Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TIPTREE INC. | ex991er12312017.htm |

| 8-K - 8-K - TIPTREE INC. | a8ker12312017.htm |

March 2018

Financial information for year ended December 31, 2017

NASDAQ: TIPT

INVESTOR PRESENTATION - 2017

Exhibit 99.2

1

LIMITATIONS ON THE USE OF INFORMATION

This presentation has been prepared by Tiptree Inc. and its consolidated subsidiaries (“Tiptree", "the Company" or "we”) solely for informational purposes, and not for the

purpose of updating any information or forecast with respect to Tiptree, its subsidiaries or any of its affiliates or any other purpose. Tiptree reports a non-controlling interest in

TFP that is not owned by Tiptree and certain other operating subsidiaries that are not wholly owned. Unless otherwise noted, all information is of Tiptree on a consolidated basis

before non-controlling interest. Neither Tiptree nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the

information contained herein and no such party shall have any liability for such information. These materials and any related oral statements are not all-inclusive and shall not

be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Performance information is historical and is

not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree's control, which may cause actual

results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical

in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect,“ “intend,” “may,” “might,” "plan," “project,” “should,” "target,“ “will,” or similar

expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree's plans, objectives,

expectations and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which

are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual

results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section

entitled “Risk Factors” in Tiptree’s Annual Report on Form 10-K, and as described in the Tiptree’s other filings with the SEC. Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could

cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could

affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking

statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake

no obligation to update any forward-looking statements.

MARKET AND INDUSTRY DATA

Certain market data and industry data used in this presentation were obtained from reports of governmental agencies and industry publications and surveys. We believe the

data from third-party sources to be reliable based upon our management’s knowledge of the industry, but have not independently verified such data and as such, make no

guarantees as to its accuracy, completeness or timeliness.

NOT AN OFFER OR A SOLICIATION

This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with Tiptree, its subsidiaries or its affiliates.

The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any

jurisdiction or country where such distribution or use would be contrary to local law or regulation.

NON-GAAP MEASURES

In this document, we sometimes use financial measures derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S.

generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under the SEC rules. These non-GAAP financial measures

supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Management's reasons for using these non-GAAP financial measures and

the reconciliations to their most directly comparable GAAP financial measures are posted in the Appendix.

DISCLAIMERS

OVERVIEW & FINANCIAL RESULTS

Key Highlights

3

Revenue

$581.8 million

14.9% vs. prior year

Adjusted EBITDA (1)

$38.0 million

vs. prior year of $78.9

million

Book Value

per share, as exchanged (1)

$9.97

(1.7%) vs. 12/31/16

Net income

$5.2 million

vs. prior year of $32.3

million

2017 PERFORMANCE SUMMARY

þ Net income for the year primarily driven by unrealized losses on equities in the Insurance

investment portfolio, partially offset by $15.2 million tax benefit from the 2017 tax act

þ Specialty Insurance operations continued to grow and expand product offerings

• Gross written premiums of $767m, up 8.3%, driven by growth in warranty and credit products

• Net written premiums of $418m, up 24.0% driven by increase in retention of credit products

and growth in warranty products

• In Q4'17, we issued $125m of 40 year Junior Subordinated Notes which refinanced existing

indebtedness and strengthened the capital position as part of our strategy to grow the

insurance company

þ Throughout 2017 and early 2018, we continued our focus on corporate efficiencies

• On February 1, 2018 we sold our senior living operations to Invesque for consideration of 16.6m

shares. The increase is estimated to be $0.91 per share or a 9.1% increase to Q4'17 BVPS

• In the fourth quarter 2017, we exited our position in Siena and entered into a definitive

agreement to sell Luxury Mortgage

þ We continue to focus on returning capital to shareholders through dividends and share buybacks,

totaling $11.8m in 2017 and $67.8m since 2014

þ BVPS decline driven by dividends paid and the exercise of a founders' option, partially offset by

2017 net income

Business highlights

(1) For a reconciliation of Non-GAAP metrics Adjusted EBITDA and book value per share as exchanged to GAAP financials, see the Appendix.

Financial Results

4

Key Metrics

FINANCIAL IMPACT OF RECENTLY ANNOUNCED TRANSACTIONS

($ in millions)

• Senior Living: Completed sale of real estate portfolio on Feb 1, 2018

þ Estimated $0.91 increase to book value per share

þ Expected to be accretive to BVPS, EPS and cash earnings

þ Combined with a larger, lower cost of capital platform to support

future growth

þ Received 16.6m shares of Invesque (TSX: IVQ.U)

• Specialty Finance: Total consideration of $20m resulting in $2m gain

relating to sale of Siena in Oct'17 and Luxury Mortgage which is

expected to close in '18

• CLO equity: exited large subordinated note positions and related

hedges at attractive prices in Q4'17 for $29m cash proceeds

• Cash available for re-investment: ~$90m available for investments and

acquisitions, net of cash at regulated insurance subsidiaries

Balance Sheet: Q4'17

Incremental

Impact to

Q4'17(2)

BVPS, as exchanged(1) $9.97 $0.91

Debt $346.1 -

Equity, as exchanged $377.6 $34.4

Cash $110.7 -

Income Statement: 2017

Pre-tax income from

continuing operations $(3.3)

Pre-tax income from

discontinued operations $(6.2)

Net Income before NCI $5.2

Normalized EBITDA(1) $60.9

Adjusted EBITDA(1) $38.0

Realized/Unrealized gain

(loss) on equities $(23.8)

þ Continue to simplify corporate structure

þ Expect to improve risk adjusted cash returns

þ Reduced leverage from 2.2x to less than 0.9x

þ Expect to increase BVPS and EPS profile

þ Significant liquidity available to invest

Transformed $(6.2)m

pre-tax loss from Care

into $12.1m of

expected income from

Invesque dividends(3)

(1) For a reconciliation of Non-GAAP metrics book value per share as exchanged, Adjusted EBITDA and Normalized EBITDA to GAAP financials, see the Appendix.

(2) Impact includes sale of Care for estimated $37.0m net gain (net of deal costs) which values Invesque shares at $9.06 reflecting the closing price as of February 1,

2018 less a discount due to lock-up restrictions.

(3) Based on 16.35m Invesque shares and historical dividend payout of $0.74 per annum.

2017 Highlights

5

$10.14 $0.27

$0.35 $0.07

$(0.42) $(0.19) $(0.13) $(0.12)

$9.97

($ in millions, except per share information)

CAPITAL ALLOCATION

(1) See the appendix for a reconciliation of Invested Capital, Total Capital and Normalized EBITDA.

(2) Corporate debt includes secured corporate credit agreements and preferred trust securities.

(3) Last twelve months dividends and share buy-backs for each respective period.

(4) Accumulated real estate depreciation and intangible amortization from Insurance and Care (discops), net of NCI and tax. $1.77 impact to BVPS from accumulated depreciation of $55.5 million and

$54.2 million within Fortegra and Care, respectively. On as exchanged basis, assumes 86.6% ownership of Care properties and 35% tax rate on total accumulated depreciation.

Return on total capital of 9.6%, flat to prior year primarily driven by:

• Insurance contributed $53.3m, up 8.1% from warranty and credit

protection growth, plus investment returns (ex. unrealized losses)

• Reduced corporate expenses from improvements in reporting

infrastructure

Offset by:

• Additional capital allocated to senior living prior to sale of Care

• Reduced distributions in asset management from sale of sub-notes

Q4'16

BVPS(1)

LTM Diluted

EPS

(Ex. Reliance

earn-out &

equity losses,

tax reform)

Q4'17

BVPS(1)

Share

Buybacks

Option

exercise

DividendsReliance

earn-out

+$1.77+$1.37

Equity

unrealized

losses

Net Impact of Care & Fortegra Accumulated D&A(4)

Book value per share, as exchanged(1)

Return on Total Capital

Invested & Total Capital(1)

As of Q4'17 Normalized EBITDA(1)

Invested

Capital(1)

Total

Capital(1) 2016 2017

Specialty Insurance $ 281.3 $ 441.3 $ 49.3 $ 53.3

Tiptree Capital 161.8 161.8 41.5 29.8

Corporate 9.5 38.0 (30.3) (22.2)

Total $ 452.6 $ 641.1 $ 60.5 $ 60.9

Q4'15 Q4'16 Q4'17

Class A equity $ 312.8 $ 293.4 $ 300.1

Tiptree Financial Partners 69.3 76.1 77.5

Equity, as exchanged $ 382.1 $ 369.5 $ 377.6

Invested Capital $ 423.1 $ 426.8 $ 452.6

Corporate debt(2) 175.0 199.0 188.5

Total Capital $ 598.1 $ 625.8 $ 641.1

Total shares, as exchanged 42.9 36.4 37.8

Returned to shareholders(3) $ 8.2 $ 47.8 $ 11.8

Tax

Act

Year Ended December 31, 2017

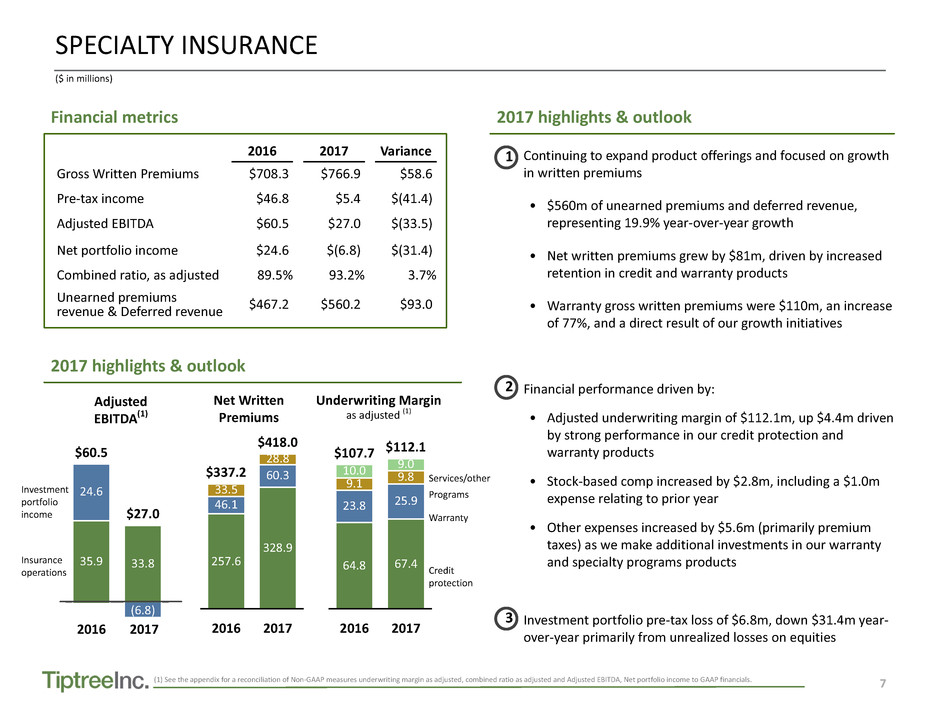

SPECIALTY INSURANCE - PERFORMANCE HIGHLIGHTS

7

35.9 33.8

$27.0

24.6

$60.5

(6.8)

Continuing to expand product offerings and focused on growth

in written premiums

• $560m of unearned premiums and deferred revenue,

representing 19.9% year-over-year growth

• Net written premiums grew by $81m, driven by increased

retention in credit and warranty products

• Warranty gross written premiums were $110m, an increase

of 77%, and a direct result of our growth initiatives

Financial performance driven by:

• Adjusted underwriting margin of $112.1m, up $4.4m driven

by strong performance in our credit protection and

warranty products

• Stock-based comp increased by $2.8m, including a $1.0m

expense relating to prior year

• Other expenses increased by $5.6m (primarily premium

taxes) as we make additional investments in our warranty

and specialty programs products

Investment portfolio pre-tax loss of $6.8m, down $31.4m year-

over-year primarily from unrealized losses on equities

(1) See the appendix for a reconciliation of Non-GAAP measures underwriting margin as adjusted, combined ratio as adjusted and Adjusted EBITDA, Net portfolio income to GAAP financials.

Underwriting Margin

as adjusted (1)

SPECIALTY INSURANCE

($ in millions)

Net Written

Premiums

2016 2017

257.6

328.9

46.1

60.3

33.5

$337.2

28.8

$418.0

2016 2017

64.8 67.4

23.8 25.9

9.1 9.8

10.0

$107.7

9.0

$112.1

Programs

Warranty

Credit

protection

Services/other

Adjusted

EBITDA(1)

Investment

portfolio

income

Insurance

operations

20172016

1

2

3

2017 highlights & outlookFinancial metrics

2017 highlights & outlook

2016 2017 Variance

Gross Written Premiums $708.3 $766.9 $58.6

Pre-tax income $46.8 $5.4 $(41.4)

Adjusted EBITDA $60.5 $27.0 $(33.5)

Net portfolio income $24.6 $(6.8) $(31.4)

Combined ratio, as adjusted 89.5% 93.2% 3.7%

Unearned premiums

revenue & Deferred revenue $467.2 $560.2 $93.0

8

2015 2016 2017

176.6

146.2

182.4

1.0 31.7

53.9

103.9

83.9

48.6

25.523.6

35.3

3.7

$181.3

4.0

$358.0

15.4

$396.4

• Net investments grew $38.5 million, or 10.8% from Q4'16

• Net portfolio income, ex. unrealized losses, of $15.5m, up $1.0m

from prior year

– Net investment income up year-over-year from portfolio

growth and increasing interest income from LIBOR based loans

as interest rates rise

– Portfolio income down year-over-year driven primarily by

unrealized losses on equities in '17 compared to gains in '16

SPECIALTY INSURANCE - INVESTMENT PORTFOLIO

$ 1.6 $ 10.0 $ (22.3) Unrealized gains (losses)

(0.6) 4.7 5.8 Realized gains (losses)

5.5 13.0 16.3 Net investment income

(0.8) (3.2) (6.6) Interest expense

$ 5.7 $ 24.5 $ (6.8) Net Portfolio Income

2.3% 8.0% (1.9)% Average Annualized Yield(4)

$0.3 $7.3 $(23.8) Equity unrealized gains (loss)

($ in millions)

Cash & cash

equivalents(3)

Other

Real Estate

Available for sale

Securities

We actively manage our investment portfolio to achieve a balance of

two primary objectives:

• Cash and liquid short and medium term securities to cover near-

term claims obligations

• Enhanced risk-adjusted returns through selective alternative

investments with a focus on longer-term higher yielding assetsLoans(2)

Equities

(1) See the appendix for a reconciliation of Non-GAAP measures Net Investments and Net Portfolio Income to GAAP financials.

(2) Net of non-recourse asset based financing of $111.5, $146.5 and $54.0 million for 2017, 2016, and 2015, respectively.

(3) Cash and cash equivalents, plus restricted cash, net of due to/due from brokers See appendix for reconciliation to GAAP financials.

(4) Average Annualized Yield % represents the ratio of annualized net investment income, realized and unrealized gains (losses) less investment portfolio interest expense to the average of the prior five

quarters total investments less investment portfolio debt plus cash.

Investment approachNet Investments(1)

Highlights

Year Ended December 31, 2017

TIPTREE CAPITAL - PERFORMANCE HIGHLIGHTS

10

Asset Management: Decline in pre-tax income driven by:

• Reduced management fees as older vintage CLOs run-off

• Distributions from credit investments decreased as we reduced

our sub-note holdings, partially offset by $3.9m of gains

Mortgage: $6.1m of Normalized EBITDA, down from 2016 due to

mortgage volume declines

Care: Flat to 2016 as recently renovated properties have been slow to

recover to stabilized occupancy levels

• Going forward, income will be replaced by Invesque dividends

Other: Decline in pre-tax income driven by non-recurring gain in 2016

of $4.4m, partially offset by gain on sale of Siena of $2.0m

TIPTREE CAPITAL

(1) See the appendix for a reconciliation of Normalized EBITDA and Invested Capital to GAAP financials.

(2) AUM is estimated and unaudited. Consists of NOPCB for CLOs, excludes Credit Opportunities Fund as it was not earning third party fees as of 12/31/2017.

(3) Includes discontinued operations related to Care. For more information, see “—FN 4 Dispositions, Assets Held for Sale and Discontinued Operations.”

($ in millions)

2015 2016 2017

98.8

73.2

5.0

21.5

25.3

30.7

74.6 100.8

119.5

15.2

$210.1

16.0

$215.3

6.6

$161.8

+ Corporate

Cash of $66m

Fee-earning

AUM ($B)(2)

Mortgage

Other

Care(3)

CLOs & credit

investments

2017 financial highlights

Invested Capital(1) Recent developments & outlook

• In 3Q'17 and early 2018, we extended and re-priced two CLOs. In

connection, we made risk retention investments in the insurance

investment portfolio

• In 2017, we reduced our exposure to CLO subordinated notes and

related hedges from $73m to $5.0m, generating cash available for

redeployment

• Continued focus on developing asset management opportunities

in other asset classes that leverage our expertise

Return on Invested Capital(1)

Pre-tax income Normalized EBITDA

2016 2017 2016 2017

Asset mgmt fees, net $4.8 $3.5 $4.8 $3.5

Credit investments 20.5 10.7 17.9 6.8

Mortgage 4.9 2.1 6.9 6.1

Care/DiscOps(3) (5.8) (6.2) 9.1 9.2

Other 7.0 4.0 2.9 4.2

Total $31.4 $14.1 $41.6 $29.8

$1.9 $1.9 $1.6

11

Book value per share(1)

as exchanged

Adjusted EBITDA(1)

OUTLOOK

• Continued growth in specialty insurance operations

– Growth in unearned premiums and deferred revenue of 19.9% in 2017

– Opportunity for inorganic growth through accretive acquisitions

• Improvements in long-term, net investment income as our insurance

investment portfolio grows

• Opportunity to re-invest capital from recent asset sales and ongoing cash flows

with goal of improving total returns on Invested Capital

2015 2016 2017

$8.90

$10.14 $9.97

2015 2016 2017

$58.4

$78.9

$38.0

ü Generated approximately $90m of capital to invest

ü Recent transactions have simplified the structure, reduced leverage from

2.2x to <0.9x; which we expect will improve cash and GAAP earnings

ü Re-positioned company for future growth

(1) See the appendix for a reconciliation of Book value per share, as exchanged and Adjusted EBITDA to GAAP financials.

($ in millions)

2017 financial highlights

Looking ahead

$0.91 Care Sale

APPENDIX

13

Management uses EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The Company believes that use of these financial measures on a consolidated basis and for each segment

provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service its debt and

to facilitate comparison among companies. The Company believes segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our segments. Adjusted

EBITDA is also used in determining incentive compensation for the Company’s executive officers. These measures are not a measurement of financial performance or liquidity under GAAP and should

not be considered as an alternative or substitute for net income. The Company’s presentation of these measures may differ from similarly titled non-GAAP financial measures used by other companies.

The Company defines EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated depreciation and amortization expense

as presented in its financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary course of its subsidiaries’ business

operations, (ii) adjust for the effect of purchase accounting, (iii) adjust for non-cash fair value adjustments, and (iv) any significant non-recurring expenses.

NON-GAAP RECONCILIATIONS - EBITDA AND ADJUSTED EBITDA

(1) The consolidated asset-based interest expense is subtracted from EBITDA to arrive at Adjusted EBITDA. This includes interest expense associated with asset-specific debt at subsidiaries in the specialty insurance, asset management, mortgage and other

operations.

(2) Following the purchase accounting adjustments, current period expenses associated with deferred costs were more favorably stated and current period income associated with deferred revenues were less favorably stated. Thus, the purchase accounting

effect related to Fortegra increased EBITDA above what the historical basis of accounting would have generated. The impact of this purchase accounting adjustments have been reversed to reflect an adjusted EBITDA without such purchase accounting

effect.

(3) For Reliance, within our mortgage operations, Adjusted EBITDA excludes the impact of changes in contingent earn-outs. For our specialty insurance operations, depreciation and amortization on senior living real estate that is within net investment

income is added back to Adjusted EBITDA.

(4) Acquisition, start-up and disposition costs including legal, taxes, banker fees and other costs. Also includes payments pursuant to a separation agreement, dated as of November 10, 2015.

($ in thousands) Year Ended December 31,

2017 2016 2015

Net income (loss) available to Class A common stockholders $ 3,604 $ 25,320 $ 5,779

Add: net (loss) income attributable to noncontrolling interests 1,630 7,018 3,023

Less: net income from discontinued operations (3,998) (4,287) $ 10,953

Income (loss) from continuing operations $ 9,232 $ 36,625 $ (2,151)

Consolidated interest expense 25,562 21,010 16,695

Consolidated income tax expense (benefit) (12,562) 12,515 (753)

Consolidated depreciation and amortization expense 13,841 14,302 $ 30,578

EBITDA from Continuing Operations $ 36,073 $ 84,452 $ 44,369

Asset-based interest expense(1) (12,724) (10,492) (5,065)

Effects of purchase accounting (2) (1,433) (5,054) (24,166)

Non-cash fair value adjustments (3) 3,547 1,277 (1,300)

Non-recurring expenses (4) 1,944 (1,736) 5,489

Adjusted EBITDA from Continuing Operations $ 27,407 $ 68,447 $ 19,327

Income (loss) from discontinued operations $ (3,998) $ (4,287) $ 10,953

Consolidated interest expense 13,068 8,691 12,022

Consolidated income tax expense (benefit) (2,224) (1,537) 17,527

Consolidated depreciation and amortization expense 15,645 14,166 15,408

EBITDA from discontinued operations $ 22,491 $ 17,033 $ 44,309

Asset based interest expense(1) (13,068) (8,691) (6,796)

Non-recurring expenses (4) 1,158 2,127 1,579

Adjusted EBITDA from discontinued operations $ 10,581 $ 10,469 $ 39,092

Total Adjusted EBITDA $ 37,988 $ 78,916 $ 58,419

14

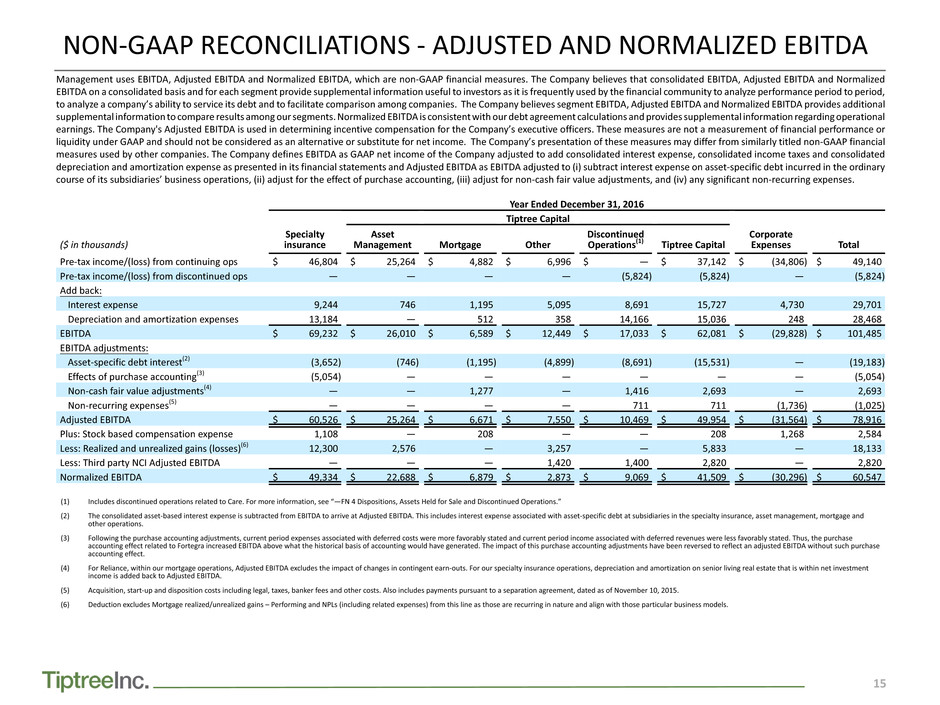

Management uses EBITDA, Adjusted EBITDA and Normalized EBITDA, which are non-GAAP financial measures. The Company believes that consolidated EBITDA, Adjusted EBITDA and Normalized

EBITDA on a consolidated basis and for each segment provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period,

to analyze a company’s ability to service its debt and to facilitate comparison among companies. The Company believes segment EBITDA, Adjusted EBITDA and Normalized EBITDA provides additional

supplemental information to compare results among our segments. Normalized EBITDA is consistent with our debt agreement calculations and provides supplemental information regarding operational

earnings. The Company's Adjusted EBITDA is used in determining incentive compensation for the Company’s executive officers. These measures are not a measurement of financial performance or

liquidity under GAAP and should not be considered as an alternative or substitute for net income. The Company’s presentation of these measures may differ from similarly titled non-GAAP financial

measures used by other companies. The Company defines EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated

depreciation and amortization expense as presented in its financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary

course of its subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) adjust for non-cash fair value adjustments, and (iv) any significant non-recurring expenses.

NON-GAAP RECONCILIATIONS - ADJUSTED AND NORMALIZED EBITDA

(1) Includes discontinued operations related to Care. For more information, see “—FN 4 Dispositions, Assets Held for Sale and Discontinued Operations.”

(2) The consolidated asset-based interest expense is subtracted from EBITDA to arrive at Adjusted EBITDA. This includes interest expense associated with asset-specific debt at subsidiaries in the specialty insurance, asset management, mortgage and

other operations.

(3) Following the purchase accounting adjustments, current period expenses associated with deferred costs were more favorably stated and current period income associated with deferred revenues were less favorably stated. Thus, the purchase

accounting effect related to Fortegra increased EBITDA above what the historical basis of accounting would have generated. The impact of this purchase accounting adjustments have been reversed to reflect an adjusted EBITDA without such purchase

accounting effect.

(4) For Reliance, within our mortgage operations, Adjusted EBITDA excludes the impact of changes in contingent earn-outs. For our specialty insurance operations, depreciation and amortization on senior living real estate that is within net investment

income is added back to Adjusted EBITDA.

(5) Acquisition, start-up and disposition costs including legal, taxes, banker fees and other costs. Also includes payments pursuant to a separation agreement, dated as of November 10, 2015.

(6) Deduction excludes Mortgage realized/unrealized gains – Performing and NPLs (including related expenses) from this line as those are recurring in nature and align with those particular business models.

Year Ended December 31, 2017

Tiptree Capital

($ in thousands)

Specialty

insurance

Asset

Management Mortgage Other

Discontinued

Operations(1) Tiptree Capital

Corporate

Expenses Total

Pre-tax income/(loss) from continuing ops $ 5,404 $ 14,245 $ 2,090 $ 4,001 $ — $ 20,336 $ (29,070) $ (3,330)

Pre-tax income/(loss) from discontinued ops — — — — (6,222) (6,222) — (6,222)

Add back:

Interest expense 15,072 12 1,034 4,632 13,068 18,746 4,812 38,630

Depreciation and amortization expenses 12,799 — 548 246 15,645 16,439 248 29,486

EBITDA $ 33,275 $ 14,257 $ 3,672 $ 8,879 $ 22,491 $ 49,299 $ (24,010) $ 58,564

EBITDA adjustments:

Asset-specific debt interest(2) (7,046) (12) (1,034) (4,632) (13,068) (18,746) — (25,792)

Effects of purchase accounting(3) (1,433) — — — — — — (1,433)

Non-cash fair value adjustments(4) 508 — 3,039 — — 3,039 — 3,547

Non-recurring expenses(5) 1,657 — — 679 1,158 1,837 (392) 3,102

Adjusted EBITDA $ 26,961 $ 14,245 $ 5,677 $ 4,926 $ 10,581 $ 35,429 $ (24,402) $ 37,988

Plus: Stock based compensation expense 3,934 — 453 — — 453 2,172 6,559

Less: Realized and unrealized gains (losses)(6) (22,415) 3,867 — (43) — 3,824 — (18,591)

Less: Third party NCI Adjusted EBITDA — — — 851 1,415 2,266 — 2,266

Normalized EBITDA $ 53,310 $ 10,378 $ 6,130 $ 4,118 $ 9,166 $ 29,792 $ (22,230) $ 60,872

15

Management uses EBITDA, Adjusted EBITDA and Normalized EBITDA, which are non-GAAP financial measures. The Company believes that consolidated EBITDA, Adjusted EBITDA and Normalized

EBITDA on a consolidated basis and for each segment provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period,

to analyze a company’s ability to service its debt and to facilitate comparison among companies. The Company believes segment EBITDA, Adjusted EBITDA and Normalized EBITDA provides additional

supplemental information to compare results among our segments. Normalized EBITDA is consistent with our debt agreement calculations and provides supplemental information regarding operational

earnings. The Company's Adjusted EBITDA is used in determining incentive compensation for the Company’s executive officers. These measures are not a measurement of financial performance or

liquidity under GAAP and should not be considered as an alternative or substitute for net income. The Company’s presentation of these measures may differ from similarly titled non-GAAP financial

measures used by other companies. The Company defines EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated

depreciation and amortization expense as presented in its financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary

course of its subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) adjust for non-cash fair value adjustments, and (iv) any significant non-recurring expenses.

NON-GAAP RECONCILIATIONS - ADJUSTED AND NORMALIZED EBITDA

Year Ended December 31, 2016

Tiptree Capital

($ in thousands)

Specialty

insurance

Asset

Management Mortgage Other

Discontinued

Operations(1) Tiptree Capital

Corporate

Expenses Total

Pre-tax income/(loss) from continuing ops $ 46,804 $ 25,264 $ 4,882 $ 6,996 $ — $ 37,142 $ (34,806) $ 49,140

Pre-tax income/(loss) from discontinued ops — — — — (5,824) (5,824) — (5,824)

Add back:

Interest expense 9,244 746 1,195 5,095 8,691 15,727 4,730 29,701

Depreciation and amortization expenses 13,184 — 512 358 14,166 15,036 248 28,468

EBITDA $ 69,232 $ 26,010 $ 6,589 $ 12,449 $ 17,033 $ 62,081 $ (29,828) $ 101,485

EBITDA adjustments:

Asset-specific debt interest(2) (3,652) (746) (1,195) (4,899) (8,691) (15,531) — (19,183)

Effects of purchase accounting(3) (5,054) — — — — — — (5,054)

Non-cash fair value adjustments(4) — — 1,277 — 1,416 2,693 — 2,693

Non-recurring expenses(5) — — — — 711 711 (1,736) (1,025)

Adjusted EBITDA $ 60,526 $ 25,264 $ 6,671 $ 7,550 $ 10,469 $ 49,954 $ (31,564) $ 78,916

Plus: Stock based compensation expense 1,108 — 208 — — 208 1,268 2,584

Less: Realized and unrealized gains (losses)(6) 12,300 2,576 — 3,257 — 5,833 — 18,133

Less: Third party NCI Adjusted EBITDA — — — 1,420 1,400 2,820 — 2,820

Normalized EBITDA $ 49,334 $ 22,688 $ 6,879 $ 2,873 $ 9,069 $ 41,509 $ (30,296) $ 60,547

(1) Includes discontinued operations related to Care. For more information, see “—FN 4 Dispositions, Assets Held for Sale and Discontinued Operations.”

(2) The consolidated asset-based interest expense is subtracted from EBITDA to arrive at Adjusted EBITDA. This includes interest expense associated with asset-specific debt at subsidiaries in the specialty insurance, asset management, mortgage and

other operations.

(3) Following the purchase accounting adjustments, current period expenses associated with deferred costs were more favorably stated and current period income associated with deferred revenues were less favorably stated. Thus, the purchase

accounting effect related to Fortegra increased EBITDA above what the historical basis of accounting would have generated. The impact of this purchase accounting adjustments have been reversed to reflect an adjusted EBITDA without such purchase

accounting effect.

(4) For Reliance, within our mortgage operations, Adjusted EBITDA excludes the impact of changes in contingent earn-outs. For our specialty insurance operations, depreciation and amortization on senior living real estate that is within net investment

income is added back to Adjusted EBITDA.

(5) Acquisition, start-up and disposition costs including legal, taxes, banker fees and other costs. Also includes payments pursuant to a separation agreement, dated as of November 10, 2015.

(6) Deduction excludes Mortgage realized/unrealized gains – Performing and NPLs (including related expenses) from this line as those are recurring in nature and align with those particular business models.

16

Management evaluates the return on Invested Capital and Total Capital, which are non-GAAP financial measures, when making capital investment decisions. Invested capital represents its total

cash investment, including any re-investment of earnings, and acquisition costs, net of tax. Total Capital represents Invested Capital plus Corporate Debt. Management believes the use of these

financial measures provide supplemental information useful to investors as they are frequently used by the financial community to analyze how the Company has allocated capital over-time and

provide a basis for determining the return on capital to shareholders. Management uses both of these measures when making capital investment decisions, including reinvesting distributable cash

flow, and evaluating the relative performance of its businesses and investments.

NON-GAAP RECONCILIATIONS - BVPS, INVESTED AND TOTAL CAPITAL

Management uses Book value per share, as exchanged, which is a non-GAAP financial measure. As exchanged assumes full exchange of the limited partners units of TFP for Tiptree Class A common

stock. Management believes the use of this financial measure provides supplemental information useful to investors as it is frequently used by the financial community to analyze company growth on

a relative per share basis. Tiptree’s book value per share, as exchanged, was $9.97 as of December 31, 2017 compared with $10.14 as of December 31, 2016. Total stockholders’ equity, net of other

non-controlling interests for the Company was $377.6 million as of December 31, 2017, which comprised total stockholders’ equity of $396.8 million adjusted for $19.2 million attributable to non-

controlling interest at certain operating subsidiaries that are not wholly owned by the Company, such as Luxury and Care. Total stockholders’ equity, net of other non-controlling interests for the

Company was $369.5 million as of December 31, 2016, which comprised total stockholders’ equity of $390.1 million adjusted for $20.6 million attributable to non-controlling interest at subsidiaries

that are not wholly owned by the Company. Additionally, the Company’s book value per share is based upon Class A common shares outstanding, plus Class A common stock issuable upon exchange

of partnership units of TFP which is equal to the number of Class B outstanding shares. The total shares as of December 31, 2017 and December 31, 2016 were 37.9 million and 36.4 million, respectively.

(1) As of December 31, 2017, excludes 5,197,551 shares of Class A common stock held by subsidiaries of the Company. See Note 23—Earnings per Share, in the Form 10-Q for December 31, 2017, for further discussion of potential dilution from warrants.

(1) As of December 31, 2017, add-back of $55.1 million of accumulated intangible amortization at Fortegra and $54.2 million of accumulated real estate depreciation and intangible

amortization on Care senior living properties. On as exchanged basis, assumes 86.6% ownership of Care properties and 35% tax rate on total accumulated depreciation.

(2) Add-back acquisition costs associated with acquiring Fortegra, Care senior living properties and Reliance net of Care NCI (86.6% ownership) and 35% tax rate.

(3) Corporate debt consists of Secured Corporate Credit Agreements, plus preferred trust securities.

($ in thousands, except per share information) Year Ended December 31,

2017 2016 2015

Total stockholders’ equity $ 396,774 $ 390,144 $ 397,694

Less non-controlling interest - other 19,203 20,636 15,576

Total stockholders’ equity, net of non-controlling interests - other $ 377,571 $ 369,508 $ 382,118

Total Class A shares outstanding (1) 29,805 28,388 34,900

Total Class B shares outstanding 8,049 8,049 8,049

Total shares outstanding 37,854 36,437 42,949

Book value per share, as exchanged $ 9.97 $ 10.14 $ 8.90

($ in thousands) Year Ended December 31,

2017 2016 2015

Total stockholders’ equity $ 396,774 $ 390,144 $ 397,694

Less non-controlling interest - other 19,203 20,636 15,576

Total stockholders’ equity, net of non-controlling interests - other $ 377,571 $ 369,508 $ 382,118

Plus Specialty Insurance accumulated depreciation and amortization, net of tax 36,088 28,497 21,010

Plus Care accumulated depreciation and amortization - discontinued operations, net of tax and NCI 30,521 21,528 13,545

Plus acquisition costs 8,427 7,311 6,412

Invested Capital $ 452,607 $ 426,844 $ 423,085

Plus corporate debt $ 188,500 $ 199,000 $ 175,000

Total Capital $ 641,107 $ 625,844 $ 598,085

17

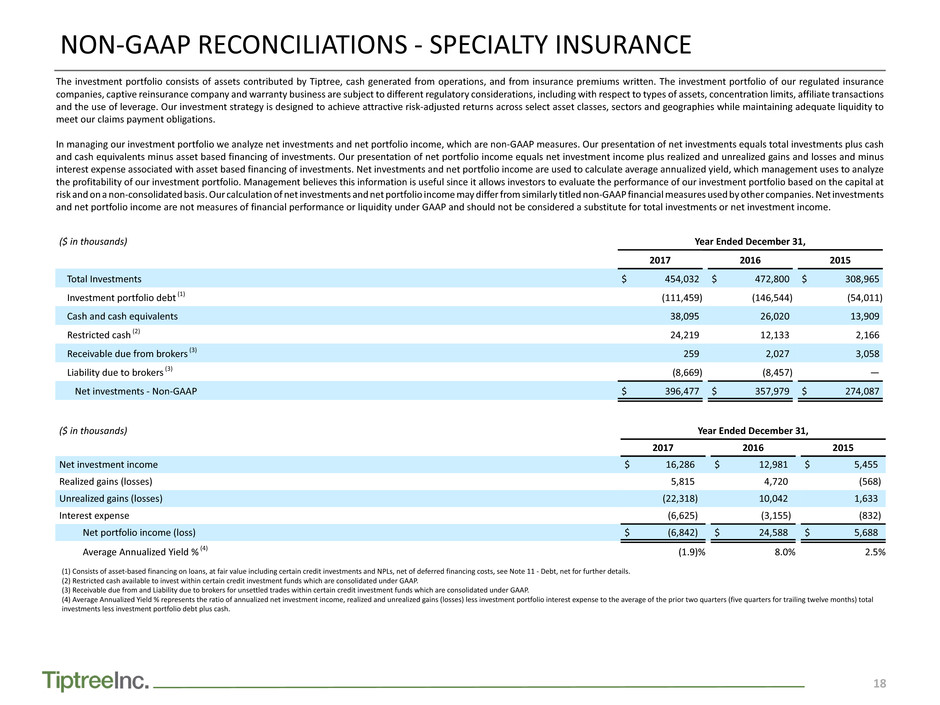

NON-GAAP RECONCILIATIONS - SPECIALTY INSURANCE

The following table provides a reconciliation between as adjusted underwriting margin and pre-tax income. We generally limit the underwriting risk we assume through the use of both reinsurance

(e.g., quota share and excess of loss) and retrospective commission agreements with our partners (e.g., commissions paid adjust based on the actual underlying losses incurred), which manage and

mitigate our risk. Period-over-period comparisons of revenues are often impacted by the PORCs and clients’ choice as to whether to retain risk, specifically with respect to the relationship between

service and administration expenses and ceding commissions, both components of revenue, and the offsetting policy and contract benefits and commissions paid to our partners and reinsurers.

Generally, when losses are incurred, the risk which is retained by our partners and reinsurers is reflected in a reduction in commissions paid. In order to better explain to investors the net financial

impact of the risk retained by the Company of the insurance contracts written and the impact on profitability, we use the Non-GAAP metric - As Adjusted Underwriting Margin. For the same reasons

that we adjust our combined ratio for the effects of purchase accounting, VOBA impacts can also mask the actual relationship between revenues earned and the offsetting reductions in commissions

paid, and thus the period over period net financial impact of the risk retained by the Company. Expressed as a percentage, the combined ratio represents the relationship of policy and contract benefits,

commission expense (net of ceding commissions), employee compensation and benefits, and other expenses to net earned premiums, service and administrative fees, and other income. Investors

use this ratio to evaluate our ability to profitably underwrite the risks we assume over time and manage our operating costs. As such, we believe that presenting underwriting margin and the combined

ratio provides useful information to investors and aligns more closely to how management measures the underwriting performance of the business.

Year Ended December 31,

($ in thousands) GAAP Non-GAAP adjustments Non-GAAP - Adjusted

Revenues: 2017 2016 2015 2017 2016 2015 2017 2016 2015

Net earned premiums $ 371,700 $ 229,436 $ 166,265 $ — $ — $ — $ 371,700 $ 229,436 $ 166,265

Service and administrative fees 95,160 109,348 106,525 968 5,638 19,518 96,128 114,986 126,043

Ceding commissions 8,770 24,784 43,217 53 416 3,410 8,823 25,200 46,627

Other income 3,552 2,859 8,361 — — — 3,552 2,859 8,361

Less underwriting expenses:

Policy and contract benefits 123,959 106,784 86,312 — — — 123,959 106,784 86,312

Commission expense 241,835 147,253 105,751 2,309 10,745 45,166 244,144 157,998 150,917

Underwriting Margin - Non-GAAP $ 113,388 $ 112,390 $ 132,305 $ (1,288) $ (4,691) $ (22,238) $ 112,100 $ 107,699 $ 110,067

Less operating expenses:

Employee compensation and benefits 41,300 37,937 38,786 — — — 41,300 37,937 38,786

Other expenses 38,596 32,964 31,386 144 363 1,928 38,740 33,327 33,314

Combined Ratio 92.9% 87.9% 77.9% — — — 93.2% 89.5% 87.4%

Plus investment revenues:

Net investment income 16,286 12,981 5,455 — — — 16,286 12,981 5,455

Net realized and unrealized gains (16,503) 14,762 1,065 — — — (16,503) 14,762 1,065

Less other expenses:

Interest expense 15,072 9,244 6,968 — — — 15,072 9,244 6,968

Depreciation and amortization expenses 12,799 13,184 29,673 (185) (3,282) (19,320) 12,614 9,902 10,353

Pre-tax income (loss) $ 5,404 $ 46,804 $ 32,012 $ (1,247) $ (1,772) $ (4,846) $ 4,157 $ 45,032 $ 27,166

18

The investment portfolio consists of assets contributed by Tiptree, cash generated from operations, and from insurance premiums written. The investment portfolio of our regulated insurance

companies, captive reinsurance company and warranty business are subject to different regulatory considerations, including with respect to types of assets, concentration limits, affiliate transactions

and the use of leverage. Our investment strategy is designed to achieve attractive risk-adjusted returns across select asset classes, sectors and geographies while maintaining adequate liquidity to

meet our claims payment obligations.

In managing our investment portfolio we analyze net investments and net portfolio income, which are non-GAAP measures. Our presentation of net investments equals total investments plus cash

and cash equivalents minus asset based financing of investments. Our presentation of net portfolio income equals net investment income plus realized and unrealized gains and losses and minus

interest expense associated with asset based financing of investments. Net investments and net portfolio income are used to calculate average annualized yield, which management uses to analyze

the profitability of our investment portfolio. Management believes this information is useful since it allows investors to evaluate the performance of our investment portfolio based on the capital at

risk and on a non-consolidated basis. Our calculation of net investments and net portfolio income may differ from similarly titled non-GAAP financial measures used by other companies. Net investments

and net portfolio income are not measures of financial performance or liquidity under GAAP and should not be considered a substitute for total investments or net investment income.

NON-GAAP RECONCILIATIONS - SPECIALTY INSURANCE

(1) Consists of asset-based financing on loans, at fair value including certain credit investments and NPLs, net of deferred financing costs, see Note 11 - Debt, net for further details.

(2) Restricted cash available to invest within certain credit investment funds which are consolidated under GAAP.

(3) Receivable due from and Liability due to brokers for unsettled trades within certain credit investment funds which are consolidated under GAAP.

(4) Average Annualized Yield % represents the ratio of annualized net investment income, realized and unrealized gains (losses) less investment portfolio interest expense to the average of the prior two quarters (five quarters for trailing twelve months) total

investments less investment portfolio debt plus cash.

($ in thousands) Year Ended December 31,

2017 2016 2015

Total Investments $ 454,032 $ 472,800 $ 308,965

Investment portfolio debt (1) (111,459) (146,544) (54,011)

Cash and cash equivalents 38,095 26,020 13,909

Restricted cash (2) 24,219 12,133 2,166

Receivable due from brokers (3) 259 2,027 3,058

Liability due to brokers (3) (8,669) (8,457) —

Net investments - Non-GAAP $ 396,477 $ 357,979 $ 274,087

($ in thousands) Year Ended December 31,

2017 2016 2015

Net investment income $ 16,286 $ 12,981 $ 5,455

Realized gains (losses) 5,815 4,720 (568)

Unrealized gains (losses) (22,318) 10,042 1,633

Interest expense (6,625) (3,155) (832)

Net portfolio income (loss) $ (6,842) $ 24,588 $ 5,688

Average Annualized Yield % (4) (1.9)% 8.0% 2.5%