Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Startek, Inc. | srtex99220183158ka.htm |

| EX-99.4 - EXHIBIT 99.4 - Startek, Inc. | srt_ex994x2018315-8ka.htm |

| EX-99.3 - EXHIBIT 99.3 - Startek, Inc. | srtex99320183158ka.htm |

| EX-99.1 - EXHIBIT 99.1 - Startek, Inc. | srtex99120183158ka.htm |

| 8-K/A - 8-K/A - Startek, Inc. | a8-kaxemployeeandothercomm.htm |

1

STARTEK + AEGIS

Transaction Overview

March 15, 2018

2

• Forward-Looking Statements

• The matters regarding the future discussed in this news release include forward-looking statements as defined in the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements are intended to be identified in this document by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar expressions. As described below, such statements are subject to a

number of risks and uncertainties that could cause STARTEK's actual results to differ materially from those expressed or implied by any such forward-looking

statements. These factors include, but are not limited to, risks relating to our reliance on a limited number of significant customers, lack of minimum purchase

requirements in our contracts, the concentration of our business in the communications industry, lack of wide geographic diversity, maximization of capacity

utilization, foreign currency exchange risk, risks inherent in the operation of business outside of the United States, ability to hire and retain qualified

employees, increases in labor costs, management turnover and retention of key personnel, trends affecting companies’ decisions to outsource non-core

services, reliance on technology and computer systems, including investment in and development of new and enhanced technology, increases in the cost of

telephone and data services, unauthorized disclosure of confidential client or client customer information or personally identifiable information, compliance

with regulations governing protected health information, our ability to acquire and integrate complementary businesses, compliance with our debt covenants,

ability of our largest stockholder to affect decisions and stock price volatility. Risks related to the Aegis transaction include failure to obtain the required vote of

STARTEK’s stockholders, the timing to consummate the proposed transaction, the risk that a condition to closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction might otherwise not occur, the risk that a regulatory approval that may be required for the proposed

transaction is not obtained or is obtained subject to conditions that are not anticipated, the diversion of management time on transaction-related issues,

difficulties with the successful integration and realization of the anticipated benefits or synergies from the proposed transaction, and the risk that the

transaction and its announcement could have an adverse effect on STARTEK’s ability to retain customers and retain and hire key personnel. Readers are

encouraged to review Item 1A. - Risk Factors and all other disclosures appearing in the Company's Form 10-K for the year ended December 31, 2017 filed

with the SEC and in certain filings that we make with the SEC for further information on risks and uncertainties that could affect STARTEK's business,

financial condition and results of operation. STARTEK assumes no obligation to update or revise and forward looking statements as a result of new

information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as the date

hereof.

1

3

• Additional Information about the Transactions and Where to Find It

• This communication is being made in respect of the transactions between STARTEK, CSP and Aegis and the related issuance of the common stock

described herein. STARTEK intends to file the proxy statement with the Securities and Exchange Commission (SEC) for the stockholder meeting that will

include a proposal relating to the issuance of common stock to CSP and an amendment of STARTEK’s certificate of incorporation related to the transaction.

This communication does not constitute a solicitation of any vote or proxy from any of STARTEK’s stockholders. Investors are urged to read the proxy

statement carefully and in its entirety when it becomes available and any other relevant documents or materials filed or to be filed with the SEC or

incorporated by reference in the proxy statement, because they will contain important information about the transactions between STARTEK, CSP and Aegis,

the issuance of common stock and the proposals to be submitted to the STARTEK stockholders. The proxy statement will be mailed to the Company’s

stockholders. In addition, the proxy statement and other documents will be available free of charge at the SEC’s internet website, www.sec.gov. When

available, the proxy statement and other pertinent documents may also be obtained free of charge at the Investor Relations section of STARTEK’s website,

www.startek.com, or by directing a written request to StarTek Investor Relations, 8200 E. Maplewood Ave., Suite 100, Greenwood Village, Colorado 80111 or

at tel: (303) 262-4500 or email: investor@startek.com.

• Participants in the Solicitation

• STARTEK and its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of

proxies from the Company’s stockholders in connection with the proposed transaction. Information about the Company’s directors and executive officers is

included in STARTEK’s Annual Report on Form 10-K for the year ended December 31, 2017, to be filed with the SEC on or about March 16, 2018, its proxy

statement for its 2017 annual meeting of shareholders, which was filed with the SEC on March 29, 2017, and in other documents filed with the SEC by

STARTEK and its officers and directors.

• This presentation is copyright 2018 STARTEK, Inc. All rights reserved.

2

Transaction Overview

4

At closing, STARTEK will issue 20.6 million shares to an affiliate of Capital Square Partners (CSP) for a strategic transaction

involving CSP portfolio company ESM Holdings Limited (Aegis) to acquire all outstanding common stock of Aegis1

Concurrently, CSP or an affiliate will purchase 833,333 shares of STARTEK common stock at a price of $12.00 per share,

representing a $10 million investment in STARTEK1

The transaction is expected to close no later than the third quarter of 2018, subject to approval by STARTEK shareholders

and other customary closing conditions

- No financing conditions

Together, STARTEK and Aegis represent the creation of a truly global enterprise with over 50,000 employees and operations

in 13 countries, serving as a pre-eminent BPO services provider worldwide

- Significant revenue diversification; top 3 clients would represent < 30% of revenue based on 2017 revenue (vs. 53% for

STARTEK in 2017)

- Combined 2017 revenue of ~$700 million and combined 2017 Adjusted EBITDA of ~$50 million2

- Synergies expected to drive incremental $30 million in EBITDA by 2020 through enhanced revenue growth and cost savings

Post-transaction, STARTEK shareholders will own approximately 45% of the combined business, while CSP will own

approximately 55%

1) The number of shares issued and amount of cash investment are subject to potential adjustment based on the relative net debt of the parties. Net debt is a non-GAAP financial measure representing indebtedness as reduced by cash.

2) Based on STARTEK financials through 12/31/2017 as reported under U.S. GAAP and Aegis financials based on unaudited LTM results through 12/31/2017 as reported under IndAS. Note, financials are preliminary and may be

updated in the anticipated proxy filing related to this transaction. EBITDA and adjusted EBITDA are non-GAAP financial measures. Refer to Appendix B for a reconciliation to STARTEK reported GAAP results. 3

Overview of Aegis

5 4

Telecom & Media

Travel, Logistics & Hospitality

Banking, Financial Services and Insurance

Retail, CPG, E-commerce

Energy & Utilities

Industrial / Technology

A Global Service Leader

Global provider of Business Process Outsourcing

(BPO) services including Contact Centre, Finance &

Accounts, Payroll, HR, Spend Management and IT

Client-centric, global delivery model – onshore,

offshore and near shore presence

Proven track record of acquisition and significant

value creation

Diversified marquee client base with strong

relationships with leading blue-chip clients; top 3

clients represent only ~33% of revenue1

~40,000 employees globally

~32,000 seats across 8 countries

44 locations worldwide

40+ languages

Broad Sector Diversification

1) Based on fiscal year-to-date 12/31/2017, Aegis fiscal year ends March 31.

Meaningful revenue synergies expected from service- and geography-based

cross-selling, and targeting new clients with global service needs

Gain scale and deepen presence in overlapping verticals

Utilization of existing capacity to support margin-accretive growth

Overnight operation of daytime facilities to serve clients across time zones

Reduced duplicative corporate overhead costs

Seasoned executive leadership and joint management team

Significant public market experience

Increased client diversification

Flexibility to respond to client needs across multiple geographies

Increased purchasing power

Shared IT and operational best practices

Key Investment Highlights of the Combined Company

6 5

Growth

Opportunities

Efficiency

Opportunities

Large Scale

and

Global Reach

Experienced

Leadership

The STARTEK and Aegis combination results in a powerful global platform

~45% ~55%

Post-Transaction

Equity Split

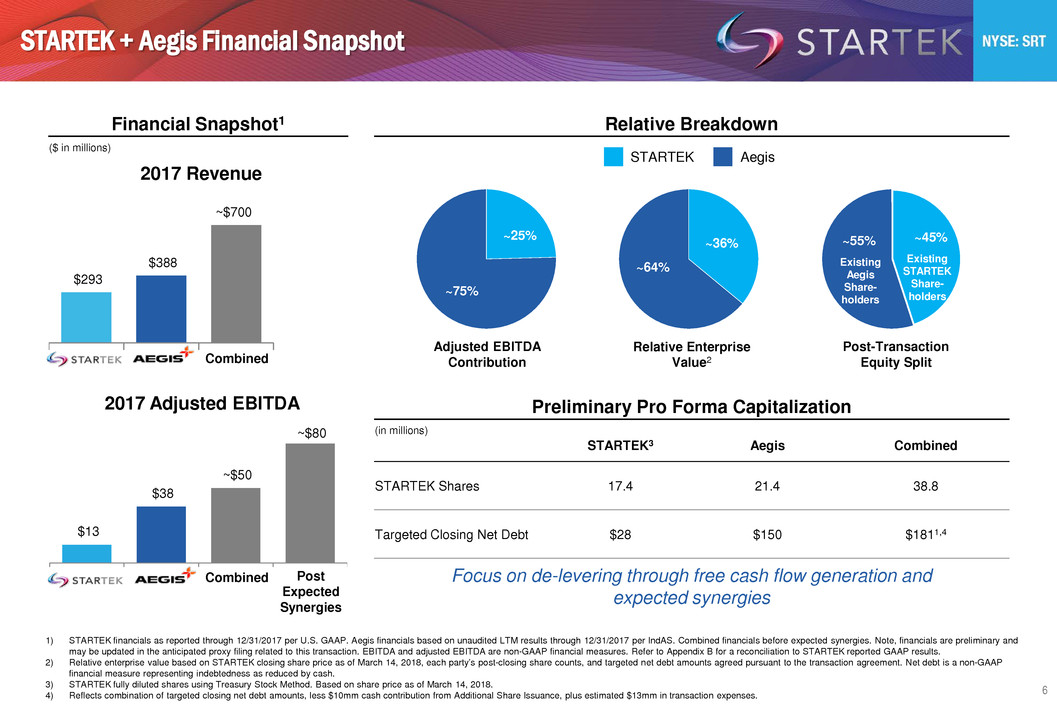

STARTEK + Aegis Financial Snapshot

7

1) STARTEK financials as reported through 12/31/2017 per U.S. GAAP. Aegis financials based on unaudited LTM results through 12/31/2017 per IndAS. Combined financials before expected synergies. Note, financials are preliminary and

may be updated in the anticipated proxy filing related to this transaction. EBITDA and adjusted EBITDA are non-GAAP financial measures. Refer to Appendix B for a reconciliation to STARTEK reported GAAP results.

2) Relative enterprise value based on STARTEK closing share price as of March 14, 2018, each party’s post-closing share counts, and targeted net debt amounts agreed pursuant to the transaction agreement. Net debt is a non-GAAP

financial measure representing indebtedness as reduced by cash.

3) STARTEK fully diluted shares using Treasury Stock Method. Based on share price as of March 14, 2018.

4) Reflects combination of targeted closing net debt amounts, less $10mm cash contribution from Additional Share Issuance, plus estimated $13mm in transaction expenses.

$293

$388

~$700

$13

$38

~$50

~$80

STARTEK Aegis Combined With

Synergies

2017 Revenue

2017 Adjusted EBITDA

Financial Snapshot1

($ in millions)

Combined

i ed

Relative Breakdown

STARTEK Aegis

~36%

~64%

Adjusted EBITDA

Contribution

~25%

~75%

Relative Enterprise

Value2

Existing

STARTEK

Share-

holders

Existing

Aegis

Share-

holders

STARTEK3 Aegis Combined

STARTEK Shares 17.4 21.4 38.8

Targeted Closing Net Debt $28 $150 $1811,4

Preliminary Pro Forma Capitalization

(in millions)

6

Focus on de-levering through free cash flow generation and

expected synergies

Post

Exp ct d

Synergies

Global Platform with Geographic Revenue Diversification

8

STARTEK Standalone Combined Geographic Reach

Combined platform provides operations in

13 countries and the scale to serve the

largest clients globally

Aegis Standalone

7

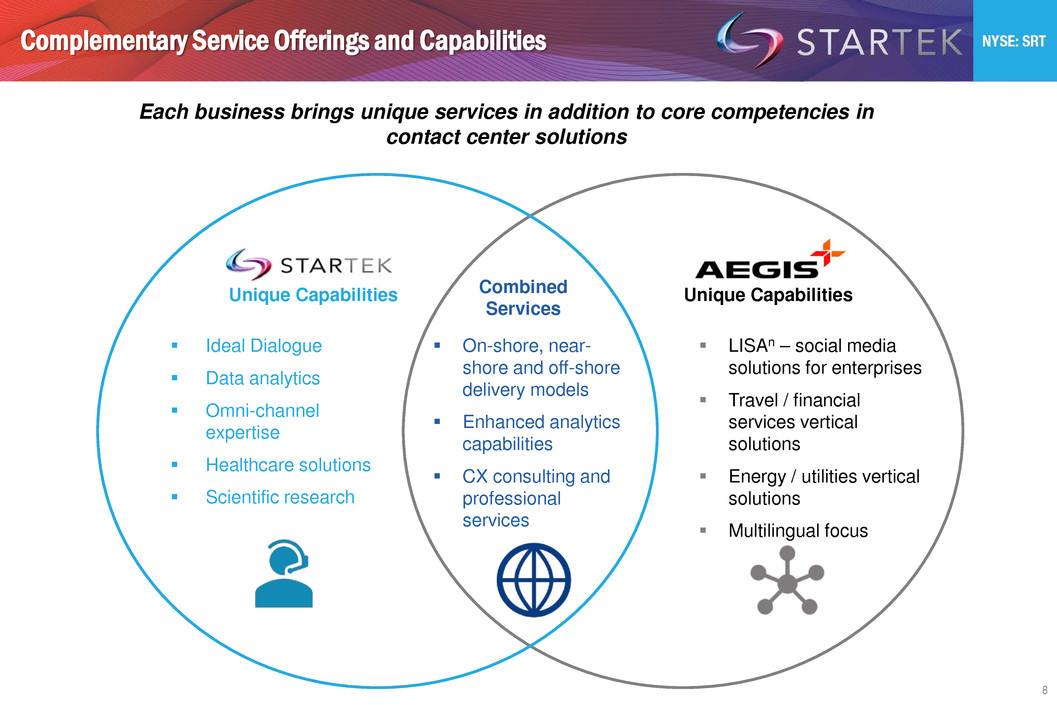

Complementary Service Offerings and Capabilities

9

Unique Capabilities Combined

Services

Unique Capabilities

Ideal Dialogue

Data analytics

Omni-channel

expertise

Healthcare solutions

Scientific research

On-shore, near-

shore and off-shore

delivery models

Enhanced analytics

capabilities

CX consulting and

professional

services

LISAn – social media

solutions for enterprises

Travel / financial

services vertical

solutions

Energy / utilities vertical

solutions

Multilingual focus

Each business brings unique services in addition to core competencies in

contact center solutions

8

Achievable annual synergies of $30 million expected within three years

Significant Synergy Potential

10

New Revenue Opportunities Operating Efficiencies Corporate Overhead

Cross-selling services

Provide clients with global access

Serve existing clients in new

geographies

Delivery of new revenue from

existing capacity; highly margin

accretive

Overnight utilization of daytime

facilities to serve clients in

different geographies

Consolidation of certain functions

and duplicative overhead

Leverage scale to drive

procurement efficiencies

9

Meaningful opportunity to drive returns from multiple synergy categories, including:

All primarily delivered through existing footprint for highly margin accretive growth

Growth Opportunities of the Combined Business

11

Existing Client

Cross-Selling

Deepen and Diversify

Targeted Verticals

Clients With

Global Needs

Utilize expanded service

offering to increase wallet

share with existing clients

Leverage two successful track

records and maintain high

quality service levels to

increase client trust

Gain scale and deepen

presence in overlapping

Telecom, Retail, and Utilities

verticals

Attack unique and under-

penetrated verticals including

Healthcare, BFSI, and

Education verticals

Utilize a truly global platform

to target largest clients with

complex, global needs

10

Numerous near-term growth avenues

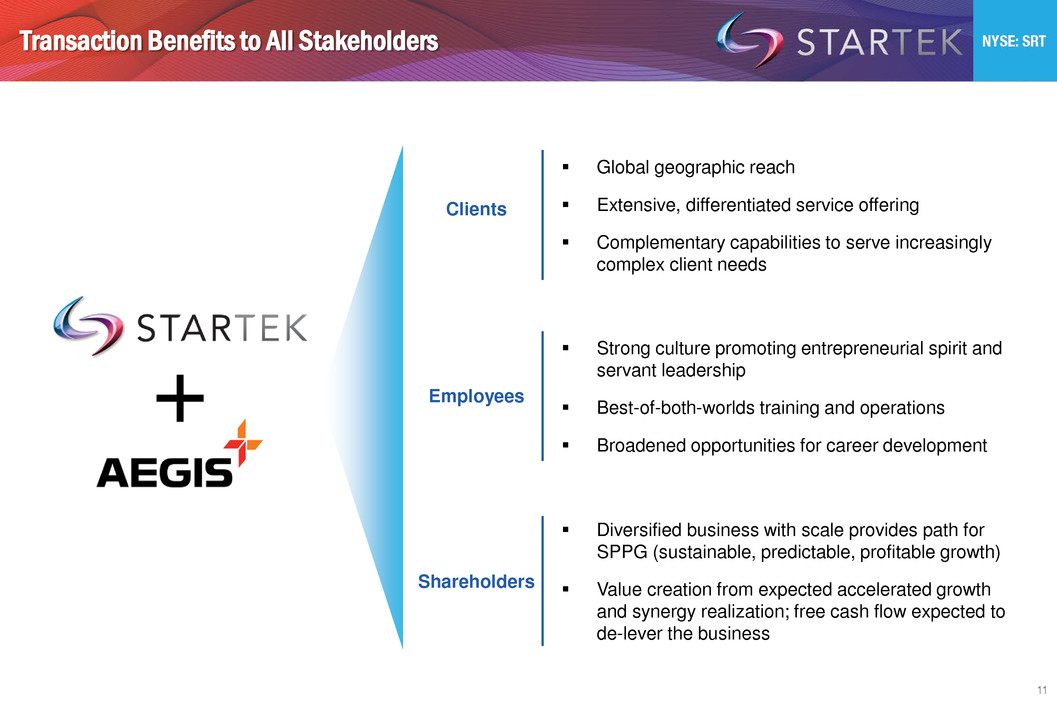

Shareholders

Transaction Benefits to All Stakeholders

12

Global geographic reach

Extensive, differentiated service offering

Complementary capabilities to serve increasingly

complex client needs

Strong culture promoting entrepreneurial spirit and

servant leadership

Best-of-both-worlds training and operations

Broadened opportunities for career development

Diversified business with scale provides path for

SPPG (sustainable, predictable, profitable growth)

Value creation from expected accelerated growth

and synergy realization; free cash flow expected to

de-lever the business

Employees

Clients

11

STARTEK, Inc.

8200 E. Maplewood Ave,

Suite 100

Greenwood Village, CO 80111

www.startek.com

INVESTOR RELATIONS

Liolios

Sean Mansouri or Cody Slach

949.574.3860

Investor@startek.com

13

CONTACT

INFORMATION

12

Appendix A: About CSP

14 13

Significant Sector Expertise

CSP has invested in a number of Technology and Business

Services business, including BPOs with multi country operations

CSP and co-investors acquired 100% of a multi-country (US,

Canada, Philippines & India operations) BPO business MINACS in

2014

CSP exited MINACS through a highly successful strategic sale to

Concentrix (NYSE:SNX) in August 2016, after improving the

EBITDA of MINACS by over 50% in ~2 years

Fund Overview

CSP is a mid-market focused private equity fund manager based

in Singapore, and regulated by the Monetary Authority of

Singapore

CSP’s fund investors are leading global institutional investors,

and its co-investors include Hermes GPE, Partners Group

(SIX:PGHN), AlpInvest Partners, Aberdeen Private Equity –

among others

Appendix B: Reconciliation of STARTEK Non-GAAP Financials

15 14

• This press release contains references to the non-GAAP financial measures of Adjusted EBITDA and Free cash flow. Reconciliation of these non-GAAP

measures to their comparable GAAP measures are included below. This non-GAAP information should not be construed as an alternative to the reported results

determined in accordance with GAAP. It is provided solely to assist in an investor’s understanding of these items on the comparability of the Company’s

operations.

• The Company defines non-GAAP Adjusted EBITDA as net income (loss) plus income tax expense (benefit), interest expense (income), impairment losses and

restructuring charges, depreciation and amortization expense, (gains) losses on disposal of assets and share-based compensation expense. Management uses

Adjusted EBITDA as a performance measure to analyze the performance of our business. Management believes that excluding these non-cash and other non-

recurring items helps investors

• and analysts assess the strength and performance of our ongoing operations.

• Management believes that measures that exclude impairment losses and restructuring charges or other non-recurring items permit a more meaningful

comparison and understanding of our operating performance for the periods presented.

STARTEK, Inc. and Subsidiaries Reconciliation of GAAP to Non-GAAP Measures

(In thousands, unaudited)

Three Months Ended Twelve Months Ended

December 31,

2017

December 31,

2016

December 31,

2017

December 31,

2016

Net income (loss) $ (2,452) $ 1,192 $ (1,276) $ 395

Income tax (benefit) expense (371) 384 (436) 718

Interest expense, net 369 530 1,604 1,574

Impairment losses and restructuring charges, net 92 8 520 364

Depreciation and amortization expense 2,697 2,868 11,080 12,250

(Gains) losses on disposal of assets (1) 16 3 (3)

Share-based compensation expense 270 443 1,015 1,722

Adjusted EBITDA $ 604 $ 5,441 $ 12,510 $ 17,020