Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION PURSUANT TO RULE 13A-14(B), AS REQUIRED BY 18 U.S.C. SECTION 1350 - SNYDER'S-LANCE, INC. | lnce-12302017xex32.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - SNYDER'S-LANCE, INC. | lnce-12302017xex312.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - SNYDER'S-LANCE, INC. | lnce-12302017xex311.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - SNYDER'S-LANCE, INC. | lnce-12302017xex231.htm |

| EX-21 - LIST OF THE SUBSIDIARIES OF THE REGISTRANT - SNYDER'S-LANCE, INC. | lnce-12302017xex21.htm |

| EX-12 - COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES - SNYDER'S-LANCE, INC. | lnce-12302017xex12.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2017

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-398

SNYDER’S-LANCE, INC.

(Exact name of Registrant as specified in its charter)

North Carolina | 56-0292920 | |

(State of incorporation) | (I.R.S. Employer Identification Number) | |

13515 Ballantyne Corporate Place, Charlotte, North Carolina 28277 | ||

(Address of principal executive offices) (zip code) | ||

Post Office Box 32368, Charlotte, North Carolina 28232-2368 | ||

(Mailing address of principal executive offices) (zip code) | ||

Registrant’s telephone number, including area code: (704) 554-1421

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

$0.83-1/3 Par Value Common Stock | The NASDAQ Stock Market LLC | |

Securities Registered Pursuant to Section 12(g) of the Act: NONE

Indicate by checkmark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by checkmark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One):

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | |||

(do not check if a smaller reporting company) | ||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of shares of the Registrant’s $0.83-1/3 par value Common Stock, its only outstanding class of voting or nonvoting common equity, held by non-affiliates as of June 30, 2017, the last business day of the Registrant’s most recently completed second fiscal quarter, was $2,603,789,780.

The number of shares outstanding of the Registrant’s $0.83-1/3 par value Common Stock, its only outstanding class of Common Stock, as of February 23, 2018, was 98,320,444 shares.

Documents Incorporated by Reference

The information that is required to be included in Part III of this Annual Report on Form 10-K is incorporated by reference to either a definitive proxy statement or an amendment to this Annual Report on Form 10-K, which will be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant's fiscal year ended December 30, 2017.

FORM 10-K

TABLE OF CONTENTS

Page | ||

Item 1 | ||

Item 1A | ||

Item 1B | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

Item 5 | ||

Item 6 | ||

Item 7 | ||

Item 7A | ||

Item 8 | ||

Item 9 | ||

Item 9A | ||

Item 9B | ||

Item 10 | ||

Item 11 | ||

Item 12 | ||

Item 13 | ||

Item 14 | ||

Item 15 | ||

Item 16 | ||

Exhibit 12 | Ratio of Earnings to Fixed Charges | |

Exhibit 21 | Subsidiaries of Snyder’s-Lance, Inc. | |

Exhibit 23.1 | Consent of PricewaterhouseCoopers LLP | |

Exhibit 31.1 | Section 302 Certification of the CEO | |

Exhibit 31.2 | Section 302 Certification of the CFO | |

Exhibit 32 | Section 906 Certification of the CEO and CFO | |

Note: Portions of the Company's Amendment to Form 10-K, which will be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant's fiscal year ended December 30, 2017, are incorporated into Part III, Items 10, 11, 12, 13, and 14. Executive Officers of the Company is included in Part I of this Form 10-K.

PART I

Cautionary Information About Forward-Looking Statements

This document includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about our estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying such statements. We use the words “anticipates,” “believes,” "continues," "could," "designed," “estimates,” “expects,” “forecasts,” "goal," "initiate," "intends," “may,” “objective,” "plan," "potential," "pursue," "should," "target," "will," "would," or the negative of any of these words or similar expressions to identify our forward-looking statements that represent our judgment about possible future events. In making these statements we rely on assumptions and analyses based on our experience and perception of historical trends, current conditions and expected future developments as well as other factors we consider appropriate under the circumstances. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors, both positive and negative. Factors that could cause these differences include, but are not limited to, the factors set forth under Part I, Item 1A - Risk Factors.

Caution should be taken not to place undue reliance on our forward-looking statements, which reflect the expectations of management only as of the time such statements are made. Except as required by law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Item 1. Business

General

Snyder's-Lance, Inc., a North Carolina corporation incorporated in 1926, is engaged in the manufacturing, distribution, marketing and sale of snack food products in North America and Europe. These products include pretzels, sandwich crackers, kettle cooked chips, pretzel crackers, popcorn, nuts, potato chips, tortilla chips, cookies, restaurant style crackers, and other salty snacks. Our brands include Snyder’s of Hanover®, the market share leader in the pretzel category in the United States ("US"), and Lance®, which is the number one ranked sandwich cracker in the US, as well as Cape Cod® kettle cooked chips and Kettle Brand® potato chips, which combined make us the market leader in the kettle chips category in the US. In addition, Snack Factory® Pretzel Crisps® is the market share leader in deli snacks and Pop Secret® popcorn currently ranks second in the microwave popcorn category. Late July® is the number one organic and non-genetically modified organism ("non-GMO") tortilla chip in the US. These products demonstrate our successful history of providing irresistible, high-quality snacks dating back over 100 years.

Snyder’s-Lance, Inc. is headquartered in Charlotte, North Carolina. References to “Snyder’s-Lance,” the “Company,” “we,” “us” or “our” refer to Snyder’s-Lance, Inc. and its subsidiaries, as the context requires.

Agreement and Plan of Merger

On December 18, 2017, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Campbell Soup Company, a New Jersey corporation (“Campbell”), and Twist Merger Sub, Inc., a North Carolina corporation and a wholly-owned subsidiary of Campbell (“Merger Sub”), pursuant to which Merger Sub will merge with and into the Company, with the Company continuing as the surviving corporation and as a wholly-owned subsidiary of Campbell (the “Merger”). The parties anticipate that the Merger will close late in the first quarter of calendar year 2018.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of our common stock, $0.83-1/3 par value, outstanding immediately prior to the Effective Time will be converted into the right to receive an amount in cash equal to $50.00 per share, without interest and subject to any required tax withholding.

The Merger Agreement contains various representations, warranties and covenants by the Company and Campbell. The Merger Agreement requires the Company to call and hold a special shareholder meeting, which is scheduled for March 23, 2018, and requires our Board of Directors to recommend that the Company’s shareholders approve the Merger Agreement and the Merger, except our Board of Directors may, in certain circumstances, change its recommendation, subject to complying with specified notice and other conditions set forth in the Merger Agreement. Additionally, the Company agreed that, among other things, it will not (i) solicit, initiate, facilitate or encourage the submission of any Acquisition Proposal (as defined in the Merger Agreement) or any proposal or offer that may reasonably be expected to lead to an Acquisition Proposal or (ii) enter into, continue or otherwise participate in discussions or negotiations with, or disclose non-public information to, any third party relating to any Acquisition Proposal or any proposal or offer that may reasonably be expected to lead to an Acquisition Proposal. Subject to the terms of the Merger Agreement, prior to the approval of the Merger Agreement by the Company’s shareholders, the Company may, however, engage in negotiations or discussions with and provide non-public information to a third party that has made an unsolicited, bona fide, written Acquisition Proposal that our Board of Directors determines in good faith, after consultation with its outside legal

1

counsel and financial advisor, constitutes, or could reasonably be expected to result in, a Superior Proposal (as defined in the Merger Agreement) and that failure to take such actions would be reasonably likely to be inconsistent with its fiduciary duties under applicable law.

Prior to the approval of the Merger Agreement by the Company’s shareholders, our Board of Directors may, upon receipt of a Superior Proposal, and in certain other circumstances set forth in the Merger Agreement, change its recommendation that the Company’s shareholders approve the Merger Agreement and the Merger, subject to complying with specified notice and other conditions set forth in the Merger Agreement, including, if requested by Campbell, negotiating in good faith with Campbell to make such revisions to the Merger Agreement in response to such Superior Proposal. If our Board of Directors changes its recommendation that the Company’s shareholders approve the Merger Agreement and the Merger, Campbell may terminate the Merger Agreement. In addition, prior to obtaining such shareholder approval, the Company may terminate the Merger Agreement to enter into a definitive agreement providing for a Superior Proposal, subject to payment of the termination fee described below and only following compliance with specified notice and other conditions set forth in the Merger Agreement, including giving Campbell the opportunity to propose changes to the Merger Agreement so that any such proposal would cease to constitute a Superior Proposal.

The Merger Agreement requires the Company and Campbell to use reasonable best efforts to take all actions necessary under applicable law to consummate the transactions contemplated by the Merger Agreement. The Merger Agreement contains certain termination rights for each of the Company and Campbell, including the right of each party to terminate the Merger Agreement if the Merger has not been consummated by the “end date” of September 18, 2018.

The Merger Agreement provides for the payment by the Company to Campbell of a termination fee in the amount of $149 million in the case of a termination of the Merger Agreement under certain circumstances described in the Merger Agreement, including if: (i) (a) the Merger Agreement is terminated by Campbell or the Company because the Merger is not consummated by the end date or the Company’s shareholders do not approve the Merger Agreement, or by Campbell because of a breach of a representation, warranty or covenant of the Company that would cause the related closing condition to be incapable of being satisfied or cured by the end date or, if curable, is not cured by the Company by the earlier of 30 days after receipt of written notice of such breach and three business days prior to the end date, (b) any person publicly discloses a bona fide Acquisition Proposal, which Acquisition Proposal had not been publicly withdrawn prior to the special meeting of the Company’s shareholders, and (c) within 12 months after such termination the Company enters into a definitive agreement with respect to any Acquisition Proposal, (ii) our Board of Directors changes its recommendation or (iii) the Company enters into definitive transaction documentation providing for a Superior Proposal.

Campbell will be required to pay the Company a termination fee of $198.6 million in the event the Merger Agreement is terminated by the Company, subject to certain limitations set forth in the Merger Agreement, if (i) there has been a breach of a representation, warranty or covenant of Campbell or Merger Sub that would cause the related closing condition to be incapable of being satisfied or cured by the end date or, if curable, is not cured by Campbell or Merger Sub by the earlier of 30 days after receipt of written notice of such breach and three business days prior to the end date, or (ii) the conditions to Campbell and Merger Sub’s obligations to consummate the closing have been satisfied or waived (other than those conditions that by their terms are to be satisfied by actions taken at the closing; provided that such conditions are then capable of being satisfied), Campbell has failed to consummate the Merger within two business days of the date the closing should have occurred and the Company has notified Campbell in writing that all of the conditions to closing have been satisfied (or waived) and it intends to terminate the Merger Agreement if Campbell and Merger Sub fail to consummate the transactions contemplated thereby within two business days.

The Merger Agreement has been approved by the boards of directors of each of the Company and Campbell. The obligations of the parties to consummate the Merger are subject to customary closing conditions, including, among others: approval of the Merger Agreement and Merger by holders of 75% of the outstanding shares of the our common stock; the accuracy of the representations and warranties of each party (subject to certain exceptions as set forth in the Merger Agreement); each of the parties having performed in all material respects all of their respective obligations under the Merger Agreement; and the absence of any injunctions or other legal restraints.

On December 18, 2017, certain trusts affiliated with Patricia A. Warehime, a member of our Board, and members of her immediate family, each such trust being a shareholder of the Company (collectively, the “Warehime Holders”), entered into a voting agreement with Campbell, pursuant to which the Warehime Holders agreed, among other things, to vote the shares of Company common stock over which they have voting power in favor of the approval of the Merger Agreement and the transactions contemplated thereby, including the Merger. As of February 16, 2018, the record date for the special meeting of our shareholders, the Warehime Holders owned 12,851,757 shares, or approximately 13.1% of the shares of our common stock outstanding and entitled to vote at the special meeting.

2

Certain terms of the Merger Agreement and Voting Agreement are summarized, and the Merger Agreement and Voting Agreement have been filed as exhibits to the Current Report on Form 8-K filed by the Company on January 18, 2018.

Recent Acquisitions and Divestiture

In recent years, we have acquired several companies and brands as we seek future growth both organically as well as through acquisitions.

In October of 2012, we completed the acquisition of Snack Factory, LLC and certain of its affiliates ("Snack Factory"), which added a Core brand to our portfolio, Snack Factory® Pretzel Crisps®. The Snack Factory® brand is known for its innovative flavor profiles, commitment to providing the highest-quality ingredients and a broadening base of passionate consumers. In June of 2014, we completed the acquisition of Baptista’s Bakery, Inc. ("Baptista's"), which is the sole manufacturer of our Snack Factory® Pretzel Crisps® products. In addition, Baptista's is an industry leader in the development, innovation and manufacturing of highly-differentiated snack foods, including organic, non-GMO, all natural and gluten-free products. In October of 2014, we made an additional investment in Late July Snacks, LLC ("Late July") which increased our total ownership interest to 80%. Late July is a leader in organic and non-GMO salty snacks and the investment supports our goal of having a stronger presence in "better-for-you" snacks.

On February 29, 2016, we completed the acquisition of all of the outstanding stock of Diamond Foods, Inc. ("Diamond Foods"). The strategic combination of Snyder's-Lance and Diamond Foods brought together two established companies with strong brands, and created an innovative, highly complementary and diversified portfolio of branded snacks. Diamond Foods was a leading snack food company with five brands, including: Kettle Brand® potato chips; KETTLE® Chips; Pop Secret® popcorn; Emerald® snack nuts; and Diamond of California® culinary nuts. The transaction expanded our footprint in "better-for-you" snacking, and increased our existing natural food channel presence. In addition, this transaction expanded and strengthened our distribution network in the US, and provided us with a platform for growth in the United Kingdom ("U.K.") and certain other countries within Europe.

On September 1, 2016, we completed the acquisition of Metcalfe's Skinny Limited ("Metcalfe") by acquiring the remaining 74% interest. Metcalfe owns the U.K.'s leading premium ready-to-eat ("RTE") popcorn brand, and also incorporates a fast growing range of corn and rice cake products. The U.K. popcorn market is one of the fastest growing categories within the U.K. snack food industry, as consumers increasingly seek out "better-for-you" snacking options.

On December 31, 2016, we completed the carve-out and sale of our culinary nuts business (comprised primarily of the Diamond of California® brand, and the Stockton, CA facility; collectively "Diamond of California"). We had previously entered the culinary nuts business as a result of the Diamond Foods acquisition. This divestiture aligns with our strategy to focus more resources on growth opportunities for our snack food brands.

Products

We are engaged in the manufacturing, distribution, marketing and sale of snack food products. These products include pretzels, sandwich crackers, kettle cooked chips, pretzel crackers, popcorn, nuts, potato chips, tortilla chips, cookies, restaurant style crackers, and other salty snacks. Our products are packaged in various single-serve, multi-pack, family-size and party-size configurations. Our branded products are principally sold under trademarks owned by us. While the majority of our branded products are manufactured by us, certain branded products are contract manufactured, due to required expertise, ingredients or equipment, or increased demand.

We also sell Partner brand products, which consist of third-party branded products that we sell to independent business owners ("IBO") through the national direct-store-delivery distribution network ("DSD network"), in order to broaden the portfolio of product offerings for the IBOs. In addition, we contract with other branded food manufacturers to produce their products and periodically sell certain semi-finished goods to other manufacturers.

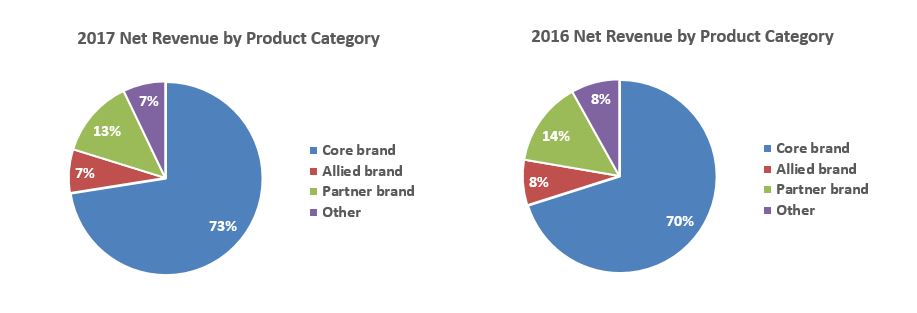

Overall sales of our products are relatively consistent throughout the year, although demand for certain products may be influenced by holidays, changes in seasons, or other annual events. In 2017, Core branded products represented approximately 73% of net revenue from continuing operations, while net revenue from Allied brand, Partner brand and Other products represented approximately 7%, 13% and 7%, respectively. In 2016, Core branded products represented approximately 70% of net revenue, while net revenue from Allied brand, Partner brand and Other products represented approximately 8%, 14% and 8%, respectively. In 2015, Branded products represented 62% of net revenue, while net revenue from Allied brand, Partner brand and Other products represented 10%, 18% and 10%, respectively. The decrease each year in both Partner brand and Other products is a result of the acquisition of the Diamond Foods core brands and the shift in our strategic direction.

3

Intellectual Property

Trademarks that are important to our business are protected by registration or other means in the US and most other international markets where the related products are sold. We own various registered trademarks for use with our Branded products, including: Snyder’s of Hanover®; Lance®; Kettle Brand®; Cape Cod®; Snack Factory® Pretzel Crisps®; Pop Secret®; KETTLE® Chips; Emerald®; and Late July® (collectively, "Core" brands), and Tom’s®; Jays®; Archway®; Stella D’oro®; O-Ke-Doke®; Metcalfe’s skinny®; Krunchers!®; and Eatsmart SnacksTM (collectively, "Allied" brands) as well as a variety of other marks and designs. On a limited basis, we license trademarks for use on certain products that are classified as Branded products. Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 10-K may appear without the ® or ™ symbols, but references are not intended to indicate, in any way, that we will not assert our rights to these trademarks and trade names to the fullest extent under applicable law.

Overall Strategy

Our goal is to deliver simple moments of happiness to everyone, everywhere, by providing uncompromisingly delicious snacks made with simple ingredients. We believe that snacks made with simple ingredients, are simply better food. As we grow, we will remain focused on delivering margin expansion through our Performance Transformation Plan, announced by us in April 2017 (the “Transformation Plan”). We expect our growth will be a result of organic investments in our research and development capabilities, and inorganic growth through strategic acquisitions.

Our strategy is built around five supporting initiatives:

• | Optimize the portfolio for growth in wholesome natural snacks. To do so we are focusing on strengthening our core brand innovation pipeline and bringing our existing brands to greater scale to more effectively compete. This involves exiting platforms with little advantage or disadvantaged scale while simultaneously evaluating new, scalable snack markets through both organic growth and inorganic mergers and acquisitions. |

• | Build superior brand preference. We build brand preference by continuously elevating our focus on product taste and quality, increasing investments in world class marketing vehicles, and renovating product ingredients around those qualifications most preferred by our consumers. In parallel we aim to continuously increase the sustainability, convenience, and functional advantage of our product packaging. These efforts will complement our focus on building improved price realization across our portfolio consistent with our value proposition. |

• | Provide the right products, in the right places, at the right times. The DSD network combined with our direct distribution capability allow us to offer our products in a broad array of large and fast growing retail channels where consumers prefer to shop. We are focused on growing in emerging channels and always delivering our products on-time and in-full. |

• | Pursue operational efficiencies. We are improving complexity by reducing manufacturing and distribution complexity and optimizing our product offering through stock keeping unit ("SKU") rationalization. In addition, we leverage zero-based-budgeting to eliminate non-critical expenses and implement proven technologies to improve operational performance. |

4

• | Foster a diverse culture centered on our values. We believe that a culture rich in diversity of thought, experiences and identity yields a strong and resilient organization. We also seek to build a safe and supporting environment, invest in our employees to build their capabilities and experiences, and recognize and reward everyone for their contributions. We believe that this philosophy ultimately benefits our shareholders in the form of a higher performing company. |

Research and Development

We consider research and development of new products to be a significant part of our overall strategy, and are committed to developing innovative, high-quality products that exceed consumer expectations. A team of professional product developers, including microbiologists, food scientists and culinary experts, work in collaboration with innovation, marketing, manufacturing and sales leaders, to develop products that meet changing consumer demands. Our research and development staff incorporates product ideas from all areas of our business in order to formulate new products. In addition to developing new products, the research and development staff routinely reformulates and improves existing products based on advances in ingredients and technology, and conducts value engineering to maintain competitive price points. We own a 60,000 square foot Research and Development Center in Hanover, Pennsylvania, where we conduct much of our research and development. In addition, we have a research and development facility adjacent to our production facility in Salem, Oregon. Our research and development costs were approximately $6.2 million, $10.0 million and $6.2 million in 2017, 2016 and 2015, respectively.

Marketing

Our marketing efforts are focused on building long-term brand equity through effective consumer marketing. In addition to volume building trade promotions to market our products, our advertising efforts utilize television, radio, print, digital, mobile and social media aimed at increasing consumer preference and usage of our brands. We also use consumer promotions, sponsorships and partnerships which include free trial offers, targeted coupons and on-package offers to generate trial usage and increase purchase frequency. These marketing efforts are an integral part of our overall strategy to grow our brands and reach more consumers in order to build superior brand preference.

We work with third-party information agencies, such as Information Resources, Inc. ("IRI"), Nielsen and other syndicated market data providers, to monitor the effectiveness of our marketing and measure product growth. All information regarding our brand market positions in the US included in this Annual Report on Form 10-K is from IRI and is based on retail dollar sales.

Distribution

We distribute snack food products throughout the US using the DSD network. The DSD network is made up of over 3,200 routes that are primarily owned and operated by IBOs. We also ship products directly to third-party distributors in areas where the DSD network does not operate. Through our direct distribution network, we distribute products directly to retail customers or to third-party distributors using freight carriers or our own transportation fleet. In Europe, we sell our salty snack products through our sales personnel directly to national grocery, co-op and impulse store chains. In 2017, approximately 55% of net revenue was generated by products distributed through the DSD network while the remaining 45% was generated by products distributed through our direct distribution network.

In order to maintain and expand the DSD network, we routinely participate in certain route purchase and sale activities. These activities include the following:

• | Acquisition of regional distributor businesses - As we expand the DSD network, we continue to look for potential regional distributor business acquisition targets in areas where we do not currently have a DSD network. Upon acquisition, the acquired routes may be reengineered to include our products and retail locations and are then sold to a new or current IBO, as described below. |

• | Reengineering of zones - Periodically, we undertake a route reengineering project for a particular geography or zone. The reasons for route reengineering projects vary, but are typically due to increased sales volume associated with new retail locations and/or the addition of new Branded or Partner brand products to the routes in that zone. In these cases, we repurchase all of the IBO routes in that zone. The repurchased routes are then reengineered, which normally results in the addition of new IBO routes (territories) because of the additional volume. Routes are then resold, usually to the original IBO, however, the original IBO has no obligation to repurchase. Upon completion, these route reengineering projects may result in modest net gains on the sale of route businesses due to the value added during the reengineering through additional volume and/or retail locations. |

• | Sale of company-owned routes - Some routes remain company-owned primarily because they need additional sales volume in order to become sustainable routes for IBOs. As we build up the volume on these routes through increased distribution of our Branded and Partner brand products, we would sell these routes to IBOs which could result in gains. |

5

• | IBO defaults - There are times when the IBOs are not successful and the IBO's distributor agreement with us is terminated. In these instances, if the existing IBO is unable to sell the route to another third party, we may repurchase the route at a price defined in the distributor agreement. We generally put the repurchased route up for sale to another third-party IBO. The subsequent sales transaction generally results in a nominal gain or loss. |

Capital Expenditures

We have invested significant capital in our facilities to ensure sufficient capacity, efficient production, effective use of technology, excellent quality, and a positive working environment for our associates. In 2017, 2016 and 2015, we had capital expenditures of $69.4 million, $73.3 million and $51.5 million, respectively. For 2018, we expect capital expenditures to be in line with 2017 expenditures. Capital spending will be used to upgrade equipment, increase capacity at our manufacturing facilities and is believed to be adequate to maintain and support our revenue growth over the next few years.

Customers

Through the DSD network, we sell our Branded and Partner brand products to IBOs that, in turn, sell to grocery/mass merchandisers, club stores, discount stores, convenience stores, food service establishments and various other retail customers, including drug stores, schools, military and government facilities and “up and down the street” outlets such as recreational facilities, offices and other independent retailers. In addition, we sell our Branded products directly to retail customers and third-party distributors, both in the US and abroad. We also contract with other branded food manufacturers to produce their products or provide semi-finished goods.

Substantially all of our revenue is from sales to customers in the US. Sales to our largest retail customer, Wal-Mart Stores, Inc. ("Wal-Mart"), either through IBOs or our direct distribution network, were approximately 13% of net revenue in 2017, 2016 and 2015. Our sales to Wal-Mart do not include sales of our products made to Wal-Mart by third-party distributors outside of the DSD network. Sales to these third-party distributors represent approximately 6% of our net revenue and may increase sales of our products to Wal-Mart by an amount we are unable to estimate. Our top ten retail customers accounted for approximately 55% of our net revenue during 2017, excluding sales of our products made by third-party distributors.

Raw Materials

The principal raw materials used to manufacture our products are flour, potatoes, oil, peanuts, other nuts, corn, sugar, chocolate, cheese and seasonings. The principal packaging supplies used are flexible film, cartons, trays, boxes and bags. These raw materials and supplies are normally available in adequate quantities in the commercial market and are generally contracted from three to twelve months in advance, depending on market conditions.

Competition and Industry

Our products are sold in highly competitive markets. Generally, we compete with companies engaged in the manufacturing, distribution, marketing and sale of snack food products, some of which have greater revenue and resources than we do. The principal methods of competition are price, service, product quality, product offerings and distribution. The methods of competition and our competitive position vary according to the geographic location, the particular product categories and the activities of our competitors.

Environmental Matters

Our operations are subject to various federal, state and local laws and regulations with respect to environmental matters. We are not a party to any material proceedings arising under these laws or regulations for the periods covered by this Annual Report on Form 10-K. We believe we are in compliance with all material environmental regulations affecting our facilities and operations and that continued compliance will not have a material impact on our capital expenditures, earnings or competitive position.

Regulation

The manufacture and sale of snack food products is highly regulated. In the US our activities are subject to regulation by various federal government agencies, including the Food and Drug Administration, US Department of Agriculture, Federal Trade Commission, Department of Labor and Department of Commerce, as well as various state and local agencies. Our business is also regulated by similar agencies outside of the US.

Sustainability

We are committed to reducing the impact that our products and operations have on the environment. We work to minimize our environmental impact by implementing more sustainable business operations and doing more with less, as we remain committed to being a responsible corporate citizen. At our bakery in Hanover, Pennsylvania, we own a solar farm that produces 3.5 megawatts of electricity that supplies 100% of the power needed at our R&D Center onsite as well as approximately 30% of the power used by the bakery for production during the day. Our Kettle Chip plant in Salem, Oregon captures solar energy by taking advantage of solar panels on the roof and is one of the largest solar installations in the northwest. The Kettle Chip plant in Beloit, Wisconsin, which was the first LEED Gold Certified food manufacturing plant in the United States, uses wind turbines to offset utility usage

6

from the local power plant. In addition, our Supply Chain team has implemented improved recycling initiatives across the organization in order to strive to bring our manufacturing plants to landfill free operations and manufacturing. At our chip producing plants, we recycle the oil used in kettle chip production to vendors that convert it to other products like biodiesel for use in many other applications. We carry the focus on sustainability beyond production. Our headquarters facility implements a single stream waste vendor so that no matter which receptacle you use, everything that can be is sorted and recycled. We also implemented motion activated light sensors in our offices and manufacturing plants to make sure we only use light when a facility is occupied.

Employees

As of December 30, 2017, we had approximately 5,900 active employees located in the US and U.K. compared to approximately 6,100 active employees as of December 31, 2016. None of our employees are covered by a collective bargaining agreement.

Available Information

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, amendments to these reports, and exhibits are available on our Investor Relations website free of charge at www.snyderslance.com. All required reports are made available on the website as soon as reasonably practicable after they are filed with or furnished to the Securities and Exchange Commission.

Item 1A. Risk Factors

In addition to the other information in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition or results of operations may be adversely affected by any of these risks. Additional risks and uncertainties, including risks that we do not presently know of or currently deem insignificant, may also impair our business, financial condition or results of operations.

Risks related to our Merger with Campbell

The failure to complete or delays in completing the merger with Campbell could adversely affect our business and our stock price.

Consummation of the merger with Campbell is subject to customary closing conditions, including approval by our shareholders. There can be no assurance that these conditions will be satisfactorily met or validly waived, or that our Company and Campbell will be able to successfully consummate the Merger, on the anticipated terms or at all. We will have incurred significant costs, including the diversion of management resources and transaction-related expenses for which we will receive little or no benefit, if the Merger is not consummated. Additionally, we may be required, in certain circumstances, to pay a termination fee of $149 million, as provided in the Merger Agreement. The Merger Agreement may be terminated by either party if the merger is not completed on or September 18, 2018. In addition, the Merger Agreement contains certain other termination rights for both us and Campbell. A failed transaction may result in negative publicity. Any of these events, individually or in combination, could have an adverse effect on our results of operations and financial condition.

The pending merger could adversely affect our business, financial results and operations, including our relationships with customers, vendors and employees.

The proposed merger with Campbell could cause material disruptions in and create uncertainty surrounding our business. This could affect our relationships with customers, vendors and employees, which could have an adverse effect on our business, financial results and operations. In particular, we could lose important personnel if some employees decide to leave in light of the proposed Merger. We could potentially lose customers or suppliers, or our customers or suppliers could modify their relationships with us in an adverse manner. In addition, we have devoted, and will continue to devote, significant management resources to complete the Merger. This may cause our business and operating results to suffer.

The Merger Agreement also places restrictions on how we conduct our business before the merger is completed. These restrictions could result in our inability to respond effectively, and in a timely manner, to competitive pressures, industry developments and future opportunities. This could harm our business, financial results and operations.

Risks related to our business

Our performance may be impacted by general economic conditions or an economic downturn.

An overall decline in economic activity could adversely impact our business and financial results. Economic uncertainty may reduce consumer spending as consumers make decisions on what to include in their food budgets. This could also result in a shift in consumer preference toward private label products. Shifts in consumer spending could result in increased pressure from competitors or customers that may require us to increase promotional spending or reduce the prices of some of our products and/or limit our ability to increase or maintain prices, which could lower our revenue and profitability.

7

Instability in financial markets may impact our ability, or increase the cost, to enter into new credit agreements in the future. Additionally, it may weaken the ability of our customers, suppliers, IBOs, third-party distributors, banks, insurance companies and other business partners to perform their obligations in the normal course of business, which could expose us to losses or disrupt the supply of inputs we rely upon to conduct our business. If one or more of our key business partners fail to perform as expected or contracted for any reason, our business could be negatively impacted.

Volatility in the price or availability of the inputs we depend on, including raw materials, packaging, energy and labor, could adversely impact our financial results.

Our financial results could be adversely impacted by changes in the cost or availability of raw materials and packaging. While we often obtain substantial commitments for future delivery of certain raw materials, continued long-term increases in the costs of raw materials and packaging, including but not limited to cost increases due to the tightening of supply, could adversely affect our financial results.

Our transportation and logistics system is dependent upon gasoline and diesel fuel, and our manufacturing operations depend on natural gas. While we may enter into forward purchase contracts to reduce the volatility associated with some of these costs, continued long-term changes in the cost or availability of these energy sources could adversely impact our financial results.

Our continued growth requires us to hire, retain and develop a highly skilled workforce and talented management team. Our financial results could be adversely affected by increased costs due to increased competition for employees, higher employee turnover or increased employee benefit costs.

We operate in the highly competitive food industry.

Price competition and industry consolidation could adversely impact our financial results. The sales of most of our products are subject to significant competition primarily through promotional discounting and other price cutting techniques by competitors, some of whom are significantly larger with greater resources. In addition, there is continuing consolidation in the snack food industry and in retail outlets for snack foods, either of which could increase competition. Significant competition increases the possibility that we could lose one or more major customers, lose existing product authorizations at customer locations, lose market share and/or shelf space, increase expenditures or reduce selling prices, which could have an adverse impact on our business or financial results.

Price increases for our products that we initiate may negatively impact our financial results if not properly implemented or accepted by our customers. Future price increases, such as those made in order to offset increased input costs, may reduce our overall sales volume, which could reduce our revenue and operating profit. We may be unable to implement price increases driven by higher input costs on a timely basis or at all, either of which may reduce our operating profit. Additionally, if market prices for certain inputs decline significantly below the prices we are required by contract to pay, customer pressure to reduce the prices for our products could lower our revenue and operating profit.

Changes in our top retail customer relationships could impact our revenue and profitability.

We are exposed to risks resulting from several large retail customers that account for a significant portion of our revenue. Our top ten retail customers accounted for approximately 55% of our net revenue during 2017, excluding sales of our products made by third-party distributors who are outside of the DSD network, with our largest retail customer, Wal-Mart, representing approximately 13% of our 2017, 2016 and 2015 net revenue. The loss of one or more of our large retail customers could adversely affect our financial results. These customers typically make purchase decisions based on a combination of price, service, product quality, product offerings, consumer demand, as well as distribution capabilities and generally do not enter into long-term contracts. In addition, these significant retail customers may change their business practices related to inventories, product displays, logistics or other aspects of the customer-supplier relationship. Our results of operations could be adversely affected if revenue from one or more of these customers is significantly reduced or if the cost of complying with customers’ demands is significant. If receivables from one or more of these customers become uncollectible, our financial results may be adversely impacted.

We may be unable to maintain our profitability in the face of a consolidating retail environment.

As the retail grocery industry continues to consolidate and our retail customers grow larger and become more sophisticated, our retail customers may demand lower pricing and increased promotional programs. Further, these customers are reducing their inventories and increasing their emphasis on products that hold either the number one or number two market position and private label products. If we fail to use our sales and marketing expertise to maintain our category leadership positions to respond to these trends, or if we lower our prices or increase promotional support of our products and are unable to increase the volume of our products sold, our profitability and financial condition may be adversely affected.

Demand for our products may be adversely affected by changes in consumer preferences and tastes or if we are unable to innovate or market our products effectively.

8

We are a consumer products company operating in highly competitive markets and rely on continued demand for our products. To generate revenue and profits, we must sell products that appeal to our customers and consumers. Any significant changes in consumer preferences or any inability on our part to anticipate or react to such changes could result in reduced demand for our products and erosion of our competitive and financial position. Our success depends on our ability to respond to consumer trends, including concerns of consumers regarding health and wellness, obesity, product attributes and ingredients. In addition, changes in product category consumption or consumer demographics could result in reduced demand for our products. Consumer preferences may shift due to a variety of factors, including the aging of the general population, changes in social trends, or changes in travel, vacation or leisure activity patterns. Any of these changes may reduce consumers’ willingness to purchase our products and negatively impact our financial results.

Our continued success also is dependent on product innovation, including maintaining a robust pipeline of new products, and the effectiveness of advertising and promotional campaigns, marketing programs and product packaging. Although we devote significant resources to meet this goal, there can be no assurance as to the continued ability to develop and launch successful new products or variants of existing products, or to effectively execute advertising and promotional campaigns and marketing programs.

Tax matters, including changes in tax laws and rates, disagreements with taxing authorities and imposition of new taxes, could adversely impact our results of operations and financial condition.

In December 2017, the United States enacted tax reform legislation (“Tax Act”). The Tax Act implements many new US domestic and international tax provisions. Many aspects of the Tax Act are unclear, and although additional clarifying guidance is expected to be issued in the future (by the Internal Revenue Service (“IRS”), the US Treasury Department or via a technical correction law change), it may not be clarified for some time. In addition, many US states have not yet updated their laws to take into account the new federal legislation. As a result, we have not yet been able to determine the full impact of the new laws on our results of operations and financial condition. It is possible that Tax Act, or interpretations under it, could change and could have an adverse effect on us, and such effect could be material.

In addition, foreign jurisdictions may also enact tax legislation that could significantly affect our ongoing operations. For example, foreign tax authorities could impose rate changes along with additional corporate tax provisions that would disallow or tax perceived base erosion or profit shifting. Aspects of the Tax Act may lead foreign jurisdictions to respond by enacting additional tax legislation that is unfavorable to us.

Adverse changes in the underlying profitability or financial outlook of our operations in several jurisdictions could lead to changes in the ability to realize our deferred tax assets and result in a charge to our income tax provision. Additionally, changes in tax laws in the US or in other countries where we have significant operations could materially affect deferred tax assets and liabilities and our income tax provision.

We are also subject to tax audits by governmental authorities. Although we believe our tax estimates are reasonable, if a taxing authority disagrees with the positions we have taken, we could face additional tax liabilities, including interest and penalties. Unexpected results from one or more such tax audits could significantly adversely affect our income tax provision and our results of operations.

The decision by British voters to exit the European Union may further negatively impact our operations.

The June 2016 referendum by British voters to exit the European Union (“Brexit”) caused uncertainty in global markets and resulted in a sharp decline in the value of the British pound, as compared to the US dollar and other currencies. As the U.K. negotiates its exit from the European Union, volatility in exchange rates and in U.K. interest rates may continue. In the near term, a weaker British pound compared to the US dollar during a reporting period causes local currency results of our U.K. operations to be translated into fewer US dollars; a weaker British pound compared to other currencies increases the cost of goods imported into our U.K. operations and may decrease the profitability of our U.K. operations; and a higher U.K. interest rate may have a dampening effect on the U.K. economy. In the longer term, any impact from Brexit on our U.K. operations will depend, in part, on the outcome of tariff, trade, regulatory and other negotiations. However, as a result of weakening demand, whether a function of Brexit or consumer preference, we recognized impairment charges of $46.3 million and $11.8 million against our European goodwill and KETTLE® Chips U.K. trademark, respectively during 2017. Further erosion of such operations, whether by consumer demand or the impact of Brexit could result in additional impairments related to our U.K. operations.

9

Our results may be adversely affected by the failure to execute acquisitions and divestitures successfully.

Our ability to meet our objectives with respect to the acquisition of new businesses or the divestiture of existing businesses may depend in part on our ability to identify suitable buyers and sellers, negotiate favorable financial terms and other contractual terms, and obtain all necessary regulatory approvals. If we pursue strategic acquisitions, divestitures, or joint ventures, we may incur significant costs and may not be able to consummate the transactions or obtain financing. Potential risks of acquisitions also include the inability to integrate acquired businesses efficiently into our existing operations; diversion of management's attention from other business concerns; potential loss of key employees and/or customers of acquired businesses; potential assumption of unknown liabilities; the inability to implement promptly an effective control environment; potential impairment charges if purchase assumptions are not achieved or market conditions decline; and the risks inherent in entering markets or lines of business with which we have limited or no prior experience. Acquisitions outside the US may present unique challenges and increase our exposure to risks associated with foreign operations, including foreign currency risks and risks associated with local regulatory agencies.

Future acquisitions also could result in potentially dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our financial results. In the event we enter into strategic transactions or relationships, our financial results may differ from expectations. We may not be able to achieve expected returns and other benefits as a result of potential acquisitions or divestitures.

Potential risks for any future divestitures, if any, include the inability to separate divested businesses or business units from our Company effectively and efficiently and to reduce or eliminate associated overhead costs. We are reliant on Diamond of California to supply walnuts under a Supply Agreement. Failure of Diamond of California to provide quality products under this arrangement could adversely affect our financial results.

Our business or financial results may be negatively affected if acquisitions or divestitures are not successfully implemented or completed.

The loss of key personnel could have an adverse effect on our financial results and growth prospects.

There are risks associated with our ability to retain key employees. If certain key employees terminate their employment, it could negatively impact manufacturing, sales, marketing or development activities. In addition, we may not be able to locate suitable replacements for key employees or offer employment to potential replacements on acceptable terms.

Failure to effectively execute and accomplish our strategy could adversely affect our financial results.

We utilize several operating strategies to increase revenue and improve operating performance. If we are unsuccessful due to unplanned events, our ability to manage change or unfavorable market conditions, our financial performance could be adversely affected.

Concerns with the safety and quality of certain food products or ingredients could cause consumers to avoid our products.

We could be adversely affected if consumers in our principal markets lose confidence in the safety and quality of certain products or ingredients. Negative publicity about these concerns, whether or not valid, may discourage consumers from buying our products or cause disruptions in production or distribution of our products and negatively impact our business and financial results.

If our products become adulterated, misbranded or mislabeled, we might need to recall those items and we may experience product liability claims if consumers are injured or become sick.

We may need to recall some of our products if they become adulterated or if they are mislabeled, and may also be liable if the consumption of any of our products causes injury to consumers. A widespread recall could result in significant losses due to the costs of a recall, the destruction of product inventory, and lost sales due to the unavailability of the affected product for a period of time. A significant product recall or product liability claim could also result in adverse publicity, damage to our reputation, and a loss of consumer confidence in the safety and/or quality of our products, ingredients or packaging. Such a loss of confidence could occur even in the absence of a recall or a major product liability claim. We also may become involved in lawsuits and legal proceedings if it is alleged that the consumption of any of our products causes injury or illness. A product recall or an adverse result in any such litigation could have an adverse effect on our operating and financial results. We may also lose customer confidence for our entire Branded portfolio as a result of any such recall or proceeding.

Disruption of our supply chain could have an adverse impact on our business and financial results.

Our ability to manufacture and sell our products may be impaired by damage or disruption to our manufacturing or distribution capabilities, or to the capabilities of our suppliers or contract manufacturers, due to factors that are hard to predict or beyond our control, such as adverse weather conditions, natural disasters, fire, pandemics or other events. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, may adversely affect our business or financial results, particularly in circumstances where a product or ingredient is sourced from a single supplier or

10

location. In addition, in light of recent transportation industry legislation, the number of freight carriers could decrease and create carrier shortages and higher freight costs.

We may be adversely impacted by inadequacies in, or security breaches of, our information technology systems.

We increasingly rely on information technology systems to conduct our business. These systems can enhance efficiency and business processes but also present risks of unauthorized access to our networks or data centers. If unauthorized parties gain access to our systems, they could obtain and exploit confidential business, customer, or employee information and harm our competitive position. In addition, these information systems may experience damage, failures, interruptions, errors, inefficiencies, attacks or suffer from fires or natural disasters, any of which could have an adverse effect on our business and financial results if not adequately mitigated by our security measures and disaster recovery plans.

Furthermore, with multiple information technology systems as a result of acquisitions, we may encounter difficulties assimilating or integrating data. In addition, we are currently in the process of consolidating systems which could provide additional security or business disruption risks which could have an adverse impact on our business and financial results.

Improper use or misuse of social media may have an adverse effect on our business and financial results.

Consumers are moving away from traditional means of electronic mail towards new forms of electronic communication, including social media. We support new ways of sharing data and communicating with customers using methods such as social networking. However, misuse of social networking by individuals, customers, competitors, or employees may result in unfavorable media attention which could negatively affect our business. Further, our competitors are increasingly using social media networks to market and advertise products. If we are unable to compete in this environment it could adversely affect our financial results.

The DSD network relies on a significant number of IBOs, and such reliance could affect our ability to efficiently and profitably distribute and market products, maintain existing markets and expand business into other geographic markets.

The DSD network relies on over 2,800 IBOs for the sale and distribution of Branded and Partner brand products. IBOs must make a commitment of capital and/or obtain financing to purchase a route business and other equipment to conduct their business. Certain financing arrangements, through third-party lending institutions, are made available to IBOs and require us to repurchase a route business if the IBO defaults on their loan and we then are required to collect any shortfall from the IBO, to the extent possible. The inability of IBOs, in the aggregate, to make timely payments could require write-offs of accounts receivable or increased provisions made against accounts receivable, either of which could adversely affect our financial results.

The ability to maintain a DSD network depends on a number of factors, many of which are outside of our control. Some of these factors include: (i) the level of demand for the brands and products which are available in a particular distribution area; (ii) the ability to price products at levels competitive with those offered by competing producers; and (iii) the ability to deliver products in the quantity and at the time ordered by IBOs and retail customers. There can be no assurance that we will be able to mitigate the risks related to all or any of these factors in any of our current or prospective geographic areas of distribution. To the extent that any of these factors have an adverse effect on our relationships with IBOs, thus limiting maintenance and expansion of the sales market, our revenue and financial results may be adversely impacted.

Identifying new IBOs can be time-consuming and any resulting delay may be disruptive and costly to the business. There also is no assurance that we will be able to maintain current distribution relationships or establish and maintain successful relationships with IBOs in new geographic distribution areas. There is the possibility that we will have to incur significant expenses to attract and maintain IBOs in one or more geographic distribution areas. The occurrence of any of these factors could result in increased expense or a significant decrease in sales volume through the DSD network and harm our business and financial results.

A disruption in the operation of the DSD network could negatively affect our results of operations, financial condition and cash flows.

We believe that the DSD network is a significant competitive advantage. A material negative change in our relationship with the IBOs could materially and negatively affect our financial condition, results of operations, cash flows, and ability to operate and conduct our business. In addition, litigation or one or more adverse rulings by courts or regulatory or governmental bodies regarding the DSD network, including actions or decisions that could affect the independent contractor classifications of the IBOs, or an adverse judgment against us for actions taken by the IBOs could materially and negatively affect our financial condition, results of operations, cash flows, and ability to operate and conduct our business.

11

Continued success depends on the protection of our trademarks and other proprietary intellectual property rights.

We maintain numerous trademarks and other intellectual property rights, which are important to our success and competitive position, and the loss of or our inability to enforce trademark and other proprietary intellectual property rights could harm our business. We devote substantial resources to the establishment and protection of our trademarks and other proprietary intellectual property rights on a worldwide basis. Efforts to establish and protect trademarks and other proprietary intellectual property rights may not be adequate to prevent imitation of products by others or to prevent others from seeking to block sales of our products. In addition, the laws and enforcement mechanisms of some foreign countries may not allow for the protection of proprietary rights to the same extent as in the US and other countries.

Impairment in the carrying value of goodwill or other intangible assets could have an adverse impact on our financial results.

The net carrying value of goodwill represents the fair value of acquired businesses in excess of identifiable assets and liabilities, and the net carrying value of other intangibles represents the fair value of trademarks, customer relationships, route intangibles and other acquired intangibles. Pursuant to generally accepted accounting principles in the US ("GAAP"), we are required to perform impairment tests on our goodwill and indefinite-lived intangible assets annually, or at any time when events occur, which could impact the value of our reporting unit or our indefinite-lived intangibles. These values depend on a variety of factors, including the success of our business, market conditions, earnings growth and expected cash flows. Impairments to goodwill and other intangible assets may be caused by factors outside our control, such as increasing competitive pricing pressures, changes in discount rates based on changes in cost of capital or lower than expected sales and profit growth rates. In addition, if we see the need to consolidate certain brands, we could experience impairment of our trademark intangible assets. During 2017, we recognized impairment charges of $46.3 million and $58.4 million for goodwill and trademarks, respectively. Significant and unanticipated changes in our business could require additional non-cash charges for impairment in a future period which may significantly affect our financial results in the period of such charge.

A significant portion of our outstanding shares of common stock is controlled by a few individuals, and their interests may conflict with those of other shareholders.

As of December 18, 2017, Patricia A. Warehime beneficially owned in the aggregate approximately 14.5% of our outstanding common stock based upon a Schedule 13D/A filed on January 22, 2018 by Mrs. Warehime. Mrs. Warehime serves as one of our directors. As a result, Mrs. Warehime may be able to exercise significant influence over us and certain matters requiring approval of our shareholders, including the approval of significant corporate transactions, such as a merger or other sale of our company or its assets. This could limit the ability of our other shareholders to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control of our Company. In addition, Mrs. Warehime may have actual or potential interests that diverge from the interests of our other shareholders.

On December 18, 2017, the Warehime Holders entered into a voting agreement with Campbell, pursuant to which the Warehime Holders agreed, among other things, to vote the shares of Company common stock over which they have voting power in favor of the approval of the Merger Agreement and the transactions contemplated thereby, including the Merger. As of February 16, 2018, the record date for the special meeting of our shareholders, the Warehime Holders owned 12,851,757 shares, or approximately 13.1% of the shares of our common stock outstanding and entitled to vote at the special meeting.

New regulations or legislation could adversely affect our business and financial results.

Food production and marketing are highly regulated by a variety of federal, state and other governmental agencies. New or increased government regulation of the food industry, including but not limited to areas related to food safety, chemical composition, production processes, traceability, product quality, packaging, labeling, school lunch guidelines, promotions, marketing and advertising (particularly such communications that are directed toward children), product recalls, records, storage and distribution could adversely impact our results of operations by increasing production costs or restricting our methods of operation and distribution. These regulations may address food industry or societal factors, such as obesity, nutritional and environmental concerns and diet trends.

We are subject to increasing legal complexity and could be party to litigation that may adversely affect our business.

Increasing legal complexity may continue to affect our operations and results in material ways. We are or could be subject to legal proceedings that may adversely affect our business, including class actions, administrative proceedings, government investigations, employment and personal injury claims, disputes with current or former suppliers, claims by current or former IBOs, and intellectual property claims (including claims that we infringed another party’s trademarks, copyrights, or patents). Inconsistent standards imposed by governmental authorities can adversely affect our business and increase our exposure to litigation. Litigation involving the independent contractor classification of the IBOs, as well as litigation related to disclosure made by us in connection therewith, if determined adversely, could increase costs, negatively impact our business prospects and the business prospects of the IBOs and subject us to incremental liability for their actions. We are also subject to the legal and compliance risks associated with privacy,

12

data collection, protection and management, in particular as it relates to information we collect from our employees, as well as information we collect when we provide products to customers, IBOs and retailers.

We may not be able to successfully execute our international expansion strategies.

We plan to drive additional growth and profitability through international distribution channels. Consumer demand, behavior, taste and purchasing trends may differ in international markets and, as a result, sales of our products may not be successful or meet expectations, or the margins on those sales may be less than currently anticipated. We may also face difficulties integrating foreign business operations with our current sourcing, distribution, information technology systems and other operations. Any of these challenges could hinder our success in new markets or new distribution channels. There can be no assurance that we will successfully complete any planned international expansion or that any new business will be profitable or meet our expectations.

Our foreign operations pose additional risks to our business.

We operate our business and market our products internationally. Our foreign operations are subject to the risks described above, as well as risks related to fluctuations in currency values, foreign currency exchange controls, compliance with foreign laws, compliance with applicable US laws, including the Foreign Corrupt Practices Act, and other economic or political uncertainties. International sales are subject to risks related to general economic conditions, imposition of tariffs, quotas, trade barriers and other restrictions, enforcement of remedies in foreign jurisdictions and compliance with applicable foreign laws, and other economic and political uncertainties. All of these risks could result in increased costs or decreased revenues, which could adversely affect our financial results.

We may not realize the benefits that we expect from our Transformation Plan.

In April 2017, we announced the Transformation Plan, our plan to significantly improve our financial performance by focusing on the following six areas: (i) reduce direct spending and accelerate zero-based budgeting to improve indirect costs, (ii) reduce manufacturing and distribution network complexity and improve productivity, (iii) reduce business complexity through SKU rationalization and ongoing portfolio maintenance, (iv) improve trade spend productivity and effectiveness and optimize brand assortment, (v) reset working/non-working ratios and increase investment in our core branded portfolio and (vi) elevate the performance of the existing IBOs and DSD network. As a part of the plan, on June 26, 2017, our Board of Directors approved the closure of our manufacturing facility in Perry, Florida and an incremental reduction in workforce across the organization. In 2017, we have eliminated approximately 300 jobs. The full scope of the Transformation Plan and specific actions to be taken are currently being developed by senior management and our Board of Directors.

The successful design and implementation of the Transformation Plan present significant challenges, many of which are beyond our control. In addition, the Transformation Plan may not advance our business strategy as expected. Events and circumstances, such as financial or strategic difficulties, delays, and unexpected costs may occur that could result in our not realizing all or any of the anticipated benefits or our not realizing the anticipated benefits on our expected timetable. If we are unable to realize the anticipated financial performance of the Transformation Plan, our ability to fund other initiatives may be adversely affected. Any failure to implement the Transformation Plan in accordance with our expectations could adversely affect our financial condition, results of operations, and cash flows.

In addition, the complexity of the Transformation Plan requires a substantial amount of management and operational resources. Our management team must successfully implement administrative and operational changes necessary to achieve the anticipated benefits of the Transformation Plan. These and related demands on our resources may divert the organization's attention from existing core businesses, integrating financial or other systems, have adverse effects on existing business relationships with suppliers and customers, and impact employee morale. As a result, our financial condition, results of operations, or cash flows may be adversely affected.

13

Risks related to our substantial indebtedness

We have substantial debt, which could adversely affect our financial health, our ability to obtain financing in the future, react to changes in our business, and make payments on our debt.

As of December 30, 2017 we had an aggregate principal amount of $1.1 billion of outstanding debt. Our substantial debt could have important consequences to holders of our common stock, including the following:

• | Our ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt service requirements, acquisitions or general corporate purposes may be impaired in the future |

• | A substantial portion of our cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for other purposes |

• | We are exposed to the risk of increased interest rates because a substantial portion of our borrowings are at variable rates |

• | It may be more difficult for us to satisfy our obligations to our lenders, resulting in possible defaults on and acceleration of such indebtedness |

• | We may be more vulnerable to general adverse economic and industry conditions |

• | We may be at a competitive disadvantage compared to our competitors with less debt or comparable debt at more favorable interest rates and they, as a result, may be better positioned to withstand economic downturns |

• | Our ability to refinance indebtedness may be limited or the associated costs may increase |

• | Our flexibility to adjust to changing market conditions and ability to withstand competitive pressures could be limited, or we may be prevented from carrying out capital spending that is necessary or important to our growth strategy and efforts to improve operating margins or our business |

The agreements and instruments governing our debt contain restrictions and limitations that could significantly impact our ability to operate our business.

Our credit facilities contain covenants that, among other things, restrict our ability to do the following:

• | Dispose of assets |

• | Incur additional indebtedness (including guarantees of additional indebtedness) |

• | Pay dividends and make certain payments |

• | Create liens on assets |

• | Make investments (including joint ventures) |

• | Engage in mergers, consolidations or sales of all or substantially all of our assets |

• | Engage in certain transactions with affiliates |

• | Change the business conducted by us |

• | Amend specific debt agreements |

Our ability to comply with these provisions in future periods will depend on our ongoing financial and operating performance, which in turn will be subject to economic conditions and to financial, market and competitive factors, many of which are beyond our control. Our ability to comply with these provisions in future periods will also depend substantially on the pricing of our products, our success at implementing cost reduction initiatives and our ability to successfully implement our overall business strategy.