Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 12 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number: 001-37945

FLEXSHOPPER, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 20-5456087 | |

| (State of jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) | |

| 2700 North Military Trail, Ste. 200 | ||

| Boca Raton, FL | 33431 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (855) 353-9289

Securities registered pursuant to Section 12 (b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.0001 Par Value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large Accelerated Filer: | ☐ | Accelerated Filer: | ☐ |

| Non-accelerated Filer: | ☐ | Smaller Reporting Company: | ☒ |

| (Do not check if a smaller reporting company) | |||

| Emerging Growth Company: | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, as of the last business day of the Registrant’s most recently completed second fiscal quarter was approximately $12,162,748 (based on the closing price of the Registrant’s Common Stock on June 30, 2017 of $4.40 per share).

The number of shares outstanding of the Registrant’s Common Stock, as of March 8, 2018, was 5,294,501.

Documents incorporated by reference: The Registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2017. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “could,” “would,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate” “strategy,” “future,” “likely” or other comparable terms and references to future periods. All statements other than statements of historical facts included in this Annual Report on Form 10-K regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding: the expansion of our lease-to-own program; expectation concerning our partnerships with retail partners; investments in, and the success of, our underwriting technology and risk analytics platform; our ability to collect payments due from customers; expected future operating results and; expectations concerning our business strategy.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| ● | our limited operating history, limited cash and history of losses; |

| ● | our ability to obtain adequate financing to fund our business operations in the future; |

| ● | the failure to successfully manage and grow our FlexShopper.com e-commerce platform; |

| ● | our ability to maintain compliance with financial covenants under our credit agreement; |

| ● | our dependence on the success of our third-party retail partners and our continued relationships with them; |

| ● | our compliance with various federal, state and local laws and regulations, including those related to consumer protection; |

| ● | the failure to protect the integrity and security of customer and employee information; and |

| ● | the other risks and uncertainties described in the Risk Factors and in Management’s Discussion; and Analysis of Financial Condition and Results of Operations sections of this Annual Report on Form 10-K. |

Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

PART I

Item 1. Business

Introduction

FlexShopper, Inc. (“we,” “us,” “our,” “FlexShopper” or the “Company”) is a corporation organized under the laws of the State of Delaware in 2006 with its common stock trading on the Nasdaq Capital Market under the symbol “FPAY.” On October 16, 2013, we changed our corporate name from Anchor Funding Services, Inc. to FlexShopper, Inc. FlexShopper owns 100% of FlexShopper, LLC, a limited liability company organized under the laws of North Carolina in 2013. Since the sale of the assets of Anchor Funding Services LLC, which sale was completed in a series of transactions between April and June 2014, FlexShopper is a holding corporation with no operations except for those conducted by FlexShopper, LLC. FlexShopper, LLC wholly owns, directly or indirectly, two Delaware subsidiaries, FlexShopper 1, LLC and FlexShopper 2, LLC. All references to our business operations refer to FlexShopper, LLC and its wholly-owned subsidiaries, unless the context indicates otherwise.

Since December 2013, we have developed a business that focuses on improving the quality of life of our customers by providing them the opportunity to obtain ownership of high-quality durable products, such as consumer electronics, home appliances, computers (including tablets), smartphones and furniture (including accessories), under affordable payment lease-to-own (“LTO”) purchase agreements with no long-term obligation, including through an extensive online experience. Our customers can acquire well-known brands such as Samsung, Frigidaire, Hewlett-Packard, LG, Whirlpool, Simmons, Philips, Ashley, Apple and more. We believe that the introduction of FlexShopper’s LTO programs support broad untapped expansion opportunities within the U.S. consumer e-commerce and retail marketplaces. We have successfully developed and are currently processing LTO transactions using our “LTO Engine,” FlexShopper’s proprietary technology that automates the process of consumers receiving spending limits and entering into leases for durable goods to within seconds. The LTO Engine is the basis for FlexShopper’s primary sales channels, which include business to consumer (“B2C”) and business to business (“B2B”) channels, as described in further detail below. Concurrently, e-tailers and retailers that work with FlexShopper may increase their sales by utilizing FlexShopper’s online channels to connect with consumers that want to acquire products on an LTO basis. FlexShopper’s sales channels include (1) selling directly to consumers via the online FlexShopper.com LTO Marketplace featuring thousands of durable goods, (2) utilizing FlexShopper’s LTO payment method at check out on e-commerce sites and through in-store terminals and (3) facilitating LTO transactions with retailers that have not yet become part of the FlexShopper.com LTO marketplace.

INDUSTRY OVERVIEW

The LTO industry offers consumers an alternative to traditional methods of obtaining electronics, computers, home furnishings, appliances and other durable goods. FlexShopper’s customers typically do not have sufficient cash or credit to obtain these goods, so they find the short-term nature and affordable payments of LTO attractive. In a typical LTO transaction, the customer has the option to acquire merchandise over a fixed term, usually 12 to 24 months, normally by making weekly lease payments. The customers may cancel the agreement as prescribed in the lease agreement by returning the merchandise, generally with no further lease obligation if their account is current. If customers lease the item to the full term, they obtain ownership of the item, though they can choose to buy it at any time prior to expiration of the term. FlexShopper’s current fixed term to acquire ownership is fifty-two weeks.

Non-prime consumers represent the largest segment of the credit market. Today, approximately 30% of Americans have low credit scores according to Experian, and approximately 8% of Americans are credit invisible, or have no credit history, according to the Consumer Financial Protection Bureau. This segment of consumers represents a significant and underserved market.

Banks do not adequately serve the non-prime. Following the last decade’s financial crisis, most banks tightened their underwriting standards and increased their minimum FICO score requirements for borrowers, leaving non-prime borrowers with severely reduced access to traditional credit. Despite the improving economy, banks continue to underserve the non-prime consumer. According to research based on securitization data for the five major credit card issuers, it is estimated that the revolving credit available to non-prime U.S. borrowers was reduced by approximately $142 billion from 2008 to 2016. This reduction has had a profound impact on non-prime consumers in the U.S. who typically have little to no savings. FlexShopper believes that there is a growing need for a flexible LTO product that offers the convenience of a digital in-store, online, or mobile experience.

| 1 |

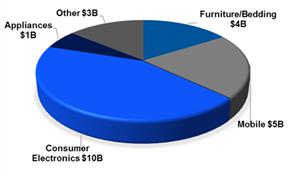

Direct Potential Addressable Market Size Totaling $20 Billion - $25 Billion:

According to KeyBanc Capital Markets’ research, the current addressable market size for non-prime consumers is between $20 and $25 billion, with consumer electronics constituting 43% of such amount. To date, we have been successful underwriting consumer electronics online and believe this is one of our competitive advantages.

GROWTH OPPORTUNITIES AND STRATEGIES

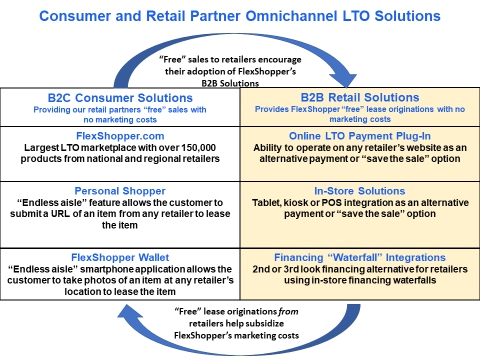

Like many industries, the internet and other technology is transforming the LTO industry. FlexShopper has positioned itself to take advantage of this transformation by focusing on the expansion of the LTO industry online and into mainstream retail and e-tail. The brick-and-mortar LTO industry currently serves approximately 3.4 million consumers annually, generating approximately $6.1 billion in sales primarily through approximately 6,700 LTO brick and mortar stores. Through its strategic sales channels FlexShopper believes it can expand the LTO industry, also known as the rent-to-own or RTO industry. FlexShopper has successfully developed and is currently processing LTO transactions using its “LTO Engine,” FlexShopper’s proprietary technology that automates the process of consumers receiving spending limits and entering into leases for durable goods to within seconds. The LTO Engine is the basis for FlexShopper’s primary sales channels, which include B2C and B2B channels, illustrated in the diagram below:

| 2 |

We believe we have created a unique platform whereby our B2B and B2C sales channels beneficially advance each other. For our B2C channels, we directly market to our consumers LTO opportunities at FlexShopper.com, where they can choose from over 150,000 of the latest products shipped directly to them by certain of the nation’s largest retailers. This generates sales for our retail partners, which encourages them to incorporate our B2B solutions into their online and in-store sales channels. The lease originations by our retail partners using our B2B channels, which have no customer acquisition cost to us, subsidize our B2C customer acquisition costs. Meanwhile, our B2C marketing promotes FlexShopper.com, which provides incremental sales for our retail partners as well as benefitting our FlexShopper.com business.

To achieve our goal of being the preeminent “pure play” virtual LTO leader, we intend to execute the following strategies:

Continue to grow FlexShopper into a dominant LTO brand. Given strong consumer demand and organic growth potential for our LTO solutions, we believe that significant opportunities exist to expand our presence within current markets via existing marketing channels. As non-prime consumers become increasingly familiar and comfortable with our retail kiosk partnerships, online marketplace and mobile solutions, we plan to capture the new business generated as they migrate away from less convenient legacy brick-and-mortar LTO stores.

Expand the range of customers served. We continue to evaluate new product and market opportunities that fit into our overall strategic objective of delivering next-generation retail, online and mobile LTO terms that span the non-prime/near-prime credit spectrum. For example, we are evaluating products with lower fees that would be more focused on the needs of more creditworthy subprime consumers that prefer a less expensive LTO option. In addition, we are continually focused on improving our analytics to effectively underwrite and serve consumers within those segments of the non-prime credit spectrum that we do not currently reach, including profitable deeper penetration of the sub-prime spectrum. We believe the current generation of our underwriting model is performing well and will continue to improve over time as its data set expands.

Pursue additional strategic retail partnerships. We intend to continue targeting regional

and national retailers to expand our B2B sales channels. As illustrated in the diagram above, we believe we have the best omnichannel

solution for retailers to “save the sale” with LTO options. In retail, the phrase “save the sale” means

offering consumers other finance options when they don’t qualify for traditional credit. We

expect these partnerships to provide us with access to a broad range of potential new customers, with low customer acquisition

costs.

| 3 |

Expand our relationships with existing customers and retail partners. Customer acquisition costs represent one of the most significant expenses for us due to our high percentage of online customers. In comparison, no acquisition cost is incurred for customers acquired through our retail partnerships. We will seek to expand our strong relationships with existing customers by providing qualified customers with increased spending limits or offering other products and services to them, as well as seek to grow our retail partnerships to reduce our overall acquisition cost.

Continue to optimize marketing across all channels. Since we began marketing our services to consumers in 2014, we have made significant progress in targeting our customers and lowering our customer acquisition costs. This is across different media including direct response television and digital channels such as social media, email, and search engines.

COMPETITION AND OUR COMPETITIVE STRENGTHS

The LTO industry is highly competitive. Our operation competes with other national, regional and local LTO businesses, as well as with rental stores that do not offer their customers a purchase option. Some of these companies have, or may develop, systems that enable consumers to obtain through online facilities spending limits and payment terms and to enter into leases nearly instantaneously, in a manner similar to that provided by FlexShopper’s proprietary technology. We believe the following competitive strengths differentiate us:

Underwriting and Risk Management

Industry-leading technology and proprietary risk analytics optimized for the non-prime credit market. We have made substantial investments in our underwriting technology and analytics platforms to support rapid scaling, innovation and regulatory compliance. Our team of data scientists and risk analysts uses our risk infrastructure to build and test strategies across the entire underwriting process, using alternative credit data, device authentication, identity verification, and many more data elements. We believe our real-time proprietary technology and risk analytics platform is better than our competitors’ in underwriting online consumers and consumer electronics; most of our peers focus on in-store consumers that acquire furniture, which we believe are easier to underwrite. In addition, all our applications are processed instantly with approvals and spending limits provided within seconds of submission.

Better LTO Products for Consumers and Retailers

Largest online LTO marketplace. We have made substantial investments in our custom e-commerce platform to provide consumers the greatest selection of popular brands delivered by certain of the nation’s largest retailers, including Best Buy, Amazon, Walmart, Overstock, Serta and many more. Our platform is custom-built for online LTO transactions, which include underwriting our consumers, serving them compliant state leases, syncing and communicating with our retail partners to fulfill orders and all front- and back-end customer relationship management functions, including collections and billing. The result is a comprehensive technology platform that manages all facets of our business and enables us to scale with hundreds of thousands of visitors and products.

A better omnichannel “save the sale” product for retailers. We believe that we have the best omnichannel solution for retailers to “save the sale” with LTO options. To our knowledge, no competitor has an LTO marketplace that provides retailers incremental sales with no acquisition cost. In addition, compared to our peers, our product for consumers requires no money down and typically fewer application fields. We believe this leads to more in-store and online sales. We also believe that we have the best LTO payment technology at checkout for e-tailers, whereby consumers can seamlessly checkout out on a third party’s e-commerce site with our LTO payment plugin.

We provide LTO consumers an “endless aisle” of products for lease-to-own. As illustrated by our B2C channels in the above diagram, we offer consumers three ways to acquire products on an LTO basis. At FlexShopper.com our customers can choose from over 150,000 of the latest products shipped by certain of the nation’s largest retailers. If customers want products that are not available on our marketplace, they may use our “personal shopper” service and simply complete a form with a link to the webpage of the desired durable good. We also offer consumers the ability to acquire durable goods with our FlexShopper Wallet smartphone application available on Apple and Android devices. With FlexShopper Wallet, consumers may apply for a spending limit and take a picture of a qualifying item in any major retail store and we will fill the order for them. With our B2C channels we believe we are providing LTO consumers with a superior LTO experience and fulfilling our mission to help improve their quality of life by shopping for what they want where they want.

| 4 |

A Lean and Scalable Model

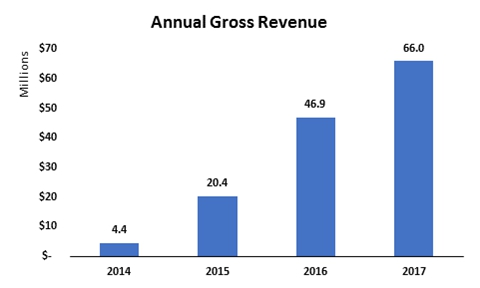

Compared to the brick-and-mortar LTO industry, which is suffering from the same headwinds as traditional retail stores and declining sales, we have been successful in addressing the LTO consumer through online channels as illustrated in the chart below.

We believe our model is more efficient and scalable for the following reasons:

We have no inventory risk and are completely drop-ship. We do not have any of the costs associated with buying, storing and shipping inventory. Instead, our suppliers ship goods directly to consumers.

We serve LTO consumers across the United States without brick-and-mortar stores. We do not have any of the costs associated with physical stores and the personnel needed to operate them.

As our sales grow we achieve more operating leverage. Our model is primarily driven by a technology platform that does not require significant increases in operating overhead to support sales growth.

The Rental Purchase Transaction

A rental purchase transaction is a flexible alternative for consumers to obtain and enjoy brand name merchandise with no long-term obligation. Key features of rental purchase transactions include:

Brand name merchandise. FlexShopper offers well-known brands such as LG, Samsung, Sony and Vizio home electronics; Frigidaire, General Electric, LG, Samsung and Whirlpool appliances; Acer, Apple, Asus, Samsung and Toshiba computers and/or tablets; Samsung and Apple smartphones; and Ashley, Powell and Standard furniture among other brands.

Convenient payment options. Our customers make payments on a weekly, bi-weekly or monthly basis. Payments are automatically deducted from the customer’s authorized checking account or debit card. Additionally, customers may make additional payments or exercise early payment options, which enable them to save money.

| 5 |

No long-term commitment. A customer may terminate a rental purchase agreement at any time with no long-term obligation by paying amounts due under the rental purchase agreement and returning the item to FlexShopper.

Applying has no impact on credit or FICO score. We do not use FICO scores to determine customers’ spending limits so our underwriting does not impact consumers’ credit with the three main credit bureaus

Flexible options to obtain ownership. Ownership of the merchandise generally transfers to the customer if the customer makes all payments during the lease term, which is one year, or exercises early payment options, which typically save the customer money.

SALES AND MARKETING

B2C Channels

We use a multi-channel, analytics-powered approach to marketing our products and services, with both broad-reach and highly-targeted channels, including television, digital, telemarketing and marketing affiliates. The goal of our marketing is to promote our brand and primarily to directly acquire new customers at a targeted acquisition cost. Our marketing strategies include the following:

Direct response television advertising. We use television advertising supported by our internal analytics and media buys from a key agency to drive and optimize website traffic and lease originations.

Digital acquisition. Our online marketing efforts include pay-per-click, keyword advertising, search engine optimization, marketing affiliate partnerships, social media programs and mobile advertising integrated with our operating systems and technology from vendors that allow us to optimize customer acquisition tactics within the daily operations cycle. In 2017 we created and launched our automated digital pay-per-click advertising platform, FLEX-AADS, which enabled us to scale up our pay-per-click marketing by utilizing better segmentation techniques and statistical models that can optimize our bidding adjustments.

User experience and conversion. We measure and monitor website visitor usage metrics and regularly test website design strategies to improve customer experience and conversion rates.

B2B Channels

We use internal business development personnel and outside consultants that focus on engaging retailers and e-tailers to use our services. This includes promoting FlexShopper at key trade shows and conferences.

MANAGEMENT INFORMATION SYSTEMS

FlexShopper uses computer-based management information systems to facilitate its entire business model, including underwriting, processing transactions through its sales channels, managing collections and monitoring leased inventory. Through the use of our proprietary software developed in-house, each of our retail partners uses our online merchant portal that automates the process of consumers receiving spending limits and entering into leases for durable goods generally to within seconds. The management information system generates reports which enable us to meet our financial reporting requirements.

GOVERNMENT REGULATIONS

The LTO industry is regulated by and subject to the requirements of various federal, state and local laws and regulations, many of which are in place for consumer protection. In general, such laws regulate, among other items, applications for leases, late fees, finance rates, disclosure statements, the substance and sequence of required disclosures, the content of advertising materials and certain collection procedures. Violations of certain provisions of these laws and regulations may result in penalties ranging from nominal amounts up to and including forfeiture of fees and other amounts due on leases. We are unable to predict the nature or effect on our operations or earnings of unknown future legislation, regulations and judicial decisions or future interpretations of existing and future legislation or regulations relating to our operations, and there can be no assurance that future laws, decisions or interpretations will not have a material adverse effect on our operations and earnings. In 2016, the Company enhanced its compliance department by hiring a Chief Compliance Counsel. See the section of this report captioned “Risk Factors” below for more information with respect to governmental laws and regulations and their effect on our business.

| 6 |

INTELLECTUAL PROPERTY

FlexShopper has provisional patent applications pending in the U.S. Patent and Trademark Office (“USPTO”) for systems that enable consumers to obtain products on an LTO basis using mobile devices and tablets and for an LTO method of payment at check-out on e-commerce sites. We can provide no assurances that FlexShopper will be granted any patents by the USPTO. We regard our pending patents, trademarks, service marks, copyrights, trade dress, trade secrets, proprietary technology, and similar intellectual property as critical to our success. In particular, we believe certain proprietary information, including but not limited to our underwriting model, and patent pending systems are central to our business model and we believe give us a key competitive advantage. We also rely on trademark and copyright law, trade secret protection, and confidentiality, license and work product agreements with our employees, customers, and others to protect our proprietary rights. See the section captioned “Risk Factors” below for more information on and risk associated with respect to our intellectual property.

Operations and Employees of FlexShopper

Brad Bernstein, our Chief Executive Officer, manages our day-to-day operations and internal growth and oversees our growth strategy. FlexShopper’s management also includes a Chief Financial Officer and a Chief Risk Officer. In addition, FlexShopper has a customer service and collections call center. As of December 31, 2017, FlexShopper had 154 employees, all of whom were full time.

Item 1A. Risk Factors

You should carefully consider the following risk factors, in addition to the other information presented in this Form 10-K, in evaluating us and our business. Any of the following risks, as well as other risks and uncertainties, could harm our business and financial results and cause the value of our securities to decline.

Our limited operating history makes it difficult to evaluate our business to date and assess our future viability. FlexShopper, LLC, which was formed in June 2013 to enter the LTO business, has a limited operating history upon which investors may judge our performance and has incurred net losses. Our ability to achieve profitability in this business will depend upon many factors, including, without limitation, our ability to execute our growth strategy and technology development, obtain sufficient capital, develop relationships with third-party retail partners, adapt to fluctuations in the economy and modify our strategy based on the degree and nature of competition. Our senior management team has very limited experience in the LTO industry. While we believe our FlexShopper business model will be successful, prior success of our senior management in other businesses should not viewed as an indication that we will be profitable. We can provide no assurances that our operations will ever be profitable.

We will require additional financing to achieve our business plans. We believe with our proprietary technology there is a significant market opportunity to expand the LTO market. However, we may be unable to successfully implement our ambitions of targeting very large markets in an intensely competitive industry segment without significantly increasing our resources. We do not currently have sufficient funds to fully implement our business plan and will need to raise capital through new financings. Such financings could include equity financing, which may be dilutive to stockholders, or debt financing, which would likely restrict our ability to borrow from other sources. In addition, such securities may contain rights, preferences or privileges senior to those of the rights of our current stockholders. There can be no assurance that additional funds will be available on terms attractive to us, or at all. If adequate funds are not available, we may be required to curtail or reduce our operations or forced to sell or dispose of our rights or assets. An inability to raise adequate funds on commercially reasonable terms would have a material adverse effect on our business, results of operation and financial condition, including the possibility that a lack of funds could cause our business to fail and liquidate with little or no return to investors.

| 7 |

Our business liquidity and capital resources are dependent upon our credit agreement with an institutional lender and our compliance with the terms thereof. We will lose access to new loans under our credit agreement in August 2018 and will need to extend or replace the credit agreement before its maturity in August 2019. If we are unable to successfully extend or replace the credit agreement in a timely manner, our future financial condition and liquidity would be materially adversely affected. FlexShopper, through FlexShopper 2, LLC (the “Borrower”), is party to a credit agreement (the “Credit Agreement”) with Wells Fargo Bank, National Association, various lenders from time to time party thereto and WE2014-1, LLC (the “Lender”). The Borrower is permitted to borrow funds under the Credit Agreement based on the Borrower’s cash on hand and the Amortized Order Value of the Borrower’s Eligible Leases (as such terms are defined in the Credit Agreement), less certain deductions described in the Credit Agreement. Under the terms of the Credit Agreement, subject to the satisfaction of certain conditions, the Borrower may borrow up to $25,000,000 from the Lender for a term of two years; however, as of December 31, 2017, there was approximately $1,061,000 in additional availability under the Credit Agreement and the outstanding balance under the Credit Agreement was $18,950,000. The Lender holds security interests in certain leases as collateral under the Credit Agreement. For the term of the Credit Agreement, FlexShopper and its subsidiaries may not incur additional indebtedness (subject to certain exceptions) without the permission of the Lender. In addition, the Lender and its affiliates have a right of first refusal on certain FlexShopper transactions involving leases or other financial products. The Credit Agreement includes customary events of default, including, among others, failures to make payment of principal and interest, breaches or defaults under the terms of the Credit Agreement and related agreements entered into with the Lender, breaches of representations, warranties or certifications made by or on behalf of the Borrower in the Credit Agreement and related documents (including certain financial and expense covenants), deficiencies in the borrowing base, certain judgments against the Borrower and bankruptcy events.

On January 9, 2018, the Credit Agreement was amended to extend the Commitment Termination Date (as defined therein) from April 1, 2018 to August 31, 2018. Upon the Commitment Termination Date, the Lender is no longer obligated to lend money to the Borrower and all amounts outstanding under the Credit Agreement will be due on the twelve-month anniversary thereof. We are currently exploring various possible financing options that may be available to us, which may include extension, modification or refinancing of the Credit Agreement and/or a sale of our securities. We have no commitments to obtain any additional funds, and there can be no assurance such funds will be available on acceptable terms or at all. If we are unable to obtain such needed capital, we may be forced to significantly curtail or suspend our operations.

Failure to effectively manage our costs could have a material adverse effect on our profitability. Certain elements of our cost structure are largely fixed in nature while consumer spending remains uncertain, which makes it challenging for us to maintain or increase our operating income. The competitiveness in our industry and increasing price transparency mean that the need to achieve efficient operations is greater than ever. As a result, we must continuously focus on managing our cost structure. Failure to manage our labor and benefit rates, advertising and marketing expenses, operating leases, charge-offs or indirect spending could materially adversely affect our profitability.

Our LTO business depends on the success of our third-party retail partners and our continued relationships with them. Our revenues depend in part on the relationships we have with third-party retailers we work with to offer our LTO services. We have entered into a variety of such arrangements and expect to seek additional such relationships in the future. However, for a variety of reasons we not be successful in these efforts. If our retail partners do not satisfy their obligations to us, we are unable to meet our retail partners’ expectations and demands or we are unable to reach agreements with additional suitable retail partners, we may fail to meet our business objectives. The terms of any additional retail partnerships or other strategic arrangements that we establish may not be favorable to us. Our inability to successfully implement retail partnerships and strategic arrangements could adversely affect our business, financial condition and results of operations. In addition, in most cases, our agreements with such third-party retailers may be terminated at the retailer’s election. There can be no assurance that we will be able to continue our relationships with our retail partners on the same or more favorable terms in future periods or that these relationships will continue beyond the terms of our existing contracts with our retail partners. The failure of our third-party retail partners to maintain quality and consistency in their operations and their ability to continue to provide products and services, or the loss of the relationship with any of these third-party retailers and an inability to replace them, could cause our business to lose customers, substantially decreasing our revenues and earnings growth.

Our growth will depend on our ability to develop our brands, and these efforts may be costly. Our ability to develop the FlexShopper brand will be critical to achieving widespread acceptance of our services and will require a continued focus on active marketing efforts. We will need to continue to spend substantial amounts of money on, and devote substantial resources to, advertising, marketing, and other efforts to create and maintain brand loyalty among our customers. If we fail to promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to do so, our business would be harmed.

| 8 |

Our LTO business depends on the continued growth of online and mobile commerce. The business of selling goods over the internet and mobile networks is dynamic and relatively new. Concerns about fraud, privacy and other problems or lack of access may discourage additional consumers from adopting the internet or mobile devices as modes of commerce or may prompt consumers to offline channels. In order to expand our user base, we must appeal to and acquire consumers who historically have used traditional means of commerce to purchase goods and may prefer internet analogues to such traditional retail means, such as the retailer’s own website, to our offerings. If these consumers prove to be less active than we expect due to lower levels of willingness or ability to use the internet or mobile devices for commerce for any reason, including lack of access to high-speed communications equipment, traffic congestion on the internet or mobile network outages or delays, disruptions or other damage to users’ computers or mobile devices, and we are unable to gain efficiencies in our operating costs, including our cost of acquiring new users, our business could be adversely impacted.

Failure to successfully manage and grow our FlexShopper.com e-commerce platform could materially adversely affect our business and future prospects. Our FlexShopper.com e-commerce platform provides customers the ability to apply, shop, review our product offerings and prices and enter into lease agreements as well as make payments on existing leases from the comfort of their homes and on their mobile devices. Our e-commerce platform is a significant and essential component of our strategic plan and we believe will drive future growth of our business. In order to promote our products and services and allow customers to transact online and reach new customers, we must effectively maintain, improve and grow our e-commerce platform. There can be no assurance that we will be able to maintain, improve or grow our e-commerce platform in a profitable manner.

The success of our business is dependent on factors affecting consumer spending that are not under our control. Consumer spending is affected by general economic conditions and other factors including levels of employment, disposable consumer income, prevailing interest rates, consumer debt and availability of credit, inflation, recession and fears of recession, tax rates and rate increases, timing of receipt of tax refunds, consumer confidence in future economic conditions and political conditions, and consumer perceptions of personal well-being and security. Unfavorable changes in factors affecting discretionary spending could reduce demand for our products and services, such as consumer electronics and residential furniture, resulting in lower revenue and negatively impacting our business and its financial results.

Our customer base presents significant risk of default for non-payment. We bear the risk of non-payment or late payments by our customers. The nature of our customer base makes it sensitive to adverse economic conditions and, in the event of an economic downturn, less likely to meet our prevailing underwriting standards, which may be more restrictive in an adverse economic environment. As a result, during such periods we may experience decreases in the growth of new customers, and we may curtail spending limits to existing customers, which may adversely affect our net sales and potential profitability.

Our customers can return merchandise without penalty. When our customers acquire merchandise through the FlexShopper LTO program, we purchase the merchandise from the retailer and enter the lease-to-own relationship with the customer. Because our customers can return merchandise without penalty, there is risk that we may end up owning a significant amount of merchandise that is difficult to monetize. While we have factored customer returns into our business model, customer return volume may exceed the levels we expect, which could adversely impact our collections, revenues and our financial performance. Returns totaled 4.4% of leased merchandise at December 31, 2017.

We rely on third-party credit/debit card and ACH (Automated Clearing House) processors to process collections from customers on a weekly basis. Our ability to collect from customers could be impaired if these processors do not work with us. These third-party payment processors may consider our business a high risk since our customer base has a high incidence of insufficient funds and rejected payments. This could cause a processor to discontinue its services to us, and we may not be able to find a replacement processor. If this occurs, we would have to collect from our customers using less efficient methods, which would adversely impact our collections, revenues and our financial performance.

| 9 |

We rely on internal models to manage risk, to provide accounting estimates and to make other business decisions. Our results could be adversely affected if those models do not provide reliable estimates or predictions of future activity. The accurate modeling of risks is critical to our business, particularly with respect to managing underwriting and spending limits for our customers. Our expectations regarding customer repayment levels, as well as our allowances for doubtful accounts and other accounting estimates, are based in large part on internal modeling. We also rely heavily on internal models in making a variety of other decisions crucial to the successful operation of our business. It is therefore important that our models are accurate, and any failure in this regard could have a material adverse effect on our results. However, models are inherently imperfect predictors of actual results because they are based on historical data available to us and our assumptions about factors such as demand, payment rates, default rates, delinquency rates and other factors that may overstate or understate future experience. Our models could produce unreliable results for a number of reasons, including the limitations or lack of historical data to predict results, invalid or incorrect underlying assumptions or data, the need for manual adjustments in response to rapid changes in economic conditions, incorrect coding of the models or inappropriate application of a model to products or events outside of the model’s intended use. In particular, models are less dependable when the economic environment is outside of historical experience, as has been the case recently. Due to the factors described above, resulting unanticipated and excessive default and charge-off experience can adversely affect our profitability and financial condition, breach covenants in our credit agreement, limit our ability to secure a future credit facility and adversely affect our ability to finance our business.

Our operations are regulated by and subject to the requirements of various federal and state laws and regulations. These laws and regulations, which may be amended or supplemented or interpreted by the courts from time to time, could expose us to significant compliance costs or burdens or force us to change our business practices in a manner that may be materially adverse to our operations, prospects or financial condition. Currently, nearly every state and the District of Columbia specifically regulate LTO transactions. At the present time, no federal law specifically regulates the LTO industry, although federal legislation to regulate the industry has been proposed from time to time. Any adverse changes in existing laws, or the passage of new adverse legislation by states or the federal government could materially increase both our costs of complying with laws and the risk that we could be sued or be subject to government sanctions if we are not in compliance. In addition, new burdensome legislation might force us to change our business model and might reduce the economic potential of our sales and lease ownership operations. Most of the states that regulate LTO transactions have enacted disclosure laws that require LTO companies to disclose to their customers the total number of payments, the total amount and timing of all payments to acquire ownership of any item, any other charges that may be imposed and miscellaneous other items. In addition, certain restrictive state lease purchase laws limit the total amount that a customer may be charged for an item, or regulate the “cost-of-rental” amount that LTO companies may charge on LTO transactions, generally defining “cost-of-rental” as lease fees paid in excess of the “retail” price of the goods. There has been increased legislative attention in the United States, at both the federal and state levels, on consumer debt transactions in general, which may result in an increase in legislative regulatory efforts directed at the LTO industry. We cannot guarantee that the federal government or states will not enact additional or different legislation that would be disadvantageous or otherwise materially adverse to us. In addition to the risk of lawsuits related to the laws that regulate LTO transactions, we could be subject to lawsuits alleging violations of federal and/or state laws and regulations relating to consumer tort law, including fraud, consumer protection, information security and privacy. A large judgment against us could adversely affect our financial condition and results of operations. Moreover, an adverse outcome from a lawsuit, even one against one of our competitors, could result in changes in the way we and others in the industry do business, possibly leading to significant costs or decreased revenues or profitability.

Our virtual LTO business differs in some potentially significant respects from the risks of a typical LTO brick-and-mortar store business, which implicates certain additional regulatory risks.

We offer LTO products directly to consumers through our e-commerce marketplace and through the stores and e-commerce sites of third-party retailers. This novel business model implicates certain regulatory risk including, among others:

| ● | possibly different regulatory risks than applicable to traditional brick-and-mortar LTO stores, whether arising from the offer by third-party retailers of FlexShopper’s B2B solutions alongside traditional cash, check or credit payment options or otherwise, including the risk that regulators may mistakenly treat virtual LTO transactions as some other type of transaction that would face different and more burdensome and complex regulations; |

| 10 |

| ● | reliance on automatic bank account drafts for lease payments, which may become disfavored as a payment method for these transactions by regulators; |

| ● | potential that regulators may target the virtual LTO transaction and/or adopt new regulations or legislation (or existing laws and regulations may be interpreted in a manner) that negatively impact FlexShopper’s ability to offer virtual LTO programs through third-party retail partners; |

| ● | potential that regulators may attempt to force the application of laws and regulations on FlexShopper’s virtual LTO business in inconsistent and unpredictable ways that could increase the compliance-related costs incurred by FlexShopper, and negatively impact FlexShopper’s financial and operational performance; and |

| ● | indemnification obligations to FlexShopper retail partners and their service providers for losses stemming from FlexShopper’s failure to perform with respect to its products and services. |

Any of these risks could have a material adverse effect on FlexShopper’s business.

Changes in regulations or customer concerns, in particular as they relate to privacy and protection of customer data, could adversely affect our business. Our business is subject to laws relating to the collection, use, retention, security and transfer of personally identifiable information about our customers. The interpretation and application of privacy and customer data protection laws are in a state of flux and may vary from jurisdiction to jurisdiction. These laws may be interpreted and applied inconsistently and our current data protection policies and practices may not be consistent with those interpretations and applications. Complying with these varying requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. Any failure, or perceived failure, by us to comply with our own privacy policies or with any regulatory requirements or orders or other privacy or consumer protection related laws and regulations could result in proceedings or actions against us by governmental entities or others, subject us to significant penalties and negative publicity and adversely affect our operating results.

If we fail to protect the integrity and security of customer and employee information, we could damage our reputation or be exposed to litigation or regulatory enforcement, and our business could be adversely impacted. We collect and store certain personal information provided to us by our customers and employees in the ordinary course of our business. Despite instituted safeguards for the protection of such information, we cannot be certain that all of our systems are entirely free from vulnerability to attack. Computer hackers may attempt to penetrate our network security and, if successful, misappropriate confidential customer or employee information. In addition, one of our employees, contractors or other third party with whom we do business may attempt to circumvent our security measures in order to obtain such information, or inadvertently cause a breach involving such information. Loss of customer or employee information could disrupt our operations, damage our reputation and expose us to claims from customers, employees, regulators and other persons, any of which could have an adverse effect on our business, financial condition and results of operations. In addition, the costs associated with information security, such as increased investment in technology, the costs of compliance with privacy laws and costs incurred to prevent or remediate information security breaches, could adversely impact our business.

The transactions offered to consumers by our businesses may be negatively characterized by consumer advocacy groups, the media and certain federal, state and local government officials, and if those negative characterizations become increasingly accepted by consumers and/or FlexShopper’s retail partners, demand for our goods and the transactions we offer could decrease and our business could be materially adversely affected. Certain consumer advocacy groups, media reports and federal and state legislators have asserted that laws and regulations should be broader and more restrictive regarding LTO transactions. The consumer advocacy groups and media reports generally focus on the total cost to a consumer to acquire an item, which is often alleged to be higher than the interest typically charged by banks or similar lending institutions to consumers with better credit histories. This “cost-of-rental” amount, which is generally defined as lease fees paid in excess of the “retail” price of the goods, is from time to time characterized by consumer advocacy groups and media reports as predatory or abusive without discussing benefits associated with LTO programs or the lack of viable alternatives for our customers’ needs. If the negative characterization of these types of LTO transactions becomes increasingly accepted by consumers or FlexShopper’s retail and merchant partners, demand for our products and services could significantly decrease, which could have a material adverse effect on our business, results of operations and financial condition. Additionally, if the negative characterization of these types of transactions is accepted by legislators and regulators, we could become subject to more restrictive laws and regulations, which could have a material adverse effect on our business, results of operations and financial condition. The vast expansion and reach of technology, including social media platforms, has increased the risk that our reputation could be significantly impacted by these negative characterizations in a relatively short amount of time. If we are unable to quickly and effectively respond to such characterizations, we may experience declines in customer loyalty and traffic and our relationships with our retail partners may suffer, which could have a material adverse effect on our business, results of operations and financial condition.

| 11 |

The loss of any of our key personnel could harm our business. Our future financial performance will depend to a significant extent on our ability to motivate and retain key management personnel. Further, FlexShopper is seeking to hire additional qualified management for its FlexShopper business. Competition for qualified management personnel is intense, and there can be no assurance that we will be able to hire additional qualified management on terms satisfactory to FlexShopper. Further, in the event we experience turnover in our senior management positions, we cannot assure you that we will be able to recruit suitable replacements. We must also successfully integrate all new management and other key positions within our organization to achieve our operating objectives. Even if we are successful, turnover in key management positions may temporarily harm our financial performance and results of operations until new management becomes familiar with our business. At present, we do not maintain key-man life insurance on any of our executive officers, although we entered into employment contracts with Brad Bernstein, our Chief Executive Officer and President, and Russ Heiser, our Chief Financial Officer. Our Board of Directors is responsible for approval of all future employment contracts with our executive officers. We can provide no assurances that said future employment contracts and/or their current compensation is or will be on commercially reasonable terms to us in order to retain our key personnel. The loss of any of our key personnel could harm our business.

We depend on hiring an adequate number of hourly employees to run our business and are subject to government regulations concerning these and our other employees, including wage and hour regulations. Our workforce is comprised primarily of employees who work on an hourly basis. To grow our operations and meet the needs and expectations of our customers, we must attract, train, and retain a large number of hourly associates, while at the same time controlling labor costs. These positions have historically had high turnover rates, which can lead to increased training, retention and other costs. In certain areas where we operate, there is significant competition for employees, including from retailers and the restaurant industries. The lack of availability of an adequate number of hourly employees, or our inability to attract and retain them, or an increase in wages and benefits to current employees could adversely affect our business, results of operations, cash flows and financial condition. We are subject to applicable rules and regulations relating to our relationship with our employees, including wage and hour regulations, health benefits, unemployment and payroll taxes, overtime and working conditions and immigration status. Accordingly, federal, state or local legislated increases in the minimum wage, as well as increases in additional labor cost components such as employee benefit costs, workers’ compensation insurance rates, compliance costs and fines, would increase our labor costs, which could have a material adverse effect on our business, prospects, results of operations and financial condition.

Employee misconduct or misconduct by third parties acting on our behalf could harm us by subjecting us to monetary loss, significant legal liability, regulatory scrutiny and reputational harm. Our reputation is critical to maintaining and developing relationships with our existing and potential customers and third parties with whom we do business. There is a risk that our employees or the employees of a third-party retailer with whom we partner could engage in misconduct that adversely affects our reputation and business. For example, if an employee or a third party associated with our business were to engage in, or be accused of engaging in, illegal or suspicious activities including fraud or theft of our customers’ information, we could suffer direct losses from the activity and, in addition, we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial condition, customer relationships and ability to attract future customers. Employee or third-party misconduct could prompt regulators to allege or to determine based upon such misconduct that we have not established adequate supervisory systems and procedures to inform employees of applicable rules or to detect violations of such rules. The precautions that we take to detect and prevent misconduct may not be effective in all cases. Misconduct by our employees or third-party contractors, or even unsubstantiated allegations of misconduct, could result in a material adverse effect on our reputation and our business. Our operations are subject to certain laws generally prohibiting companies and their intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business, such as the U.S. Foreign Corrupt Practices Act, and similar anti-bribery laws in other jurisdictions. Our employees, contractors or agents may violate the policies and procedures we have implemented to ensure compliance with these laws. Any such improper actions could subject us to civil or criminal investigations, could lead to substantial civil and criminal, monetary and non-monetary penalties, and related shareholder lawsuits, could cause us to incur significant legal fees, and could damage our reputation.

| 12 |

Competition in the LTO business is intense. The LTO industry is highly competitive. Our operation competes with other national, regional and local LTO businesses, as well as with rental stores that do not offer their customers a purchase option. Some of these companies have, or may develop, systems that enable consumers to obtain through online facilities spending limits and payment terms and to enter into leases nearly instantaneously, in a manner similar to that provided by FlexShopper’s proprietary technology. Greater financial resources may allow our competitors to grow faster than us, including through acquisitions. This in turn may enable them to enter new markets before we can, which may decrease our opportunities in those markets. Greater name recognition, or better public perception of a competitor’s reputation, may help them divert market share away from us, even in our established markets. Some competitors may be willing to offer competing products on an unprofitable basis in an effort to gain market share, which could compel us to match their pricing strategy or lose business. With respect to customers desiring to purchase merchandise for cash or on credit, we also compete with retail stores. Competition is based primarily on store location, product selection and availability, customer service and lease rates and terms. We believe we do not currently have significant competition for our online LTO marketplace and patent-pending LTO payment method. However, such competition is likely to develop over time, and we may be unable to successfully compete in our target markets. We can provide no assurances that we will be able to successfully compete in the LTO industry.

Worsening of current economic conditions could result in decreased revenues or increased costs. Although we believe an economic downturn can result in increased business in the LTO market as consumers increasingly find it difficult to purchase home furnishings, electronics and appliances from traditional retailers on store installment credit, it is possible that if the conditions continue for a significant period of time, or get worse, consumers may curtail spending on all or some of the types of merchandise we offer, in which event our revenues may suffer.

Continuation or worsening of current economic conditions faced by a portion of our customer base could result in decreased revenues. The geographic concentration of our retail partners may magnify the impact of conditions in a particular region, including economic downturns and other occurrences. Much of our customer base continues to experience prolonged economic uncertainty and, in certain areas, unfavorable economic conditions. We believe that the extended duration of that economic uncertainty and unfavorable economic conditions may be resulting in our customers curtailing purchases of the types of merchandise we offer, or entering into agreements that generate smaller amounts of revenue for us (i.e., a 90-day same-as-cash option), resulting in decreased revenues for FlexShopper. Any increases in unemployment or underemployment within our customer base may result in increased defaults on lease payments, resulting in increased merchandise return costs and merchandise losses. In addition, our retail partners as well as our online customer base are subject to the effects of adverse acts of nature, such as winter storms, hurricanes, hail storms, strong winds, earthquakes and tornadoes, which have in the past caused damage such as flooding and other damage to our retail partners and online customers.

We are subject to sales, income and other taxes, which can be difficult and complex to calculate due to the nature of our business. A failure to correctly calculate and pay such taxes could result in substantial tax liabilities and a material adverse effect on our results of operations. The application of indirect taxes, such as sales tax, is a complex and evolving issue, particularly with respect to the LTO industry generally and our virtual LTO business more specifically. Many of the fundamental statutes and regulations that impose these taxes were established before the growth of the LTO industry and e-commerce and, therefore, in many cases it is not clear how existing statutes apply to our various businesses. In addition, governments are increasingly looking for ways to increase revenues, which has resulted in discussions about tax reform and other legislative action to increase tax revenues, including through indirect taxes. This also could result in other adverse changes in or interpretations of existing sales, income and other tax regulations. For example, from time to time, some taxing authorities in the United States have notified us that they believe we owe them certain taxes imposed on transactions with our customers. Although these notifications have not resulted in material tax liabilities to date, there is a risk that one or more jurisdictions may be successful in the future, which could have a material adverse effect on our results of operations.

| 13 |

System interruption and the lack of integration and redundancy in our order entry and online systems may adversely affect our net sales. Customer access to our customer service center and websites is key to the continued flow of new orders. Anything that would hamper or interrupt such access could adversely affect our net sales, operating results and customer satisfaction. Examples of risks that could affect access include problems with the internet or telecommunication infrastructure, limited web access by our customers, local or more systemic impairment of computer systems due to viruses or malware, or impaired access due to breaches of internet security or denial of service attacks. Changes in the policies of service providers or others that increase the cost of telephone or internet access could inhibit our ability to market our products or transact orders with customers. In addition, our ability to operate our business from day-to-day largely depends on the efficient operation of our computer hardware and software systems and communications systems. Our computer and communications systems and operations could be damaged or interrupted by fire, flood, power loss, telecommunications failure, earthquakes, acts of war or terrorism, acts of God, computer viruses, physical or electronic break-ins or denial of service attacks, improper operation by employees and similar events or disruptions. Any of these events could cause system interruption, delays and loss of critical data and could prevent us from accepting and fulfilling customer orders and providing services, which would impair our operations. Certain of our systems are not redundant, and we have not fully implemented a disaster recovery plan. In addition, we may have inadequate insurance coverage to compensate us for any related losses. Interruptions to customer ordering, particularly if prolonged, could damage our reputation and be expensive to remedy and have significant adverse effects on our financial results.

We face risk related to the strength of our operational, technological and organizational infrastructure. We are exposed to operational risks that can be manifested in many ways, such as errors related to failed or inadequate processes, faulty or disabled computer systems, fraud by employees, contractors or third parties and exposure to external events. In addition, we are heavily dependent on the strength and capability of our technology systems that we use to manage our internal financial, credit and other systems, interface with our customers and develop and implement effective marketing campaigns. Our ability to operate our business to meet the needs of our existing customers and attract new ones and to run our business in compliance with applicable laws and regulations depends on the functionality of our operational and technology systems. Any disruptions or failures of our operational and technology systems, including those associated with improvements or modifications to such systems, could cause us to be unable to market and manage our products and services and to report our financial results in a timely and accurate manner, all of which could have a negative impact on our results of operations. In some cases, we outsource delivery, maintenance and development of our operational and technological functionality to third parties. These third parties may experience errors or disruptions that could adversely impact us and over which we may have limited control. Any increase in the amount of our infrastructure that we outsource to third parties may increase our exposure to these risks.

If we do not respond to technological changes, our services could become obsolete, and we could lose customers. To remain competitive, we must continue to enhance and improve the functionality and features of our e-commerce websites and other technologies. We may face material delays in introducing new products and enhancements. If this happens, our customers may forego the use of our websites and use those of our competitors. The internet and the online commerce industry are rapidly changing. If competitors introduce new products and services using new technologies or if new industry standards and practices emerge, our existing websites and our proprietary technology and systems may become obsolete. Our failure to respond to technological change or to adequately maintain, upgrade and develop our computer network and the systems used to process customers’ orders and payments could harm our business, prospects, financial condition and results of operations.

| 14 |

We may not be able to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties. We have filed provisional patents for a system that enables consumers to buy products on an LTO basis using mobile devices and tablets and for an LTO method of payment at check-out on e-commerce sites. We can provide no assurances that we will be granted any patents by the USPTO. We regard our pending patents, trademarks, service marks, copyrights, trade dress, trade secrets, proprietary technology, and similar intellectual property as critical to our success. In particular, we believe certain proprietary information, including but not limited to our underwriting model, and patent-pending systems are central to our business model, and we believe give us a key competitive advantage. We rely on trademark and copyright law, trade secret protection, and confidentiality, license and work product agreements with our employees, customers and others to protect our proprietary rights. We may be unable to prevent third parties from acquiring trademarks, service marks and domain names that are similar to, infringe upon, or diminish the value of our trademarks and other proprietary rights. Failure to protect our domain names could affect adversely our reputation and brand, and make it more difficult for users to find our website. We may be unable to discover or determine the extent of any unauthorized use of our proprietary rights. The protection of our intellectual property may require the expenditure of significant financial and managerial resources. In addition, the steps we take to protect our intellectual property may not adequately protect our rights or prevent parties from infringing or misappropriating our proprietary rights. We can be at risk that others will independently develop or acquire equivalent or superior technology or other intellectual property rights. The use of our technology or similar technology by others could reduce or eliminate any competitive advantage we have developed, cause us to lose sales or otherwise harm our business. We cannot be certain that the intellectual property used in our business does not and will not infringe the intellectual property rights of others, and we are from time to time subject to third party infringement claims. Due to recent changes in patent law, we face the risk of a temporary increase in patent litigation due to new restrictions on including unrelated defendants in patent infringement lawsuits in the future particularly from entities that own patents but that do not make products or services covered by the patents. Any third party infringement claims against us, whether or not meritorious, may result in the expenditure of significant financial and managerial resources, injunctions against us or the payment of damages. Moreover, should we be found liable for infringement, we may be required to seek to enter into licensing agreements, which may not be available on acceptable terms or at all.

In deciding whether to provide a spending limit to customers, we rely on the accuracy and completeness of information furnished to us by or on behalf of our customers. If we and our systems are unable to detect any misrepresentations in this information, this could have a material adverse effect on our results of operations and financial condition. In deciding whether to provide a customer with a spending amount, we rely heavily on information furnished to us by or on behalf of our customers and our ability to validate such information through third-party services, including personal financial information. If a significant percentage of our customers intentionally or negligently misrepresent any of this information, and we or our systems do not or did not detect such misrepresentations, it could have a material adverse effect on our ability to effectively manage our risk, which could have a material adverse effect on our results of operations and financial condition.

If we fail to timely contact delinquent customers, then the number of delinquent customer receivables eventually being charged off could increase. We contact customers with delinquent account balances soon after the account becomes delinquent. During periods of increased delinquencies it is important that we are proactive in dealing with these customers rather than simply allowing customer receivables to go to charge-off. During periods of increased delinquencies, it becomes extremely important that we are properly staffed and trained to assist customers in bringing the delinquent balance current and ultimately avoiding charge-off. If we do not properly staff and train our collections personnel, or if we incur any downtime or other issues with our information systems that assist us with our collection efforts, then the number of accounts in a delinquent status or charged-off could increase. In addition, managing a substantially higher volume of delinquent customer receivables typically increases our operational costs. A rise in delinquencies or charge-offs could have a material adverse effect on our business, financial condition, liquidity and results of operations.

Our management information systems may not be adequate to meet our evolving business and emerging regulatory needs and the failure to successfully implement them could negatively impact the business and its financial results. We are investing significant capital in new information technology systems to support our growth plan. These investments include redundancies, and acquiring new systems and hardware with updated functionality. We are taking appropriate actions to ensure the successful implementation of these initiatives, including the testing of new systems, with minimal disruptions to the business. These efforts may take longer and may require greater financial and other resources than anticipated, may cause distraction of key personnel, may cause disruptions to our systems and our business, and may not provide the anticipated benefits. The disruption in our information technology systems, or our inability to improve, integrate or expand our systems to meet our evolving business and emerging regulatory requirements, could impair our ability to achieve critical strategic initiatives and could adversely impact our sales, collections efforts, cash flows and financial condition.

| 15 |

If we fail to maintain adequate systems and processes to detect and prevent fraudulent activity, our business could be adversely impacted. Criminals are using increasingly sophisticated methods to engage in illegal activities such as paper instrument counterfeiting, fraudulent payment or refund schemes and identity theft. As we make more of our services available over the internet and other media we subject ourselves to consumer fraud risk. We use a variety of tools to protect against fraud; however, these tools may not always be successful.