Attached files

| file | filename |

|---|---|

| 8-K - 8-K - iHeartCommunications, Inc. | d541390d8k.htm |

We understand that the PGNs/Term Lenders have been negotiating individual RSAs with each of the 2021 Group and the Sponsors around a restructuring. While the Company has not been involved in these discussions, we are not opposed to each of you continuing your bilateral efforts with the PGNs/Term Lenders. Please keep us advised real time of the results of those discussions. Since its February 8 Proposal, the Company has been in regular contact with each of its creditor and equity constituents to develop a proposal that has the most support possible. The attached proposal reflects the Company’s attempt to harmonize the views received directly from each of you. We ask that you each consider it as soon as possible. A couple of additional observations: This proposal provides less value to the equity holders than what we understand is being offered by the PGNs/Term Lenders under their RSA. This proposal provides less value to the junior creditors than what we understand is being offered by the PGNs/Term Lenders under their RSA. This proposal does not contemplate any additional consideration to the Legacy Holders. We understand that the Legacy Holders proposal of February 26, which only allocated value among creditors, was rejected by each of PJT and the 2021 Group. The 2021 Group has stated that they do not support any additional consideration for the Legacy Holders. We would want to continue those discussions to ensure that every possible opportunity for full consensus is explored. This proposal requests a modest increase from the PGNs/Term Lenders from their February 8 Proposal, but the Company believes that the February 8 Proposal offered less value to the Company than the January 19th Proposal made by the PGNs/Term Lenders. We look forward to hearing from you. Privileged and Confidential Privileged Settlement Communication Subject to FRE 408 and TRE 408 and Related Provisions Exhibit 99.1

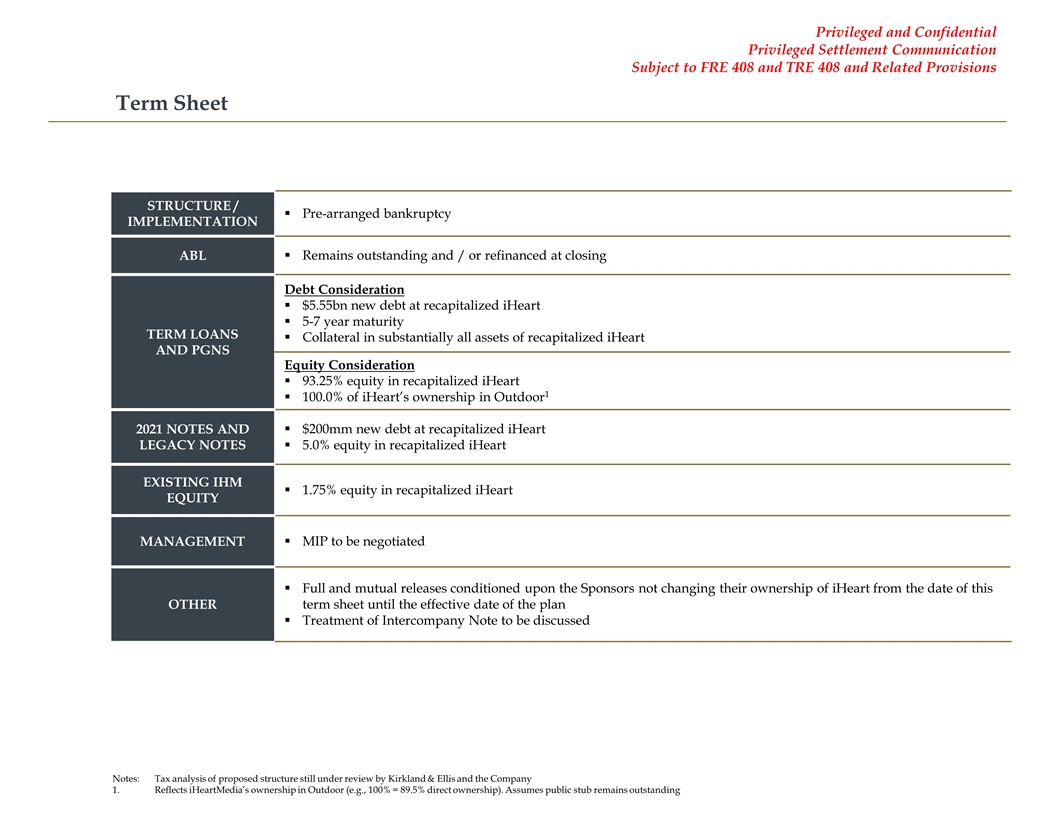

Term Sheet STRUCTURE / IMPLEMENTATION Pre-arranged bankruptcy ABL Remains outstanding and / or refinanced at closing TERM LOANS AND PGNS Debt Consideration $5.55bn new debt at recapitalized iHeart 5-7 year maturity Collateral in substantially all assets of recapitalized iHeart Equity Consideration 93.25% equity in recapitalized iHeart 100.0% of iHeart’s ownership in Outdoor1 2021 NOTES AND LEGACY NOTES $200mm new debt at recapitalized iHeart 5.0% equity in recapitalized iHeart EXISTING IHM EQUITY 1.75% equity in recapitalized iHeart MANAGEMENT MIP to be negotiated OTHER Full and mutual releases conditioned upon the Sponsors not changing their ownership of iHeart from the date of this term sheet until the effective date of the plan Treatment of Intercompany Note to be discussed Notes:Tax analysis of proposed structure still under review by Kirkland & Ellis and the Company Reflects iHeartMedia’s ownership in Outdoor (e.g., 100% = 89.5% direct ownership). Assumes public stub remains outstanding Privileged and Confidential Privileged Settlement Communication Subject to FRE 408 and TRE 408 and Related Provisions