Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - READING INTERNATIONAL INC | rdi-20180223xex99_2.htm |

| EX-99.1 - EX-99.1 - READING INTERNATIONAL INC | rdi-20180223xex99_1.htm |

| 8-K - 8-K - READING INTERNATIONAL INC | rdi-20180223x8k.htm |

SUPERIOR COURT OF CALIFORNIA, COUNTY OF LOS ANGELES

Probate Division

Stanley Mosk Dept. - 9, Stanley Mosk Dept. - 9

BP159755

In re: COTTER, JAMES J. LIVING TRUST DTD 8/1/2000

February 14, 2018

1:30 PM

Honorable Clifford Klein, Judge

|

Joan Choi, Judicial Assistant |

Not Reported, Court Reporter |

|

Terrilynn Edwards, Court Services |

Luis A Flores, Deputy Sheriff |

|

Assistant |

|

NATURE OF PROCEEDINGS: Ruling on Submitted Matter;

The following parties are present for the aforementioned proceeding:

No appearances.

Out of the presence of the court reporter, the Court makes the following findings and orders:

The Court having taken the above captioned matter under submission on Tuesday, January 16, 2018 hereby rules as follows:

The Court having taken the above captioned matter under submission on Wednesday, August 02, 2017 hereby rules as fully reflected in the Tentative Statement of Decision issued this date. A copy of the Tentative Statement of Decision is sent to the parties this date as indicated below.

The Court orders the Clerk to give notice.

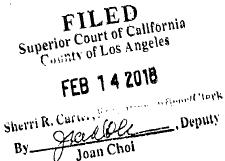

CLERK'S CERTIFICATE OF MAILING/

NOTICE OF ENTRY OF ORDER

I, SHERRI R. CARTER, Executive Officer/Clerk of the above-entitled court, do hereby certify that I am not a party to the cause herein, and that on this date I served the Notice of Entry of the above minute order of February 14, 2018 upon each party or counsel named below by placing the document for collection and mailing so as to cause it to be deposited in the United States Mail at the courthouse in Los Angeles, California, one copy of the original filed/entered herein in a separate sealed envelope to each address as shown below with the postage thereon fully prepaid, in accordance with standard court practices.

|

Dated: February 14, 2018 |

|

By: |

/s/ Joan Choi |

|

|

|

|

Joan Choi, Deputy Clerk |

Eric V. Rowen

Greenberg Traurig

1840 Century Park East

Suite 1900

|

|

Minute Order |

Page 1 of 2 |

SUPERIOR COURT OF CALIFORNIA, COUNTY OF LOS ANGELES

Probate Division

Stanley Mosk Dept. - 9, Stanley Mosk Dept. - 9

BP159755

In re: COTTER, JAMES J. LIVING TRUST DTD 8/1/2000

February 14, 2018

1:30 PM

Los Angeles, CA 90067

Adam Streisand, Esq.

Sheppard Mullin Richter & Hampton LLP

1901 Avenue of the Starts, Suite 1600

Los Angeles, CA 90067

Christopher D. Carico, Esq.

Carico Johnson Toomey LLP

841 Apollo Street, Suite 450

El Segundo, CA 90245

Margaret G. Lodise, Esq.

Sacks, Glazier, Franklin & Lodise LLP

350 South Grand Avenue, Suite 3500

Los Angeles, CA 90071

Harry P. Susman, Esq.

Susman Godfrey, LLP

1000 Louisiana, Suite 5100

Houston, TX 77002

Glenn C. Bridgman, Esq.

Susman Godfrey, LLP

1901 Avenue of the Stars, Suite 950

Los Angeles, CA 90067-6029

|

|

Minute Order |

Page 2 of 2 |

SUPERIOR COURT OF THE STATE OF CALIFORNIA

FOR THE COUNTY OF LOS ANGELES

|

In Re: JAMES J. COTTER LIVING TRUST |

) |

Case No.: BP159755 |

|

|

) |

|

|

ELLEN MARIE COTTER |

) |

|

|

MARGARET COTTER |

) |

STATEMENT OF DECISION |

|

Petitioners, |

) |

|

|

|

) |

|

|

vs. |

) |

|

|

JAMES J. COTTER Jr., |

) |

|

|

Respondent. |

) |

|

James Jr. (Jr.) filed an ex parte application for the appointment of a temporary trustee ad litem, based on the evidence introduced at the trial of the testamentary documents related to RDI. Although not required, this court chooses to issue a written statement of decision due to the complexity of the issues and the lengthy litigation. The court recognizes that an order was issued during the trial, at the request of the two daughters and the management of RDO, to seal documents relating to an assessment of RDI's financial stability. This order severely restricted all counsels' opportunity to cross examine expert witnesses, specifically Ron Miller, who was appointed to prepare such a report. The sealing order was issued at the request of the objectors to the ex parte application. This sealing order was later vacated after the conclusion of the evidentiary hearing with the consent of all the parties. A number of declarations were filed in lieu of witness testimony. The court considers the James Cotter Jr., as the party who filed the ex parte application, to have the burden of proof.

The court makes the following findings in this case:

Although James Cotter, Sr. (Sr.) intended for the voting stock and other assets of his trust to remain with the family, there is no explicit prohibition on their sale, as circumstances have changed, both as to the ability of his children to work cooperatively as executives in his company RDI, the extensive and protracted litigation between James Cotter Jr. and his two sisters Ellen Marie Cotter and Margaret Cotter (Ellen) (Margaret), the potential conflict of interest with any of these three children as to the grandchildren, and the lack of diversification with the extensive holdings in the cinema industry.

The court exercises its power pursuant to Probate Code section 15642 to appoint a temporary trustee ad litem, with the narrow and specific authority to obtain offers to purchase the RDI stock in the voting trust, but not to exercise any other powers without court approval, specifically the sale of the company or any other powers possessed by the permanent trustees. The trustees are not suspended or removed, pending future hearings if necessary. The court has previously ruled that the "hospital amendment" signed by James Cotter Sr. 2014. is invalid due to lack of capacity and undue influence.

The significant asset of Sr.'s estate at issue in this case is the company Sr. owned and managed, RDI, and specifically the company voting stock. RDI was his family business. RDI has a dual-class stock structure with non-voting (Class A) and voting (Class B) stock. At his death, Sr. owned roughly 1.2 million voting shares (70% of the voting stock), which are not actively traded, and about 2.2 million non-voting shares.

His assets also included citrus farms in Tulare and Fresno counties, consisting of over 2000 acres of orchards and a packaging house, Cecelia Packing, that processed citrus both from the its own orchards and other farms. The court does not sense that Sr.'s children have a sentimental attachment to these Central Valley orange groves as with a traditional family farm or ranch. These farms are not the subject of this decision.

Sr. owned numerous private investments and real estate, often as partnership shares of real-estate ventures. These investments include, among others, the properties known as Sutton Hill, Shadow View, Sorento, and Panorama, and a Laguna Beach condominium. Sr. owned an interest in the

120 Central Park South Cooperative Apartment that his daughter Margaret has lived in for over 20 years. Sr.'s Supplemental Executive Retirement Plan ("SERP") from RDI is worth approximately $7.5 million.

TRUSTEE AD LITEM

Pursuant to Probate Code section 15642 the court is appointing a temporary trustee ad litem, with the narrow and specific authority to obtain offers to purchase the RDI stock in the voting trust. There is substantial discussion by the guardian ad litem for the grandchildren, in documents originally sealed, about the need for diversification in a company with principal holdings in the fluid cinema industry. The court also recognizes that it has not heard evidence at a trial on whether Jr. is qualified to serve in management in RDI, and whether his allegations against his sisters' mismanagement are supported by the evidence. Regardless of the trust's terms, it is illogical to construe that it guarantees Jr. a lifetime appointment as president or CEO of RDI, nor the same guarantees to his sisters.

Nevertheless, Jr.'s concerns are appropriate that due to the hostile relationship with his sisters, they should not be the trustees of his children's substantial interest in the stock and future of RDI. The court cannot make any definitive findings as to 1) whether Margaret and Ellen are properly exercising their fiduciary responsibilities to the beneficiaries, 2) if they were the most qualified persons to be appointed for the top executive positions at RDI, considering that Sr. apparently did not foresee such promotions, 3) whether the board is beholden to them for their own status on the board, 4) whether they could favor Margaret's children as opposed to Jr.'s by rejecting favorable offers to sell the company or award themselves lucrative salaries, 5) whether Margaret disbursed funds for her child's kindergarten and denied Jr.'s identical request, 6) whether they see any risk in the lack of RDI's diversification, and 7) whether they would remain as executives regardless of the company's performance. Even though the court has not made findings that the sisters legally engaged in fraud, they have confessed to serious errors in judgment when having Sr. sign documents, "ludicrous and sad" to use their own words, which raises questions as to whether Jr.'s children's large inheritance should be subject to someone with whom he will have no communication. Whether Margaret and Ellen should be removed from their fiduciary positions is very premature; the court lacks an evidentiary basis for such a decision at this time. But the

guardian ad litem entrusted with the interests of the grandchildren has petitioned for a temporary trustee ad litem to entertain offers to sell RDI, which the court is granting.

The court has carefully reviewed the testamentary documents to determine if the voting stock can be legally sold. Sr.' intention and hopes that RDI remain in the family is obvious and undisputed, incorporating the phrase "for as long as possible" in the trust. He also refers to a possibility that the stock could be sold. He did not ask his lawyers to draft language to explicitly prohibit any such sale, even though his intentions to keep RDI in the family were discussed. As discussed previously, circumstances have changed, and one would assume that a businessman of Sr.'s described brilliance would not want RDI management to refuse to adjust business strategies to a rapidly changing world. The entertainment business is obviously undergoing technological changes, such as the growth of streaming and home video systems. The Cotter family is in disarray.

The court gives some weight to the trial testimony of Margaret's and Ellen's lawyers that the voting stock could be legally sold, but this was not conclusive. There was extensive discussion on this subject with two of the attorneys in court, including the sisters' expert witness. However, under the circumstances at a hearing, asking them these unanticipated questions at a trial, their opinions, even if deemed party admissions, are not conclusive. For example, Scot Kirkpatrick did not remember the exact language in Sr.'s trust. But there are also statements in public filings by Margaret and Ellen that the executors of Sr.'s will and the trustees of the voting trust have this authority to sell shares, which could be "monetized" if necessary.

Sr. used the word "hope". He absolved the trustees from any duty to diversify and directed that they should not do so (possibly to avoid the prudent investor rule.) Absolving someone from liability is not synonymous with forbidding the person from performing an act. These are words properly characterized as "precatory" rather than constituting a command. (In re Estate of Marti (1901) 132 Ca. 666, 671)

Respondent counsel for Jr. appropriately references the important distinction between permissive and mandatory provisions, citing the explanation in the Restatement 3d. of Trusts:

A trustee is not under a duty to make or retain investments that are made merely permissive by trust provision. Less clear is the degree to which the trustee may have to give special consideration to specially authorized investments, as against simply omitting them from serious consideration ...[T]he fact that an investment is permitted does not relieve the trustee of the fundamental duly to act with prudence ...Whether and to What extent a specific investment authorization may affect the normal duty to diversify the trust portfolio can be a difficult question of interpretation. Because permissive provisions do not abrogate the trustee's duty to act prudently and because diversification is fundamental to prudent risk management, trust provisions are strictly construed against dispensing with that requirement altogether.

The court is familiar with Copley V. Copley 126 Cal.App.3d 248, 288, which reversed a trial court appointment of an independent fiduciary, based on hostility alone between the trustees. The court did not believe that these conflicts and the risk of future litigation were proper grounds where there was insufficient evidence that the proper administration of the trust was not impaired. However, in this case there are additional factors, including the admissions of signing documents or having Sr. sign documents when he obviously lacked capacity, the concerns of the grandchildren's attorney about the security of the assets due to the lack of diversification in a rapidly changing industry, the sisters' appointment to the highest management positions at RDI, and the prompt rejection of an offer with minimal explanation to the shareholders or Jr., also a trustee, that could be beneficial to Jr.'s children. These children historically have only benefited from the stock price rather than any payment of dividends. Margaret herself testified that neither she nor Jr. wanted the other sibling to be a sole trustee over their children.

Perhaps the most important distinction with Copley is explained in Getty v. Getty (1988) 205 Cal.App.3d 134. "Appellants argue that whether or not there was a conflict of interest, where the trustor is fully aware of possible conflicts inherent in the appointment, the court will remove the trustee only for extreme grounds and not where there is a potential conflict of interest, citing Copley v. Copley (l 981) 126 Cal. App.3d 248|. While this is a correct statement of the law, there is no showing here that the trustor knew of any potential conflict of interest. Cases stating the Copley rule rely on the conflict of interest being fully known to the appointing party. (Estate of Gilliland (1977) 73 Cal. App.3d 515, 528.)"

It is inconceivable to this writer, as stated in court, that Sr. ever foresaw this extensive and expensive litigation. We see siblings refusing to speak for years, with a son uttering a stream of obscenities to his mother, with his mother in turn disowning her son, and the hectic and pressured attempts with the lawyer de jour for an advantageous trust in Sr.'s final days. (In one response, Ellen and Margaret point out that the mother's estate was not a subject of the trial, and thus Jr. was not "disowned." The court is well aware of this fact, and obviously did not use "disown" as a legal term.)

The Getty court held, which is applicable to this case,

"The appointment of a trustee ad litem was a proper exercise of the court's general equity jurisdiction. Since the court has the power to remove a trustee entirely in the exercise of its general equity jurisdiction (Prob. Code, §§ 15642, 16420, 17000, former Civ. Code § 2283; Estate of Schloss, supra, 56 Cal.2d at pp. 254-255; Fatjo v. Swasey (1896) 111 Cal. 628, 635-636|; Estate of Gilmaker (1962) 57 Cal.2d 627, 630 the removal from the existing trustee of his power to conduct certain lawsuits and appointment of a trustee ad litem, where there is a conflict of interest, are also an exercise of that general equity jurisdiction. As courts may entirely remove a trustee and appoint a replacement (see Bowles v. Superior Court (1955) 44 Cal.2d 574, 584 appointment of a trustee ad litem with limited powers to conduct certain litigation is an intrinsically included exercise of the court's inherent equity power within its greater power to remove and replace the trustee."

The court-appointed expert Ron Miller has raised some important questions about the stability of RDI, specifically for interests of the beneficiaries, the grandchildren. As the shares have a low trading volume, only one reputable analyst has covered the stock. A strategy of diversification of the holdings would reduce the "downside risk of loss inherent in holding a highly-concentrated asset such as a stock, and creating liquidity and flexibility for the trustees allowing them to make adjustments to the portfolio as circumstances and economic conditions dictate (Ron Miller's report). As RDI does not pay dividends, the grandchildren's' interest is completely dependent on the RDI's appreciation. As such, Mr. Miller expresses "grave concerns about the prudence of exposing the beneficiaries to such high risk." Other than selling stock, there are no other apparent ways to provide greater liquidity for the company. Prudence is best accomplished for an investment portfolio by some diversification of assets.

With respect to general economic conditions, there is no reason to anticipate that a change in economic conditions resulting from normal business cycles would dramatically impact the beneficiaries any more or less than the market in general,

assuming the proceeds of a sale would be invested in a diversified portfolio of equities and fixed income investments. However, retention of the RDI stock would subject the trust to potentially greater industry related and operating risk than might be expected in a diversified portfolio of investments across a variety of industries both foreign and domestic. (Ron Miller report)

Therefore were the beneficiaries to be in need of funds for their health, education, maintenance or support, the trustee would have no source of income or liquid assets from which to provide such distributions and would be forced to sell the stock to raise the liquidity necessary to meet the distribution requirements. With all or the trust assets concentrated in a single stock, this is potentially a risky strategy..." (Ron Miller report)

In their Request for Statement or Decision and Proposed Additional Findings filed September 18, 2017, counsel for Ellen and Margaret Cotter have raised many excellent questions with the 61 they proffered, some of which are premature because the actual sale of RDI stock is not before the court. As counsel correctly stated in a later response, "A statement of decision need not detail every piece of evidence considered and how the court was persuaded or not persuaded by each piece or evidence and the interplay of the evidence."

Although not required for the appointment of a temporary trustee, in this case a trustee with minimal powers, the court will address some of the questions. For example, Ellen and Margaret ask in question number 1 about the potential business disruptions RDI will suffer with the appointment or a trustee ad litem to solicit purchase offers for the RDI stock. The court has tried and will continue to try to minimize any such disruptions, but also recognizes that any future uncertainty with the appointment a trustee ad litem pales in comparison to the original conduct of the three children. These questions would be of greater relevance if the Cotter family resembled Ozzie and Harriet. This is Nero fiddling while Rome is burning. Their actions have resulted in drastically different trust documents, one of which literally changed control of RDI as often as every January 1st, all signed by Sr., followed by this extensive hostile litigation, and the filing of the ex parte itself. Disruptions have not appeared to be a major concern of Sr.'s children. Whether the potential sale of the stock of RDI, or any company for that matter, would adversely impact the grandchildren cannot be determined before any offers have been tendered. The court emphasizes

in response to these questions that the trustee ad litem is not authorized to accept any offers. If necessary, the parties still have the right to a full trial on the merits.

Question 14 raises the issue of a present need for liquidity for the trust, which is addressed in Ron Miller's report, who though concerned about the lack of liquidity, is more concerned about the lack of diversification. Regarding question 15, the temporary trustee is not being appointed to alter or preserve the status quo, but to evaluate offers to buy the voting stock. However, there are many historical and well known examples of companies who chose to preserve the status quo to their ultimate detriment. But this discussion is better left for another day.

The court candidly does not understand question 21 regarding the "rate" of change in the cinema exhibition industry or national economy. The questions of potential changes in the cinema exhibition industry, the different assets of RDI, RDI's business plan, beginning with question 22 through 38 should be reflected in the share price of any offers to buy the voting stock, as they relate to the present and future value of the company and market conditions, and could be relevant should the court consider a sale following the temporary trustee's appointment. Ultimately, it is more likely that the market will better answer these excellent and relevant questions, rather than a parade of experts in a courtroom.

Regarding questions 39 and 40 about ways to mitigate risks, the court has not heard any proposals from any parties, nor any indication of plans to pay dividends. Questions 51 and 52 pertaining to Jim Jr.'s motivation are irrelevant as the court has clearly stated, as has the 730 expert and Ron Miller, that the concern is for the beneficiaries, the grandchildren. Questions about potential buyers can best be answered by a trustee ad litem soliciting buyers and a price for the voting shares, not by expert testimony.

A possible buyer has expressed interest in purchasing controlling shares of RDI in the voting trust. In these uncertain economic times, both with the national economy and the cinema industry, the court believes it is most prudent for the trustee ad litem to immediately research a possible sales price. A delay due to an appeal could make the court's ruling regarding a trustee ad litem in effect

moot. Losing a buyer is an imminent loss that comes within the ruling in Sterling v. Sterling (2015) 242 Ca4th 185, 199. The court has not authorized an actual sale. There is a necessity for immediate but limited action to determine if there are other prospective buyers, as well as the price the current interested buyer is prepared to pay, and also the parties to this litigation. The court finds Probate Code section 1310(b) to apply to these facts, which limits any stay due to an appeal.

CONCLUSION

The court has "lived" with this case over a year, and has often thought with much disappointment about the disintegration of what on the surface appeared to be at one point a united, successful and caring family. All three children were dedicated to the health and comfort of their father during his final clays. At times, this court has expressed some harsh words in their presence about each of them, but the court recognizes that the immense stresses of this litigation may not be indicative of their true character. A potential sale of stock in the voting trust of RDI is not the preferred outcome for any of the parties, nor for the court. The sisters ask the court in question 60 whether there is a more preferable outcome. Yes. Reconciliation. Family over money. As for other suggestions, at this point, the court looks to the three siblings.

Unfortunately, the court sees no evidence of any progress. The alternative of a sale should be explored for the benefit of the grandchildren, and perhaps this next generation can best carry out the hopes of James Cotter Sr.

BASED UPON THE FOREGOING, THE COURT RULES AS FOLLOWS:

1. A temporary trustee ad litem, with the narrow and specific authority to obtain offers to purchase the RDI stock in the voting trust, but not to exercise any other powers without court approval, specifically the sale of the company or any other powers possessed by the trustees. The parties shall agree on a trustee or submit three acceptable names to this court.

2. Pursuant to Probate Code section 1310(b), the appointment of a trustee ad litem shall exercise the powers granted as if no appeal were pending and shall not be stayed.

3. Each party shall bear their own costs.

4. James Cotter Jr. shall prepare a judgment and order consistent with this statement of decision.

IT IS SO ORDERED.

Dated 2/14/18

Clifford L. Klein Judge of the Los Angeles Superior Court