Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CENTERSPACE | iret033118-10qex322.htm |

| EX-32.1 - EXHIBIT 32.1 - CENTERSPACE | iret033118-10qex321.htm |

| EX-31.2 - EXHIBIT 31.2 - CENTERSPACE | iret033118-10qex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CENTERSPACE | iret033118-10qex311.htm |

| EX-10.2 - EXHIBIT 10.2 - CENTERSPACE | exhibit102firstamendmentto.htm |

| 10-Q - 10-Q - CENTERSPACE | iret013118-10q.htm |

PURCHASE AND SALE AGREEMENT

BY AND BETWEEN

IRET PROPERTIES, A NORTH DAKOTA LIMITED PARTNERSHIP,

together with certain affiliates as more particularly set forth herein

AND

HARRISON STREET REAL ESTATE, LLC, A DELAWARE LIMITED LIABILITY COMPANY

DATED

NOVEMBER 30, 2017

EAST\148676904.7

Table of Contents

1.1 | Affiliate | |||

1.2 | Agreement | |||

1.3 | Broker | |||

1.4 | Closing | |||

1.5 | Closing Date | |||

1.6 | Commitments | |||

1.7 | Contingency Date | |||

1.8 | Contracts | |||

1.9 | Due Diligence Period | |||

1.10 | Earnest Money | |||

1.11 | Ground Leased Sites | |||

1.12 | Ground Leases | |||

1.13 | Hazardous Materials | |||

1.14 | Hazardous Materials Laws | |||

1.15 | Improvements | |||

1.16 | Intangible Personal Property | |||

1.17 | Land | |||

1.18 | Leases | |||

1.19 | Licenses and Permits | |||

1.20 | Major Tenant | |||

1.21 | Non-Disclosure Agreement | |||

1.22 | Owned Sites | |||

1.23 | Permitted Exceptions | |||

1.24 | Personal Property | |||

1.25 | Properties | |||

1.26 | Purchase Price | |||

1.27 | Real Property | |||

1.28 | Retained Liabilities | |||

1.29 | Surveys | |||

1.30 | Tangible Personal Property | |||

1.31 | Title Company | |||

1.32 | Title Evidence | |||

Article 2. Purchase and Sale | ||||

Article 3. Purchase Price | ||||

3.1 | Amount | |||

3.2 | Manner of Payment | |||

Article 4. Closing | ||||

4.1 | Closing Date | |||

4.2 | Seller's Closing Documents | |||

4.3 | Notice to Tenants | |||

4.4 | Purchaser's Closing Documents | |||

4.5 | Purchaser's Closing Deliveries | |||

4.6 | Closing Escrow | |||

4.7 | Closing Adjustments | |||

4.8 | Possession | |||

Article 5 Title Examination | ||||

5.1 | Title Evidence | |||

5.2 | Purchaser's Objections and Requirements | |||

5.3 | Correction of Title | |||

Article 6. Conditions Precedent | ||||

6.1 | Conditions in Favor of Purchaser | |||

6.2 | Conditions inf Favor of Seller | |||

Article 7. Representations and Warranties | ||||

7.1 | Seller's Representations and Warranties | |||

7.2 | Purchaser's Representations and Warranties | |||

Article 8. Inspection; Due Diligence Period; Condition of Property at Closing | ||||

8.1 | Inspections; Right of Entry | |||

8.2 | Due Diligence | |||

8.3 | Conditions of Properties at Closing | |||

8.4 | Estoppel Certificates | |||

8.5 | Tenant Communications | |||

8.6 | Purchaser's Reliance on its Investigations; "As Is" Sale | |||

Article 9. Operation Pending Closing | ||||

9.1 | Existing Operations | |||

9.2 | New Contracts and Leases | |||

9.3 | Termination of Service Contracts | |||

Article 10. Damage or Destruction | ||||

Article 11. Condemnation | ||||

Article 12. Brokers | ||||

Article 13. Default | ||||

13.1 | Default by Purchaser | |||

13.2 | Default by Seller | |||

Article 14. Termination | ||||

Article 15. Assignability | ||||

Article 16. Confidentiality | ||||

16.1 | General | |||

16.2 | Permitted Disclosures | |||

16.3 | Representatives | |||

16.4 | Public Disclosures | |||

16.5 | Survival | |||

Article 17. Notices | ||||

Article 18. Deferred Exchange | ||||

Article 19. Miscellaneous | ||||

19.1 | Entire Agreement; Modification | |||

19.2 | Survival; No Merger | |||

19.3 | Governing Law | |||

19.4 | Severability | |||

19.5 | Time of Essence | |||

19.6 | Construction | |||

19.7 | Captions, Gender, Number and Language of Inclusion | |||

19.8 | Binding Effect | |||

19.9 | Counterparts | |||

19.10 | Limitation of Liability | |||

Exhibits

Exhibit A: Schedule of Properties and Allocated Values

Exhibit B: Legal Descriptions of Land

Exhibit C: Reserved

Exhibit D: Primary Tenant Estoppel Certificates

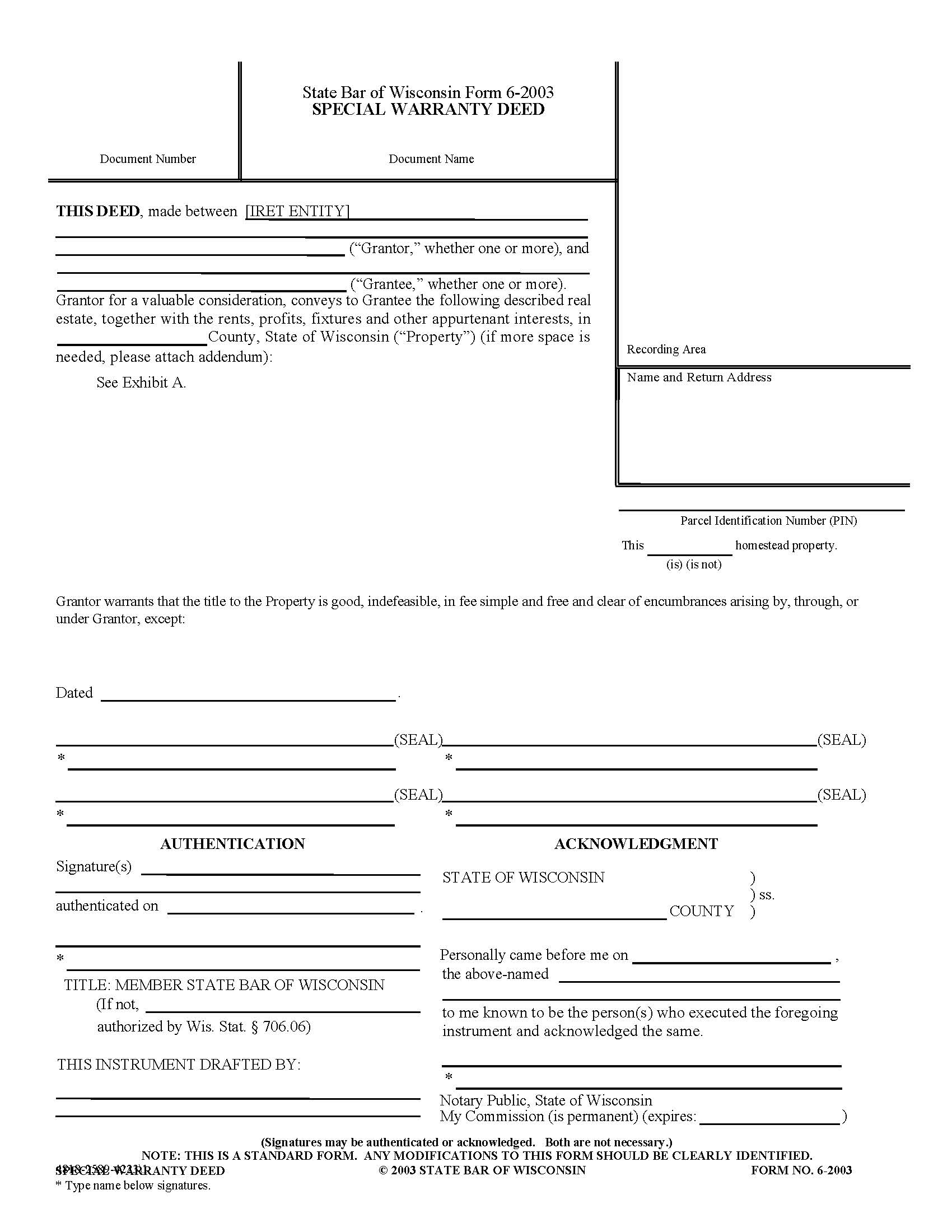

Exhibit E: Forms of Deeds

Exhibit F: Form of Assignment of Ground Lease

Exhibit G: Form of Quitclaim Bill of Sale

Exhibit H: | Form of Assignment and Assumption of Leases, Warranties and Contracts |

Exhibit I: | Form of Tenant Notice |

Exhibit J: | Form of Tenant Estoppel Certificate |

Exhibit K: Form of Ground Lease Estoppel Certificate

Exhibit L-1 Requested CC&R Estoppels

Exhibit L-2 Material Campus Declaration Estoppels

Exhibit M Form of CC&R Estoppel

Exhibit N Due Diligence Materials

Schedules

Schedule 7.1.2 Ground Leases

Schedule 7.1.3 Leases

Schedule 7.1.4 Contracts

Schedule 7.1.5 ROFOs, ROFRs, Purchase Options

Schedule 9.3 Pending Capital Improvement Projects

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (“Agreement”) is made as of the 30th day of November, 2017 (“Effective Date”), by and between IRET Properties, a North Dakota limited partnership (“IRET Properties”), SMB Operating Company, LLC, a Delaware limited liability company (“SMB”), Missoula 3050 CBR, LLC, a North Dakota limited liability company (“IRET Missoula”), IRET - Billings 2300 CBR, LLC, a North Dakota limited liability company (“IRET Billings”), Minnesota Medical Investors, LLC, a Delaware limited liability company (“MN Medical”, and together with IRET Properties, SMB, IRET Missoula and IRET Billings, collectively, “Seller”), and Harrison Street Real Estate, LLC, a Delaware limited liability company (“Purchaser”).

Purchaser desires to purchase a portfolio of medical office building properties (collectively, the “Properties” or each a “Property”) both owned and ground leased by Seller (the applicable individual Seller for each Property being as listed on Exhibit A hereto), and Seller desires to sell all such owned Properties and assign Seller’s rights as lessee under all such ground leased Properties to Purchaser pursuant to the terms and conditions set forth in this Agreement.

Accordingly, Seller and Purchaser agree as follows:

Article 1.Definitions.

The following terms shall have the meanings set forth below:

1.1 Affiliate. With respect to any person or entity, any person or entity directly or indirectly controlling, controlled by, or under common control with such person or entity. Control for such purposes shall mean either the ownership of 50% or more of the direct or indirect beneficial interests in the subject entity or the power to direct or cause the direction of the management and policies of such entity, whether through the ownership of voting securities, by contract, or otherwise.

1.2 Agreement. This Agreement, including the following exhibits attached hereto and hereby made a part hereof:

Exhibit A: Schedule of Properties and Allocated Values

Exhibit B: Legal Descriptions of Land

Exhibit C: Reserved

Exhibit D: Primary Tenant Estoppel Certificates

Exhibit E: Forms of Deed

Exhibit F: Form of Assignment of Ground Lease

5

Exhibit G: Form of Quitclaim Bill of Sale

Exhibit H: | Form of Assignment and Assumption of Leases, Warranties and Contracts |

Exhibit I: | Form of Tenant Notice |

Exhibit J: | Form of Tenant Estoppel Certificate |

Exhibit K: | Form of Ground Lease Estoppel Certificate |

Exhibit L-1 | Requested CC&R Estoppels |

Exhibit L-2 | Material Campus Declaration Estoppels |

Exhibit M | Form of CC&R Estoppel |

Exhibit N | Due Diligence Materials |

1.3 Broker. BMO Capital Markets and CBRE, Inc.

1.4 Closing. Concurrently, the transfer of title to the Owned Properties, and the assignment of leasehold title to the Ground Leased Properties, to Purchaser, the payment to Seller of the Purchase Price, and the performance by each party of the other obligations on its part then to be performed, all in accordance with Article 4 herein.

1.5 Closing Date. The date on which the Closing shall occur as provided in Section 4.1, subject to Section 5.3 and any other provision of this Agreement which provides for postponement of the Closing Date.

1.6 Commitments. The owner’s and leasehold title insurance commitments with respect to the Real Property delivered to Purchaser prior to the Effective Date and described in Section 5.1.1.

1.7 Contingency Date. December 22, 2017.

1.8 Contracts. Collectively, all service contracts, operating contracts and equipment leases, if any, in effect with respect to the Properties.

1.9 Due Diligence Period. The period between the Effective Date and the Contingency Date.

1.10 Earnest Money. The earnest money deposit, together with any interest earned thereon, paid by Purchaser and held by Title Company as described Section 3.2.1.

1.11 Ground Leased Sites. The Real Property for which Seller is ground lessee pursuant to applicable ground leases, as identified on attached Exhibit A.

1.12 Ground Leases. The ground leases in effect with respect to the Ground Lease Sites, including all amendments, modifications and supplements thereto.

1.13 Hazardous Materials. Any chemical, substance, waste, material, gas, microorganism or emission which is deemed hazardous, toxic, a pollutant or a contaminant under any Hazardous Materials Law (as hereinafter defined), or which has been shown to have significant adverse effects on human health or the environment. "Hazardous Materials" shall include, without limitation, petroleum and petroleum products, asbestos, chlorofluorocarbons, radon gas, polychlorinated biphenyls and stachybotrys.

1.14 Hazardous Materials Laws. All statutes, ordinances, bylaws, rules and regulations, executive orders and other administrative orders, judgments, decrees, injunctions or other judicial orders of or by any governmental authority, now or hereafter in effect, relating to pollution or protection of human health or the environment, including, without limitation, any of the foregoing relating to emissions, discharges, releases or threatened releases, manufacturing, processing, distribution, use, treatment, storage, disposal, transport or handling of materials or substances that may be harmful to human health, safety or the environment, including, without limitation, CERCLA (Comprehensive Environmental Response, Compensation, and Liability Act of 1980, 42 U.S.C. §§9601 et seq., as amended by SARA (Superfund Amendment and Reauthorization Act of 1986) and as may be further amended from time to time), the Resource Conservation and Recovery Act of 1976, 42 U.S.C. §§6901 et seq.

1.15 Improvements. With respect to each parcel of Real Property, all buildings, structures, fixtures and other improvements located on the Land.

1.16 Intangible Personal Property. All of Seller’s right, title and interest, if any, in and to all of the following items, to the extent assignable and without representation or warranty from Seller except as expressly set forth herein: (A) all Licenses and Permits; (B) trade name of any of the Properties (if any) in connection with the Properties; (C) if still in effect, any warranties or guaranties received by Seller from any contractor, manufacturer or other person in connection with the construction and operation of the Properties; (D) all architectural drawings, plans, construction drawings, CAD files or other plans and drawings of the Improvements; and (E) all books, records, tenant files, vendor files and operating manuals pertaining to the Properties; but, Intangible Personal Property shall specifically exclude any and all trademarks, service marks and trade names (except as set forth in clause (B) above) of Seller and Seller’s Affiliates, and with reservation by Seller to use such names in connection with other property owned by Seller.

1.17 Land. The real property for each of the Properties, including both the Owned Sites and the Ground Leased Sites, as identified and legally described on attached Exhibit B.

1.18 Leases. The various tenant building leases, subleases, space licenses or other occupancy agreements in effect with respect to each of the Properties.

1.19 Licenses and Permits. All licenses and permits relating to the construction, development, occupancy and operation of the Properties

1.20 Major Tenant. A tenant that, together with its Affiliates, leases 5,000 square feet or more of gross leasable area pursuant to one or more Leases at any individual Property.

1.21 Non-Disclosure Agreement. That certain Non-Disclosure Agreement by and between Investors Real Estate Trust and Purchaser, dated August 23, 2017.

1.22 Owned Sites. The Real Property owned by Seller in fee simple, as identified on attached Exhibit A.

1.23 Permitted Exceptions. With respect to each Property, the matters affecting title to the Real Property that are determined to be Permitted Exceptions pursuant to Section 5.2.

1.24 Personal Property. Collectively, the Tangible Personal Property and the Intangible Personal Property.

1.25 Properties. The Real Property, the Personal Property, the Leases and the Contracts to be assumed by Purchaser in accordance with the terms hereof, collectively for each Property (including both the Owned Sites and the Ground Leased Sites), together with all right, title and interest of Seller in and to appurtenances of the Real Property, including easements or rights-of-way relating thereto, as identified and valued on attached Exhibit A.

1.26 Purchase Price. The purchase price for the Properties, as described in Article 3.

1.27 Real Property. Collectively, the Land and the Improvements for both the Owned Sites and the Ground Leased Sites.

1.28 Retained Liabilities. All liabilities with respect to the ownership and operation of the Properties arising out of matters occurring prior to the Closing Date, including, without limitation, the payment of state, local, or federal taxes and assessments except to the extent of any credit received by Purchaser at Closing with respect thereto, third-party claims or litigation related to the Properties and arising out of or pertaining to matters occurring prior to the Closing Date and liabilities pertaining to any employees of Seller or the Properties for the period prior to Closing.

1.29 Surveys. The existing, and, if applicable, updated surveys of the Real Property as described in Section 5.1.2.

1.30 Tangible Personal Property. The items of personal property for each of the Properties, including without limitation all fixtures, furniture, equipment, and other tangible personal property, if any, owned by Seller and presently located on the Land, but excluding any items of personal property owned by tenants, any managing agent, or unaffiliated third parties.

1.31 Title Company. First American Title Insurance Company.

1.32 Title Evidence. The title evidence with respect to each of the Properties as described, in Section 5.1 herein.

Article 2. Purchase and Sale.

Seller hereby agrees to sell, and Purchaser hereby agrees to purchase, upon and subject to the terms and conditions hereinafter set forth, the Properties.

Article 3. Purchase Price.

3.1 Amount. Purchaser shall pay to Seller as and for the Purchase Price for the Properties the sum of Four Hundred Seventeen Million Five Hundred Thousand and No/100s Dollars ($417,500,000.00).

3.2 Manner of Payment. The Purchase Price shall be payable as follows:

3.2.1 Four Million Five Hundred Thousand and No/100s Dollars ($4,500,000.00) as Earnest Money to be deposited with the Title Company within five (5) days of the Effective Date, the receipt of which is hereby acknowledged, and which shall be held and disbursed pursuant to the terms of this Agreement. The Title Company shall invest the Earnest Money in government insured, interest‑bearing accounts satisfactory to Purchaser and Seller, shall not commingle the Earnest Money with any funds of the Title Company or others. The Title Company shall promptly provide Purchaser and Seller with confirmation of the investments made. If the Closing under this Agreement occurs, the Title Company shall apply the Earnest Money to the Purchase Price at Closing and deliver it to Seller. Otherwise, the Earnest Money promptly shall be delivered to Seller or Purchaser in accordance with the provisions of this Agreement

3.2.2 The balance of the Purchase Price in cash or by wire transfer of immediately available funds on the Closing Date.

Article 4. Closing.

4.1 Closing Date. The Closing shall occur on the earlier of (a) December 28, 2017, or (b) five (5) business days after the date when Purchaser shall notify Seller that all of the contingencies in Section 6.1 have been waived by Purchaser or satisfied, as such date may be adjourned in accordance with the express terms hereof. The Closing shall occur on the Closing Date at the offices of Title Company or at such other place, date and time as Seller and Purchaser may agree.

4.2 Seller’s Closing Documents. At or before Closing, Seller shall execute, acknowledge (where appropriate), and deliver to Purchaser the following, each dated as of the Closing Date.

4.2.1 The limited warranty deeds (collectively, “Deeds”), for each of the Owned Sites, utilizing the form are attached hereto as Exhibit E, conveying to Purchaser fee simple title to the Owned Sites, subject only to Permitted Exceptions.

4.2.2 The assignments of ground leases assigning to Purchaser all of Seller’s rights, and delegating to Purchaser all of Seller’s duties, under the ground leases for each of the Ground Leased Sites, in the form of attached Exhibit F (collectively, “Ground Lease Assignments”), and to the extent either required by the Title Company or requested by Purchaser and consistent with the means through which title thereto was vested in Seller, a supplemental quitclaim deed with respect to the improvements located on the Ground Leased Sites in the customary form used in the applicable jurisdiction.

4.2.3 A quitclaim bill of sale conveying to Purchaser the tangible items of Personal Property owned by Seller and located on each of the Properties in the form of attached Exhibit G.

4.2.4 An Assignment and Assumption of Leases, Warranties, Contracts and Intangible Personal Property assigning to Purchaser all of Seller’s right, title and interest in the Leases, warranties and Contracts and Intangible Personal Property with respect to the Properties in the form of attached Exhibit H (“Assignment and Assumption”).

4.2.5 An affidavit of Seller regarding liens, judgments, residence, tax liens, bankruptcies, parties in possession, survey and mechanics’ or materialmens’ liens and other matters affecting title to the Real Property in the form required by the Title Company, including without limitation, any “gap indemnity” required by the Title Company.

4.2.6 A Foreign Investment in Real Property Tax Act (“FIRPTA”) affidavit stating that Seller is not a “foreign person”, “foreign partnership”, “foreign trust” or “foreign estate” as those terms are defined in Section 1445 of the Internal Revenue Code.

4.2.7 All other documents and instruments which (a) Title Company may reasonably determine are necessary to evidence the authority of Seller to enter into and perform this Agreement and the documents and instruments required to be executed and delivered by Seller pursuant to this Agreement, or (b) may be required of Seller under applicable law, including any revenue or tax certificates or statements, or any affidavits, certifications or statements relating to the environmental condition of any of the Real Property, the presence (or absence) of wells about the Real Property, the presence (or absence) of storage tanks about the Real Property, or the extent of compliance of any of the Real Property with applicable law.

4.2.8 A settlement statement consistent with the terms of this Agreement.

4.2.9 The Ground Lease Estoppel Certificates, the Required Tenant Estoppel Certificates, the Material Declaration Estoppel Certificates and any Seller Estoppel Certificate, as provided in Section 8.4 herein.

4.2.10 A current rent roll for the Leases relating to each Property, certified by Seller to Purchaser to be true and correct as of the Closing Date (“Rent Roll”).

4.2.10 A “bring-down” certificate of Seller certifying that, except to the extent the express terms of this Agreement permit otherwise, the representations and warranties of Seller set forth herein are true and correct in all material respects as of the Closing Date.

4.3 Notice to Tenants. Immediately after Closing, Seller and Purchaser shall deliver to each tenant under the Leases a notice regarding the sale and the change in ownership in substantially the form of Exhibit I attached hereto, or such other form as may be required by applicable state law.

4.4 Purchaser’s Closing Documents. At Closing, Purchaser shall execute, acknowledge (where appropriate), and deliver to Seller the following, each dated as of the Closing Date:

4.4.1 The Assignment and Assumption.

4.4.2 The Ground Lease Assignments.

4.4.3 All documents and instruments, each executed and acknowledged (where appropriate) by Purchaser, which (a) Seller or Title Company may reasonably determine are necessary to evidence the authority of Purchaser to enter into and perform this Agreement and the documents and instruments required to be executed and delivered by Purchaser pursuant to this Agreement, or (b) may be required of Purchaser under applicable law, including any purchaser’s affidavits or revenue or tax certificates or statements.

4.4.4 A settlement statement consistent with the terms of this Agreement executed by Purchaser.

4.4.5 A “bring-down” certificate of Purchaser certifying that, except to the extent the express terms of this Agreement permit otherwise, the representations and warranties of Purchaser set forth herein are true and correct in all material respects as of the Closing Date.

4.5 Purchaser’s Closing Deliveries. At Closing, Purchaser shall cause the following to be delivered to Seller:

4.5.1 The Purchase Price, payable pursuant to Section 3.2.2, as adjusted pursuant to Section 4.7, by wire transfer of immediately available funds. The Earnest Money shall be applied to and credited against the Purchase Price and shall be disbursed to Seller by Title Company at closing.

4.6 Closing Escrow. Purchaser and Seller shall deposit their respective Closing deliveries described above with Title Company with appropriate instructions for recording and disbursement consistent with this Agreement prior to the Closing Date, except that Purchaser shall not be required to deliver the Purchase Price into escrow until the Closing Date.

4.7 Closing Adjustments. The following adjustments shall be made at Closing:

4.7.1 General real estate taxes applicable to any of the Real Property due and payable in the year of Closing, together with all special assessments payable therewith, shall be prorated between Seller and Purchaser on a daily basis as of the Closing Date based upon a calendar fiscal year, with Seller paying amounts allocable to the period on and prior to the Closing Date and Purchaser being responsible for amounts allocable subsequent thereto.

4.7.2 With respect to the Ground Leased Sites, any and all rents, additional rents, operating expenses, real estate taxes, and any other amounts owed or credited pursuant to the applicable ground leases for each of the Ground Leased Sites (collectively, the “Ground Leases”) shall be prorated between Seller and Purchaser on a daily basis as of the Closing Date, with Seller retaining the charges and credits allocable to the period on and prior to the Closing Date and Purchaser being responsible for the charges and credits allocable subsequent to the Closing Date.

4.7.3 Personal property taxes applicable to any of the Personal Property due and payable in the year of Closing shall be prorated between Seller and Purchaser on a daily basis as of the Closing Date based upon a calendar fiscal year, with Seller paying amounts allocable to the period on and prior to the Closing Date and Purchaser being responsible for amounts allocable subsequent to the Closing Date.

4.7.4 Purchaser shall assume all special assessments (and charges in the nature of or in lieu of such assessments) due and payable with respect to the period following the Closing Date with respect to any of the Real Property.

4.7.5 Purchaser shall pay all sales tax due regarding this transaction.

4.7.6 Seller shall pay all state deed tax or any transfer taxes or fees regarding the Deeds to be delivered by Seller to Purchaser or the conveyance of the Real Property to Purchaser at Closing. Purchaser shall pay any mortgage registry tax or any similar taxes or fees regarding any mortgage(s) given by Purchaser on the Real Property in connection with this transaction.

4.7.7 Purchaser shall pay the cost of recording all documents, including the Deeds and Ground Lease Assignments.

4.7.8 Seller will pay all costs associated with the issuance of the Commitments.

4.7.9 Seller shall pay all premiums required for a standard owner’s title insurance policies, and Purchaser shall pay all premiums required any mortgagee’s title insurance policies and any extended owner’s title insurance coverage, including any endorsements issued in connection with such policies.

4.7.10 Seller and Purchaser shall each pay one half (1/2) of any Closing fee payable to Title Company with respect to the transaction(s) contemplated by this Agreement.

4.7.11 All utility expenses, including water, fuel, gas, electricity, telephone, sewer, trash removal, heat and other services furnished to or provided for the each of the Properties paid by Seller shall be prorated between Seller and Purchaser on a daily basis as of the Closing Date, with Seller paying amounts allocable to the period on and prior to the Closing Date and Purchaser being responsible for amounts allocable subsequent to the Closing Date. Seller agrees to have all meters with respect to any such utilities read as of the Closing Date.

4.7.12 Seller shall be responsible for all leasing commission, tenant allowances, tenant improvement costs and free rent periods applicable to the Leases (collectively, “Leasing Costs”), if any, for any Leases (including amendments, extensions or renewals thereof) executed prior to the Effective Date, and Purchaser shall be responsible for all Leasing Costs for Leases executed on or after the Effective Date; provided that Purchaser shall be responsible for Leasing Costs payable in connection with an extension and amendment of the Fairview Health Services Leases executed prior to the Effective Date if Purchaser has provided its prior approval to the material terms thereof (including the amount of the commissions payable in connection therewith) prior to the Effective Date.

4.7.13 All other operating costs of the Properties shall be prorated between Seller and Purchaser on a daily basis as of the Closing Date, with Seller paying amounts allocable to the period on and prior to the Closing Date and Purchaser being responsible for amounts allocable subsequent to the Closing. To the extent any operating expenses of the Properties (including real estate taxes and special assessments) are reimbursable by tenants under the Leases, Purchaser shall pay to Seller the amount of such operating expenses actually paid by Seller and reimbursable by tenants under the Leases but not yet reimbursed as of the Closing Date as and when collected from the applicable tenants following Closing. To the extent any reconciliation of operating expenses and other amounts payable by tenants under their Leases for the period prior to Closing results in amounts being due, reimbursed or credited to such tenants, Seller shall reimburse Purchaser for such amounts within ten (10) business days of notice thereof from Purchaser. Notwithstanding the foregoing, to the extent Seller is aware as of the Closing Date of any overcharge to tenants for reimbursable expenses payable with respect to the period prior to Closing, Seller shall instead credit Purchaser for such amounts at Closing and Purchaser shall thereafter be responsible for reimbursing or crediting such amounts to the applicable tenants. Following Closing, Seller shall reasonably cooperate with Purchaser in the preparation of any required cost reconciliation with respect to the tenants under the Leases for periods prior to the Closing Date.

4.7.14 All rent and other charges payable by tenants under the Leases and collected by Seller shall be prorated between Seller and Purchaser on a daily basis as of the Closing Date, with Seller retaining the charges, payments and credits allocable to the period on and prior to the Closing Date and Purchaser receiving the charges, payments and credits allocable subsequent to the Closing Date. If at Closing a tenant is delinquent in any payment required under its Lease for period prior to the Closing Date, then, to the extent Purchaser receives rent amounts from such tenants after Closing, Purchaser shall pay such amounts in excess of the rent and other amounts then owing to Purchaser to Seller within ten (10) business days of receipt. Purchaser shall use reasonable efforts to collect any such delinquent amounts.

4.7.15 Seller shall pay to Purchaser all security deposits under the Leases to the extent collected or held by Seller.

4.7.16 Except as expressly provided herein, Seller and Purchaser shall each pay its own attorneys’ fees incurred in connection with this transaction.

4.7.17 Seller shall be responsible for all brokerage fees and commissions payable to BMO Capital Markets and/or CBRE arising out of this Agreement and the transactions contemplated herein.

4.7.18 Purchaser shall be responsible for making any deposits required with utility companies from and after Closing.

If any of the amounts under this Section 4.7 cannot be calculated with complete precision at Closing because the amount or amounts of one or more items included in such calculation are not then known, then such calculation shall be made on the basis of the reasonable estimates of Seller and Purchaser as soon as reasonably possible after the Closing but in no event later than ninety (90) days after Closing, subject to prompt adjustment (by additional payment or refund, as necessary) when the amount of any such item or items become known. This Section 4.7 shall survive Closing.

4.8 Possession. Seller shall deliver exclusive legal and actual possession of the Properties to Purchaser on the Closing Date, subject to the Leases.

Article 5. Title Examination.

5.1 Title Evidence. As of the Effective Date, Seller shall have furnished access to the following title evidence to Purchaser by providing Purchaser with access to the transaction data room (collectively, the “Title Evidence”):

5.1.1 The Commitments, to insure title to the Real Property issued by Title Company. The Commitments shall (a) be in amounts allocated to each Property, which in the aggregate shall equal the Purchase Price, and (b) include copies of all documents, instruments and matters shown as exceptions or referenced therein.

5.1.2 The most current Surveys of the Properties, to the extent such surveys exist. Purchaser shall have the right to update any of the existing Surveys or to have new Surveys performed, at Purchaser’s expense, for any of the Properties.

5.2 Purchaser’s Objections and Requirements. Purchaser shall be allowed until and including December 15, 2017 to examine the Title Evidence and to make any objections to the condition of title to the Real Property (“Title Objections”). Purchaser shall not object to any of the Permitted Exceptions. “Permitted Exceptions” shall include: all zoning and building laws, ordinances, maps, resolutions, and regulations of all governmental authorities having jurisdiction which affect the Properties and the use, improvement or enjoyment thereof; the Leases; matters affecting title created by or with the prior written consent of Purchaser; and

liens to secure taxes and assessments not yet due and payable. Any title exceptions or encumbrances set forth in the Commitments and not objected to as Title Objections in accordance with the terms hereof, except for any Required Removal Exceptions, shall be deemed to be waived by Purchaser and automatically shall become Permitted Exceptions. From and after the Effective Date and prior to Closing, Seller shall not cause any new easement, lien or other encumbrance to be recorded against any Property without the prior written approval of Purchaser.

5.3 Correction of Title. Except as expressly provided in this Article 5, Seller shall have no obligation to cure any of Purchaser’s Title Objections. If Purchaser timely provides Seller with any Title Objections, Seller shall have until the earlier of (i) five (5) business days following receipt of the applicable Purchaser’s Title Objections and (ii) the Contingency Date to notify Purchaser that Seller: (a) will cause or (b) elects not to cause any or all of the Title Objections to be cured or removed by the Title Company at or prior to Closing (“Cure Notice”). Seller will be deemed not to have elected to cure or remove any of the Title Objections that Seller does not expressly agree to have cured or removed by providing the Cure Notice for the same to Purchaser within such five (5) business day period. If Seller makes the election in clause (a) above with respect to any Title Objections, Seller shall cause such Title Objections to be cured or removed by the Title Company at or prior to Closing. If Seller elects, or is deemed hereunder to have elected, not to cause certain of the Title Objections not to be removed or cured, Purchaser shall have the option to do either of the following:

5.3.1 Terminate this Agreement, by providing written notice of termination within five (5) business days of the date Seller elects, or is deemed to have elected, not to cure or remove any such Title Objection; or

5.3.2 Waive the applicable Title Objections and proceed to Closing.

5.4 Notwithstanding the foregoing, Seller shall be obligated to remove or cure on or prior to the Closing Date all of the following exceptions and encumbrances affecting the Properties, whether or not Purchaser issues a Title Objection with respect thereto (collectively, “Required Removal Exceptions”): (a) any mortgage, deed of trust, assignment of leases and rents or other lien securing debt encumbering all or any portion of the Real Property, (b) all liens for delinquent real estate taxes and assessments, (c) mechanics’ liens and other involuntary liens that can be cured and/or discharged by the payment of a monetary sum up to a maximum amount of $100,000.00 for each individual Property, and (d) any other lien or encumbrance or other title exception voluntarily created by or through Seller or a Seller Affiliate after the Effective Date unless Purchaser provides its prior written consent to the same.

5.5 It shall be a condition to Purchaser’s obligations at Closing that the Title Company shall be irrevocably committed, subject to the payment of applicable premiums therefor, to issue effective as of Closing in favor of Purchaser or its permitted assignee(s) owner’s policies of title insurance insuring fee and/or leasehold title to the Properties, as applicable, subject only to Permitted Exceptions.

Article 6. Conditions Precedent.

6.1 Conditions in Favor of Purchaser. The obligations of Purchaser under this Agreement are contingent upon each of the following:

6.1.1 On or before the Contingency Date, Purchaser shall have determined that the matters and conditions disclosed by the reports, investigations and tests received or performed by Purchaser are acceptable to Purchaser in its sole discretion.

6.1.2 On the Closing Date, each of the representations and warranties of Seller in Section 7.1 shall be true and correct as if the same were made on the Closing Date.

6.1.3 On and as of the Closing Date, Seller shall have performed all of the obligations required to be performed by Seller under this Agreement as and when required under this Agreement, and no breach by Seller of its obligations hereunder shall remain outstanding following any applicable cure period expressly set forth in Section 13.2 below.

6.1.4 Seller shall have delivered on or prior to the Estoppel Delivery Deadline (hereafter defined) a written waiver in form and substance reasonably acceptable to Purchaser and the Title Company with respect to any right of first offer, right of first refusal or other option for a third party to purchase all or any portion of the Property that becomes operative as a result of the execution of this Agreement or consummation of the transactions contemplated herein, and a written instrument providing any consent to the transfer of any Property required under any Ground Lease, Lease or other agreement or instrument in effect with respect to the Property. If Seller is unable to provide Purchaser with a written waiver or consent required to satisfy the condition set forth in this Section 6.1.4 prior to the Estoppel Delivery Deadline, Seller shall have the right to adjourn the Closing Date one or more times by delivery of written notice to Purchaser on or prior to the Estoppel Delivery Deadline, but for not more than thirty (30) days in the aggregate, to satisfy this condition.

6.1.5 No Material Casualty or Material Condemnation (as defined in Articles 10 and 11 herein) shall have occurred as of the Closing Date.

6.1.6 No a material default, bankruptcy or insolvency of a Major Tenant shall have occurred after the expiration of the Due Diligence Period.

6.1.7 No litigation shall be pending or threatened challenging Purchaser’s right to acquire, or Seller’s right to sell, the Property.

6.1.8 Seller shall have delivered to Purchaser on or prior to the Estoppel Delivery Deadline (hereafter defined):

a. A Ground Lease Estoppel in the form required hereunder with respect to each Ground Lease in effect with respect to the Properties pursuant to Section 8.4.1;

b. The Required Tenant Estoppel Certificates in the form required hereunder pursuant to Section 8.4.2; and

c. The Material Campus Declaration Estoppel Certificates in the form required hereunder pursuant to Section 8.4.3.

If any conditions in this Section 6.1 have not been satisfied on or before the applicable date set forth in this Section 6.1 with respect to each condition, then Purchaser may terminate this Agreement by providing written notice of termination to Seller on or before the applicable date, subject however to Section 13.2 with respect to a breach by Seller of its obligations hereunder, in which case the Earnest Money shall be returned to Purchaser. To the extent that any of the conditions in this Section 6.1 require the satisfaction of Purchaser, such satisfaction shall be determined by Purchaser in its sole and absolute discretion. The conditions in this Section 6.1 are specifically stated and for the sole benefit of Purchaser. Purchaser in its discretion may unilaterally waive (conditionally or absolutely) the fulfillment of any one or more of the conditions, or any part thereof, by written notice to Seller.

Notwithstanding the foregoing, if (i) the conditions set forth in Sections 6.1.3 are not satisfied with respect to any individual Property as the result of a voluntary material default by Seller of its obligations hereunder, or (ii) any of the conditions set forth in Sections 6.1.4- 6.1.7 are not satisfied with respect to any individual Property, taking into account any extension of the Closing Date and Estoppel Delivery Deadline pursuant to Sections 6.1.4 or 8.4 hereof, Purchaser, in its sole and absolute discretion, may elect to exclude any such Property from the Closing, and the applicable Purchase Price allocation for such Property, as set forth on attached Exhibit A shall be deducted from the Purchase Price.

6.2 Conditions in Favor of Seller. The obligations of Seller under this Agreement are contingent upon each of the following:

6.2.1 On the Closing Date, each of the representations and warranties of Purchaser in Section 7.2 shall be true and correct as if the same were made on the Closing Date.

6.2.2 On the Closing Date, Purchaser shall have performed all of the obligations required to be performed by Purchaser under this Agreement as and when required under this Agreement.

If any of the conditions in this Section have not been satisfied on or before the applicable date set forth in this Section 6.2 with respect to each condition, then Seller may terminate this Agreement by providing written notice of termination to Purchaser on or before the applicable date, subject however to Article 13. To the extent that any of the conditions in this Section 6.2 require the satisfaction of Seller, such satisfaction shall be determined by Seller in its sole and absolute discretion. The conditions in this Section 6.2 are specifically stated and for the sole benefit of Seller. Seller in its discretion may unilaterally waive any one or more of the conditions, or any part thereof, by written notice to Purchaser.

Article 7. Representations and Warranties.

7.1 Seller’s Representations and Warranties. Seller represents and warrants to Purchaser as of the date of this Agreement as follows:

7.1.1 Seller has been duly formed under the laws of the State of North Dakota, and is in good standing under the laws of the jurisdictions in which the Properties are located, is duly qualified to transact business in the jurisdictions in which the Properties are located, and has the requisite power and authority to enter into and perform this Agreement and the documents and instruments required to be executed and delivered by Seller pursuant hereto. This Agreement has been duly executed and delivered by Seller and is a valid and binding obligation of Seller enforceable in accordance with its terms. This Agreement and the documents and instruments required to be executed and delivered by Seller pursuant hereto have each been duly authorized by all necessary action on the part of Seller and that such execution, delivery and performance does and will not conflict with or result in a violation of Seller’s partnership agreement or any judgment, order or decree of any court or arbiter to which Seller is a party, or any agreement to which Seller and/or any of the Property is bound or subject including the Ground Leases and the Leases.

7.1.2 The list of the Ground Leases set forth on Schedule 7.2.1 hereto is true and complete. Seller has provided full copies of the Ground Leases, and to Seller’s knowledge, the Ground Leases are in full force and effect, and neither Seller nor any of the lessors under the Ground Leases are in material default under the respective Ground Leases. The copies of such Ground Leases, including any amendments thereto, provided or made available to Purchaser in the Records are true and complete in all material respects.

7.1.3 The Rent Roll to be provided to Purchaser with respect to the Leases in the Records is, as of the Effective Date, and, as of the Closing Date will be, true, correct and complete in all material respects. The list of Leases affecting the Property set forth on Schedule 7.1.3 hereto is true and complete as of the Effective Date with respect to all Leases in excess of 2,000 rentable square feet and, to Seller’s knowledge, is true and complete with respect to all such other Leases, and there are no written or oral promises, understandings, agreements or commitments with tenants other than as set forth in such Leases. The copies of the Leases provided or made available to Purchaser in the Records are true and complete in all material respects with respect to all Leases in excess of 2,000 rentable square feet, and, to Seller’s knowledge, are true correct and complete with respect to all such other Leases. To Seller’s knowledge, neither Seller, nor any tenant, is in material default under any Lease. Notwithstanding anything to the contrary contained herein, Seller does not represent or warrant that any particular Lease will be in full force and effect as of the Closing or that any particular Lease will be free from default as of Closing.

7.1.4 To Seller’s knowledge, the list of Contracts affecting each of the Properties set forth on Schedule 7.1.4 hereto is true and complete in all material respects and the Records contain copies of all such Contracts that are true and complete in all material respects. Except for the Contracts set forth on Schedule 7.1.4 hereto, Seller has not entered into any contracts or other agreements that will be binding upon Purchaser after the Closing. To Seller’s knowledge, neither Seller, nor any other party, is in material default under any such Contract.

7.1.5 To Seller’s knowledge, except as disclosed in the environmental reports contained in the Records: (i) Hazardous Materials have not been used, generated, transported, treated, stored, released, discharged or disposed of in, onto, under or from any of the Properties in violation of any Hazardous Materials Laws by Seller, by any predecessor-in-title or agent of Seller, by any tenants, or by any other person at any time; (ii) except as disclosed in the environmental reports contained in the Records, there are no above-ground or underground tanks or any other underground storage facilities located on the Properties, and there have never been such tanks or facilities on the Properties; (iii) except as disclosed in the environmental reports contained in the Records, there are no wells or private sewage disposal or treatment facilities located on the Properties and there have never been such wells or private sewage disposal or treatment facilities located on the Properties, and (iv) for purposes of Minn. Stat. Sec. 115.55 with respect to the Properties located in the State of Minnesota, any sewage generated on any of the Property located in the State of Minnesota goes to a facility permitted by the Minnesota Pollution Control Agency. Seller has not received written notice of any violation of Hazardous Materials Law at the Properties that remains uncured or requires any remediation action pursuant to applicable laws and regulations.

7.1.6 To Seller’s knowledge, there has been no use or production of methamphetamine on the Properties and no disclosure statement is required under applicable law.

7.1.7 Seller: (a) is not in receivership or dissolution; (b) has not made any assignment for the benefit of creditors or admitted in writing its inability to pay its debts as they mature; (c) has not been adjudicated a bankrupt or filed a petition in voluntary bankruptcy or a petition or answer seeking reorganization or an arrangement with creditors under the federal bankruptcy law or any other similar law or statute of the United States or any jurisdiction and no such petition has been filed against Seller or any of its property or affiliates, if any; (d) has not suffered the attachment or other judicial seizure of all, or substantially all, of Seller’s assets, which remains pending as of such time; (e) has not made an offer of settlement, extension or composition to its creditors generally; and (f) none of the foregoing are pending or threatened.

7.1.8 Seller is not a “foreign person”, “foreign partnership”, “foreign trust” or “foreign estate” as those terms are defined in Section 1445 of the Internal Revenue Code.

7.1.9 Seller and the Properties are not subject to any pending litigation (or to Seller’s knowledge) any threatened litigation.

7.1.10 Seller has not received notice of any violation of applicable laws or regulations or any defaults under any applicable covenants, conditions or restrictions with respect to the Properties nor of any violation of other recorded instruments, any condemnation, rezoning or re-assessment affecting the Properties, and, to Seller’s knowledge, no material violation of the foregoing exists with respect to the Property.

7.1.11 To Seller’s knowledge, the operating statements provided in the Records furnished to Purchaser are true and complete in all material respects.

7.1.12 The Properties are not subject to any collective bargaining agreements, and all employment costs arising from the operation of the Property or accruing prior to the Closing Date have been and will be paid by Seller.

7.1.13 To Seller’s knowledge, Seller holds all required licenses and permits for the operation and occupancy of the Properties, which are in full force and effect without material violations.

7.1.14 The Records that have been or will be provided by Seller are true and complete copies of the applicable documents with respect to the Properties in Seller’s possession or control.

7.1.15 No right of first offer, right of first refusal or other option entitling a third party to purchase all or any portion of the Properties as a result of the execution of this Agreement or consummation of the transactions contemplated herein is in effect except as set forth on Schedule 7.1.15 hereto. No consent of any third party is required to effectuate the sale and conveyance of the Properties as contemplated herein pursuant to any Ground Lease, Lease or other agreement or instrument binding on the Properties except as set forth on Schedule 7.1.15.

7.1.16 Neither Seller nor, to Seller’s knowledge, any of its affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents, is a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of OFAC (including those named on OFAC’s Specially Designated and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action.

The representations of warranties of Seller set forth in this Section 7.1 shall survive Closing, subject to the terms of this paragraph. Seller shall have no liability with respect to any breach of a particular representation and warranty if (a) Purchaser has actual knowledge of the breach of such representation prior to the Closing Date and fails to notify Seller thereof and nevertheless proceeds to Closing, or (b) Purchaser does not commence an action against Seller with respect to the breach in question within twelve (12) months after the Closing. Further, in no event may Seller’s liability for a breach of any warranty under this Agreement with respect to any individual Property exceed the greater of (x) 1.5% of the allocated Purchase Price for such Property as set forth on attached Exhibit A and (y) $500,000.00. Wherever herein a representation is made based upon the knowledge of Seller, such knowledge is limited to the actual knowledge of Charles Greenberg and Anne Olson, without any duty of investigation or inquiry.

7.2 Purchaser’s Representations and Warranties. Purchaser represents and warrants to Seller as of the date of this Agreement as follows:

7.2.1 Purchaser has been duly formed under the laws of the State of Delaware, is, or will be as off the Closing Date, in good standing under the laws of the

jurisdictions in which the Properties are located to the extent required by applicable law, is duly qualified to transact business in the jurisdictions in which the Properties are located, and has the requisite power and authority to enter into and perform this Agreement and the documents and instruments required to be executed and delivered by Purchaser pursuant hereto. This Agreement has been duly executed and delivered by Purchaser and is a valid and binding obligation of Purchaser enforceable in accordance with its terms. This Agreement and the documents and instruments required to be executed and delivered by Purchaser pursuant hereto have each been duly authorized by all necessary action on the part of Purchaser and that such execution, delivery and performance does and will not conflict with or result in a violation of Purchaser’s organizational documents or any judgment, order or decree of any court or arbiter to which Purchaser is a party, or any agreement to which Purchaser and/or any of the Property is bound or subject.

7.2.2 Purchaser has not (i) made a general assignment for the benefit of creditors, (ii) filed any involuntary petition in bankruptcy or suffered the filing of any involuntary petition by Purchaser’s creditors, (iii) suffered the appointment of a receiver to take possession of all or substantially all of Purchaser’s assets, (iv) suffered the attachment or other judicial seizure of all, or substantially all, of Purchaser’s assets, (v) admitted in writing its inability to pay its debts as they come due, or (vi) made an offer of settlement, extension or composition to its creditors generally.

7.2.3 Neither Purchaser, nor, to Purchaser’s knowledge, any of its affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents, is a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of OFAC (including those named on OFAC’s Specially Designated and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action.

Purchaser shall have no liability with respect to any breach of a particular representation and warranty if (a) Seller has actual knowledge of the breach of such representation prior to the Closing Date and fails to notify Purchaser thereof and nevertheless proceeds to Closing, or (b) Seller does not commence an action against Purchaser with respect to the breach in question within twelve (12) months after the Closing. Further, in no event may Purchaser’s liability for a breach of any warranty under this Agreement with respect to any individual Property exceed the greater of (x) 1.5% of the allocated Purchase Price for such Property as set forth on attached Exhibit A and (y) $500,000.00.

Article 8. Inspection; Due Diligence Period; Condition of Property at Closing.

8.1 Inspections; Right of Entry. During the Due Diligence Period, and subject to the conditions contained herein and the rights of tenants under the Leases, Purchaser and its employees, agents and independent contractors shall have the right to enter onto the Properties during normal business hours and, upon a minimum of one (1) business days’ prior written notice Seller, to inspect the same, perform surveys, non-invasive soil and other tests and assessments

and for other investigations and activities consistent with the purposes of this Agreement. Before any such entry, Purchaser shall provide Seller with a certificate of insurance naming Seller as an additional insured on its commercial general liability insurance with limits of no less than $2,000,000.00 in the aggregate and $1,000,000.00 per occurrence. Seller expressly reserves the right to have a representative of Seller present at all times while Seller or Seller’s representatives of consultants are located on a Property. Further, Purchaser may only perform invasive testing, including without limitation Phase II environmental testing, geotechnical borings and soil samples, on any Property only after obtaining Seller’s prior written consent, which shall not be unreasonably withheld, conditioned or delayed. Seller will in good faith reasonably cooperate with Purchaser to accomplish such tests and investigations, and when entering a Property, Purchaser agrees not to disrupt any Seller or tenant business operations on the Properties. Purchaser shall restore any damage to or disruption of the Properties caused by such inspections to the same or better condition as existed before the inspection or test and shall defend, indemnify and hold Seller harmless from any and all liabilities incurred by Seller and any of Seller’s officers, employees, representatives, agents and consultants arising out of any such entries; provided that Purchaser shall not indemnify Seller or the above listed parties for any gross negligence or willful misconduct of such parties, nor for the mere discovery of any condition at the Properties, and in no event for any consequential, punitive or speculative damages. The foregoing indemnity and defense obligations shall survive termination of this Agreement. Purchaser shall deliver to Seller copies of any reports Purchaser obtains in connection with such investigations and inspections within five (5) business days after the same are received by Purchaser.

8.2 Due Diligence. On or before the Effective Date, and subject to the terms and conditions of the Non-Disclosure Agreement, Seller shall have given Purchaser access to the transaction data room, which will contain all relevant and material documents and records with respect to the Properties, including all Leases and amendments thereto, Ground Leases, Contracts, Licenses and Permits and other materials pertaining to the Property set forth on Exhibit N hereto in Seller’s possession or control (collectively, the “Records”). During the Due Diligence Period, and subject to the confidentiality and non-disclosure obligations contained herein and in the Non-Disclosure Agreement, Purchaser shall make a complete review of the Records as well as the physical, legal, economic and environmental condition of the Properties, including the Ground Leases and the Leases. Purchaser may terminate this Agreement by providing written notice of termination to Seller on or before the expiration of the Due Diligence Period, and upon delivery of such notice, this Agreement shall terminate, and the Earnest Money shall be refunded to Purchaser. If Purchaser delivers to Seller an affirmative notice electing to waive due diligence and proceed to Closing on or before the expiration of the Due Diligence Period, the Earnest Money immediately shall become non-refundable to Buyer, except as expressly provided to the contrary herein. If Purchaser does not provide an affirmative notice to proceed or a termination notice on or prior to the expiration of the Due Diligence Period, Purchaser will be deemed to have elected to terminate this Agreement as set forth above.

8.3 Condition of Properties at Closing. Except for the express representations and warranties of Seller hereunder and the Retained Liabilities, Purchaser, for Purchaser and Purchaser’s successors and assigns, releases Seller from, and waives all claims and liability

against Seller for, any structural, physical or environmental conditions at the Properties arising or discovered after Closing and further releases Seller from, and waives all liability against Seller attributable to, the structural, physical and environmental condition of the Properties arising or discovered after Closing, including without limitation the presence, discovery or removal of any lead, asbestos containing materials or any other Hazardous Materials in, at, about or under the Properties, or for, connected with or arising out of any and all claims or causes of action based upon any Hazardous Materials Laws. Except as set forth in Section 7.1.5, Seller makes no representations or warranties whatsoever to Purchaser regarding the presence or absence of any Hazardous Materials. Purchaser hereby acknowledges and agrees that it shall rely solely on the express representations, warranties and covenants of Seller hereunder and the investigations, information, studies and reports prepared by or through Purchaser, at its sole cost and expense, with regard to Hazardous Materials. Purchaser may make such studies and investigations, conduct such tests and surveys, and engage such specialists as Purchaser deems appropriate to evaluate the Properties and their risks from a Hazardous Materials standpoint.

8.4 Estoppel Certificates.

8.4.1 Following the Effective Date, Seller shall request and shall exercise commercially reasonable efforts to obtain and deliver to Purchaser on or prior to December 21, 2017 (as may be extended in accordance with the terms hereof, the “Estoppel Delivery Deadline”), Ground Lease Estoppel Certificates substantially in the form of Exhibit K from each ground lessor under the Ground Leases (“Ground Lease Estoppel Certificates”).

8.4.1.1 If Seller is unable to provide Purchaser with Ground Lease Estoppel Certificates in the form required hereunder for each of the Ground Leases on or before the Estoppel Delivery Deadline, Seller shall have the right to adjourn the Closing Date one or more times by delivery of written notice to Purchaser on or prior to the Estoppel Delivery Deadline, but for not more than thirty (30) days in the aggregate, to satisfy this condition. If Seller does not deliver the Ground Lease Estoppel Certificates for one or more Ground Lease Sites on or prior to the Estoppel Delivery Deadline, as may be extended in accordance with the terms hereof, Purchaser shall have the remedies described in Section 6.1 above.

8.4.1.2 Purchaser hereby acknowledges and agrees that the failure of Seller to deliver any Ground Lease Estoppel Certificate(s) shall not be a default hereunder nor shall it give rise to any remedy of any kind against Seller other than Purchaser’s rights set forth in Section 6.1 above.

8.4.2 Following the Effective Date, Seller shall request and shall exercise commercially reasonable efforts to obtain and deliver to Purchaser on or prior to the Estoppel Delivery Deadline, estoppel certificates substantially in the form of attached Exhibit J from each tenant under the Leases (each, a “Tenant Estoppel Certificate”).

8.4.2.1 It shall be a condition to Purchaser’s obligations to close the transactions contemplated herein on the Closing Date that Seller shall have provided Purchaser with Tenant Estoppel Certificates in the form required hereunder on or prior to the Estoppel Delivery Deadline with respect to (a) each of the Leases for the tenants specifically identified on attached Exhibit D (collectively, the “Primary Tenants”), and (b) for Leases

covering at least 85% of the leased square footage for the Properties in the aggregate and at least 50% of the leased square footage for each individual Property (collectively, the Required Tenant Estoppel Certificates”). If Seller does not deliver the Required Tenant Estoppel Certificates to Purchaser on or before the Estoppel Delivery Deadline, Seller shall have the right to adjourn the Closing Date one or more times by delivery of written notice to Purchaser on or prior to the Estoppel Delivery Deadline, but for not more than thirty (30) days in the aggregate, to satisfy this condition. If Seller does not deliver the Required Tenant Estoppel Certificates on or prior to the Estoppel Delivery Deadline, as may be extended in accordance with the terms hereof, Purchaser shall have the remedies described in Section 6.1 above. In lieu of a Required Tenant Estoppel Certificate, Seller may provide one or more Seller estoppel certificates in the form attached as Exhibit J hereto (“Seller Estoppel Certificate”); provided that Seller may not provide a Seller Estoppel Certificate with respect to (x) any Primary Tenant Lease, or (y) Leases in excess of 7.5% of the total leased square footage of the Properties in the aggregate, or more than 30% of the total leased square footage for any individual Property. Seller’s liability with respect to any Seller Estoppel Certificate shall not be subject to the limitations set forth in Section 7.1 hereof; provided that Seller shall be relieved of liability with respect to any Seller Estoppel Certificate for which Seller delivers on or prior to the date 30 days following the Closing Date a Required Tenant Estoppel Certificate in the form required hereunder signed by the tenant under the applicable Lease.

8.4.2.2 Purchaser hereby acknowledges and agrees that the failure of Seller to deliver any Tenant Estoppel Certificate(s) shall not be a default hereunder nor shall it give rise to any remedy of any kind against Seller other than Purchaser’s rights set forth in Section 6.1 above.

8.4.3 During the period commencing on the Effective Date and ending on the Closing Date, Seller shall request and shall exercise commercially reasonable efforts to obtain estoppel certificates from each declarant (or similarly situated beneficiary) under the declarations, or conditions, covenants and restrictions identified on attached Exhibit L-1 (collectively, the “CC&Rs”) substantially in the form of Exhibit M hereto (each, a “Declarant Estoppel Certificate”). Purchaser hereby acknowledges and agrees that, except as set forth below with respect to the Material Campus Declaration Estoppel Certificates, Seller shall have no obligation whatsoever to deliver any Declarant Estoppel Certificate with respect to any CC&R and Purchaser’s receipt of the same shall not be a condition to Closing. Notwithstanding the foregoing, it shall be a condition to Purchaser’s obligations to close the transactions contemplated herein on the Closing Date that Seller shall have provided Purchaser with Declarant Estoppel Certificates in the form required hereunder with respect to the material campus CC&Rs listed on Exhibit L-2 hereto (the “Material Campus Declaration Estoppel Certificates”) on or prior to the Estoppel Delivery Deadline.

8.4.3.1 Purchaser specifically acknowledges and agrees that the failure of Seller to deliver any Declarant Estoppel Certificate(s) shall not be a default hereunder nor shall it give rise to any termination rights with respect to any Properties or any other remedy of any kind against Seller except for Purchaser’s rights set forth in Section 6.1 above with respect

to the failure to deliver any Material Campus Declaration Estoppel Certificate on or prior to the Estoppel Delivery Deadline, as may be extended in accordance with the terms hereof.

8.4.3.2 If Seller does not deliver the Material Campus Declaration Estoppel Certificates to Purchaser on or before the Estoppel Delivery Deadline, Seller shall have the right to adjourn the Closing Date one or more times by delivery of written notice to Purchaser on or prior to the Estoppel Delivery Deadline, but for not more than thirty (30) days in the aggregate, to satisfy this condition. If Seller does not deliver the Material Campus Declaration Estoppel Certificates on or prior to the Estoppel Delivery Deadline, Purchaser shall have the remedies described in Section 6.1 above.

8.4.4 Notwithstanding anything to the contrary contained herein, if any Ground Lease Estoppel Certificate, Required Tenant Estoppel Certificate or Material Campus Declaration Estoppel Certificate required to be delivered hereunder by Fairview Health Systems or its Affiliates or subsidiaries is not delivered to Purchaser on or prior to the Estoppel Delivery Deadline, Purchaser may adjourn the Closing Date from time to time for a period of up to thirty (30) days in the aggregate upon written notice to Seller delivered on or prior to the Estoppel Delivery Deadline to facilitate delivery of such required estoppel certificates.

8.4.5 Purchaser shall not be required to accept any estoppel certificate referenced above that indicates that any default exists with respect to the applicable agreement or making any other material change to the applicable form contemplated herein, and any such estoppel certificate shall not satisfy the delivery conditions set forth above. The Seller rights to extend the Closing Date described in this Section 8.4 and in Section 6.1.4 above shall run concurrently such that Seller may only adjourn the Closing Date up to 30 days in the aggregate. Upon any Closing Date extension pursuant to this Section 8.4 or section 6.1.4 above, the Estoppel Delivery Deadline shall be concurrently adjourned to the date three (3) business days prior to the extended Closing Date. Seller shall deliver to Purchaser any signed estoppel certificate, or any comments from the counterparty thereto received by Seller.

8.5 Tenant Communications. Upon providing Seller a minimum of one (1) business day’s prior written notice, Purchaser may communicate with and interview tenants under Leases, (a) with a Major Tenant, and (b) for Leases with 2,500 square feet or more of gross leasable area and with lease terms of three (3) years or fewer, provided that Seller shall have the right to have a representative of Seller present at all times during all such interviews and communications.

8.6 Purchaser’s Reliance on its Investigations; “As Is” Sale. To the maximum extent permitted by applicable law and except for Seller’s express representations and warranties and covenants herein and in any Closing document delivered by Seller (“Seller’s Warranties”), this sale is made and will be made without representation or warranty of any kind (whether express or implied) by Seller. Purchaser agrees to accept the Properties on an “As is” and “Where is” basis, with all faults and any and all latent and patent defects, and without any representation or warranty, all of which Seller hereby disclaims, except for Seller’s Warranties. Except for Seller’s Warranties, no warranty or representation is made by Seller as to (a) fitness for any particular purpose, (b) merchantability, (c) design, (d) quality, (e) condition, (f) operation

or income, (g) compliance with drawings or specifications, (h) absence of defects, (i) absence of hazardous or toxic substances, (j) absence of faults, (k) flooding, or (l) compliance with laws and regulations including, without limitation, those relating to health, safety, and the environment. Purchaser acknowledges that Purchaser has entered into this Agreement with the intention of making and relying upon its own investigation of the physical, environmental, economic use, compliance, and legal condition of the Property and that Purchaser has not been induced by and has not relied upon any disclosures, representations or warranties (in each case whether express or implied or oral or written) made by Seller, Seller’s affiliates, or any other person or entity purporting to represent Seller with respect to the Properties or any other matter affecting or relating to the transactions contemplated hereby, except for Seller’s Warranties. In addition, Purchaser expressly acknowledges that from and after the Effective Date, Purchaser has not been and will not be induced by and has not relied and will not rely upon any disclosures, representations or warranties (in each case whether express or implied or oral or written) made by Seller, Seller’s affiliates, or any other person or entity purporting to represent Seller with respect to the Property or any other matter affecting or relating to the transactions contemplated hereby, except for Seller’s Warranties.

CONSISTENT WITH THE FOREGOING AND SUBJECT SOLELY TO CLAIMS AGAINST SELLER ON THE SELLER’S WARRANTIES AND THE RETAINED LIABILITIES, EFFECTIVE AS OF THE CLOSING DATE FOR THE PROPERTIES, PURCHASER, FOR ITSELF AND ITS AGENTS, AFFILIATES, SUCCESSORS AND ASSIGNS, HEREBY ACQUIRES THE PROPERTIES SUBJECT TO (AND AGREES TO ASSUME THE RISK THEREOF, IN FULL RELIANCE UPON ITS OWN INVESTIGATIONS) AND RELEASES AND FOREVER DISCHARGES, WAIVES AND EXONERATES SELLER, SELLER’S AFFILIATES, AND THE AGENTS, AFFILIATES, MEMBERS, PARTNERS, OFFICERS, DIRECTORS, MANAGERS, TRUSTEES, SUBSIDIARIES, PRINCIPALS, OWNERS, GENERAL PARTNERS, LIMITED PARTNERS, AS WELL AS THE SUCCESSORS AND ASSIGNS OF EACH OF PERSONS (COLLECTIVELY THE “RELEASEES”) FROM ANY AND ALL LIABILITIES, OBLIGATIONS, RIGHTS, CLAIMS, CAUSES OF ACTION AND DEMANDS AT LAW OR IN EQUITY, CONTROVERSIES, DAMAGE, COSTS, LOSSES AND EXPENSES WHETHER KNOWN OR UNKNOWN AT THE TIME OF THIS AGREEMENT, WHICH PURCHASER HAS OR MAY HAVE IN THE FUTURE, ARISING OUT OF THE PROPERTIES OR RELATING TO THE PROPERTIES, THE PHYSICAL, ENVIRONMENTAL, ECONOMIC OR LEGAL CONDITION OF THE PROPERTIES AND THE PROSPECTS, FINANCIAL CONDITION, OPERATION OR RESULTS OF OPERATIONS OF THE PROPERTIES, INCLUDING, WITHOUT LIMITATION, ALL CLAIMS IN TORT OR CONTRACT, ALL CLAIMS UNDER A WARRANTY OF ANY KIND (WHETHER EXPRESS OR IMPLIED) AND INCLUDING ANY WARRANTY OF MERCHANTABILITY, HABITABILITY OR WARRANTIES OF FITNESS FOR USE OR ACCEPTABILITY FOR THE PURPOSE INTENDED (COLLECTIVELY, THE “CLAIMS”); PROVIDED THAT PURCHASER DOES NOT RELEASE OR WAIVE ANY CLAIM AGAINST SELLER ARISING OUT OF THE FRAUD, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF SELLER OR SELLER’S AFFILIATES OR FOR ANY RETAINED LIABILITY OR BREACH BY SELLER OF ITS OBGLITIONS UNDER THIS AGREEMENT, INCLUDING, WITHOUT LIMITATION, SELLER’S WARRANTIES.

PURCHASER, UPON CLOSING, SHALL BE DEEMED TO HAVE WAIVED, EXONERATED, RELINQUISHED AND RELEASED SELLER AND ALL OTHER RELEASEES FROM AND AGAINST ANY AND ALL MATTERS AFFECTING PURCHASER AND/OR THE PROPERTY, OTHER THAN SELLER’S WARRANTIES, THE RETAINED LIABILITIES OR ANY CLAIMS ARISING OUT OF THE BREACH BY SELLER OF ITS OBLIGATIONS UNDER THIS AGREEMENT. IN THIS CONNECTION AND TO THE GREATEST EXTENT PERMITTED BY LAW, PURCHASER HEREBY AGREES, REPRESENTS AND WARRANTS THAT PURCHASER REALIZES AND ACKNOWLEDGES THAT FACTUAL MATTERS NOW KNOWN OR UNKNOWN TO IT MAY HAVE GIVEN OR MAY HEREAFTER GIVE RISE TO CLAIMS WHICH ARE PRESENTLY UNKNOWN, UNANTICIPATED AND UNSUSPECTED, AND PURCHASER FURTHER AGREES, REPRESENTS AND WARRANTS THAT THE WAIVERS AND RELEASES HEREIN AND THE PROVISIONS OF THIS PARAGRAPH HAVE BEEN NEGOTIATED AND AGREED UPON IN LIGHT OF THAT REALIZATION AND THAT PURCHASER NEVERTHELESS HEREBY INTENDS TO RELEASE, DISCHARGE AND ACQUIT SELLER FROM ANY SUCH UNKNOWN CLAIMS (OTHER THAN CLAIMS ARISING FROM THE BREACH BY ONE OR MORE SELLER’S WARRANTIES, THE RETAINED LIABILITIES OR ANY BREACH BY SELLER OF ITS OBLIGATIONS HEREUNDER). SELLER HAS GIVEN PURCHASER MATERIAL CONCESSIONS REGARDING THIS TRANSACTION IN EXCHANGE FOR PURCHASER AGREEING TO THE PROVISIONS OF THIS PARAGRAPH.

The provisions of this Paragraph 8.6 shall survive the Closing or termination of this Agreement and shall not be merged into the Closing documents.

Article 9. Operation Pending Closing.

9.1 Existing Operations. Until the Closing Date, Seller shall operate, maintain and manage each of the Properties in a manner substantially consistent with Seller’s past practices.

9.2 New Contracts and Leases. Prior to the date that is two (2) business days prior to the expiration of the Due Diligence Period, Seller may sign or amend any Lease and may enter into any service contracts without the prior consent of Purchaser, provided, however, that Seller shall provide Purchaser no less than three (3) business days’ notice prior to execution of any new Lease, Lease amendment or Contract. After the expiration of the Due Diligence Period, Seller will not, without the prior consent of Purchaser (which shall not be unreasonably withheld or delayed), enter into any Lease, Lease amendment or any other Contract relating to the operation of the Property that will be an obligation affecting the Property subsequent to the Closing or modify, extend or terminate any existing Lease or issue any material waiver or consent with respect to any of the foregoing, except for service contracts entered into in the ordinary course of business that are terminable without cause or payment of any fee or penalty on 30-days’ notice. Seller shall not terminate any Lease prior to Closing without obtaining Purchaser’s prior written consent. Seller shall not amend, modify, supplement or terminate any Ground Lease prior to Closing without the prior written consent of Purchaser.

9.3 Termination of Service Contracts. During the Due Diligence Period, Purchaser shall notify Seller which Contracts Purchaser desires to assume at Closing. Failure to timely deliver such notice for any service contract shall constitute Purchaser’s binding election to assume each such service contract. Purchaser shall pay any transfer or assignment fees or charges due in connection with the assumption of any Contracts Purchaser elects to assume hereunder. Seller shall cause all Contracts that Purchaser elects not to assume to be terminated effective on or prior to the Closing Date and Seller shall be responsible for any termination fee or penalty payable in connection therewith.

9.3 Capital Improvements. All ongoing capital improvements being performed by Landlord at the Properties are described on Schedule 9.3 hereto. Seller shall continue to perform such projects in the ordinary course and with commercially reasonable diligence from and after the Effective Date through Closing. Purchaser shall be entitled to a credit at Closing for the outstanding amount of any such capital improvement project not completed and paid in full as of the Closing Date.

9.4 Management Agreements; Leasing and Brokerage Agreements. Seller shall cause any and all property management agreements and leasing and brokerage agreements in effect with respect to the Properties to be terminated effective on or prior to the Closing Date at Seller’s sole cost and expense.

9.5 Employees. Purchaser shall not be required to hire at or following Closing (i) any employee of Seller or Seller’s Affiliates, or (ii) any other employee that is employed at the Properties prior to Closing. All obligations and liabilities related to (x) any employee of Seller or Seller’s Affiliates, or (y) any other employee that is employed at the Properties prior to Closing and arising out of the Closing or matters occurring prior to Closing, shall, in each case, constitute Retained Liabilities of Seller hereunder. This Section 9.5 shall survive Closing.

Article 10. Damage or Destruction.