Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PACIFIC PREMIER BANCORP INC | ex_991-prxq4x2017xkbwconf.htm |

| 8-K - 8-K - PACIFIC PREMIER BANCORP INC | a8k_prxip-2017q4xkbwconf.htm |

Investor Presentation

Fourth Quarter 2017

Steve Gardner

Chairman, President & Chief Executive Officer

sgardner@ppbi.com - 949-864-8000

Exhibit 99.2

2

Forward-Looking Statements

The statements contained in this presentation that are not historical facts are forward-looking statements based on management’s

current expectations and beliefs concerning future developments and their potential effects on Pacific Premier Bancorp, Inc. (the

“Company” or “Pacific Premier”) including, without limitation, plans, strategies and goals, and statements about the Company’s

expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns,

loan diversification and credit management, shareholder value creation and the impact of the Plaza Bancorp (“Plaza”) acquisition and

other acquisitions. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally

beyond the control of the Company. There can be no assurance that future developments affecting the Company will be the same as

those anticipated by management. The Company cautions readers that a number of important factors could cause actual results to

differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties

include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local

economies in which the Company conducts operations; the effects of, and changes in, trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary

fluctuations; the timely development of competitive new products and services and the acceptance of these products and services by

new and existing customers; the willingness of users to substitute competitors’ products and services for the Company’s products and

services; the impact of changes in financial services policies, laws and regulations (including the Dodd-Frank Wall Street Reform and

Consumer Protection Act) and of governmental efforts to restructure the U.S. financial regulatory system; technological changes; the

effect of acquisitions that the Company has made or may make, if any, including, without limitation, the failure to achieve the expected

revenue growth and/or expense savings from its acquisitions; changes in the level of the Company’s nonperforming assets and charge-

offs; any oversupply of inventory and deterioration in values of California real estate, both residential and commercial; the effect of

changes in accounting policies and practices, as may be adopted from time-to-time by bank regulatory agencies, the Securities and

Exchange Commission (“SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other

accounting standards setters; possible other-than-temporary impairment of securities held by us; changes in consumer spending,

borrowing and savings habits; the effects of the Company’s lack of a diversified loan portfolio, including the risks of geographic and

industry concentrations; ability to attract deposits and other sources of liquidity; changes in the financial performance and/or

condition of our borrowers; changes in the competitive environment among financial and bank holding companies and other financial

service providers; unanticipated regulatory or judicial proceedings; and the Company’s ability to manage the risks involved in the

foregoing. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking

statements are discussed in the 2016 Annual Report on Form 10-K of Pacific Premier Bancorp, Inc. filed with the SEC and available at

the SEC’s Internet site (http://www.sec.gov).

The Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the

forward-looking statements included herein to reflect future events or developments.

3

33 Full-Service

Branch Locations

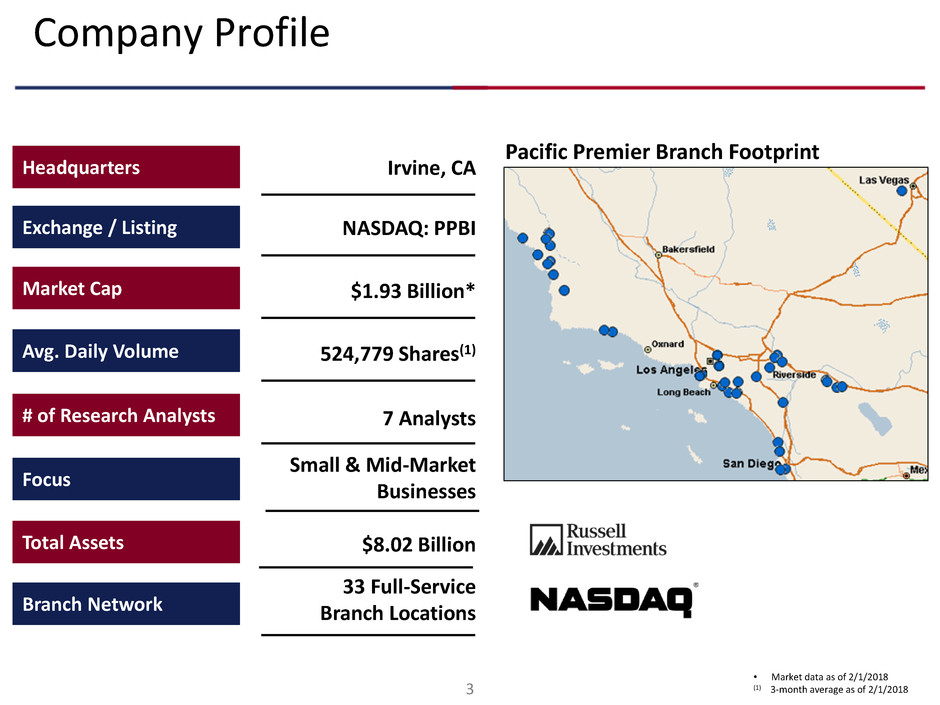

Company Profile

Exchange / Listing NASDAQ: PPBI

Focus

Small & Mid-Market

Businesses

Total Assets $8.02 Billion

Branch Network

• Market data as of 2/1/2018

(1) 3-month average as of 2/1/2018

Pacific Premier Branch Footprint

Headquarters Irvine, CA

# of Research Analysts 7 Analysts

Market Cap $1.93 Billion*

Avg. Daily Volume 524,779 Shares(1)

4

Strategic Transformation

2008 - 2012

Organic growth driven by dynamic sales culture

Geographic expansion through highly accretive FDIC-assisted acquisitions

Canyon National Bank (“CNB”) - $192 million in assets, closed on 2/11/2011 (FDIC-Assisted)

Palm Desert National Bank (“PDNB”) - $103 million in assets, closed on 4/27/2012 (FDIC-Assisted)

2018 and Beyond

Focus on producing EPS growth from scale, efficiency and balance sheet leverage

Target ROAA and ROATCE of 1.50% and 17%, respectively

Continue disciplined organic and acquisitive growth increasing scarcity value

2013 - 2017

Build out of commercial banking platform through acquisitions

First Associations Bank (“FAB”) - $424 million in assets, closed on 3/15/2013 (151 days)

San Diego Trust Bank (“SDTB”) - $211 million in assets, closed on 6/25/2013 (111 days)

Infinity Franchise Holdings (“IFH”) - $80 million in assets, closed on 1/30/2014 (73 days)

Independence Bank (“IDPK”) - $422 million in assets, closed on 1/26/2015 (96 days)

Security California Bancorp (“SCAF”) - $715 million in assets, closed 1/31/2016 (123 days)

Heritage Oaks Bancorp (“HEOP”) – $2 billion in assets, closed on 4/1/2017 (109 days)

Plaza Bancorp (“PLZZ”) - $1.3 billion in assets, closed on 11/1/2017 (84 days)

A balance of organic and acquisitive growth to create a California centric commercial

bank franchise with $8.02 billion in assets

5

Highlights – Q4 2017

Earnings Net income of $16.2 million, which included $5.4 million in merger-related expense and a $5.6

million deferred tax asset revaluation

Operating net income of $25.2* million or $0.56* per diluted per share

Adjusted ROAA of 1.35%*

Adjusted ROATCE of 15.9%*

Loans/

Asset Quality

New loan commitments of $648 million

Net interest margin of 4.56%, core net interest margin of 4.26% excluding accretion

Nonperforming assets as a percent of total assets of 0.04%

Delinquencies as a percent of total loans of 0.16%

Deposits

Deposits totaled $6.1 billion, an increase of $1.1 billion, or 21%, from prior quarter

Noninterest-bearing deposits represent 37% of total deposits

Non-maturity deposits equal 82% of total deposits

Cost of Deposits of 0.32%

Key Ratios

Increasing operating leverage, with an efficiency ratio of 48.2%

Tangible book value per share of $15.26*, 6% higher than the third quarter of 2017, including

DTA revaluation, and 22% higher than the fourth quarter of 2016

Acquisition

Completed acquisition of Plaza Bancorp on November 1, 2017 (84 days), adding approximately

$1.3 billion in assets

* Please refer to non-GAAP reconciliation

6

History of PPBI

• Total deposits compound annual growth rate of 39% since 2011

• Total loans compound annual growth rate of 43% since 2011

Total Assets – Acquired vs. Non-Acquired

February 2011

Acquired Canyon

National Bank

($192MM assets) in

FDIC-assisted deal

$8,025

$961

$1,174

$1,714

$2,039

$2,791

$4,040 $4,174

$6,440 $6,532

$8.00

$10.50

$13.00

$15.50

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

2011 2012 2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

Non-Acquired Acquired TBV/Share

November 2017

Acquired PLZZ

($1.3B assets)

April 2012

Acquired Palm

Desert National

Bank ($103MM

assets) in FDIC-

assisted deal

March 2013 and June 2013

Acquired First Associations

Bank ($424MM assets) and

San Diego Trust Bank

($211MM assets)

January 2014

Acquired Infinity

Franchise Holdings

($80MM assets), a

specialty finance

company

January 2015

Acquired

Independence

Bank ($422MM

assets)

January 2016

Acquired SCAF

($715MM assets)

Timely and efficient acquisitions have accelerated PPBI’s growth and performance

Total Assets TBV/Share*

April 2017

Acquired HEOP

($2.0B assets)

Note: All dollars in millions

* Please refer to non-GAAP reconciliation

7

Small and middle market business banking focus

Full suite of business banking services, including: cash

management, payroll and merchant card services

Customized commercial and industrial (“C&I”) and

commercial real estate loans (“CRE”)

C&I and CRE business loans

Originated $201M Q4 2017 vs. $75M Q4 2016

38% of loan portfolio

Commercial Lines of Business

Business Banking SBA Lending

Franchise Lending

Income Property Lending

Small Business Administration (“SBA”) Loans

Nationwide origination capability

California Capital Access Program (“Cal CAP”) Loans

United State Department of Agriculture (“USDA”) Loans

Originated $58M Q4 2017 vs. $36M Q4 2016

Sell guaranteed portion – 75% of loan amount

Gross gain rates 8-12%

National lender for established and experienced owner

operators of Quick Serve Restaurants (“QSR”)

C&I and CRE based lending secured by equipment and

real estate

Originated $66M Q4 2017 vs. $57M Q4 2016

Average originated rate of 5.4% in Q4 2017

11% of loan portfolio

Credit facilities and banking services for CRE investors in

SoCal

Structured CRE and bridge loan flexibility

Originated $79M Q4 2017 and $81M Q4 2016

20% of loan portfolio

Construction Lending

Construction loans for developers and owner users on

properties predominantly in coastal SoCal

New team assembled in first half of 2013

Originated $106M Q4 2017 vs. $90M Q4 2016

Attractive risk adjusted yields

5% of loan portfolio

HOA Banking

Nationwide leader of customized cash management,

electronic banking services and credit facilities for:

Home Owner Association (“HOA”) Companies

HOA Management Companies

Predominately money market and demand deposits

8

Increasing Loan Commitments & Attractive Yields

$251

$299

$322

$385

$455

$492

$558

$648

4.97% 4.93%

4.87%

4.80%

4.88%

4.99% 4.9… 5.00%

3.00%

3.50%

4.00%

4.50%

5.00%

$-

$100

$200

$300

$400

$500

$600

$700

1Q'16 2Q'16 3Q'16 4Q'16 1Q'17 2Q'17 3Q'17 4Q'17

Business Loans Real Estate Loans Other Loans Weighted Average Coupon

Note: All dollars in millions

Q

ua

rt

er

ly

L

oa

n

Co

mm

itm

en

ts

A

vg

. R

at

e

on

N

ew

C

omm

itm

en

ts

9

Commercial Bank Transformation - Deposit Composition

Deposits – 12/31/2009 Deposits – 12/31/2017

Total Deposits: $618.7 Million

Cost of Deposits: 1.91%

Total Deposits: $6.1 Billion

Cost of Deposits: 0.32%

Non-interest-

Bearing Demand

5%

Interest-Bearing

Demand

4%

Money Market/

Savings

23%

Certificate of

Deposits

68%

• 37% of deposit balances are non-interest-bearing deposits

• 82% of deposits are non-maturity deposits

• 89% of deposits are core deposits*

* Core deposits are all transaction accounts and non-brokered CD accounts below $250,000

Non-interest

Bearing

Demand

37%

Interest-

Bearing

Demand

6%

Money

Market/Savings

39%

Certificate of

Deposits

18%

10

Commercial Bank Transformation – Loan Composition

Loans – 12/31/2009 Loans – 12/31/2017

• Loan portfolio is high quality and well-diversified

• Business-related loans represent 54% of total loans at 12/31/17*

• Business loan commitments originated for FY 2017 were $1.26 billion, 58% of total commitments

Total Loans: $576.3 Million Total Loans: $6.2 Billion

• Business loans are defined as commercial and industrial, franchise, commercial owner

occupied, agriculture and SBA

Commercial and

Industrial

5% CRE Owner

Occupied

18%

CRE Non-Owner

Occupied

26%

Multi-Family

48%

1-4 Family

2%

Other

1%

CRE Owner

Occupied

21%

CRE Non-

Owner

Occupied

20%

Commercial

and Industrial

18%

Multi-Family

13%

Franchise

11%

Construction &

Land

5%

One-to-Four

family

4%

Farm & Agric.

4%

SBA

3%

Consumer

1%

11

Conservative Credit Culture

Nonperforming Assets to Total Assets (%)

The Company has a history of effective credit risk management and outperforming peers

• Loan delinquencies to loans held for investment of 0.16% as of 12/31/2017

• Nonperforming assets to total assets of 0.04% at 12/31/2017

1.04

1.70

1.58 1.66

1.36

0.48 0.58

0.40

3.26

1.62

1.31

0.76

0.55

1.67

1.08

0.38 0.33

0.21 0.15 0.20 0.20 0.14 0.12 0.12 0.21 0.19 0.18 0.18 0.17

0.13 0.17 0.04

0.02 0.01 0.01 0.04

2.93

3.62

3.96

4.11

4.26 4.30 4.24

4.39

4.23 4.29

4.06 4.04

3.77

3.48 3.39

3.21

2.96

1.56

1.24

1.10 1.18 1.05

0.91

0.80 0.74 0.69 0.59 0.58

0.74

0.53 0.48 0.50 0.49 0.46 0.44

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

PPB Peers *

CNB

Acquisition

2/11/11

PDNB

Acquisition

4/27/12

* California peer group consists of all insured California institutions, from SNL Financial.

12

CRE to Capital Concentration

• CRE concentrations are well managed across the organization

• Our growth across our key businesses has diversified our loan portfolio

Managed Growth

CRE as a Percent of Total Capital

627%

499%

415%

372%

310%

349%

316%

336%

362% 352%

365% 376%

378%

340% 336%

287%

0%

100%

200%

300%

400%

500%

600%

700%

2008 2009 2010 2011 2012 2013 2014 2015 1Q'16 2Q'16 3Q'16 4Q'16 1Q'17 2Q'17 3Q'17 4Q'17

13

Strong Loan Yields - Low Cost of Deposits

Portfolio Core Loan Yields Cost of Total Deposits

0.33%

0.36%

0.32%

0.28% 0.27%

0.25%

0.28%

0.32%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

Total Deposits Cost of Deposits

Our specialty lines of business have optimized our net interest margin through diversification

and disciplined pricing as well as accelerating organic loan and deposit growth…

Note: All dollars in millions

Note: Core loan yields exclude accretion.

5.28% 5.18% 5.17% 5.13% 5.05%

4.94% 4.98%

5.16%

0.00%

0.75%

1.50%

2.25%

3.00%

3.75%

4.50%

5.25%

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

Loans Portfolio Core Loan Yield

14

Revenue & Net Interest Margin

Annual Operating Revenue(1)

Note: All dollars in millions

(1) Operating revenue = net interest income + noninterest income.

(2) Core net interest margin excludes accretion.

*Annualized

$67

$87

$121

$173

$279

$350

$0

$50

$100

$150

$200

$250

$300

$350

$400

2013 2014 2015 2016 2017 4Q'17*

Core Net Interest Margin(2)

And delivered compounded annual revenue growth rate of 51% as well as strong net

interest margin of over 4%

3.93%

4.09%

4.06%

4.20%

4.27%

4.09%

4.14%

4.26%

3.70%

3.80%

3.90%

4.00%

4.10%

4.20%

4.30%

2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

Acquired

HEOP

4/1/17

15

Noninterest Expense & Efficiency

Adjusted Noninterest Expense / Avg. Assets Efficiency Ratio

In addition to leveraging technology to drive growth, the Company has continually

improved its operational processes to achieve greater operating leverage and

economies of scale

Note: Efficiency Ratio represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger related expense to the sum of net

interest income before provision for loan losses and total noninterest income less gains/(loss) on sale of securities, and other-than-temporary impairment recovery (loss) on investment securities.

Adjusted noninterest expense excludes other real estate owned operations, core deposit intangible amortization and merger related costs.

2.95%

2.87%

2.58% 2.55%

2.40%

2.30% 2.32% 2.27%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

64.7%

61.4%

55.9%

53.6% 52.3% 52.3% 52.1%

48.2%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

16

Pre-Tax, Pre-Provision Income(1) Tangible Book Value per Share

$23

$34

$52

$79

$132

$156

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2013 2014 2015 2016 2017 Q4'17*

$9.08

$10.12

$11.17

$12.51

$12.88

$13.83

$14.35

$15.26

$7.00

$8.00

$9.00

$10.00

$11.00

$12.00

$13.00

$14.00

$15.00

$16.00

2013 2014 2015 2016 1Q'17 2Q'17 3Q'17 4Q'17

Strong operating income has consistently resulted in shareholder value creation

Operating Income and Tangible Book Value

Note: All dollars in millions, except per share data

Note: Tangible book values are based on basic shares outstanding.

Refer to non-GAAP reconciliation

(1) Excludes merger-related expenses

*Annualized

17

(1) Pro forma capital ratios as of 12/31/2017

(2) Refer to non-GAAP reconciliation

The consolidated Company and the Bank will remain well capitalized with strong

earnings capacity to sustain growth strategy and well-capitalized levels

Capital Ratios – As of 12/31/2017

Pacific

Premier

Well-Capitalized

Requirement

Consolidated

Leverage Ratio 10.7% N/A

Common Equity Tier-1 Ratio 10.6% N/A

Tier-1 Ratio 10.9% N/A

Risk Based Capital Ratio 12.6% N/A

Tangible Common Equity ("TCE") Ratio (2) 9.4% N/A

Bank

Leverage Ratio 11.7% 5.0%

Common Equity Tier-1 Ratio 11.9% 6.5%

Tier-1 Ratio 11.9% 8.0%

Risk Based Capital Ratio 12.3% 10.0%

18

Superior Market Performance (PPBI)

Source: SNL Financial, market information as of 12/31/2017

Since December 2015, PPBI’s stock price has significantly outperformed its publicly traded

bank peers (SNL Bank Index / NASDAQ Bank Index)

PPBI +88%

NASDAQ

Bank

SNL Bank +40%

+43%

-40.0%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

Dec-15 Feb-16 Apr-16 Jun-16 Aug-16 Oct-16 Dec-16 Feb-17 Apr-17 Jun-17 Aug-17 Oct-17 Dec-17

PPBI SNL Bank NASDAQ Bank

19

Strategically Focused – Financially Motivated

The Company’s management team operates the bank with the understanding we are growing toward $10.0 billion

• Our business model is always evolving, transforming and improving

• Continue to build a quality banking franchise and leverage our core competencies

• Investments in and the strengthening of the entire team is an on-going process

Continue to Evolve and Strive for Superior Performance

Operational Integrity Leads to Strong Internal Controls and Risk Management

The Company’s operating environment and culture have been built over the years to be scalable

• Disciplined credit underwriting culture remains a fundamental underpinning

• BSA/AML – automated Rule Based Risk Rating and statistical analytics covering entire client base

• CRA – enhanced program to exceed community group requirements and large bank exam standards

Keen Focus on Creating Maximum Shareholder Value

Management consistently communicates and executes on its strategic plan

• Our Board regularly evaluates capital management, strategic direction and the alternatives to maximize shareholder value

• Focused on increasing earnings and building tangible book value through growth strategies and improving efficiencies

• Our goal is to create a fundamentally sound franchise with strong earnings and risk management

20

Scarcity Value in Southern California

• Significant scarcity value for quality and

sizeable banking franchises in Southern

California

• PPBI is 5th largest bank headquartered in

Southern California

• Includes all banks and thrifts headquartered

in Southern California (Orange, Los Angeles,

San Bernardino, Riverside, and San Diego

counties). Sorted by total assets, excludes

pending merger targets and ethnic-focused

banks

Largest 25 Banks Headquartered in Southern California

Source: SNL Financial for period-ending 12/31/2017

*Total assets includes impact from First Foundation’s acquisition of PPB Bancorp

Note: All dollars in thousands

Rank Company Name Exchange City

Total Assets

($000s)

1 PacWest Bancorp NASDAQ Beverly Hills 24,994,876$

2 Banc of California, Inc. NYSE Santa Ana 10,327,852$

3 BofI Holding, Inc. NASDAQ San Diego 8,581,628$

4 CVB Financial Corp. NASDAQ Ontario 8,270,586$

5 Pacific Premier Bancorp, Inc. NASDAQ Irvine 8,024,501$

6 Opus Bank NASDAQ Irvine 7,486,809$

7 Farmers & Merchants Bank of Long Beach OTCQB Long Beach 6,991,578$

8 First Foundation Inc.* NASDAQ Irvine 4,637,822$

9 Community Bank OTC Pink Pasadena 3,747,398$

10 Grandpoint Capital, Inc. OTC Pink Los Angeles 3,203,002$

11 Manufacturers Bank Los Angeles 2,477,688$

12 American Business Bank OTC Pink Los Angeles 1,758,336$

13 Pacific Mercantile Bancorp NASDAQ Costa Mesa 1,322,604$

14 Silvergate Bank La Jolla 1,216,674$

15 Provident Financial Holdings, Inc. NASDAQ Riverside 1,162,131$

16 Sunwest Bank Irvine 1,082,839$

17 Malaga Bank F.S.B. OTC Pink Palos Verdes Estates 1,041,000$

18 Seacoast Commerce Bank OTC Pink San Diego 938,927$

19 Commercial Bank of California Irvine 800,518$

20 Bank of Hemet Riverside 698,703$

21 San Diego Private Bank OTCQX Coronado 671,245$

22 California First National Bank OTCQX Irvine 629,516$

23 CommerceWest Bank OTC Pink Irvine 573,071$

24 Pacific Commerce Bank OTC Pink Los Angeles 536,111$

25 Pacific Enterprise Bank - Irvine 514,069$

21

• Proven track record of executing on acquisitions and organic growth

• Well positioned to evaluate attractive acquisition opportunities

• Continue to drive economies of scale and operating leverage

• Positioned to deliver continued growth and strong profitability

• Ability to integrate business lines that generate higher risk adjusted returns

• Create scarcity value among banks in Southern California

Pacific Premier Outlook

Building Long-term Franchise Value

22

Appendix material

23

Consolidated Financial Highlights

(1) Represents the ratio of noninterest expense less OREO operations, core deposit intangible amortization and merger related expense to the sum of net interest

income before provision for loan losses and total noninterest income less gains/(loss) on sale of securities.

(2) Nonperforming assets excludes nonperforming investment securities.

(3) Classified assets includes substandard loans, doubtful, substandard investment securities, and OREO.

(4) Annualized

* Please refer to non-GAAP reconciliation

Note: All dollars in thousands, except per share data

December 31, March 31, June 30, September 30, December 31,

2016 2017 2017 2017 2017

Summary Balance Sheet

Total Assets $4,036,311 $4,174,428 $6,440,631 $6,532,334 $8,024,501

Loans Held for Investment 3,241,613 3,385,697 4,858,611 5,009,317 6,196,468

Total Deposits 3,145,581 3,297,073 4,946,431 5,018,153 6,085,868

Loans Held for Investment / Total Deposits 103.1% 102.7% 98.2% 99.8% 101.8%

Summary Income Statement

Total Revenue $46,622 $46,386 $72,097 $72,512 $87,621

Total Noninterest Expense 25,377 29,747 48,496 39,612 49,895

Provision for Loan Losses 2,054 2,502 1,904 2,049 2,185

Net Income 11,953 9,521 14,176 20,232 16,171

Diluted EPS $0.43 $0.34 $0.35 $0.50 $0.36

Performance Ratios

Return on Average Assets* (4) 1.24% 0.94% 0.89% 1.26% 0.87%

Return on Average Tangible Common Equity* (4) 14.2% 11.0% 11.3% 15.0% 10.5%

Efficiency Ratio (1) 50.9% 52.3% 52.3% 52.1% 48.2%

Net Interest Margin 4.59% 4.39% 4.40% 4.34% 4.56%

Asset Quality

Delinquent Loans to Loans Held for Investment 0.03% 0.01% 0.06% 0.07% 0.16%

Allowance for Loan Losses to Loans Held for Investment 0.66% 0.68% 0.52% 0.54% 0.47%

Nonperforming Loans to Loans Held for Investment 0.04% 0.02% 0.01% 0.01% 0.05%

Nonperforming Assets to Total Assets (2) 0.04% 0.02% 0.01% 0.01% 0.04%

Classified Assets to Total Risk-Based Capital (3) 3.00% 2.54% 5.00% 6.15% 5.68%

Classified Assets to Total Assets (3) 0.33% 0.28% 0.52% 0.66% 0.61%

Capital Ratios

Tangible Common Equity/ Tangible Assets * 8.86% 8.85% 9.18% 9.41% 9.42%

Tangible Book Value Per Share * $12.51 $12.88 $13.83 $14.35 $15.26

Common Equity Tier 1 Risk-based Capital Ratio 10.12% 9.84% 10.71% 10.59% 10.59%

Tier 1 Risk-based Ratio 10.41% 10.11% 11.08% 10.94% 10.88%

Risk-based Capital Ratio 12.72% 12.34% 12.69% 12.51% 12.57%

`

24

Non-GAAP Financial Measures

Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per share are a non-GAAP financial measures derived from GAAP-based

amounts. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We

calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by

dividing common stockholders’ equity by common shares outstanding. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude

intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-GAAP financial measures provide information that is important to investors

and that is useful in understanding our capital position and ratios. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on

GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by

other companies. A reconciliation of the non-GAAP measure of tangible common equity ratio to the GAAP measure of common equity ratio and tangible book value per share to the

GAAP measure of book value per share are set forth below.

Note: All dollars in thousands, except per share data

December 31, December 31, December 31, December 31, December 31, December 31, March 31, June 30, September 30, December 31,

2011 2012 2013 2014 2015 2016 2017 2017 2017 2017

Total stockholders' equity 86,777$ 134,517$ 175,226$ 199,592$ 298,980$ 459,740$ 471,025$ 959,731$ 981,660$ 1,241,996$

Less: Intangible assets (2,069) (2,626) (24,056) (28,564) (58,002) (111,941) (111,432) (405,869) (405,222) (536,343)

Tangible common equity 84,708$ 131,891$ 151,170$ 171,028$ 240,978$ 347,799$ 359,593$ 553,862$ 576,438$ 705,653$

Total assets 961,128$ 1,173,792$ 1,714,187$ 2,037,731$ 2,789,599$ 4,036,311$ 4,174,428$ 6,440,631$ 6,532,334$ 8,024,501$

Less: Intangible assets (2,069) (2,626) (24,056) (28,564) (58,002) (111,670) (111,432) (405,869) (405,222) (536,343)

Tangible assets 959,059$ 1,171,166$ 1,690,131$ 2,009,167$ 2,731,597$ 3,924,641$ 4,062,996$ 6,034,762$ 6,127,112$ 7,488,158$

Common Equity ratio 9.03% 11.46% 10.22% 9.79% 10.72% 11.39% 11.28% 14.90% 15.03% 15.48%

Less: Intangible equity ratio (0.20%) (0.20%) (1.28%) (1.28%) (1.90%) (2.53%) (2.43%) (5.72%) (5.62%) (6.06%)

Tangible common equity ratio 8.83% 11.26% 8.94% 8.51% 8.82% 8.86% 8.85% 9.18% 9.41% 9.42%

Basic shares outstanding 10,337,626 13,661,648 16,656,279 16,903,884 21,570,746 27,798,283 27,908,816 40,047,682 40,162,026 46,245,050

Book value per share 8.39$ 9.85$ 10.52$ 11.81$ 13.86$ 16.54$ 16.88$ 23.96$ 24.44$ 26.86$

Less: Intangible book value per share (0.20) (0.20) (1.44) (1.69) (2.69) (4.03) (4.00) (10.13) (10.09) (11.60)

Tangible book value per share 8.19$ 9.65$ 9.08$ 10.12$ 11.17$ 12.51$ 12.88$ 13.83$ 14.35$ 15.26$

25

Non-GAAP Financial Measures

Pre-tax, pre-provision income, excluding merger-related expense, is a non-GAAP financial measure derived from GAAP-based amounts. We calculate it by excluding income taxes,

the provision for loan losses and merger-related expenses. We believe that this non-GAAP financial measure provides information that is important to investors. However, this non-

GAAP financial measure is a supplement and is not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for this measure, this

presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of pre-tax, pre-provision income, excluding merger-related

expenses is set forth below.

Note: All dollars in thousands

Annualized

Three Months Ended

December 31, December 31, December 31, December 31, December 31, December 31,

2013 2014 2015 2016 2017 2017

Net income 8,993$ 16,616$ 25,515$ 40,103$ 60,100$ 64,684$

Add: Income tax 5,587 10,719 15,209 25,215 42,126 77,480

Add: Provision for loan losses 1,860 4,684 6,425 8,776 8,640 8,740

Add: Merger-related expense 6,926 1,490 4,799 4,388 21,002 5,436

Pre-tax, pre-provision income

(excluding merger-related expense) 23,366$ 33,509$ 51,948$ 78,482$ 131,868$ 156,340$

For the Years Ended

26

Non-GAAP Financial Measures

For quarter period presented below, adjusted net income and adjusted diluted earnings per share are non-GAAP financial measures derived from GAAP-based amounts. We

calculate these figures by excluding merger related expenses and DTA revaluations in the period results. Management believes that the exclusion of such items from these financial

measures provides useful information to an understanding of the operating results of our core business. However, these non-GAAP financial measures are supplemental and are not

a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to

other similarly titled adjusted measures reported by other companies.

(1) Annualized

Note: All dollars in thousands

December 31,

2017

Net income 16,171$

Add: Merger-related expense 5,436

Add: DTA revaluation 3,545

Adjusted net income 25,152$

Diluted earnings per share 0.36$

Add: Merger-related and litigation expense, net of tax 0.20

Adjusted diluted earnings per share 0.56$

Return on average assets 0.87%

Add: Merger-related and litigation expense, net of tax 0.48%

Adjusted return on average assets(1) 1.35%

27

Non-GAAP Financial Measures

For the quarter period presented below, adjusted net income for return on average tangible common equity and average tangible common equity are non-GAAP financial measures

derived from GAAP-based amounts. We calculate return on average tangible common equity by adjusting net income for the effect of CDI amortization and exclude the average CDI

and average goodwill from the average stockholders' equity during the period. We calculate adjusted return on average tangible common equity by adjusting net income for the

effect of CDI amortization and merger related expense and exclude the average CDI and average goodwill from the average stockholders' equity during the period. We believe that

this is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these

non-GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-GAAP

financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted

measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. A reconciliation of the non-GAAP measures of return

on average tangible common equity and adjusted return on average tangible common equity to the GAAP measure of return on common stockholders’ equity is set forth below.

• Please refer to non-GAAP reconciliation

(1) Annualized

Note: All dollars in thousands

December 31,

2017

Adjusted net income* 25,152$

Plus: Tax effected CDI amortization 2,111

Less: CDI amortization expense tax adjustment 815

Adjusted net income for return on average tangible

common equity 26,448$

Average stockholders' equity 1,161,174$

Less: Average core deposit intangible 40,274

Less: Average goodwill 454,362

Average tangible common equity 666,538$

Adjusted return on average tangible common equity(1) 15.9%