Attached files

| file | filename |

|---|---|

| 8-K - INVESTOR PRESENTATION - CITIZENS FINANCIAL SERVICES INC | investorshow2018.htm |

Rooted for the Future CZFSListed: OTC BB / OTC Pink CITIZENSFINANCIAL SERVICESINCORPORATED

Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations, future performance and business of Citizens Financial Services, Inc. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. To the extent that statements in this presentation do not relate to historical or current facts, they constitute forward-looking statements. Although such statements are based on current estimates and expectations, and currently available competitive, financial, and economic data, forward-looking statements are inherently uncertain. These forward-looking statements are made subject to certain risks, uncertainties and other factors, which could cause actual results to differ materially from those presented. You will find more detailed information regarding these factors in our filings with the U.S. Securities and Exchange Commission, including in the “Risk Factors” section of our most recently filed Annual Report on Form 10-K and of our most recently filed Quarterly Report on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which speak only to the date such data was presented. Citizens Financial Services, Inc. undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise following this presentation, whether as a result of new information, future developments or otherwise, except as may be required by law. February 2018 Citizens Financial Services, Inc. 2

Company Profile

Company Profile Headquartered in Mansfield, PAStock Symbol: CZFS (OTC BB / OTC Pink)$1.362 billion in assets at December 31, 2017Market Capitalization: $219.7 million (12/31/2017)Attractive markets with diverse economic base, which has benefited from Marcellus Shale exploration and drilling activities. New markets have provided additional agricultural and commercial opportunities. Long history of successful operation dating from 1932.28 offices located in Tioga, Bradford, Potter, Clinton, Lebanon, Berks, Schuylkill, Lancaster, Centre and Union Counties of PA and Allegany County, NY.Simple capital structure (no outstanding preferred stock, $23.3 million of goodwill). February 2018 Citizens Financial Services, Inc. 4

Investment Merits(NOTE: 12/31/2017 numbers are unaudited)

Investment Merits Geographic Diversification, Which Presents OpportunitiesSuccessful Acquisition of Lending TeamsStrong Long-Term Record of GrowthSteady Record of High ProfitabilityDiversity of Interest Earning AssetsImpressive Shareholder Returns February 2018 Citizens Financial Services, Inc. 6

Investment MeritsAttractive Market February 2018 Citizens Financial Services, Inc. 7

Investment MeritsAttractive Market - Favorable Deposit Trends February 2018 Citizens Financial Services, Inc. 8 Deposit and Deposit Market Share Growth, by County * June 30, 2014 2015 2016 2017 $ % $ % $ % $ % Bradford, PA 338 29.75 342 30.57 341 30.97 343 31.05 Tioga, PA 316 44.50 327 44.08 329 44.83 343 45.14 Potter, PA 86 31.99 91 32.19 79 29.48 79 28.15 Clinton, PA n/a n/a 7 1.80 11 2.31 15 3.29 Lebanon, PA n/a n/a n/a n/a 137 6.43 155 7.05 Berks, PA n/a n/a n/a n/a 42 0.28 43 0.26 Schuylkill, PA n/a n/a n/a n/a 36 1.75 36 1.77 Allegany, NY 27 5.48 30 6.05 32 6.08 35 6.21 Lancaster, PA n/a n/a n/a n/a n/a n/a 6 0.06 Centre, PA n/a n/a n/a n/a n/a n/a 38 1.16 * Based on FDIC data as of June 30, 2017. Deposit dollars in millions.

Investment MeritsAttractive Market - Deposit Composition February 2018 Citizens Financial Services, Inc. 9

Investment MeritsStrong Long-Term Record of Growth February 2018 Citizens Financial Services, Inc. 10 Long-Term Growth Rates 12/31/2012 12/31/2017 CGR* Assets ($mm) $882 $1,362 9.1% Net Loans ($mm) $496 $989 14.8% Deposits ($mm) $737 $1,105 8.4% Stockholders’ Equity ($mm) $89 $129 7.6% Book Value / Share $25.94 $37.81 7.8% Net Income ($mm) $14.2 $13.0 -1.7% EPS (2017 annualized) $4.33 $3.74 -2.9% Stock Price $43.00 $63.00 7.9% * Annual compound growth rate

Investment MeritsStrong Long-Term Record of Growth February 2018 Citizens Financial Services, Inc. 11

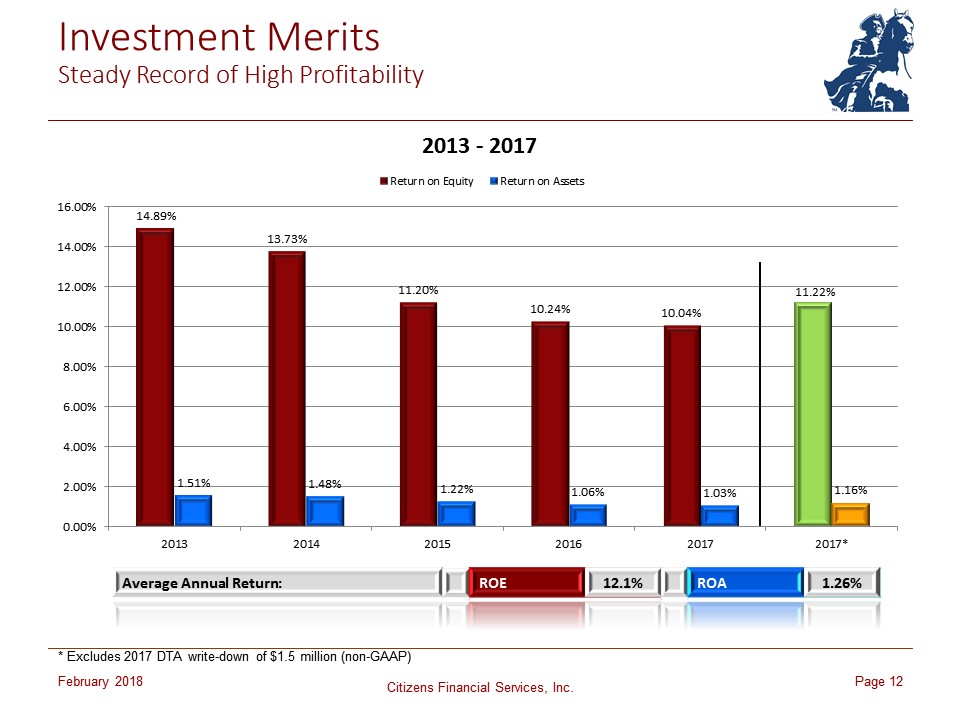

Investment MeritsSteady Record of High Profitability February 2018 Citizens Financial Services, Inc. 12 Average Annual Return: ROE 12.1% ROA 1.26% * Excludes 2017 DTA write-down of $1.5 million (non-GAAP)

Investment MeritsSteady Record of High Profitability February 2018 Citizens Financial Services, Inc. 13 * Peer group is banks with assets between $1 billion and $3 billion. Source: September 30, 2017 and December 31, 2016 Federal Reserve Bank Holding Company Performance Report.** Excludes 2017 DTA write-down of $1.5 million (non-GAAP).

Investment MeritsSteady Record of High Profitability February 2018 Citizens Financial Services, Inc. 14 * Peer group is banks with assets between $1 billion and $3 billion. Source: September 30, 2017 and December 31, 2016 Federal Reserve Bank Holding Company Performance Report.** Excludes 2017 DTA write-down of $1.5 million (non-GAAP).

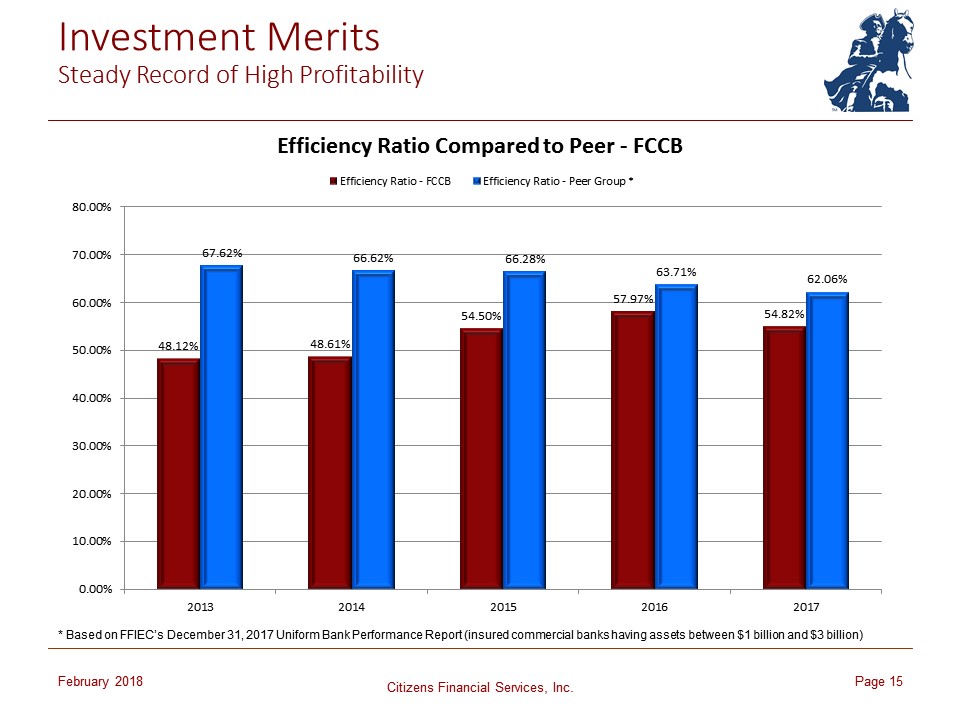

Investment MeritsSteady Record of High Profitability February 2018 Citizens Financial Services, Inc. 15 * Based on FFIEC’s December 31, 2017 Uniform Bank Performance Report (insured commercial banks having assets between $1 billion and $3 billion)

Investment MeritsSteady Record of High Profitability February 2018 Citizens Financial Services, Inc. 16

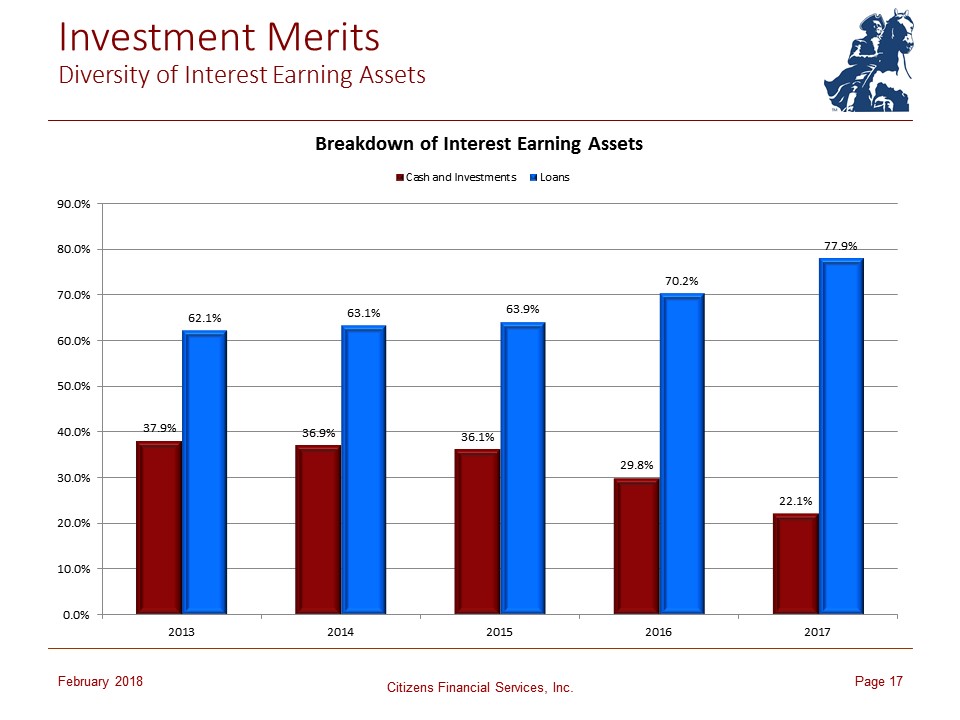

Investment MeritsDiversity of Interest Earning Assets February 2018 Citizens Financial Services, Inc. 17

Investment MeritsDiversity of Interest Earning Assets February 2018 Citizens Financial Services, Inc. 18

Investment MeritsDiversity of Interest Earning Assets February 2018 Citizens Financial Services, Inc. 19

Investment MeritsSolid Asset Quality February 2018 Citizens Financial Services, Inc. 20 * Based on FFIEC’s December 31, 2017 Uniform Bank Performance Report (insured commercial banks having assets between $1 billion and $3 billion)

Investment MeritsSolid Asset Quality February 2018 Citizens Financial Services, Inc. 21 * Based on FFIEC’s December 31, 2017 Uniform Bank Performance Report (insured commercial banks having assets between $1 billion and $3 billion)

Investment MeritsSolid Asset Quality February 2018 Citizens Financial Services, Inc. 22 * Based on FFIEC’s December 31, 2017 Uniform Bank Performance Report (insured commercial banks having assets between $1 billion and $3 billion)

Investment MeritsConsistent Shareholder Returns February 2018 Citizens Financial Services, Inc. 23

Investment MeritsConsistent Shareholder Returns February 2018 Citizens Financial Services, Inc. 24

Summary Successful and profitable franchise in attractive markets.Fundamentals remain strong, with favorable comparison to peers.For the ninth consecutive year, Citizens Financial Services has been named as one of the top 200 community banks in the country by US Banker Magazine based upon our three-year average return on equity, including #1 once in this nine year span. As of September 30, 2017, First Citizens Community Bank was ranked as one of the top 100 farm lenders by dollar volume in the nation and number 2 headquartered in the state of Pennsylvania by American Banker Magazine. In 2015, S&P Global Market Intelligence, which ranks the 100 best performing community banks with assets between $1 billion and $10 billion using six categories for analysis, ranked us 47th in our first year of eligibility since exceeding $1 billion assets. First Citizens Community Bank has been ranked #1 by the FFIEC in both small business and ag lending in Tioga, Bradford and Potter Counties. Emphasis is on remaining an independent community bank, providing outstanding customer service, and above market shareholder returns. With experienced management team and strong capital position, positioned for disciplined organic growth and accretive opportunities through acquisition. February 2018 Citizens Financial Services, Inc. 25

Citizens Financial Services, Inc.15 South Main StreetMansfield, PA 16933570-662-2121800-326-9486www.firstcitizensbank.com First Citizens Community Bank locations: Mansfield – Mansfield WalMart – Blossburg – Wellsboro – Millerton – Troy – Gillett – Canton – Towanda – Sayre Lockhart – Sayre Elmira Street – LeRaysville – Rome – Ulysses – Genesee – Mill Hall – Winfield – Fredericksburg – Lebanon Sunset – Lebanon Isabel Drive – Lebanon Valley Mall – Mt Aetna – Mount Joy – Schuylkill Haven – Friedensburg – Narvon – State College – Wellsville, NY