Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Impax Laboratories, LLC | exhibit991.htm |

| 8-K - 8-K - Impax Laboratories, LLC | ipxl-3x01x2018x8k.htm |

1

Fourth Quarter and Full Year

2017 Results

March 1, 2018

2

Impax Cautionary Statement Regarding Forward

Looking Statements

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this news release contain information that is not historical, these statements are forward-looking in nature and express the beliefs and expectations of

management. Such statements are based on current expectations and involve a number of known and unknown risks and uncertainties that could cause the Company’s future results,

performance, or achievements to differ significantly from the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties

include, but are not limited to, fluctuations in the Company’s operating results and financial condition, the volatility of the market price of the Company’s common stock, the Company’s ability to

successfully develop and commercialize pharmaceutical products in a timely manner, the impact of competition, the effect of any manufacturing or quality control problems, the Company’s

ability to manage its growth, risks related to acquisitions of or investments in technologies, products or businesses, risks relating to goodwill and intangibles, the reduction or loss of business

with any significant customer, the substantial portion of the Company’s total revenues derived from sales of a limited number of products, the impact of continuing consolidation of the

Company’s customer base, the Company’s ability to sustain profitability and positive cash flows, the impact of any valuation allowance on the Company’s deferred tax assets, the restrictions

imposed by the Company’s credit facility and indenture, the Company’s level of indebtedness and liabilities and the potential impact on cash flow available for operations, the availability of

additional funds in the future, any delays or unanticipated expenses in connection with the operation of the Company’s manufacturing facilities or at its third party suppliers, the effect of foreign

economic, political, legal and other risks on the Company’s operations abroad, the uncertainty of patent litigation and other legal proceedings, the increased government scrutiny on the

Company’s agreements to settle patent litigations, product development risks and the difficulty of predicting FDA filings and approvals, consumer acceptance and demand for new

pharmaceutical products, the impact of market perceptions of the Company and the safety and quality of its products, the Company’s determinations to discontinue the manufacture and

distribution of certain products, the Company’s ability to achieve returns on its investments in research and development activities, changes to FDA approval requirements, the Company’s

ability to successfully conduct clinical trials, the Company’s reliance on third parties to conduct clinical trials and testing, the Company’s lack of a license partner for commercialization of

Numient® (IPX066) outside of the United States and Taiwan, the impact of illegal distribution and sale by third parties of counterfeits or stolen products, the availability of raw materials and

impact of interruptions in the Company’s supply chain, the Company’s policies regarding returns, rebates, allowances and chargebacks, the use of controlled substances in the Company’s

products, the effect of global economic conditions on the Company’s industry, business, results of operations and financial condition, disruptions or failures in the Company’s information

technology systems and network infrastructure caused by cyber-attacks or other third party breaches or other events, the Company’s reliance on alliance and collaboration agreements, the

Company’s reliance on licenses to proprietary technologies, the Company’s dependence on certain employees, the Company’s ability to comply with legal and regulatory requirements

governing the healthcare industry, the regulatory environment, the effect of certain provisions in the Company’s government contracts, the Company’s ability to protect its intellectual property,

exposure to product liability claims, changes in tax regulations, uncertainties involved in the preparation of the Company’s financial statements, the Company’s ability to maintain an effective

system of internal control over financial reporting, the effect of terrorist attacks on the Company’s business, the location of the Company’s manufacturing and research and development

facilities near earthquake fault lines, expansion of social media platforms, risks related to the Company’s proposed business combination with Amneal Pharmaceuticals, Inc. (“Amneal”),

including whether the transactions (the “Combination”) contemplated by the Business Combination Agreement dated as of October 17, 2017 by and among us, Amneal, Atlas Holdings, Inc.,

and K2 Merger Sub Corporation as amended by Amendment No. 1, dated November 21, 2017 and Amendment No. 2 dated December 16, 2017 (the “Business Combination Agreement”) will

be completed on the terms or timeline contemplated, if at all, the risk that governmental entities could take actions under antitrust laws to enjoin the completion of the Combination, business

uncertainties and contractual restrictions while the Combination is pending, challenges related to the Company’s integration with Amneal after the closing, the fact that ownership interests will

not be adjusted if there is a change in value of the Company or Amneal, provisions in the Business Combination Agreement that may discourage other companies from acquiring the Company,

transaction related costs related to the Combination and integration, the lower ownership and voting interests that the Company’s stockholders will have in New Amneal after the closing, the

pending litigation related to the Combination and other risks described in the Company’s periodic reports filed with the Securities and Exchange Commission. Forward-looking statements

speak only as to the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, regardless of whether new

information becomes available, future developments occur or otherwise.

Trademarks referenced herein are the property of their respective owners.

©2018 Impax Laboratories, Inc. All Rights Reserved.

3

Important Information for Investors and

Shareholders

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be

solicitation material in respect of the proposed transaction between Impax Laboratories, Inc. (“Impax”) and Amneal Pharmaceuticals LLC (“Amneal”) pursuant to the Business Combination

Agreement dated as of October 17, 2017 by and among Impax, Amneal, Atlas Holdings, Inc. (“Holdco”), and K2 Merger Sub Corporation, as amended by Amendment No. 1, dated November

21, 2017, and Amendment No. 2, dated December 16, 2017. In connection with the proposed transaction, Holdco filed a registration statement on Form S- 4, containing a proxy

statement/prospectus, with the Securities and Exchange Commission (“SEC”) on November 21, 2017, Amendment No. 1 to the registration statement filed on December 29, 2017, Amendment

No. 2 to the registration statement filed on January 23, 2018, Amendment No. 3 to the registration statement filed on February 1, 2018 and Amendment No. 4 to the registration statement filed

on February 6, 2018, which was declared effective by the SEC on February 9, 2018. Impax has filed a definitive proxy statement on Schedule 14A with the SEC on February 12, 2018, and the

definitive proxy statement and a form of proxy have been mailed to the shareholders of Impax on or about February 13, 2018. This communication is not a substitute for the registration

statement, definitive proxy statement/prospectus or any other documents that Impax or Holdco may file or have filed with the SEC, or will send or have sent to stockholders in connection with

the proposed business combination. INVESTORS AND SECURITY HOLDERS OF IMPAX ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE

PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain copies of the registration statement, including the proxy statement/prospectus and other documents filed with the SEC (when available) free

of charge at the SEC’s website, http://www.sec.gov. Copies of the documents filed with the SEC by Impax or Holdco will be available free of charge on Impax’s internet website at

http://www.impaxlabs.com or by contacting Mark Donohue, Investor Relations and Corporate Communications at (215) 558-4526.

Participants in Solicitation

Impax, Amneal, Holdco and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Impax’s stockholders in respect of the proposed

transaction. Information about the directors and executive officers of Impax is set forth in its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on April

5, 2017, and in its Annual Report on Form 10-K for the year ended December 31, 2016. Other information regarding the participants in the proxy solicitations and a description of their direct

and indirect interests, by security holdings or otherwise, are contained in the proxy statement/prospectus regarding the proposed transaction and other relevant materials that have been or will

be filed with the SEC when they become available. You may obtain free copies of these documents as described in the preceding paragraph. This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

3

Important Information for Investors and

Shareholders

4

Paul Bisaro

President & CEO

5

4Q and Full Year 2017 Financial Summary

$ millions, except EPS 4Q 2017 4Q 2016 FY 2017 FY 2016

Total Revenues, net $183 $198 $776 $824

Generic, net $113 $139 $549 $606

Specialty, net $70 $59 $227 $218

Adjusted Gross Margin 50% 47% 49% 50%

Adjusted EBITDA $33 $37 $150 $200

Adjusted EPS $0.11 $0.16 $0.63 $1.16

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

6

2017 Initiatives Original Timing Updated Timing

Consolidation of all generic R&D to Hayward, CA Completed mid-2017 Completed on-time

Closure of Middlesex packaging site Completion by end of 1Q18 Completed end of 2017

Strategic alternatives for Taiwan manufacturing site As late as end of 2019 Completed sale Feb. 2018

Rationalizing generic portfolio to eliminate low-value products Completion by 1Q18 Completed 1Q18

Reorganizing certain functions including quality, engineering and supply chain operations As late as end of 2019 Completed 1Q18

Impax Consolidation and Improvement Plan

~$85M Run-Rate Savings Achieved

2017

~$10 million

Q2 2018

Full run-rate savings of ~$85M

Completed more than one year ahead of schedule

7

Strategic Combination for Long-Term Growth

(1) Per Last Twelve Months IMS Gross Revenues as of June 2017.

(2) Includes expected Year 1 run-rate synergies.

(3) In addition to the previously announced Impax standalone cost savings initiatives.

Expanded Portfolio to Drive Growth

Creates 5th largest U.S. generics company(1)

Increases scale and diversification across

currently marketed product families and R&D

pipeline

High-margin specialty franchise is expected to

provide stable cash flow and a long-term growth

platform

Significant Financial Benefits

Annual double-digit revenue, adjusted EBITDA

and adjusted EPS growth over next 3 years

driven by already filed new product launches

Significant projected cash flow generation

enables de-leveraging and future investment in

high-growth specialty and other adjacencies

Accretive to Impax’s adjusted EPS in the first 12

months after close(2)

$200 million in expected annual synergies within

3 years(3)

Announced October 17, 2017

8

Transaction Timeline

Pre-close integration planning well underway

Enhanced leadership team of combined company

Regulatory review process progressing as expected

Impax shareholder meeting March 27, 2018 to approve combination

Developing debt structure to maximize flexibility and maintain low cost

Combined company 2018 financial guidance after close

Currently on target for close 2Q 2018

9

35 new products launched

36 ANDAs approved; 9 tentatively approved

48 ANDAs filed

Launched traimcinolone injection (first generic)

Launched thiotepa 15mg and 100mg injection (only

100mg product available)

Launched gAggrenox capsules and mometasone

nasal spray

Filgrastim (NeupogenTM) biosimilar filing accepted by

the FDA

Amneal Impax

9 new products launched

7 ANDAs approved; 2 tentatively approved

5 ANDAs filed

Positive phase IIb study for IPX203

Favorable district court decision on Zomig® Nasal

Spray patent challenge

Settled Opana® ER litigation with Endo

Announced sale of Taiwan facility for $18.5MM

Accelerated $85MM cost improvement program

Product Data as of December 31, 2017.

2017 Achievements

10

6 generic products approved

5 generic products launched including:

gConcerta® 18 mg, 27 mg, 36 mg and 54 mg

gAccutane® 10 mg, 20 mg, 30 mg and 40 mg

gEntocort® EL 3 mg

gNamenda XR® 7 mg, 14 mg, 21 mg and 28 mg

gTamiflu oral suspension 6 mg/ml

Amneal Impax

Launched authorized generic Solodyn® 65 mg

and 115 mg

Two player generic market for six months

Partner Perrigo received approval for generic

Estrace® cream

Impax expected to launch in second quarter 2018

New Rytary® patent issued – expires late 2028

Product Data as of March 1, 2018.

Solid Start to 2018

11

Bryan Reasons

Chief Financial Officer

12

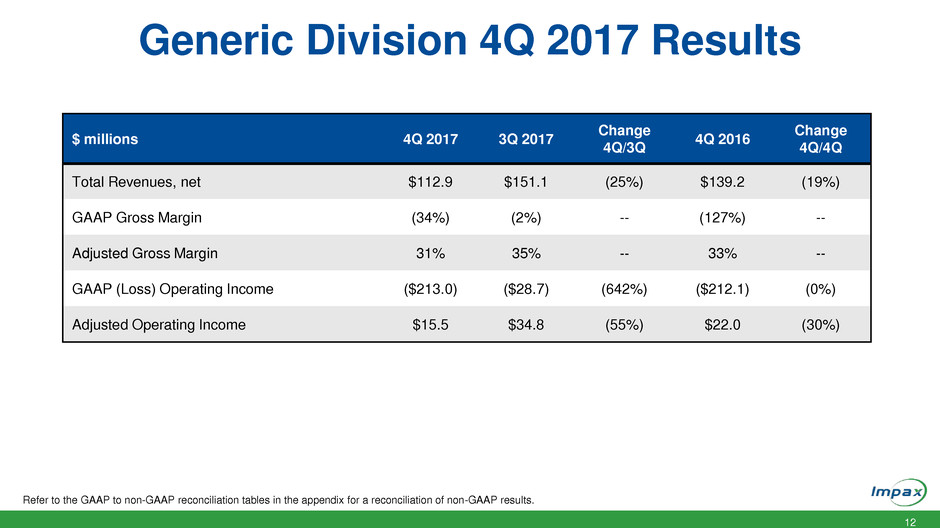

Generic Division 4Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

$ millions 4Q 2017 3Q 2017

Change

4Q/3Q

4Q 2016

Change

4Q/4Q

Total Revenues, net $112.9 $151.1 (25%) $139.2 (19%)

GAAP Gross Margin (34%) (2%) -- (127%) --

Adjusted Gross Margin 31% 35% -- 33% --

GAAP (Loss) Operating Income ($213.0) ($28.7) (642%) ($212.1) (0%)

Adjusted Operating Income $15.5 $34.8 (55%) $22.0 (30%)

13

Specialty Pharma Division 4Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

$ millions 4Q 2017 3Q 2017

Change

4Q/3Q

4Q 2016

Change

4Q/4Q

Total Revenues, net $70.0 $55.3 27% $59.2 18%

GAAP Gross Margin 72% 68% -- 26% --

Adjusted Gross Margin 80% 85% -- 79% --

GAAP Operating Income ($46.7) $16.4 (385%) ($17.4) (168%)

Adjusted Operating Income $36.1 $25.6 41% $26.3 37%

14

Selected 4Q 2017 Non-GAAP Adjustments

$ millions 4Q 2017 Related to:

Intangible Asset Impairment Charges $231

In-process R&D (gConcerta® and QVAR®) and

two marketed products acquired in 2016

Change in Fair Value of Contingent Consideration ($38)

Reduction in milestone liability related to

delayed launch of gConcerta

Fixed Asset Impairment Charges $80

Sale of Taiwan subsidiary/facility and

Middlesex, NJ facility

Restructuring and Severance Charges $13

Middlesex, NJ manufacturing, packaging and

R&D closure and Specialty Pharma division

reorg.

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

15

Consolidated 4Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results.

$ millions, except per share amounts 4Q 2017 3Q 2017

Change

4Q/3Q

4Q 2016

Change

4Q/4Q

EBITDA ($274.8) ($15.4) (1,684%) ($234.0) (17%)

Adjusted EBITDA $33.1 $45.6 (27%) $37.3 (11%)

GAAP Loss Per Share ($4.18) ($0.69) (506%) ($3.91) (7%)

Adjusted Diluted EPS $0.11 $0.23 (52%) $0.16 (31%)

GAAP Tax Rate 3% 6% -- (3%) --

Adjusted Tax Rate 49% 35% -- 23% --

16

Paul Bisaro

President & CEO

17

Position New

Amneal For

Sustainable

Long-Term

Growth

• Generics: Continuing internal R&D investment focused on all seven dosage forms

• Specialty: Continuing focus on Movement Disorders pipeline and opportunistically

in-license external opportunities

INVEST IN

ORGANIC

GROWTH

• Maintain high level of Quality and Compliance

• Continue to provide superior service levels

• Deliver differentiated products to our customers

MAINTAIN

CUSTOMER

FOCUS

• Strengthen Generic and Specialty franchises

and other adjacencies

PURSUE

CREATIVE

BUSINESS

DEVELOPMENT

Path Forward

18

Q&A

19

GAAP to Adjusted Results Reconciliation

The following table reconciles total Company reported cost of revenues to adjusted cost of revenues, adjusted gross profit, adjusted gross margin, adjusted

research and development expenses, and adjusted selling, general and administrative expenses.

Refer to the Fourth Quarter and Full Year 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(Unaudited, In thousands) Three Months Ended Year Ended

Dec 31, 2017 Sept 30, 2017 Dec 31, 2016 2017 2016

Cost of revenues $126,480 $158,736 $129,047 $535,123 $486,899

Cost of revenues impairment charges $43,961 $13,623 $230,625 $96,865 $488,632

Adjusted to deduct:

Amortization $16,909 $17,015 $16,886 $68,375 $56,490

Intangible asset impairment charges $43,961 $13,623 $230,625 $96,865 $488,632

Business development - $55 - $112 -

Restructuring and severance charges $11,778 $13,836 $6,414 $44,136 $18,761

Inventory related charges $6,224 $20,478 - $26,702 -

Adjusted cost of revenues $91,569 $107,352 $105,747 $395,798 $411,648

Adjusted gross profit (a) $91,341 $99,040 $92,675 $379,989 $412,781

Adjusted gross margin (a) 49.9% 48.0% 46.7% 49.0% 50.1%

Research and development expenses $15,689 $15,821 $20,530 $80,847 $80,466

In-process research and development impairment charges $186,731 - $23,248 $192,809 $52,965

Adjusted to deduct:

Intangible asset impairment charges $186,731 - $23,248 $192,809 $52,965

Restructuring and severance charges $98 $356 - $3,378 -

Other - $60 $600 $2,534 $1,522

Adjusted research and development expenses $15,591 $15,405 $19,930 $74,935 $78,944

Selling, general and administrative expenses $64,016 $53,585 $57,586 $216,270 $201,830

Adjusted to deduct:

Business development expenses $8,061 $2,833 $251 $10,985 $4,540

Turing legal expenses $642 $214 $2,111 $451 $7,554

Restructuring and severance charges $3,676 $511 $5,291 $4,458 $5,455

Adjusted selling, general and administrative expenses $51,637 $50,027 $49,933 $200,376 $184,281

20

GAAP to Adjusted Net Income Reconciliation

The following table reconciles reported net loss to adjusted net income.

Refer to the Fourth Quarter and Full Year 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

Three Months Ended Year Ended

(Unaudited, In thousands, except per share and per share data) Dec 31, 2017 Sept 30, 2017 Dec 31, 2016 2017 2016

Net loss ($301,070) ($49,369) ($279,585) ($469,287) ($472,031)

Adjusted to add (deduct):

Amortization $16,909 $17,015 $16,886 $68,375 $56,490

Non-cash interest expense $6,660 $6,547 $6,241 $25,950 $22,846

Business development expenses $8,061 $2,888 $251 $11,097 $4,540

Intangible assets impairment charges $230,692 $13,623 $253,873 $289,674 $541,597

Fixed asset impairment charges $79,705 828 - $82,508 -

Reserve for Turing receivable $1,328 - ($7,731) $3,999 $40,312

Turing legal expenses $642 $214 $2,111 $451 $7,554

Restructuring and severance charges $13,483 $14,443 $11,705 $49,563 $24,040

Gain on sale of assets ($656) (4,379) - ($17,236) -

Loss on extinguishment of debt - - - $1,215 -

Inventory related charges $6,224 $20,478 - $26,702 -

Change in fair value of contingent consideration ($38,123) $6,333 - ($31,048) -

Legal settlements - - - $7,900 -

Other - $60 $2,762 $2,534 $3,684

Income tax effect ($16,213) ($11,998) $5,136 ($7,205) ($145,368)

Adjusted net income $7,642 $16,683 $11,649 $45,192 $83,664

Adjusted net income per diluted share $0.11 $0.23 $0.16 $0.63 $1.16

Net loss per diluted share ($4.18) ($0.69) ($3.91) ($6.53) ($6.63)

Diluted weighted-average common shares outstanding $72,635 $72,172 $71,489 $71,857 $71,830

21

GAAP to Adjusted EBITDA Reconciliation

Refer to the Fourth Quarter and Full Year 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

The following table reconciles reported net loss to adjusted EBITDA.

Three Months Ended Year Ended

(Unaudited, In thousands) Dec 31, 2017 Sept 30, 2017 Dec 31, 2016 2017 2016

Net loss ($301,070) ($49,369) ($279,585) ($469,287) ($472,031)

Adjusted to add (deduct):

Interest expense, net $13,672 $13,636 $13,440 $53,412 $40,419

Interest Income - ($336) - - -

Income taxes ($9,010) ($3,045) $8,572 $18,326 ($104,294)

Depreciation and amortization $21,570 $23,708 $23,573 $93,731 $82,879

EBITDA ($274,838) ($15,406) ($234,000) ($303,818) ($453,027)

Adjusted to add (deduct):

Share-based compensation expense $6,586 $6,490 $8,334 $26,258 $31,709

Business development expenses $8,061 $2,888 $251 $11,097 $4,540

Intangible asset impairment charges $230,692 $13,623 $253,873 $289,674 $541,597

Fixed assets impairment charges $79,705 828 - $82,508 -

Reserve for Turing receivable $1,328 - ($7,731) $3,999 $40,312

Turing legal expenses $642 $214 $2,111 $451 $7,554

Restructuring and severance charges $13,483 $14,443 $11,705 $49,563 $24,040

Gain on sale of assets ($656) ($4,379) - ($17,236) -

Loss on extinguishment of debt - - - $1,215 -

Inventory related charges $6,224 $20,478 - $26,702 -

Change in fair value of contingent consideration ($38,123) $6,333 - ($31,048) -

Legal settlements - - - $7,900 -

Other - $60 $2,762 $2,534 $3,684

Adjusted EBITDA $33,104 $45,572 $37,305 $149,799 $200,409

22

Generic Division GAAP to Adjusted Results

Reconciliation

The following tables reconcile the Impax Generics Division reported cost of revenues and loss from operations to adjusted cost of revenues, adjusted gross profit,

adjusted gross margin and adjusted operating income.

Refer to the Fourth Quarter and Full Year 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by total revenues.

Three Months Ended

(Unaudited, In thousands) Dec 31, 2017 Sept 30, 2017 Dec 31, 2016

Cost of revenues $106,801 $141,133 $109,380

Cost of revenues impairment charges $43,961 $13,623 $206,312

Adjusted to deduct:

Amortization $13,075 $13,181 $9,470

Intangible asset impairment charges $43,961 $13,623 $206,312

Restructuring and severance charges $9,960 $8,579 $6,414

Inventory related charges $6,224 $20,478 -

Adjusted cost of revenues $77,542 $98,895 $93,496

Adjusted gross profit (a) $35,401 $52,203 $45,730

Adjusted gross margin (a) 31.3% 34.5% 32.8%

GAAP Loss from operations ($212,951) ($28,658) ($212,088)

Adjusted to add (deduct):

Amortization $13,075 $13,181 $9,470

Intangible asset impairment charges $230,692 $13,623 $217,587

Restructuring and severance $10,058 $8,935 $6,414

Inventory related charges $6,224 $20,478 -

Fixed asset impairment charges $6,486 828 -

Change in fair value of contingent consideration ($38,123) 6,333 -

Other - 60 $600

Adjusted Income from operations $15,461 $34,780 $21,983

23

Specialty Pharma Division GAAP to Adjusted

Results Reconciliation

The following tables reconcile the Impax Specialty Pharma Division reported cost of revenues and (loss) income from operations to adjusted cost of revenues,

adjusted gross profit, adjusted gross margin and adjusted income from operations.

Refer to the Fourth Quarter and Full Year 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by total revenues.

Three Months Ended

(Unaudited, In thousands) Dec 31, 2017 Sept 30, 2017 Dec 31, 2016

Cost of revenues $19,679 $17,603 $19,667

Cost of revenues impairment charges - - $24,313

Adjusted to deduct:

Amortization $3,834 $3,834 $7,416

Restructuring and severance charges $1,818 $5,257 -

Intangible asset impairment charges - - $24,313

Adjusted cost of revenues $14,027 $8,512 $12,251

Adjusted gross profit (a) $55,940 $46,782 $46,945

Adjusted gross margin (a) 80.0% 84.6% 79.3%

GAAP (Loss) income from operations ($46,698) $16,364 ($17,437)

Adjusted to add:

Amortization $3,834 $3,834 $7,416

Intangible asset impairment charges - - $36,286

Restructuring and severance $4,825 $5,367 -

Fixed asset impairment charges $74,128 - -

Adjusted Income from operations $36,089 $25,565 $26,265