Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - R1 RCM INC. | a2017pressrelease.htm |

| 8-K - 8-K - R1 RCM INC. | a3-98xk.htm |

Fourth Quarter and Full Year 2017 Results Conference Call

March 9, 2018

Exhibit 99.2

2

Forward-Looking Statements and Non-GAAP Financial Measures

This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events

and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often

identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements

contain these identifying words. Such forward-looking statements are based on management’s current expectations about future

events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from

those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or

changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements

except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking

statements.

All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual

results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors,

including, but not limited to our ability to close the acquisition of and integrate the Intermedix business as planned, our ability to

enter into contracts to provide services to Ascension Medical Group and Presence Health, our ability to successfully deliver on our

commitments to Intermountain and Ascension, our ability to successfully integrate transitioned Ascension employees, our ability

to achieve or maintain profitability and retain existing customers or acquire new customers, risks associated with the

implementation of our technologies or services with our customers or implementation costs that exceed our expectations,

fluctuations in our quarterly results of operations and cash flows, as well as the factors discussed under the heading “Risk Factors”

in our annual report on Form 10-K for the year ended December 31, 2017, and any other periodic reports that the Company files

with the Securities and Exchange Commission.

This presentation includes the following non-GAAP financial measures : Gross Cash Generated and Net Cash Generated from

Customer Contracting Activities (on a historical basis), free cash flow (on a historical basis) and Adjusted EBITDA (on a historical

and projected basis). Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP

financial measures to the most directly comparable GAAP financial measure.

3

Q4 and Full Year 2017 Financial Highlights

Fourth Quarter Financial Highlights

▪ Revenue of $140.3 million, up $17.1 million sequentially

▪ GAAP net loss of $40.2 million, down $36.6 million sequentially

▪ Adjusted EBITDA of $5.7 million, up $2.6 million sequentially

▪ Includes $0.5 million of legal costs primarily related to Intermountain contract

Full Year 2017 Financial Highlights

▪ Revenue of $449.8 million

▪ GAAP net loss of $58.8 million

▪ Adjusted EBITDA of $4.1 million

Additional Highlights

▪ $33 million free cash flow in 2H’17

▪ Driven by positive adjusted EBITDA in 2H’17 and working capital

4

2017 Highlights

First Quarter

▪ Announced new company brand and vision

▪ Listed on Nasdaq and early-adopted ASC 606 accounting

Second Quarter

▪ Expanded Ascension relationship in Wisconsin; added Physician business

▪ Launched Modular Solutions; followed by hiring of chief commercial officer

Third Quarter

▪ Strategic partnership with Phreesia

▪ Launched front-end transformation pilot sites

Fourth Quarter

▪ Completed buildout of commercial team

▪ Exited 2017 with robust qualified pipeline of new leads

Overall 2017

▪ Onboarded $8.5 billion in NPR

▪ Increased headcount by 4,700

5

2018 Announcements Year-to-Date

▪ Intermountain Healthcare

▪ 10-year exclusive operating partner agreement, increases NPR under management by $800M

▪ R1 technology suite fully deployed across 23 hospitals, core platform for RCM workflow, data

validation and analytics

▪ Onboarding expected to begin in April

▪ Presence Health

▪ Presence has $2.2 billion in NPR, including $100 million in Physician NPR

▪ Contract signing expected in Q2’18, and onboarding to begin shortly thereafter

▪ Intermedix

▪ Transaction expected to close in Q2’18, subject to HSR approval and other closing conditions

▪ Intermedix will add deep capabilities to serve non-acute markets, increase target addressable

market by $40 billion, and accelerates onboarding of $3.2 billion in physician NPR

▪ Ascension Medical Group

▪ Contract signing expected in Q2’18, and onboarding scheduled to begin in Q3 or Q4 2018

▪ Lessons learned from Wisconsin, and capacity/capability from Intermedix should allow for easier

deployment and faster value creation

6

Technology and Commercial Update

▪ Technology

▪ Announced general availability of R1 Patient Experience platform at HIMSS’18

▪ R1 Automate – expect to have more than 100 RPA programs by year-end

▪ Intermedix to add full suite of physician practice management services and related technology

▪ Commercial

▪ Commercial effort fully ramped up, driving company’s awareness in the market

▪ Prospective customer funnel is growing

▪ Actively involved in discussions with integrated health systems

▪ Considerable inbound interest for both modular and end-to-end offerings

7

2018 Goals

Growth Goals

▪ Signing of new end-to-end agreement

▪ Launch patient experience platform

Operational Goals

▪ High-quality deployment across newly signed business

▪ Expansion of R1 Automate capability

Strategic Goals

▪ Close Intermedix acquisition

▪ Leverage Intermedix platform to deliver a highly differentiated physician-acute RCM platform to

our customers and the market

8

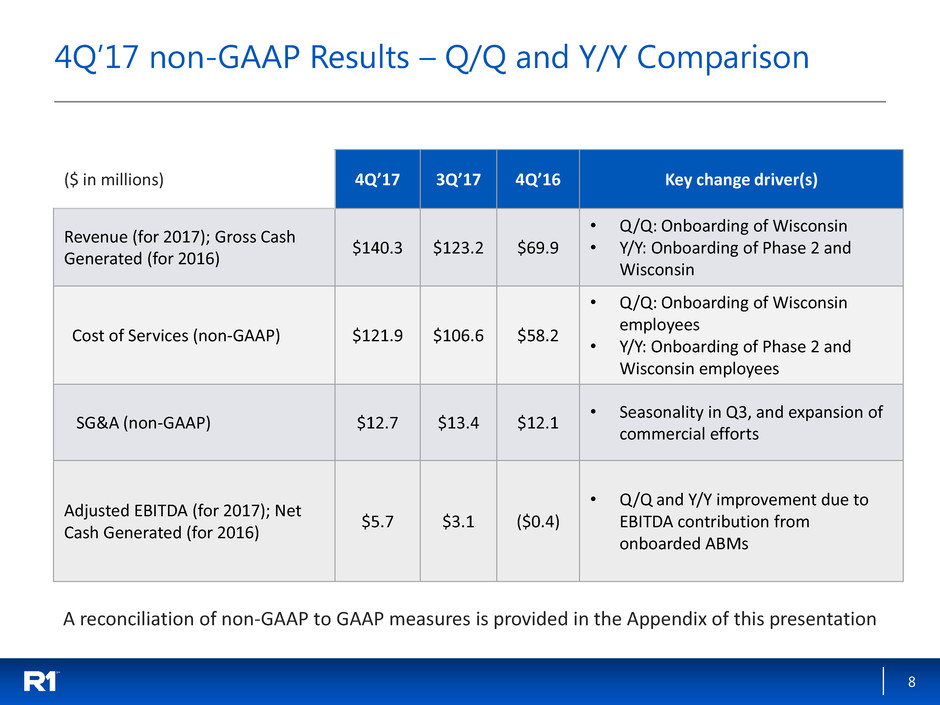

4Q’17 non-GAAP Results – Q/Q and Y/Y Comparison

($ in millions) 4Q’17 3Q’17 4Q’16 Key change driver(s)

Revenue (for 2017); Gross Cash

Generated (for 2016)

$140.3 $123.2 $69.9

• Q/Q: Onboarding of Wisconsin

• Y/Y: Onboarding of Phase 2 and

Wisconsin

Cost of Services (non-GAAP) $121.9 $106.6 $58.2

• Q/Q: Onboarding of Wisconsin

employees

• Y/Y: Onboarding of Phase 2 and

Wisconsin employees

SG&A (non-GAAP) $12.7 $13.4 $12.1

• Seasonality in Q3, and expansion of

commercial efforts

Adjusted EBITDA (for 2017); Net

Cash Generated (for 2016)

$5.7 $3.1 ($0.4)

• Q/Q and Y/Y improvement due to

EBITDA contribution from

onboarded ABMs

A reconciliation of non-GAAP to GAAP measures is provided in the Appendix of this presentation

9

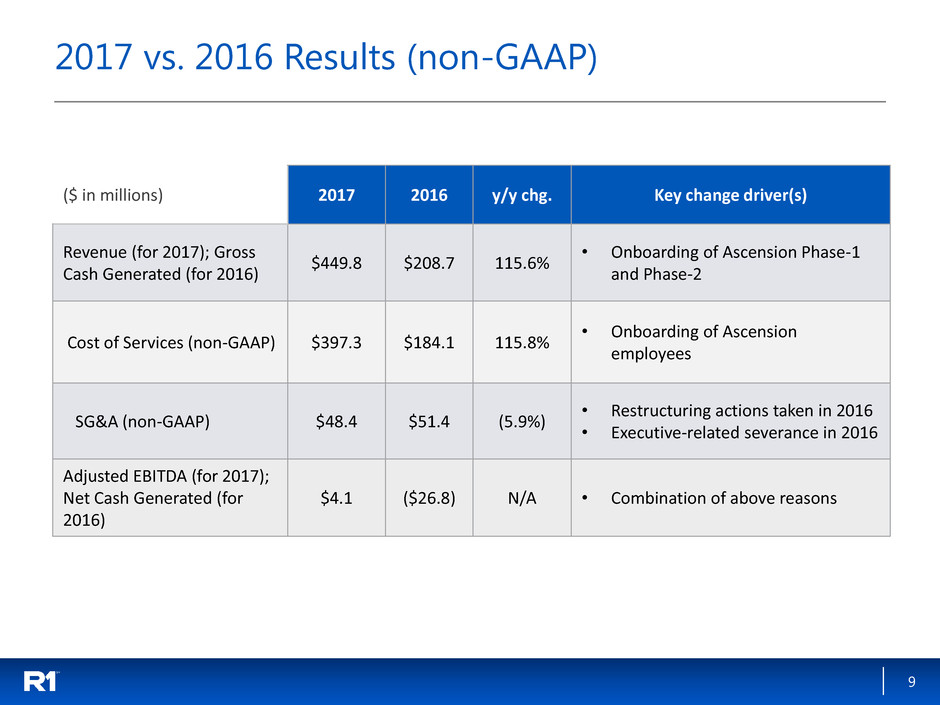

2017 vs. 2016 Results (non-GAAP)

($ in millions) 2017 2016 y/y chg. Key change driver(s)

Revenue (for 2017); Gross

Cash Generated (for 2016)

$449.8 $208.7 115.6%

• Onboarding of Ascension Phase-1

and Phase-2

Cost of Services (non-GAAP) $397.3 $184.1 115.8%

• Onboarding of Ascension

employees

SG&A (non-GAAP) $48.4 $51.4 (5.9%)

• Restructuring actions taken in 2016

• Executive-related severance in 2016

Adjusted EBITDA (for 2017);

Net Cash Generated (for

2016)

$4.1 ($26.8) N/A • Combination of above reasons

10

Additional Commentary

▪ Cash and equivalents of $166 million as of 12/31/17, incl. restricted cash

▪ Increased $22 million from 9/30/17, driven by:

▪ $5.7 million adjusted EBITDA in Q4

▪ Positive contribution from working capital

▪ $1.8M Acquisition-related diligence costs in Q4 2017

▪ Continued diligence costs related to Intermedix acquisition

▪ Costs included in GAAP financials but not reflected in non-GAAP adjusted EBITDA

11

Preliminary 2018 Financial Outlook1

($ in millions)

Prior 2018 Outlook

(provided 1/8/18)

Revenue $675 – $725

GAAP Operating Income $5 – $15

Adjusted EBITDA $40 – $50

NPR growth assumptions – $B

New customer $3.0

Total $3.0

Updated 2018 Outlook

(provided 2/28/18)

$850 – $900

($30)-($55)

$50 – $55

NPR growth assumptions – $B

Intermountain Health $4.6

Presence Health $2.2

Ascension Medical Group $2.0

Total $8.8

Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures.

Updated guidance absorbs ~$25 million of upfront costs associated with

onboarding of new business announced in 2018

Note1: Preliminary outlook subject to changes including but not limited to adoption of ASC 606 accounting for Intermedix,

depreciation of fixed assets, purchase-price accounting for amortization of intangibles, signing of Ascension Medical Group

and Presence Health contracts, and closing date of Intermedix acquisition.

12

Preliminary 2020 Financial Outlook1

($ in millions)

Prior 2020 Outlook

(provided 1/8/18)

Revenue $800 – $900

GAAP Operating Income $80 – $100

Adjusted EBITDA $120 – $135

Updated 2020 Outlook

(provided 2/26/18)

$1,200 – $1,300

$115 – $155

$225 – $250

Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures.

Note1: Preliminary outlook subject to changes including but not limited to adoption of ASC 606 accounting for Intermedix,

depreciation of fixed assets, purchase-price accounting for amortization of intangibles, signing of Ascension Medical Group

and Presence Health contracts, and closing date of Intermedix acquisition.

Appendix

14

Use of Non-GAAP Financial Measures

▪ In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and

operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP

financial measures, which are included in this presentation.

▪ For the three months and year ended December 31, 2017: As of January 1, 2017, the Company adopted Accounting Standards

Update ("ASU") No. 2014-09, Revenue from Contracts with Customers (Topic 606). Subsequent to adoption of Topic 606, the

non-GAAP financial measure referenced in the press release is adjusted EBITDA. Adjusted EBITDA is defined as GAAP net income

before net interest income, income tax provision, depreciation and amortization expense, share-based compensation expense,

and severance & certain other items.

▪ For the three months and year ended December 31, 2016: Prior to the adoption of Topic 606, non-GAAP financial measures

utilized by the company included gross cash generated from customer contracting activities, and net cash generated from

customer contracting activities. Gross cash generated from customer contracting activities was defined as GAAP net services

revenue, plus the change in deferred customer billings. Accordingly, gross cash generated from customer contracting activities

was the sum of (i) invoiced or accrued net operating fees, (ii) cash collections on incentive fees and (iii) other services fees. Net

cash generated from customer contracting activities was defined as net income before net interest income, income tax

provision, depreciation and amortization expense, share-based compensation expense, severance and certain other items, and

change in deferred customer billings. Deferred customer billings included the portion of both (i) invoiced or accrued net

operating fees and (ii) cash collections of incentive fees, in each case, that did not meet our prior revenue recognition criteria.

Deferred customer billings are included in the detail of our customer liabilities and customer liabilities – related party balance in

the condensed consolidated balance sheets available in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2017.

▪ Our Board and management team use non-GAAP measures as (i) one of the primary methods for planning and forecasting

overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in

determining achievement of certain executive incentive compensation programs, as well as for incentive compensation

programs for employees.

▪ Free cash flow is defined as cash flow from operations less capital expenditures.

▪ These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information

prepared in accordance with GAAP.

15

Reconciliation of GAAP net services revenue to non-GAAP Gross Cash

Generated from Customer Contracting Activities (for 2016 only)

Due to the adoption of Topic 606 as of January 1, 2017, the non-GAAP measure of gross cash generated from customer contracting

activities that was utilized by the Company in 2016 is not applicable for 2017. Gross cash generated from customer contracting activities

has been provided for the three months and year ended December 31, 2016 as it is the most comparable metric to net services revenue

for the three months and year ended December 31, 2017.

Due to rounding, numbers presented in this table may not add up precisely to the totals provided.

$ in millions

Three Months Ended

December 31, 2016 Year Ended December 31, 2016

Net Services

Revenue

Change in

deferred

customer

billings

Gross cash

generated

Net Services

Revenue

Change in

deferred

customer

billings

Gross cash

generated

RCM services: net operating fees $68.5 $(12.8 ) $55.7 $368.8 $(218.3 ) $150.5

RCM services: incentive fees 24.8 (19.5 ) 5.3 191.3 (162.2 ) 29.1

RCM services: other 8.0 (3.9 ) 4.1 16.3 (3.3 ) 13.0

Other services fees 4.8 — 4.8 16.1 — 16.1

Total $106.2 $(36.2 ) $69.9 $592.6 $(383.8 ) $208.7

16

Reconciliation of GAAP to non-GAAP Financials

n.m. - not meaningful

n.a. - not applicable

Due to the adoption of Topic 606 as of January 1, 2017, the non-GAAP measure of gross and net cash generated from customer contracting

activities, that was utilized by the Company in 2016, is not applicable for 2017. Gross and net cash generated from customer contracting

activities has been provided for the three months and year ended December 31, 2016 as they are the most comparable metric to net services

revenue and adjusted EBTIDA for the three months and year ended December 31, 2017.

Due to rounding, numbers may not add up precisely to the totals provided.

Three Months Ended

December 31,

Three Months Ended

September 30, Year Ended December 31,

2017 2016 2017 2016 2017 2016

(Unaudited) (Unaudited)

RCM services: net operating fees $ 119.4 $ 68.5 $ 104.6 $49.0 $ 374.8 $ 368.8

RCM services: incentive fees 8.8 24.8 7.5 68.5 29.0 191.3

RCM services: other 3.8 8.0 2.8 3.8 13.6 16.3

Other services fees 8.3 4.8 8.3 4..2 32.4 16.1

Net Services Revenue $ 140.3 $ 106.2 $ 123.2 $125.5 $ 449.8 $ 592.6

Change in deferred customer billings (non-GAAP)

n.a. (36.3 ) n.a. (65.8) n.a. (383.9 )

Gross cash generated from customer contracting

activities (non-GAAP)

n.a. $ 69.9

n.a. 59.7 n.a. $ 208.7

Net income (loss) $ (40.2 ) $ 13.2 $ (3.6) $37.4 $ (58.8 ) $ 177.1

Net interest income (0.1 ) (0.1 ) - (0.1) (0.2 ) — (0.3 )

Income tax provision (benefit) 36.6 14.5 (1.5) 24.1 31.5 121.1

Depreciation and amortization expense (GAAP)

4.8

2.9

4.5

2.7 16.3

10.2

Share-based compensation expense (GAAP) 2.5 4.6 2.4 4.8 10.7 28.1

Other (GAAP) 2.1 0.8 1.4 0.5 4.7 20.8

Adjusted EBITDA (non-GAAP) $ 5.7 $ 35.9 $ 3.1 $69.4 $ 4.1 $ 357.0

Change in deferred customer billings (non-GAAP)

n.a. (36.3 ) n.a. (65.8) n.a. (383.9 )

Net cash generated from customer contracting activities

(non-GAAP)

n.a. $ (0.4 ) n.a. $3.6 n.a. $ (26.8 )

17

Reconciliation of GAAP to non-GAAP Financials

Reconciliation of GAAP Cash Flow from Operating Activities to Free Cash Flow (for 2H’17)

$ in millions

$ in millions

$ in millions

Reconciliation of GAAP Cost of Services to Non-GAAP Cost of Services

Reconciliation of GAAP Selling, General and Administrative to Non-GAAP Selling, General and Administrative

Three Months Ended

December 31,

Three Months Ended

September 30,

Twelve Months Ended

December 31,

2017 2016 2017 2016 2017 2016

Cost f servic s 127.2 62.1 $ 111.8 $ 47.4 416.3 199.7

Less:

Share-based compensation expense 1.2 1.3 1.2 1.3 4.5 6.1

Depreciation and amortization expense 4.1 2.6 4.0 2.6 14.5 9.5

Non-GAAP cost of services $ 121.9 $ 58.2 $ 106.6 $ 43.5

$ 397.3 $ 184.1

Three Months Ended

December 31,

Three Months Ended

September 30,

Twelve Months Ended

December 31,

2017 2016 2017 2016 2017 2016

Selling, general a d dministrative $ 14.7 $ 15.7 $ 15.1 $ 16.2 $ 56.3 $ 74.1

Less:

Share-based compensation expense 1.3 3.3 1.2 3.5 6.1 22.0

Depreciation and amortization expense 0.7 0.3 0.5 0.1 1.8 0.7

Non-GAAP selling, general and administrative $ 12.7 $ 12.1 $ 13.4 $ 12.6 $ 48.4 $ 51.4

Six months ended

June 30, 2017

Twelve months ended

December 31, 2017

Free cash flow

change in 2H'17

Net cash provided by (used in) operating activities ($22.9) $20.9 $43.8

Less: Purchases of property, equipment, and software ( 3.2) ($33.6) ($10.4)

Free cash flow during period ($46.1) ( 12.7) 33.

18

Consolidated non-GAAP Financial Information

$ in millions

(1) Excludes share-based compensation, depreciation and amortization and other costs

(2) Due to the adoption of Topic 606 as of January 1, 2017, the non-GAAP measure of gross and net cash generated from customer

contracting activities that were utilized by the Company in 2016 are not applicable for 2017. Gross and net cash generated from customer

contracting activities have been provided for the three months and year ended December 31, 2016 as they are the most comparable metric

to net services revenue and adjusted EBITDA, respectively, for the three months and year ended December 31, 2017.

Three Months Ended December 31, Year Ended December 31,

2017 2016 2017 2016

(Unaudited) (Unaudited)

RCM services: net operating fees $ 119.4 $ 55.7 $ 374.8 $ 150.5

RCM services: incentive fees 8.8 5.3 29.0 29.1

RCM services: other 3.8 4.1 13.6 13.0

Other services fees 8.3 4.8 32.4 16.1

Net services revenue (GAAP) (2017), Gross

cash generated from customer contracting

activities (non-GAAP) (2016) (2) $ 140.3

$ 69.9

$ 449.8

$ 208.7

Operating expenses (1) :

Cost of services (non-GAAP) 121.9 58.2 397.3 184.1

Selling, general and administrative (non-

GA P) 12.7

12.1

48.4

51.4

Sub-total $ 134.6 $ 70.3 $ 445.7 $ 235.5

Adjusted EBITDA (non-GAAP) (2017), Net

cash generated from customer contracting

activities (non-GAAP) (2016) (2) $ 5.7

$ (0.4 ) $ 4.1

$ (26.8 )

19

Reconciliation GAAP Operating Income Guidance to non-GAAP

Adjusted EBITDA Guidance

$ in millions

Prior Outlook (provided on 1/08/18)

Updated 2018 and 2020 Outlook (provided on 2/26/18)

$ in millions

2018 2020

GAAP perating Income Guidance ($30)-($55) $115-$155

Plus:

Depreciation and amortization expense $25-$30 $30-$40

Share-based compensation expense $15-$20 $20-$25

Amortization of intangibles $15-$30 $25-$40

Transaction expenses, severance and other costs $15-$20 $5-$10

Adjusted EBITDA Guidance $50-$55 $225-$250

2018 2020

GAAP Operating Income Guidance $5-$15 $80-$100

Plus:

Depreciation and amortization expense $13-$18 $15-$20

Share-based compensation expense $15-$20 $15-$20

Severance and other costs $3-$5 $3-$5

Adjusted EBITDA Guidance $40-$50 $120-$135