Attached files

| file | filename |

|---|---|

| 8-K - DK 8-K INVESTOR PRESENTATION 2.27.17 - Delek US Holdings, Inc. | dk-8kxinvestorpresentation.htm |

March 2018

Delek US Holdings, Inc.

Investor Presentation

EX 99.1

Disclaimers

2

Forward Looking Statements:

Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; collectively with Delek US, defined as “we”, “our”) are traded on the New York Stock Exchange in the

United States under the symbols “DK” and ”DKL”, respectively, and, as such, are governed by the rules and regulations of the United States Securities and Exchange Commission. These slides

and any accompanying oral and written presentations contain forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties.

Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns,

or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not

limited to, statements regarding WTI-Brent crude oil differentials including improvement thereof and impact thereof on light crude oil refineries; global improvements and OPEC cuts; crude

oil markets, production, quality, pricing, imports, global production decline, exports, cuts, growth and transportation costs; light production from shale plays and Permian growth; differentials

including increases, trends and the impact of thereof on crack spreads; crude oil pricing; rig counts; Permian Crude capacity; pipeline takeaway capacity; crack spreads, refinery complexity,

configurations, utilization, crude oil slate flexibility, capacities, equipment limits and margins; the ability to unlock value from the Alon USA Energy, Inc. (“ALJ”) and Alon USA Partners LP

(“ALDW”) transactions from, among other things, simplification of corporate structure, synergy capture, improved operations, logistics growth, future dropdowns, cash flows, debt refinancing,

run rate synergies and reduced public company costs; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; improved product netbacks; our ability to

complete the Alkylation project at Krotz Springs successfully or at all and the benefits, flexibility, returns and EBITDA therefrom; our ability to identify and complete California initiatives

successfully or at all and the costs, cash flow and benefits thereof; the ability to complete the sale of four asphalt terminals and other assets to a third party successfully or at all and the timing

and benefits therefrom; logistic asset growth; increases in drop down inventory and organic projects and the timing of and potential benefits therefrom; increased capacity on the Paline

Pipeline and the impacts and benefits therefrom; potential logistics dropdowns and the benefits therefrom; the ability of the newly formed joint venture with Green Plains Partners LP to

acquire additional assets, and the timing for and amount of such acquisitions; future distribution growth; retail growth and opportunities and the value therefrom; financial flexibility to

support initiatives; long-term value creation from capital allocation; share repurchases and returning cash to shareholders; execution of strategic initiatives and the benefits therefrom;

valuation relative to peer group; long term shareholder returns; organic growth; margin improvement; financial flexibility; access to crude oil and the benefits therefrom; potential dropdown

EBITDA and the timing thereof. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include, but are not

limited to: risks and uncertainties related to the ability to successfully integrate the businesses of Delek US, ALJ and ALDW; the risk that the combined company may be unable to achieve cost-

cutting synergies, or it may take longer than expected to achieve those synergies; uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with

respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; gains and losses from derivative instruments;

management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment

in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance

projects; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of

competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks

contained in Delek US’and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future

performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information

available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ

materially from those expressed in the statements. Neither Delek US nor Delek Logistics Partners undertakes any obligation to update or revise any such forward-looking statements.

Non-GAAP Disclosures:

Delek US and Delek Logistics believe that the presentation of earnings before interest, taxes, depreciation and amortization ("EBITDA"), adjusted EBITDA, adjusted net income (loss) per share,

distributable cash flow and distribution coverage ratio provides useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating.

EBITDA, adjusted EBITDA, adjusted net income (loss) per share, distributable cash flow and distribution coverage ratio should not be considered as alternatives to net income, operating income, cash

from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, adjusted EBITDA, adjusted net income (loss) per share, distributable cash

flow and distribution coverage ratio have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because EBITDA, adjusted EBITDA,

adjusted net income (loss) per share, distributable cash flow and distribution coverage ratio may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may

not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA, adjusted EBITDA, adjusted net income (loss) per share and

distributable cash flow to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix.

Investment Highlights

(1) Based on price per common share as of close of trading on February 23, 2018.

(2) Currently 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The

remaining ownership interest is held by a subsidiary of Delek US.

(3) Please see page 36 for reconciliation of GAAP to non GAAP amounts 3

•Current Price: $34.26/share (1)

•Market Capitalization: $2.9 billion (1)

•NYSE: DKL: (Market cap $735.72 mm) Own 63.5%, including 2% GP(2)

Overview (NYSE: DK)

•Net income of $2.56/share

•Adjusted net income of $0.50 /share

•Adjusted EBITDA of $154.0 million

Strong Fourth Quarter 2017

Performance (3)

•Repurchased $118.8 million of stock from Nov. 2017 to Feb. 23, 2018

•Approved new $150.0 million authorization

• Increased regular quarterly dividend by 33% to $0.20/share from

$0.15/share

Cash Returns to Shareholders

•Closed Alon USA Energy transaction on July 1, 2017 to purchase

remaining 53%

•Closed purchase remaining 18.4% Alon USA Energy Partners LP units

on February 7, 2018

•Executing on strategic initiatives to unlock value

• Simplified corporate structure

Alon Acquisition

•December 31, 2017 balance sheet:

•Delek US: $931.8 million of cash; $1,465.6 million of debt

•Includes $4.7 million cash and $422.6 million debt of DKL

Flexible Financial Position to Support

Growth

Integrated Company with Asset Diversity and Scale

Strategically Located Assets with Permian Basin Exposure

4

Retail

• Approximately 300

stores

• Southwest US locations

• Largest licensee of 7-

Eleven stores in the US

• West Texas wholesale

marketing business

Asphalt (3)

• 14 asphalt terminals

located in TN, OK, TX,

WA, CA, AZ and NV

• Five terminals in CA, NV

and AZ in process of

being sold

• Largest asphalt supplier

in CA and second

largest asphalt supplier

in TX

Refining (1)

• 7th largest independent

refiner

• 302,000 bpd in total

•El Dorado, AR

•Tyler, TX

•Big Spring, TX

•Krotz Springs, LA

• Crude oil supply: 262,000

bpd WTI linked (207,000

bpd of Permian access)

Logistics (2)

• 10 terminals

• Approximately 1,290

miles of pipeline

• 11.4 million bbls of

storage capacity

• West Texas wholesale

• Joint venture crude oil

pipelines: RIO / Caddo

• Own 63.5%, incl. 2% GP,

of DKL

1) California refineries have not operated since 2012

2) Amounts include the Big Spring drop down that is expected to close in March 2018 with an effective date of March 1, 2018.

3) On February 12, 2018, Delek announced definitive agreement to sell the Mojave, Elk Grove, Phoenix, Fernley and Bakersfield terminals for $75.0 million.

Renewables

Approx. 61m gallons

Biodiesel:

• Crossett, AR

• Cleburne, TX

Renewable Diesel/Jet:

• California

Delek US Permian Focused WTI-Linked Crude Oil

Refining System

Current Refining Market Environment

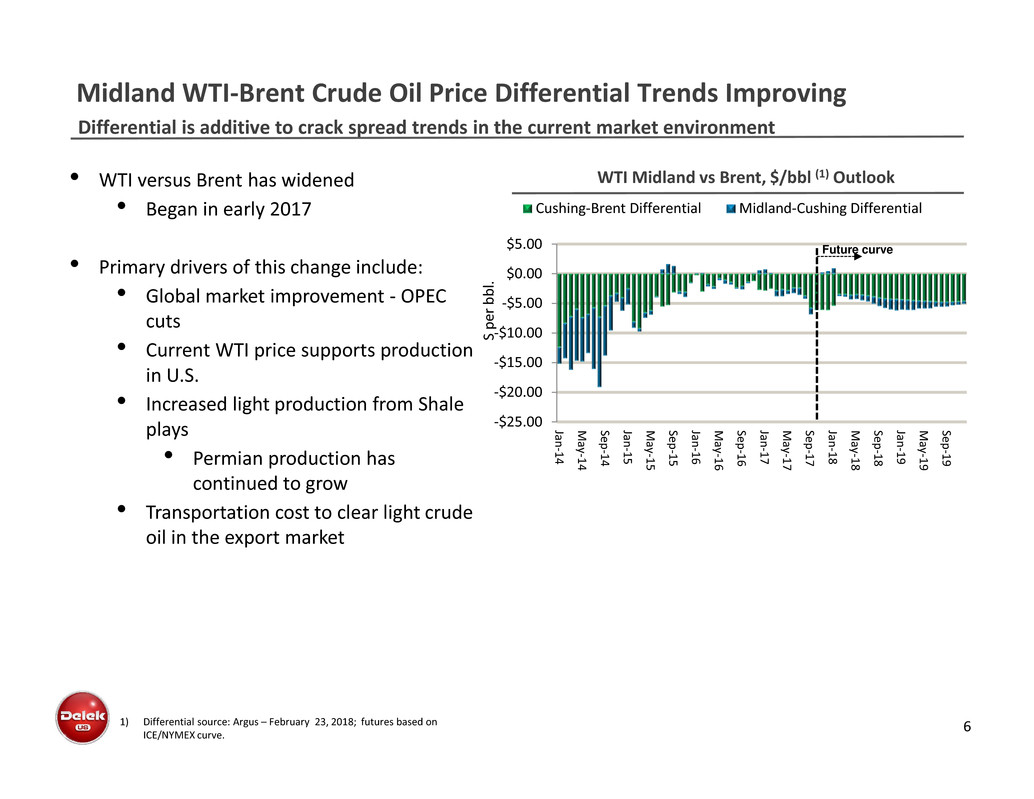

Differential is additive to crack spread trends in the current market environment

Midland WTI-Brent Crude Oil Price Differential Trends Improving

61) Differential source: Argus – February 23, 2018; futures based on ICE/NYMEX curve.

• WTI versus Brent has widened

• Began in early 2017

• Primary drivers of this change include:

• Global market improvement - OPEC

cuts

• Current WTI price supports production

in U.S.

• Increased light production from Shale

plays

• Permian production has

continued to grow

• Transportation cost to clear light crude

oil in the export market

-$25.00

-$20.00

-$15.00

-$10.00

-$5.00

$0.00

$5.00

Jan-14

M

ay-14

Sep-14

Jan-15

M

ay-15

Sep-15

Jan-16

M

ay-16

Sep-16

Jan-17

M

ay-17

Sep-17

Jan-18

M

ay-18

Sep-18

Jan-19

M

ay-19

Sep-19

S

p

e

r

b

b

l

.

Cushing-Brent Differential Midland-Cushing Differential

WTI Midland vs Brent, $/bbl (1) Outlook

Future curve

1) EIA production data through January 2018, Drilling Productivity Report; Baker Hughes rig count as of Feb 23, 2018.

2) Company estimates; current production based on EIA for January 2018.

7

Crude Oil Production Grew Despite Rig Decline (1)

-

500

1,000

1,500

2,000

2,500

3,000

J

a

n

-

0

7

J

u

n

-

0

7

N

o

v

-

0

7

A

p

r

-

0

8

S

e

p

-

0

8

F

e

b

-

0

9

J

u

l

-

0

9

D

e

c

-

0

9

M

a

y

-

1

0

O

c

t

-

1

0

M

a

r

-

1

1

A

u

g

-

1

1

J

a

n

-

1

2

J

u

n

-

1

2

N

o

v

-

1

2

A

p

r

-

1

3

S

e

p

-

1

3

F

e

b

-

1

4

J

u

l

-

1

4

D

e

c

-

1

4

M

a

y

-

1

5

O

c

t

-

1

5

M

a

r

-

1

6

A

u

g

-

1

6

J

a

n

-

1

7

J

u

n

-

1

7

N

o

v

-

1

7

0

100

200

300

400

500

600

P

r

o

d

u

c

t

i

o

n

,

0

0

0

b

p

d

A

c

t

i

v

e

R

i

g

C

o

u

n

t

Rig Count Oil Prod. (MBbl/d)

Production continued to grow through crude oil price volatility

Permian Basin Attractive Drilling Economics Support Growth

• Crude oil production benefited by low

breakeven costs and improved

efficiencies

• As crude oil prices have increased, rig

count has followed

• Expected crude oil production

growth of 600,000 bpd in 2018

and 2019

• Delek US has access to approximately

207,000 bpd of Permian Crude

Permian Basin Crude Oil Production Growth (2)

0.9 0.9 1.0 1.2

1.4 1.6 1.9

2.0 2.4

3.1

3.7

2009 2010 2011 2012 2013 2014 2015 2016 2017E 2018E 2019E

Current production Jan. 2018:2.8m bpd

Permian Basin Outlook - Production versus Pipeline Takeaway Capacity

8

• Outlook assumes production growth of approximately 600 kbpd

• Permian pipeline take-away utilization should remain >90% during 2018

• Plains Sunrise Expansion and Cactus II are the only 2019 projects currently committed out of

announced pipelines

Source: Delek US, company reports. Takes into consideration pipelines that are currently being constructed and does not take into account announced

potential pipelines that may be constructed in the future.

Crack Spread Cycle Turning Up

Crack spread at highest since 2015 and expected to continue upward trend

9

-$30

-$20

-$10

$0

$10

$20

$30

$40

$50

1

0

-

J

a

n

-

1

0

1

0

-

M

a

r

-

1

0

1

0

-

M

a

y

-

1

0

1

0

-

J

u

l

-

1

0

1

0

-

S

e

p

-

1

0

1

0

-

N

o

v

-

1

0

1

0

-

J

a

n

-

1

1

1

0

-

M

a

r

-

1

1

1

0

-

M

a

y

-

1

1

1

0

-

J

u

l

-

1

1

1

0

-

S

e

p

-

1

1

1

0

-

N

o

v

-

1

1

1

0

-

J

a

n

-

1

2

1

0

-

M

a

r

-

1

2

1

-

M

a

y

-

1

2

1

-

J

u

l

-

1

2

1

-

S

e

p

-

1

2

1

-

N

o

v

-

1

2

2

-

J

a

n

-

1

3

2

-

M

a

r

-

1

3

2

-

M

a

y

-

1

3

2

-

J

u

l

-

1

3

2

-

S

e

p

-

1

3

2

-

N

o

v

-

1

3

2

-

J

a

n

-

1

4

2

-

M

a

r

-

1

4

2

-

M

a

y

-

1

4

2

-

J

u

l

-

1

4

2

-

S

e

p

-

1

4

2

-

N

o

v

-

1

4

2

-

J

a

n

-

1

5

2

-

M

a

r

-

1

5

2

-

M

a

y

-

1

5

2

-

J

u

l

-

1

5

2

-

S

e

p

-

1

5

2

-

N

o

v

-

1

5

2

-

J

a

n

-

1

6

2

-

M

a

r

-

1

6

2

-

M

a

y

-

1

6

2

-

J

u

l

-

1

6

2

-

S

e

p

-

1

6

2

-

N

o

v

-

1

6

2

-

J

a

n

-

1

7

2

-

M

a

r

-

1

7

2

-

M

a

y

-

1

7

2

-

J

u

l

-

1

7

2

-

S

e

p

-

1

7

2

-

N

o

v

-

1

7

2

-

J

a

n

-

1

8

2

-

M

a

r

-

1

8

2

-

M

a

y

-

1

8

Q

3

2

0

1

8

2

0

1

9

Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel

(1) Source: Platts as of February 23, 2018; 5-3-2 crack spread based on HSD. Mitsui Forward Curve as of February 23, 2018

(2) Crack Spreads: (+/-) Contango/Backwardation

2010

Avg:

$9.08

2011

Avg:

$23.78

2012

Avg:

$26.91

2013

Avg:

$18.08

2014

Avg:

$12.60

2015

Avg:

$15.67

2016

Avg:

$10.36

2017

Avg:

$13.51

2018F

Avg:

$14.57

2010 Brent-

WTI Diff:

$(0.67)

2011 Brent-

WTI Diff:

$(15.81)

2012 Brent-

WTI Diff:

$(17.57)

2013 Brent-

WTI Diff:

$(10.77)

2014 Brent-

WTI Diff:

$(6.48)

2015 Brent-

WTI Diff:

$(4.86)

2016 Brent-

WTI Diff:

$(1.71)

2017 Brent-

WTI Diff:

$(3.88)

2018F Brent-

WTI Diff:

$(3.93)

System with Over 300,000 bpd of Crude Oil Throughput Capacity (~69% Permian Basin Based)

WTI-Linked Refining System with Permian Based Crude Oil Slate

10

Tyler, Texas

• 75,000 bpd crude

throughput

• 8.7 complexity

• Light crude refinery

• Permian Basin and

east Texas sourced

crude

El Dorado, Arkansas

• 80,000 bpd crude

throughput

• 10.2 complexity

• Flexibility to process

medium and light

crude

• Permian Basin, local

Arkansas, east Texas

and Gulf Coast crudes

Big Spring, Texas

• 73,000 bpd crude

throughput

• 10.5 complexity

• Process WTI and WTS

crude

• Located in the Permian

Basin

Krotz Springs, Louisiana

• 74,000 bpd crude

throughput

• 8.4 complexity

• Permian Basin, local

and Gulf Coast crude

sources

Crude Oil Supply is Primarily WTI Linked barrels -

• Currently approximately 262,000 bpd/95.6 million barrels per year; $1/bbl. change in WTI-Brent differential

is approximately $96 million of EBITDA

• Access to Permian crude oil accounts for 207,000 bpd/ 75 million barrels per year of crude oil supply

• Krotz Springs – Midland vs LLS - Ability to increase Midland barrels by 10,000 bpd

Big Spring

73 kbpd

26.6 m bbls

100% WTI

linked

Tyler

75 kbpd

27.4 m bbls

100% WTI

linked

El Dorado

80 kbpd

29.2 m bbls

100% WTI

linked

Krotz

74 kbpd

27.0 m bbls

46% WTI

linked

Initiatives Underway to Create Sustainable Value

Simplifies corporate structure of Delek US

Acquisition of the remaining Alon USA Partners LP Units

12

• On February 7, 2018, acquired remaining limited partner units of Alon USA Partners (ALDW)

• Delek US owned 81.6% of the outstanding common units

• All stock for unit transaction for remaining 18.4% of the outstanding common units

• Exchange ratio of 0.49 shares of Delek US for each ALDW common unit not already owned

by Delek US

• Expected benefits

• Simplified corporate structure

• Ability to reallocate cash flow from distributions to investment

• Enables ability to more efficiently drop down logistic assets to DKL in the future

• Ability to use the balance sheet strength of Delek US to refinance high cost debt at ALDW

• Reduces number of public companies to 2 (DK and DKL) lowering public company costs

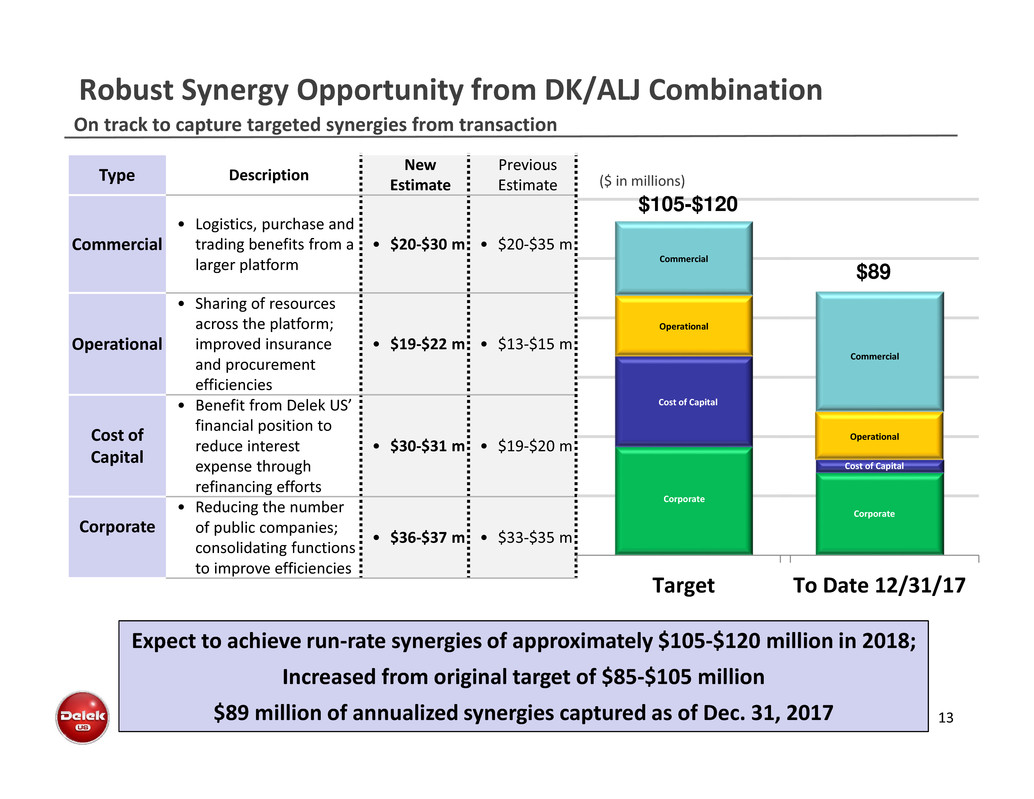

Robust Synergy Opportunity from DK/ALJ Combination

13

Expect to achieve run-rate synergies of approximately $105-$120 million in 2018;

Increased from original target of $85-$105 million

$89 million of annualized synergies captured as of Dec. 31, 2017

Type Description New Estimate

Previous

Estimate

Commercial

• Logistics, purchase and

trading benefits from a

larger platform

• $20-$30 m • $20-$35 m

Operational

• Sharing of resources

across the platform;

improved insurance

and procurement

efficiencies

• $19-$22 m • $13-$15 m

Cost of

Capital

• Benefit from Delek US’

financial position to

reduce interest

expense through

refinancing efforts

• $30-$31 m • $19-$20 m

Corporate

• Reducing the number

of public companies;

consolidating functions

to improve efficiencies

• $36-$37 m • $33-$35 m

Corporate

Cost of Capital

Operational

Commercial

Target

$105-$120

($ in millions)

On track to capture targeted synergies from transaction

To Date 12/31/17

Commercial

Operational

Corporate

$89

Cost of Capital

Areas of focus to add flexibility and increase margin potential from refinery

Krotz Springs Improvement Initiatives

14

Improve Units to Add Product Flexibility

• Alkylation Project – under construction - provides

ability to upgrade low value production into higher

value gasoline

Crude – Transportation and Flexibility

• Transportation – focus on reducing the cost of crude

oil delivered into Krotz Springs

• Flexibility – Working with DKL to explore ways to

increase ability to access lower cost crude oil

• Create ability to adjust crude slate between

LLS and Midland based on market conditions

and refinery runs

Product Netback Improvement

• Build out wholesale business along the Colonial

Pipeline system

Expected annual EBITDA $35 to $40 million; Target completion in 1Q19

Krotz Springs Alkylation Project

15

• Alkylation unit with 6,000 bpd capacity

• Approx. $103.0 estimated capital costs with

$29.0 million spent as of Dec. 31, 2017

• Improves refinery flexibility

• Converts lower priced iso-butane into higher

value alkylate

• Enables multiple summer grades of gasoline to

be produced

• Increases octane to produce premium gasoline

• Ability to access local markets

• Estimated project returns

• Estimated annual EBITDA(1) $35-$40 million

• Driven by the conversion/Reduces

dependency on crack spread environment for

project return

• Economics based on 67 cents/gallon spread

between CBOB 7.8 and iso-butane

• Sensitivity: each 10 cents/gallon change equals

$3.2 million EBITDA change

$0.69

$0.97

$1.23 $1.21

$0.90

$0.61 $0.65

$0.69

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

S

p

r

e

a

d

,

C

P

G

Gulf Coast CBOB 7.8 – Isobutane Spread

38.4 44.0

22.2 22.2

8.0

8.0 11.1

8.7

Base Alky

Change in Yields, in 000 bpd

Gasoline Diesel/Jet Heavy Oils Other

1) Please see page 37 for a reconciliation of forecasted EBITDA to forecasted net income.

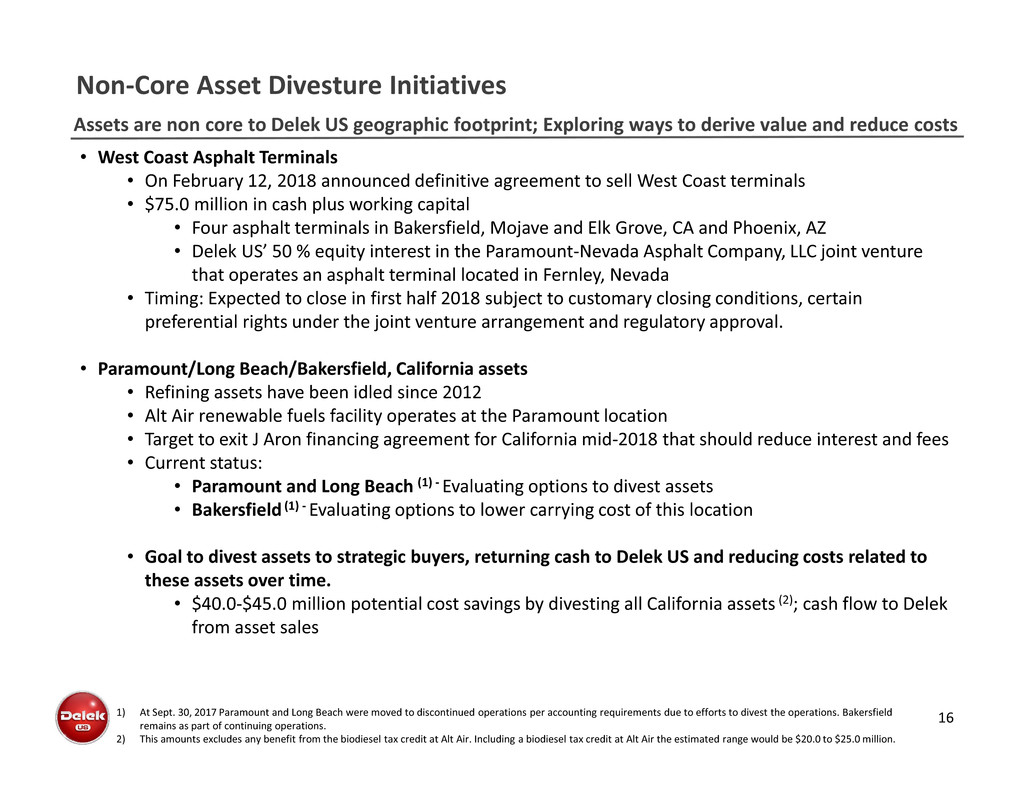

Assets are non core to Delek US geographic footprint; Exploring ways to derive value and reduce costs

Non-Core Asset Divesture Initiatives

16

• West Coast Asphalt Terminals

• On February 12, 2018 announced definitive agreement to sell West Coast terminals

• $75.0 million in cash plus working capital

• Four asphalt terminals in Bakersfield, Mojave and Elk Grove, CA and Phoenix, AZ

• Delek US’ 50 % equity interest in the Paramount-Nevada Asphalt Company, LLC joint venture

that operates an asphalt terminal located in Fernley, Nevada

• Timing: Expected to close in first half 2018 subject to customary closing conditions, certain

preferential rights under the joint venture arrangement and regulatory approval.

• Paramount/Long Beach/Bakersfield, California assets

• Refining assets have been idled since 2012

• Alt Air renewable fuels facility operates at the Paramount location

• Target to exit J Aron financing agreement for California mid-2018 that should reduce interest and fees

• Current status:

• Paramount and Long Beach (1) - Evaluating options to divest assets

• Bakersfield (1) - Evaluating options to lower carrying cost of this location

• Goal to divest assets to strategic buyers, returning cash to Delek US and reducing costs related to

these assets over time.

• $40.0-$45.0 million potential cost savings by divesting all California assets (2); cash flow to Delek

from asset sales

1) At Sept. 30, 2017 Paramount and Long Beach were moved to discontinued operations per accounting requirements due to efforts to divest the operations. Bakersfield

remains as part of continuing operations.

2) This amounts excludes any benefit from the biodiesel tax credit at Alt Air. Including a biodiesel tax credit at Alt Air the estimated range would be $20.0 to $25.0 million.

Logistics Assets Positioned for

Growth

• ~805 miles (1) of crude

and product

transportation pipelines,

including the 195 mile

crude oil pipeline from

Longview to Nederland,

TX

• ~ 600 mile crude oil

gathering system in AR

• Storage facilities with 10

million barrels (2) of

active shell capacity

• Rail Offloading Facility

Pipelines/Transportation

Segment

• Wholesale and

marketing business in

Texas

• 10 light product

terminals: (2) TX, TN, AR

• Approx. 1.4 million

barrels (2)of active shell

capacity

Wholesale/Terminalling

Segment

18

Logistics Assets Positioned to Benefit from Permian Basin Activity

Growing logistics assets support crude sourcing and product marketing for customers

(1) Includes approximately 240 miles of leased pipeline capacity.

(2) Amounts include the Big Spring drop down that is expected to close in March 2018 with an effective date of March 1, 2018.

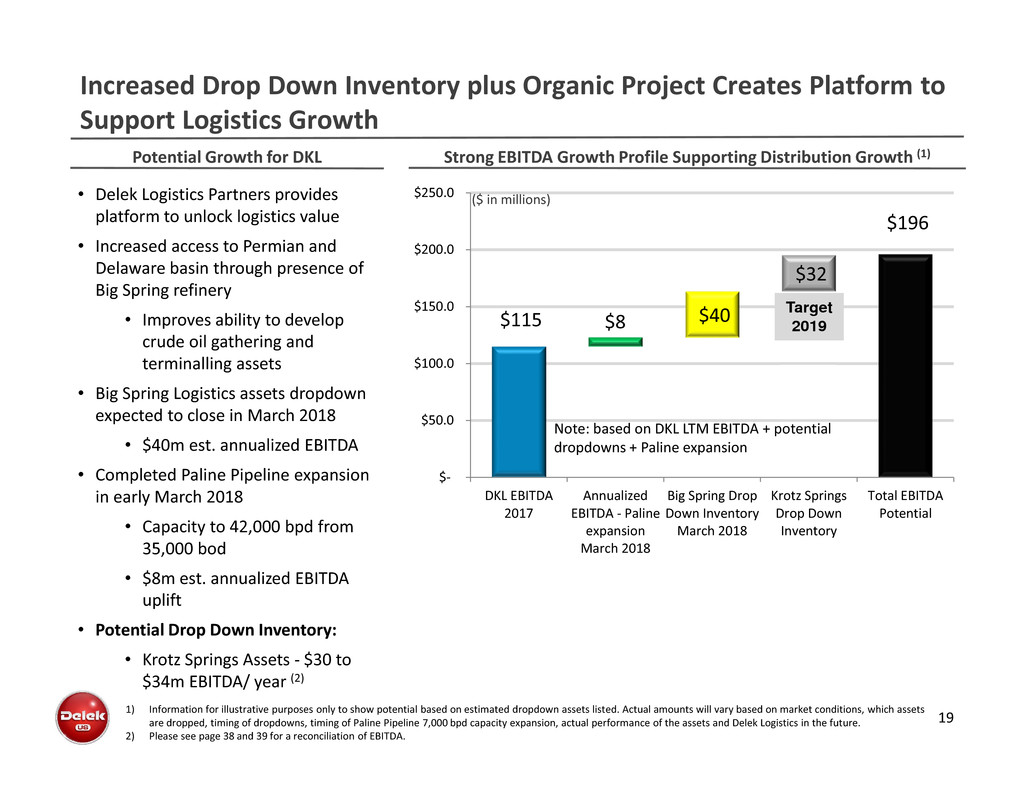

Increased Drop Down Inventory plus Organic Project Creates Platform to

Support Logistics Growth

19

Potential Growth for DKL

• Delek Logistics Partners provides

platform to unlock logistics value

• Increased access to Permian and

Delaware basin through presence of

Big Spring refinery

• Improves ability to develop

crude oil gathering and

terminalling assets

• Big Spring Logistics assets dropdown

expected to close in March 2018

• $40m est. annualized EBITDA

• Completed Paline Pipeline expansion

in early March 2018

• Capacity to 42,000 bpd from

35,000 bod

• $8m est. annualized EBITDA

uplift

• Potential Drop Down Inventory:

• Krotz Springs Assets - $30 to

$34m EBITDA/ year (2)

1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets

are dropped, timing of dropdowns, timing of Paline Pipeline 7,000 bpd capacity expansion, actual performance of the assets and Delek Logistics in the future.

2) Please see page 38 and 39 for a reconciliation of EBITDA.

Strong EBITDA Growth Profile Supporting Distribution Growth (1)

$115 $8 $40

$32

$196

$-

$50.0

$100.0

$150.0

$200.0

$250.0

DKL EBITDA

2017

Annualized

EBITDA - Paline

expansion

March 2018

Big Spring Drop

Down Inventory

March 2018

Krotz Springs

Drop Down

Inventory

Total EBITDA

Potential

($ in millions)

Note: based on DKL LTM EBITDA + potential

dropdowns + Paline expansion

Target

2019

20

1) Please see page 39 for a reconciliation of EBITDA.

Big Spring Logistics Asset Dropdown

• Drop down expected to close in March with an effective date of March 1, 2018

• Purchase price of $315.0 million which equates to a 7.8x EBITDA multiple.

• Expected annualized EBITDA of $40.2M

• Financed through a combination of cash on hand and borrowings on the revolving

credit facility.

• This acquisition consists of:

• Storage tanks and salt wells – ~2.9 million barrels of aggregate shell capacity,

consisting of 62 tanks, 4 salt wells and ancillary assets, including piping and pumps

located at the refinery.

• Product terminals – Consists of an asphalt terminal that operated at 3,900 bpd during

2H17 and a light products terminal with 54,000 bpd throughput capacity, which

operated at 28,000 bpd during 2H17

• Marketing agreement – Delek US will enter into a new wholesale marketing

agreement whereby Delek Logistics will provide services necessary to market various

refinery products produced at the Big Spring refinery. During 2H17, total sales

volume for products to be covered by this agreement was ~74,700 bpd

21

Joint Venture with Green Plains Partners

Improves logistics presence in North Little Rock and east Texas

• On February 20, 2018 announced a joint venture with Green Plains Partners to purchase

third party logistics assets

• Acquisition

• Two light products terminals – Caddo Mills, TX and North Little Rock, AR

• Purchased from an affiliate of American Midstream for $138.5 million in cash

• Subject to customary closing conditions and regulatory approval, the transaction is

expected to close in the first half of 2018

• Joint venture structure

• Immediately prior to closing Delek Logistics will contribute its North Little Rock, Arkansas

terminal and the Greenville tank farm located in Caddo Mills, Texas location plus

approximately $57.25 in cash

• At closing, Green Plains will contribute approximately $81.25 million in cash

• Delek Logistics will be the operator

• Strategic Rationale

• Acquired and contributed assets are complementary creating synergy opportunities

• Well positioned to support Delek US’ Tyler, Texas and El Dorado, AR refineries

• North Little Rock location has ability to unload ethanol unit trains

• Expected annualized EBITDA of $19.2 million in 2019 at joint venture

1) Please see page 39 for a reconciliation of EBITDA.

Positive Outlook for Paline Pipeline and West Texas Wholesale

22

• Approximately 195-mile 35 kbpd crude oil pipeline from

Longview, TX south to Beaumont

• Allows shippers the ability to ship Midland or Cushing

crude barrels to the Gulf Coast

• Adding capacity in March 2018

• Adding pump capacity to achieve 42,000 bpd

• Evaluating potential for additional capacity

• Transmission service agreement period until

February 28, 2018 for one year minimum volume

commitments

1) Source: Baker Hughes Drilling Rig report through Feb. 16, 2018.

2) RINs gross margin benefit included in the 2013 west Texas gross margin per barrel was approximately $6.4 million, or $0.99/Bbl, 2014 gross margin included $4.6 million, or $0.75/Bbl,

2015 gross margin included $5.3 million, or $0.89/Bbl, 2016 gross margin included $6.7 million, or $1.39/bbl, 2017 gross margin included $5.6 million, or $1.11/bbl

Paline Pipeline West Texas Wholesale

• Operates in an area around the Permian Basin;

Complementary to Delek US refining / retail in region:

• Purchases refined products from third parties for resale

at owned and third party terminals in west Texas

• Includes ethanol blending activity

• Drilling rig count has increased since May 2016; there

are currently 433 rigs operating in the Permian Basin(1)

West Texas Wholesale and Marketing Gross Margin

13,377

Bbl/d

14,353

Bbl/d

15,493

Bbl/d

16,523

Bbl/d 18,156

Bbl/d

16,707

Bbl/d

16,357

Bbl/d

13.482

Bbl/d

(2) (2) (2) (2)

($ in millions)

13.942

Bbl/d13,257

Bbl/d

(2) (2)

$7.2 $7.6 $8.5

$15.5 $14.0

$28.2

$8.0 $6.9

$20.3

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

2009 2010 2011 2012 2013 2014 2015 2016 2017

13,377

bpd

14,353

bpd

15,493

bpd

16,523

bpd 18,156

bpd

16,707

bpd

16,357

bpd 13,257bpd

13,817

bpd

23

Delek US GP and IDR Ownership is in DKL in the high splits

Future Potential Dropdowns to DKL Benefit Delek US Cash Flow

Supports Long Term Distribution Growth at Delek Logistics

Total Quarterly Distribution Per Unit

Target Amount Unitholders General Partner

Minimum Quarterly Distribution below $0.37500 98.0% 2.0%

First Target Distribution $0.37500 to $0.43125 98.0% 2.0%

Second Target Distribution $0.43125 to $0.46875 85.0% 15.0%

Third Target Distribution $0.46875 to $0.56250 75.0% 25.0%

Thereafter above $0.56250 50.0% 50.0%

• DKL Distribution was

$0.725/unit for 4Q 2017

• DKL distribution growth

target per LP unit of at least

10% annually through 2019

• Delek US Ownership:

• 61.5% of LP Units

• 2% GP Interest

(1) Based on no change in number of units and assumes all units are paid distribution, including IDRs to Delek US and its affiliates. Targeted annual growth rate in distribution

based on 10% through 2019 per Delek Logistics guidance in 4Q16 earnings release. Growth based on declared amounts. Growth from 2019 to 2020 based on 10% per year.

Delek US and affiliates own approximately 61% of limited partner units and 100% of the general partner units. Information for illustrative purposes only, actual amounts will

be determined by Delek Logistics based on future performance and pursuant to its partnership agreement.

Assumed Annual Distribution (LP and GP) to Delek US if Delek Logistics were to have a long term distribution

growth of 10% per year.(1) Combination of all Alon logistic assets, including asphalt, could potentially support

growth to 2020

$28.1 $33.1 $38.3

$42.7 $47.0 $51.7

$56.8$1.9

$5.0

$12.4

$18.8

$24.0

$31.5

$39.6

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

2014 2015 2016 2017E 2018E 2019E 2020E

Distribution - LP Distribution - GP

$ in millions 2016 – 2020E GP distribution CAGR +33%

24

(1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement.

(2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see page 38 for reconciliation.

(3) 4Q17 based on total distributions paid on February 12, 2018.

(4) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek rather than the cash

amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015.

(5) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

1.70x 1.58x

2.28x 2.40x 3.21x 2.69x 2.55x 2.56x 3.00x

3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.83x 3.88x 3.72x 3.77x

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

DKL: Increased Distribution with Conservative Coverage and Leverage

Distribution per unit has been increased twentieth consecutive time since the IPO

Distributable Cash Flow Coverage Ratio (2)(3)(4)

Leverage Ratio (5)

$0.375 $0.385 $0.395 $0.405 $0.415 $0.425 $0.475 $0.490

$0.510 $0.530 $0.550 $0.570 $0.590 $0.610 $0.630

$0.655 $0.680 $0.690 $0.705 $0.715 $0.725

MQD (1)1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

Increased 93.3% through 4Q 2017 distribution

1.39x 1.32x 1.35x 1.30x 1.61x

2.02x 1.42x 1.67x 1.25x 1.49x 1.47x 1.18x 1.20x 1.29x 0.98x 1.00x 0.88x

1.06x

0.97x 0.96x

1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q16 1Q17 2Q17 3Q17 4Q17

Avg. 1.35x in 2013

Avg. 1.68x in 2014

Avg. 1.35x in 2015

Avg. 1.11x in 2016 Avg. 0.97x in 2017

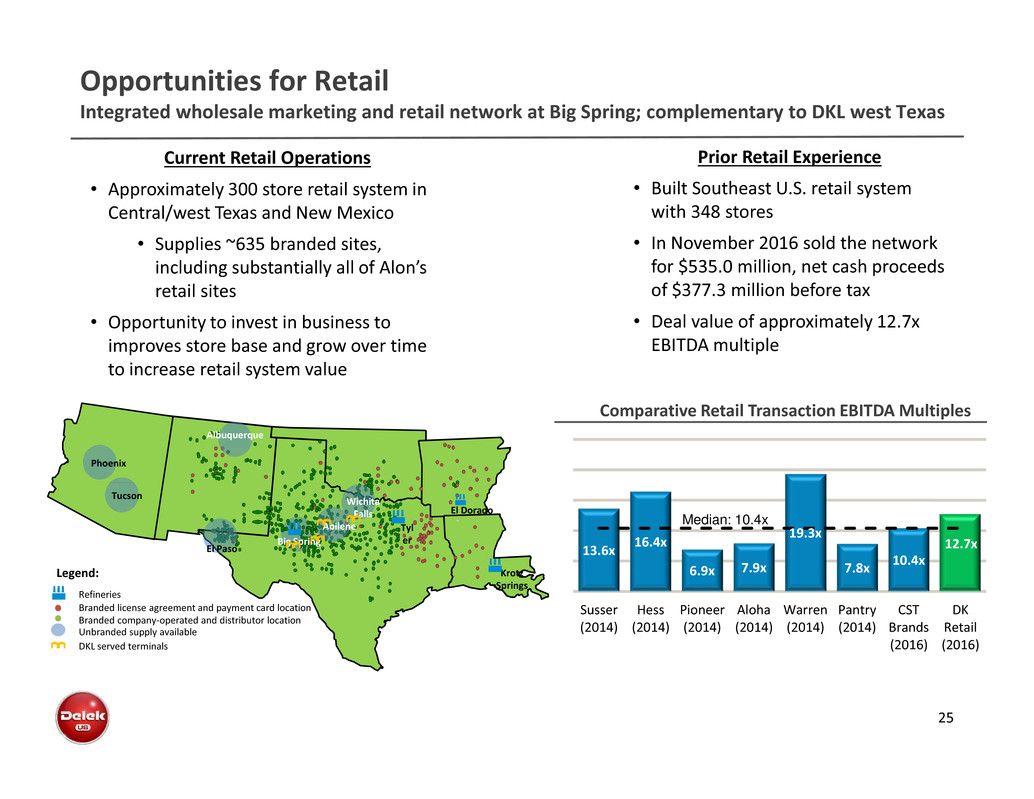

Opportunities for Retail

Integrated wholesale marketing and retail network at Big Spring; complementary to DKL west Texas

25

Current Retail Operations

• Approximately 300 store retail system in

Central/west Texas and New Mexico

• Supplies ~635 branded sites,

including substantially all of Alon’s

retail sites

• Opportunity to invest in business to

improves store base and grow over time

to increase retail system value

Refineries

Legend:

Big Spring

Krotz

Springs

Branded license agreement and payment card location

Branded company-operated and distributor location

Unbranded supply available

Phoenix

Tucson

El Paso

Abilene

Wichita

Falls

Albuquerque

DKL served terminals

El Dorado

Tyl

er

Prior Retail Experience

• Built Southeast U.S. retail system

with 348 stores

• In November 2016 sold the network

for $535.0 million, net cash proceeds

of $377.3 million before tax

• Deal value of approximately 12.7x

EBITDA multiple

13.6x 16.4x

6.9x 7.9x

19.3x

7.8x 10.4x

12.7x

Susser

(2014)

Hess

(2014)

Pioneer

(2014)

Aloha

(2014)

Warren

(2014)

Pantry

(2014)

CST

Brands

(2016)

DK

Retail

(2016)

Comparative Retail Transaction EBITDA Multiples

Median: 10.4x

Solid Financial Position

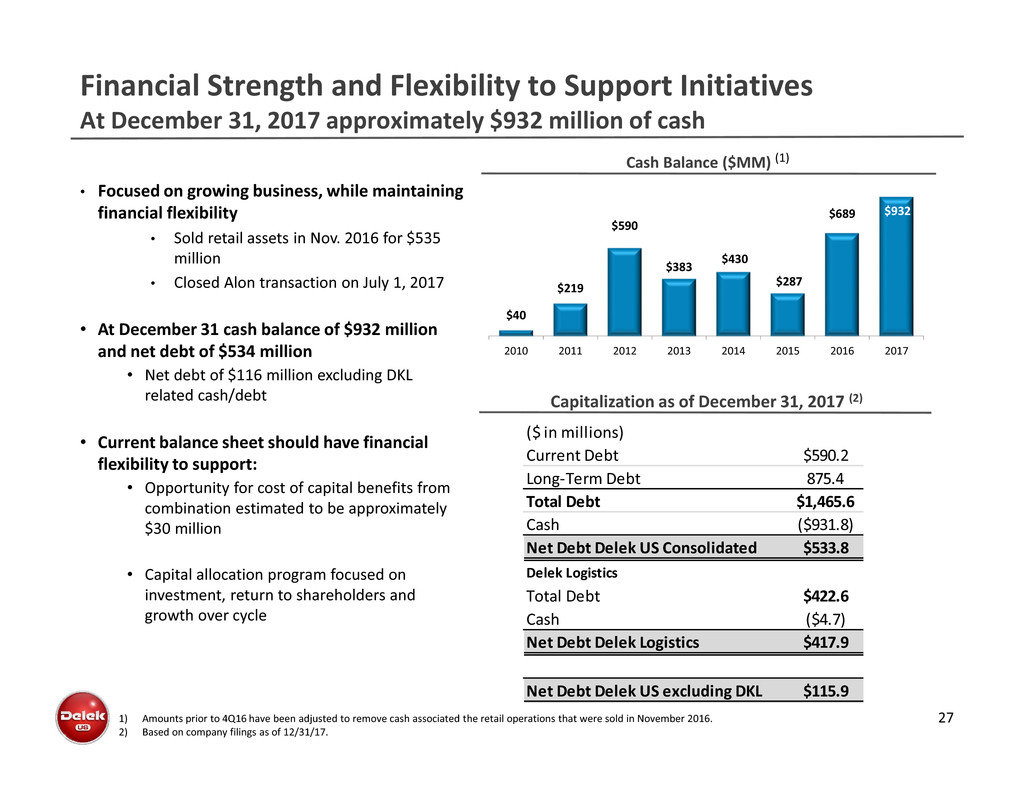

Financial Strength and Flexibility to Support Initiatives

At December 31, 2017 approximately $932 million of cash

27

• Focused on growing business, while maintaining

financial flexibility

• Sold retail assets in Nov. 2016 for $535

million

• Closed Alon transaction on July 1, 2017

• At December 31 cash balance of $932 million

and net debt of $534 million

• Net debt of $116 million excluding DKL

related cash/debt

• Current balance sheet should have financial

flexibility to support:

• Opportunity for cost of capital benefits from

combination estimated to be approximately

$30 million

• Capital allocation program focused on

investment, return to shareholders and

growth over cycle

1) Amounts prior to 4Q16 have been adjusted to remove cash associated the retail operations that were sold in November 2016.

2) Based on company filings as of 12/31/17.

Capitalization as of December 31, 2017 (2)

Cash Balance ($MM) (1)

$40

$219

$590

$383 $430

$287

$689 $932

2010 2011 2012 2013 2014 2015 2016 2017

($ in millions)

Current Debt $590.2

Long-Term Debt 875.4

Total Debt $1,465.6

Cash ($931.8)

Net Debt Delek US Consolidated $533.8

Delek Logistics

Total Debt $422.6

Cash ($4.7)

Net Debt Delek Logistics $417.9

Net Debt Delek US excluding DKL $115.9

• Invest in the business

• 2018 spending includes the Alky unit project at Krotz

Springs

• 1Q 2019 El Dorado Turnaround planning underway

• Programs in place allow different options to return cash to

shareholders

• Increased regular dividend by 33% to $0.20/qtr

• $150 million DK share repurchase plan(1) with

approximately $31 million remaining as of 2/23/18

• New $150 million DK share repurchase plan(1)

• Announced $75.0 million of asset divestitures in February

2018

Capital Allocation Focused on Long-Term Value Creation

28

Dividends Declared ($/share)

$0.15 $0.15 $0.21

$0.55 $0.60

$0.39

$0.40 $0.40

$0.15

$0.33

$0.60

$0.95 $1.00

$0.60 $0.60 $0.60

$0.80

2010 2011 2012 2013 2014 2015 2016 2017 2018F

Regular Special

$37.0

$74.6

$42.3

$6.0

$25.0

$93.8

2013 2014 2015 2016 4Q17 1Q18 to date

- 2/22/18

DK Share Repurchases ($MM)

1) These plans do not have expiration dates.

2) Based on annualized quarterly dividend of $0..20/share declared on 2/26/18. Actual amount for 2018 subject to approval by the Board of Directors during the year.

3) In addition to 2018 capital expenditures shown, there is approximately $40.0 million of midstream projects to enhance Delek’s Permian position in 2018.

$88.6

$157.1

$213.6 $191.0

$46.3

$177.5 $211.5

2012A 2013A 2014A 2015A 2016A 2017A 2018E

Historical Capital Spending (3)

($ in millions)

(2)

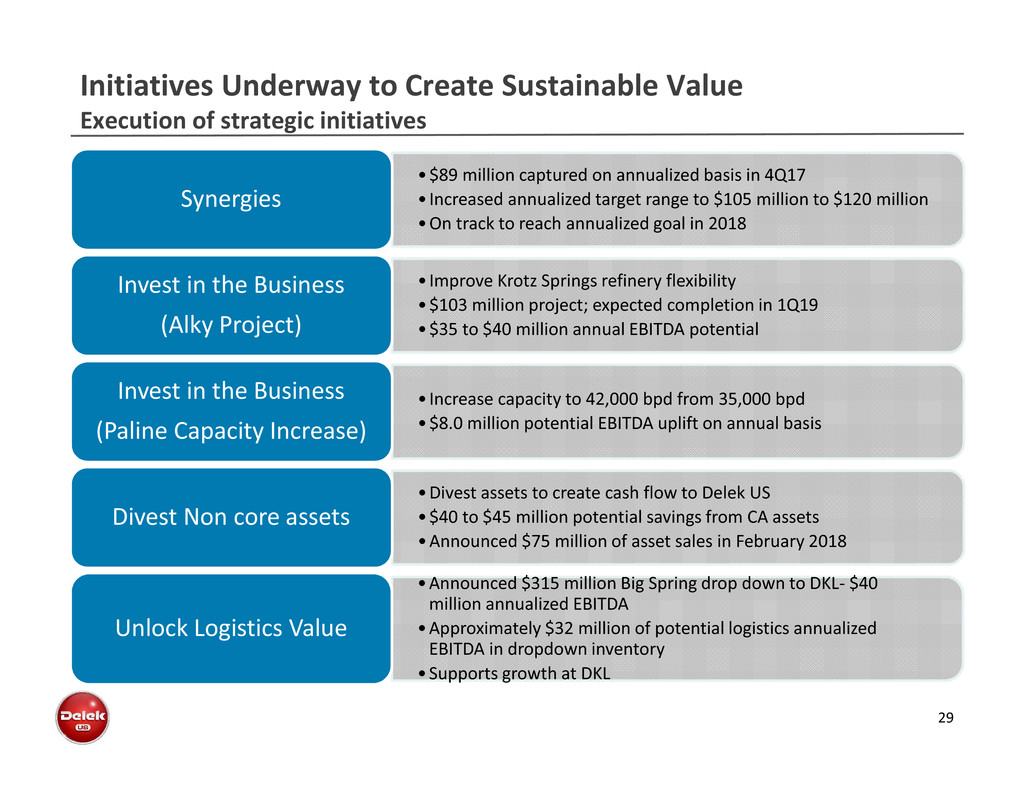

Initiatives Underway to Create Sustainable Value

Execution of strategic initiatives

29

•$89 million captured on annualized basis in 4Q17

• Increased annualized target range to $105 million to $120 million

•On track to reach annualized goal in 2018

Synergies

• Improve Krotz Springs refinery flexibility

•$103 million project; expected completion in 1Q19

•$35 to $40 million annual EBITDA potential

Invest in the Business

(Alky Project)

• Increase capacity to 42,000 bpd from 35,000 bpd

•$8.0 million potential EBITDA uplift on annual basis

Invest in the Business

(Paline Capacity Increase)

•Divest assets to create cash flow to Delek US

•$40 to $45 million potential savings from CA assets

•Announced $75 million of asset sales in February 2018

Divest Non core assets

•Announced $315 million Big Spring drop down to DKL- $40

million annualized EBITDA

•Approximately $32 million of potential logistics annualized

EBITDA in dropdown inventory

•Supports growth at DKL

Unlock Logistics Value

Current Valuation Below Peer EV to EBITDA

Permian focused refining system with flexible financial position

30(1) Based on NASDAQ IR Insights/Factset as of February 23, 2018.

• Balance sheet with $932 million of cash at 4Q17 supports company initiatives

• Permian focused refining system

• Capital allocation program returning cash to shareholders through share repurchases

• Current valuation for Delek US below peer group may create attractive opportunity

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

8.0x

9.0x

EV/EBITDA

2018 2019 18 avg 19 avg

31

Complementary

Logistics Systems

Significant Organic

Growth / Margin

Improvement

Opportunities

Focus on Long Term

Shareholder Returns

Financial FlexibilityPermian Focused Refining System

Questions and Answers

An Integrated and

Diversified Refining,

Logistics and Marketing

Company

Appendix

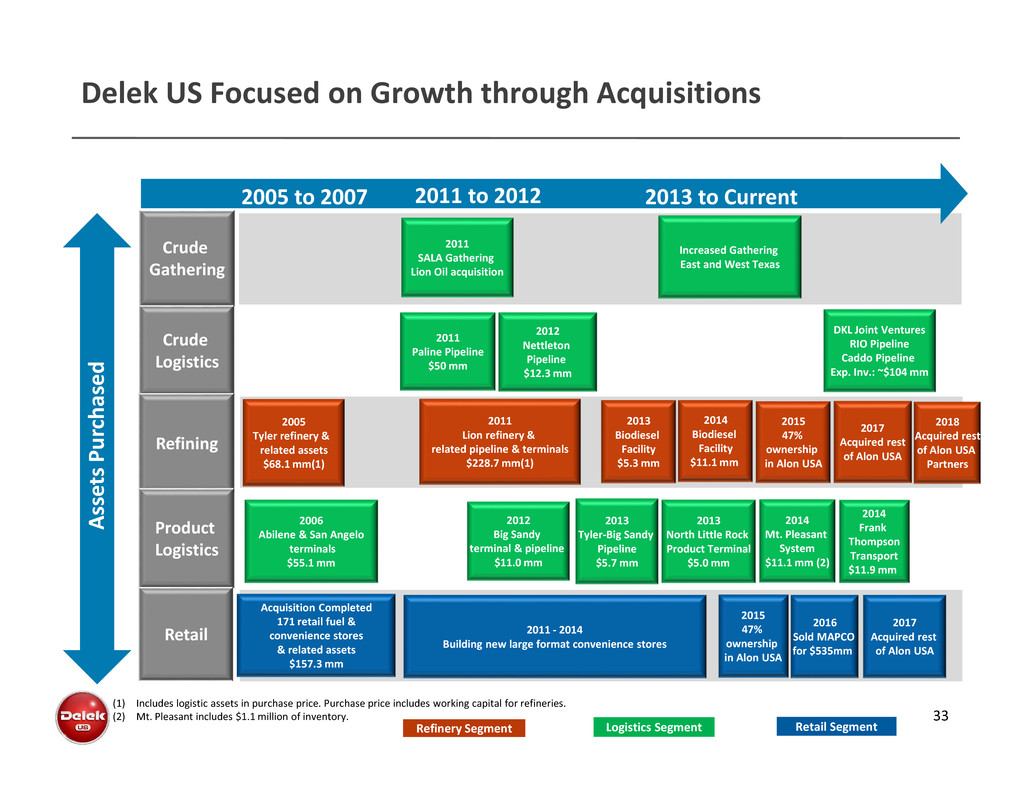

Delek US Focused on Growth through Acquisitions

(1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries.

(2) Mt. Pleasant includes $1.1 million of inventory.

2006

Abilene & San Angelo

terminals

$55.1 mm

2012

Nettleton

Pipeline

$12.3 mm

2011

Paline Pipeline

$50 mm

Acquisition Completed

171 retail fuel &

convenience stores

& related assets

$157.3 mm

2005 to 2007 2011 to 2012 2013 to Current

Crude

Gathering

2013

Biodiesel

Facility

$5.3 mm

2011

Lion refinery &

related pipeline & terminals

$228.7 mm(1)

2005

Tyler refinery &

related assets

$68.1 mm(1)

2011 - 2014

Building new large format convenience stores

2013

Tyler-Big Sandy

Pipeline

$5.7 mm

2014

Biodiesel

Facility

$11.1 mm

Logistics Segment Retail SegmentRefinery Segment

Crude

Logistics

Refining

Product

Logistics

Retail

2012

Big Sandy

terminal & pipeline

$11.0 mm

2013

North Little Rock

Product Terminal

$5.0 mm

2011

SALA Gathering

Lion Oil acquisition

A

s

s

e

t

s

P

u

r

c

h

a

s

e

d

Increased Gathering

East and West Texas

33

2014

Mt. Pleasant

System

$11.1 mm (2)

2014

Frank

Thompson

Transport

$11.9 mm

DKL Joint Ventures

RIO Pipeline

Caddo Pipeline

Exp. Inv.: ~$104 mm

2015

47%

ownership

in Alon USA

2015

47%

ownership

in Alon USA

2016

Sold MAPCO

for $535mm

2017

Acquired rest

of Alon USA

2017

Acquired rest

of Alon USA

2018

Acquired rest

of Alon USA

Partners

34

Current Delek US Corporate Structure

(1) As of December 31, 2017, a 5.4% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The

remaining ownership interest is indirectly held by Delek US.

(2) Market cap based on share and unit prices on February 23, 2018.

94.6%

ownership interest (1)

2.0% interest

General partner interest

Incentive distribution

rightsDelek Logistics Partners, LP

NYSE: DKL

Market Cap: $735.7 million

Delek Logistics GP, LLC

(the General Partner)

Delek US Holdings, Inc.

NYSE: DK

Market Cap: $2.9 billion

61.5% interest in

LP units

($14.00)

($12.00)

($10.00)

($8.00)

($6.00)

($4.00)

($2.00)

$0.00

$2.00

J

a

n

-

1

1

F

e

b

-

1

1

M

a

r

-

1

1

A

p

r

-

1

1

M

a

y

-

1

1

J

u

n

-

1

1

J

u

l

-

1

1

A

u

g

-

1

1

S

e

p

-

1

1

O

c

t

-

1

1

N

o

v

-

1

1

D

e

c

-

1

1

J

a

n

-

1

2

F

e

b

-

1

2

M

a

r

-

1

2

A

p

r

-

1

2

M

a

y

-

1

2

J

u

n

-

1

2

J

u

l

-

1

2

A

u

g

-

1

2

S

e

p

-

1

2

O

c

t

-

1

2

N

o

v

-

1

2

D

e

c

-

1

2

J

a

n

-

1

3

F

e

b

-

1

3

M

a

r

-

1

3

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

F

e

b

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

M

a

y

-

1

4

J

u

n

-

1

4

J

u

l

-

1

4

A

u

g

-

1

4

S

e

p

-

1

4

O

c

t

-

1

4

N

o

v

-

1

4

D

e

c

-

1

4

J

a

n

-

1

5

F

e

b

-

1

5

M

a

r

-

1

5

A

p

r

-

1

5

M

a

y

-

1

5

J

u

n

-

1

5

J

u

l

-

1

5

A

u

g

-

1

5

S

e

p

-

1

5

O

c

t

-

1

5

N

o

v

-

1

5

D

e

c

-

1

5

J

a

n

-

1

6

F

e

b

-

1

6

M

a

r

-

1

6

A

p

r

-

1

6

M

a

y

-

1

6

J

u

n

-

1

6

J

u

l

-

1

6

A

u

g

-

1

6

S

e

p

-

1

6

O

c

t

-

1

6

N

o

v

-

1

6

D

e

c

-

1

6

J

a

n

-

1

7

F

e

b

-

1

7

M

a

r

-

1

7

A

p

r

-

1

7

M

a

y

-

1

7

J

u

n

-

1

7

J

u

l

-

1

7

A

u

g

-

1

7

S

e

p

-

1

7

O

c

t

-

1

7

N

o

v

-

1

7

D

e

c

-

1

7

J

a

n

-

1

8

F

e

b

-

1

8

M

a

r

-

1

8

WTI Midland vs. WTI Cushing Crude Oil Pricing

Access to Midland Crude Oil Benefits Margins

($ per barrel)

Approx. 207,000

bpd of Midland

crude oil in DK

system

35Source: Argus – as of February 23, 2018

Non GAAP Reconciliations Delek US EPS and EBITDA

36

Reconciliation of U.S. GAAP Net Income

(Loss) to Adjusted Net Income (Loss) 2017 2016 2017 2016

Reported net income (loss) per share

attributable to Delek $2.56 $0.72 $4.00 ($2.49)

Adjustments, after tax (per share) (13)

Net inventory valuation gain (0.11) (0.08) (0.12) (0.35)

Alon goodwill impairment — — — —

Asset write offs — 0.03 0.01 0.05

Business interruption proceeds — — — (0.44)

Unrealized hedging loss 0.02 0.13 0.12 0.36

Loss on impairment of equity method

investment — — — 2.50

Inventory fair value adjustment — — 0.26 —

Transaction related expenses 0.03 0.06 0.24 0.09

Gain on remeasurement of equity method

investment in Alon — — (1.67) —

Deferred tax write-off — — 0.65 —

Tax Cuts and Jobs Act adjustment (2.02) — (2.31) —

Discontinued operations loss (gain) 0.02 (1.31) 0.08 (1.39)

Total adjustments (2.06) (1.17) (2.74) 0.81

Adjusted net income (loss) per share $0.50 ($0.45) $1.26 ($1.68)

Three Months Ended

December 31,

Year Ended

December 31,

(Unaudited) (Unaudited)

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted

EBITDA 2017 2016 2017 2016

Reported net income (loss) per share attributable to Delek $ 211.1 $ 44.2 $ 288.8 $ (153.7)

Add:

Interest expense, net 30.0 13.1 89.8 52.9

Income tax expense - continuing operations (140.7) (34.7) (29.2) (171.5)

Depreciation and amortization 47.9 29.8 153.3 116.4

EBITDA 148.3 52.4 502.7 (155.9)

Adjustments

Net inventory valuation gain (14.4) (7.8) (14.0) (33.8)

Alon goodwill impairment — — — —

Asset write offs — 2.7 0.7 4.9

Business interruption proceeds — — — (42.4)

Unrealized hedging loss 2.0 12.5 13.0 34.2

Loss on impairment of equity method investment in Alon — — — 245.3

Inventory fair value adjustment — — 33.2 —

Transaction related expenses 2.3 6.0 24.7 8.9

Gain on remeasurement of equity method investment in

Alon — — (190.1) —

Non controlling interest 14.0 4.6 33.8 20.3

Discontinued operations loss (gain), net of tax 1.8 (80.8) 5.9 (86.3)

Total adjustments 5.7 (62.8) (92.8) 151.1

Adjusted EBITDA $ 154.0 $ (10.4) $ 409.9 $ (4.8)

(Unaudited) (Unaudited)

Three Months Ended

December 31,

Year Ended December

31,

Non GAAP Reconciliations of Potential Alky Unit EBITDA (1)

37

(1) Based on projected range of potential future performance from the alkylation unit project at Krotz Springs. Amounts of EBITDA, net income and timing will vary. Actual

amounts will be based on timing of completion, performance of the project and market conditions.

Reconciliation of Forecast U.S. GAAP Net Income (Loss) to Forecast

EBITDA for Alkylation Project

Forecasted

Range

Forecasted Net Income $ 17.8 $ 21.0

Add:

Interest Expense, net — —

Income tax expense 10.3 12.1

Depreciation and amortization 6.9 6.9

Forecasted EBITDA $ 35.0 $ 40.0

Non GAAP Reconciliations of Potential Dropdown EBITDA (1)

38

(1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing

will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets,

DKL’s growth plans and valuation multiples for such assets at the time of any transaction.

Reconciliation of Forecasted Logistics Dropdown EBITDA to Forecasted Amounts under US GAAP

Delek Logistics Partners LP

($ in millions)

Forecasted Net Income Range 2.9$ 3.3$

Add: Depreciation and amortization expenses 15.6$ 17.7$

Add: Interest and financing costs, net 11.5$ 13.0$

Forecasted EBITDA Range 30.0$ 34.0$

Potential Dropdown Range

Non GAAP Reconciliations of EBITDA (1)

39

(1) Amounts of EBITDA, net income and timing will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be

based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction.

(2) This amount represents the forecasted 2019 performance for the total joint venture. Each partner will record performance based on their respective percentage ownership in

the joint venture.

($ in millions)

Tanks, Terminals

and Marketing

Agreement

Forecasted Net income $ 20.5

Add:

Income tax expense -

Depreciation and amortization 5.1

Interest expense, net 14.6

Forecasted EBITDA $ 40.2

Big Spring Logistics Drop Down and Marketing Agreement

Reconciliation of Forecasted Annualized EBITDA to Forecasted Net Income

($ in millions) DKGP Joint Venture (2)

Forecasted Net income $ 11.0

Add:

Income tax expense -

Depreciation and amortization 8.2

Interest expense, net -

Forecasted EBITDA $ 19.2

DKGP Energy Terminals LLC

Reconciliation of Forecasted 2019 EBITDA to Forecasted Net Income

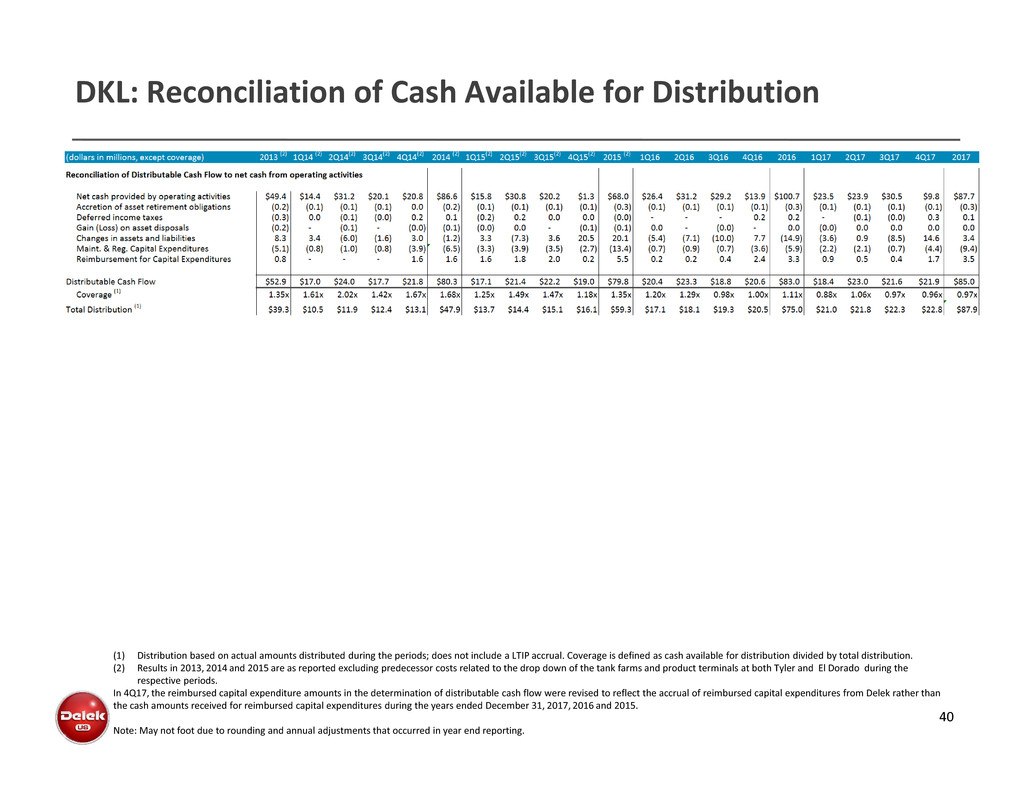

DKL: Reconciliation of Cash Available for Distribution

40

(1) Distribution based on actual amounts distributed during the periods; does not include a LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution.

(2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the

respective periods.

In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek rather than

the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015.

Note: May not foot due to rounding and annual adjustments that occurred in year end reporting.

DKL: Income Statement and Non-GAAP EBITDA Reconciliation

41

(1) Includes approximately $2.0 million of estimated annual incremental general and administrative expenses expected to incur as a result of being a separate publicly traded partnership.

(2) Interest expense and cash interest both include commitment fees and interest expense that would have been paid by the predecessor had the revolving credit facility been in place during the 12

months ended 9/30/13 period presented and Delek Logistics had borrowed $90.0 million under the facility at the beginning of the period. Interest expense also includes the amortization of debt

issuance costs incurred in connection with our revolving credit facility.

(3) Forecast provided in the IPO prospectus on Nov. 1, 2012.

(4) Results in 2013 and 2014 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the respective periods.

(5) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 drop downs.

Note: May not foot due to rounding.

2013(4) 1Q14(4) 2Q14 3Q14 4Q14 2014 (4) 1Q15(5) 2Q15 3Q15 4Q15 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17 2Q17 3Q17 4Q17 2017

Total Net Sales $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 $129.5 $126.8 $130.6 $151.2 $538.1

Cost of Goods Sold (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) (92.6) (85.0) ($89.1) ($106.1) (372.9)

Operating Expenses (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) (10.4) (10.0) ($10.7) ($12.3) (43.3)

Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 $26.5 $31.8 $30.8 $32.8 $121.9

Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) (5.2) (5.7) ($5.5) ($5.5) (21.9)

General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) (2.8) (2.7) ($2.8) ($3.6) (11.8)

Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 (0.0) 0.0 ($0.0) ($0.0) (0.0)

Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 $18.5 $23.4 $22.6 $23.7 $88.1

Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (4.1) (5.5) ($7.1) ($7.3) (23.9)

(Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) 0.2 1.2 $1.6 $1.9 5.0

Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) (0.1) (0.1) ($0.2) $0.6 0.2

Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 $14.6 $19.0 $16.9 $18.9 $69.4

EBITDA:

Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 $14.6 $19.0 $16.9 $18.9 $69.4

Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 $0.1 ($0.3) 0.1 0.1 0.1 0.2 (0.6) (0.2)

Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 $5.4 $5.6 20.8 5.2 5.7 5.5 5.5 21.9

Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 $3.4 $3.7 13.6 4.1 5.5 7.1 7.3 23.9

EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 $23.9 $30.3 $29.7 $31.1 $115.0

Investor Relations Contact:

Kevin Kremke Keith Johnson

Executive Vice President, CFO Vice President of Investor Relations

615-224-1323 615-435-1366