Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GI DYNAMICS, INC. | d521001d8k.htm |

JAN 2018 GI Dynamics, Inc. (ASX: GID) Pioneering treatment for type 2 diabetes /obesity without invasive surgery Company Overview Exhibit 99.1

Q1 2018 Important Notice The Information contained in this document (Information) has been prepared by GI Dynamics, Inc (Company). The distribution of this document in jurisdiction outside Australia may be restricted by law and persons who come into possession of this document should seek their own advice on and observe any such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities laws. This document does not constitute an offer in any place which, or to any person to whom, it would not be lawful to make such an offer or receive this document. The information is not an investment or financial product advice or any recommendation (nor tax, accounting or legal advice) and is not intended to be used as the basis for making an investment decision. In providing this document, the Company has not considered the objectives, financial position or needs or any particular recipients. If you are in any doubt as to whether invest in the Company,, you should seek professional guidance from your financial planner, stockbroker, solicitor, accountant or other independent and qualified professional adviser before deciding to invest. This document has been prepared by the Company as of the date of the presentation, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after that date. No other party has made a statement in, or authorized, permitted or caused the issue, submission, dispatch or provision of this document. The information does not purport to be complete, does not necessarily contain all information, which a prospective investor would consider material, and should not form the basis of any investment decision. This document is not a disclosure document under Chapter 6D of the Corporations Act 2001 (Cth) (Act) or a PDS under Part 7.9 of the Act and has not been lodged with the Australian Securities and Investments Commission. Currency References Financial amounts in this presentation are expressed in US Dollars, except where specifically noted. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements are based on GI Dynamics management’s current estimates and expectations of future events as of the date of this announcement. Furthermore, the estimates are subject to several risks and uncertainties that could cause actual results to differ materially and adversely from those indicated in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, risks associated with our ability to continue to operate as a going concern, our ability to maintain compliance with our obligations under the Convertible Loan Note executed with Crystal Amber Fund Limited, obtaining and maintaining regulatory approvals required to market and sell our products; obtaining funding from third parties; the consequences of stopping the ENDO trial and the possibility that future clinical trials will not be successful or confirm earlier results; the timing and costs of clinical trials; the timing of regulatory submissions; the timing, receipt and maintenance of regulatory approvals; the timing and amount of other expenses; the timing and extent of third-party reimbursement; intellectual-property risk; risks related to excess inventory; and risks related to assumptions regarding the size of the available market, the benefits of our products, product pricing, timing of product launches, future financial results and other factors, including those described in our filings with the U.S. Securities and Exchange Commission. Given these uncertainties, one should not place undue reliance on these forward-looking statements. We do not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or otherwise, unless we are required to do so by law. Disclaimer This presentation and any supplemental materials have been prepared by GI Dynamics, Inc. based on available information. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of such information and opinions and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of GI Dynamics, Inc., or any of its members, directors, officers, employees, or agents or advisors, nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of GI Dynamics, Inc. or any of its directors, officers, employees or agents. EndoBarrier® is not commercially available. Property of GI Dynamics, Inc

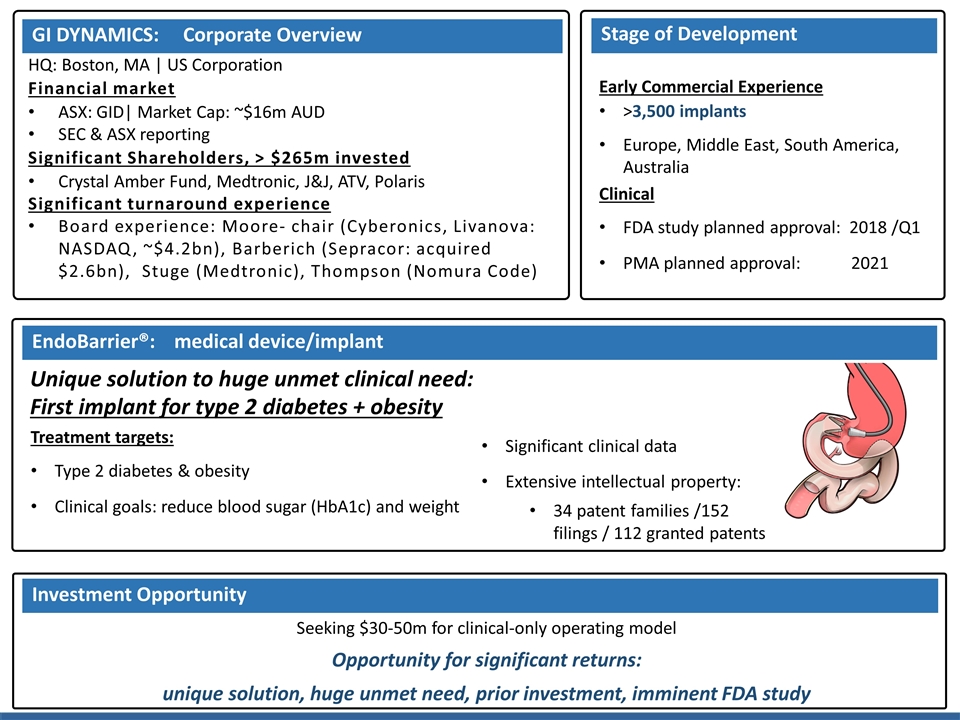

HQ: Boston, MA | US Corporation Financial market ASX: GID| Market Cap: ~$16m AUD SEC & ASX reporting Significant Shareholders, > $265m invested Crystal Amber Fund, Medtronic, J&J, ATV, Polaris Significant turnaround experience Board experience: Moore- chair (Cyberonics, Livanova: NASDAQ, ~$4.2bn), Barberich (Sepracor: acquired $2.6bn), Stuge (Medtronic), Thompson (Nomura Code) Unique solution to huge unmet clinical need: First implant for type 2 diabetes + obesity Stage of Development GI DYNAMICS: Corporate Overview EndoBarrier®: medical device/implant Seeking $30-50m for clinical-only operating model Opportunity for significant returns: unique solution, huge unmet need, prior investment, imminent FDA study Early Commercial Experience >3,500 implants Europe, Middle East, South America, Australia Clinical FDA study planned approval: 2018 /Q1 PMA planned approval: 2021 Investment Opportunity Significant clinical data Extensive intellectual property: 34 patent families /152 filings / 112 granted patents Treatment targets: Type 2 diabetes & obesity Clinical goals: reduce blood sugar (HbA1c) and weight

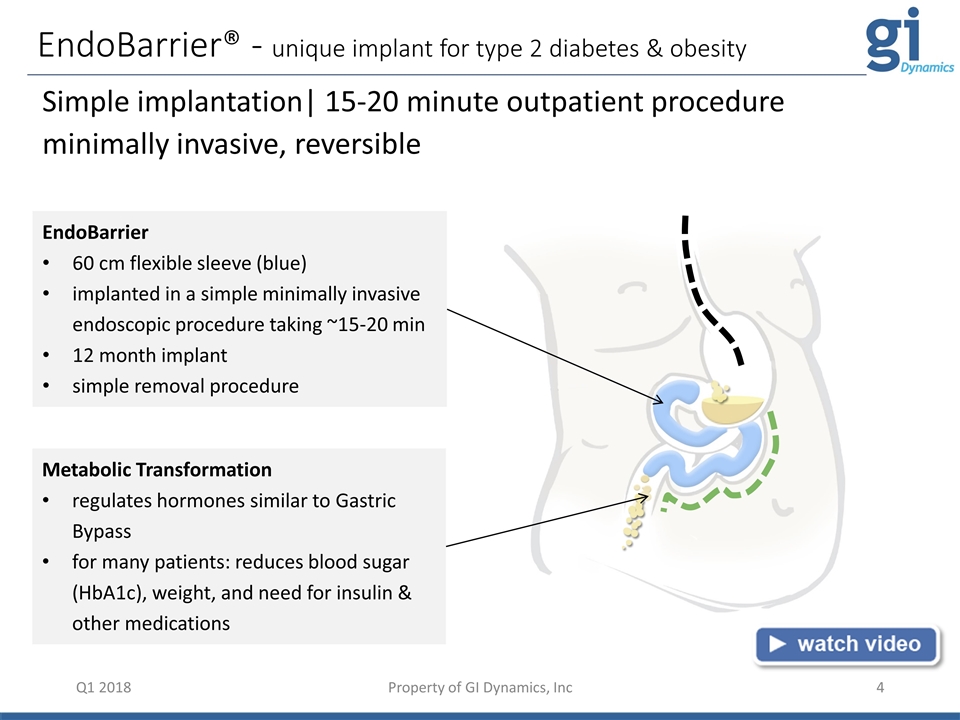

EndoBarrier® - unique implant for type 2 diabetes & obesity Q1 2018 Simple implantation| 15-20 minute outpatient procedure minimally invasive, reversible Metabolic Transformation regulates hormones similar to Gastric Bypass for many patients: reduces blood sugar (HbA1c), weight, and need for insulin & other medications EndoBarrier 60 cm flexible sleeve (blue) implanted in a simple minimally invasive endoscopic procedure taking ~15-20 min 12 month implant simple removal procedure Property of GI Dynamics, Inc

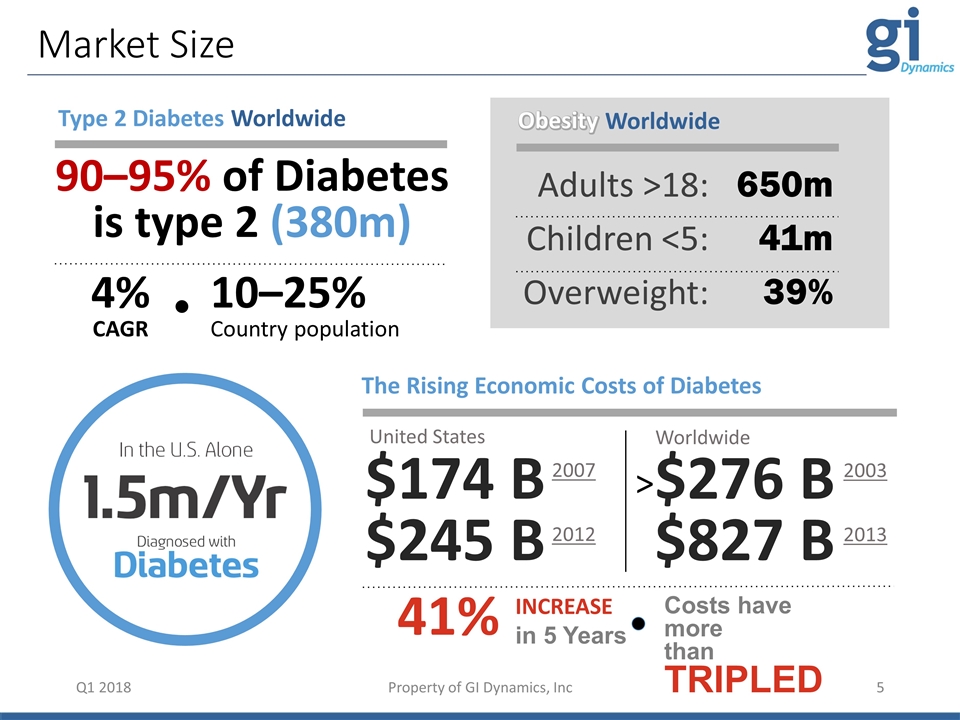

Market Size Q1 2018 The Rising Economic Costs of Diabetes United States $174 B $245 B $276 B $827 B INCREASE in 5 Years Costs have more than TRIPLED 41% Worldwide 2007 2012 2003 2013 Adults >18: Children <5: Overweight: 650m 41m 39% Obesity Worldwide Obesity > Type 2 Diabetes Worldwide 10–25% Country population 4% CAGR 90–95% of Diabetes is type 2 (380m) Property of GI Dynamics, Inc

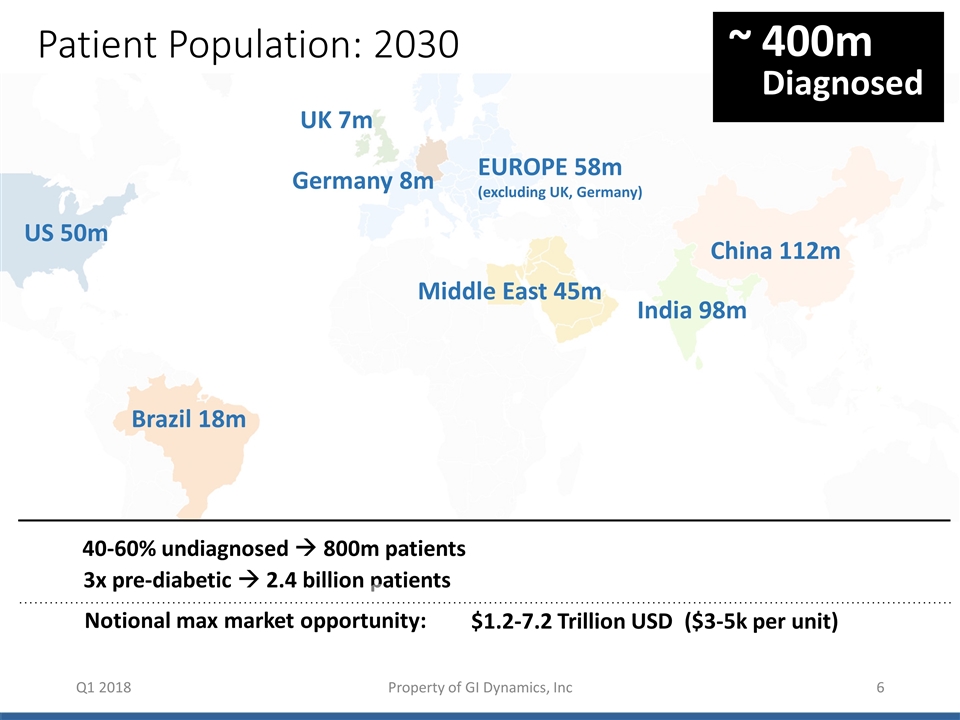

Patient Population: 2030 Q1 2018 Patient Population: 2030 400m Diagnosed ~ 40-60% undiagnosed à 800m patients 3x pre-diabetic à 2.4 billion patients $1.2-7.2 Trillion USD ($3-5k per unit) { US 50m Brazil 18m UK 7m China 112m Germany 8m Middle East 45m India 98m EUROPE 58m (excluding UK, Germany) Notional max market opportunity: Property of GI Dynamics, Inc

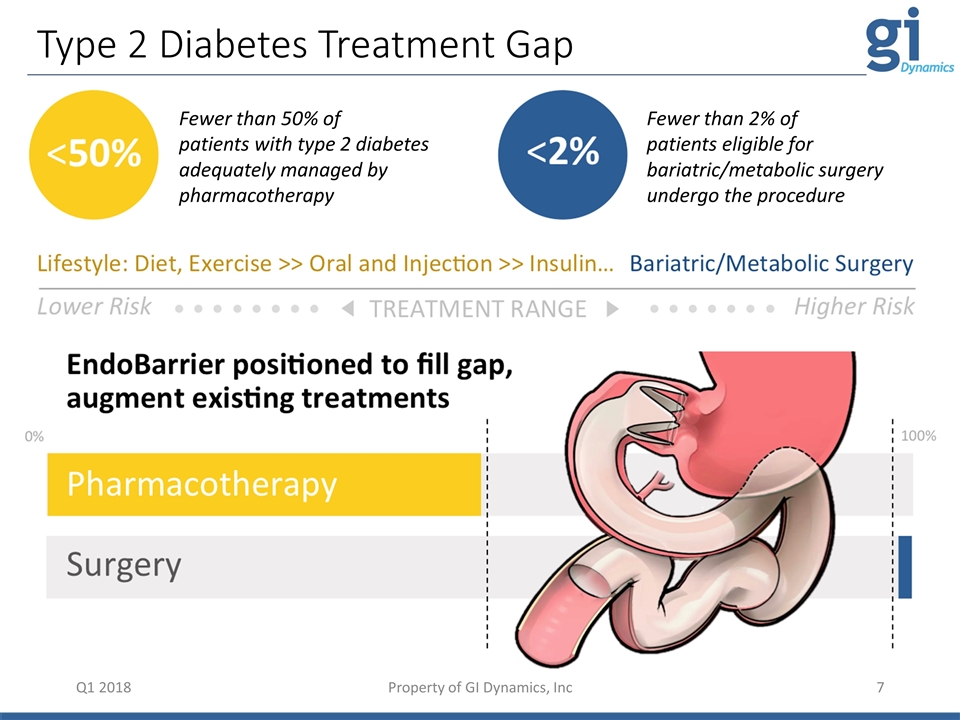

• • • • • • • • TREATMENT RANGE • • • • • • • Lower Risk Higher Risk 0% 100% Type 2 Diabetes Treatment Gap Q1 2018 fewer than 50% of patients with type 2 diabetes adequately managed by pharmacotherapy <50% <2% fewer than 2% of patients eligible for bariatric/metabolic surgery undergo the procedure Surgery Lifestyle: Diet, Exercise >> Oral and Injection >> Insulin… Bariatric/Metabolic Surgery EndoBarrier positioned to fill gap, augment existing treatments Pharmacotherapy Fewer than 50% of patients with type 2 diabetes adequately managed by pharmacotherapy Fewer than 2% of patients eligible for bariatric/metabolic surgery undergo the procedure Property of GI Dynamics, Inc

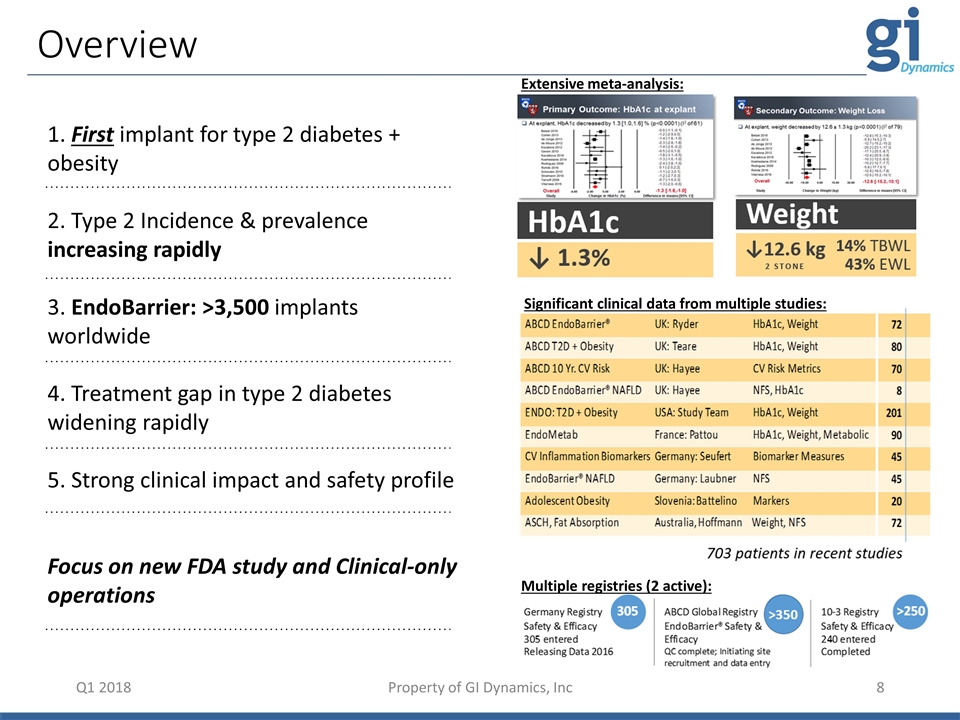

1. First implant for type 2 diabetes + obesity 2. Type 2 Incidence & prevalence increasing rapidly 3. EndoBarrier: >3,500 implants worldwide 4. Treatment gap in type 2 diabetes widening rapidly 5. Strong clinical impact and safety profile Focus on new FDA study and Clinical-only operations Q1 2018 Overview Property of GI Dynamics, Inc Extensive meta-analysis: Significant clinical data from multiple studies: Multiple registries (2 active):

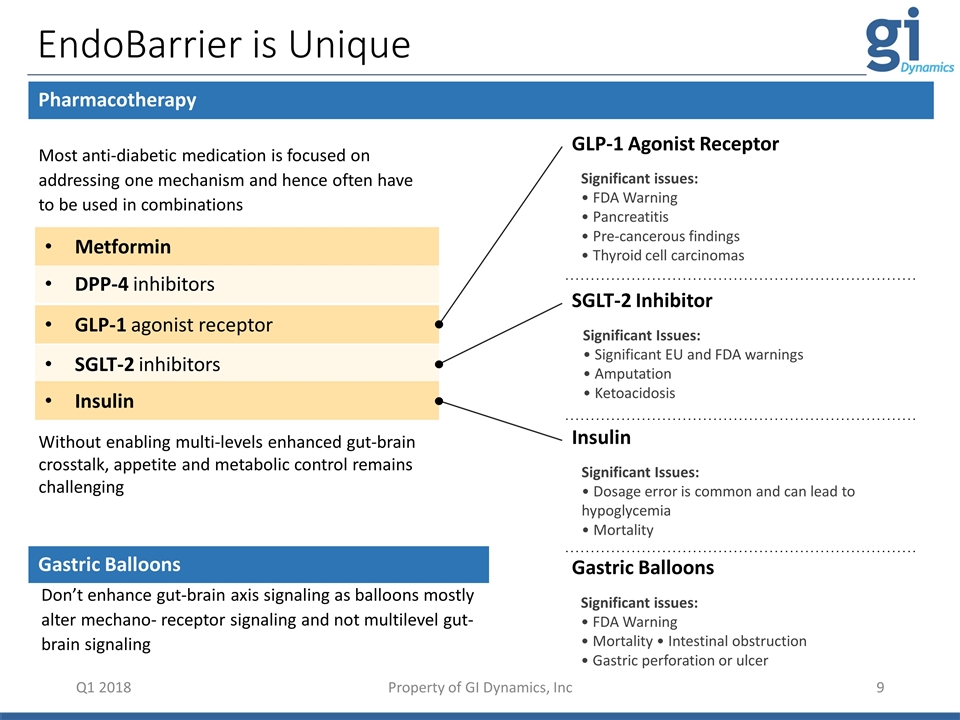

Metformin GLP-1 agonist receptor DPP-4 inhibitors SGLT-2 inhibitors Insulin EndoBarrier is Unique Q1 2018 Pharmacotherapy Don’t enhance gut-brain axis signaling as balloons mostly alter mechano- receptor signaling and not multilevel gut-brain signaling Gastric Balloons Significant issues: • FDA Warning • Mortality • Intestinal obstruction • Gastric perforation or ulcer Significant issues: • FDA Warning • Pancreatitis • Pre-cancerous findings • Thyroid cell carcinomas Significant Issues: • Significant EU and FDA warnings • Amputation • Ketoacidosis SGLT-2 Inhibitor Significant Issues: • Dosage error is common and can lead to hypoglycemia • Mortality Insulin Without enabling multi-levels enhanced gut-brain crosstalk, appetite and metabolic control remains challenging Most anti-diabetic medication is focused on addressing one mechanism and hence often have to be used in combinations Gastric Balloons GLP-1 Agonist Receptor Property of GI Dynamics, Inc

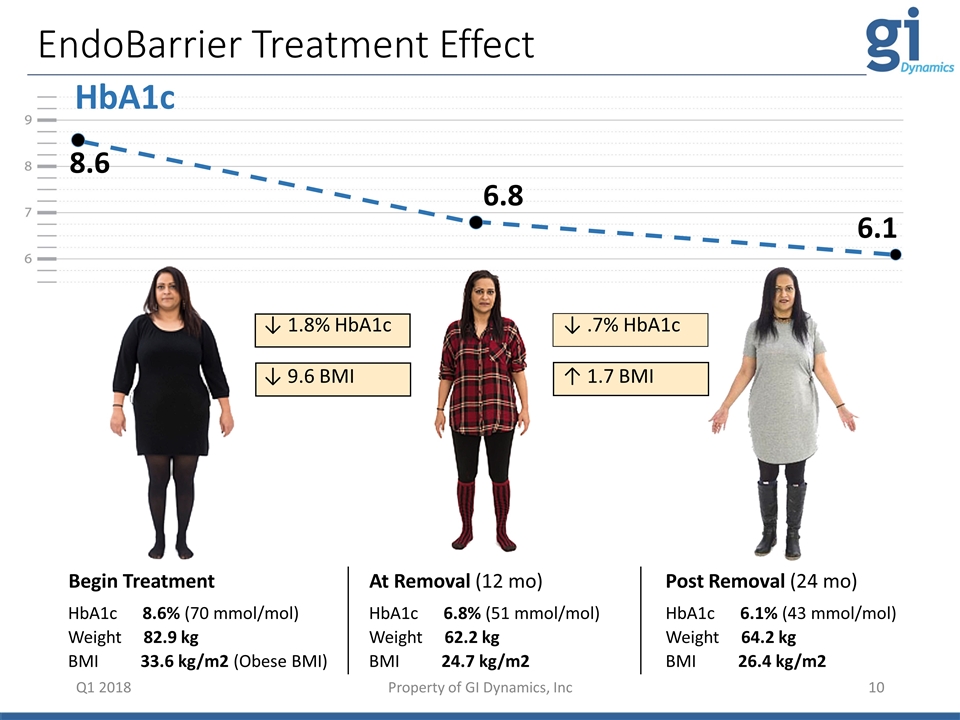

HbA1c EndoBarrier Treatment Effect 8.6 6.8 6.1 Q1 2018 HbA1c 8.6% (70 mmol/mol) Weight 82.9 kg BMI 33.6 kg/m2 (Obese BMI) HbA1c 6.8% (51 mmol/mol) Weight 62.2 kg BMI 24.7 kg/m2 HbA1c 6.1% (43 mmol/mol) Weight 64.2 kg BMI 26.4 kg/m2 Begin Treatment At Removal (12 mo) Post Removal (24 mo) ↓ 1.8% HbA1c ↓ 9.6 BMI ↓ .7% HbA1c ↑ 1.7 BMI Property of GI Dynamics, Inc

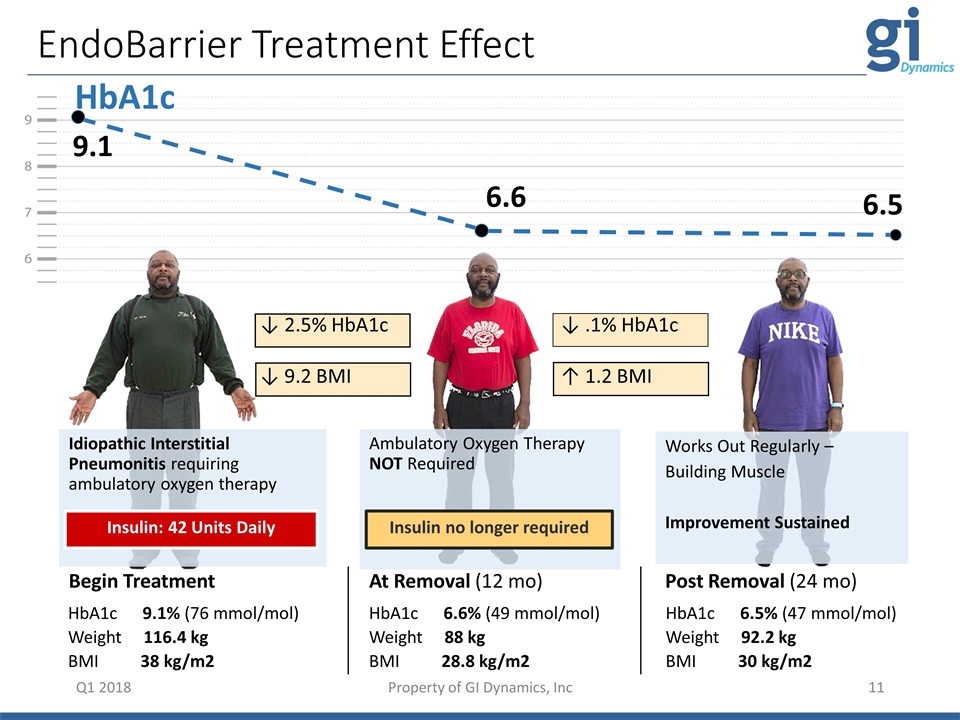

HbA1c 9.1 6.6 6.5 EndoBarrier Treatment Effect Q1 2018 HbA1c 9.1% (76 mmol/mol) Weight 116.4 kg BMI 38 kg/m2 HbA1c 6.6% (49 mmol/mol) Weight 88 kg BMI 28.8 kg/m2 HbA1c 6.5% (47 mmol/mol) Weight 92.2 kg BMI 30 kg/m2 Begin Treatment At Removal (12 mo) Post Removal (24 mo) Idiopathic Interstitial Pneumonitis requiring ambulatory oxygen therapy Insulin: 42 Units Daily Ambulatory Oxygen Therapy NOT Required Insulin no longer required Works Out Regularly – Building Muscle Improvement Sustained ↓ 2.5% HbA1c ↓ 9.2 BMI ↓ .1% HbA1c ↑ 1.2 BMI Insulin: 42 Units Daily Insulin no longer required Property of GI Dynamics, Inc

Scientific Advisory Board (SAB) Q1 2018 David Cummings, MD Washington, D.C. USA Carel le Roux, MD, PhD Dublin, Ireland Gastroenterology Manoel Galvao Neto, MD Sao Paulo, Brazil Christopher Thompson, MD, FACG, AGAF, FASGE Boston, M.A. USA Ricardo Cohen, MD Sao Paulo, Brazil Jan Willem Greve, MD, PhD Heerlen, Netherlands Francesco Rubino, MD London, UK Philip Schauer, MD Cleveland, O.H. USA Thomas Rösch, MD Hamburg, Germany Gerald Holtmann, MD Brisbane, Australia Metabolic Surgery Endocrinology Property of GI Dynamics, Inc

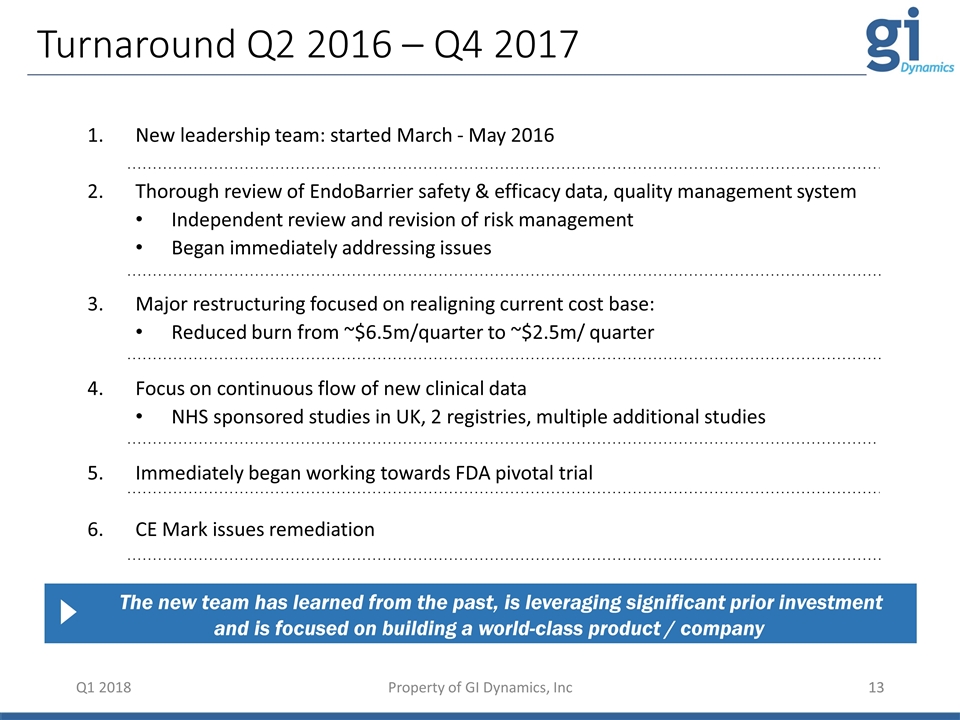

Turnaround Q2 2016 – Q4 2017 New leadership team: started March - May 2016 Thorough review of EndoBarrier safety & efficacy data, quality management system Independent review and revision of risk management Began immediately addressing issues Major restructuring focused on realigning current cost base: Reduced burn from ~$6.5m/quarter to ~$2.5m/ quarter Focus on continuous flow of new clinical data NHS sponsored studies in UK, 2 registries, multiple additional studies Immediately began working towards FDA pivotal trial CE Mark issues remediation The new team has learned from the past, is leveraging significant prior investment and is focused on building a world-class product / company Q1 2018 Property of GI Dynamics, Inc

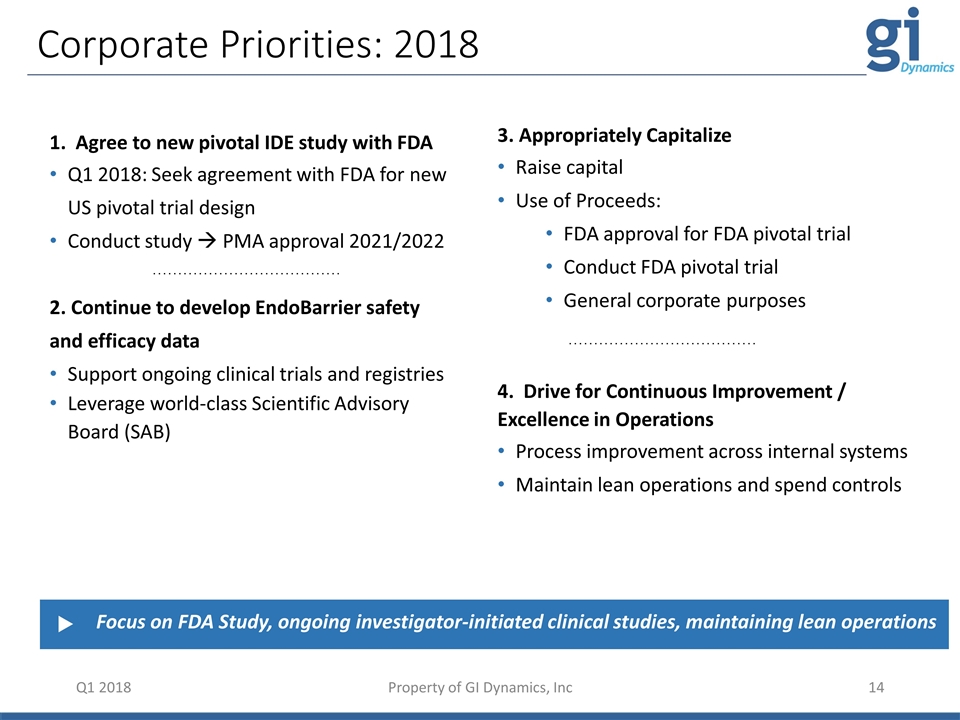

1. Agree to new pivotal IDE study with FDA Q1 2018: Seek agreement with FDA for new US pivotal trial design Conduct study à PMA approval 2021/2022 2. Continue to develop EndoBarrier safety and efficacy data Support ongoing clinical trials and registries Leverage world-class Scientific Advisory Board (SAB) Corporate Priorities: 2018 3. Appropriately Capitalize Raise capital Use of Proceeds: FDA approval for FDA pivotal trial Conduct FDA pivotal trial General corporate purposes 4. Drive for Continuous Improvement / Excellence in Operations Process improvement across internal systems Maintain lean operations and spend controls Focus on FDA Study, ongoing investigator-initiated clinical studies, maintaining lean operations Q1 2018 Property of GI Dynamics, Inc

Leadership Team Q1 2018 Scott Schorer CEO & President Experienced in new company / technology enterprise building Multiple product approvals & product launches Raised >$120m through private equity, public equity and debt financings Systagenix Wound Management; IST; CentriMed/Global Healthcare Exchange (GHX) US Army Infantry: 82nd Airborne Division Brian Callahan CCO, EVP Clinical, Regulatory, Quality Involved in numerous compliance recovery projects Excellent working relationship with current and former FDA officials Strong Clinical, Regulatory (multiple 510k, PMA, BLA, ANDA and NDAs), and Quality experience (40+ FDA, ISO inspections) Histogenics, Prochon Biotech, Organogenesis, Quintiles US Army nuclear weapons Property of GI Dynamics, Inc Houry Youssoufian VP, Finance Experienced financial professional Proven capabilities to develop, lead & manage financial operations of publicly or privately held enterprises Instrumental in raising capital through private and public sector for private company MIT, PricewaterhouseCoopers, Novartis, Immunetics, Sage Therapeutics

Dan Moore Chairman, NED Juliet Thompson NED Oern Stuge, MD NED Tim Barberich NED Board of Directors NED: Livanova (NASDAQ: LIVN), Epilepsy Foundation of America, BioHouston, Weldon School of Bioengineering, BrainScope Served as president, CEO and director of Cyberonics, Inc., a medical technology company Boston Scientific: Extensive experience in domestic and international sales, operations and executive management in global medical device manufacturing NED: Lumenis, Mainstay Medical, Balt Extrusion, Vision Ophthalmology Group, Pulmonx, Phagenesis, Aleva 30+ years serving as an executive in various medical device, health care and life sciences companies Medtronic: multiple senior management roles NED: Nexstim, Novacyt, Premier Vet Group (PVG.L) 20+ years experience healthcare banking Founder: Code Securities, sold to Nomura Head Corporate Finance & MD: Nomura Code Nomura Code executed >150 life sciences transactions, including 40 IPOs raising more than €4bn NED: BioNevia, Verastem, Inotek, Neurovance, Frequency Therapeutics 40+ years serving as an executive in various medical device and pharmaceutical companies Sepracor: Founder & CEO (NASDAQ: SEPR) Sold to Dainippon for $2.6Bn Q1 2018 Property of GI Dynamics, Inc

Q1 2018 Summary Executive leadership team, board of directors with significant turnaround experience Committed world-class scientific advisory board and key opinion leaders EndoBarrier is first implant for treatment of type 2 diabetes and obesity Significant efficacy shown in glucose control, weight loss and other risk factors Less invasive therapy with advantageous cost-benefit profile Substantial clinical experience: > 3,500 EndoBarrier implants- clinical profile well characterized Significant upside potential for shareholder value creation Property of GI Dynamics, Inc

Reference List Slide 5 2016 World Health Organization (WHO) Global Report on Diabetes; http://apps.who.int/iris/bitstream/10665/204871/1/9789241565257_eng.pdf American Diabetes Association (ADA), Diabetes Care; Economic Costs of Diabetes in the U.S. in 2012; http://care.diabetesjournals.org/content/36/4/1033.full?loc=dorg_statistics Center for Disease Control and Prevention (CDC); https://www.cdc.gov/media/releases/2017/p0718-diabetes-report.html and https://www.cdc.gov/media/presskits/aahd/diabetes.pdf World Health Organization; WHO, Obesity and Overweight Fact Sheet; http://www.who.int/mediacentre/factsheets/fs311/en/ Slide 6 Our World in Data, Future World Population Growth; https://ourworldindata.org/future-world-population-growth/ Aruvian’s Research, Analyzing the Global Diabetes Market Diabetes Atlas, 7th Edition of the Diabetes Atlas (2015) http://www.diabetesatlas.org/ Slide 7 American Diabetes Association (ADA) The Journal of Clinical and Applied Research and Education, Diabetes Care, Volume 40│Supplement 1 (January 2017) American Society for Metabolic and Bariatric Surgery (ASMBS) Professional Resource Center, Fact Sheets (November 2013); https://asmbs.org/resource-categories/fact-sheets US National Library of Medicine National Institute of Health, Management of Type-2 Diabetes Mellitus in Adults (December 2012); https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3541864/ Slides 8 Investigator Led Trials; https://www.clinicaltrials.gov/ Brigham and Women’s Hospital, “Effect of the Duodenal-Jejunal Bypass Liner on Glycemic Control in Type-2 Diabetic Patients with Obesity: A Meta-Analysis with Secondary Analysis on Weight Loss and Hormonal Changes,” Digestive Disease Week (DDW) Presentation; Pichamol Jirapinyo (May 2017) Q1 2018 Property of GI Dynamics, Inc

Reference List (continued) Slide 9 GLP-1 Agonist Receptor References: https://www.fda.gov/Drugs/DrugSafety/ucm343187.htm https://www.belmarrahealth.com/new-study-highlights-possible-side-effects-of-glp-1-agonists-drugs-for-type-2-diabetes/ https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4509428/ SGLT-2 Inhibitor References: https://www.fda.gov/Drugs/DrugSafety/ucm475463.htm https://www.fda.gov/downloads/Drugs/DrugSafety/UCM558427.pdf Insulin References: https://www.nice.org.uk/guidance/ktt20/resources/safer-insulin-prescribing-pdf-58758006482629 https://www.sciencedaily.com/releases/2013/02/130204114244.htm Gastric Balloon References: https://www.fda.gov/Safety/MedWatch/SafetyInformation/SafetyAlertsforHumanMedicalProducts/ucm570916.htm https://www.mayoclinic.org/tests-procedures/intragastric-balloon/basics/risks/prc-20146867 http://www.healthcentre.org.uk/weight-loss-surgery/weight-loss-surgery-gastric-balloon-complications.html Slides 10 & 11 Association of British Clinical Diabetologists (ABCD) “Why not consider establishing an NHS EndoBarrier service in your hospital?” Diabetes UK Presentation; Dr. Bob Ryder, Consultant Diabetologist, SWBH, Birmingham, DUK Manchester (8 March 2017) Q1 2018 Property of GI Dynamics, Inc