Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Internap Corp | form8k.htm |

Exhibit 99.1

CompanyPresentation January 2018

Forward-Looking Statements © 2017 Internap Corporation (INAP) This presentation contains forward-looking statements. These forward-looking statements include statements related to our expectations related to revenue, Adjusted EBITDA, Adjusted EBITDA margin, growth, synergies, sales and operations improvements and capital structure. These assumptions may prove inaccurate in the future. Because such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, there are important factors that could cause INAP’s actual results to differ materially from those expressed or implied in the forward-looking statements, due to a variety of important factors. Such important factors include, without limitation: the parties' ability to satisfy the definitive agreement conditions, including but not limited to failure to obtain applicable regulatory approval of the transaction in a timely manner or at all, and complete the SingleHop acquisition on the anticipated timeline or at all; INAP's ability to realize anticipated revenue, growth, synergies and cost savings from the acquisition; INAP's ability to successfully integrate SingleHop’s sales, operations, technology, and products generally; or the impact on INAP’s business and financial condition from the additional indebtedness and other financial obligations. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. All forward-looking statements attributable to INAP or persons acting on its behalf are expressly qualified in their entirety by the foregoing forward-looking statements. All such statements speak only as of the date made, and INAP undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Measures © 2017 Internap Corporation (INAP) In addition to results presented in accordance with GAAP, this presentation includes non-GAAP financial measures. INAP believes these non-GAAP financial measures provide additional information that is useful to investors in helping to understand our underlying performance and trends.Non-GAAP financial measures have inherent limitations, which are not required to be uniformly applied. Readers should be aware of these limitations and should be cautious with respect to the use of such measures. To compensate for these limitations, we use non-GAAP financial measures as comparative tools, together with GAAP financial measures, to assist in the evaluation of our operating performance or financial condition. Our method of calculating these non-GAAP financial measures may differ from methods used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for those financial measures prepared in accordance with GAAP.Although we believe that our presentation of non-GAAP financial measures provides useful supplemental information to investors regarding our results of operations, our non-GAAP financial measures should only be considered in addition to, and not as a substitute for, or superior to, any measure of financial performance prepared in accordance with GAAP.As required by SEC rules, we have provided in the Appendix to this presentation reconciliations of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measures.

Transaction Overview Internap Corporation (“INAP” or the “Company”), founded in 1996 and headquartered in Atlanta, GA, provides information technology ("IT") infrastructure solutions to businesses in North America, Europe, and Asia-Pacific. INAP is publicly traded on NASDAQ Global Market under the ticker “INAP”.The Company operates in two business segments: (i) INAP COLO and (ii) INAP CLOUDIn March 2017, INAP closed on $325MM Senior Secured Credit Facilities consisting of a $25MM Revolver (undrawn at close) and a $300MM Senior Secured First Lien Term Loan INAP last twelve months (“LTM”) 12/31/16 GAAP net loss was ($124.8)MMThe transaction resulted in net leverage of 4.2x based on LTM 12/31/16 Adjusted EBITDA of $82.0MM (non-GAAP)* On January 27, 2018, INAP signed a definitive agreement to acquire SingleHop LLC (the “Target”), a provider of highly-automated, scalable managed hosting and on-demand infrastructure-as-a-Service (IaaS) solutions based in Chicago, IllinoisSingleHop annualized GAAP Net Income for 3Q2017 was $4.4MMAcquisition valued at approximately $132MM reflecting a purchase multiple of approximately 7x after synergies, based on Annualized Adjusted EBITDA (non-GAAP)* of approximately $16MM(1) for 3Q2017 and expected annualized cost synergies of $2MM to $3MMThe Company is seeking to raise $135MM of Incremental First Lien Term Loan to support the acquisition of SingleHopPro forma for the transaction, net leverage is expected to be 4.7x based on Pro Forma Adjusted EBITDA (non-GAAP)* of $103.2MM(1)(2)The Company is seeking to amend its First Lien Agreement to allow for incremental debt and reset the maximum Total Leverage(3) and Interest Coverage covenant levels. The key elements of the Amendment are:Permit the issuance of a fungible Incremental First Lien Term Loan of $135.0MM associated with the acquisitionReset of the Maximum Total Net Leverage(3) and Interest Coverage(3) covenants © 2017 Internap Corporation (INAP) * Reconciliation to GAAP on pages 14-19.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2 million.Includes INAP LTM 9/30/17 CA Adjusted EBITDA (non-GAAP) of $83.6MM (Adjusted EBITDA of $89.4MM less adjustments as defined in INAP’s credit facility), SingleHop LTM 9/30/17 Adjusted EBITDA (non-GAAP) of $17.1MM, and $2.5MM of pro forma synergies, representing the midpoint of the projected range of $2-3MM.As defined in INAP’s credit facility.

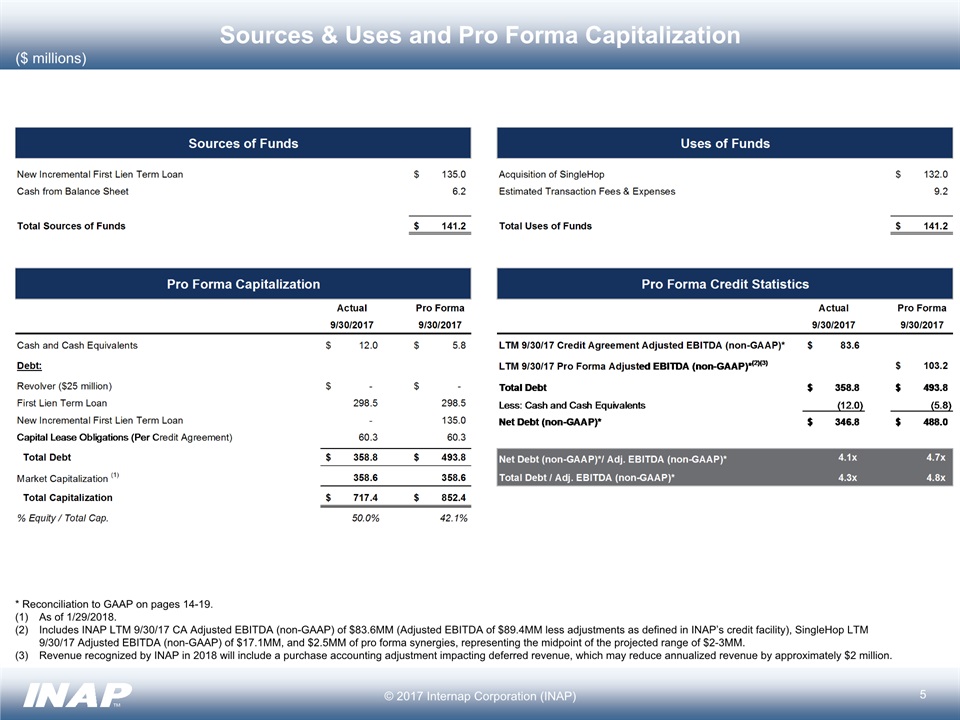

Sources & Uses and Pro Forma Capitalization ($ millions) © 2017 Internap Corporation (INAP) * Reconciliation to GAAP on pages 14-19.As of 1/29/2018.Includes INAP LTM 9/30/17 CA Adjusted EBITDA (non-GAAP) of $83.6MM (Adjusted EBITDA of $89.4MM less adjustments as defined in INAP’s credit facility), SingleHop LTM 9/30/17 Adjusted EBITDA (non-GAAP) of $17.1MM, and $2.5MM of pro forma synergies, representing the midpoint of the projected range of $2-3MM.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2 million.

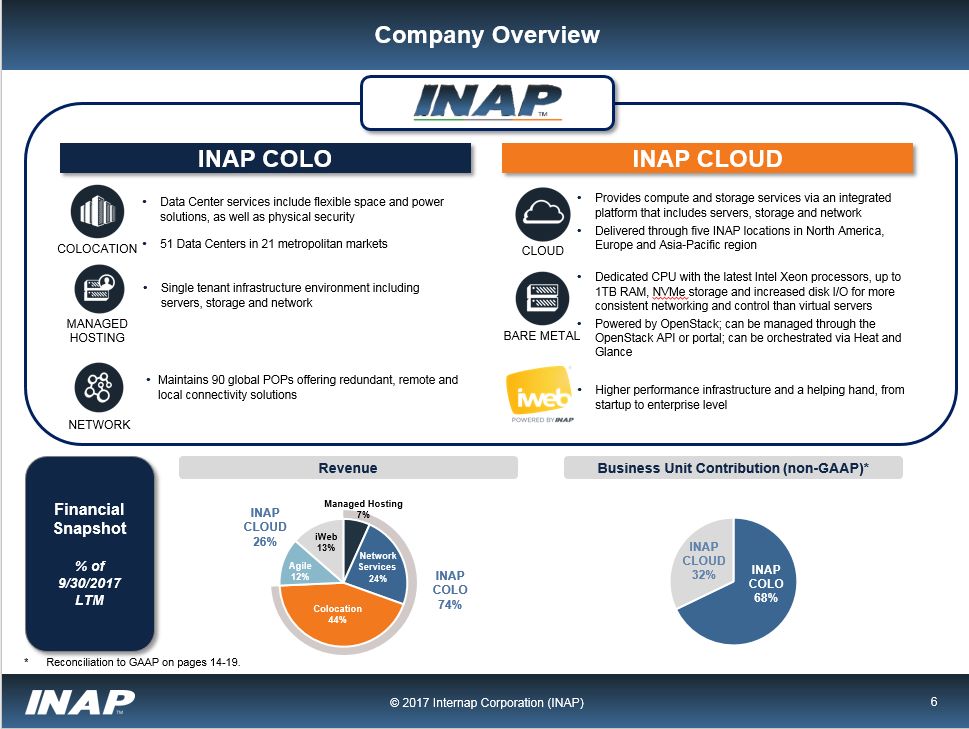

Company Overview INAP COLO INAP CLOUD Data Center services include flexible space and power solutions, as well as physical security 51 Data Centers in 21 metropolitan markets Maintains 90 global POPs offering redundant, remote and local connectivity solutions Single tenant infrastructure environment including servers, storage and network Provides compute and storage services via an integrated platform that includes servers, storage and network Delivered through five INAP locations in North America, Europe and Asia-Pacific region Dedicated CPU with the latest Intel Xeon processors, up to 1TB RAM, NVMe storage and increased disk I/O for more consistent networking and control than virtual servers Powered by OpenStack; can be managed through the OpenStack API or portal; can be orchestrated via Heat and Glance COLOCATION MANAGED HOSTING NETWORK CLOUD BARE METAL Higher performance infrastructure and a helping hand, from startup to enterprise level © 2017 Internap Corporation (INAP) INAP COLO74% NetworkServices 24% Revenue Business Unit Contribution (non-GAAP)* Financial Snapshot% of 9/30/2017LTM INAP CLOUD26% * Reconciliation to GAAP on pages 14-19.

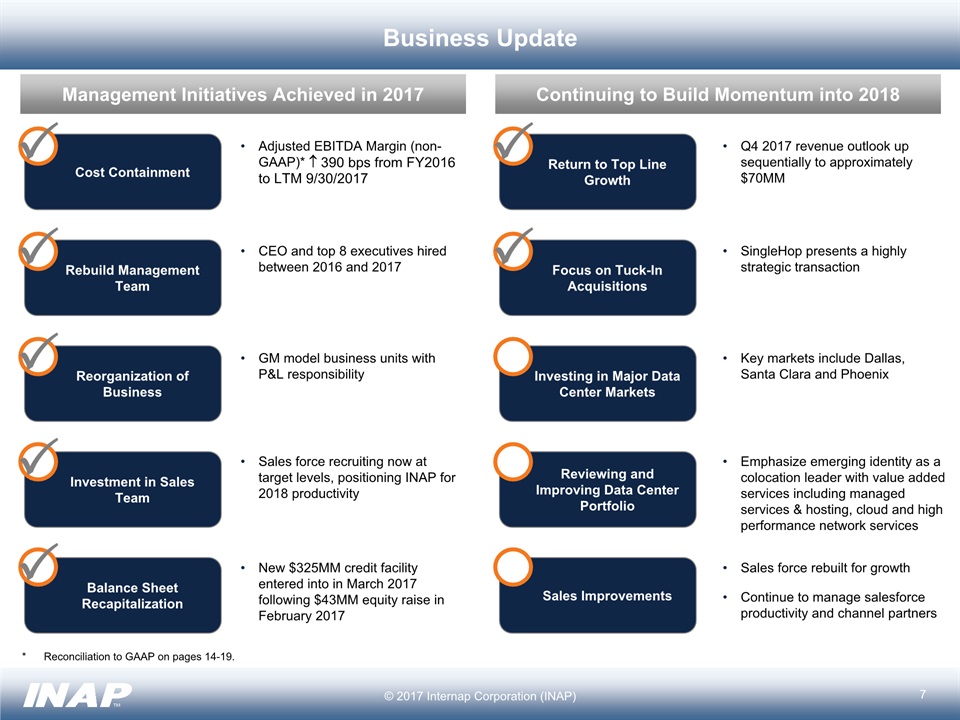

Business Update Management Initiatives Achieved in 2017 Update Status Appointed Bob Dennerlein, a veteran with over 25 years of financial leadership experience, as new CFOAppointed Andrew Day and Corey Needles as new General Managers to assume complete responsibility for newly aligned business segmentsAlso appointed Richard Diegnan and Mark Weaver as new General Counsel and Chief Accounting Officer, respectively Rebuild Management Team Complete Reinstituted bonuses and enhanced success-based commissionsBookings beginning to show upward momentum as sales team initiatives ramp upBookings, net of churn, turned positive in December 2016 Investment in Sales Teams In Progress Potential Equity Offering process underway Balance Sheet Recapitalization In Progress Reorganization of Business Complete Internal reorganization into two pure-play business segments complete with new business managers (with P&L responsibility) appointedEvaluating the sale of non-core assets and expect to discontinue unprofitable programs Cost Containment Phase I of III Phase I reduced operating expenses by an annualized run-rate of $6 millionNet headcount reduction of ~60Proceeds partially reinvested in sales teamPhase II to begin in early 2017 © 2017 Internap Corporation (INAP) Continuing to Build Momentum into 2018 Cost Containment Rebuild Management Team Reorganization of Business Investment in Sales Team Balance Sheet Recapitalization Return to Top Line Growth Focus on Tuck-In Acquisitions Investing in Major Data Center Markets Reviewing and Improving Data Center Portfolio Sales Improvements Adjusted EBITDA Margin (non-GAAP)* 390 bps from FY2016 to LTM 9/30/2017 CEO and top 8 executives hired between 2016 and 2017 GM model business units with P&L responsibility Sales force recruiting now at target levels, positioning INAP for 2018 productivity New $325MM credit facility entered into in March 2017 following $43MM equity raise in February 2017 Q4 2017 revenue outlook up sequentially to approximately $70MM SingleHop presents a highly strategic transaction Key markets include Dallas, Santa Clara and Phoenix Emphasize emerging identity as a colocation leader with value added services including managed services & hosting, cloud and high performance network services Sales force rebuilt for growthContinue to manage salesforce productivity and channel partners * Reconciliation to GAAP on pages 14-19.

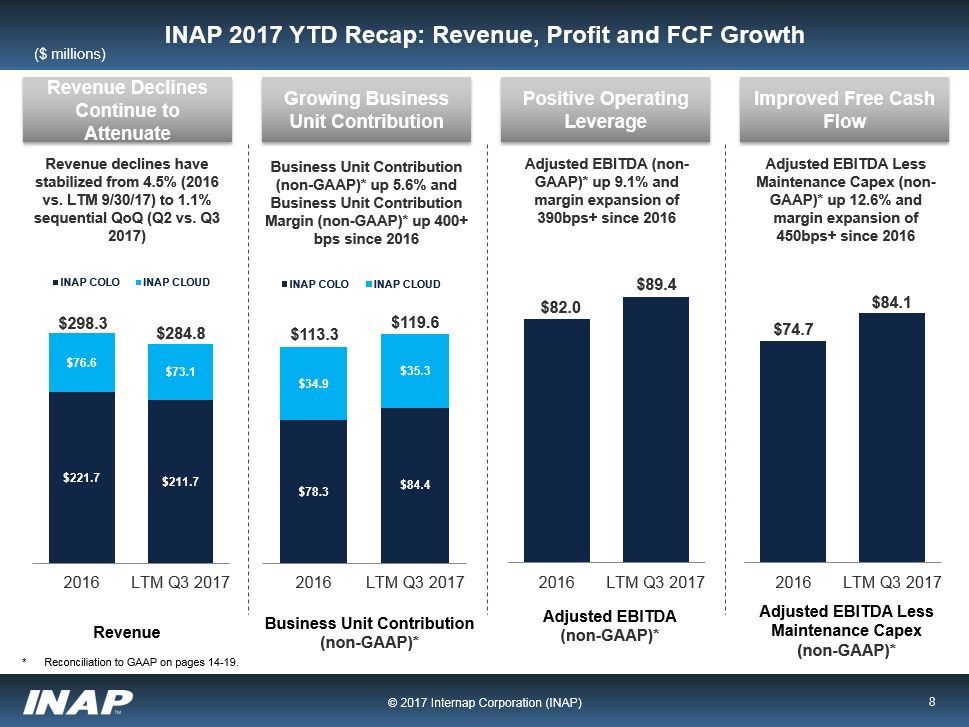

INAP 2017 YTD Recap: Revenue, Profit and FCF Growth Revenue Business Unit Contribution (non-GAAP)* up 5.6% and Business Unit Contribution Margin (non-GAAP)* up 400+ bps since 2016 Adjusted EBITDA (non-GAAP)* up 9.1% and margin expansion of 390bps+ since 2016 $298.3 $284.8 Adjusted EBITDA(non-GAAP)* Business Unit Contribution (non-GAAP)* $113.3 $119.6 Revenue Declines Continue to Attenuate Growing Business Unit Contribution Positive Operating Leverage ($ millions) $82.0 $89.4 Revenue declines have stabilized from 4.5% (2016 vs. LTM 9/30/17) to 1.1% sequential QoQ (Q2 vs. Q3 2017) © 2017 Internap Corporation (INAP) Improved Free Cash Flow Adjusted EBITDA Less Maintenance Capex (non-GAAP)* $74.7 $84.1 Adjusted EBITDA Less Maintenance Capex (non-GAAP)* up 12.6% and margin expansion of 450bps+ since 2016 * Reconciliation to GAAP on pages 14-19.

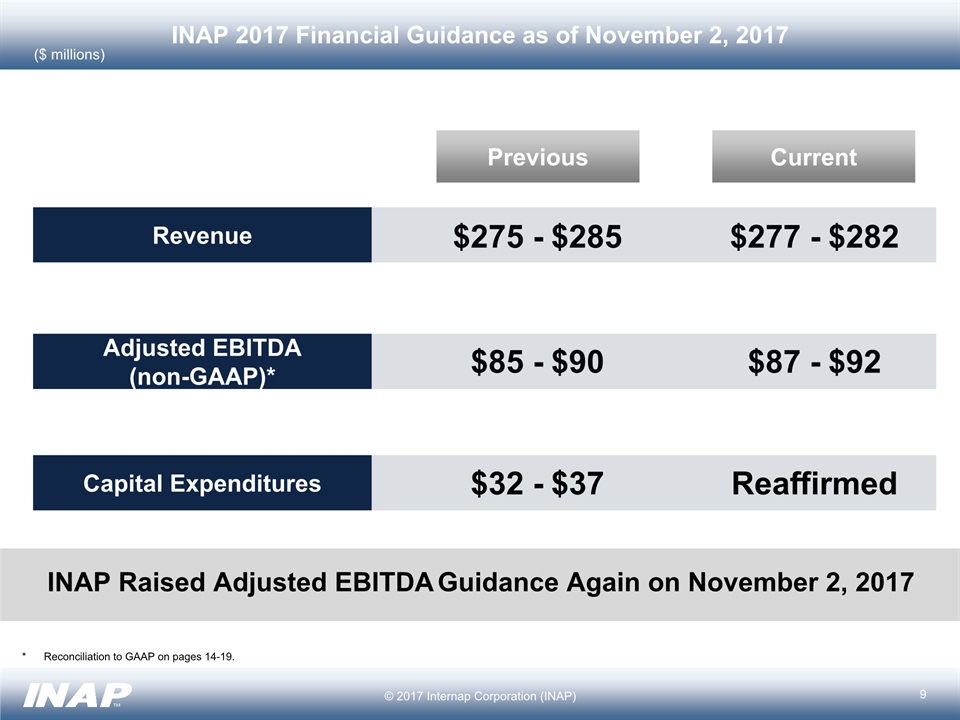

INAP 2017 Financial Guidance as of November 2, 2017 © 2017 Internap Corporation (INAP) Building on Adjusted EBITDA less Capex in 2017 $275 - $285 $277 - $282 $85 - $90 $87 - $92 $32 - $37 Reaffirmed INAP Raised Adjusted EBITDA Guidance Again on November 2, 2017 Previous Current Revenue Capital Expenditures Adjusted EBITDA (non-GAAP)* * Reconciliation to GAAP on pages 14-19. ($ millions)

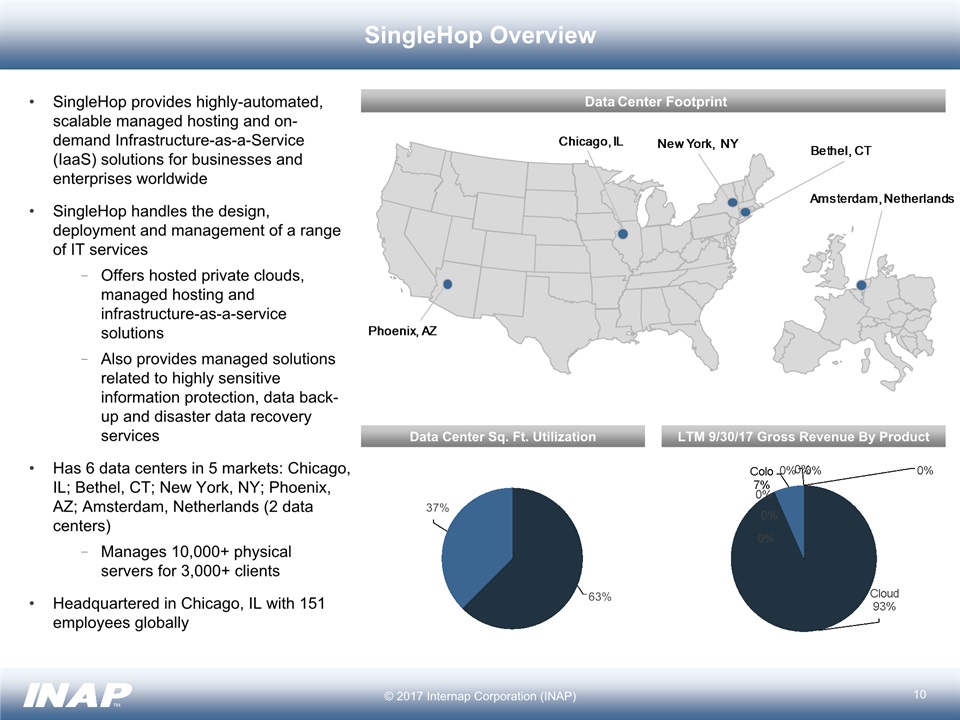

SingleHop Overview SingleHop provides highly-automated, scalable managed hosting and on-demand Infrastructure-as-a-Service (IaaS) solutions for businesses and enterprises worldwideSingleHop handles the design, deployment and management of a range of IT servicesOffers hosted private clouds, managed hosting and infrastructure-as-a-service solutionsAlso provides managed solutions related to highly sensitive information protection, data back-up and disaster data recovery servicesHas 6 data centers in 5 markets: Chicago, IL; Bethel, CT; New York, NY; Phoenix, AZ; Amsterdam, Netherlands (2 data centers)Manages 10,000+ physical servers for 3,000+ clientsHeadquartered in Chicago, IL with 151 employees globally Phoenix, AZ Chicago, IL New York, NY Bethel, CT Amsterdam, Netherlands © 2017 Internap Corporation (INAP) Data Center Footprint LTM 9/30/17 Gross Revenue By Product Data Center Sq. Ft. Utilization

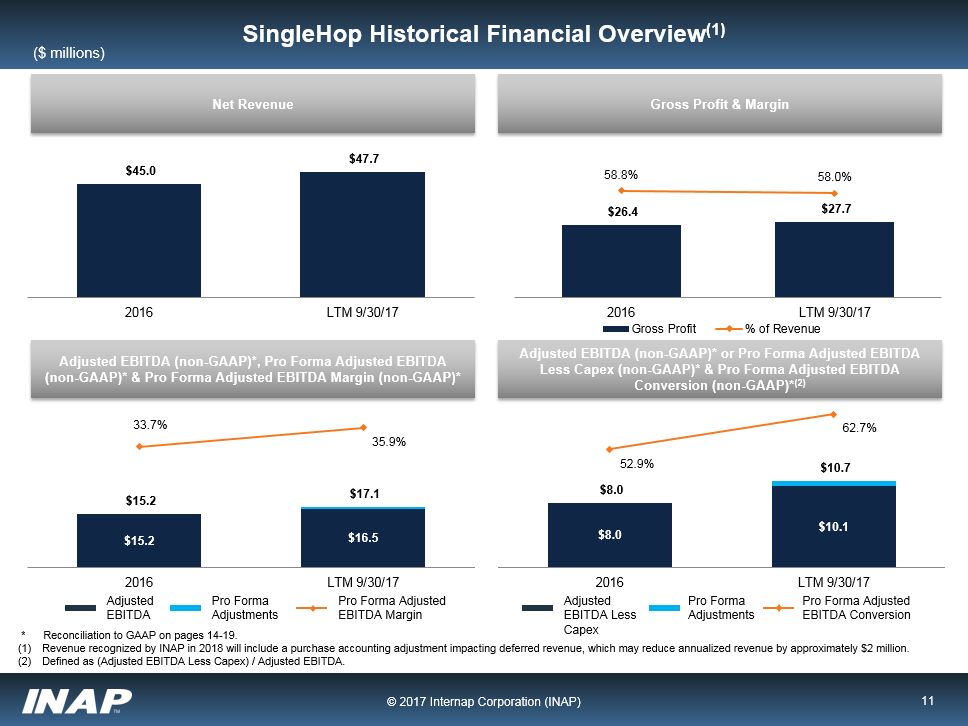

SingleHop Historical Financial Overview(1) ($ millions) © 2017 Internap Corporation (INAP) Net Revenue Gross Profit & Margin Adjusted EBITDA (non-GAAP)*, Pro Forma Adjusted EBITDA (non-GAAP)* & Pro Forma Adjusted EBITDA Margin (non-GAAP)* Adjusted EBITDA (non-GAAP)* or Pro Forma Adjusted EBITDA Less Capex (non-GAAP)* & Pro Forma Adjusted EBITDA Conversion (non-GAAP)*(2) * Reconciliation to GAAP on pages 14-19.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2 million.Defined as (Adjusted EBITDA Less Capex) / Adjusted EBITDA. Adjusted EBITDA Pro Forma Adjustments Pro Forma Adjusted EBITDA Margin Adjusted EBITDA Less Capex Pro Forma Adjustments Pro Forma Adjusted EBITDA Conversion

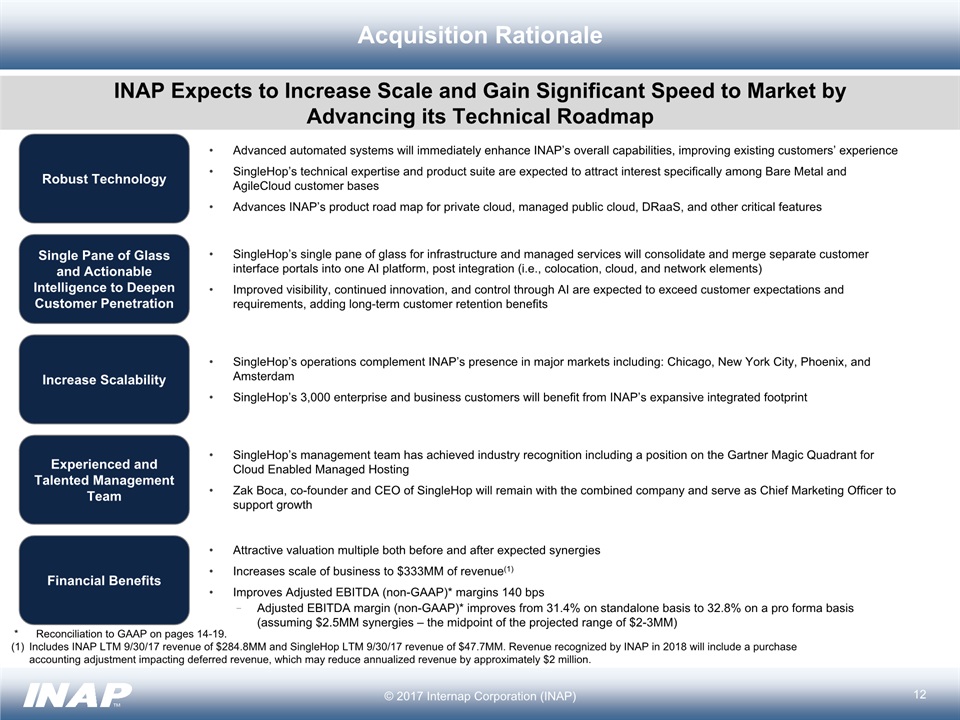

Acquisition Rationale London (2) Amsterdam (3 – INAP; 2 - SH) Frankfurt Singapore (3) Hong Kong (2) Tokyo (3) Sydney Phoenix (1 – INAP; 1 – SH) Houston Dallas (4) Miami Atlanta (3) San Francisco Seattle (2) Chicago (3 – INAP; 1 - SH) Ashburn Oakland Los Angeles (4) New York / New Jersey (3 – INAP; 1 - SH) Boston (2) Montréal (3) INAP Data Centers SingleHop (“SH”) Data Centers Connecticut Santa Clara / San Jose (5) Osaka (1) © 2017 Internap Corporation (INAP) Pro Forma Relative Size (2016 Revenue) Robust Technology Single Pane of Glass and Actionable Intelligence to Deepen Customer Penetration INAP Expects to Increase Scale and Gain Significant Speed to Market by Advancing its Technical Roadmap Increase Scalability Experienced and Talented Management Team Advanced automated systems will immediately enhance INAP’s overall capabilities, improving existing customers’ experienceSingleHop’s technical expertise and product suite are expected to attract interest specifically among Bare Metal and AgileCloud customer basesAdvances INAP’s product road map for private cloud, managed public cloud, DRaaS, and other critical features SingleHop’s single pane of glass for infrastructure and managed services will consolidate and merge separate customer interface portals into one AI platform, post integration (i.e., colocation, cloud, and network elements)Improved visibility, continued innovation, and control through AI are expected to exceed customer expectations and requirements, adding long-term customer retention benefits SingleHop’s operations complement INAP’s presence in major markets including: Chicago, New York City, Phoenix, and AmsterdamSingleHop’s 3,000 enterprise and business customers will benefit from INAP’s expansive integrated footprint SingleHop’s management team has achieved industry recognition including a position on the Gartner Magic Quadrant for Cloud Enabled Managed HostingZak Boca, co-founder and CEO of SingleHop will remain with the combined company and serve as Chief Marketing Officer to support growth Financial Benefits Attractive valuation multiple both before and after expected synergiesIncreases scale of business to $333MM of revenue(1)Improves Adjusted EBITDA (non-GAAP)* margins 140 bpsAdjusted EBITDA margin (non-GAAP)* improves from 31.4% on standalone basis to 32.8% on a pro forma basis (assuming $2.5MM synergies – the midpoint of the projected range of $2-3MM) TBUTo be updated * Reconciliation to GAAP on pages 14-19.Includes INAP LTM 9/30/17 revenue of $284.8MM and SingleHop LTM 9/30/17 revenue of $47.7MM. Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2 million.

Appendix London (2) Amsterdam (3 – INAP; 2 - SH) Frankfurt Singapore (3) Hong Kong (2) Tokyo (3) Sydney Phoenix (1 – INAP; 1 – SH) Houston Dallas (4) Miami Atlanta (3) San Francisco Seattle (2) Chicago (3 – INAP; 1 - SH) Ashburn Oakland Los Angeles (4) New York / New Jersey (3 – INAP; 1 - SH) Boston (2) Montréal (3) INAP Data Centers SingleHop (“SH”) Data Centers Connecticut Santa Clara / San Jose (5) Osaka (1) © 2017 Internap Corporation (INAP) Pro Forma Relative Size (2016 Revenue) TBUTo be updated Reconciliation of Non-GAAP Financial Measures

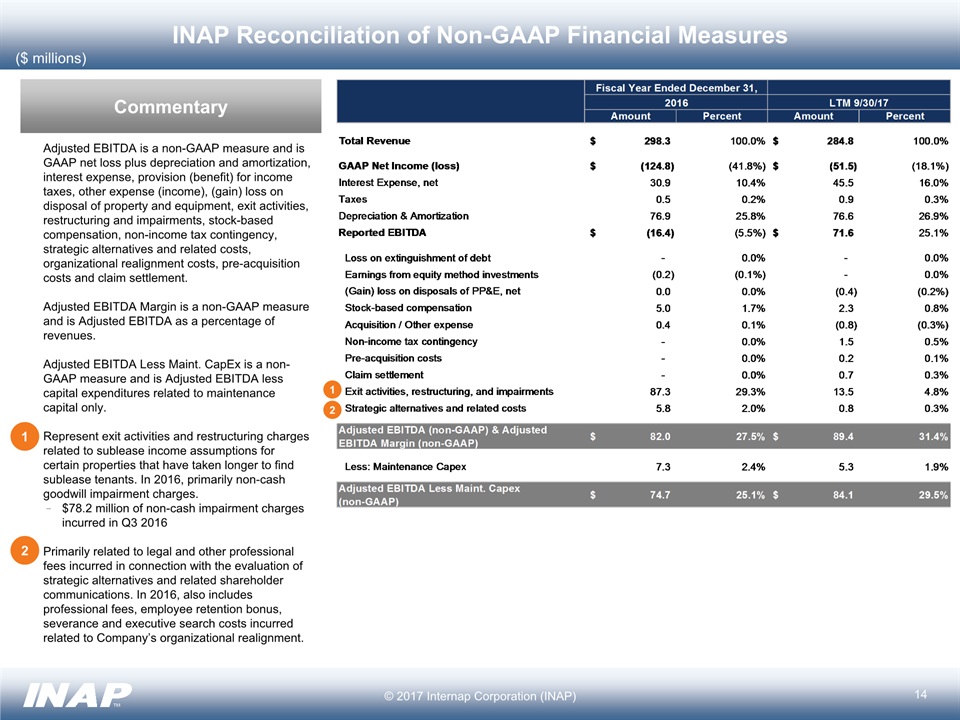

INAP Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA is a non-GAAP measure and is GAAP net loss plus depreciation and amortization, interest expense, provision (benefit) for income taxes, other expense (income), (gain) loss on disposal of property and equipment, exit activities, restructuring and impairments, stock-based compensation, non-income tax contingency, strategic alternatives and related costs, organizational realignment costs, pre-acquisition costs and claim settlement.Adjusted EBITDA Margin is a non-GAAP measure and is Adjusted EBITDA as a percentage of revenues.Adjusted EBITDA Less Maint. CapEx is a non-GAAP measure and is Adjusted EBITDA less capital expenditures related to maintenance capital only.Represent exit activities and restructuring charges related to sublease income assumptions for certain properties that have taken longer to find sublease tenants. In 2016, primarily non-cash goodwill impairment charges. $78.2 million of non-cash impairment charges incurred in Q3 2016Primarily related to legal and other professional fees incurred in connection with the evaluation of strategic alternatives and related shareholder communications. In 2016, also includes professional fees, employee retention bonus, severance and executive search costs incurred related to Company’s organizational realignment. 1 ($ millions) 2 2 1 14 © 2017 Internap Corporation (INAP) Commentary

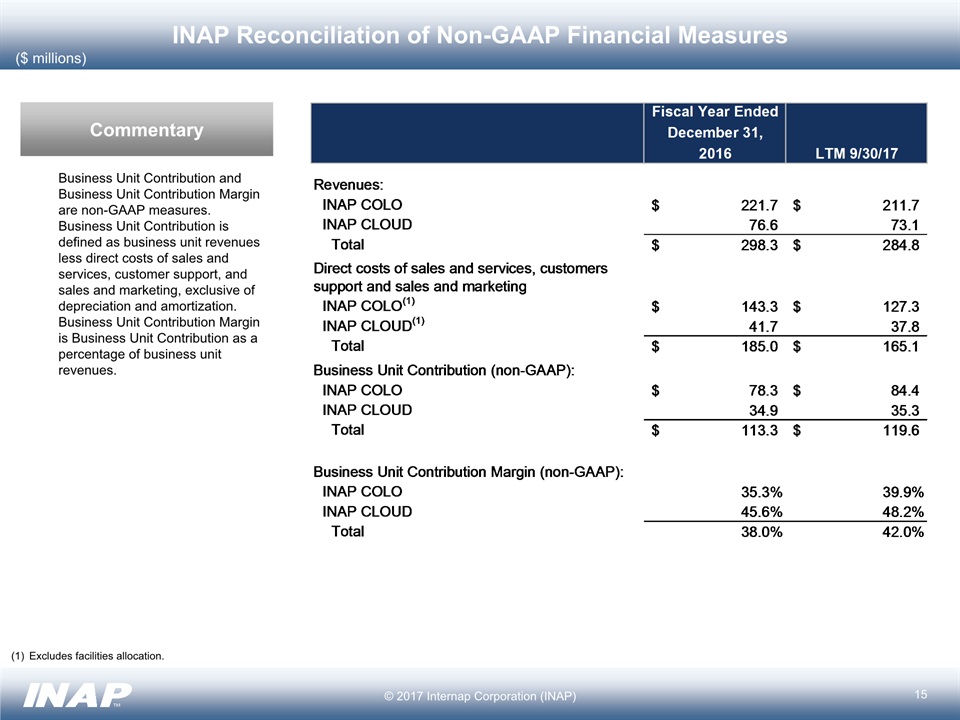

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 15 © 2017 Internap Corporation (INAP) Business Unit Contribution and Business Unit Contribution Margin are non-GAAP measures. Business Unit Contribution is defined as business unit revenues less direct costs of sales and services, customer support, and sales and marketing, exclusive of depreciation and amortization. Business Unit Contribution Margin is Business Unit Contribution as a percentage of business unit revenues. Commentary Excludes facilities allocation.

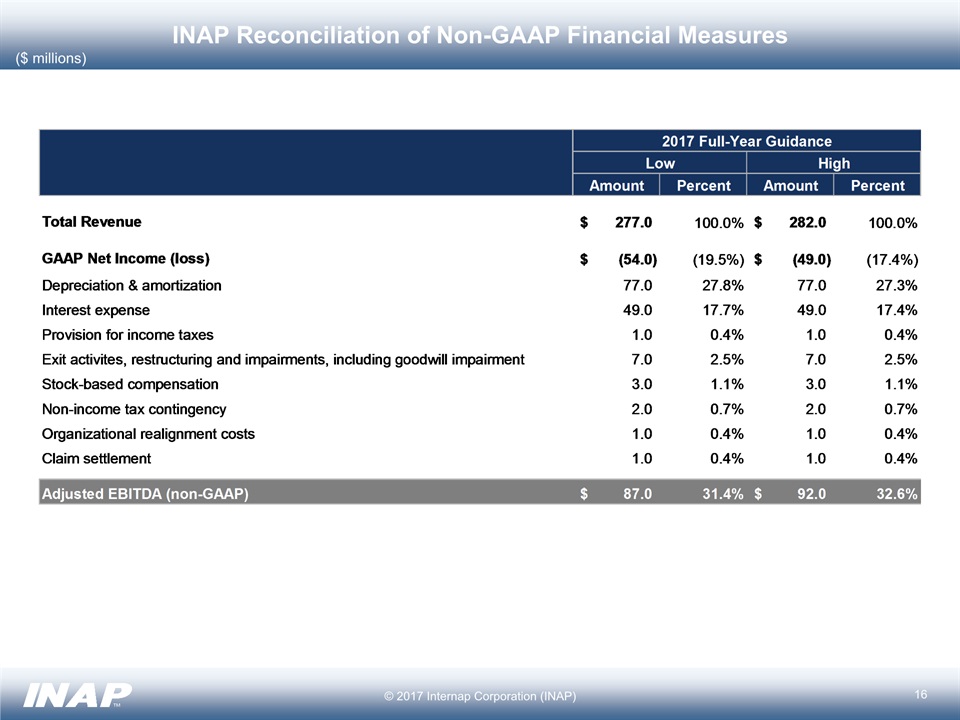

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 16 © 2017 Internap Corporation (INAP)

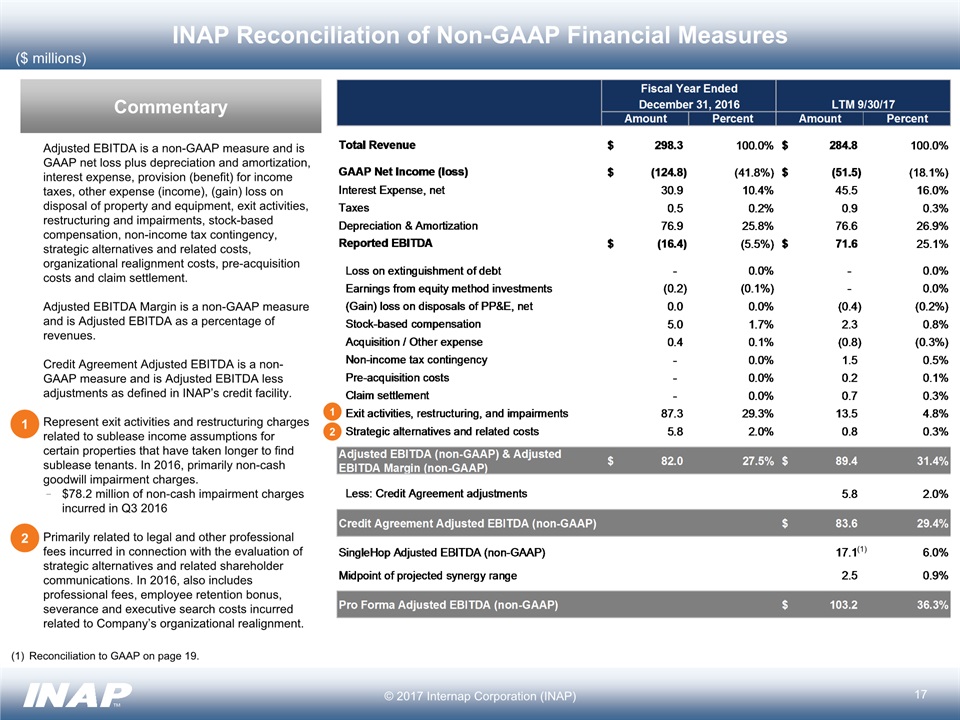

INAP Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA is a non-GAAP measure and is GAAP net loss plus depreciation and amortization, interest expense, provision (benefit) for income taxes, other expense (income), (gain) loss on disposal of property and equipment, exit activities, restructuring and impairments, stock-based compensation, non-income tax contingency, strategic alternatives and related costs, organizational realignment costs, pre-acquisition costs and claim settlement.Adjusted EBITDA Margin is a non-GAAP measure and is Adjusted EBITDA as a percentage of revenues.Credit Agreement Adjusted EBITDA is a non-GAAP measure and is Adjusted EBITDA less adjustments as defined in INAP’s credit facility.Represent exit activities and restructuring charges related to sublease income assumptions for certain properties that have taken longer to find sublease tenants. In 2016, primarily non-cash goodwill impairment charges. $78.2 million of non-cash impairment charges incurred in Q3 2016Primarily related to legal and other professional fees incurred in connection with the evaluation of strategic alternatives and related shareholder communications. In 2016, also includes professional fees, employee retention bonus, severance and executive search costs incurred related to Company’s organizational realignment. 1 ($ millions) 2 2 1 17 © 2017 Internap Corporation (INAP) Commentary (1) Reconciliation to GAAP on page 19.

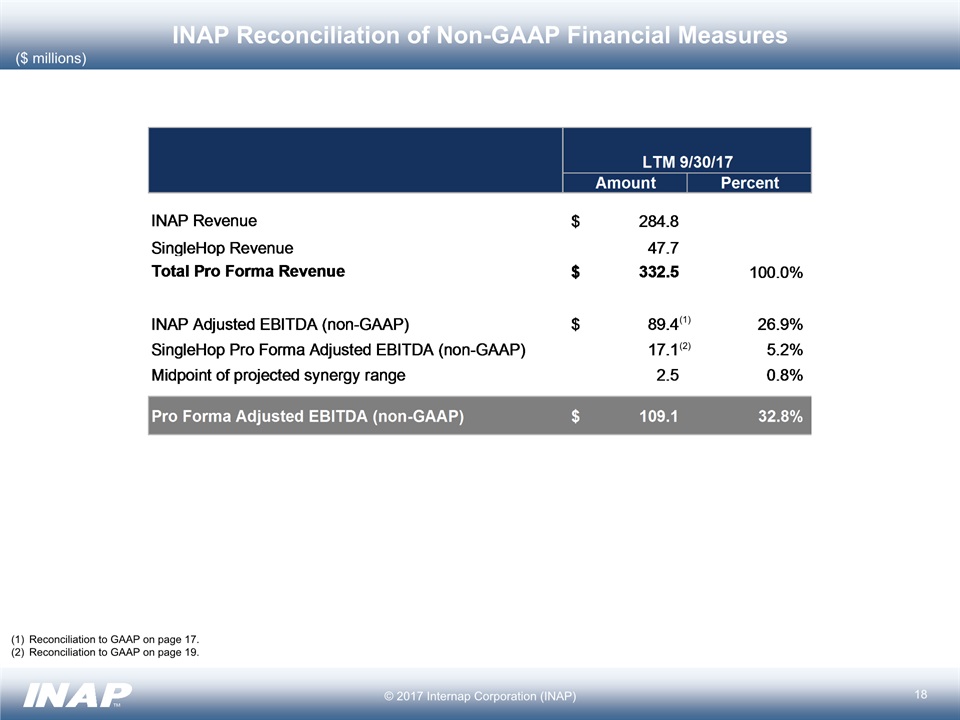

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 18 © 2017 Internap Corporation (INAP) Reconciliation to GAAP on page 17.Reconciliation to GAAP on page 19. (1) (2)

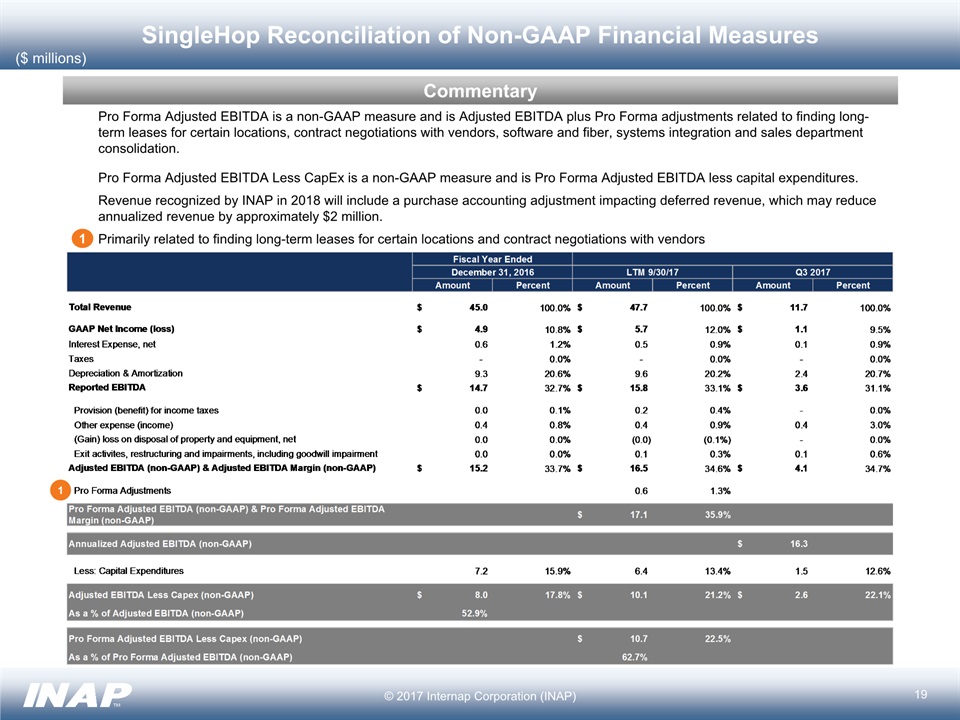

SingleHop Reconciliation of Non-GAAP Financial Measures Pro Forma Adjusted EBITDA is a non-GAAP measure and is Adjusted EBITDA plus Pro Forma adjustments related to finding long-term leases for certain locations, contract negotiations with vendors, software and fiber, systems integration and sales department consolidation.Pro Forma Adjusted EBITDA Less CapEx is a non-GAAP measure and is Pro Forma Adjusted EBITDA less capital expenditures.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2 million.Primarily related to finding long-term leases for certain locations and contract negotiations with vendors 1 ($ millions) 1 19 © 2017 Internap Corporation (INAP) Commentary