Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - TimkenSteel Corp | tmstexhibit32112312017.htm |

| EX-31.2 - EXHIBIT 31.2 - TimkenSteel Corp | tmstexhibit31212312017.htm |

| EX-31.1 - EXHIBIT 31.1 - TimkenSteel Corp | tmstexhibit31112312017.htm |

| EX-24.1 - EXHIBIT 24.1 - TimkenSteel Corp | tmstexhibit24112312017.htm |

| EX-23.1 - EXHIBIT 23.1 - TimkenSteel Corp | tmstexhibit23112312017.htm |

| EX-21.1 - EXHIBIT 21.1 - TimkenSteel Corp | tmstexhibit21112312017.htm |

| EX-12.1 - EXHIBIT 12.1 - TimkenSteel Corp | tmstexhibit12112312017.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-36313

TIMKENSTEEL CORPORATION (Exact name of registrant as specified in its charter) |

Ohio | 46-4024951 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

1835 Dueber Avenue SW, Canton, Ohio | 44706 | |

(Address of principal executive offices) | (Zip Code) | |

(330) 471-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Shares, without par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this Chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this Chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ý | Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates was $682,807,485 based on the closing sale price as reported on the New York Stock Exchange for that date.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

Class | Outstanding at January 31, 2018 | |

Common Shares, without par value | 44,475,795 shares | |

DOCUMENTS INCORPORATED BY REFERENCE

Document | Parts Into Which Incorporated | |

Proxy Statement for the 2018 Annual Meeting of Shareholders | Part III | |

TimkenSteel Corporation

Table of Contents

PAGE | ||

Principal Accounting Fees and Services | ||

2

PART I. FINANCIAL INFORMATION

ITEM 1. BUSINESS

Overview

TimkenSteel Corporation (we, us, our, the Company or TimkenSteel) was incorporated in Ohio on October 24, 2013, and became an independent, publicly traded company as the result of a spinoff (spinoff) from The Timken Company on June 30, 2014. In the spinoff, Timken transferred to us all of the assets and generally all of the liabilities related to Timken’s steel business.

TimkenSteel traces its roots back to The Timken Roller Bearing Company, which was founded in 1899 by carriage-maker/inventor Henry Timken and his two sons. By 1913, the Company launched its first formal research facility, centered on improving the quality of the raw materials used to make its bearings. Early research demonstrated the superiority of bearing steel made in electric-arc furnaces (rather than existing Bessemer and open hearth processes), and that finding, coupled with a desire to ensure a dependable supply of premium steel in the years leading into World War I, led to the decision to competitively produce steel in-house. When The Timken Roller Bearing Company’s Canton, Ohio steel plant became operational in 1917, it included one of the largest electric arc-furnace facilities in the country.

We manufacture alloy steel, as well as carbon and micro-alloy steel, with an annual melt capacity of approximately 2 million tons and shipment capacity of 1.5 million tons. Our portfolio includes special bar quality (SBQ) bars, seamless mechanical tubing (tubes), value-add solutions such as precision steel components, and billets. In addition, we supply machining and thermal treatment services, and we manage raw material recycling programs, which are used as a feeder system for our melt operations. Our products and services are used in a diverse range of demanding applications in the following market sectors: oil and gas; oil country tubular goods (OCTG); automotive; industrial equipment; mining; construction; rail; aerospace and defense; heavy truck; agriculture; and power generation.

Based on our knowledge of the steel industry, we believe we are the only focused SBQ steel producer in North America and have the largest SBQ steel large bar (6-inch diameter and greater) production capacity among North American steel producers. In addition, we are the only steel manufacturer able to produce rolled SBQ steel large bars up to 16-inches in diameter. SBQ steel is made to restrictive chemical compositions and high internal purity levels and is used in critical mechanical applications. We make these products from nearly 100% recycled steel, using our expertise in raw materials to create custom steel products. We focus on creating tailored products and services for our customers’ most demanding applications. Our engineers are experts in both materials and applications, so we can work closely with each customer to deliver flexible solutions related to our products as well as to their applications and supply chains. We believe our unique operating model and production assets give us a competitive advantage in our industry.

The SBQ bars, tubes, and billets production processes take place at our Canton, Ohio manufacturing location. This location accounts for all of the SBQ bars, seamless mechanical tubes, and billets we produce and includes three manufacturing facilities: the Faircrest, Harrison, and Gambrinus facilities. Our value-add solutions production processes take place at three downstream manufacturing facilities: TimkenSteel Material Services (Houston, TX), Tryon Peak (Columbus, NC), and St. Clair (Eaton, OH). Many of the production processes are integrated, and the manufacturing facilities produce products that are sold in all of our market sectors. As a result, investments in our facilities and resource allocation decisions affecting our operations are designed to benefit the overall business, not any specific aspect of the business.

Operating Segments

Effective January 1, 2016, we eliminated our segment reporting as a result of organizational changes made in the second half of 2015 to reflect the integrated nature of our business as described above. These organizational changes were made to better align resources to support the business strategy of operating in a leaner, more efficient environment. Specifically, we centralized our customer-facing activities under one leadership role and eliminated the former two segment operating structure. Since that change, we are organized in a centralized manner based on functionality. As a result, we conduct our business activities and report financial results as one business segment.

The presentation of financial results as one reportable segment is consistent with the way we operate our business under the realigned organization and is consistent with the manner in which the Chief Operating Decision Maker (CODM) evaluates performance and makes resource and operating decisions for the business as described above. Furthermore, the Company notes that monitoring financial results as one reportable segment helps the CODM manage costs on a consolidated basis, consistent with the integrated nature of our operations.

3

Industry Segments and Geographical Financial Information

Information required by this Item is incorporated herein by reference to Note 11 - Segment Information in the Notes to the Consolidated Financial Statements.

Strengths and Strategy

We believe our business model is unique in our industry and focuses on creating industry-leading tailored products and services for our customers’ most demanding applications and supply chains. Our customers depend on us to be the leader in solving their industries’ constantly evolving challenges. Our team, including degreed engineers and experienced manufacturing professionals in both materials and applications, work closely with each customer to deliver flexible solutions related to our products as well as the customer’s applications and supply chains. We believe few others can consistently deliver that kind of customization and responsiveness.

The TimkenSteel business model delivers these tailored solutions based on the following foundation:

• | Deep and experienced management and technical team. |

• | Close and trusted working relationship with customers across diverse end markets. |

• | Leadership position in niche markets with differentiated products. |

• | Track record of innovation rooted in a deep technical knowledge of steel materials, manufacturing processes and a focus on end-user applications. Our research and development efforts focus on creating solutions for our customers’ toughest challenges. |

• | On average, over a 5-year period, approximately 30% of our sales are based on new business and enhancing existing applications. |

Major Customers

We sell products and services that are used in a range of demanding applications around the world. We have over 600 diverse customers in the following market sectors: oil and gas; OCTG; automotive; industrial equipment; mining; construction; rail; aerospace and defense; heavy truck; agriculture; and power generation. In 2017, sales to one customer accounted for approximately 10% of our total sales. We do not believe the loss of this customer would have a material adverse effect on the Company.

Products

We believe we produce some of the cleanest, highest performing alloy air-melted steels in the world for our customers’ most demanding applications. Most of our steel is custom-engineered. We leverage our technical knowledge, development expertise and production and engineering capabilities across all of our products and end-markets to deliver high-performance products to our customers.

SBQ Steel Bar, Seamless Mechanical Steel Tubes, and Billets. Our focus is on alloy steel, although in total we manufacture more than 500 grades of high-performance carbon, micro-alloy and alloy steel, sold as ingots, bars, tubes and billets. These products are custom-made in a variety of chemistries, lengths and finishes. Our metallurgical expertise and what we believe to be unique operational capabilities drive high-value solutions for industrial, energy and mobile customers. Our specialty steels are featured in a wide variety of end products including: oil country drill pipe; bits and collars; gears; hubs; axles; crankshafts and connecting rods; bearing races and rolling elements; bushings; fuel injectors; wind energy shafts; anti-friction bearings; and other demanding applications where mechanical power transmission is critical to the end customer.

Value-add Precision Products and Services. In addition to our customized steels, we also custom-make precision components that provide us with the opportunity to further expand our market for bar and tube products and capture additional sales. These products provide customers, especially those in the automotive industry, with ready-to-finish components that simplify vendor management, streamline supply chains and often cost less than other alternatives. We also customize products and services for the energy market sector. We offer well-boring and finishing products that, when combined with our wide range of high-quality alloy steel bars and tubes and our expansive thermal treatment capabilities, can create a one-stop steel source for customers in the energy market sector. Our experts operate precision honing, pull-boring, skiving, outside diameter turning and milling equipment to deliver precision hole-finishing to meet exacting dimensional tolerances.

4

Sales and Distribution

Our sales force is made up largely of engineers that are backed by a team of metallurgists and other technical experts. While most of our products are sold directly to original equipment (OE) manufacturers, a portion of our sales are made through authorized distributors and steel service centers, representing approximately 18% of net sales during 2017.

The majority of our customers are served through individually-negotiated price agreements that have at least a one-year term. A smaller percentage of our customers have pricing agreements that extend for more than one year and contain prices fixed for a period extending beyond current shipments. We do not believe there is any significant loss of earnings risk with any given pricing term.

Competition

The steel industry, both domestically and globally, is highly competitive and is expected to remain so. Maintaining high standards of product quality and reliability, while keeping production costs competitive, is essential to our ability to compete with domestic and foreign manufacturers of mechanical components and alloy steel. For bar products less than 6-inch in diameter, principal competitors include foreign-owned domestic producers Gerdau Special Steel North America (a unit of Brazilian steelmaker Gerdau, S.A) and Republic Steel (a unit of Mexican steel producer ICH). For bar products up to 9-inch in diameter, domestic producers Steel Dynamics, Inc. and Nucor Corporation (in some cases up to 10-inch) are our principal competitors. For very large bars from 10 to 16 inches in diameter, offshore producers as well as specialty forging companies in North America such as Scot Forge and Sorel Steel are the primary competitors. For seamless mechanical tubing, offshore producers such as Tenaris, S.A., Vallourec, S.A. and TMK Group are our primary competitors as well as the foreign-owned domestic producer ArcelorMittal Tubular Products (a unit of Luxembourg based ArcelorMittal, S.A.). We also provide unique value-add steel products and supply chain solutions to our customers in the industrial, energy and automotive sectors.

Backlog

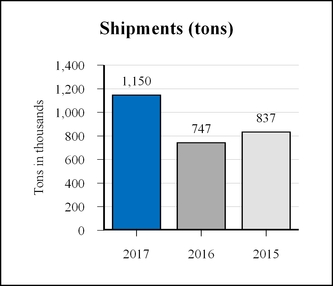

The backlog of orders for our operations is estimated to have been approximately 410,000 and 200,000 tons at December 31, 2017 and 2016, respectively.

Virtually our entire backlog at December 31, 2017 is scheduled for delivery in the succeeding 12 months. Actual shipments depend upon customers’ production schedules, and may not be a meaningful indicator of future sales. Accordingly, we do not believe our backlog data, or comparisons thereof as of different dates, reliably indicate future sales or shipments.

Raw Materials

The principal raw materials that we use to manufacture steel are recycled scrap metal, chrome, nickel, molybdenum oxide, vanadium and other alloy materials. Raw materials comprise a significant portion of the steelmaking cost structure and are subject to price and availability changes due to global demand fluctuations and local supply limitations. Proper selection and management of raw materials can have a significant impact on procurement cost, flexibility to supply changes, steelmaking energy costs and mill productivity. Because of our diverse order book and demanding steel requirements, we have developed differentiated expertise in this area and have created a raw material management system that contributes to our competitive cost position and advantage. In addition to accessing scrap and alloys through the open market, we have established a scrap return supply chain with many of our customers, and we operate a scrap processing company for improved access, reliability and cost. This part of our business solidly rests on a deep knowledge of the raw material supply industry and an extensive network of relationships that result in steady, reliable supply from our raw material sources.

Research and Development

Our engineers analyze customer application challenges and develop new solutions to address them. With a century of experience in materials science and steelmaking, we leverage our technical know-how to improve the performance of our customers’ products and supply chains.

This expertise extends to advanced process technology in which advanced material conversion, finishing, gaging and assembly enables high quality production of our products. With resources dedicated to studying, developing and implementing new manufacturing processes and technologies, we are able to support new product growth and create value for our customers.

Our research and development expenditures for the years ended December 31, 2017, 2016 and 2015 were $8.0 million, $8.0 million and $8.6 million, respectively.

5

Environmental Matters

We consider compliance with environmental regulations and environmental sustainability to be our responsibility as a good corporate citizen and a key strategic focus area. We have invested in pollution control equipment and updated plant operational practices and are committed to implementing a documented environmental management system worldwide, which includes being certified under the ISO 14001 Standard. All of our domestic steel making operations, our water treatment plant, and two of our four value-add plants have obtained and maintain ISO 14001 certification. Our value-add facility in Houston has started the ISO 14001 certification process, which it expects to achieve in 2018.

We believe we have established appropriate reserves to cover our environmental expenses. We have a well-established environmental compliance audit program for our domestic units and any international facilities that process steel. This program measures performance against applicable laws as well as against internal standards that have been established for all units. It is difficult to assess the possible effect of compliance with future requirements that differ from existing ones both domestically and internationally. As previously reported, we are unsure of the future financial impact to us from the U.S. Environmental Protection Agency’s (EPA) rule changes related to the Clean Air Act (CAA), Clean Water Act (CWA), waste and other environmental rules and regulations.

We and certain of our subsidiaries located in the U.S. have been identified as potentially responsible parties under the Toxic Substances Control Act (TSCA), Resource Conservation and Recovery Act (RCRA), CAA and CWA, as well as other laws. In general, certain cost allocations for investigation and remediation have been asserted by us against other entities, which are believed to be financially solvent and are expected to substantially fulfill their proportionate share of any obligations.

From time to time, we may be a party to lawsuits, claims or other proceedings related to environmental matters and/or receive notices of potential violations of environmental laws and regulations from the EPA and similar state or local authorities. As of December 31, 2017 and 2016, we recorded reserves for such environmental matters of $0.5 million and $0.6 million, respectively. Accruals related to such environmental matters represent management’s best estimate of the fees and costs associated with these matters. Although it is not possible to predict with certainty the outcome of such matters, management believes the ultimate disposition of these matters should not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Legal Proceedings

We are involved in various claims and legal actions arising in the ordinary course of business. In the opinion of our management, the ultimate disposition of these matters will not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Patents, Trademarks and Licenses

While we own a number of U.S. and foreign patents, trademarks, licenses and copyrights, none are material to our products and production processes.

Employment

At December 31, 2017, we had approximately 2,830 employees, with about 61% of our employees covered under one of two collective bargaining agreements that expire in December 2019 and September 2021.

Available Information

We use our Investor Relations website at http://investors.timkensteel.com, as a channel for routine distribution of important information, including news releases, analyst presentations and financial information. We post filings (including our annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K, respectively; our proxy statements and any amendments to those reports or statements) as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). All such postings and filings are available on our website free of charge. In addition, our website allows investors and other interested persons to sign up to automatically receive e-mail alerts when we post news releases and financial information on our website. The SEC also maintains a website, www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report unless expressly noted.

6

ITEM 1A. RISK FACTORS

The following are certain risk factors that could affect our business, financial condition and results of operations. The risks that are highlighted below are not the only ones we face. You should carefully consider each of the following risks and all of the other information contained in this Annual Report on Form 10-K. Some of these risks relate principally to our business and the industry in which we operate, while others relate principally to our debt, the securities markets in general, ownership of our common shares and our spinoff from Timken. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected.

Risks Relating to Our Industry and Our Business

Competition in the steel industry, together with potential global overcapacity, could result in significant pricing pressure for our products.

Competition within the steel industry, both domestically and worldwide, is intense and is expected to remain so. The steel industry has historically been characterized by periods of excess global capacity and supply. Excess global capacity and supply has negatively affected, and could continue to negatively affect domestic steel prices, which could adversely impact our results of operations and financial condition. High levels of steel imports into the U.S. could exacerbate a decrease in domestic steel prices.

Additionally, in some applications, steel competes with other materials. Increased use of materials in substitution for steel products could have a material adverse effect on prices and demand for our steel products.

Any change in the operation of our raw material surcharge mechanisms, a raw material market index or the availability or cost of raw materials and energy resources could materially affect our revenues and earnings.

We require substantial amounts of raw materials, including scrap metal and alloys and natural gas, to operate our business. Many of our customer agreements contain surcharge pricing provisions that are designed to enable us to recover raw material cost increases. The surcharges are generally tied to a market index for that specific raw material. Recently, many raw material market indices have reflected significant fluctuations. Any change in a raw material market index could materially affect our revenues. Any change in the relationship between the market indices and our underlying costs could materially affect our earnings. Any change in our projected year-end input costs could materially affect our last-in, first-out (LIFO) inventory valuation method and earnings.

Moreover, future disruptions in the supply of our raw materials could impair our ability to manufacture our products for our customers or require us to pay higher prices in order to obtain these raw materials from other sources, and could thereby affect our sales and profitability. Any increase in the prices for such raw materials could materially affect our costs and therefore our earnings.

We rely to a substantial extent on third parties to supply certain raw materials that are critical to the manufacture of our products. Purchase prices and availability of these critical raw materials are subject to volatility. At any given time we may be unable to obtain an adequate supply of these critical raw materials on a timely basis, on acceptable price and other terms, or at all. If suppliers increase the price of critical raw materials, we may not have alternative sources of supply. In addition, to the extent we have quoted prices to customers and accepted customer orders or entered into agreements for products prior to purchasing necessary raw materials, we may be unable to raise the price of products to cover all or part of the increased cost of the raw materials.

Our operating results depend in part on continued successful research, development and marketing of new and/or improved products and services, and there can be no assurance that we will continue to successfully introduce new products and services.

The success of new and improved products and services depends on their initial and continued acceptance by our customers. Our business is affected, to varying degrees, by technological change and corresponding shifts in customer demand, which could result in unpredictable product transitions or shortened life cycles. We may experience difficulties or delays in the research, development, production, or marketing of new products and services that may prevent us from recouping or realizing a return on the investments required to bring new products and services to market.

New technologies in the steel industry may: (a) improve cost competitiveness; (b) increase production capabilities; or (c) improve operational efficiency compared to our current production methods. However, we may not have sufficient capital to invest in such technologies or to make certain capital improvements, and may, from time to time, incur cost over-runs and difficulties adapting and fully integrating these technologies or capital improvements into our existing operations. We may also encounter

7

control or production restrictions, or not realize the cost benefit from such capital-intensive technology adaptations or capital improvements to our current production processes. Customers continue to demand stronger and lighter products, among other adaptations to traditional products. We may not be successful in meeting these technological challenges and there may be increased liability exposure connected with the supply of additional products and services or an adverse impact to our results of operations and profitability.

Our business is capital-intensive, and if there are downturns in the industries we serve, we may be forced to significantly curtail or suspend operations with respect to those industries, which could result in our recording asset impairment charges or taking other measures that may adversely affect our results of operations and profitability.

Our business operations are capital-intensive. If there are downturns in the industries we serve, we may be forced to significantly curtail or suspend our operations with respect to those industries, including laying-off employees, recording asset impairment charges and other measures. In addition, we may not realize the benefits or expected returns from announced plans, programs, initiatives and capital investments. Any of these events could adversely affect our results of operations and profitability.

We are dependent on our key customers.

As a result of our dependence on our key customers, we could experience a material adverse effect on our business, financial condition and results of operations if any of the following, among other things, were to occur: (a) a loss of any key customer, or a material amount of business from such key customer; (b) the insolvency or bankruptcy of any key customer; (c) a declining market in which customers reduce orders; or (d) a strike or work stoppage at a key customer facility, which could affect both its suppliers and customers. For the year ended December 31, 2017, sales to our 10 and 20 largest customers accounted for approximately 50% and 65% of our net sales, respectively.

Weakness in global economic conditions or in any of the industries or geographic regions in which we or our customers operate, as well as the cyclical nature of our customers’ businesses generally or sustained uncertainty in financial markets, could adversely impact our revenues and profitability by reducing demand and margins.

Our results of operations may be materially affected by conditions in the global economy generally and in global capital markets. There has been volatility in the capital markets and in the end markets and geographic regions in which we or our customers operate, which has negatively affected our revenues. Many of the markets in which our customers participate are also cyclical in nature and experience significant fluctuations in demand for our steel products based on economic conditions, consumer demand, raw material and energy costs, and government actions, and many of these factors are beyond our control.

A decline in consumer and business confidence and spending, together with severe reductions in the availability and increased cost of credit, as well as volatility in the capital and credit markets, could adversely affect the business and economic environment in which we operate and the profitability of our business. We also are exposed to risks associated with the creditworthiness of our suppliers and customers. If the availability of credit to fund or support the continuation and expansion of our customers’ business operations is curtailed or if the cost of that credit is increased, the resulting inability of our customers or of their customers to either access credit or absorb the increased cost of that credit could adversely affect our business by reducing our sales or by increasing our exposure to losses from uncollectible customer accounts. These conditions and a disruption of the credit markets could also result in financial instability of some of our suppliers and customers. The consequences of such adverse effects could include the interruption of production at the facilities of our customers, the reduction, delay or cancellation of customer orders, delays or interruptions of the supply of raw materials or other inputs we purchase, and bankruptcy of customers, suppliers or other creditors. Any of these events could adversely affect our profitability, cash flow and financial condition.

Our capital resources may not be adequate to provide for all of our cash requirements, and we are exposed to risks associated with financial, credit, capital and banking markets.

In the ordinary course of business, we will seek to access competitive financial, credit, capital and/or banking markets. Currently, we believe we have adequate capital available to meet our reasonably anticipated business needs based on our historic financial performance, as well as our expected financial position. However, if we need to obtain additional financing in the future, to the extent our access to competitive financial, credit, capital and/or banking markets was to be impaired, our operations, financial results and cash flows could be adversely impacted.

Product liability, warranty and product quality claims could adversely affect our operating results.

We produce high-performance carbon and alloy steel, sold as ingots, bars, tubes and billets in a variety of chemistries, lengths and finishes designed for our customers’ demanding applications. Failure of the materials that are included in our customers’ applications could give rise to product liability or warranty claims. There can be no assurance that our insurance coverage will be

8

adequate or continue to be available on terms acceptable to us. If we fail to meet a customer’s specifications for its products, we may be subject to product quality costs and claims. A successful warranty or product liability claim against us could have a material adverse effect on our earnings.

The cost and availability of electricity and natural gas are also subject to volatile market conditions.

Steel producers like us consume large amounts of energy. We rely on third parties for the supply of energy resources we consume in our steelmaking activities. The prices for and availability of electricity, natural gas, oil and other energy resources are also subject to volatile market conditions, often affected by weather conditions as well as political and economic factors beyond our control. As a large consumer of electricity and gas, we must have dependable delivery in order to operate. Accordingly, we are at risk in the event of an energy disruption. Prolonged black-outs or brown-outs or disruptions caused by natural disasters or governmental action would substantially disrupt our production. Moreover, many of our finished steel products are delivered by truck. Unforeseen fluctuations in the price of fuel would also have a negative impact on our costs or on the costs of many of our customers. In addition, changes in certain environmental laws and regulations, including those that may impose output limitations or higher costs associated with climate change or greenhouse gas emissions, could substantially increase the cost of manufacturing and raw materials, such as energy, to us and other U.S. steel producers.

We may incur restructuring and impairment charges that could materially affect our profitability.

Changes in business or economic conditions, or our business strategy, may result in actions that require us to incur restructuring or impairment charges in the future, which could have a material adverse effect on our earnings.

We are subject to extensive environmental, health and safety laws and regulations, which impose substantial costs and limitations on our operations, and environmental, health and safety compliance and liabilities may be more costly than we expect.

We are subject to extensive federal, state, local and foreign environmental, health and safety laws and regulations concerning matters such as worker health and safety, air emissions, wastewater discharges, hazardous material and solid and hazardous waste use, generation, handling, treatment and disposal and the investigation and remediation of contamination. We are subject to the risk of substantial liability and limitations on our operations due to such laws and regulations. The risks of substantial costs and liabilities related to compliance with these laws and regulations, which tend to become more stringent over time, are an inherent part of our business, and future conditions may develop, arise or be discovered that create substantial environmental compliance or remediation or other liabilities and costs.

Compliance with environmental, health and safety legislation and regulatory requirements may prove to be more limiting and costly than we anticipate. To date, we have committed significant expenditures in our efforts to achieve and maintain compliance with these requirements, and we expect that we will continue to make significant expenditures related to such compliance in the future. From time to time, we may be subject to legal proceedings brought by private parties or governmental authorities with respect to environmental matters, including matters involving alleged contamination, property damage or personal injury. New laws and regulations, including those that may relate to emissions of greenhouse gases, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements, could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition or results of operations.

From both a medium- and long-term perspective, we are likely to see an increase in costs relating to our assets that emit relatively significant amounts of greenhouse gases as a result of new and existing legal and regulatory initiatives. These initiatives will be either voluntary or mandatory and may impact our operations directly or through our suppliers or customers. Until the timing, scope and extent of any future legal and regulatory initiatives become known, we cannot predict the effect on our business, financial condition or results of operations.

Unexpected equipment failures or other disruptions of our operations may increase our costs and reduce our sales and earnings due to production curtailments or shutdowns.

Interruptions in production capabilities would likely increase our production costs and reduce sales and earnings for the affected period. In addition to equipment failures, our facilities and information technology systems are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions or violent weather conditions. Our manufacturing processes are dependent upon critical pieces of equipment for which there may be only limited or no production alternatives, such as furnaces, continuous casters and rolling equipment, as well as electrical equipment, such as transformers, and this equipment may, on occasion, be out of service as a result of unanticipated failures. In the future, we may experience material plant shutdowns or

9

periods of reduced production as a result of these types of equipment failures, which could cause us to lose or prevent us from taking advantage of various business opportunities or prevent us from responding to competitive pressures.

A significant portion of our manufacturing facilities are located in Stark County, Ohio, which increases the risk of a significant disruption to our business as a result of unforeseeable developments in this geographic area.

It is possible that we could experience prolonged periods of reduced production due to unforeseen catastrophic events occurring in or around our manufacturing facilities in Stark County, Ohio. As a result, we may be unable to shift manufacturing capabilities to alternate locations, accept materials from suppliers, meet customer shipment deadlines or address other significant issues, any of which could have a material adverse effect on our business, financial condition or results of operations.

We may be subject to risks relating to our information technology systems and cybersecurity.

We rely on information technology systems to process, transmit and store electronic information and manage and operate our business. A breach in security could expose us and our customers and suppliers to risks of misuse of confidential information, manipulation and destruction of data, production downtimes and operations disruptions, which in turn could adversely affect our reputation, competitive position, business or results of operations. While we have taken reasonable steps to protect the Company from cybersecurity risks and security breaches (including enhancing our firewall, workstation, email security and network monitoring and alerting capabilities, and training employees around phishing, malware and other cybersecurity risks), and we have policies and procedures to prevent or limit the impact of systems failures, interruptions, and security breaches, there can be no assurance that such events will not occur or that they will be adequately addressed if they do. Although we rely on commonly used security and processing systems to provide the security and authentication necessary to effect the secure transmission of data, these precautions may not protect our systems from all potential compromises or breaches of security.

Work stoppages or similar difficulties could significantly disrupt our operations, reduce our revenues and materially affect our earnings.

A work stoppage at one or more of our facilities could have a material adverse effect on our business, financial condition and results of operations. As of December 31, 2017, approximately 61% of our employees were covered under one of two collective bargaining agreements that expire in December 2019 and September 2021. Any failure to negotiate and conclude new collective bargaining agreements with the unions when the existing agreements expire could cause work interruptions or stoppages. Also, if one or more of our customers were to experience a work stoppage, that customer may halt or limit purchases of our products, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to a wide variety of domestic and foreign laws and regulations that could adversely affect our results of operations, cash flow or financial condition.

We are subject to a wide variety of domestic and foreign laws and regulations, and legal compliance risks, including securities laws, tax laws, employment and pension-related laws, competition laws, U.S. and foreign export and trading laws, and laws governing improper business practices. We are affected by new laws and regulations, and changes to existing laws and regulations, including interpretations by courts and regulators. With respect to tax laws, with the finalization of specific actions (Actions) contained within the Organization for Economic Development and Cooperation’s (OECD) Base Erosion and Profit study, many OECD countries have acknowledged their intent to implement the Actions and update their local tax regulations. The extent (if any) to which countries in which we operate adopt and implement the Actions could affect our effective tax rate and our future results from non-U.S. operations.

Compliance with the laws and regulations described above or with other applicable foreign, federal, state, and local laws and regulations currently in effect or that may be adopted in the future could materially adversely affect our competitive position, operating results, financial condition and liquidity.

If we are unable to attract and retain key personnel, our business could be materially adversely affected.

Our business substantially depends on the continued service of key members of our management. The loss of the services of a significant number of members of our management could have a material adverse effect on our business. Modern steel-making uses specialized techniques and advanced equipment that requires experienced engineers and skilled laborers. Our future success will depend on our ability to attract and retain such highly skilled personnel, as well as finance, marketing and senior management professionals. Competition for these employees is intense, and we could experience difficulty from time to time in hiring and retaining the personnel necessary to support our business. If we do not succeed in retaining our current employees and attracting new high-quality employees, our business could be materially adversely affected.

10

We may not realize the improved operating results that we anticipate from past and future acquisitions and we may experience difficulties in integrating acquired businesses.

We may seek to grow, in part, through strategic acquisitions and joint ventures, which are intended to complement or expand our businesses. These acquisitions could involve challenges and risks. In the event that we do not successfully integrate these acquisitions into our existing operations so as to realize the expected return on our investment, our results of operations, cash flows or financial condition could be adversely affected.

Our ability to use our net operating loss and credit carryforwards to offset future taxable income may be subject to certain limitations.

As of December 31, 2017, we have loss carryforwards totaling $335 million (of which $289 million relates to the U.S.

and $46 million relates to various non-U.S. jurisdictions), having various expiration dates, as well as certain credit carryforwards. The majority of the non-U.S. loss carryforwards represent local country net operating losses for entities treated as branches of TimkenSteel under U.S. tax law. Operating losses generated in the U.S. resulted in a decrease in the carrying value of our U.S. deferred tax liability to the point of a net U.S. deferred tax asset at December 31, 2016. At that time, we assessed, based upon operating performance in the U.S. and industry conditions that it was more likely than not we would not realize a portion of our U.S. deferred tax assets. The Company recorded a valuation allowance in 2016 and remained in a valuation allowance position in 2017. Going forward, the need to maintain valuation allowances against deferred tax assets in the U.S. and other affected countries will cause variability in our effective tax rate. We will maintain a valuation allowance against our deferred tax assets in the U.S. and applicable foreign countries until sufficient positive evidence exists to eliminate them. Our ability to utilize our net operating loss and credit carryforwards is dependent upon our ability to generate taxable income in future periods and may be limited due to restrictions imposed on utilization of net operating loss and credit carryforwards under federal and state laws upon a change in ownership. Refer to Note 12 - Income Tax Provision in the Notes to the Consolidated Financial Statements for more information.

Section 382 and Section 383 of the Internal Revenue Code of 1986, as amended (the “Code”), provide an annual limitation on our ability to utilize our U.S. net operating loss and credit carryforwards against future U.S. taxable income in the event of a change in ownership, as defined in the Code, which could result from one or more transactions involving our shares, including transactions that are outside of our control, as well as the issuance of shares upon conversion of our 6.00% Convertible Senior Notes due 2021 (Convertible Notes). Accordingly, such transactions could adversely impact our ability to offset future tax liabilities and, therefore, adversely affect our financial condition, net income and cash flow. Refer to Note 6 - Financing Arrangements in the Notes to the Consolidated Financial Statements for more information.

Risks related to our debt

Our substantial debt could adversely affect our financial health and we may not be able to generate sufficient cash to service our debt.

We have substantial debt and, as a result, we have significant debt service obligations. As of December 31, 2017, we had outstanding debt of approximately $165.3 million. Our debt may:

• | make it more difficult for us to satisfy our financial obligations under our indebtedness and our contractual and commercial commitments and increase the risk that we may default on our debt obligations; |

• | require us to use a substantial portion of our cash flow from operations to pay interest and principal on our debt, which would reduce the funds available for working capital, capital expenditures and other general corporate purposes; |

• | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions and other investments, or general corporate purposes, which may limit the ability to execute our business strategy and affect the market price of our common shares; |

• | heighten our vulnerability to downturns in our business, our industry or in the general economy and restrict us from exploiting business opportunities or making acquisitions; |

• | place us at a competitive disadvantage compared to those of our competitors that may have less debt; |

• | limit management’s discretion in operating our business; |

• | limit our flexibility in planning for, or reacting to, changes in our business, the industry in which we operate or the general economy; and |

11

• | result in higher interest expense if interest rates increase and we have outstanding floating rate borrowings. |

We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on (as well as any cash due upon conversion of) our debt. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our debt. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. If our operating results and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or to obtain the proceeds that we could realize from them, and these proceeds may not be adequate to meet any debt service obligations then due. Further, we may need to refinance all or a portion of our debt on or before maturity, and we cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or at all.

Restrictive covenants in the agreements governing our other indebtedness may restrict our ability to operate our business, which may affect the market price of our common shares.

Our Amended and Restated Credit Agreement, dated as of December 21, 2015, as further amended on February 26, 2016 (as amended, the Credit Agreement) contains, and agreements governing indebtedness we may incur in the future may contain, covenants that restrict our ability to, among other things, incur additional debt, pay dividends, make investments, enter into transactions with affiliates, merge or consolidate with other entities or sell all or substantially all of our assets.

On January 26, 2018, we entered into a Second Amended and Restated Credit Agreement (Amended Credit Agreement), which amends and restates the Company’s existing Credit Agreement. The Amended Credit Agreement contains covenants that restrict our ability to, among other things, incur or suffer to exist certain liens, make investments, incur or guaranty additional indebtedness, enter into consolidations, mergers, acquisitions, sale-leaseback transactions and sales of assets, make distributions and other restricted payments, change the nature of its business, engage in transactions with affiliates and enter into restrictive agreements, including agreements that restrict the ability to incur liens or make distributions.

A breach of any of these covenants could result in a default, which could allow the lenders to declare all amounts outstanding under the applicable debt immediately due and payable and which may affect the market price of our common shares. We may also be prevented from taking advantage of business opportunities that arise because of the limitations imposed on us by the restrictive covenants under our indebtedness. Refer to Note 6 - Financing Arrangements in the Notes to the Consolidated Financial Statements for more detail on the Credit Agreement. Refer to Note 16 - Subsequent Events in the Notes to the Consolidated Financial Statements for more detail regarding the Amended Credit Agreement.

The conditional conversion feature of the Convertible Notes, if triggered, may adversely affect our financial condition and operating results.

In the event the conditional conversion feature of the Convertible Notes (refer to Note 6 - Financing Arrangements in the Notes to the Consolidated Financial Statements) is triggered, holders of Convertible Notes will be entitled to convert the Convertible Notes at any time during specified periods at their option. If one or more holders elect to convert their Convertible Notes, unless we elect to satisfy our conversion obligation by delivering solely our common shares (other than paying cash in lieu of delivering any fractional share), we would be required to settle a portion or all of our conversion obligation through the payment of cash, which could adversely affect our liquidity. In addition, even if holders do not elect to convert their Convertible Notes, we could be required under applicable accounting rules to reclassify all or a portion of the outstanding principal of the Convertible Notes as a current rather than long-term liability, which would result in a material reduction of our net working capital.

12

Risks related to our common shares

The price of our common shares may fluctuate significantly.

The market price of our common shares may fluctuate significantly in response to many factors, including:

• | actual or anticipated changes in operating results or business prospects; |

• | changes in financial estimates by securities analysts; |

• | an inability to meet or exceed securities analysts’ estimates or expectations; |

• | conditions or trends in our industry or sector; |

• | the performance of other companies in our industry or sector and related market valuations; |

• | announcements by us or our competitors of significant acquisitions, strategic partnerships, divestitures, joint ventures or other strategic initiatives; |

• | general financial, economic or political instability; |

• | hedging or arbitrage trading activity in our common shares; |

• | changes in interest rates; |

• | capital commitments; |

• | additions or departures of key personnel; and |

• | future sales of our common shares or securities convertible into, or exchangeable or exercisable for, our common shares. |

Many of the factors listed above are beyond our control. These factors may cause the market price of our common shares to decline, regardless of our financial condition, results of operations, business or prospects.

Provisions in our corporate documents and Ohio law could have the effect of delaying, deferring or preventing a change in control of us, even if that change may be considered beneficial by some of our shareholders, which could reduce the market price of our common shares.

The existence of some provisions of our articles of incorporation and regulations and Ohio law could have the effect of delaying, deferring or preventing a change in control of us that a shareholder may consider favorable. These provisions include:

• | providing that our board of directors fixes the number of members of the board; |

• | providing for the division of our board of directors into three classes with staggered terms; |

• | establishing advance notice requirements for nominations of candidates for election to our board of directors or for proposing matters that can be acted on by shareholders at shareholder meetings; and |

• | authorizing the issuance of “blank check” preferred shares, which could be issued by our board of directors to increase the number of outstanding securities of ours with voting rights and thwart a takeover attempt. |

As an Ohio corporation, we are subject to Chapter 1704 of the Ohio Revised Code. Chapter 1704 prohibits certain corporations from engaging in a “Chapter 1704 transaction” (described below) with an “interested shareholder” for a period of three years after the date of the transaction in which the person became an interested shareholder, unless, among other things, prior to the interested shareholder’s share acquisition date, the directors of the corporation have approved the transaction or the purchase of shares on the share acquisition date.

After the three-year moratorium period, the corporation may not consummate a Chapter 1704 transaction unless, among other things, it is approved by the affirmative vote of the holders of at least two-thirds of the voting power in the election of directors and the holders of a majority of the voting shares, excluding all shares beneficially owned by an interested shareholder or an affiliate or associate of an interested shareholder, or the shareholders receive certain minimum consideration for their shares. A Chapter 1704 transaction includes certain mergers, sales of assets, consolidations, combinations and majority share acquisitions

13

involving an interested shareholder. An interested shareholder is defined to include, with limited exceptions, any person who, together with affiliates and associates, is the beneficial owner of a sufficient number of shares of the corporation to entitle the person, directly or indirectly, alone or with others, to exercise or direct the exercise of 10% or more of the voting power in the election of directors after taking into account all of the person’s beneficially owned shares that are not then outstanding.

We are also subject to Section 1701.831 of the Ohio Revised Code, which requires the prior authorization of the shareholders of certain corporations in order for any person to acquire, either directly or indirectly, shares of that corporation that would entitle the acquiring person to exercise or direct the exercise of 20% or more of the voting power of that corporation in the election of directors or to exceed specified other percentages of voting power. The acquiring person may complete the proposed acquisition only if the acquisition is approved by the affirmative vote of the holders of at least a majority of the voting power of all shares entitled to vote in the election of directors represented at the meeting, excluding the voting power of all “interested shares.” Interested shares include any shares held by the acquiring person and those held by officers and directors of the corporation.

We believe these provisions protect our shareholders from coercive or otherwise unfair takeover tactics by requiring potential acquirors to negotiate with our board of directors and by providing our board of directors with more time to assess any acquisition proposal, and are not intended to make our Company immune from takeovers. However, these provisions apply even if the offer may be considered beneficial by some shareholders and could delay, defer or prevent an acquisition that our board of directors determines is not in the best interests of our Company and our shareholders, which under certain circumstances could reduce the market price of our common shares.

We may issue preferred shares with terms that could dilute the voting power or reduce the value of our common shares.

Our articles of incorporation authorize us to issue, without the approval of our shareholders, one or more classes or series of preferred shares having such designation, powers, preferences and relative, participating, optional and other special rights, including preferences over our common shares respecting dividends and distributions, as our board of directors generally may determine. The terms of one or more classes or series of preferred shares could dilute the voting power or reduce the value of our common shares. For example, we could grant holders of preferred shares the right to elect some number of our directors in all events or on the happening of specified events or the right to veto specified transactions. Similarly, the repurchase or redemption rights or liquidation preferences we could assign to holders of preferred shares could affect the residual value of the common shares.

Risks Relating to the Spinoff

We remain subject to continuing contingent liabilities of Timken following the spinoff.

There are several significant areas where the liabilities of The Timken Company may yet become our obligations. The separation and distribution agreement and employee matters agreement generally provide that we are responsible for substantially all liabilities that relate to our steel business activities, whether incurred prior to or after the spinoff, as well as those liabilities of The Timken Company specifically assumed by us. In addition, under the Internal Revenue Code (Code) and the related rules and regulations, each corporation that was a member of the The Timken Company consolidated tax reporting group during any taxable period or portion of any taxable period ending on or before the completion of the spinoff is jointly and severally liable for the federal income tax liability of the entire The Timken Company consolidated tax reporting group for that taxable period. In connection with the spinoff, we entered into a tax sharing agreement with The Timken Company that allocated the responsibility for prior period taxes of the The Timken Company consolidated tax reporting group between us and The Timken Company. However, if The Timken Company is unable to pay any prior period taxes for which it is responsible, we could be required to pay the entire amount of such taxes. Other provisions of federal law establish similar liability for other matters, including laws governing tax-qualified pension plans as well as other contingent liabilities.

14

Potential liabilities associated with certain assumed obligations under the tax sharing agreement cannot be precisely quantified at this time.

Under the tax sharing agreement with The Timken Company, we are responsible generally for all taxes paid after the spinoff attributable to us or any of our subsidiaries, whether accruing before, on or after the spinoff. We also have agreed to be responsible for, and to indemnify The Timken Company with respect to, all taxes arising as a result of the spinoff (or certain internal restructuring transactions) failing to qualify as transactions under Sections 368(a) and 355 of the Code for U.S. federal income tax purposes (which could result, for example, from a merger or other transaction involving an acquisition of our shares) to the extent such tax liability arises as a result of any breach of any representation, warranty, covenant or other obligation by us or certain affiliates made in connection with the issuance of the tax opinion relating to the spinoff or in the tax sharing agreement. As described above, such tax liability would be calculated as though The Timken Company (or its affiliate) had sold its common shares of our Company in a taxable sale for their fair market value, and The Timken Company (or its affiliate) would recognize taxable gain in an amount equal to the excess of the fair market value of such shares over its tax basis in such shares. That tax liability could have a material adverse effect on our Company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We are headquartered in Canton, Ohio, at a facility we own in fee. We have facilities in five countries: U.S., China, U.K., Mexico and Poland. We lease sales offices in all of these countries.

We have manufacturing facilities at multiple locations in the U.S. These manufacturing facilities are located in Akron, Canton and Eaton, Ohio; Houston, Texas; and Columbus, North Carolina. In addition to these manufacturing facilities, we own or lease warehouses and distribution facilities in the U.S., Mexico and China. The aggregate floor area of these facilities is 3.8 million square feet, of which approximately 154,000 square feet is leased and the rest is owned in fee. The buildings occupied by us are principally made of brick, steel, reinforced concrete and concrete block construction.

15

Our facilities vary in age and condition, and each of them has an active maintenance program to ensure a safe operating environment and to keep the facilities in good condition. We believe our facilities are in satisfactory operating condition and are suitable and adequate to conduct our business and support future growth.

Please refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations for further discussion of our melt capacity utilization.

ITEM 3. LEGAL PROCEEDINGS

We are involved in various claims and legal actions arising in the ordinary course of business. In the opinion of our management, the ultimate disposition of these matters will not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

16

ITEM 4A. EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers are elected by the Board of Directors normally for a term of one year and until the election of their successors. All of the following officers have been with the Company for at least five years in some capacity, except Frank A. DiPiero, who joined the Company in 2014. The executive officers of our Company as of February 20, 2018, are as follows:

Name | Age | Current Position | |

Ward J. Timken, Jr. | 50 | Chairman, Chief Executive Officer and President | |

Christopher J. Holding | 59 | Executive Vice President and Chief Financial Officer | |

Frank A. DiPiero | 61 | Executive Vice President, General Counsel and Secretary | |

Thomas D. Moline | 55 | Executive Vice President, Commercial Operations | |

William P. Bryan | 58 | Executive Vice President, Manufacturing, Supply Chain and Information Technology | |

Ward J. Timken, Jr. is Chairman of the Board of Directors, Chief Executive Officer and President. Prior to the spinoff, Mr. Timken served as a director of The Timken Company beginning in 2002 (a position which he still holds) and as Chairman of the Board of Directors of The Timken Company from 2005 until 2014. Mr. Timken was President of The Timken Company’s steel business from 2004 to 2005, Corporate Vice President from 2000 to 2003, and he held key leadership positions in The Timken Company’s European and Latin American businesses from 1992 to 2000. Prior to joining The Timken Company, Mr. Timken opened and managed the Washington, D.C. office of McGough & Associates, a Columbus, Ohio-based government affairs consulting firm.

Christopher J. Holding is Executive Vice President and Chief Financial Officer. From 2010 to the spinoff, he served as The Timken Company’s Senior Vice President of Tax and Treasury. Other Timken Company positions included Controller of the Process Industries segment, Industrial Controller and Operations Controller. Mr. Holding earned his bachelor’s and master’s degrees from the University of Cincinnati and is a certified public accountant.

Frank A. DiPiero is Executive Vice President, General Counsel and Secretary. Mr. DiPiero joined The Timken Company in 2014. Previously, Mr. DiPiero was Associate General Counsel, UTC Aerospace Systems of United Technologies Corporation, a provider of technology products and services to the global aerospace and building systems industries; Vice President, Corporate Secretary and Segment Counsel, Electronic Systems of Goodrich Corporation; and Segment Counsel, Actuation and Landing Systems of Goodrich Corporation. Mr. DiPiero earned his bachelor’s degree from Youngstown State University and a J.D. from The University of Toledo College of Law.

Thomas D. Moline is Executive Vice President of Commercial Operations. Prior to assuming his current role in 2017, Mr. Moline served as Executive Vice President of Manufacturing, where he led steel plant operations and a five-year capital investment project that positioned the Company for significant growth. Since joining The Timken Company in 1984, Mr. Moline held a variety of leadership positions, including as an engineer on the team that built the Faircrest Steel Plant. He earned his bachelor’s degree in manufacturing engineering from Miami University in Ohio.

William P. Bryan is Executive Vice President of Manufacturing, Supply Chain and Information Technology. Mr. Bryan also leads the TSB Metal Recycling and the TimkenSteel Material Services subsidiaries. In 2017, he assumed responsibility for manufacturing operations in addition to his existing role as Executive Vice President, Supply Chain and Information Technology. Since joining The Timken Company in 1977, Mr. Bryan served in various positions related to supply chain, economics and information technology in both the U.S. and Europe. He holds bachelor's and master's degrees in business administration from Kent State University. Mr. Bryan also completed the Executive Development for Global Excellence (EDGE) program at the University of Virginia's Darden School of Business.

17

PART II.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Quarterly Common Stock Prices and Cash Dividends Per Share:

Our common shares are traded on the New York Stock Exchange (NYSE) under the symbol “TMST.” The estimated number of record holders of our common shares at December 31, 2017 was 3,885.

The following table provides information about the high and low closing sales prices for our common shares and dividends declared for each quarter for the years ended December 31, 2017 and 2016, respectively.

2017 | 2016 | ||||||||||||||

Stock Prices | Dividend | Stock prices | Dividend | ||||||||||||

High | Low | per share | High | Low | per share | ||||||||||

First quarter | $ | 22.84 | $ | 14.43 | $— | $10.05 | $3.99 | $— | |||||||

Second quarter | $ | 20.02 | $ | 12.88 | $— | $13.39 | $8.48 | $— | |||||||

Third quarter | $ | 16.83 | $ | 13.76 | $— | $11.90 | $8.48 | $— | |||||||

Fourth quarter | $ | 18.45 | $ | 12.83 | $— | $18.08 | $9.52 | $— | |||||||

Our Credit Agreement and our Amended Credit Agreement each place certain limitations on the payment of cash dividends. Please refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional discussion.

Issuer Purchases of Common Shares:

Our Credit Agreement and our Amended Credit Agreement each place certain limitations on our ability to purchase our common shares. Please refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional discussion.

18

Securities Authorized for Issuance Under Equity Compensation Plans:

The following table sets forth certain information as of December 31, 2017, regarding the only equity compensation plan maintained by us on that date, the TimkenSteel Corporation Amended and Restated 2014 Equity and Incentive Compensation Plan (the Equity Plan).

(a) | (b) | (c) | ||||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (1) | Weighted-average exercise price of outstanding options, warrants and rights (2) | Number of securities remaining available for future issuance under equity reflected in column (a) (3) compensation plans (excluding securities) | |||||||

Equity compensation plans approved by security holders(4) | 3,086,769 | $22.03 | 5,125,539 | |||||||

Equity compensation plans not approved by security holders | — | — | — | |||||||

Total | 3,086,769 | $22.03 | 5,125,539 | |||||||

(1) The amount shown in column (a) includes the following: nonqualified stock options - 2,338,355; deferred shares - 118,850; performance-based restricted stock units - 112,719; and time-based restricted stock units - 516,845 (which includes 284,115 cliff-vested restricted stock units).

(2) The weighted average exercise price in column (b) includes nonqualified stock options only.

(3) The amount shown in column (c) represents common shares remaining available under the Equity Plan, under which the Compensation Committee is authorized to make awards of option rights, appreciation rights, restricted shares, restricted stock units, deferred shares, performance shares, performance units and cash incentive awards. Awards may be credited with dividend equivalents payable in the form of common shares. Under the Equity Plan, for any award that is not an option right or a stock appreciation right, 2.46 common shares for awards granted before April 28, 2016 and 2.50 common shares for awards granted on or after April 28, 2016, are subtracted from the maximum number of common shares available under the plan for every common share issued under the award. For awards of option rights and stock appreciation rights, however, only one common share is subtracted from the maximum number of common shares available under the plan for every common share granted.

(4) The Company also maintains the Director Deferred Compensation Plan pursuant to which non-employee Directors may defer receipt of common shares authorized for issuance under the Equity Plan. The table does not include separate information about this plan because it merely provides for the deferral, rather than the issuance, of common shares.

19

Performance Graph:

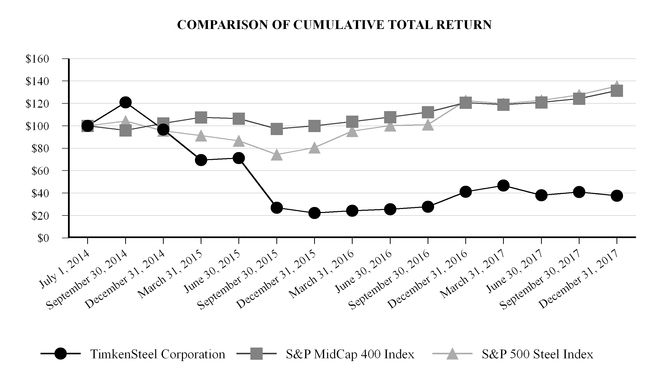

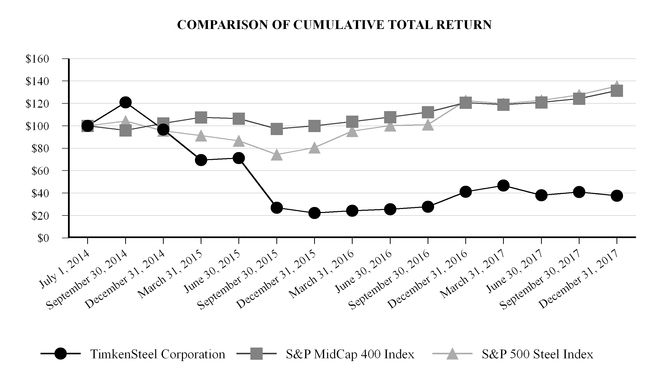

The following graph compares the cumulative total return of our common shares with the cumulative total return of the Standard & Poor’s (S&P) MidCap 400 Index and S&P Steel Group Index, assuming $100 was invested and that cash dividends were reinvested for the period from July 1, 2014 through December 31, 2017.

Date | TimkenSteel Corporation | S&P MidCap 400 Index | S&P 500 Steel Index | ||||||||

July 1, 2014 | $100.00 | $100.00 | $100.00 | ||||||||

September 30, 2014 | $120.95 | $96.02 | $104.20 | ||||||||

December 31, 2014 | $96.71 | $102.11 | $95.49 | ||||||||

March 31, 2015 | $69.46 | $107.54 | $91.25 | ||||||||

June 30, 2015 | $71.13 | $106.40 | $86.54 | ||||||||

September 30, 2015 | $26.92 | $97.36 | $74.31 | ||||||||

December 31, 2015 | $22.29 | $99.89 | $80.49 | ||||||||

March 31, 2016 | $24.21 | $103.67 | $95.22 | ||||||||

June 30, 2016 | $25.59 | $107.81 | $100.25 | ||||||||

September 30, 2016 | $27.80 | $112.28 | $101.09 | ||||||||

December 31, 2016 | $41.18 | $120.61 | $122.43 | ||||||||

March 31, 2017 | $46.80 | $118.99 | $119.73 | ||||||||

June 30, 2017 | $38.04 | $120.86 | $122.81 | ||||||||

September 30, 2017 | $40.83 | $124.27 | $127.67 | ||||||||

December 31, 2017 | $37.59 | $131.51 | $135.49 | ||||||||

This performance graph shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Exchange Act.

20

ITEM 6. SELECTED FINANCIAL DATA

The periods prior to the separation from The Timken Company include the historical results of operations, assets and liabilities of the legal entities that are considered to comprise TimkenSteel. The selected financial data in the table below for periods prior to the separation may not be indicative of what they would have been had we actually been a separate stand-alone entity during such periods, nor are they necessarily indicative of our future results of operations, financial position and cash flows.

Year Ended December 31, | |||||||||||||||||||

(dollars and shares in millions, except per share data) | 2017 | 2016(2) | 2015(2) | 2014 | 2013 | ||||||||||||||

Statement of Operations Data: | |||||||||||||||||||

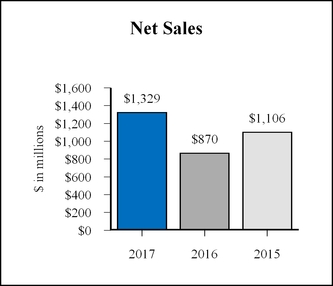

Net sales | $1,329.2 | $869.5 | $1,106.2 | $1,674.2 | $1,380.9 | ||||||||||||||

Net (loss) income | (43.8 | ) | (105.5 | ) | (45.0 | ) | 46.1 | 89.5 | |||||||||||

(Loss) earnings per share(1): | |||||||||||||||||||

Basic | ($0.99 | ) | ($2.39 | ) | ($1.01 | ) | $1.01 | $1.96 | |||||||||||

Diluted | ($0.99 | ) | ($2.39 | ) | ($1.01 | ) | $1.00 | $1.94 | |||||||||||

Cash dividends declared per share | $— | $— | $0.42 | $0.28 | $— | ||||||||||||||

Weighted average shares outstanding, diluted | 44.4 | 44.2 | 44.5 | 46.0 | 46.2 | ||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Total assets | $1,156.6 | $1,069.9 | $1,142.5 | $1,366.9 | $1,078.8 | ||||||||||||||

Long-term debt | 165.3 | 136.6 | 200.2 | 185.2 | 30.2 | ||||||||||||||

Total shareholders’ equity | 560.7 | 597.4 | 682.0 | 749.8 | 800.8 | ||||||||||||||

Other Data: | |||||||||||||||||||

Book value per share(3) | $12.63 | $13.52 | $15.33 | $16.30 | $17.33 | ||||||||||||||

(1) See Note 9 - Earnings Per Share in the Notes to the Consolidated Financial Statements for additional information.

(2) Amounts reflect the adoption of Accounting Standard Update (ASU) 2017-07 “Retirement Benefits: Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost (Topic 715).” See Note 2 - Significant Accounting Policies in the Notes to the Consolidated Financial Statements for additional information.

(3) Book value per share is calculated by dividing total shareholders’ equity (as of the period end) by the weighted average shares outstanding, diluted.

21

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF