Attached files

| file | filename |

|---|---|

| 8-K - 8-K Q3 FY18 EARNINGS RELEASE - MoneyOnMobile, Inc. | a8-kq3fy18earningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE: Q3 FY18 EARNINGS RELEASE ANNOUNCEMENT - MoneyOnMobile, Inc. | q3fy18earningsreleasepr.htm |

Q3 -

FY2018

Earnings Call

February 21, 2018

DALLAS, TEXAS, USA

MONEYONMOBILE OTCQB:MOMT

MONEYONMOBILE OTCQB:MOMT

Presented by

2

Will Dawson

COO

Harold Montgomery

CEO and Chairman

Scott Arey

CFO

Greg Allbright

Head of Global

Communications

MONEYONMOBILE OTCQB:MOMT

Safe Harbor Provision

This presentation and comments made by management may contain forward-looking

statements that involve a number of risks and uncertainties associated with our business.

The factors that could cause our actual results of operations to differ materially from any

forward-looking statements by our management are detailed in our most recently filed Form

10-K or 10-Q’s as applicable.

We undertake no obligation to revise any of these statements to reflect future

circumstances or the occurrence of unanticipated events.

In light of the foregoing, investors are cautioned not to place undue reliance on such

forward-looking statements. This presentation does not constitute an offer to sell or a

solicitation of offers to buy any securities of any entity.

3

MONEYONMOBILE OTCQB:MOMT

Highlights

4

Two month decline in

MOM/ATM monthly net

revenue

Upcoming product launches:

Additional MOM ATM,

Fingerprint scanner, eKYC

Raised $12.6 million through two

fundraises, and restructured $6.1 in debt

Q3-2018 net revenue was 193% up from

Q3-2017 revenue

Monthly net revenue grew 210% from

January to December of 2017

MONEYONMOBILE OTCQB:MOMT

Connecting Cash-based

Indians to the Digital

World

5

MONEYONMOBILE OTCQB:MOMT

That’s 600 million people

95% of consumer payments

in India are cash-based

Half of all Indians don’t have

access to a bank account

Context

6

MONEYONMOBILE OTCQB:MOMT

Platform

Our platform aggregates transactions

making for one-stop shopping

7

Money Transfer

Mobile Top-Up

Bill Payment

Travel

Retail purchase

Insurance

e-Commerce

Cash Out

MONEYONMOBILE OTCQB:MOMT

How it Works

8

The Flow

Consumer hands

cash to retailer

MoneyOnMobile conducts

transaction with vendor

Retailer

processes cash

electronically

Consumer receives

receipt of transaction

via SMS text

MONEYONMOBILE OTCQB:MOMT

Our Results

9

Negligible customer

acquisition cost

Near zero

transaction cost

350,000

retailers

Over $2 billion

USD processed

since inception

Over 200 million

customers

touched

10

MONEYONMOBILE OTCQB:MOMT

Lowered Transactional Costs

Opens Opportunities

11

Number of Transactions

T

ran

s

a

c

ti

o

n

Si

z

e

Number of Transactions

T

ran

s

a

c

ti

o

n

Si

z

e

Card-Based

Model

Processing

Costs

Our

Processing

Costs

Card-Based Model MoneyOnMobile

Addressable

Market

Addressable

Market

MONEYONMOBILE OTCQB:MOMT

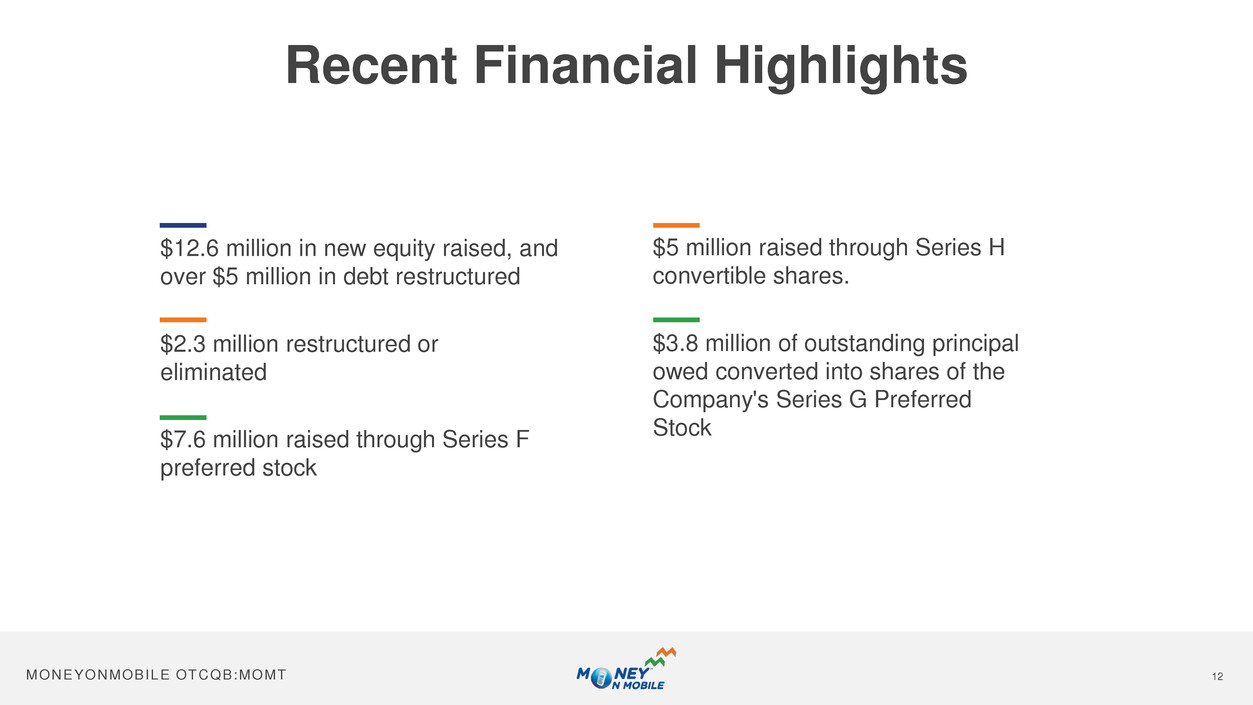

Recent Financial Highlights

12

$5 million raised through Series H

convertible shares.

$3.8 million of outstanding principal

owed converted into shares of the

Company's Series G Preferred

Stock

$12.6 million in new equity raised, and

over $5 million in debt restructured

$2.3 million restructured or

eliminated………

$7.6 million raised through Series F

preferred stock

MONEYONMOBILE OTCQB:MOMT

Vision for 2018

13

Product emphasis on expanding

MOM ATM units in stores

Demand remains strong as

evidenced by revenue growth from

existing MOM ATM deployments

Focus for growth is to deepen retailer

engagement and productivity

Expanding number of products and

services used by retailers

Goal is to increase number of

transactions per retailer; and revenue

per retailer

MONEYONMOBILE OTCQB:MOMT

Revenue Trends

Selected Financial Overview

Other Growth Drivers

Margin Trend

Financial Overview

14

MONEYONMOBILE OTCQB:MOMT

FY18-YTD FY17-YTD

Net Revenue $ 6.04 $ 3.46

Cost of Revenues $ 2.78 $ 1.55

Gross Profit $ 3.27 $ 1.91

Gross Profit Margin 54% 55%

Comparison

75%

79%

71%

-1%

Amounts shown in US$ millions

Q3-FY2018 Financials

(Year-to-Date Comparison)

15

Unaudited

MONEYONMOBILE OTCQB:MOMT

Q3-FY18 Q3-FY17

Net Revenue $ 2.84 $ 0.97

Cost of Revenues $ 1.32 $ 0.39

Gross Profit $ 1.52 $ 0.58

Gross Profit Margin 53% 59%

Comparison

193%

236%

164%

-10%

Amounts shown in US$ millions

Q3-FY2018 Financials

(Quarterly Comparison)

16

Unaudited

MONEYONMOBILE OTCQB:MOMT

Q3-FY18 Q3-FY17

Salaries & Wages $ 1.29 $ 0.83

SG&A $ 2.85 $ 2.13

Deprec & Amortization $ .14 $ 0.22

Operating Loss -$ 2.76 -$ 2.60

Comparison

56%

34%

-37%

-6%

Amounts shown in US$ millions

Q3-FY2018 Financials

(Quarterly Comparison)

17

Unaudited

MONEYONMOBILE OTCQB:MOMT

Q3-FY18 Q3-FY17

Gross Profit $ 1.52 $ 0.58

Salaries & Wages $ 0.74 $ 0.58

SG&A $ 1.05 $ 0.88

Deprec & Amortization $ 0.14 $ 0.22

Operating Loss -$ 0.42 -$ 1.11

Comparison

164%

29%

19%

-37%

62%

Amounts shown in US$ millions

Q3-FY2018 Financials – India Only

(Quarterly Comparison)

18

Unaudited

MONEYONMOBILE OTCQB:MOMT

Revenue growth

from January

thru

December 2017*

210%

Growth Drivers

2017 Financial Results

19

Unaudited

Increased # of ATM’s in the

field

Domestic remittance growing

faster than the market

Increased revenue generated

per Retailer

MONEYONMOBILE OTCQB:MOMT

FY2017-18 Net Revenue

20

Actual + Projection (Unaudited)

In US$ thousands

Q3 FY17 Q4 FY17 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18

Projectio

$969

$1,211

$2,841

$1,992

$2,300

$801

MONEYONMOBILE OTCQB:MOMT

Jul „17 Aug „17 Sep „17 Oct „17 Nov „17 Dec „17 Jan „18

Domestic

Remittance

42% 21% 17% 9% 1% 10% -10%

MOM ATM -23% 85% 20% 81% -10% -21% -71%

Mobile /

TV Top Up

19% -5% -5% -13% -15% 6% 2%

All Other 0% -12% 837% -86% 10% 2% 0%

Category Level Net Revenue

July 2017 – January 2018

21

MONEYONMOBILE OTCQB:MOMT

Bank of India MOM ATM‟s

22

Updated hardware design

…………….

Sales focus on new retailer

segment for card purchase

transactions and cash out

Contract for 3,000 new MOM ATM’s

………..

Bank of India to serve as 2nd acquirer for

MOM ATM payments

MONEYONMOBILE OTCQB:MOMT

Aadhaar Enabled Payment System (AEPS)

23

Integrates with India Stack/Open

Banking

Permits cash out withdrawals 5x

larger than current MOM ATM’s

Fingerprint scanner; biometric based

cash out solution

Target is uncarded consumer and the

retailers who serve them

MONEYONMOBILE OTCQB:MOMT

Electronic “Know Your Customer” (eKYC)

24

Enables larger domestic

remittance transfers

Sets the stage for international

remittance acceptance

Seemless collection of customer data to

integrate with existing financial

institutions

Based on Aadhaar ID and enables

customer transactions

Complies with existing regulations, and

requires minimal level of effort and

understanding

MONEYONMOBILE OTCQB:MOMT

MOM CAPITAL - UPDATE

25

Loan risk is assumed by 3rd party

provider, not MoneyOnMobile

3rd party uses retailer transaction

history to assess credit worthiness

Loan service provides transformative

financial support to retailers

Typical loan amounts will range from

$500 to $5,000 USD.

MoneyOnMobile earns a commission

based on loan amount

MONEYONMOBILE OTCQB:MOMT

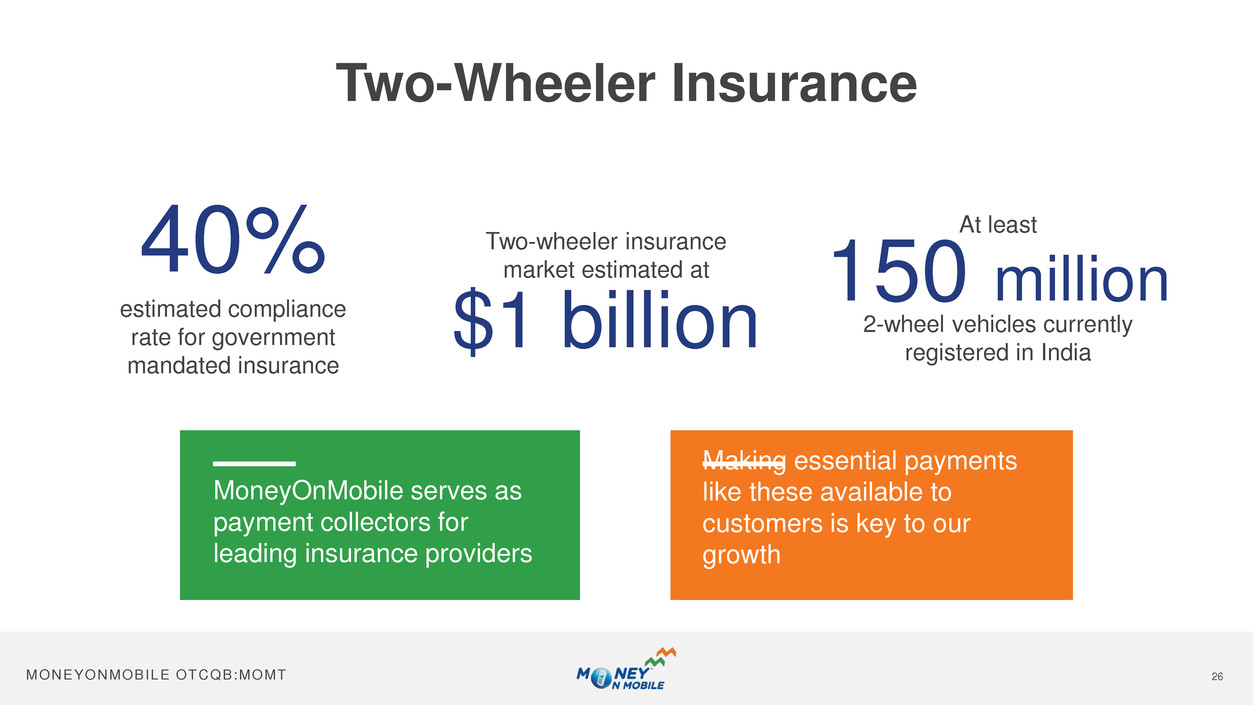

Two-Wheeler Insurance

26

Two-wheeler insurance

market estimated at

$1 billion estimated compliance rate for government

mandated insurance

40%

2-wheel vehicles currently

registered in India

150 million

At least

MoneyOnMobile serves as

payment collectors for

leading insurance providers

Making essential payments

like these available to

customers is key to our

growth

MONEYONMOBILE OTCQB:MOMT

Questions & Answers

27

Will Dawson

COO

Harold Montgomery

CEO and Chairman

Scott Arey

CFO

Greg Allbright

Head of Global

Communications

Thank you!