 versus a net loss for the nine months ended December 31, 2016 of $13,017,508 (which includes a reserve for excess and obsolete inventory of $7,166,916). At December 31, 2017, our cash, cash equivalents and restricted cash totaled $6,809,325. We expect our losses to continue for the foreseeable future. Our existing cash resources and cash generated from our revenues, are expected to be sufficient to complete our business plan for at least the next twelve months. Should those resources be insufficient, we may need to renegotiate existing debt, secure additional debt or equity funding, which may not be available on terms acceptable to us, if at all.

We may not be able to sell the remaining PowerPhase Pro® inventory and may recognize additional loss on the value of this inventory carried on our books.

Following the write-down of the value of inventory of the PowerPhase Pro® systems we still have aged inventory of $739,262 of PowerPhase Pro® systems. Based upon anticipated customer demand, we continue to believe there is still a market for this product. If customers do not purchase the amount of inventory they have ordered or we are unable to find new customers for this inventory, it may become obsolete, causing an adverse effect on our results of operations.

Our business depends, in part, on the expansion of the market for all-electric and hybrid electric vehicles.

Although our electric propulsion systems may be used in a wide variety of products, the market for electric and hybrid vehicles is fairly new. At the present time, batteries used to power electric motors have limited life and require several hours to charge, and charging stations for electric motors are not widely available. Electric and hybrid vehicles also tend to be priced higher than comparable gasoline-powered vehicles. As a result, consumers may experience concerns about driving range limitations, battery charging time and higher purchase costs of electric or hybrid vehicles. If consumer preferences shift to vehicles powered by other alternative methods, or if concerns about the availability of charging stations cannot be overcome, the market for all-electric vehicles, and therefore our electric propulsion systems, may be limited. In addition, our electric propulsion systems are incorporated in buses used for mass transit in several U.S. cities. If passenger traffic in these mass transit systems declines or government funding to transportation districts declines from current levels, demand for our products may also decrease.

The popularity of alternative fuel based vehicles and “green energy” initiatives are highly dependent on macro-economic conditions, including oil prices and the overall health of the economy. When oil prices fall, interest in and resources allocated to the development of advanced technology vehicles and propulsion systems may diminish. We cannot predict how and the extent to which the recent substantial decrease of oil prices will affect the domestic interest in electric and hybrid vehicles. Downturns in the world economy may also have a severe impact on the automotive industry, slowing the demand for vehicles generally and reducing consumers' willingness to pay more for environmentally friendly technology.

If our products do not achieve market acceptance, our business may not grow.

Although we believe our proprietary systems are suited for a wide-range of vehicle electrification applications, our business and financial plan relies heavily on our introduction of new products that have limited testing in the marketplace. We have made substantial investments in manufacturing facilities and equipment, production and application engineering, among other things, to increase our production capacity in order to capitalize on the anticipated expansion in demand for electric propulsion systems and generators in the commercial truck, bus and automobile markets. We cannot be certain that our existing products will achieve broad market acceptance, or that we will be able to develop new products or product enhancements that will achieve broad market acceptance.

9

Our sales cycle is inherently long.

We must go through lengthy processes to achieve supply contracts with our customers. Our products must conform to the technical specifications of the customer and meet design requirements of the electric vehicle. Typically prototype testing is required to ensure consistent system performance on an ongoing basis. These steps can often take many months to multiple years until decisions are made on whether or not to take a vehicle to production. We may spend considerable financial and human resources over an extended period of time and not end up with a completed supply contract. Failure to secure volume production levels within a reasonable period of time could have an adverse effect on our results of operations and our liquidity.

CODA Automotive filed for bankruptcy protection on May 1, 2013 and it is unlikely we will be able to recover more than insignificant amounts due to us under our CODA Supply Agreement, including substantial amounts due for accounts receivable, inventory purchases and guaranteed minimum payments.

We executed a ten-year supply agreement with CODA in July, 2009 which provided a framework for CODA, or its manufacturing partner, to purchase from us electric propulsion systems for use in automobiles to be manufactured by CODA. On May 1, 2013, CODA filed for bankruptcy protection. Amounts due from CODA at December 31, 2017 totaled $3,838,092, all of which had been written off as uncollectible in prior years. In addition, CODA was obligated under the supply agreement for inventory purchases totaling approximately $8.2 million and for a guaranteed minimum payment of $2 million due to their failure to purchase at least 15,000 units. It is likely that we will recover only an insignificant amount of the balance owed to us under the CODA supply agreement, if any.

All funding from our DOE Grant to develop non-rare –earth magnet electric motors ended as of September 30, 2016 when the Grant expired.

Funds from the DOE Grant were very useful in supporting our growth initiatives and reducing our losses over the past several years. While we are pursuing other grant opportunities, there can be no assurance that we will be successful in obtaining other government grants.

The reduction or elimination of government subsidies and economic incentives for alternative energy technologies, including our electric vehicle motor technology, could reduce demand for our products and services, lead to a reduction in our revenues and adversely impact our operating results.

We believe that the near-term growth of alternative energy technologies, including our electric vehicle motor technology, relies on the availability and size of government and economic incentives both in the United States and in other countries. Many of these government incentives expire, phase out over time, exhaust the allocated funding, require renewal by the applicable authority, and/or could be reduced or discontinued for other reasons. The reduction, elimination, or expiration of government subsidies and economic incentives may result in the diminished demand from our customers and could materially and adversely affect our future operating results.

We are subject to risks inherent in international operations.

Since we market our products both inside and outside the United States, our success depends in part, on our ability to secure international customers and our ability to manufacture products that meet foreign regulatory and commercial requirements in target markets. In addition, we are subject to tariff regulations and requirements for export licenses. We can face numerous challenges in our international growth plans, including unexpected changes in regulatory requirements, potential conflicts or disputes that countries may have to deal with, fluctuations in currency exchange rates, longer accounts receivable requirements and collections, difficulties in managing international operations, potentially adverse tax consequences, restrictions on repatriation of earnings and the burdens of complying with a wide variety of international laws. Any of these factors could adversely affect our results of operations and financial condition.

Our revenue is highly concentrated among a small number of customers.

A large percentage of our revenue is typically derived from a small number of customers, and we expect this trend to continue.

10

Our customer arrangements generally are non-exclusive, have no long-term volume commitments and are typically done on a purchase order basis. We cannot be certain that customers that have accounted for significant revenue in past periods will continue to purchase our products. Accordingly, our revenue and results of operations may vary substantially from period to period. We are also subject to credit risk associated with the concentration of our accounts receivable from our customers. If one or more of our significant customers were to cease doing business with us, significantly reduce or delay its purchases from us or fail to pay us on a timely basis, our business, financial condition and results of operations could be materially adversely affected.

Our business relies on third parties, whose success we cannot predict.

As a manufacturer of motors, generators, and other component parts, our business model depends on the ability of third parties in our industry to develop, produce and market products that include or are compatible with our technology and then to sell these products into the marketplace. Our ability to generate revenue depends significantly on the commercial success of our customers and partners. Failure of these third parties to achieve significant sales of products incorporating our products and fluctuations in the timing and volume of such sales could have a material adverse effect on our business, financial condition and results of operations.

Our electric propulsion systems use rare-earth minerals and unavailability or limited supply of these minerals could prevent us from manufacturing our products in production quantities or increase our costs.

Neodymium and dysprosium, rare-earth minerals, are key elements used in the production of magnets that are components of our electric propulsion systems. We currently source our magnets from China, and China has indicated its intent to retain more of this mineral for China use, rather than exporting it. During calendar year 2011, for example, we experienced significant price escalation in the cost of magnets used in our motors. This price escalation was primarily due to rare-earth government policy in China. Rare-earth prices have decreased substantially since peaking in the summer of 2011, and are now approaching the baseline prices (defined as the beginning of calendar year 2011). We have implemented a magnet surcharge process to recover these additional costs in the event of another price escalation. Although rare-earth magnets are available from other sources, these alternative sources are currently more costly. Reduced availability of neodymium and dysprosium from China could adversely affect our ability to obtain magnets in sufficient quantities, in a timely manner, or at a commercially reasonable cost. In the event that China's actions cause us to seek alternate sources of supply for magnets, it could cause an increase in our product costs, thereby reducing or eliminating our profit margin on electric propulsion systems if we are unable to pass the increase on to our customers. Increasing prices to our customers due to escalating magnet costs may reduce demand for our motors and make it difficult or impossible to compete with other motor manufacturers whose motors do not use rare-earth minerals.

Some of our contracts can be cancelled with little or no notice and could restrict our ability to commercialize our technology.

Our contracts with government agencies are subject to the risk of termination at the convenience of the contracting agency and in some cases grant "march-in" rights to the government. March-in rights are the right of the United States government or the applicable government agency, under limited circumstances, to exercise a non-exclusive, royalty-free, irrevocable worldwide license to any technology developed under contracts funded by the government to facilitate commercialization of technology developed with government funding. March-in rights can be exercised if we fail to commercialize the developed technology. The exercise of march-in rights by the government or an agency of the government could restrict our ability to commercialize our technology.

Some of our orders for the future delivery of products are placed under blanket purchase orders which may be cancelled by our customers at any time. The amount payable to us, if any, upon cancellation by the customer varies by customer. Accordingly, we may not recognize as revenue all or any portion of the amount of outstanding order backlog we have reported.

We face intense competition and may be unable to compete successfully.

In developing electric motors for use in vehicles and other applications, we face competition from very large domestic and international companies, including the world's largest automobile manufacturers. Many of our competitors have far greater resources to apply to research and development efforts than we have, and they may independently develop motors that are technologically more advanced than ours. These competitors also have much greater experience in and

11

resources for marketing their products. For these reasons, potential customers may choose to purchase electric motors from our competitors rather than from us.

Changes in environmental policies could hurt the market for our products.

The market for electric and other alternative fuel vehicles and equipment and the demand for our products are influenced, to a degree, by federal, state and local regulations relating to air quality, greenhouse gases and pollutants. These laws and regulations may change, which could result in transportation or equipment manufacturers abandoning or delaying their interest in electric or hybrid electric vehicles or equipment. In addition, a failure by authorities to enforce current laws and regulations or to adopt additional environmental laws or regulations could limit the demand for our products.

Although many governments have identified as a significant priority the development of alternative energy sources, governments may change their priorities, and any change they make could materially affect our revenue or the development of our products.

If we are unable to protect our patents and other proprietary technology, we will be unable to prevent third parties from using our technology, which would impair our competitiveness and ability to commercialize our products. In addition, the cost of enforcing our proprietary rights may be expensive and result in increased losses.

Our ability to compete effectively against other companies in our industry will depend, in part, on our ability to protect our proprietary technology. Although we have attempted to safeguard and maintain our proprietary rights, we do not know whether we have been or will be successful in doing so. We have historically pursued patent protection in the United States and a limited number of foreign countries where we believe significant markets for our products exist or where potentially significant competitors have operations. It is possible that a substantial market could develop in a country where we have not received patent protection and under such circumstances our proprietary products would not be afforded legal protection in these markets. Further, our competitors may independently develop or patent technologies that are substantially equivalent or superior to ours. We cannot assure that additional patents will be issued to us or, if they are issued, as to the scope of their protection. Patents granted may not provide meaningful protection from competitors. Even if a competitor's products were to infringe patents owned by us, it would be costly for us to pursue our rights in an enforcement action, it would divert funds and resources which otherwise could be used in our operations and we may not be successful in enforcing our intellectual property rights. In addition, effective patent, trademark, service mark, copyright and trade secret protection may not be available in every country where we may operate or sell our products in the future. If third parties assert technology infringement claims against us, the defense of the claims could involve significant legal costs and require our management to divert time and attention from our business operations. If we are unsuccessful in defending any claims of infringement, we may be forced to obtain licenses or to pay royalties to continue to use our technology. We may not be able to obtain any necessary licenses on commercially reasonable terms or at all. If we fail to obtain necessary licenses or other rights, or if these licenses are costly, our results of operations may suffer either from reductions in revenues through our inability to serve customers or from increases in costs to license third-party technologies. Finally, patents may not deter third parties from attempting to reverse engineer our products and discovering our intellectual property.

We rely, in part, on contractual provisions to protect our trade secrets and proprietary knowledge, the adequacy of which may not be sufficient.

Confidentiality agreements to which we are party may be breached, and we may not have adequate remedies for any breach. Our trade secrets may also be known without breach of such agreements or may be independently developed by competitors. Our inability to maintain the proprietary nature of our technology and processes could allow our competitors to limit or eliminate any competitive advantages we may have.

Use of our motors in vehicles could subject us to product liability claims or product recalls, and product liability insurance claims could cause an increase in our insurance rates or could exceed our insurance limits, which could impair our financial condition, results of operations and liquidity.

The automotive industry experiences significant product liability claims. As a supplier of electric propulsion systems or other products to vehicle OEMs, we face an inherent business risk of exposure to product liability claims in the event that our products, or the equipment into which our products are incorporated, malfunction and result in personal injury or

12

death. We may be named in product liability claims even if there is no evidence that our systems or components caused an accident. Product liability claims could result in significant losses as a result of expenses incurred in defending claims or the award of damages. The sale of systems and components for the transportation industry entails a high risk of these claims, which may increase as our production and sales increase. In addition, we may be required to participate in recalls involving these systems if any of our systems prove to be defective, or we may voluntarily initiate a recall or make payments related to such claims as a result of various industry or business practices or the need to maintain good customer relationships.

We carry product liability insurance of $10 million covering most of our products. If we were to experience a large insured loss, it might exceed our coverage limits, or our insurance carriers could decline to further cover us or raise our insurance rates to unacceptable levels, any of which could impair our financial position and results of operations. Any product liability claim brought against us also could have a material adverse effect on our reputation.

We may be subject to warranty claims, and our provision for warranty costs may not be sufficient.

We may be subject to warranty claims for defects or alleged defects in our products, and the risk of such claims arising will increase as our production and sales increase. In addition, in response to consumer demand, vehicle manufacturers have been providing, and may continue to provide, increasingly longer warranty periods for their products. As a consequence, these manufacturers may require their suppliers, such as us, to provide correspondingly longer product warranties. As a result, we could incur substantially greater warranty claims in the future.

Our future success will depend on our ability to attract and retain qualified management and technical personnel.

Our future success is substantially dependent on the continued services and on the performance of our executive officers and other key management, engineering, manufacturing and operating personnel. The loss of the services of any executive officer, or other key management, engineering, manufacturing and operating personnel, could materially adversely affect our business. Our ability to achieve our growth plans will also depend on our ability to attract and retain additional qualified management and technical personnel, and we do not know whether we will be able to be successful in these regards. Our inability to attract and retain additional qualified management and technical personnel, or the departure of key employees, could materially and adversely affect our growth plans and, therefore, our business prospects, results of operations and financial condition.

The maintenance and security of our information systems are critical to our operations.

We rely on our information systems to be functioning at all times, and that the data in those systems is protected and secure from viruses, illegal access and any other form of unauthorized use. Should our information systems be compromised in any way, our business operations could be severely impacted.

13

Threats to information technology systems associated with cybersecurity risks and cyber incidents or attacks continue to grow. Cybersecurity attacks could include, but are not limited to, malicious software, viruses, attempts to gain unauthorized access, whether through malfeasance or error, either from within or outside of our organization, to our data or that of our customers or our customers’ customers which may be in our possession, and the unauthorized release, corruption or loss of the data, loss of the intellectual property, theft of the proprietary or licensed technology, whether ours, that of our customers or their customers, loss or damage to our data delivery systems, other electronic security breaches that could lead to disruptions in our critical systems, and increased costs to prevent, respond to or mitigate cybersecurity events. It is possible that our business, financial and other systems could be compromised, which might not be noticed for some period of time. Although we utilize various procedures and controls to mitigate our exposure to such risk, cybersecurity attacks are evolving and unpredictable and we cannot guarantee that any risk prevention measures implemented will be successful. The occurrence of such an attack could lead to financial losses and have a material adverse effect on our reputation, business, financial condition and results of operations.

Our stock price has been and could remain volatile.

The market price for our common stock has been and may continue to be volatile and subject to extreme price and volume fluctuations in response to market and other factors, including the following, some of which are beyond our control:

|

· |

failure to meet growth expectations; |

|

· |

variations in our quarterly operating results from the expectations of investors; |

|

· |

downward changes in general market conditions; |

|

· |

announcements of new products or services by our competitors; |

|

· |

announcements by our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

|

· |

additions or departures of key personnel; |

|

· |

investor perception of our industry or our prospects; |

|

· |

insider selling or buying; |

|

· |

demand for our common stock; and |

|

· |

general technological or economic trends. |

In the past, following periods of volatility in the market price of their stock, many companies have been the subjects of securities class action litigation. If we become involved in securities class action litigation in the future, it could result in substantial costs and diversion of management’s attention and resources and could harm our stock price, business prospects, results of operations and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We own our offices and manufacturing facility and believe the facility to be well maintained, adequately insured and suitable for its present and intended uses. Information concerning our facility as of December 31, 2017 is set forth in the table below:

|

|

|

|

|

Ownership or |

|

|

|

|

Location |

|

Square Feet |

|

Expiration Date of Lease |

|

Use |

|

|

Longmont, Colorado |

|

129,304 |

|

Own |

|

Manufacturing, laboratories and offices |

|

Litigation

We are involved in various claims and legal actions arising in the ordinary course of business. In the opinion of management, and based on current available information, the ultimate disposition of these matters is not expected to have a material adverse effect on our financial position, results of operations or cash flow.

14

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NYSE American under the symbol UQM. The high and low trade prices, by fiscal quarter, as reported by the NYSE American stock exchange for the last two fiscal years are as follows:

|

Year Ended December 31, 2017 |

|

High |

|

Low |

|

||

|

Fourth Quarter |

|

$ |

1.66 |

|

$ |

1.10 |

|

|

Third Quarter |

|

$ |

1.34 |

|

$ |

0.73 |

|

|

Second Quarter |

|

$ |

0.96 |

|

$ |

0.46 |

|

|

First Quarter |

|

$ |

0.53 |

|

$ |

0.43 |

|

|

Year Ended December 31, 2016 |

|

High |

|

Low |

|

||

|

Fourth Quarter |

|

$ |

0.62 |

|

$ |

0.42 |

|

|

Third Quarter |

|

$ |

0.69 |

|

$ |

0.54 |

|

|

Second Quarter |

|

$ |

0.90 |

|

$ |

0.55 |

|

|

First Quarter |

|

$ |

0.67 |

|

$ |

0.43 |

|

On March 16, 2018 the closing price of our common stock, as reported on the NYSE American, was $1.40 per share and there were 516 active holders of record of our common stock. Because many of our shares of common stock are held by brokers and other institutions on behalf of shareholders, we are unable to estimate the total number of shareholders represented by these record holders.

We have not paid any cash dividends on our common stock since inception and we intend for the foreseeable future to retain any earnings to finance the growth of our business. Future dividend policy will be determined by our Board of Directors based upon consideration of our earnings, capital needs and other factors then relevant.

15

PERFORMANCE GRAPH 1

The following graph represents the yearly percentage change in the cumulative total return on the common stock of UQM Technologies, Inc., the group of companies comprising the S&P Electrical Components & Equipment Index, and those companies comprising the S&P 500 Index for the five year period from March 31, 2013 through December 31, 2017:

|

|

|

3/13 |

|

3/14 |

|

3/15 |

|

3/16 |

|

12/16 2 |

|

12/17 |

|

|

UQM Technologies, Inc. |

|

100 |

|

356.76 |

|

148.65 |

|

77.31 |

|

58.11 |

|

187.84 |

|

|

S&P 500 |

|

100 |

|

121.86 |

|

137.37 |

|

139.82 |

|

154.46 |

|

188.18 |

|

|

S&P Electrical Components & Equipment |

|

100 |

|

125.16 |

|

115.83 |

|

113.41 |

|

121.22 |

|

154.32 |

|

*$100 invested on 3/31/13 in stock or index, including reinvestment of dividends Fiscal year ending December 31.

Copyright 2018 S&P Global Market Intelligence. All rights reserved.

1 The stock price performance graph depicted is not “soliciting material,” is not deemed "filed" with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation contained in such filing.

2 The Company changed its fiscal year end from March to December in 2016.

16

ITEM 6. SELECTED FINANCIAL DATA

Selected consolidated financial data presented below should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this document.

UQM Technologies, Inc.

Selected Consolidated Financial Data

|

|

|

Year Ended December 31, |

|

Three months ended March 31, |

|

Nine months ended December 31, |

||||||

|

|

|

2017 |

|

2016 |

|

2016 |

|

2016 |

||||

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

|

||

|

Product sales |

|

$ |

7,162,456 |

|

$ |

4,710,654 |

|

$ |

1,218,795 |

|

$ |

3,491,859 |

|

Contract services revenue |

|

$ |

616,293 |

|

$ |

916,629 |

|

$ |

285,493 |

|

$ |

631,136 |

|

Loss from operations |

|

$ |

(5,284,502) |

|

$ |

(13,945,725) |

|

$ |

(940,425) |

|

$ |

(13,005,300) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(4,778,316) |

|

$ |

(13,948,426) |

|

$ |

(930,918) |

|

$ |

(13,017,508) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted |

|

$ |

(0.10) |

|

$ |

(0.29) |

|

$ |

(0.02) |

|

$ |

(0.27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

15,134,176 |

|

$ |

11,272,750 |

|

$ |

23,350,903 |

|

$ |

11,272,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term obligations |

|

$ |

3,241,117 |

|

$ |

141,667 |

|

$ |

288,889 |

|

$ |

141,667 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividend declared per common share |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

17

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

UQM develops, manufactures and sells power dense, high efficiency electric motors, generators, power electronic controllers and fuel cell compressors for the commercial truck, bus, automotive, marine, and industrial markets. We generate revenue from two principal activities: 1) the sale of motors, generators, electronic controls, and fuel cell compressors; and 2) research, development and application engineering contract services. Our product sales consist of annually recurring volume production, prototype low volume sales, and revenues derived from the sale of refurbished and serviced products. The sources of engineering service revenue typically vary from year to year and individual projects may vary substantially in their periods of performance and aggregate dollar value.

We have invested considerable financial and human resources into the development of our technology and manufacturing operations. We have developed and production-validated a full range of products for use in full-electric, hybrid electric, plug-in-hybrid and fuel cell applications for the commercial bus and truck, automotive, marine, military, and industrial markets. These products are all highly efficient permanent magnet designs and feature outstanding performance, package size and weight valued by our customers. Our production capabilities and capacity are sufficient to meet the demands of our current and future customers for the foreseeable future. We are certified as an ISO/TS 16949 quality supplier, which is the highest level of quality standards in the automotive industry, and we are ISO 14001 certified, meeting the highest environmental standards. We have a management team with significant experience in the automotive industry and the requirements for high quality production programs and very deep technical knowledge of the motor and controller business. This team has the ability and background to grow the business to significantly higher levels, and we believe we have adequate cash and bank financing resources to fund our operations for at least the next twelve months.

Our most important strategic initiative going forward is to develop customer relationships that lead to longer-term supply contracts. Volume production is the key to our ongoing operations. We are driving business development in the following ways:

|

· |

We have created a well-defined, structured process to target potential customers of vehicle electric motor technology in the commercial truck/van and shuttles, passenger buses, automotive, marine, military and other targeted markets both domestically and internationally, particularly in China. |

|

· |

We hired our first employees in China in 2016. As China represents the largest market in the world for electric vehicles, our presence in that market is critical to our long-term success. |

|

· |

On August 28, 2017, we entered into a definitive stock purchase agreement (“Agreement”) with China National Heavy Duty Truck Group Co., Ltd. through its wholly owned subsidiary, Sinotruk (BVI) Limited (collectively, “CNHTC”), the parent company of Sinotruk (Hong Kong) Limited (“Sinotruk”), a leading Chinese commercial vehicle manufacturer, and also announced that UQM and CNHTC plan to create a joint venture to manufacture and sell electric propulsion systems for commercial vehicles and other vehicles in China, the largest market in the world for electric vehicles.. |

|

· |

We have developed a customer pipeline where identified potential customers are synergistic and strategic in nature for longer-term growth potential. |

|

· |

We are building long term quantifiable and sustainable relationships within the identified target markets. |

|

· |

We provide service and support to our customers from pilot and test activities through commissioning processes and then ultimately leading to volume production operations. |

|

· |

We improve our purchasing and manufacturing processes to develop competitive costs to ensure that our pricing to customers is market competitive. |

|

· |

We provide customized solutions to meet specification requirements that some customers require. |

18

|

· |

We participate in trade show events globally to demonstrate our products and engage with users of electric motor technology. |

|

· |

We actively involve all functional groups within the Company to support the needs of our customers. |

We believe that the successful execution of these activities will lead us to secure volume production commitments from customers, so that our operations will become cash flow positive and ultimately profitable.

Recent Events

In April 2017, we announced a significant purchase order from a major Chinese OEM for delivery of our R340 fuel cell compressor systems. The purchase order was valued at $2.2 million. Shipments were completed by fall of 2017. These compressor modules are a key component in hydrogen powered fuel cell systems.

In August 2017, we entered into a definitive stock purchase agreement (“Agreement”) with China National Heavy Duty Truck Group Co., Ltd. through its wholly owned subsidiary, Sinotruk (BVI) Limited (collectively, “CNHTC”), the parent company of Sinotruk (Hong Kong) Limited (“Sinotruk”), a leading Chinese commercial vehicle manufacturer, and also announced that UQM and CNHTC plan to create a joint venture (“JV”) to manufacture and sell electric propulsion systems for commercial vehicles and other vehicles in China. CNHTC has headquarters in Jinan, China. CNHTC’s investment is expected to occur in two stages. First, CNHTC will acquire newly issued common shares of UQM, resulting in a 9.9% ownership interest of common shares issued and outstanding. This stage was completed on September 25, 2017, with net proceeds to UQM of $5.1 million. Second, CNHTC will acquire additional newly issued common shares resulting in CNHTC owning a total of 34% of UQM’s issued and outstanding common stock on a fully diluted basis. The purchase price is $0.95 per share for each stage, which represents a 15% premium over the 30-day closing price average for the period ending on the last trading date before the execution date of the Agreement. If completed, the total transaction will bring approximately $28.3 million in cash to UQM. The terms of the Agreement were unanimously approved by the boards of directors of both companies. UQM shareholders will continue to hold their shares in UQM, and UQM stock will continue to be traded on the NYSE American.

Closing of the second stage investment is subject to certain closing conditions, including the approval by the Committee on Foreign Investment in the United States (“CFIUS”) under Section 721 of the Defense Production Act of 1950, as amended, as it would result in a material investment by a foreign-controlled entity in UQM. On March 5, 2018, we announced that UQM, along with CNHTC, have decided to withdraw their joint application to CFIUS for the approval of the second stage investment provided. Based upon the request of CFIUS, the application has been withdrawn to allow for more time to consider modifications to the business relationship of UQM and CNHTC that CFIUS would find acceptable. Upon completion of this re-evaluation, both parties intend to resubmit the application to CFIUS for approval.

In September 2017, we announced that Sinotruk had made an initial purchase of UQM PowerPhase® DT systems for implementation and evaluation in their commercial vehicles. This is the first step towards the long term strategy of utilizing UQM electric drive products across Sinotruk’s portfolio of commercial vehicles signaled the beginning of the commercial partnership with UQM.

In November 2017, we announced we had signed a Joint Venture Agreement (“JVA”) with CNHTC and Sinotruk Global Village Investment Limited, a Hong Kong based limited liability company owned by CNHTC. Under the JVA, we will acquire a 25% ownership share of the joint venture with CNHTC and its affiliate collectively acquiring a 75% share. We have the option to increase our ownership position to 33% in the next one to three years. The initial total capital of the joint venture will be $24 million, with UQM contributing $6 million in three installments during the next year. Our funding requirement is contingent on the closing of the second stage investment with CNHTC in accord with the terms of the Agreement.

The JV will be named Sinotruk Qingdao Zhongqi New Energy Automobile Co., Ltd. and will be headquartered in the city of Qingdao, China. The purpose of the JV will be to serve the China market for commercial vehicle E-drives and the global market for E-axles. The annual production capacity which the JV intends to establish is 50,000 systems, and it is anticipated to commence commercial operations in 2019.

19